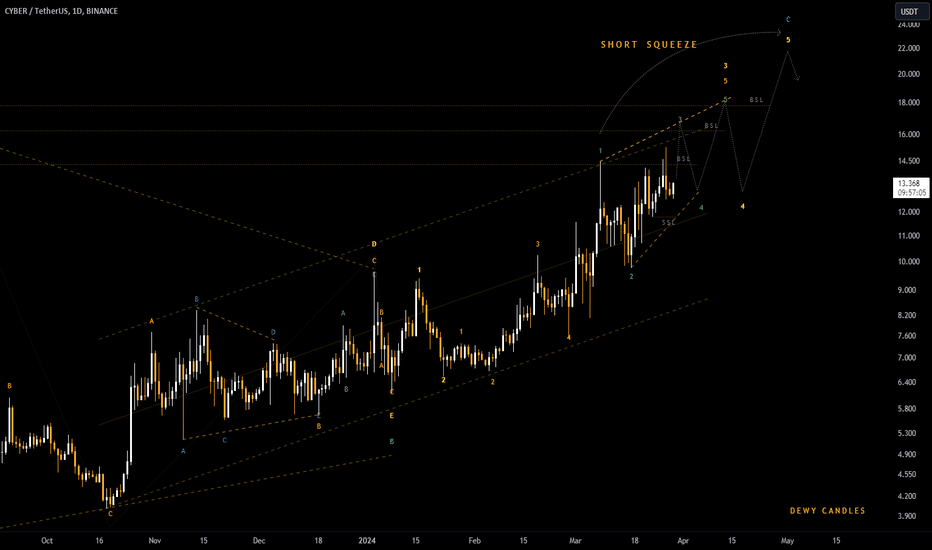

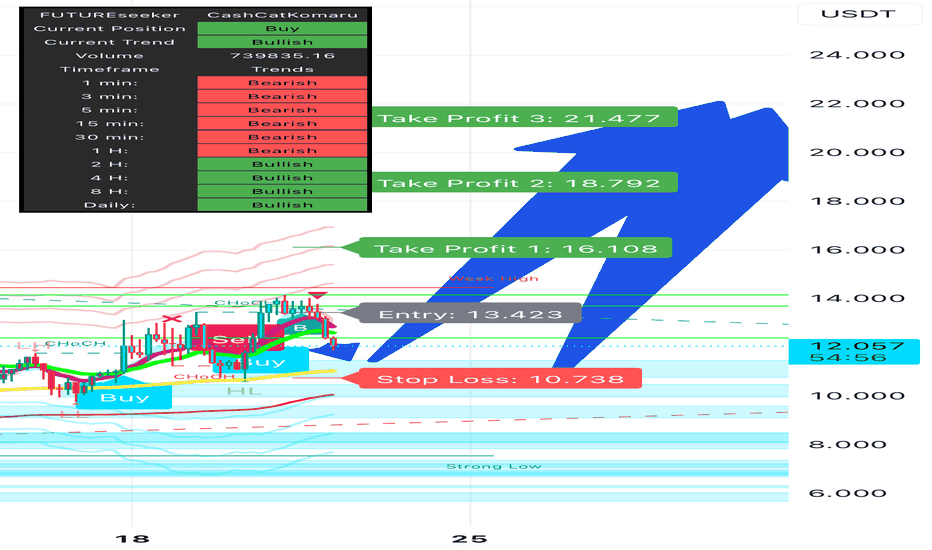

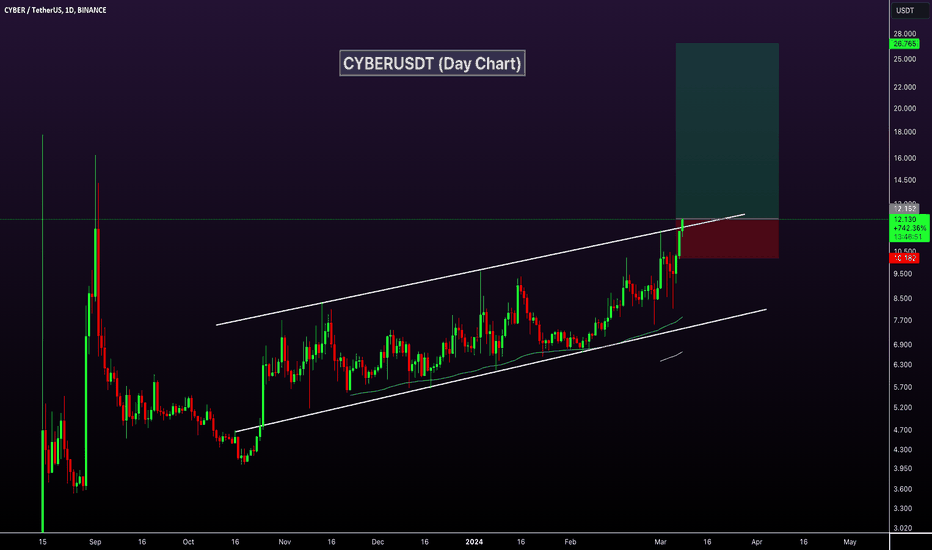

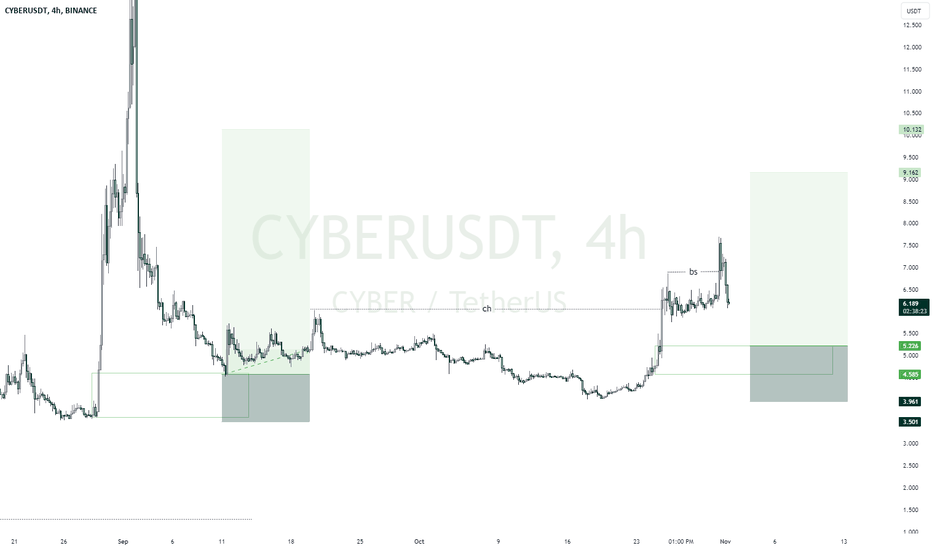

CYBERCONNECT - HOW WE CAN POSSIBLE SEE $17 - 22 - SHORT SQUEEZE

On the previous post I seems to can't stop about how BINANCE:CYBERUSDT could possibly make a new high by short squeezing early BEARS and that led me to having this scenario for caution or awareness.

