NDQUSD trade ideas

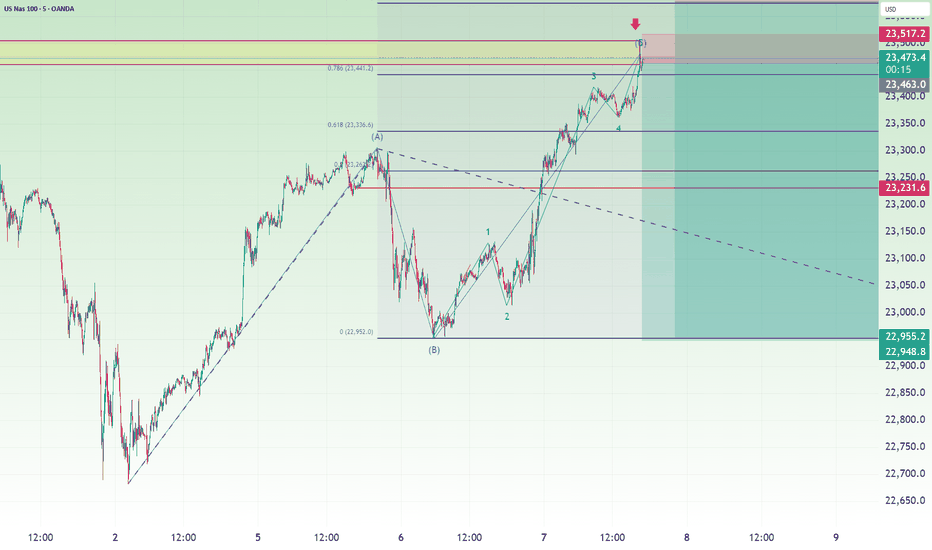

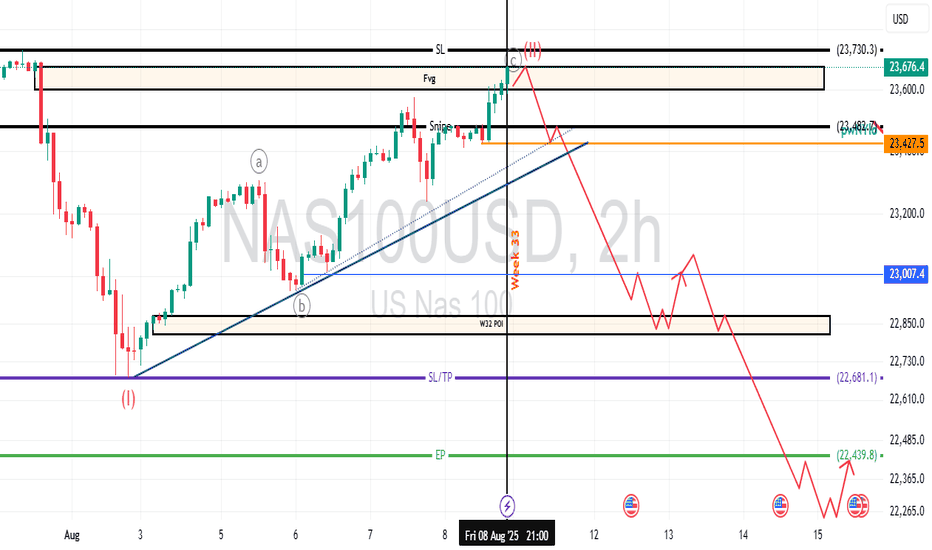

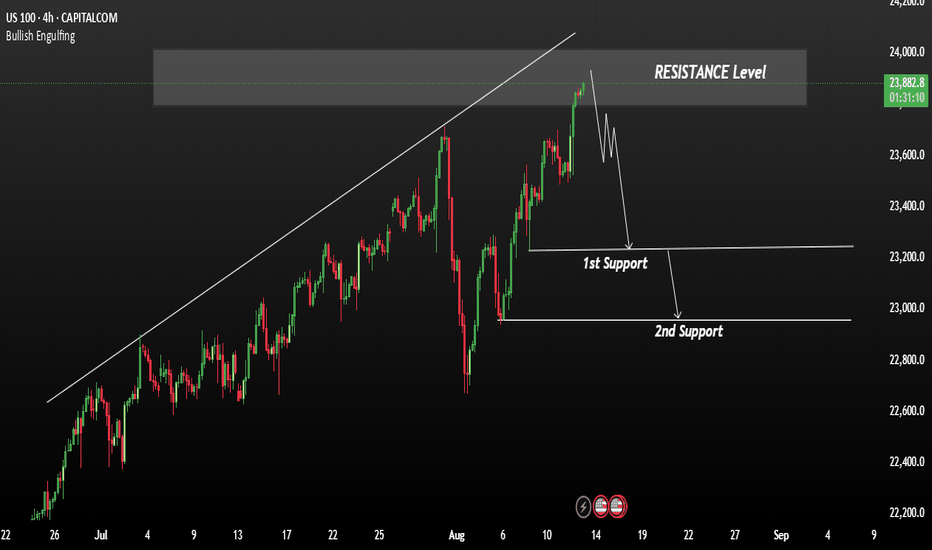

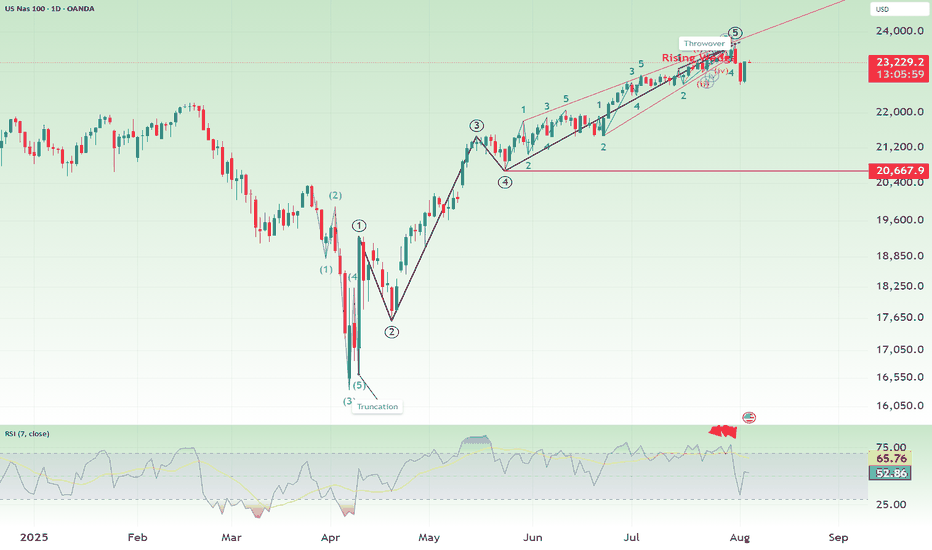

Nasdaq and S&P500 short: Update on wave counts and trade setupOver here, I update on the wave counts and explain why I think Nasdaq and S&P500 is once again, short opportunities. If you had try out my previous idea on 5th Aug, the maximum profit would be around 250 points on Nasdaq before the price reversed and went higher.

As traders, we are not so much concerned with being right but more on risk-reward and active trade and risk management. So I hope you would have taken your profit on that idea. The general macro and fundamental outlook remains the same as per previous video, which is why my recent ideas had been short ideas. In the near future, I foresee more short ideas too.

Anyway, I believe that the risk-reward is good this time for another short for Nasdaq and S&P500. Good luck!

Behold the grand NAS100 short expeditionBehold the grand NAS100 short expedition, unleashed by my top-secret pyramidal formula (concealed in golden tombs and guarded by laser-eyed sphinxes):

Pharaoh’s Pivot Points

– We superimpose recent NAS100 peaks onto the Great Pyramid’s four secret chambers. When price breaches the “Upper Antechamber Zone” near 23,300, the ibis-headed guardian squawks—our signal to draw the short sword.

Oracular Sphinx Sentiment

– We feed Fed minutes hieroglyphs and mega-cap earnings scrolls into the Sphinx’s riddle engine. If the answer murmurs “overheating” or “tech fatigue,” it confirms our bearish quest.

Ra’s Wall-Street Candle Filter

– Only candles closing between 09:30–16:00 ET count as true “New York sun-blessed bars.” Any rogue moves in the witching hour? Mirage dust—ignored.

Anubis’ Volume Veil

– Volume spikes are weighed in pharaoh-ounces of pure gold. When daily turnover eclipses 30,000 pharaoh-ounces, the Underworld Flush ritual begins—time to tighten our longs… er, shorts.

Tomb-Run Trend Confirmation

– Trendlines aren’t drawn from ordinary swing highs; we connect the three sacred glyph-points carved into the sarcophagus walls. Once that “Tomb-Run Downtrend” appears, we descend into the dark.

