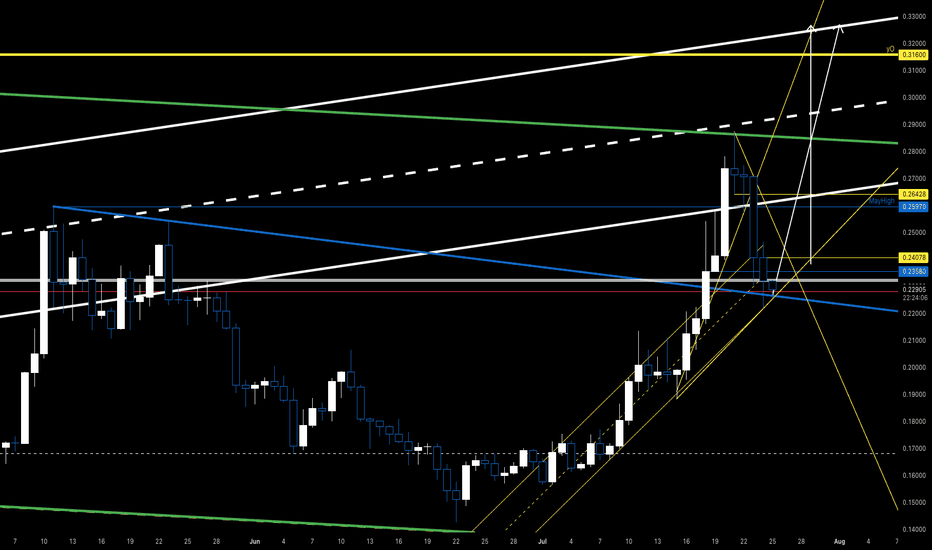

#DOGE Update #3 – July 29, 2025#DOGE Update #3 – July 29, 2025

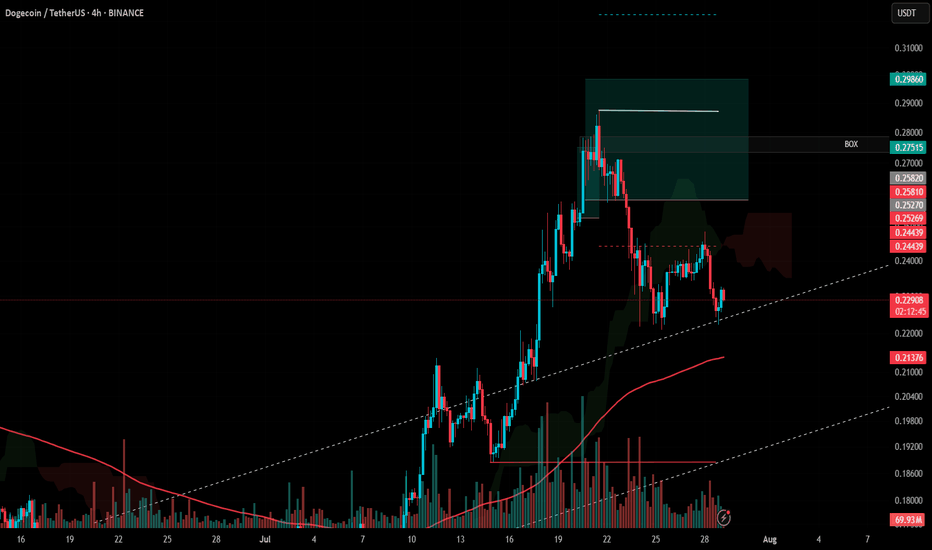

I’m still holding my Doge position and haven’t been stopped out. I plan to lower my average cost by adding to the position at potential reversal zones. This is how I intend to proceed. My entry level is currently $0.2583, and my target is $0.2986, which means I’m aiming for roughly a 15% profit.

At the moment, the price has pulled back about 11% from that level. There’s nothing to worry about—it’s perfectly normal. Doge is continuing its movement by taking support from the bottom of an upward trend. I’m still in the position and planning to exit with profit without setting a stop.

DOGEUSDT trade ideas

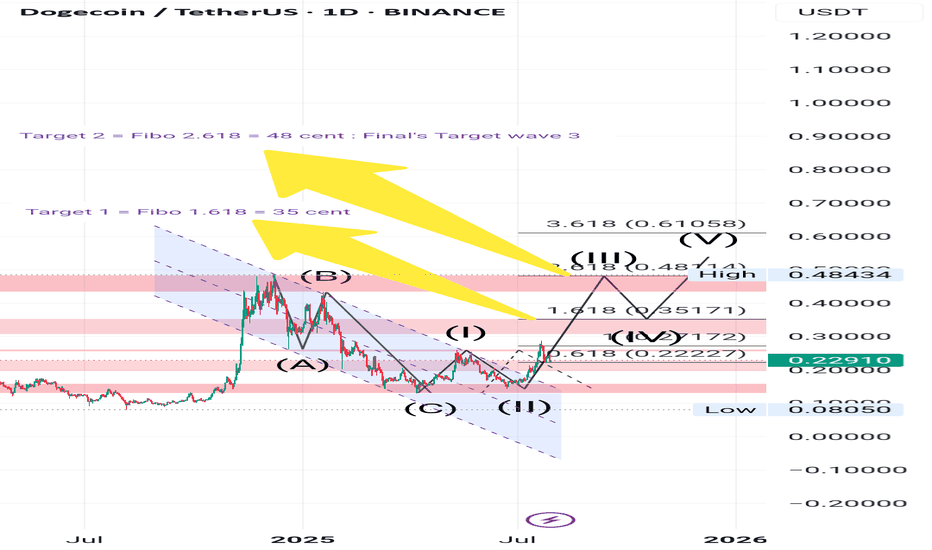

DOGE MACD Liquidity Tracker Strategy – Trend Flip & Breakdown 1DThis DOGE 1D chart highlights two key directional shifts caught by the MACD Liquidity Tracker Strategy — a bullish breakout near $0.12 and a clean reversal near $0.33. The system flipped long once MACD momentum aligned with trend structure, and later rotated bearish as the trend exhausted.

Both moves were captured without guessing — using dynamic trend coloring and a momentum-backed entry logic. Visual bias (blue/pink) helps contextualize the trend at a glance, and the EMA filters reduce chop during sideways conditions.

To explore this setup yourself, search for the strategy by name and run your own backtests to refine inputs per asset and timeframe.

📊 Strategy Name:

MACD Liquidity Tracker Strategy

This is one of several strategy visualizations — more incoming.

