GC1! trade ideas

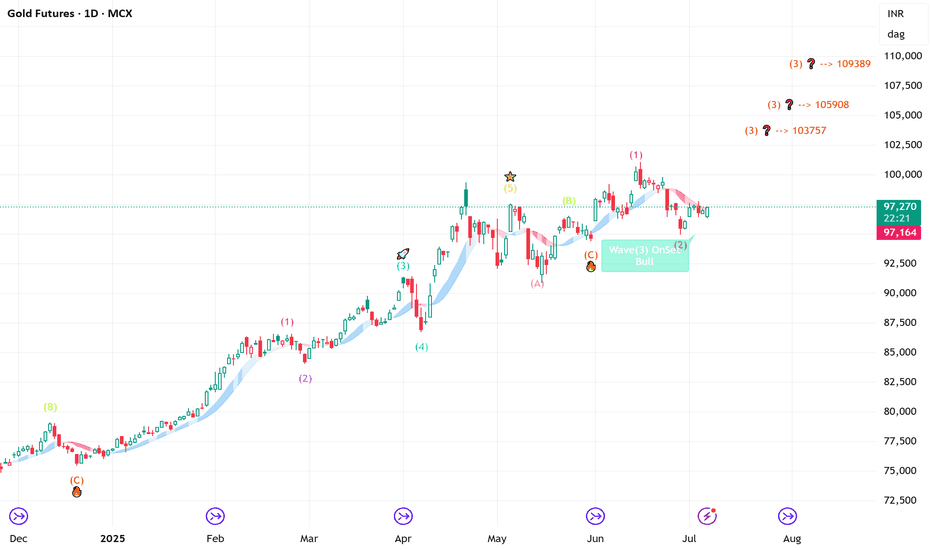

GOLD - Lovers Elliott wave - looking strong Short/Medium termGOLD-----Daily counts indicate Excellent bullish wave structure.

Both appear to be optimistic and this stock invalidation number (S L) wave 2 low

target short / long term are already shared as per charts

correction wave leg seems completed (C)

Investing in declines is a smart move for short/ long-term players.

Buy in DIPS recommended

Long-term investors prepare for strong returns over the next two to five years.

one of best counter

Every graphic used to comprehend & LEARN & understand the theory of Elliot waves, Harmonic waves, Gann Theory, and Time theory

Every chart is for educational purposes.

We have no accountability for your profit or loss.

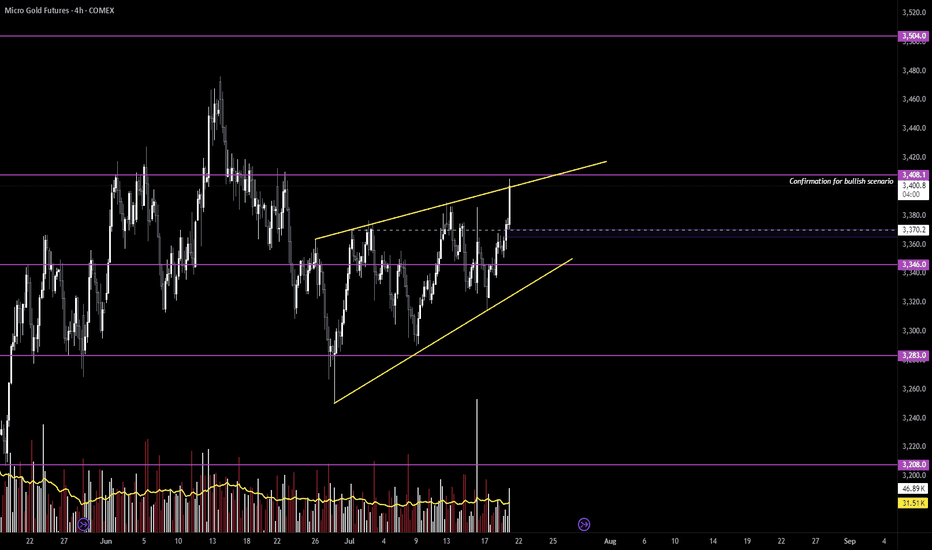

$GC/Gold Elliot Wave Analysis Update - 7/21Hello fellow gamblers,

Both scenarios that we are watching are still valid and as price approaches a confirmation level, we do gotta be aware possible fakouts as we trade inside a flag/wedge pattern.

- A rejection of 3408 could drive us towards the other end of the pattern and a possible break to the downside.

- If we do have a rejection, I will be watching for price to find support at 3370 for my bullish bias.

