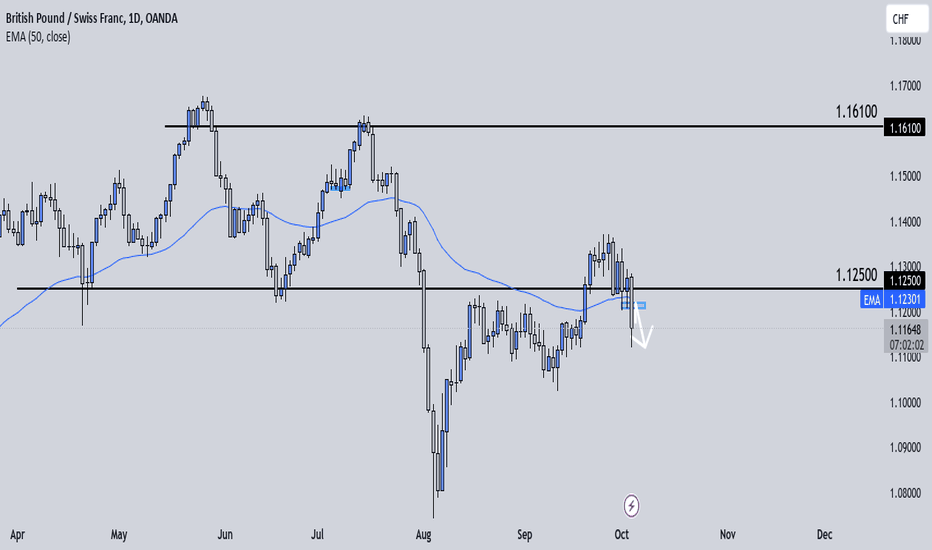

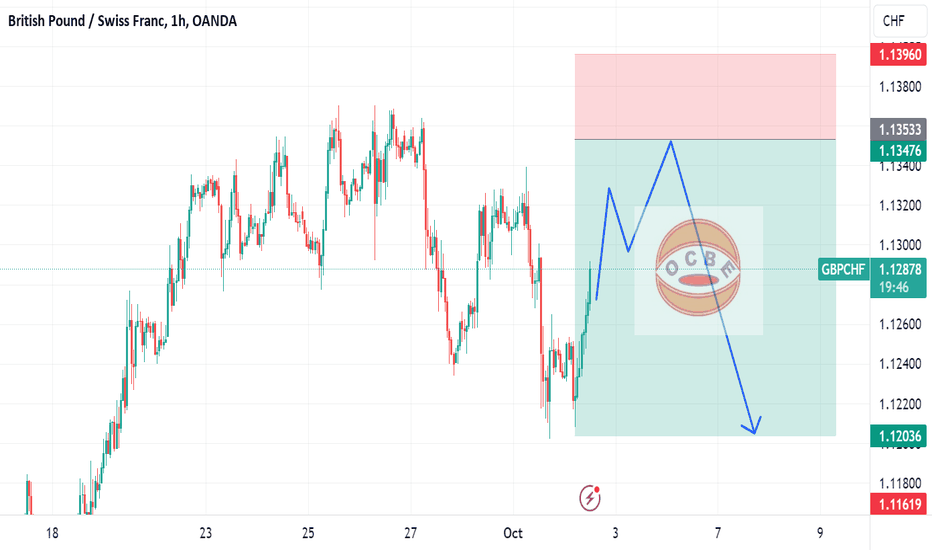

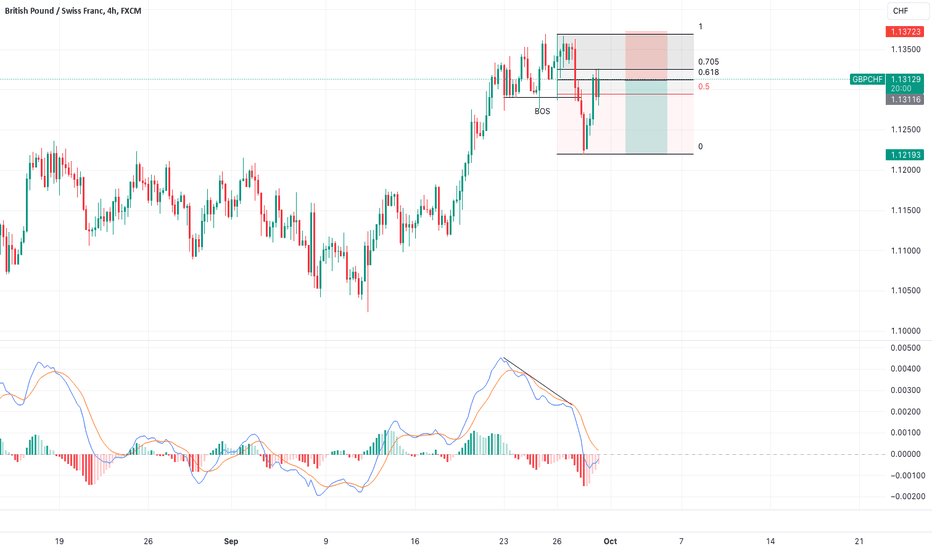

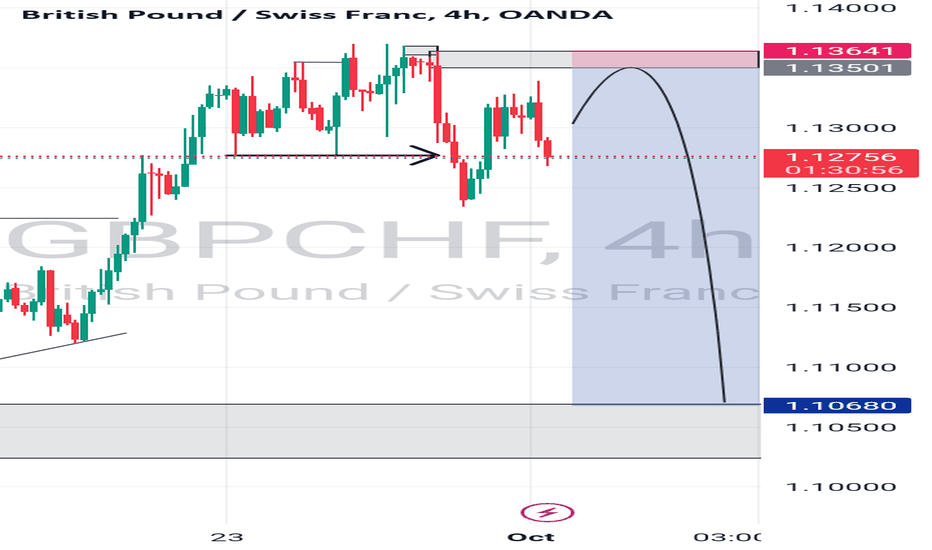

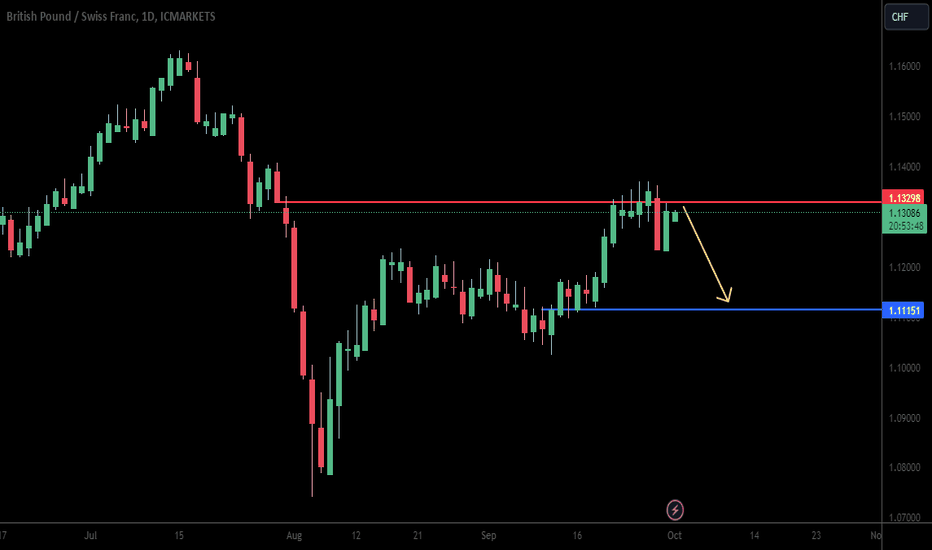

GbpChf Trade IdeaGC is currently at a strong level of support that seems to be flipped into resistance. At the moment I am short on the pair with structures flipping from bullish to bearish on smaller time frames. There's a level on the 4hr that I do want to see price pullback to before continuing the dump to the downside. I'll publish another post showing what I'm looking for on the 1hr-4hr. But I'm definitely BEARISH on this pair.