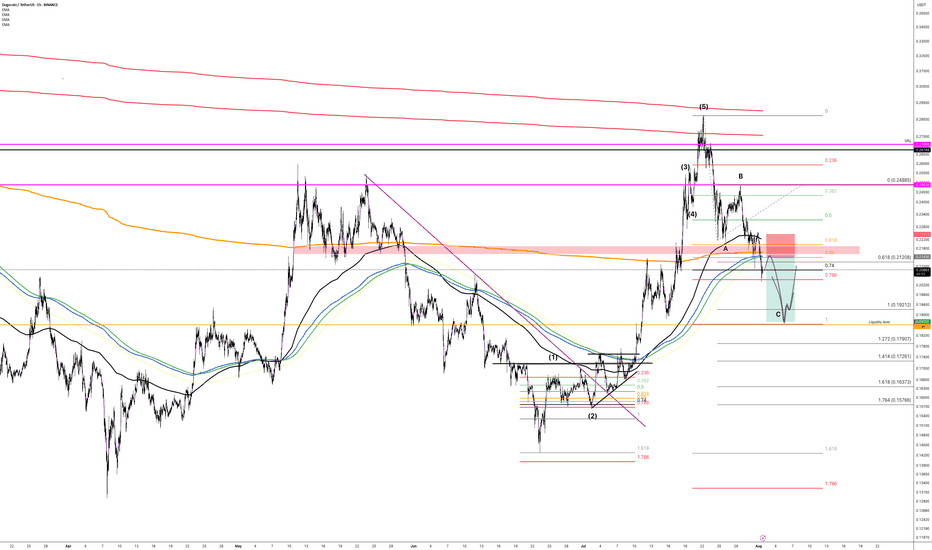

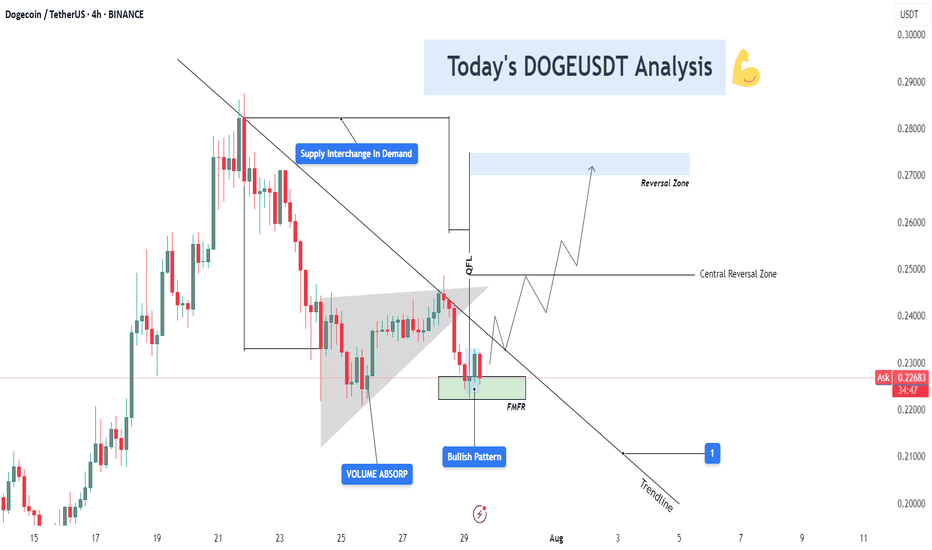

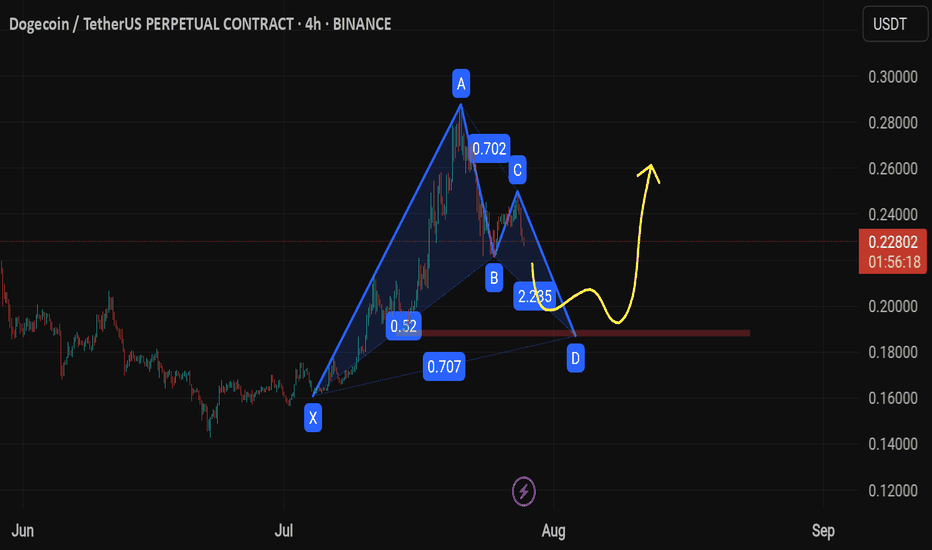

DOGEUSDT 4H – Bullish Reversal Building from FMFR Zone📊 Chart Context & Market Maker Concept Breakdown

DOGEUSDT on the 4H timeframe is setting up for a potential trend reversal, following a structured retracement into a strong demand zone that aligns with multiple smart money confirmations: QFL base, trendline break, volume absorption, and FMFR (Final Move Final Reaction). Let’s dive into the technical layers of this setup:

🔻 1. Downtrend Phase & Structure Setup

After peaking near $0.29, DOGE entered a controlled downtrend, respecting a descending trendline and forming a consistent lower-high structure.

Each rejection from the trendline reflects institutional distribution, gradually pushing price into lower demand levels where value buyers can step in.

🔄 2. Supply Flips into Demand (S/D Flip Zone)

A key level near $0.225 – $0.230 initially acted as a supply zone — but following QFL logic and smart money reaccumulation, it is now showing signs of demand activation.

The chart highlights “Supply Interchange in Demand”, which means that this zone has been repurposed — from distribution to accumulation — another MMC footprint.

📌 Interpretation: This is where large players flip their position bias and start loading for the next leg up.

🔵 3. Volume Absorption Confirmed

Prior to the current bounce, a strong volume absorption phase was detected within a falling wedge or triangular base, shown on the chart.

Despite sell-side pressure, buyers continued to absorb orders — a sign that selling is weakening, and accumulation is underway.

📌 Clue: Volume absorption often precedes an explosive breakout, especially when aligned with FMFR or QFL patterns.

🔁 4. Final Move Final Reaction (FMFR)

Price tapped into the green box zone one final time, marked as FMFR (Final Move Final Reaction) — a key MMC reversal signal.

This occurs when market makers fake a breakdown (creating panic) and then sharply reverse, trapping breakout sellers and scooping up liquidity.

A small bullish candle formation (Bullish Engulfing / Pin Bar) can be seen within this zone — the “Bullish Pattern” label marks this.

🧠 Smart Money Logic: Institutions want liquidity. FMFR fakes weakness to attract retail shorts, then reverses to ride liquidity to the upside.

🔗 5. QFL Base + Break of Structure Setup

A QFL (Quick Flip Level) pattern is forming. This represents a market structure flip, where price first drops from a base, reclaims it later, and continues in the opposite direction.

Breaking this base and confirming above it would mark a true reversal in structure.

🛠️ Technical Confluences at Work

Element Insight

🔹 QFL Structure Base level reclaim in play (structure shift)

🔹 Volume Absorption Smart money soaking up sell pressure

🔹 FMFR Reaction Final stop hunt before the rally begins

🔹 S/D Flip Supply turned to demand near $0.225 zone

🔹 Bullish Pattern Early confirmation of reversal

📈 Projection Path & Reversal Zones

Two projected zones are mapped for price behavior:

🔸 Central Reversal Zone (~$0.250):

First significant resistance where price may pause or react.

Ideal partial profit level or re-entry after pullback.

🔹 Main Reversal Zone (~$0.270–0.275):

Target area for a full liquidity sweep.

This was a previous high-volume supply zone.

If price reaches here, expect potential rejection or distribution unless momentum is strong.

🎯 Trade Setup Strategy (Based on Your Chart)

Entry Area: $0.225 – $0.229 (FMFR Reversal Zone)

Stop-Loss: Below $0.221 (beneath FMFR low)

Take Profit 1: $0.250 (central zone)

Take Profit 2: $0.270 – $0.275 (main reversal zone)

📐 Risk-to-Reward:

TP1: 1:2

TP2: 1:3+ depending on entry timing

🧠 Psychology Behind the Setup

This DOGE setup is engineered to trap emotional traders:

Retail sellers enter late near the bottom.

Smart money waits at FMFR zone, absorbing liquidity.

Volume builds quietly.

Market reverses explosively, catching retail off guard.

By recognizing this setup early, you’re aligned with Market Makers, not against them.

