With increasing signs of a potential rate-cut by September, we're looking bullish for the long-term. I think the market is slowly going to start pricing that in, so expect us to climb. CPI data is coming in next Tuesday. If that's favorable, we're going to breakout past the 3500 current ATH. If not, we're likely going to be stuck within the 3500-3350 range until the end of the month. China and India trade deals are also key events here to keep an eye out for. Bullish bias overall because of the increased rate cut probability, but keeping an eye out for impulses off of news.

Gold Futures (Jun 2016) forum

With increasing signs of a potential rate-cut by September, we're looking bullish for the long-term. I think the market is slowly going to start pricing that in, so expect us to climb. CPI data is coming in next Tuesday. If that's favorable, we're going to breakout past the 3500 current ATH. If not, we're likely going to be stuck within the 3500-3350 range until the end of the month. China and India trade deals are also key events here to keep an eye out for. Bullish bias overall because of the increased rate cut probability, but keeping an eye out for impulses off of news.

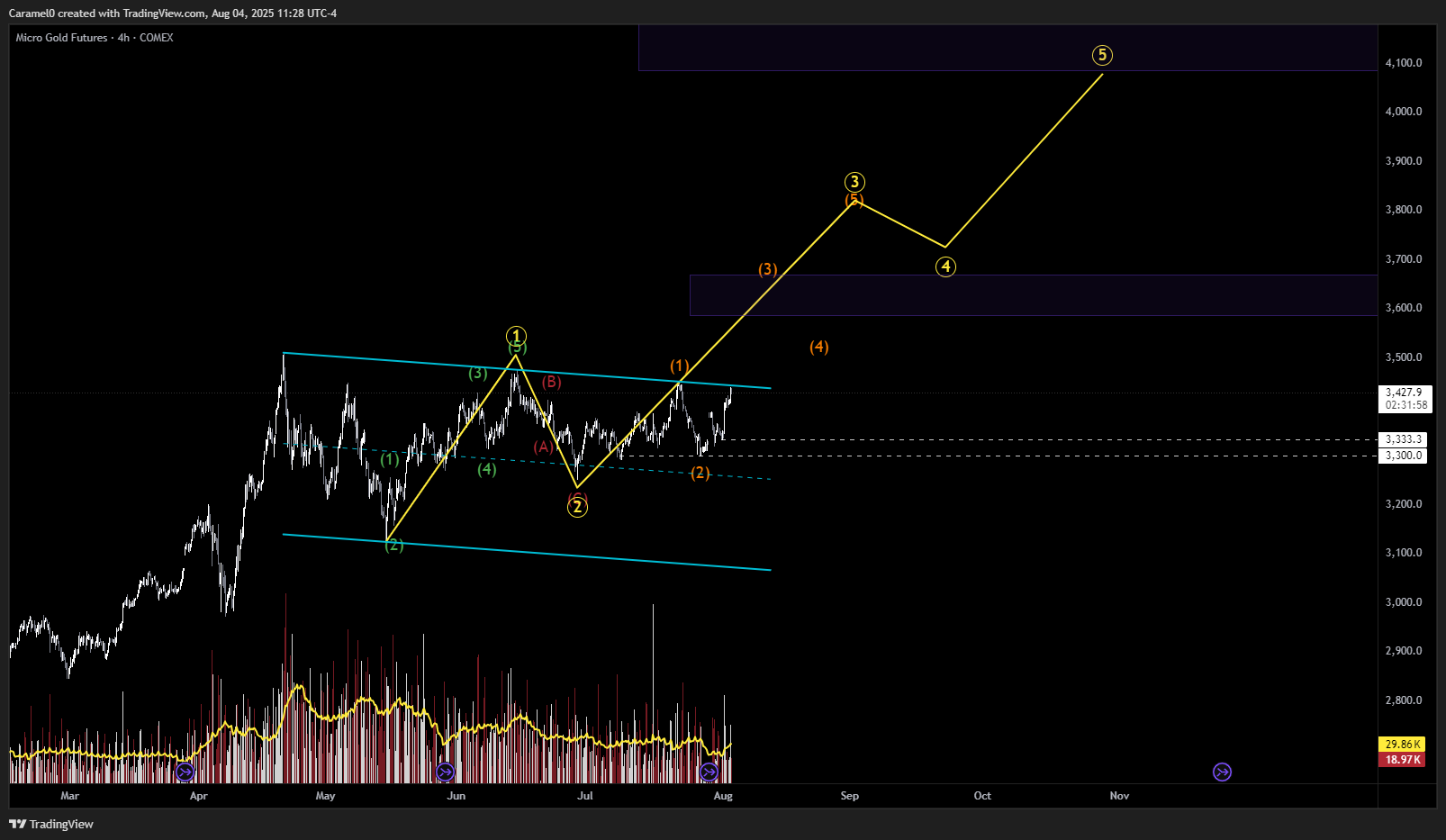

In my bullish scenario, my next target is around 3600, but for that, we need to breakout from this bearish parallel channel.

