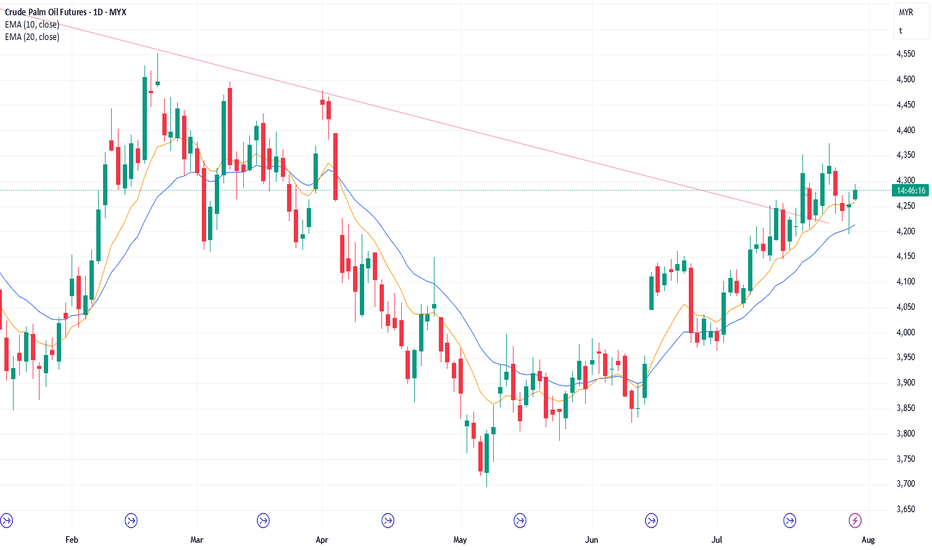

28/7/25 Minor Pullback or Something Stronger?

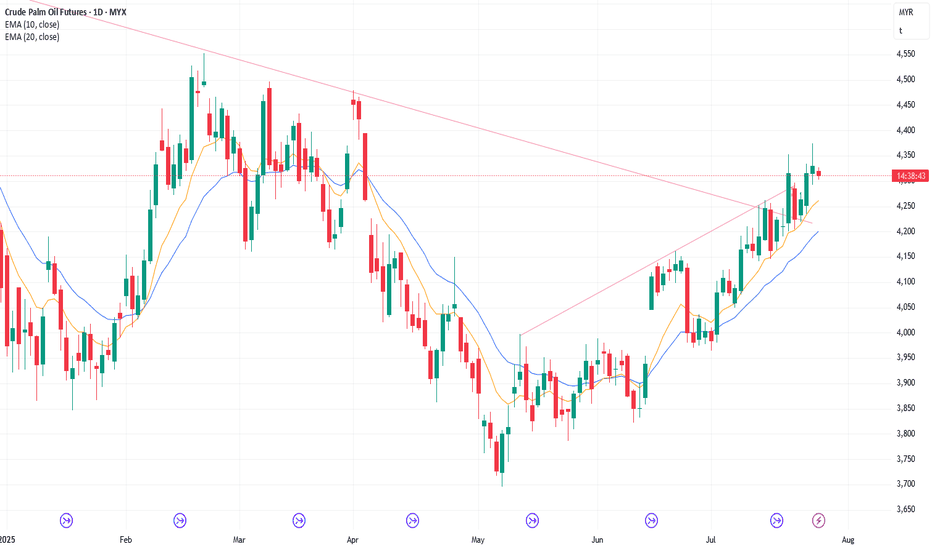

Friday’s candlestick (Jul 25) was a bear bar closing slightly below the middle of its range with a long tail below.

In our last report, we stated that traders would assess whether the bulls could generate follow-through buying or if the bears would create a strong pullback, which would close th

