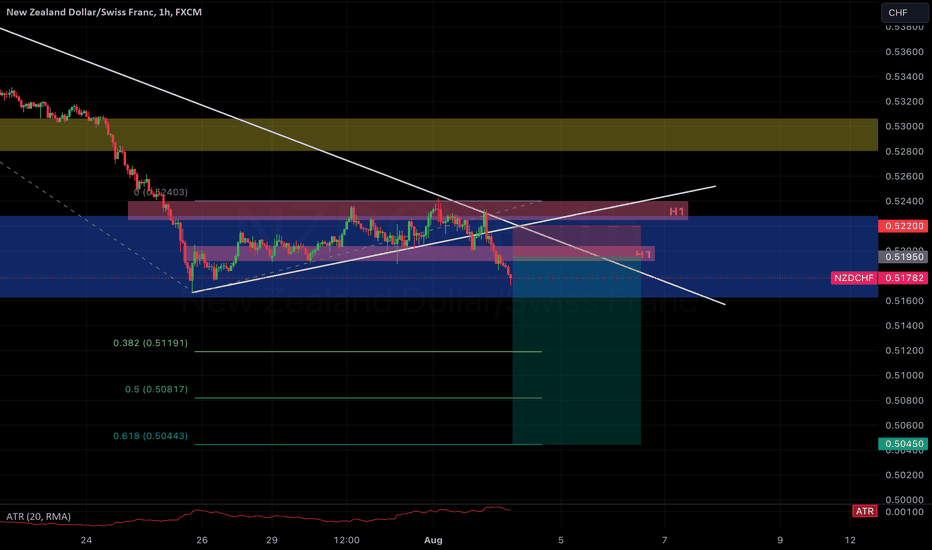

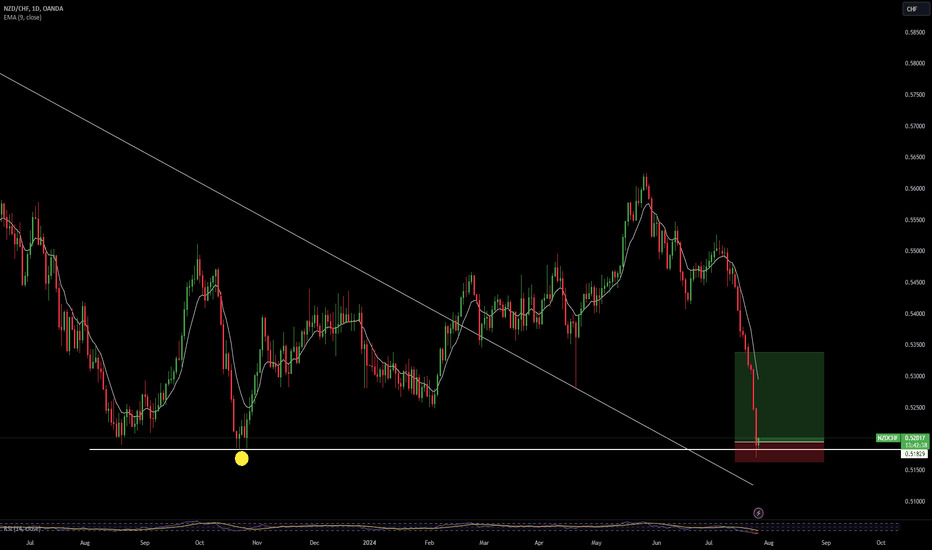

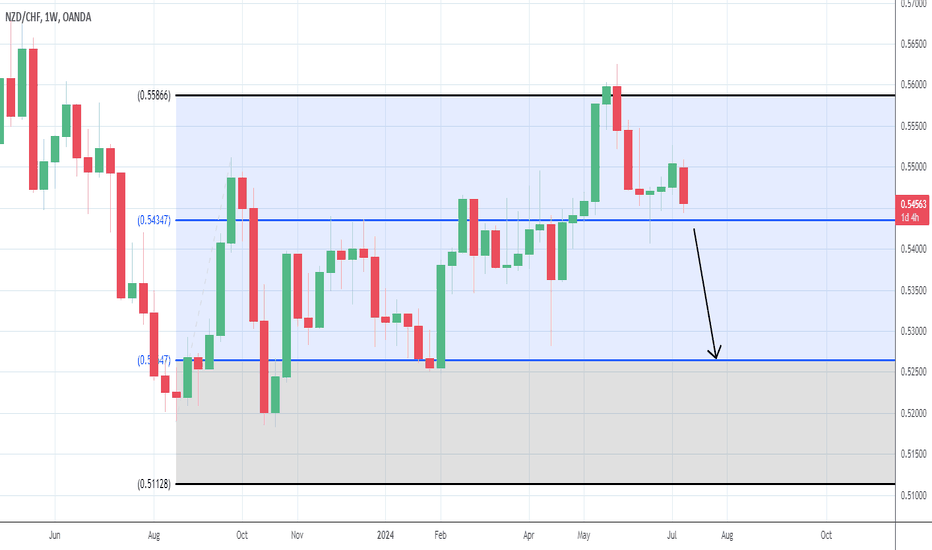

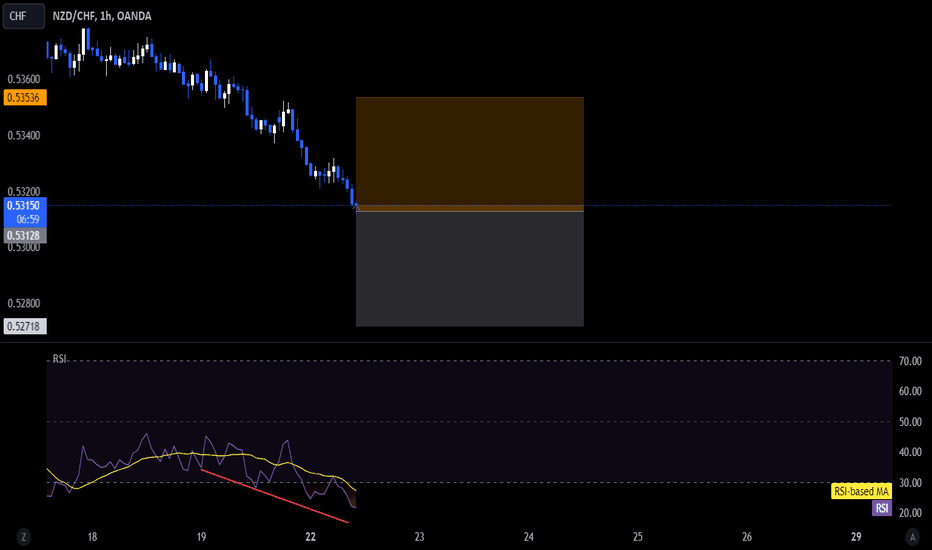

NZDCHF Flag down timeBias Bearish

Fundamental NZD is weak and CHF is holding strong

Price action

Price rejected from H4 Bearish TL and broke out of raising flag pattern. The price also break and close below H1 SR level. This indicates that bearish momentum is still going strong. All time low, so using Fibo Extension for targets.

Confluence

H4 Bearish TL, Broken Flag SR level and H1 SR level.

Setup

Entry at H1 broken SR level

SL 2x ATR(20)

