USIRYY trade ideas

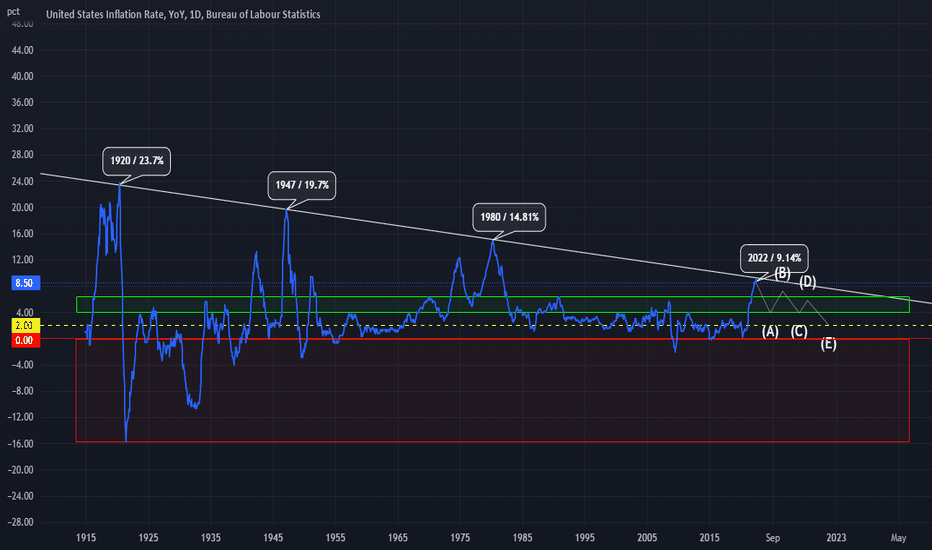

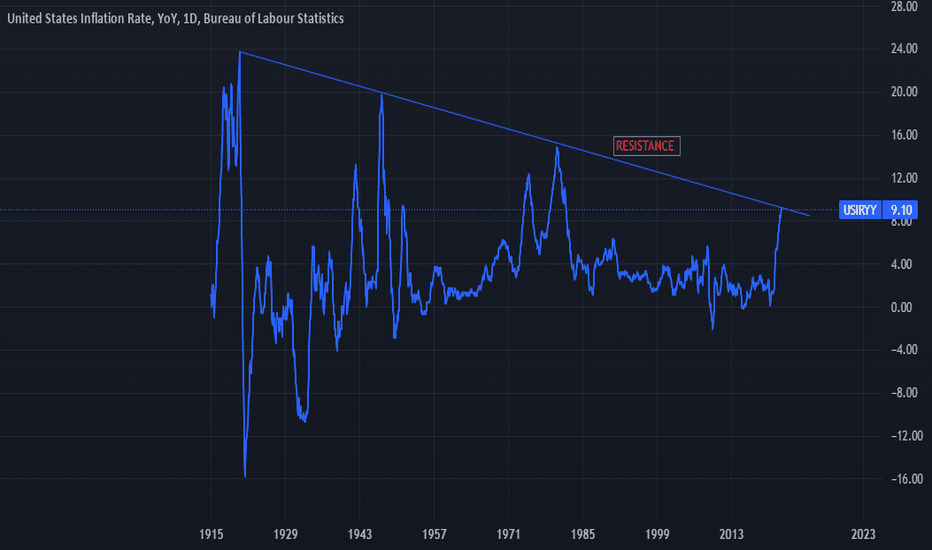

INFLATION HAS TOPPED OUT!Good day

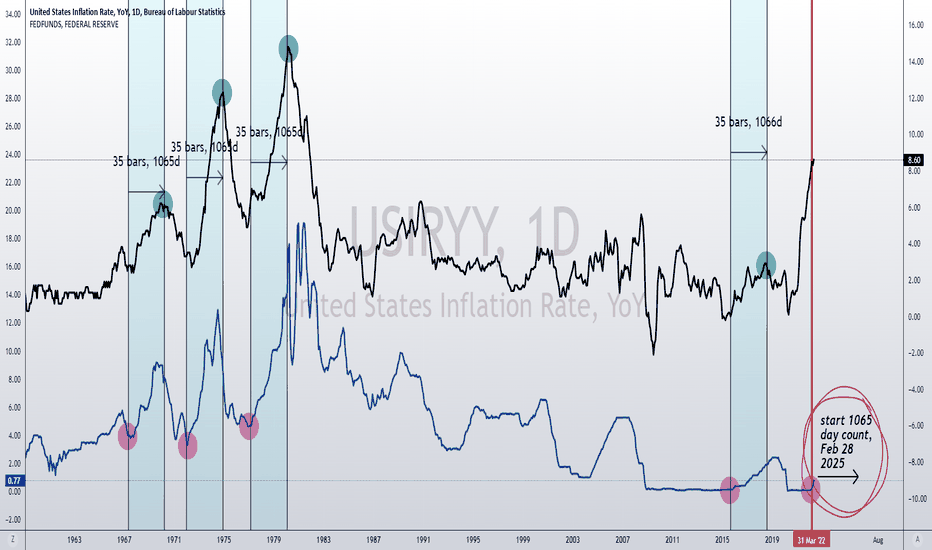

We have all heard the news regarding the FED increasing interest rates in order to solve the inflation "crisis" we are currently enduring. Some say this is great, some say this is horrible, however, overall this move was inevitable as markets such as this are cyclical and manipulatable by those who control monetary policy. For those who are in the market for a quick buck that follows the advice of so-called pro traders, this may not be the greatest time for you. On the other hand those with diamond hands, the smart money understand the benefits of this very rare occurrence in time. Not only will you be handed a highly decreased asset to invest in, in the next few days/weeks but, your spending power will increase due to the FED's attempt to bring inflation to 2% on top of a substantial increase in wealth once we are out of the thick of it. (2024)

It is not possible to know when inflation will reach 2%, only those who control the market fluctuation know these dates but for now, we need to understand that we are going to be in a recession most likely for the better part of 2 years, which coincidentally will line up with the cyclical bull market structure of BTC. Could this be a coincidence or are we heading for a bull market never seen before? it could be argued that the crypto space specifically has been held back in the recent bull market and like a spring will eventually jump to levels only one could dream of.

This statement will be strengthened dramatically as the world moves into a space where digital currency becomes the framework of the exchange of value internationally and in all aspects of the current macroeconomic structure. This narrative will only be pushed on an institutional level once the ever-desired and increasing space achieves regulatory clearance of some sort in order to enable governments to sustain some sort of market dominance. This idea is widely unexcepted by the retail investor as most feel governments must be done away with in order to open up for a fully decentralized network to govern our financial sector globally... as great as this sounds it just sounds more and more like a pipe dream.

We as people need to have some sort of governance and a system that regulates our decision-making on a financial level or else chaos will break out leading to potentially societal collapse. But on the bright side, the crypto space will eventually allow for a stable deflationary environment where our wealth will have a safe haven to grow.

All we need to do is sacrifice complete decentralization in order to achieve a potential innovation of the financial system that will revolutionize finance forever... In this case, we all win...

