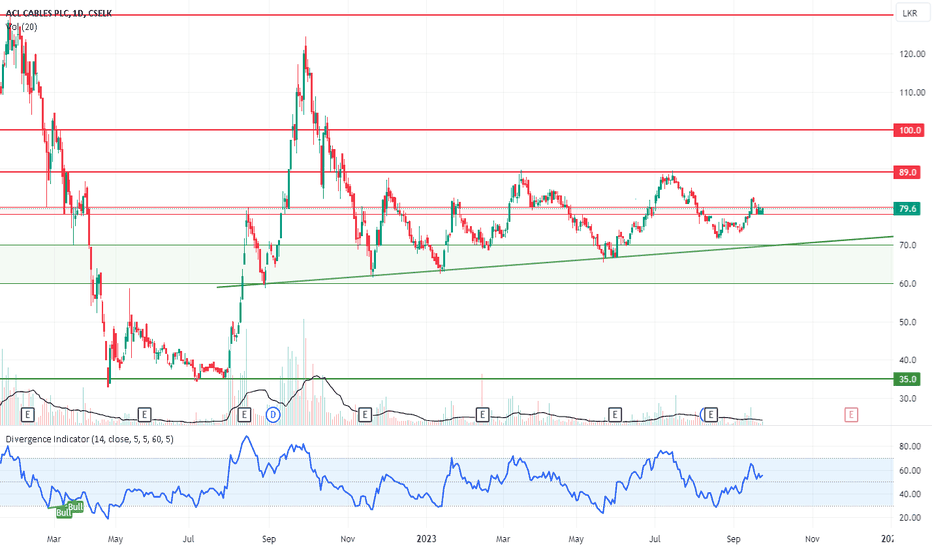

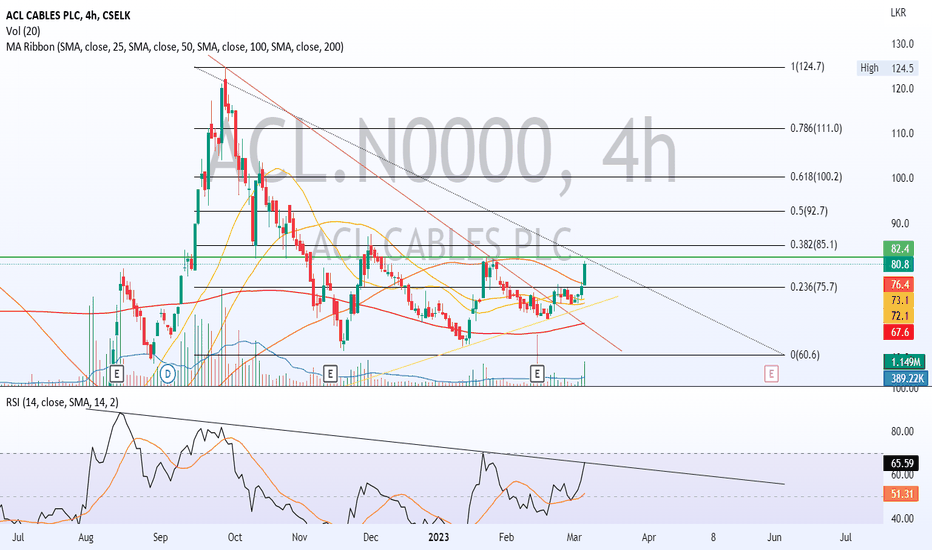

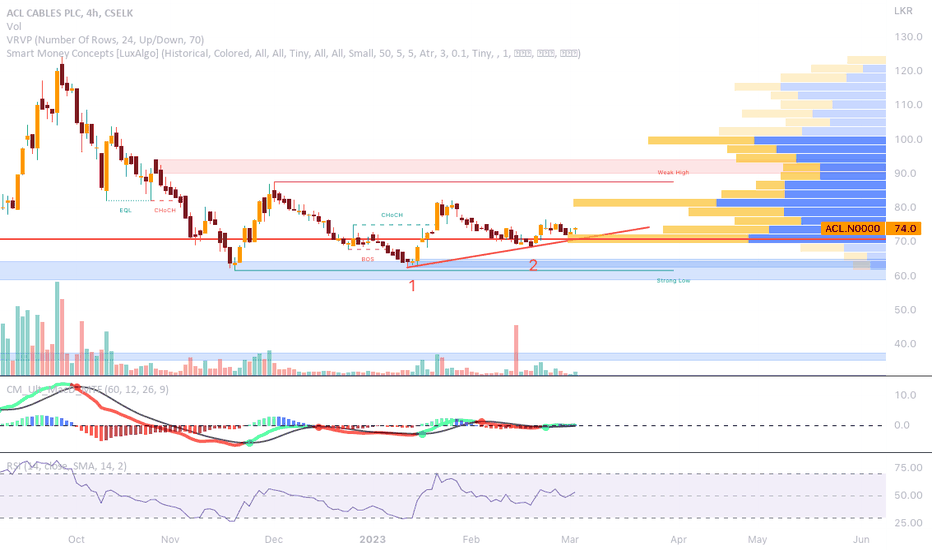

#CSEACL Bear trap possibly!The share has been consolidating since last october between 75-65 levels. The Co has been able to improve its export business in great strides over the last few years. This ensures steady flow of export revenue that can be utilised for import of raw material required for production.

ACL.N0000 trade ideas

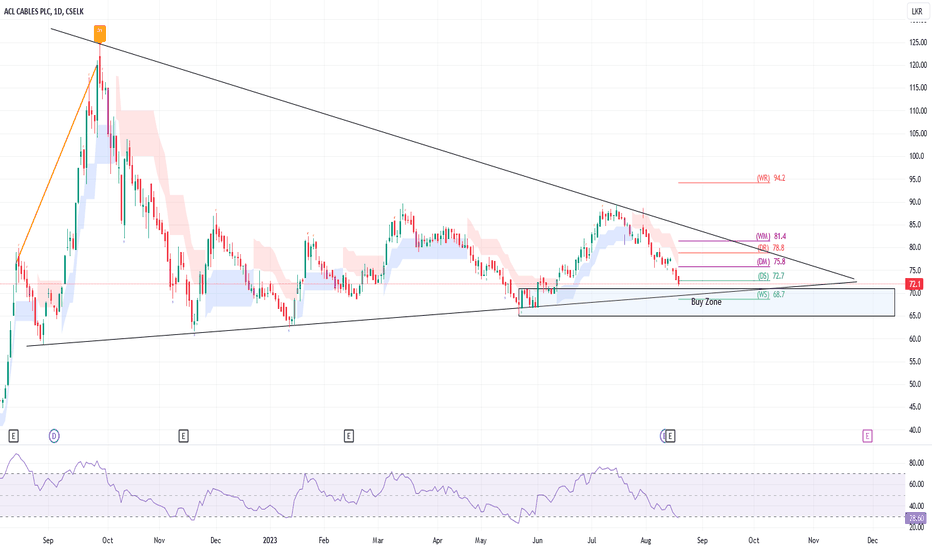

ACL.N0000Buy Zone - 65 to 71

Disclaimer: The information and analysis provided in this publication are for educational purposes only and should not be construed as financial advice or recommendations to buy, sell, or hold any securities. The author and TradingView are not responsible for any investment decisions made based on the content presented herein. Always consult a financial professional before making any investment decisions.

ACL.N0000Wait for pullback to 65 - 70

Disclaimer: The information and analysis provided in this publication are for educational purposes only and should not be construed as financial advice or recommendations to buy, sell, or hold any securities. The author and TradingView are not responsible for any investment decisions made based on the content presented herein. Always consult a financial professional before making any investment decisions.

