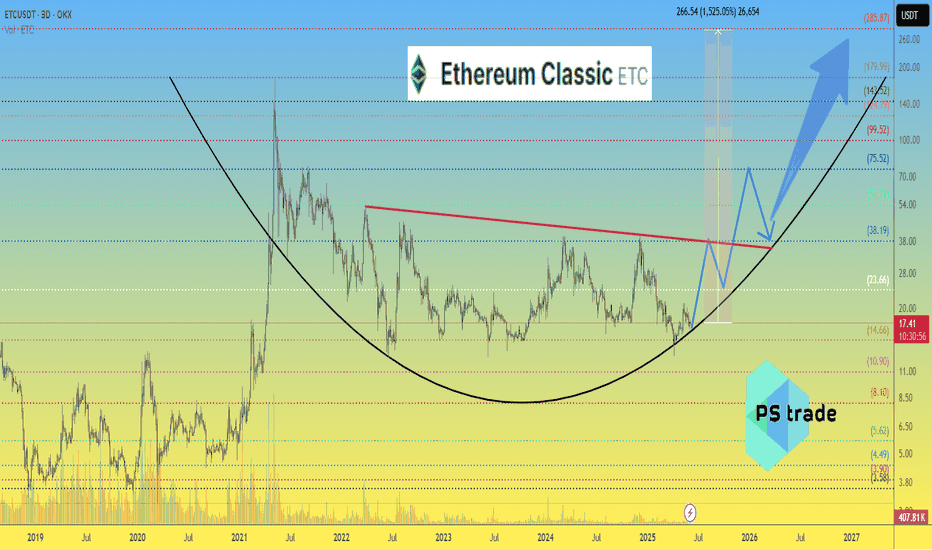

Ethereum Classic ETC price analysisToday, we will talk about the prospects for the #ETC price

For those who have been in the crypto market not a long, we remind you that the primordial from the House of Targaryen #Ethereum was #EthereumClassic

But its fork CRYPTOCAP:ETH has surpassed it tenfold...

The moral is better to be “flexible” and adapt to situations and opportunities, not stubborn...

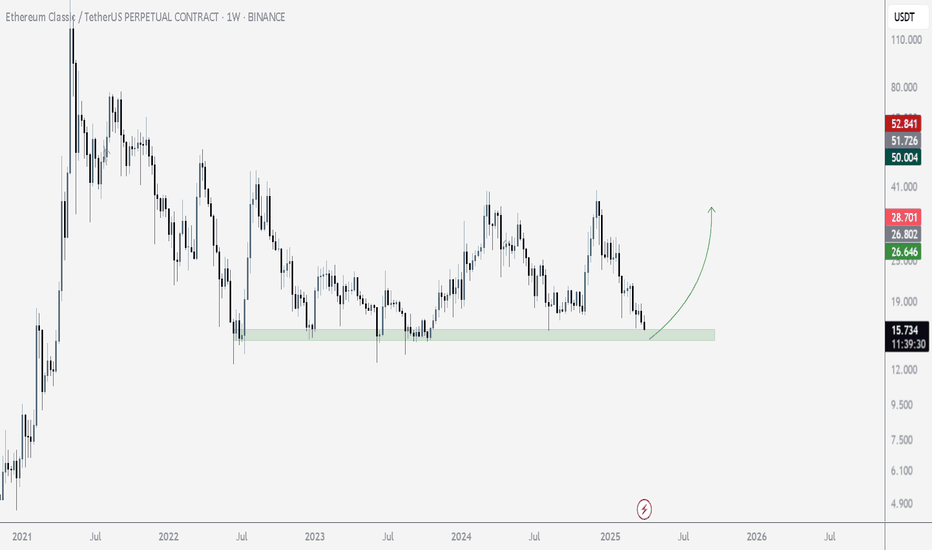

But perhaps soon the price of OKX:ETCUSDT will shoot up after a super long consolidation with a base around $15.

1⃣ In 2017, the #ETC price made more than 5000% growth after almost a year of consolidation

2⃣ In 2021, the #ETC price rose by more than 2000% after 2 years of consolidation

3⃣ Now the corrective consolidation of the OKX:ETCUSD price has been going on for more than 4 years, maybe it's time to start a rapid wave of growth by at least +1000-1500% ?)

By the way, did you notice the pattern? write in the comments !)

