Related pairs

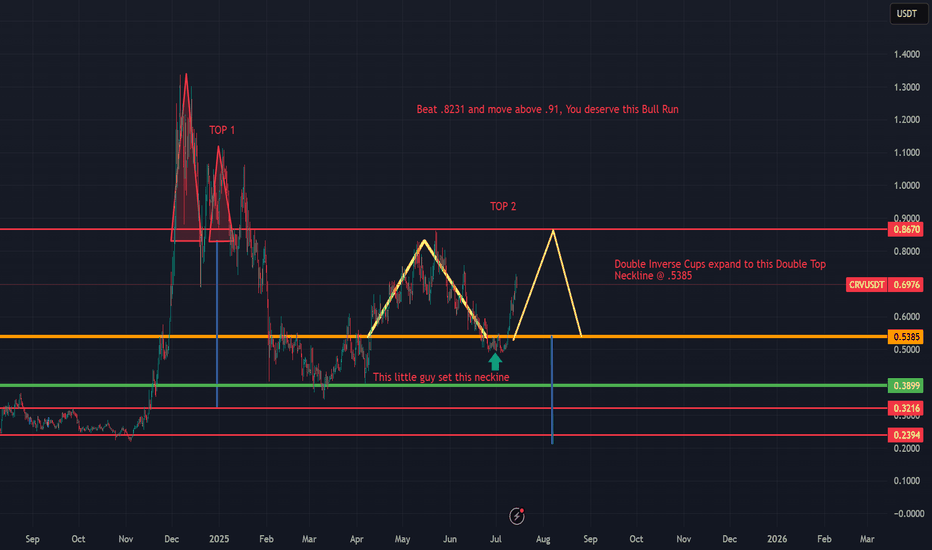

$CRV Macro Bearish PlayWe had an inverse cup and handle at .6266 that broke down to .50 and didn't meet its target (.40-.42 area). Instead, we consolidated at .50 to expand the smaller inverse cup neckline to .5503. This move up from .50 to .73 (currently) is a slighty over extended handle. If we continue higher but fail

