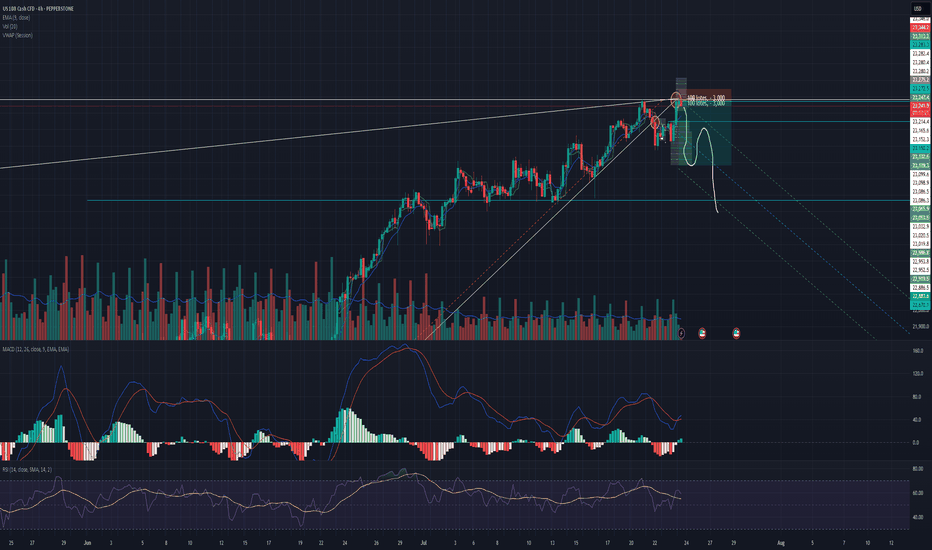

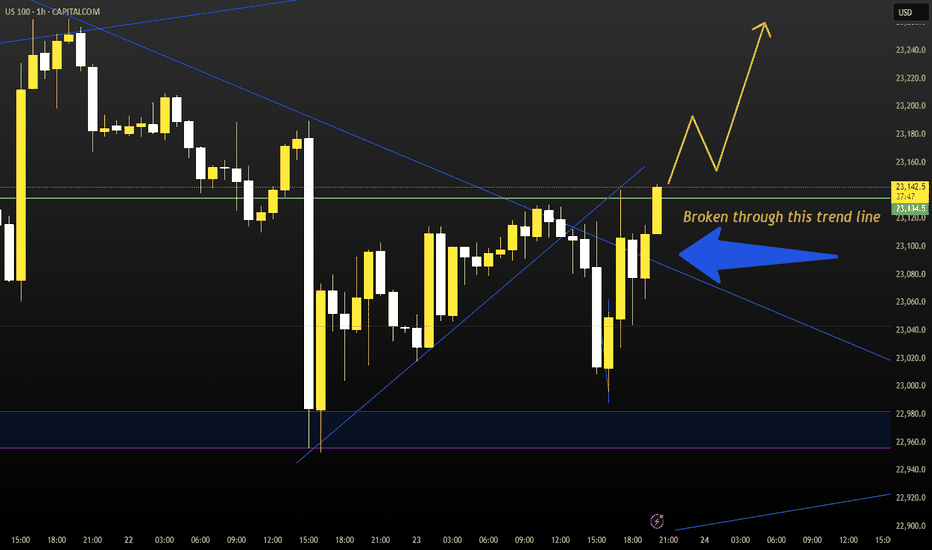

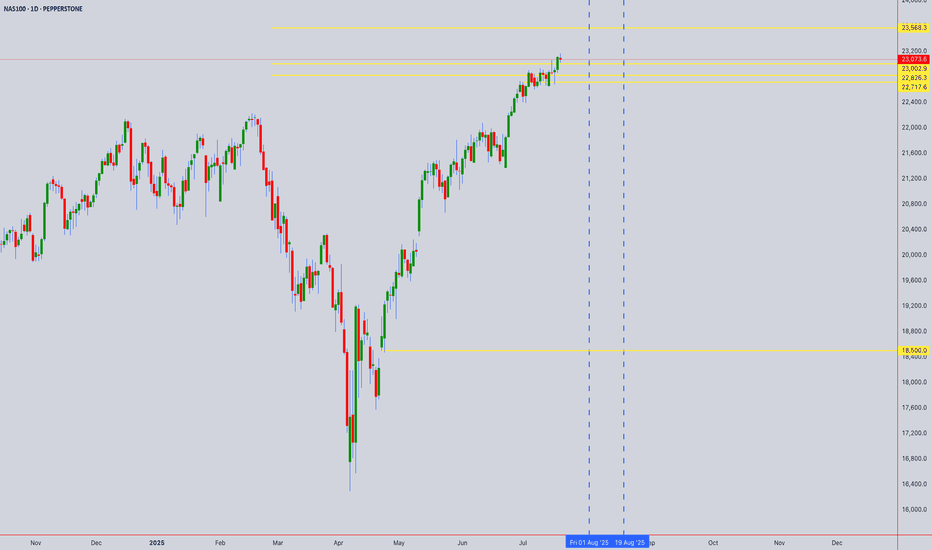

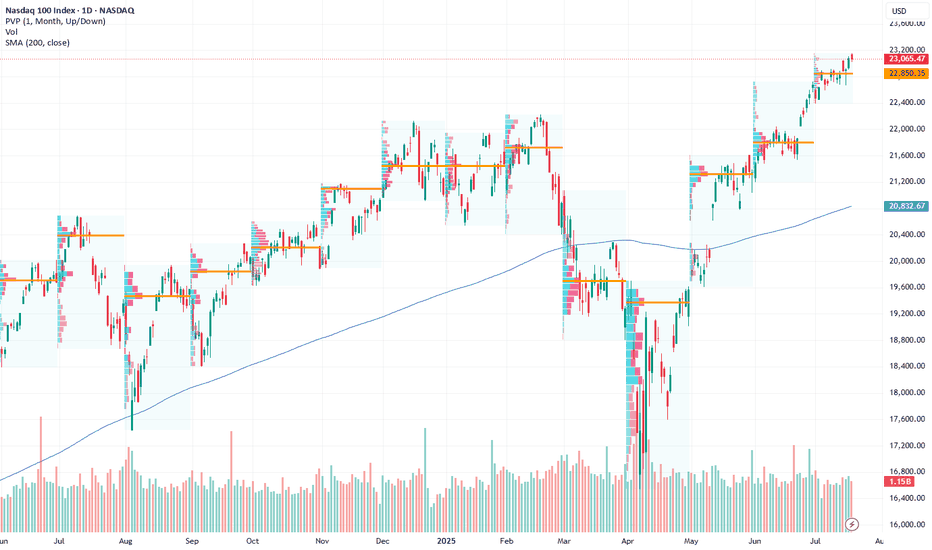

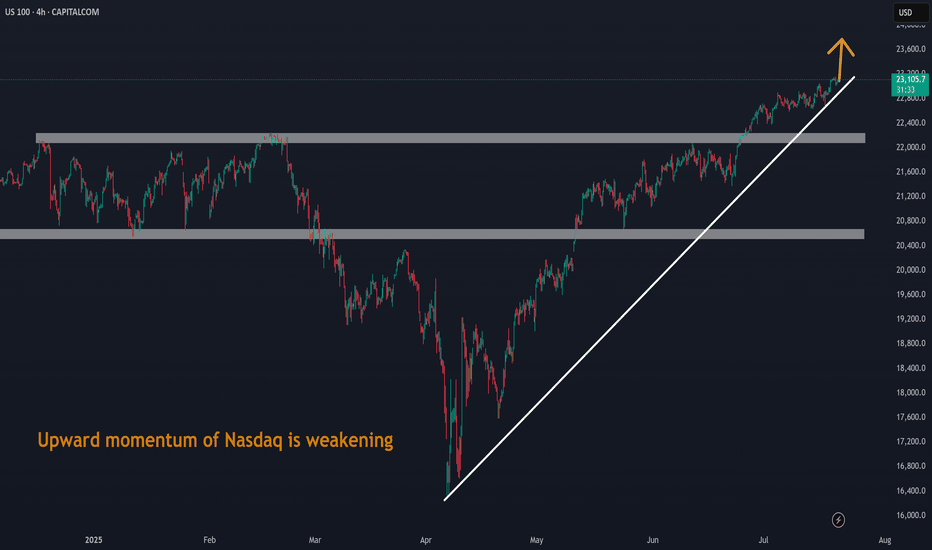

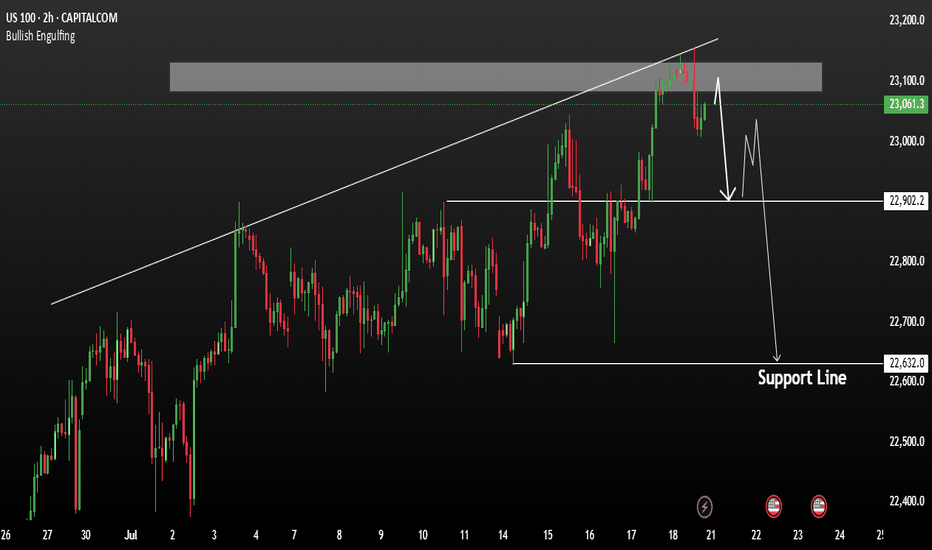

Nasdaq Ascending Trend has been broken.Good night traders.

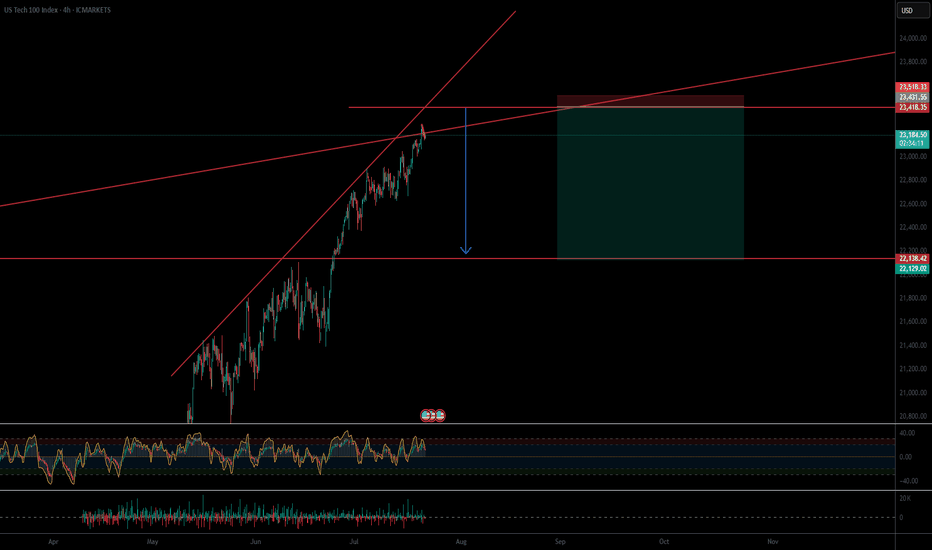

With Tuesday & today's move. NQ has broken the ascending trend, and retested the highs.

A total of 107 daily candles, 7,000pips move.

Reasons for taking this trade:

Current monthly candle has 2.9m volume, compared to a 6m & 7million from last 2 months. With only 8 days missing to end the month, how to fill all that pending volume?

Ascending trend has been broken and retested.

Expect a deep correction, around 2000-2400-2600 pips. There is correlation between 38.2 Fibo level.

Last week there was a manipulation with Powell dismiss rumor on Wednesday, next day on Thursday NQ rallied to the upside. Today being also Wednesday we saw a huge rejection to the upside, but there is no continuation.

DXY reaching bottom, + has a deeper short trend initiation, starting on January 13.

Trade will be validated if NQ creates a LL followed by a LH within the next 2 days.

What do you think of this analysis?

Thank you.