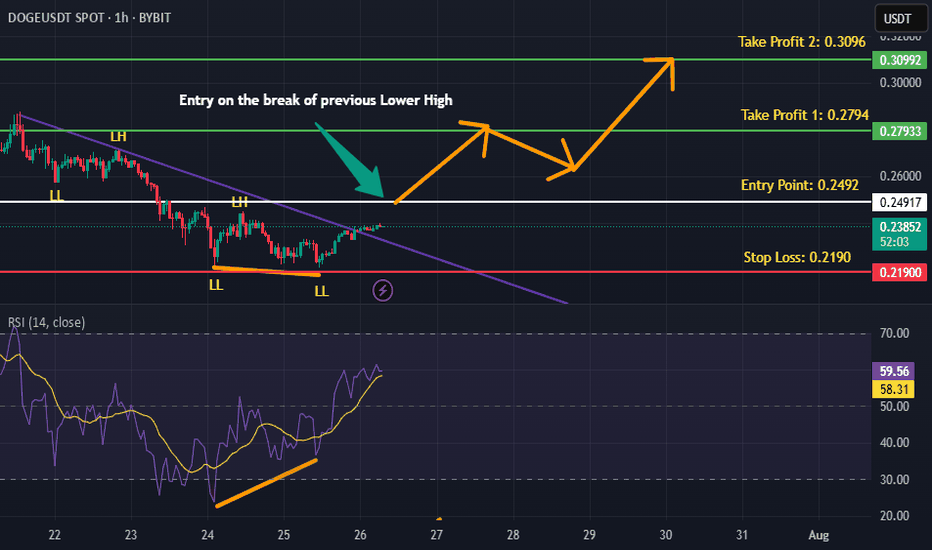

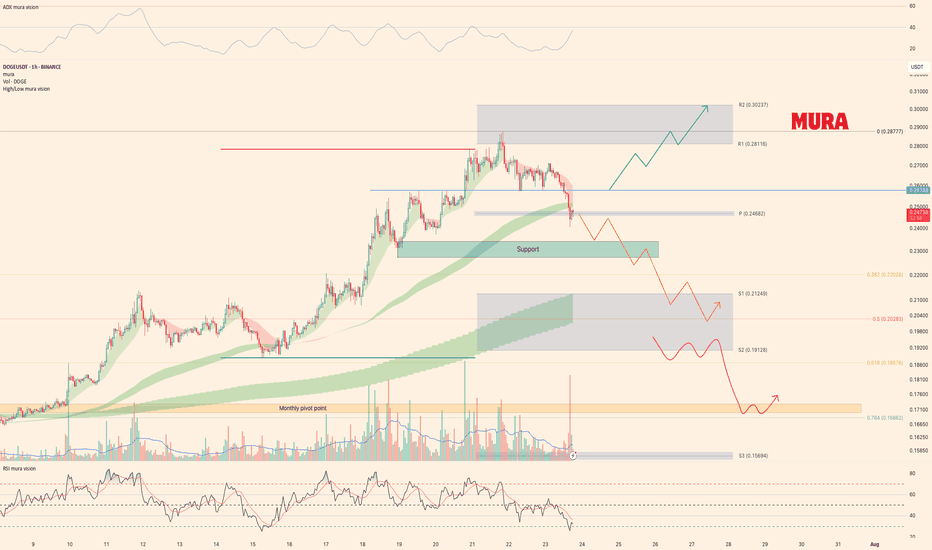

DOGEUSDT is BullishPrice went down for a small retracement on hourly timeframe, however the double bottom formation coupled with bullish divergence and breaking of descending trendline hints that bulls are assuming control of the price action. This sentiment would be validated with the break of previous lower high, according to Dow theory. Targets are mentioned on the chart.

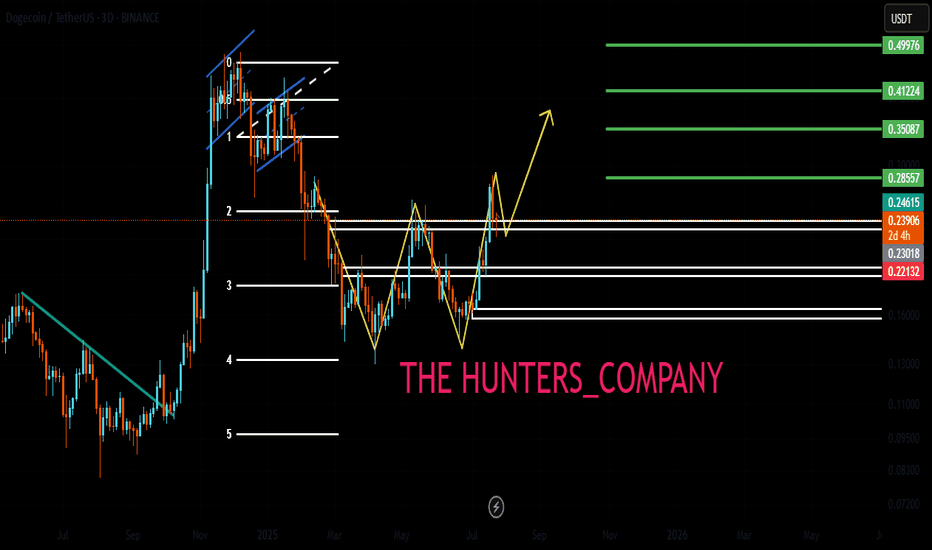

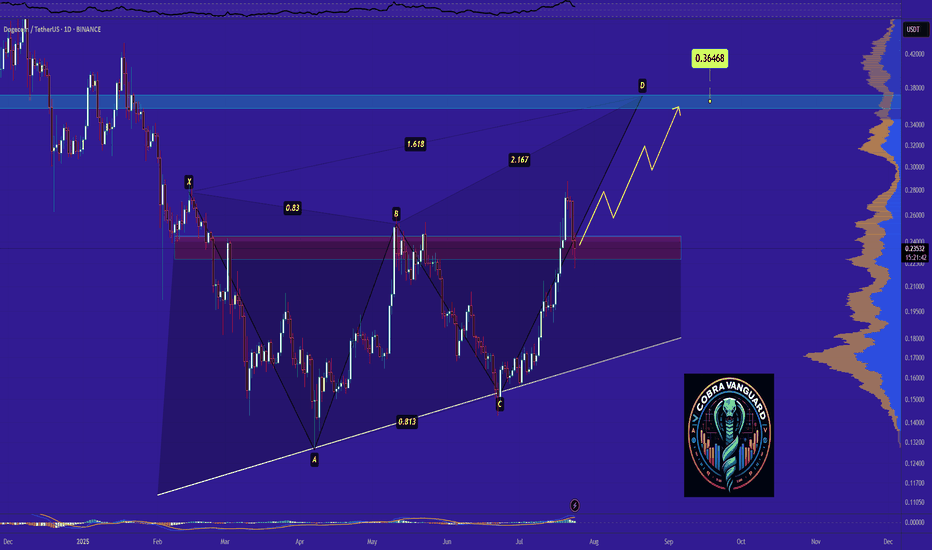

next levels for Dogecoin id very promising honest and well-made TA for doge next levels , with explanations and know how notes full of evedinces with solid knowledg of TA and Volume prifiles with calsics too. btc also , startes is wave D formation upwords, after that a good correction is comming to the market for late entries who did not see our TA's before and now . your support join and share some of a littile bit of your profit will make you make more and safe in this very hard market. peace and stay safe

DOGECOIN : Should we expect an increase?Hello friends🙌

📈Given the decline we had, you can see that buyers entered at the specified support and formed a double bottom reversal pattern, which is a strong signal on support.

📉Considering the possible market correction, we placed two more buy levels lower so that we can buy there if the price corrects.

