COPPER Supply And Demand Short Trade IdeaSee Chart For Analysis.

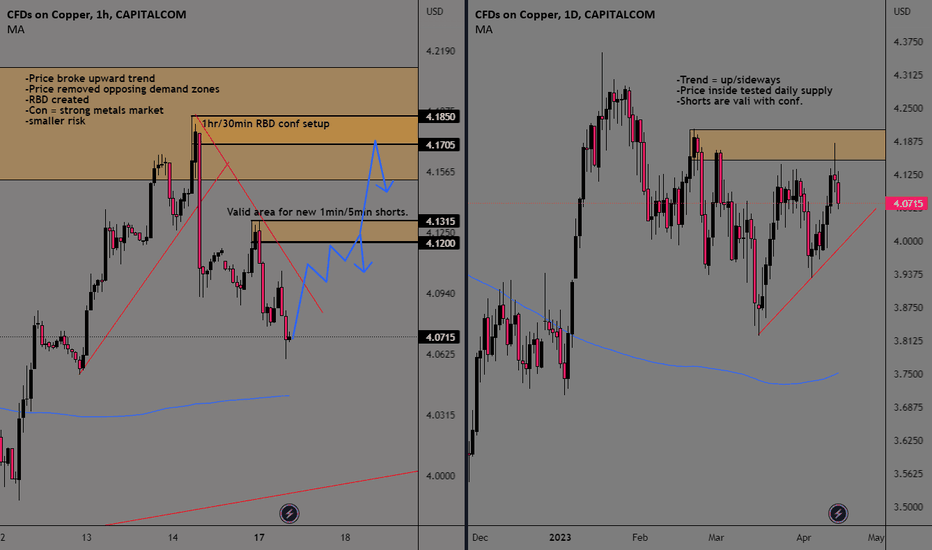

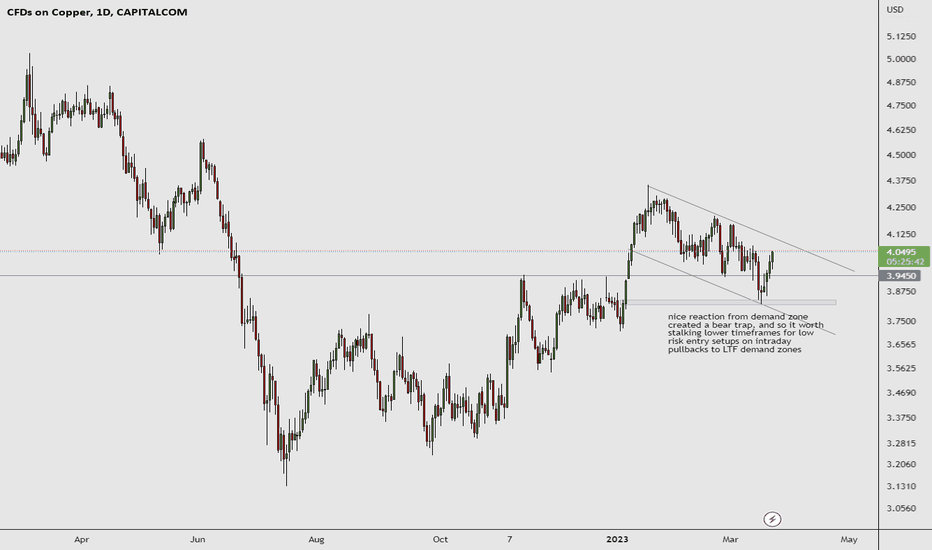

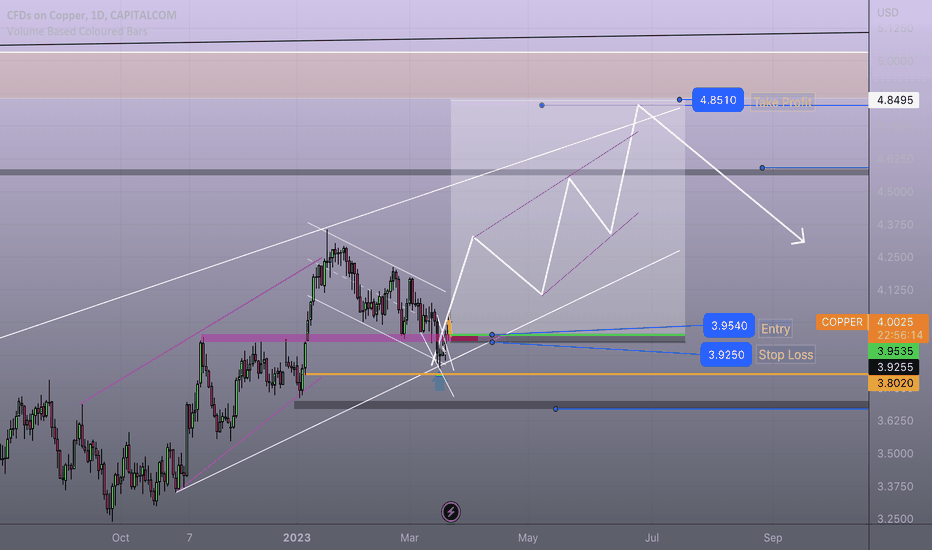

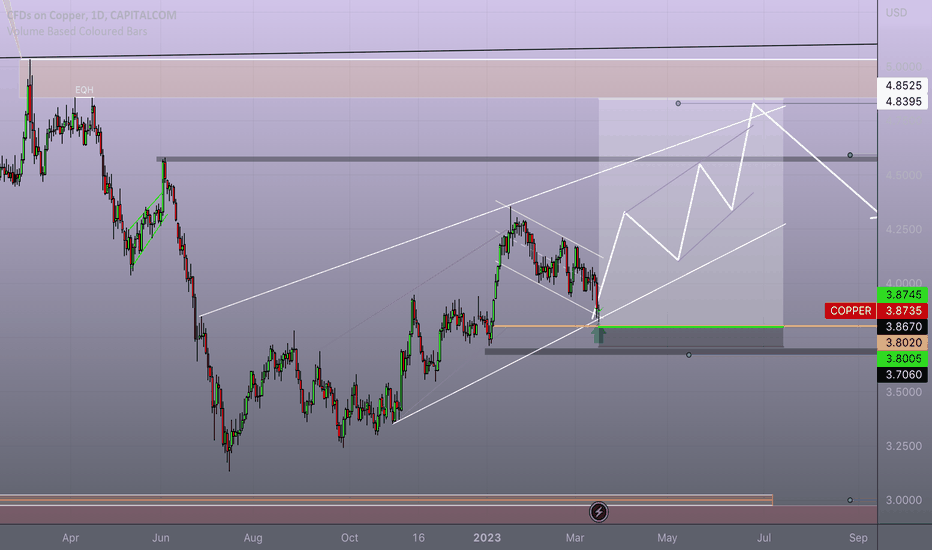

HTF Daily Supply:

-Price reqcting off of daily supply

-Trend = up/sideways

-Looking for shorts but wait for ocnfirmation shorts on LTF.

LTF 1hr Timeframe:

-Price broke upward trend line

-Price removed opposing pivot demand

-RBD created

-Price continued to make new LH/LL so sellign in those areas of supply with new 1min supply is also valid.

