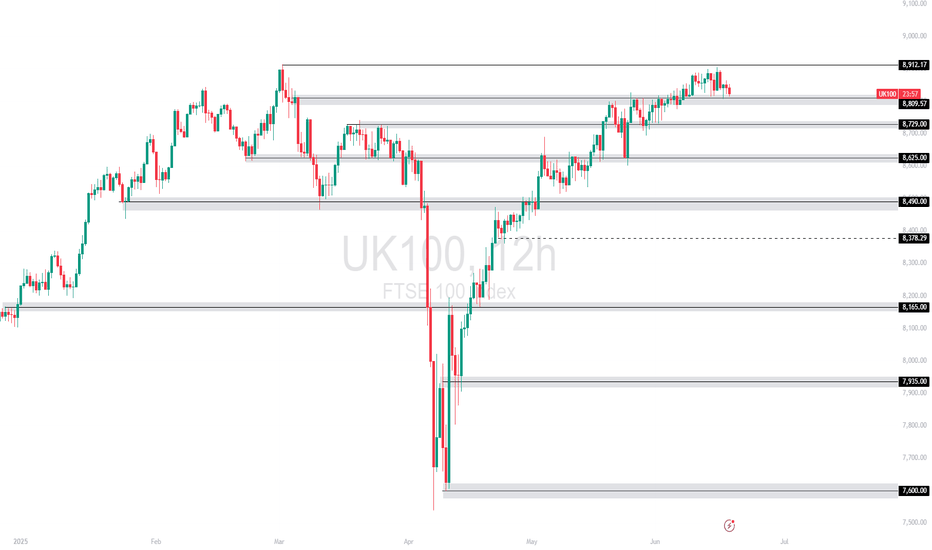

UK100 [Consolidation Below Resistance] – Will Bulls Break Out?After a strong recovery from the April lows, UK100 has been trending upward, recently stalling just below the 8,912.17 resistance level. The price action is currently consolidating between the 8,809.57 support and the key resistance. The structure remains bullish overall, though the momentum has slightly weakened near the top.

Support at: 8,809.57 🔽 | 8,729.00 🔽 | 8,625.00 🔽

Resistance at: 8,912.17 🔼

🔎 Bias:

🔼 Bullish: A strong break and close above 8,912.17 could trigger a continuation toward fresh highs.

🔽 Bearish: A sustained drop below 8,809.57 and especially 8,729.00 may open downside moves toward 8,625.00 and 8,490.00.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

FTSGBP trade ideas

UK100/FTSE100 - SHORT THE HELL OUT OF UK - Team, last week we kill few times SHORTING ON UK100/FTSE100

Here is a million strategy from Active Trader Room

SHORT NOW at the current price 8992-96

DOUBLE SHORT at 8912-36

Target 1 at 8870-62

Target 2 at 8855-47

Please note: once it hit first target ,take 50% profit

the rule is always pocket first and reduce the risk.