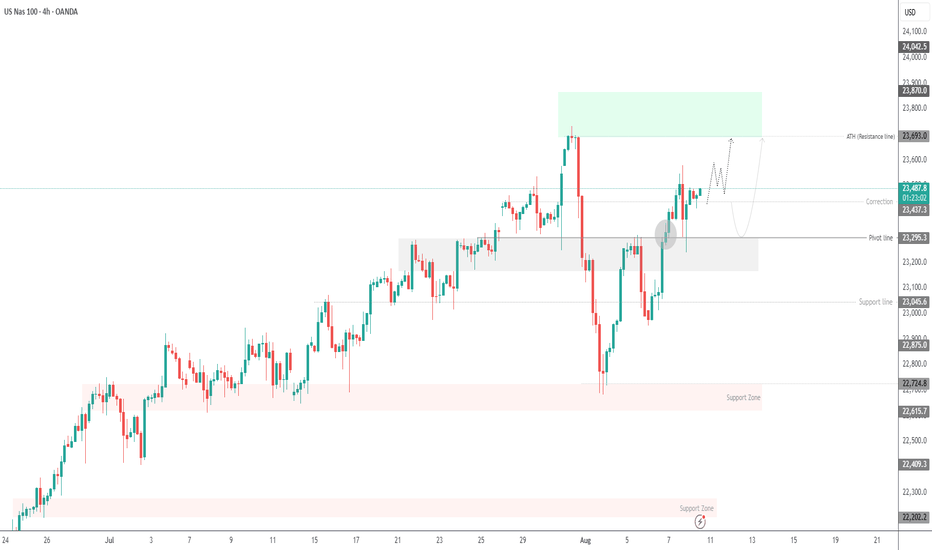

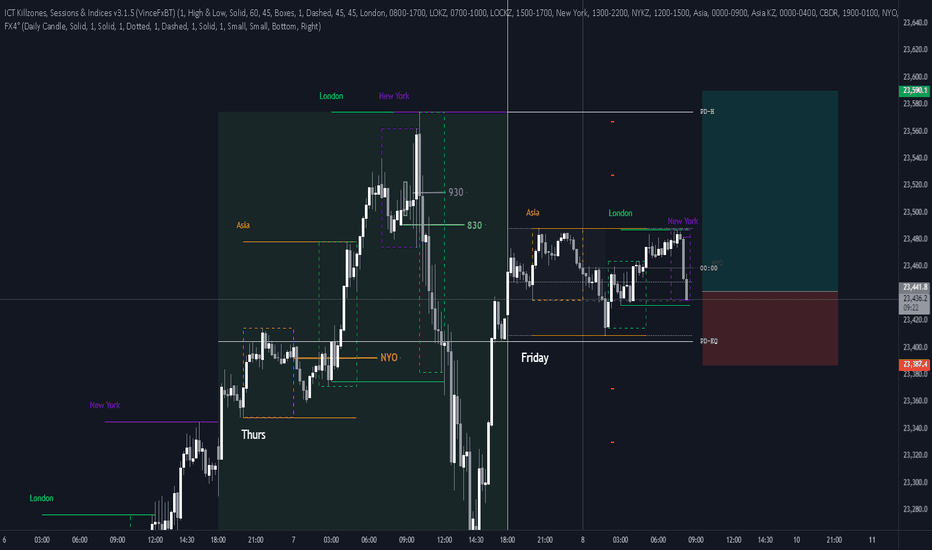

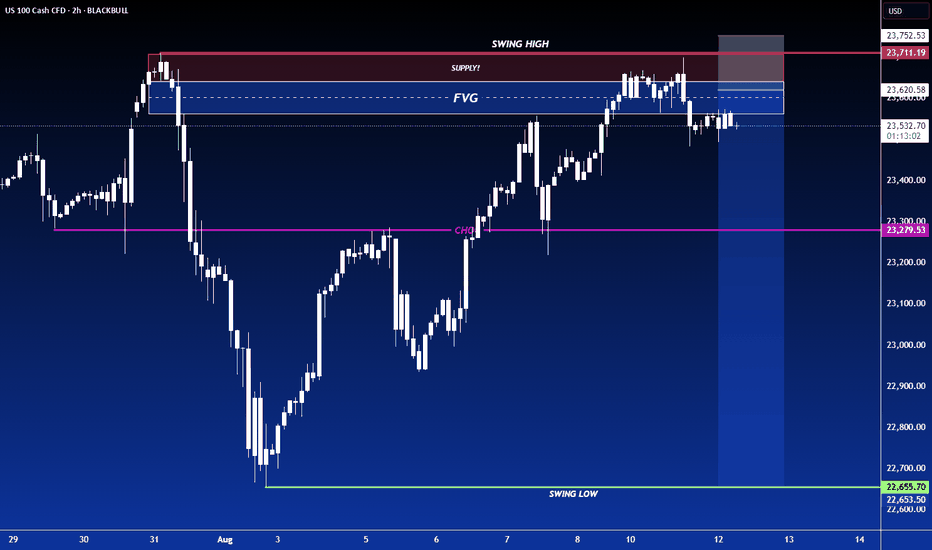

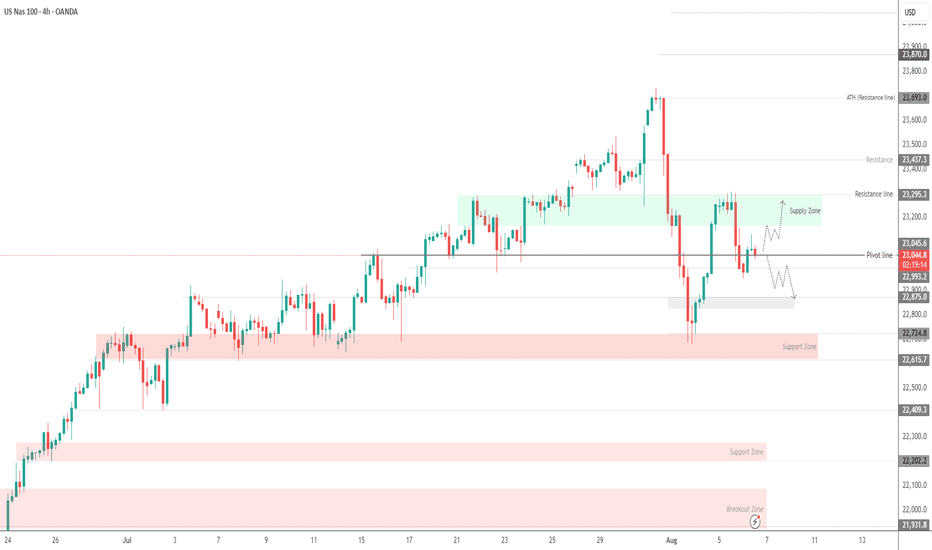

USNAS100 Volatile – Key Level at 23440 in FocusUSNAS100 – Market Overview

The indices market remains highly volatile following the latest developments regarding the Federal Reserve Chairman.

The situation remains tense, with the possibility of one rate cut this year still on the table.

Technical Outlook

Bullish Scenario:

Stability above 23440 will keep bullish momentum intact, targeting the All-Time High (ATH) at 23690, with further potential toward 23870.

Bearish Scenario:

A 1H close below 23430 would shift the bias to bearish, targeting 23295, and possibly lower.

Resistance: 23570 – 23690 – 23870

Support: 23295 – 23180 – 23045

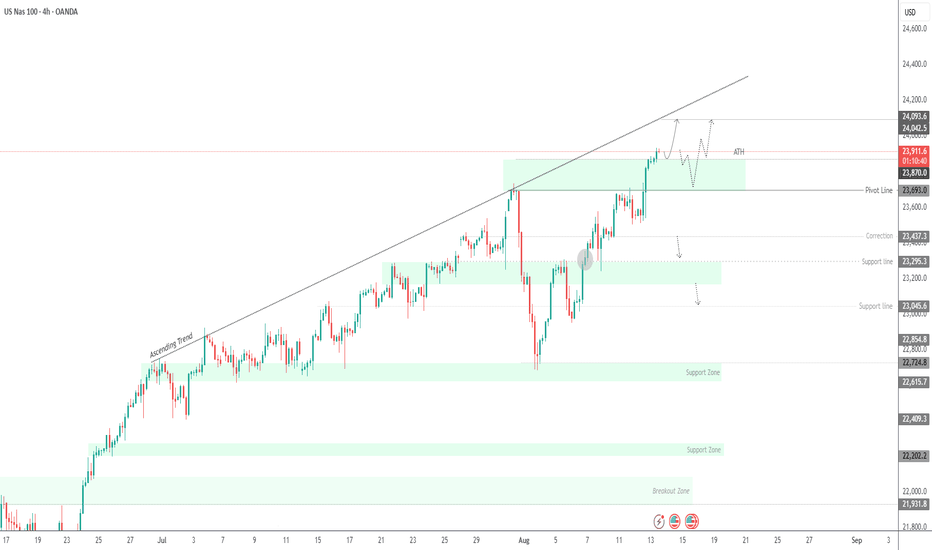

USNAS100 | Holding Above ATH – Key Pivot at 23870USNAS100 at Record Highs on Fed Rate Cut Hopes

Nasdaq indexes held at record highs on Wednesday, supported by growing confidence that the Federal Reserve could restart its monetary policy easing cycle next month.