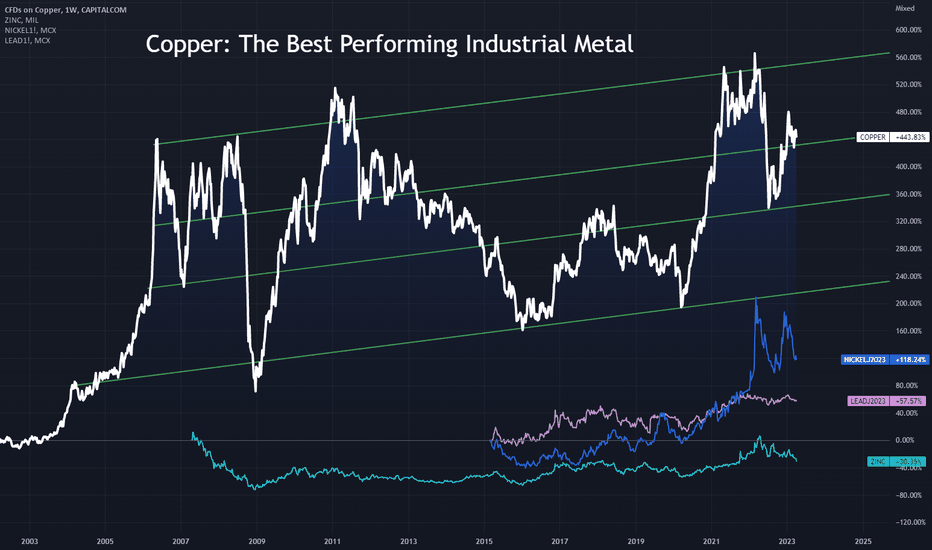

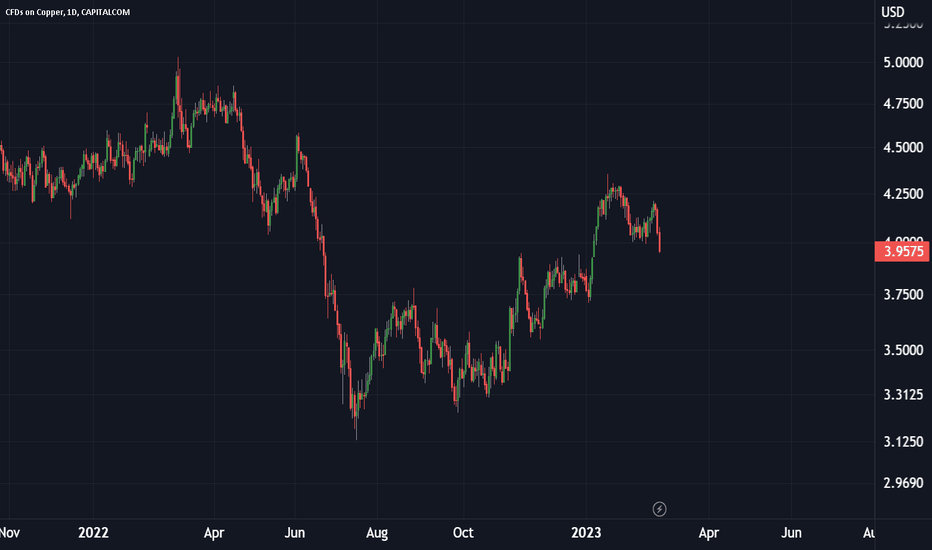

CPRUSD trade ideas

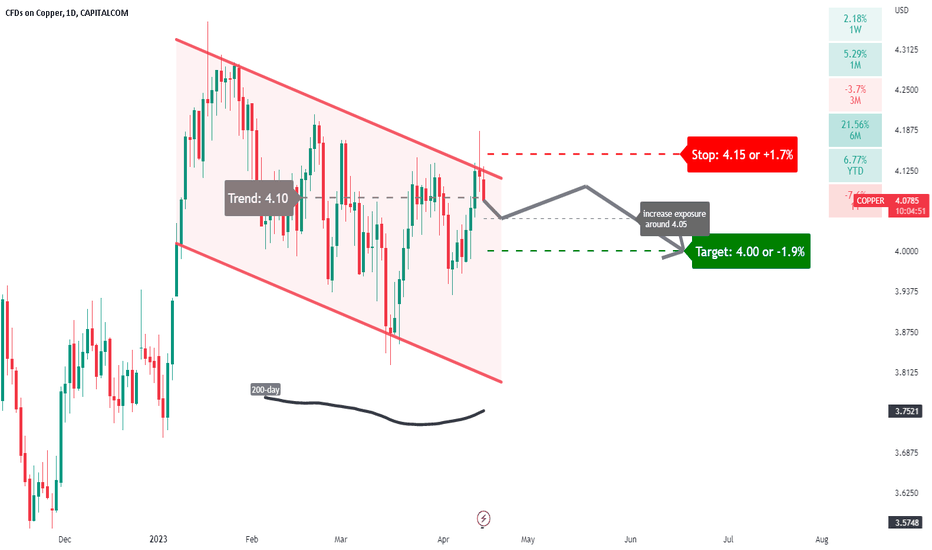

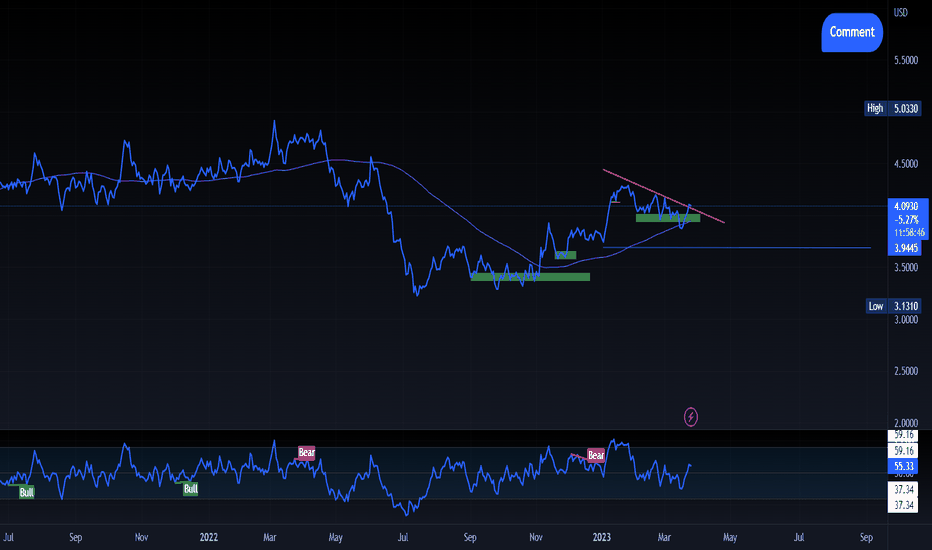

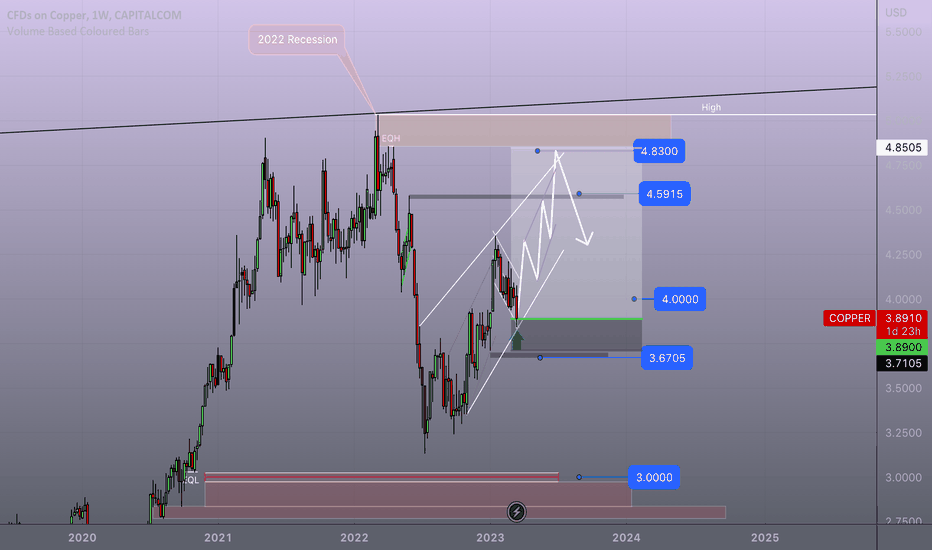

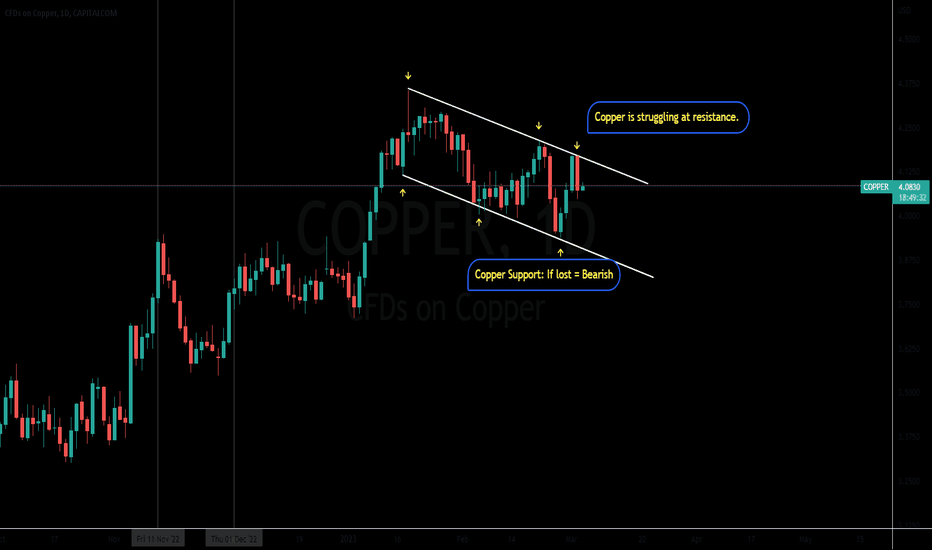

Copper: a correction?A price action below 4.15 supports a bearish trend direction.

Increase short exposure for a break below 4.05.

The target price is set at 4.00.

The stop-loss price is set at 4.15. Negate the bearish stance for a break above this level.