Enjoy

NDQ100 trade ideas

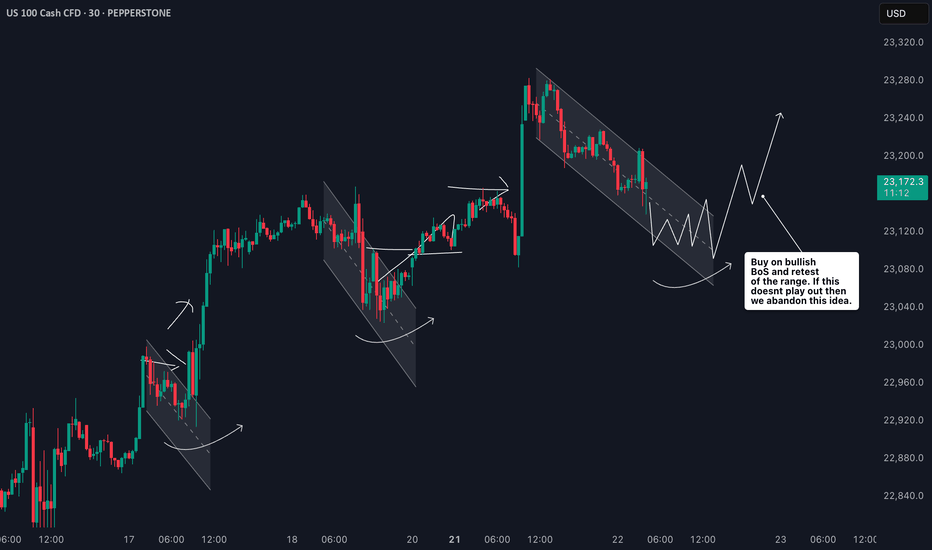

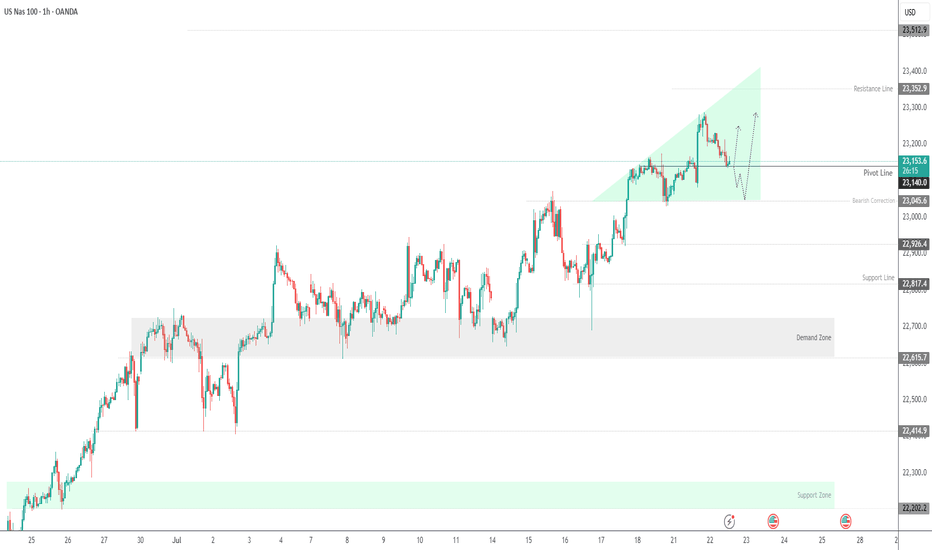

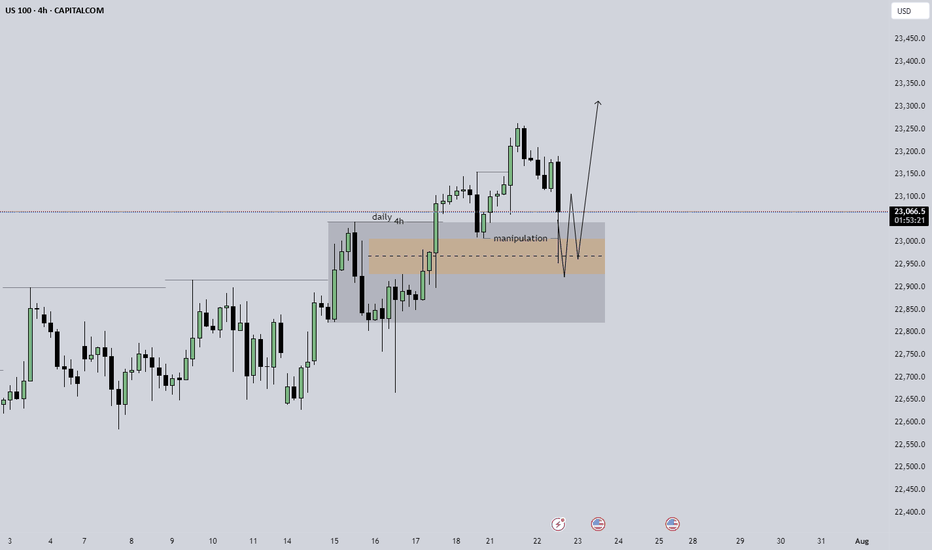

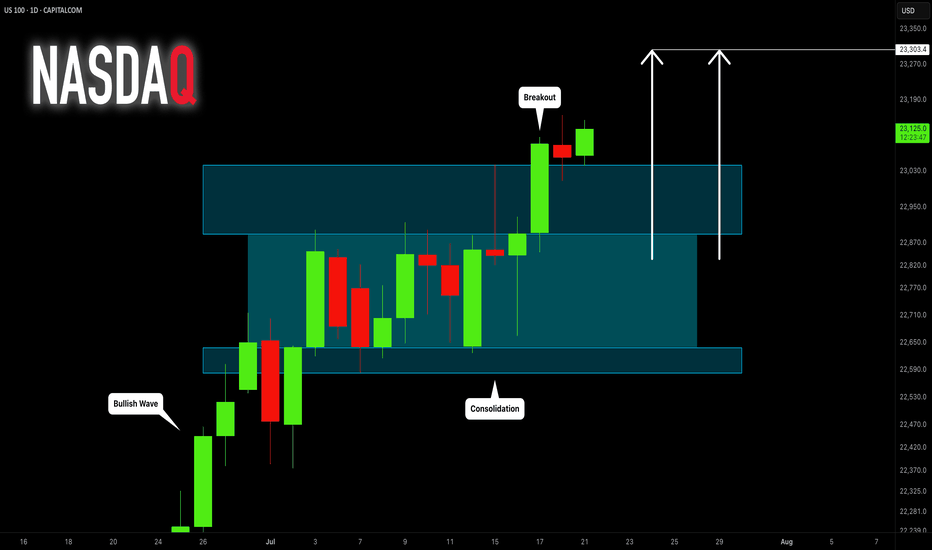

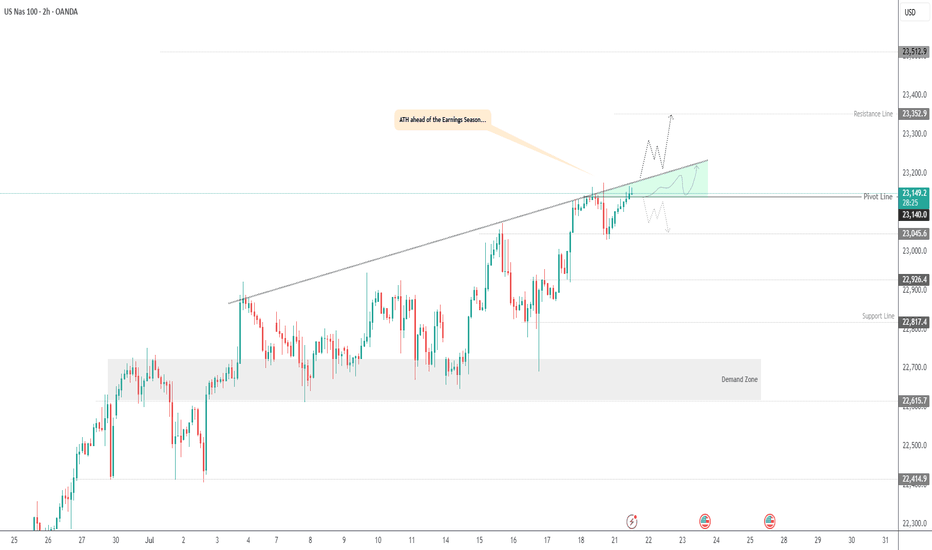

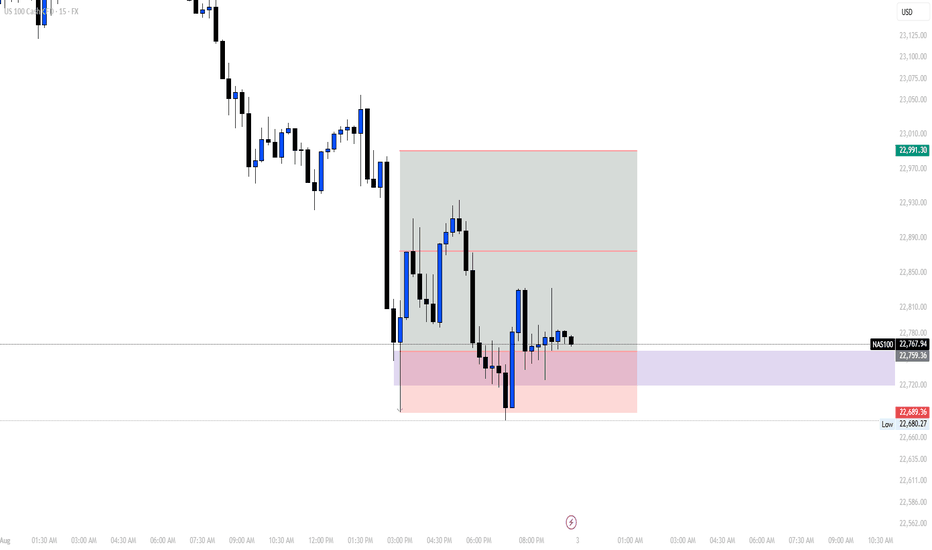

NAS100 Bullish Setup: Clean Structure & Entry Zone Pending📊 NASDAQ 100 (NAS100) remains bullish, showing a clean, well-structured uptrend—higher highs and higher lows 🔼📈.

Price has now pulled back into my optimal entry zone 🎯. At this stage, I’m waiting for a bullish break in market structure before considering an entry 🟢🔓.

Patience is key—let the structure confirm first.

