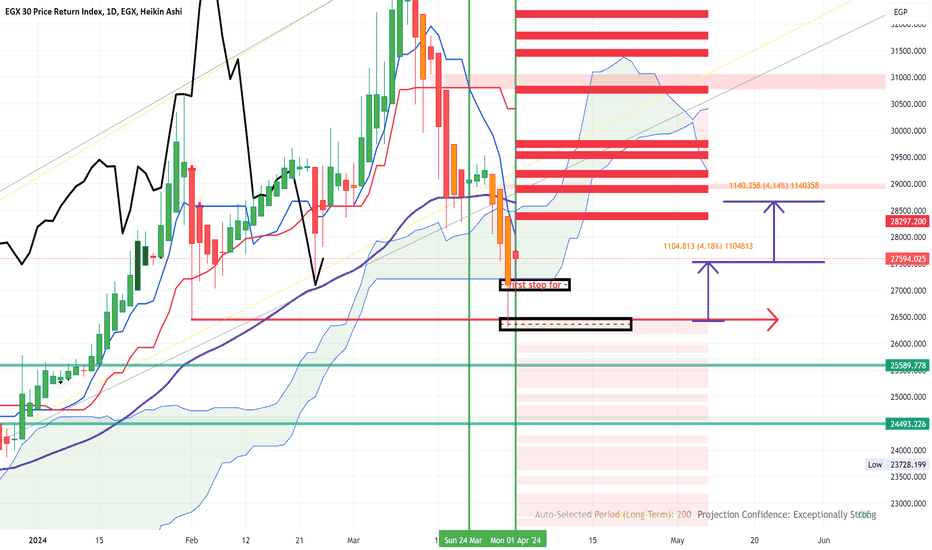

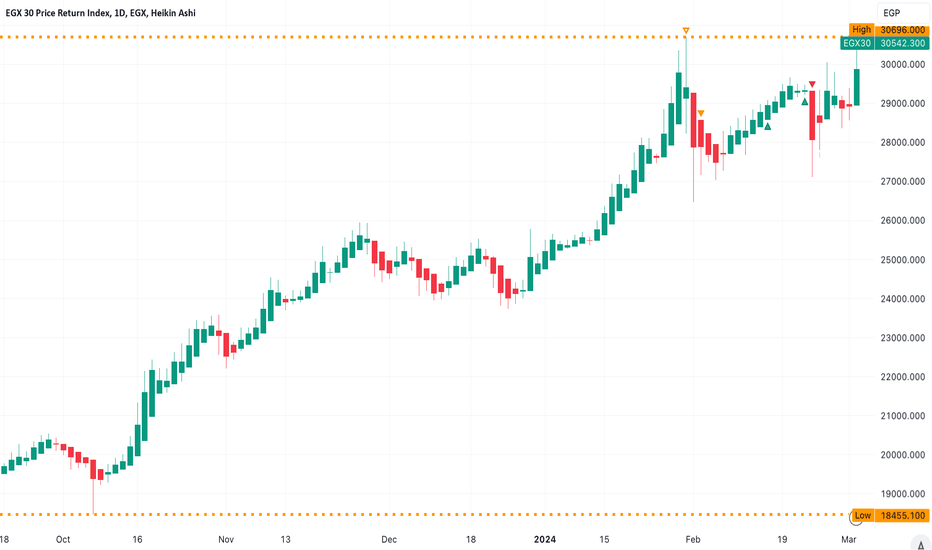

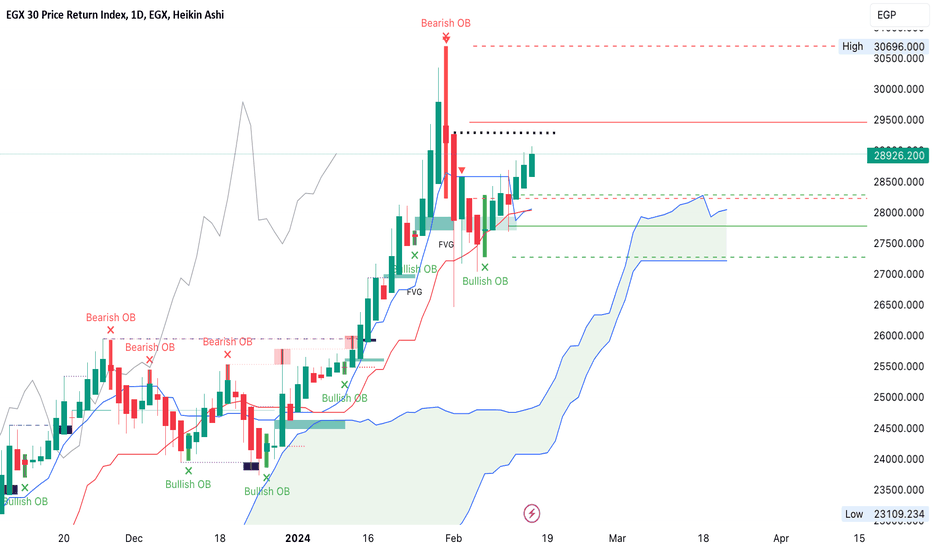

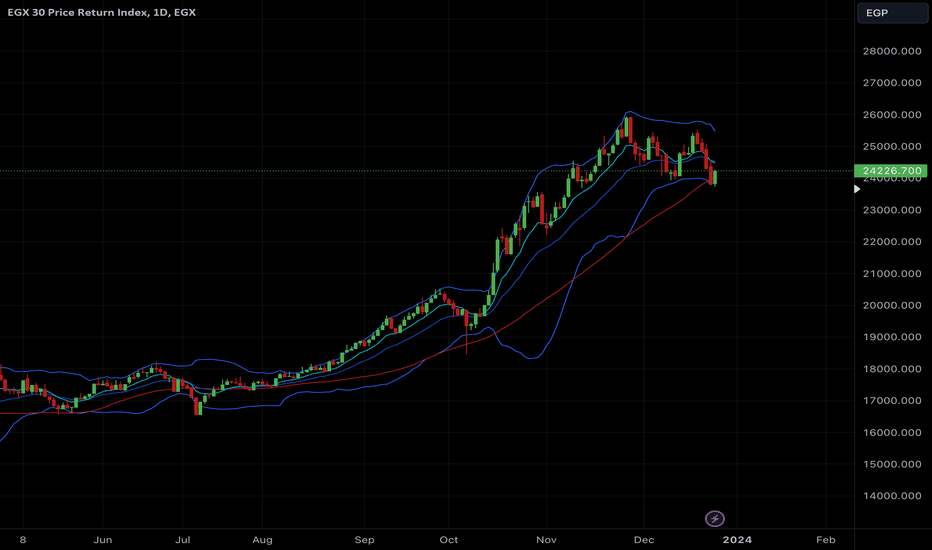

EGX30EGX30 is trading in the KUMO & Inflated. volume is soaring & Value is inflated ..

confirmation for the recovery is as follows:

1- One Solid Green Bar (Marubuzo) above 28,400 level

2- Exiting the KUMO

3- Tenken sen is below the Marubuzo

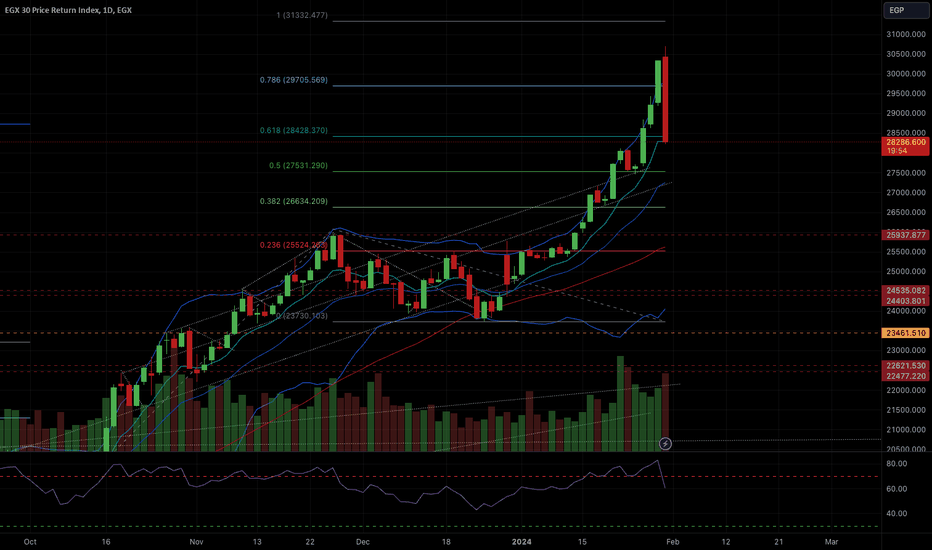

ANALYSIS in this video is based on Ichimoku & Elliot Waves

Disclaimer:

The content provided is for informational purposes only. It should not be interpreted as legal, tax, investment, financial, or any other form of advice. Investing in stocks carries inherent risks and may lead to potential losses, including the loss of principal. It's important for investors to recognize that past performance does not guarantee future returns, and market fluctuations can impact investment value. Stocks discussed here are not synonymous with, nor should they be seen as a replacement for time deposits or similar saving instruments. Investing in securities of smaller companies may involve higher risks compared to larger, more established firms, possibly resulting in substantial capital losses.