⚠Don't forget about capital and risk management, friends.

🔥Follow us for more signals🔥

*Trade safely with us*

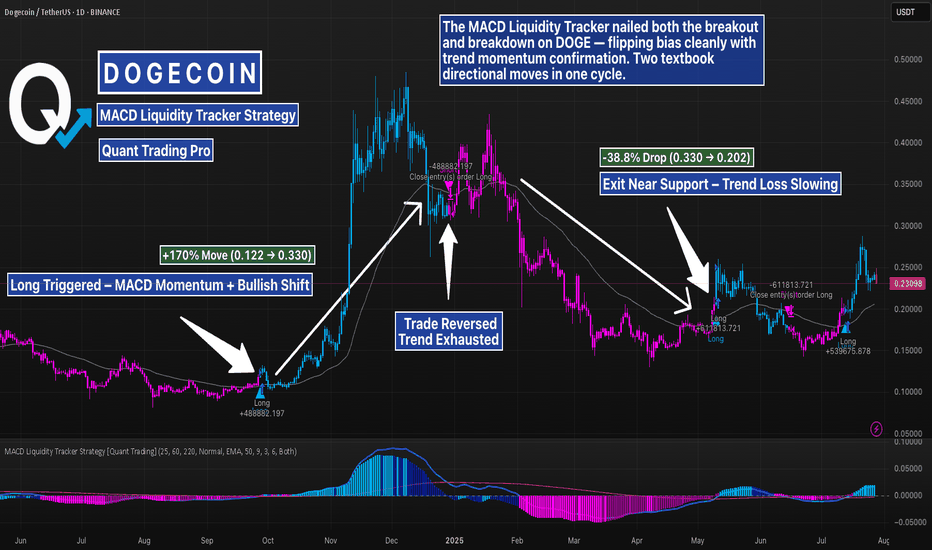

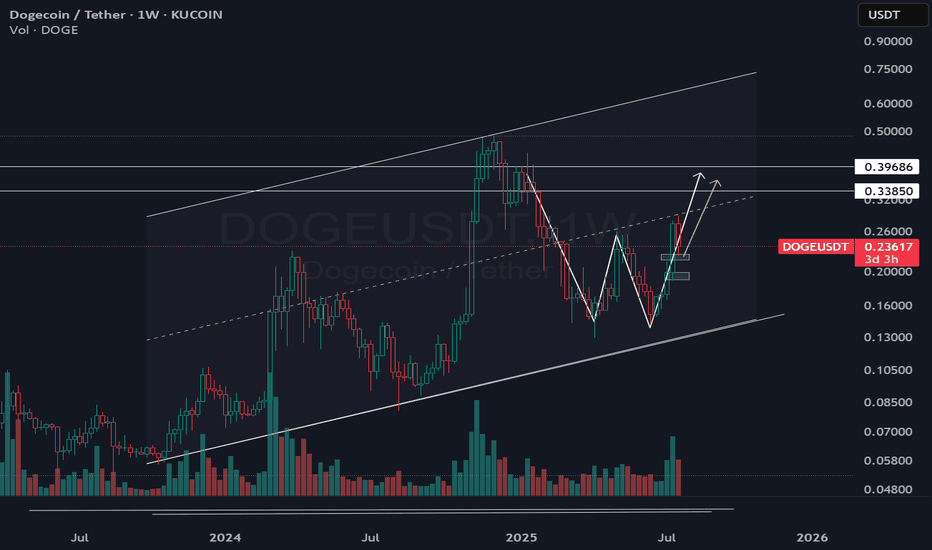

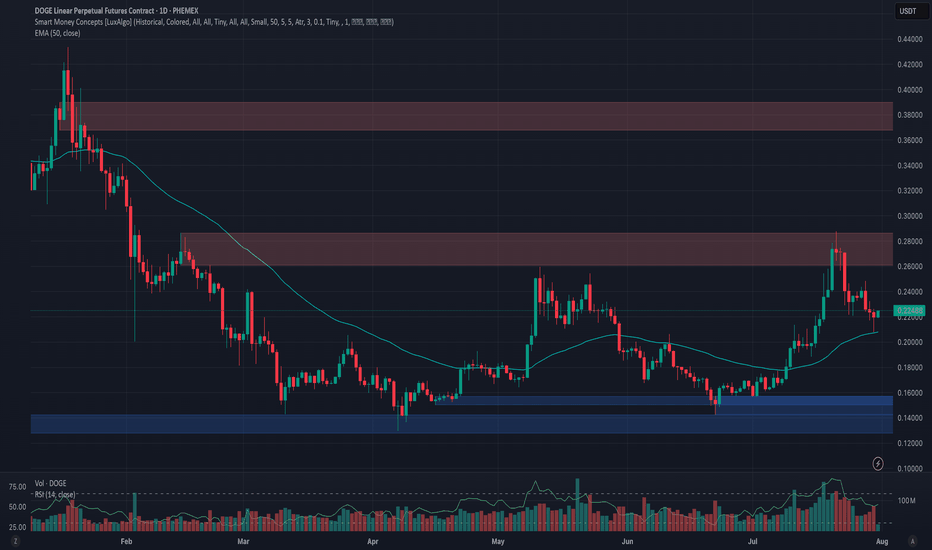

Phemex Analysis #101: Is Dogecoin (DOGE) Ready to Moon Again?Dogecoin ( PHEMEX:DOGEUSDT.P ), the original meme cryptocurrency, is once again capturing investor attention, fueled by impressive bullish movements. Currently trading around $0.2245, DOGE surged approximately 70% in July, decisively breaking the key resistance at $0.22 and challenging the next resistance level near $0.28.

With whale accumulation intensifying, renewed retail investor enthusiasm, and heightened speculation surrounding possible ETF approvals, Dogecoin appears poised to potentially sustain or even amplify its recent gains. But the key question remains: is DOGE truly ready to moon again, or is caution necessary following such rapid price movement?

Let’s carefully explore a few potential scenarios to inform your trading strategies:

Possible Scenarios

1. Bullish Continuation—Targeting Higher Levels

After successfully breaking above the crucial $0.22 resistance, Dogecoin could maintain its upward momentum if buying pressure remains strong. In this bullish scenario, DOGE might swiftly retest the immediate resistance at $0.25, then target higher levels near $0.28, and potentially surge toward the significant resistance at $0.39.

Pro Tips:

Entry Signals: Watch for a confirmed breakout above $0.25, especially if accompanied by rising trading volume, as a potential bullish entry point.

Profit-Taking: Strategically secure partial profits at resistance zones around $0.28 and $0.39.

Risk Management: Implement tight stop-loss orders just below the key support at $0.20 to guard against unexpected reversals.

2. Retest and Accumulation—Neutral Scenario

Given DOGE’s rapid price rise, a short-term pullback towards previous resistance-turned-support at $0.22 or even $0.20 is plausible. Such retracements, particularly on decreasing volume, might signal healthy consolidation, setting the stage for future bullish momentum.

Pro Tips:

Buying Opportunities: Look to accumulate DOGE if a low-volume pullback occurs toward support zones around $0.22 or $0.20.

Monitor Volume: Observe closely for decreasing trading volume during retracements, which typically indicates positive consolidation rather than a bearish reversal.

3. Bearish Scenario—Deeper Correction Possible

Should overall market sentiment shift negatively or DOGE fail to hold crucial support at $0.22, bearish pressure could escalate, potentially pushing Dogecoin down to deeper support levels around $0.198, and possibly as low as $0.15 or $0.13.

Pro Tips:

Risk Management: Consider reducing or exiting positions if DOGE decisively breaks below $0.22 on increased selling volume.