TP fibo extension 61.8% R:R 1:6

CHFNZD trade ideas

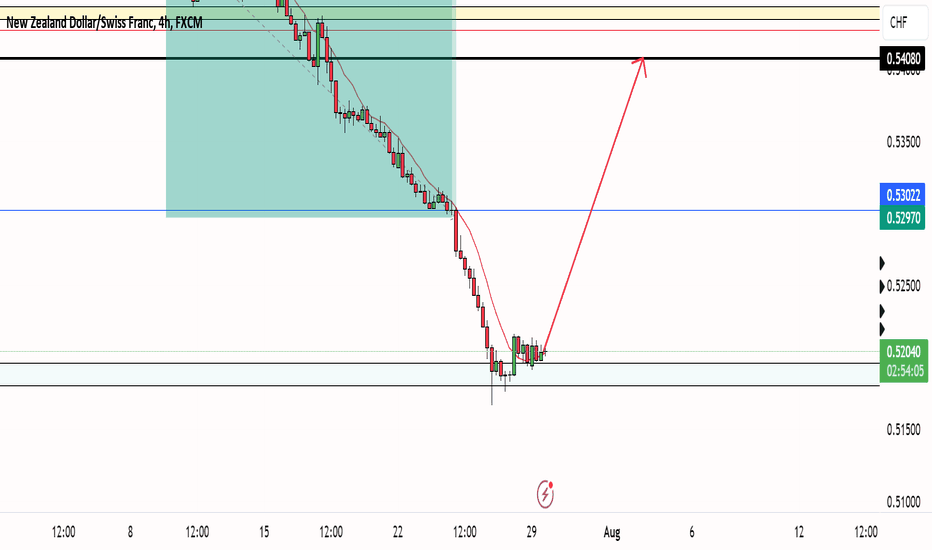

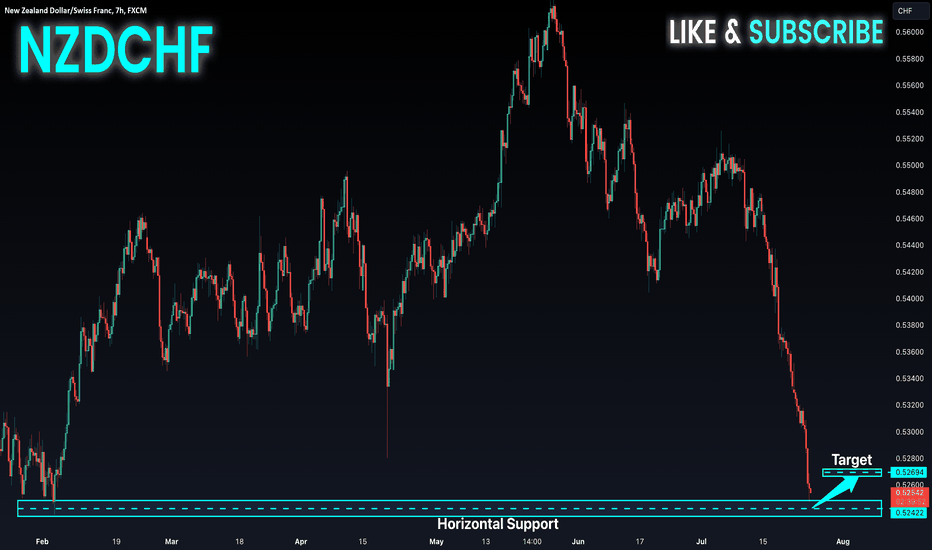

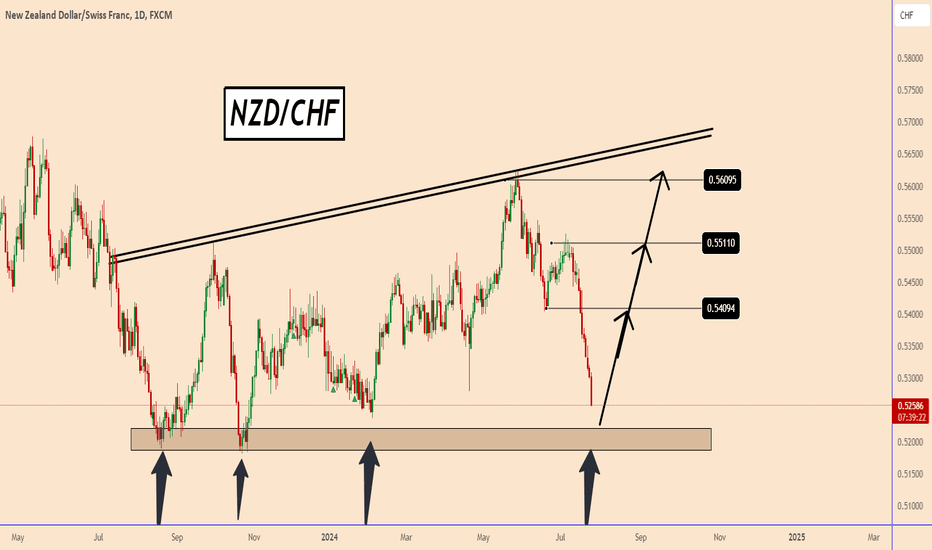

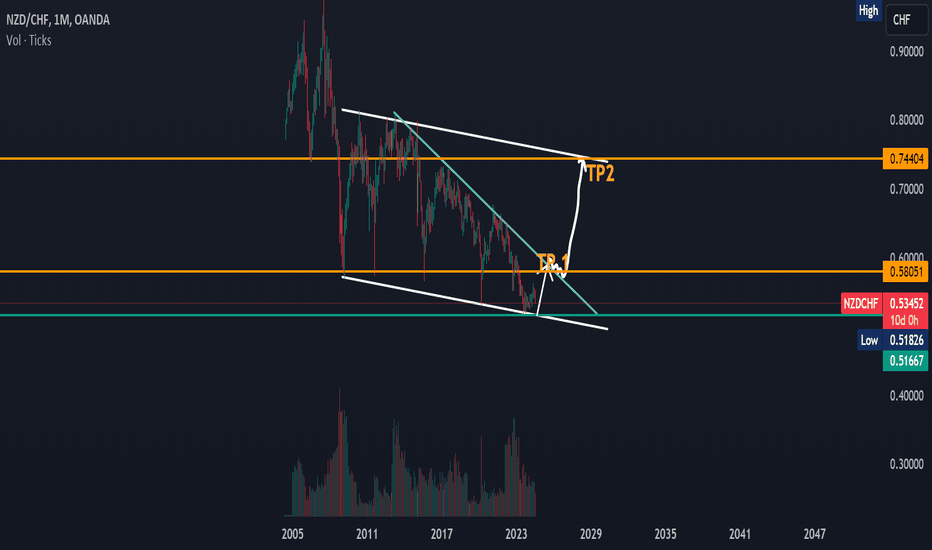

Can the Kiwi learn how to fly?The Kiwi Dollar has been very weak against the Swiss Franc for pretty much the entirety of 2023, with the last noteworthy bull run occurring last autumn. After this year's prolonged and massive bear run, the pair has finally reached its all-time lowest price. The current area around 0.52 seems to have potential as a good support price.

I feel a short-term bullish retracement might occur from this area, pushing price back up to around 0.55 area. From there, initial bias would be the continuation of the downtrend, but perhaps a risk-on bias will overtake the market, pushing price even higher.

