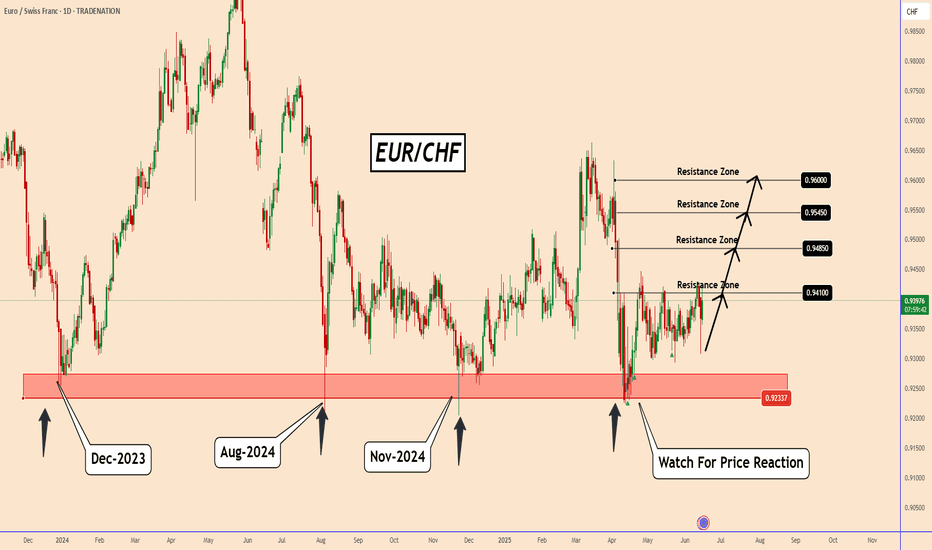

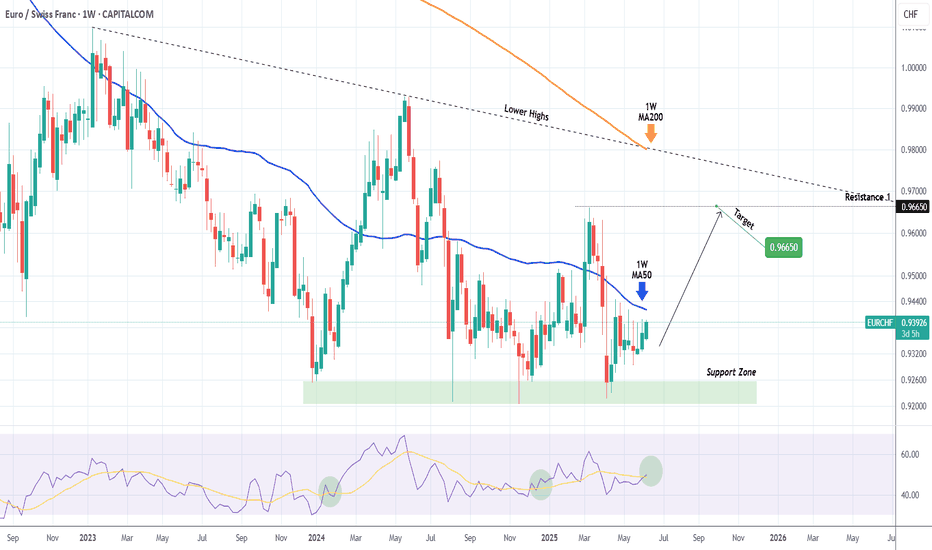

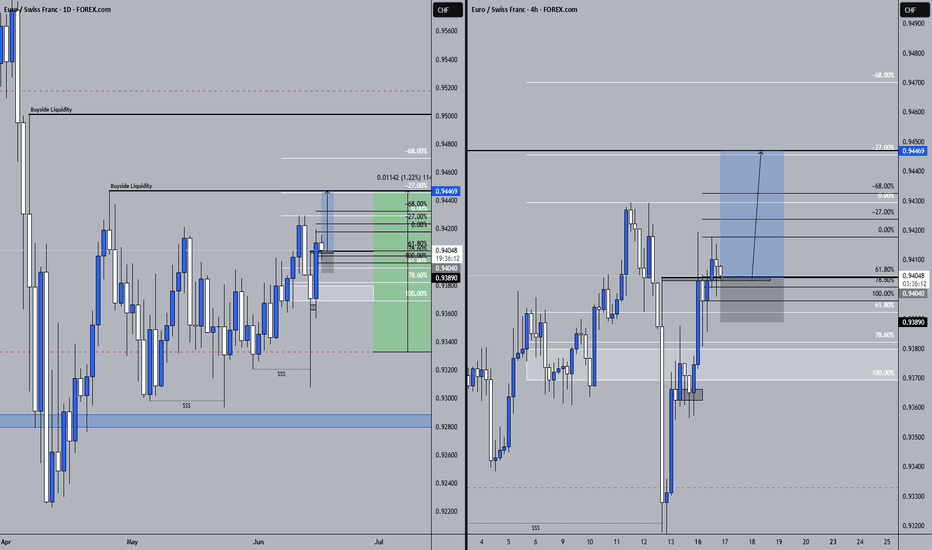

EURCHF: Get Ready For Another Bullish Movement -UpdateEURCHF: Get Ready For Another Bullish Movement -Update

