CRO (Crypto.com Coin) Token Analysis 28/07/2021Fundamental Analysis:

Crypto.com Coin (CRO) is the native cryptocurrency token of Crypto.com Chain — a decentralized, open-source blockchain developed by the Crypto.com payment, trading and financial services company.

Crypto.com Chain is one of the products in Crypto.com’s lineup of solutions designed to accelerate the global adoption of cryptocurrencies as a means of increasing personal control over money, safeguarding user data and protecting users’ identities. The CRO blockchain serves primarily as a vehicle that powers the Crypto.com Pay mobile payments app.

In the future, Crypto.com plans to expand the reach of the CRO platform to power its other products as well.

CRO went live in November-December 2018.

CRO blockchain is mainly focused on providing utility to the users of Crypto.com’s payment, trading and financial services solutions.

CRO owners can stake their coins on the Crypto.com Chain to act as a validator and earn fees for processing transactions on the network. Additionally, CRO coins can be used to settle transaction fees on the Crypto.com Chain.

Within the framework of the Crypto.com Pay payments app, users can get cashback of up to 20% by paying merchants in CRO and up to 10% by purchasing gift cards and making peer-to-peer transfers to other users.

When it comes to trading use cases, the Crypto.com App allows users to earn token rewards for select listings by staking CRO.

Additionally, users can earn annual interest of up to 10-12% on their Crypto.com Coins by staking them on either the Crypto.com Exchange app or Crypto.com’s metal Visa Card.

Overall, CRO acts as an instrument that powers Crypto.com’s drive to increase the adoption of cryptocurrencies on a global scale. As such, the company is continuously working on finding and developing new use cases that will allow users to leverage the cryptocurrency to enhance the control they have over their money, data and identities.

CRO is built on top of Ethereum’s (ETH) blockchain according to the ERC-20 compatibility standard, which means that its network is secured by the Ethash function.

Crypto.com Coin was launched by the Crypto.com company as part of its vision of “putting cryptocurrency in every wallet.” Crypto.com itself was founded in June 2016 as “Monaco Technologies GmbH” by Kris Marszalek, Rafael Melo, Gary Or and Bobby Bao.

Kris Marszalek, an alum of the Polish Adam Mickiewicz University, has founded and headed three companies prior to starting Crypto.com: consumer electronics design and manufacturing business Starline Polska, location-based service mobile app and platform YIYI and the e-commerce firm BEECRAZY.

Rafael Melo earned his bachelor’s degree in engineering from the PUC-Rio. Over his more than 15-year-long career in finance, Melo has worked with major companies in Asia and helped secure over 50 million AUD in funding for the Ensogo social commerce website.

Gary Or is a software engineer with over nine years of fullstack engineering experience. Prior to co-founding Crypto.com, Or worked as platform architect at Ensogo and co-founded the mobile app development firm Foris. He received his bachelor’s degree in engineering, computer science from the University of Hong Kong.

Before helping launch Crypto.com, Bobby Bao worked in the M&A department of the China Renaissance investment bank. Bao has studied at the University of Melbourne, NYU Stern School of Business and the College of William & Mary.

The total supply of CRO is limited to 30 billion coins (following 70 billion CRO burned in 2021), all of which were created when the blockchain went live — making it a non-mineable cryptocurrency.

The total supply of CRO will be allocated for five different purposes:

30% — Secondary distribution and launch incentives - released in batches on a daily basis over five years from November 14, 2018;

20% — Capital reserve - frozen until Nov, 7, 2022;

20% — Network Long-Term Incentives - frozen until Nov. 7, 2022;

20% — Ecosystem grants - frozen until the launch of Crypto.com Chain Mainnet;

10% — Community development.

The live Crypto.com Coin price today is $0.123236 USD with a 24-hour trading volume of $41,467,222 USD. Crypto.com Coin is up 5.78% in the last 24 hours. The current CoinMarketCap ranking is #30, with a live market cap of $3,113,312,195 USD. It has a circulating supply of 25,263,013,692 CRO coins and a max. supply of 30,263,013,692 CRO coins.

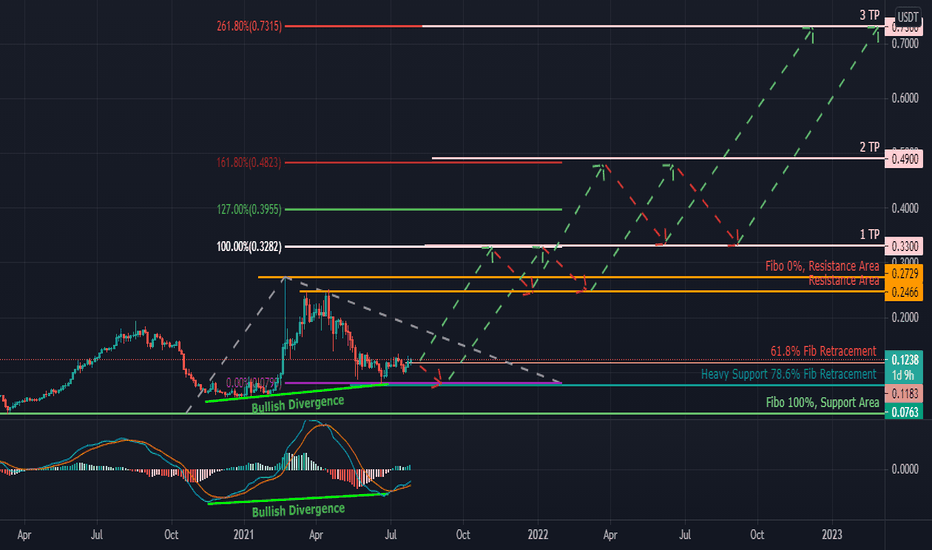

Technical Analysis:

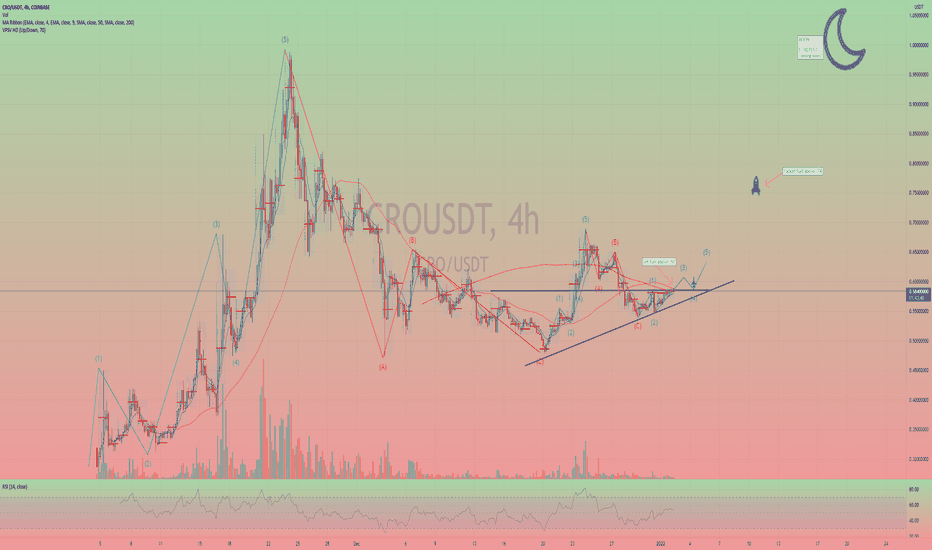

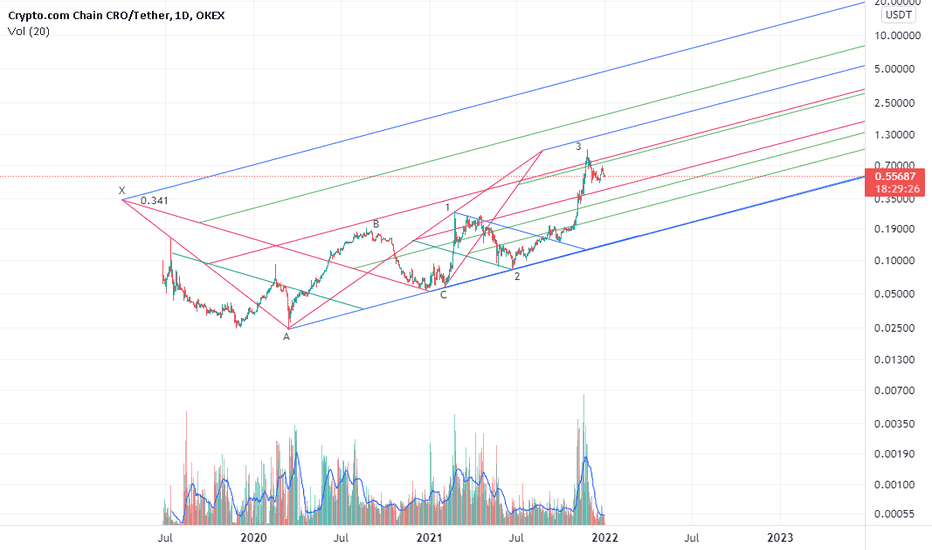

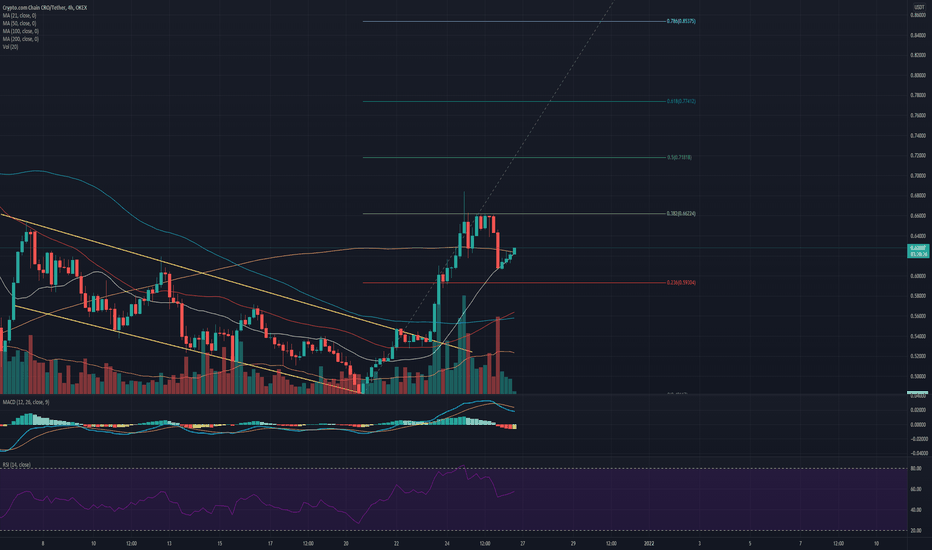

as we can see there exist a Hidden Bullish Divergence with MACD which is the sign of bearish trend reversal and as the price is currently reaccumulating at the 78.6% retracement level of Fibonacci which is a very powerful Pivot level and can turn the trend from bearish to bullish.

