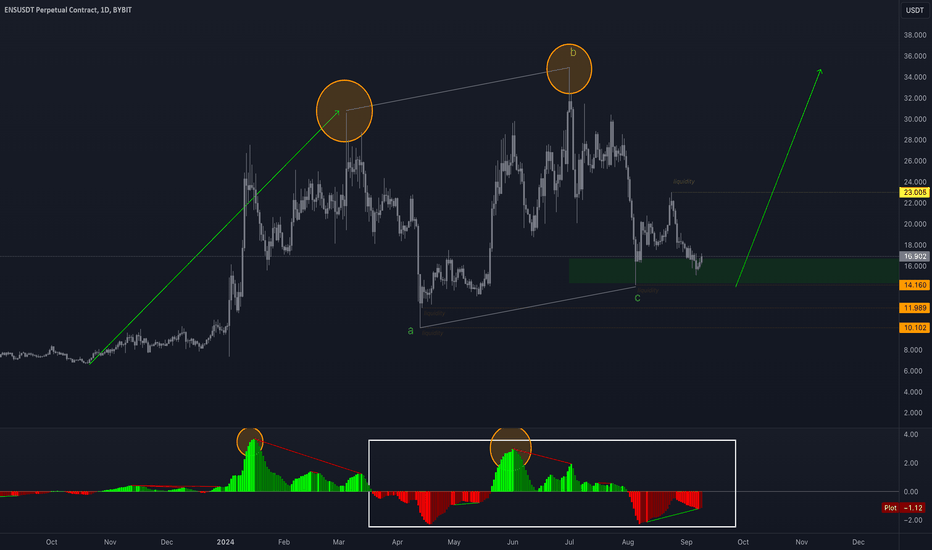

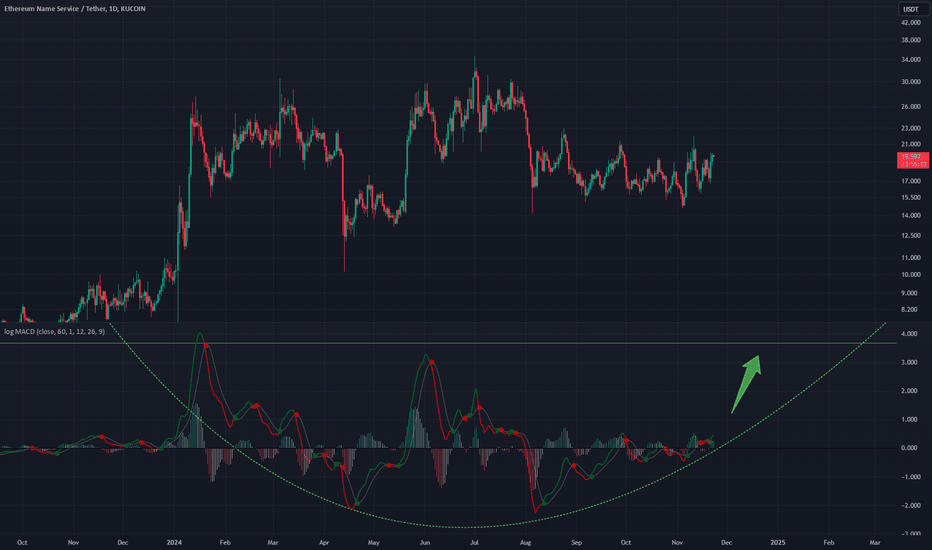

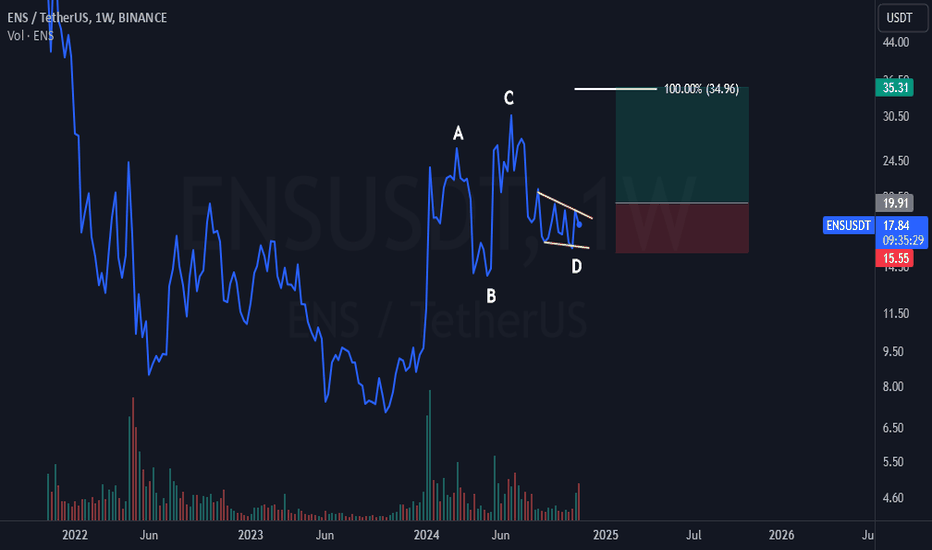

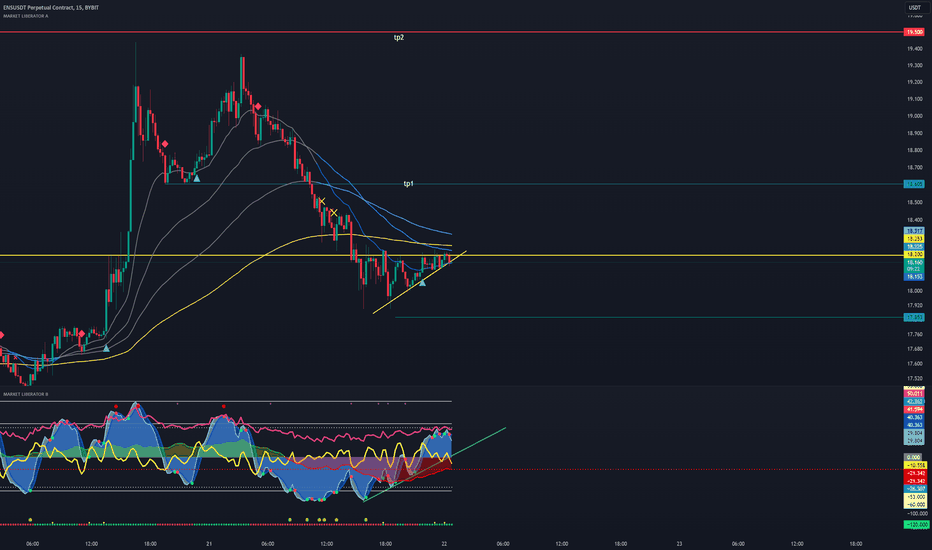

ENS showing a stunning Regular-Flat🚀 #ENS @ensdomainsis showing a stunning Regular-Flat (a,b,c) structure 😍

There’s a slight bullish divergence on the MACD between the two tops (🟠).