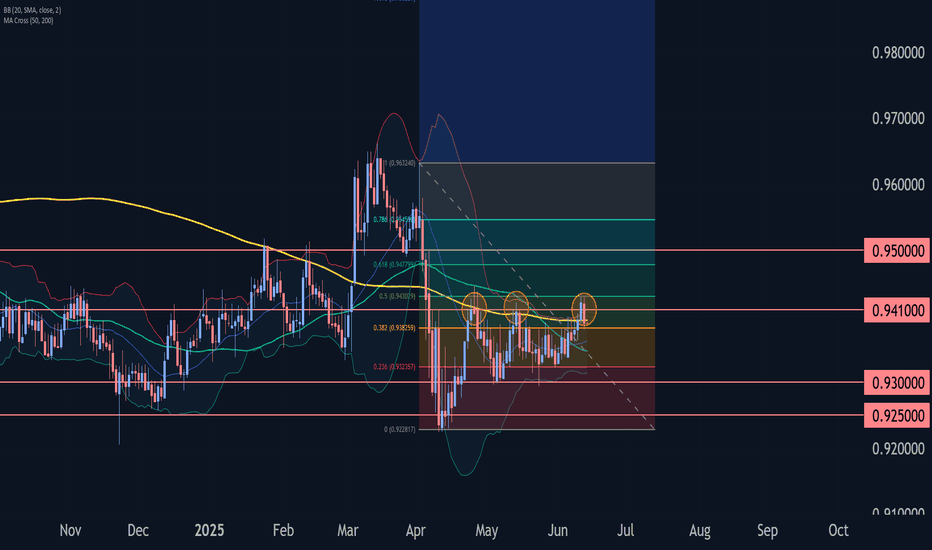

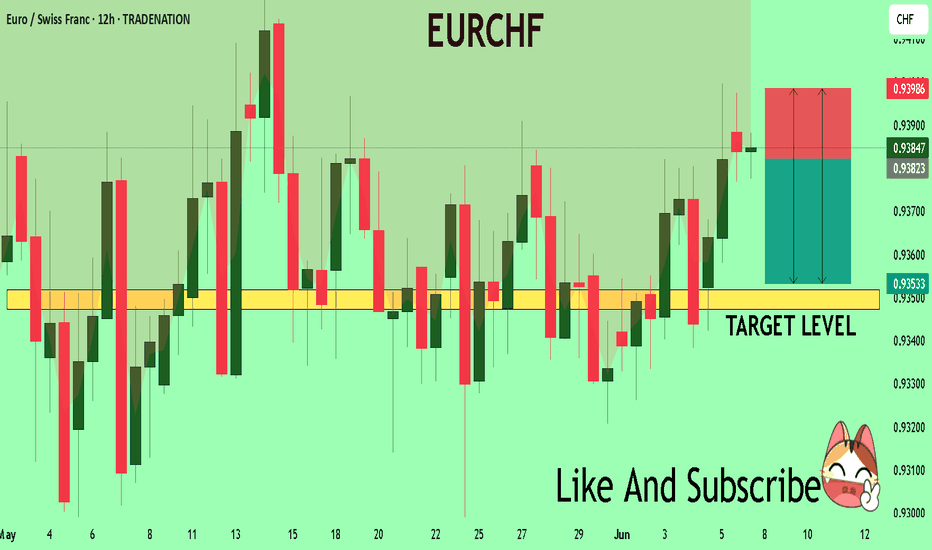

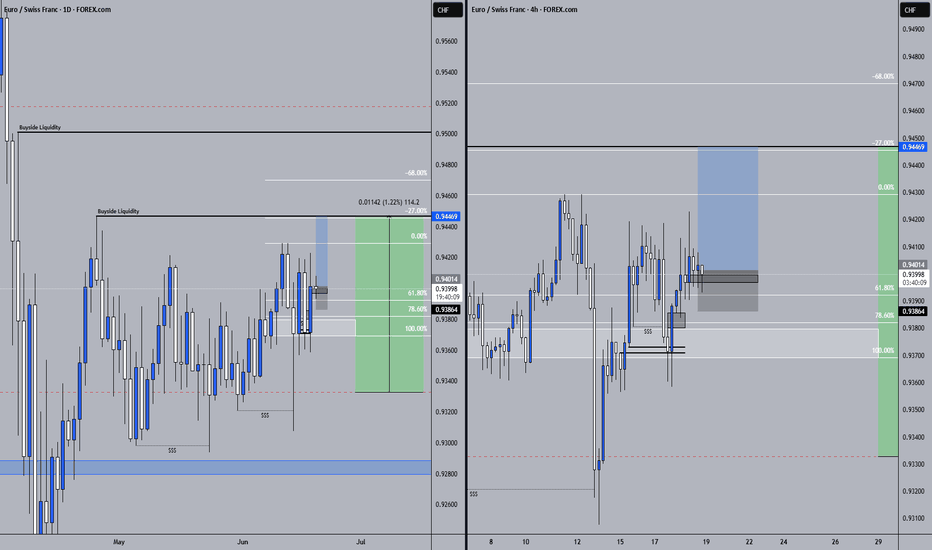

The EURCHF pair has tested a major support zone for the fourth time since December 2023.

This level also marks the lowest price in years.

If this support holds, EURCHF could rebound towards key resistance levels: 0.9410, 0.9425, 0.9485, 0.9545, and 0.9600.

✅On Thursday, the Swiss National Bank (SNB) will announce its latest interest rate decision, with expectations pointing to a 25 basis point cut, bringing rates down to 0%.

