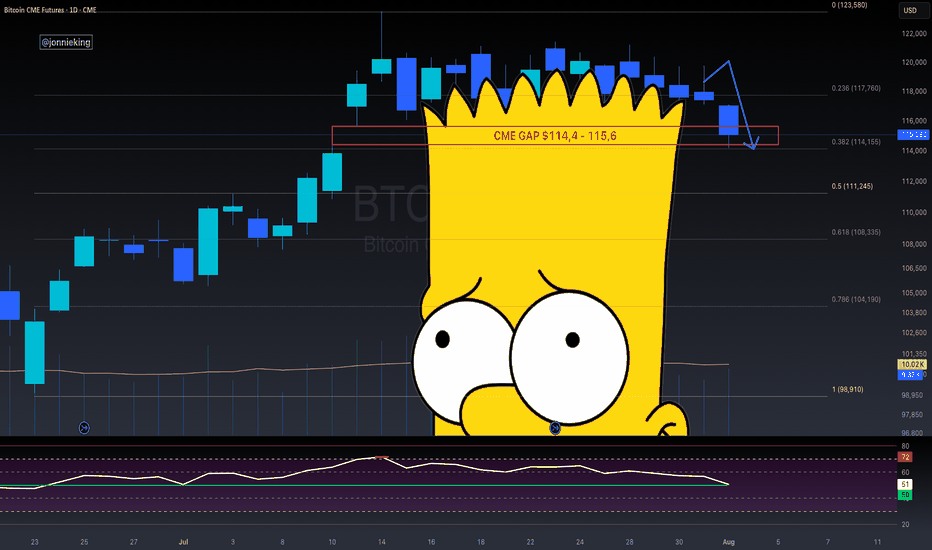

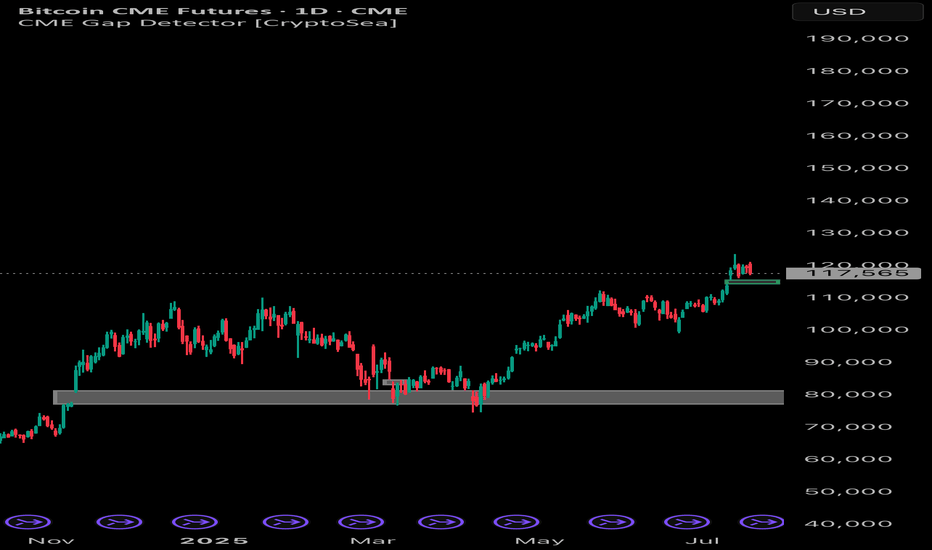

$BTC CME Gap + Bad Bart = Easiest Short EverCME Gap + Bad Bart is like taking candy from a baby 👨🏻🍼

Look at that textbook bounce off the .382 Fib 🤓

Pain ain’t over folks.