If the pullback goes lower than 3333.3 - 3300.0, we could go towards the mid-line of the channel, and if broken we could retrace towards 3000

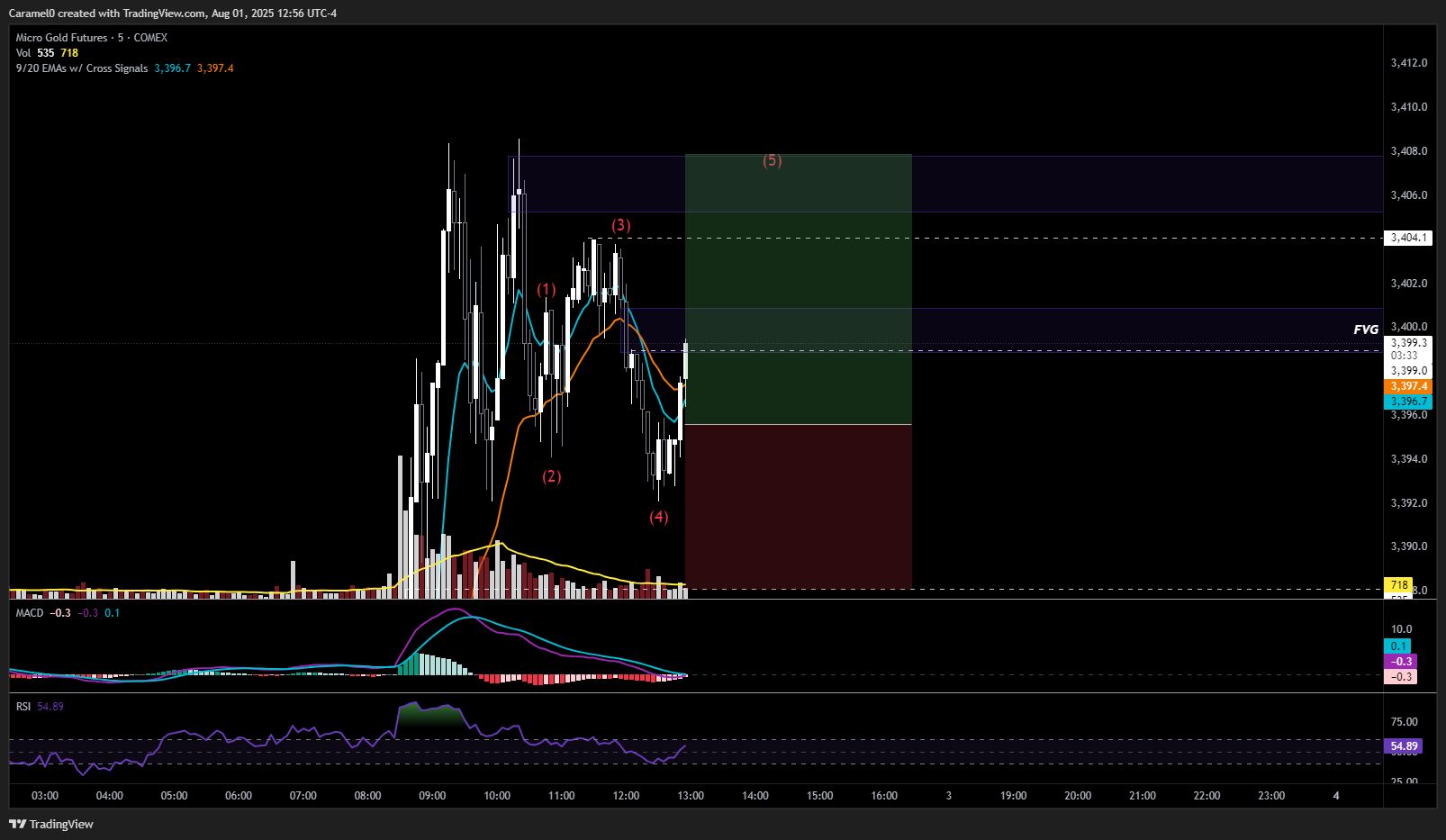

Entry: Long at 3418-3423 (rejection confirmed via pinbar & +delta on Bookmap).

