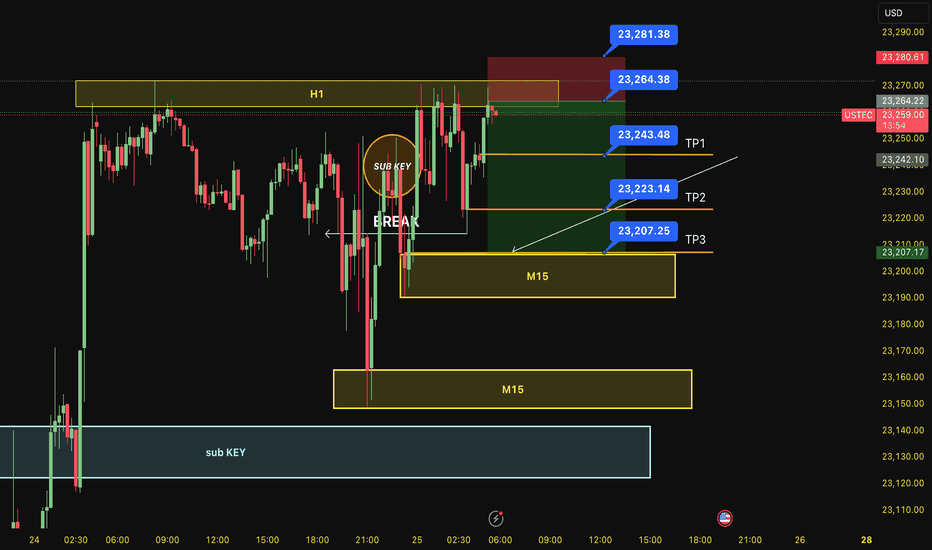

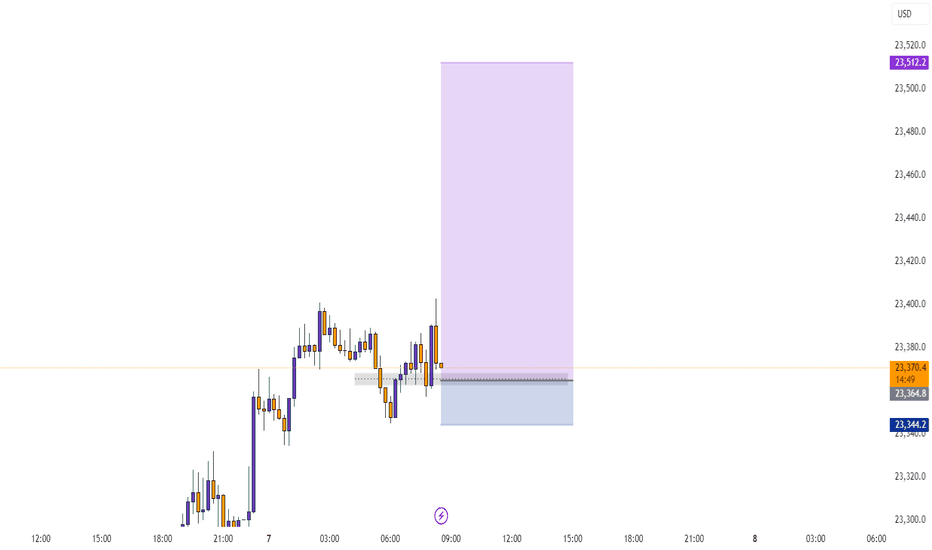

SELL USTEC 25.7.2025Reversal trade order: SELL at H1~M15 (all-time high - ATH)

Type of entry: Limit order

Reason:

- The price breakout the sub key of M15, confirming it will hit the main key M15.

- There is a key H1 support at the entry point.

Note:

- Management of money carefully at the price of bottom of M15 (23,343)

Set up entry:

- Entry sell at 23,264

- SL at 23,281

- TP1: 23,243

- TP2: 23,223

- TP3: 23,207

Trading Method: Price action (No indicator, only trend and candles)

NQCUSD trade ideas

USNAS100Preferably suitable for scalping and accurate as long as you watch carefully the price action with the drawn areas.

With your likes and comments, you give me enough energy to provide the best analysis on an ongoing basis.

And if you needed any analysis that was not on the page, you can ask me with a comment or a personal message.

Enjoy Trading ;)