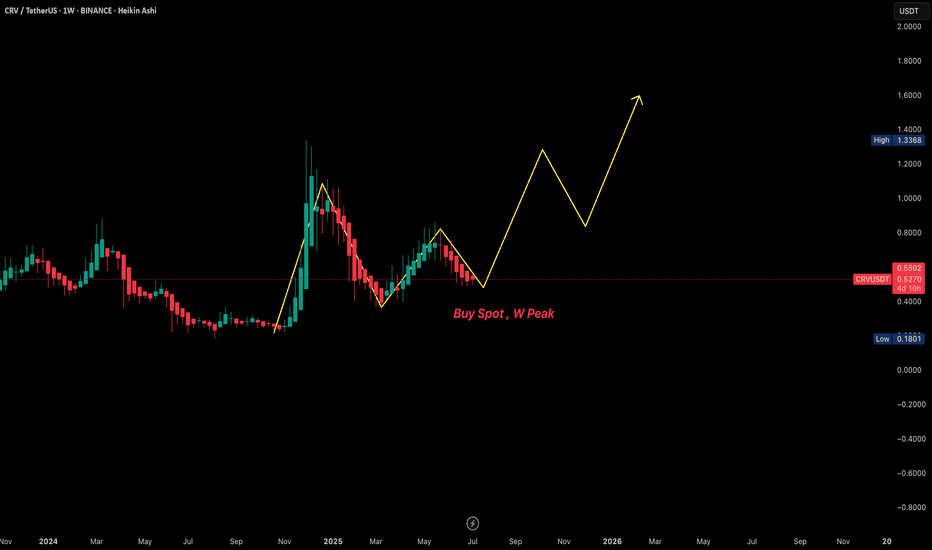

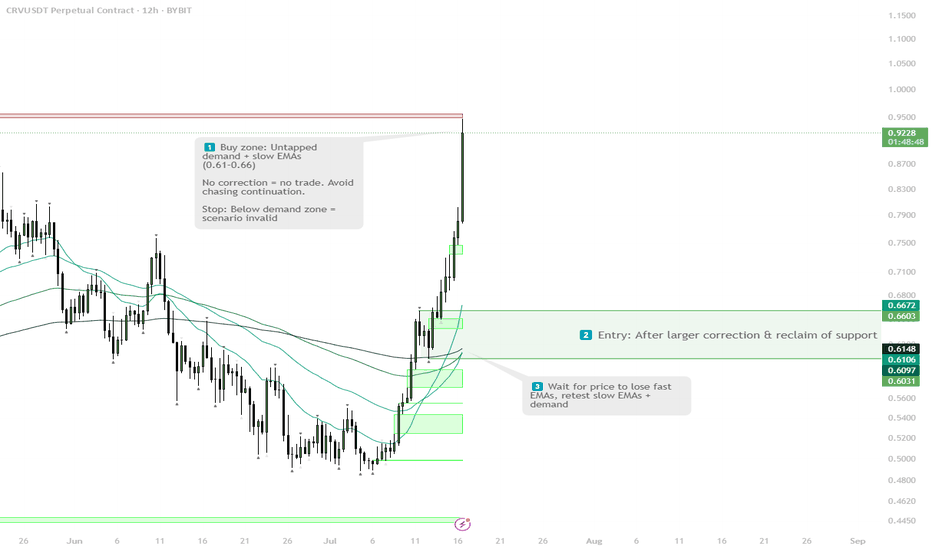

CRVUSDT - Swing Spot Trade RecommendationCRVUSDT - Swing Spot Trade Recommendation

Entry: Current price at $0.55

Targets: $0.83 - $1.40 - $1.80

Strategy: Follow and take profits at W's peak.

Rationale: Monthly trend (M) remains bullish. Weekly timeframe (W) is currently in correction, forming a bottom, with potential reversal confir

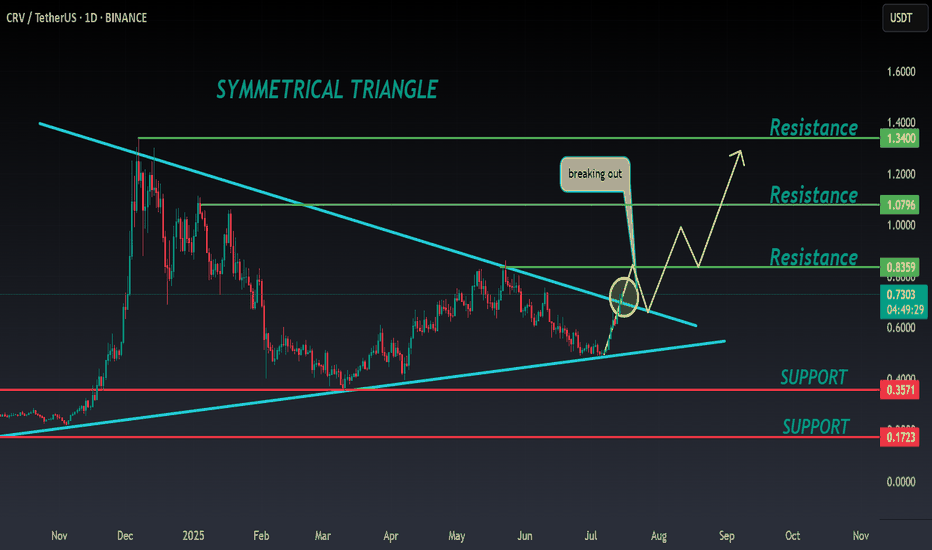

CRV ANALYSIS🔮 #CRV Analysis 💰💰

🌟🚀 As we can see that #CRV is trading in a symmetrical triangle and given a perfect breakout. But there is an instant resistance. If #CRV breaks the resistance 1 then we will see a good bullish move in few days . 🚀🚀