RSI still shows room on the downside 📉

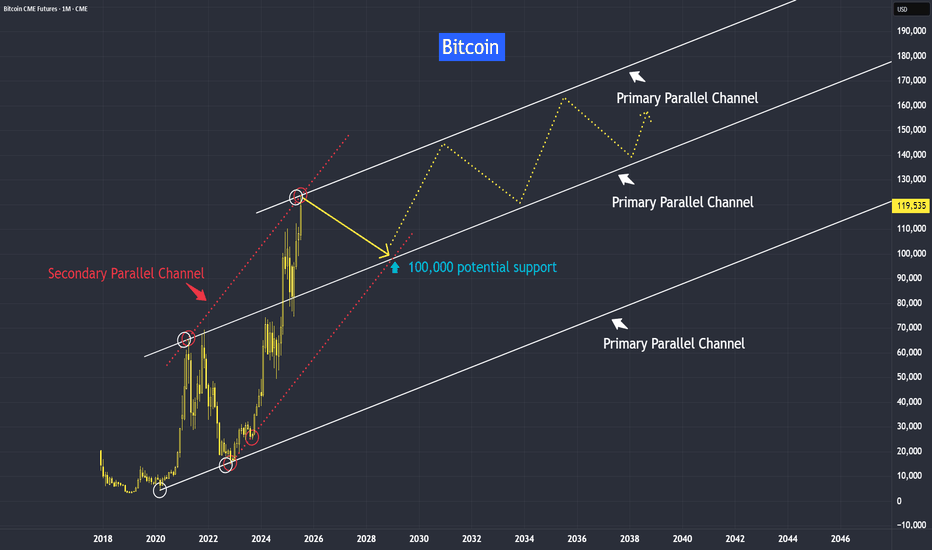

Global Liquidity drain on the 4th.