But on the MACD (⬜️) we can see that the correction is done.

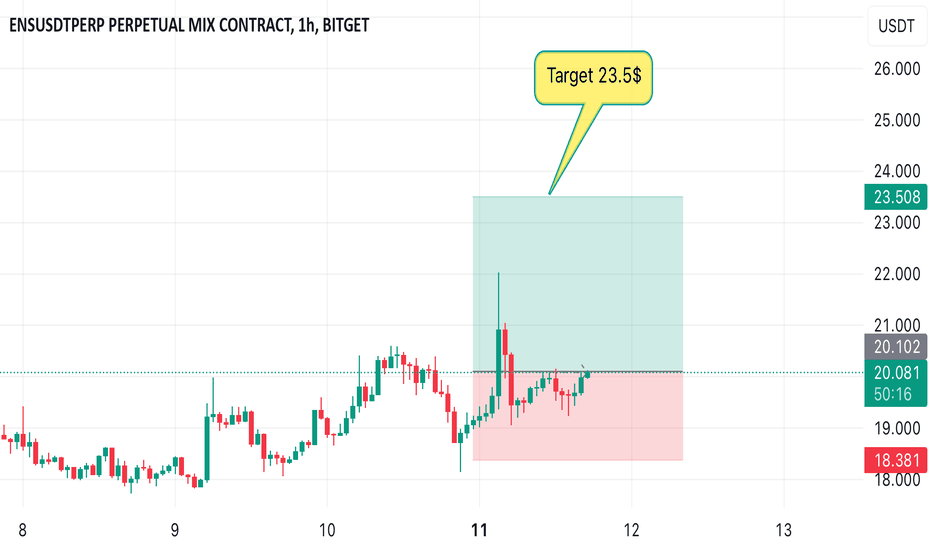

Looking for to reach at least $23, then aiming for the top! 💸

ENSUSDT trade ideas

Here I buy Ethereum Name Service at $40Here I buy Ethereum Name Service at $40

Buy orders starting at $40 on the spot market.

And Ethereum Name Service supply shock is being triggered by me as usual.