LET'S MAKE ANOTHER MILLIONS THIS WEEK

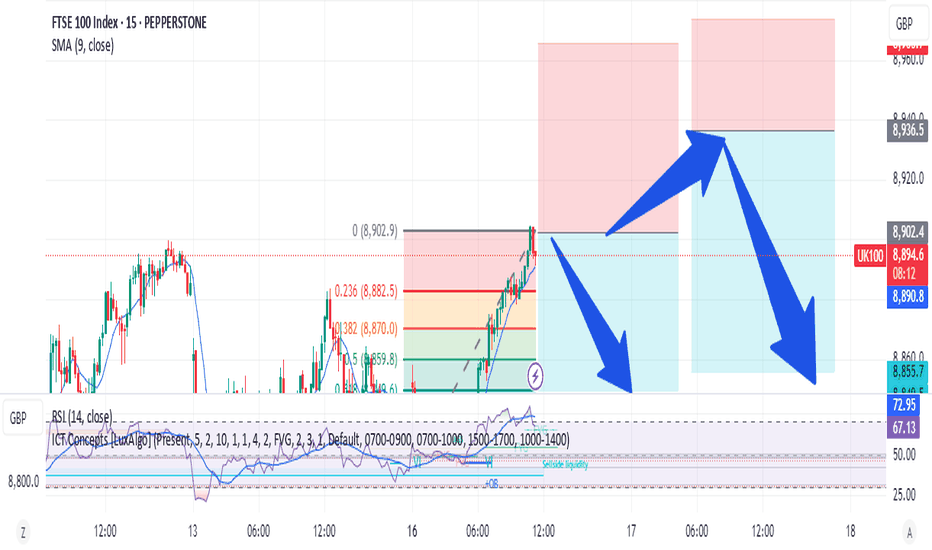

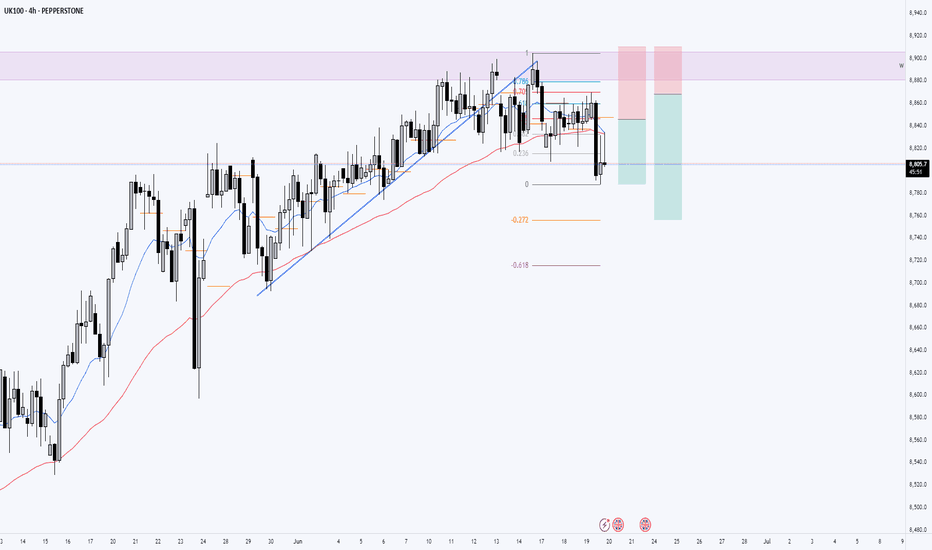

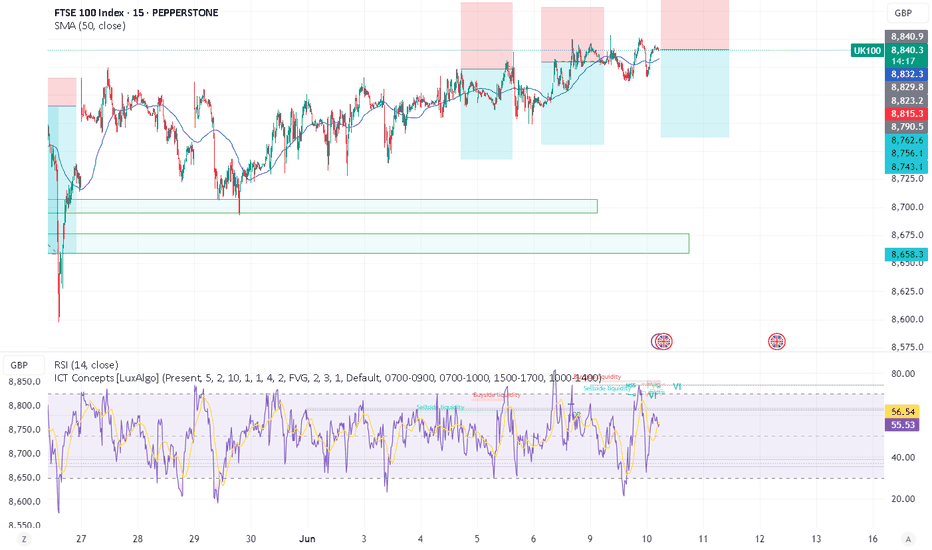

UK100 - Long?📈 Possible Scenarios After the “UP” Signal on FTSE 100 (UK100):

✅ Scenario 1: Reversion Rally (Most Probable Based on the Indicator)

The “UP” label suggests the system has detected short-term exhaustion to the downside.

Price may now revert higher toward the previous breakdown zone (~8,740–8,755), acting as a first resistance and potential take-profit zone.

If momentum picks up, a second leg higher toward ~8,770 is possible, especially if other indices (e.g. DAX, US500) are bouncing as well.

🔹 Trade Idea: Long from signal candle close with SL just below the low of that candle, targeting 20–40 pts higher.

⚠️ Scenario 2: Shallow Bounce & Continuation Lower

If the bounce stalls below the 8,740 level and price begins consolidating with weak candles, this could signal a bearish continuation pattern.

In that case, expect a retest of 8,700 or even 8,680.

🔹 Action: Tighten stop once price hits +15 pts from entry. Watch for bearish reversal candles near 8,740.

🧠 Confluence Tips:

✅ Check if RSI is crossing back above its moving average from oversold territory — this adds confidence to the long setup.

🔁 Align the signal with other indices (e.g., if DAX or US100 also showed reversion UP signals at the same time, it strengthens the case).

📊 If volume increased on the signal candle, it likely confirms real interest at that level.

📌 Summary:

Your indicator just printed an “UP” reversal — historically this is a high-probability bounce zone. Immediate price action over the next 2–3 candles will confirm whether this is a true reversion move or just a pause before further downside.

