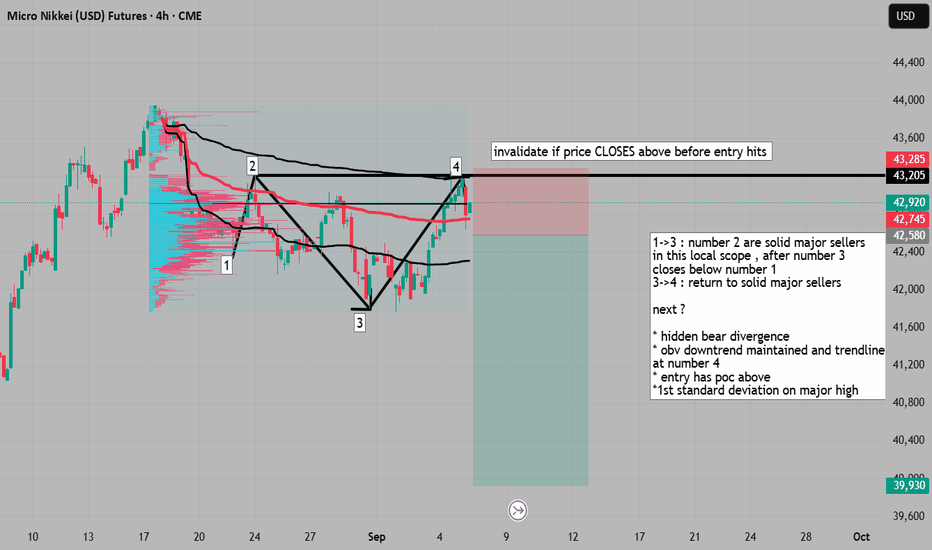

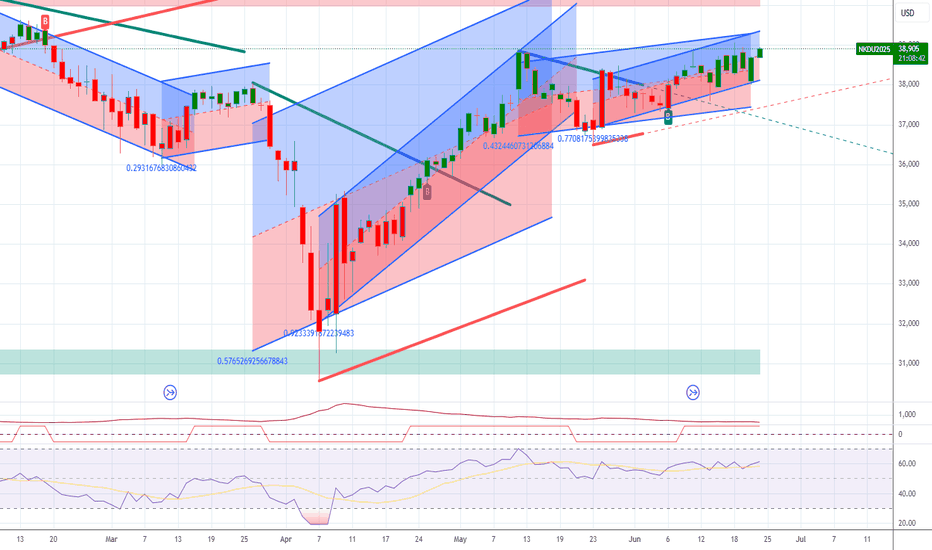

double top++ in potential downtrend formation 1->3 : number 2 are solid major sellers

in this local scope , after number 3

closes below number 1

3->4 : return to solid major sellers

next ?