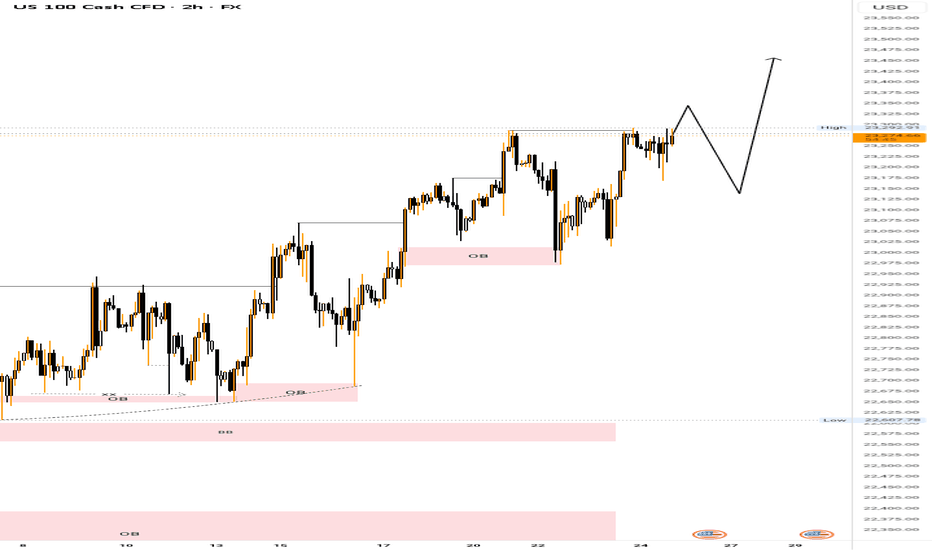

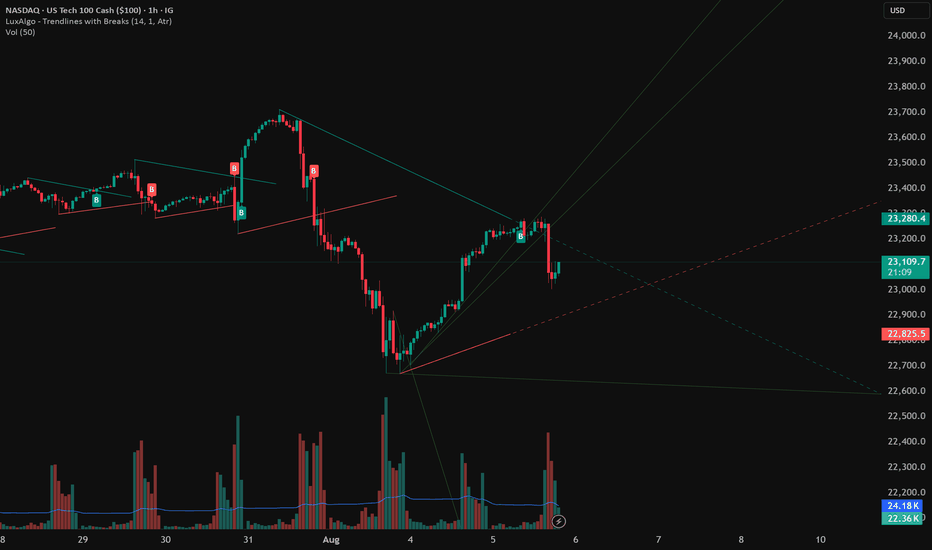

Nasdaq bull flag forming with a sweet entry.I think we've got a bull flag forming on the hourly on the NASDAQ. I think we need to take out this wick. And I think we come down and take out these stops just above where the red box is. And I think that's a pretty sweet entry before we go to new all-time highs. Um, let's see what happens. Hope you guys can follow.