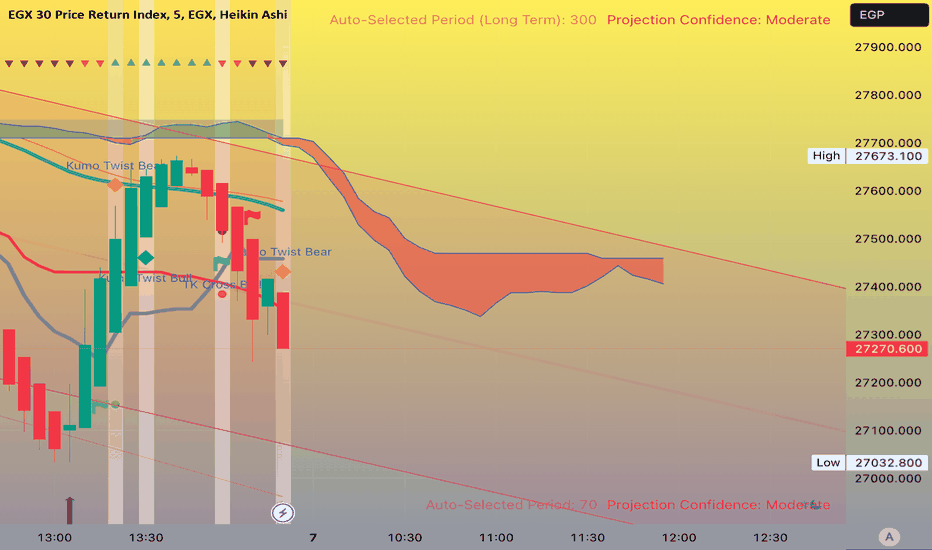

EGX30 trade ideas

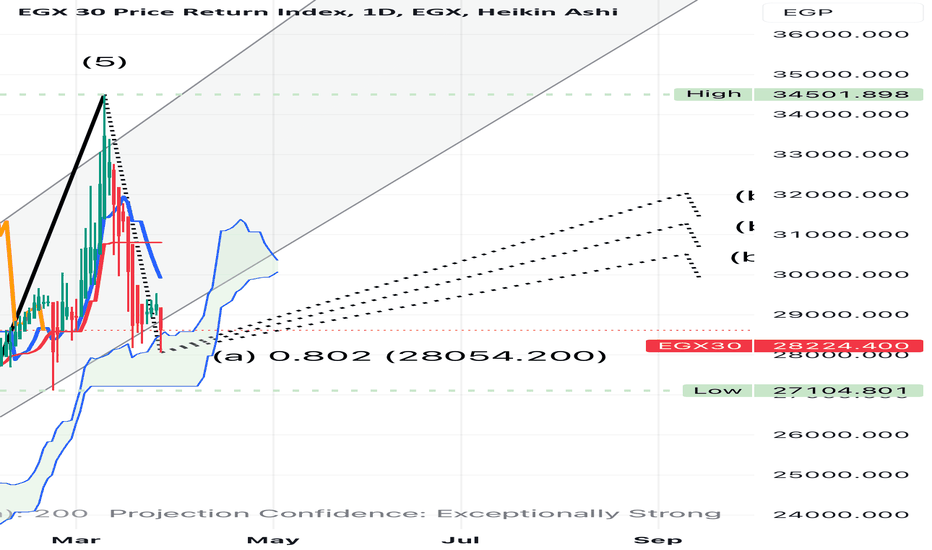

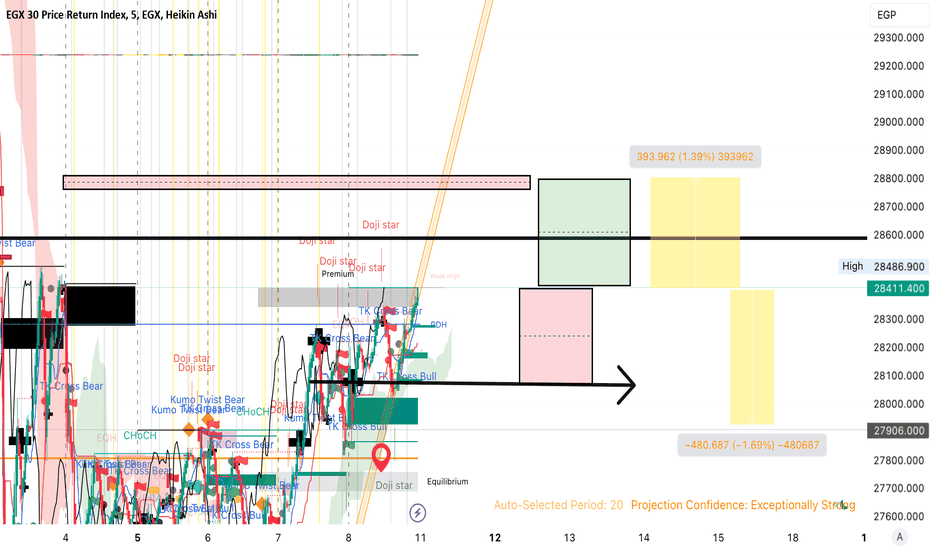

Wave (a) might reach Senko Span BThe correction wave A for the EGX30 index appears to be ongoing as it has broken Senko Span A, with a potential target of reaching Senko Span B at 27280 bars. It is evident, even to those less familiar with Elliott Wave theory, that the current wave cycle has concluded, primarily due to the break in the existing trend. Some observers may be unwilling to accept this reality and continue to believe in the continuity of the current trend, despite evidence suggesting otherwise.

Finally, the probability of a breakout is dependent on New Money.

Wave 2 didn’t end yetBased on today's performance, SenkoSpan B serves as a key support level for the EGX30, aligning with the 23.8% Fibonacci retracement. Wave 3 begins when reaching 27,000 Bar, expect couple of bumps.

It's disheartening, but hopeful trading can sometimes be a delusion. The DotCom bubble's commemorative date is March 10, coinciding with the devaluation bubble. The EGX30 in USD exposed the EGX30 in EGP's burn rate, influenced by COMI & TMGH. The prices of USD-hedged stocks reflect the 24,000 bar prices. This situation represents a potentially bursting bubble. Regrettably, incidents of friendly fire can occur due to miscommunication, misidentification, or errors during intense and chaotic scenarios.

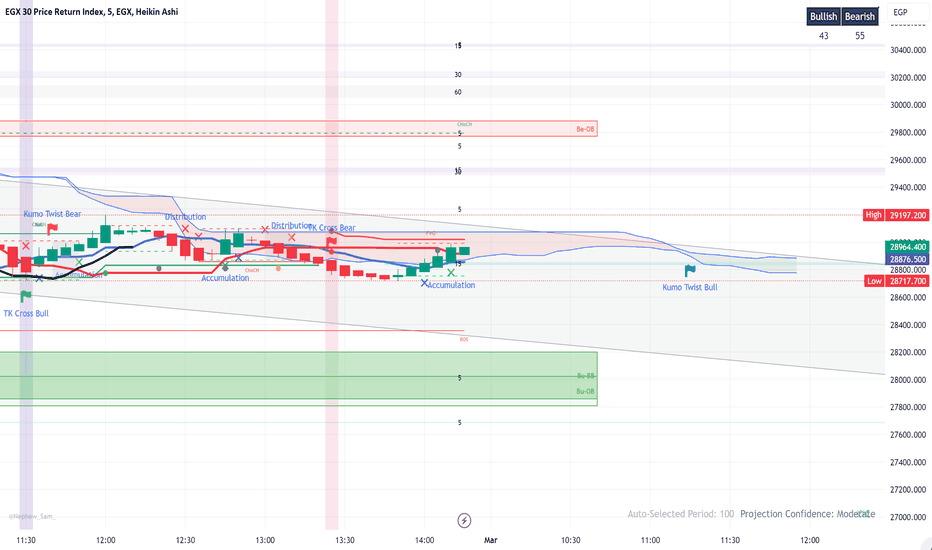

Correction didn’t endBearish sentiment is flying around.

