CPO1! trade ideas

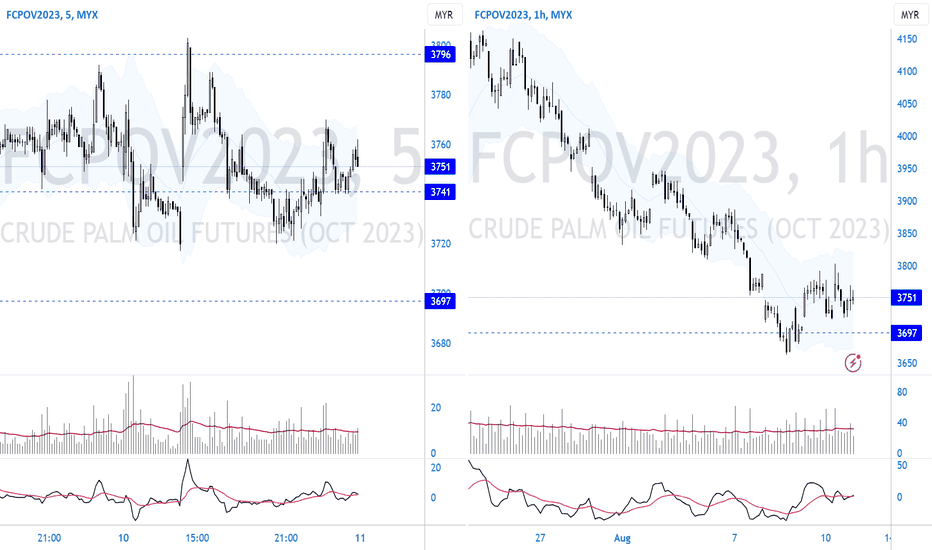

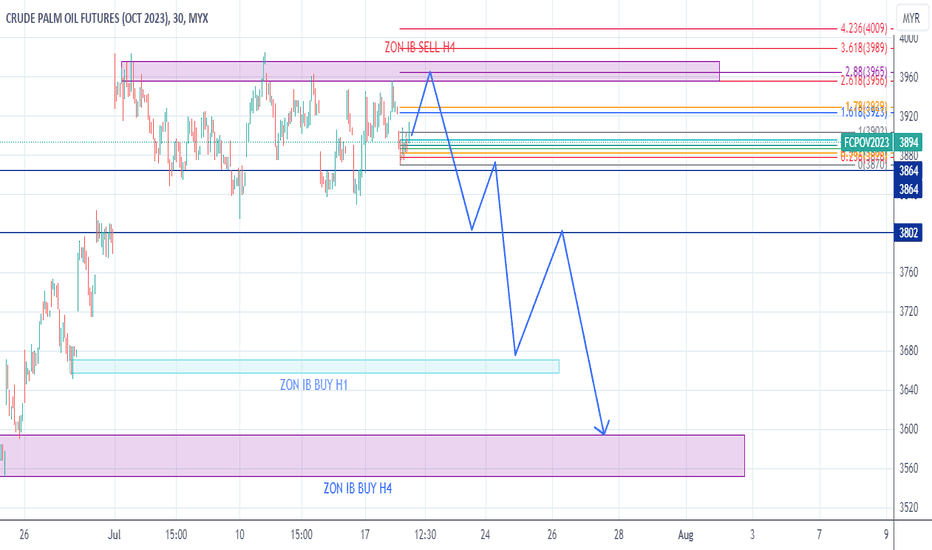

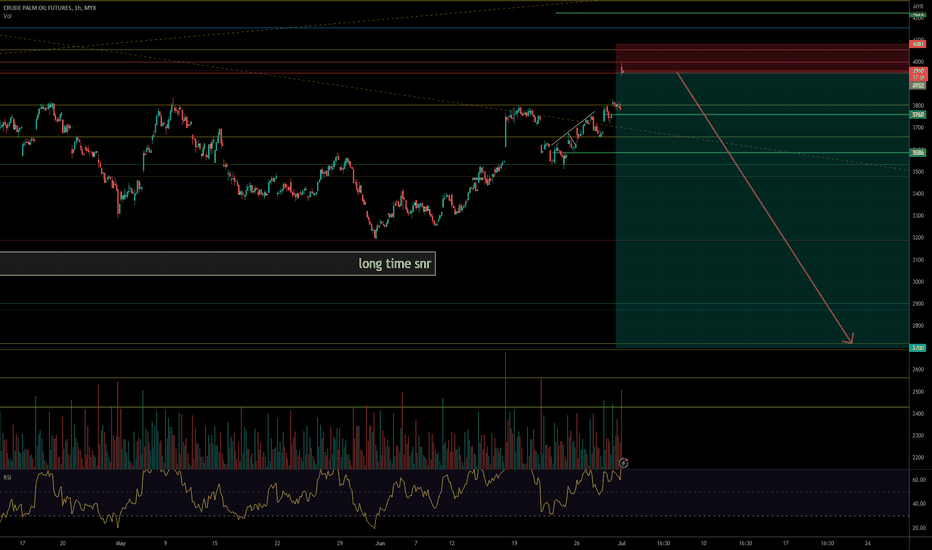

11AUG23 FCPOV23 1002AM Condition is bearishIntra-day trading, 5min is the trading timeframe.