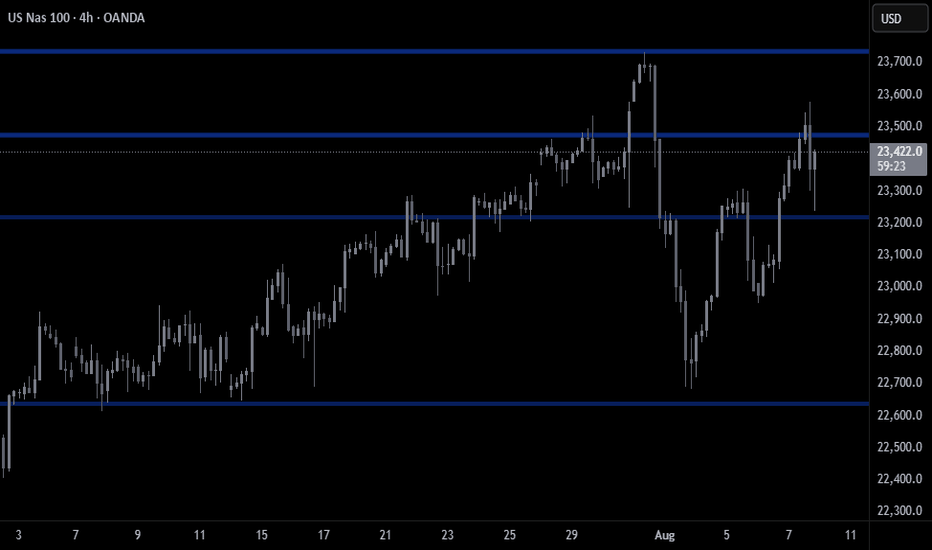

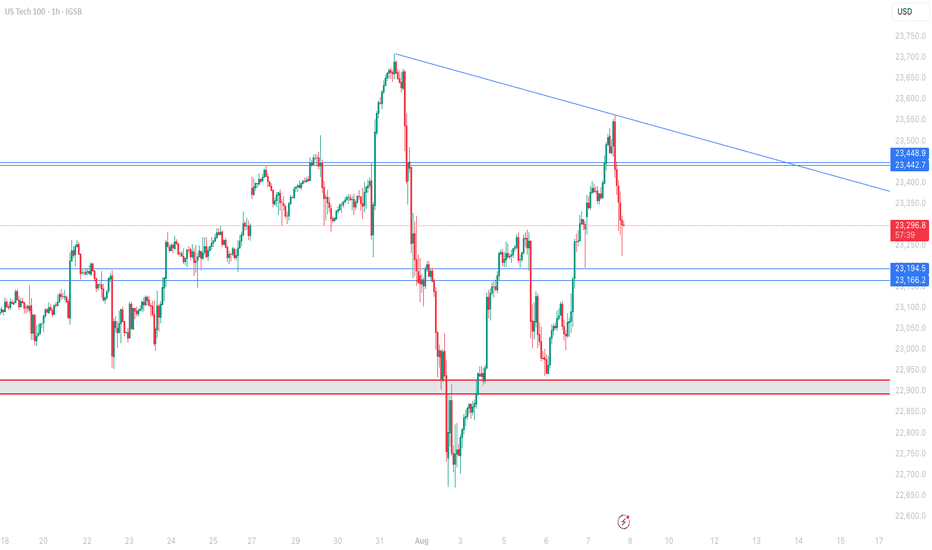

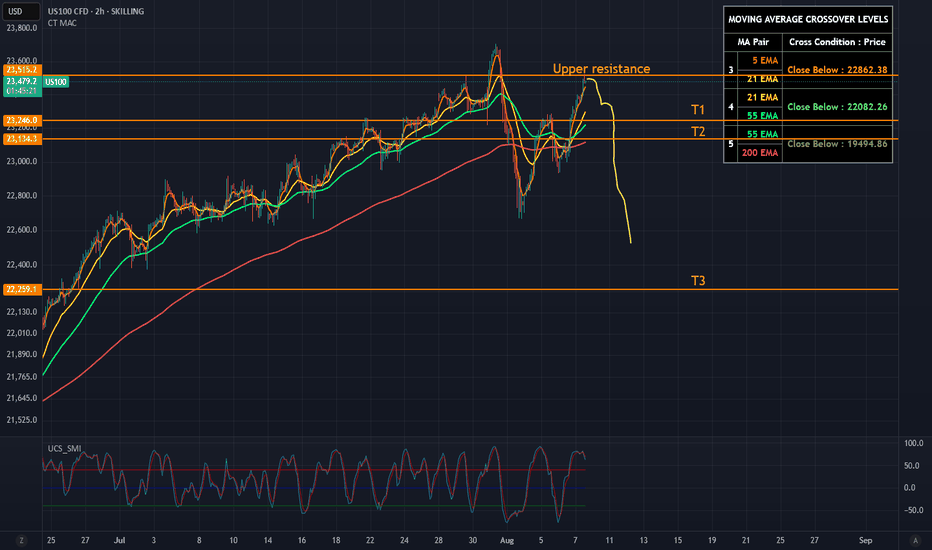

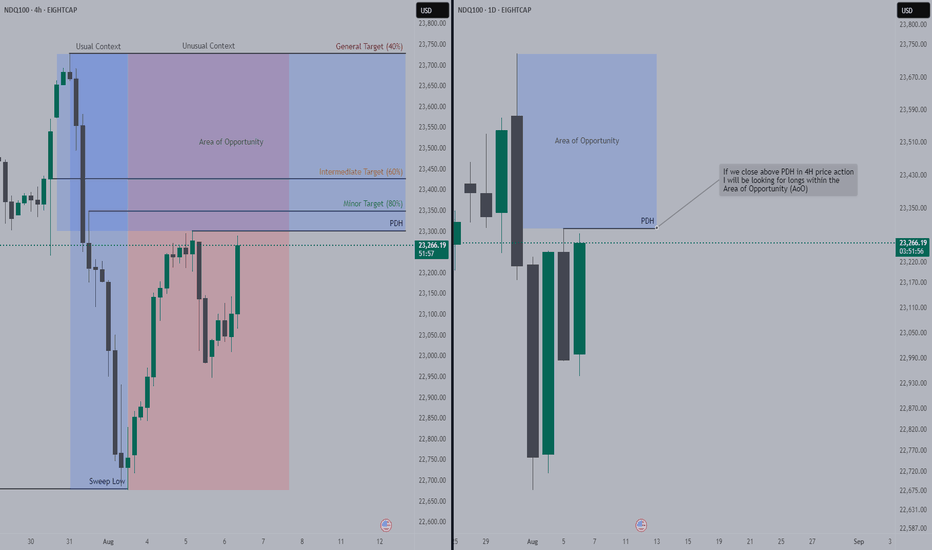

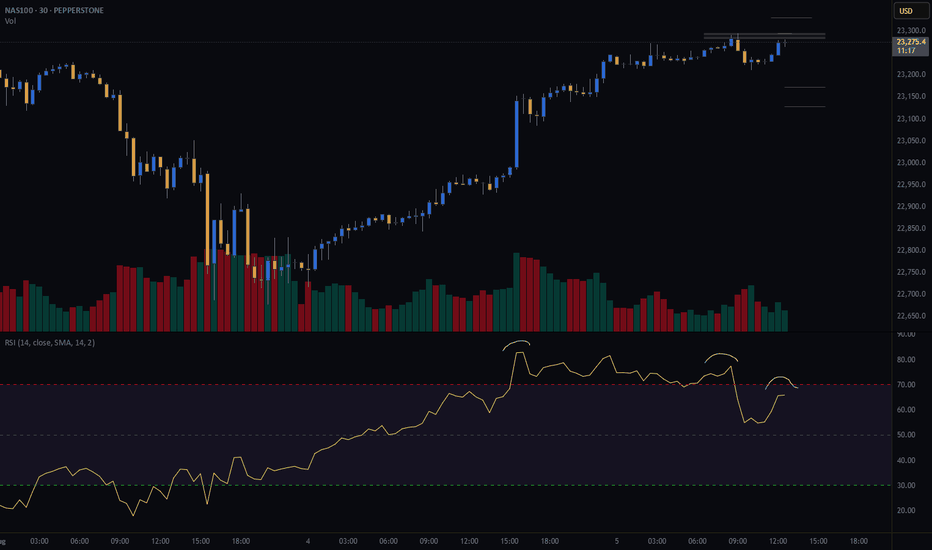

US100: Near All Time Highs, Weak FoundationThe Nasdaq 100 (US100) is hovering near all-time highs (~23,500), but signs of exhaustion are mounting. Momentum is fading, RSI is overstretched, and volume has been declining - all classic symptoms of a tired rally.