Looking like the 50% Gann Level is next ~$111k

Get those bids in 😎

And never forget the Bul

Related futures

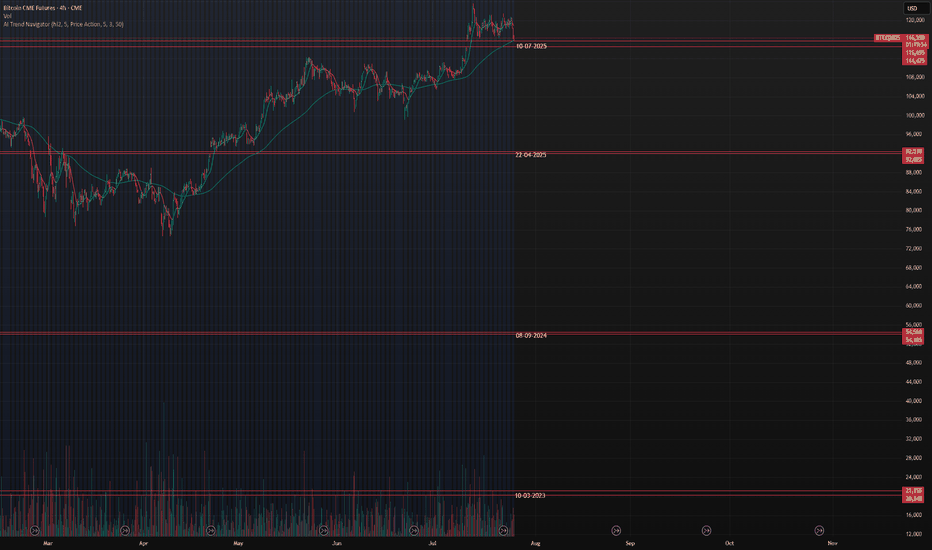

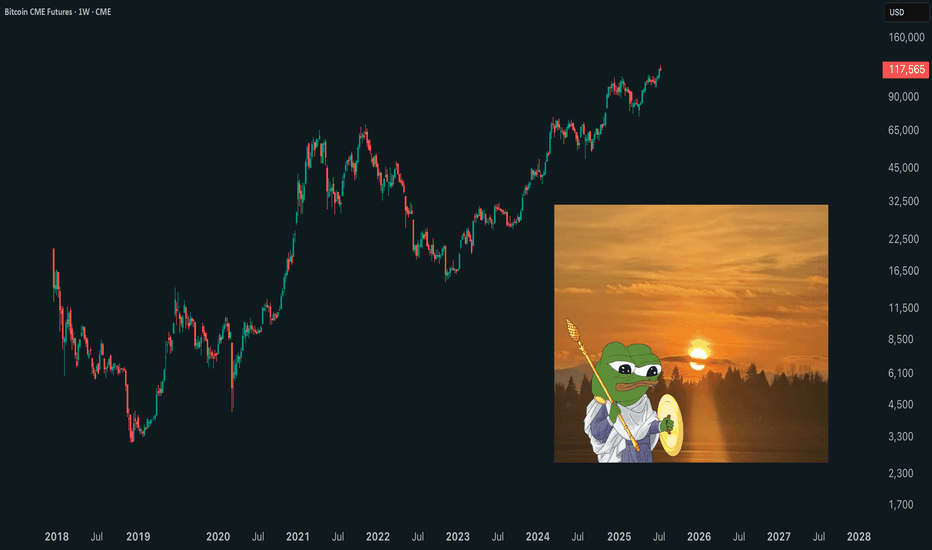

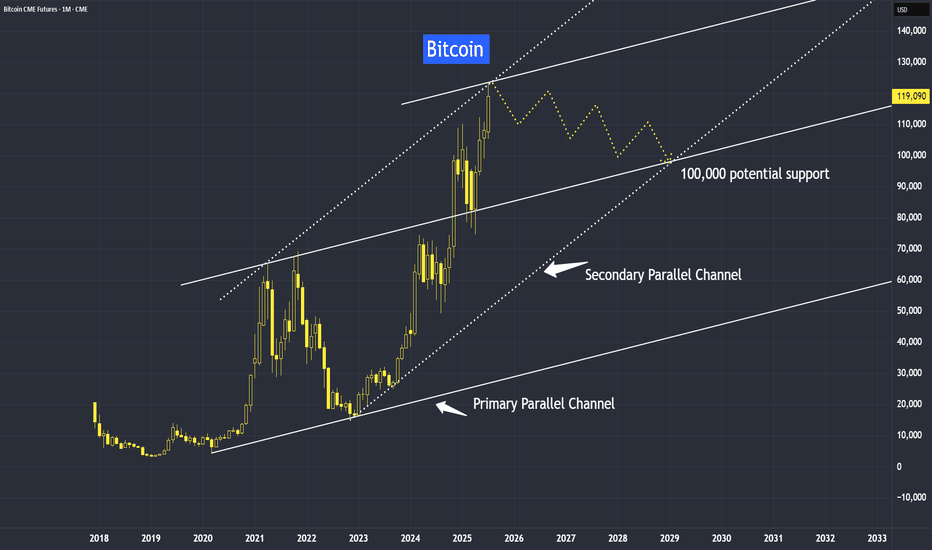

Bitcoin New Support at 100,000Bitcoin’s trend has been growing from strength to strength — and it’s likely to stay that way. Why?

This trend isn’t driven purely by speculation; it’s supported by strong fundamental reasons.

One of the most widely debated topics in finance today is the comparison between Bitcoin and gold. While