@TradingView

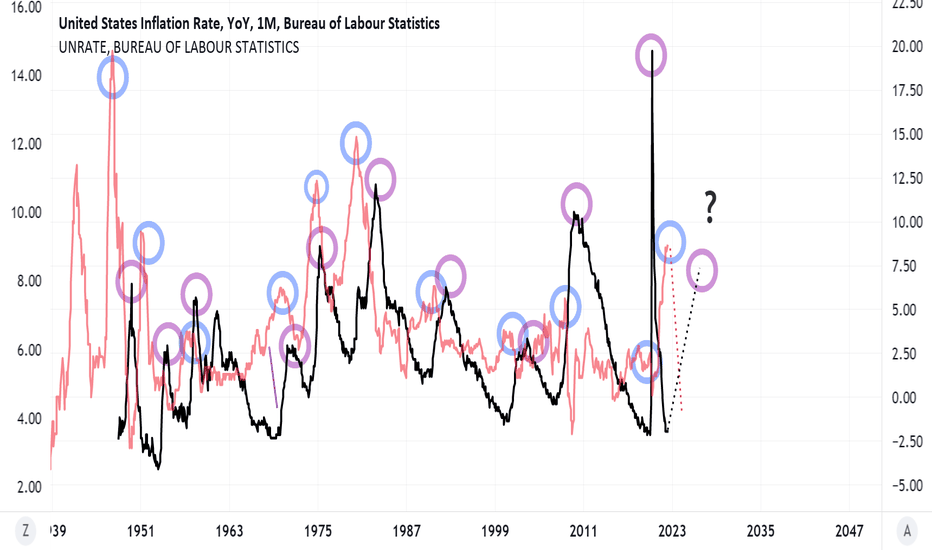

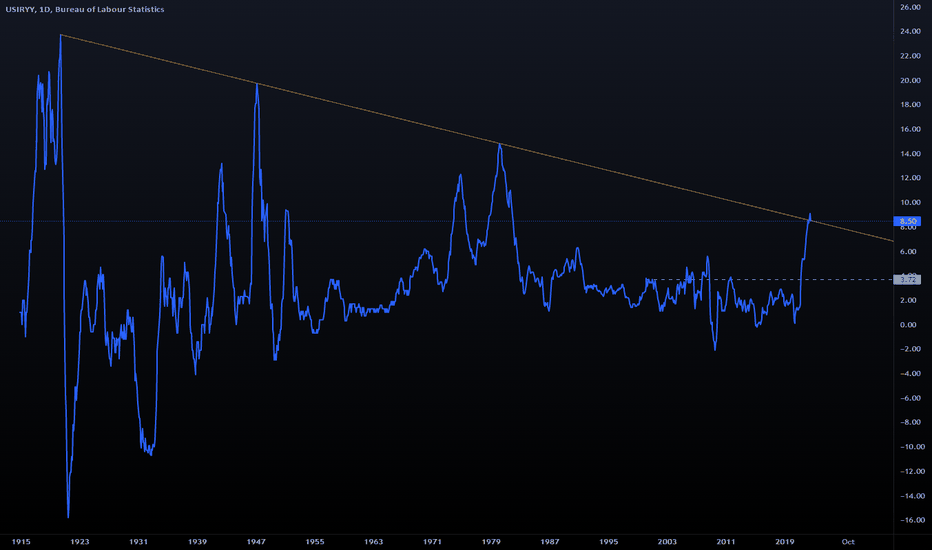

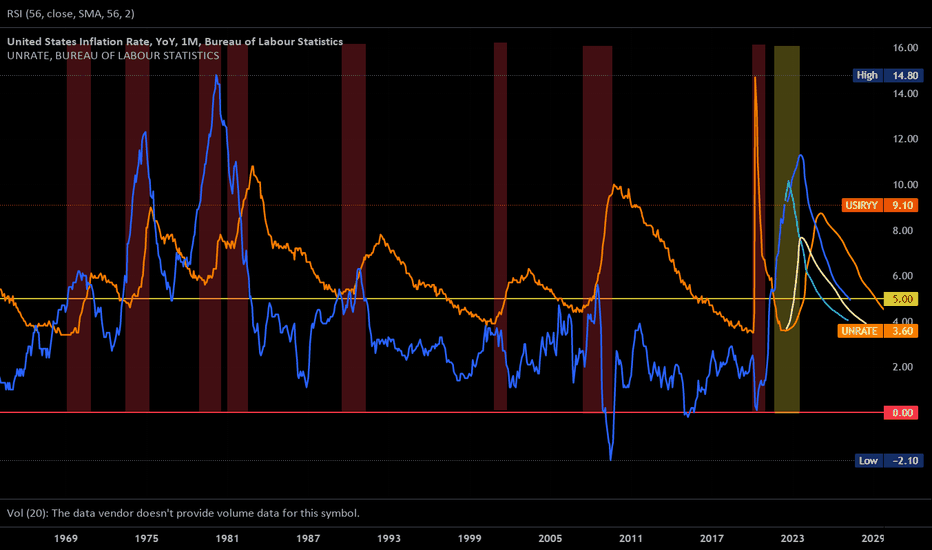

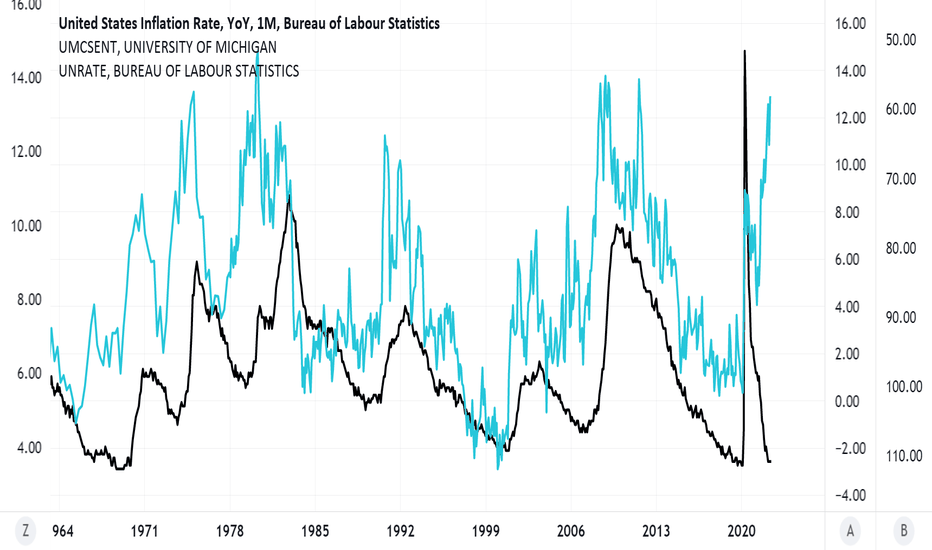

Unemployment is inevitable according to market history.Graph of the inflation rate with unemployment rate laid over top.