🔖 Current Price: $0.7280

⏳ Target Price: $1.0800

#CRV #Cryp

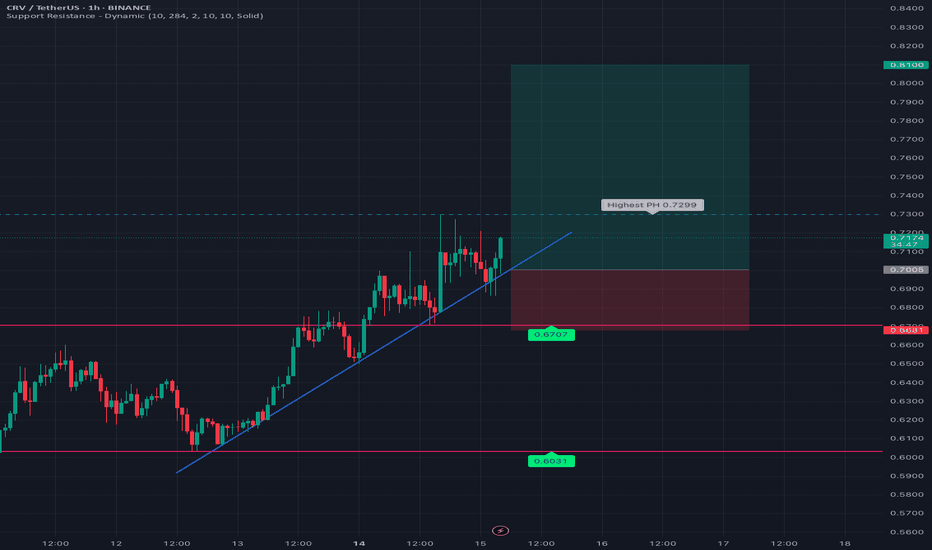

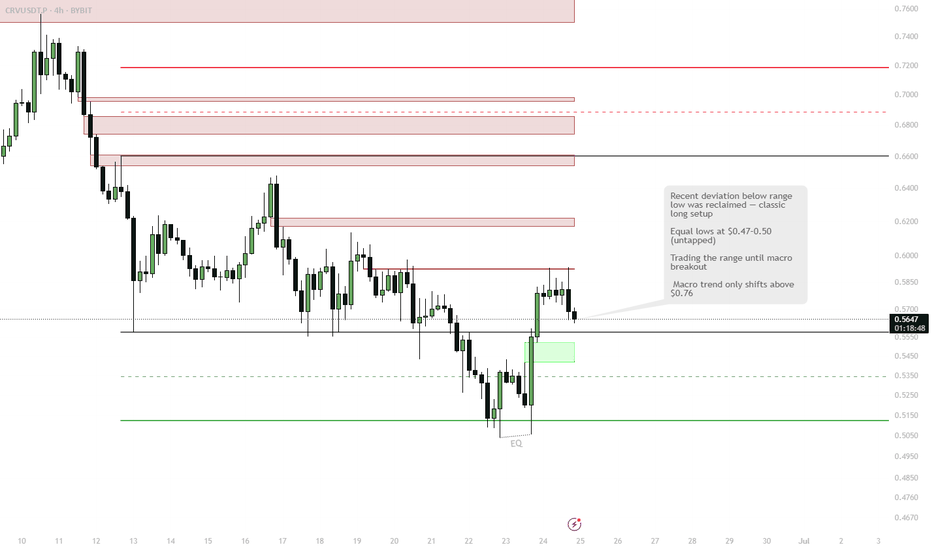

CRV Range Reclaim — Eyes on $0.70 After Classic Deviation Setup🎯 BINANCE:CRVUSDT Trading Plan:

Active Range Setup:

Long Trigger: Deviation and reclaim below $0.5585

Target: $0.70 (mid/upper range)

Stops: Below most recent deviation

Alternative:

If $0.47–$0.50 is swept, look for LTF reversal signals for a new long entry

No Macro Shift:

Stay in range-tr

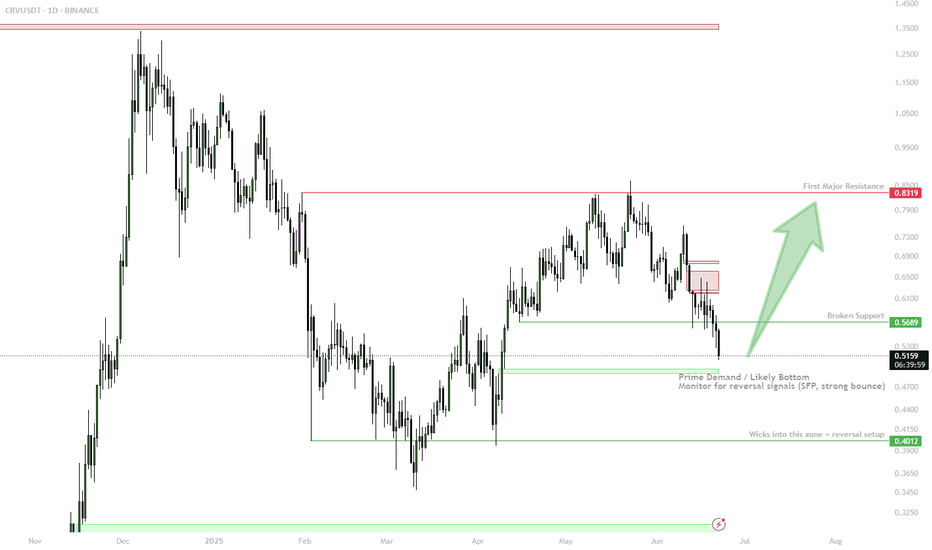

CRV Approaching Demand — Bottom Fishing in the $0.40–$0.49 Zone🎯 BINANCE:CRVUSDT Trading Plan:

Scenario 1 (Reversal from Demand):

Look for bullish SFP, engulfing, or reclaim in $0.40–$0.49 zone

If confirmed, long with first target $0.83

Tight stop below $0.39

Scenario 2 (Breakdown):

If $0.39 breaks decisively, step aside — risk of new lows

🔔 Triggers &

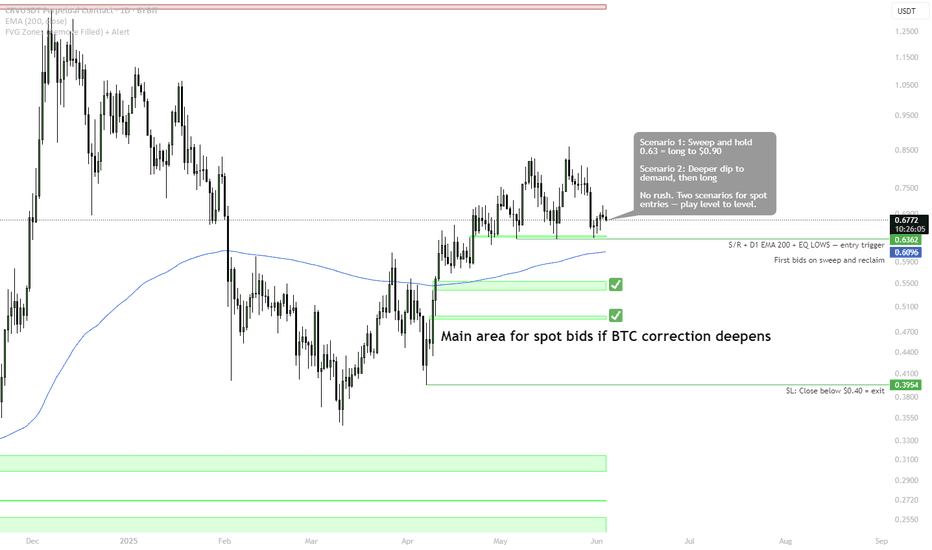

CRV - Two Scenarios for Strategic Spot BidsBINANCE:CRVUSDT

No FOMO, two clean entries.

Sweep S/R and reclaim EMA 200 — first trigger for spot longs. Equal lows at $0.61 — magnet for liquidity.

Deeper flush to demand = main buy zone ($0.40–0.56).

Stops under main demand.

Plan simple: let the market pick the entry for you.

