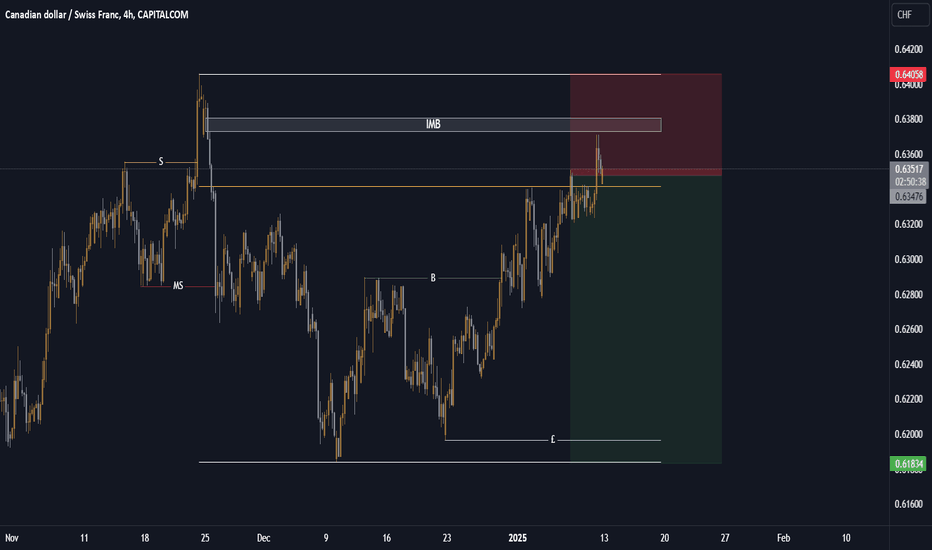

CADCHF - SELLCADCHF - SELL POSITION

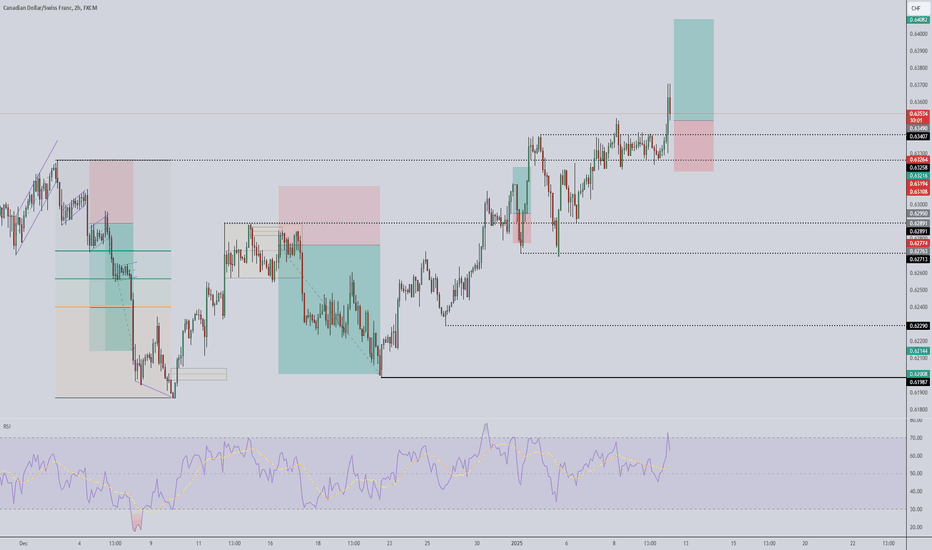

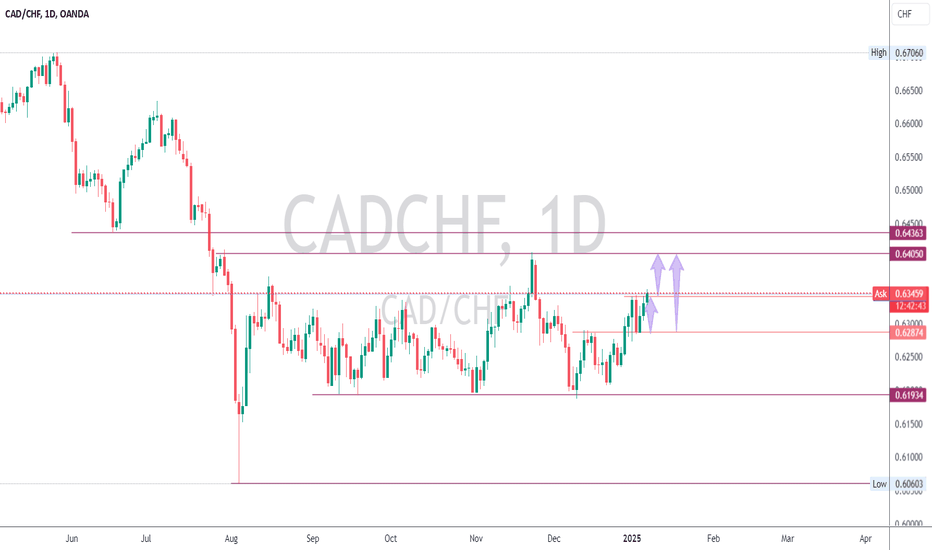

Price created a market shift with seller momentum leaving a area of imbalance behind.

Price then started pulling back creating a opposing break of structure which means the low of that structure is our targeted liquidity followed by the low of the whole structure as liquidity points.

Fibanacci retracement levels marked out with my trade entry point being the 71% fibancci level which price has tapped into.