there are 3 targets defined for the upcoming Bullish Cycles Fibonacci projection where the 3 TP gets its confirmation as the 2 TP gets triggered followed by some retracement and price correction

CROUSDT.P trade ideas

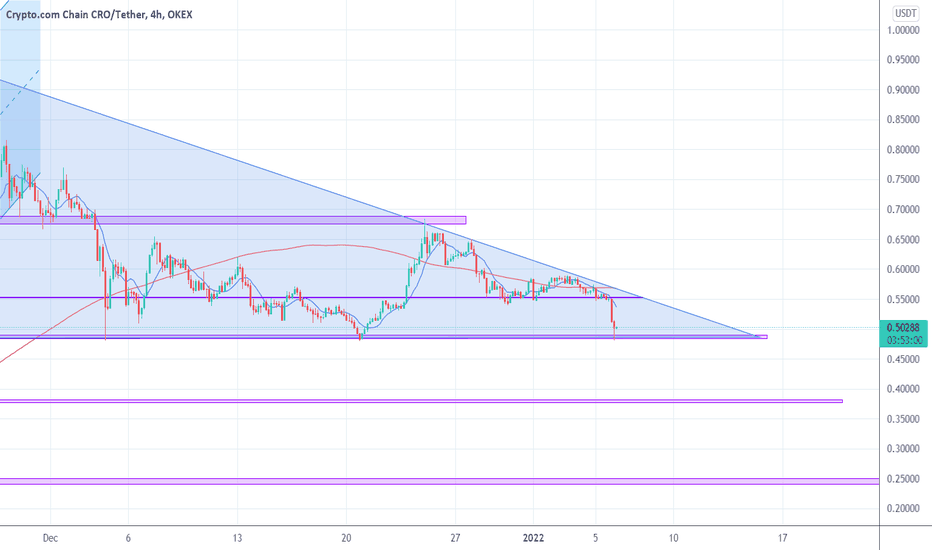

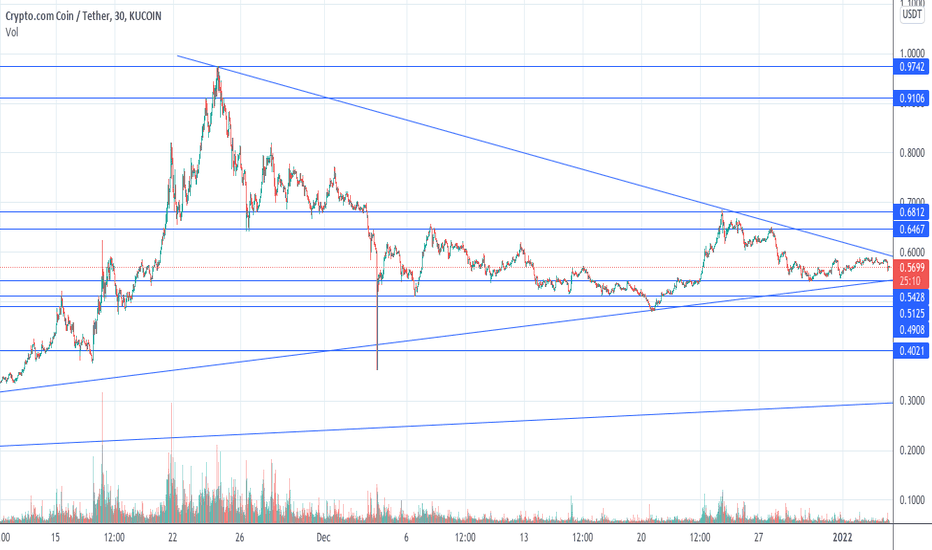

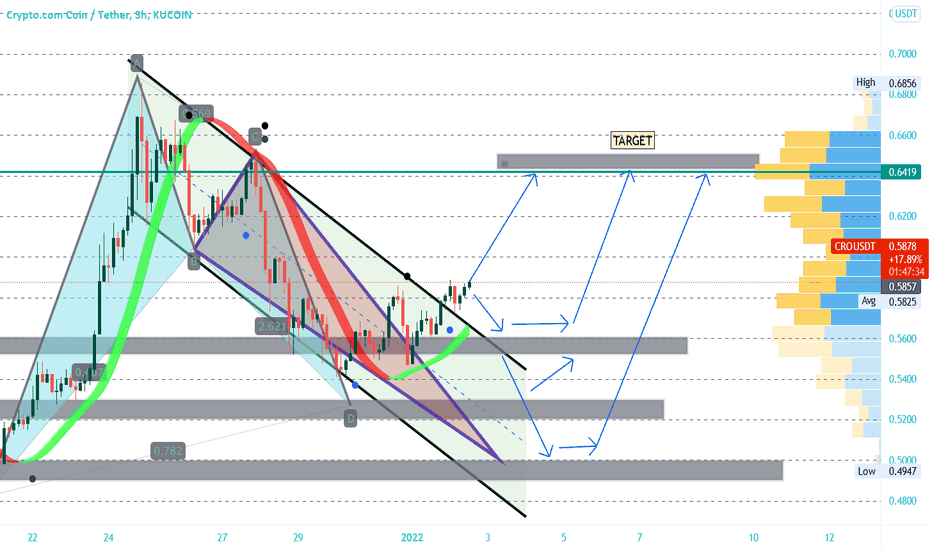

Eyes on CRO TokenCRO has formed a triangle and is trading within this area. It looks poised to break out in any direction soon.