PREVIOUS ANALYSIS

OTHER ANALYSIS

tradingview.sweetlogin.com

CYBERUSDT.P trade ideas

CYBERCONNECT UPDATE

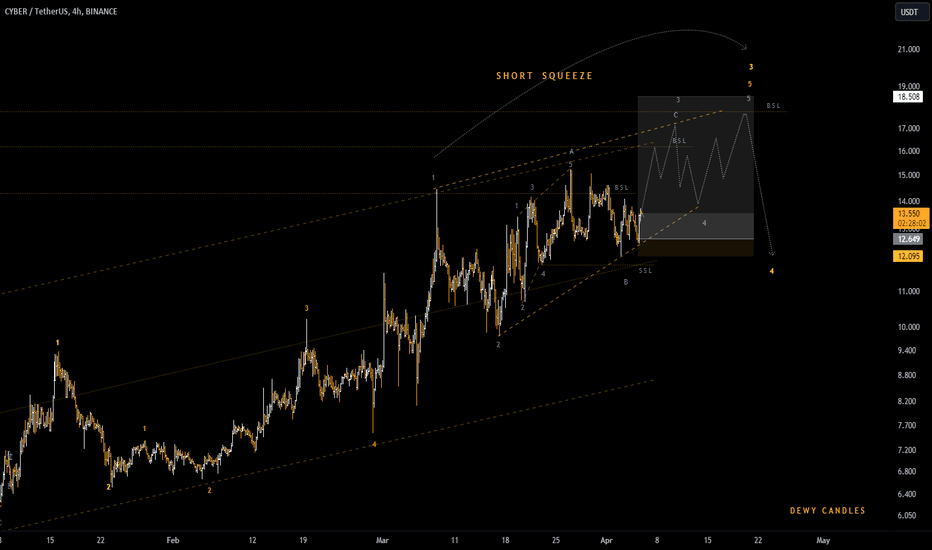

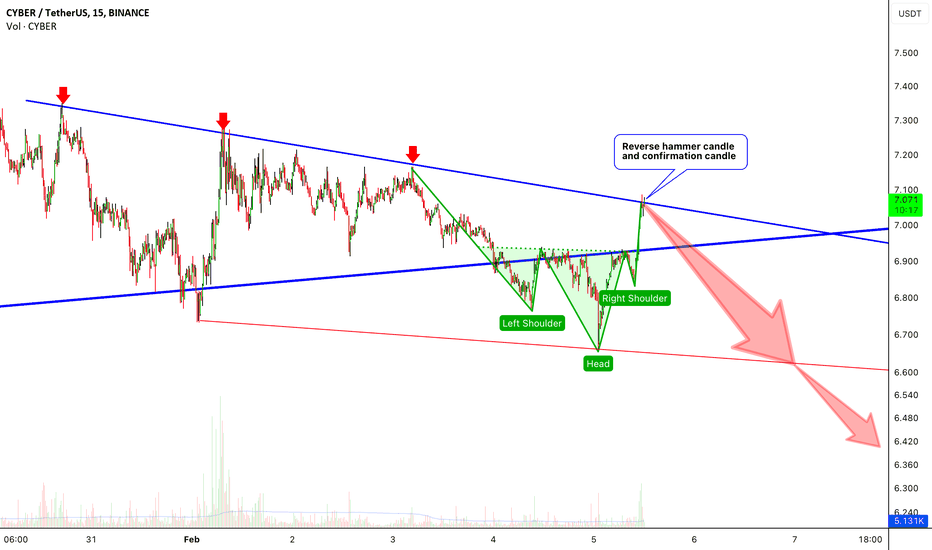

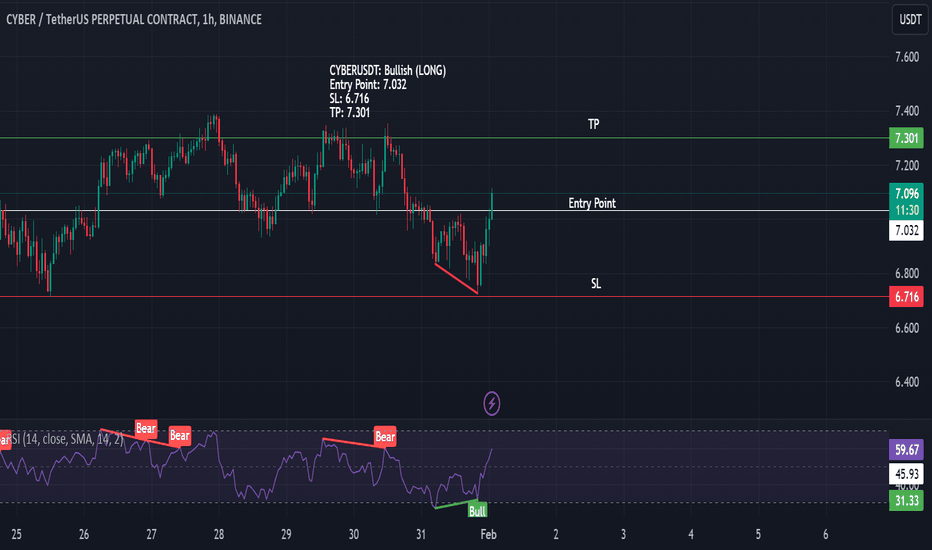

if you are following then you would have noticed by now that BINANCE:CYBERUSDT is following our previous scenario nicely, which makes this our primary scenario right now. Good thing I told you to close the short at breakeven when I saw some changes.

Now we have a definite Invalidation level (SL - previous swing low) which is just roughly 5% if things go south.

NEVER MARRY AN IDEA/POSITION, ALWAYS STAY UNBIASED AND FLEXIBLE.