- Levels to watch: 3408, 3346, 3283

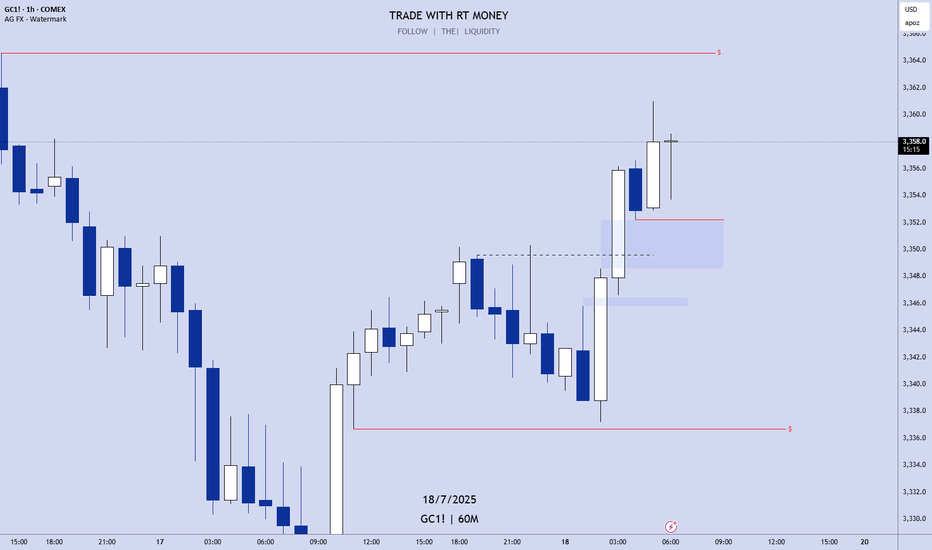

GC Outlooklooking to for a continuation into 3390. then look for a retracement back towards the 50 ema. this will set up a push to the previous all time high. now keep in mind the fluid dynamic of the market based on the ever changing fundamental landscape, tariffs and other news that can shake the market. but the over all picture remains very bullish for gold

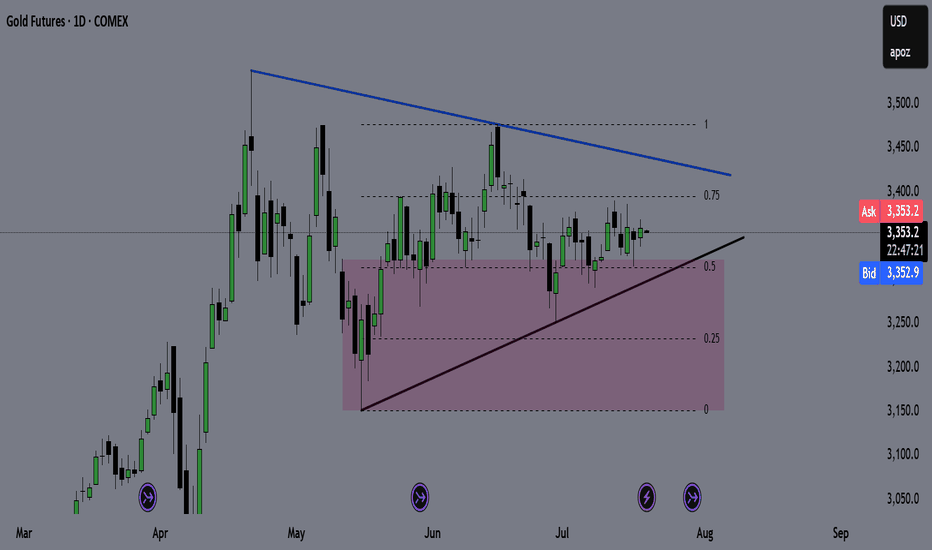

GOLD (GC) Weekly Recap & Game Plan 20/07/2025🪙 GOLD (GC) Weekly Recap & Game Plan

📊 Market Context:

Price is currently forming an accumulation pattern.

The purple zone marks a key weekly demand zone, and I expect a potential bounce from that level.

I'm closely watching for trendline deviations to determine the directional bias.

🎯 Game Plan:

If price drops below the trendline and bounces from the weekly demand, I’ll look for longs targeting the bearish trendline.

If price taps the bearish trendline and shows clear rejection, I’ll look for shorts targeting the bullish trendline.

I'll wait for LTF confirmations before entering any position.

✅ Follow for weekly recaps & actionable game plans.