Breaks upwards: if it breaks above, the recent high would be a good place to take profit.

Breaks downwards: if it breaks below, the next area of support would be a good place to take profit.

Do wait for a close above/below the pattern for additional confirmation, preferably a close on the daily chart.

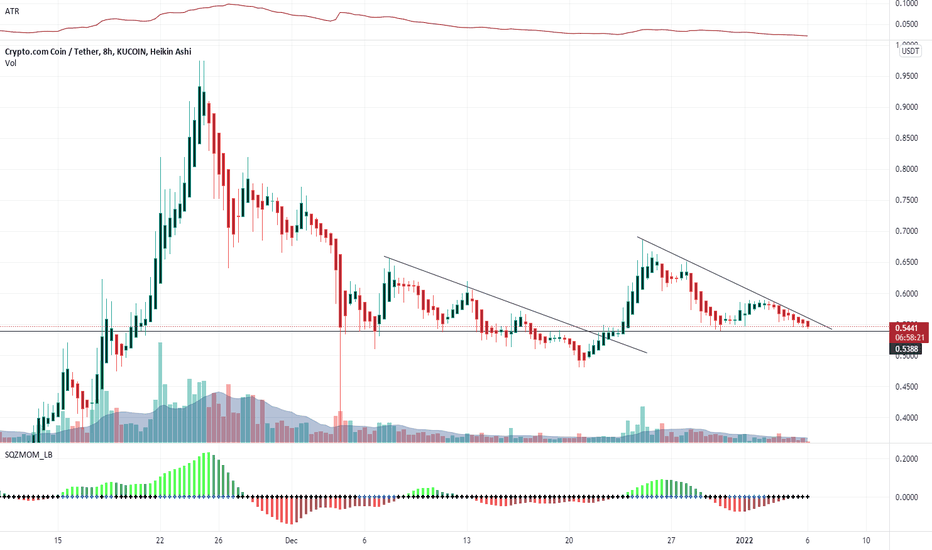

CRO-USDT descending triangle set up.$CRO-USDT descending triangle set up.

Very low volatility currently, with potential expansion coming soon. (if $BTC wakes up)

Currently sitting near support at $0.54

A breakout of the diagonal downtrend line (with volume ) could see a big move to the upside targeting the previous swing highs.