EVERY TIME that inflation has peaked and rolled over, unemployment has spiked shortly after.

If you wonder why Powell says things like "The labor market is unsustainable." it's because he and every central banker in the world (more or less) are trying to kill inflation.

Inflation dies, it takes out employment.

So the next time someone points to labor statistics as a sign of economic health, you can tell them that employment is transitory.

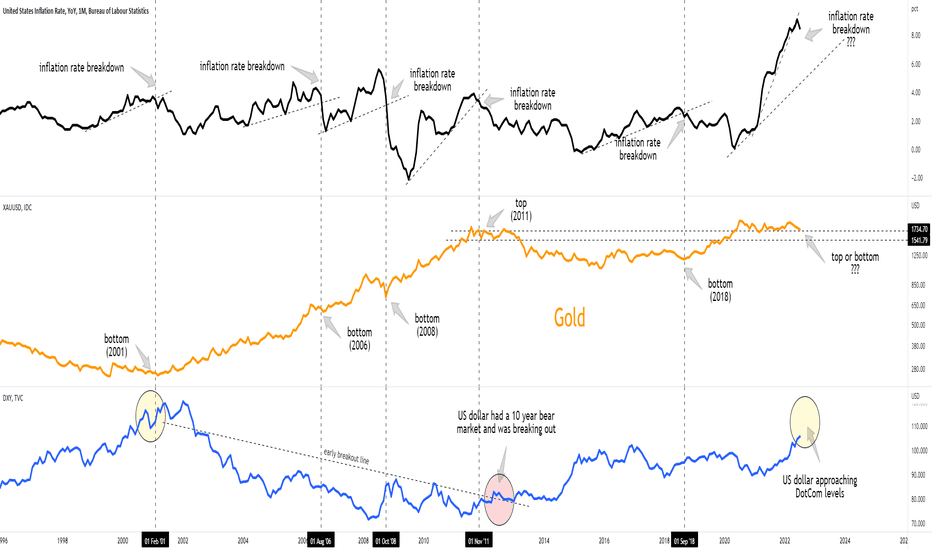

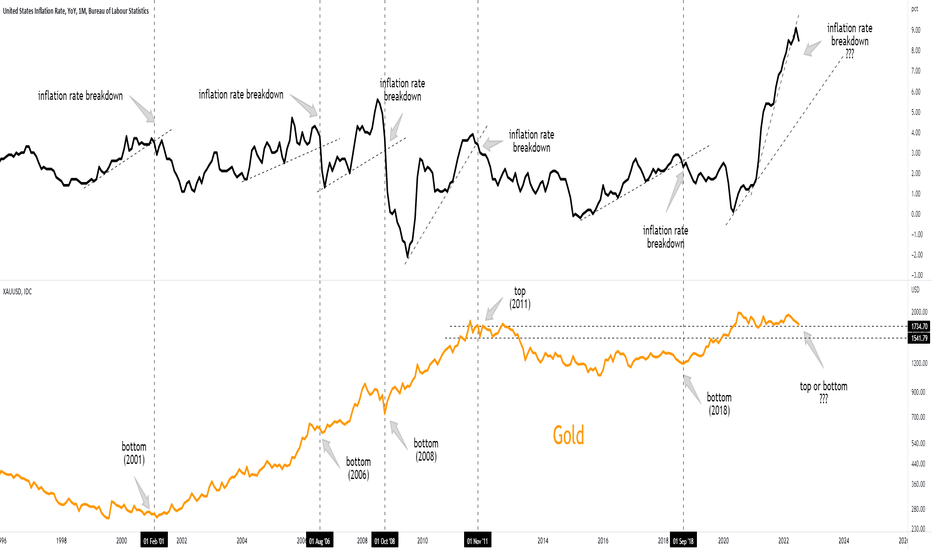

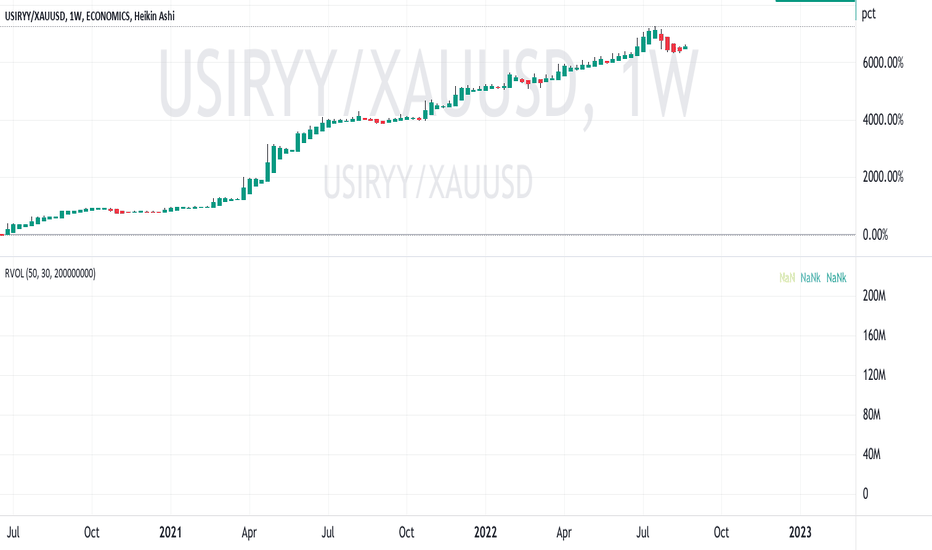

US Inflation Rate relative to Gold Price ( Bull Run preface?)As this chart shows since the onset of the Covid- Era, the inflation rate to gold price ratio has increased