* hidden bear divergence

* obv downtrend maintained and trendline touch

at number 4

* entry has poc above

*1st standard deviation on major high

Related futures

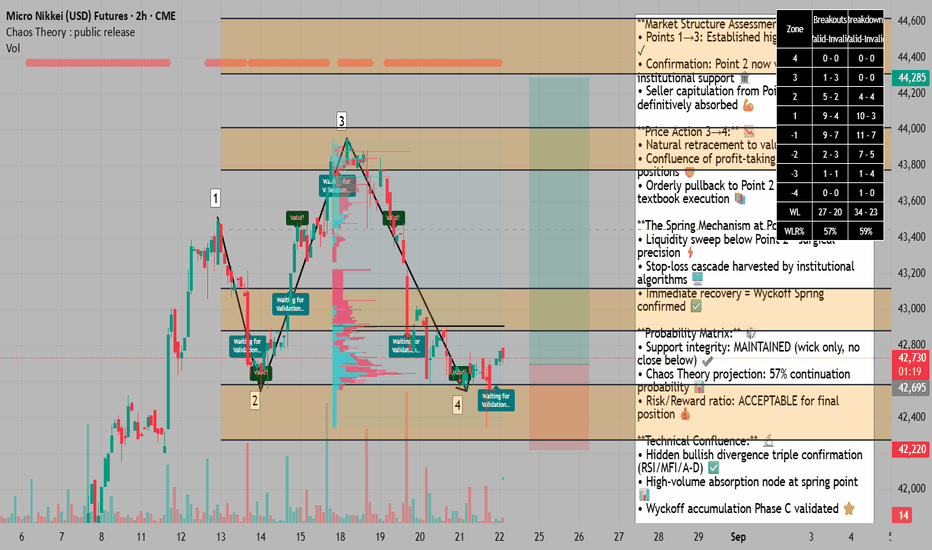

MNK1 Shakeout Complete at 42,650 =BUY the Smart Money Move**Market Structure Assessment:** 📈

• Points 1→3: Established higher high formation ✓

• Confirmation: Point 2 now validated as institutional support 🏛️

• Seller capitulation from Point 1 has been definitively absorbed 💪

**Price Action 3→4:** 📉

• Natural retracement to value area identified ✓

• Confl

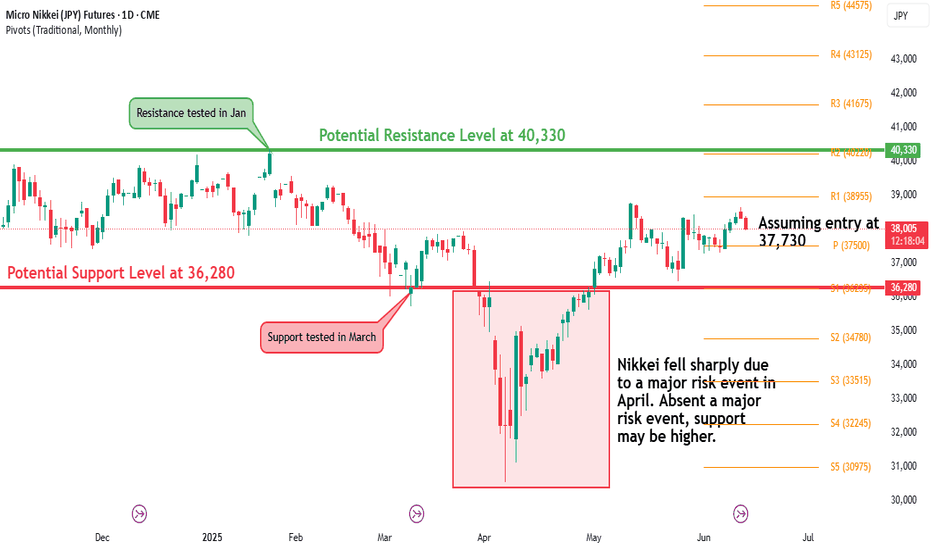

NIKKEI FUTURES: Liquidity Hunt → Rally → Major Correction SetupSharing my current outlook on Nikkei futures with a simple but effective read. 📈

**🎯 My Expectation:**

I'm anticipating a classic liquidity grab below recent lows, followed by another leg higher. After this move, we might see a more significant corrective pullback. 📉