CHFGBP trade ideas

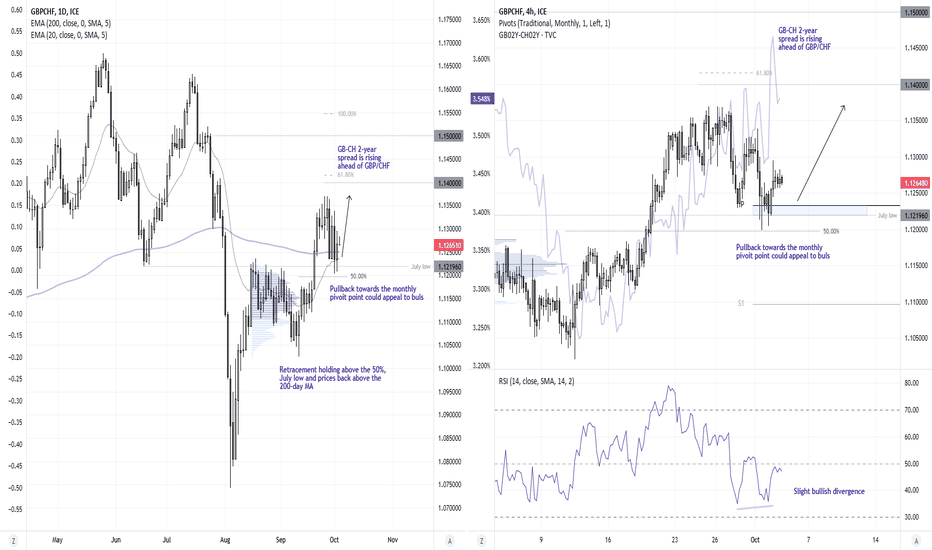

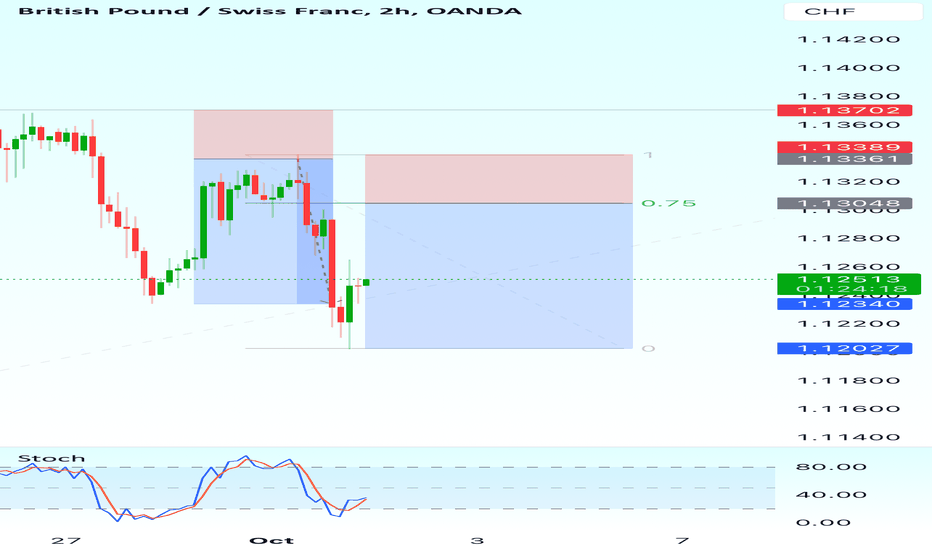

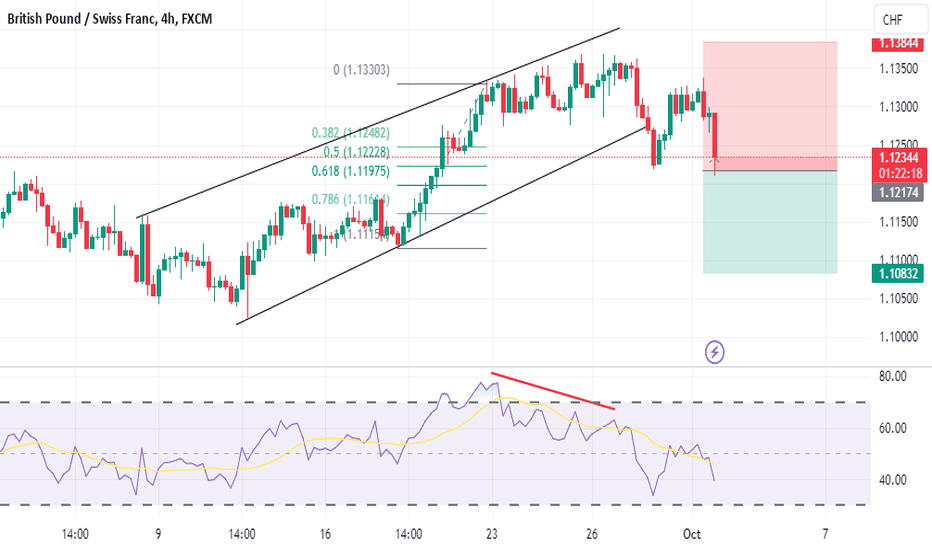

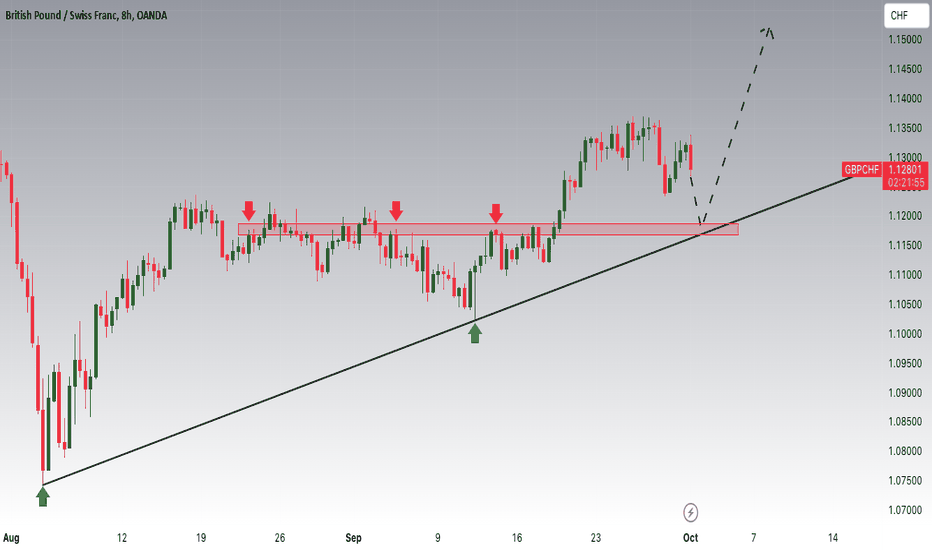

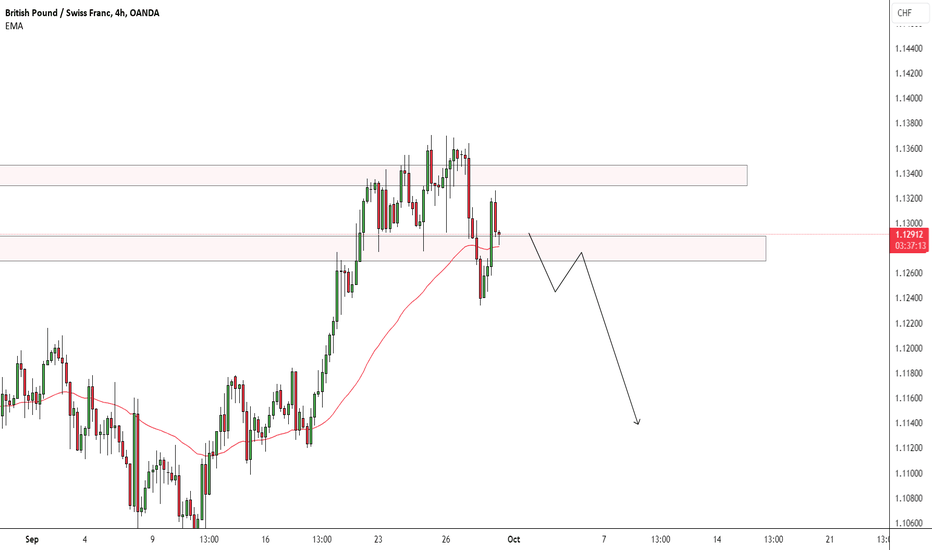

Seeking dips on GBP/CHFA bullish trend has developed on the daily chart. Prices have pulled back lower, yet support was found at the 50 retracement level and the cross now trades back above the 200-day MA.

A bullish divergence has formed on the 4-hout chart, and price action appears to be corrective on this timeframe. Also note that the 2-year spread between GB-CH yields ahead of prices to suggest upwards pressure could be building on GBP/CHF.

Given the bullish structure of the daily timeframe, pullbacks towards the monthly pivot point could be appealing for bullish setups, in anticipation of a move up to 1.14.

BUY GBPCHF - trade explained in detail Trader Tom, a technical analyst with over 15 years’ experience, explains his trade idea using price action and a top down approach. This is one of many trades so if you would like to see more then please follow us and hit the boost button.

We are proud to be an OFFICIAL Trading View partner so please support the channel by using the link below and unleash the power of trading view today!