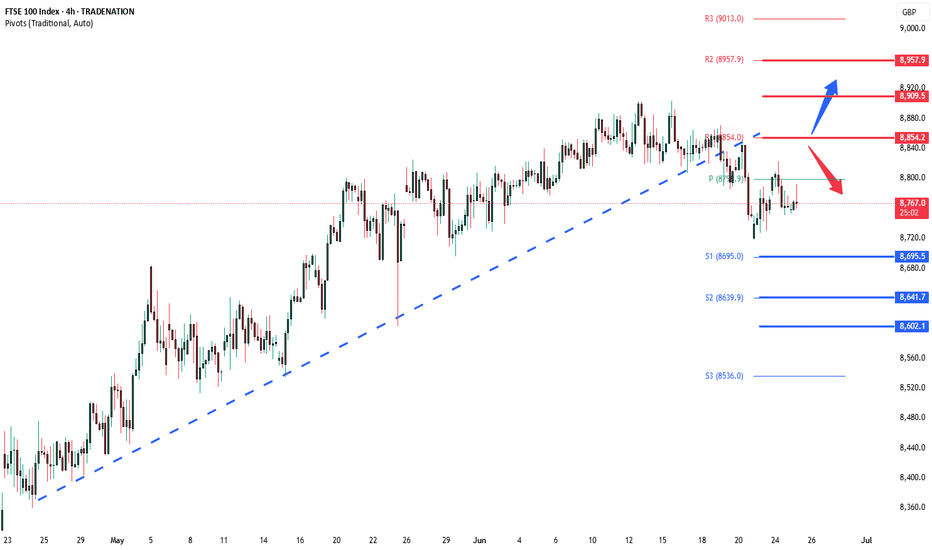

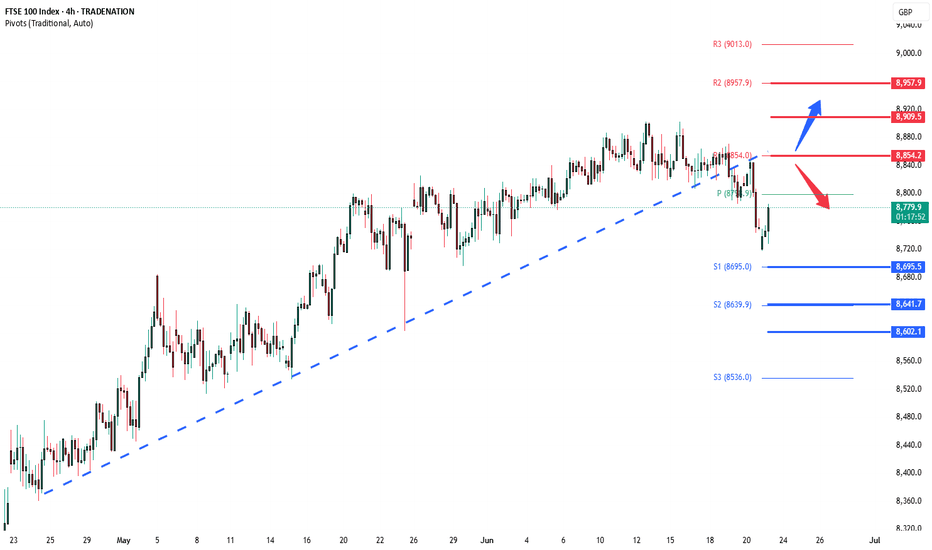

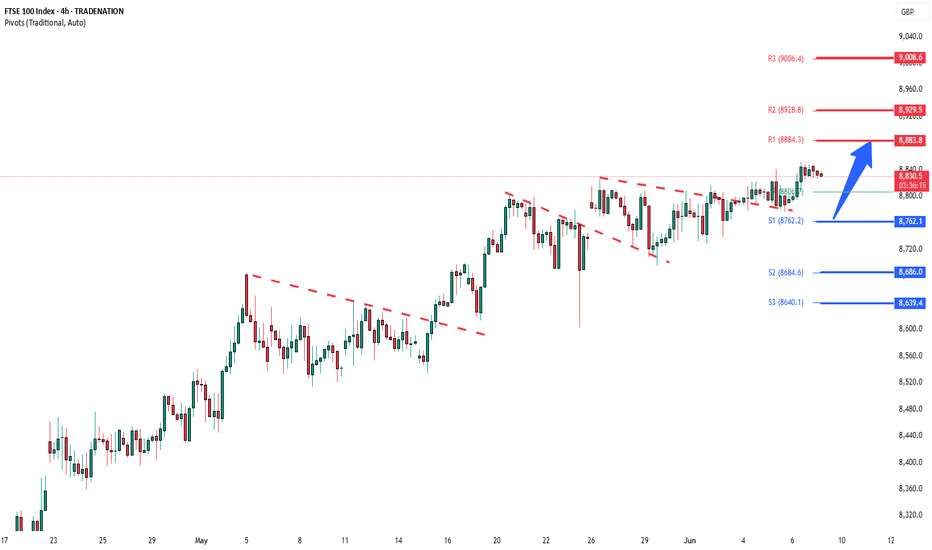

FTSE uptrend pause capped at 8854The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 8695 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 8695 would confirm ongoing upside momentum, with potential targets at:

8854 – initial resistance

8900 – psychological and structural level

8960 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 8695 would weaken the bullish outlook and suggest deeper downside risk toward:

8640 – minor support

8600 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the FTSE holds above 8695. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

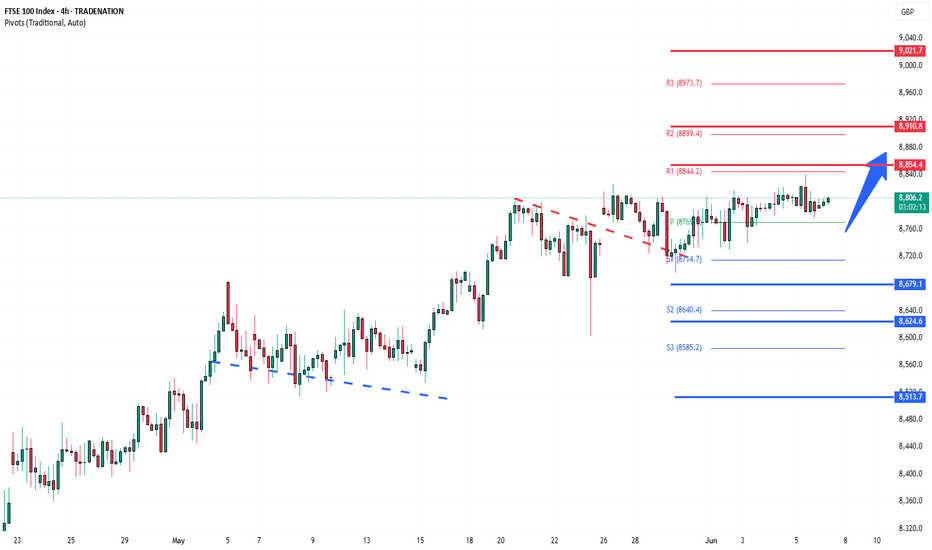

FTSE pivotal level at 8854The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 8695 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 8695 would confirm ongoing upside momentum, with potential targets at:

8854 – initial resistance

8900 – psychological and structural level

8960 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 8695 would weaken the bullish outlook and suggest deeper downside risk toward:

8640 – minor support

8600 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the FTSE holds above 8695. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