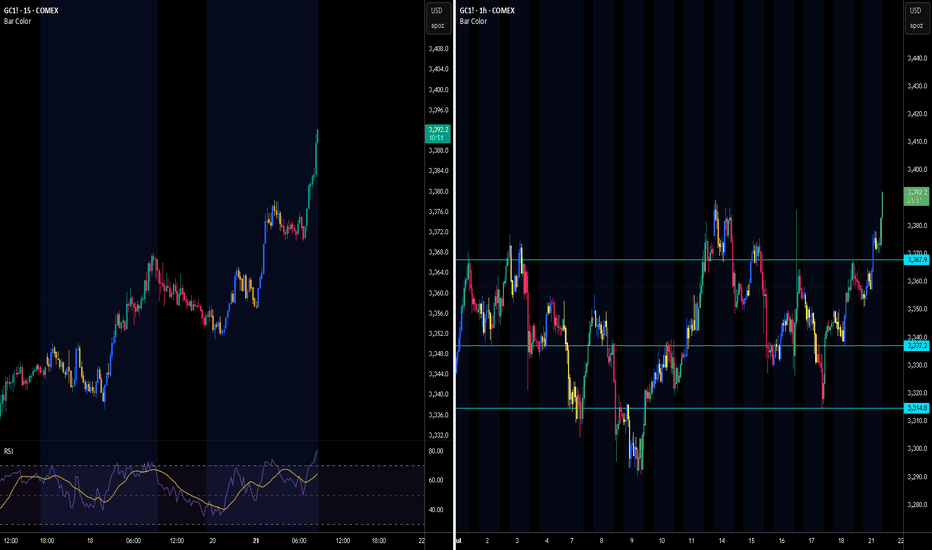

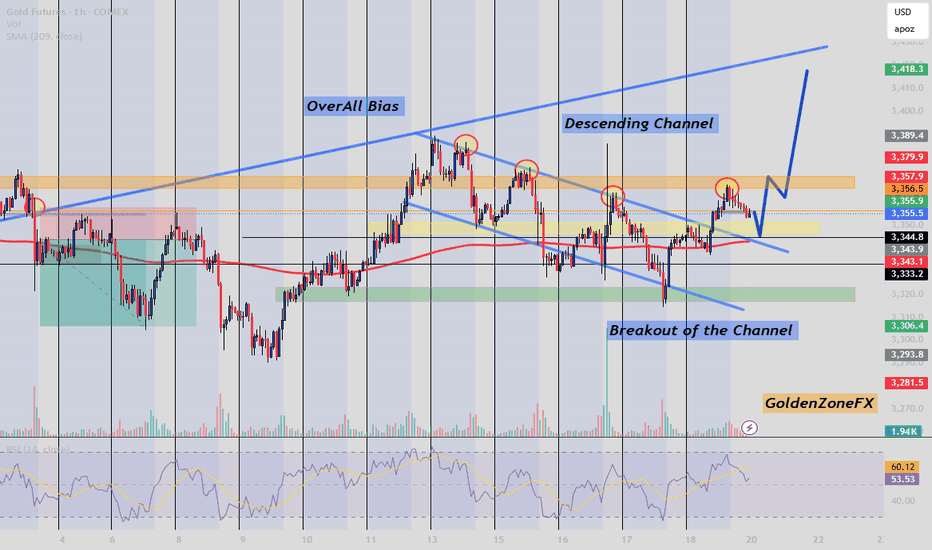

GC1! Breakout Confirmation & Bullish Continuation Potential Gold Futures Analysis – Breakout Confirmation & Bullish Continuation Potential

After an extended consolidation within a descending channel, Gold has successfully broken out, aligning with the overall bullish bias evident from the broader market structure.

Key Observations:

Overall Bias: Bullish, supported by higher-timeframe structure and trendline confluence.

Breakout Confirmation: Clean breakout above the descending channel, showing increased bullish momentum.

200 SMA Flip: Price reclaimed the 200-period SMA, reinforcing a shift in sentiment.

Key Zone Retests: The market is expected to retest the previous resistance (now support) around the 3345–3350 zone before any continuation.

Volume & RSI: Rising volume and RSI above 50 support further bullish continuation, with a short-term target toward the 3418 region.

Plan Ahead: I anticipate a short pullback to the support zone followed by bullish continuation if price holds above the breakout structure.

Follow @GoldenZoneFX For more content and valuable insights.

Gold. 14.07.2025. The plan for the next few days.The nearest resistance zones are where it's interesting to look for sales. It's not certain that there will be a big reversal, but I think we'll see a correction. We're waiting for a reaction and looking for an entry point.

The post will be adjusted based on any changes.

Don't forget to click on the Rocket! =)