tradingview.sweetlogin.com

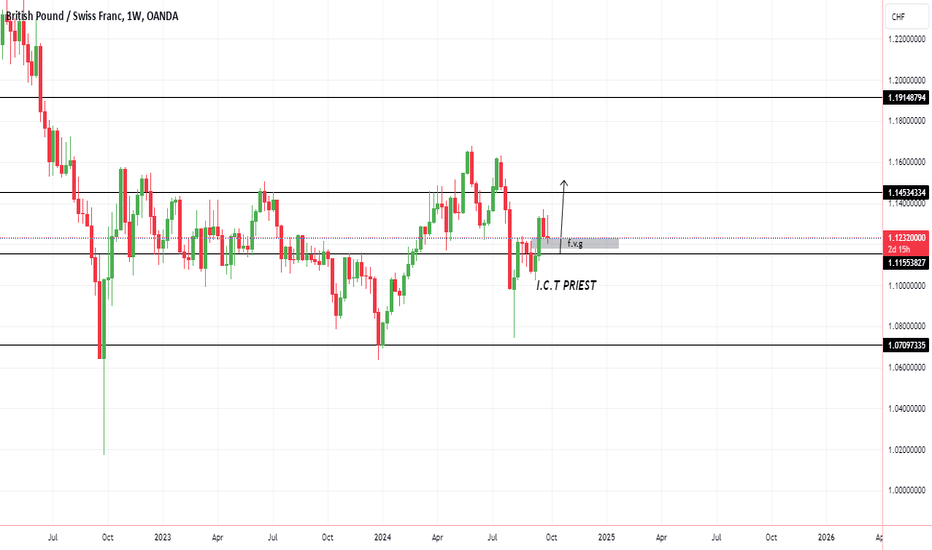

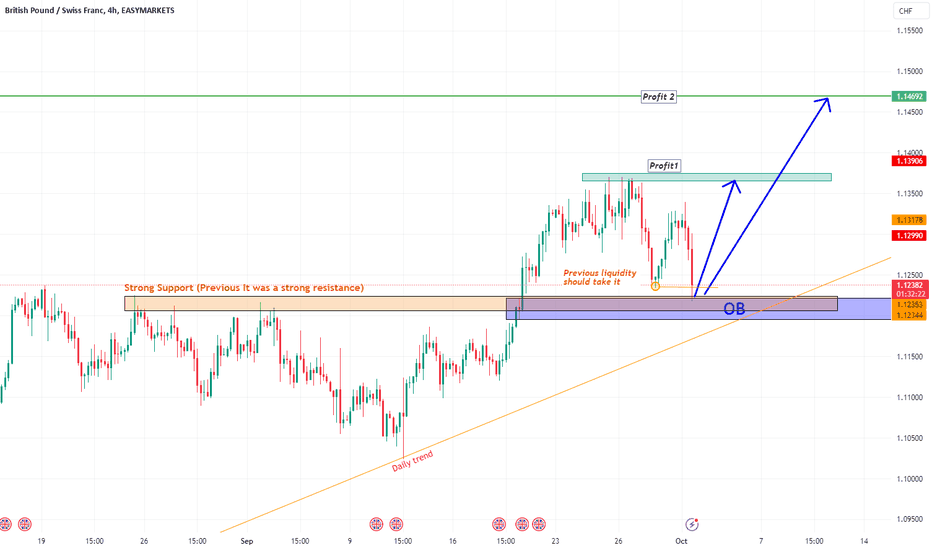

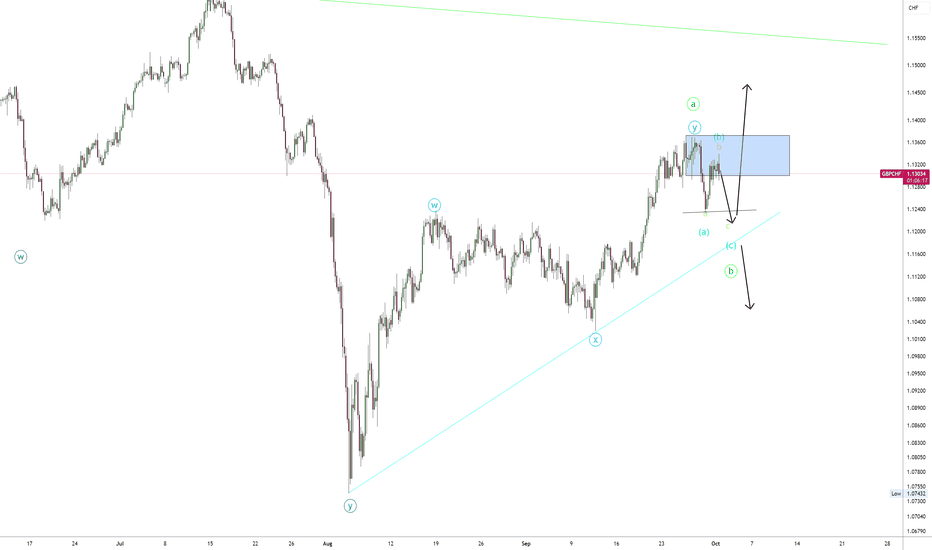

GBPCHF LONG IDEATIONMy story starts from 12 months time frame where there is price imbalance (between 1.1457 & 1.1914) which is partially filled, that is the only target i expect to see price drawing to.

Come to weekly time frame, there is a fair value gap down the price, between 1.1229 & 1.1187.

so i expect to see price turning into bullish once it fills the fair value gap.

The first target will be 300 pips

NB: If you are interested please follow me

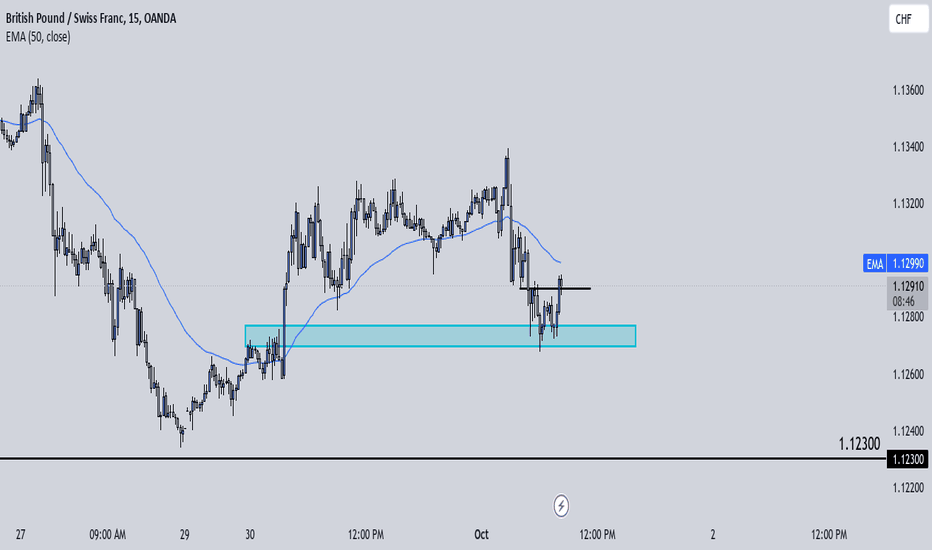

GbpChf Trade IdeaGC has flipped bullish after tapping into a level of support being 1.12300. I wanted to see price pullback and retest 1.127 before going long on the pair. At the moment price is bearish on smaller time frames for the pullback so in order to execute longs on the pair I would need to see the bearish structure on smaller time frames to shift in order to be in sync with the higher time frame and confirm the bullish trend. Executing longs once price goes bullish after the retest.

GBPCHF Potential UpsidesHey Traders, in today's trading session we are monitoring we are monitoring GBPCHF for a buying opportunity around 1.11900 zone, GBPCHF is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 1.11900 support and resistance area.

Trade safe, Joe.