Technical Outlook:

The price has stabilized in a bullish trend after breaking its all-time high, with a 4H candle closing above it on strong volume.

As long as it trades above 23870, the bullish trend remains intact toward 24090.

To turn bearish, the price would need to close at least 1H below 23870, targeting 23690.

Resistance: 24090, 24190

Support: 23690, 23430

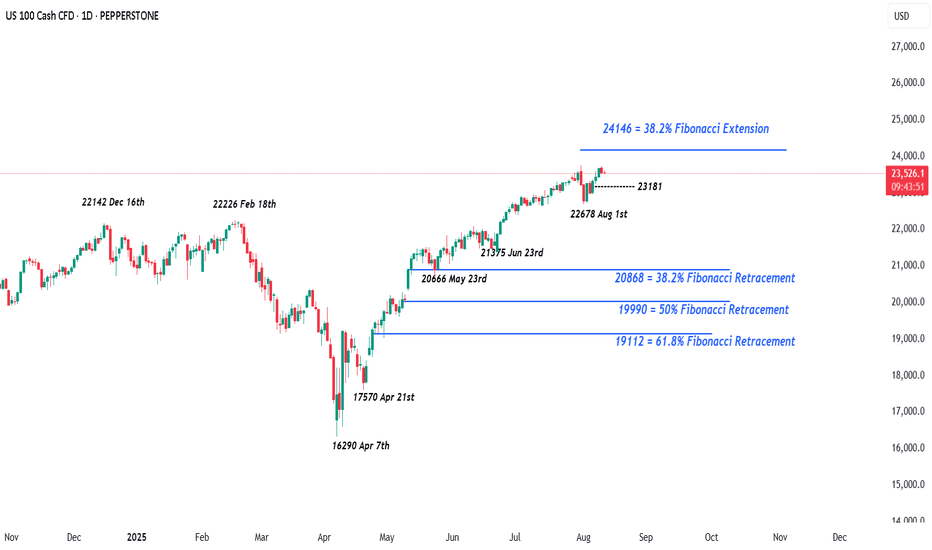

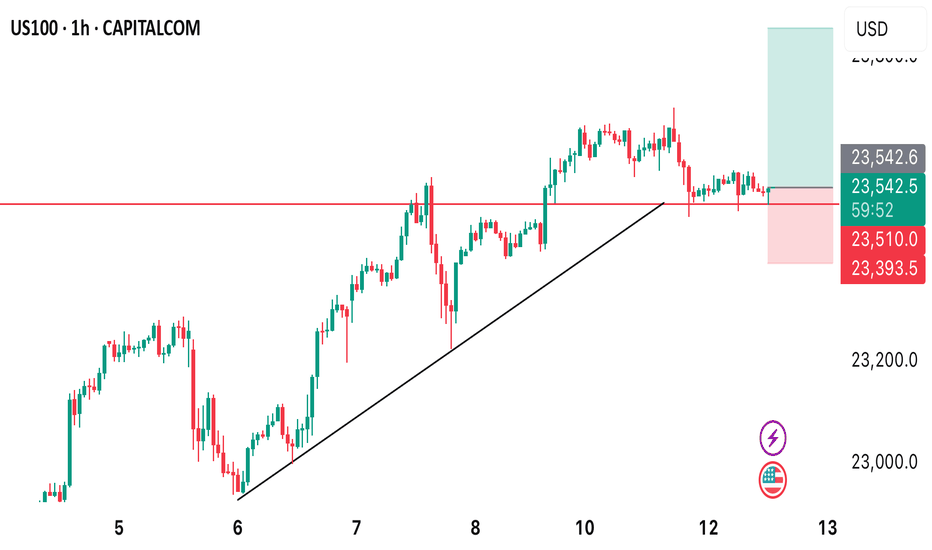

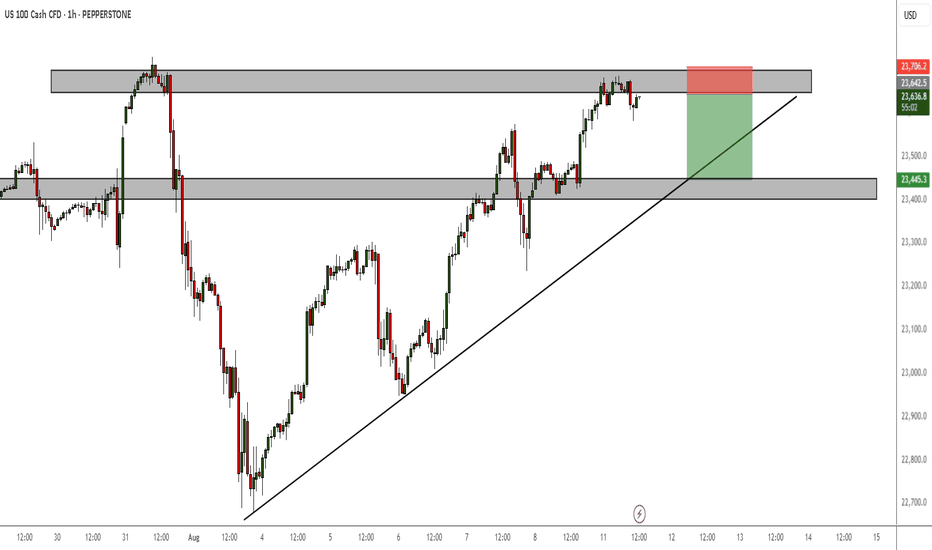

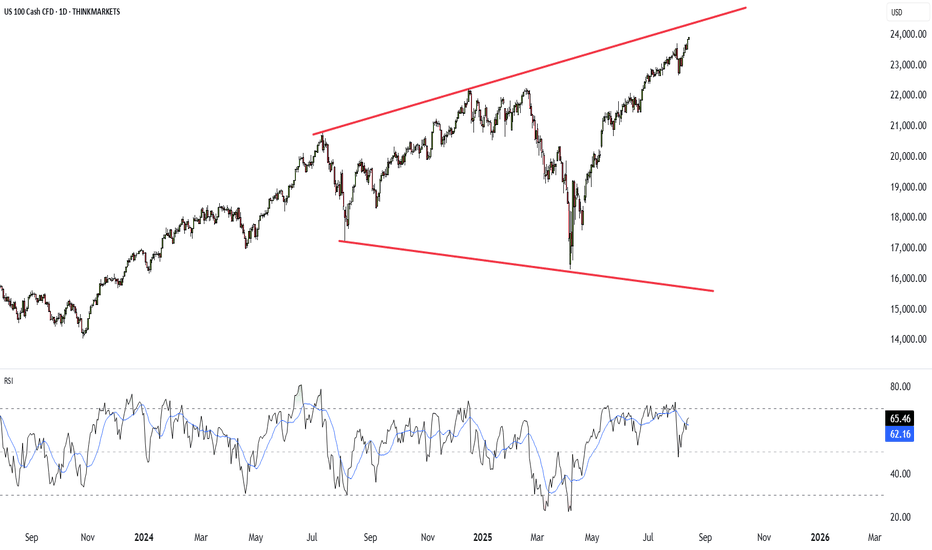

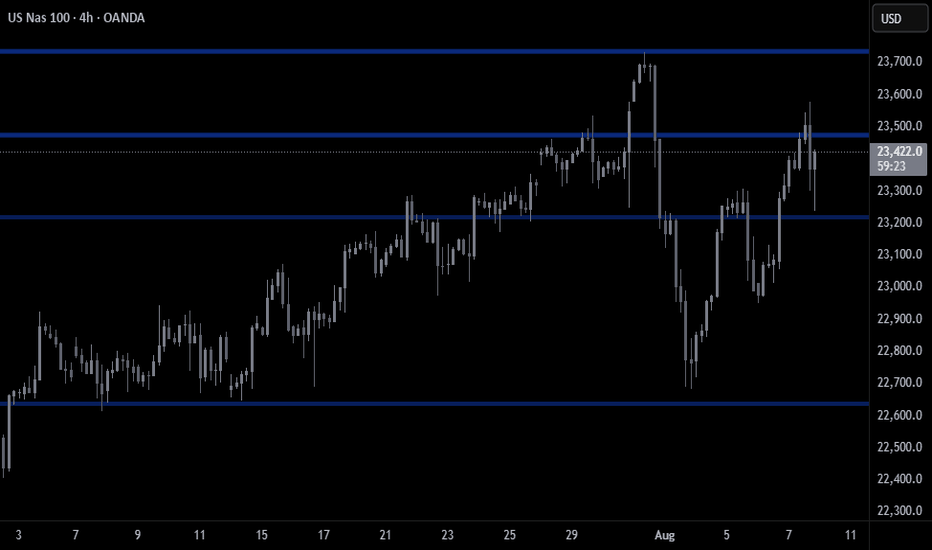

US 100 – US CPI in Focus, Could this Be Moving Day? Technology stocks in the US 100 have been leading the resurgence of US assets back up from their April lows for a while now, driven higher by fresh demand for magnificent 7 stocks, artificial intelligence capital expenditure and increased expectations for Federal Reserve (Fed) interest rate cuts, which its hoped by traders will restart again when the Fed have their next rate decision meeting on September 17th.

Dips in the US 100 have remained shallow, with the latest blip lower, caused by a weaker than expected US Non-farm payrolls report, causing a sell off from the record high set on July 31st at 23730 down to a low at 22678 (Payrolls Friday August 1st) before the uptrend resumed again, setting a new record closing high at 23660 on Friday since when prices have consolidated so far this week between 23500 and 23716.

Today could potentially be moving day for US 100 stocks with the latest US CPI release due at 1330 BST. Traders are very sensitive to US inflation updates right now as they await the effects of President Trump’s trade tariffs to feed through into higher consumer prices. US corporates initially absorbed the higher tariff costs which has helped to shield US consumers but there has been signs that this trend may be starting to change.

