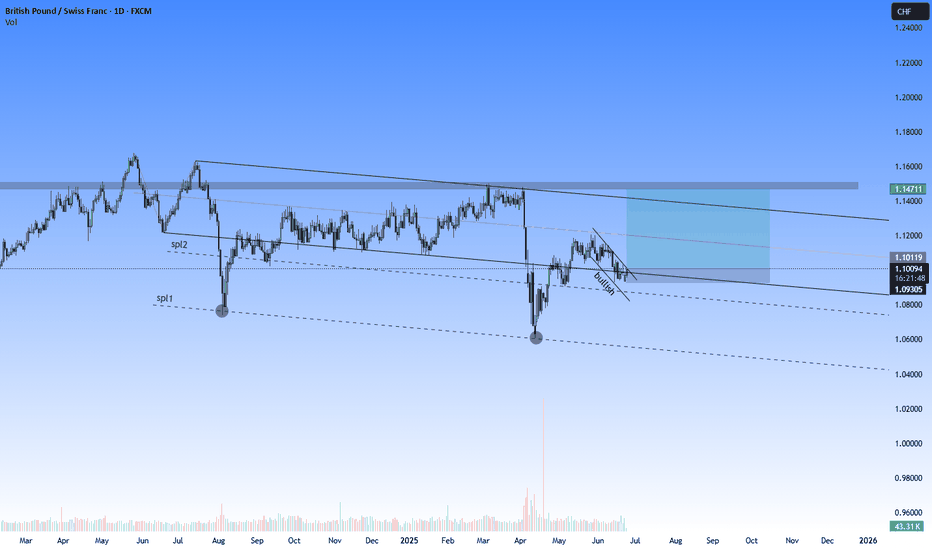

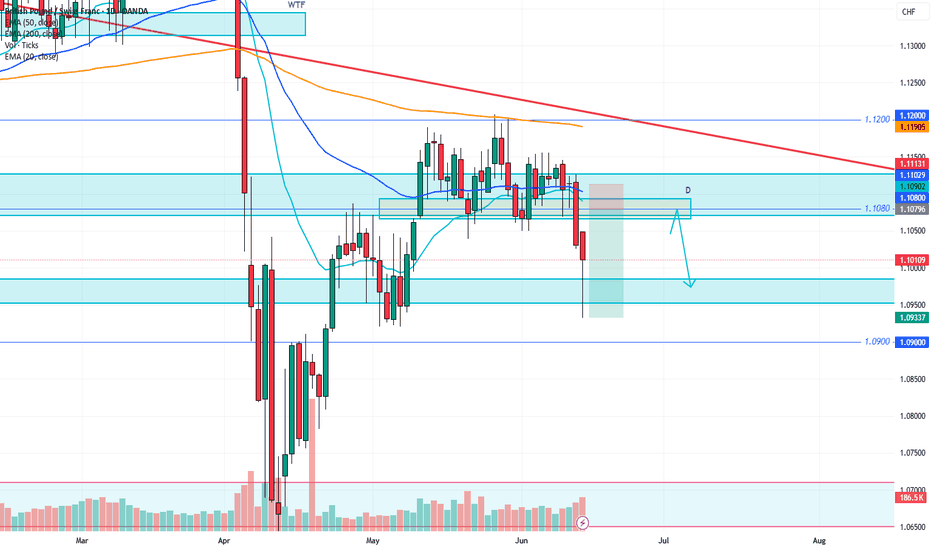

GBPCHF Rising Wedge bearish breakout The GBP/CHF currency pair is currently exhibiting a bearish sentiment, aligned with the broader downtrend. Recent price action shows the market is in a sideways consolidation phase, indicating a potential pause before the next directional move.

Key Trading Level: 1.1230

This level marks a prior intraday consolidation zone and serves as a critical resistance area within the current trend context.

Bearish Scenario (on rejection from 1.1230):

A failed test of 1.1230 resistance would likely reinforce bearish momentum.

Downside support targets include:

1.1100 – Initial support

1.1050 – Next structural support

1.0980 – Long-term bearish target

Bullish Scenario (on breakout above 1.1230):

A confirmed breakout and daily close above 1.1230 would invalidate the bearish structure.