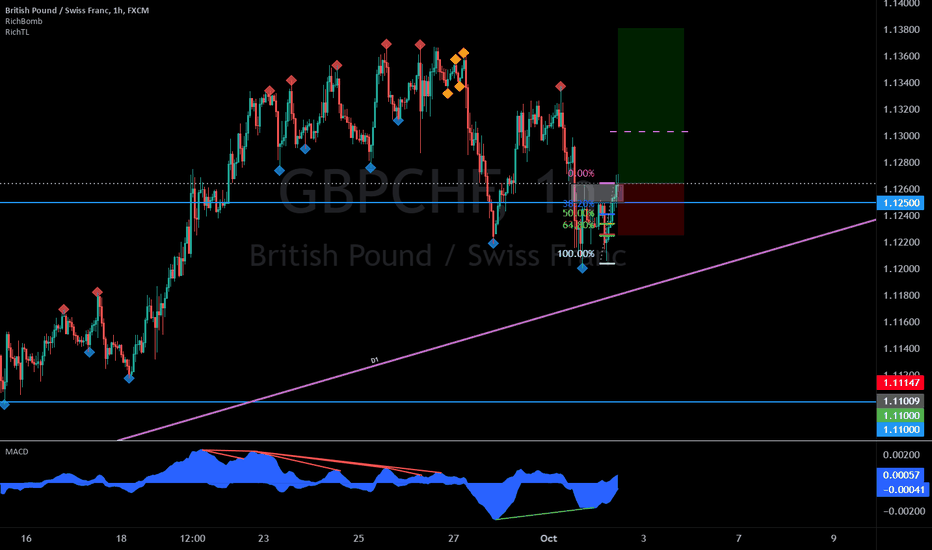

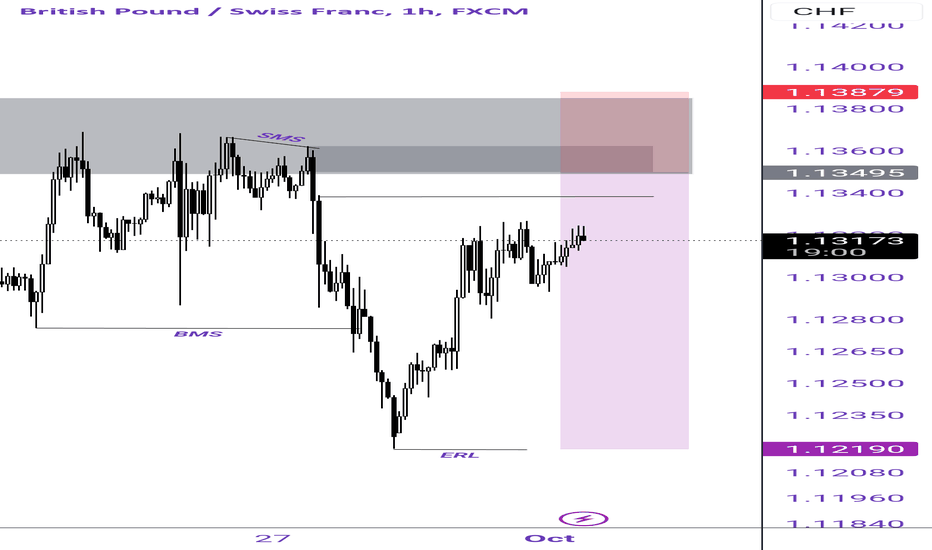

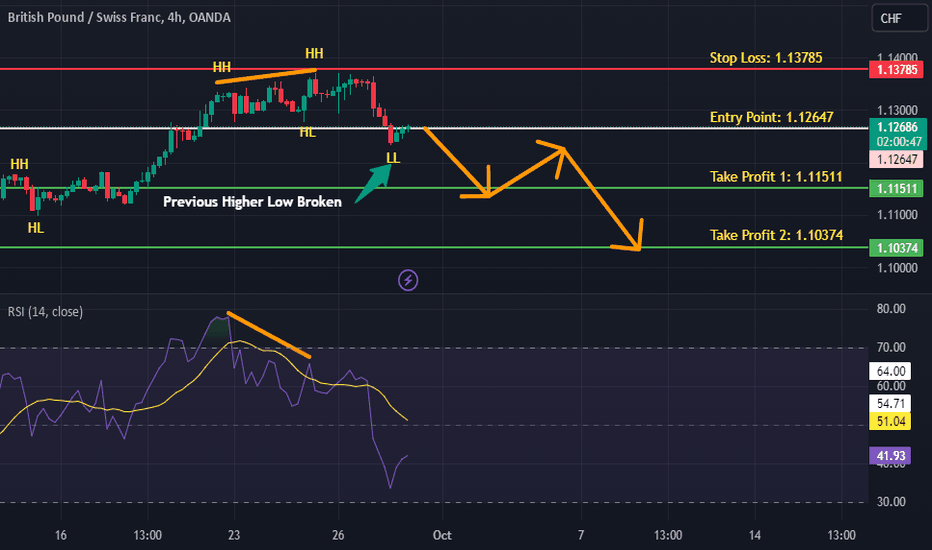

GBPCHF SHORT BIAS. BIAS BASED ON SHIFT OF MARKET STRUCTURE. GBPCHF has failed to create a higher high at the top, hence a "SHIFT OF MARKET STRUCTURE" (SMS) and currently the bulls are driving the "RETURN ORDER" (RTO) to the unmitigated POI at the " BUYSIDE LQD's" BSL.