From a technical perspective, the index is pressing against upper trendline resistance after an aggressive multi-week run. Price action shows weakening follow-through on each new high, hinting at buyer fatigue. Best example was the huge sell-out last week.

Fundamentally, the rally is losing its foundation:

- Earnings surprises from Big Tech (Apple, Shopify) are already priced in.

- AI hype is cooling off, and valuation multiples remain extreme.

- Macro data (ISM Services, jobs) suggest economic softness.

- Fed rate cut hopes are baked in — any disappointment could trigger a sharp repricing.

Conclusion for me:

The Nasdaq looks ripe for a pullback.

We may possibly see a short spike above my drawn "upper resistance line" but I'm pretty convinced we won't see new ATH, - in my opinion it would be just a stop hunt.

If 23,000 then breaks, watch for acceleration toward 22,500 and beyond. The air is thin up here.

T1: 23250

T2: 23100

And if we get the break - I see T3 - 22250

One unpredictable variable, though? The world’s leaders.

Their "creative" decision-making has the power to nuke any technical setup.

Markets may follow charts and earnings - until a politician wakes up and chooses chaos.

No trading advice, just my ideas. :)

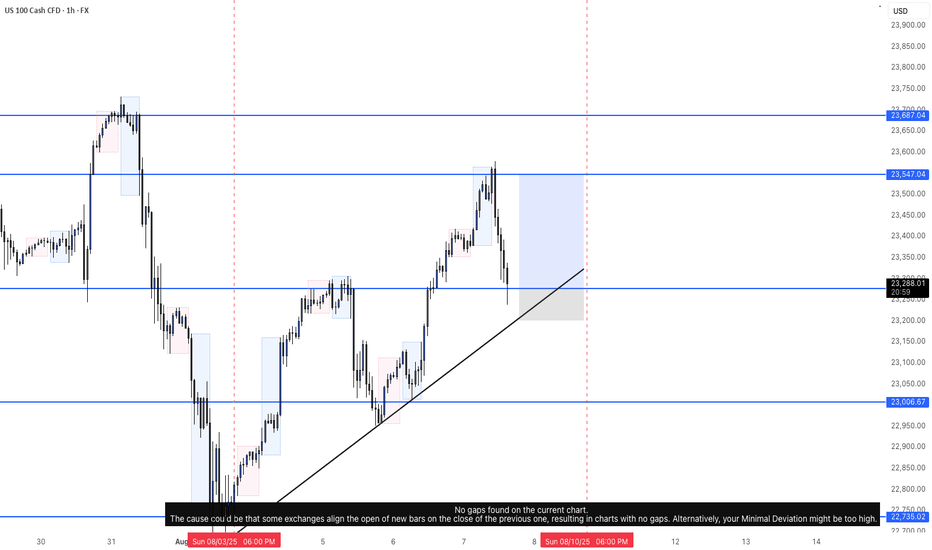

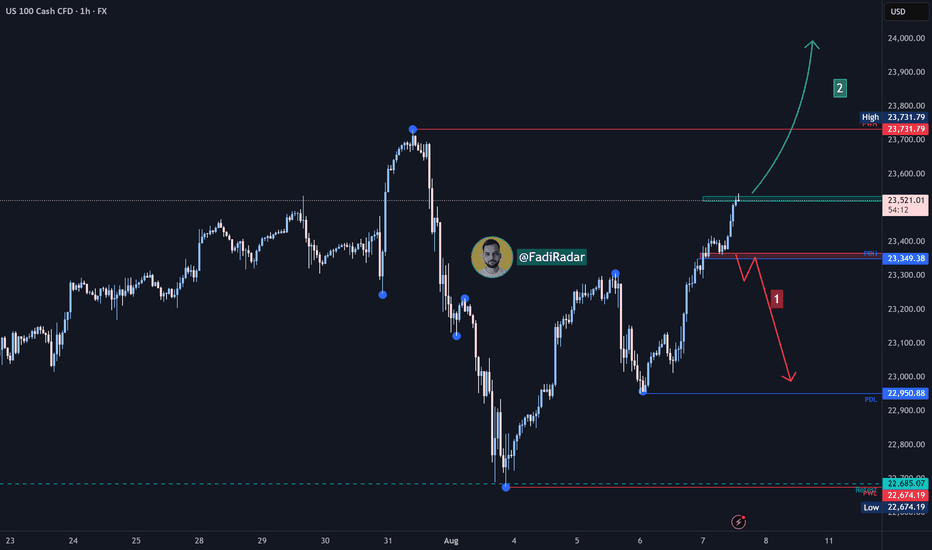

NASDAQ Index (US100 / NASDAQ) Analysis:The NASDAQ index has shown strong bullish momentum recently and is currently trading near a key resistance level at 23,530.

🔻 Bearish Scenario:

If the price fails to break above 23,530 and selling pressure begins to appear, we may see a downside correction toward 23,350. A break below this level could extend the decline toward 23,000.

🔺 Bullish Scenario:

If the price successfully breaks and holds above 23,530, it could support a continued move upward toward 23,730 as the first target. With sustained momentum, we might see a further push toward 24,000.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.

