AUSTRALIA200CFD trade ideas

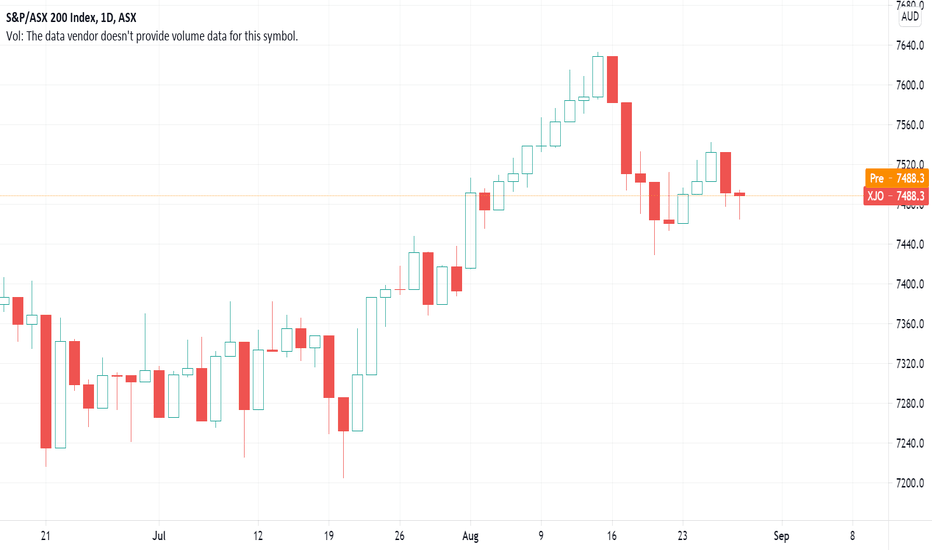

S&P/ASX 200 Index - Aug / Sep Turn of the Month EffectNo evidence of an August / September Turn of the Month Effect for the S&P ASX 200 Index (ASX:XJO). Since 2000, the last 2 days of August & first 2 days of September reveals a slight upward bias. Albeit, noise dominates the data. 4-day average return of 0.35%, win rate 12 from 21, standard deviation of 1.67%.

XJO - Historical Performance - Last 5 trading days of AugustSince 2000, the historical performance of the S&P ASX 200 Index XJO for the last 5 trading days of August reveals a slight upward bias. Albeit, noise dominates the data. 5-day average return of 0.51%, win rate 13 from 21, standard deviation 1.98%.