Long-Term Accumulation: Long-term holders may strategically accumulate DOGE at historically strong support levels ($0.15 or $0.13) once price stabilization occurs.

Conclusion

Dogecoin (DOGE) stands at a pivotal point, balancing bullish enthusiasm against the possibility of a correction. Traders should carefully monitor resistance at $0.25, the critical support at $0.22, and closely observe volume dynamics. By strategically aligning their trades with these outlined scenarios and employing disciplined risk management, traders can confidently navigate DOGE’s volatility and potentially capitalize on its next significant move.

🔥 Tips:

Armed Your Trading Arsenal with advanced tools like multiple watchlists, basket orders, and real-time strategy adjustments at Phemex. Our USDT-based scaled orders give you precise control over your risk, while iceberg orders provide stealthy execution.

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

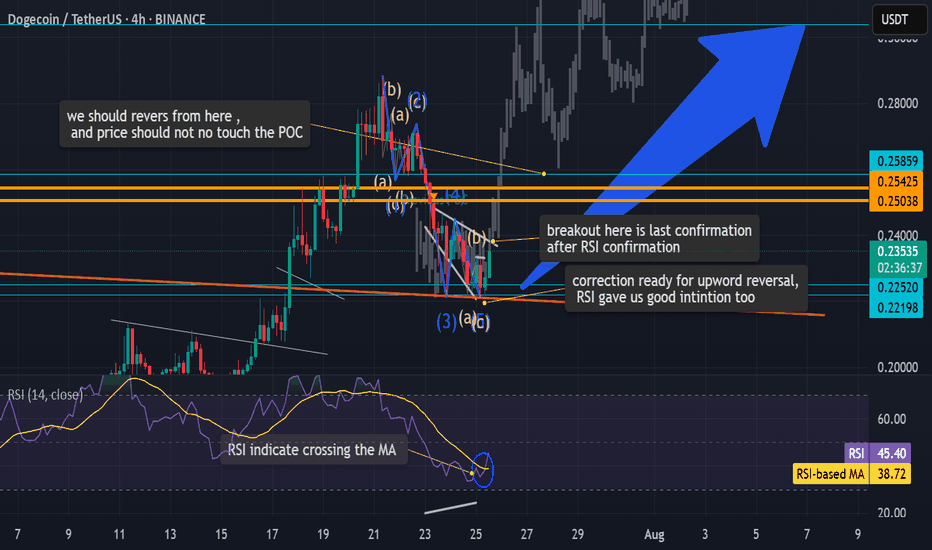

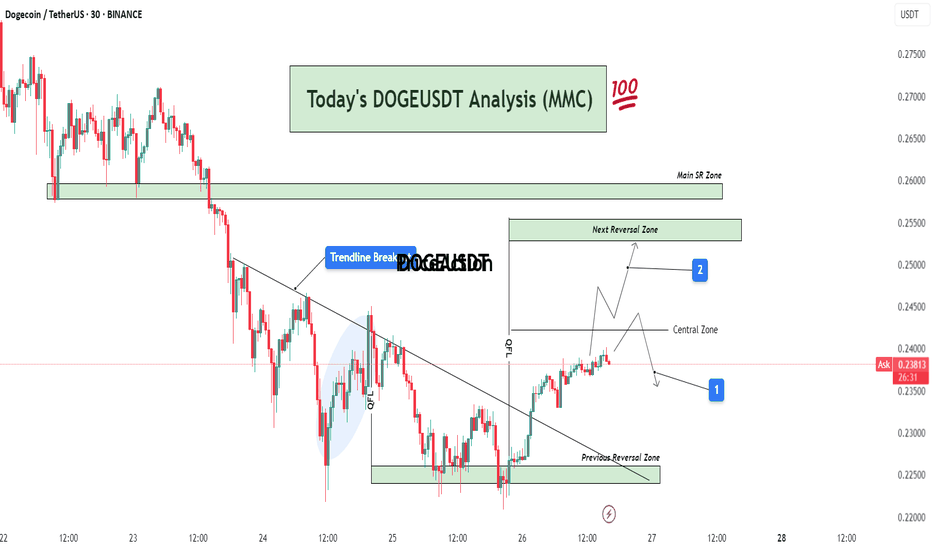

DOGEUSDT Analysis : Bullish Breakout, Reversal Zones + Target📊 Full Technical Analysis:

This chart presents a structured and precise MMC-based analysis of DOGE/USDT on the 30-minute timeframe, integrating key price action zones, trendline structure, and potential market scenarios.

🧩 1. Downtrend Phase and Trendline Formation

DOGE was in a continuous downtrend, creating lower highs and lower lows. A bearish trendline had been acting as dynamic resistance for multiple sessions. Price consistently respected this trendline, indicating strong seller dominance.

However, after repeated taps on the trendline and rejection from lower support, price finally broke above the trendline — marking a potential trend reversal or corrective phase.

🔄 2. Previous Reversal Zone – Demand Zone (0.225–0.228)

This zone acted as the major turning point where buyers aggressively stepped in. The demand was previously tested and respected, indicating strong accumulation here.

From this zone, a bullish reversal was initiated, leading to the current price rally.

This area can now be considered a structural support base – ideal for watching future re-tests or consolidation.

🔁 3. Central Zone – Decision Area (0.238–0.240)

This is a critical intraday resistance zone acting as a central decision-making area for traders.

Two Key Scenarios Could Play Out from Here:

Scenario 1 (Marked by Blue Box 1):

Price could face rejection from this zone and fall back slightly toward minor support levels for a retest or liquidity grab. If bullish pressure sustains, a higher low may form before continuation upward.

Scenario 2 (Marked by Blue Box 2):

If price breaks above the central zone with strong volume, momentum can push it toward the Next Reversal Zone between 0.250–0.255.

In either case, watching price behavior and candle structure near the central zone is critical for confirmation of the next move.

🔼 4. Next Reversal Zone – Supply/Resistance (0.250–0.255)

This zone marks a historical resistance area where DOGE faced heavy selling pressure before.

If price reaches this zone, expect:

Either profit-taking and short-term selling from intraday traders.

Or a possible breakout continuation if broader market sentiment remains bullish.

This zone will act as a key test of DOGE's strength and market conviction.

📌 5. Main SR Zone – Strong Structure (0.258–0.260)

Beyond the Next Reversal Zone lies the Main SR (Support-Resistance) Zone, where price has reacted strongly in the past.

If DOGE manages to break and hold above the 0.255 range, this zone will likely become the next upside target and strong resistance zone.

🔍 Additional Market Context:

Breakout Volume: The trendline breakout was accompanied by rising volume, which suggests stronger conviction behind the move.

QFL Zone: Price structure also aligned with a QFL (Quick Flip Level) bounce within the shaded region before breakout, further validating the bullish pressure.

Psychological Levels: 0.240 and 0.250 are psychological levels, which often act as magnet points and temporary resistance/support.

🧠 Mirror Market Concepts (MMC) Insight:

This analysis is rooted in Mirror Market Concepts, where the market tends to reflect past behavioral zones. Each marked zone (Demand, Central, Reversal, SR) is based on previous reaction points that guide current sentiment.

The market is now in a mirror reaction phase, moving from the previous demand zone toward historical supply zones. If the symmetry continues, the pattern supports a gradual bullish continuation with measured pullbacks.

✅ Trading Plan (Educational Purpose Only – Not Financial Advice):

Entry Zone 1: Breakout traders may have entered after the trendline breakout near 0.233–0.235.

Entry Zone 2: Conservative traders can look for retest confirmation in the Central Zone.

Target Zone: Next Reversal Zone (0.250–0.255) and possibly Main SR (0.260).

Stop Loss: Below the Previous Reversal Zone (~0.224) for swing setups.

Risk-to-Reward: RR setup of 1:2 or higher possible depending on entry strategy.