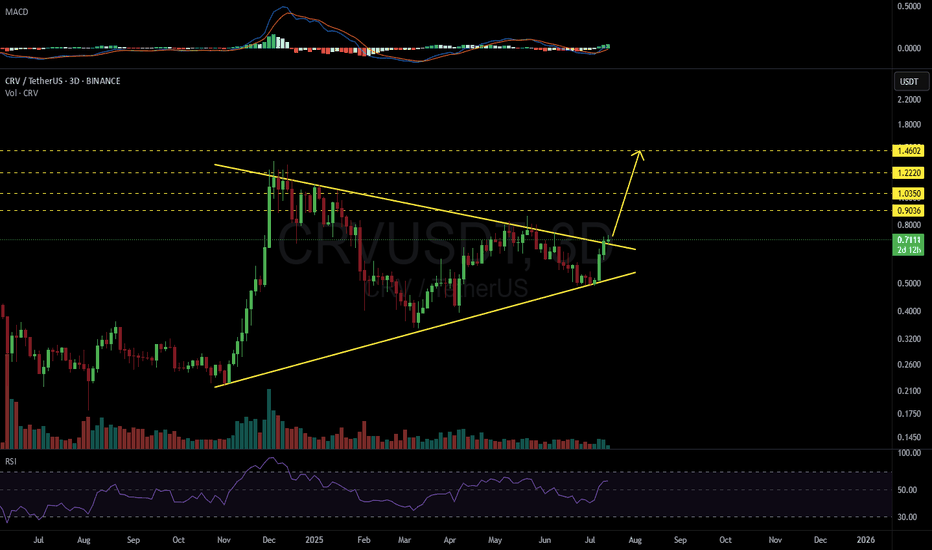

CRVUSDT 3D#CRV has broken above the symmetrical triangle on the 3-day timeframe.

If it manages to close the 3-day candle above the pattern, it could trigger a 2x bullish rally. Keep an eye on it — if confirmed, the targets are:

🎯 $0.9036

🎯 $1.0350

🎯 $1.2220

🎯 $1.4602

⚠️ Always use a tight stop-loss and appl

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of CRV3xLong/Tether (CRV) is 0.032435 USDT — it has risen 5.35% in the past 24 hours. Try placing this info into the context by checking out what coins are also gaining and losing at the moment and seeing CRV price chart.

CRV3xLong/Tether price has risen by 310.68% over the last week, its month performance shows a 168.71% increase, and as for the last year, CRV3xLong/Tether has decreased by −9.15%. See more dynamics on CRV price chart.

Keep track of coins' changes with our Crypto Coins Heatmap.

Keep track of coins' changes with our Crypto Coins Heatmap.

CRV3xLong/Tether (CRV) reached its highest price on Feb 6, 2021 — it amounted to 36.620200 USDT. Find more insights on the CRV price chart.

See the list of crypto gainers and choose what best fits your strategy.

See the list of crypto gainers and choose what best fits your strategy.

CRV3xLong/Tether (CRV) reached the lowest price of 0.000900 USDT on May 19, 2022. View more CRV3xLong/Tether dynamics on the price chart.

See the list of crypto losers to find unexpected opportunities.

See the list of crypto losers to find unexpected opportunities.

The safest choice when buying CRV is to go to a well-known crypto exchange. Some of the popular names are Binance, Coinbase, Kraken. But you'll have to find a reliable broker and create an account first. You can trade CRV right from TradingView charts — just choose a broker and connect to your account.

Crypto markets are famous for their volatility, so one should study all the available stats before adding crypto assets to their portfolio. Very often it's technical analysis that comes in handy. We prepared technical ratings for CRV3xLong/Tether (CRV): today its technical analysis shows the buy signal, and according to the 1 week rating CRV shows the neutral signal. And you'd better dig deeper and study 1 month rating too — it's neutral. Find inspiration in CRV3xLong/Tether trading ideas and keep track of what's moving crypto markets with our crypto news feed.

CRV3xLong/Tether (CRV) is just as reliable as any other crypto asset — this corner of the world market is highly volatile. Today, for instance, CRV3xLong/Tether is estimated as 17.29% volatile. The only thing it means is that you must prepare and examine all available information before making a decision. And if you're not sure about CRV3xLong/Tether, you can find more inspiration in our curated watchlists.

You can discuss CRV3xLong/Tether (CRV) with other users in our public chats, Minds or in the comments to Ideas.