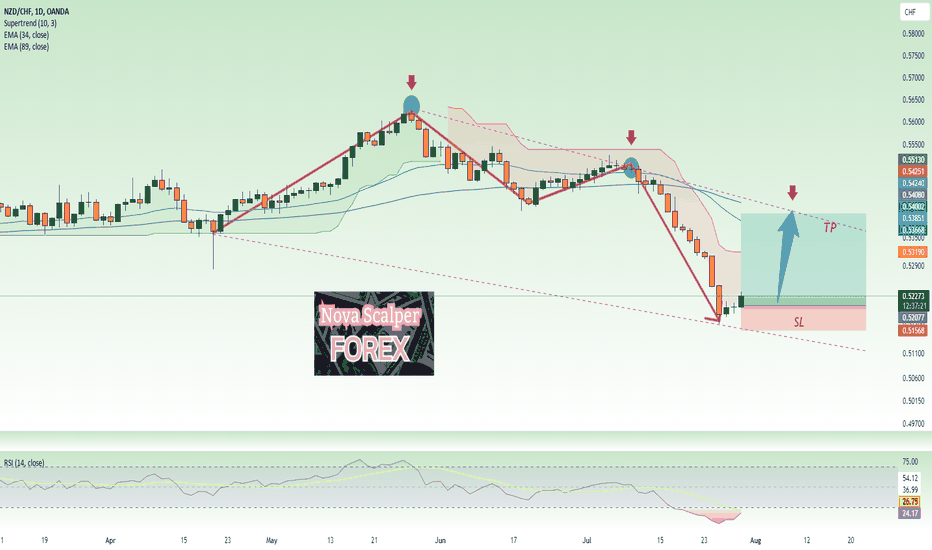

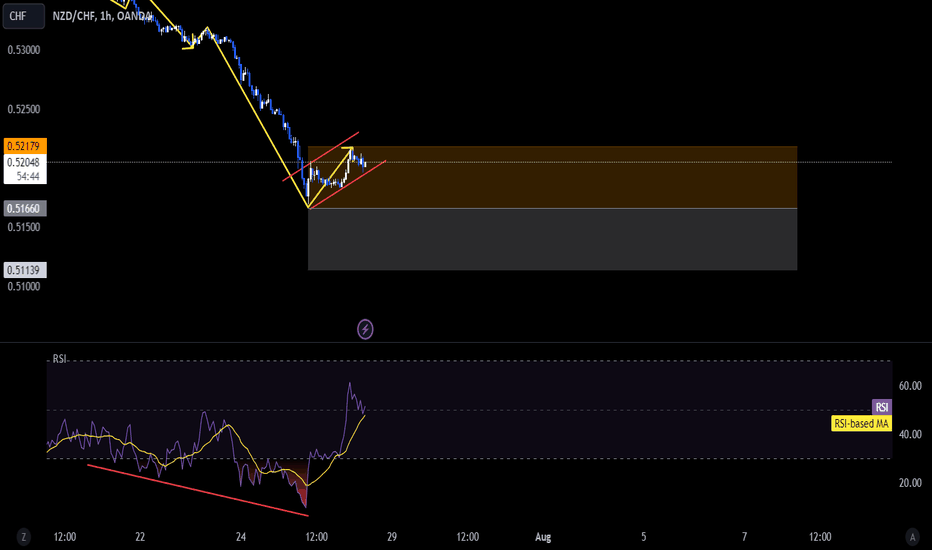

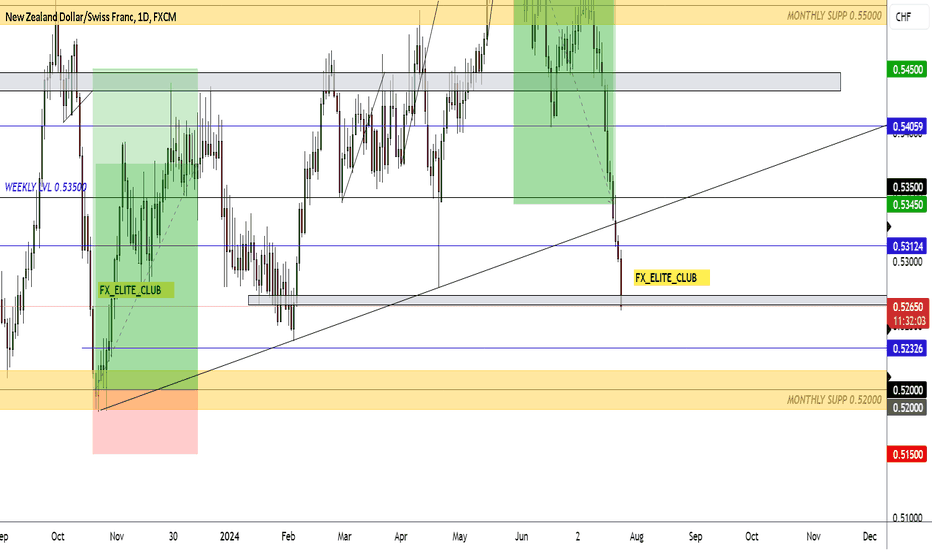

NZD / CHF !! recovering in a DOWN trend⭐️ Smart investment, Strong finance

⭐️ Personal comments NOVA:

Oversold signs - selling pressure gradually decreasing, expect a temporary recovery for NZD/CHF

⭐️ SET UP NZDCHF PRICE:

🔥BUY zone: 0.52200 - 0.52000 SL 0.51700

TP1: 0.52500

TP2: 0.52900

TP3: 0.53500

⭐️ Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️ NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