Look at the sea horizon

He's coming to make more dollar

It's clear as water

Look at the sea horizon

The bull shark is getting closer

let the rhythm take you over

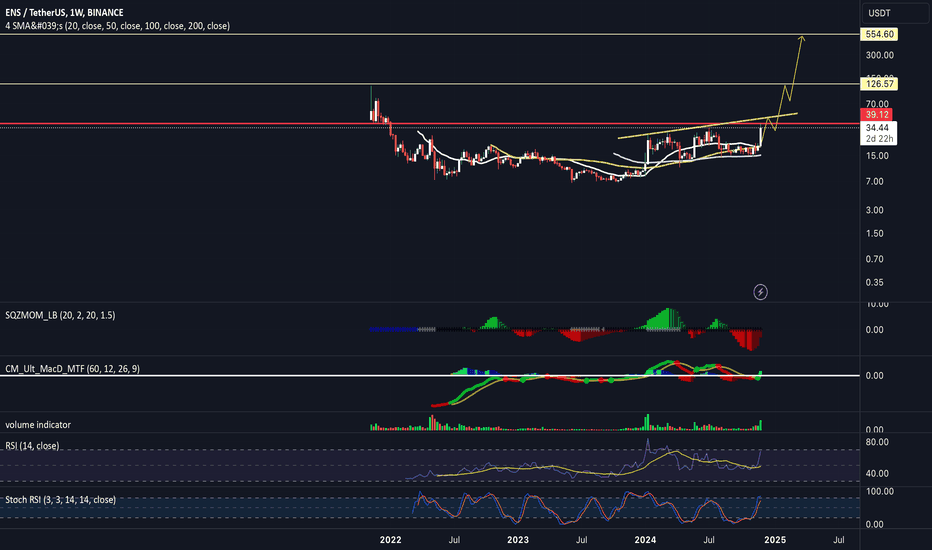

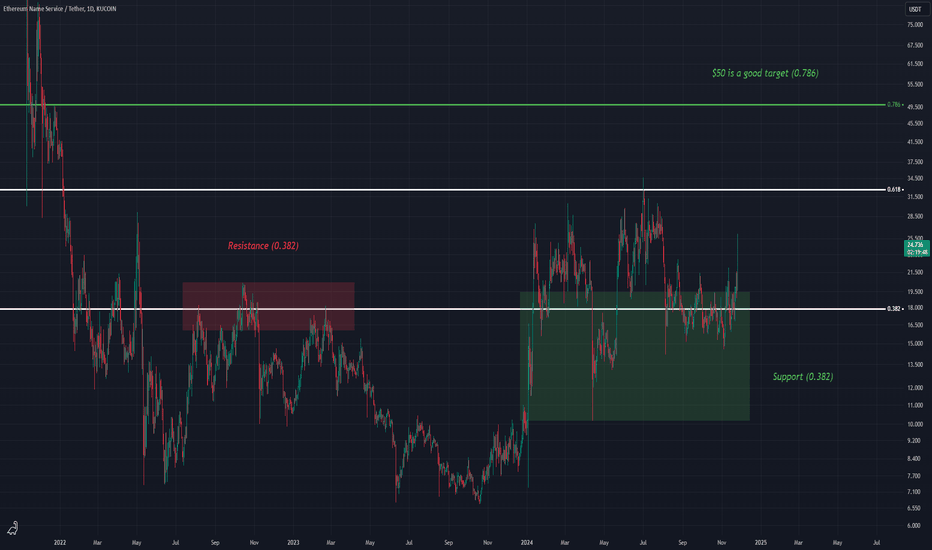

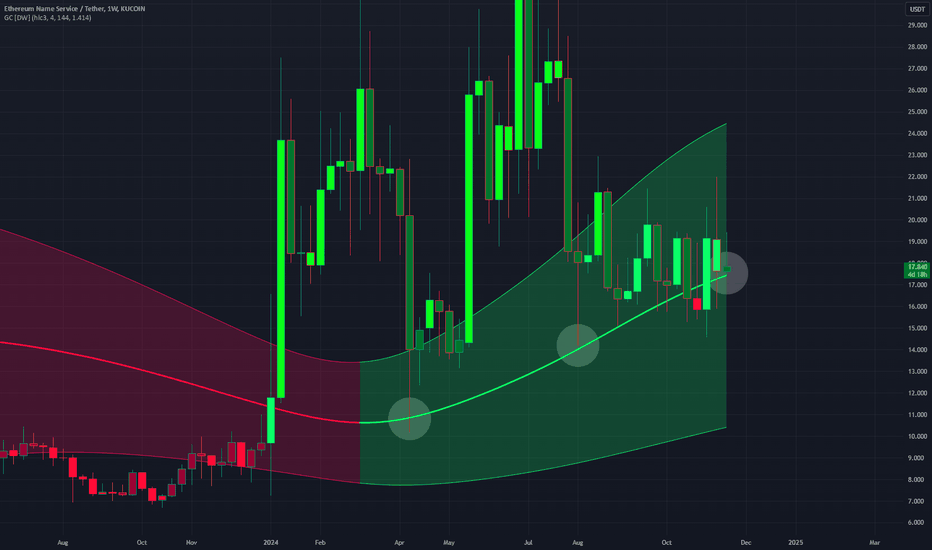

Ethereum Name Service ENS price needs to take a break from growtThe price of CRYPTOCAP:ETH has finally started to rise 👇

follow they're accelerating growth of the #ENS price (which has the word #Ethereum in its name)

#ENS is an Ethereum Name Service control token used to control the protocol and influence the pricing decisions of its .eth address and price oracle.

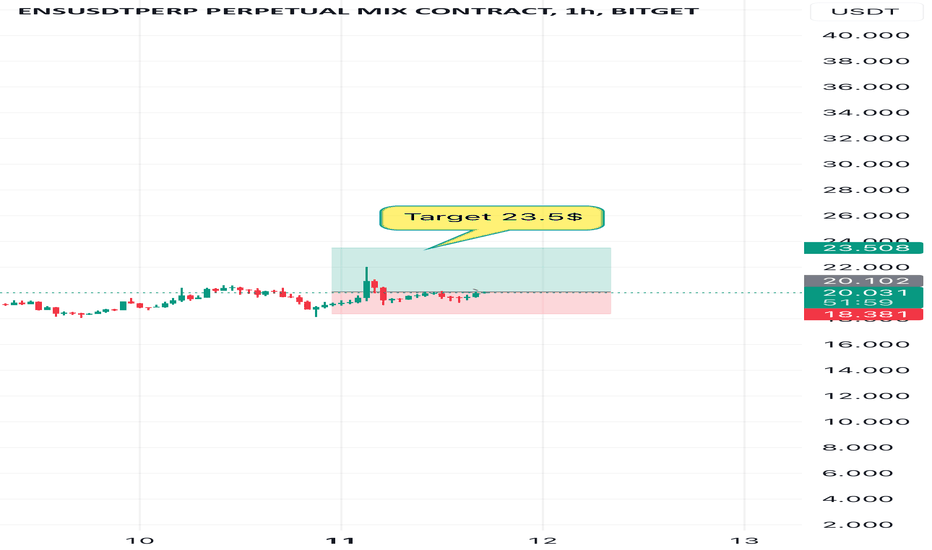

In our opinion, now it is not so much important for #ENSUSDT buyers to continue their rapid growth as it is to finally hold the price above $23.60 , which they have not been able to do by all 2024.