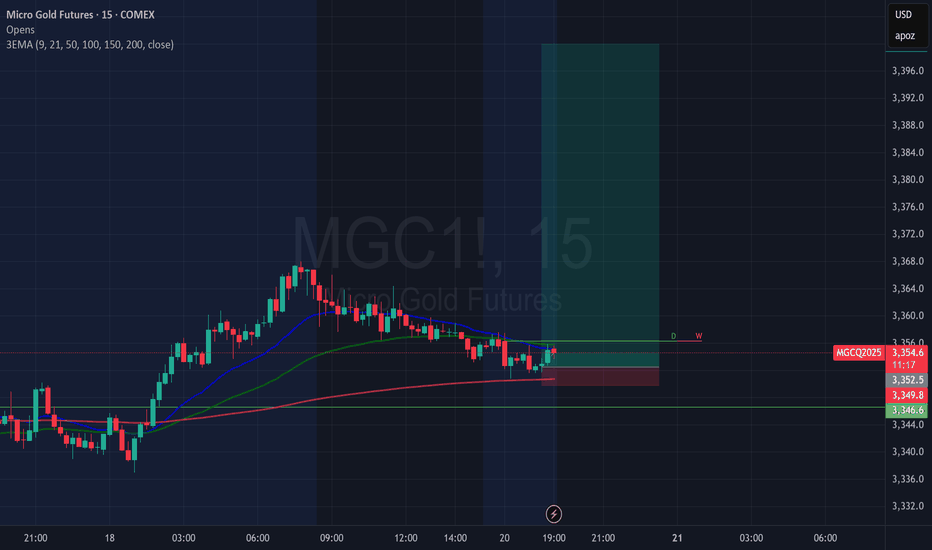

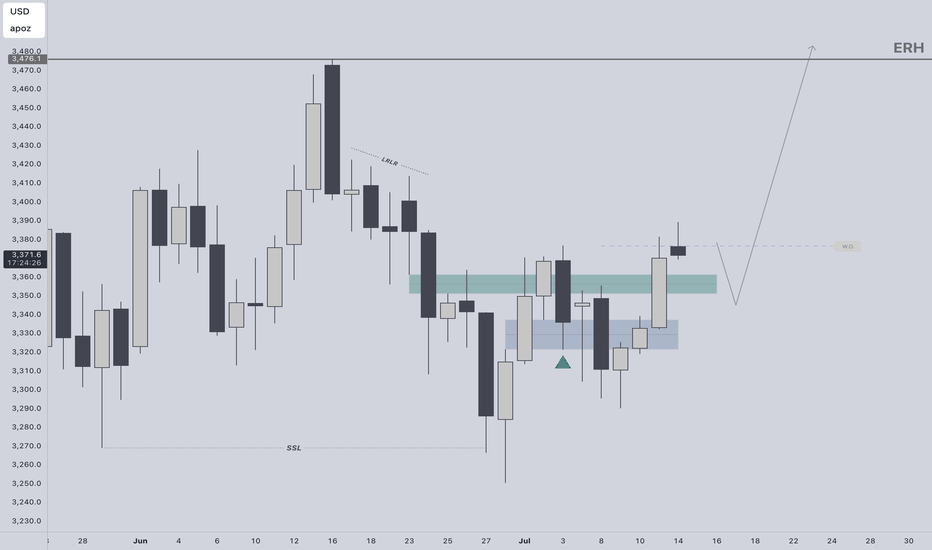

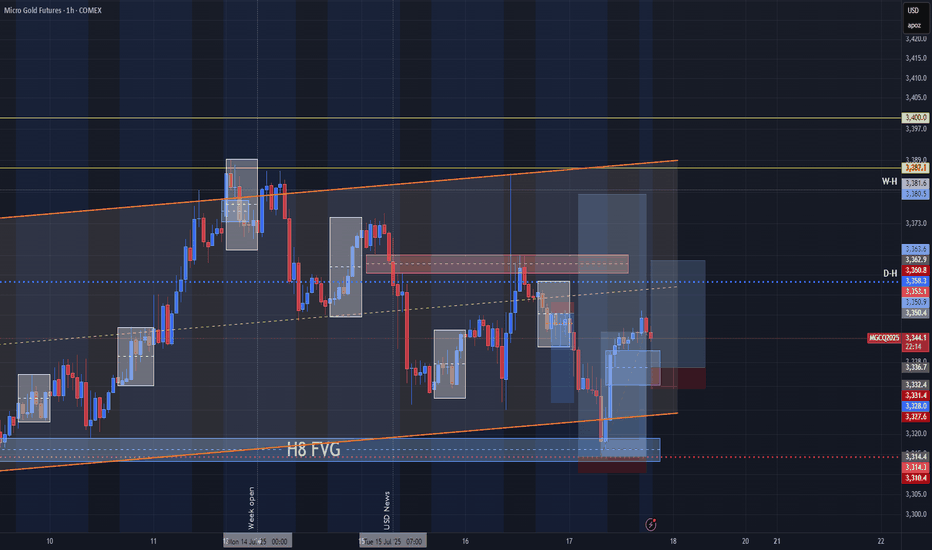

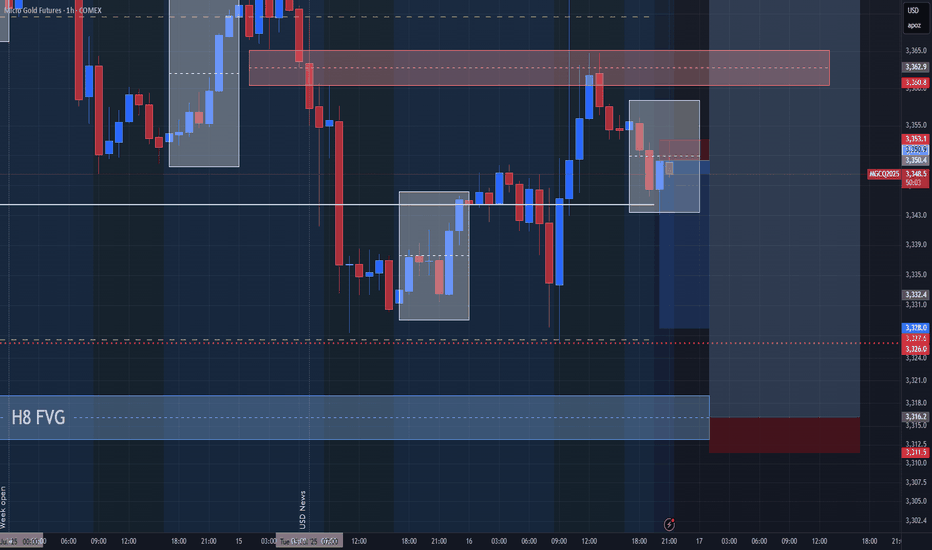

Gold LongsFollowing last weeks bias. Looking for REQH target.