#DYOR #NFA #technicalanalysis

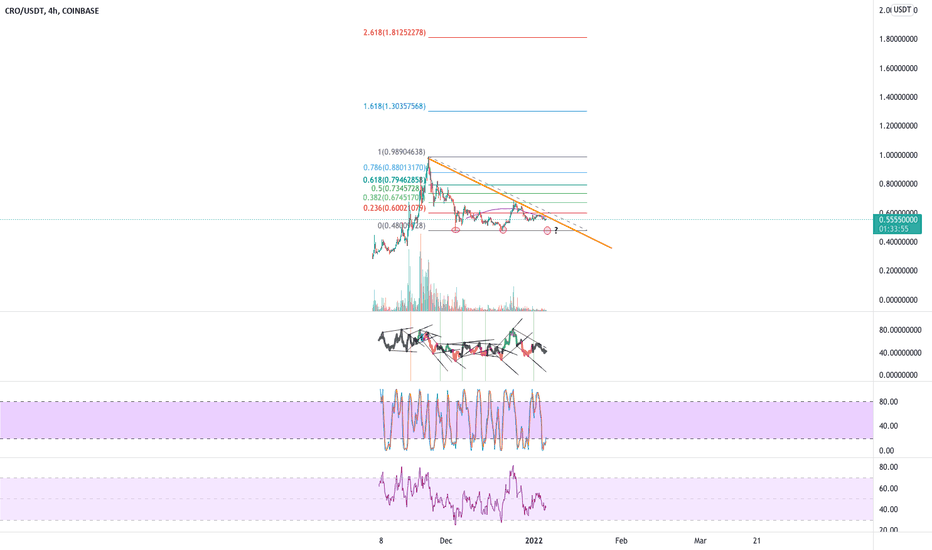

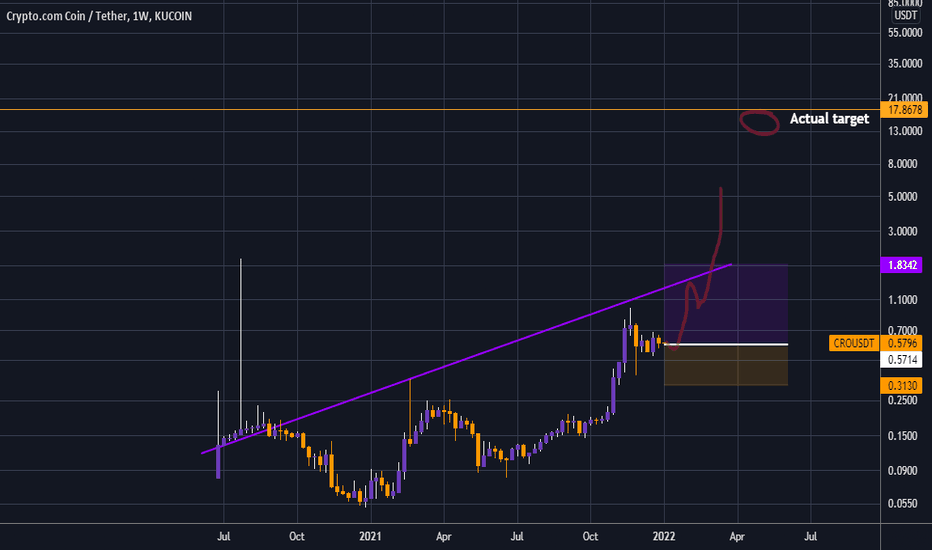

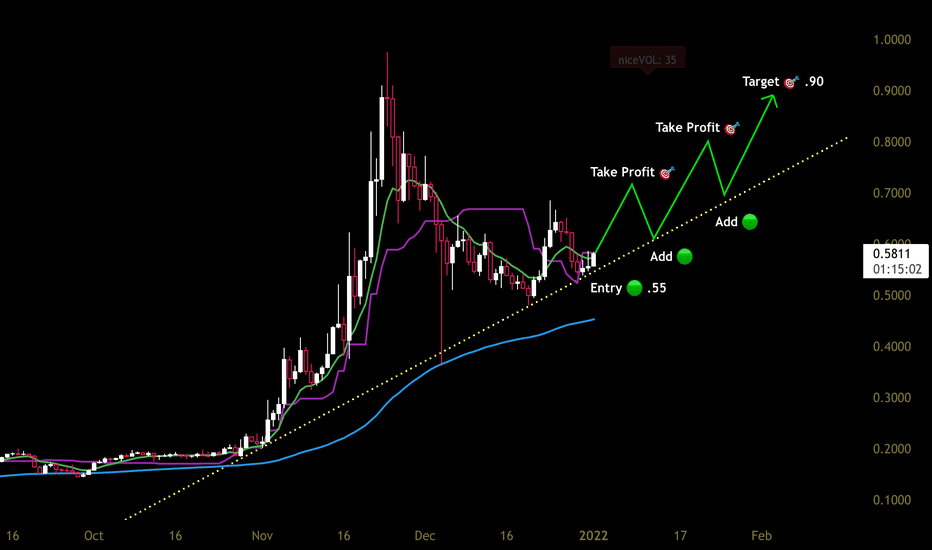

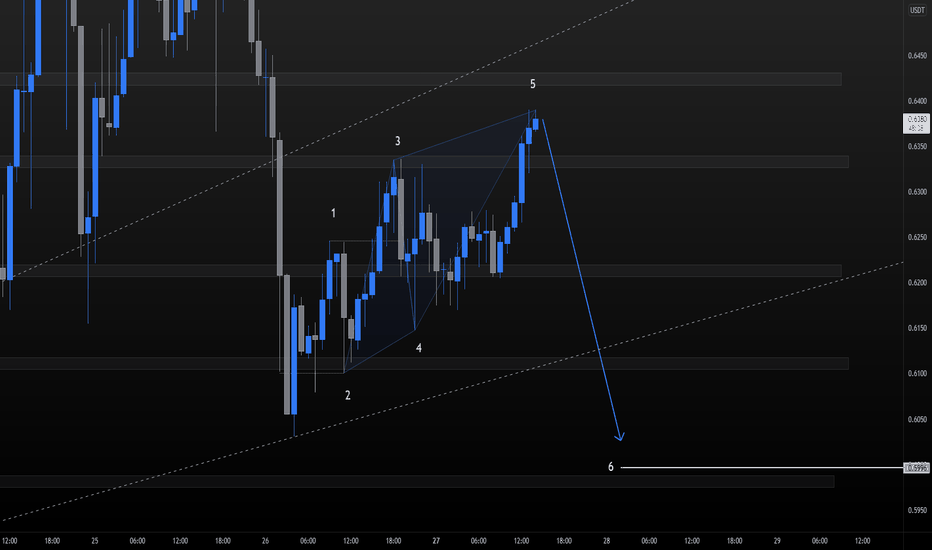

$CRO Aiming for $1A very simple analysis, which are normally the best...

We have completed waves 1, 2, 3 and 4 of an impulsive movement, and wave 4 respected the limit of wave 1, with favorable fib conditions (rejection at 61.8%, 100% extension of zig-zag).

Since wave 3 was extended (3x the size of wave 1), we shouldn´t expect much from wave 5. Therefore my target is $1, just above wave 3.

CRO long set up#cro $cro looking for this long set up. If it can break diagonal and horizontal resistances, it could play for a nice 8:1 set up. Previous trade played out nicely and another breakout should retest green line.

Wait for confirmation

——————————————————————————————

Top 10 trading tips:

1. DO NOT FOMO into a trade. Let it come to you. Don’t force it.

2. Find a strategy that works for you and be consistent. Operate like a machine and less like the wind.

3. Let your winners run and cut your losers short.

4. You will not win every trade, but if you are disciplined with great RM you don't need to be right all the time to win!

5. Before you enter a trade, know your target AND your exit strategy.

6. When you are up, you can use a trailing stop or trim off some profit at a logical resistance point with a stop loss at breakeven.