over 60x in the intervening 30 month. Pricipally this is due to the inflation rate escalating while

spot gold has been stable or decreased. This would seem to suggest that gold is undervalued

and may be overdue for the price adjustment of a bull run. Time will tell as they say

USIRYY analysis for crypto market#USIRYY

All eyes on US inflation Rate (9.10) 🧐

Long Story short Expectation is 8.7%

🐻 - if new CPI data is above 9.4 then Market will Crash.

🐮 - if Remain between 9.1-9.4 then Market will be Stable and can Pump as well.

🐮🐮 - if below 9.1 then Crypto Market will Pump Hard.

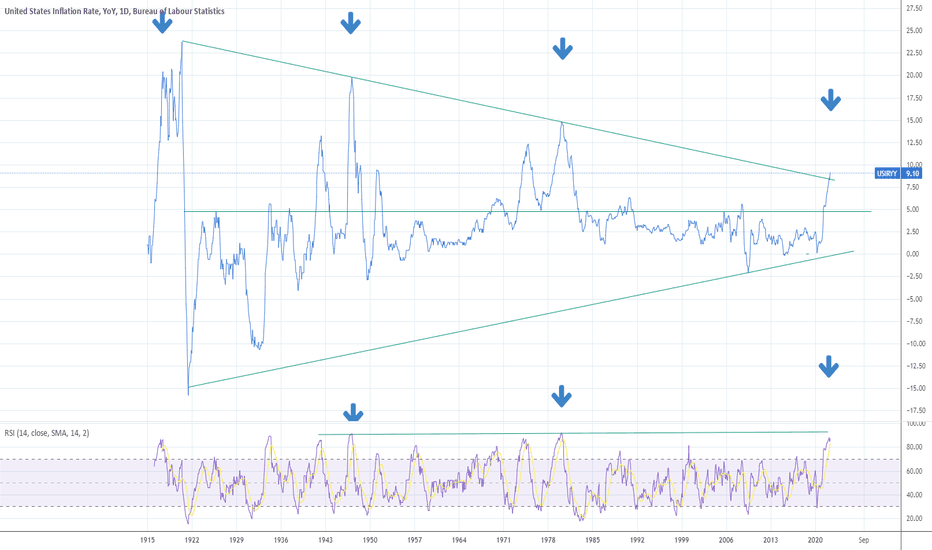

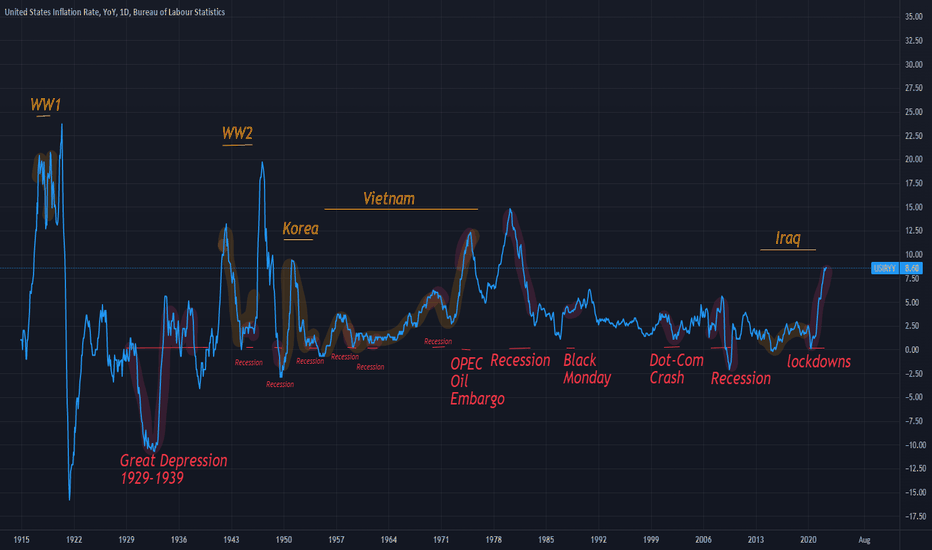

This recession identifies as an apache helicopterChart displays the US inflation rate and US unemployment rate. Red zones mark recessions (from stlouisfed.org).