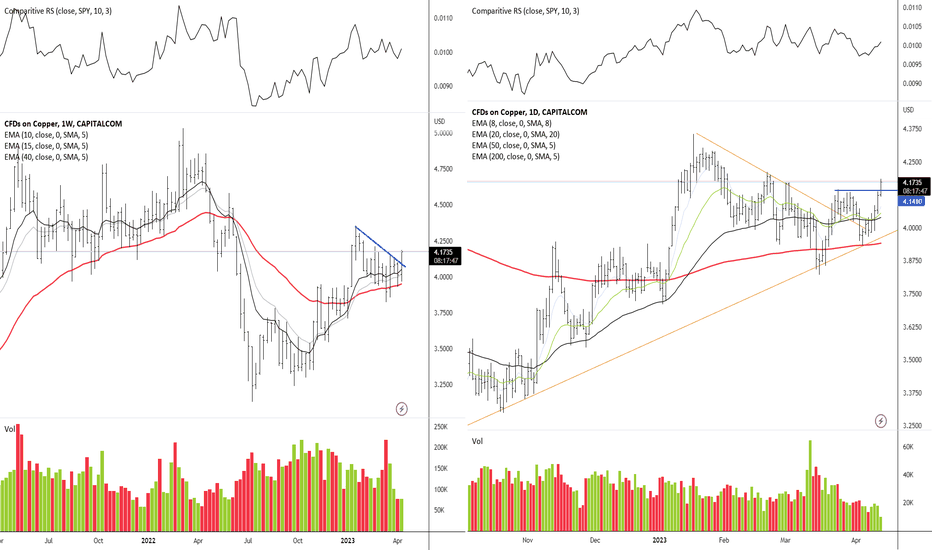

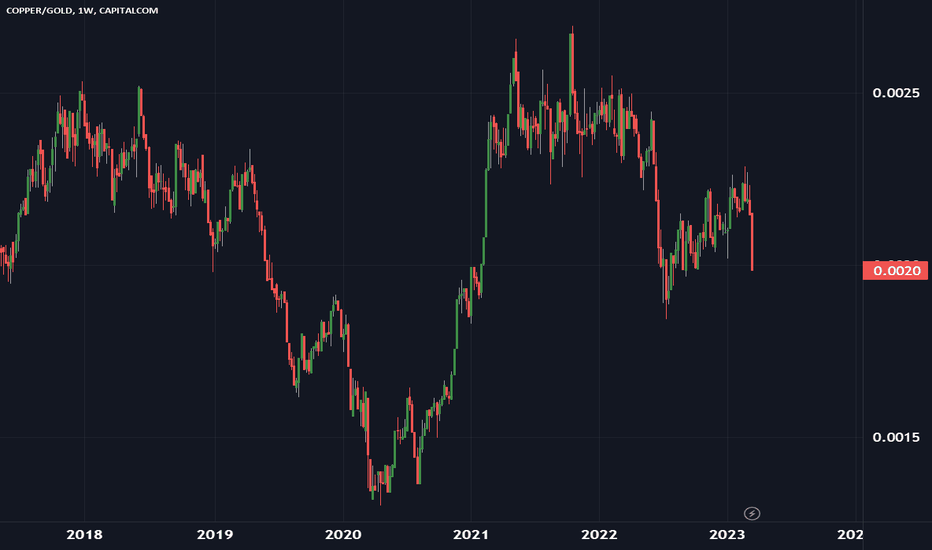

Copper is often referred to as "Dr. Copper" because it has a reputation for being a good indicator of global economic growth (Economic growth indicator). Might it signal something?