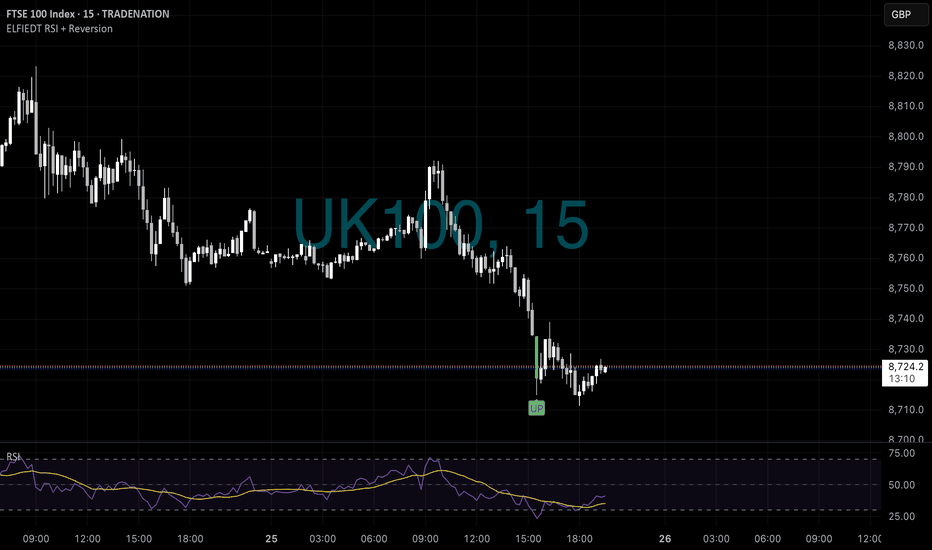

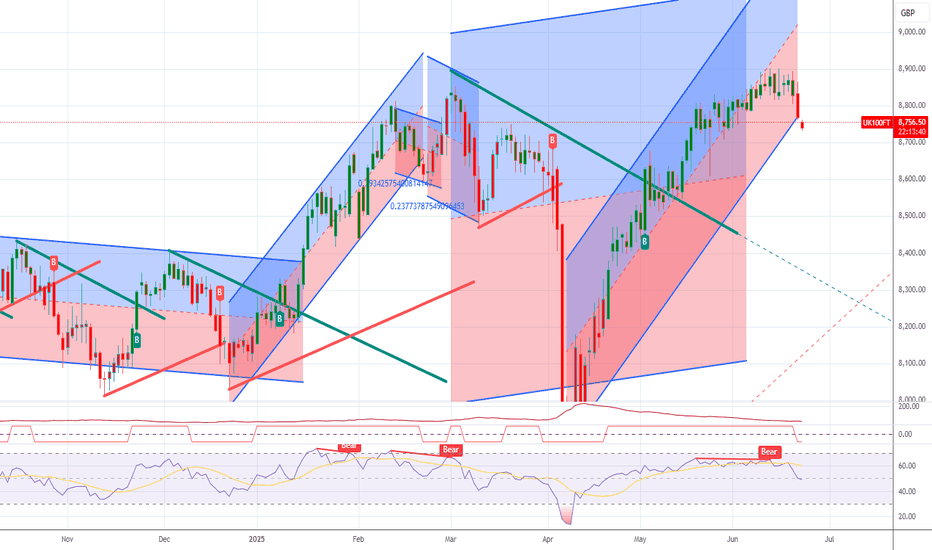

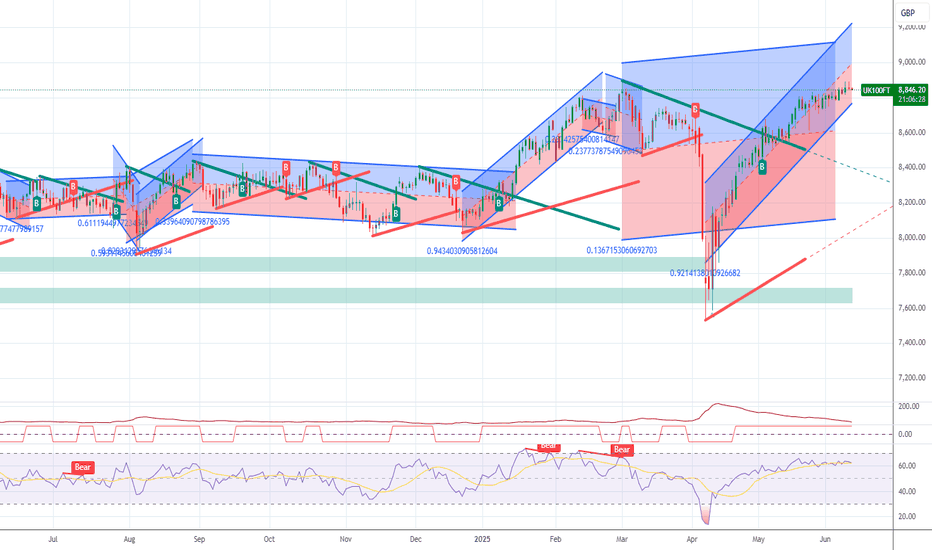

UK100 Bearish Setup Developing📉 Weekly Overview:

Price is currently held by a significant weekly resistance level. Last week formed bearish price action, indicating potential exhaustion from buyers and room for sellers to step in.

📉 Daily Chart:

Although no strong momentum candle yet, price has already broken internal bullish structure to the downside. EMA50 is starting to flatten, hinting at a potential momentum shift.

📉 4H Chart:

Clear sign of bearish transition – uptrend line is broken, price is now trading below the 50EMA, and we recently see strong seller momentum candles. This adds further confluence to bearish bias.

🔍 Plan:

Bias: Bearish

Entry: After bearish confirmation candle on 1H or 4H retracement to premium zone

Targets:

TP1: Previous 4H low

TP2: Daily support zone

Invalidation: Break and close above 4H 50EMA and recent structure high

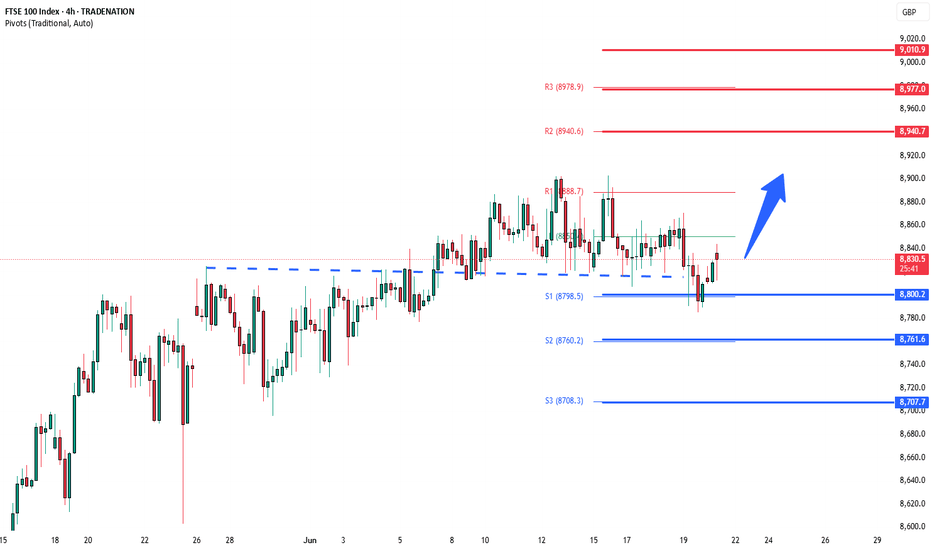

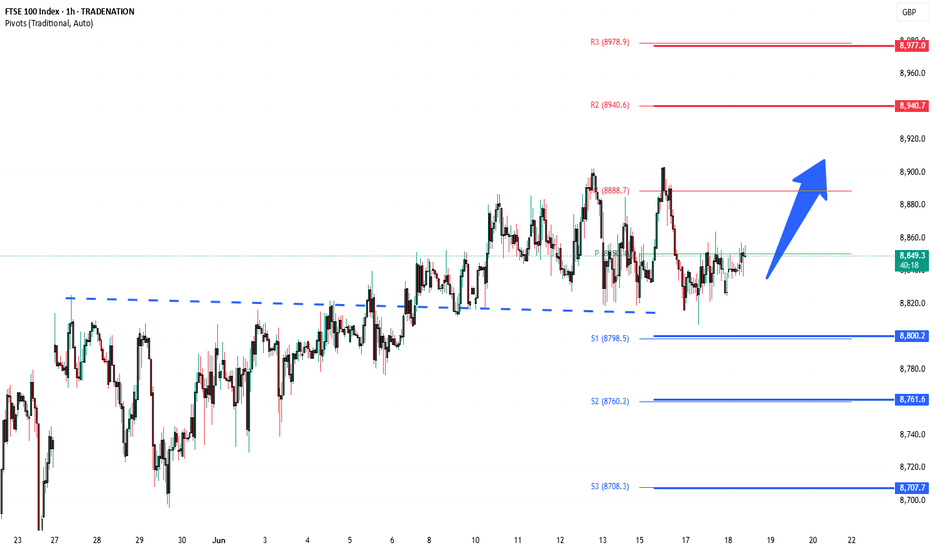

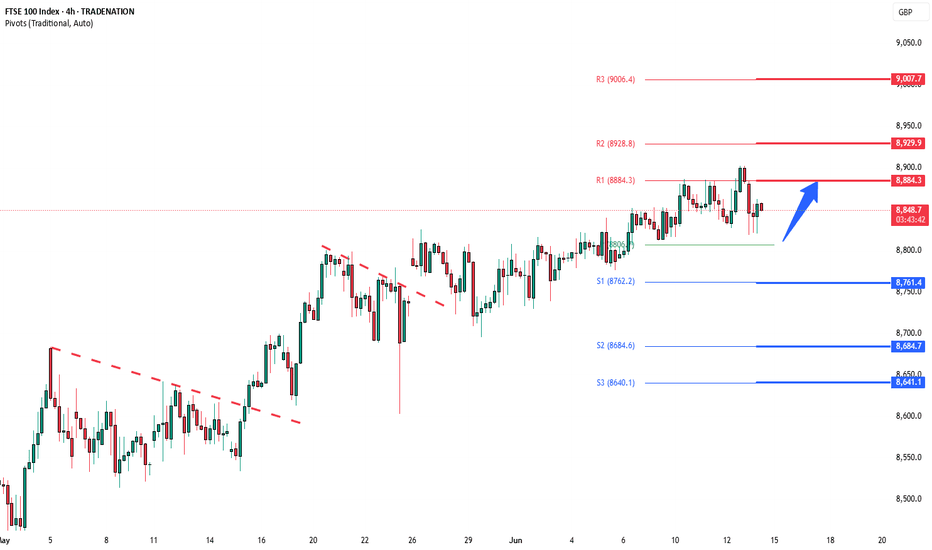

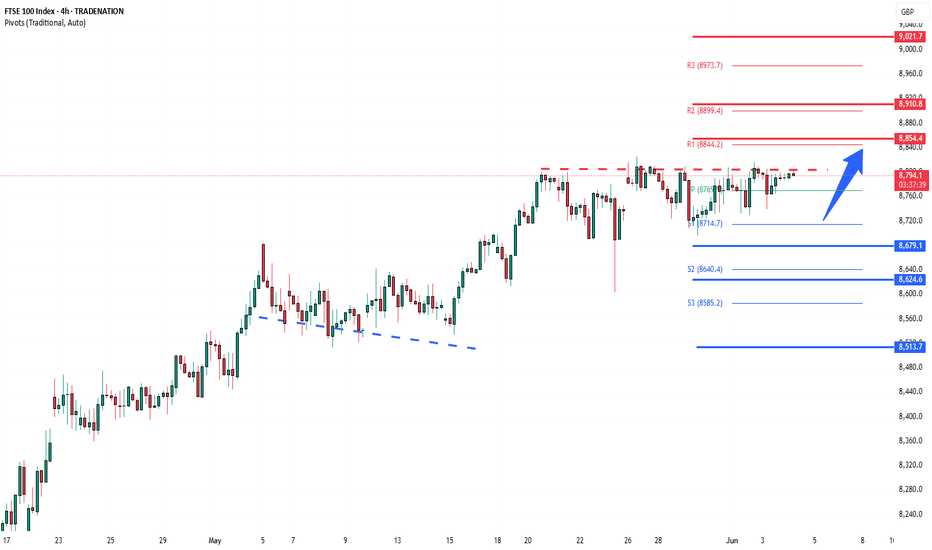

FTSE INTRADAY bullish sideways consolidation Trend Overview:

The FTSE100 equity index remains in a bullish trend, characterised by higher highs and higher lows. The recent intraday price action is forming a continuation consolidation pattern, suggesting a potential pause before a renewed move higher.

Key Technical Levels:

Support: 8800 (primary pivot), followed by 8760 and 8700

Resistance: 8940 (initial), then 8977 and 9010

Technical Outlook:

A pullback to the 8800 level, which aligns with the previous consolidation zone, could act as a platform for renewed buying interest. A confirmed bounce from this support may trigger a continuation toward the next resistance levels at 8940, 8977, and ultimately 9010.

Conversely, a daily close below 8800 would suggest weakening bullish momentum. This scenario would shift the bias to bearish in the short term, potentially targeting 8760 and 8700 as downside levels.

Conclusion:

FTSE100 maintains a bullish structure while trading above the 8800 support. A bounce from this level would validate the consolidation as a continuation pattern, with upside potential toward the 8940 area. A breakdown below 8800, however, would invalidate this view and suggest deeper corrective risk.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

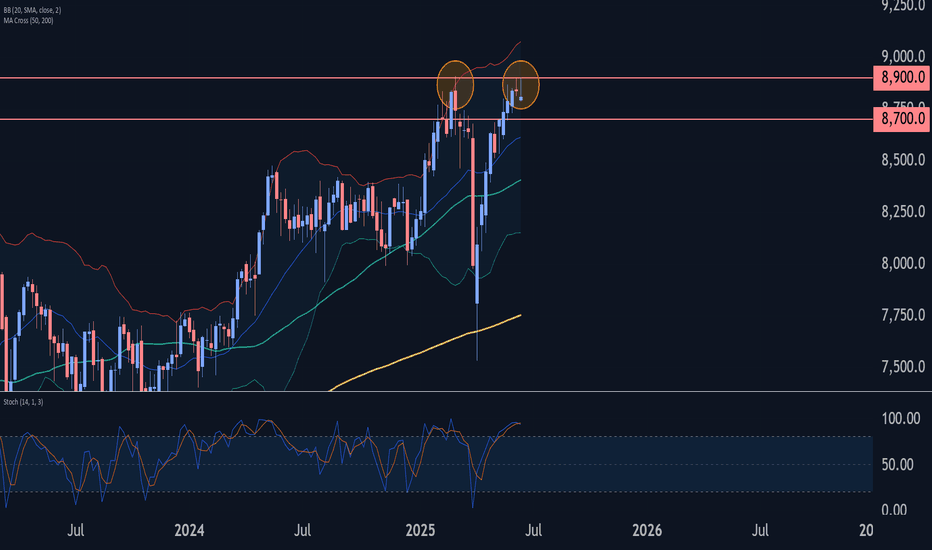

FTSE 100 Wave Analysis – 19 June 2025

- FTSE 100 reversed from the resistance zone

- Likely to fall to support level 8700.00

FTSE 100 index recently reversed down from the resistance zone located between the strong resistance level 8900.00 (which stopped the weekly uptrend at the end of February) and the upper daily Bollinger Band.