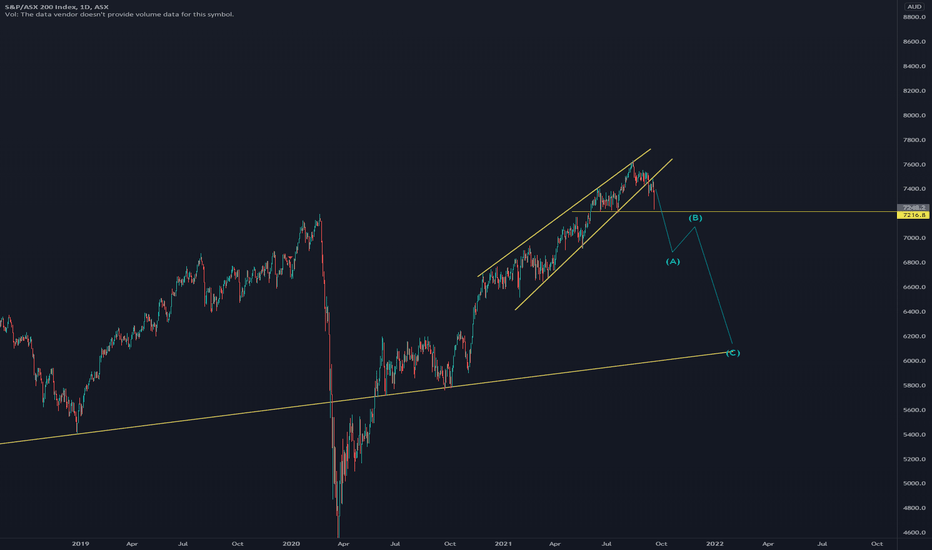

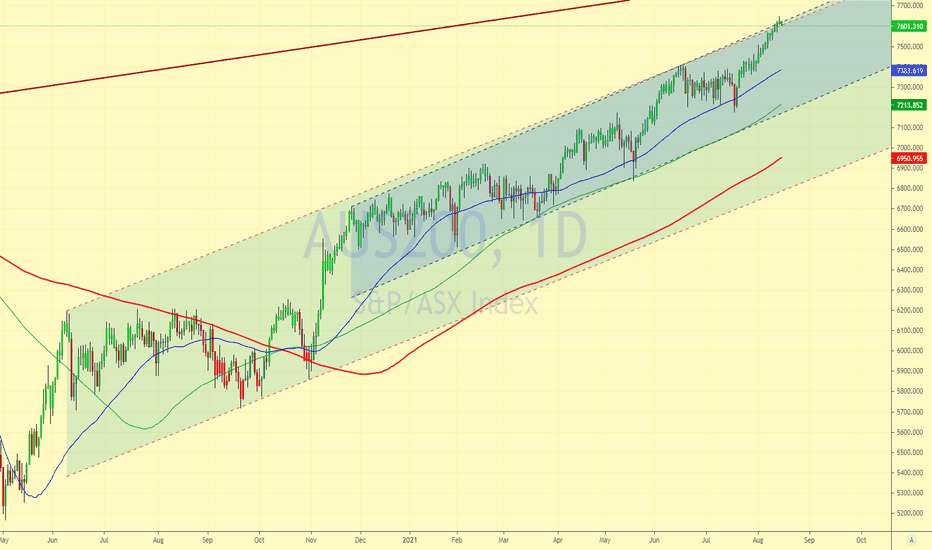

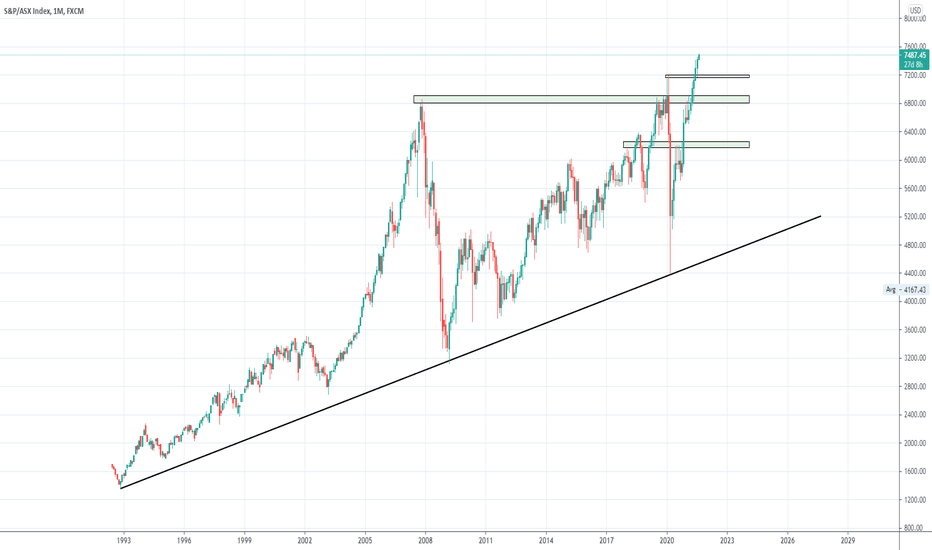

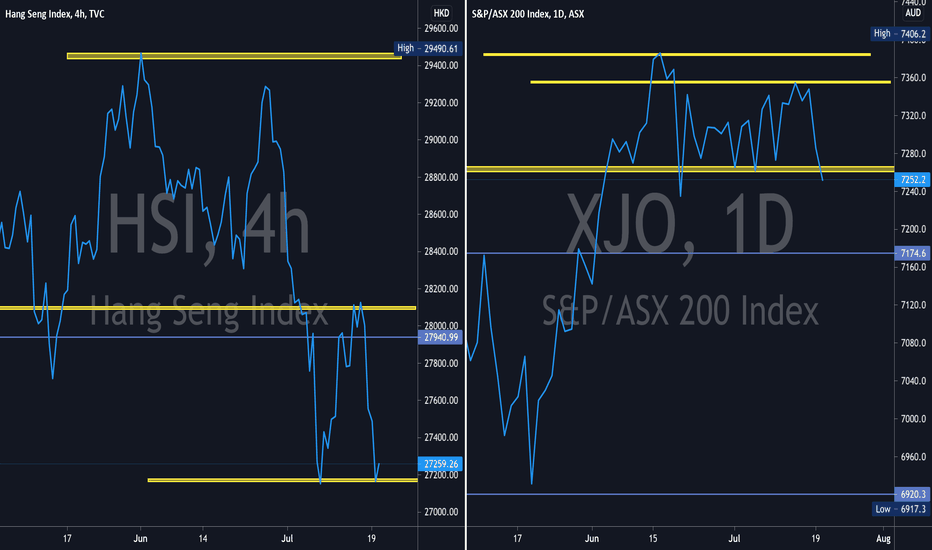

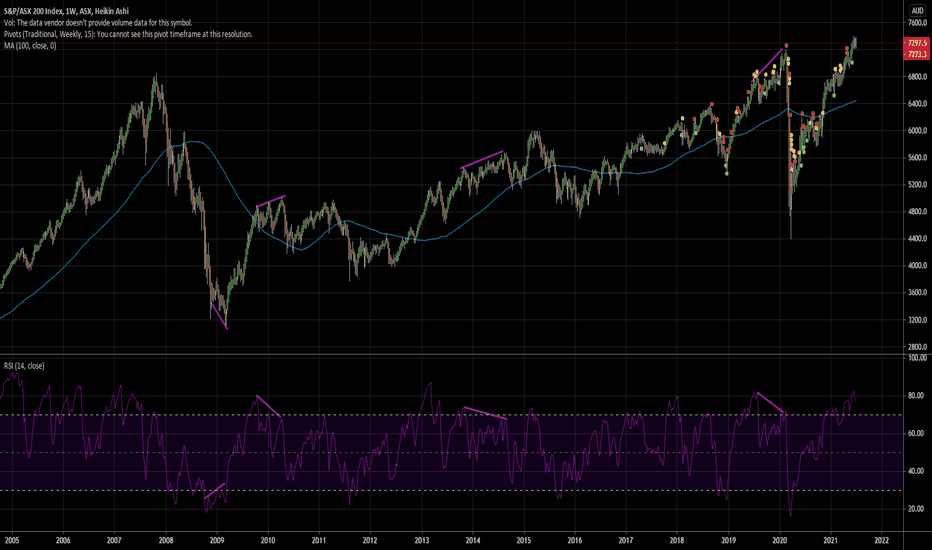

Australian stocks looking pretty goodAfter more than a decade of poor performance relative to other markets, the Australian stock market has clearly broken out. At least it has broken out in AUD terms, not USD terms (not yet). It's looking pretty strong and in my opinion it could continue much higher. Definitely one market that makes me have a more bullish outlook on stocks in general.

At some point it could return to 6300, but for now I can easily see it go to 10000 over the next 12-18 months.

