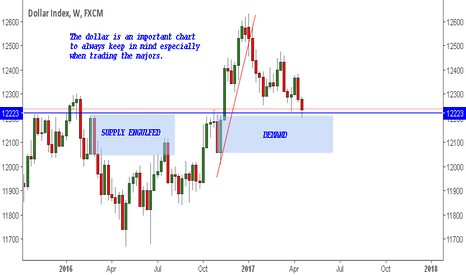

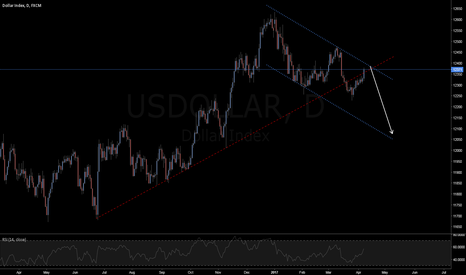

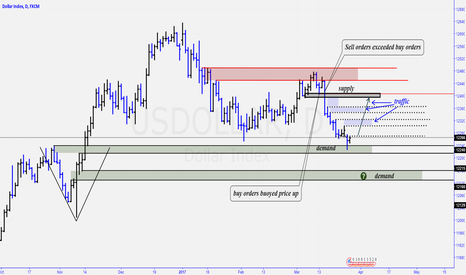

US Dollar ForecastTechnically forming a descending triangle since the start of 2017, the US Dollar is positioned for a technical breakout in the run up to the third quarter.

Fundamentally the US dollar is weakening given softer data likely to postpone rate increases until any other further notice. Administratively, the US is at risk and investors seem to be fleeing to safe havens. This is however not just an American phenomenon as prevalent risks are spreading to various locations around the world.

Should the US Dollar break to the downside, it is likely that we will be testing 11,800 - 11,900 support levels, with opportunity to sell on rallies.

USDOLLAR trade ideas

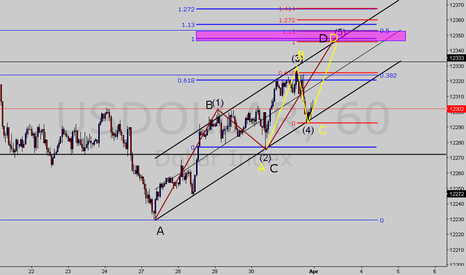

DOLLAR INDEX daily short term bullish / long term bearishPrice seems to retest the median of the bullish pitchfork (main dashed trend line) and maybe design a new lower high. Depending on it, then return in a bearish trend.

There is a high probaility that price will go bearish to join the median of the bearish pitchfork (dotted trend). If it doens't reach the median by september, there willl have then a high probability for a bullish trend.

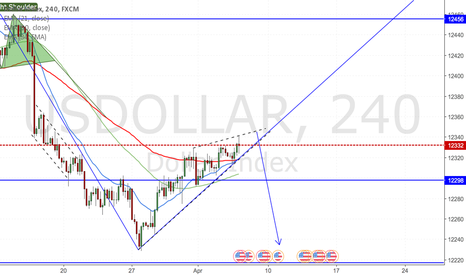

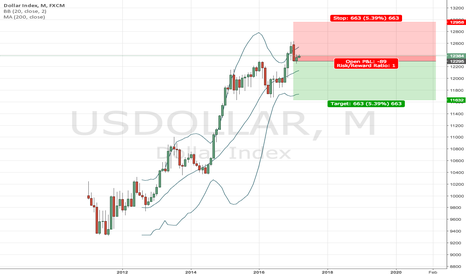

USDOLLAR DJINDEX FXCM short on monthly chartSL = 12958

ENTRY ORDER = 12295

TP1 = 11632

Two positions with the same stop loss and x1 target for the first position

The stop loss of the second position to breakeven when the first position hits the target1.

The second position has no target, only exit

Risk= 2% of account capital (1% each position)