This move could put the Swiss franc (CHF) at a significant disadvantage against other major currencies, many of which still maintain relatively high interest rates. However, the extent of CHF weakness remains uncertain, as broader monetary policy and market sentiment will play a crucial role.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CHFEUR trade ideas

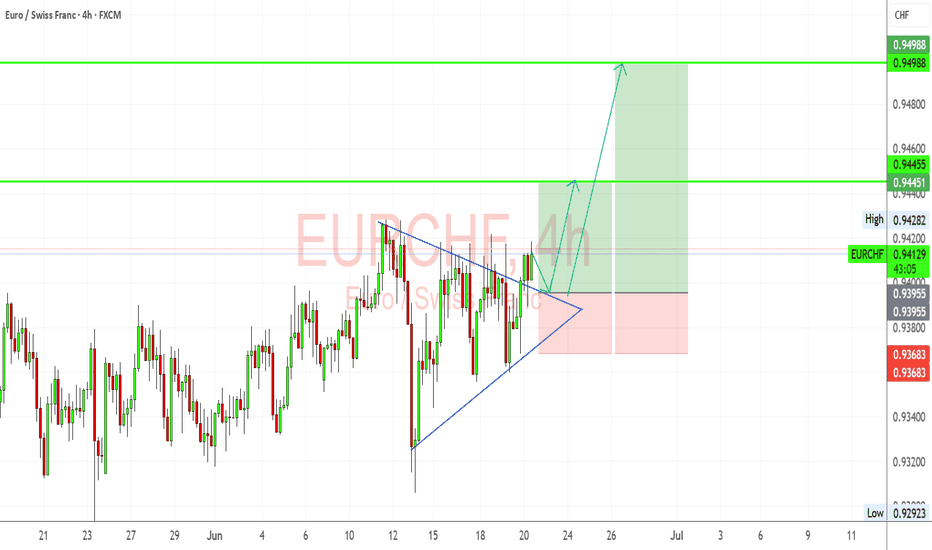

EURCHF Analysis – “Euro Inches Higher, But Safe-Haven CHF LurksEURCHF is breaking out from a symmetrical triangle, indicating potential bullish momentum.

Key resistances to watch:

0.9445 – local swing high

0.9498 – potential measured target from the triangle breakout

Entry on retest of the triangle may offer a favorable risk-reward opportunity.

However, upside could be capped if CHF regains strength.

Structure Bias: Bullish breakout, confirmation needed with a clean retest and sustained move above 0.9440

📊 Current Bias: Cautiously Bullish

🧩 Key Fundamentals Driving EURCHF

EUR Side (Neutral to Slightly Bearish):

ECB remains cautious: June’s Economic Bulletin showed soft patches in core inflation and weak consumer activity.

German & French PMIs are mixed; services weaker than expected.

Political uncertainty (France snap elections) weighs on EUR sentiment in the medium term.

CHF Side (Fundamentally Stronger):

SNB is cautious but hawkish: Monetary policy assessment showed a steady hand, maintaining rates with no clear signal of easing.

Safe-haven flows persist due to:

Middle East risk (Israel–Iran escalation)

Russia–Ukraine tensions

Weak equity sentiment

CHF remains supported on global risk aversion, even with SNB standing pat.

⚠️ Risks That May Reverse or Accelerate Trend

Breakout fails to hold → Bearish fakeout leads to drop toward 0.9290 again

Renewed CHF strength from geopolitical shocks

Eurozone political turbulence (especially France & ECB doves)

🗓️ Important News to Watch

🇨🇭 Swiss CPI, SNB statements

🇪🇺 Eurozone PMI Flash (June 21), CPI (June 28), and political updates

Global market risk sentiment (VIX, bonds, oil, Iran/Israel news)

🏁 Which Asset Might Lead the Broader Move?

EURCHF is lagging behind EURUSD and USDCHF, but provides clean geopolitical risk signals. If markets stabilize, this pair has upside potential. However, if fear returns, CHF may quickly regain control, trapping long trades.

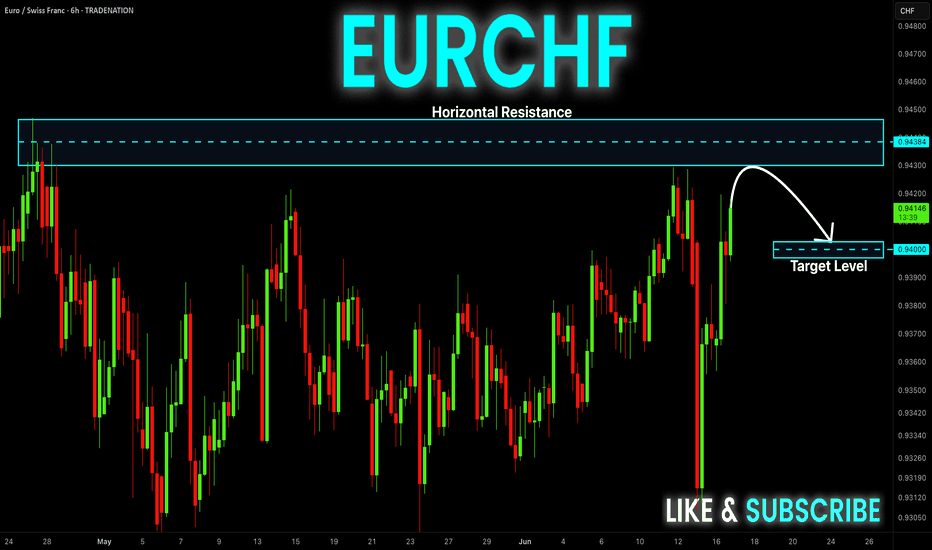

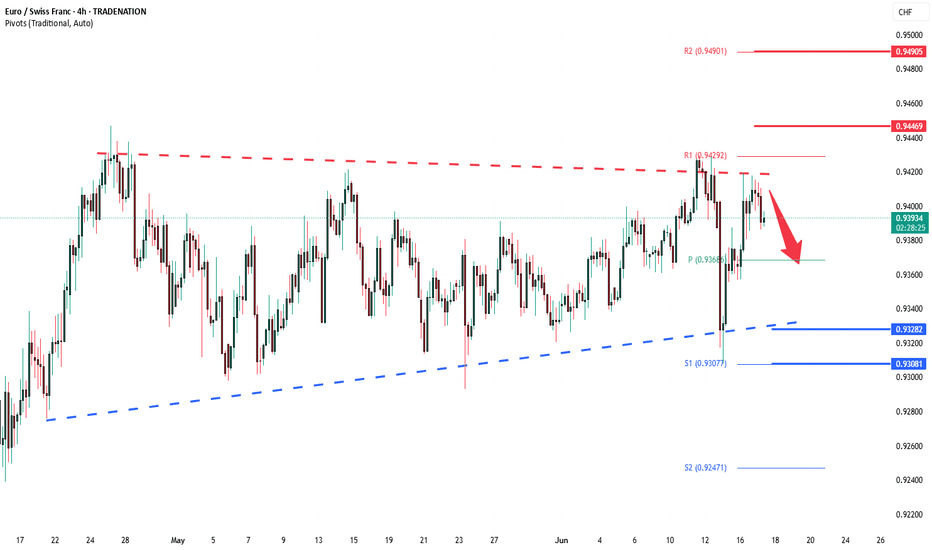

EUR-CHF Resistance Ahead! Sell!