7. Set your trade parameters up front so you keep your self accountable and remove emotions from the equation. (stop loss, take profit levels, etc)

8. Don't fight the trend. The trend is your friend.

9. Don’t enter a trade based on one indicator.

10. Horizontals > Diagonals

Please note:

- This is not financial advice.

- I do not take every trade I post.

- Never trade off of someone else's chart until you DYOR!

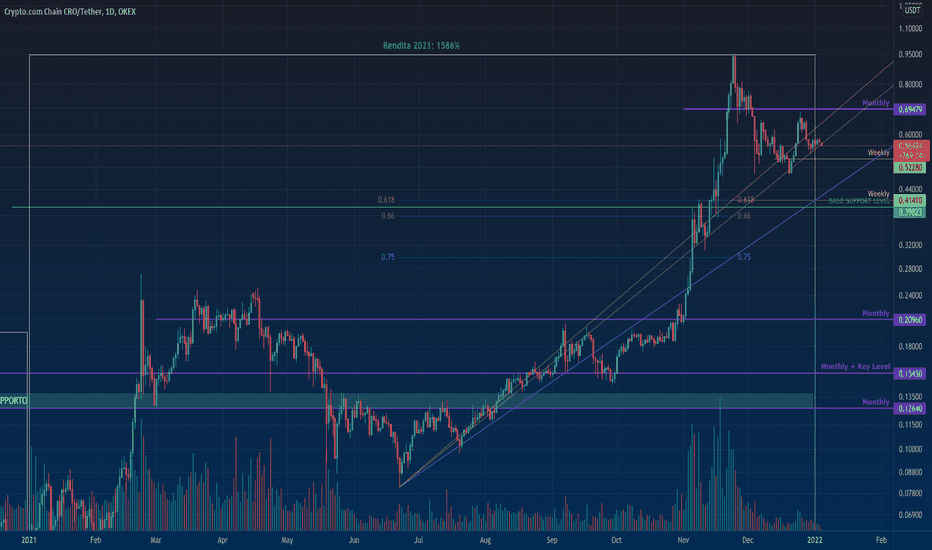

Is Crypto.com Coin (CRO) Trending Lower or Higher SundayCrypto.com Coin's price is $0.1800000 (43.32%) above its 100-day moving average price of $0.410000000 as its price at the moment sits at $0.590000000. Additionally, CRO is $0.5300000 (-17803.07%) higher than its 52-week low price of $0.060000000 while -$0.38000000 (-970.81%) under its 52-week high of $0.970000000.

The current trading price in relation to its long-term average along with its 52-week high and low, gives CRO a strong long-term technical score of 70.

CRO long term price prediction:

Long-term trading movement of Crypto.com Coin suggest that investors are neutral on the token at the moment. Crypto.com Coin currently has a total market cap of $14,779,325,038.65 to go along with its average daily volume of $1,418,975,141.93 worth of the currency over the past seven days.

CRO's volume is below its seven day average as of the past 24 hours, with 177,202,230.38 exchanged in that period.

This token's subclass Payment Tokens: A token used as a form of payment for goods and services either in or outside of the crypto ecosystem. Often used as payment for services in a particular blockchain environment.