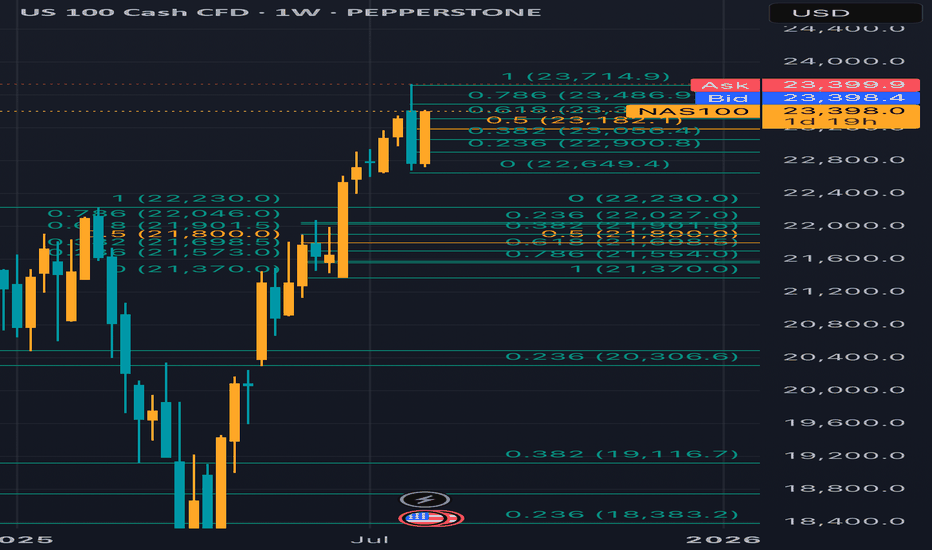

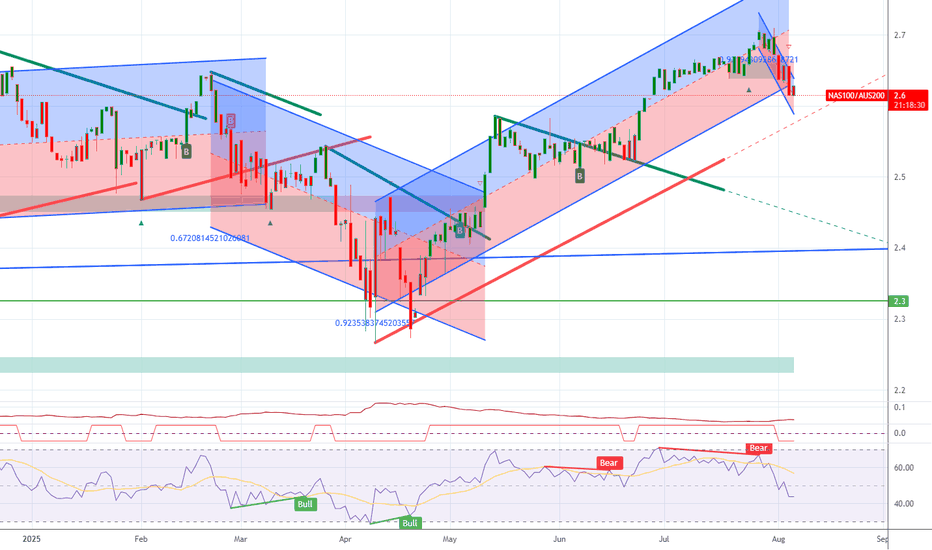

Nasdaq Eyes Record Highs Once AginNasdaq faces pressure as it trades below the trendline connecting the consecutive higher lows from April 2025. However, the latest decline rebounded from strong support at 22,700. Price action has reclaimed the 23,000 and 23,400 levels, suggesting a potential shift in tone.

A clean close above 23,500 is likely needed to push the index toward new highs above 23,700. From there, price may either pull back or continue an extended rally toward 24,000 and 24,400.

On the downside, if price falls back below 22,700, the risk increases for a move toward the previous key peaks from 2025 near 22,400 and 22,200.

