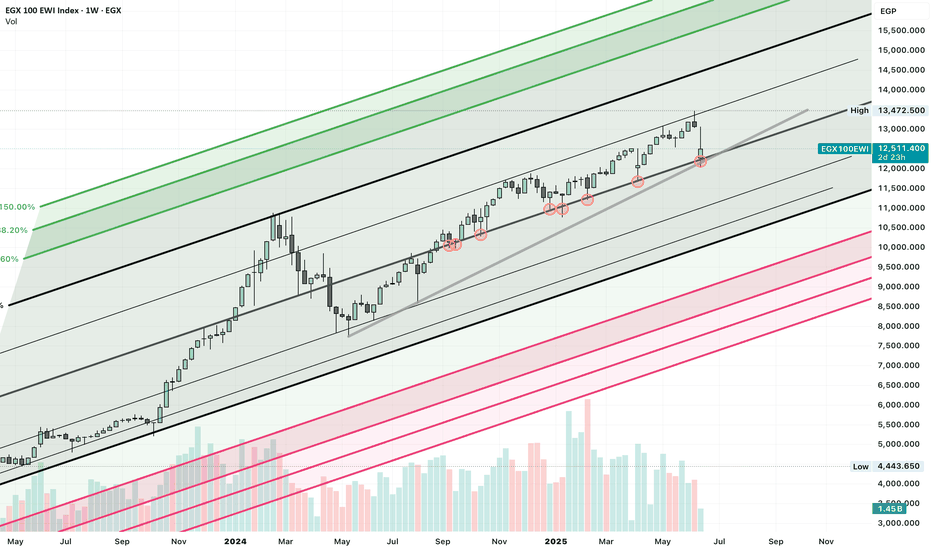

EGX100 Equal Weight – Is a Strong Rebound Coming?On the weekly timeframe, the EGX100 Equal Weight Index is showing a technically significant structure:

🔹 Touched the midline of the Fibonacci channel for the 9th time, after a confirmed breakout — this midline has acted as a dynamic support zone over time.

🔹 Also testing an ascending trendline for the 3rd time, adding strength to the current support confluence.

📌 A strong weekly close above both the channel midline and the trendline could be the trigger for a powerful rebound, God willing.

This zone might represent a critical inflection point — keep an eye on how price action unfolds in the coming weeks.

EGX100EWI trade ideas

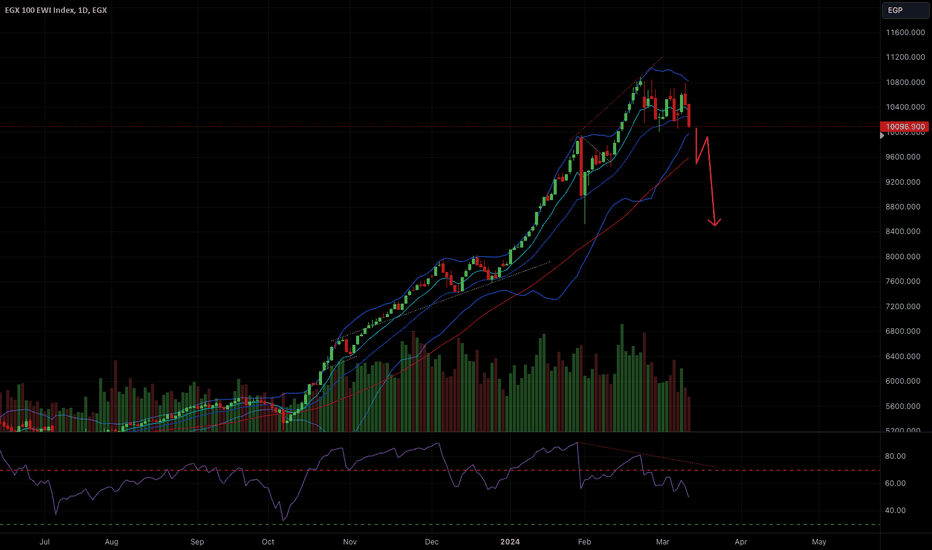

Is The Market Ready to Bounce?- EGX100 is down around 27% from its high.

- Today it hit a very important level, the 200 day MA which was tested before on March 2023, and also if we measure the fib level, we find that it retraced to a 50% level.

- This also occurs while EGX30 hitting its 200 day MA as well.

- Now we can never know for sure if this bottom or not, but we can be prepared for both scenarios.

- Resistance overhead @ 8500 if this can be breached, the way is clear towards the 9000 level,

and this a very critical level, as anywhere between 8500/9000 the sellers may show up again and try to push the market down.

- If buyers manage to break the 9000 level, the probability that this is a bottom is high, with only the level between 9300-9700 will be left to confirm the continuation of the bull trend.

- Pls note that currently the market is considered on a downtrend with 20/50/100 MA all pointing down.

- Not a good advice to reenter those tickers that became so cheap, look for the ones that were holding their levels as those are the ones with higher strength comparing to the market.