Not financial advice ❌💼

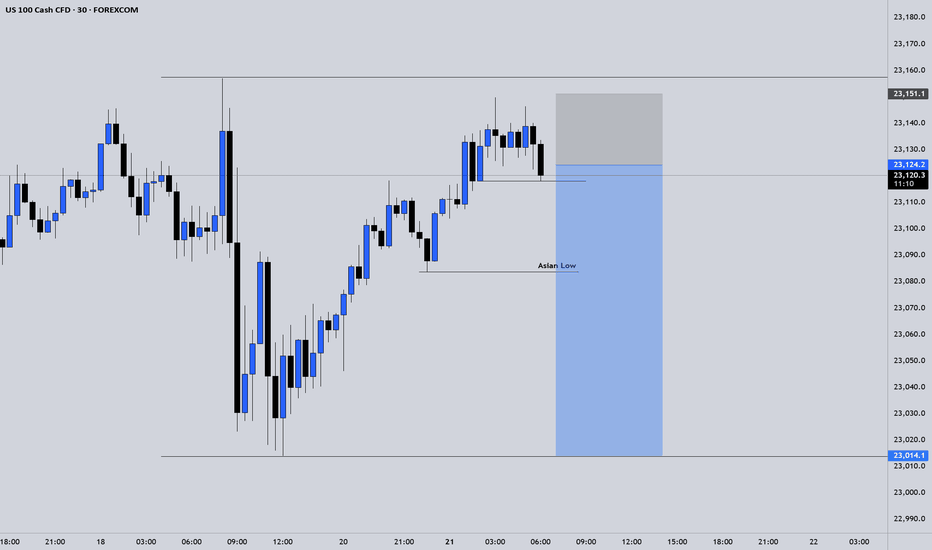

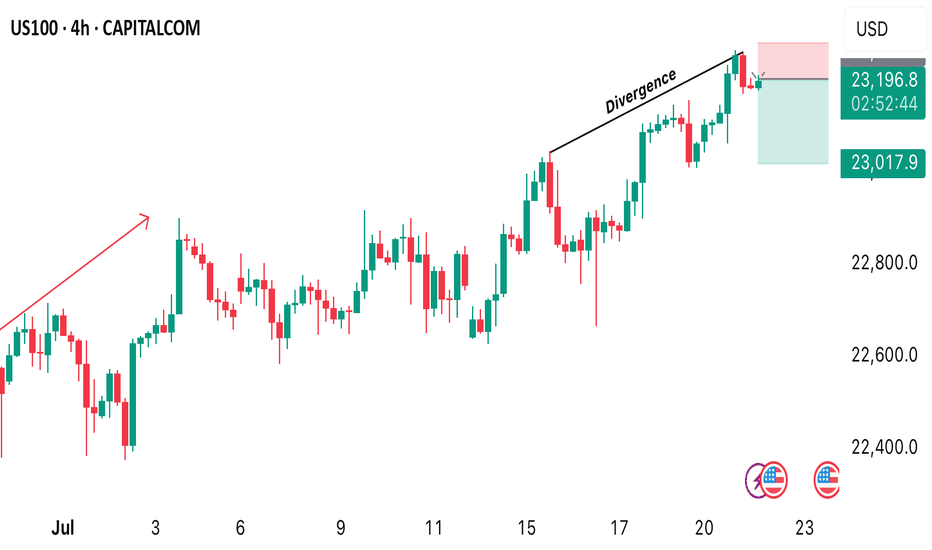

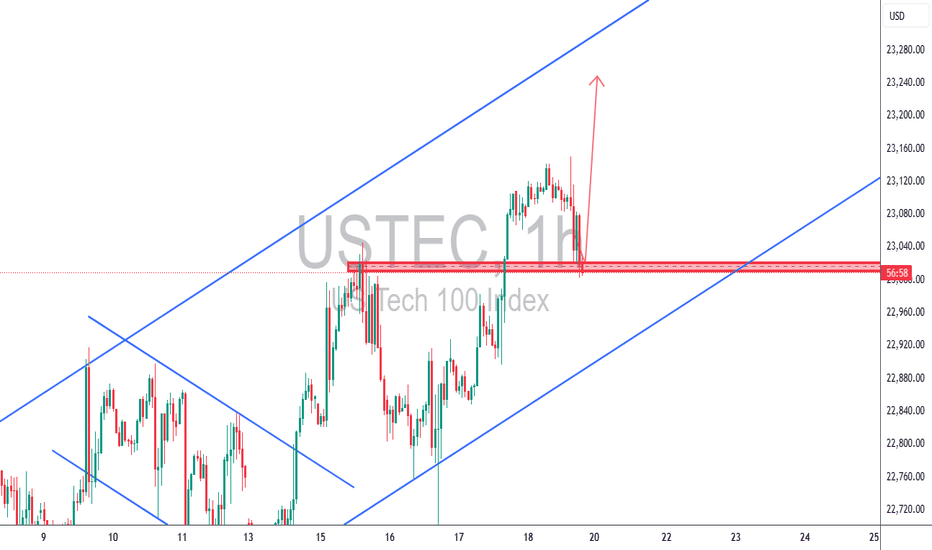

USNAS100 Eyes 23350 Ahead of Powell & Earnings StormUSNAS100

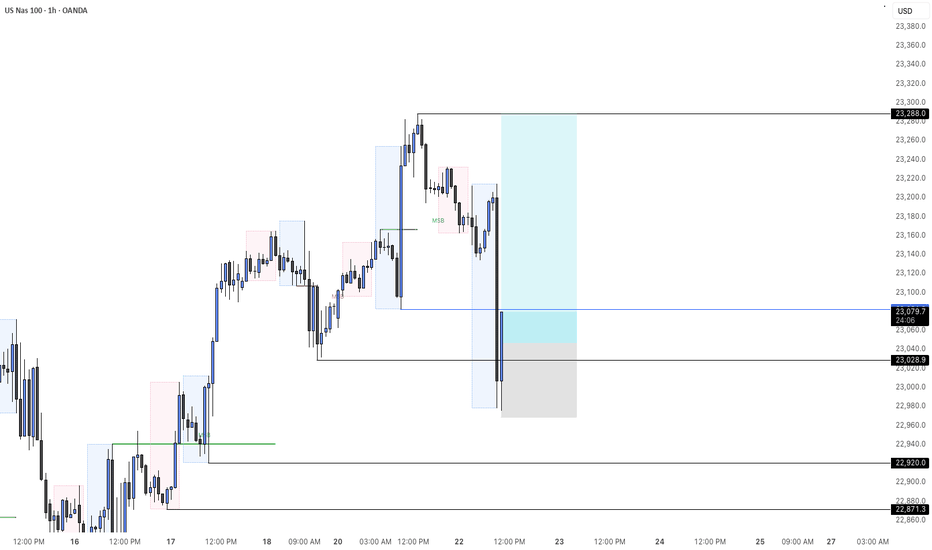

The price maintains bullish momentum, as outlined in the previous idea, with a clean rejection from the 23280 zone. Today, volatility is expected to increase ahead of Jerome Powell’s speech and a wave of key earnings reports.

As long as price holds above 23140, the outlook remains bullish toward 23230 and 23350.

A short-term correction toward 23045 is possible if we get a 1H close below 23140.