- Written by Razan Hilal, CMT

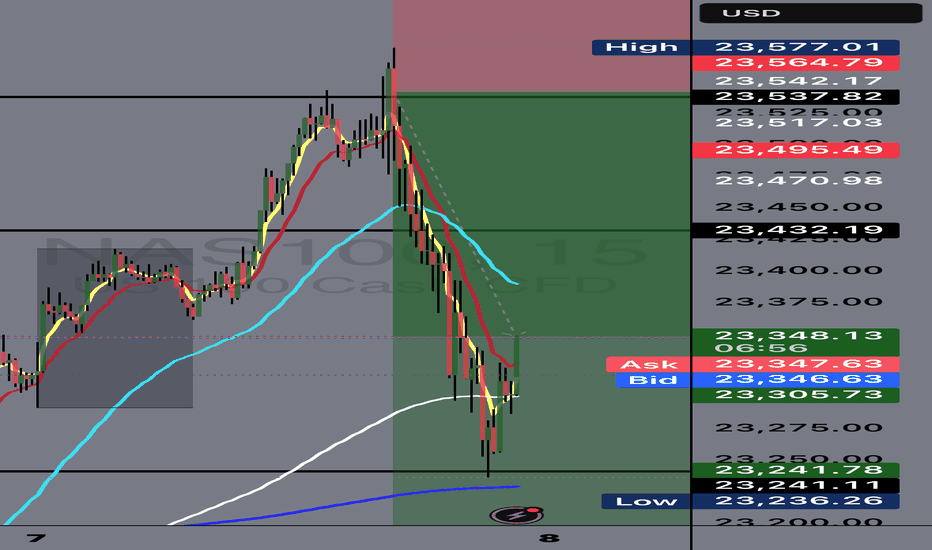

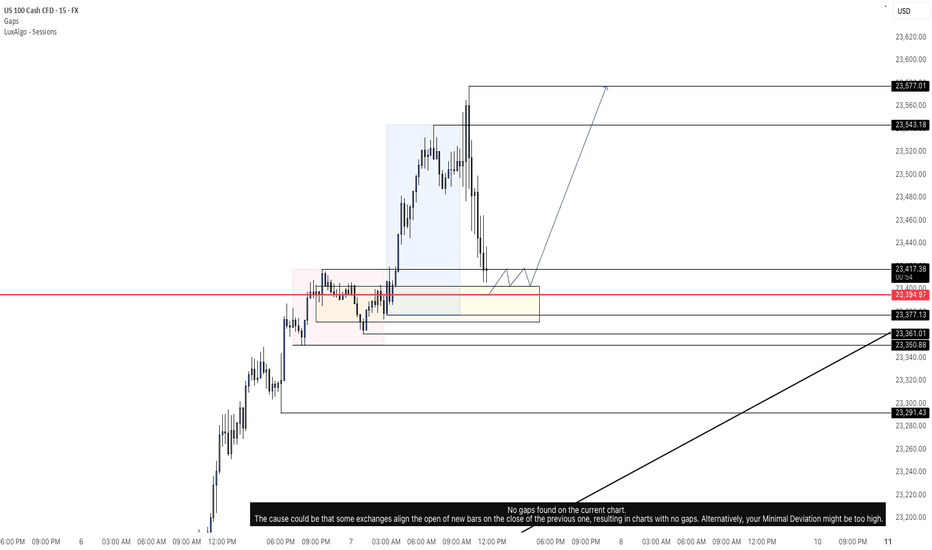

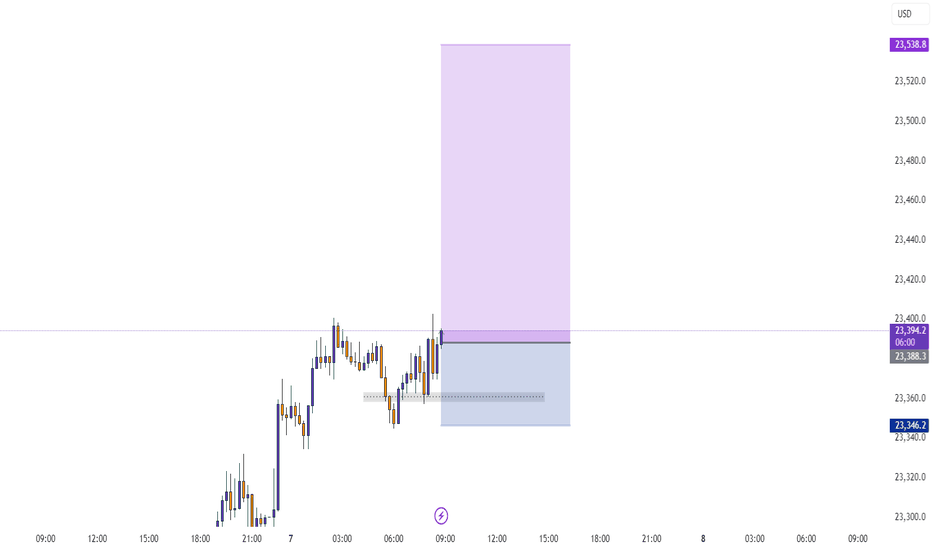

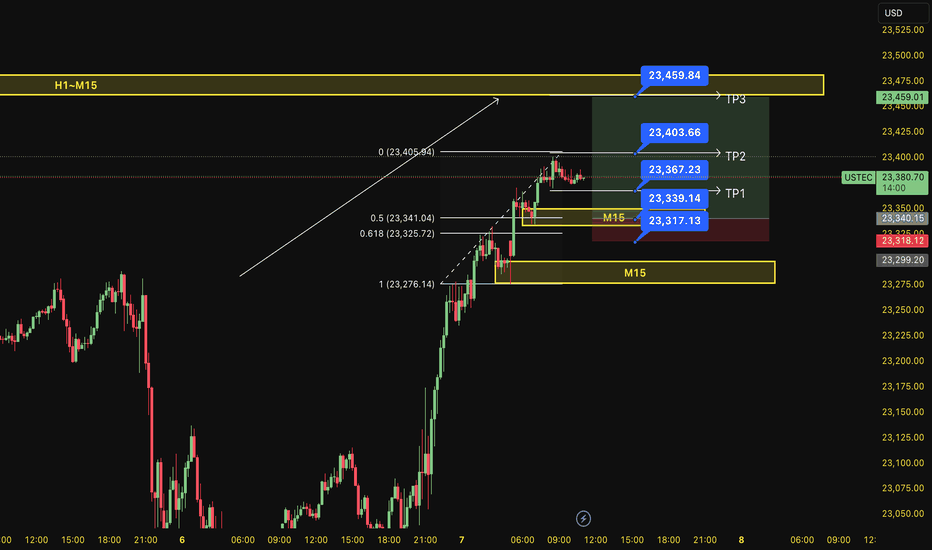

BUY USTEC 7.8.2025Confluence order: BUY at M15

Type of order: Limit order

Reason:

- The current top is not touching anything, expected to rise to the sub-key of H1~M15 above.

