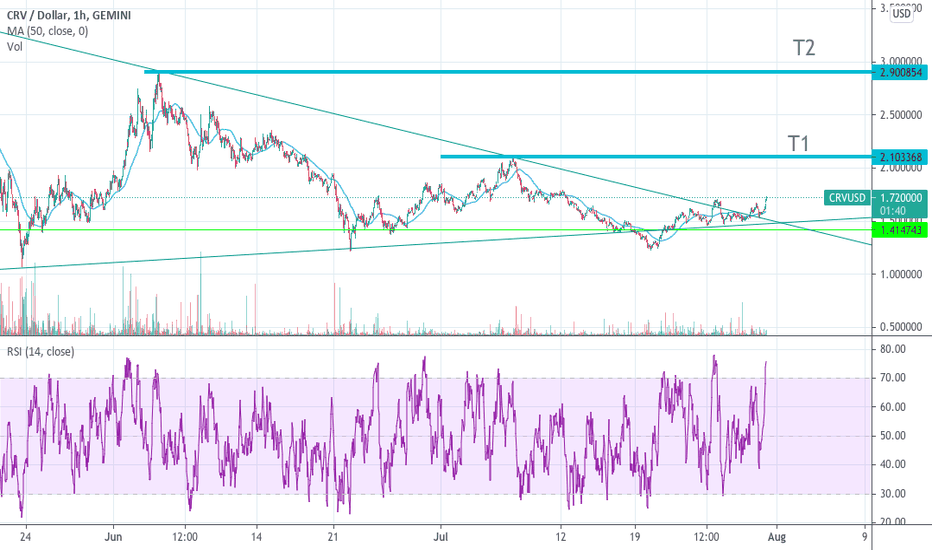

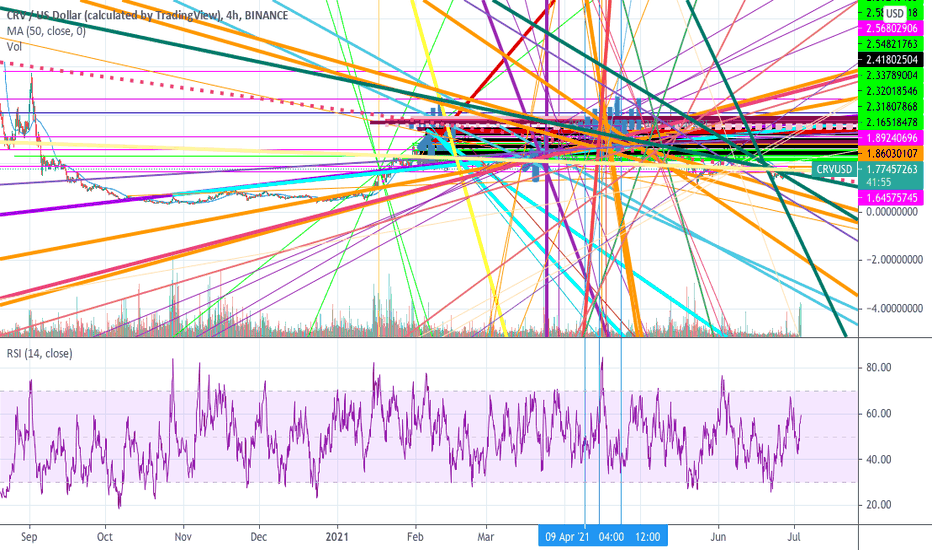

CRVUSD trade ideas

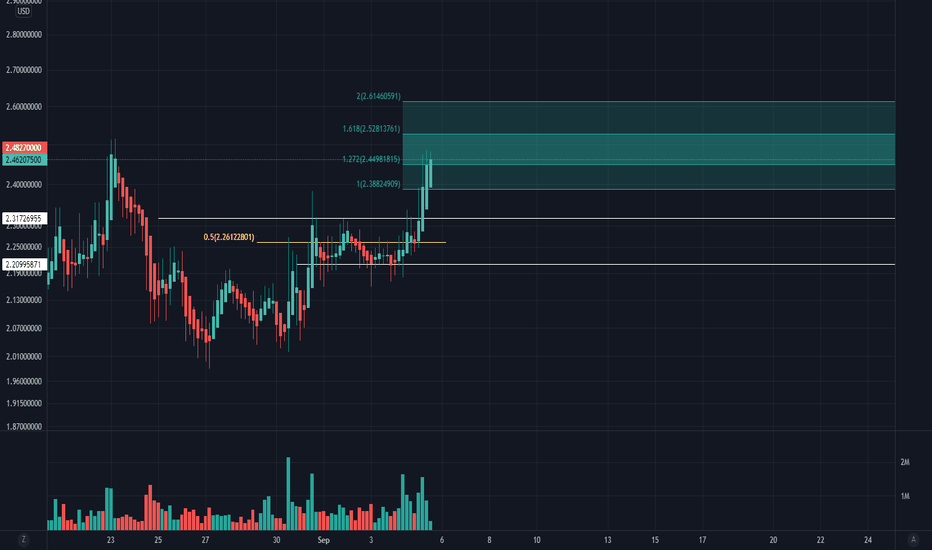

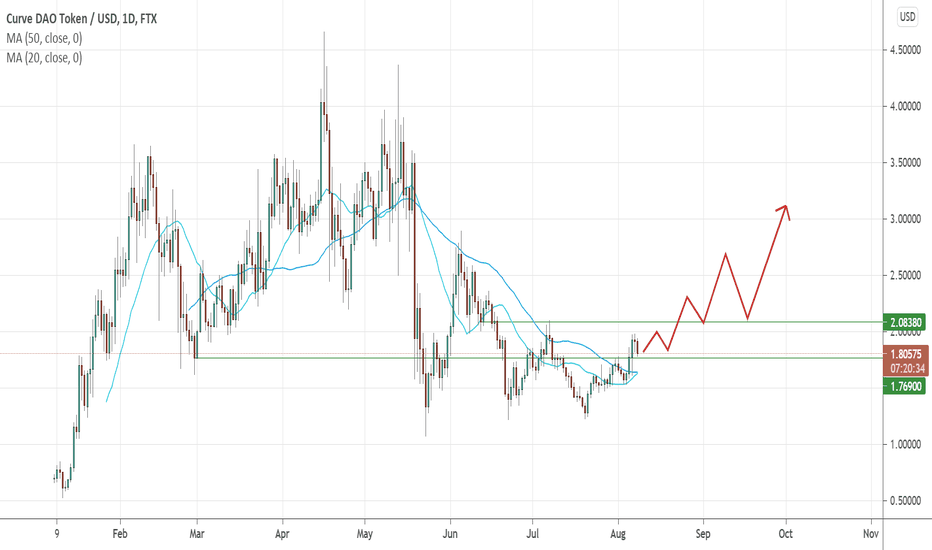

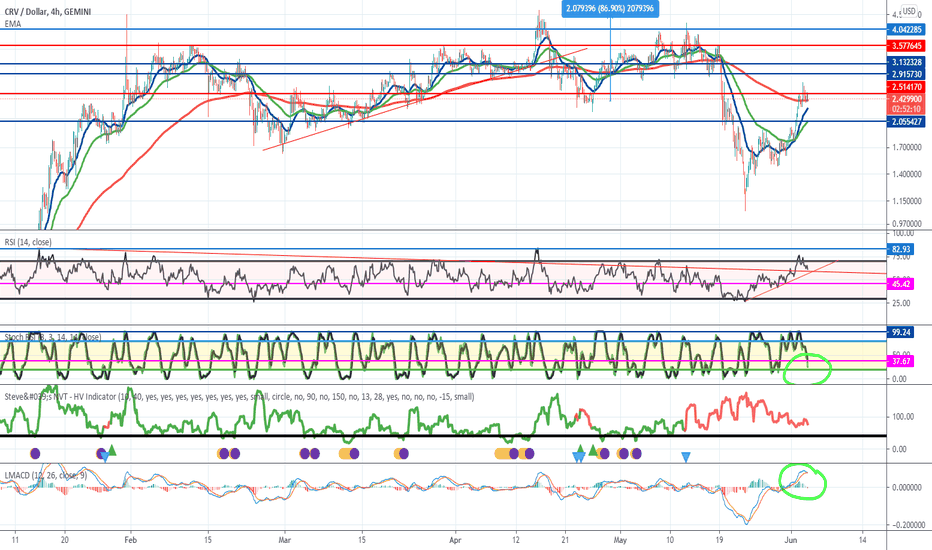