Resistance: 23230 · 23350 · 23510

Support: 23045 · 22920

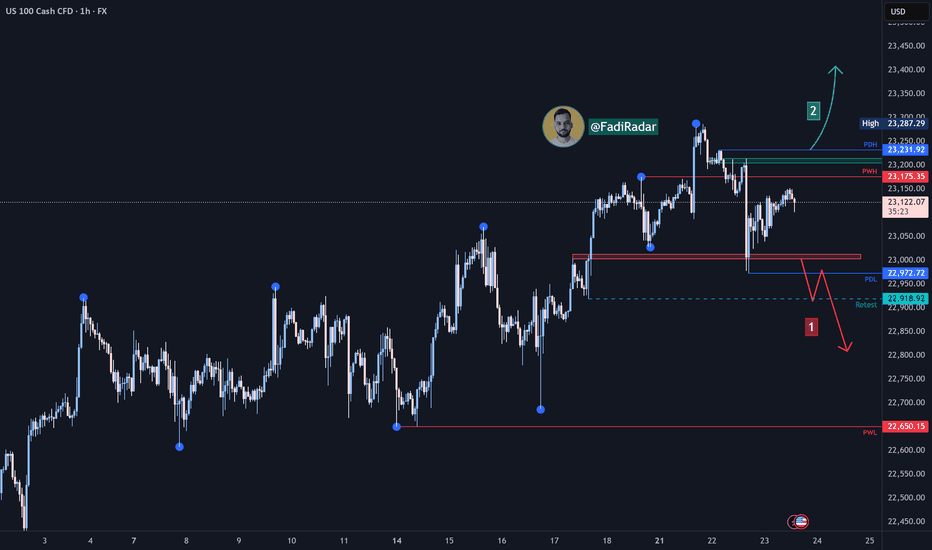

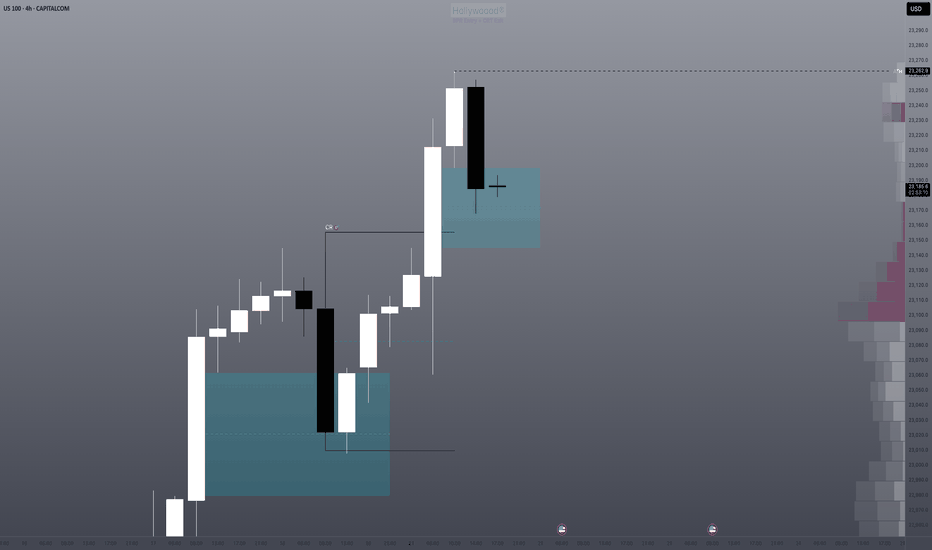

Nasdaq Index (US100 / NASDAQ):The Nasdaq index continues to move in a medium- to long-term uptrend, recently testing the 23,000 support zone and bouncing upward.

🔹 Bearish Scenario:

If the price breaks and closes below 23,000, it may lead to a decline toward 22,920, followed by a deeper move toward 22,650.

🔹 Bullish Scenario:

If the price holds above 23,200, further upside toward a new high around 23,400 is likely.

⚠️ Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always monitor the markets and perform your own due diligence before making any investment decisions.

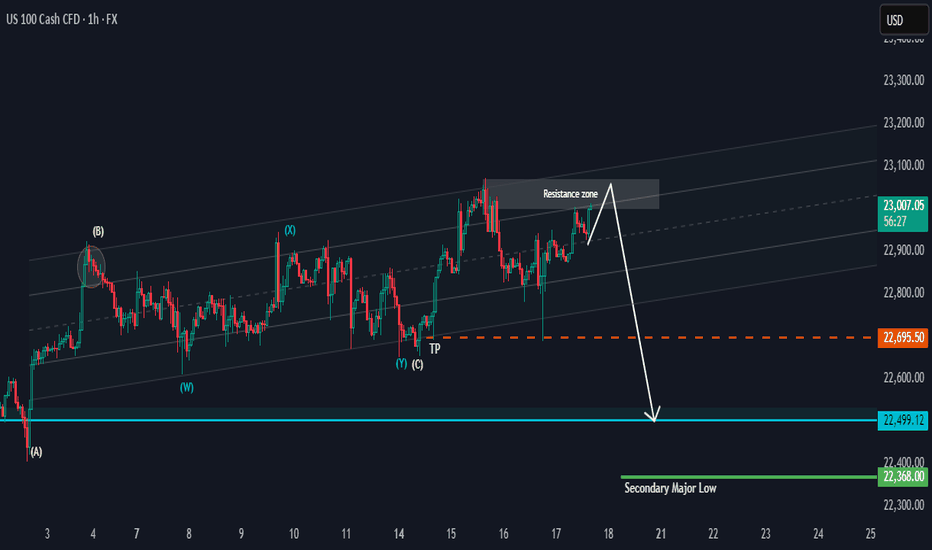

NAS 100 Potential PullbackHi there,

NAS100 has the potential to drop as it keeps testing the resistance zone in the range of 23100. This looks more like bull exhaustion than a reversal. The 22695.50 is the target for a bias of 22499.12

The overall bigger trend is bullish, with price highs aiming as far as 23717.44, 24837.28, and 26222.31, making this a potentially massive bullish trend, and it will take time to reach those highs.

Happy Trading, 🌟

K.

US100 (NASDAQ 100) 24-Hour Technical Analysis ForecastCurrent Price: 23,076.60 (Close: Friday, July 18th, 2025)

Analysis Period: Next 24 Hours (July 19-20, 2025)

Market Status: Weekend - Preparing for Monday Open

---------------------------------------------------------------------------------------------

EXECUTIVE SUMMARY - 24H OUTLOOK

Primary Bias: Neutral to Bullish (Short-term consolidation expected)

Key Resistance: 23,150 - 23,250

Critical Support: 22,850 - 22,950

Expected Range: 22,900 - 23,200

Volatility Level: Moderate (Tech earnings season approach)

---------------------------------------------------------------------------------------------

1. CANDLESTICK PATTERN ANALYSIS

Friday's Close Formation

---------------------------------------------------------------------------------------------

Pattern: Small-bodied candle with upper shadow at 23,076

Significance: Indecision after testing resistance near 23,150

Volume: Above-average volume suggesting institutional activity

Context: Failed to break cleanly above psychological 23,100 level

---------------------------------------------------------------------------------------------

Expected 24H Patterns

---------------------------------------------------------------------------------------------

Monday Gap: Potential small gap up to 23,100-23,120 area

Continuation Pattern: Bullish flag/pennant formation developing

Key Reversal: Watch for hammer formation at 22,950 support if decline occurs

---------------------------------------------------------------------------------------------

Pattern Probability Assessment

---------------------------------------------------------------------------------------------

Doji/Spinning Top: 40% probability (continued indecision)

Bullish Engulfing: 35% probability (if gap up occurs)

Bearish Reversal: 25% probability (if resistance holds)

---------------------------------------------------------------------------------------------

2. HARMONIC PATTERN ANALYSIS

Current Harmonic Setup

---------------------------------------------------------------------------------------------

Primary Pattern: Bullish Cypher Pattern in Development

---------------------------------------------------------------------------------------------

X: 22,400 (previous major low)

A: 23,250 (recent swing high)

B: 22,800 (61.8% retracement)

C: 23,150 (127.2% extension - current test area)

D (Completion): 22,650-22,750 (78.6% retracement zone)

---------------------------------------------------------------------------------------------

Alternative Pattern: Bull Flag

---------------------------------------------------------------------------------------------

Pole: 22,400 → 23,250 (850-point move)

Flag: Current consolidation 22,950-23,150

Target: 23,250 + 850 = 24,100 (extended projection)

---------------------------------------------------------------------------------------------

Fibonacci Levels (24H Focus)

---------------------------------------------------------------------------------------------

Golden Ratio Support: 22,950 (61.8% of recent swing)

38.2% Retracement: 23,025

23.6% Retracement: 23,050

Extension Target: 23,375 (161.8% projection)

---------------------------------------------------------------------------------------------

3. ELLIOTT WAVE THEORY - 24H COUNT

Primary Wave Count (Bullish Scenario)

---------------------------------------------------------------------------------------------

Macro Structure: Wave 5 of larger degree impulse in progress

Current Position: Wave 4 correction completing

Mini-wave Count: Flat correction pattern (A-B-C structure)

---------------------------------------------------------------------------------------------

24-Hour Wave Projection

---------------------------------------------------------------------------------------------

Wave A: 23,250 → 22,800 (Completed)

Wave B: 22,800 → 23,150 (Completed - 70% retrace)

Wave C: 23,150 → 22,950 (In Progress - Equal to A)

Wave 5 Target: 24,000-24,200 (1.618 extension)

---------------------------------------------------------------------------------------------

Alternative Count (Corrective Scenario)

---------------------------------------------------------------------------------------------

Structure: Double zigzag correction

Current Phase: Second zigzag development

Target: 22,750-22,850 (Wave Y completion)

---------------------------------------------------------------------------------------------

Critical Elliott Levels

---------------------------------------------------------------------------------------------

Wave 4 Low: 22,750 (must hold for bullish count)

Invalidation: Below 22,400 (Wave 1 high)

Confirmation: Break above 23,250 (Wave 3 high)

---------------------------------------------------------------------------------------------

4. WYCKOFF THEORY - 24H PHASE

Current Market Phase Assessment

---------------------------------------------------------------------------------------------

Primary Phase: Reaccumulation (Phase B-C transition)

Composite Operator Action: Testing supply at 23,150 area

Volume Analysis: Absorption of selling pressure evident

Smart Money Activity: Institutional buying on dips below 23,000

---------------------------------------------------------------------------------------------