Only then will it be possible to continue the steady wave of growth to $80+.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

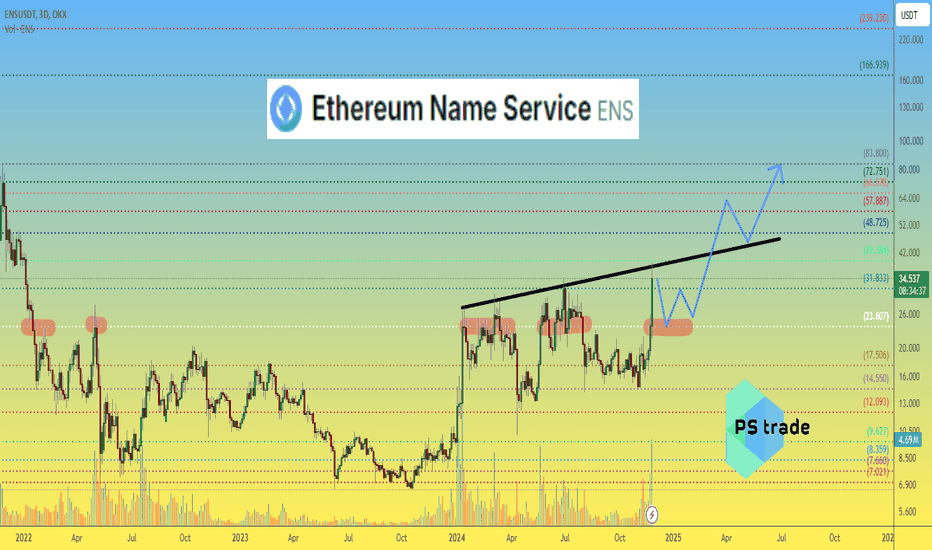

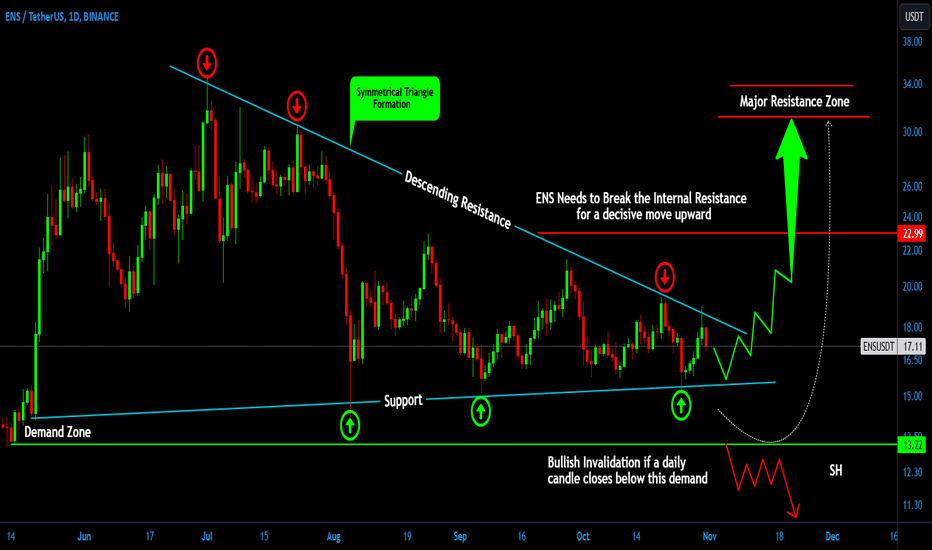

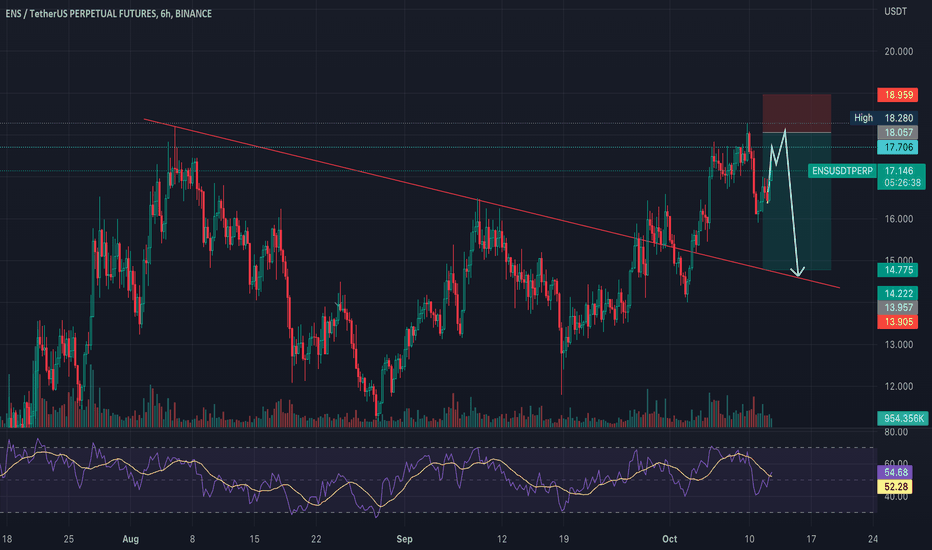

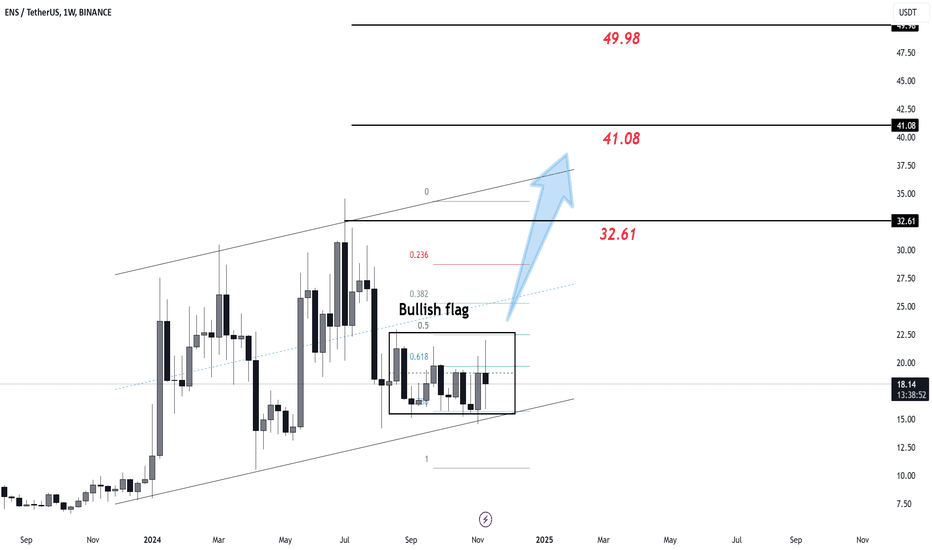

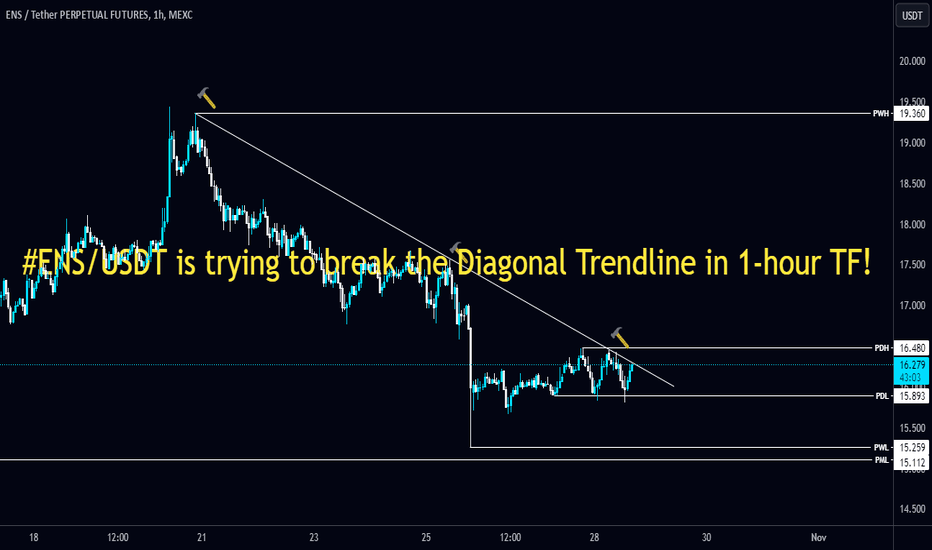

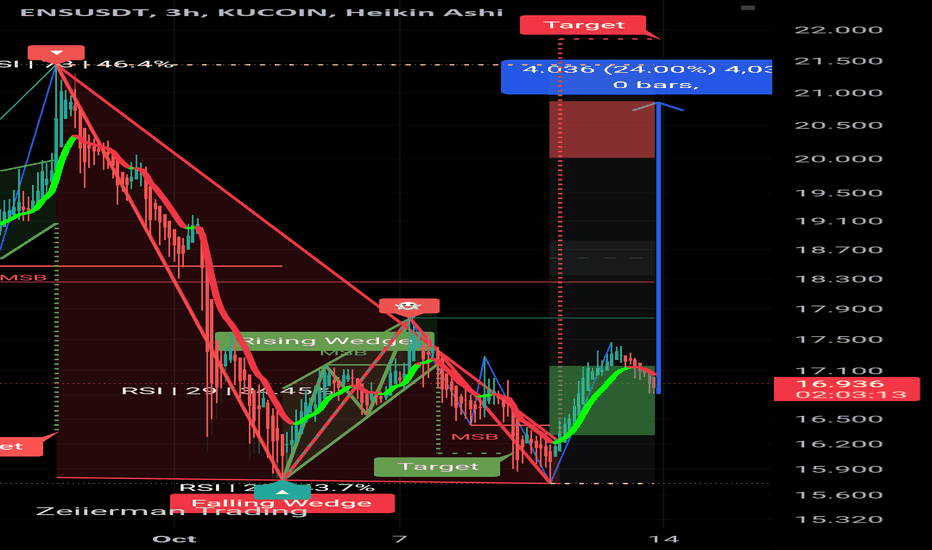

Will #ENSUSDT Explode or Collapse Soon? Key Levels to WatchYello, Paradisers! Are you prepared for what could be a massive move on #ENSUSDT? Let's discuss the latest analysis of #EthereumNameService:

💎Currently, #ENS is gaining momentum at the ascending support line, hinting at a bullish push. If the momentum holds, we might see a strong breakout above the triangle, setting the stage for a significant rally. But here's the kicker: we’re not quite there yet.