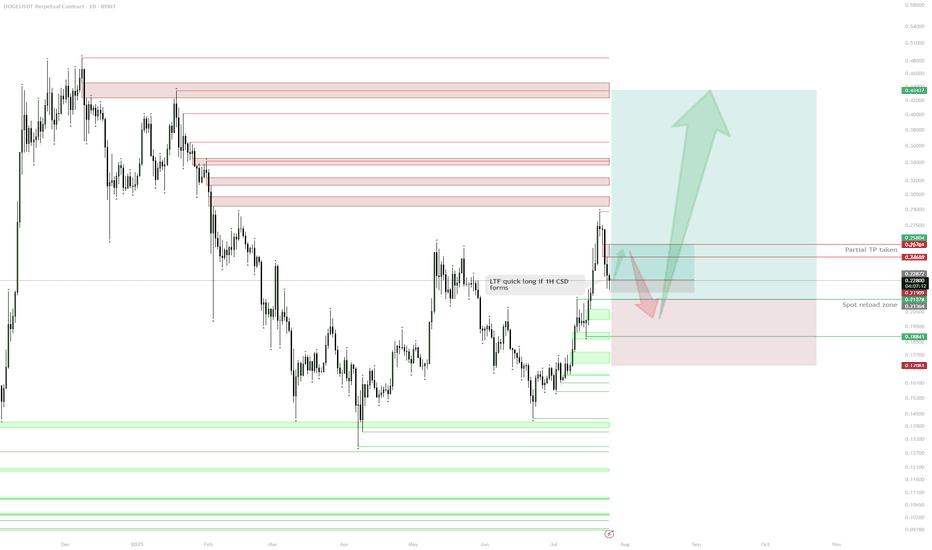

DOGE – HTF Plan & Spot Reload ZoneSpot Position & Realized Profit:

Spot position held from the $0.19 sweep.

Previous long from demand taken and partially realized at $0.26, de-risking the core position.

Current Structure:

After reaching resistance ($0.26–$0.27 zone), price is retracing.

Daily demand/support sits around $0.20–$0.21, with multiple confluences for spot re-accumulation.

Immediate Plan:

Waiting for price to revisit daily demand ($0.20–$0.21) to reload spot and/or open fresh longs.

Watching for a possible lower timeframe (1H) bullish confirmation (e.g., 1H change of structure/1H CSD) as a trigger for a tactical long before daily demand is tagged.

LTF Play:

If price prints a 1H CSD, a quick long up to daily imbalance ($0.24–$0.25) can be considered.

Invalidation:

Loss of daily demand ($0.188) would invalidate the bullish scenario and require re-evaluation.

Upside Target:

If demand holds, looking for moves back into daily supply/imbalance, with ultimate HTF targets at $0.26, $0.32, and higher.

Reasoning:

The core plan is to build spot exposure at strong demand after de-risking on the first move up. The context is that DOGE has shown willingness to bounce at major demand, and with realized profits in the pocket, risk can be managed comfortably on new entries. Short-term, LTF confirmation (such as a 1H CSD) can offer a tactical long back into daily imbalance before the main reloading zone is tagged. Patience and precise triggers are key—no need to rush until price action confirms.

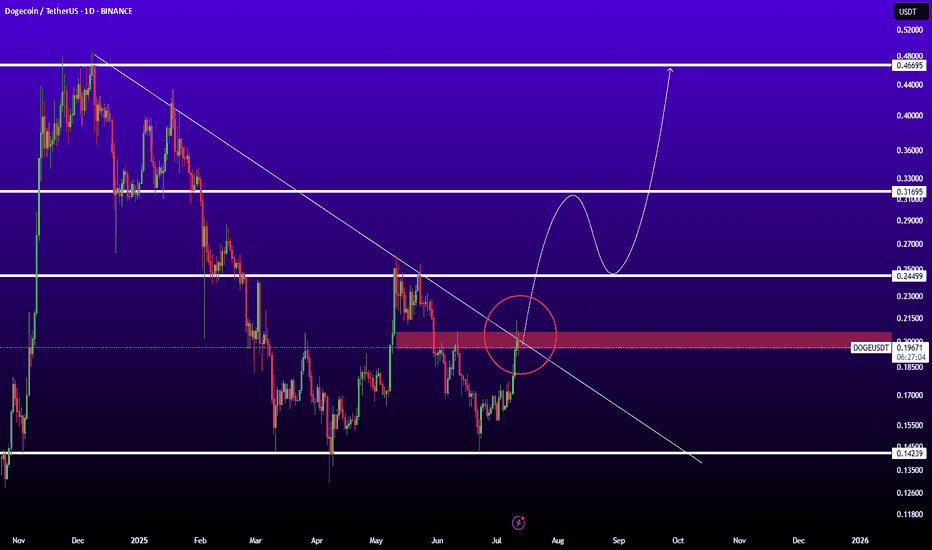

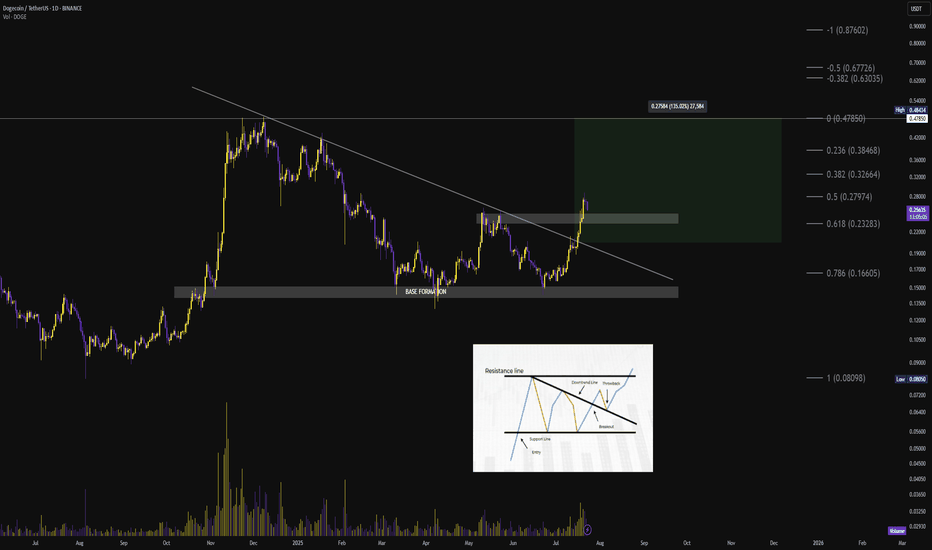

$DOGE Daily [Descending Triangle Breakout] Structure: Descending Triangle into Breakout

Duration: ~9 months (October 2024 – July 2025)

🟩 Breakout Level:

→ $0.24

🟩 Fib-Based Targets:

→ $0.28 (0.5 fib)

→ $0.32 (0.382 fib)

→ $0.38 (0.236 fib)

→ $0.48 (full move completion)

🟥 Invalidation: Close below $0.22 would invalidate the breakout and re-enter previous consolidation zone

Strong volume expansion. Breakout clean. Momentum trending upward post-retest with no immediate overhead resistance until $0.32

Textbook pattern resolution with major upside room — meme king waking up again.