Expected 24H Wyckoff Dynamics

---------------------------------------------------------------------------------------------

Phase Progression: Moving toward Phase D (Sign of Strength)

Testing Action: Final test of support at 22,950-23,000

Volume Expectation: Declining volume on any weakness

Breakout Setup: Spring action possible below 22,950

---------------------------------------------------------------------------------------------

Key Wyckoff Signals (24H Watch List)

---------------------------------------------------------------------------------------------

Sign of Strength (SOS): Break above 23,150 with volume

Last Point of Support (LPS): 22,950 area test

No Supply: Expected on rallies to 23,100-23,150

Backup to Edge of Creek: Potential dip to 22,850

---------------------------------------------------------------------------------------------

5. W.D. GANN THEORY - 24H ANALYSIS

Square of Nine Analysis

---------------------------------------------------------------------------------------------

Current Position: 23,076° on Gann wheel

Next Cardinal Point: 23,100° (significant psychological resistance)

Natural Support: 23,000° (perfect square - strong magnetic level)

Critical Angle: 22,900° (45-degree angle support from recent low)

---------------------------------------------------------------------------------------------

Time Theory - 24H Cycle

---------------------------------------------------------------------------------------------

Natural Time Cycle: 24-hour cycle from Friday's close

Critical Time Windows:

---------------------------------------------------------------------------------------------

6 hours: 02:00 UTC Monday (potential turn time)

18 hours: 14:00 UTC Monday (major turn potential)

24 hours: 20:00 UTC Monday (cycle completion)

---------------------------------------------------------------------------------------------

Angle Theory Application

---------------------------------------------------------------------------------------------

Rising 45° Line: Currently at 22,950 (critical support)

Rising 63.75° Line: 23,100 (steep resistance angle)

Declining 26.25° Line: 23,150 (gentle resistance)

---------------------------------------------------------------------------------------------

Gann Price Forecasting

---------------------------------------------------------------------------------------------

Square Root Method:

---------------------------------------------------------------------------------------------

Current: √23,076 ≈ 151.9

Next resistance: 152² = 23,104

Major resistance: 153² = 23,409

---------------------------------------------------------------------------------------------

Primary Target: 23,104 (natural Gann resistance)

Extended Target: 23,409 (next perfect square)

---------------------------------------------------------------------------------------------

Time-Price Harmony

---------------------------------------------------------------------------------------------

Harmonic Time: 144 hours from last major low

Price Harmony: 23,076 in harmony with 22,500 base

Next Harmony Level: 23,400 (Fibonacci price relationship)

---------------------------------------------------------------------------------------------

6. MULTI-TIMEFRAME INTRADAY ANALYSIS

5-Minute Chart Analysis

---------------------------------------------------------------------------------------------

Micro Trend: Consolidating triangle pattern

Support: 23,050-23,060 (recent lows)

Resistance: 23,090-23,100 (intraday highs)

Volume Profile: Balanced - no clear direction

RSI (5M): 48-52 range (neutral)

Pattern: Symmetrical triangle (breakout pending)

---------------------------------------------------------------------------------------------

15-Minute Chart Analysis

---------------------------------------------------------------------------------------------

Structure: Bull flag formation

Flag Boundaries: 23,040-23,120

Breakout Level: Above 23,120 (bullish)

Breakdown Level: Below 23,040 (bearish)

Moving Averages: EMA20 at 23,065 (support)

MACD: Consolidating above zero line

---------------------------------------------------------------------------------------------

30-Minute Chart Analysis

---------------------------------------------------------------------------------------------

Primary Pattern: Ascending triangle

Horizontal Resistance: 23,150 (multiple tests)

Rising Support Line: From 22,950 to current levels

Breakout Target: 23,350 (triangle height projection)

Volume: Decreasing (typical triangle behavior)

Bollinger Bands: Contracting (low volatility)

---------------------------------------------------------------------------------------------

1-Hour Chart Analysis

---------------------------------------------------------------------------------------------

Major Structure: Bullish continuation pattern

Cup and Handle: Handle formation in progress

Handle Depth: 7% correction (healthy)

Breakout Level: 23,175 (handle resistance)

Target: 24,000 (cup depth projection)

RSI (1H): 55 (bullish but not overbought)

---------------------------------------------------------------------------------------------

4-Hour Chart Analysis

---------------------------------------------------------------------------------------------

Macro Trend: Strong uptrend intact

Correction Type: Shallow pullback (wave 4 character)

Support Cluster: 22,900-23,000 (multiple confluences)

Resistance Zone: 23,150-23,250

Ichimoku Cloud: Price above cloud (bullish)

Volume Trend: Higher lows pattern (accumulation)

---------------------------------------------------------------------------------------------

7. TECHNICAL INDICATORS MATRIX

Momentum Indicators

---------------------------------------------------------------------------------------------

RSI (4H): 58 (Bullish momentum, room for upside)

RSI (1H): 55 (Neutral-bullish)

Stochastic %K: 62 (Above %D line - bullish)

Williams %R: -35 (Not oversold, upside potential)

---------------------------------------------------------------------------------------------

Trend Indicators

---------------------------------------------------------------------------------------------

MACD (4H): Above signal line, histogram positive

ADX: 35 (Strong trend strength)

Parabolic SAR: 22,950 (supportive)

Supertrend: 22,850 (strong support)

---------------------------------------------------------------------------------------------

Volume Indicators

---------------------------------------------------------------------------------------------

OBV: Rising trend (accumulation pattern)

Volume Rate of Change: Positive

Chaikin Money Flow: +0.15 (buying pressure)

Accumulation/Distribution: Uptrend

---------------------------------------------------------------------------------------------

8. KEY SUPPORT & RESISTANCE LEVELS (24H)

Critical Resistance Levels

---------------------------------------------------------------------------------------------

R1: 23,100 (Psychological + Gann)

R2: 23,150 (Technical resistance + harmonic)

R3: 23,200 (Minor resistance)

R4: 23,250 (Major swing high)

R5: 23,350 (Extended target)

---------------------------------------------------------------------------------------------

Vital Support Levels

---------------------------------------------------------------------------------------------

S1: 23,040 (Immediate support)

S2: 23,000 (Psychological + Gann)

S3: 22,950 (Critical support cluster)

S4: 22,900 (Strong technical support)

S5: 22,850 (Major support zone)

---------------------------------------------------------------------------------------------

9. 24-HOUR TRADING SCENARIOS

Scenario 1: Bullish Breakout (50% Probability)

---------------------------------------------------------------------------------------------

Trigger: Break above 23,120 with volume expansion

Initial Target: 23,180-23,200

Extended Target: 23,300-23,350

Stop Loss (Longs): Below 22,990

Expected Timeline: 12-18 hours from breakout

---------------------------------------------------------------------------------------------

Scenario 2: Continued Consolidation (35% Probability)

---------------------------------------------------------------------------------------------

Range: 23,000-23,150

Trading Strategy: Range-bound scalping

Buy Zone: 23,020-23,040

Sell Zone: 23,120-23,140

Duration: Full 24-hour period

---------------------------------------------------------------------------------------------

Scenario 3: Bearish Breakdown (15% Probability)

---------------------------------------------------------------------------------------------

Trigger: Break below 22,990 on volume

Target 1: 22,900-22,950

Target 2: 22,850-22,900

Bounce Level: 22,800-22,850

Recovery Above: 23,050 negates bearish scenario

---------------------------------------------------------------------------------------------

10. RISK FACTORS & CATALYSTS (24H)

Bullish Catalysts

---------------------------------------------------------------------------------------------

Tech earnings optimism building

AI sector momentum continuation

Institutional portfolio rebalancing (month-end flows)

Strong economic data expectations

Risk-on sentiment from Asia markets

---------------------------------------------------------------------------------------------

Bearish Risk Factors

---------------------------------------------------------------------------------------------

Profit-taking ahead of earnings

Rising bond yields concern

Geopolitical tensions impact

Overbought technical condition worries

Sector rotation out of tech

---------------------------------------------------------------------------------------------

High-Impact Events (Next 24H)

---------------------------------------------------------------------------------------------

Asian market opening (risk sentiment gauge)

Weekend news flow analysis

Pre-earnings positioning

Options expiry effects

Futures gap analysis

---------------------------------------------------------------------------------------------