Sell trade is entered targeting the low of the whole structure with my stop loss being the high of the structure.

Now patients is at play and we wait for results.

CHFCAD trade ideas

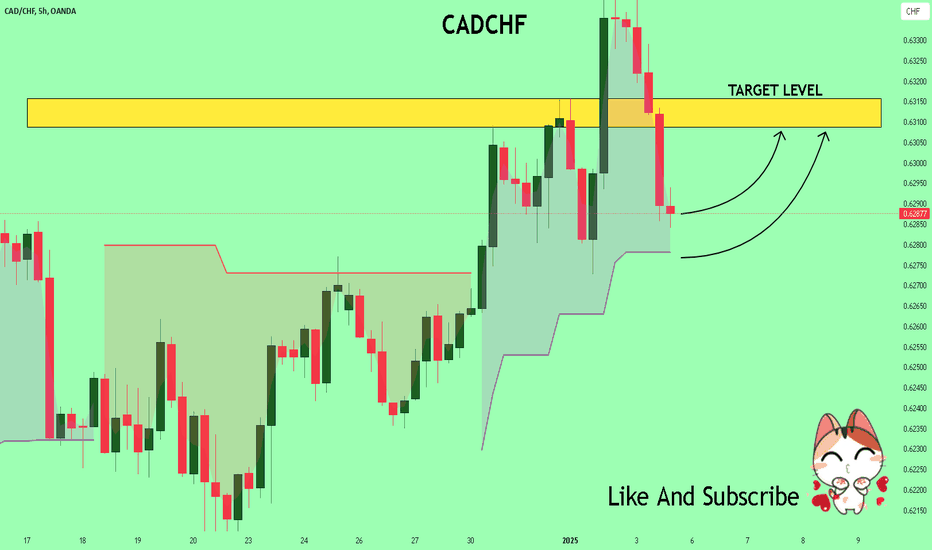

CADCHF Technical Analysis! BUY!

My dear friends,

Please, find my technical outlook for CADCHF below:

The price is coiling around a solid key level - 0.6285

Bias - Bullish

Technical Indicators : Pivot Points High anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 0.6310