In that case, potential upside targets include:

1.1300 – Key resistance level

1.1370 – Higher resistance from previous reversal zones

Conclusion

The medium-term outlook for GBP/CHF remains bearish, with 1.1230 acting as a decisive pivot level. As long as price stays below this threshold, downside continuation toward 1.1100 and beyond remains favored. However, a clear breakout above 1.1230 on a daily closing basis would shift the sentiment and open the door for a bullish correction toward 1.1300–1.1370. Traders should monitor the 1.1230 level closely for directional confirmation.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

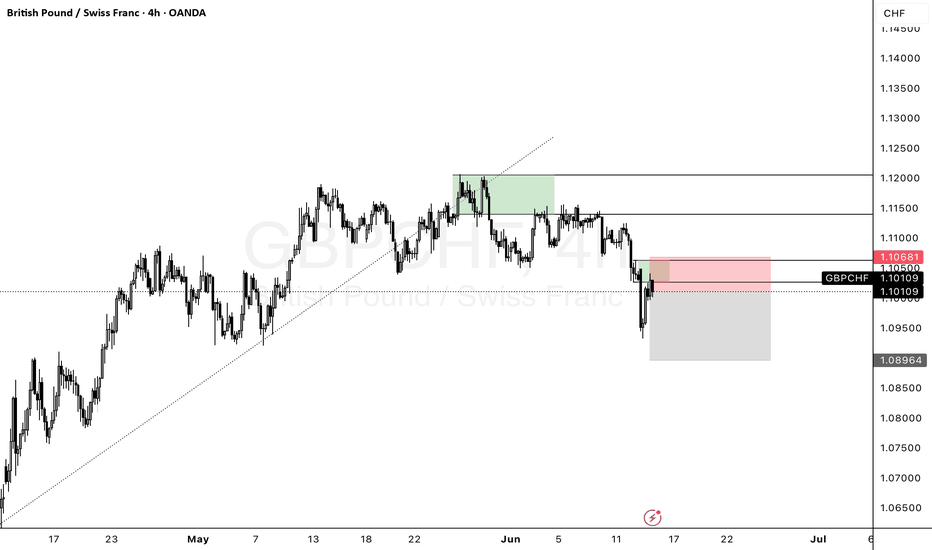

CHFGBP trade ideas

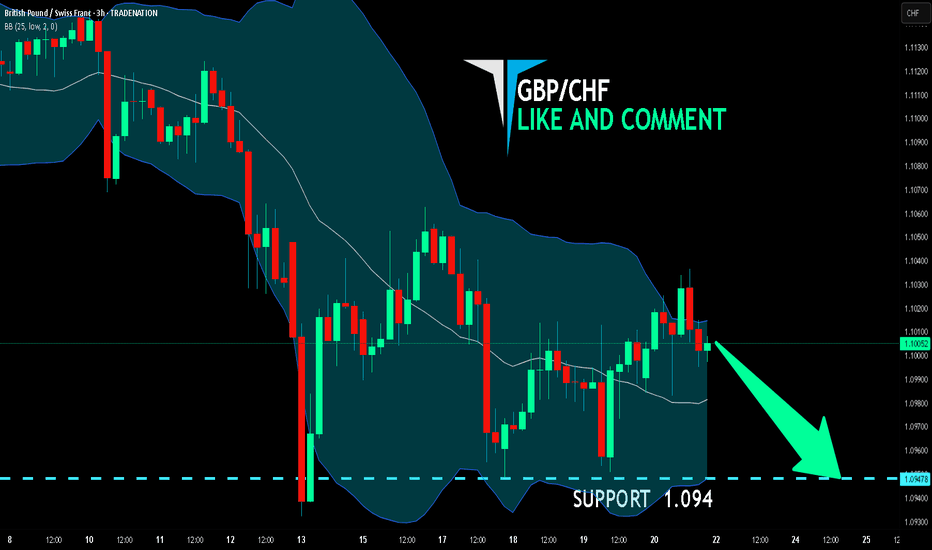