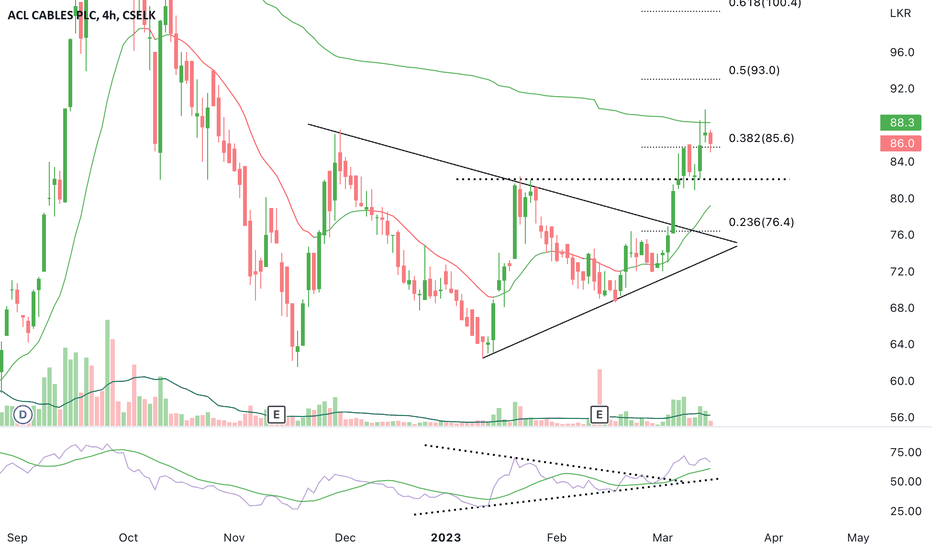

ACL.N - ACL CABLES PLCCSELK:ACL.N0000

Disclaimer: This chart and analysis are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations. Do your own due diligence before trading or investing in any stock exchanges, Indices, Stocks, Forex, Crypto etc.

ACL.N - ACL CABLES PLCDisclaimer: This chart and analysis are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations. Do your own due diligence before trading or investing in this stock.