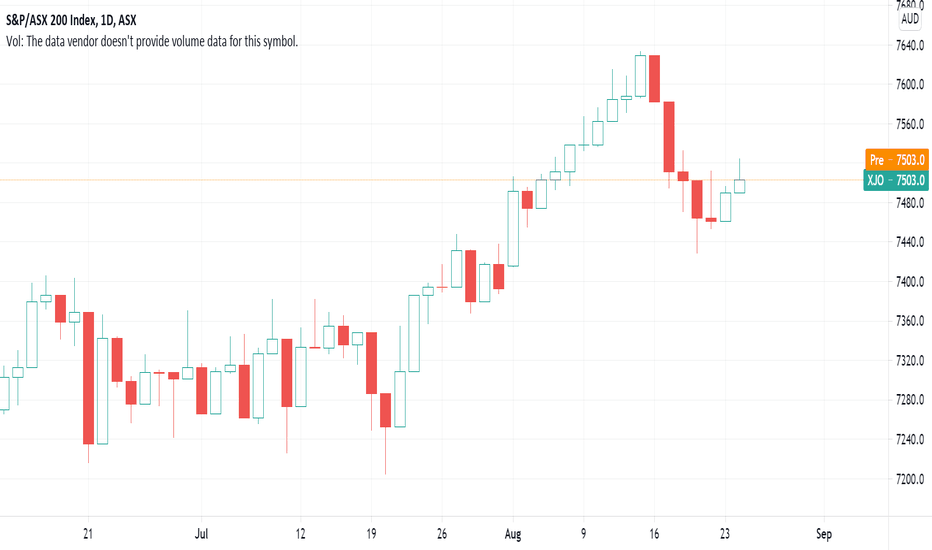

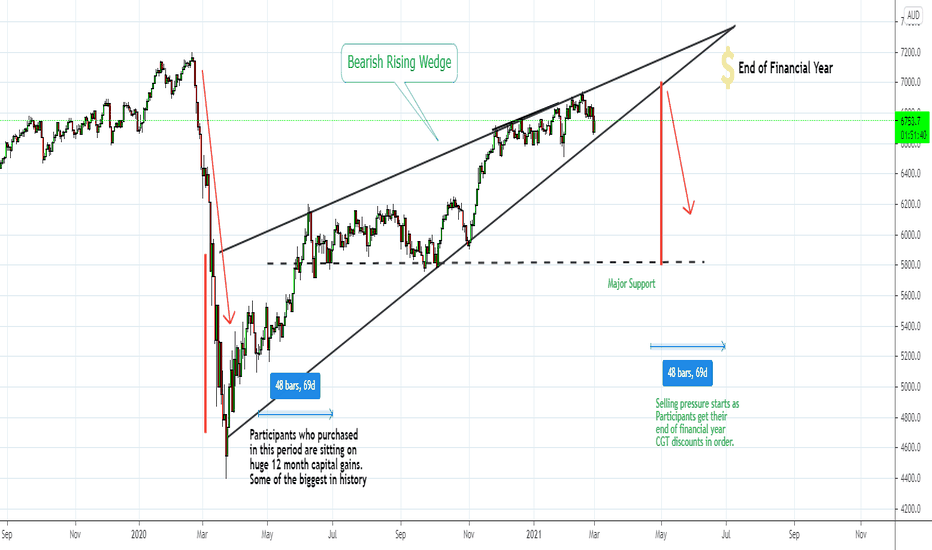

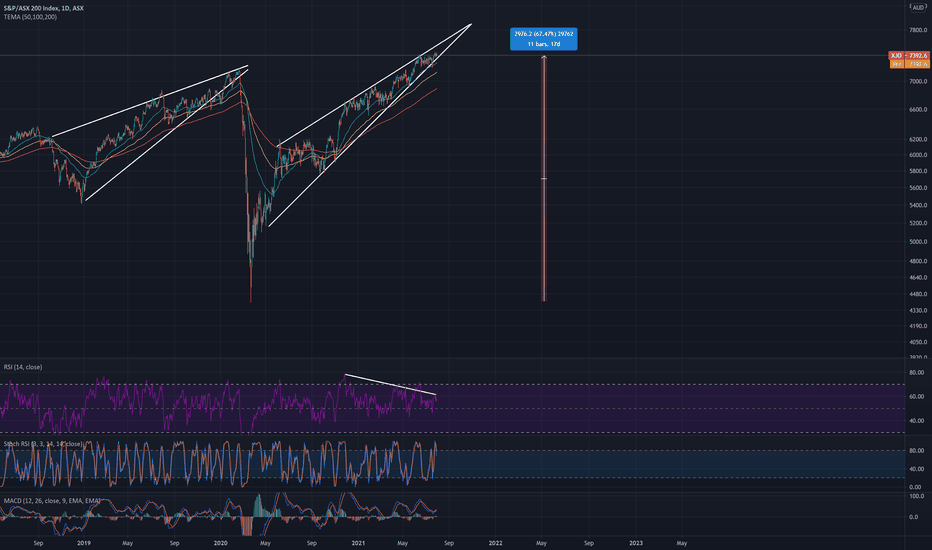

LONG ASX - Rising Wedge and Bearish RSI Divergence RiskSUMMARY: Long, expect to see continued fiscal and monetary support pushing asset prices higher

ASX200 is highly correlated to the S&P500. Correction in the SPX will cause one in the ASX.

-- Technical --

It is a bearish and the price action is way above the EMAs , a correction is due.

--Fundamentals --

However, because of the government support, anticipate further upside.

Please HIT the --->>> "LIKE" and "FOLLOW" button. <<<----

*Not financial advice and is for educational purposes only. Always DYOR.

SO: What do you think, i? Let me know below.

