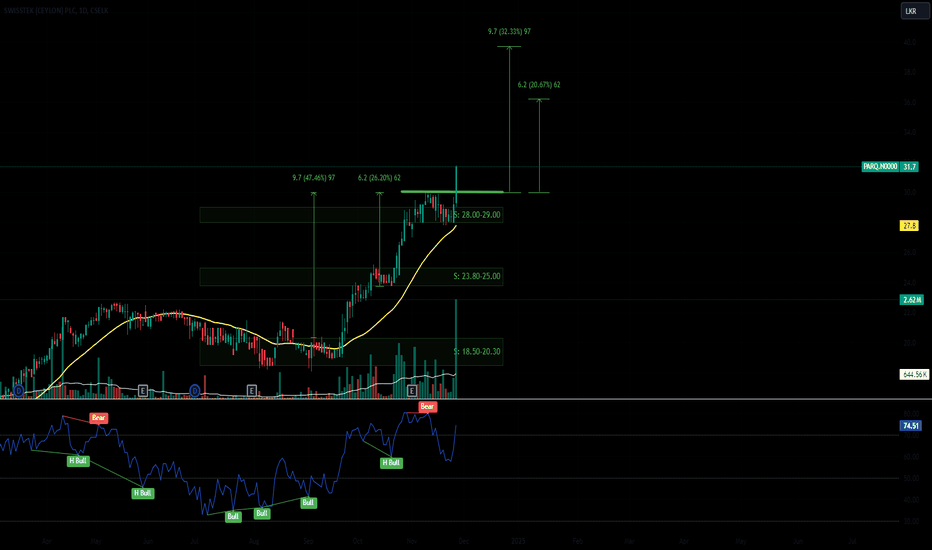

PARQ.N00001. Current Trend and Price Action

Uptrend: The stock is in a strong bullish trend, with consistent higher highs and higher lows evident in the weekly chart.

Key Resistance Levels:

The stock is approaching a critical resistance zone between 36.7 (0.618 Fibonacci level) and 38.0 (0.65 Fib level). These levels could act as barriers unless strong buying momentum continues.

Support Levels:

Immediate support is at 32.5 (0.5 Fibonacci level). If the stock pulls back, this level should act as a strong support zone.

Additional support lies at 27.2 (0.382 Fib level) if further corrections occur.

2. Fibonacci Analysis

The 0.618 (Golden Pocket) zone at 36.7 is a critical level to watch. If the stock breaks above this zone, it may head toward the 0.786 Fib level (~43.4).

All-Time High Target: The 1.0 Fibonacci level at 52.0 represents the potential all-time high target if the uptrend continues.

3. Indicators

RSI (Relative Strength Index):

The RSI is currently at 76.89, indicating that the stock is in the overbought region. This suggests a potential for a short-term pullback or consolidation before continuing the upward momentum.

Volume and Momentum:

The recent candles show strong bullish momentum, supported by rising volume. However, caution is needed as the price approaches the resistance levels.

4. Observations

Bullish Case: If PARQ breaks above 38.0, the next target would likely be 43.4, followed by 52.0 as the long-term target.

Bearish Case: Failure to break the 36.7 - 38.0 resistance zone could result in a pullback toward 32.5 or even 27.2.

PARQ.N0000 trade ideas

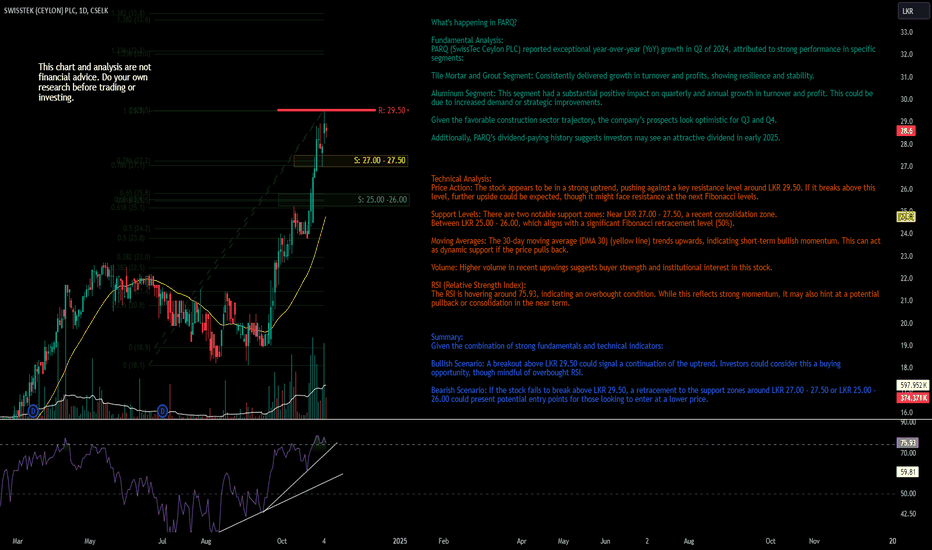

PARQ.N DailyThis chart and analysis are not financial advice. Do your own research before trading or investing.