There is no logic behind today’s market crash other than Margin Call from brokerage firms.

Hopefully tomorrow will be the last correction day .

Correction wave(A) might end, Senko Span (A) will slightly decline.

This is confirmed by Chikou span.

For the next 9 consecutive period, an upward trend is more likely to occur.

EGX 30 is still up trending; chikou span is higher than the previous 26 day bar.

27750 mark can be reached, however, the 28500 is more likely to be reached in the first 1H.

Tomorrow’s closing price is most likely to be equal to =

today’s closing price

Less

(Thursday closing price - Sunday’s closing price)

Can you do the math?

Please challenge my idea, and correct me if I am wrong.

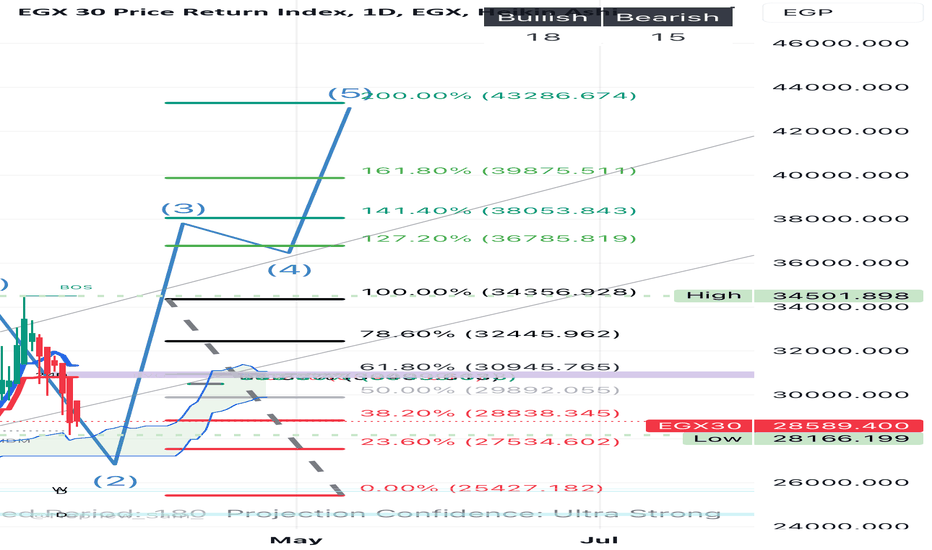

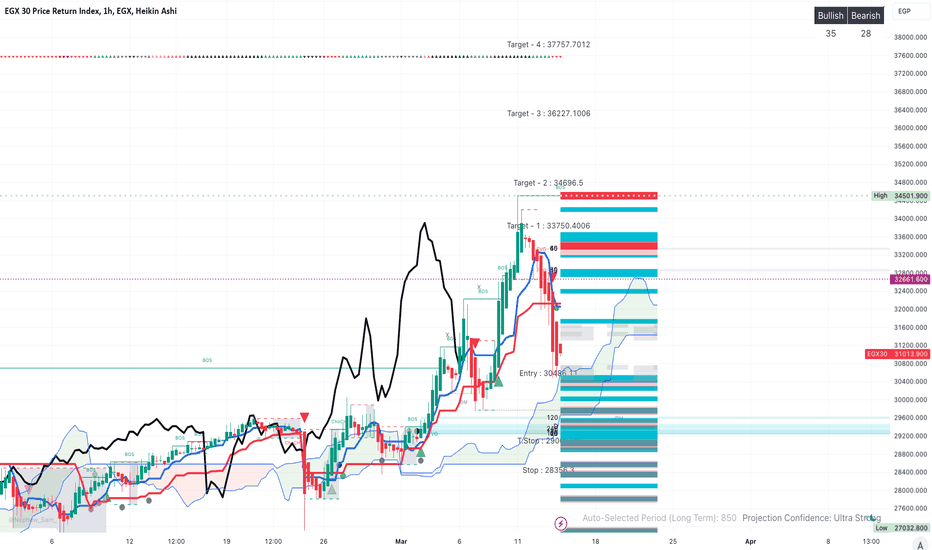

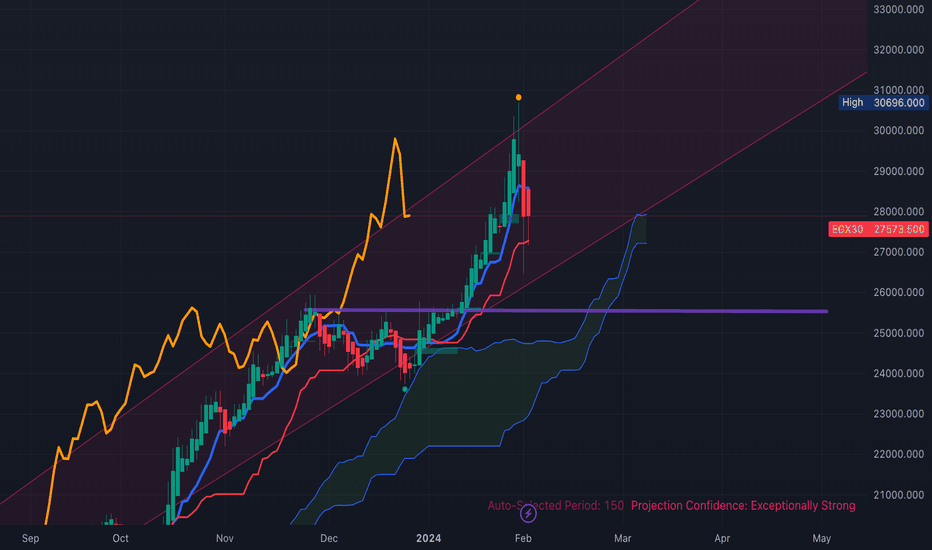

EGX30 1H time frame:target remains 33750 points.EGX30 1H time frame:target remains 33750 points.

You will find R & S on the chart (Red& turquoise lines).

Senko Span A is upward; however; in the very near future, EGX will consolidate.

Senko Span B is flying upward. EGX30 reached the entry point where it broke out.