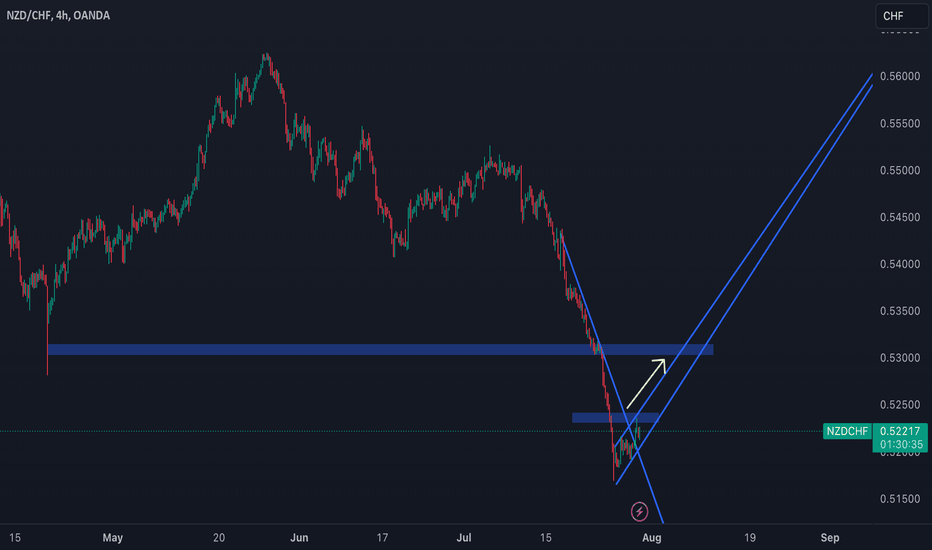

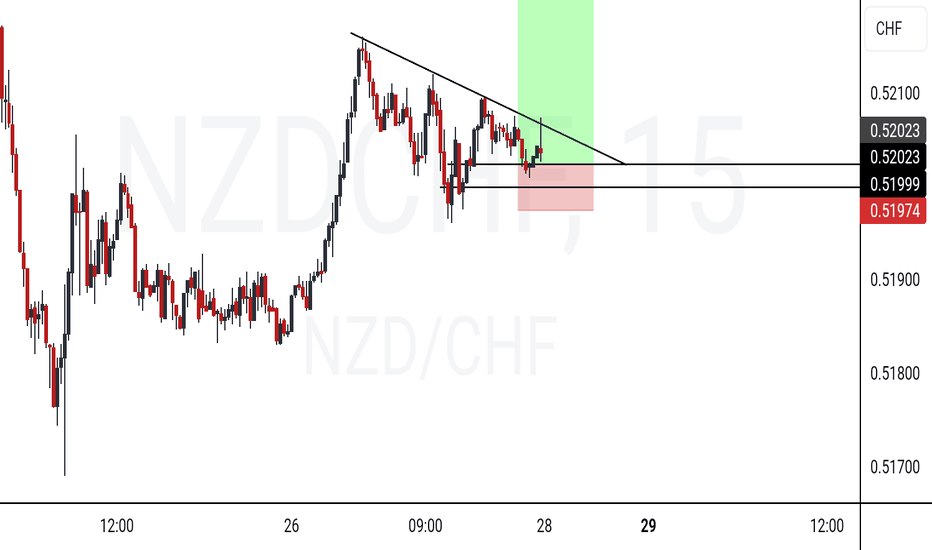

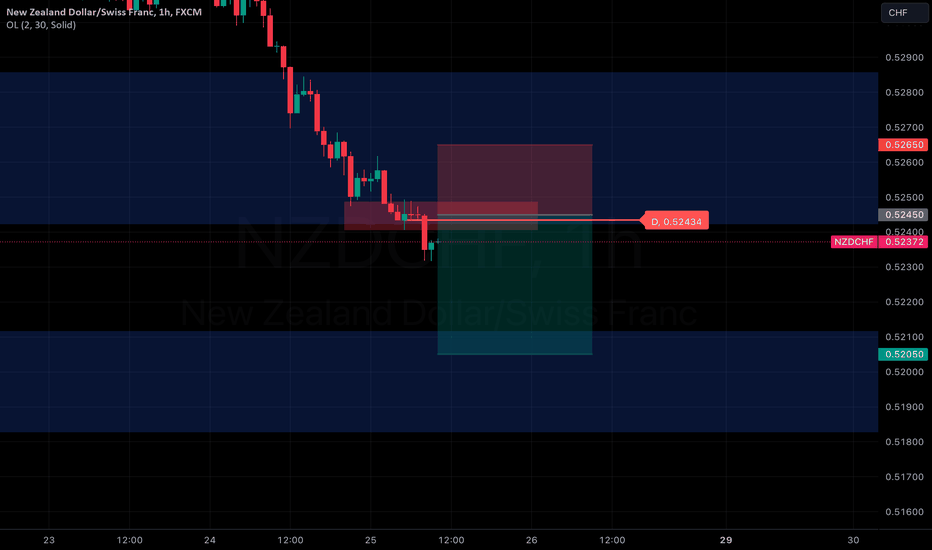

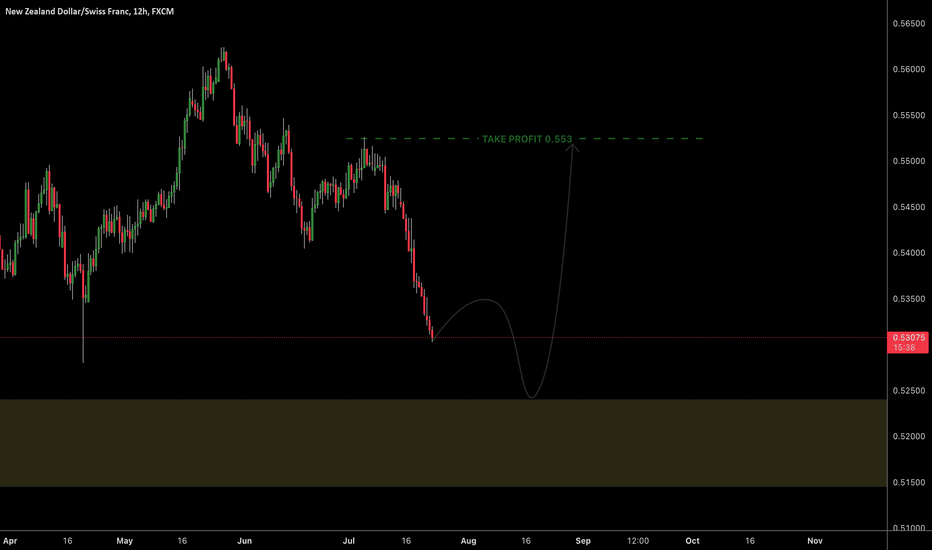

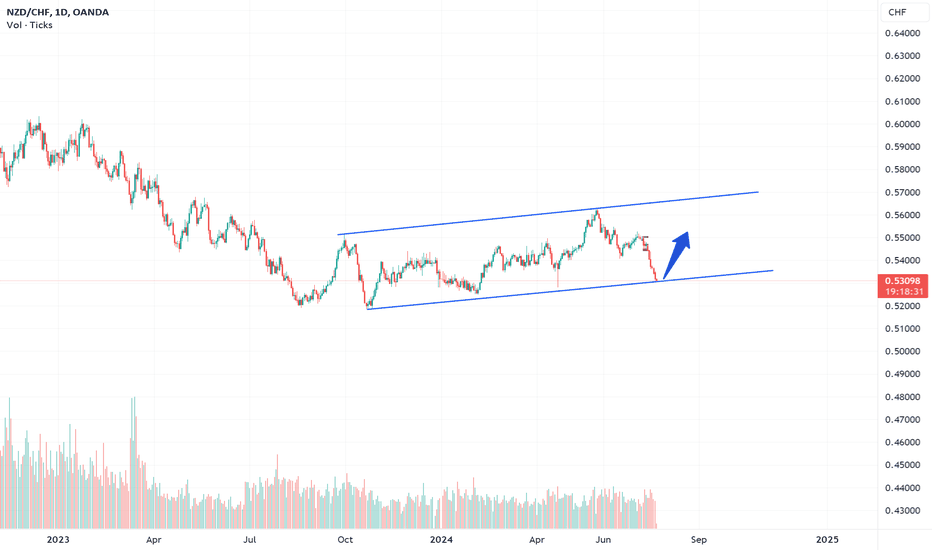

NZD/CHF - Breakout to the upside coming soon?Following on from a substantial downtrend in this pair, we can see that price has broken out of the descending channel and been ranging sideways for the last 4 days. Price is now consolidating within a small ascending channel. This is a pivotal area for this pair as any break above this could signal the beginning of a large correctional move to the upside.

