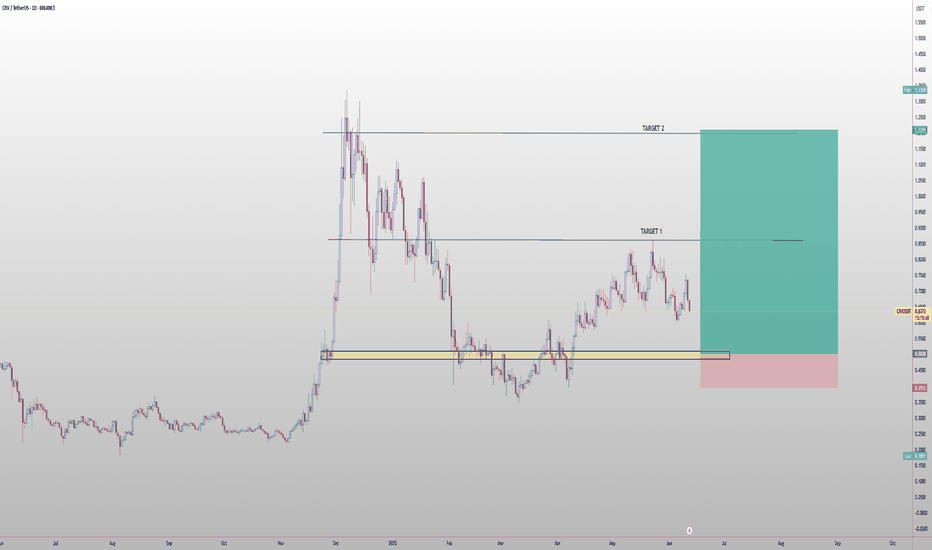

CRV TARGET FOR NEXT 3 MONTHS 🔥 LSE:CRV long setup (1 D) 🚀

✅ Entry Zone: $0.52 – $0.47 (Nov-24 launchpad demand)

🎯 Targets

• TP-1: $0.90 (Dec swing-high cluster)

• TP-2: $1.30 (#IPO wick fill)