- M15~FIBO 0,5-0,618 (same position)

Note:

- Management of money carefully at the last bottom (23,,367)

Set up entry:

- Entry buy at 23,339

- SL at 23,317

- TP1: 23,367 (~1R)

- TP2: 23,403 (~3R)

- TP3: 23,459 (~5R)

Trading Method: Price action (No indicator, only trend and candles)

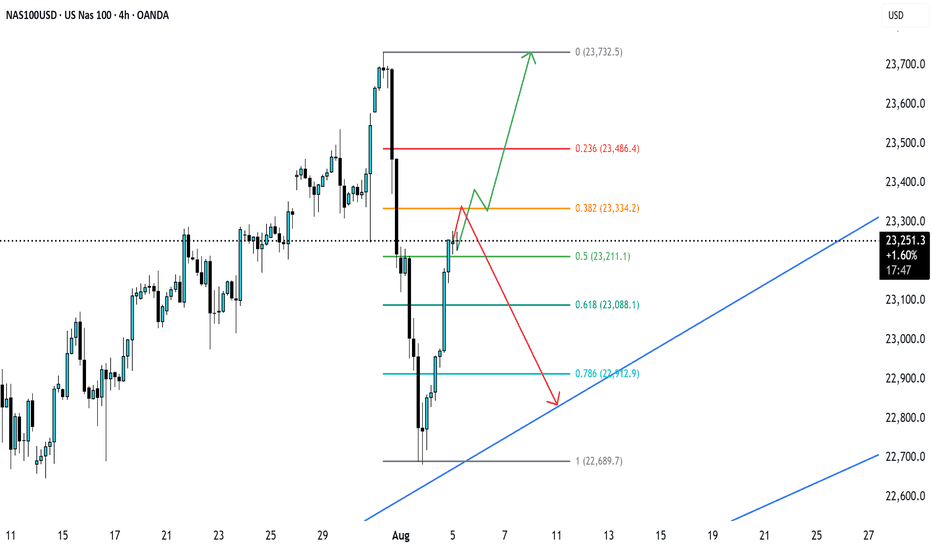

Aug 6th corrective phase, bullish trade setup The Nasdaq 100 is a tech-heavy index, highly sensitive to macroeconomic factors like interest rates, tech earnings, and market sentiment. On August 6, 2025, the market is likely influenced by:

• Monetary Policy: Recent Federal Reserve actions (rate cuts or pauses) could drive bullish momentum, as lower rates favor growth stocks in the Nasdaq.

• Economic Data: Employment, CPI, or tech sector earnings reports could impact volatility.

• Technical Levels: Fibonacci retracements, support/resistance, and trendlines are critical for intraday trading.

I entered Nasdaq above the 0.382 level (23,056.4), First target 23400 was reach at approximately 7pm PST the next targets are the 1.0 (23,700)

*this is not financial advice entertain at your own risk 📊📈

NAS100 at mjaor resistance area Fib 0.5Price has reached the 0.5–0.382 Fibonacci retracement zone of the recent swing. If the bears are strong, we may see a rejection toward the trendline support. However, if this resistance is broken, a bullish continuation is also possible. Let's see how it plays out.

NSDQ100 Pre US Open Key Trading levelsTrade Policy & Tariff Risks:

Donald Trump escalated trade rhetoric, signaling higher tariffs on countries importing Russian energy, and previewing new tariffs on semiconductors and pharmaceuticals within days. This raises geopolitical and supply chain uncertainty—key risks for NSDQ 100 tech and healthcare stocks, particularly chipmakers, drug manufacturers, and firms exposed to global trade.

Swiss Tariff Dispute:

Swiss President Keller-Sutter is in Washington seeking to lower a newly imposed 39% tariff—highlighting the broader unpredictability of US trade actions, which could fuel market volatility and weigh on investor sentiment.

Ukraine Conflict & Sanctions Outlook:

As the US pushes toward an Aug. 8 deadline to resolve the Ukraine conflict, Trump's envoy is in Moscow. Potential Kremlin concessions (e.g., halting airstrikes) may reduce geopolitical risk premiums, especially for defense, energy, and global consumer tech firms.

Federal Reserve & Rate Policy:

With Fed Governor Kugler resigning, Trump is expected to name a replacement this week. His ongoing pressure on the Fed to cut rates adds policy uncertainty. This could support rate-sensitive NSDQ stocks in the near term, especially growth names in tech, if dovish expectations build.

Takeaway for NSDQ100 Traders:

Expect increased volatility around tariff news, Fed appointments, and geopolitical headlines. Traders should watch for:

Semiconductor stocks (e.g., NVDA, AMD, INTC) under pressure from tariff threats.

Big tech and biotech swings tied to pharma trade policy.

Potential relief rallies if Russia concessions materialize or Fed commentary turns dovish.