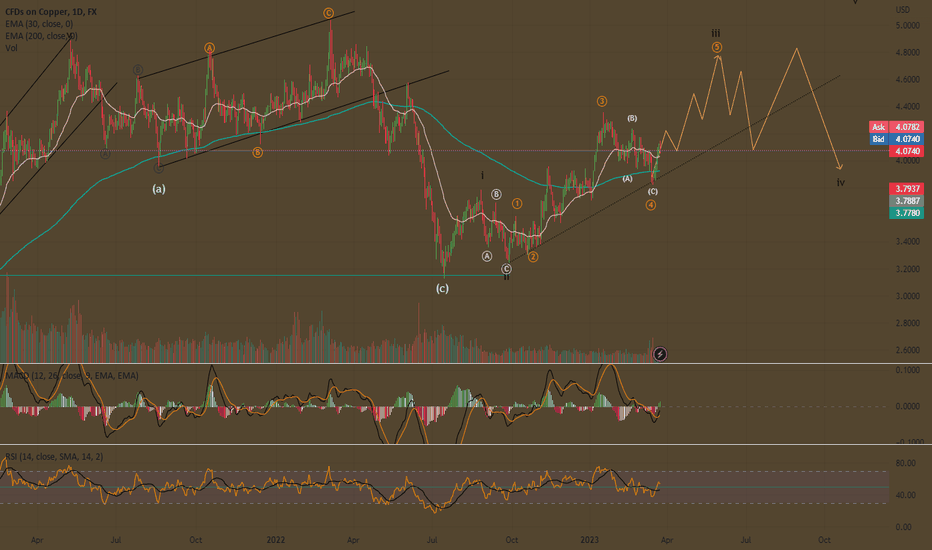

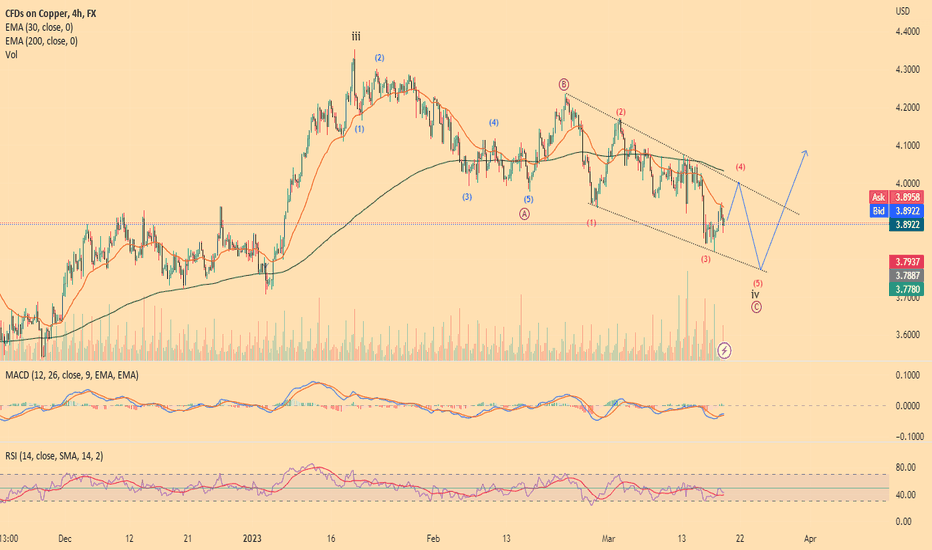

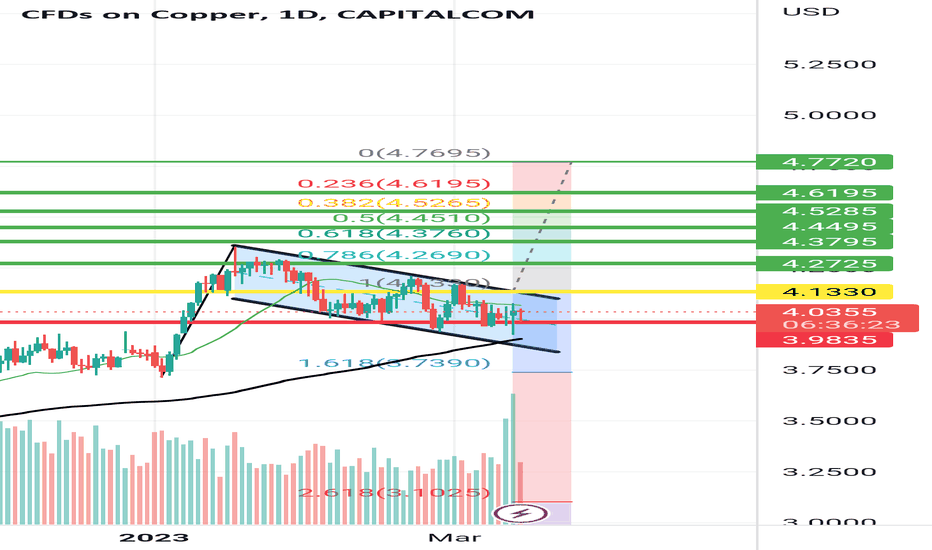

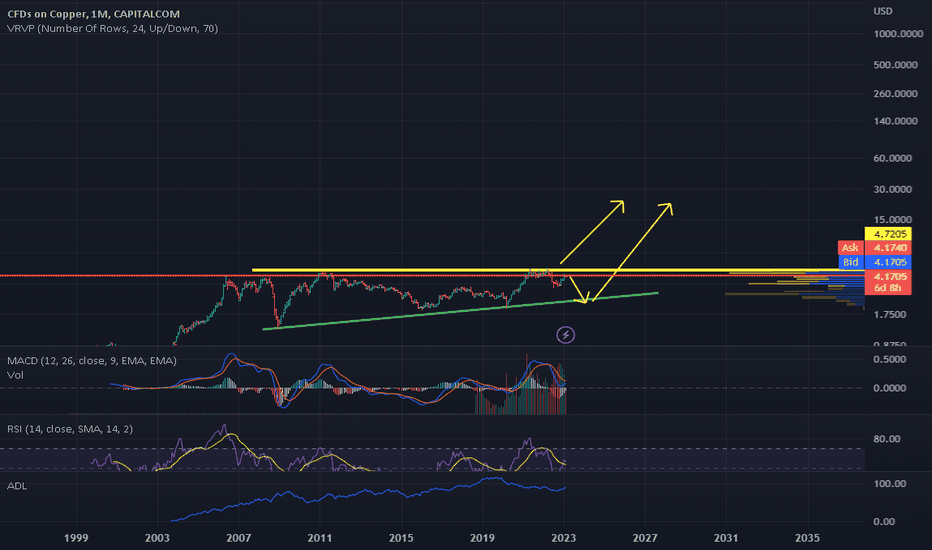