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

———————————

WISH YOU ALL LUCK

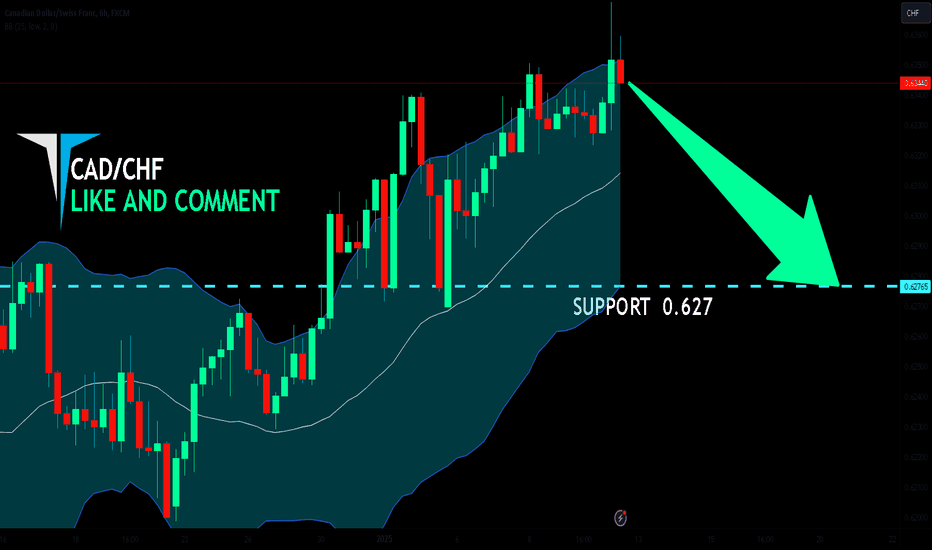

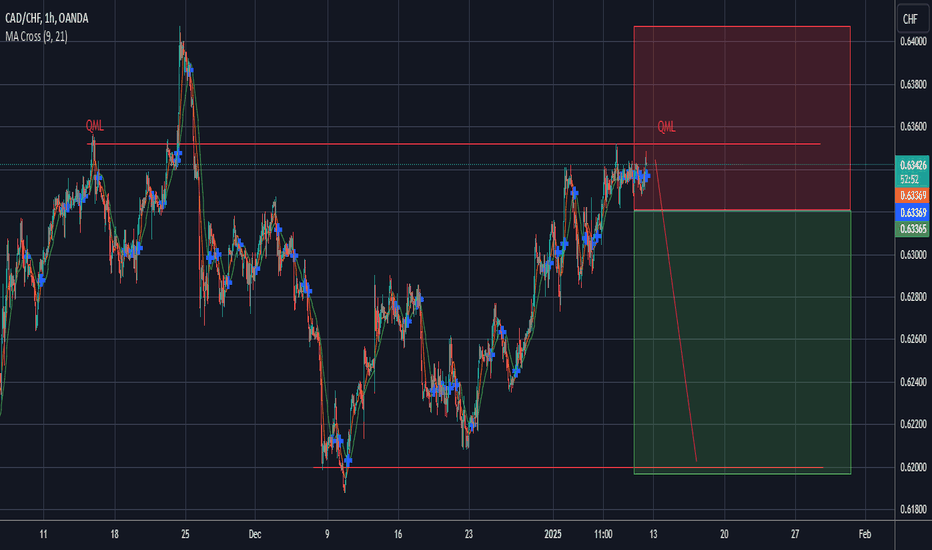

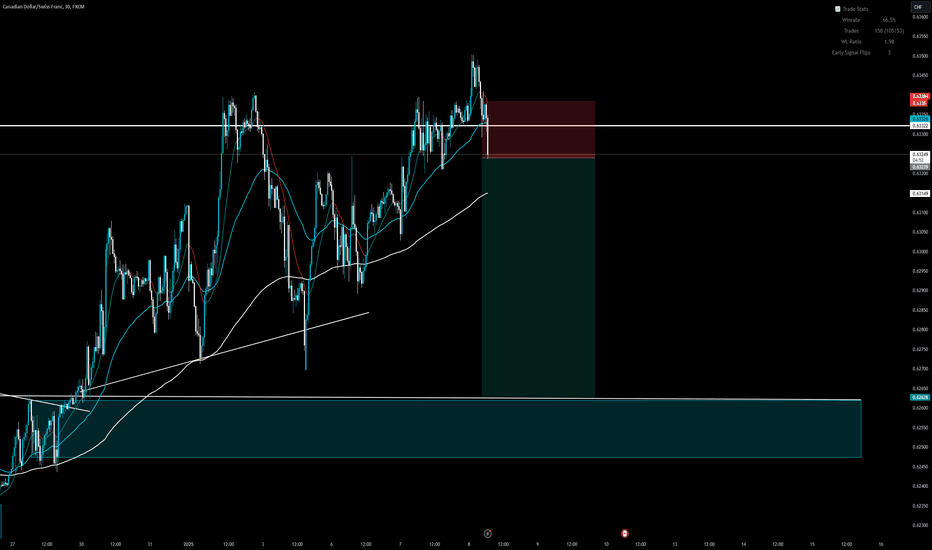

CAD/CHF SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

The BB upper band is nearby so CAD/CHF is in the overbought territory. Thus, despite the uptrend on the 1W timeframe I think that we will see a bearish reaction from the resistance line above and a move down towards the target at around 0.627.

✅LIKE AND COMMENT MY IDEAS✅

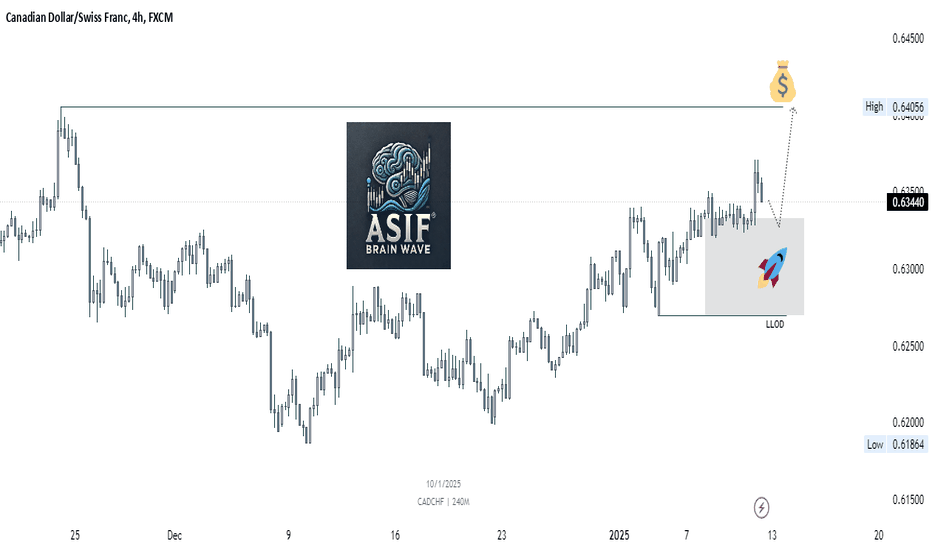

Buy Opportunity in CADCHFBuy Opportunity in CADCHF

Current Price Action: Observe the current price movement in CADCHF. Ensure the market is in a consolidation or retracement phase after a strong upward move, indicating potential for further upward movement.

Liquidity Pool: Identify a liquidity pool above the current price. This could be a significant swing high, a market structure level, or a large order block where there is likely to be a build-up of stop-loss orders and pending buy orders from institutional participants.

Entry Point:

Buy when price breaks above a key resistance level that is aligned with the liquidity pool (previous swing highs, order blocks, or major resistance zones).

Look for a small retracement or consolidation just below the liquidity zone to confirm strength before executing the buy.

Confirmation with Order Flow:

Watch for bullish order flow or an uptick in buying volume as price approaches the liquidity zone. If there is increased buying pressure, this could signal the accumulation phase has completed, and the price will likely move higher.

A break and close above the liquidity zone, combined with higher volume, can act as a strong confirmation for entering a buy.

Stop Loss:

Place a stop loss just below the recent swing low or consolidation area, ensuring a favorable risk-to-reward ratio.

Take Profit:

Set your target at the next significant resistance zone, liquidity pool, or Fibonacci extension levels above, depending on your desired risk-reward ratio.