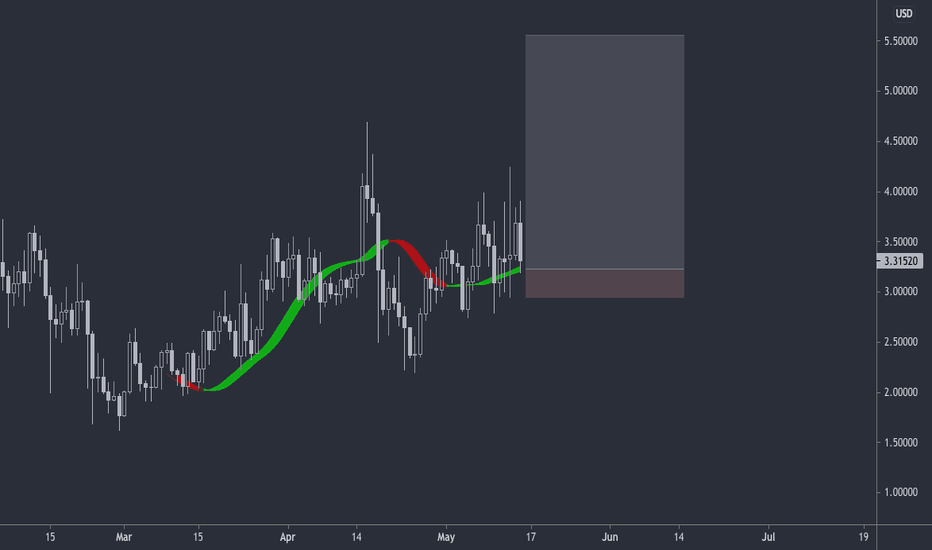

CRV Up 3.78% from PreliminaryCRV has netted a 3.78% return after taking a 2.362 preliminary entry on 8/22 up nearly 9% overall. It's coming to life at last.