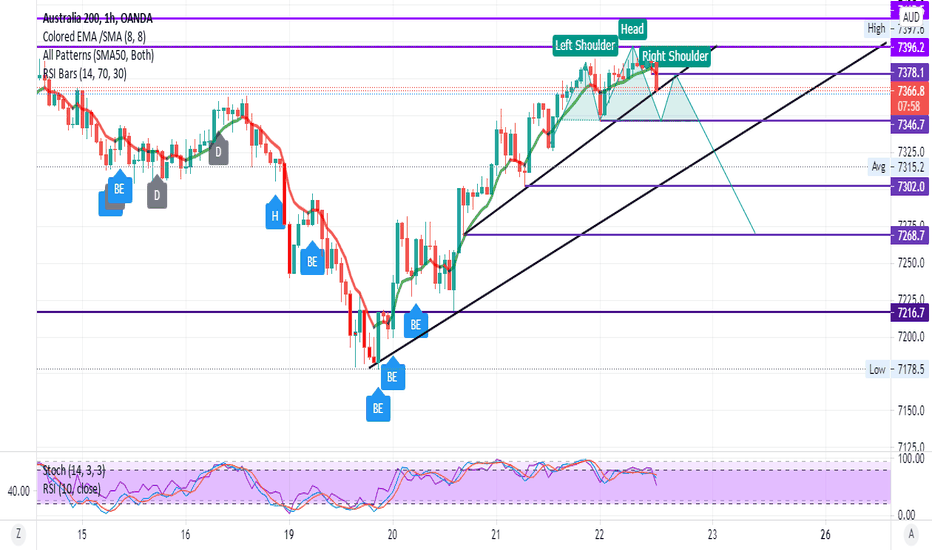

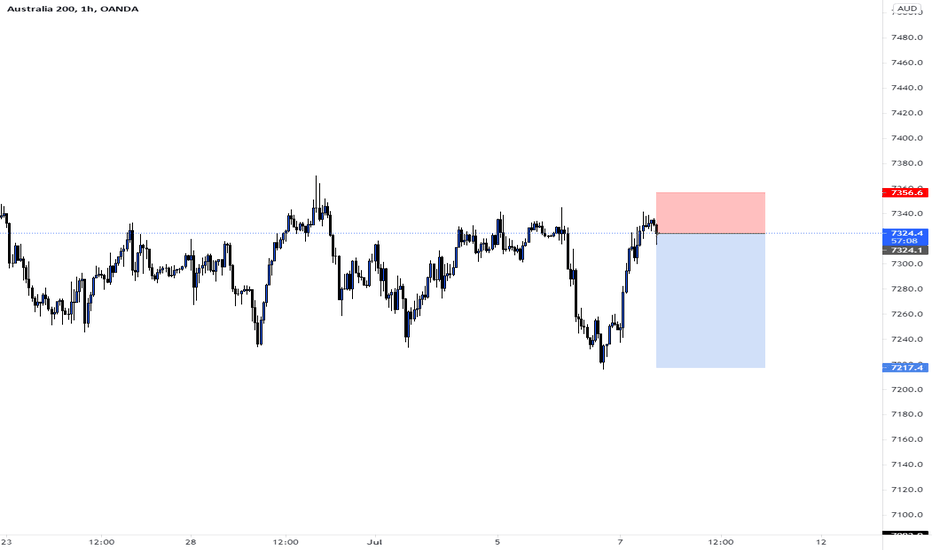

Expected Breakout Higher in AUS200Disclaimer

The views expressed are mine and do not represent the views of my employers and business partners. Persons acting on these recommendations are doing so at their own risk. These recommendations are not a solicitation to buy or to sell but are for purely