OTHER ANALYSIS

tradingview.sweetlogin.com

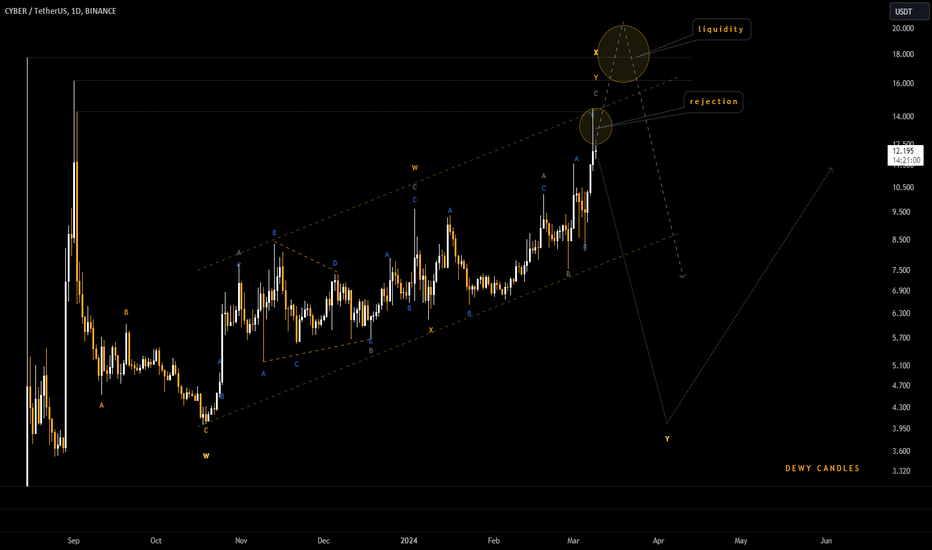

CYBER - UPDATE

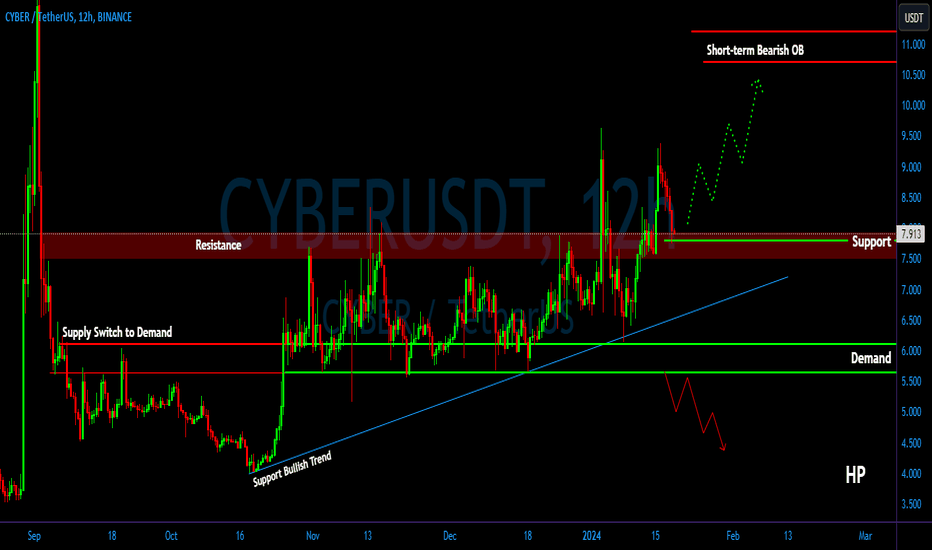

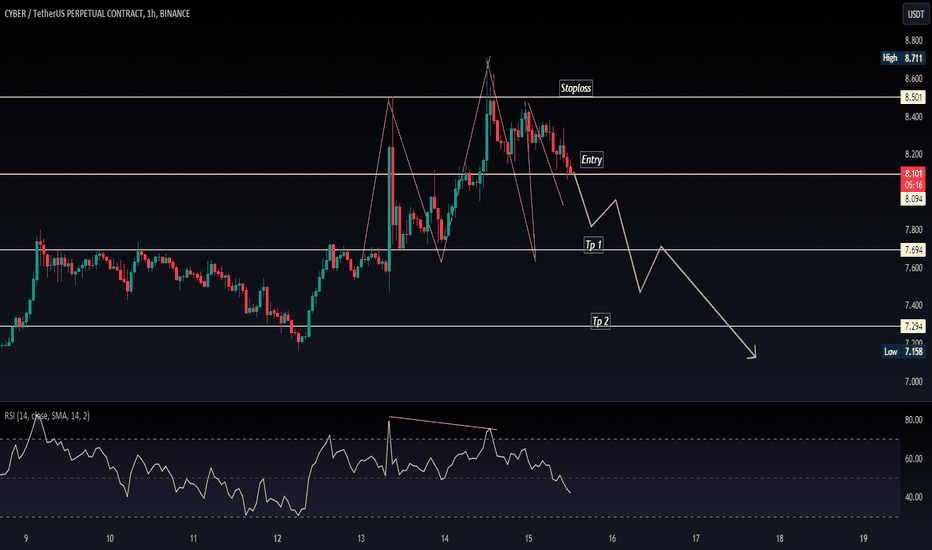

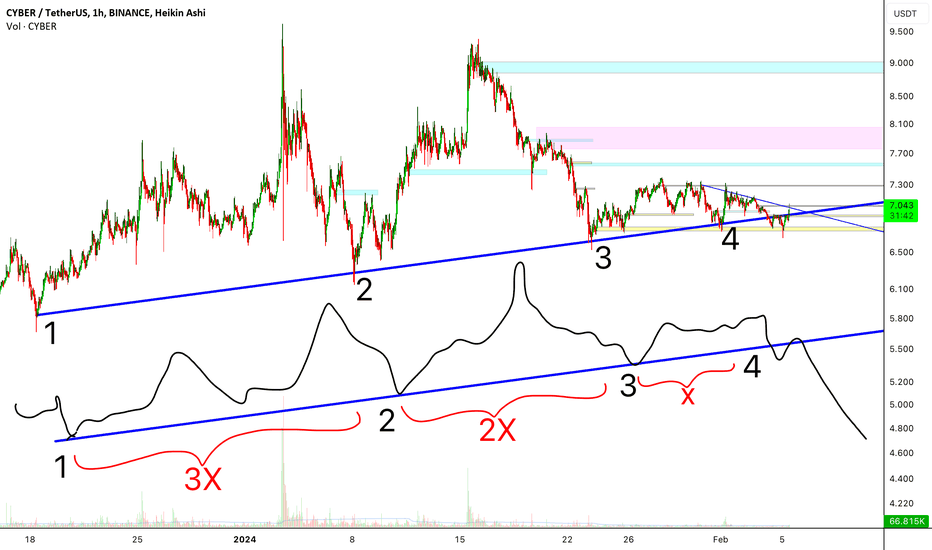

Personally this area is the best target to take profit for BINANCE:CYBERUSDT if you're short term holder. If you're mid-long term holder it is best to take at least 50% of overall hold and leave the rest to run wild especially seeing the liquidity lying above.

I don't have much fundamentals on CYBER but if it is strong, price might continue to soar high with the ALT bull run but technically, I see that at this point there is need for a healthy retracement after ending the wave X-yellow especially after that long strong wick rejection. For further confirmation I will wait few more days to see drop in volume too.

I will keep updating as I get more clarity.