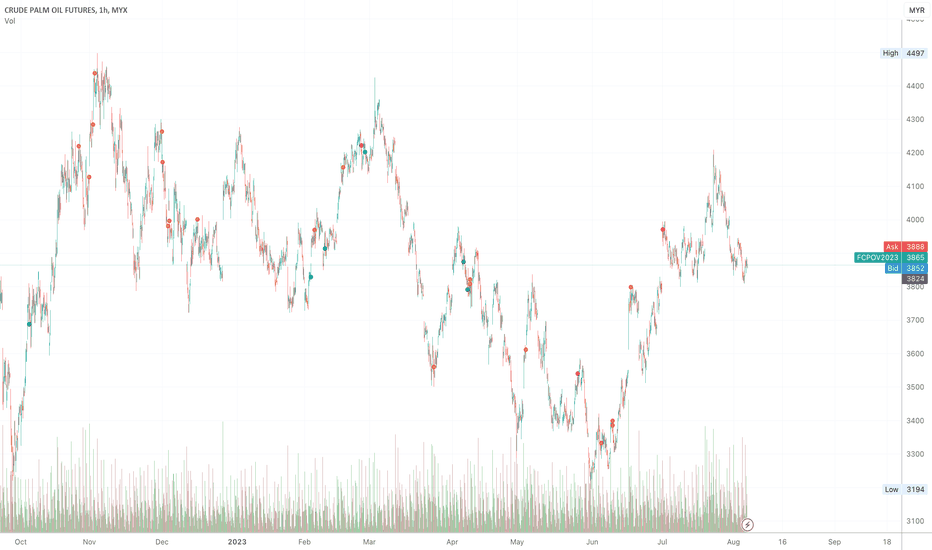

1. My bias leans towards bearish. The 1-hour timeframe shows a strong major downtrend. Price correction provides relief from the overextension of the major downtrend.

2. Bearish condition is reset when price hit 3796 or 3697.

3. 3741 is the key level to watch for setup.