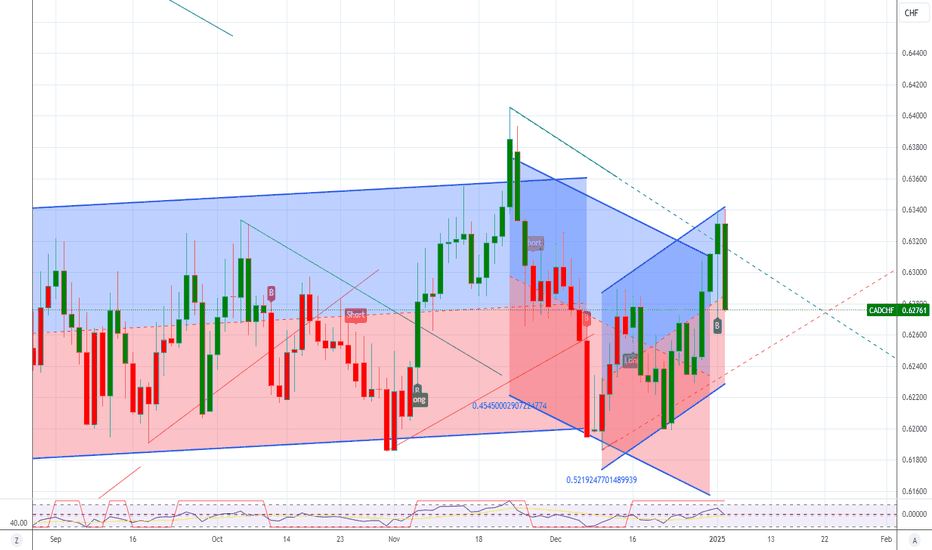

CADCHFAn old dog trying new tricks, this is what resembles the pattern called Quasimodo. Basically similar to Head and Shoulders but traded differently and unfolds like a correction. On Elliots waves, it could be the correction after an impulse breakout, the sellers on this one will be coming in, what do you see?

CADCHFIn lower timeframe guys, this pair is not looking direct, but the reason why I look this pair today is because of how higher timeframe looks like. When you look the 4H timeframe it is looking good as we already have a flat correction early on the move this, is the clear indication that volume has already been created for the push to the downside. If you are not interest on 4H entry you better wait for the price to give clear impulsive run, then wait a correction below the previous correction low.

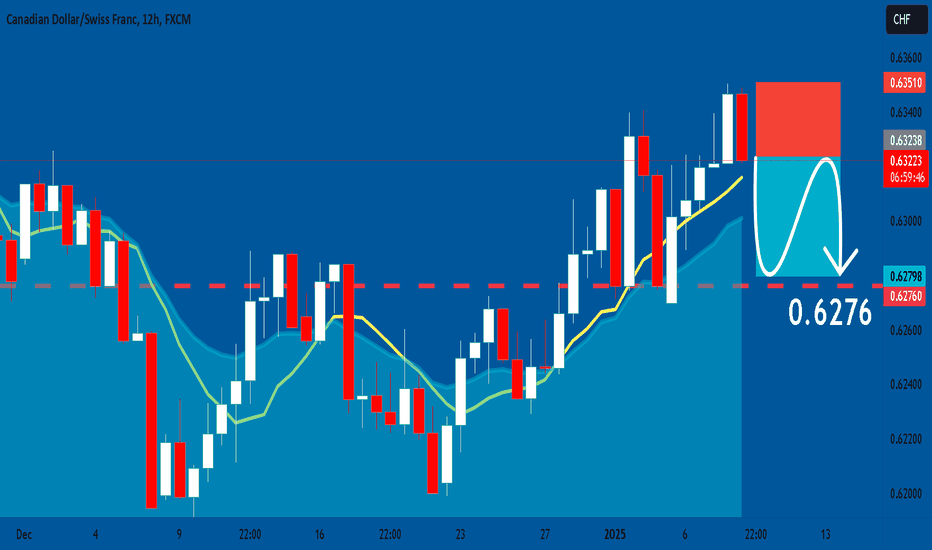

CADCHF: Short Signal with Entry/SL/TP

CADCHF

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short CADCHF

Entry Point - 0.6324

Stop Loss - 0.6351

Take Profit - 0.6276

Our Risk - 1%

Start protection of your profits from lower levels

❤️ Please, support our work with like & comment! ❤️

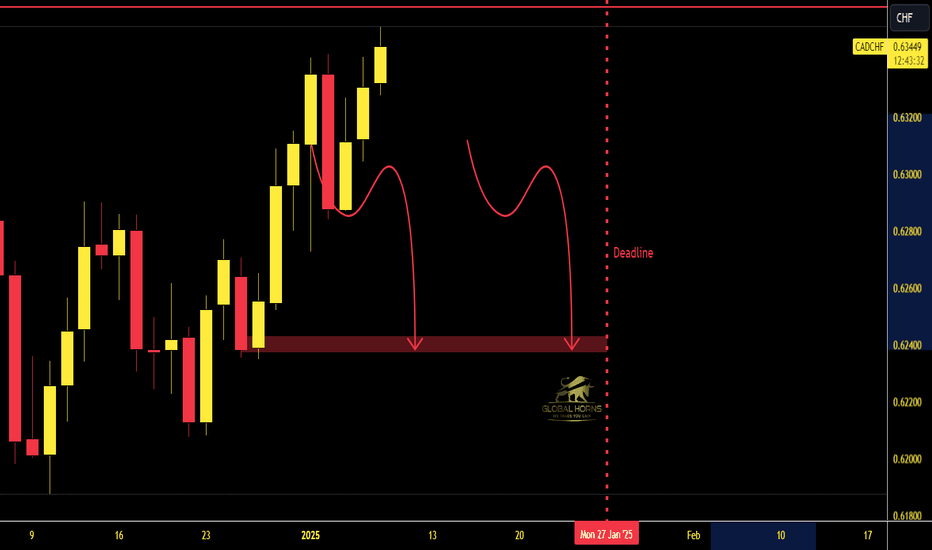

CADCHF, Sell - Deadline Jan 27thCAD/CHF Trade Setup

We’re seeing temporary strength in the Canadian Dollar due to businesses stockpiling ahead of anticipated trade restrictions and tariffs, along with political shifts like Trudeau’s resignation. However, this momentum is likely to fade as stockpiling slows, oil prices stabilize, and safe-haven demand for the Swiss Franc picks up.