discussion purposes. At the time publishing, I have a position in AUS200.

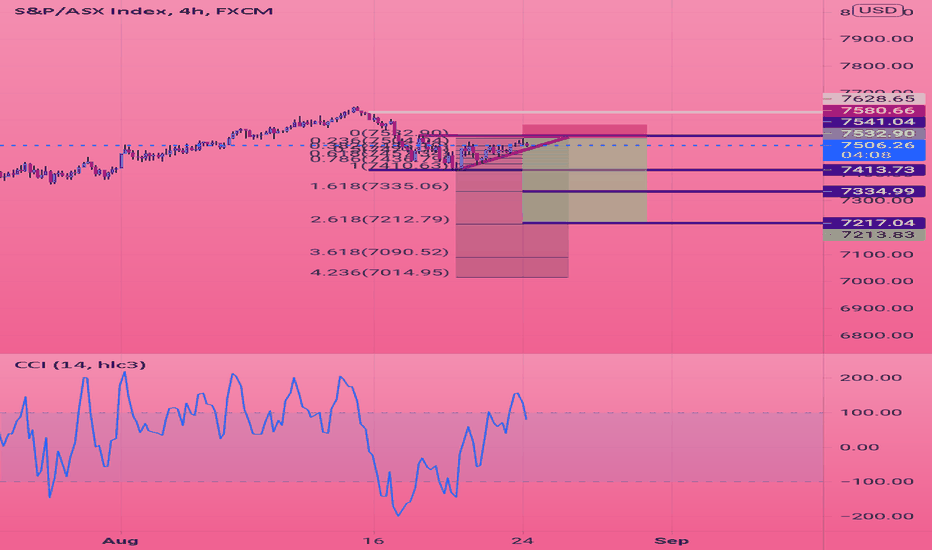

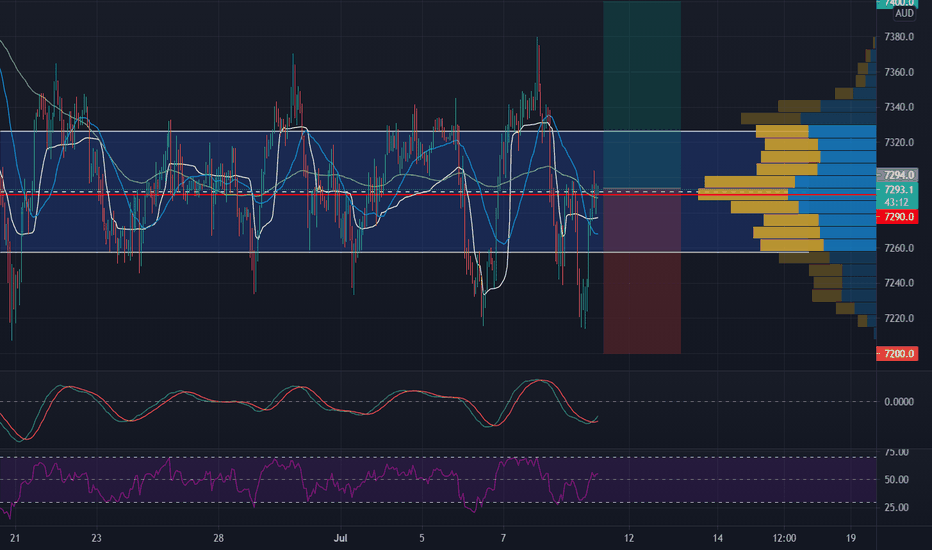

Trend Analysis

The main view of this trade idea is on the 1-Hour chart. AUS200 has been in a rangebound move and is expected to breakout in the short to medium term. Based on the market profile, the range is between 7255 and 7325.