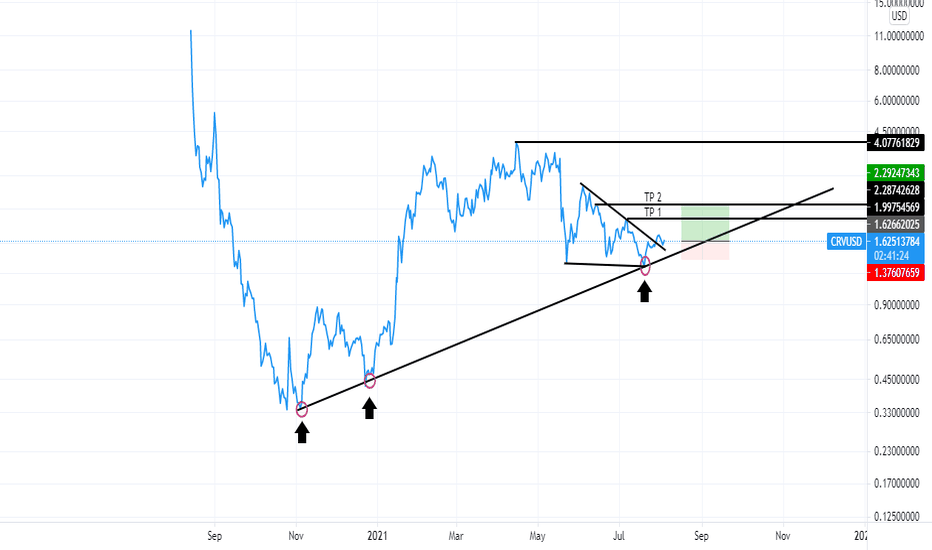

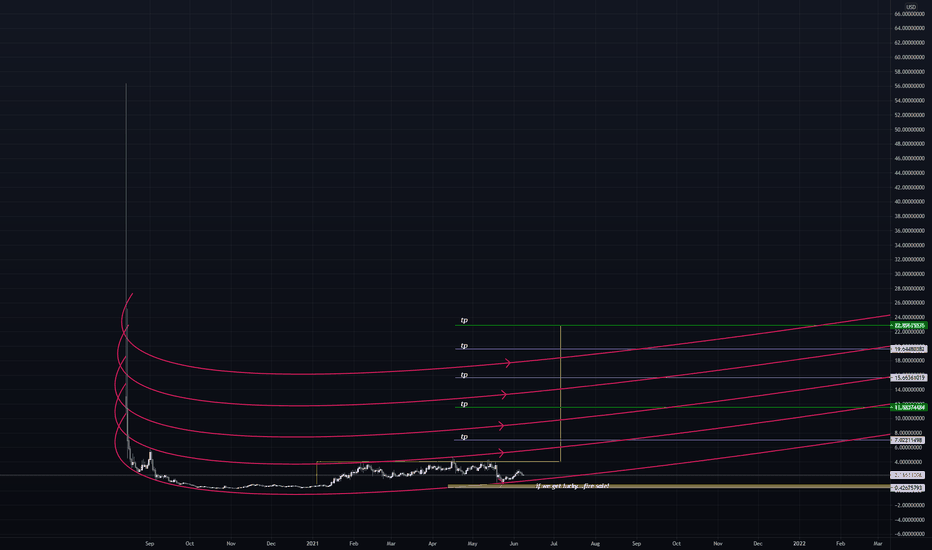

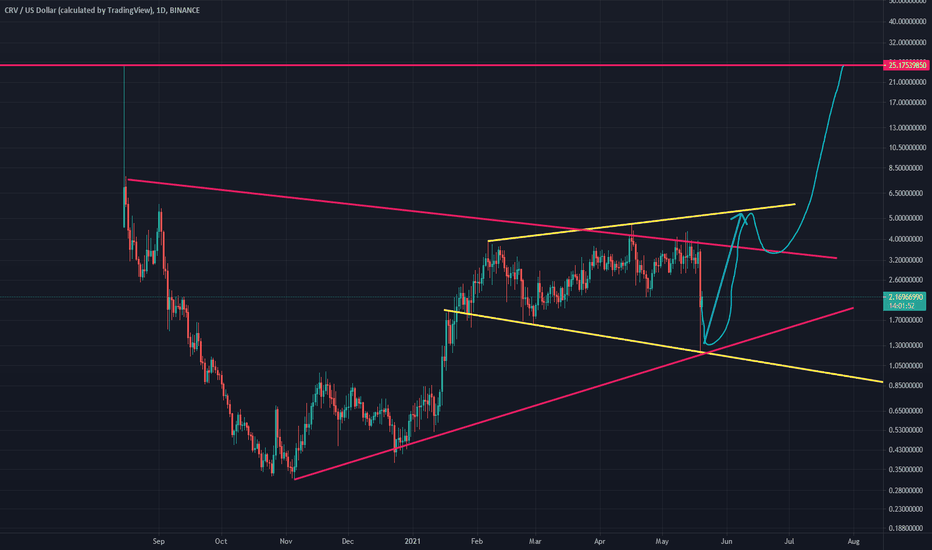

Prognosis: Standard Fibonacci target zone progression. Look for retracements around the 1.618 and a retest of the 1.0 or .272.

*Professional Wyckoffian VSA crypto swing trader (since 2017). I regularly seek out the most lucrative swings on all the major exchanges.

All my charts are clean, straightforward, and easy to follow. No junk, no needless indicators, just solid volume spread analysis ( VSA ) and 'take-the-money-and-run' Fibonacci target zones.

I go after the runners and big money. My win rates are between 80-85%. Follow me on TradingView and see for yourself.

I review over 300 coins & tokens daily and handpick all the runners myself (no bot signals).