Want to pair longs with a weekly profile. Ideally Monday or Tuesday creates the low of week. Will look to get onside with longs once theres a clear intraweek reversal. Trade the continuation higher. A close below 3320 is invalidation. Expecting previous week low to be protected and expansion to the upside

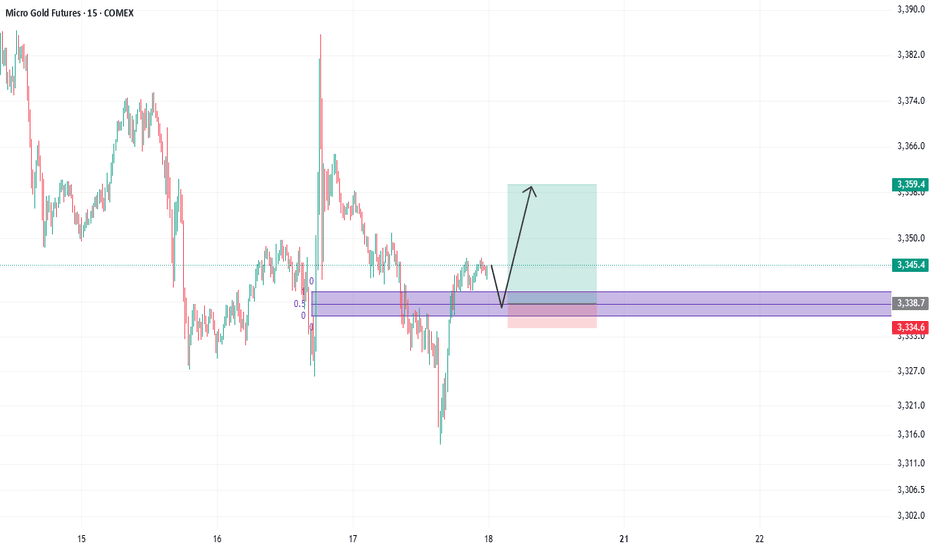

GOLD! Pre-Market Analysis For Friday July 18th!In this video, we'll present pre-market analysis and best setups for Friday July 18th.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

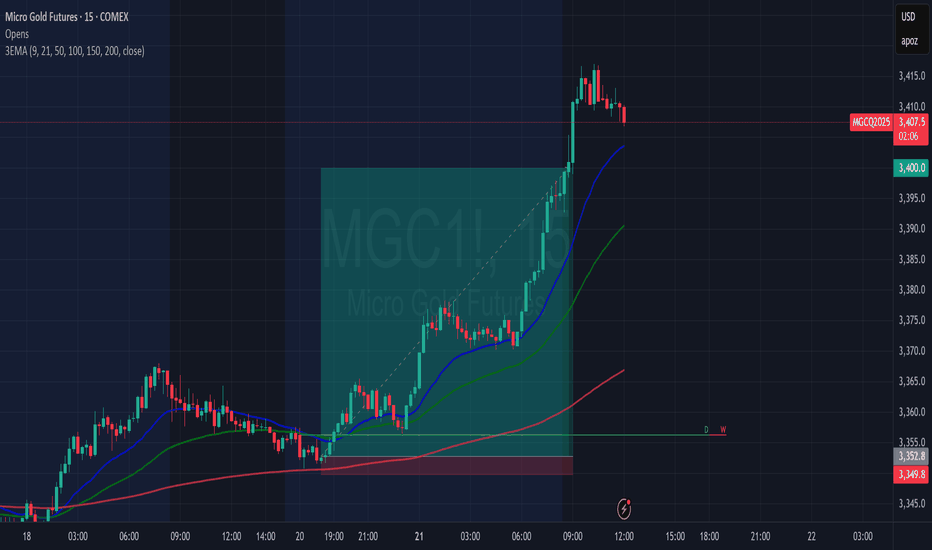

Sweep On levels and Confirmation of Bullish pressure! Now that we have a sweep on levels we are looking for bullish pressure to continue. They have closed the 4Hr bullish. Being that it is Friday keeping expectation low cause price can break out and push hard or it can end up being Rotational. I feel there is a move here. We just have to wait for it to line up inside of the killzone. NOFOMO Mayn!