#DOGE #Altseason #MemeCoin #DOGECOIN

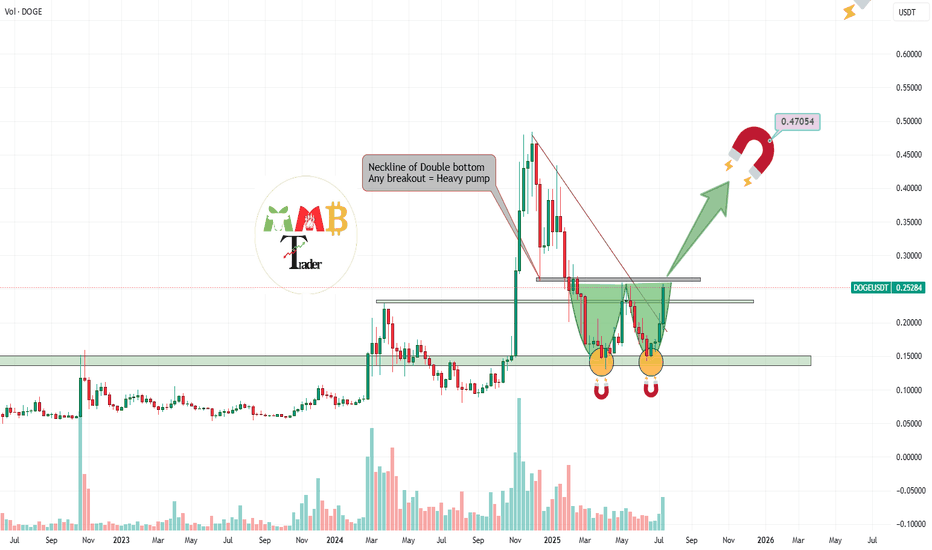

DOGEUSDT double bottom pattern or my Magnet pattern???So many of Traders around the world sees weekly Strong reversal pattern which is double Bottom and they are waiting for breakout of neckline which is last major resistance of 0.26$ and i think soon it can break the resistance and heavy pump ahead after breakout is expected.

But you may be wrong the upcoming pump here is due to my magnets on chart.

find them all and see how it pump price.

Who finds all targets for BINANCE:DOGEUSDT ?

But remember and never forget this was not

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

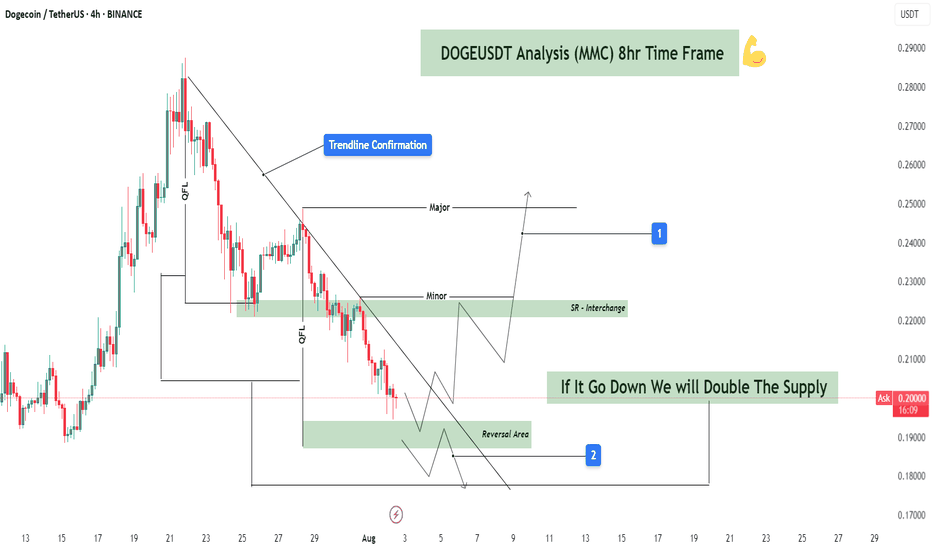

DOGEUSDT Analysis : Trendline Decision & Dual Directional Point📌 Market Context & Current Setup:

DOGEUSDT has been trading within a well-defined descending channel, respecting a strong trendline resistance, which has acted as a bearish ceiling for several sessions. The price action has been heavily influenced by supply zones formed after sharp impulsive drops, creating multiple QFL (Quick Flip Levels) — key to spotting structural bottoms and high-probability reversal zones.

Currently, the price is hovering near a critical decision point, where two key scenarios may play out:

A breakout and bullish reversal toward major resistance

A dip into a deep demand zone for final accumulation before reversal

Your plan reflects MMC (Market-Mind-Confirmation) methodology, preparing for either scenario with clear levels, logic, and psychology in place.

📐 Technical Breakdown:

🔻 1. Trendline Confirmation (Bearish Control):

The price has respected the downtrend line multiple times, confirming strong bearish momentum.

No candle body has closed decisively above it, showing sellers still have control.

However, price is now consolidating near this line, indicating a potential weakening of selling pressure — a classic sign of upcoming trend exhaustion.

🟩 2. Support Zones – Structural Layers:

📍 Minor Zone (S/R Flip – ~$0.215–0.220):

This zone is a previous support turned resistance.

It’s the first checkpoint the price needs to reclaim to confirm a breakout.

A successful flip from resistance back to support would add strong bullish confidence.

🟩 Reversal Zone (~$0.185–0.190):

Marked on your chart as a "Reversal Area" — likely derived from QFL methodology.

Price has historically bounced from this area, indicating buyers are willing to step in aggressively.

This zone aligns with smart money demand accumulation and could serve as a final liquidity sweep zone before a major reversal.

📍 Major Resistance Zone (~$0.250–0.260):

The next major objective once a trendline break is confirmed.

Also aligns with previous highs and volume nodes — a solid target for bullish trades.

🔄 Scenario-Based Strategy:

📈 Scenario 1 – Breakout Toward Major Resistance:

Price breaks above the descending trendline and reclaims the minor S/R zone.

This would confirm a bullish structure shift, validating that sellers are losing strength.

After reclaiming ~$0.215, the path toward $0.240–0.260 opens up.

Retests or flag breakouts within this range can be re-entry points for trend traders.

📉 Scenario 2 – Deeper Retest and Accumulation:

If the price fails to break out and dips further, the reversal demand area (~$0.185) becomes critical.

This is where buying pressure is expected to return, and as labeled in your chart:

👉 “If it goes down, we will double the supply”

This suggests an averaging-down or pyramiding strategy based on strong structural confidence.

This technique is valid only when the area is backed by solid confluence (trend exhaustion, demand, and past bounces).

🧠 MMC Strategy (Market – Mind – Confirmation):

Market: Bearish short-term trend, but price is approaching oversold territory near structural demand.

Mind: You’re prepared for both outcomes – breakout or dip. Emotion is out of the plan.

Confirmation: You wait for signs — break and retest of trendline, bullish engulfing candles, or wick rejections from demand.

This mental clarity helps maintain trading discipline and keeps emotional bias out of decision-making.

⚙️ Execution Plan:

Component Scenario 1 (Breakout) Scenario 2 (Deep Buy Zone)

Entry Signal Break & close above trendline + minor SR reclaim Bullish reversal candle within demand zone

Stop Loss Below trendline + S/R flip (~0.210) Below demand zone (~0.182)

Target 1 $0.235 $0.235

Target 2 $0.255–$0.260 $0.255–$0.260

Risk Level Medium Higher R:R potential

Strategy Notes Aggressive on confirmation only Add to position on wick traps

🧠 Trader Psychology Tips:

Be patient — confirmation beats prediction.

Set alerts at key levels to avoid emotional entries.

Scaling into trades based on zone reactions builds flexibility and control.

"Double the supply" approach must be paired with strict invalidation levels.

✅ Summary:

DOGE is trading within a descending wedge.

Key decision zones are marked clearly (trendline, S/R flip, reversal demand).

Breakout could lead to a quick 15–25% upside.

Reversal zone offers great R:R with accumulation opportunity.

Strategy is well-aligned with disciplined execution and trader psychology.