**📍 Target Zone:**

A move up

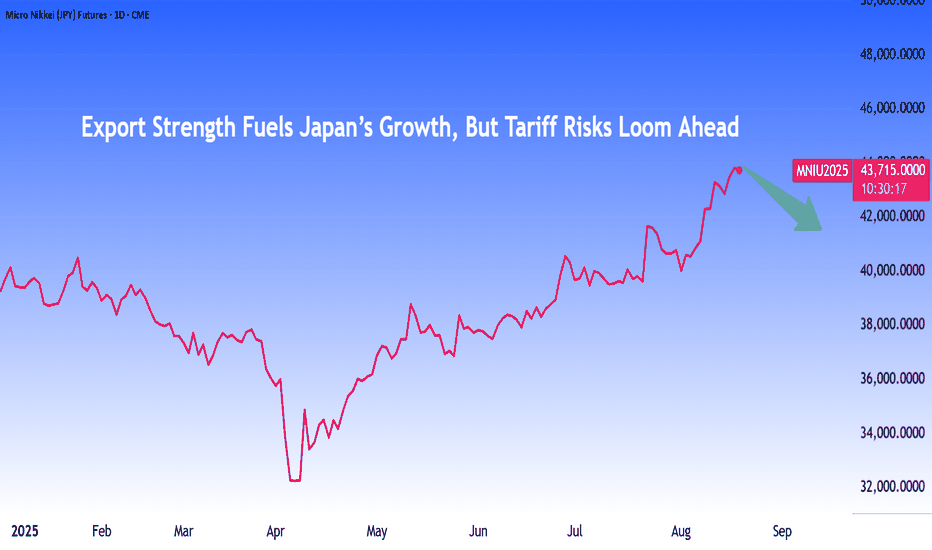

Export Strength Fuels Japan’s Growth,But Tariff Risks Loom AheadJapan’s economy defied expectations in Q2 2025. Exports roared back as a key driver, powered by a new U.S. trade deal and a weaker yen, sending the Nikkei higher. However, with tariffs and a cooling investment outlook on the horizon, the question is whether this upside has staying power.

Nikkei R

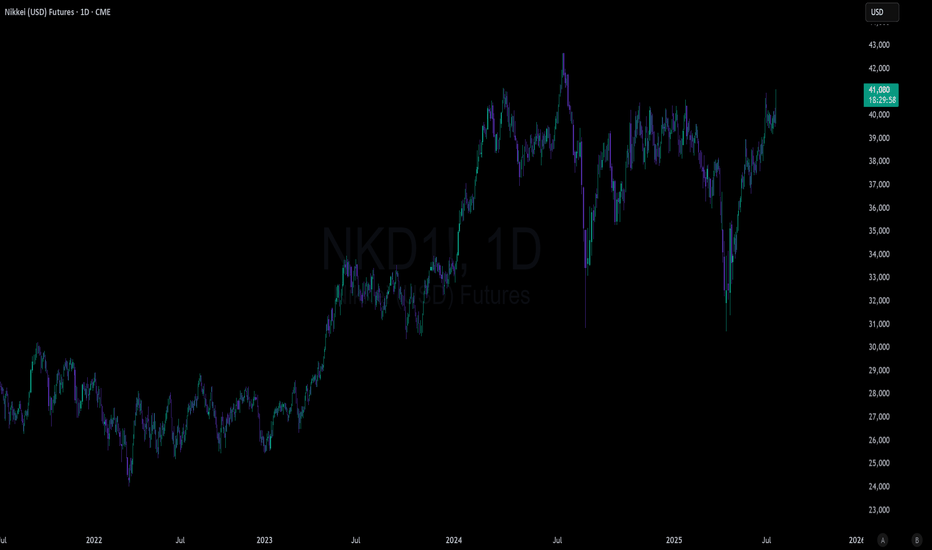

Bond Market Uncertainty Weighs on NikkeiBy Pranay Yadav, Portfolio Analyst, Mint Finance

Rising bond yields and an unexpected economic slowdown in Japan pose new risks to the Nikkei 225, following its recovery from the tariff-driven decline.

Warning lights are flashing. Downside risk potential is present. Nikkei 225 is trading near its