Hello,Traders!

EUR-CHF keeps growing

But a strong horizontal

Resistance of 0.9445

Is ahead so after the

Retest we will be expecting

A local bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

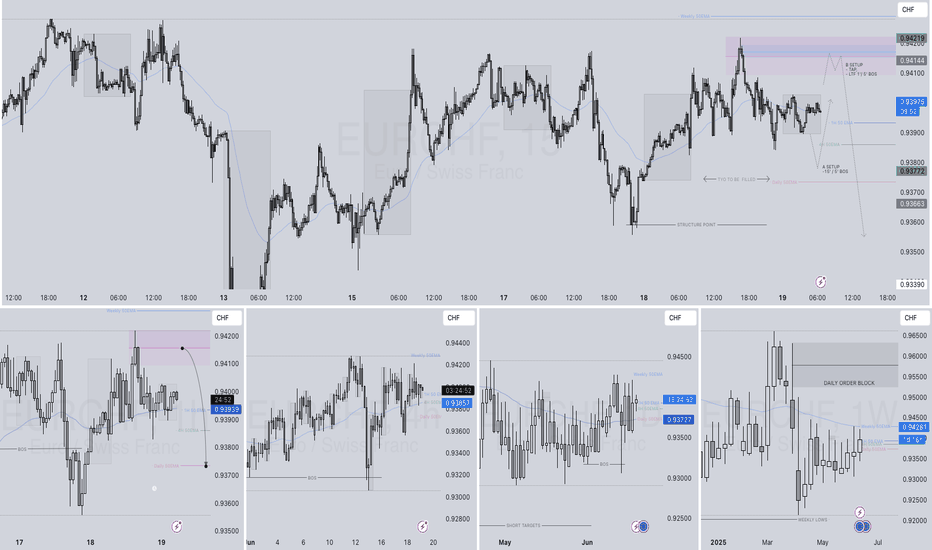

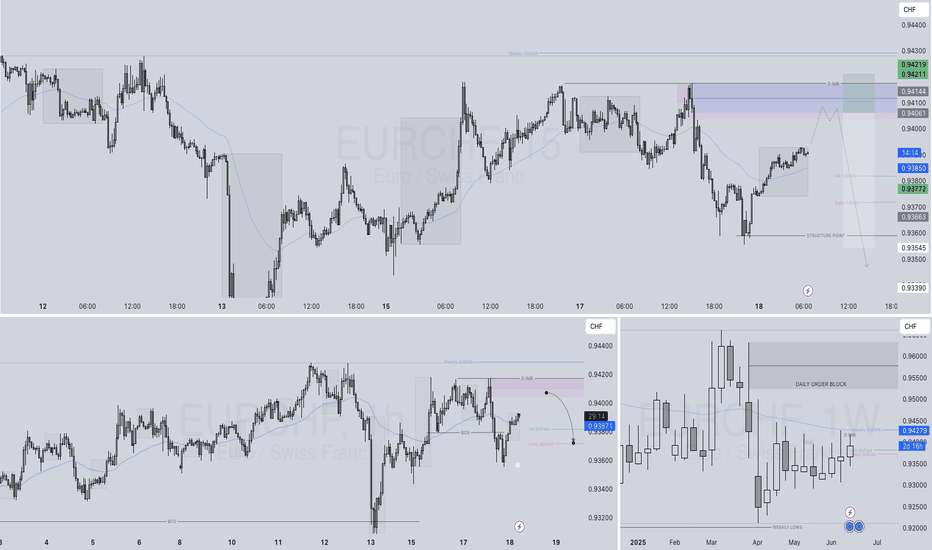

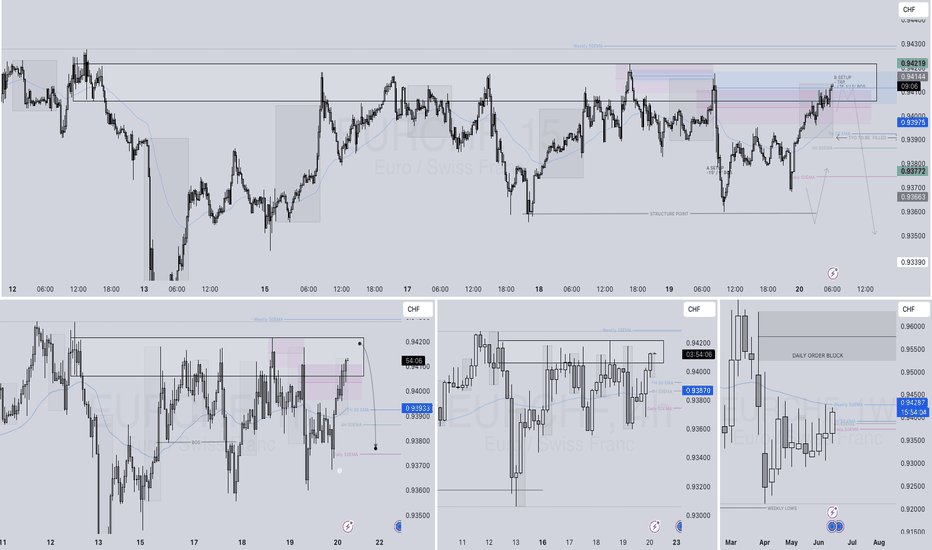

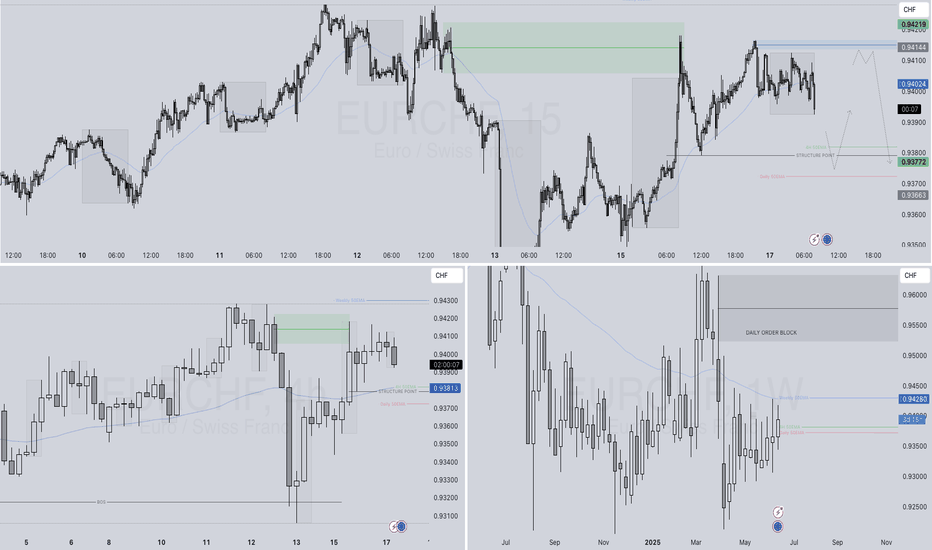

EURCHF SHORT FORECAST Q2 W25 D19 Y25EURCHF SHORT FORECAST Q2 W25 D19 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly 50EMA Rejection

✅15' Order block

✅1H Order Block

✅Intra day bearish BOS

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURCHF SHORT FORECAST Q2 W25 D18 Y25EURCHF SHORT FORECAST Q2 W25 D18 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly 50EMA Rejection