6/8 of the past recessions are lead by inflation rates surpassing 5%. Only the dotcom recession had an inflation rate below 5%, and the other was COVID, which we are experiencing the resulting inflation currently.

so, every time the inflation rate jumps, unemployment follows on a lag. we can see that the ends of recessions are usually marked by a declining inflation rate and peaking unemployment rate.

but remember, this is not a recession and our country is in great hands.

ECONOMICS:USIRYY

FRED:UNRATE

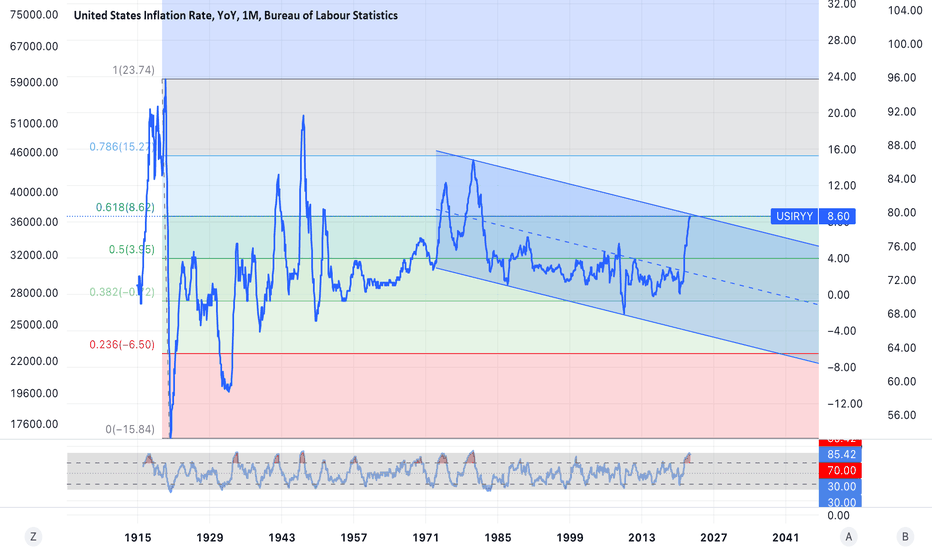

FED vs Inflation - The doomsday chartThe current administration says the FED today has "more credibility than Volcker FED". I didn't think I had to clarify why this is a poor joke, but considering the state of afairs... Let's us examine that statement.

Above is a chart comparing the CPI vs the interest rates and is very clear to me how bad this administration is, but nobody seems to realize yet how big of a f**up this is. America's time as the world wealthiest and most powerful country are counted. I don't think China is the future, but certaintly America doesn't have one to boast about it. As far as I can see it, these next generations won't have much of a future at all. The worst part is that the US debt is so large that even if they want it, they couldn't raise the rate more to control inflation, at the current size every 1% increase of the rates would mean 300bl more paid annually by the US government, that means that 2% would end the military budget (the US largest expense). Volcker had to push rate well into 2-digits to control inflation, today that would colapse the whole economic system by itself. That's it boys. This is how the world ends. Not with a boom, but with a click.