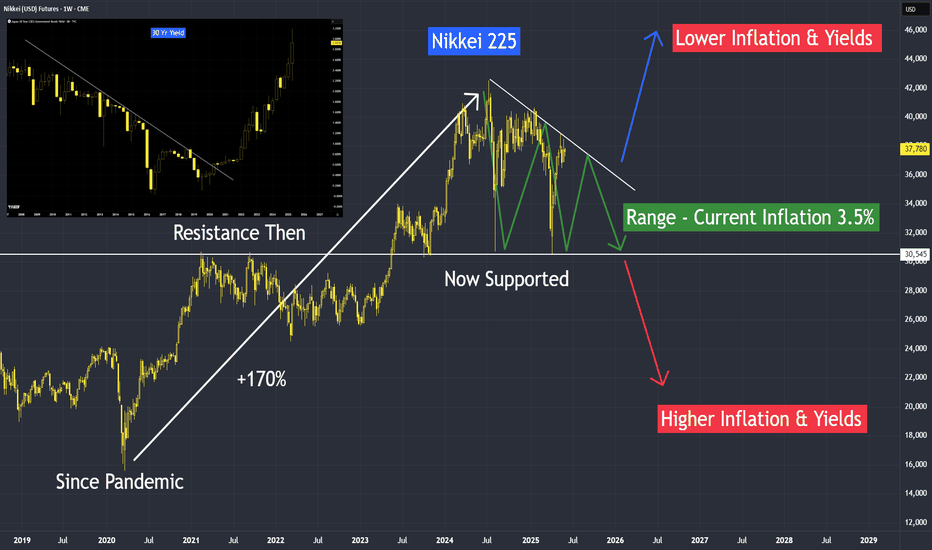

Japanese Yield Surged to Record High 3.2% - Nikkei OutlookAre Japanese markets still a buy after rising 170% since the pandemic, surpassing their roaring 1980s levels?

The reason why Japanese stocks have become some of the best-performing equities in Asia is largely due to the falling yen — a depreciation of around 60%. A weaker yen boosts Japan’s major e

Japanese Markets: Still a Buy?Are Japanese markets still a buy after rising 170% since the pandemic, surpassing their roaring 1980s levels?

The reason why Japanese stocks have become some of the best-performing equities in Asia is largely due to the falling yen — a depreciation of around 60%. A weaker yen boosts Japan’s major e

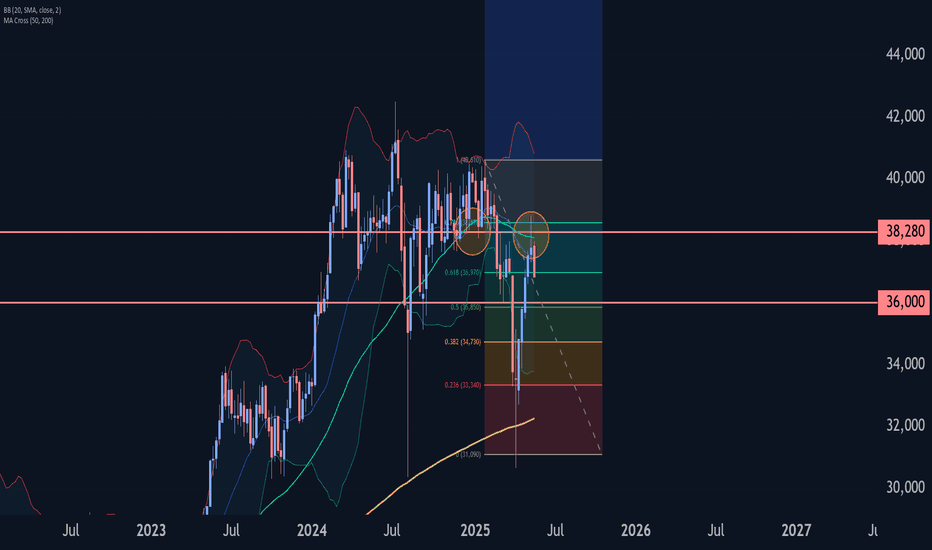

Nikkei 225 Wave Analysis – 21 May 2025

- Nikkei 225 reversed from the resistance level 38280.00

- Likely to fall to support level 36000.00

Nikkei 225 index recently reversed down from the pivotal resistance level 38280.00 (former top of wave 4 from the start of this year).

The downward reversal from the resistance level 66.00 created

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Frequently Asked Questions

The current price of Nikkei (JPY) Futures (Jun 2028) is 44,060 JPY — it has risen 2.41% in the past 24 hours. Watch Nikkei (JPY) Futures (Jun 2028) price in more detail on the chart.

Track more important stats on the Nikkei (JPY) Futures (Jun 2028) chart.

The nearest expiration date for Nikkei (JPY) Futures (Jun 2028) is Jun 9, 2028.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Nikkei (JPY) Futures (Jun 2028) before Jun 9, 2028.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Nikkei (JPY) Futures (Jun 2028). Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Nikkei (JPY) Futures (Jun 2028) technicals for a more comprehensive analysis.