The downward reversal from this resistance zone stopped the previous impulse wave i of the intermediate impulse wave 3 from May.

Given the strength of the resistance level 8900.00, FTSE 100 index can be expected to fall to the next support level at 8700.00 (the former low of wave 2 from last month).

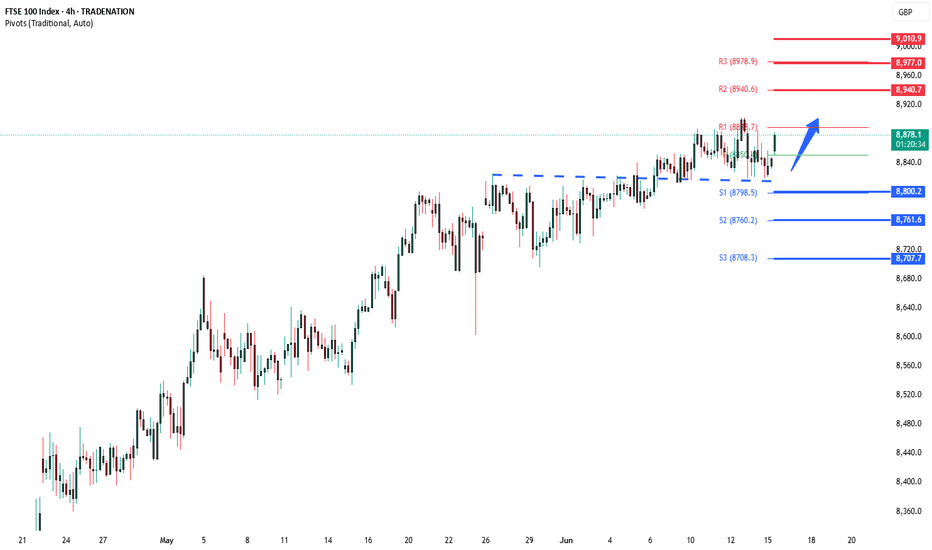

FTSE sideways consolidation supported at 8800Trend Overview:

The FTSE100 equity index remains in a bullish trend, characterised by higher highs and higher lows. The recent intraday price action is forming a continuation consolidation pattern, suggesting a potential pause before a renewed move higher.

Key Technical Levels:

Support: 8800 (primary pivot), followed by 8760 and 8700

Resistance: 8940 (initial), then 8977 and 9010

Technical Outlook:

A pullback to the 8800 level, which aligns with the previous consolidation zone, could act as a platform for renewed buying interest. A confirmed bounce from this support may trigger a continuation toward the next resistance levels at 8940, 8977, and ultimately 9010.

Conversely, a daily close below 8800 would suggest weakening bullish momentum. This scenario would shift the bias to bearish in the short term, potentially targeting 8760 and 8700 as downside levels.

Conclusion:

FTSE100 maintains a bullish structure while trading above the 8800 support. A bounce from this level would validate the consolidation as a continuation pattern, with upside potential toward the 8940 area. A breakdown below 8800, however, would invalidate this view and suggest deeper corrective risk.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

FTSE100 bullish sideways consolidation above 8800Trend Overview:

The FTSE100 equity index remains in a bullish trend, characterised by higher highs and higher lows. The recent intraday price action is forming a continuation consolidation pattern, suggesting a potential pause before a renewed move higher.

Key Technical Levels:

Support: 8800 (primary pivot), followed by 8760 and 8700

Resistance: 8940 (initial), then 8977 and 9010

Technical Outlook:

A pullback to the 8800 level, which aligns with the previous consolidation zone, could act as a platform for renewed buying interest. A confirmed bounce from this support may trigger a continuation toward the next resistance levels at 8940, 8977, and ultimately 9010.

Conversely, a daily close below 8800 would suggest weakening bullish momentum. This scenario would shift the bias to bearish in the short term, potentially targeting 8760 and 8700 as downside levels.

Conclusion:

FTSE100 maintains a bullish structure while trading above the 8800 support. A bounce from this level would validate the consolidation as a continuation pattern, with upside potential toward the 8940 area. A breakdown below 8800, however, would invalidate this view and suggest deeper corrective risk.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

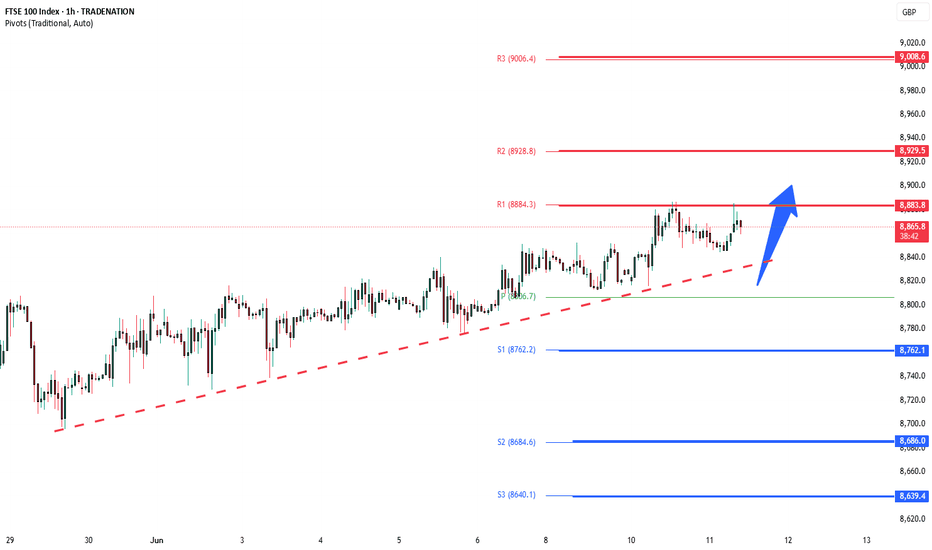

FTSE INTRADAY sideways consolidation Overall trend remains bullish, supported by rising price action.