If price can breach higher above the 5240 zone this may indicate further upside in this pair.

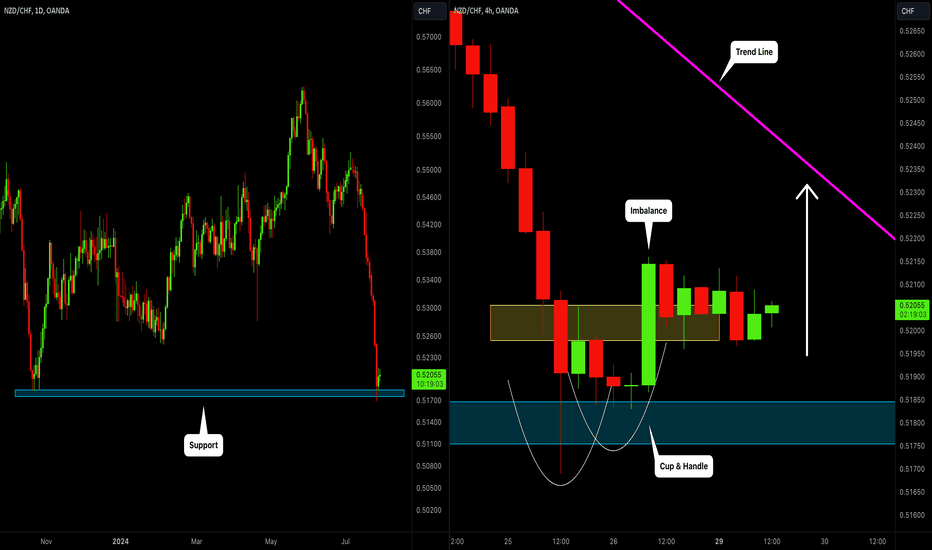

NZDCHF: Time For Pullback 🇳🇿🇨🇭

NZDCHF may bounce from a key daily historic support.

After its test, the price formed a cup & handle pattern on a 4H time frame

and broke its neckline with a bullish imbalance.

I expect a bullish move to a falling trend line.

❤️Please, support my work with like, thank you!❤️

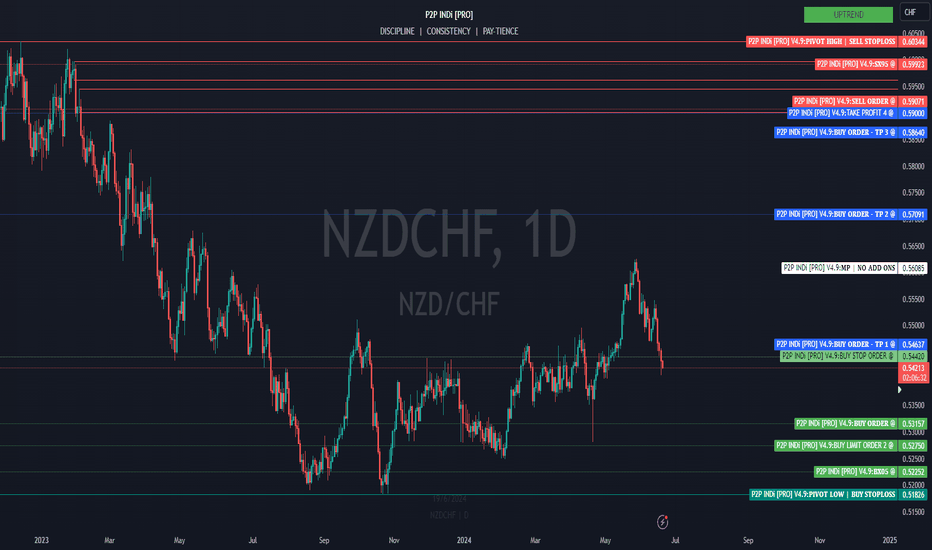

NZDCHF: ITF CURVE ANALYSIS (1D)✨NZDCHF: ITF CURVE ANALYSIS (1D) ✨ (UPTREND)