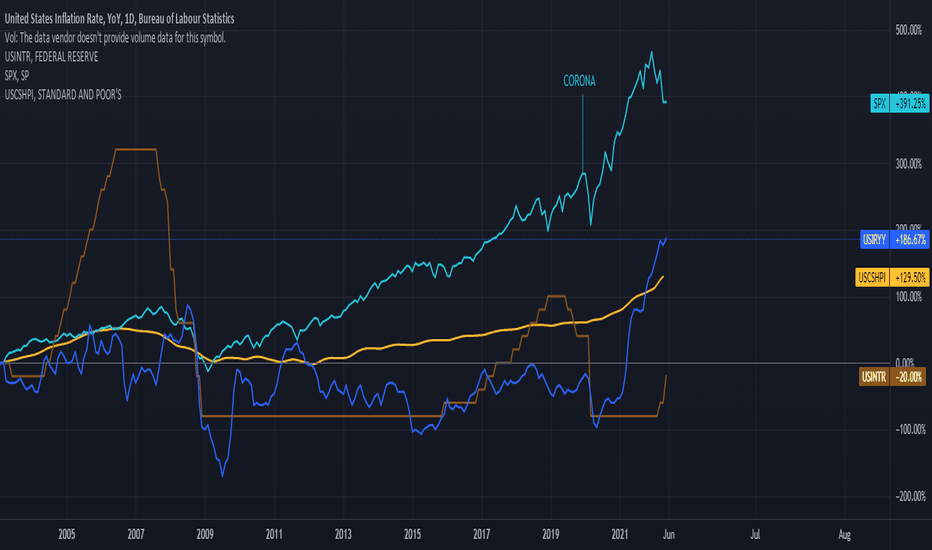

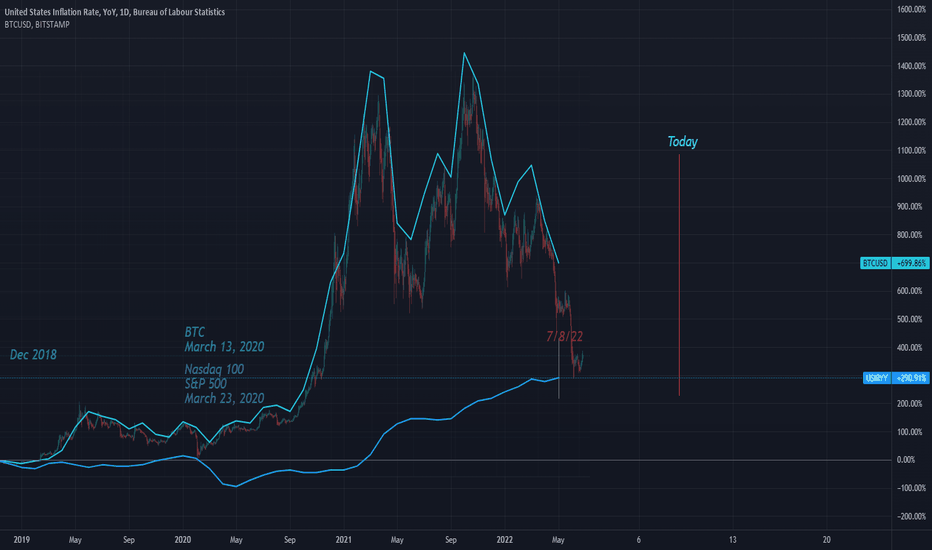

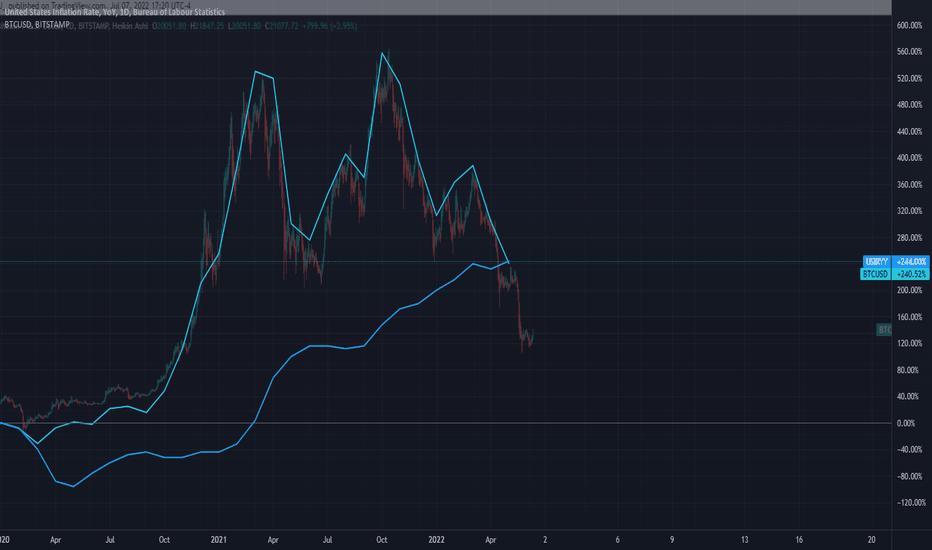

BTC vs the Dollar Inflation Rate :-)I thought this was an interesting chart Dollar Inflation vs Bitcoin BTC percentage different with the Bitcoin BTC price on top since the start of the pandemic. I used this Date Jan. 31, 2020 since it was short of a worldwide reset of the financial system. It appeared to give about a week notice before the BTC price collapse. I will follow this chart thru the next bull run to see if gives any earlier indicators or not.

BTC vs the Dollar Inflation Rate :-)I thought this was an interesting chart Dollar Inflation vs Bitcoin BTC percentage different with the Bitcoin BTC price on top since the start of the pandemic. I used this Date Jan. 31, 2020 since it was short of a worldwide reset of the financial system. It appeared to give about a week notice before the BTC price collapse. I will follow this chart thru the next bull run to see if gives any earlier indicators or not.