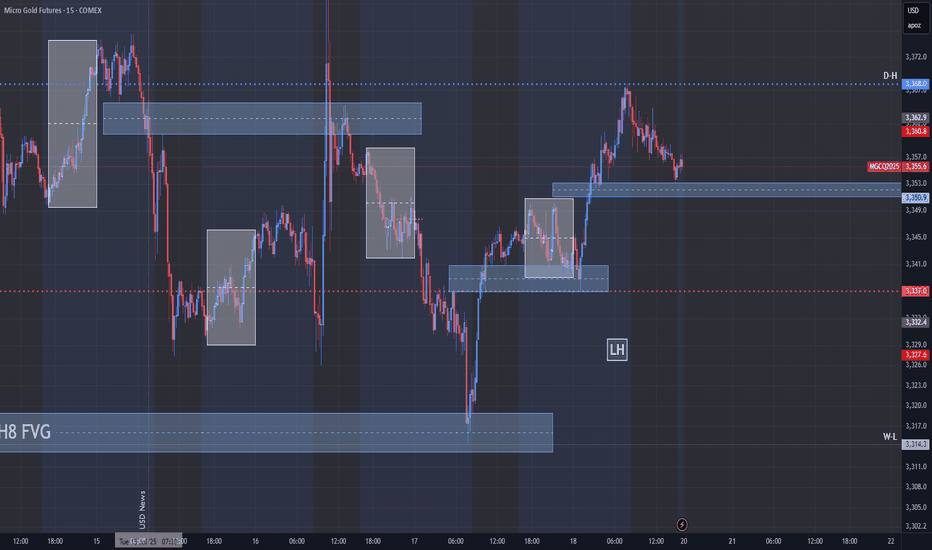

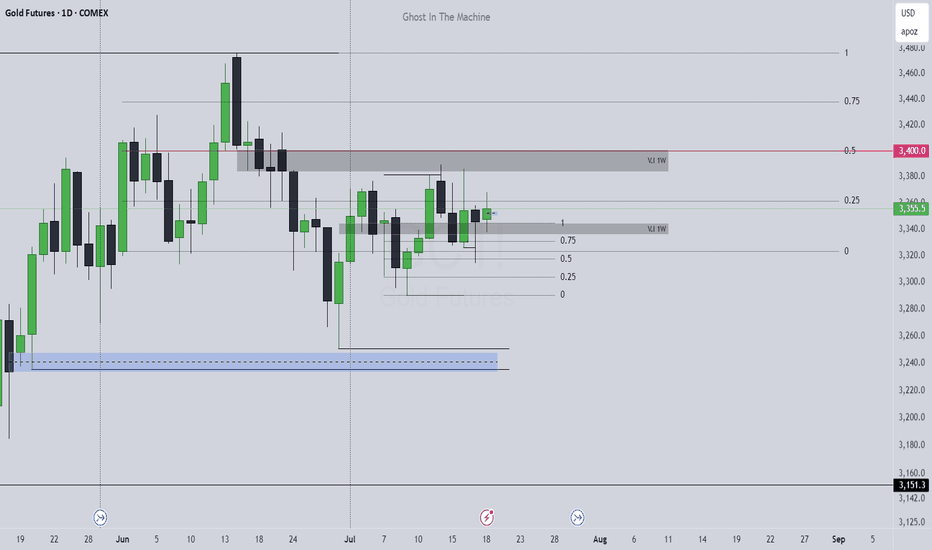

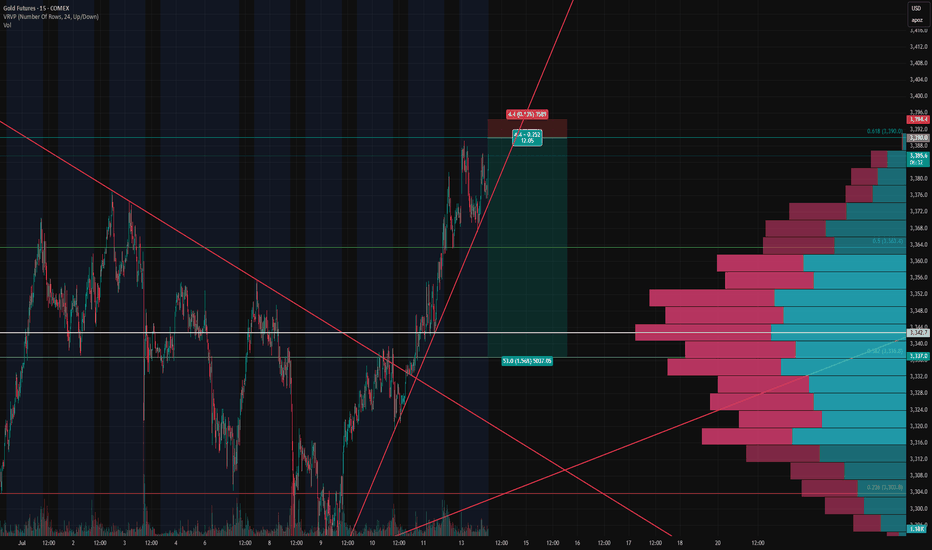

Gold Futures ($GC1!) — US Session Setup: Bearish Retest from 618🟡 Gold Futures ( COMEX:GC1! ) — US Session Setup: Bearish Retest from 0.618 Fib in Bullish Breakout Context

⏳ Pre-US Session Playbook

We're currently watching Gold Futures ( COMEX:GC1! ) for a potential short opportunity into the US session open. While the broader structure has broken bullish, we're anticipating a bearish retest scenario from a key Fibonacci level — aligning cleanly with last week’s breakout structure.