BLO2 @ 0.5275 ⏳

BLO1 @ 0.5315 ⏳

BSO @ 0.5442 ⏳

TP1 @ 0.54637

TP2 @ 0.57091

TP3 @ 0.5864

TP4 @ 0.5900

SLO1 @ 0.59071 ⏳

SLO2 @ 0.59923 ⏳

🔑

BLO = BUY LIMIT ORDER

ITF = INTERMEDIATE TIME FRAME

SLO = SELL LIMIT ORDER

TP = TAKE PROFIT

Intermediate time frames (4 hours to 6 day):

— Offer a clearer picture of the underlying trend compared to short-term frames.

— Provide more opportunities for confirmation signals and technical analysis.

— Allow for more flexible trading schedules, trades can be held overnight.

— Suitable for swing traders and some positional traders.

NZDCHF lowerBias Bearish

Fundamental

NZD data are bearish

CHF data are bullish

Price has break through the Daily SR level. Price is extreme bearish. In the Daily S/R level, lower TF H1, price broke through support level. Bearish movement have higher probability

Short set up

Short trade at H1 broken support level. SL above the swing high of H1. TP targeting the next lower Daily S/R level

NZD-CHF Very Risky Long! Buy!

Hello,Traders!

NZD-CHF is collapsing

Further down and has lost

Almost 7% from the local peak

So the pair is massively oversold

And as it is about to retest

The horizontal support of 0.5237

A local bullish correction

But this is a risky setup

Because of how easily

The pair broke all the

Previous support levels

So please use no more

Than 0.5% of the account

For this trade

Buy!

Like, comment and subscribe to help us grow!

Check out other forecasts below too!

NZD/CHF - Bearish CampaignThe NZD/CHF is on the move south after a major downside reversal started taking shape about a month and a half ago. On the short-term scale, price-action seems to be finishing up an upside technical correction. This could be that prime timing to take action. We short the pair to the next significant support key-level at 0.5262. We should be watchful about the coming support at 0.5432.

NZDCHF in a Complex Bullish ScenarioNZDCHF in a Complex Bullish Scenario

The current area was tested in August and October 2023 and February 2024.

Chances are that we could see the price rise again from this support area, given that it also corresponds to all-time lows.

On the other hand, the price also decreased due to the manipulation of the SNB. So, in general, we should be cautious, but an uptrend may start soon.

The current area was tested in August and October 2023 and February 2024.

We could see the price rise again from this support area, given that it also corresponds to all-time lows.

On the other hand, the price also decreased due to the manipulation of the SNB. So, in general, we should be cautious, but an uptrend may start soon.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

NZD/CHF Vey Near Best The Place To Buy It And Get 250 Pips !This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

NZD/CHF BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

We are now examining the NZD/CHF pair and we can see that the pair is going down locally while also being in a downtrend on the 1W TF. But there is also a powerful signal from the BB lower band being nearby indicating that the pair is oversold so we can go long from the support line below and a target at 0.541 level.

✅LIKE AND COMMENT MY IDEAS✅

Long and Strong, NZDCHF Plays Its SongI've always wanted to be a part of a thrilling Kiwi-Swiss adventure, and what's more thrilling than a 0.55 target?

1. Risk-On Sentiment and Economic Recovery

The New Zealand Dollar (NZD) is often considered a risk-correlated currency, meaning it tends to perform well during periods of global economic optimism and growth. As the global economy shows signs of recovery, particularly in the second half of 2024, the NZD is likely to strengthen

. This is further supported by the Reserve Bank of New Zealand's (RBNZ) efforts to maintain inflation within a target range, which can boost investor confidence in the NZD .

2. Technical Indicators Suggest Bullish Patterns

Recent technical analysis indicates the formation of bullish patterns in the NZDCHF pair. Specifically, a cup and handle formation on the 4-hour chart suggests a potential breakout, with confirmation expected if the price closes above 0.5433 . This technical setup supports a bullish outlook, with potential targets at 0.5448 and 0.5460, making the 0.55 target plausible .

3. Economic Data and Forecasts

New Zealand's economic data and forecasts provide a supportive backdrop for the NZD. The country is expected to see a reduction in inflation to below 3% by Q3 2024, with further decreases anticipated by 2026 . Additionally, while the first half of 2024 saw GDP contraction, growth is expected to resume in the second half of the year . These factors contribute to a positive economic outlook for New Zealand, which can strengthen the NZD.

4. Safe Haven Dynamics of the Swiss Franc

The Swiss Franc (CHF) is traditionally seen as a safe haven currency, attracting investment during times of economic uncertainty . However, as global economic conditions improve, the demand for safe haven assets like the CHF may decrease, leading to a relative weakening of the CHF against riskier currencies like the NZD . This shift in investor sentiment can support a long position in NZDCHF.