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

ETCUST trade ideas

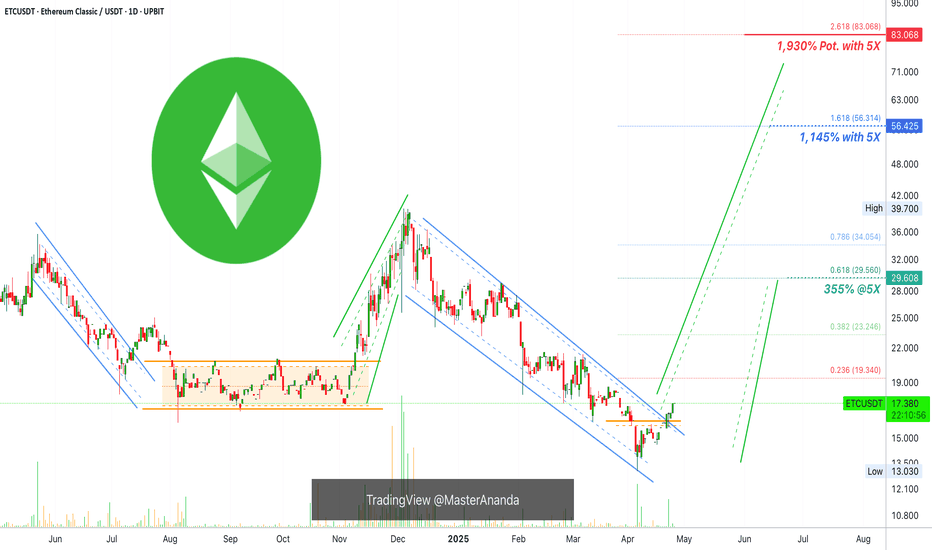

Ethereum Classic 5X Lev. Full PREMIUM Trade-Numbers (PP: 1930%)Good afternoon my fellow trader, I have another one for you.

This is a high probability trade setup.

This is a high probability trade and is easy to take.

Two main guess to approach this set of numbers:

1) Buy and hold and wait until 500% up and take profits. 500% profits not a rise of 500%.

2) Wait until the final target patiently and collect the full bounty for this trade.

There are many other ways to approach these numbers and this is up to you. But the time is right now... It will be months before the charts produce conditions like ones available today, similar and years before something like this is repeated. This opportunity does not present itself often.

Full trade-numbers below:

_____

LONG ETCUSDT

Leverage: 5X

Entry levels:

1) $18.0

2) $17.0

3) $16.0

4) $15.0

Targets:

1) $19.1

2) $23.1

3) $26.3

4) $29.5

5) $34.1

6) $39.9

7) $46.4

8) $50.3

9) $56.8

10) $67.2

11) $74.6

12) $84.1

Stop-loss:

Close monthly below $14.5

Potential profits: 1930%

Capital allocation: 4%

_____

In several months, not many but just 2 full months maybe we will have the first high. This high will be followed by a correction and once this correction is in we will have similar conditions to now but not as good because bottom prices won't be available for more than a few hours or days at max.

To repeat the same situation we have now across all Altcoins, it will take years, when the next bear market hits bottom. And then it will repeat again before the next bull market around 2029 or 2028. So this is a solid opportunity for you to take.

Leveraged trading is for those with experience already with some form of trading. After you trade for a while, you can engage this tool and not produce many loses while learning. If you start with leverage right away, you might end up quitting in disgust with tons of losses. So make sure to be smart when approaching this tool as there is the risk of becoming an addict and major losses.

If you have a messed up mind and life and need money, stay away.

If you have a good life, you feel grateful about the air you breathe and you can see the stars, the moon and appreciate a simple breeze, you can make huge money with this system.

If you lie to people and to yourself the market will take everything away. If you are honest with yourself and can accept your mistakes, it doesn't matter what you do you will be successful in the end. It is all a mental game.

What's on your mind?

Depending on your thoughts, you produce your results.

Think positive, love yourself and love life, and you already won.

Being ungrateful, hating and with a bad mood always for this or that, blaming others, the market will take everything from you. It will only give you space to breathe once you see yourself and accept your mistakes.

You are responsible for your own actions.

This is not financial advice.

You are appreciated and thank you for reading.

Namaste.