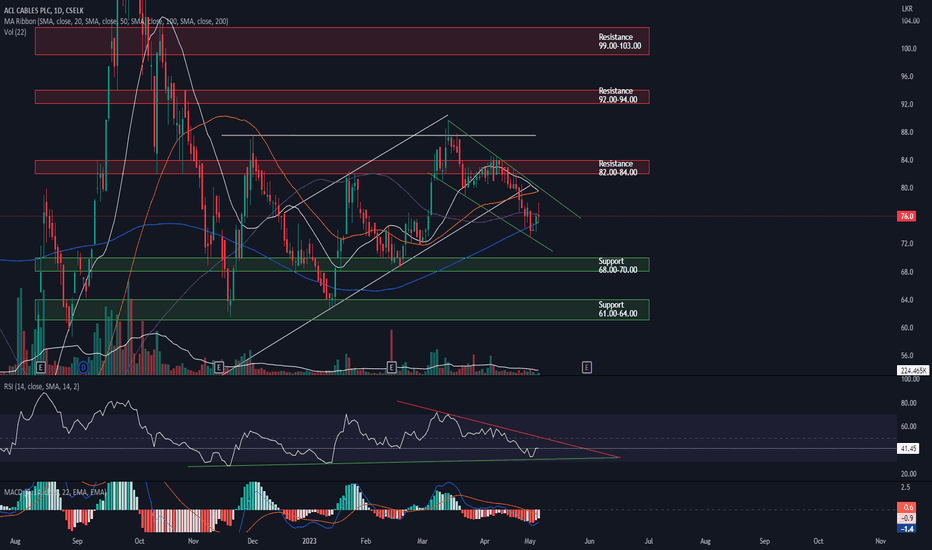

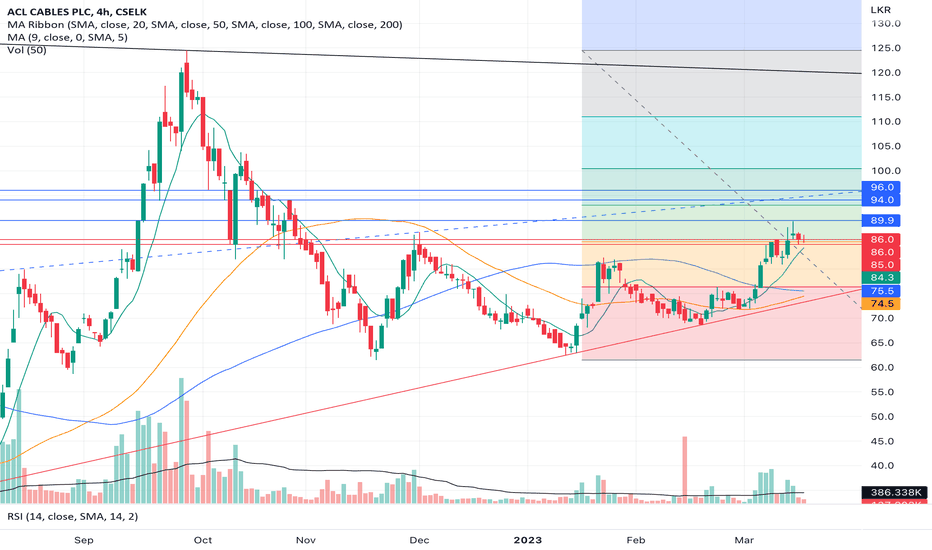

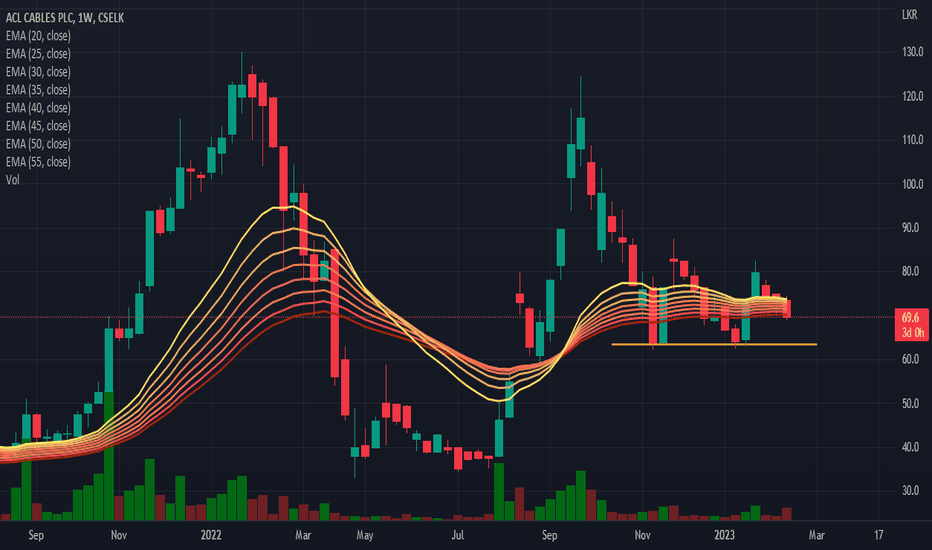

Share price is struggling to break the resistance zone.

The dotted ascending triangle pattern is intact. We need to watch how this line will be held.

Bollinger Bands are starting to squeeze too.

ACL.N - ACL CABLES PLCDisclaimer: This chart and analysis are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations. Do your own due diligence before trading or investing in this stock.

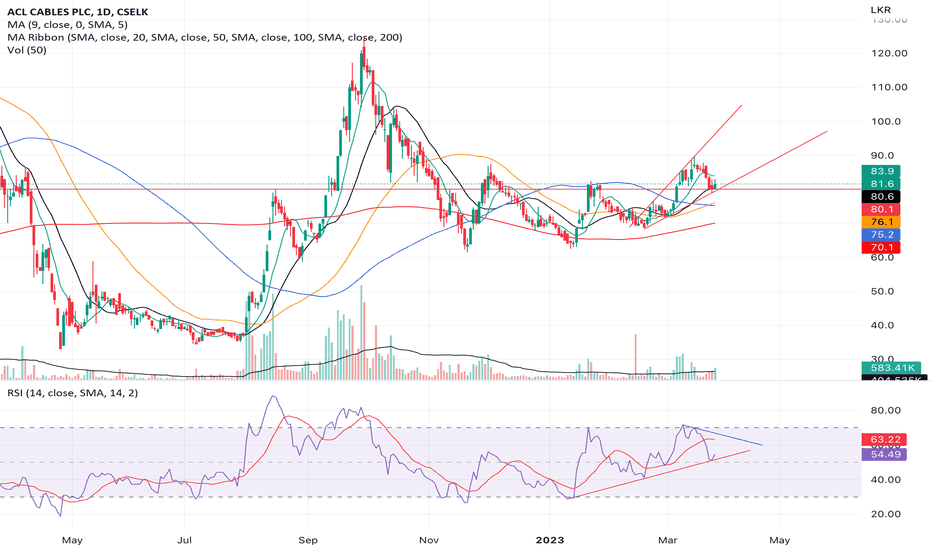

The stock is trading at the resistance zone 82.00-84.00 and trying to break it above. There is a supporting trend line (marked with the dotted line) which is also acting as near-term support.

The share is showing bullish behaviour. It is not beaten down because of the weak movements of the market.

The MAs are also looking fine and aligned correctly.