PREVIOUS ANALYSIS

tradingview.sweetlogin.com

OTHER ANALYSIS

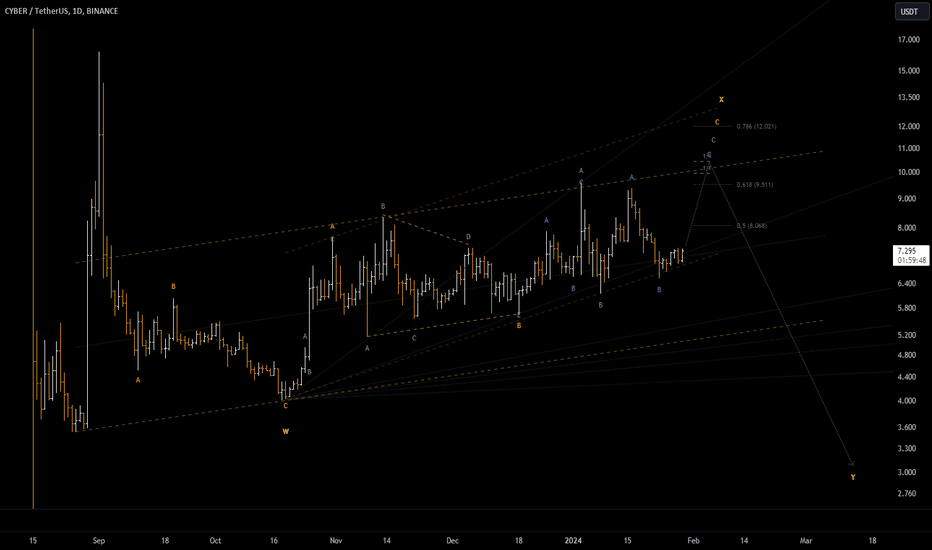

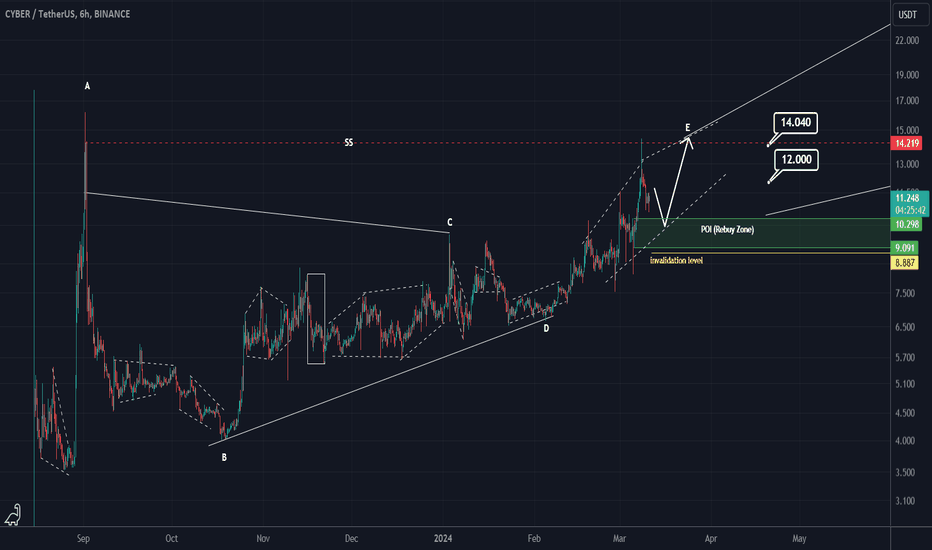

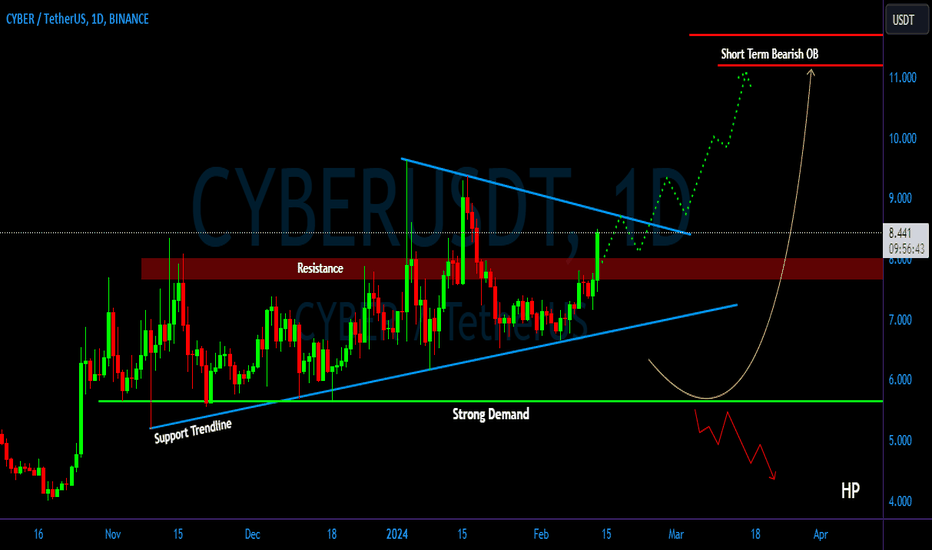

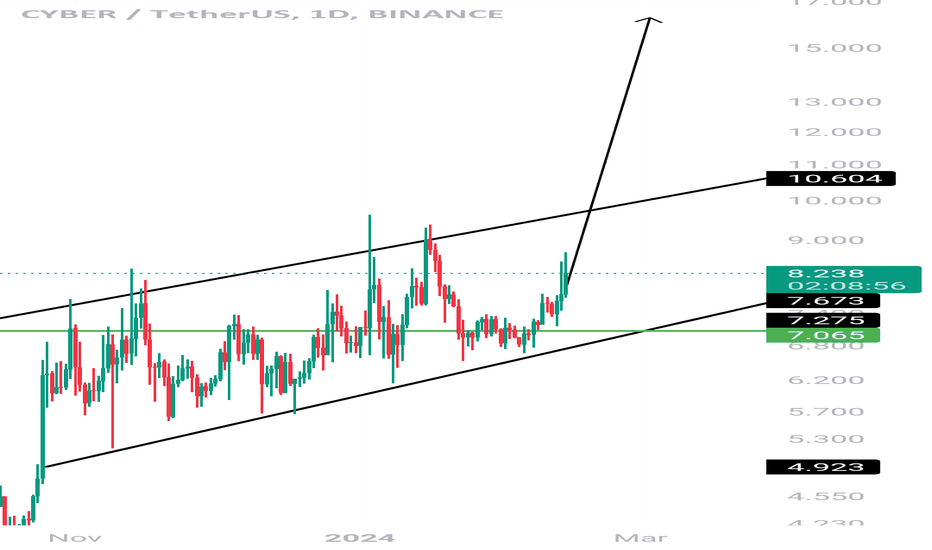

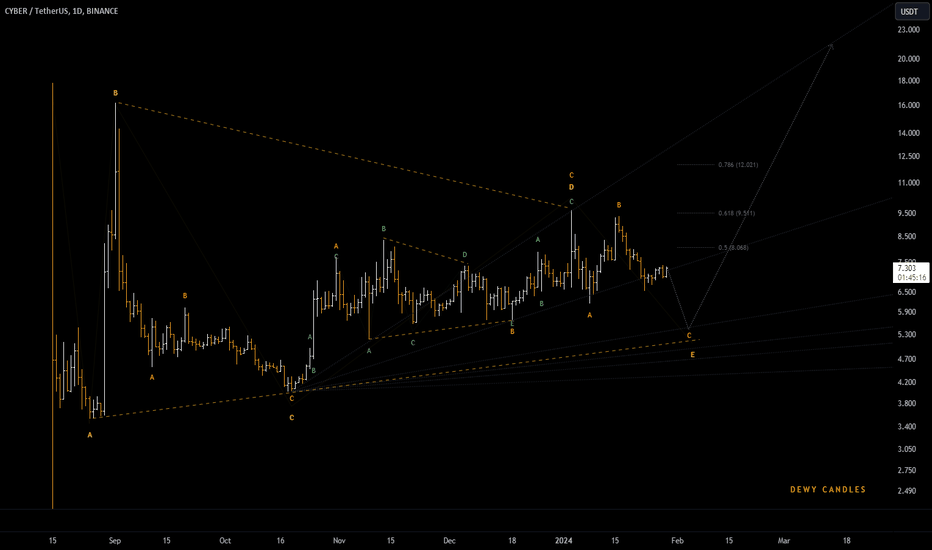

CYBER ANALYSISCYBER seems to be in a large symmetrical.

Now it looks like the inside of wave E is symmetrical.

Wave E appears to be a diametric.

If there is a pullback on the POI range, we can enter a buy/long position.

Closing a daily candle below the invalidation level will violate the analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