Any deviation in today’s US CPI release from market expectations may alter the current pricing for Fed rate cuts across the next 6 months, which could have an outsized impact on US 100 volatility across the remainder of this week.

Technical Update: Is the Trend Still Your Friend?

When an asset gains fresh buying support and approaches a previous all-time price high, it can be a very important period for both price action and traders. It can lead to the question being asked.

Will buying pressure be strong enough to break above this important resistance and extend the bullish trend, or will sellers re-emerge at the all-time high, triggering a potential reversal in price?

This appears to be the backdrop unfolding for the US 100 index, and as the chart above shows, having seen price weakness briefly post the August 1st low at 22678, the latest price strength since that dip is currently testing 23730 again, the all-time high registered on July 31st.

This 23730 resistance level could be an important focus for traders this week, as successful closing breaks above the all-time high are required to suggest potential for a more sustained phase of price strength, while failure to close above this 23730 resistance level, may lead to increased possibilities for deeper declines in price.

Potential Upside If a Closing Break Develops Above 23730:

If, and it could still be argued it is a big ‘if’, a successful closing break develops above 23730, it could open potential for further price strength towards the next resistance at 24146, which is equal to the 38.2% Fibonacci extension of the July 31st to August 1st price weakness, may be even further.

Potential downside If the Resistance at 23730 Holds:

It is equally possible, the resistance at 23730 can cap the current strength, even prompt fresh selling pressure to turn price activity lower for a phase of weakness.