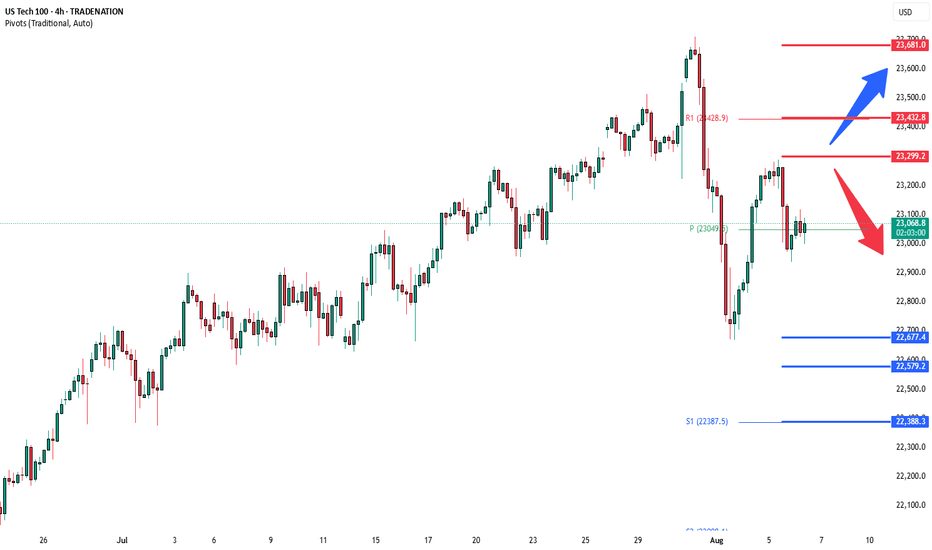

Key Support and Resistance Levels

Resistance Level 1: 23300

Resistance Level 2: 22430

Resistance Level 3: 23680

Support Level 1: 22677

Support Level 2: 22580

Support Level 3: 22388

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

US indices paused as fragile macro data undermined recent gains

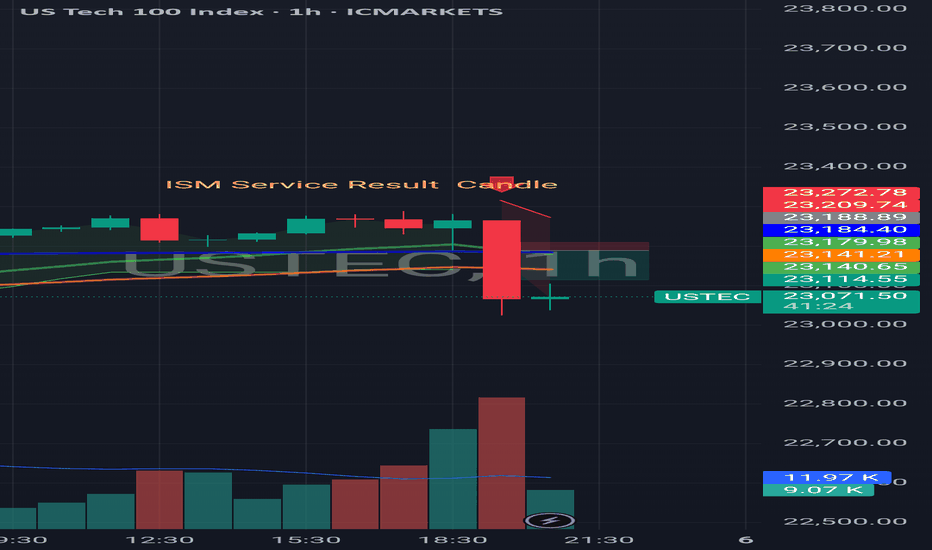

US equity gains paused amid President Trump’s renewed tariff threats and weakening economic data. Trump warned of steep tariff hikes on India and a potential 35% levy on the EU if obligations are not met. Meanwhile, the US July Services PMI fell from 50.8 to 50.1, missing the 51.5 consensus. New orders dropped to 50.3, while employment declined to 46.4—the lowest since March.

USTEC briefly tested 23300 before breaking below both EMAs. The widening gap between EMA21 and EMA78 suggests a potential shift toward bearish momentum. If USTEC fails to break above the resistance at 23300, the index could decline further toward 22700. Conversely, if USTEC breaks above both EMAs and 23300, the index may gain bullish traction toward 23700.

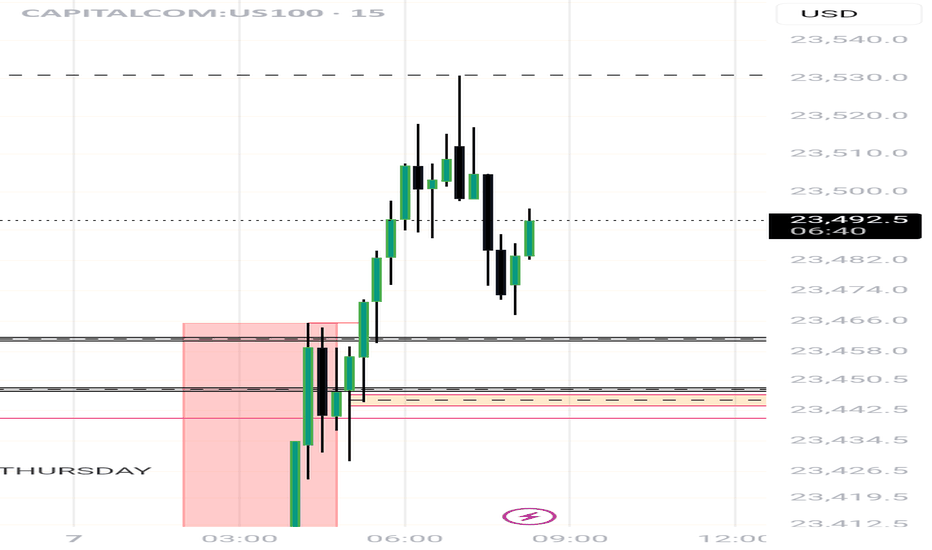

NAS100 (CASH100) Short - Double top 30minThe 15min head and shoulders setup got invalidated.

However, my double top variables are currently being met.

Still need confirmation before entering trade.

Risk/reward = 2.7

Entry price = 23 284

Stop loss price = 23 331

Take profit level 1 (50%) = 23 173

Take profit level 2 (50%) = 23 129

What does everyone thing the NASDAQ is going to do today?