CIND.N0000 trade ideas

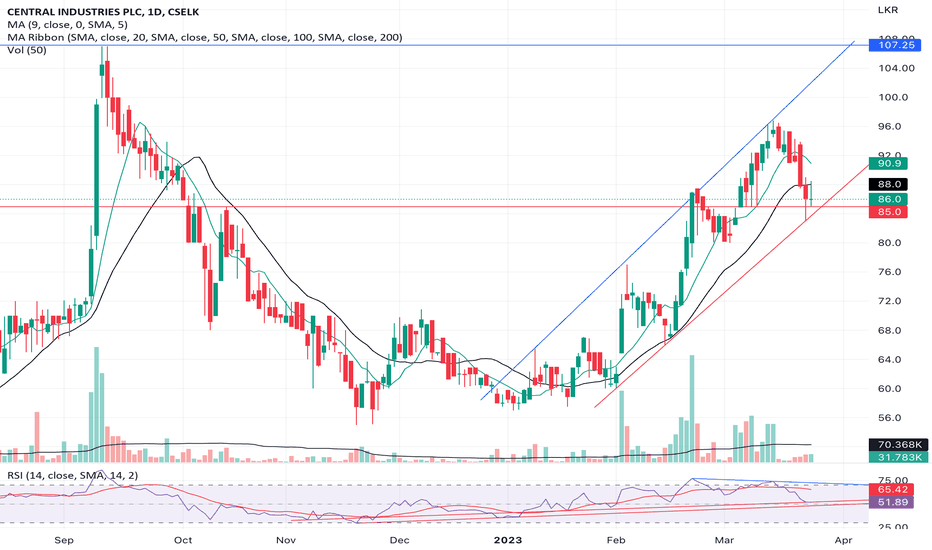

CINDTrading within a channel since the breakout from the base. It has taken the support from the trend line also the bottom line of the channel ideally should move towards the upper band of the channel.

For the first time it has fallen below MA 20 within the channel and MA 20 remains a resistance.

If the counter fails to break MA 9,20 resistance and falls below 85, might fall further.

However volume is gradually picking up and RSI also looks to have taken support.