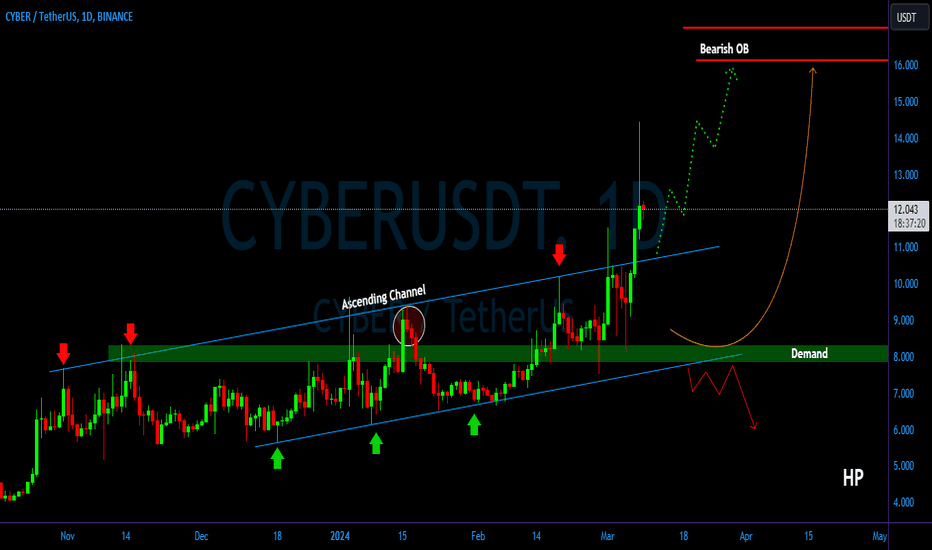

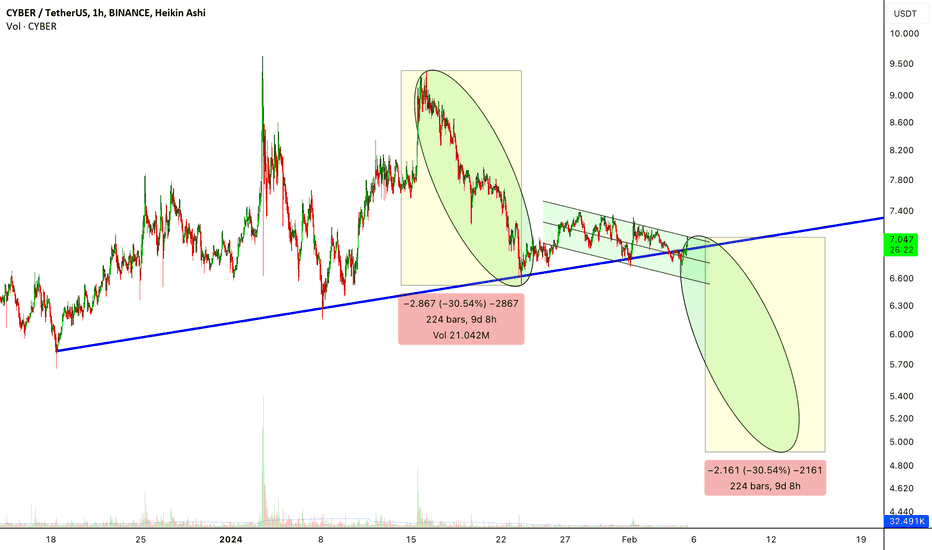

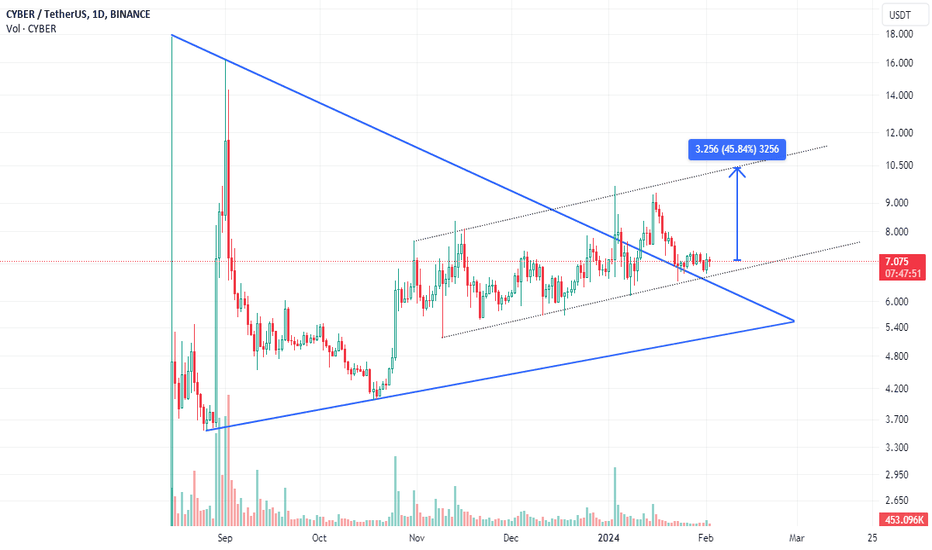

CYBER/USDT Break Alert! Indicating Continue The upward Movement!💎 CYBER has recently exhibited significant market dynamics, breaking out of the ascending channel pattern, which indicates a continuation of bullish upward movement.

💎 However, before continuing its ascent, the price is likely to undergo a retesting phase at the support trendline around the $10.5 area. Following this retest, CYBER may resume its upward trajectory, probability of reaching our target area.

💎 During the retesting phase, it's crucial for CYBER to bounce off the support trendline to confirm the bullish momentum. However, if CYBER fails to bounce and closes below the support trendline, this could signal a false breakout. In such a scenario, the price may retreat downwards, potentially reaching the demand area of around $8.3.

💎 At the demand area, it's imperative for CYBER to bounce, as it serves as both a historical support level and the lower boundary of the ascending channel. If CYBER fails to bounce and breaks below the demand area and the support line, this could mark a shift to bearish momentum.

💎 In this case, the bullish trend would be broken, and the price could continue moving downwards, potentially reaching even lower levels.

CYBER/USDT If the retest is valid, Potential CYBER Continue Up!💎 CYBER has been a focal point in the market recently. At present, CYBER is undergoing a retesting phase at a crucial support level, which previously acted as a resistance barrier. This phase follows a successful breakout from the resistance level.

💎 Should this retesting prove valid, CYBER is expected to bounce off the support and embark on an upward trajectory, probability reaching the bearish OB area as its next target.

💎 However, there's a risk that CYBER might repeat its earlier pattern of a false breakout. Such a scenario would indicate a loss of bullish momentum, potentially leading to a reversal in the price movement towards the bullish trend support. A breach of this support trendline would leave the demand area as CYBER's last line of defense.

💎 The demand area holds significant importance in this context. For CYBER to resume its upward journey, the asset must bounce back from this zone and reclaim its position above the support area. Historical data suggests that the demand area has been robust in preventing further declines. Yet, should this area fail to hold, it would signal a bearish turn for CYBER, opening the possibility for a further descent to lower levels.