⛔ Stop-Loss

Daily close < $0.40

📊 Thesis

• #crvUSD supply just hit a $179.8 M ATH 🏦

• #LlamaLend + Resupply loop turbo-cha

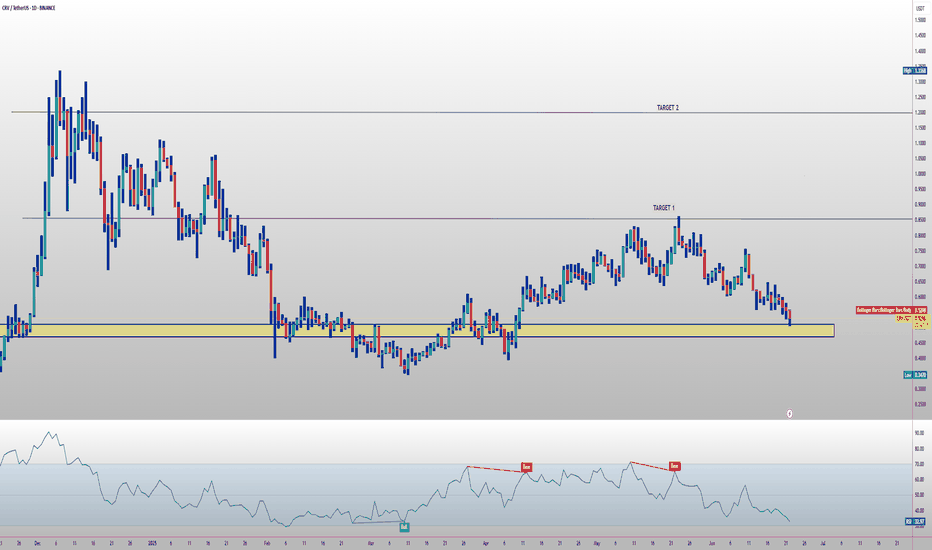

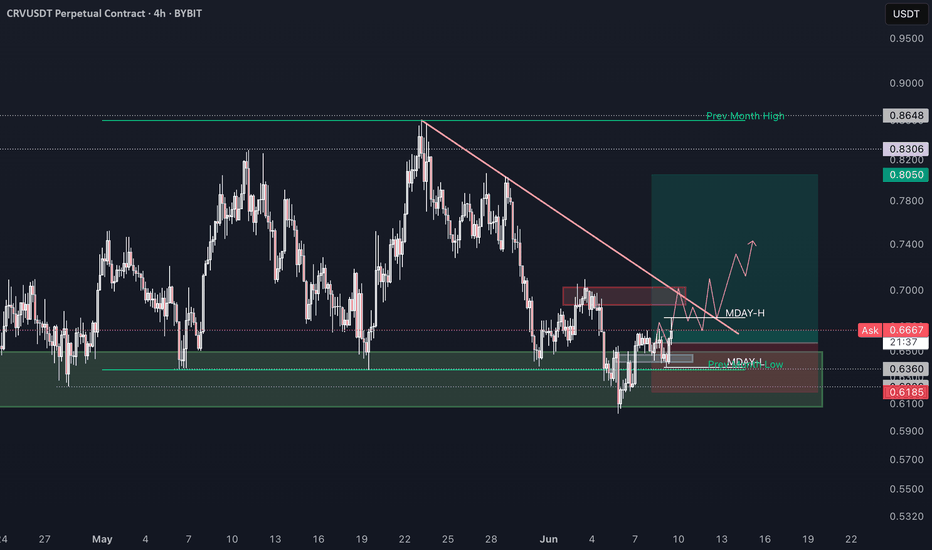

CRV Approaching Demand — Bottom Fishing in the $0.40–$0.49 Zone🎯 BINANCE:CRVUSDT Trading Plan:

Scenario 1 (Reversal from Demand):

Look for bullish SFP, engulfing, or reclaim in $0.40–$0.49 zone

If confirmed, long with first target $0.83

Tight stop below $0.39

Scenario 2 (Breakdown):