Recent Movement: Price is in a sideways consolidation phase after a strong uptrend.

Key Levels

Support:

8760 – Key level from prior consolidation.

8680, then 8640 – Next supports if 8680 breaks.

Resistance:

8830 – First upside target.

8930, then 9000 – Further resistance levels on continued strength.

Trading Scenarios

Bullish Scenario:

A pullback to 8760 followed by a bounce could lead to a move towards 8830, then higher to 8930 and 9000.

Bearish Scenario:

A confirmed break and daily close below 8760 would weaken the bullish case. In that case, expect a potential drop to 8680, then 8640.

Conclusion

The FTSE remains bullish, but a short-term pullback is possible. A bounce from 8760 would confirm trend strength. Watch 8680 closely — holding above favors bulls; a break below shifts sentiment to bearish.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

FTSE INTRADAY resistance retest Overall trend remains bullish, supported by rising price action.

Recent Movement: Price is in a sideways consolidation phase after a strong uptrend.

Key Levels

Support:

8760 – Key level from prior consolidation.

8680, then 8640 – Next supports if 8680 breaks.

Resistance:

8830 – First upside target.

8930, then 9000 – Further resistance levels on continued strength.

Trading Scenarios

Bullish Scenario:

A pullback to 8760 followed by a bounce could lead to a move towards 8830, then higher to 8930 and 9000.

Bearish Scenario:

A confirmed break and daily close below 8760 would weaken the bullish case. In that case, expect a potential drop to 8680, then 8640.

Conclusion

The FTSE remains bullish, but a short-term pullback is possible. A bounce from 8760 would confirm trend strength. Watch 8680 closely — holding above favors bulls; a break below shifts sentiment to bearish.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

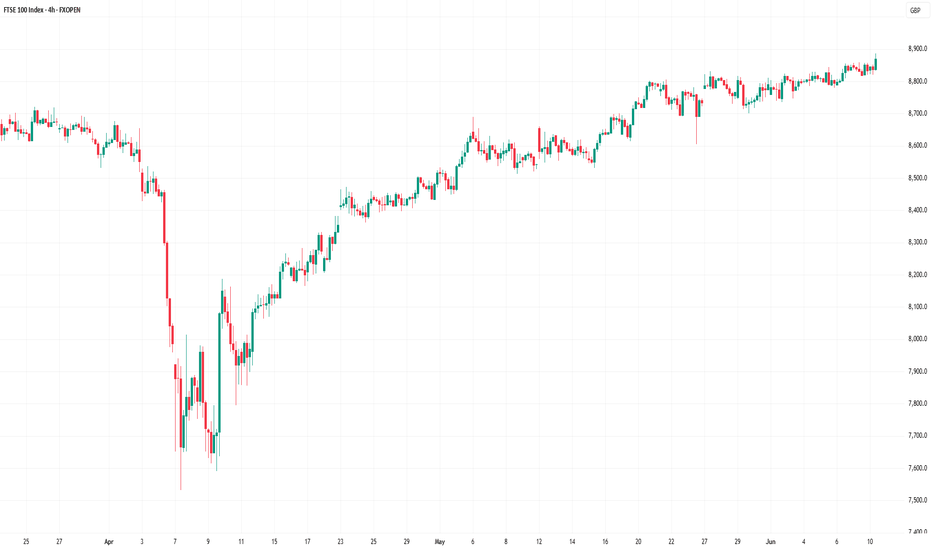

FTSE 100 Surges Towards Record HighFTSE 100 Surges Towards Record High

Today saw the release of new data on the UK labour market.

According to official statistics, the number of payrolled employees in the UK fell by 55,000 (0.2%) between March and April 2025. Over the broader period from February to April 2025, the number declined by 78,000 (0.3%).

In response to the drop in employment, the UK’s FTSE 100 index (UK 100 on FXOpen) jumped sharply, rising close to the 8,900 mark — near its all-time high reached in early March this year.

Market participants likely interpreted the weakening labour market as an additional argument in favour of interest rate cuts by the Bank of England. Such a move would be seen as supportive of the economy and a bullish factor for equities.

Technical Analysis of the FTSE 100 (UK 100 on FXOpen)

From a technical perspective:

→ The FTSE 100 continues to trade within an ascending channel (shown in blue);

→ Today’s bullish momentum broke through the resistance line from below — a level that had previously capped the upward movement within the channel.

If the bulls can maintain the price above the 8,860 level, the likelihood increases for a continued uptrend and a potential new all-time high for the FTSE 100 index.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

UK100/FTSE100 - ANOTHER SECRET STRATEGY OF 95% WINNING RATIOTeam, this morning we booked UK100/FTSE100 again from our short position

As mentioned, it should drop low at 8817

We are now re-short the UK100/FTSE100 again at 8838-45 ranges

We should focus on the target at 8818-8807

or possible 87-92-86

However, we ALSO add more short at 8856-65

These will be target at 8832-28

Let's kill the UK100/FTSE100 together.

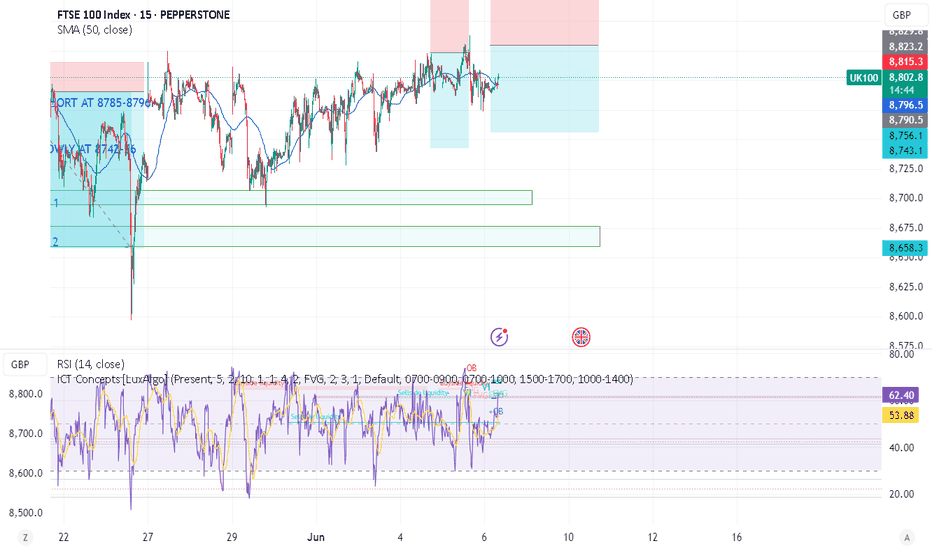

UK100G AnalysisLooking at the chart it's clear we are in a current uptrend, but we have quite a significant level just above our current position.