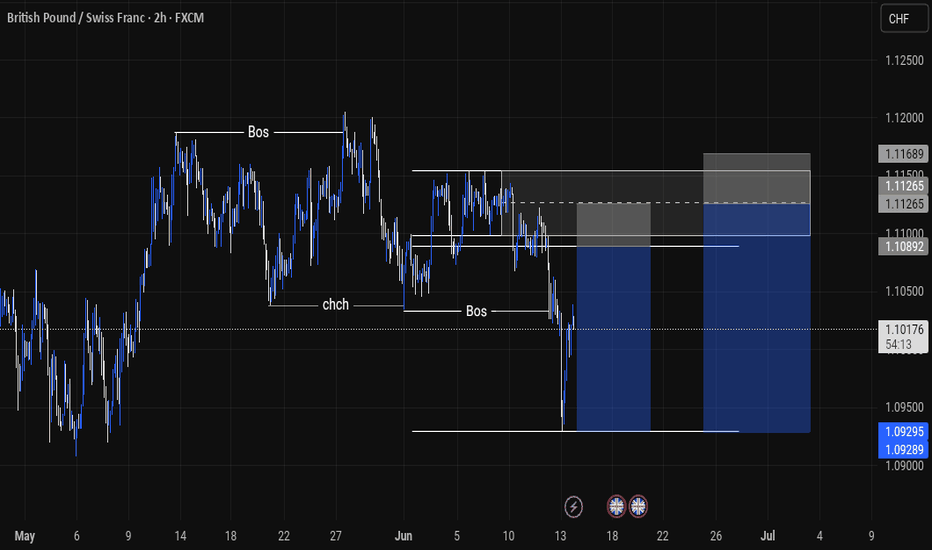

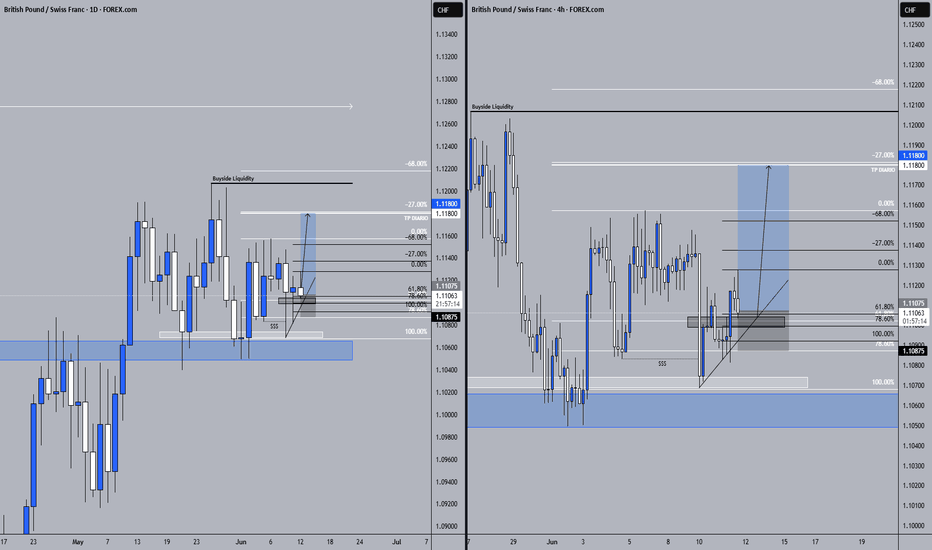

GBPCHF SHORT Market structure bearish on HTFs 3

Entry at both Weekly And Daily AOi

Weekly Rejection at AOi

Daily Rejection at AOi

Previous Structure point Daily

Around Psychological Level 1.10000

H4 EMA retest

H4 Candlestick rejection

Levels 4

Entry 100%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

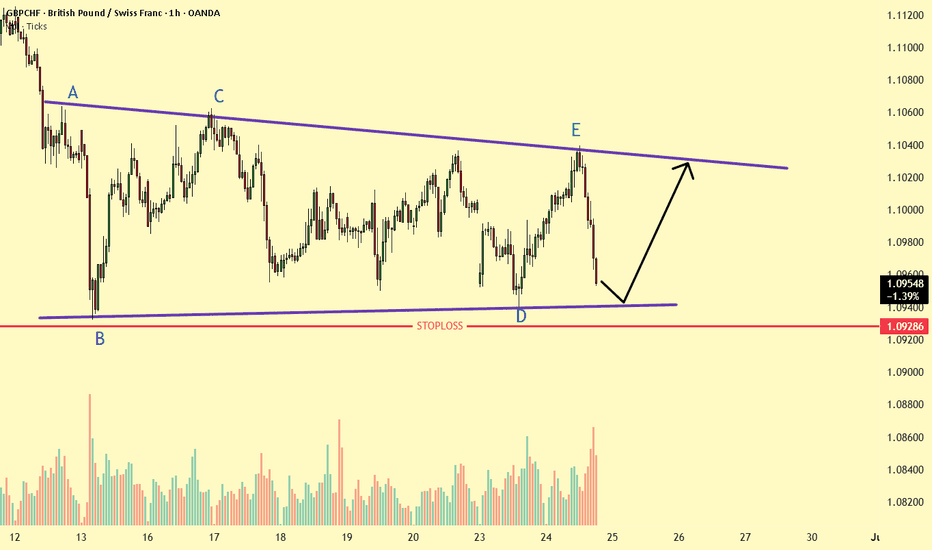

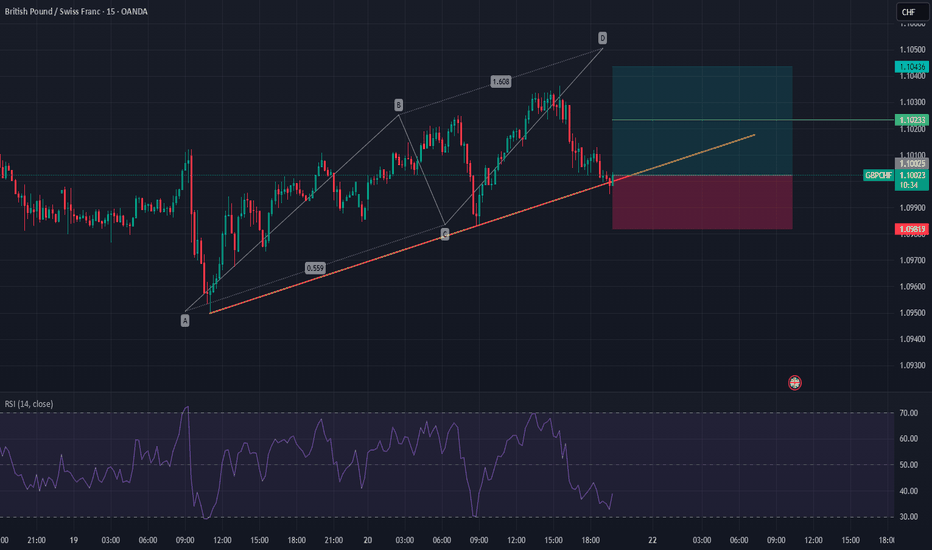

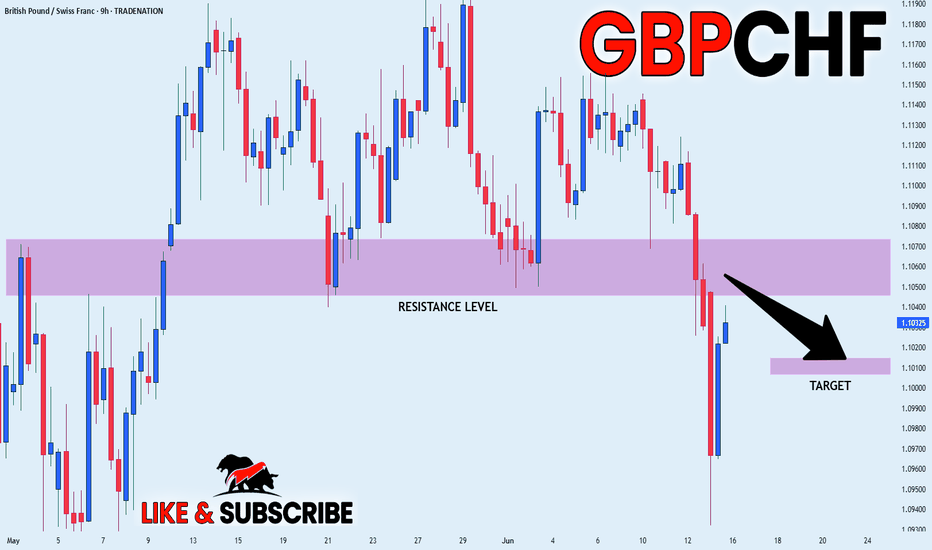

GBP/CHF BEARS ARE STRONG HERE|SHORT

Hello, Friends!

GBP/CHF pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 3H timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 1.094 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Trade Idea: Sell GBP/CHF **📉 Trade Idea: Sell GBP/CHF**

**Bias:** 🔻 Bearish

**Timeframe:** Short-Term

---

### **📊 Why Sell?**

**🇬🇧 GBP Weakness:**

* UK economy slowing 🛑

* BoE might cut rates soon 🔻

* Pound under pressure across the board 😓

**🇨🇭 CHF Stability:**

* Dovish SNB, but still a safe-haven 🛡️

* Weak data, but no big downside 👣

* CHF holds up well in risk-off mood 🌫️

---

### **🧭 Technical View:**

* **Structure:** Lower highs forming ⏬

* **Break Level:** Clean rejection from 1.1300 resistance 🚫

* **Next Support:** 1.1150 zone 📉

* **Momentum:** Bearish bias under 1.1280 🔻

---

**⚠️ Risk:**

> Only invalid if price pushes back above 1.1350 and holds.