5. Impact of Chinese Economic Performance

China is New Zealand's largest trading partner, and the performance of the Chinese economy significantly impacts the NZD . Positive developments in China can lead to increased demand for New Zealand exports, thereby strengthening the NZD. As the Chinese economy shows signs of stabilization and growth, this can further support a bullish outlook for NZDCHF.

6. Market Sentiment and Real-Time News

Real-time market sentiment and news also play a crucial role in currency movements. Recent reports indicate a slight decline in the NZD, but this could present a buying opportunity if the broader economic and technical indicators remain positive . Additionally, consumer confidence in New Zealand, as measured by the ANZ Roy Morgan Consumer Confidence index, remains a key indicator to watch .

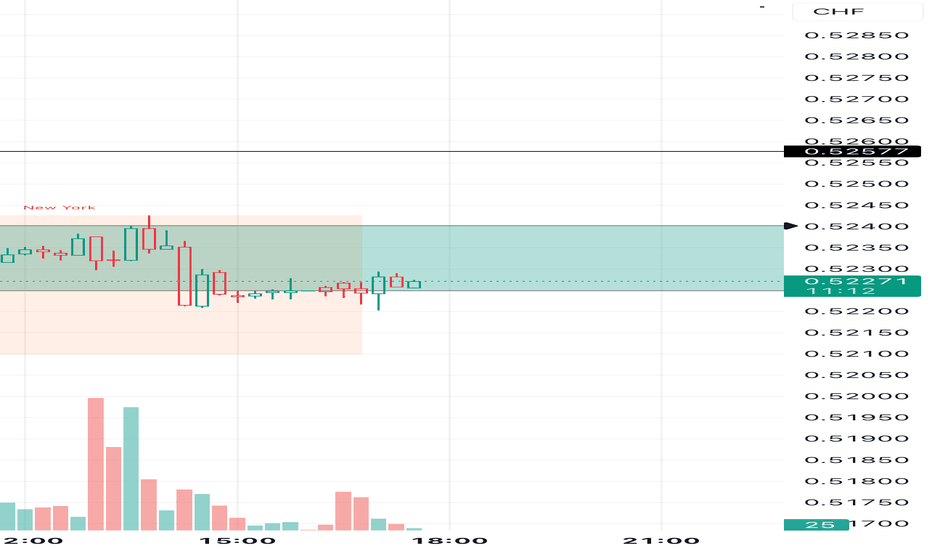

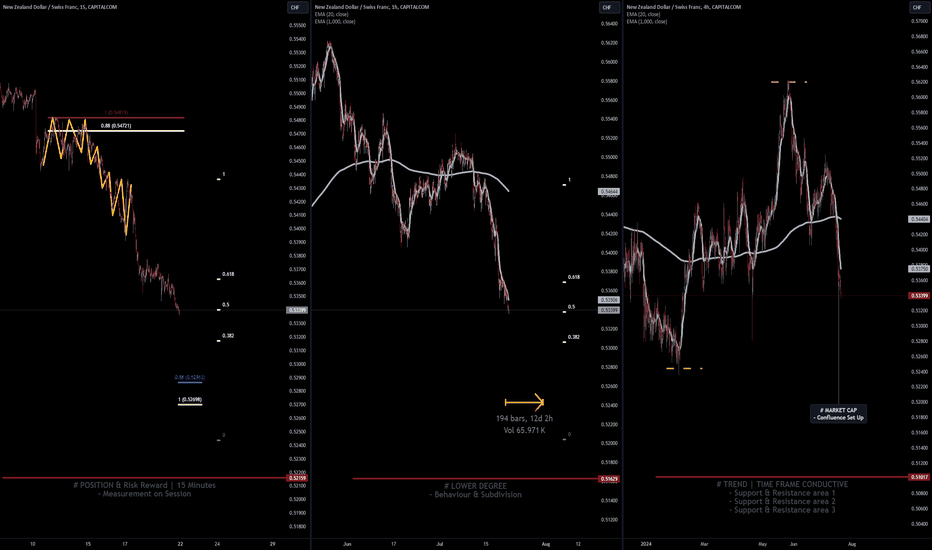

NZDCHF | Range Idea | Pre-MarketWithin a 100K Account Balance the split on Trade & Risk Management = 1/10% - 1/20% margin as an Execution Range, to set up an Order Entry and select a per Trade on Average, to avoid any drawdown hit regarding to Stop Loss & to execute Risk on Management Specifics. Trail Stop efforts are a Focus of Attention to the set up in general when Volatile-Price-Action is involved, mainly because of the usage of an Intraday-Scalp-Position tool on behalf on the Trade Plan in general

# POSITION & Risk Reward | 15 Minutes Time Frame

- Measurement on Session

* Retracement | 0.5 & 0.618

* Extension | 0.88 & 1

# POSITION & Risk Reward | 1 Hour Time Frame

- Measurement on Session

* 20 EMA

* 1000 EMA

* Retracement

# TREND | TIME FRAME CONDUCTIVE | 4 Hour Time Frame

- Support & Resistance area 1

- Support & Resistance area 2

- Support & Resistance area 3

- Subdivision & General Trend

- Measurement on Session

* Retracement

* Support & Resistance

* Trade Area | Focus & Motion ahead

Active Sessions on Relevant Range & Elemented Probabilities;

* Asian(Ranging) - London(Upwards) - NYC(Downwards)

* Weekend Crypto Session