✅15' Order block

✅1H Order Block

✅Intra day bearish BOS

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURCHF SHORT FORECAST Q2 W25 D20 Y25EURCHF SHORT FORECAST Q2 W25 D20 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly 50EMA Rejection

✅15' Order block

✅1H Order Block

✅4H Highs

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

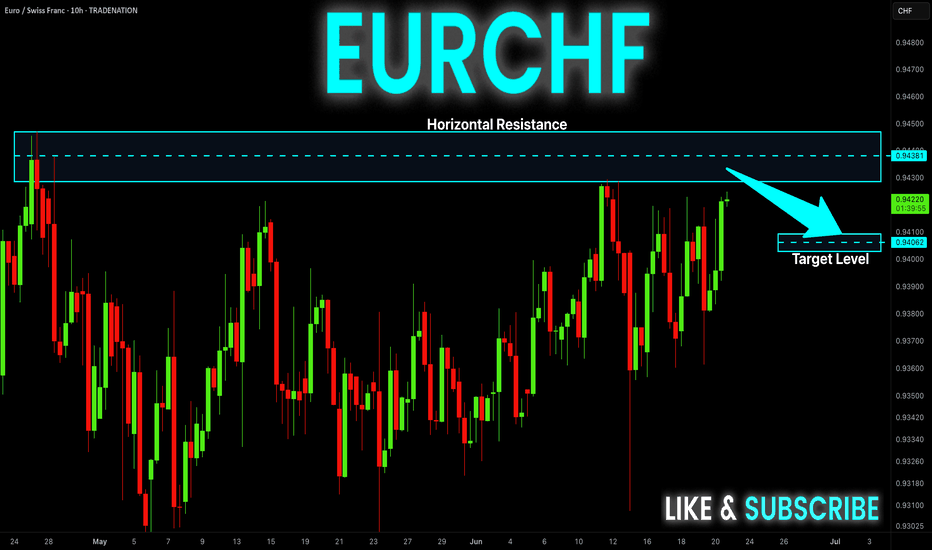

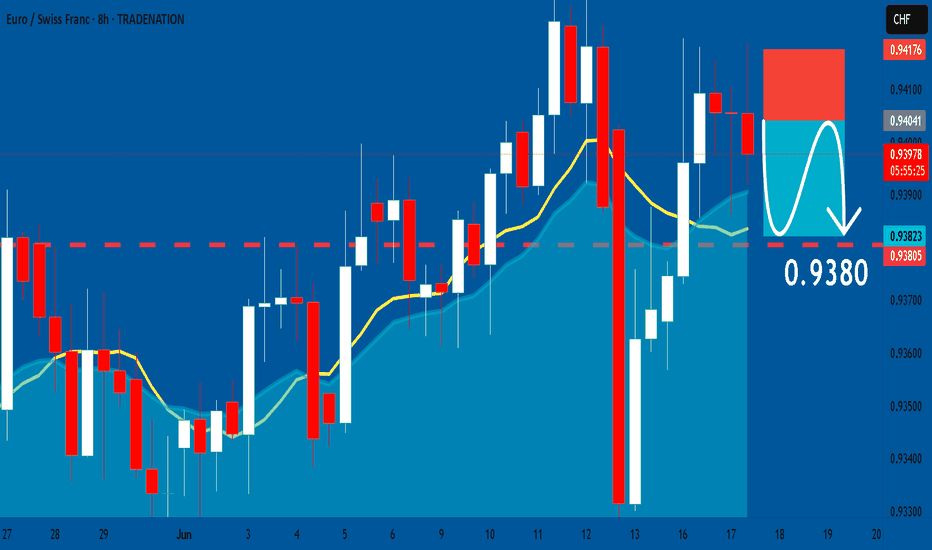

EURCHF sideways consolidation capped at 0.9430Trend Overview:

EUR/CHF continues to display a bearish trend, with current price action forming a corrective pullback against the broader downward momentum.