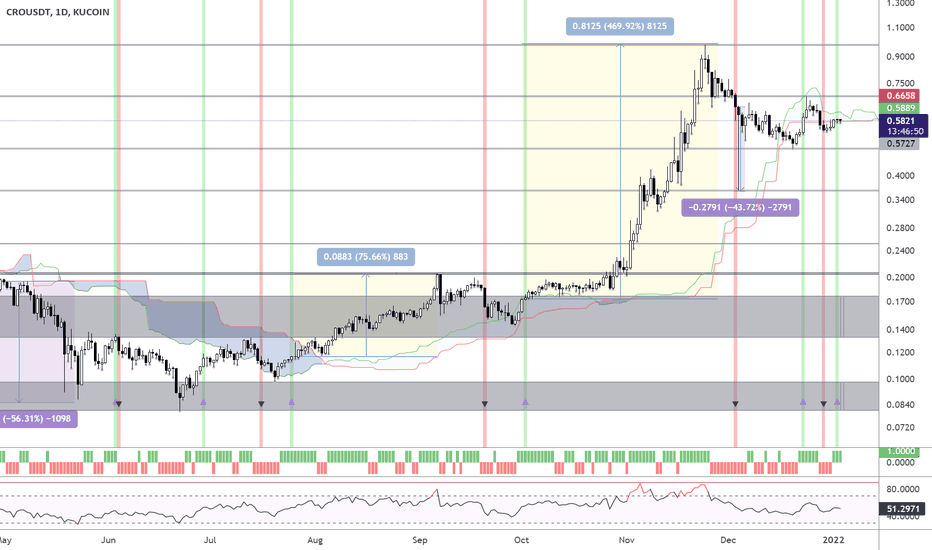

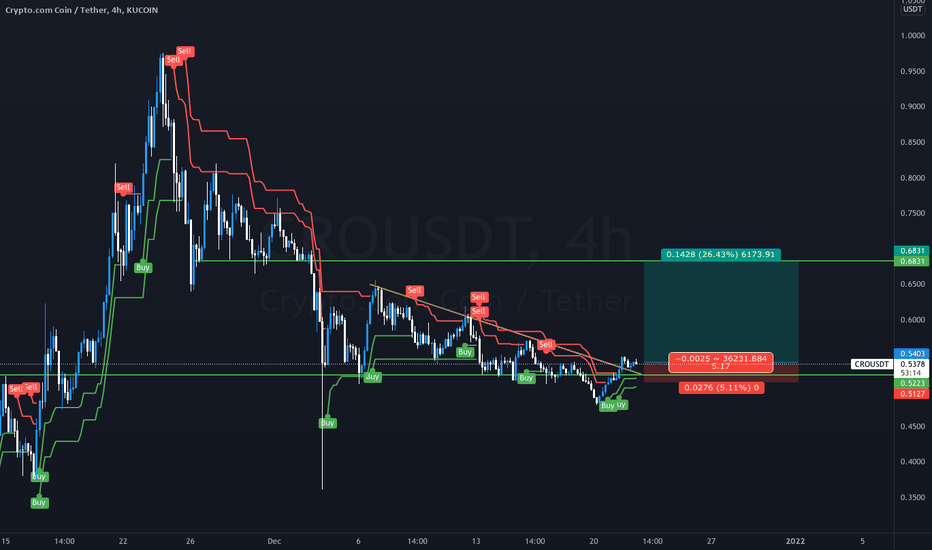

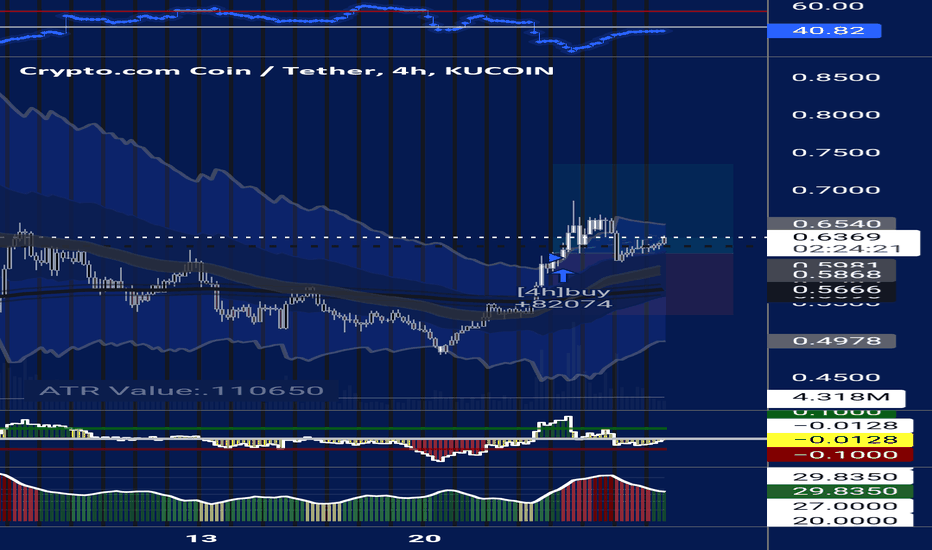

UPDATE: CRO UP 470% after bull signal - What Next?Please Like or Follow if you enjoyed this content.

UPDATE: The price jumped 470+% after the bullish Supertrend Ninja signal in Oct 2021. And 275% in July 2021. The Supertrend Ninja also predicted the heavy drops of April 2021 and Dec 2021.

The price is ranging, which is visible from the sideways movement. RSI is in a range as well. Although CRO got a bullish signal from my indicator Supertrend Ninja. Right now the price is in the middle of two grey blocks. Supports and Resistances are highlighted as grey blocks. Next support around 0.48 USDT. Next resistance around 0.68 USDT.

Profits can be taken at each grey block. Supports and resistances are drawn using the indicator 'Yo Show Me Some Support - and Resistances'. Pun intended.

Thank you for reading.

Namasté 🙏

What Indicators Do I Use:

In the chart I am using my Supertrend Ninja indicator, which is a trend-following indicator (Green and red vertical line with arrows).

When the background of the candlestick closes green (vertical line) with an upwards pointing pink arrow. It indicates a possible bullish (up)trend.

With each trade proper risk management is essential. Either by using my script Trailing Stoploss Bottom Activation indicator, visible as grey dots below the candles. Which sends an alert, when current price goes below the previous candle low. Or using my Heikin Ashi Trailing Stoploss Activation, the indicator below with green and red blocks. Or third option, exit when the Supertrend Ninja indicator displays a vertical red line with a downwards pointing black arrow. Remember, the first stop(loss) is always the cheapest stop.

Disclaimer: Ideas are for entertainment purposes only. Not financial advice. Your own due diligence is highly advised before entering trades. Past performance is no guarantee of future returns.

CROUSDTIn the loving memory of my child Muffin I present you this chart analysis....please take trade after strong candle pattern confirmation or rejection from support/resistance ...if my chart analysis helps you then please do " LIKE" ... it will help me a lot and encourage me to do more hard work in chart fundamental and technical analysis ...