If we manage to break this level then I would expect a continuation to the upside and be looking for longs, If we fail to break this level then I expect that we will come back to collect some of these areas of imbalance marked on the chart. These are 1D and 4H levels that have not been mitigated fully and could provide liquidity for the next leg up.

We could still come back for some of this liquidity if we break that level but would give a much better indication of the price heading up, a failure to break could see us hit some of the recent lows again. Marked by the demand zone on the chart.

I'll be waiting to see what happens as it stands and using my usual ORB strat in my daily trades while I wait for a swing either way.

FTSE INTRADAY Bullish above support at 8760Overall trend remains bullish, supported by rising price action.

Recent Movement: Price is in a sideways consolidation phase after a strong uptrend.

Key Levels

Support:

8760 – Key level from prior consolidation.

8680, then 8640 – Next supports if 8680 breaks.

Resistance:

8830 – First upside target.

8930, then 9000 – Further resistance levels on continued strength.

Trading Scenarios

Bullish Scenario:

A pullback to 8760 followed by a bounce could lead to a move towards 8830, then higher to 8930 and 9000.

Bearish Scenario:

A confirmed break and daily close below 8760 would weaken the bullish case. In that case, expect a potential drop to 8680, then 8640.

Conclusion

The FTSE remains bullish, but a short-term pullback is possible. A bounce from 8760 would confirm trend strength. Watch 8680 closely — holding above favors bulls; a break below shifts sentiment to bearish.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

FTSE100 sideways consolidation capped at 8850Overall trend remains bullish, supported by rising price action.

Recent Movement: Price is in a sideways consolidation phase after a strong uptrend.

Key Levels

Support:

8680 – Key level from prior consolidation.

8625, then 8510 – Next supports if 8680 breaks.

Resistance:

8850 – First upside target.

8910, then 9020 – Further resistance levels on continued strength.

Trading Scenarios

Bullish Scenario:

A pullback to 8680 followed by a bounce could lead to a move towards 8850, then higher to 8910 and 9020.

Bearish Scenario:

A confirmed break and daily close below 8680 would weaken the bullish case. In that case, expect a potential drop to 8625, then 8510.

Conclusion

The FTSE remains bullish, but a short-term pullback is possible. A bounce from 8680 would confirm trend strength. Watch 8680 closely — holding above favors bulls; a break below shifts sentiment to bearish.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

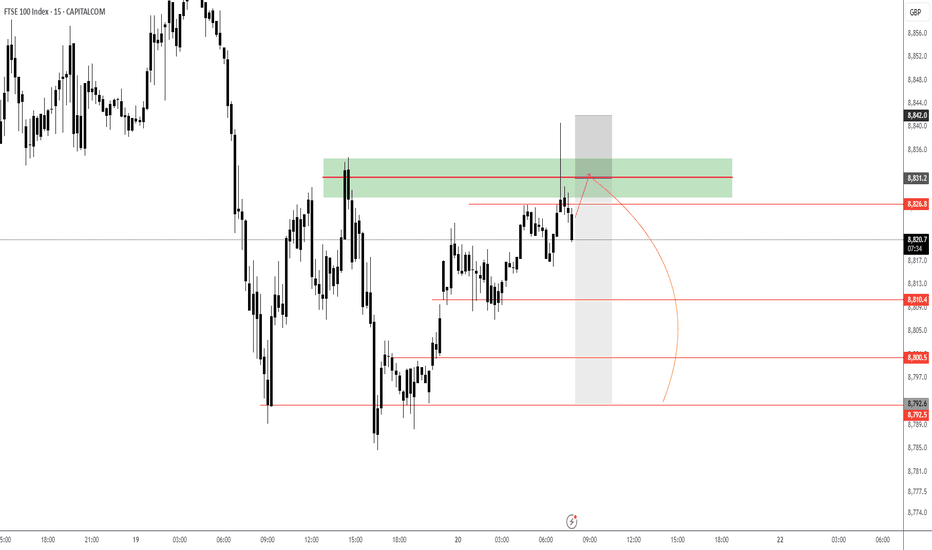

UK100/FTSE100 - FOLLOW THIS STRUCTURE, SURELY YOU MAKE PROFITTeam, last night for the first time I make LIVE trading on video.

Everyday i did LIVE trading but not recording

last night we have SHORT EURUSD, LONG USDCHF, LONG US30 LONG NAS AND SHORT GOLD - 5/5 perfectly hit target

Today I want to show you the structure how we can deal with UK100/FTSE100

SHORT UK at 8817-26 - double up at 8846-62

lets set this LIMIT ORDER IN

Target 1 at 8792-96

Target 2 at 8776-8755

Lets kill the market tonight!

UK100/FTSE100 - TIME TO MAKE MILLION ON UK100/FTSE100Team,

Time to make millions on UK100/FTSE100

short slowly at 8811-14

Double the short at 8818-35

Target at 8797-93

EASY MONEY, no stress

If you see my videos. Every day we print money, yesterday we long USDCHF, SHORT EURUSD - We hardly trade those, but when we do, we kill them. Both also closed out today.

We also shorted the UK100 yesterday, and the target hit closed today.

FTSE INTRADAY sideways consolidation continuationrend: Overall trend remains bullish, supported by rising price action.

Recent Movement: Price is in a sideways consolidation phase after a strong uptrend.

Key Levels

Support:

8680 – Key level from prior consolidation.

8625, then 8510 – Next supports if 8680 breaks.

Resistance:

8850 – First upside target.

8910, then 9020 – Further resistance levels on continued strength.

Trading Scenarios

Bullish Scenario:

A pullback to 8680 followed by a bounce could lead to a move towards 8850, then higher to 8910 and 9020.

Bearish Scenario:

A confirmed break and daily close below 8680 would weaken the bullish case. In that case, expect a potential drop to 8625, then 8510.

Conclusion

The FTSE remains bullish, but a short-term pullback is possible. A bounce from 8680 would confirm trend strength. Watch 8680 closely — holding above favors bulls; a break below shifts sentiment to bearish.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.