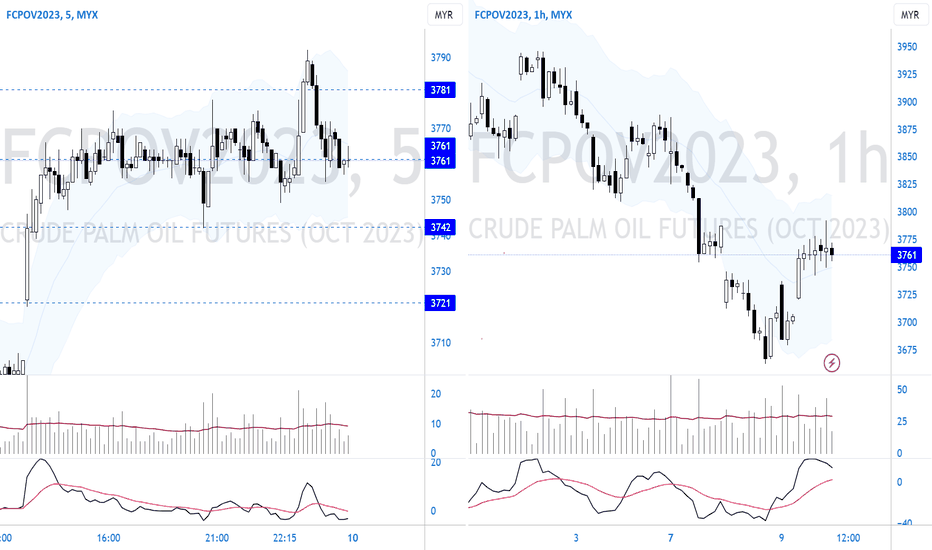

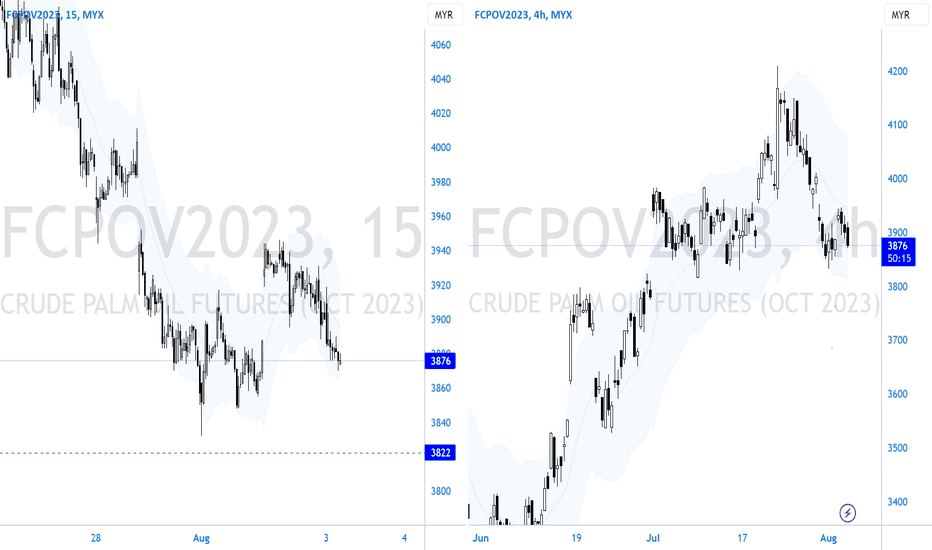

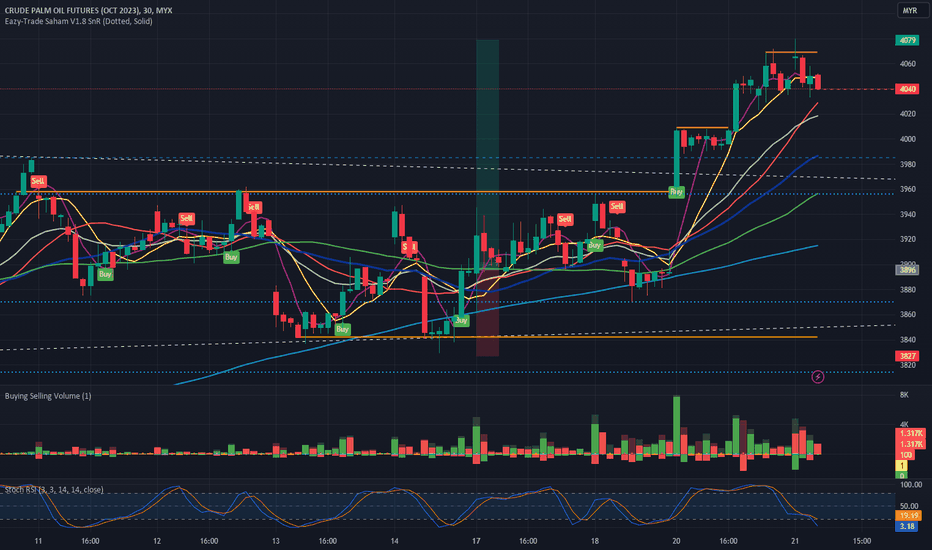

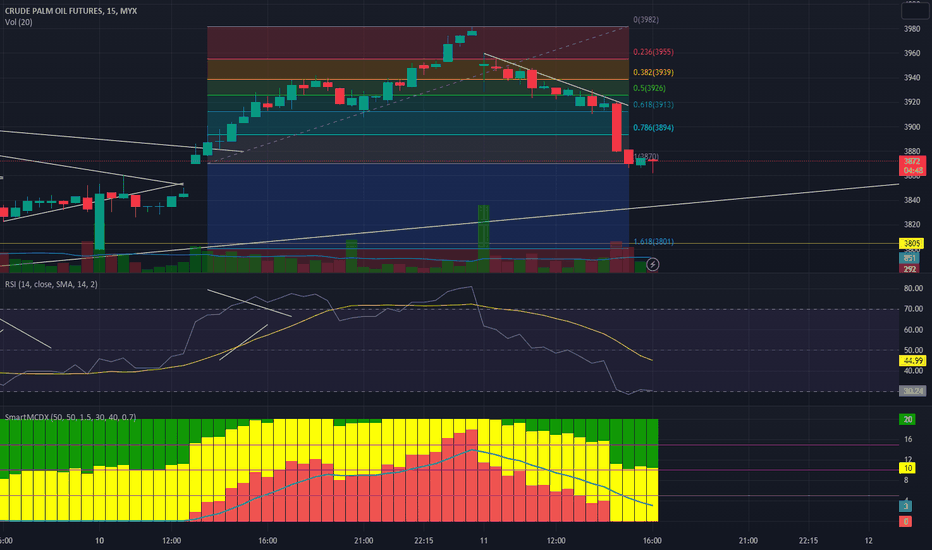

10AUG2023 FCPOV23 1025AM Bearish condition, be conservative. 1. 1 HOUR: The major trend is bearish, and there has been a significant retracement in that major downtrend, indicating short-term buyer exhaustion relative to the major downtrend.