** Not financial advice. Trade at your own risk.

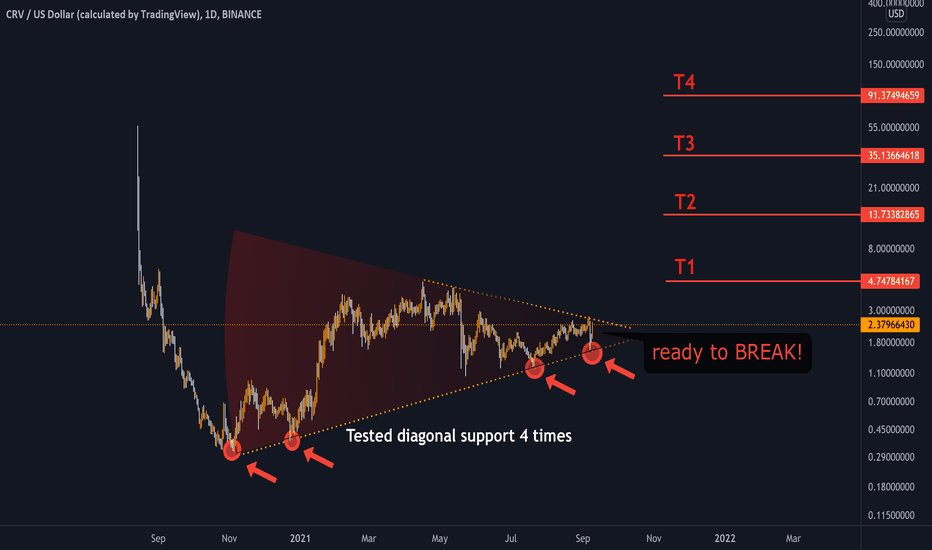

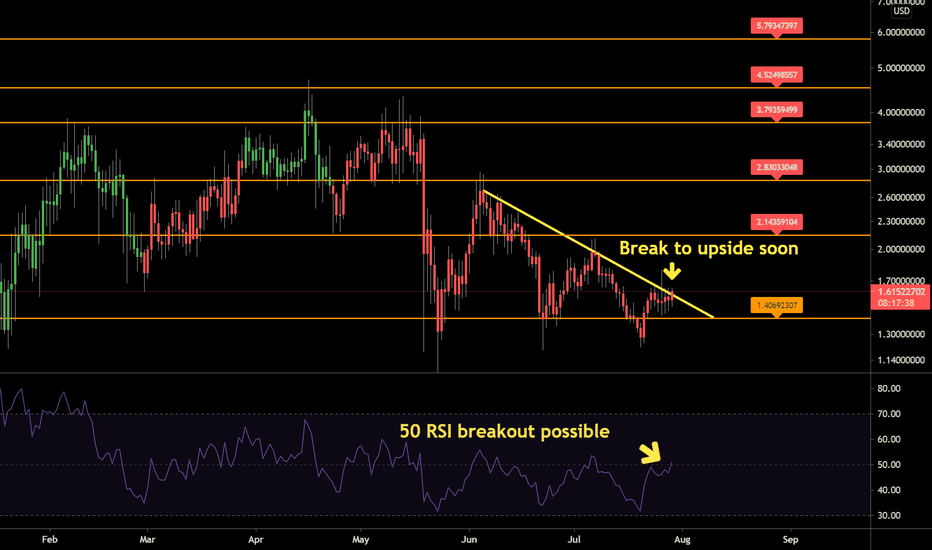

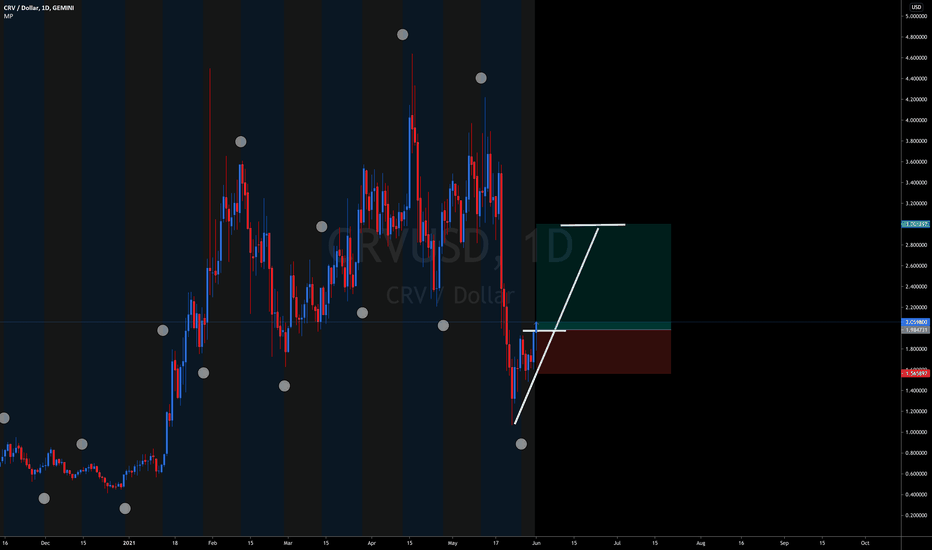

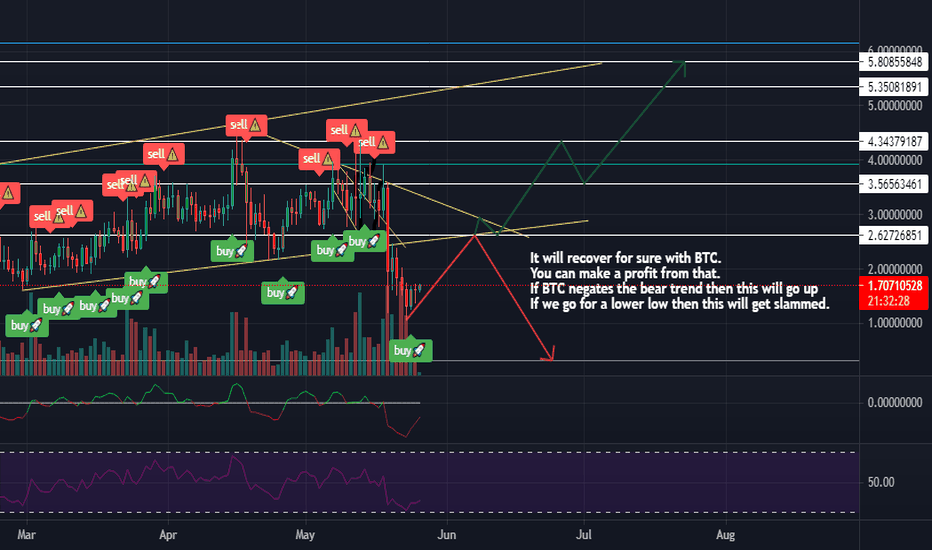

CRVUSD Decision TimeLooks like resistance and support lines converge around Aug 4th. I drew resistance from the most recent peaks, excluding blow off tops from the run north of $4.50. If up, first stop is $2.6, if down, back up the truck at $0.33.

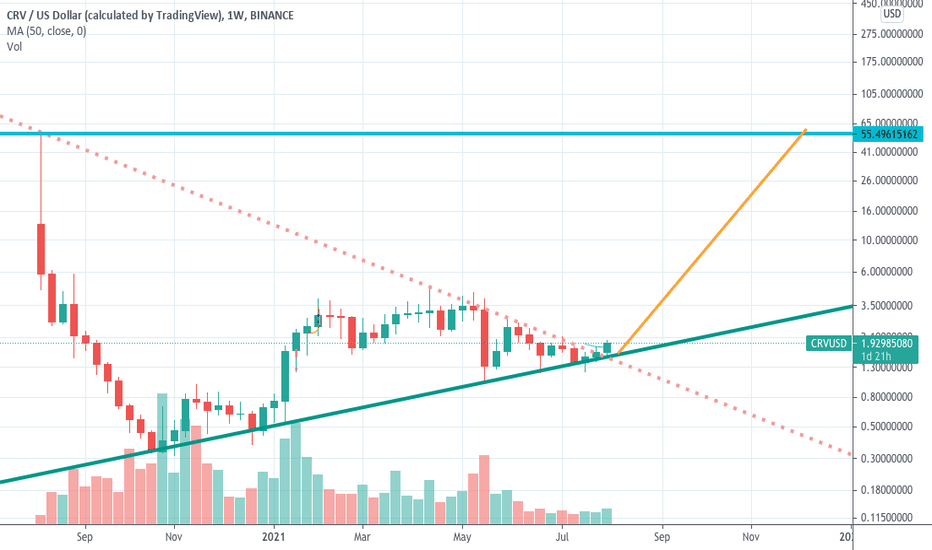

CRV is part of Greyscale Defi portfolio, and may get its own listing as well. V2 supports variable prices asset swaps, TVL #2 on defi pulse and defi llama.. only other project with similar MCP/TVL ratio that's top 3 is Instadapp, which is lending (not DEX AMM like curve).

$inst $crv

If CRV TVL/MCP reaches parity with competitors (with lower TVL) like sushi or uni, it'll be 20x easy from here.

Just needs volume. Yes CRV has a much different inflation schedule, but I've seen a shift in sentiment on the admin forums.. I think CRV is poised to shine come Christmas.

