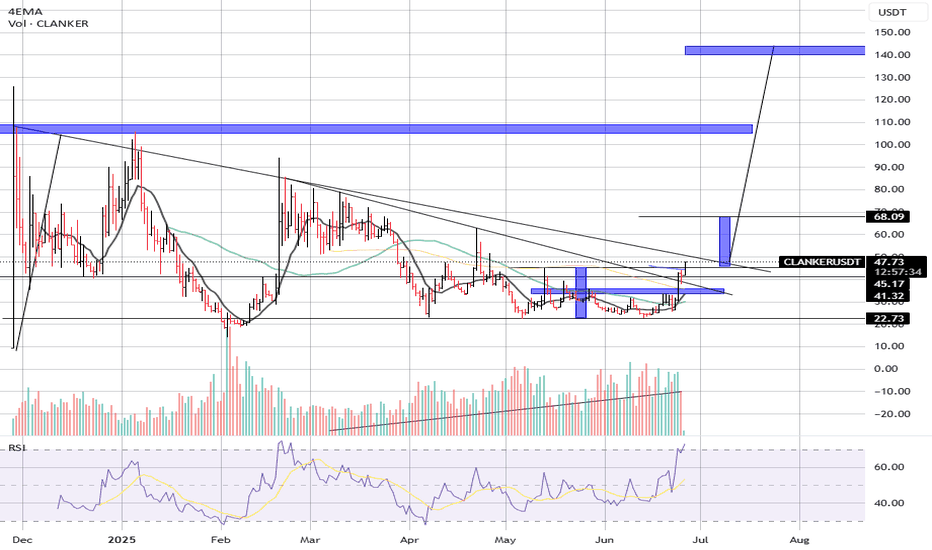

CLANKER/USDT – Major Breakout from Descending Triangle Points to

Date: June 26, 2025

CLANKER/USDT has just broken out of a long-term descending triangle pattern, a move that signals a shift in market sentiment from bearish to bullish. This breakout is accompanied by increasing volume and rising momentum, indicating strong buyer interest.

📊 Technical Overview:

Current Price: $46.44

Breakout Level: ~$45.00

Key Support Levels:

$41.32 (local support and former resistance)

$22.73 (macro support zone)

📈 Resistance/Target Zones:

Short-Term Target: $68.09 (first measured move)

Mid-Term Resistance: ~$105–110 zone (historical supply)

Long-Term Target: $145.00 (measured projection from pattern breakout)

📈 Indicators:

RSI: 72.09 – bullish momentum confirmed, entering overbought zone (but healthy in breakouts)

Moving Averages (EMAs): All EMAs are beginning to turn upwards and align bullishly, with price now clearly above them.

📉 Volume:

Volume has shown a steady uptick since early June, confirming the breakout is supported by accumulation and strong demand.

🔍 Chart Structure:

Price was previously stuck in a descending triangle with a base around the $22–45 range.

Breakout has occurred above both horizontal resistance and the descending trendline.

Bull flag or ascending triangle structure formed just before breakout, confirming the build-up phase.

🎯 Upside Projections:

First Target: $68.09

Second Target: ~$105–110 (historical supply zone)

Final Target: ~$145.00 based on the measured move from the height of the descending triangle.

📉 Invalidation:

A move back below $41.32 would weaken the bullish case.

A breakdown below $22.73 would invalidate the entire bullish thesis and suggest renewed selling pressure.