Key Resistance Level:

0.9430 – This is a significant previous intraday consolidation zone and currently acts as a pivotal resistance level.

Bearish Scenario (Primary Bias):

A short-term oversold rally into the 0.9430 level followed by a bearish rejection would reinforce the dominant downtrend.

Downside price targets include:

0.9370 – Initial support zone.

0.9330 – Mid-term support level.

0.9300 – Long-term structural support.

Bullish Scenario (Invalidation):

A confirmed breakout and daily close above 0.9430 would invalidate the current bearish bias.

This would open the path for a continuation toward:

0.9446 – Immediate resistance.

0.9490 – Key upper resistance and possible trend reversal confirmation level.

Conclusion:

EUR/CHF remains in a bearish structure, with the corrective pullback offering potential short entries if price is rejected at 0.9430. A failure to break this level would likely drive the pair lower toward 0.9300. However, a sustained move above 0.9430 would shift sentiment to bullish in the short term and open space for further upside toward 0.9490.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Trade Idea: EUR/CHF Short-Term Buy

**Why Buy EUR/CHF?**

**Euro (EUR):**

* Getting stronger as the USD weakens.

* Risk mood in the market is better, helping the euro.

* The ECB isn’t hiking rates, but they’re not cutting soon either.

**Swiss Franc (CHF):**

* Gained a bit on fear, but the SNB surprised by cutting rates to 0%.

* They may cut again — very dovish.

* Inflation in Switzerland is low and growth is slow.

**Overall Sentiment:**

* The euro is holding steady.

* CHF is soft due to the SNB’s dovish tone.

---

### **Outlook:**

This isn’t a strong breakout setup — more of a slow climb. But the fundamentals lean slightly in favor of the euro over the franc right now. If market risk stays calm, EUR/CHF could continue to edge up.

---

**Note:**

> *“Not the strongest setup, but the euro looks a bit better here. Worth watching if it keeps trending up slowly.”*

---

EURCHF Bullish break-out signal above the 1W MA50.The EURCHF pair has rebounded on its 1.5-year Support Zone. A break above its 1W MA50 (blue trend-line) is a bullish break-out signal that would target Resistance 1 at 0.96650. That is where it can potentially make contact with the 1W MA200 (orange trend-line) for the first time since March 01 2021.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

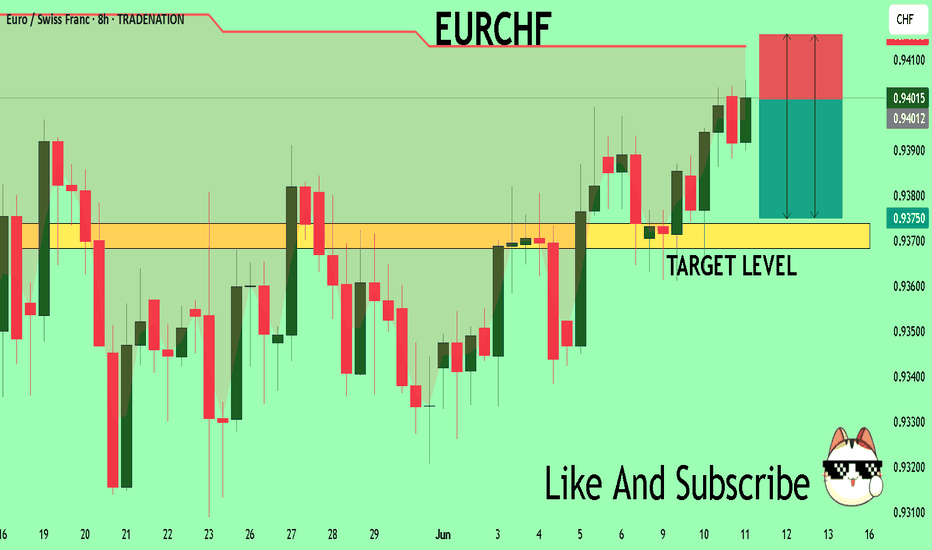

EURCHF Wave Analysis – 12 June 2025- EURCHF reversed from the resistance zone

- Likely to fall to support level 0.9300

EURCHF currency pair recently reversed down from the resistance zone between the key resistance level 0.9410 (which has been reversing the price from April), the upper daily Bollinger Band and the 50% Fibonacci correction of the downward impulse from April.

The downward reversal from this resistance zone stopped the (c)-wave of the previous ABC correction ii.

Given the overbought daily Stochastic, EURCHF currency pair can be expected to fall to the next support level 0.9300 (which stopped earlier waves b and ii).

EURCHF: Will Keep Falling! Here is Why:

The analysis of the EURCHF chart clearly shows us that the pair is finally about to tank due to the rising pressure from the sellers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURCHF Will Collapse! SELL!