While 23730 continues to limit current price strength, the focus may shift to possible support at 23181, which is equal to half the August price strength. Closing breaks below 23181 could potentially be a catalyst for further declines to test 22678, the August 1st low, and even lower if this level in turn gives way.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

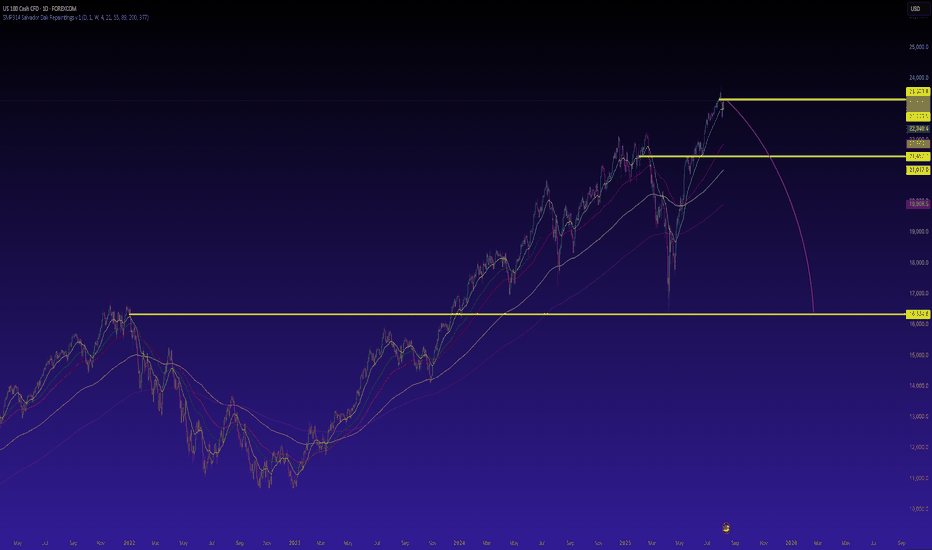

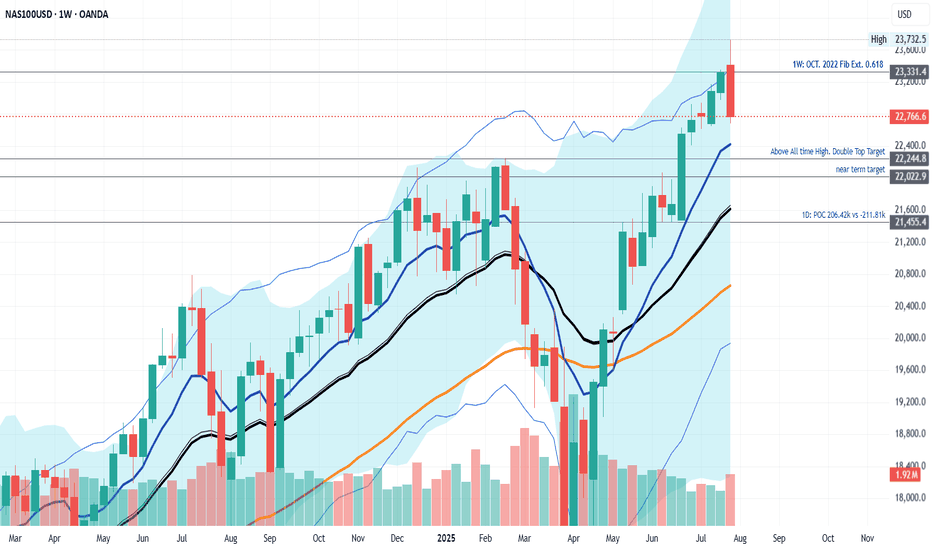

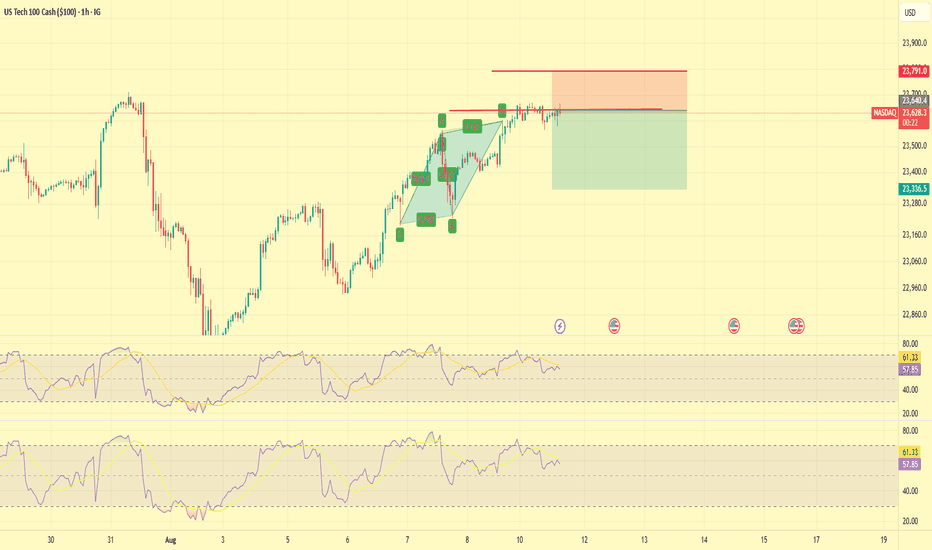

NAS100 Reversal Confirmed: Is the Rally Over?The NASDAQ 100 (NAS100) may have just hit its ceiling. In this video, I break down the technical evidence pointing to a confirmed reversal—including key candlestick formations and indicator signals that suggest the recent rally is losing steam.

The bearish engulfing candle on both the daily and weekly, along the monthly RSI divergence is signaling a deeper correction. Our initial target for this week is the previous high with a bounce for a much deeper correction which will be analyzed next week so stay tuned to all my updates and new publications. Thank you and have a great trading week. Cheers!!