- It's always better and safer to wait until the market confirms the bull trend before buying.

EGX100 RISK OFF?- Market keeps rejecting 10800 level. and sellers seem to be taking control.

- A lot of stocks already into bearish setups.

- Noone can ever predict the price accurately all the time so Im going to keep it simple.

* Bellow 9800 market is a risk off. with a handful of tickers can hold their levels.

* wait for bullish reversal confirmation before entering any trades.

-Remember: the market will be here tomorrow, no need to rush into trades.

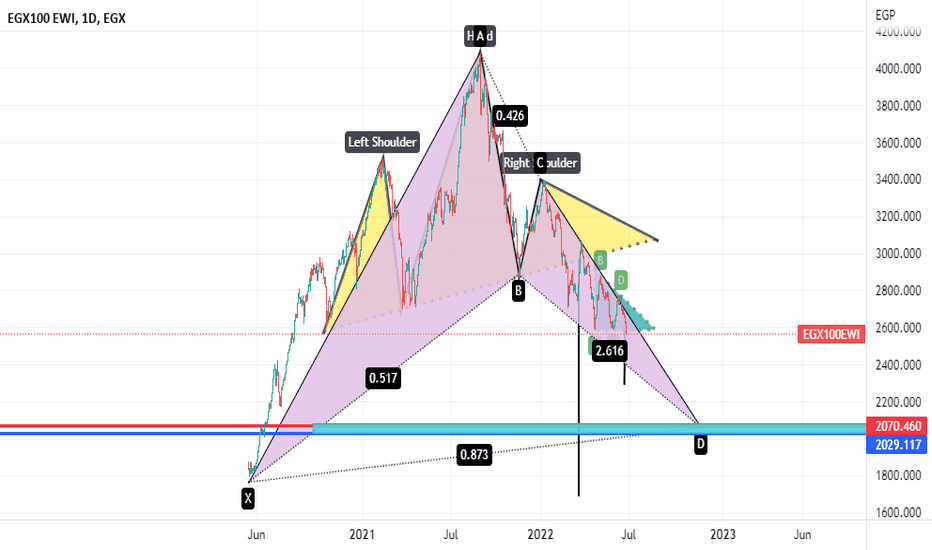

Can the index EGX100 escape a bearish double top pattern?Daily chart,

Index EGX100 needs some correction, and probably will rebound from 7550 - 7500, to re-test the resistance line.

Below 7409 will form a bearish double top pattern, leading to 6865, which is below the support line #1 !

Just be careful!

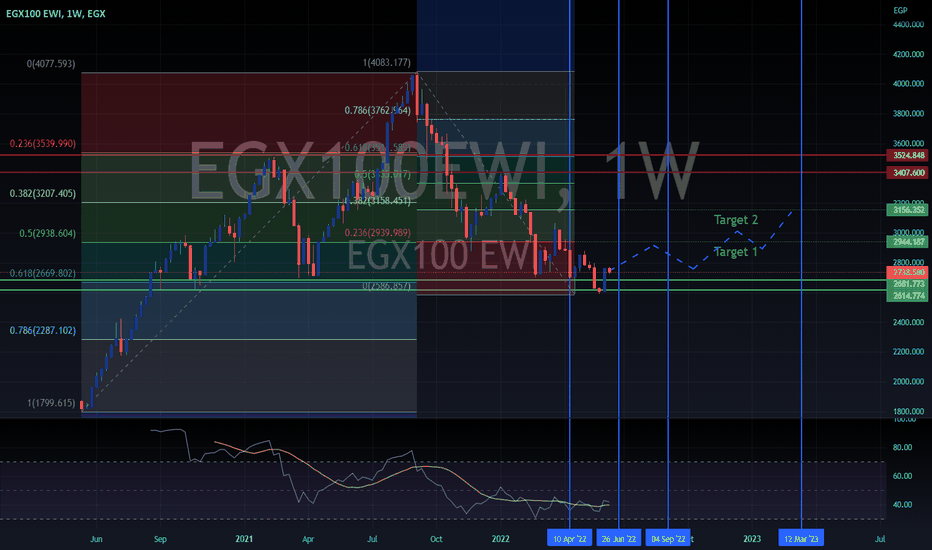

EGX100EGX100 test two support level at 2614.774 and 2681.773 in the last 7 weeks but as seen the price rebound 2765.140 making a move towards retracement.

we may reach 2944.187 as a first target then the 3156.352 after expected correction from Fibo 0.5.

AS EGX will get soon some new IPO after the pressure of the interest rate hike of the CBE to control inflation.

The monthly core inflation, computed by the CBE, recorded 2.4% in April 2022, down from 3.1% in March 2022, and 0.7% in April 2021.

Accordingly, the annual core inflation increased in April 2022, compared to 10.1% in March 2022.

The current interest rate:

Actual: 11.25

Previous: 9.25

lowest: 8.25

A devaluation in the Egyptian Pound and the Fed hikes make a large immigration of investment capital during the past three months.

but the ability of market recovery still exist but it will take time.