---

**🎯 Summary:**

GBP is soft, CHF is steady — trend favors downside. Clean setup if 1.1300 holds as resistance.

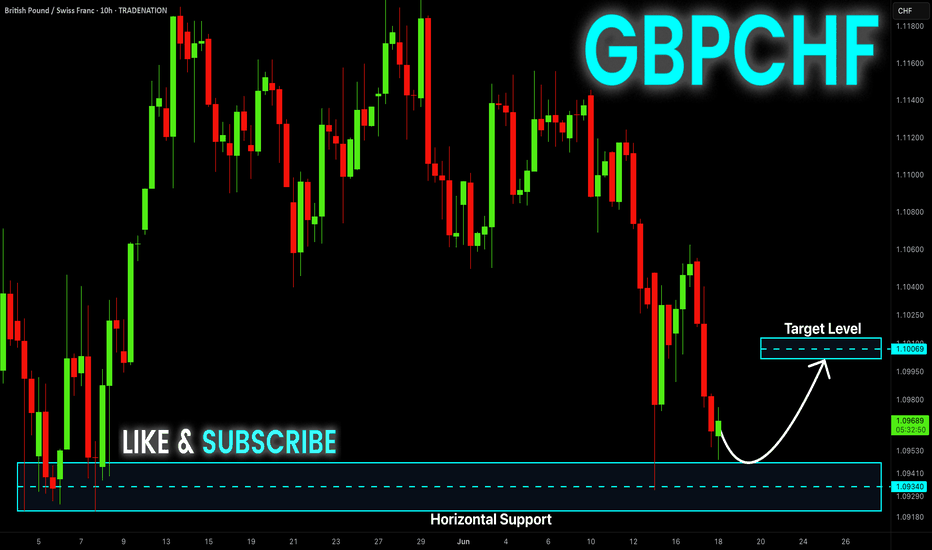

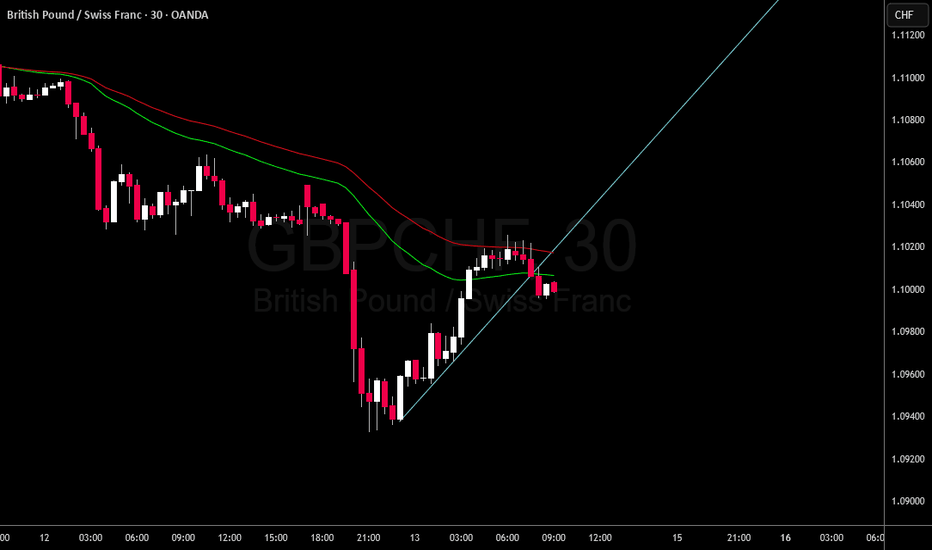

GBP-CHF Support Ahead! Buy!

Hello,Traders!