2. 5 MIN: Its condition is choppy, suggesting a balance between buyers and sellers.

Summary: The condition is slightly bearish. If the price reaches 3781 or 3742, the bearish condition will be reset. 3761 is a key level to watch. If the price love to stay around this level, plan for a short setup. I expect a quick outcome; otherwise, abort the mission.

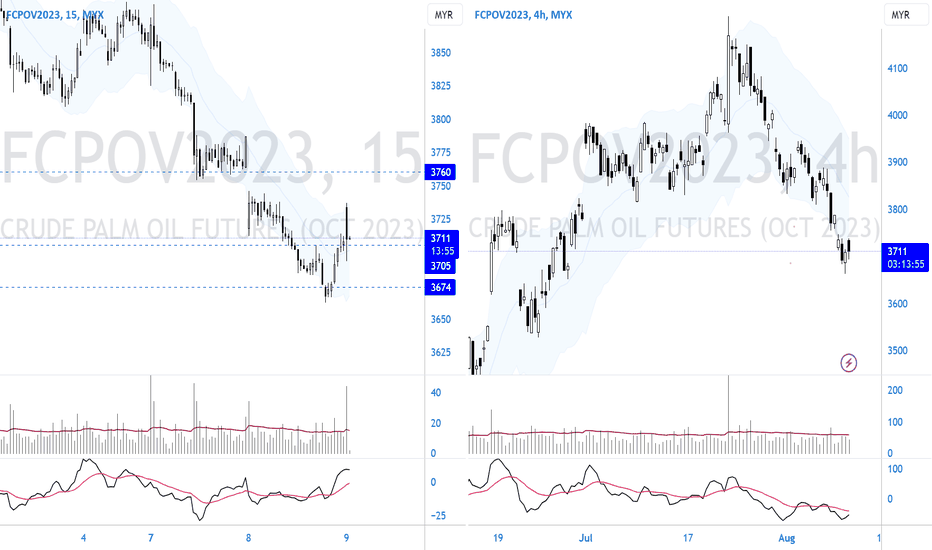

9AUG23 FCPOV23 1030AM Current condition is bullishThe 4-hour chart is currently experiencing a major uptrend, albeit weakened due to a substantial retracement.

The heavy retracement is showing signs of short-term exhaustion, which may favor short-term buyers.

On the 15-minute chart, sellers appear to be losing momentum.

Summary: The overall condition suggests a leaning towards a bullish trend, but a cautious approach is advisable. If price hit 3760 or 3674, the bullish conditions is reset and look for new conditions.

Key Level to Monitor: Keep an eye on the level at 3707. Anticipate potential interruptions in the 15-minute price movement initially. If the price rejects from 3707, consider planning for a long setup.