SL: 3408 (below swing low, ~15 pts risk).

TPs:

TP1: 3443 (50%, 2R partial)

TP2: 3463 (25%)

TP3: 3503+ (25%, trail on BOS)

thanks Forex

#GOLDIE_LOCKS

#GOLDIE_LOCKS

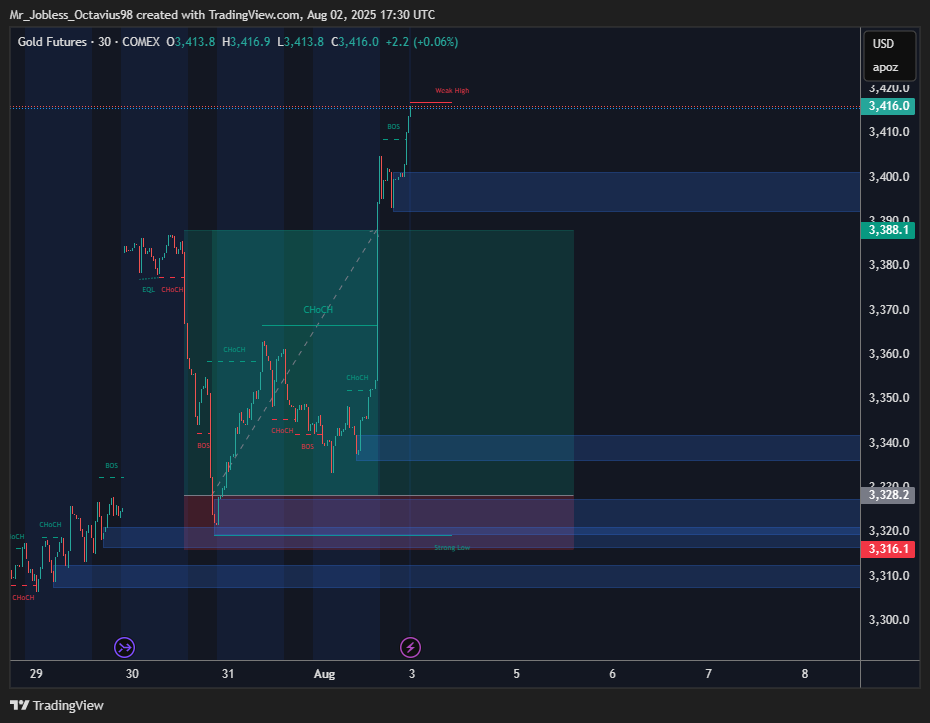

• Price had a strong impulsive breakout above the 3354–3360 zone during the 8:30 AM news, followed by range compression under the 3398–3401 supply zone (premium).

• On the 1-min, price printed LHs just under supply and failed to break 3401.

• On the 5-min, price is holding a series of HLs with EMAs stacked bullish, but struggling to reclaim HHs.

Two Scenarios for A++ Setup

1. Short Setup (More likely for now)

• Trigger: Rejection and failure to hold above 3398–3401, especially on a liquidity sweep.

• Entry: Ideally on a sweep of 3401 with absorption or bearish engulfing candle.

• TP Zones:

• First target: 3388–3386

• Final target: 3380–3375 (low-volume area)

Avoid shorting early — need clear failure or rejection + weakness.

⸻

2. Long Setup (If breakout occurs)

• Trigger: Break and close above 3401 with strong volume and continuation structure.

• Entry: Pullback to 3398 or 3401 (flip level).

• TP Zones:

• 3410 minor extension

• 3416–3420 strong imbalance from July

Current Levels:

• Immediate Resistance:

• $3,407 – $3,410 zone (Strong Heatmap and Premium Zone rejection likely)

• Support/Reaction Zones to Watch:

• $3,385.8: Clean impulse base before launch – 54-handle rally zone

• $3,372.8 – $3,374.8: Fair value gap + PDH

• $3,361.4 – $3,353.7: Layered liquidity cluster (can be base for bounce or reload)

• $3,344.6 – $3,335.8: Deep discount demand zone

What to Wait For:

• A++ Setup: Return to FVG/PDH with bullish BOS or CHoCH, large volume + absorption, then engulf structure back upward.

• Trap short scenario: Fake breakdown of $3,385 then V-shape reclaim.