Related commodities

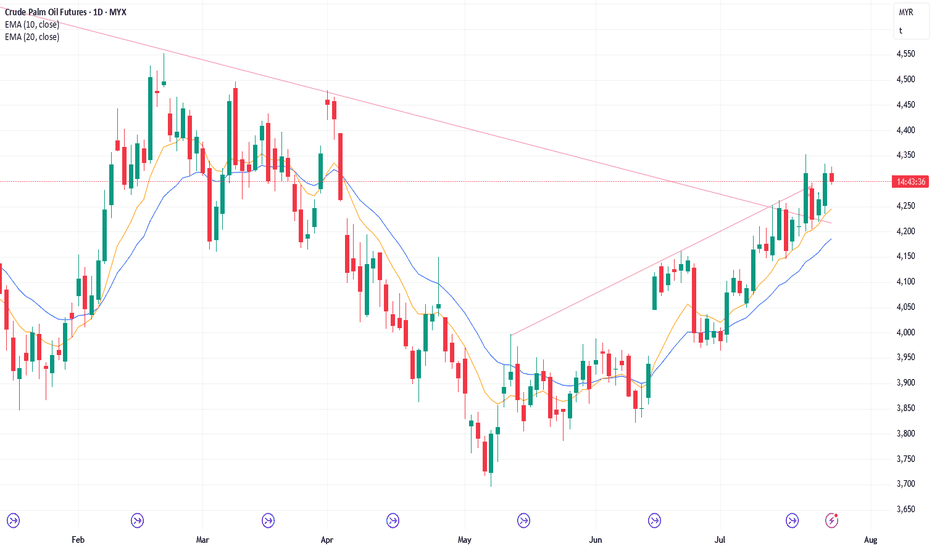

25/7/25 Follow-through Buying or Pullback Instead?

Thursday’s candlestick (Jul 24) was a bull doji closing slightly below the middle of its range with a long tail above.

In our last report, we said the odds slightly favor sideways to up. Traders would see if the bulls could create follow-through buying, breaking above the July 18 high, or if th