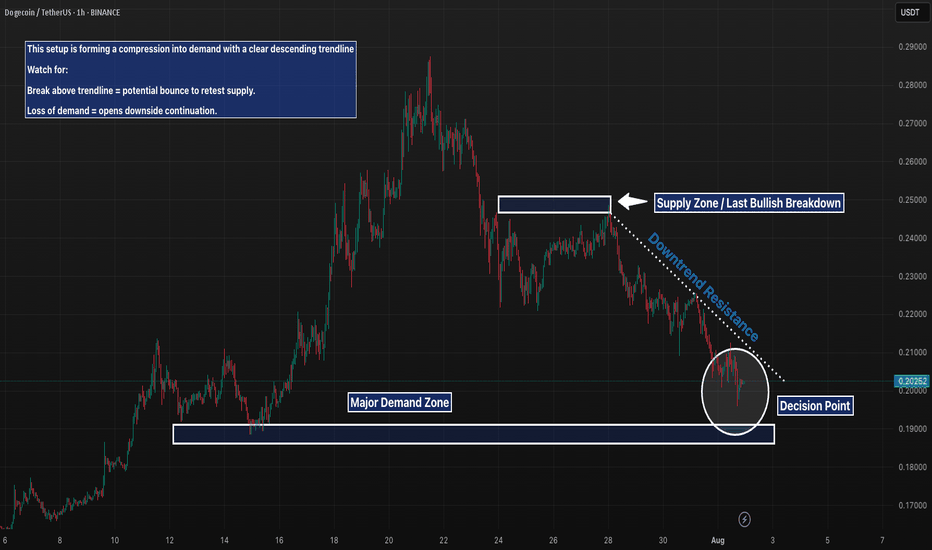

DOGE 1H – Descending Into Demand, But Will Buyers Step Up Again?DOGE is approaching a key inflection point after a clean rejection from the previous supply zone (~0.23) and consistent lower highs. The descending trendline has acted as dynamic resistance, compressing price into a major demand zone that previously triggered a strong rally. If bulls step in here, we could see a breakout and retest of the overhead supply. However, failure to hold this zone opens up potential for a deeper move toward the mid-$0.18s.

📌 Key Levels:

– Resistance: 0.23 (supply zone)

– Support: 0.19 (demand zone)

– Structure: Lower highs into horizontal demand = potential spring or breakdown.

This is a classic make-or-break structure — momentum and volume will reveal the winner.

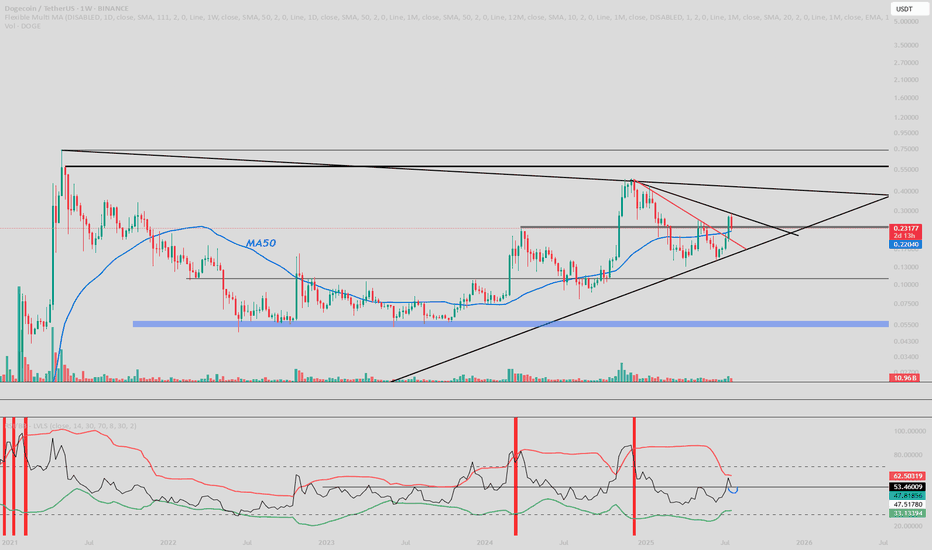

DOGE : Idea.Hello, good ? Good.

Enter in doge here is not a bad idea in SPOT.

• Above the last important resistance.

• Retest on 50 Weekly MA.

• Above 50 rsi weekly.

• Bollinger bands in consolidation.

Need to confirm rejection in weekly like always.

If rejectyion here : x2 incoming.

Good luck guys, take care of you.

Trading plan for DOGELast week, BINANCE:DOGEUSDT rode the market wave with solid gains. Now we're in a correction phase, sitting right at the weekly pivot point. Here's the breakdown:

Upside potential: Needs to cleanly break and hold above $0.257 to target new local highs

Current reality: While below the weekly pivot, odds favor more downside toward $0.20

Trade the reality until the market proves otherwise. Watch those levels and let price lead the way.

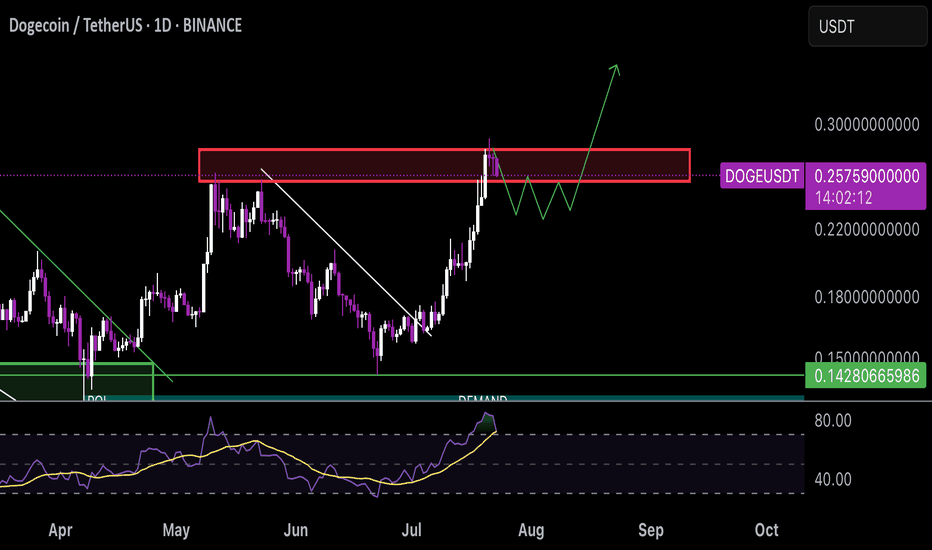

Doge

• Current Price Level: The current price is 0.25770 USD, with a decrease of 0.01323 USD (4.88%).

• Support and Resistance Levels:

◦ Key Resistance: Around 0.25770 USD (red line), which is currently a critical level to test. Breaking this could push toward the 0.30000 USD marked level.

◦ Key Support: At 0.14280 USD (green line). If the price drops below this, it might fall to 0.11000 USD.

• Trend Line: The white diagonal line indicates a previous downtrend that has recently been broken. This could signal a shift to an uptrend, but it needs confirmation with higher volume.

• RSI (Relative Strength Index): At the bottom of the chart, RSI has moved out of the oversold territory (below 30) and is around 40-50. This suggests selling pressure is easing and it may soon enter a neutral or bullish zone (above 50).

• Trading Volume: The recent increase in volume as the price approaches resistance indicates buyer interest, but sustained volume is needed to confirm an uptrend.

• Patterns: The price movement forming a wavy (W-shaped) pattern near resistance could indicate consolidation. A decisive break above 0.25770 with a confirmation candle could activate the next target.

Conclusion: The chart suggests DOGE is at a pivotal price point. Breaking the 0.25770 resistance could confirm an upward move, otherwise a drop to the 0.14280 support is possible. It’s recommended to use a stop loss below the support and monitor trading volume. For real-time data, I can search if you’d like.