30461 point is a main support point.

To conclude EGX30 $ represent best value for money. This is witnessed by foreigners net sales. However trading value in EGP 5.5b EGP is equal 110M$. This is poor performance ( equal to 3.4b EGP before the devaluation)

New cash injection will drive the EGX30.

EGX30 performance for locals is similar to Las Vegas Circus Circus but for foreigners is Walmart, low cost supermarket.

New cash will be injected. All stocks are cheap in EGP,and Best Buy in USD.

in sha’a Allah tomorrow, Market will rebound.

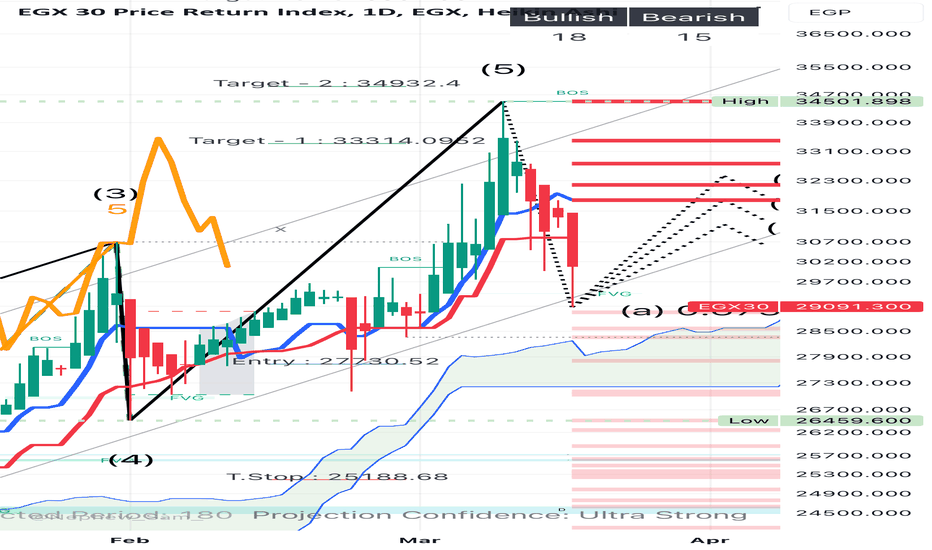

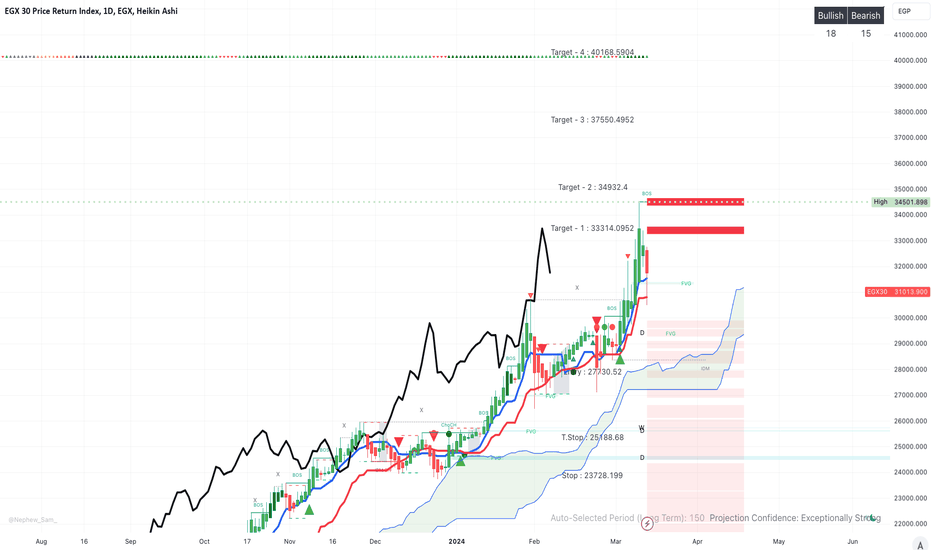

Target is 33314 pointsEGX30 is trading above green kumo. Chikou span is downward.

Red Long wick. Senko Span A is up trending. Senko Span B is plateau.

Target is 33314 points. However, hickups are FVG related. You can discover it in the 1H chart.

EGX30 1H time frame:target remains 33750 points.

You will find R & S on the chart (Red& turquoise lines).

Senko Span A is upward; however; in the very near future, EGX will consolidate.

Senko Span B is flying upward. EGX30 reached the entry point where it broke out.