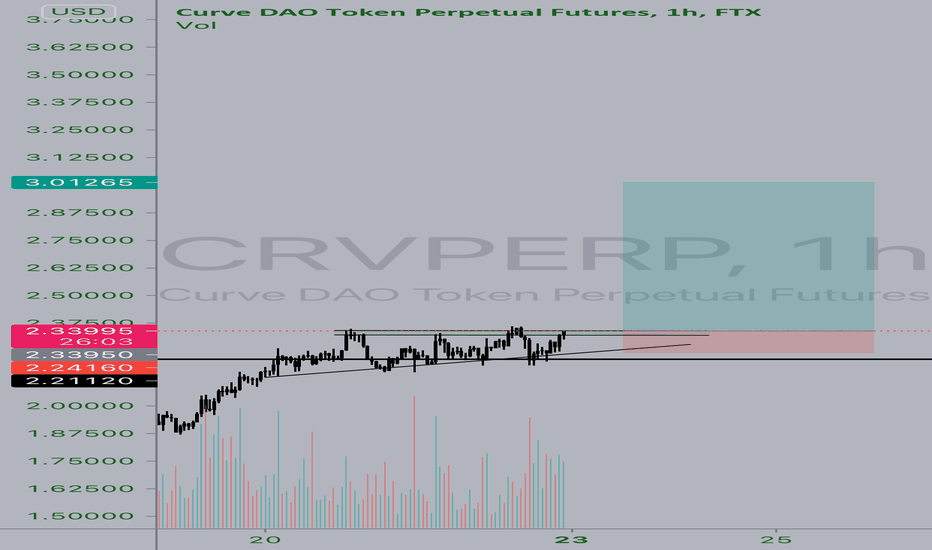

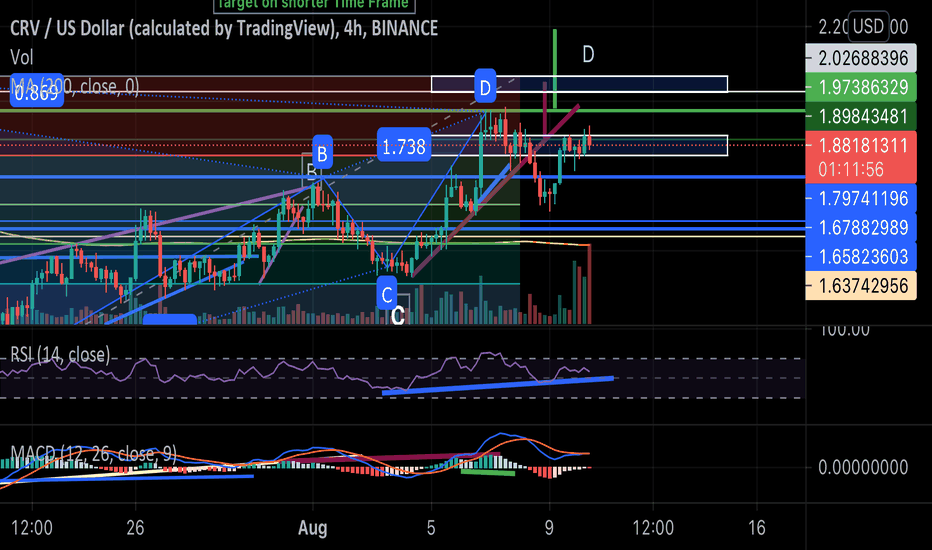

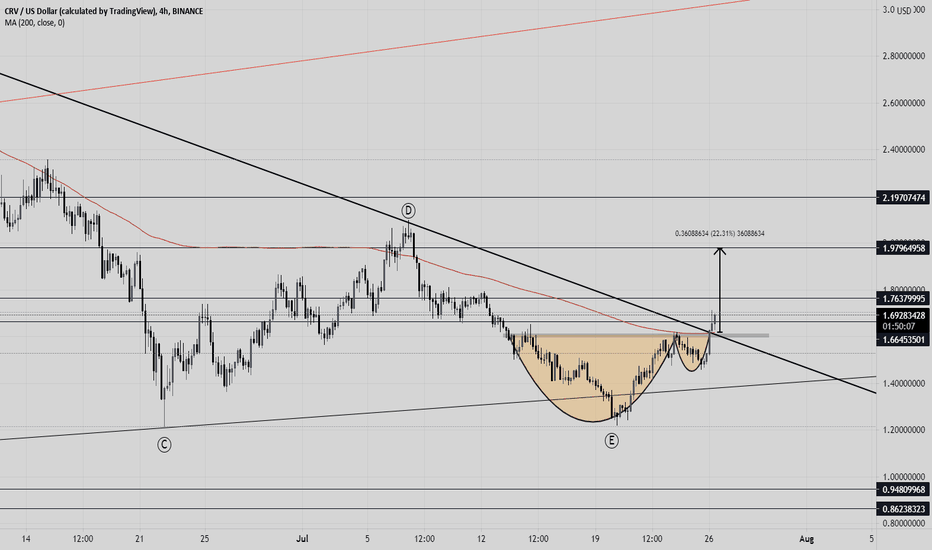

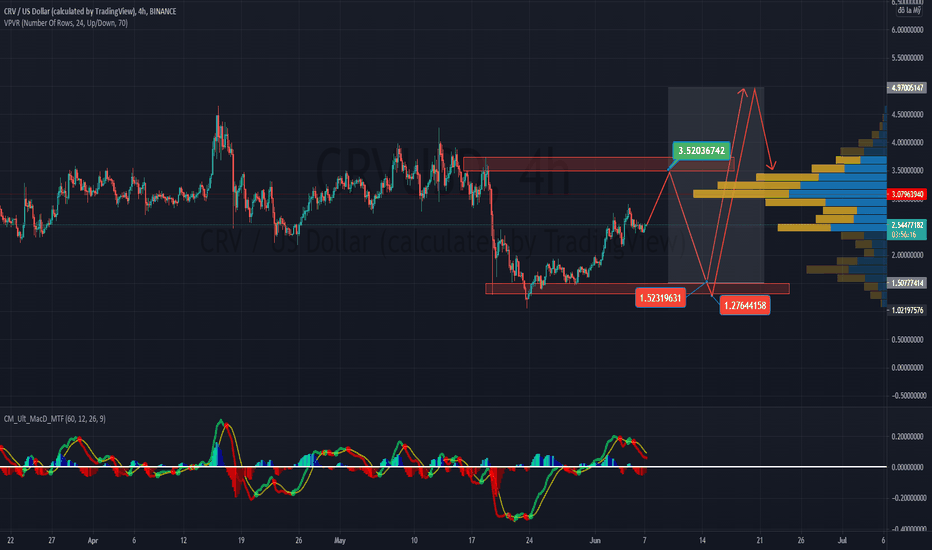

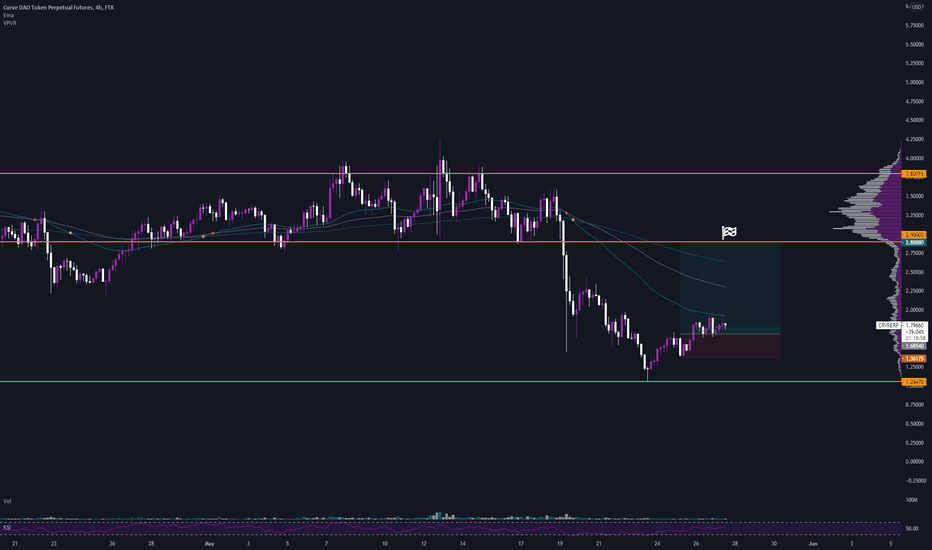