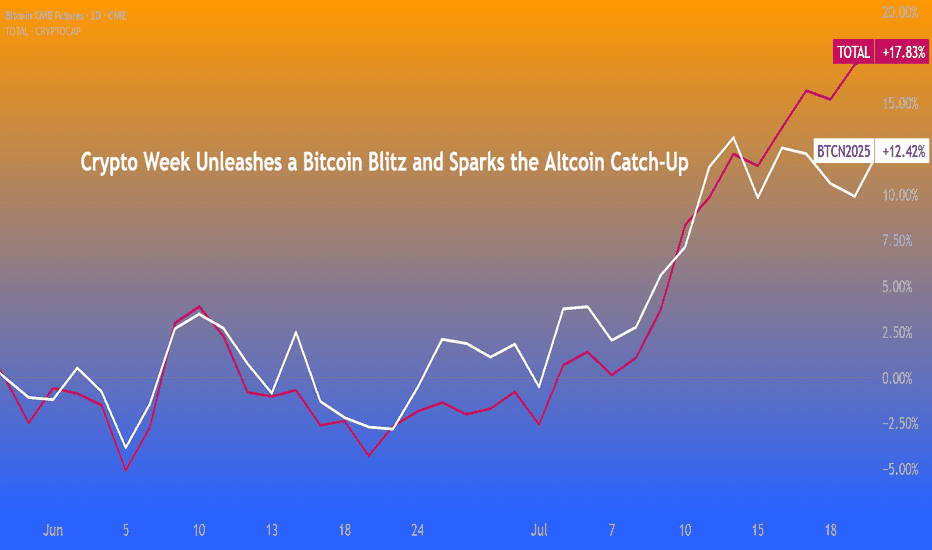

Crypto Week Unleashes a BTC Blitz & Sparks the Altcoin Catch-UpTotal crypto market capitalization has reached a new record high, driven by Bitcoin’s stunning rally. Other major coins, notably Solana and Ethereum, remain below their previous peaks.

These price records coincide with what President Trump has dubbed “Crypto Week.” Market insiders are preparing

Survival First, Success LaterThere was once a stone that lay deep in the heart of a flowing river.

Every day, the water rushed past it, sometimes gently, sometimes with force. The stone wanted to stay strong, unmoved. It believed that by holding its ground, it could outlast the river.