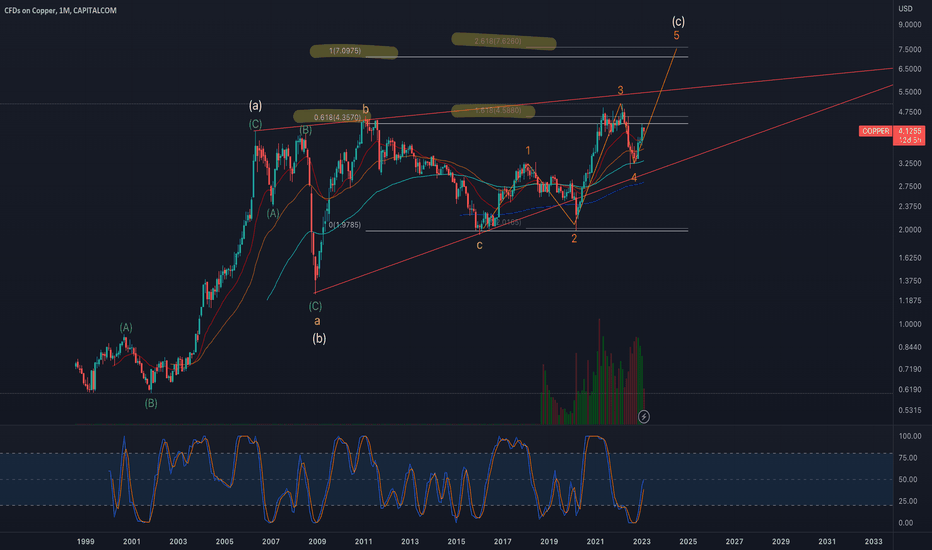

COPPERImpulsive wave 5 is on the progress which will terminate the high of the wave 3.