No positions have been taken yet — we are setting up for the US session — and are closely monitoring price action near the 0.618 retracement zone before committing.

📍 Setup Breakdown

• 0.618 Fib Retracement from the last bearish impulse aligns with:

○ Recent volume shelf resistance

○ Retest zone from prior breakout

○ An overextended local push into thin volume above 3380

• Bullish Context:

○ HTF breakout from descending wedge structure remains valid

○ Macro buyers still in control

○ Upside continuation risk is high if sellers don’t show up

• Short Bias Conditions:

○ Rejection or absorption in the 3385–3390 zone

○ Weak follow-through above 0.618 (failed breakout scenario)

○ Breakdown of LTF higher low structure post-test

🧠 Strategy Commentary

Although we’re in bullish breakout mode, this is a tactical short setup — a fade into prior structure with clear invalidation. We're not fighting trend, but looking to short into exhaustion at a defined level, with tight risk parameters.

Confluence Factors:

• 0.618 fib alignment

• VRVP volume shelf

• Prior breakout structure retest

• LTF divergence or absorption confirming the fade

🎯 Trade Parameters (Planned)

• Entry Zone: ~3385–3390

• Stop Loss: Tight, 3395–3400

• Target Zone: 3342–3337 (full structure retest)

📌 Patience is key — this remains a setup until confirmed. We'll post live if and when conditions are met.

Let the market come to you.

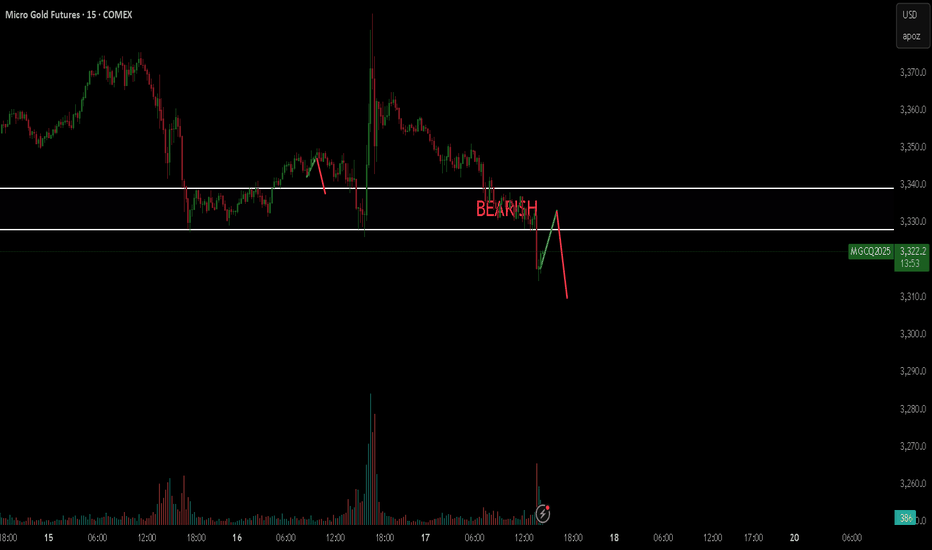

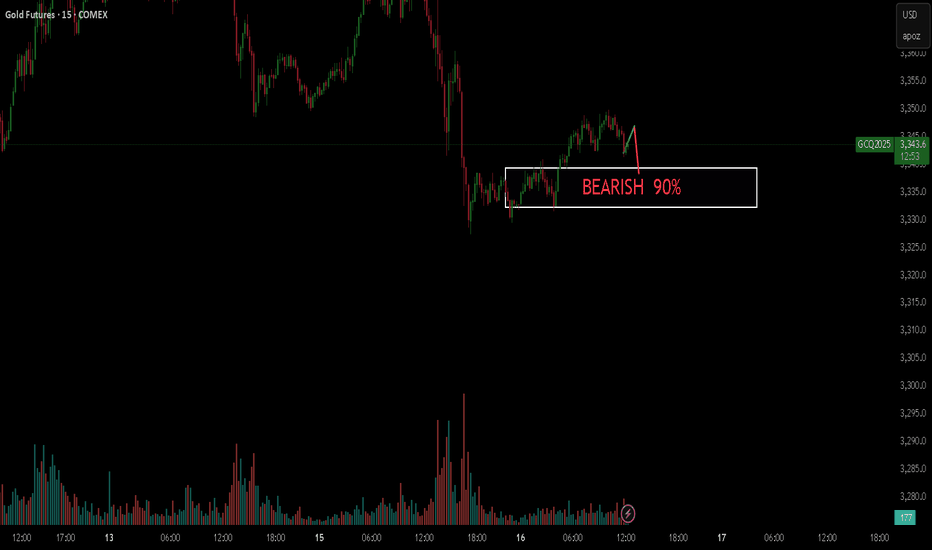

Why says they want to short gold again, line up in hereLol, so far whales keeps manipulating the price to stop me out 🙄.