Don't worry Deeper Network DPR Crypto i have not forgotten about you. Your just taking to long to play out your Bearish M Pattern and i am getting bored waiting..................................

Unemployment is inevitable part 2INVERTED GRAPH

Unemployment rates in black.

INVERTED Michigan consumer index in blue.

As consumer sentiment falls, unemployment rises.

Every.

Time.

The consumer index just fell to all-time lows.

Unemployment hasn't risen.

Either we have done something completely unique in the history of the stock market redefining how modern economics work...

Or there's a lot of unemployment coming.

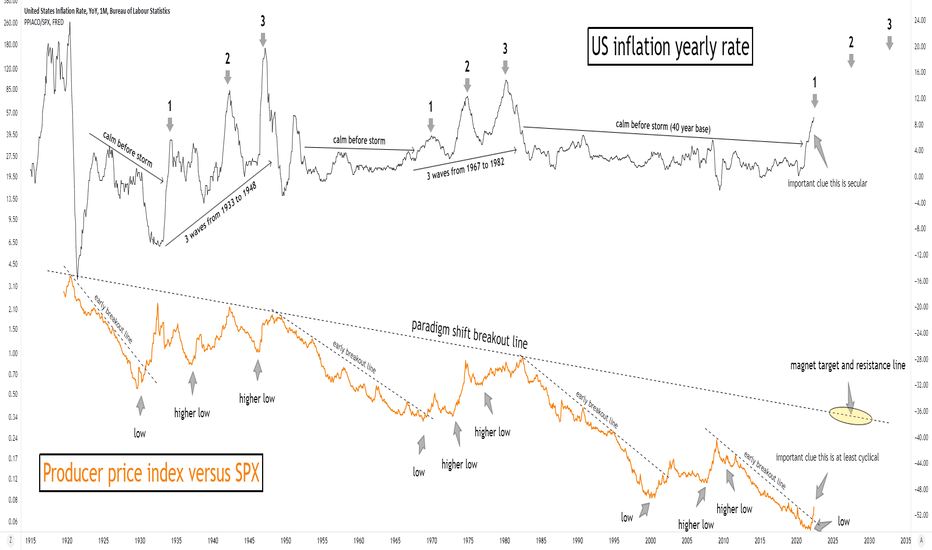

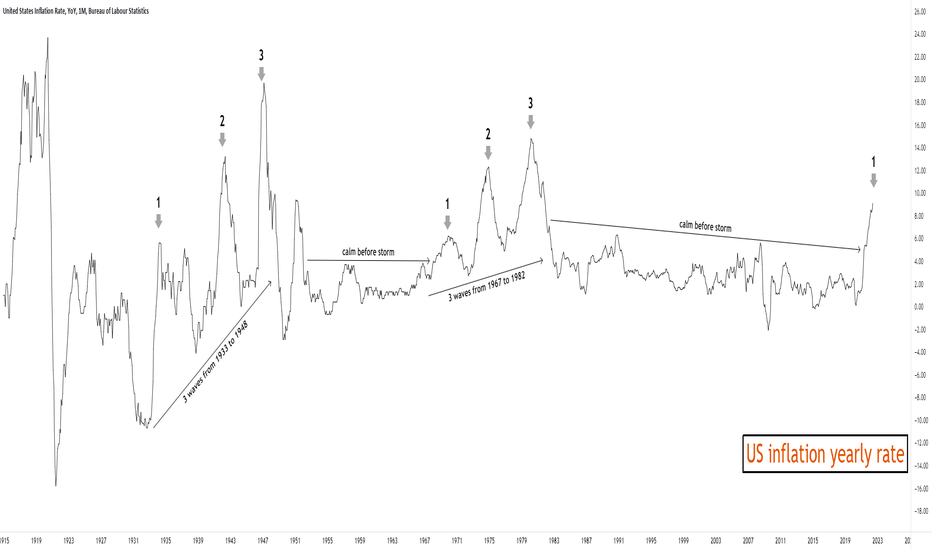

US Inflation.US inflation is very correlated with the extreme rallies we have seen in US stocks, Oil and crypto, FED are increasing rates frequently to counter this abnormal levels inflation show as the bar graph in my chart, one thing that is going to directly affect asset prices is rates, the dollar should look to gain strength too. So increased Inflation will see rising asset prices, and a falling inflation should drop asset prices from their highs. FED are beginning to try tackle the major inflation seen in the US, and the market conditions are going to change, so be prepared and manage your risk very safely, these coming market conditions are going to be a tough sea in my opinion.