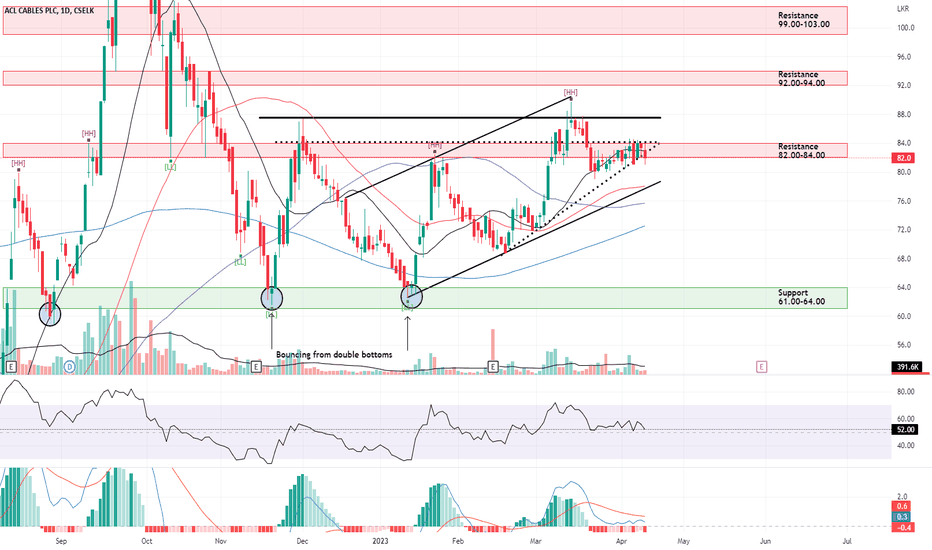

ACLShould move towards the next Resistance of 94 - 96 where fib 0.5 also is.

MA's aligned except 50,100 which is also nearing cross.

Keep an eye on the dashed blue trend line. Each time the counter crossed it, it made an upward movement of 50%, 100% and 50%

Volumes are high on green days and low on red days.

ACLCounter got rejected at the 85 Resistance. Possible to retest the 79.5 BO if failed, 76.

RSI BO and should remain above. possible retest with the price.

Double bottom visible.

MA's aligned. 100 will turn upwards once it is settled below 50

Price needs to settle within the channel to appreciate further.

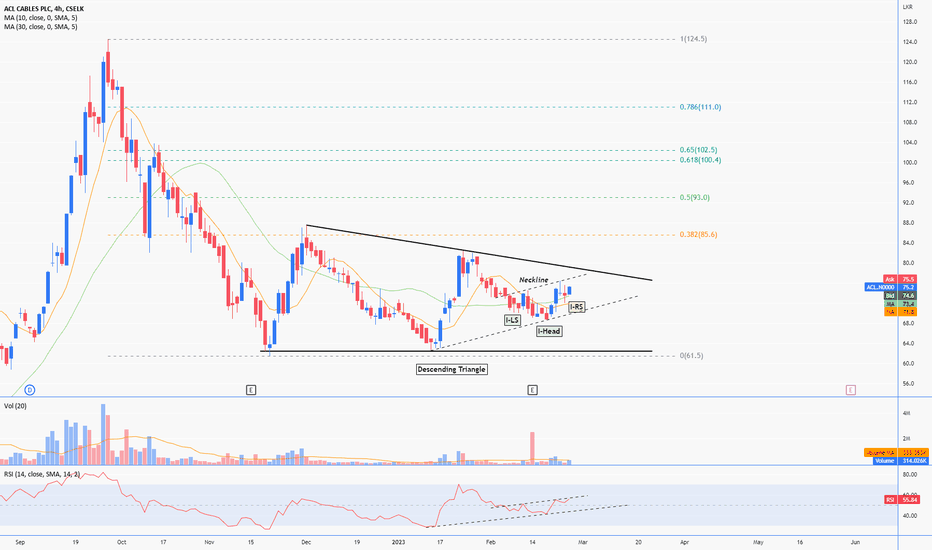

ACLThe stock has formed an Inverted Head and Shoulders pattern within a Descending Triangle. Traders could consider placing their stop loss at the previous higher low of 72. If the neckline around the 77 range is broken, it's possible that the stock may break out of the triangle pattern and move higher.

CSEACLResults for the 6 Months ending is 18Rs EPS. Upcoming earnings for the year to have a bearing on the future direction of the share price. PE wise the share is attractive under 70rs. The company is exposed to Export markets, and thus an automatic hedge. Support is expected to come below 70rs. Technically share price declined today on heavy selling pressure. This could be due to anticipated earnings release in this week.