30461 point is a main support point.

To conclude EGX30 $ represent best value for money. This is witnessed by foreigners net sales. However trading value in EGP 5.5b EGP is equal 110M$. This is poor performance ( equal to 3.4b EGP before the devaluation)

New cash injection will drive the EGX30.

EGX30 performance for locals is similar to Las Vegas Circus Circus but for foreigners is Walmart, low cost supermarket.

New cash will be injected. All stocks are cheap in EGP,and Best Buy in USD.

in sha’a Allah tomorrow, Market will rebound.

EGX: Bearish Market SentimentsThe shadow of RAS Hikma transaction on the construction sector was superb; however, process industries sector, and USD-base revenue companies lead the sharp fall.

3-4 days to recover based on ghosting the Bars pattern.

in the mean time, FLOATING is the QUEEN.

FORTY EIGHT is the jack of all spades.

words of wisdom: he is no fool who gave up what he cant afford to keep to gain what he can never imagine to lose.

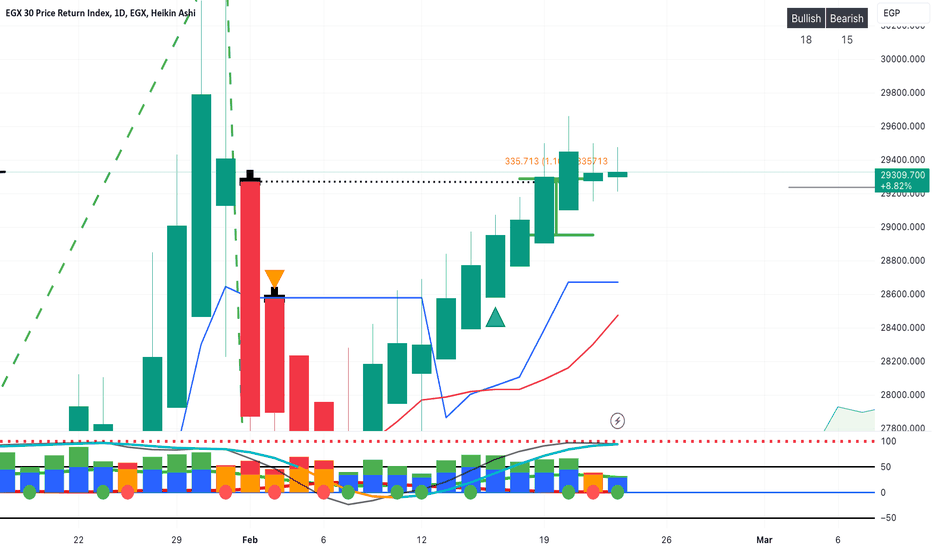

Special Message from EGX 30 to COMI & MFPC :"Laissez-moi danser"Special Message from EGX 30 to COMI & MFPC:"Laissez-moi danser , chanter ... laissez moi "

Bullish TK-Cross on daily Timeframe

looking forward to reach 29,300 .. Turning point to start dancing Monday & Tuesday.

1.16% point will make Wednesday a brighter day.

Thank you Dalida, je vais dancer Monday.

EGX30 heading for a fallCOMI, MFPC, ABUK, ALCN, AMOC, SKPC, BINV, EGCH, & sugar are the main drivers for the fall.

Traders' sentiment is to trade in strong balance sheets with solid fixed assets as well as avoiding trading in MYX:REVENUE stocks.

EGX30 is heading toward 26,600 points to end this correction or the correction will end as soon as FLOATING the EGP.

consolidating 4//2/24still consolidating... Defensive industries are the sole Winners such as Pharmaceuticals, Real State development, and/or food.

Losers are USD hedge , High Net Debt absolute vlaue, and/or High YoY debt growth companies.

Basically its a defensive bullish market with strong Fixed Asset in Balance Sheet .