The chart indicates potential rejection from resistance levels, with bearish price action signaling further downside. We anticipate CAD/CHF to revisit the key support zone around 0.62382 (Deadline Jan 27th) as market sentiment shifts.

Stay patient and manage risk as we hold the sell, looking for confirmation of continued weakness.

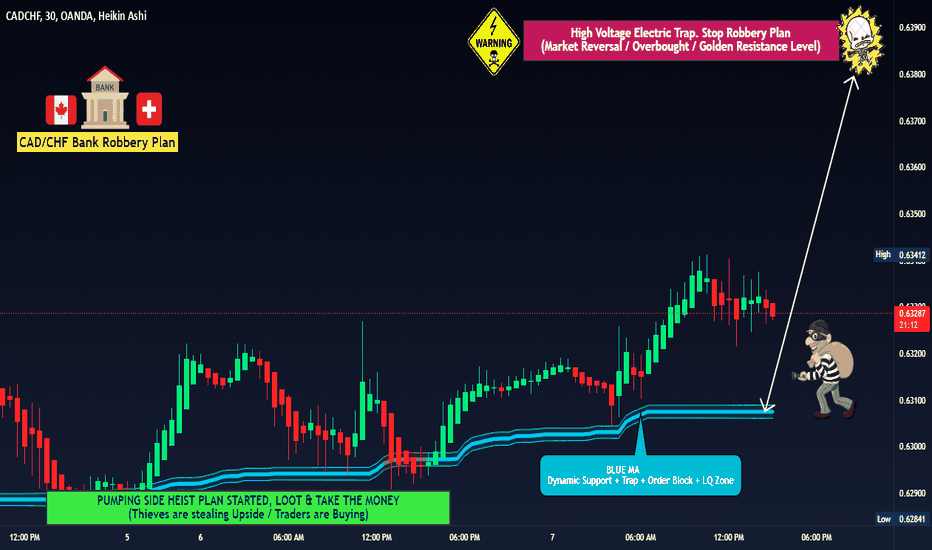

CAD/CHF "Canadian vs Swissy" Forex Market Heist Plan on Bullish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CAD/CHF "Canadian vs Swissy" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 Be wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade at any point,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 30min period, the recent / nearest low or high level.

Goal 🎯: 0.63900

Scalpers, take note : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

Based on the fundamental analysis, I would conclude that the CAD/CHF (Canadian Dollar/Swiss Franc) pair is : Bullish

Reasons:

Strong Canadian economy: Canada's economy is expected to grow at a rate of 2.0% in 2023, driven by a strong labor market, increasing business investment, and a rebound in the energy sector.

High interest rates: The Bank of Canada (BoC) has kept interest rates at a relatively high level of 1.75%, which is expected to support the Canadian dollar.

Commodity prices: Canada is a major exporter of commodities such as oil, gas, and metals, and increasing prices for these commodities are expected to support the Canadian dollar.

Swiss franc weakness: The Swiss franc has been weakening against other major currencies, due to the Swiss National Bank's (SNB) dovish monetary policy and the country's low interest rates.

Diverging monetary policies: The BoC and SNB have diverging monetary policies, with the BoC expected to keep interest rates high and the SNB expected to keep interest rates low, which could lead to a stronger Canadian dollar against the Swiss franc.

However, it's essential to consider the following risks:

Global economic slowdown: A slowdown in global economic growth could reduce demand for Canadian exports and impact the country's economic growth.

Trade tensions: Escalating trade tensions between Canada and other countries, particularly the US and China, could impact the country's trade balance and economic growth.

Oil price volatility: Canada's economy is heavily dependent on the energy sector, and oil price volatility could impact the Canadian dollar.

Market Sentiment:

Bullish sentiment: 70%

Bearish sentiment: 30%

Neutral sentiment: 0%

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

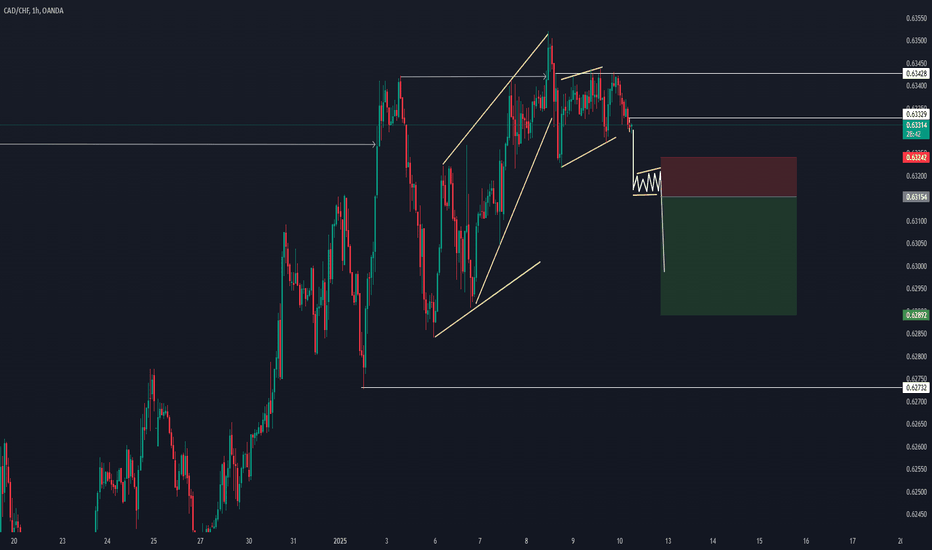

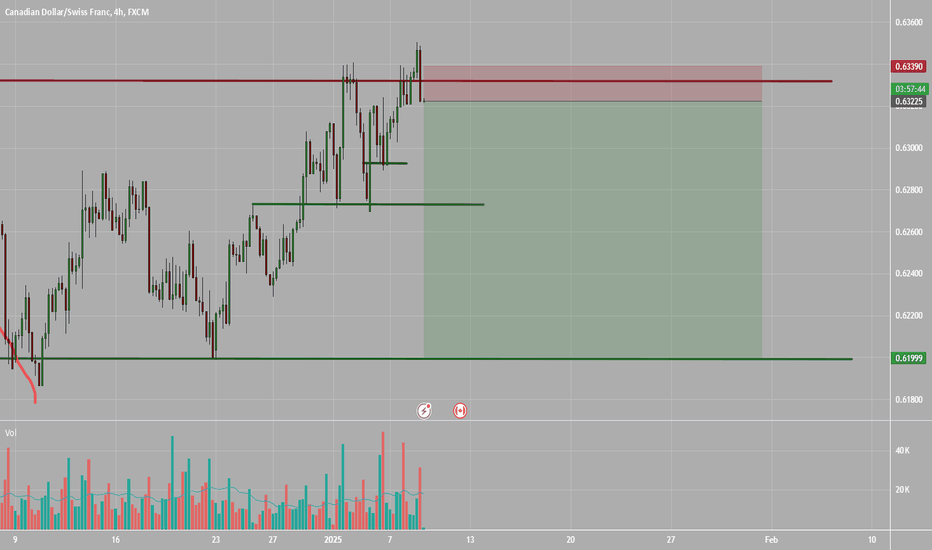

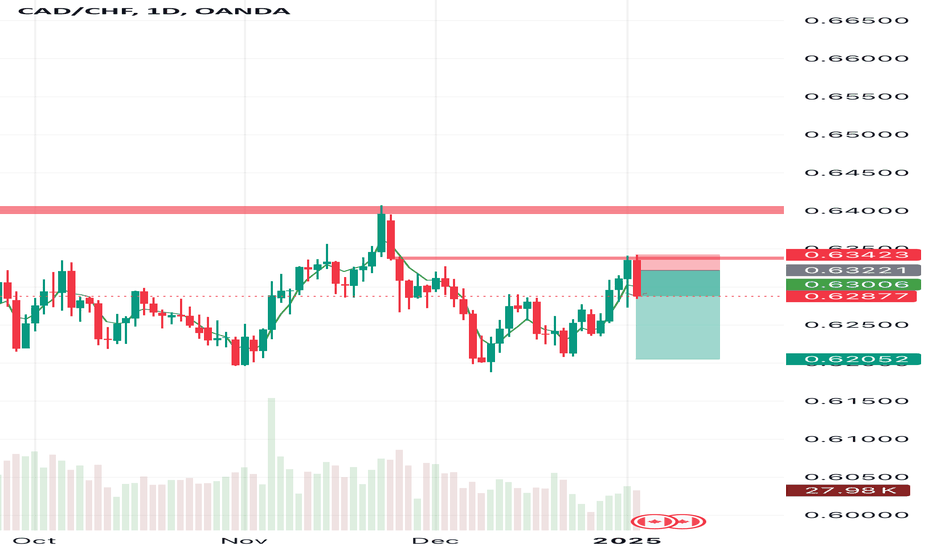

CAD/CHF Bearish Reversal Setup in Play The chart suggests a potential short setup based on the price's reaction to a resistance zone and the presence of a bearish order block. The trade appears to follow a risk-to-reward ratio strategy with a clear stop-loss and multiple take-profit levels defined below the current price.

Key Observations

1. Entry Zone: The short trade is initiated near 0.63230, around a resistance area.

2. Stop-Loss: Positioned at 0.64002, just above the recent highs, to minimize risk.

3. Take-Profit Levels:

First target: 0.62836 (close support).

Second target: 0.62458.

Final target: 0.62080, aligned with a strong demand zone.

4. Order Block: The highlighted zone indicates a bearish order block, signaling a potential reversal from the resistance level.

5. Momentum: The price is consolidating near the resistance, indicating a potential move downward, provided sellers gain control.

Strategic Implications:

Bearish Confirmation: Wait for a decisive bearish candle or rejection pattern before adding positions.

Risk Management: Maintain the stop-loss at 0.64002 to avoid overexposure to risk.

Profit Targets: Use scaling-out strategies at each take-profit level to lock in gains progressively.

This setup appears well-structured, with a high probability of success if the bearish bias plays out. However, traders should remain vigilant of false breakouts or sudden reversals.