For years, the stone resisted. It didn’t

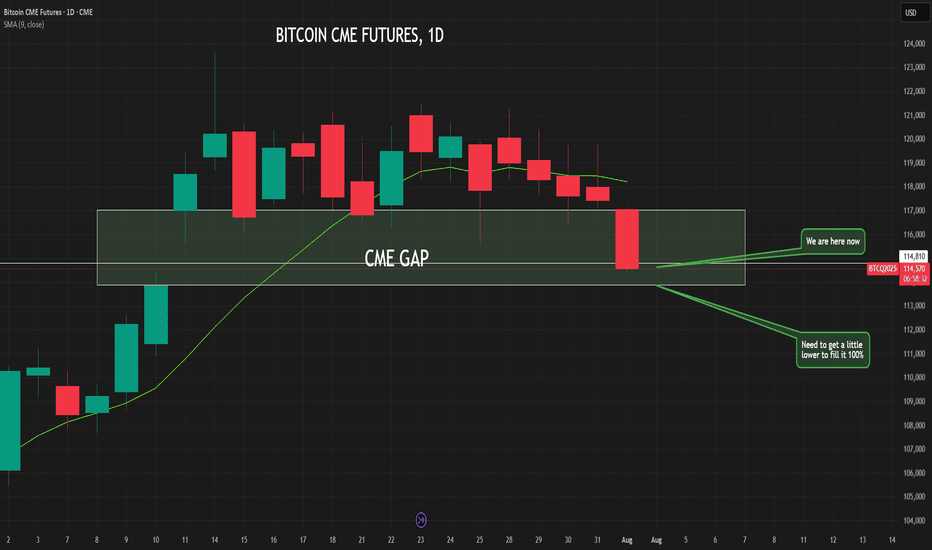

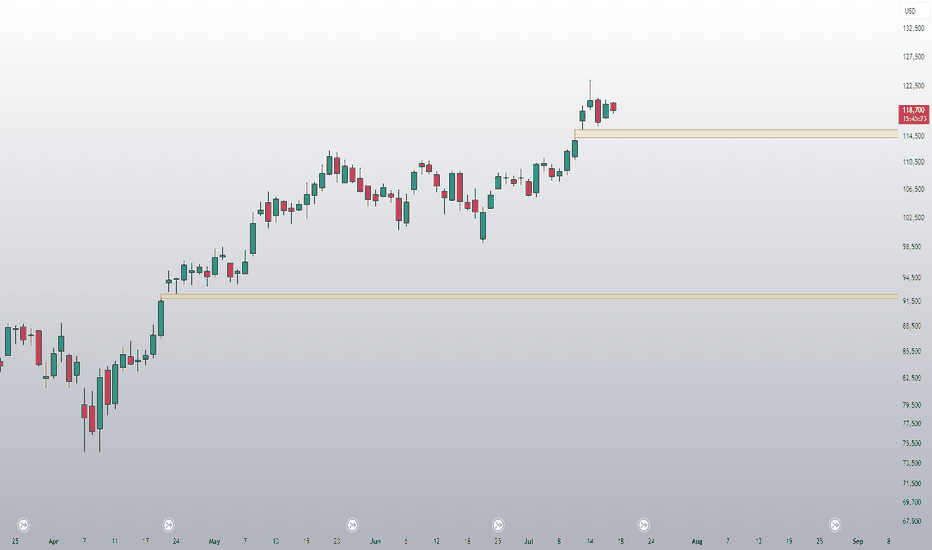

CME Gap: $115.8K–$116.8K Target or Trap?There’s a clear gap between $115,800 – $116,800 on the Bitcoin CME Futures chart. Historically, BTC tends to revisit and fill these gaps. Will we see a pullback to close it before the next move up? 📊

🧠 Watching price action closely around this zone. Share your thoughts below! 👇

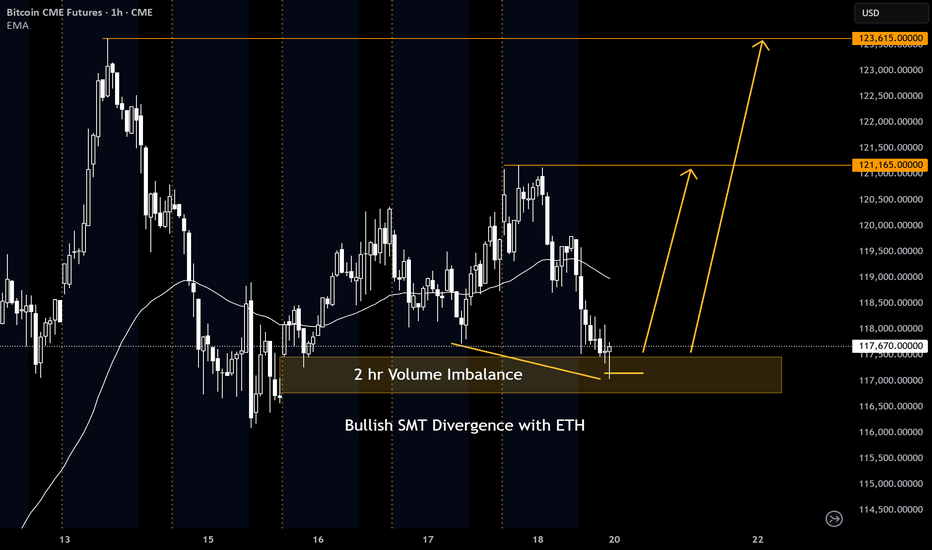

BTC Futures hitting ATH again???? Hmm....Looking at BTC futures, we have some bullish divergence with ETH. We also have a liquidity sweep into a 2 hr volume imbalance.

I will be looking at two areas to target. The first area is at 121,165 at the previous high and the second area is at 123,615 where the ATH will be broken.

Lets drop down

Bitcoin and Upcoming TrendBitcoin’s trend has been growing from strength to strength — and it’s likely to stay that way. Why?

This trend isn’t driven purely by speculation; it’s supported by strong fundamental reasons.

One of the most widely debated topics in finance today is the comparison between Bitcoin and gold. While

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Frequently Asked Questions

The current price of Micro Bitcoin Futures (Nov 2025) is 115,750 USD — it has fallen −3.38% in the past 24 hours. Watch Micro Bitcoin Futures (Nov 2025) price in more detail on the chart.

The volume of Micro Bitcoin Futures (Nov 2025) is 71.00. Track more important stats on the Micro Bitcoin Futures (Nov 2025) chart.

The nearest expiration date for Micro Bitcoin Futures (Nov 2025) is Nov 28, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Micro Bitcoin Futures (Nov 2025) before Nov 28, 2025.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Micro Bitcoin Futures (Nov 2025) this number is 11.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Micro Bitcoin Futures (Nov 2025) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Micro Bitcoin Futures (Nov 2025). Today its technical rating is strong sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Micro Bitcoin Futures (Nov 2025) technicals for a more comprehensive analysis.