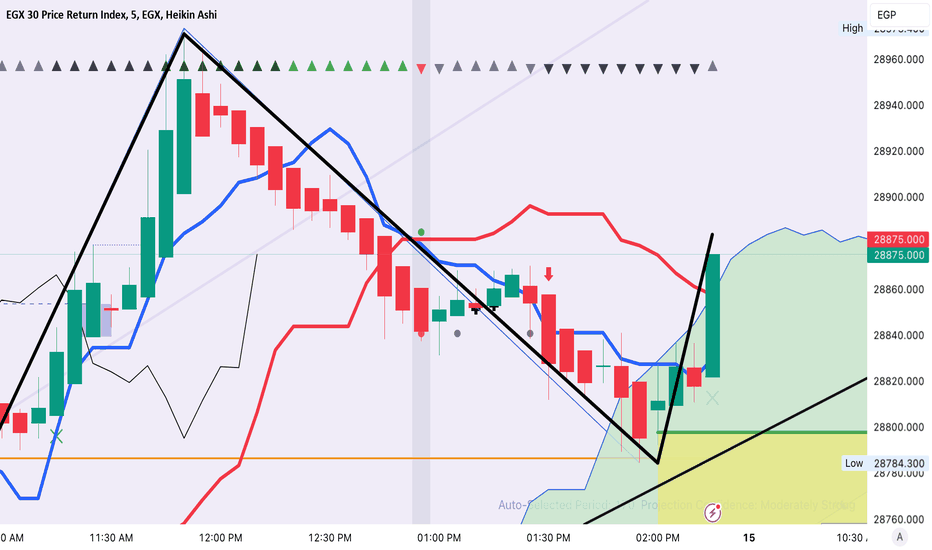

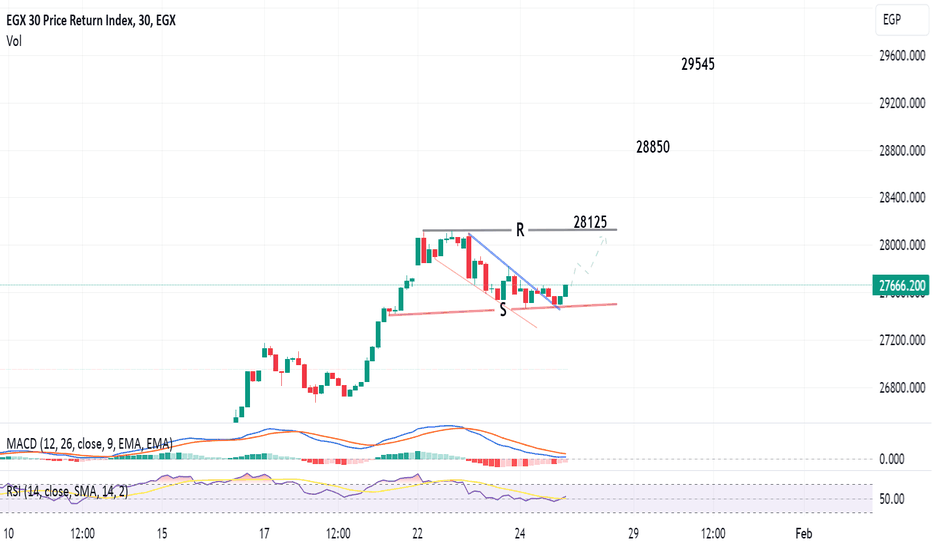

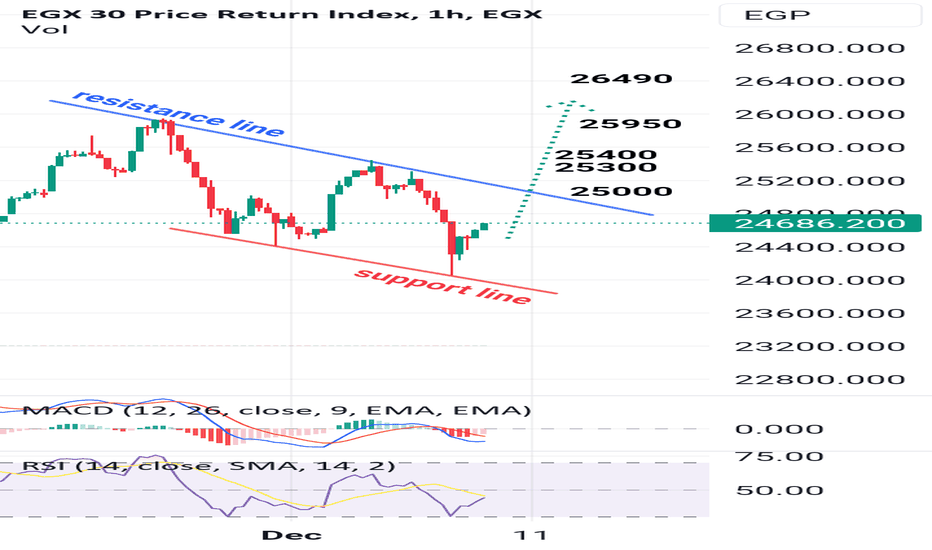

EGX30 to target 29545 after crossing Resistance30-min chart, the index has formed a falling wedge, and should target the Resistance line (R) at around 28125. After crossing it, the target will be 28850 extending to 29545

Technical indicator RSI is positive.

Below Support line (S) should be a stop loss.