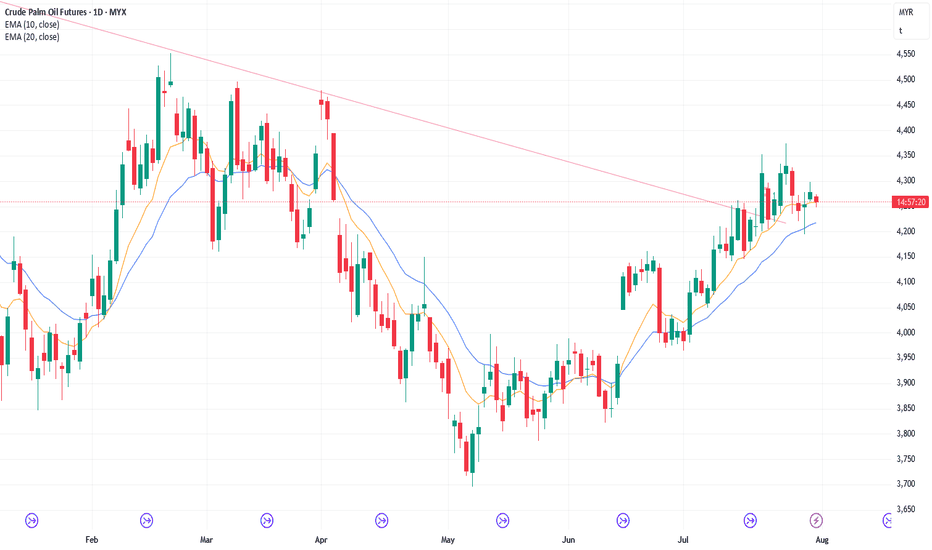

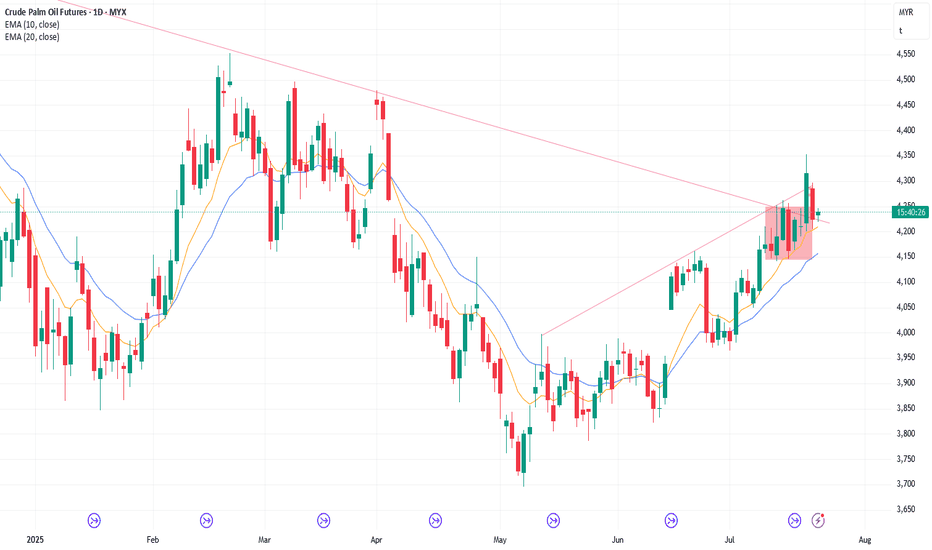

1/8/25 Will Weekly Candlestick Close Near Low or Long Tail Below

Thursday’s candlestick (Jul 31) was a bear bar closing near its low.

In our last report, we said traders would see if the bears could create a strong retest of the July 29 low, or if the market would trade slightly lower, but find support around the 20-day EMA instead.

The market traded lower

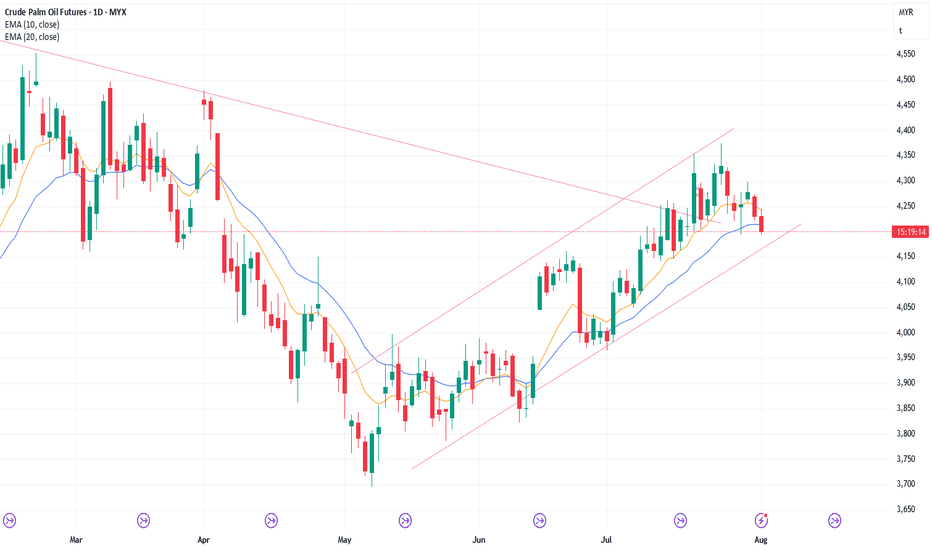

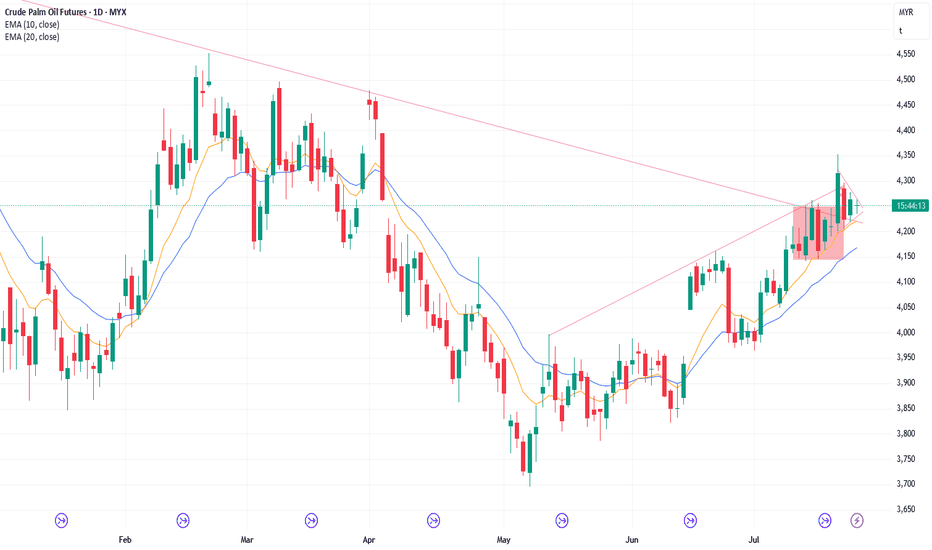

31/7/25 Still Sideways to Down Pullback Phase

Wednesday’s candlestick (Jul 30) was a small bull bar with a prominent tail above.