GBP-CHF keeps falling but

A strong horizontal support

Level is ahead at 1.0921

From where we will be

Expecting a rebound

And a local bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

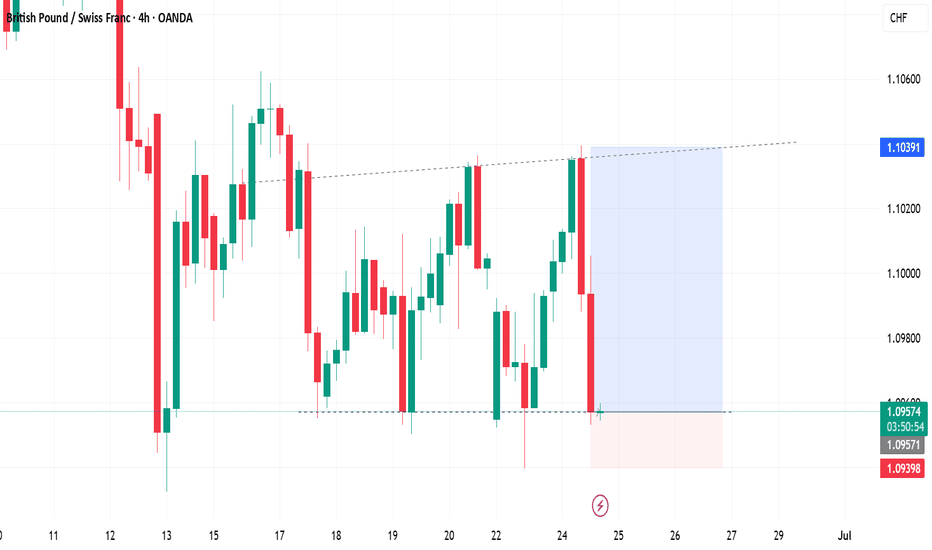

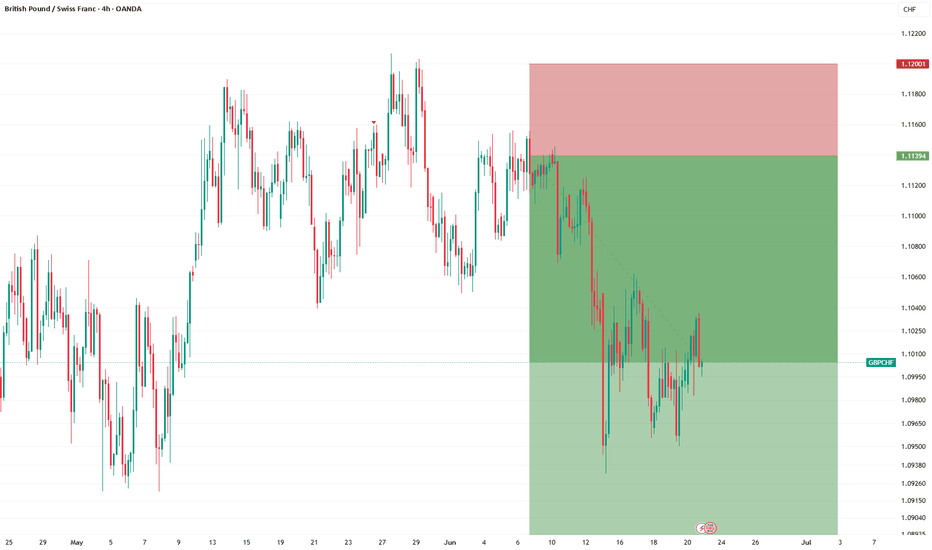

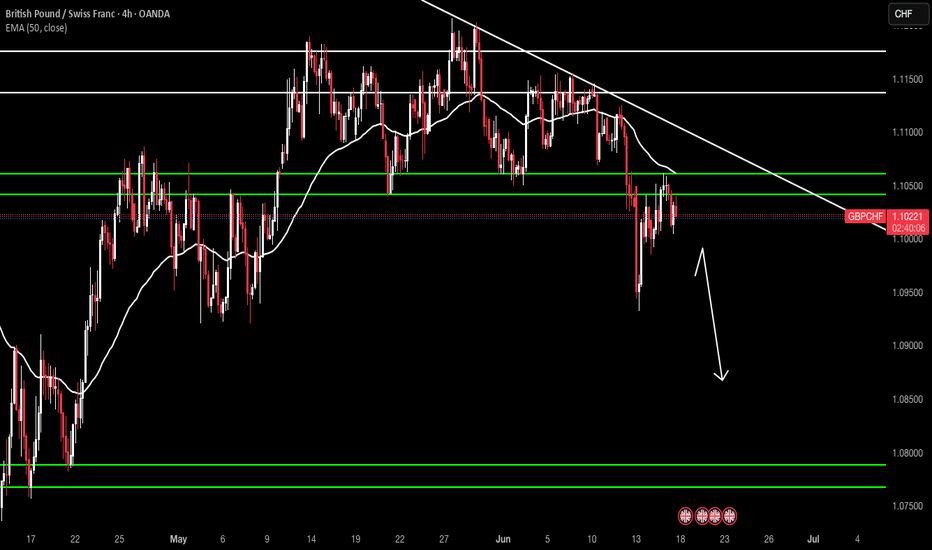

gbpchf 4h cp Pair: GBPCHF

Direction: Short

Chart: View Setup

Status: Pending

Notes:

Daily Trend: Bearish structure in play

4H CP (Continuation Pattern): Formed after daily supply reaction

Clean bearish sequence – expecting continuation lower

Ideal scenario: price respects 4H CP zone and breaks to new lows

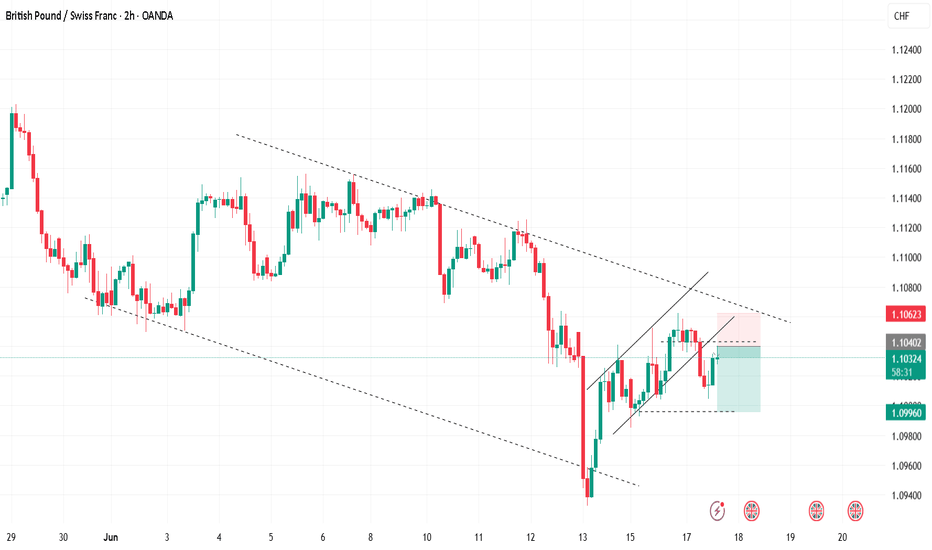

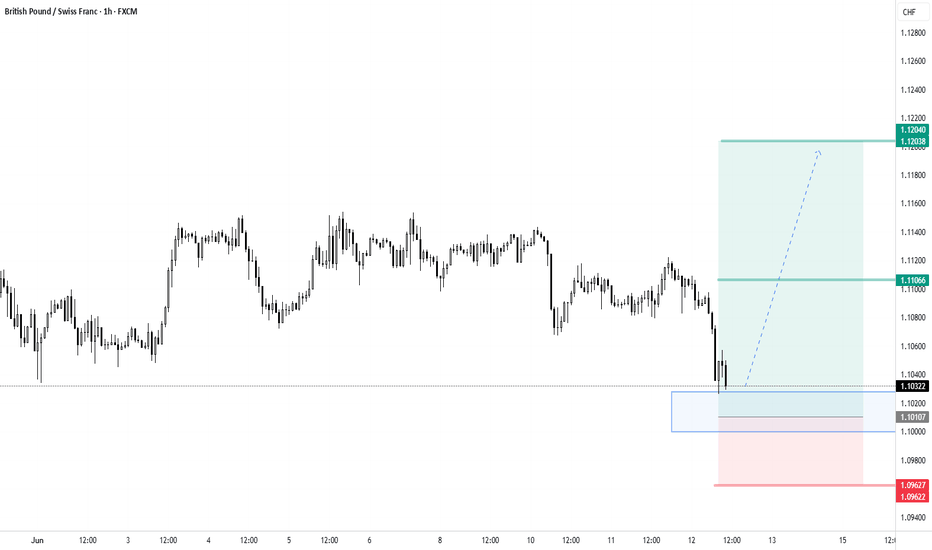

GBP_CHF RESISTANCE AHEAD|SHORT|

✅GBP_CHF is going up now

But a strong resistance level is ahead at 1.1070

Thus I am expecting a pullback

And a move down towards the target of 1.1013

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

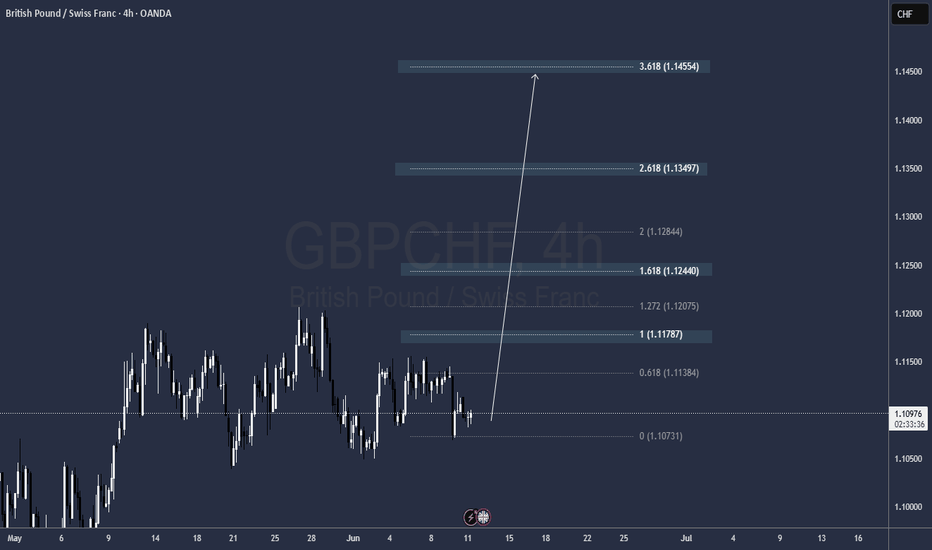

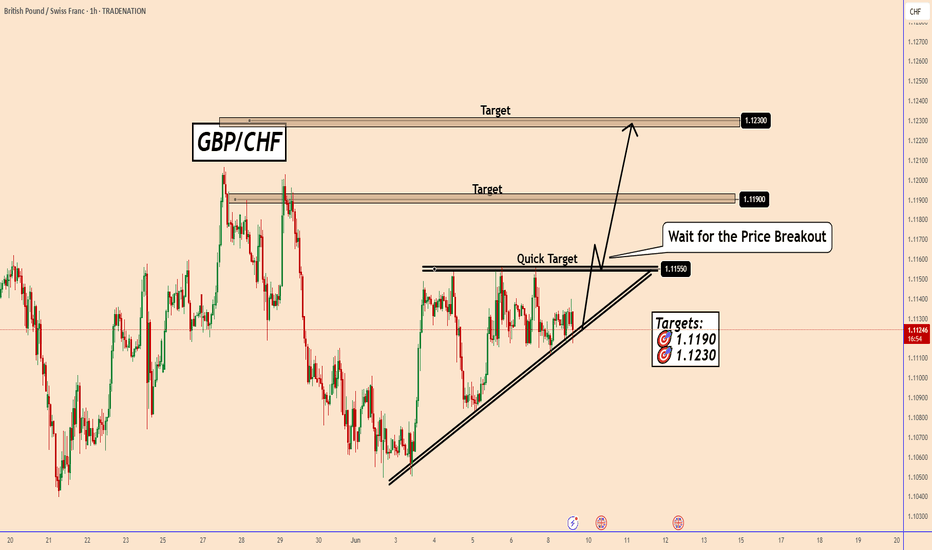

GBPCHF may rise supported by FundamentalsGBPCHF may rise supported by Fundamentals

Today, the Swiss 10-year bond yield is near a 3-week high.

The Swiss 10-year government bond yield was near 0.40%, its highest level since May 20.

The latest Swiss CPI and GDP data increased the chances that the Swiss National Bank (SNB) will cut interest rates by 25 basis points at its next meeting.

Technical Analysis:

GBPCHF is gathering and is forming an ascending triangle pattern. Once the price breaks the top of the pattern at 1.1155, it should rise further and could reach 🎯 1.1190; 🎯 1.1230.

If it moves up from the current zone the first short term target will be at 1.1155

The first zone is very strong and could also act as a reversal zone and could push the price lower again, so be careful near that zone.

Targets:

🎯 1.1155

🎯 1.1190

🎯 1.1230

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.