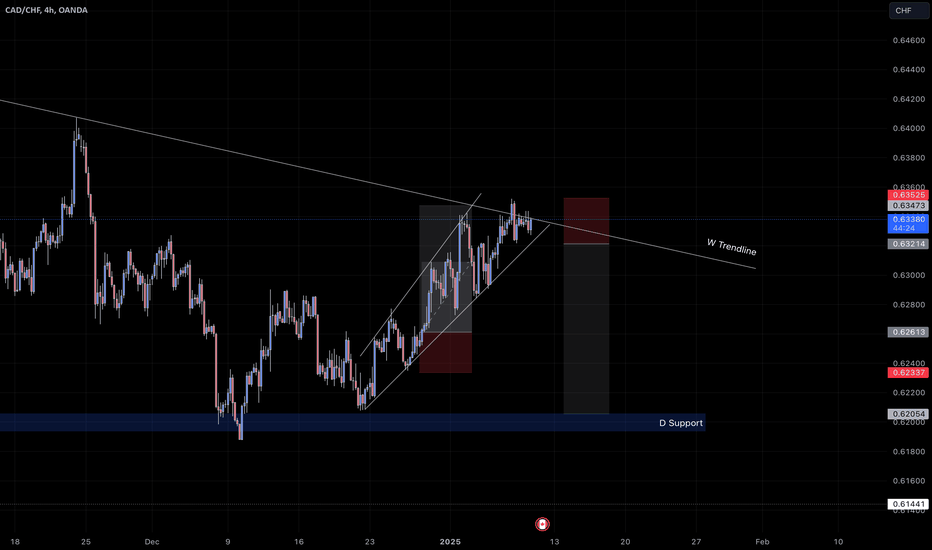

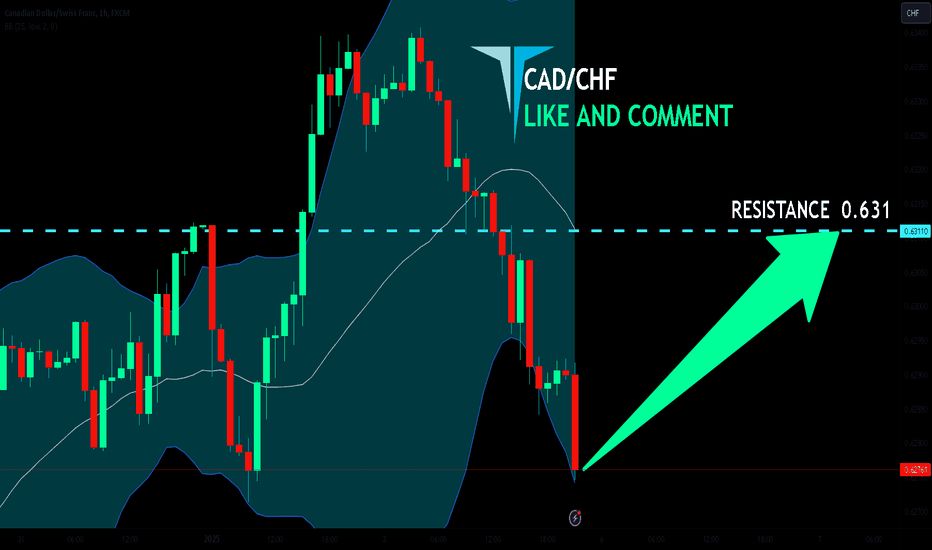

CAD/CHF BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

CAD/CHF is making a bearish pullback on the 1H TF and is nearing the support line below while we are generally bullish biased on the pair due to our previous 1W candle analysis, thus making a trend-following long a good option for us with the target being the 0.631 level.

✅LIKE AND COMMENT MY IDEAS✅

Potential bullish rise?CAD/CHF is reacting off the pivot which acts as a pullback support and could rise to the 1st resistance.

Pivot: 0.62795

1st Support: 0.61928

1st Resistance: 0.63967

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

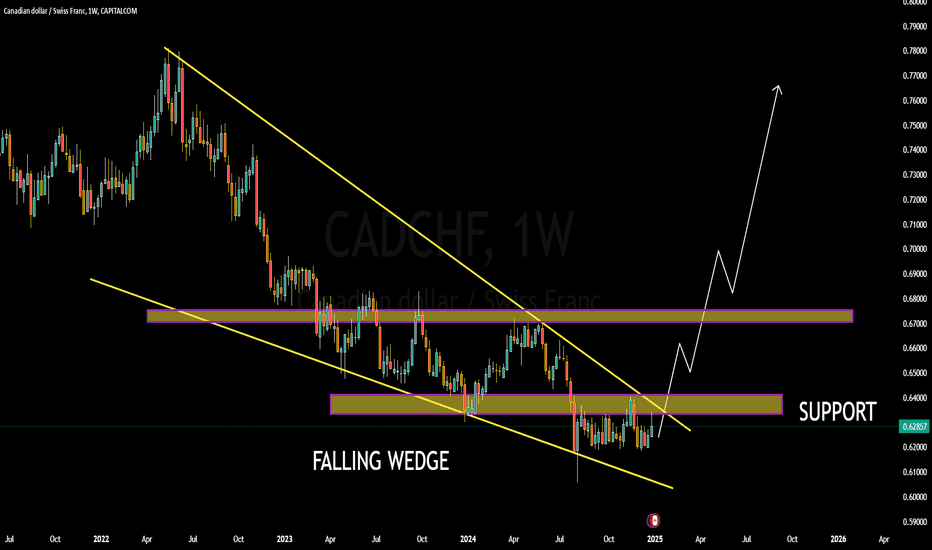

BULLISH SETUP IN CADCHF WITH 500PIPS+ POTENTIALThe CADCHF forex pair is currently trading at 0.62, with a target price set at 0.77, indicating a potential upward movement of over 500 pips. The chart pattern identified is a falling wedge, which is typically a bullish reversal pattern. This suggests that the price may soon break out upward, signaling a potential trend change. Before reaching the target price, the pair is expected to undergo retesting, a phase where the price revisits key support or resistance levels to confirm the breakout's validity. Traders should monitor the breakout zone closely, as it could trigger significant price momentum. Risk management is essential due to potential volatility during the breakout and retesting phase. The falling wedge provides a favorable risk-to-reward ratio, making it attractive for long trades. Patience is key as the pattern unfolds and confirms. Watching volume during the breakout will provide additional confirmation. Overall, the CADCHF setup offers a promising opportunity for traders targeting long-term gains.