💎To confirm a genuine bullish move, we need a clear break above the triangle and the internal supply zone at $22.99. This breakout must be accompanied by solid buying pressure—think strong engulfing candles and consistent momentum. Without these signs, jumping in early could be costly. Patience is the name of the game here.

💎But what if the bullish momentum fades? If #EthereumNameService struggles to breach the triangle and the $22.99 level, it might signal waning buyer strength, inviting sellers to take control. The critical area to watch is the lower demand zone at $13.22.

💎This historically strong support level could be our last line of defense for bulls. If the price bounces from $13.22, the bullish outlook could stay intact. But—brace yourself—a break below $13.22 would invalidate the bullish setup and could trigger a sharp decline.

Stay patient and only act on the best and high probability setups.

MyCryptoParadise

iFeel the success🌴

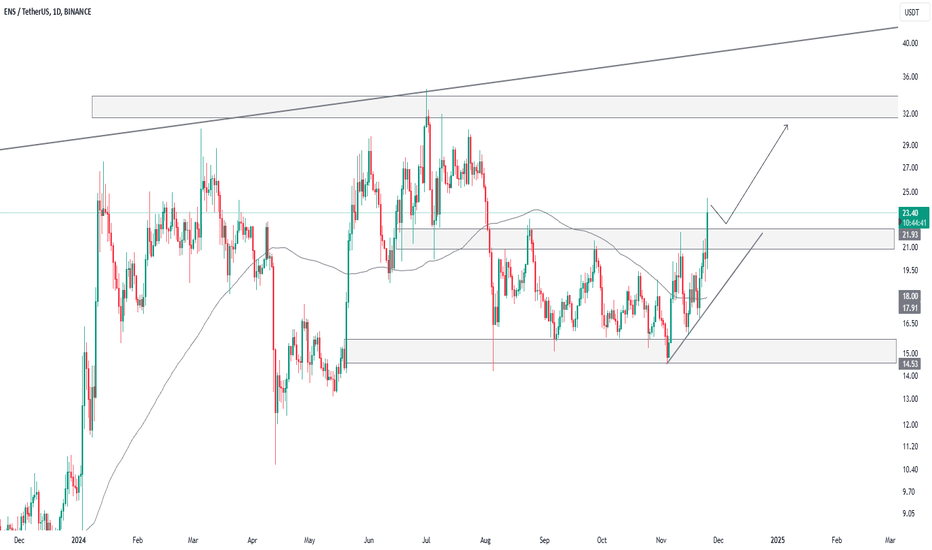

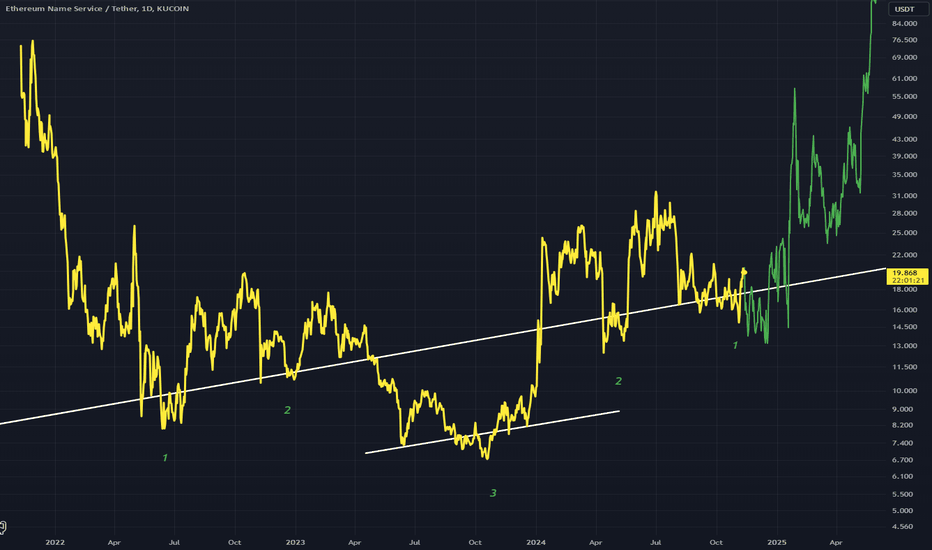

Very bullish on ENSUSDWhite trend line represent two shoulder touches (1,2) and a head breakdown at (3)

This is acting as a large inverted H&S where we are yet to experience the move up at (1) which is opposite move of the first (1) which was a downward move

Very bullish

Hopefully my reasoning can be observed

ENS/USDT trade:ENS/USDT trade:

*Market Overview*

1. *Pair*: ENS/USDT (Ethereum Name Service/USDT)

2. *Exchange*:

3. *Entry Price*: Market Price ($ )

4. *Trade Type*: Long (Buy)

5. *Timeframe*:

*Technical Analysis*

1. *Trend*: Uptrend/Neutral/Downtrend ( )

2. *Support Levels*: $ , $

3. *Resistance Levels*: $ , $

4. *Indicators*:

- RSI (14):

- MACD (12, 26):

- Moving Averages (50, 200):

1. *Candlestick Patterns*:

*Fundamental Analysis*

1. *ENS Token*: Ethereum Name Service, a decentralized domain name system

2. *Market Capitalization*: $

3. *24-Hour Trading Volume*: $

4. *Circulating Supply*:

5. *Recent Developments*:

6. *Competitor Analysis*:

*Targets and Risk Management*

1. *Target 1*: $21 ( potential gain: )

2. *Target 2*: $22 (moderate gain: )

3. *Target 3*: $23.22 (aggressive gain: )

4. *Stop Loss*: Hold (consider setting a stop loss, e.g., 5-10% below entry)

5. *Risk-Reward Ratio*:

6. *Position Sizing*:

*Market Sentiment*

1. *Fear & Greed Index*:

2. *Social Media Sentiment*:

3. *Community Support*:

4. *Influencer Opinions*:

*Recommendations*

1. Set a stop loss to limit potential losses.

2. Monitor market volatility and adjust targets.

3. Consider scaling investments.

4. Continuously evaluate market trends.

5. Reassess trade strategy based on market developments.

*Additional Resources*

1. ENS website:

2. CoinMarketCap:

3. TradingView:

4. Crypto news platforms:

To refine this analysis, please provide:

1. Timeframe

2. Exchange

3. Entry price

4. Stop loss considerations

5. Risk tolerance

Would you like me to analyze specific indicators or market sentiment?

ENS/USDT trade:ENS/USDT trade:

*Market Overview*

1. *Pair*: ENS/USDT (Ethereum Name Service/USDT)

2. *Exchange*:

3. *Entry Price*: Market Price ($ )

4. *Trade Type*: Long (Buy)

5. *Timeframe*:

*Technical Analysis*

1. *Trend*: Uptrend/Neutral/Downtrend ( )

2. *Support Levels*: $ , $

3. *Resistance Levels*: $ , $

4. *Indicators*:

- RSI (14):

- MACD (12, 26):

- Moving Averages (50, 200):

1. *Candlestick Patterns*:

*Fundamental Analysis*

1. *ENS Token*: Ethereum Name Service, a decentralized domain name system

2. *Market Capitalization*: $

3. *24-Hour Trading Volume*: $

4. *Circulating Supply*:

5. *Recent Developments*:

6. *Competitor Analysis*:

*Targets and Risk Management*

1. *Target 1*: $21 ( potential gain: )

2. *Target 2*: $22 (moderate gain: )

3. *Target 3*: $23.22 (aggressive gain: )

4. *Stop Loss*: Hold (consider setting a stop loss, e.g., 5-10% below entry)

5. *Risk-Reward Ratio*:

6. *Position Sizing*:

*Market Sentiment*

1. *Fear & Greed Index*:

2. *Social Media Sentiment*:

3. *Community Support*:

4. *Influencer Opinions*:

*Recommendations*

1. Set a stop loss to limit potential losses.

2. Monitor market volatility and adjust targets.

3. Consider scaling investments.

4. Continuously evaluate market trends.

5. Reassess trade strategy based on market developments.

*Additional Resources*

1. ENS website:

2. CoinMarketCap:

3. TradingView:

4. Crypto news platforms:

To refine this analysis, please provide:

1. Timeframe

2. Exchange

3. Entry price

4. Stop loss considerations

5. Risk tolerance

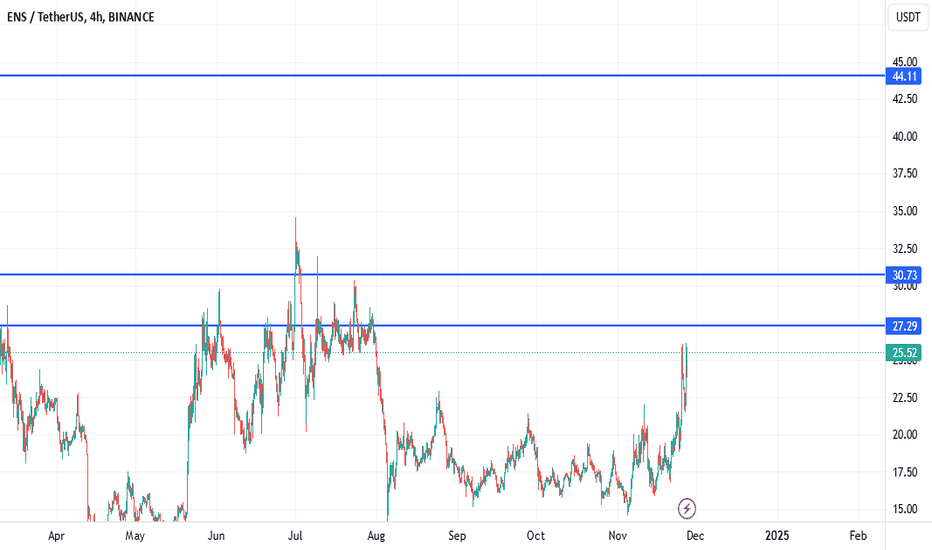

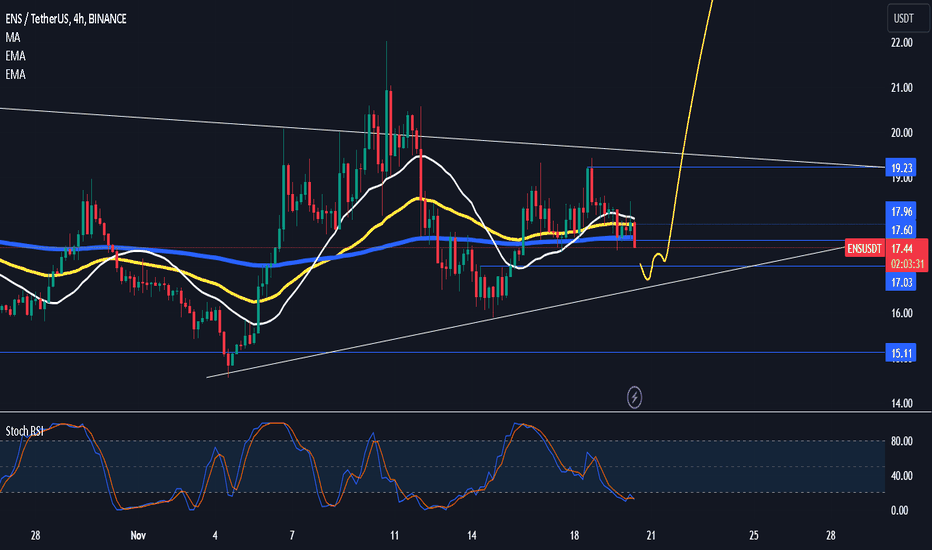

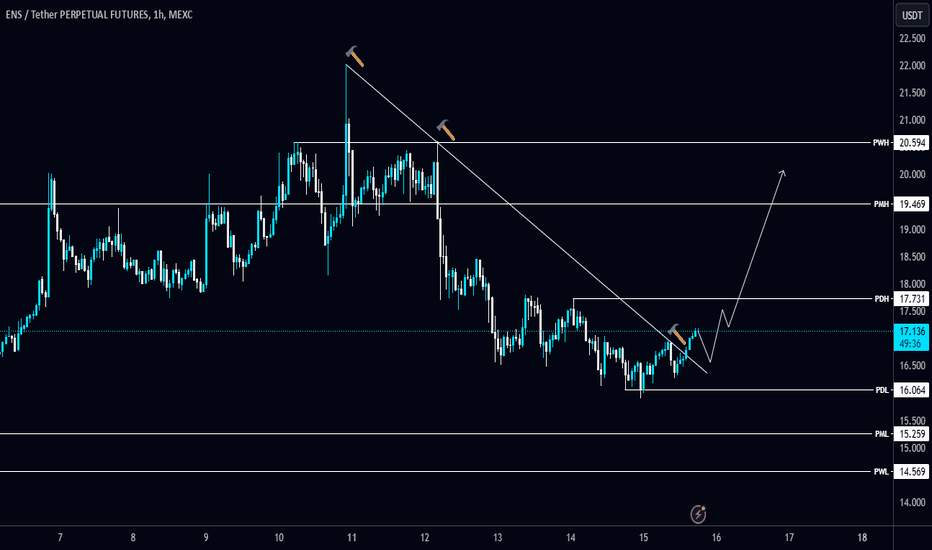

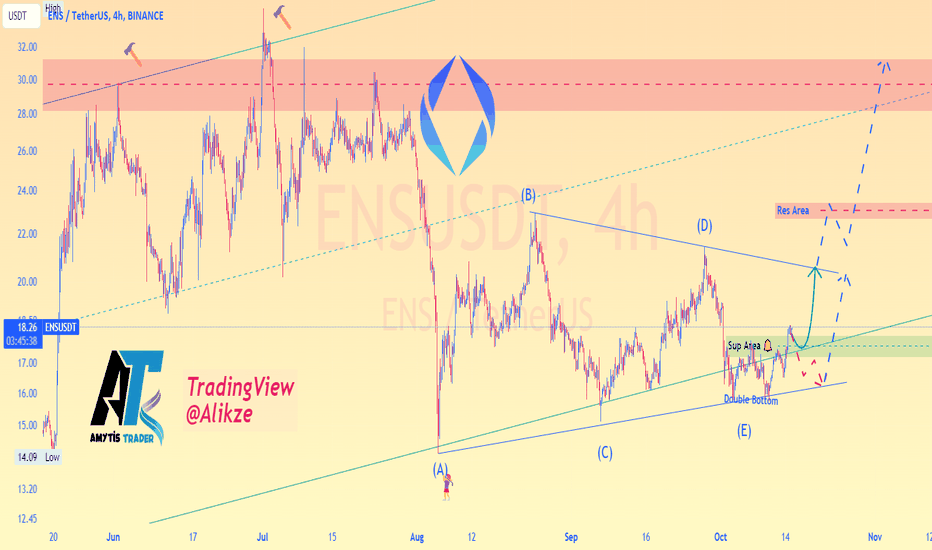

Alikze »» ENS | Corner pattern formation - 4H🔍 Technical analysis: Corner pattern formation - 4H

- It is moving in a corner pattern in the 4-hour time frame.

- Due to the formation of the Double Bottom pattern, higher floors and higher ceilings have been formed in the range of 15.80.

- Therefore, it can continue its growth with pullback to the range of 17.50 to the dynamic trigger and form a newer ceiling.

- In addition, with the failure of the dynamic trigger, it can continue to grow until the supply area.

💎 Alternative scenario:

If the green box is broken sharply, it can continue its dynamic correction (origin of movement) until the bottom of the trigger.

»»»«««»»»«««»»»«««

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support.

Best Regards,❤️

Alikze.

»»»«««»»»«««»»»«««

BINANCE:ENSUSDT