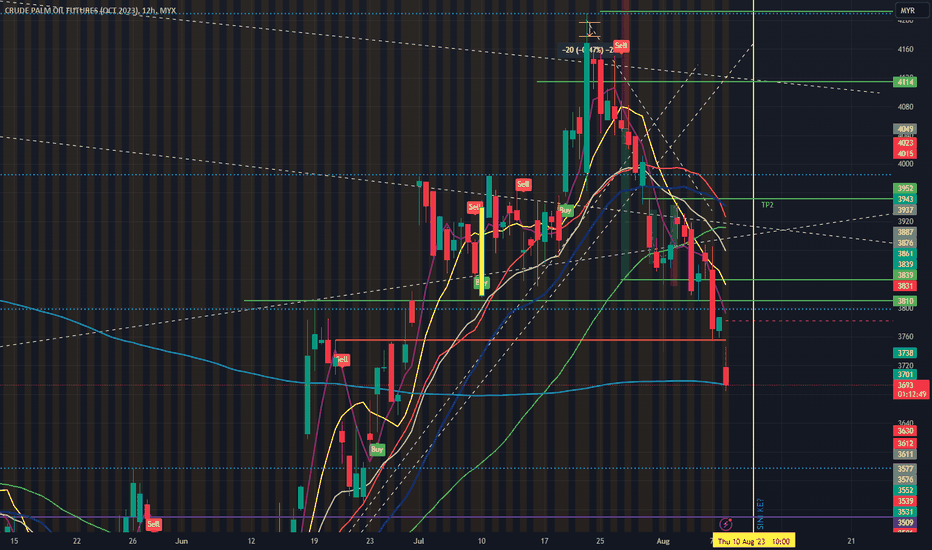

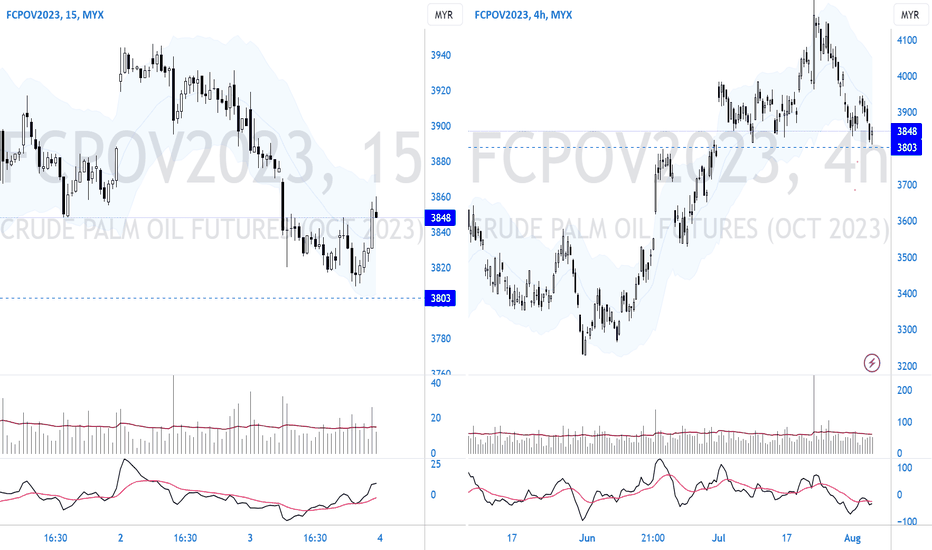

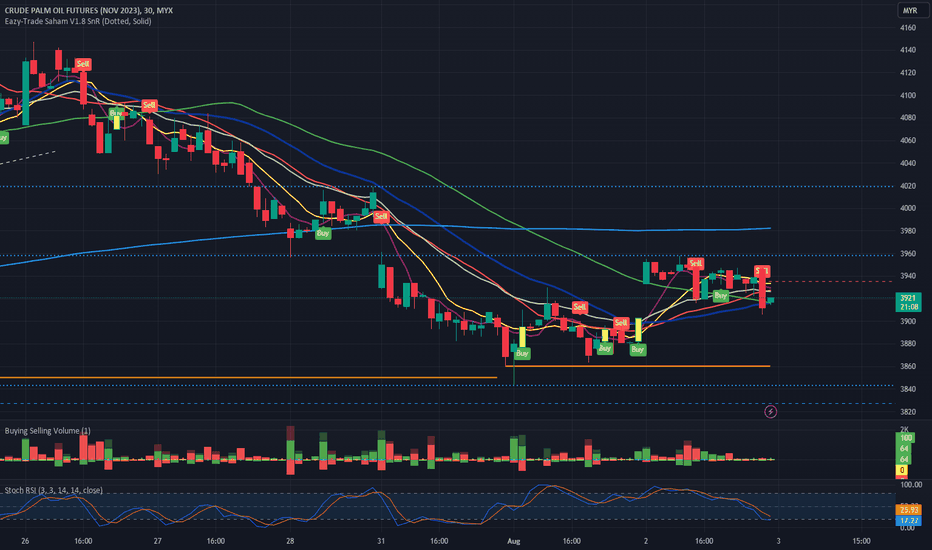

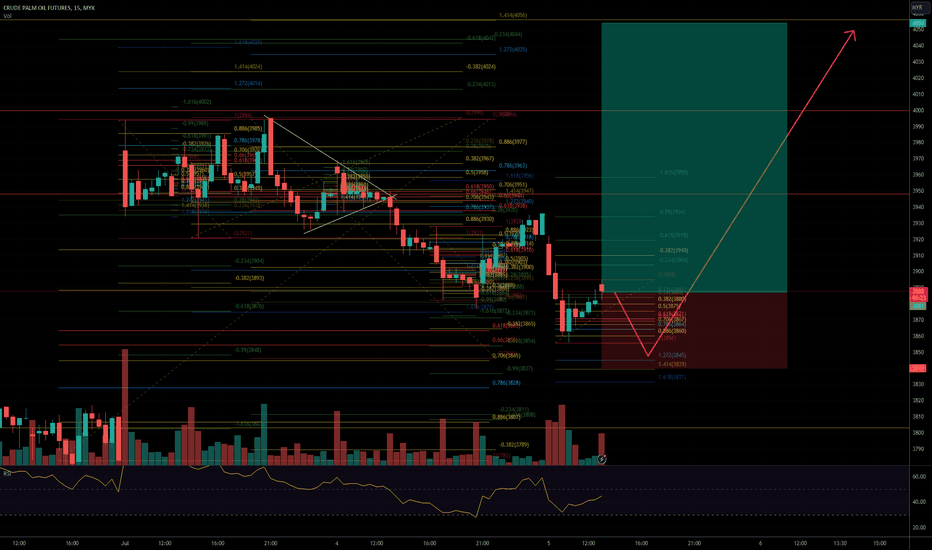

4AUG2023 1019AM FCPOV23 Current conditions is favor for buyer4hour (higher timeframe)

4hour price by broad view, it is having uptrend. Currently, its pullback is a bit heavy and getting slightly overextended. This condition is favor for buyer.