you can ask me any thing in comment section I will reply 100 %

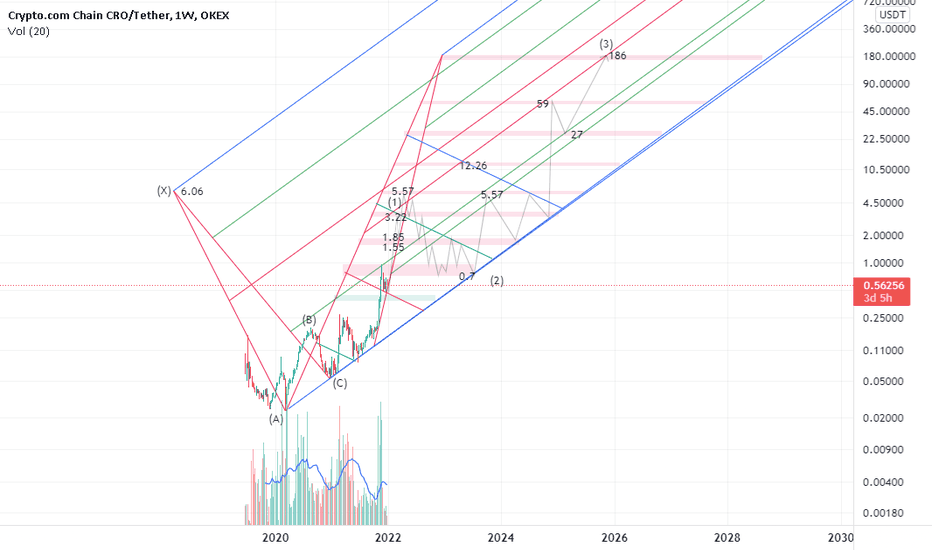

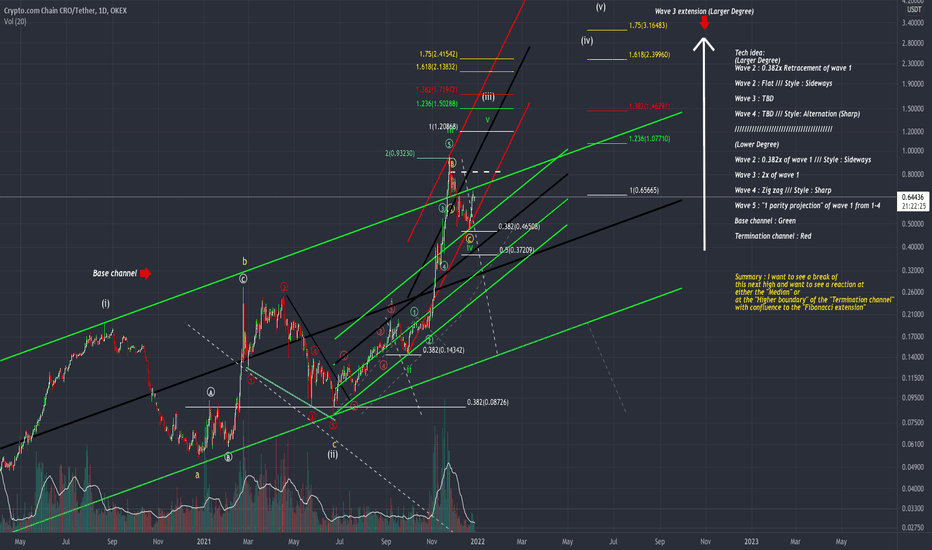

CRO AnalysisTech idea:

(Larger Degree)

Wave 2 : 0.382x Retracement of wave 1

Wave 2 : Flat /// Style : Sideways

Wave 3 : TBD

Wave 4 : TBD /// Style: Alternation (Sharp)

////////////////////////////////////////

(Lower Degree)

Wave 2 : 0.382x of wave 1 /// Style : Sideways

Wave 3 : 2x of wave 1

Wave 4 : 0.382x wave 3

Wave 4 : Zig zag /// Style : Sharp

Wave 5 : "1 parity projection" of wave 1 from 1-4

Base channel : Green

Termination channel : Red

////////////////////////////////////////////

Summary : I want to see a break of

this next high and want to see a reaction at

either the "Median" or

at the "Higher boundary" of the "Termination channel"

with confluence to the "Fibonacci extension"

CRO long setup (20% gains)$cro looks nice here. R:R is great at a 5% stop vs 20-26% reward depending on how you want to play it. Just retested LTF break of diagonal trend line .

I feel like I owed a bullish post for all of the shade I threw at CRO on its run up :)

And for those that said we would never see .50 again...well, I hope you survived the fly by down to .36 hehe

Dont fall in love with a project so much that you ignore what the price action is telling you.

——————————————————————————————

Top 10 trading tips:

1. DO NOT FOMO into a trade. Let it come to you. Don’t force it.

2. Find a strategy that works for you and be consistent. Operate like a machine and less like the wind.

3. Let your winners run and cut your losers short.

4. You will not win every trade, but if you are disciplined with great RM you don't need to be right all the time to win!

5. Before you enter a trade, know your target AND your exit strategy.

6. When you are up, you can use a trailing stop or trim off some profit at a logical resistance point with a stop loss at breakeven.

7. Set your trade parameters up front so you keep your self accountable and remove emotions from the equation. (stop loss, take profit levels, etc)

8. Don't fight the trend. The trend is your friend.

9. Don’t enter a trade based on one indicator.

10. Horizontals > Diagonals

Please note:

- This is not financial advice.

- I do not take every trade I post.

- Never trade off of someone else's chart until you DYOR!

CRO #bitcoin #cryptocurrency #crypto #forex #blockchain #btc #money #ethereum #trading #bitcoinmining #investment #business #forextrader #investing #entrepreneur #bitcoins #invest #bitcoinnews #binaryoptions #trader #bitcointrading #forextrading #cryptocurrencies #cryptotrading #eth #bitcoincash #investor #binary #success #bhfyp