I hope to see more downward moves after price tapping into the POI.

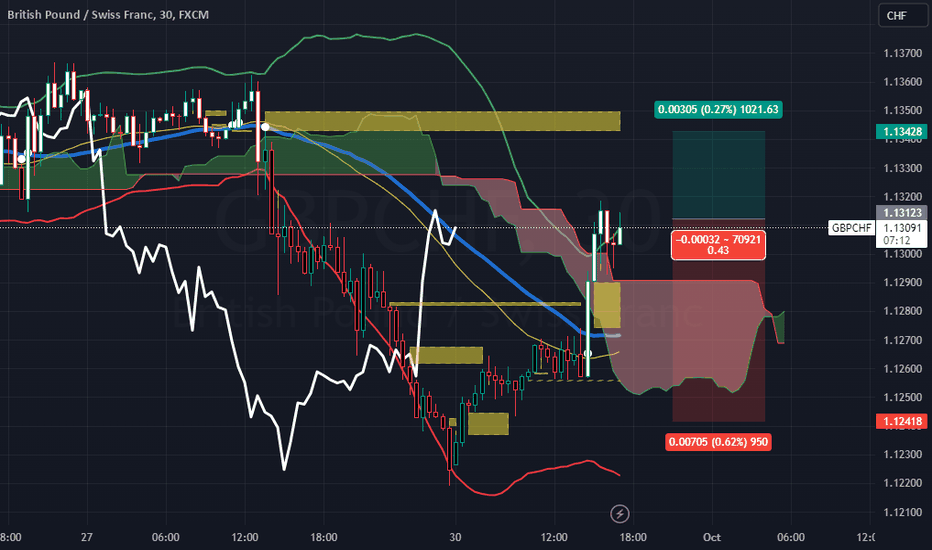

GBPCHF(Short)Turtle soup and Smart Money Concept Trading Strategy

The Turtle Soup strategy, however, flips the script, aiming to profit when those anticipated trend.

Linda Raschke’s Turtle Soup strategy is a counter-trend trading approach that capitalizes on failed breakouts.

ENTRY :- SELL -Above opening price (daily) BUY - Below opening price (daily)

STOPLOSS :- above or below recent swing High

1st TARGET :- Book profit 50%

2nd TARGET :- Book profit 25%

3rd TARGET :- Book profit 25%

Consisitency and hard working is the key of success.

KEY OF SUCCESS :-

*) Buy below opening price of Daily Candle AND Sell above opening price of Daily Candle.

*) Do not take risk more than 1% of Equity.

*) Take Profite Should be More then 2% of Equity .

*) Book 50% profit of running trade first and remaining 50% hold for long term.

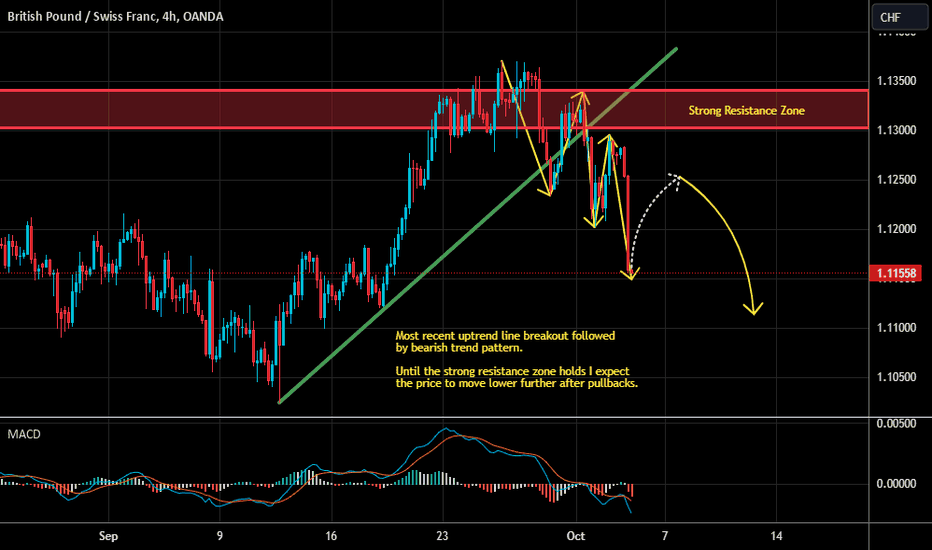

GBPCHF is BearishPrice was in a good uptrend, however the bearish divergence on four hourly time frame hinted the bearish control, which was validated by the break of previous higher low. If the bearish momentum sustains then we can expect further downside in price action. Targets are mentioned on the chart.