If $0.39 breaks decisively, step aside — risk of new lows

🔔 Triggers &

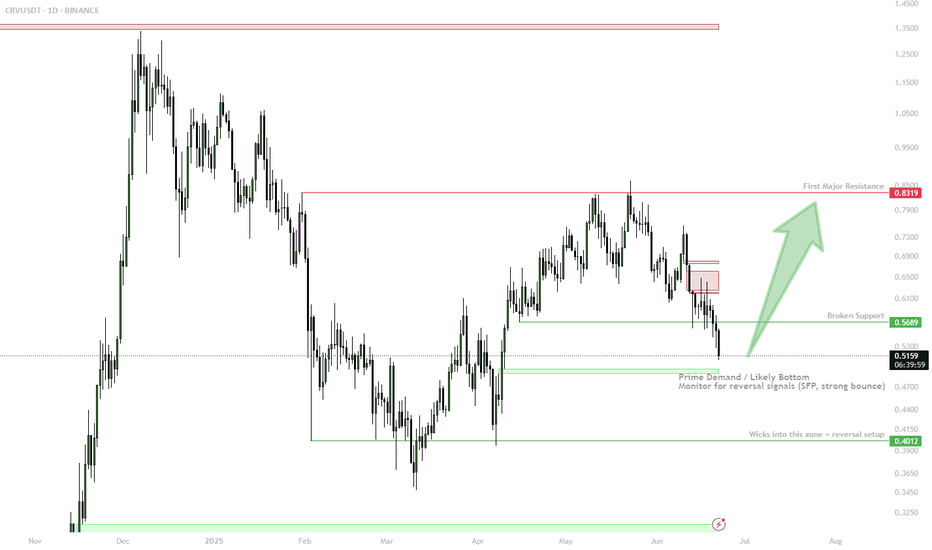

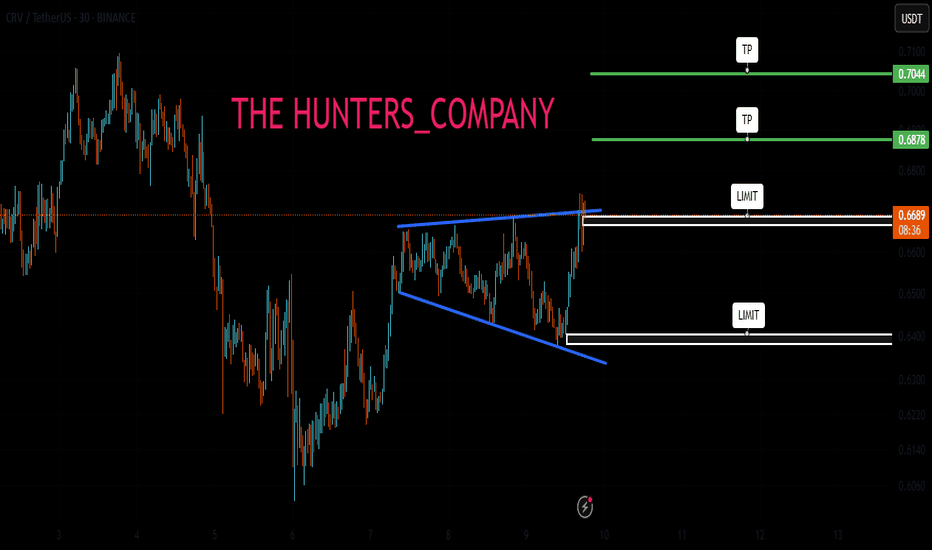

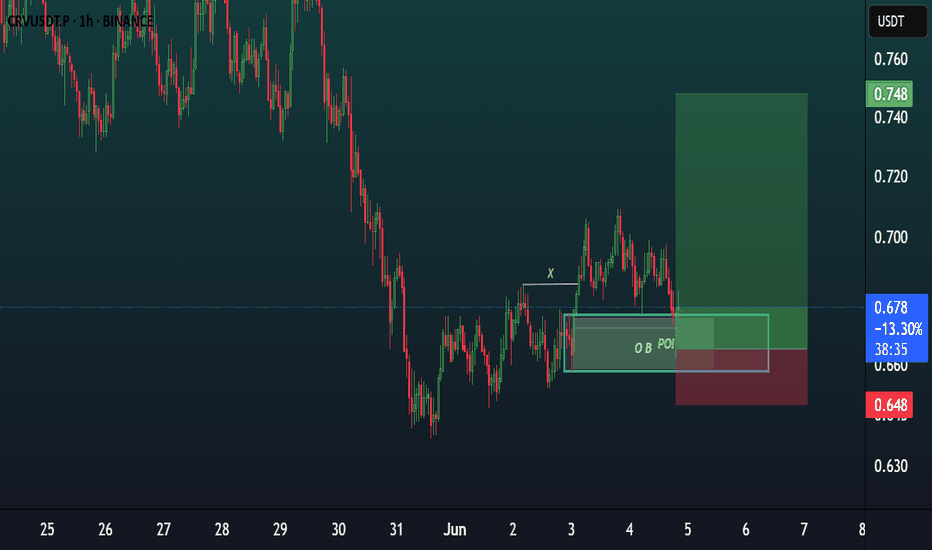

CRV | bounce then another sweep to form a local lowLiquidity taken, now eyeing push to $0.70–0.72 local supply.

Watching for another low after that move:

• HL triple tap = bullish base

• Or final drive into $0.47–0.50 = max opportunity for R:R swing longs

Breakout only confirmed above $0.75.

Patience — best setups come after the next local low.

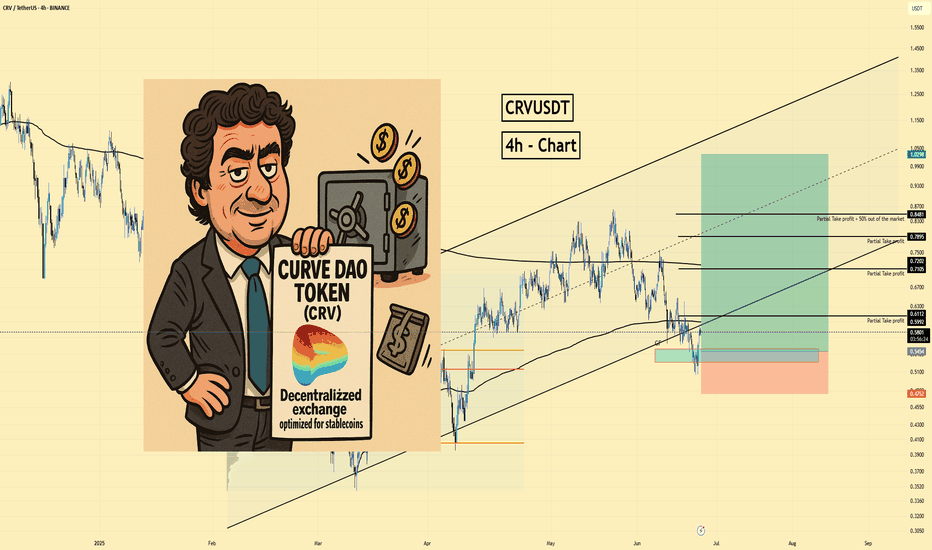

CRV BULLISH Q3 2025🔥 LSE:CRV long setup (1D) 🚀

✅ Entry Zone: $0.52 – $0.48 (re-test of Nov-24 launchpad base)

🎯 Targets

• TP-1: $0.90 (Dec swing high)