CSELK:PARQ.N0000

What's happening in PARQ?

Fundamental Analysis:

PARQ (SwissTec Ceylon PLC) reported exceptional year-over-year (YoY) growth in Q2 of 2024, attributed to strong performance in specific segments:

Tile Mortar and Grout Segment: Consistently delivered growth in turnover and profits, showing resilience and stability.

Aluminum Segment: This segment had a substantial positive impact on quarterly and annual growth in turnover and profit. This could be due to increased demand or strategic improvements.

Given the favorable construction sector trajectory, the company’s prospects look optimistic for Q3 and Q4.

Additionally, PARQ’s dividend-paying history suggests investors may see an attractive dividend in early 2025.

Technical Analysis:

Price Action: The stock appears to be in a strong uptrend, pushing against a key resistance level around LKR 29.50. If it breaks above this level, further upside could be expected, though it might face resistance at the next Fibonacci levels.

Support Levels: There are two notable support zones: Near LKR 27.00 - 27.50, a recent consolidation zone.

Between LKR 25.00 - 26.00, which aligns with a significant Fibonacci retracement level (50%).

Moving Averages: The 30-day moving average (DMA 30) (yellow line) trends upwards, indicating short-term bullish momentum. This can act as dynamic support if the price pulls back.

Volume: Higher volume in recent upswings suggests buyer strength and institutional interest in this stock.

RSI (Relative Strength Index):

The RSI is hovering around 75.93, indicating an overbought condition. While this reflects strong momentum, it may also hint at a potential pullback or consolidation in the near term.

Summary:

Given the combination of strong fundamentals and technical indicators:

Bullish Scenario: A breakout above LKR 29.50 could signal a continuation of the uptrend. Investors could consider this a buying opportunity, though mindful of overbought RSI.

Bearish Scenario: If the stock fails to break above LKR 29.50, a retracement to the support zones around LKR 27.00 - 27.50 or LKR 25.00 - 26.00 could present potential entry points for those looking to enter at a lower price.

SwissTek (Ceylon) PLC (CSE: PARQ)This chart and analysis are not financial advice. Do your own research before trading or investing.

Bullish Observations:

Price Surge with Momentum: The stock price has risen to 23.20 LKR (+3.57%), showing strong bullish momentum. It has cleared the important 21.40-22.70 resistance zone, turning it into new support, which signals potential for further upward movement.

Upward Breakout: The price has broken above a descending trendline, signaling that the downward pressure has been overcome. Breakouts above trendlines typically mark the start of a new bullish trend.

Golden Cross (Purple 50-day MA): The 50-day moving average (purple) is about to cross over the 200-day moving average (blue), forming a golden cross. This is a classic bullish signal suggesting further upward momentum.

Bullish RSI Divergence: The RSI shows a bullish divergence where the stock made lower lows, but the RSI made higher lows previously. This often indicates building bullish momentum, which has already materialized with the price breakout.

High Volume: The breakout is confirmed by strong trading volume, which suggests that the price rise is supported by market interest. This is another positive indicator of a sustained upward move.

Support Zones: The stock has established solid support levels at 21.40-22.70 and further below at 20.10-20.50. This gives it a strong base for further upward moves, with a potential next target at 24.50-25.00.

Potential Risks:

RSI Overbought: The RSI is currently at 72.03, which indicates the stock is in the overbought zone. This can sometimes lead to a short-term pullback or consolidation before further upward movement.

Resistance Around 24.50-25.00: The stock is approaching a resistance zone around 24.50-25.00. If it struggles to break through this, a retracement toward the newly formed support at 21.40-22.70 may happen.

Volume Concerns: While the breakout volume has been strong, any significant drop in volume could indicate a false breakout or weakening buying interest, which might cause the price to revisit lower support zones.