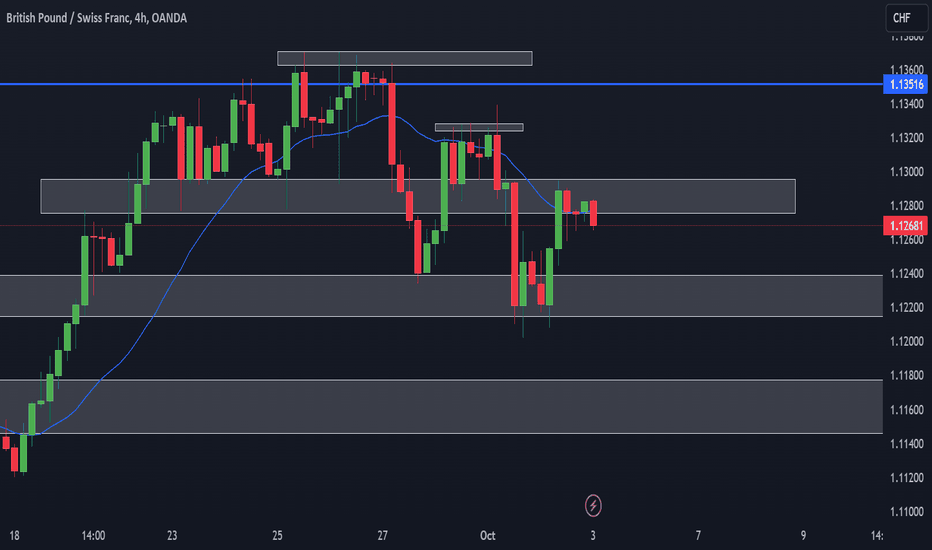

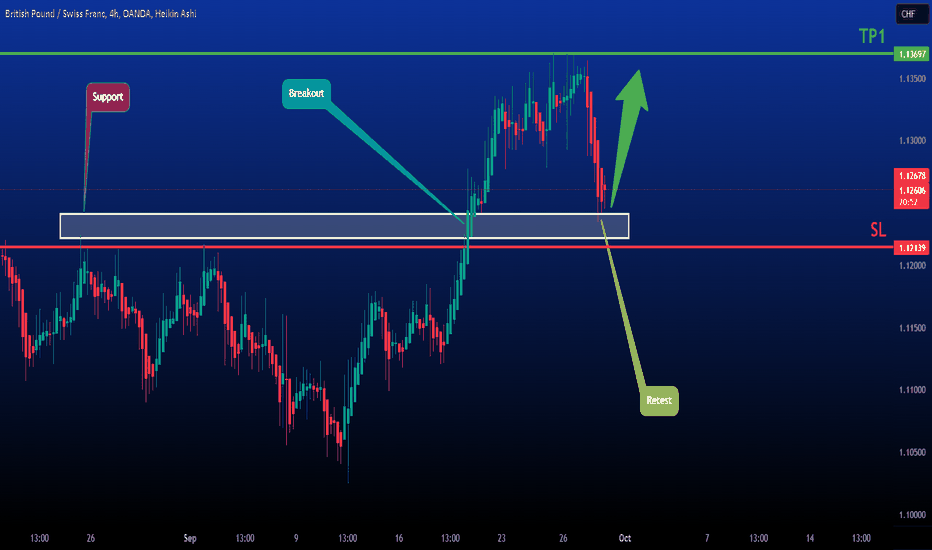

GBPCHF - H4 Buy SetupDear traders,

After that breakout candle as shown in our picture, we can see a beautiful support. We believe that the price will retest this area and go up to reach the previous HH.

This is how we will take the trade:

𝐄𝐧𝐭𝐫𝐲 𝐏𝐫𝐢𝐜𝐞 (Buy Now) → 1.2680

𝐒𝐋 → 1.12139

𝐓𝐏𝟏 → 1.13697

What do you think?

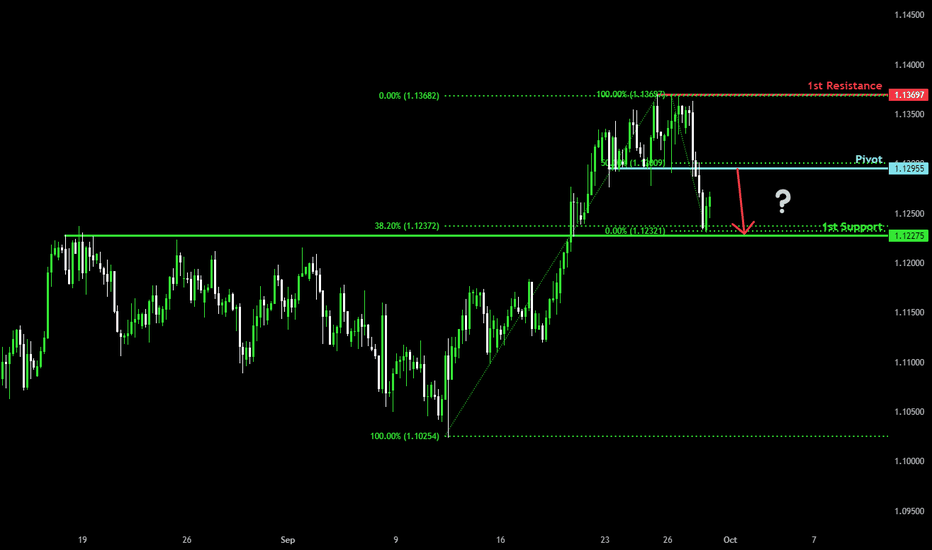

Bearish reversal?GBP/CHF is rising towards the pivot which acts as a pullback resistance and could reverse to the 1st support which has been identified as a pullback support.

Pivot: 1.12955

1st Support: 1.12275

1st Resistance: 1.13697

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.