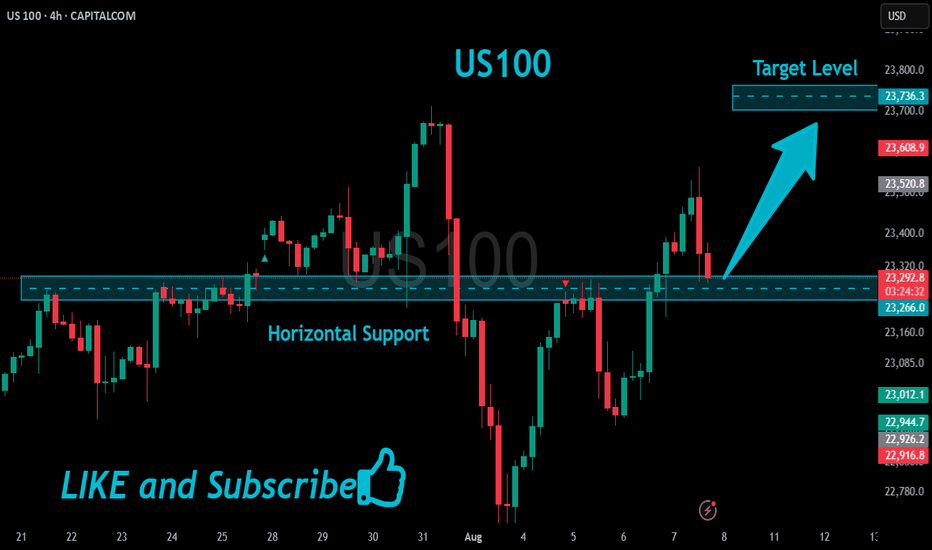

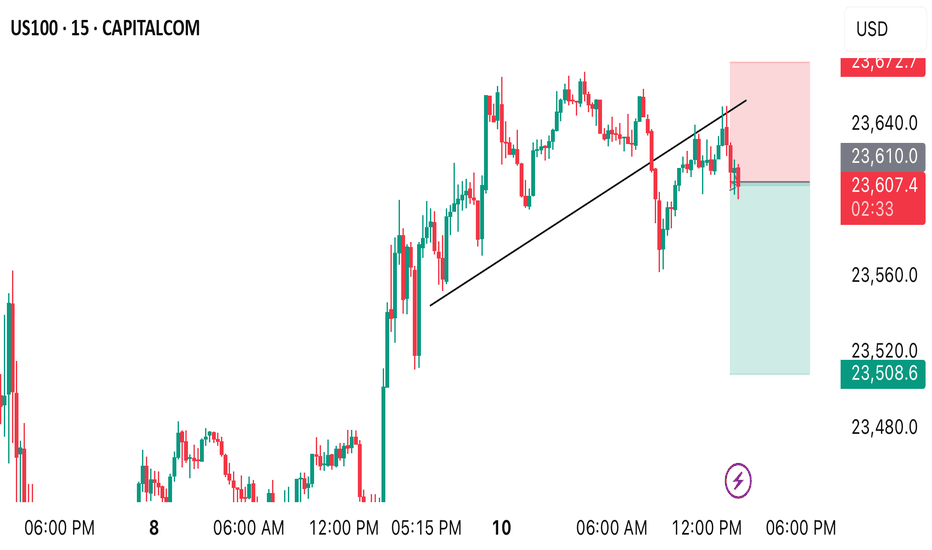

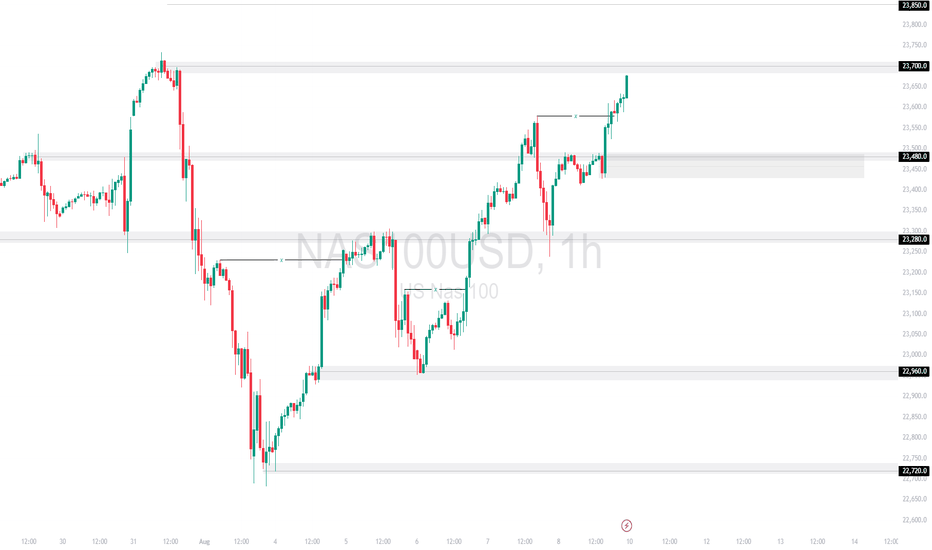

NAS100 – Eyeing 23,700.0 ResistanceNAS100 continues its bullish momentum, breaking above the 23,480.0 zone after a strong rally. Price is now approaching the 23,700.0 resistance, with short-term support building near 23,480.0. A retest of support before another push higher remains likely.

Support at: 23,480.0 🔽 | 23,280.0 | 22,960.0 | 22,720.0

Resistance at: 23,700.0 🔼 | 23,850.0

🔎 Bias:

🔼 Bullish: Holding above 23,480.0 and breaking 23,700.0 could extend gains toward 23,850.0.

🔽 Bearish: Failure to hold 23,480.0 may lead to a deeper pullback toward 23,280.0.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