CADCHF ____ INCOMING BEARISH MOVEHi there,

Price on this pair traded into a monthly FVG, went into a range (consolidation), created a false break upwards, and now, I would like to see price trade lower to take the sell-side liquidity.

This is a typical case of Accumulation, Manipulation and Distribution.

You can put this on your radar.

Cheers,

Jabari

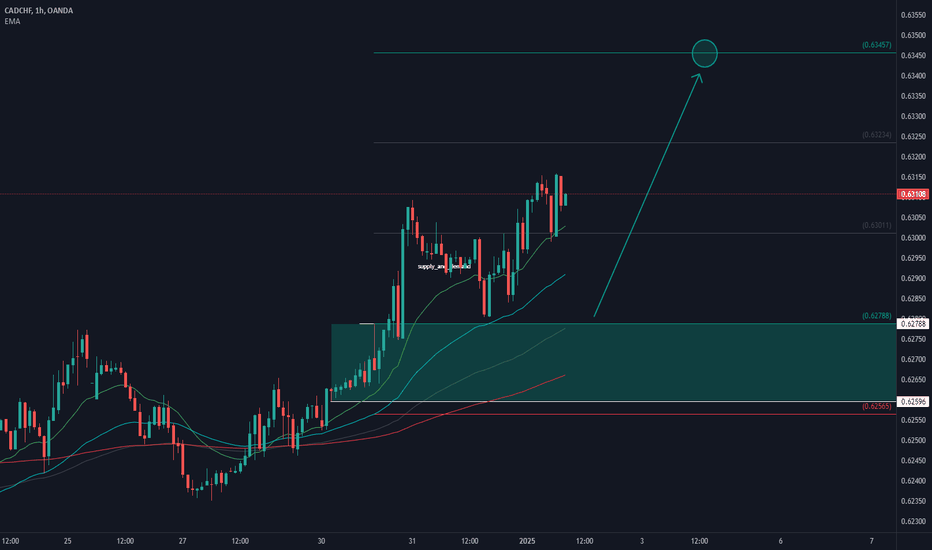

[Vienmelodic] CADCHF - 2 Jan 2025 SetupCADCHF Market structure are now in Bullish structure. Spotted demand area (Green Rectangle) and this area are breaking a new high so it the evidence of strong trend continuation.

Entry Position : Long

Profit Target : 1:3 Shown on the chart image (Green Line)

Stop Loss : Slightly below demand area (Red Line)

Follow me if u guys making any gains from this idea.

Thanks

Vienmelodic

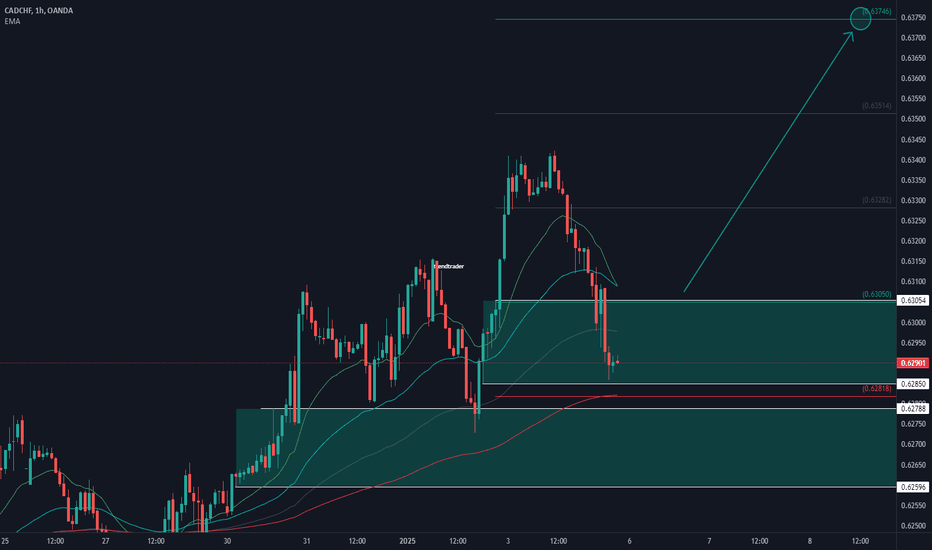

[Vienmelodic] CADCHF - 3 Jan 2025 SetupCADCHF Market structure are making Bullish breakout once again. Spotted demand area (Green Rectangle) near our last worked area. this is the second demand area since we already got profits 1:3 on yesterday's setup

Entry Position : Long

Profit Target : 1:3 Shown on the chart image (Green Line)

Stop Loss : Slightly below demand area (Red Line)

Follow me if u guys making any gains from this idea.

Thanks

Vienmelodic