My dear friends,

Please, find my technical outlook for EURCHF below:

The price is coiling around a solid key level - 0.9401

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 0.9373

Safe Stop Loss - 0.9415

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

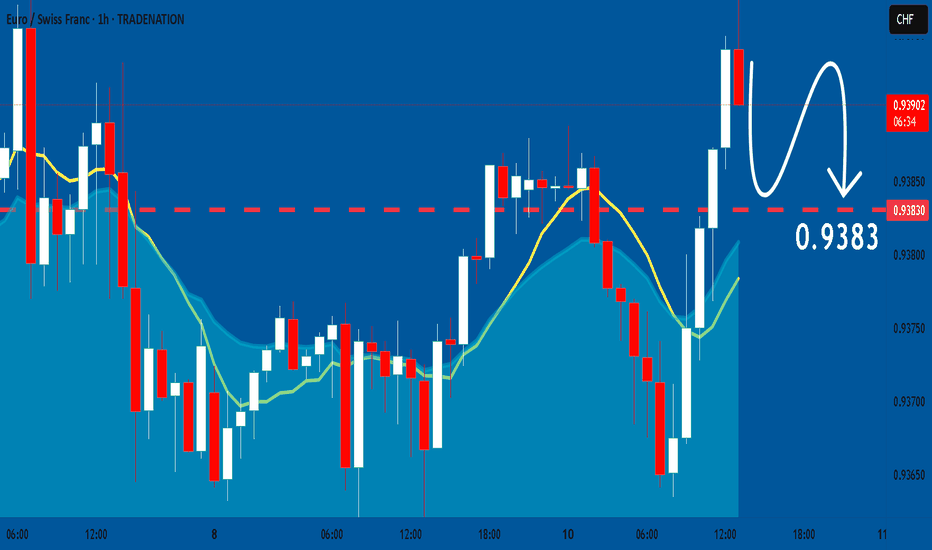

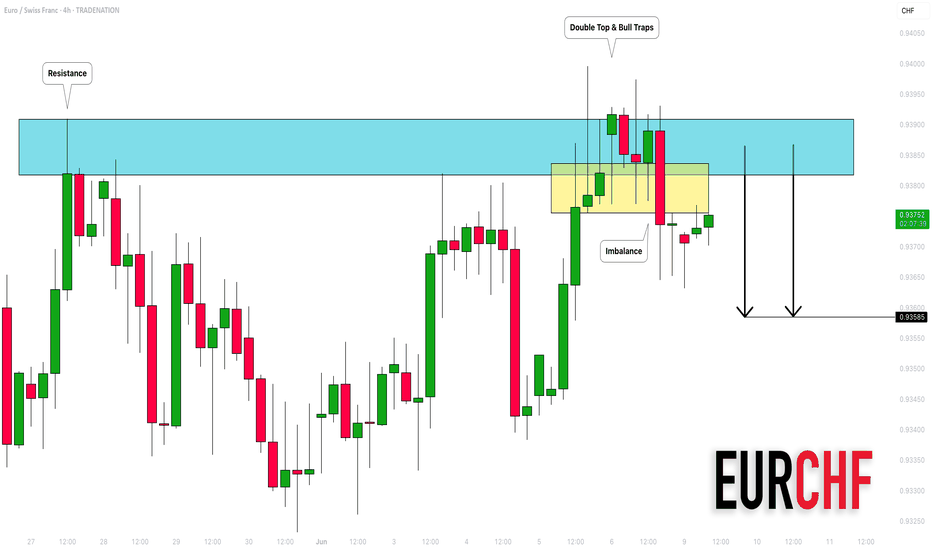

EURCHF: Pullback From Resistance Confirmed 🇪🇺🇨🇭

EURCHF may pull back from the underlined resistance today.

As a confirmation, I spotted a double top pattern after a test

of a key intraday resistance and a violation of its neckline with

a high momentum bearish candle on Friday.

Goal - 0.93585

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-CHF Local Short! Sell!

Hello,Traders!

EUR-CHF is making a rebound

And will soon hit a horizontal

Resistance level of 0.9400

From where we will be

Expecting a local bearish

Pullback and a move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURCHF Buyers In Panic! SELL!

My dear friends,

My technical analysis for EURCHF is below:

The market is trading on 0.9383 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 0.9351

Recommended Stop Loss - 0.9398

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EUR-CHF Resistance Ahead! Sell!

Hello,Traders!

EUR-CHF keeps growing

But a strong horizontal

Resistance level is ahead

Around 0.9443 so after

The retest we will be

Expecting a local pullback

And a local bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

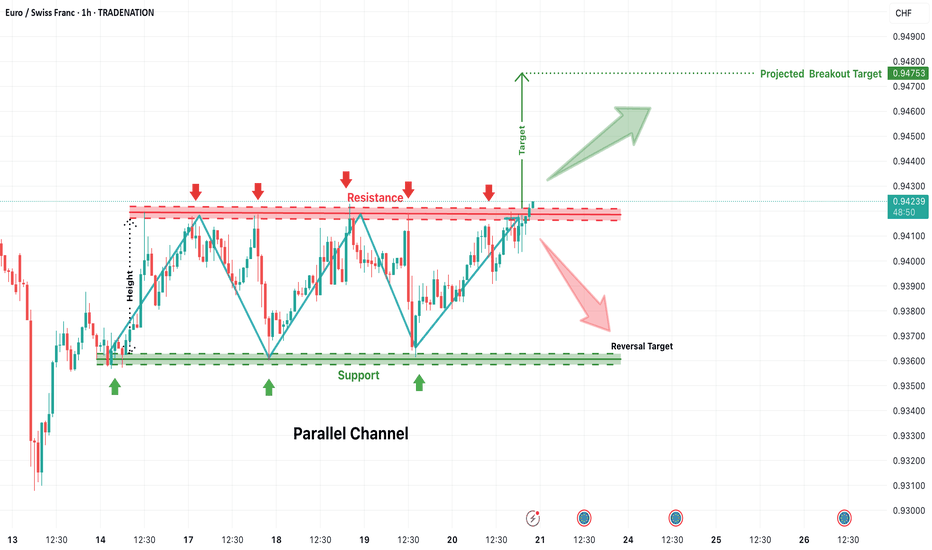

EUR/CHF Parallel Channel Breakout WatchThe EUR/CHF pair has been trading within a well-defined parallel channel on the 1-hour timeframe. The price action is contained between a strong resistance zone near 0.9420–0.9425 (marked in red) and a support zone near 0.9365–0.9370 (marked in green). Multiple rejections from both the top and bottom of the range indicate solid market structure and participation from both buyers and sellers.