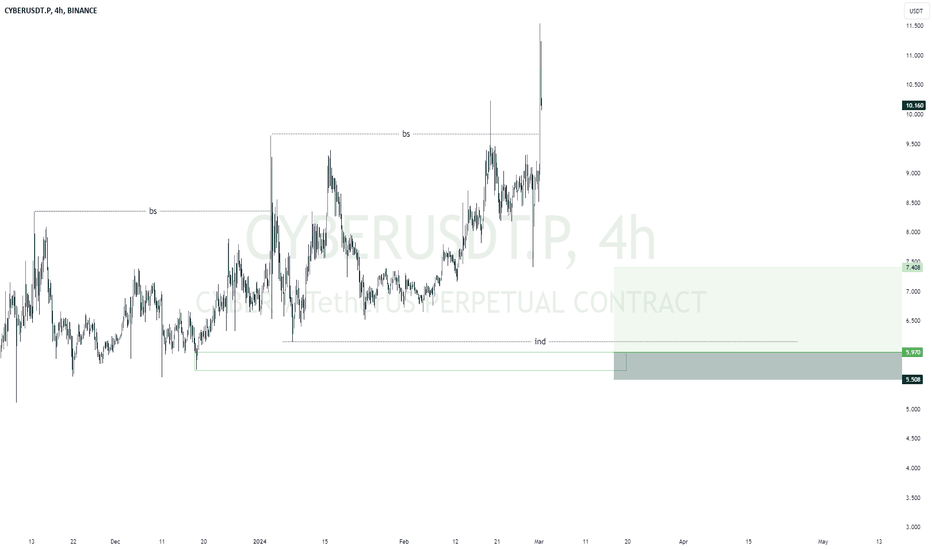

CYBER/USDT Break a key area, Possible continue upward !!💎 CYBER has recently encountered significant market dynamics. Presently, it is encountering resistance in its price movement.

💎 A successful breakthrough of this zone would facilitate an easier breach of the resistance trendline, probability leading to movement towards our target area.

💎 However, if CYBER fails to surpass this resistance and faces rejection, there is a possibility of a downward movement towards the support trendline.

💎 The support trendline holds significant importance, as a breakout above it would signal a bullish trend continuation. Conversely, if the support is breached, it could indicate a shift back to a bearish trend, with the next target being the strong demand area.

💎 The strong demand area has historically proven to be resilient, providing support for CYBER's price. A bounce from this area could signify a reversal in trend. Nevertheless, if CYBER breaks below this area, it would confirm a continuation of the downward movement, potentially leading to further declines.

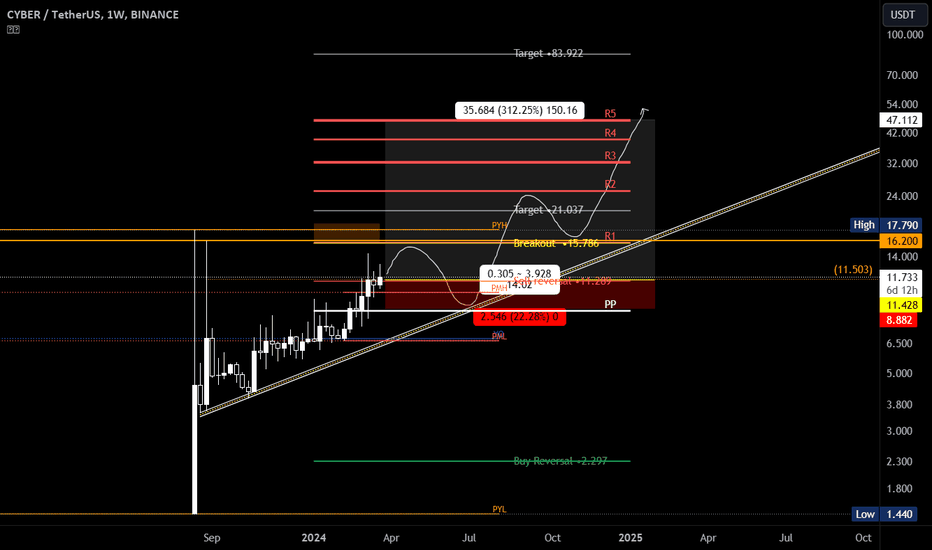

Cyber/Usdt Update Bullish Outlook for Cyber/USDT with Potential for Significant Gains

After careful analysis, it seems that the Cyber/USDT pair is exhibiting promising signs of a bullish move. Over the course of 108 days, there has been significant accumulation in this market. As a result, it is highly likely that new price highs will be achieved in the near future.

We anticipate a potential 50-100% bullish move, although the exact timing is uncertain. While it is essential to note that this information does not constitute financial advice, it does present a compelling opportunity for traders to consider.

Disclaimer:

This information is provided for informational purposes only and does not constitute financial advice. Trading involves risks, and individuals should conduct thorough research or consult with a financial professional before making any investment decisions.

CYBER/USDT-1H-BINANCEThis is not a financial advice. Always do your own research and always put stoploss in your trade (SL) :) If you want more detailed info

how to study and read charts or just need help with some coin, just write to me here a comment, i will try to answer to everybody...

i can help you :) all for free, don't worry, BE HAPPY!

CYBERCONNECT - PICK YOUR POISON - 3RD SCENARIOSo they say the market is a replica of social behavoiur right? and just like life is a facade our conciousness we see what we want to see. All BINANCE:CYBERUSDT potential move is presented to you in 3 scenarios and I will let you pick your poison.

PREVIOUS ANALYIS

CYBERI think CYBER has great potential. It has now found a nice support at the bottom of the parallel channel. It would not be surprising to see a rise of close to 50% from here. Considering Ceyber's supply and the number of coins in circulation, we can say that it is undervalued. In the light of all these data, the last peak of $16 may be among our close target.