In our last report, we said traders would see if the bulls could create a retest of the July 24 high and a breakout above, or if the market would trade slightly higher but stall around or below the July 24 high,

30/7/25 Weak Selling Pressure So Far

Tuesday’s candlestick (Jul 29) was a bull doji bar closing in its upper half with a long tail below.

In our last report, we stated traders would see if the bears could create follow-through selling, or if the pullback phase would be weak and sideways, holding above or around the 20-day EMA inst

29/7/25 Pullback Underway, Minor or Something More?

Monday’s candlestick (Jul 28) was a bear doji bar closing around the middle of its range with prominent tails.

In our last report, we stated traders would see if the bears could create follow-through selling, or if the pullback phase would be weak and sideways instead.

The market traded slight

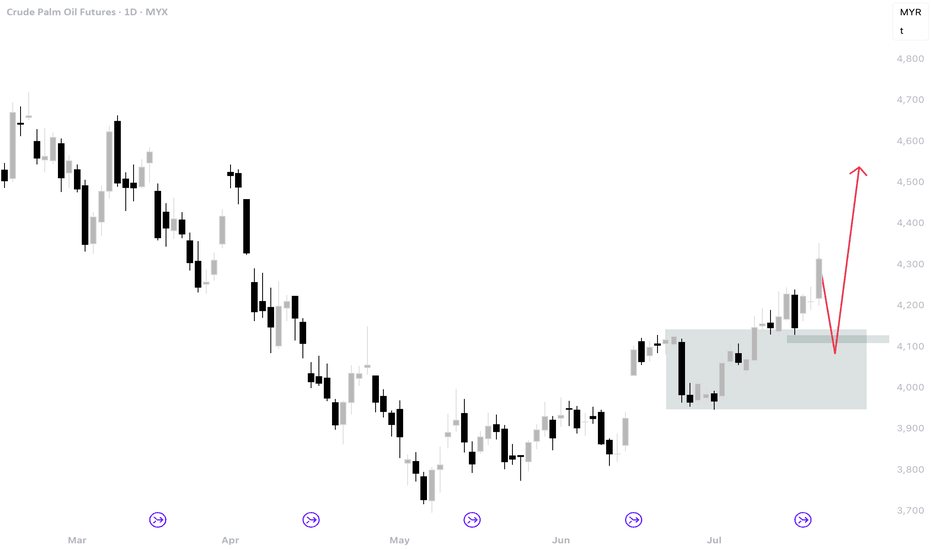

24/7/25 Buying Pressure Is Slightly Stronger

Wednesday’s candlestick (Jul 22) was a bull bar closing near its high.

In our last report, we said traders would see if the bulls could create follow-through buying and test near the July 18 high, or if the market would form a breakout below the triangle and ii (inside-inside) pattern instead.

23//7/25 No FT Selling Again. Market in Breakout Mode

Tuesday’s candlestick (Jul 22) was an inside bull bar closing near its high.

In our last report, we said traders would see if the bears could create follow-through selling, or if the market would trade higher and retest the July 18 high instead.

The market traded higher for the day, and the be

22/7/25 Can Bears Finally Create Follow-through Selling?

Monday’s candlestick (Jul 21) was a big inside bear bar closing in its lower half with a prominent tail below.

In our last report, we said traders would see if the bulls could create follow-through buying, or if the follow-through buying over the next 1-2 days would be limited. If this is the c

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of USD Malaysian Crude Palm Oil Calendar Futures is 994.25 USD — it has risen 0.23% in the past 24 hours. Watch USD Malaysian Crude Palm Oil Calendar Futures price in more detail on the chart.

The volume of USD Malaysian Crude Palm Oil Calendar Futures is 960.00. Track more important stats on the USD Malaysian Crude Palm Oil Calendar Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For USD Malaysian Crude Palm Oil Calendar Futures this number is 3.30 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for USD Malaysian Crude Palm Oil Calendar Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for USD Malaysian Crude Palm Oil Calendar Futures. Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of USD Malaysian Crude Palm Oil Calendar Futures technicals for a more comprehensive analysis.