• TP-2: $1.30 (IPO wick fill)

⛔ Stop-Loss

Daily close < $0.44

📊 Thesis

crvUSD supply just hit a $179.8 M ATH 🏦, LlamaLend soft-liquidation markets are live, and

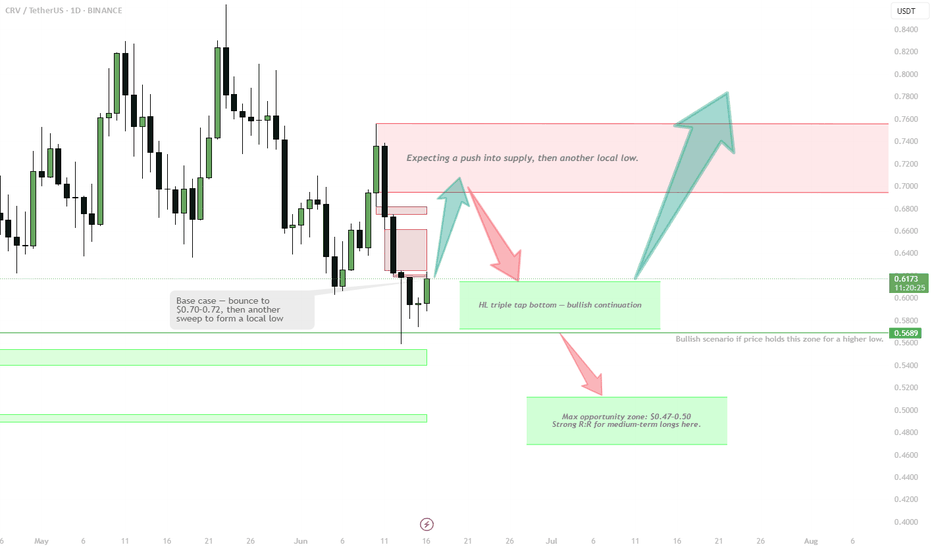

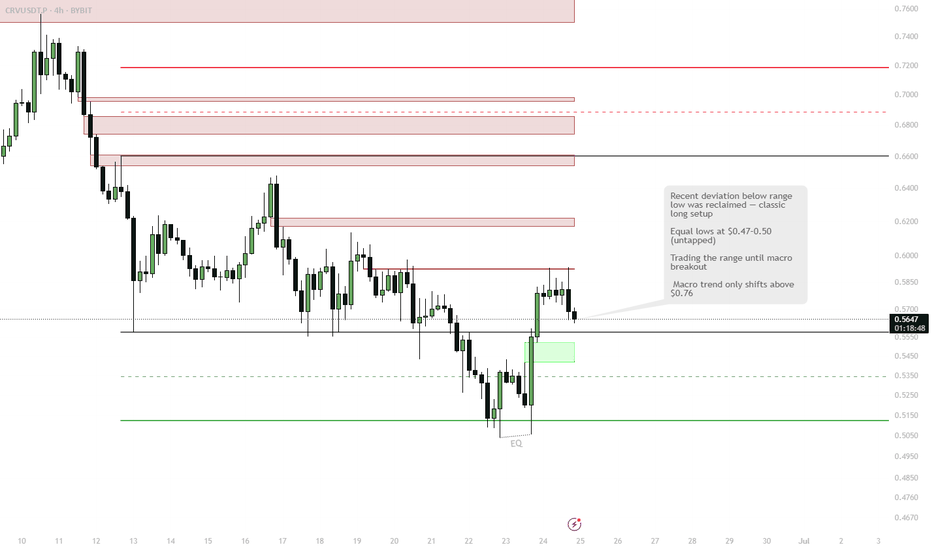

CRV Range Reclaim — Eyes on $0.70 After Classic Deviation Setup🎯 BINANCE:CRVUSDT Trading Plan:

Active Range Setup:

Long Trigger: Deviation and reclaim below $0.5585

Target: $0.70 (mid/upper range)

Stops: Below most recent deviation

Alternative:

If $0.47–$0.50 is swept, look for LTF reversal signals for a new long entry

No Macro Shift:

Stay in range-tr

CRV/USDT | Long | DeFi Utility | (June 24, 2025)CRV/USDT | Direction: Long | Key Reason: Pattern Reversal & DeFi Utility | (June 24, 2025)

1️⃣ Insight Summary

CRV is forming a bullish “W” at the bottom of its parallel channel, supported by value area highs, point-of-control, and structural support around $0.47–$0.55. If it flips that zone into s

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.