11. TRADING RECOMMENDATIONS (24H)

For Scalpers (5M-15M Timeframes)

---------------------------------------------------------------------------------------------

Primary Setup: Triangle breakout trade

Entry Long: Above 23,120

Target: 23,160-23,180

Stop Loss: 23,080

Risk/Reward: 1:2 ratio

---------------------------------------------------------------------------------------------

For Intraday Traders (30M-1H)

---------------------------------------------------------------------------------------------

Strategy: Bull flag continuation

Entry Zone: 23,050-23,070 (on dips)

Target 1: 23,150

Target 2: 23,200

Stop Loss: 23,000

---------------------------------------------------------------------------------------------

For Swing Setup (4H basis)

---------------------------------------------------------------------------------------------

Approach: Pullback buying opportunity

Optimal Entry: 22,950-23,000

Primary Target: 23,350-23,400

Extended Target: 23,600

Stop Loss: 22,850

---------------------------------------------------------------------------------------------

12. CONFLUENCE ANALYSIS

Bullish Confluence at 22,950-23,000

---------------------------------------------------------------------------------------------

Gann Theory: 23,000° perfect square support

Elliott Wave: Wave 4 completion zone

Wyckoff: Last Point of Support (LPS)

Fibonacci: 61.8% retracement level

Moving Averages: EMA 50 confluence

Volume Profile: High volume node support

---------------------------------------------------------------------------------------------

Resistance Confluence at 23,150-23,200

---------------------------------------------------------------------------------------------

Harmonic: Cypher pattern C-point resistance

Previous Structure: Multiple test area

Psychological: Round number resistance

Gann Angles: 63.75° resistance line

Elliott Wave: Wave B completion area

Technical: Flag pattern upper boundary

---------------------------------------------------------------------------------------------

FINAL 24H FORECAST SUMMARY

Most Likely Scenario: Continued consolidation with upward bias, testing 23,150 resistance with potential breakout to 23,200+ levels.

Trading Range Expectation: 22,980 - 23,180 (primary range)

Breakout Levels:

---------------------------------------------------------------------------------------------

Bullish: Above 23,120 → targets 23,200-23,350

Bearish: Below 22,980 → targets 22,900-22,950

---------------------------------------------------------------------------------------------

Key Time Windows:

---------------------------------------------------------------------------------------------

Asian Open: 00:00-02:00 UTC (gap direction)

US Pre-market: 08:00-13:30 UTC (institutional flows)

US Cash Open: 13:30 UTC (volume confirmation)

---------------------------------------------------------------------------------------------

Risk Management Notes:

---------------------------------------------------------------------------------------------

Position sizing should account for tech sector volatility

Weekend gap risk considerations

Earnings season positioning effects

---------------------------------------------------------------------------------------------

Probability Assessment:

---------------------------------------------------------------------------------------------

50% - Bullish breakout scenario

35% - Range-bound consolidation

15% - Bearish breakdown

---------------------------------------------------------------------------------------------

Disclaimer: This analysis is for educational purposes only. Trading involves substantial risk of loss. Always use appropriate risk management and never risk more than you can afford to lose. Past performance does not guarantee future results.

---------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------

For those interested in further developing their trading skills based on these types of analyses, consider exploring the mentoring program offered by Shunya Trade.

I welcome your feedback on this analysis, as it will inform and enhance my future work.

Regards,

Shunya Trade

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

Go Long – Bullish Targets for Next Week- Current Price: $23065.47

- Key Insights: NASDAQ has exhibited resilience despite recent sentiment shifts,

showing signs of potential upside driven by a solid rebound in major tech

stocks. With earnings season approaching, improved performance in underlying

components reinforces long-term confidence in the index.

- Price Targets:

- T1: $23427.43

- T2: $23696.12

- S1: $22834.82

- S2: $22604.17

- Recent Performance: Over the past week, NASDAQ has consolidated near its

current levels, with intraday volatility driven by sector rotations and

macro concerns. While sentiment has weakened, the index remains supported by

key levels near the $23,000 mark.

- Expert Analysis: Analysts express optimism around key components such as

Apple, Microsoft, and Nvidia, which have recently seen improved outlooks.

Broader tech sector strength may drive NASDAQ higher. Caution is advised

given geopolitical uncertainties but upside opportunities dominate momentum.

- Sentiment Analysis:

- Current sentiment: 0

- Last week: 62.5

- Change: -62.5

- Total mentions: 386

- News Impact: Positive developments in semiconductor growth forecasts and

easing fears over rate hikes have supported bullish sentiment. However, last

week’s lower-than-expected inflation data and Federal Reserve signals for

"higher rates for longer" dampened sentiment overall.

NASDAQ INDEX (US100): Bullish Continuation Confirmed

NASDAQ Index broke and closed above a resistance of a horizontal

parallel channel on a daily.

It confirms a bullish trend continuation and a highly probable growth

to the next strong resistance.

Goal - 23300

❤️Please, support my work with like, thank you!❤️

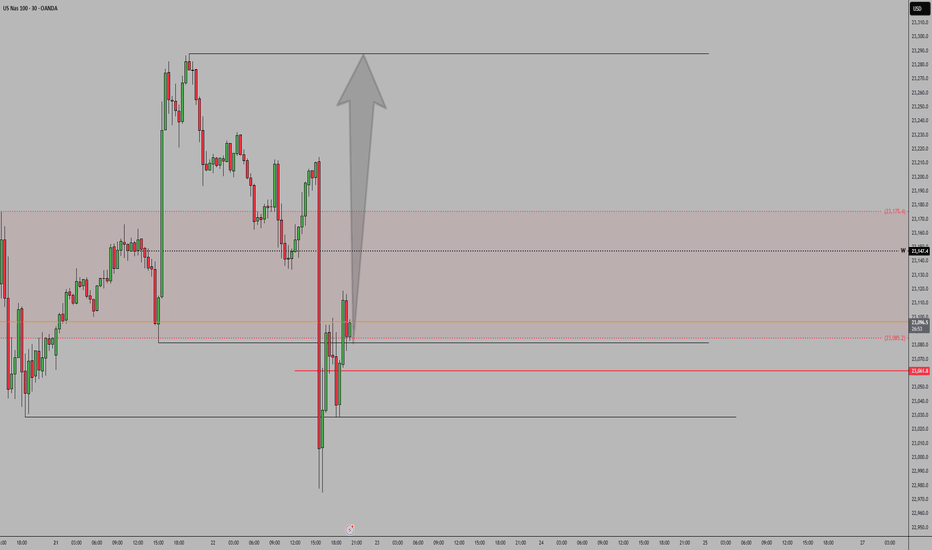

USTEC 1H – Bullish Continuation Play🔥 USTEC 1H – Bullish Continuation Play

Price pulled back into a strong demand zone and ascending channel support. We're in a clear bullish trend, and this retest offers a high-probability continuation setup.

✅ Demand zone confluence

✅ Previous resistance turned support

✅ Trendline + bullish wick rejection

✅ Clean structure with 1:3+ potential

🎯 Targeting 23,250+ while SL remains below 22,990

Strategy: TCB – Trend Phase (Pullback Entry)

Checklist Score: 100% ✅ A+ setup

Bias: Bullish – continuation expected

#USTEC #NASDAQ100 #US100 #TechnicalAnalysis #TCBStrategy #PriceAction #ForexTrading #IndicesTrading #SmartMoney #BreakoutTrading #TrendTrading #ChartAnalysis #BullishSetup #TradeIdeas #TradingView

Let me know if you want custom hashtags for XAUUSD, BTCUSD, USDCAD, or others.

USNAS100 | Bullish Setup Ahead of Tech Earnings & Trade RiskUSNAS100 | Bullish Setup Ahead of Tech Earnings & Trade Risk

U.S. equity markets are entering a pivotal week with big-tech earnings and renewed focus on Trump’s proposed trade tariffs. Both the S&P 500 and Nasdaq are hovering near record highs, but new catalysts are required for continuation.

Technical Outlook:

The price has stabilized above 23140, breaking the pivot and confirming bullish momentum. As long as the price holds above this level, the trend remains bullish, especially if it breaks the green triangle resistance structure.

A sustained move above 23140 opens the path toward 23250 and 23350, with further extension possible to 23510.