15min (main timeframe)

Initially, price is falling heavily, but falling price is slowing down in the later event, indicate that seller is losing steam.

Summary - Overall situation is more toward bullish. 3803 is the key level to watch, but I need key price action happen there, I expects price reject strongly there, and look for setup.

If price burst up strongly to 3900 during market open at 1030am, I think my bullish bias is reset.

If price burst down strongly to 3780, my bullish bias is reset too.

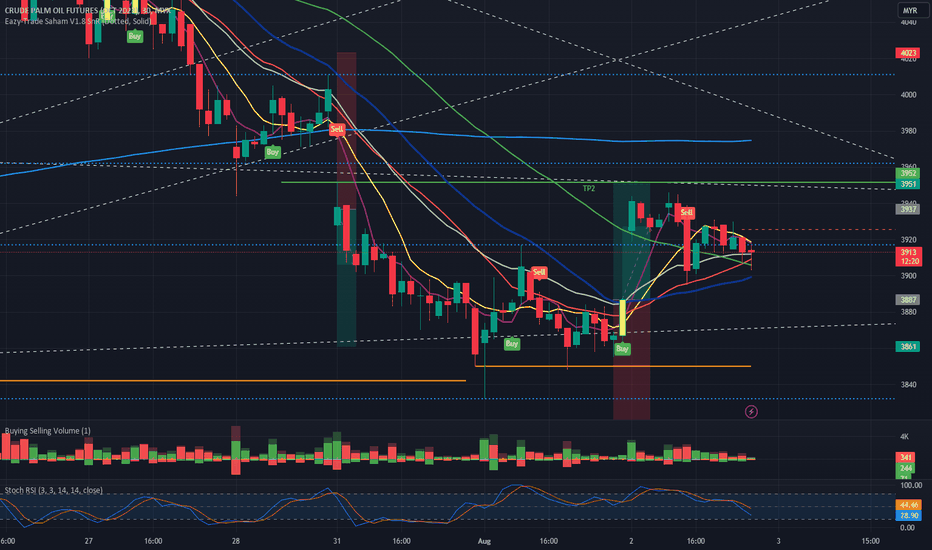

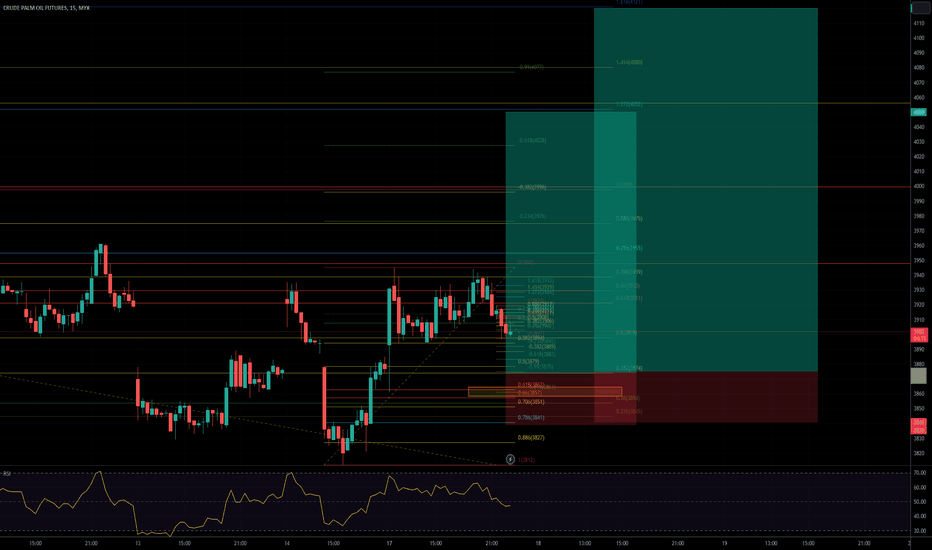

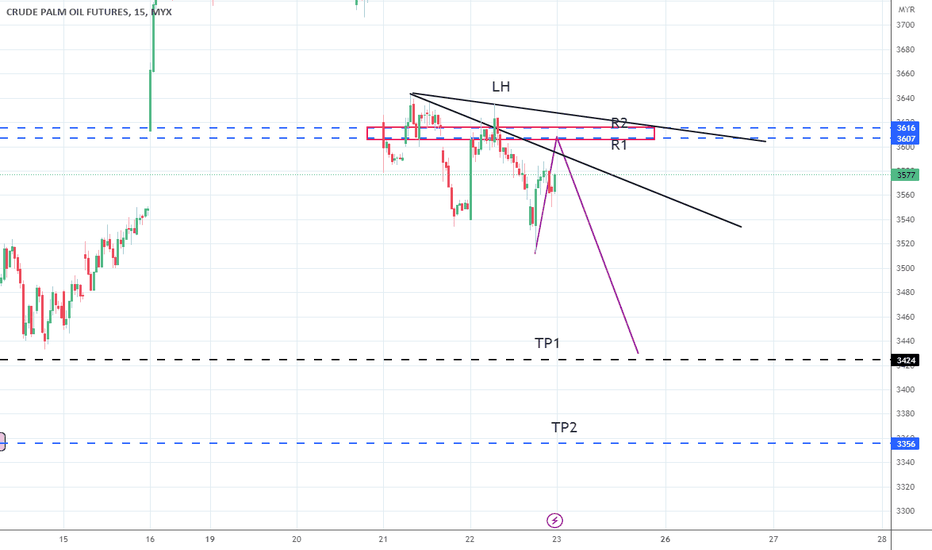

3AUG2023 1230PM FCPOV23 Buyer and seller in balanceDaytrading analysis.

15-minute timeframe is my trading timeframe (TTF), while 4-hour is my higher timeframe (HTF). The 15-minute price structure is a bit choppy, indicating a balance between supply and demand. A potential trading location is at zone 3822. I'm looking for the 15-minute price to fall heavily and slightly chop outside 3822, and then I'll try to play scalping.

Summary - Look for long setup at zone 3822 if price spike down strongly.

FCPO BONDO SETUPThis is for FCPO Trading SYstem : using BONDO setup that can win every month.

Why it is consistent winning rate?

WE use Probability on our indicator and setup, we tested it for more than 2 year backtest and Live Trade.

Every month Win. 60% winning Rate.

We only have class in malaysia in malay language.