This type of formation often leads to explosive moves when the price eventually breaks out of the consolidation range. The current chart shows price testing the upper boundary of the channel once again, and now attempting a bullish breakout.

📈 Bullish Breakout Scenario

If the price sustains above the resistance zone (confirmed breakout), we could see a continuation of bullish momentum toward the projected breakout target near 0.9475. This target is calculated using the height of the channel added to the breakout level, a classic price projection method. A strong candle close above the resistance with volume would validate this move. Traders may look for long entries on breakout confirmation or on a successful retest of the resistance zone as new support.

📉 Bearish Reversal Scenario

However, if the breakout fails and price gets rejected again from the red zone, a sharp reversal back toward the support zone around 0.9370 may occur. This would keep the channel intact and suggest continued range-bound movement. A breakdown below support would then be required for further bearish confirmation, leading toward deeper downside targets.

This setup provides a high-probability opportunity in either direction with clearly defined levels and structure. Wait for breakout confirmation before entering to avoid false moves.

=================================================================

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

=================================================================

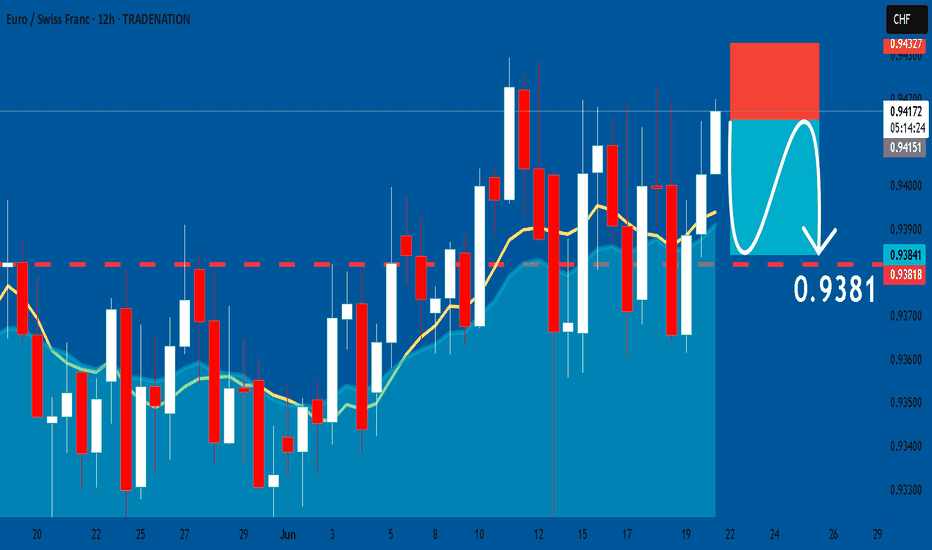

EURCHF: Bearish Continuation & Short Trade

EURCHF

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short EURCHF

Entry Point - 0.9414

Stop Loss - 0.9432

Take Profit - 0.9381

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

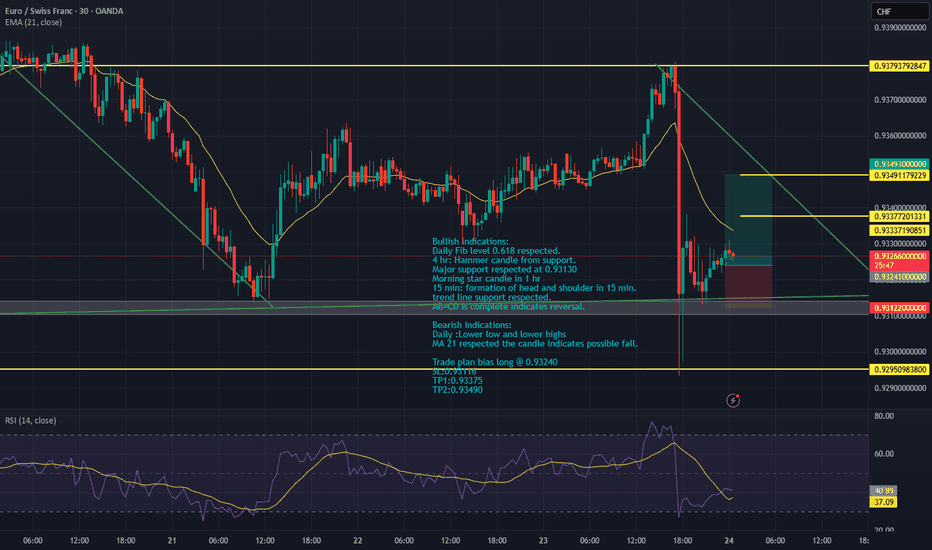

EURCHF -bias long Bullish indications:

Daily Fib level 0.618 respected.

4 hr: Hammer candle from support.

Major support respected at 0.93130

Morning star candle in 1 hr

15 min: formation of head and shoulder in 15 min.

trend line support respected.

AB=CD is complete indicates reversal.

Bearish indications:

Daily :Lower low and lower highs

MA 21 respected the candle indicates possible fall.

Trade plan bias long @ 0.93240

SL:0.93116

TP1:0.93375

TP2:0.93490

EURCHF: Bearish Continuation & Short Signal

EURCHF

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short EURCHF

Entry Point - 0.9403

Stop Loss - 0.9417

Take Profit - 0.9380

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURCHF SHORT FORECAST Q2 W25 D17 Y25EURCHF SHORT FORECAST Q2 W25 D17 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly 50EMA Rejection

✅15' Order block

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X