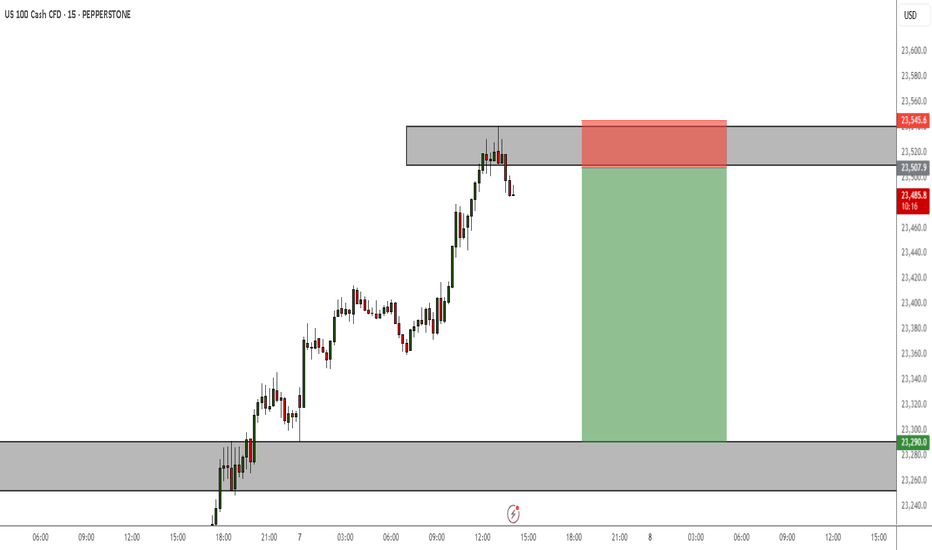

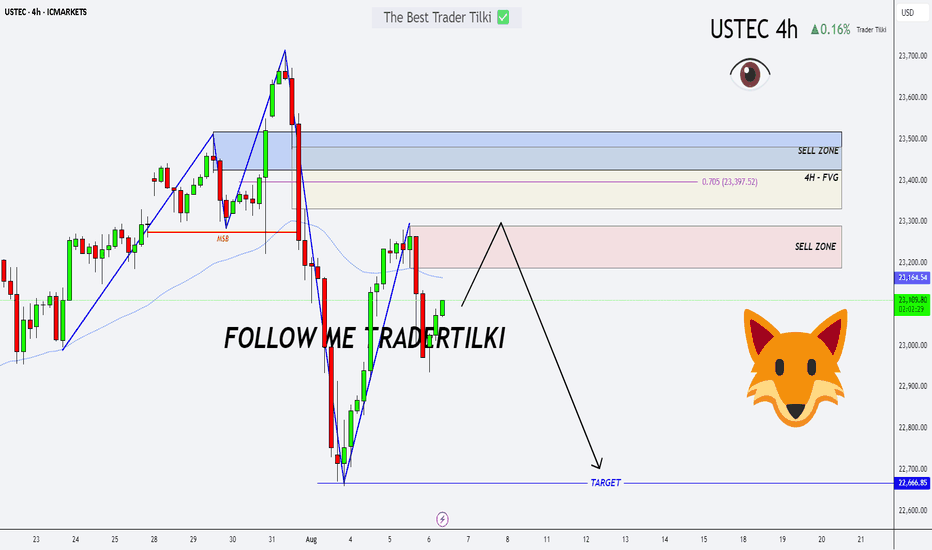

Double Trap on USTEC: Sell Zones Locked In!Hey Guys,

I’ve prepared a NASDAQ 100 / USTEC 100 analysis for you. I’m planning to open sell positions from two key levels:

🔹 First entry: 23,290 or 23,164

🔹 Second entry: 23,397 – 23,450

🎯 Target levels:

TP1: 22,800

TP2: 22,666

Every single like from you is my biggest source of motivation to keep sharing these analyses. Huge thanks to everyone who supports with a like! 🙏

NASDAQ at Record Highs after US CPI report, but can it last?In today’s video, we break down the major market moves triggered by the July US CPI report. Headline CPI rose 0.2% month-over-month—right in line with expectations and a slowdown from the previous month. Year-over-year, headline inflation came in at 2.7%, just under the 2.8% forecast, while Core CPI rose 0.3% MoM (matching forecasts) but was a bit hotter at 3.1% YoY (vs. 3.0% expected).

These “not as bad as feared” inflation numbers kept hopes alive for a September Fed rate cut, pushing the odds of a cut to 96%. Markets responded strongly: the NASDAQ 100 closed at a record high, just shy of the 24K handle, with broad gains in tech and communication stocks, as traders bet on a more dovish Fed.

We also cover the technical setup for the NASDAQ 100 and key risk factors heading into the second part of August.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

US100 A Waiting Reject from resistanceThe market is currently watching for a rejection from the top resistance zone. Sentiment improved after the US and China extended their tariff truce until November 10, avoiding triple-digit duties on each other’s goods.

2.8% or higher reading likely supports a bearish move toward 23,250 and then 23,950mBelow 2.8% reading → could fuel bullish momentum toward a new ATH at 23,900.

You may find more details in the chart.

Trade wisely best of Luck Buddies.

Ps; Support wit like and comments for better analysis Thanks.

USNAS100Preferably suitable for scalping and accurate as long as you watch carefully the price action with the drawn areas.

With your likes and comments, you give me enough energy to provide the best analysis on an ongoing basis.

And if you needed any analysis that was not on the page, you can ask me with a comment or a personal message.

Enjoy Trading ;)

Market Gains on Fed Optimism – Will 23440 Be Reached?Wall Street Edges Up Amid Fed Rate Cut Optimism; Earnings in Focus

U.S. stock indices rose on Wednesday, supported by growing expectations of Federal Reserve rate cuts later this year. Investors are also closely monitoring a fresh wave of corporate earnings, which continues to influence sentiment.

Technical Outlook

The price is currently holding above the key pivot level at 23045.

As long as it remains above this level, bullish momentum is expected to continue toward 23180 and 23295.

A confirmed breakout above 23295 would likely extend the rally toward 23440.

⚠️ On the other hand, a 1H close below 23045 would shift momentum to bearish, targeting 22870 and possibly 22725.

🔹 Resistance Levels: 23180, 23295, 23440

🔹 Support Levels: 22870, 22725

Nasdaq and S&P500 Short: A multi-factor analysisIn this long video, I go through why I think the equity markets are going to crash in August.

Here are the important points:

1. I talk about the stealth liquidity which is the reverse repo balance being drawn down and almost emptied.

2. The risk-off asset classes rising: Gold, Japanese Yen.

3. The risk-on asset classes falling: Nasdaq, Bitcoin, Ethereum.

Here's my outlook for the markets from now till September FOMC:

1. The equity markets, USDJPY, Bitcoin, and Ethereum will crash.

2. 3-month treasury yield will fall below 4.25% and even below 4%.

3. Fed will cut target rates to be within the 3-month treasury yield.

As usual, good luck in your trading and keep your risks tight!