Wave 5 is the smaller degree of a wave iii. The next wave iv would be a flat pattern. As a rule, if wave ii ended with a zigzag pattern, then the wave iv might end as flat pattern.

The price is very strong enough to go up as it has supported the 200ma along with RSI and MACD with a positive indication.

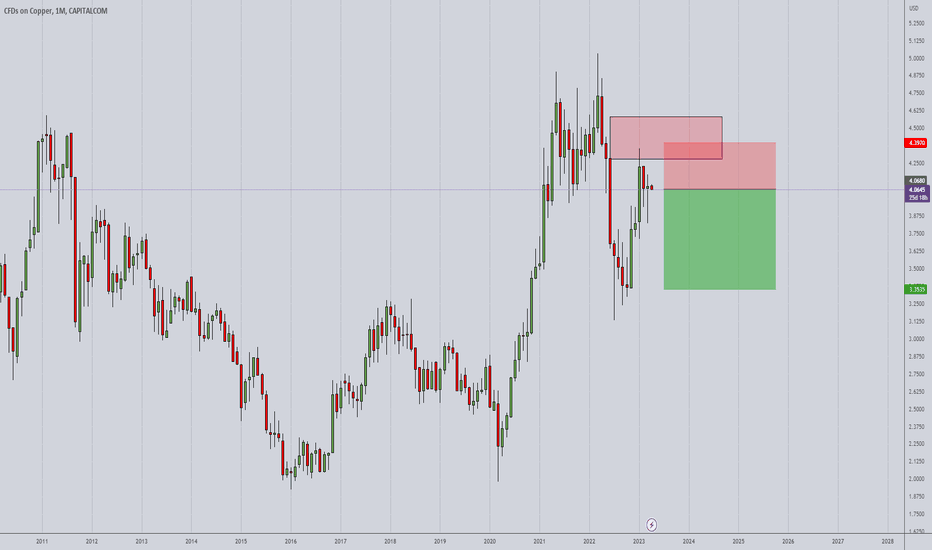

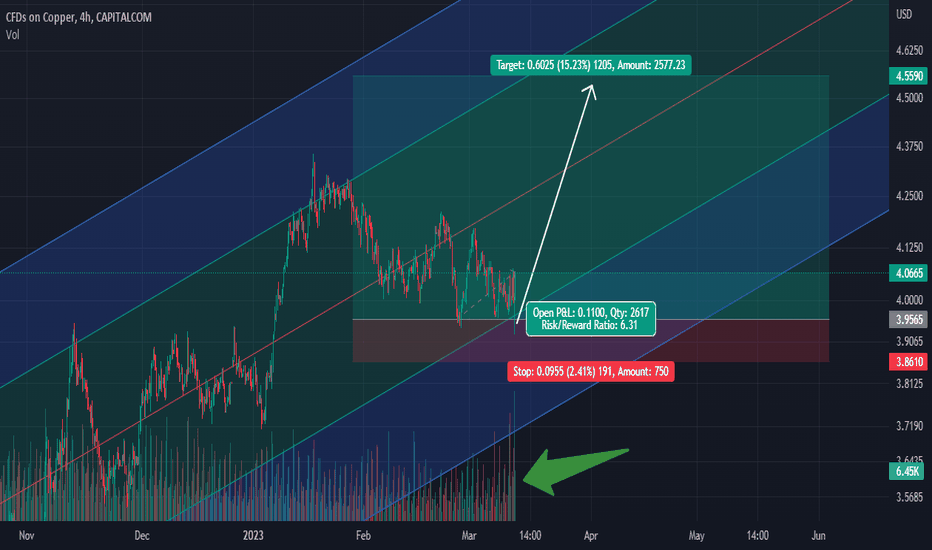

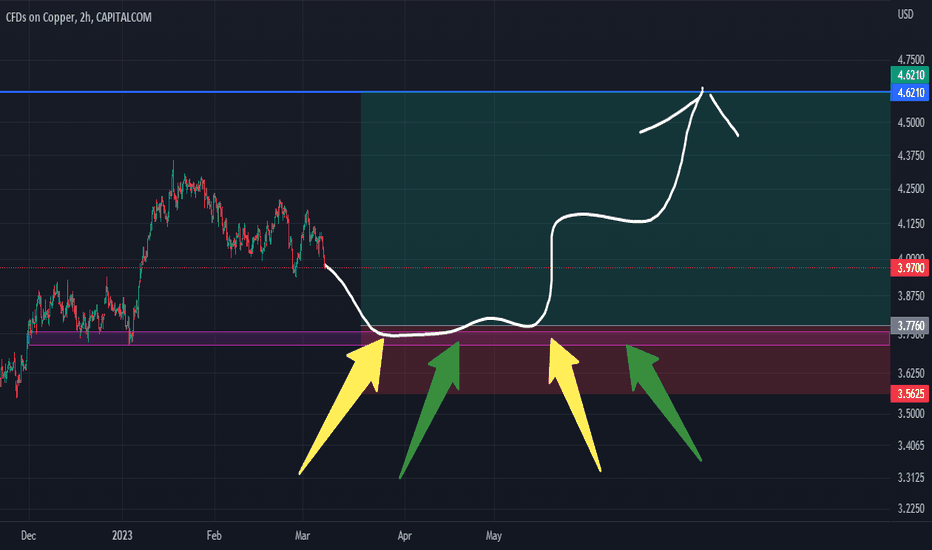

Copper Long5.3 Risk to Reward

Swing trade idea.

You may want to find some structural breaks on the lower time frame to get more refined entries and get a better risk to reward ratio.