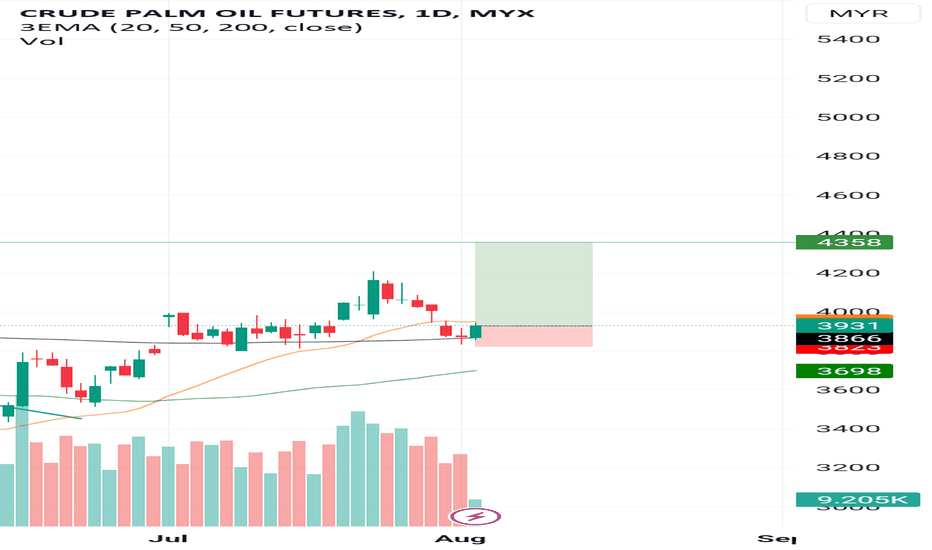

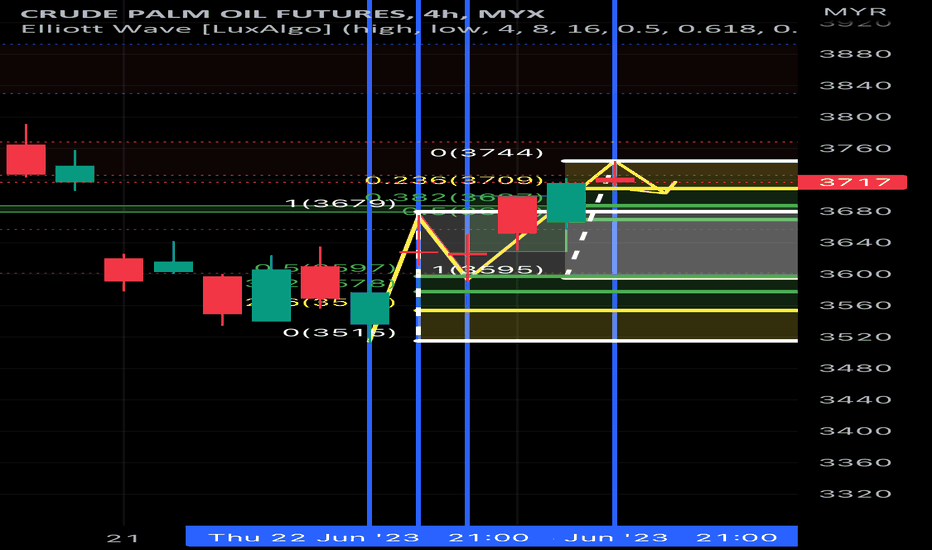

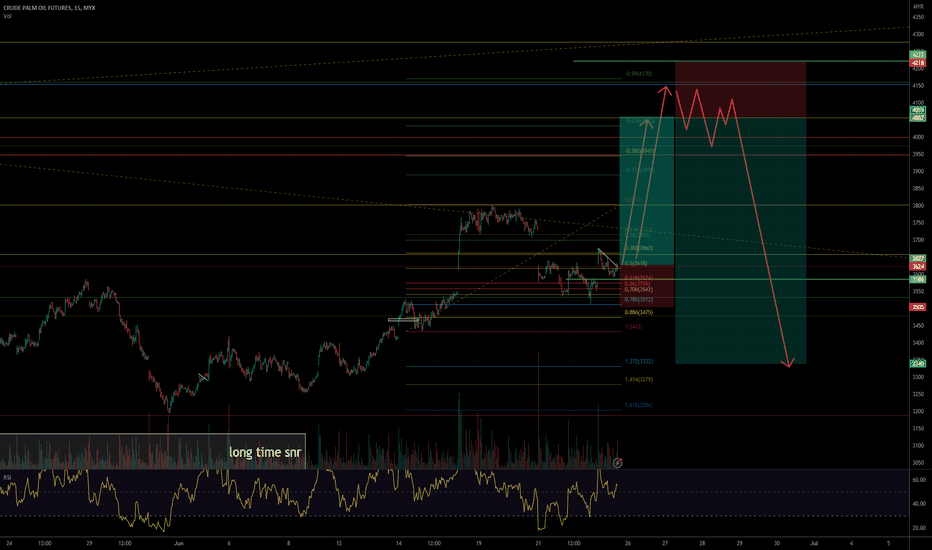

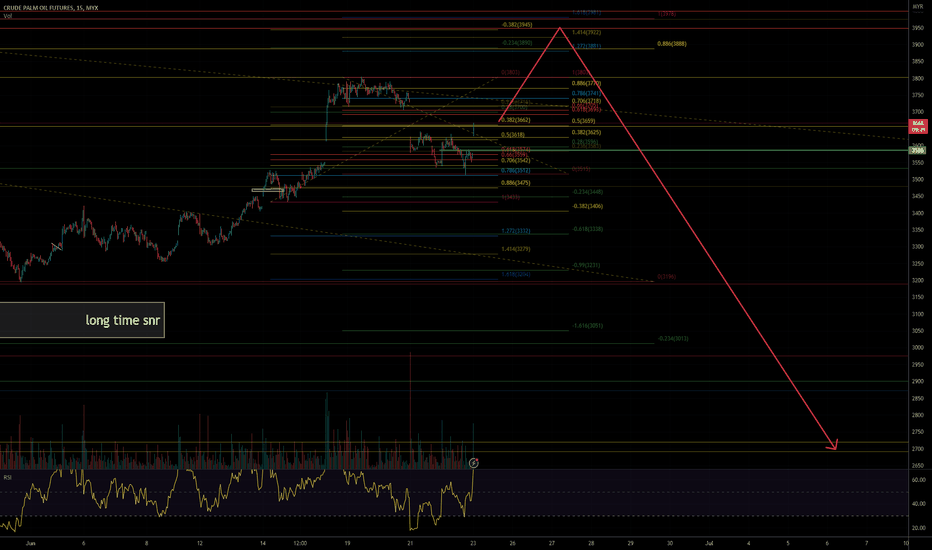

Potential FCPO make wave 5MYX:FCPO1! Is making zigzag correction wave c at tf 1D. From tf 4H seem like making wave 4 of motive wave. Correction wave have Predicted to make wave 5 of EW tomorrow. Wave 4 Normally retract to 0.38 fibo from wave 3. Waiting for wave to complete 5 wave in tf1min and ready to long