However, a 4H close below 23140 may activate a bearish correction toward 23045, and possibly deeper toward 22920 and 22820.

Resistance Levels: 23250 · 23350 · 23510

Support Levels: 23045 · 22920 · 22820

Bias: Bullish above 23140

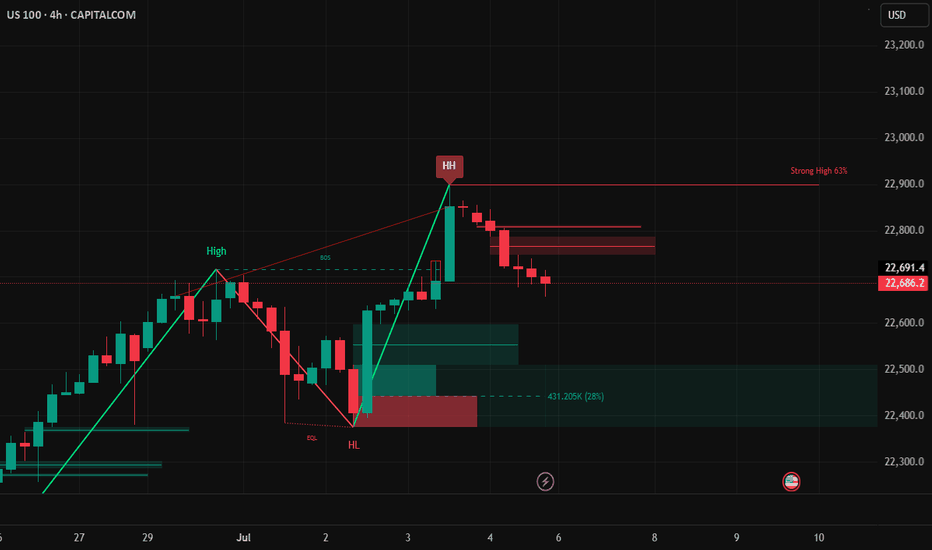

Nas Long to clear HH liquidity before correctionHTF Context – Monthly / Weekly / Daily

• Big Beautiful Bill (Trump Tax + Spending Bill)

o Passed July 4th, acting as a stimulus.

o Markets historically rally on fiscal stimulus expectations (tax cuts + spending packages).

o This fuels bullish sentiment short-term, but long-term raises debt, inflation risk, and rate hike concerns.

• Seasonality

o July is typically strong for equities, especially tech, with mid-July often marking local tops before August pullbacks.

• Monthly structure

o Strong bullish monthly candles.

o Next major fib retracements if rejected: 38.2% ~20,398, 50% ~19,625, 61.8% ~18,852.

• Weekly / Daily structure

o HH-HL sequence continues.

o Price in premium zone, approaching major supply block 23,200–23,300.

o Daily BOS not broken downwards yet.

________________________________________

Key Levels

• Major supply / liquidity magnet: 23,200–23,300 (sell-side OB in futures, uncollected liquidity above HH)

• Recent swing high: 22,900

• Daily pivot: 22,470

• Intraday demand zone: 22,450–22,350 (4H wedge base + VWAP)

• Weekly support shelf: 22,100–22,200 (if lost, major trend shift bearish)

________________________________________

My View – Most Likely Path

1. Price is likely to sweep the liquidity above recent highs into the 23,200–23,300 supply zone.

o Why? Market rarely leaves liquidity uncollected. This move traps breakout buyers and hits stops above HHs.

o Big Beautiful Bill fuels the final squeeze higher as algorithms price in fiscal stimulus.

2. After liquidity sweep above 23,200–23,300:

o Expect strong rejection from that zone.

o Institutions offload positions into trapped retail longs.

o Price pulls back towards daily and weekly support zones for reaccumulation.

3. Alternate scenario (less likely)

o Immediate sell-off from current levels without sweeping HH.

o Weak move; would still expect a revisit higher later to clear liquidity before a proper downtrend.

________________________________________

Trade Setups – Intraday & Swing

Intraday Long (Most Likely)

• Bias: Bullish continuation

• Entry Zone: 22,450–22,350 (4H demand + VWAP)

• Trigger: 5m/15m BOS up

• Stop: Below 22,300.

• Targets: First at 22,615, next at 22,845, final at 23,200–23,300.

________________________________________

Intraday Short (Countertrend / Liquidity Sweep Reversal)

• Bias: Short from supply after liquidity grab

• Entry Zone: 23,200–23,300

• Trigger: Sweep of HH with rejection wick or bearish engulfing candle

• Stop: Above 23,350 (structure invalidation).

• Targets: First at 22,845, then 22,600, extend to 22,450 if momentum accelerates.

________________________________________

Swing Long (Continuation)

• Bias: Bullish trend intact

• Entry: After retest of daily pivot (22,470) or 4H demand (22,350–22,450) with 4H CHoCH + BOS up.

• Stop: Below 22,200 (weekly support break invalidates).

• Targets: 22,845 then 23,200–23,300. Blue sky if above.

________________________________________

Swing Short (Only if structure breaks)

• Trigger: Daily close below 22,200

• Bias: Bearish trend shift

• Targets: 21,800 first, then 21,000 major fib cluster and weekly MA.

________________________________________

Summary – My Final Opinion

Price is in a strong uptrend fuelled by fiscal stimulus, rate cuts and tarrif hopes . I think it will sweep the liquidity above 23,200–23,300 before any deeper pullback or trend reversal. Any rejection from that supply zone will be the cue to short for a structural retracement. Until then, I’ll keep buying dips aligned with the HTF bullish structure.

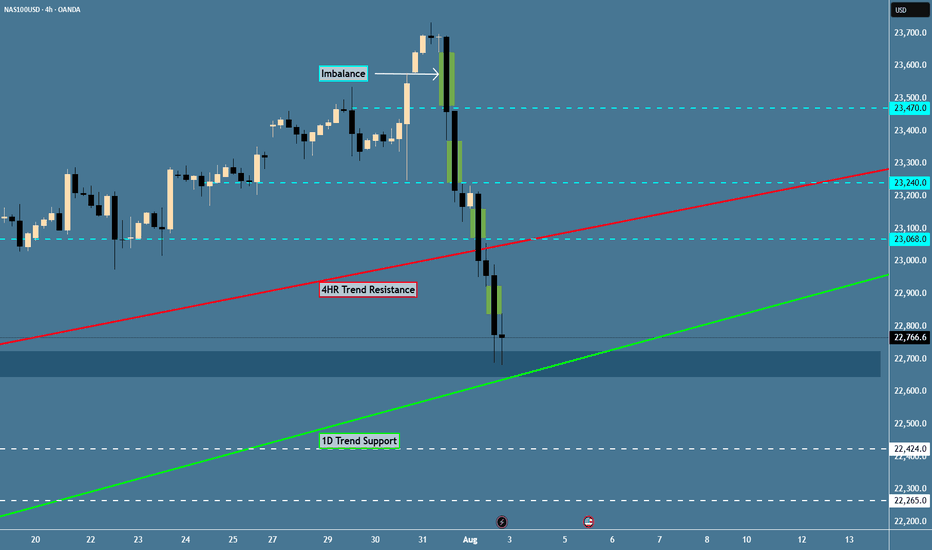

USNAS100 signs of a potential bearish trend Nasdaq Composite ended Friday little changed, recovering from a brief dip triggered by financial reports suggesting that former President Donald Trump is pushing for new tariffs. This geopolitical uncertainty is adding pressure to tech-heavy indices, with broader market sentiment turning cautious.

The price action on USNAS100 currently appears weak, showing early signs of a potential bearish trend in the upcoming week. However, before further downside, we may see the price retest key resistance levels.

You may find more details in the chart Ps Support with like and comments for better analysis.

NAS100 - Potential Targets this WeekDear Friends in Trading,

How I see it,

(My week is building up; I'm using the DATA we have thus far)

Keynotes:

510k orders stacked at the current demand area.

If sellers push through Daily support decisively, it will become a strong resistance.

The real battlefield between sellers and buyer lies between 23250 - 23500.

Remember with stocks, Imbalances can remain unfilled for very long periods.

I sincerely hope my point of view offers a valued insight

Thank you for taking the time study my analysis.