CRVUSD 14 MAY 2021 1120 hrs (follow up)Took about 4-5 days to reach the target area. The volume looks crazy at the moment.

One way you can practice is by setting alerts at key support and resistance areas. Test your patience and then once price gets there see if you can identfy the phases of accumulation Phases A through D.

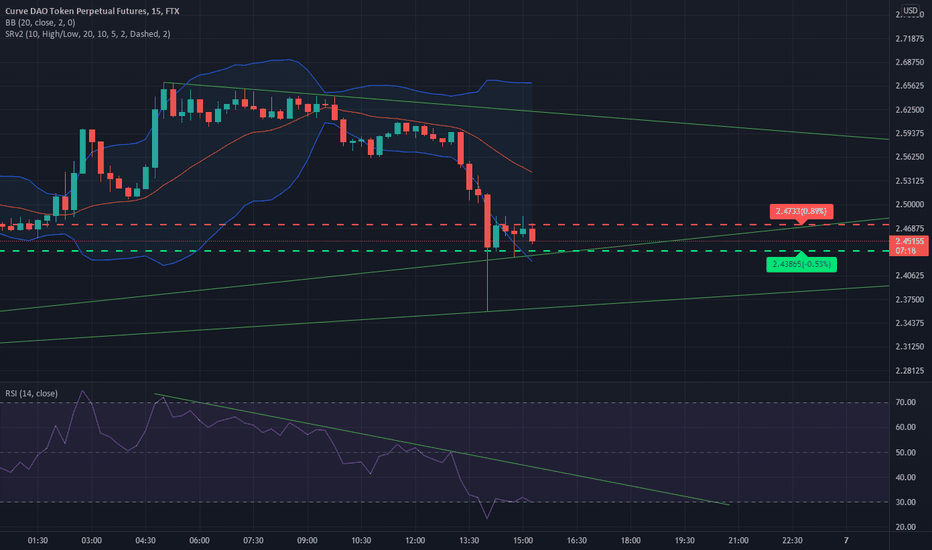

MTF