This trade is probably a 2/5 probability idea, so still a positive expectancy. Just expect this to fail 60% of the time though.

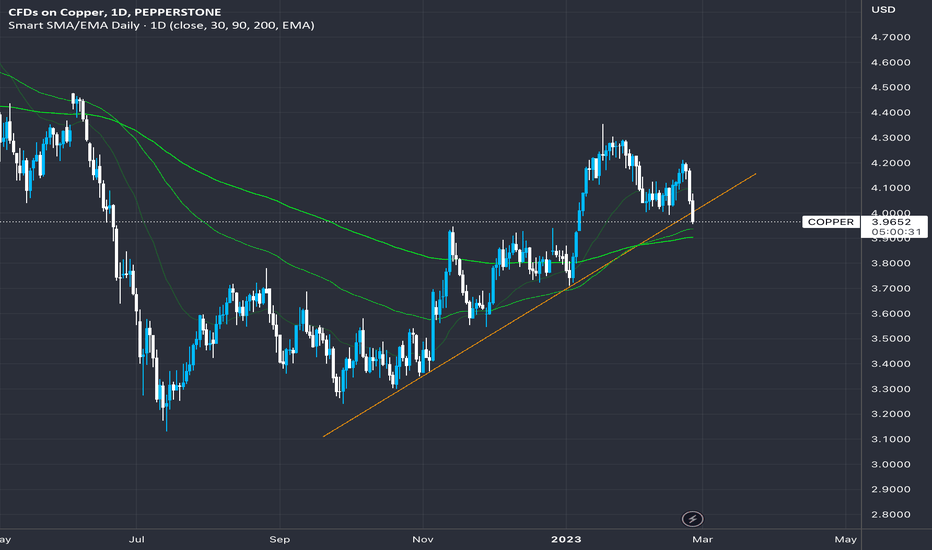

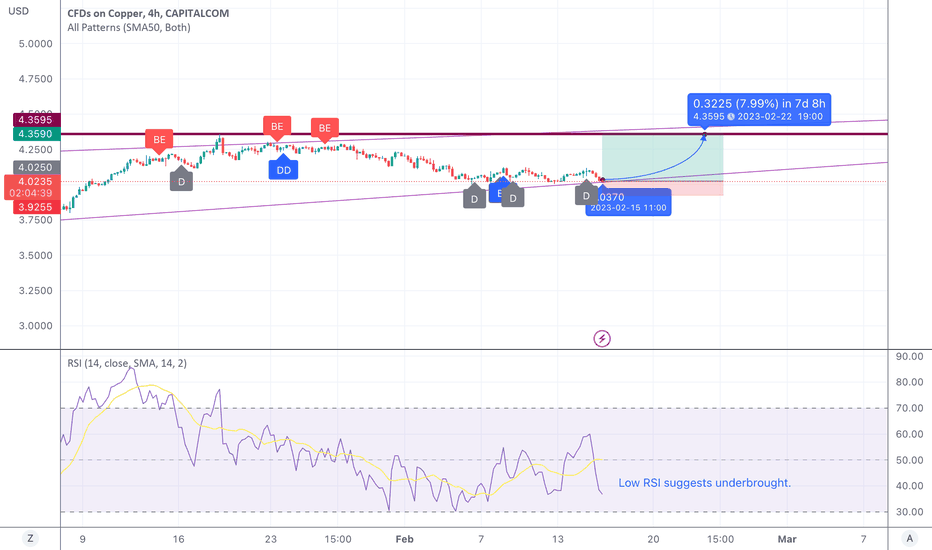

Short-run Bearish on Copper - Converging channel pattern indicates upward trend in short-run.

- Low risk (SL is optional at any point below the lower channel trend line) because price hit channel bottom. Only movement upwards likely.

- RSI at approx. 40 suggests underbought.

- Watch for breakout as channel increasingly converging. After TP is successful, can set a trade order partly above or below the current price - to catch the breakout for a quick profit.