CSELK:CIND.N0000

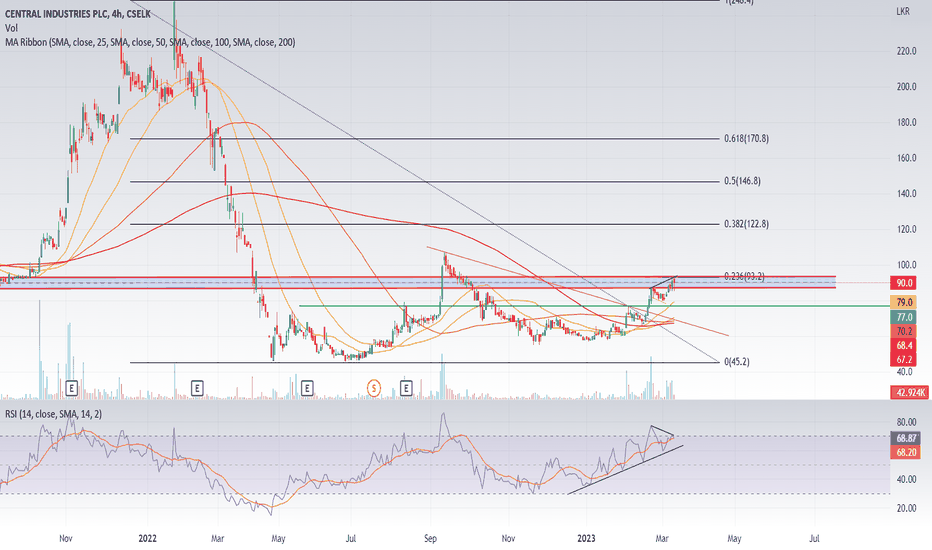

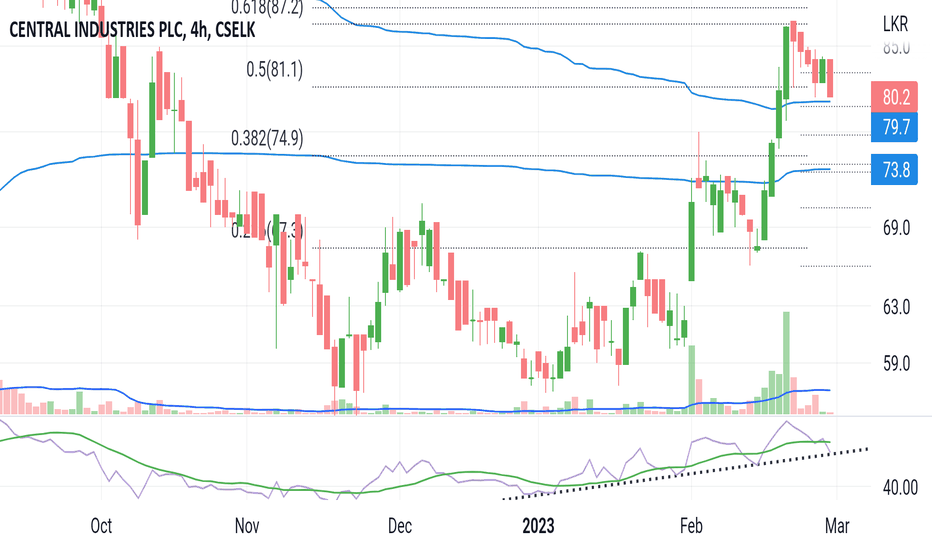

CIND | Cup & HandleThe stock has broken above the Cup and Handle pattern and is currently facing resistance at the target price of 87. Additionally, it appears to be forming another, wider handle formation. If the stock retraces, it could test the neckline at 79.50 levels for support before potentially moving higher towards the second target price of 96 levels (at Fibonacci retracement of 0.786) based on the broader Cup and Handle pattern. However, if the 79.50 level fails to provide support, the stock may test the 74.50 level (which represents the 0.618 Fibonacci retracement taken from the levels of 66 to 86.4).

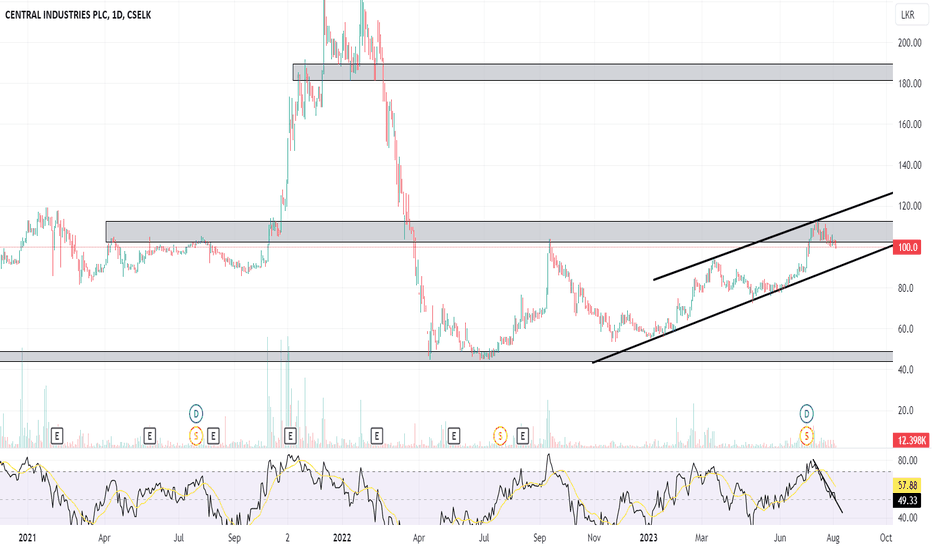

CIND - waterworks

As mentioned in above chart, Cind is being rejected at marked level. But it made to breakout from a flag pattern with a considerable volume.

However, Keep an eye at given resistance zone. It could still make a bearish divergence if price appreciate abruptly.

Counter in Midterm looks much bullish, since its trading above most of SMAs 25>200

Green line is a safer entry point.