Nah, fr, i will short gold again today for sure, iam just waiting to see a confirmation that this is even the right decision.

But so far it looks massively short, it could yield anything from 1:3, or 1:4. Depends on the setup.

Wait for confirmation, will make sure that whales dont get me this time. LOL

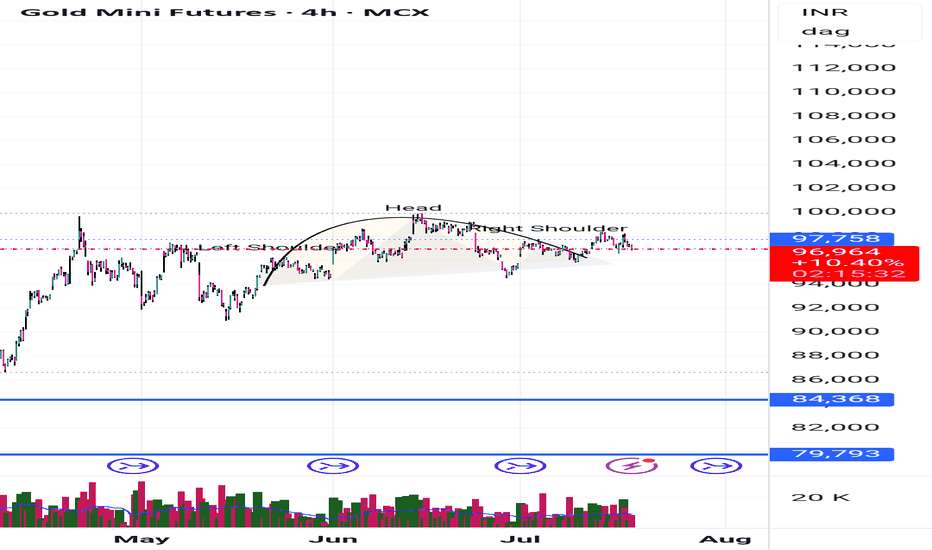

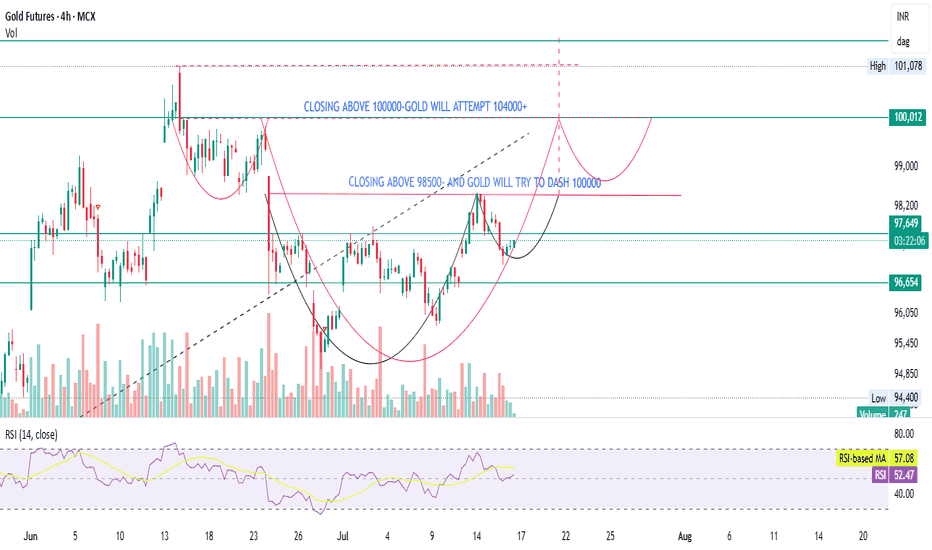

GOLD- CONTRARION OPINIONGold is forming a bullish structure, but a confirmed breakout above ₹98,500 (on volume) is essential for momentum toward ₹100,000.

If ₹100,000 is broken with strength, ₹104,000+ is a reasonable technical target.

RSI is neutral, allowing room for upside.

Watch for a volume spike and confirmation candles before entering.

Gold.. in the fog of global chaosNotes:

Markets for metals are at a ATH.

Global events are evolving rapidly.

Most of the time, war=raging gold prices

Markets are ripe to retrace and or maybe reverse at all. Taking setups on gold with a grain of salt.

Gold is an event driven market. I expect for now a consolidation until bearish signals show.