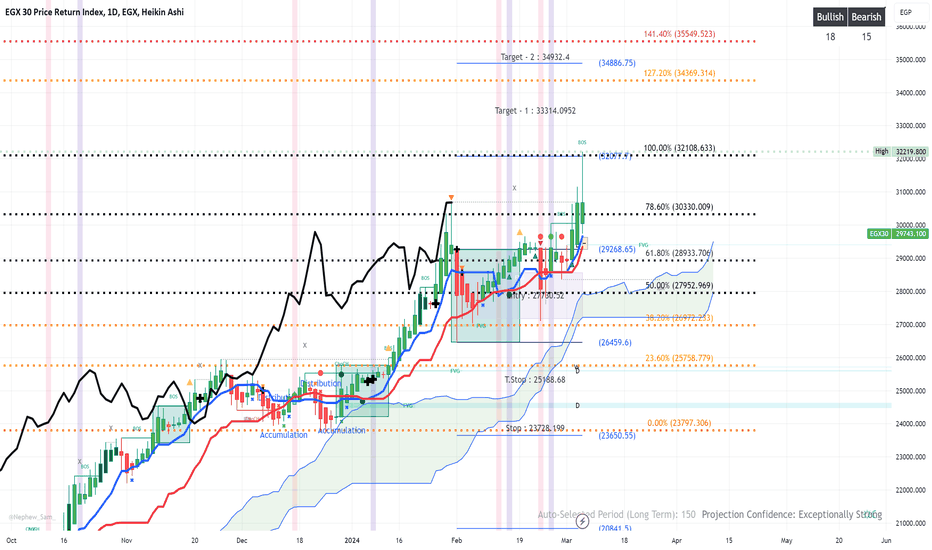

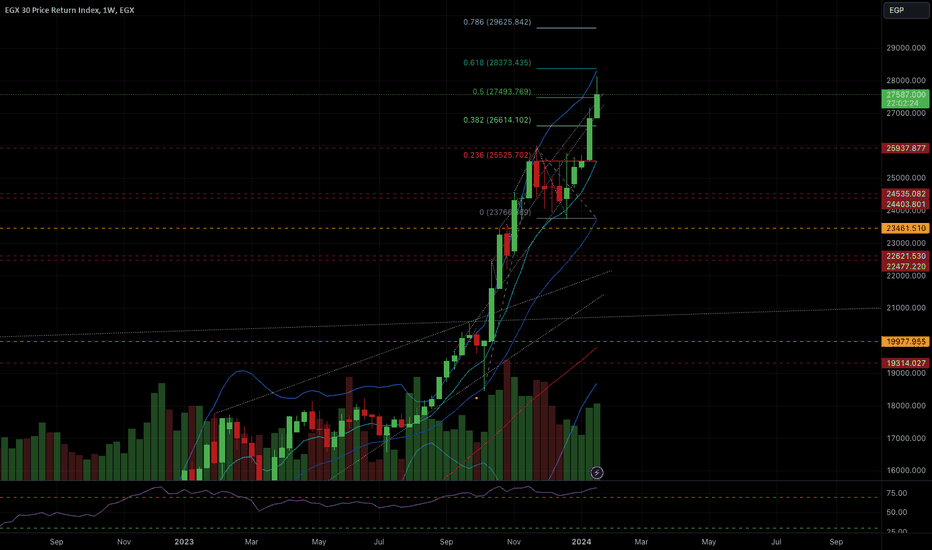

EGX Weekly Analysis- EGX30 came near the 60% Fib level and it was due to a pullback.

- It cant stay overbought for too long and a healthy pullback was necessary.

- In my opinion, it can stay in a range for a couple of weeks and its a good opportunity to add more shares to winning trades.

- In case the market decides to pullback more than the range. stop losses for each trades should be monitored. and sell losers.

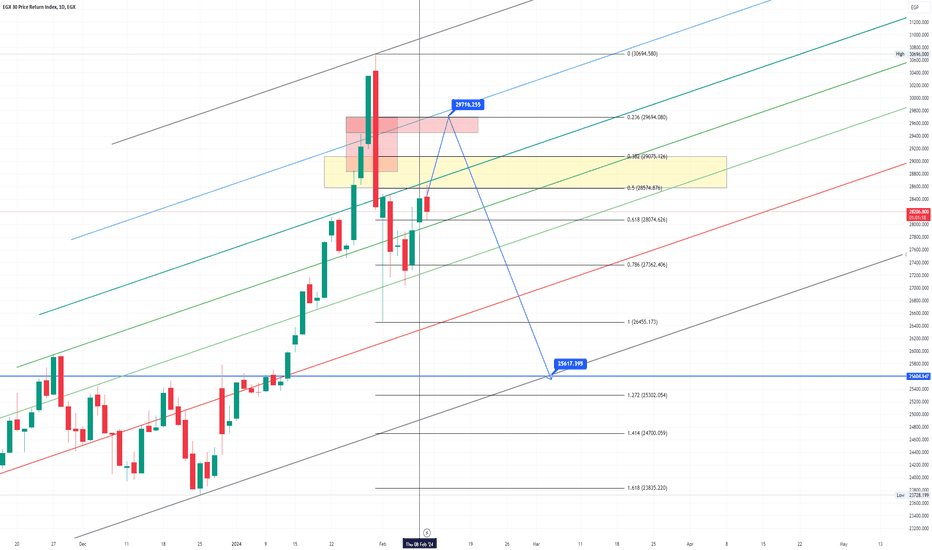

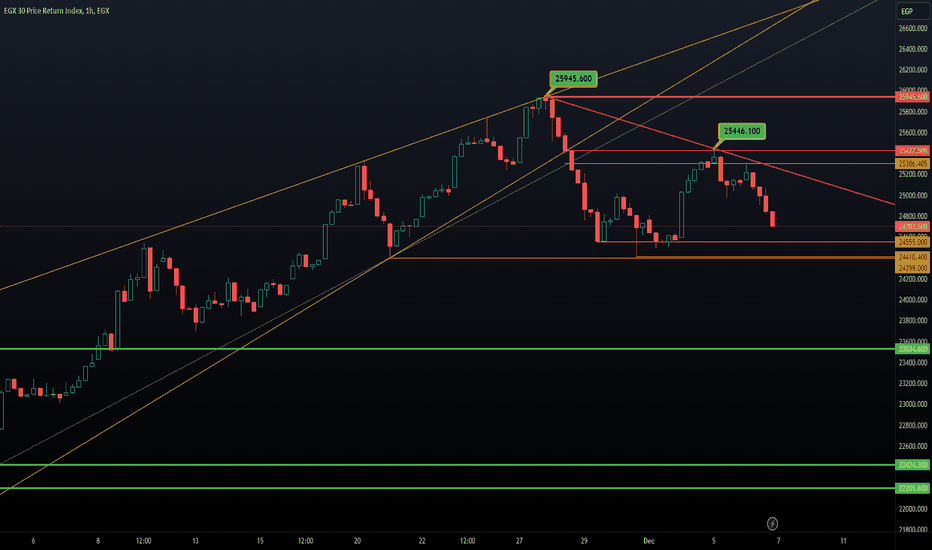

Egx30Its Bearish As Long as you are Under That TOP

First Bullish signal would be Breaking and Closing above The red Down Trend Line.

We had a Rising Wedge for the past weeks formed.

Broke under it,,

Then retested the Breaking Point which then Formed us our Red Trendline.

on The Chart Important Support And Resistance Levels.

Take Care of The big CAPs Stocks Which Made above 100%++++..

Good Luck To you all.