Technical Indicators

AUS200 recently crossed above its short (25-SMA), medium (75-SMA) and fractal moving averages and it is currently at the middle of the range. The RSI is above 50 and is heading higher. Moreover, the KST confirmed bullish move with a positive crossover.

Recommendation

The recommendation will be to go long at market. At the time of publishing AUS200 is trading around 7293. The medium-term target price is observed around the 7400 price level. A stop loss is set at 7200.

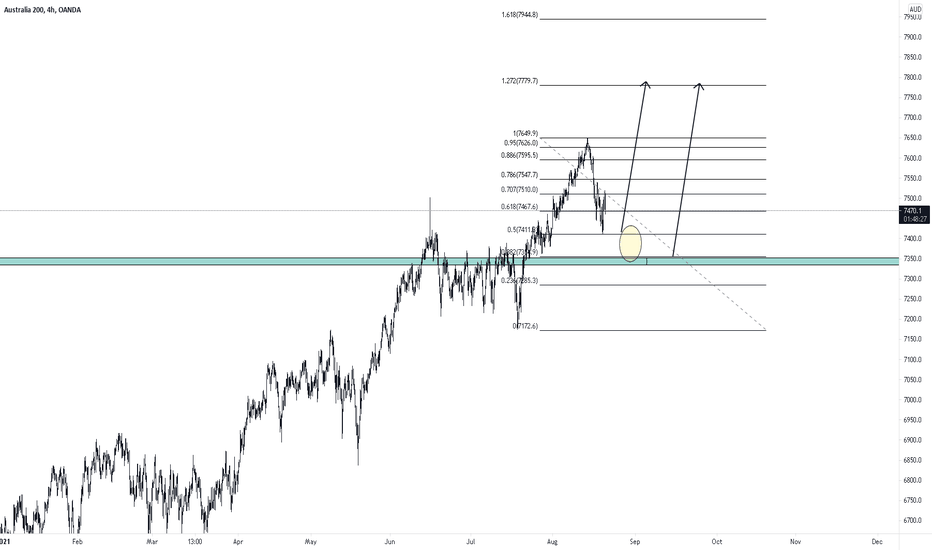

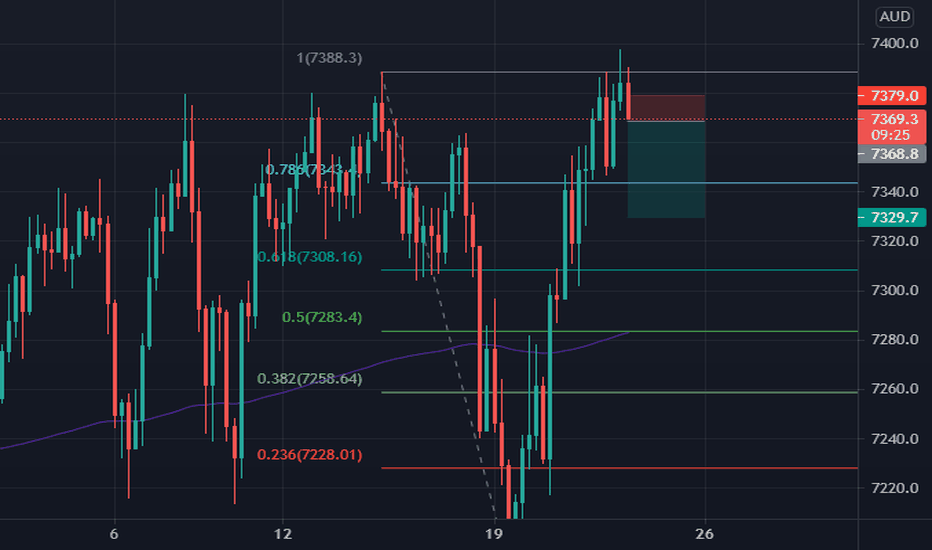

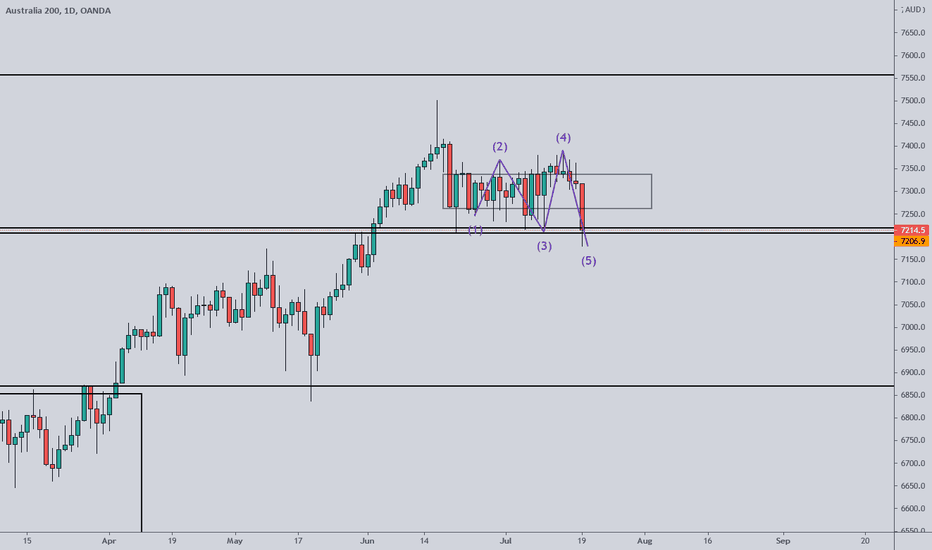

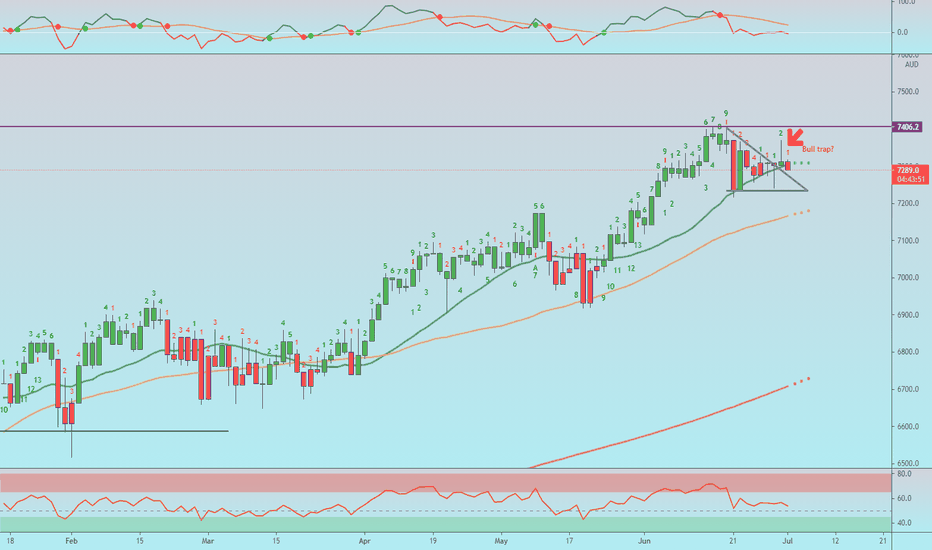

Risk Management - Tom DeMark TD 9 Still in Play ASX200 $XJO Was 7406 the top for the short term?

Was the breakout this week a bull trap?

Technical indicators such as the MACD and RSI are still with the bears.

If we close below the 21 daily moving average, time to reduce position size and risk until we can close above 7406 again.