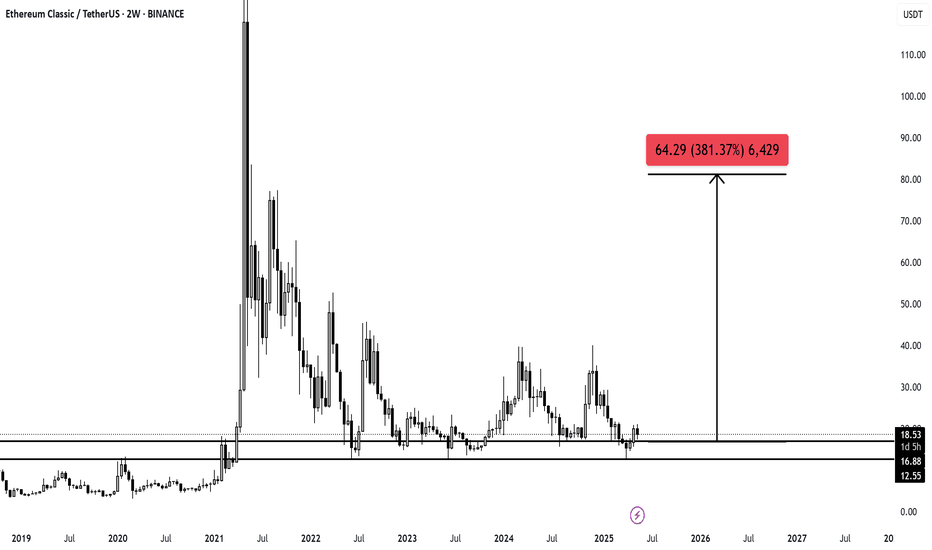

The chart shows a long-term bullish setup for Ethereum Classic

📊 Technical Summary

Support Levels: $12.55 and $16.88 – both have historically acted as accumulation zones.

Current Price: ~$18.55

Resistance/Target Zone: $64.29 — this aligns with a historical resistance area and implies a +381% potential upside.

Pattern Context: Price has been consolidating for nearly two years within a wide range after the 2021 peak. This long base often precedes explosive moves.

🔍 Key Observations

Long-term Base Formation: ETC is forming a strong multi-year base — a common precursor to major bullish breakouts.

Historical Breakout Zone: The $12–$18 range acted as launchpad in 2021 and is now holding again.

Massive Upside Potential: If the breakout is confirmed, a move toward $64.29 is realistic based on prior price action.

🎯 Outlook

Bullish Bias while price holds above $16.88.

Confirmation of breakout above ~$22–$25 range could trigger parabolic rally.

Target: $64.29

Risk: Breakdown below $12.55 would invalidate the setup.

✅ Conclusion

Ethereum Classic is showing classic signs of a macro reversal. As long as it maintains the current accumulation zone, it remains a strong candidate for long-term upside.

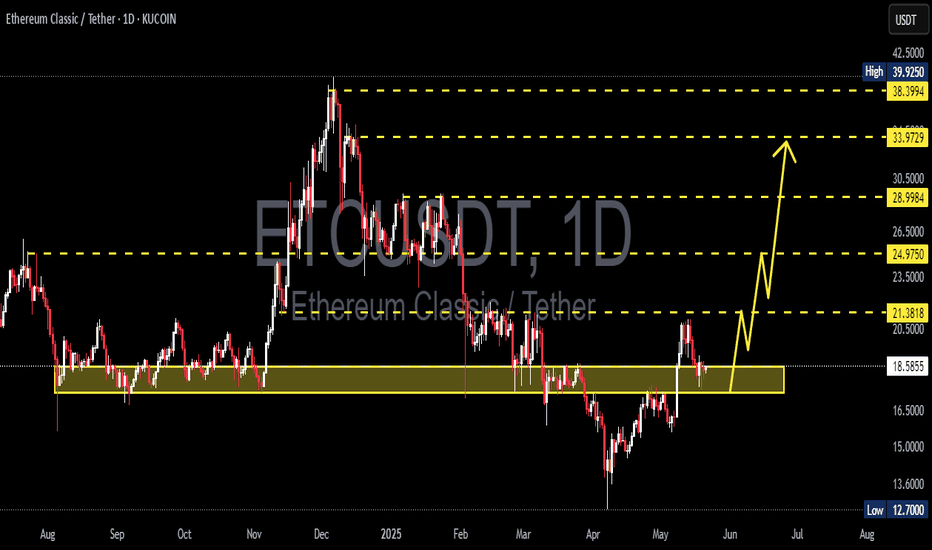

Ethereum Classic 5X Lev. Trade Reminder (PP: 1470% Spot)I have a set of trade-numbers for ETCUSDT with 5X Leverage. I will not post them again but instead will link them below, this is a friendly reminder.

The small retrace now is sending prices back into our entry zone or entry levels. "The market always gives a second chance."

You see, there is no need to rush to try and catch a bullish wave. Notice how the market always offers countless chances after the bottom is in. Right?

Ethereum Classic started to move up but retraced back into the entry zone. Rushing can produce a buy at $21 and then a liquidation. Being patient allows for a lower entry and then massive profits. Notice how long it takes for the market to move.

Many people message me saying, "OMG! I don't want to fomo buy." "I don't want to miss-out, fast, I have to buy." But nothing is happening fast. We are here day after day, always, and we can see the swings and the waves.

If one pair starts moving, that's ok, there will always be another pair trading at bottom prices. Instead of buying LONG the one at resistance, go LONG with the one at support. This is a great example.

ETCUSDT is looking good now because prices are lower and an entire week red. This is good, simply more consolidation before the start of the 2025 bull market phase-wave.

We are going up, and it will be awesome.

Namaste.

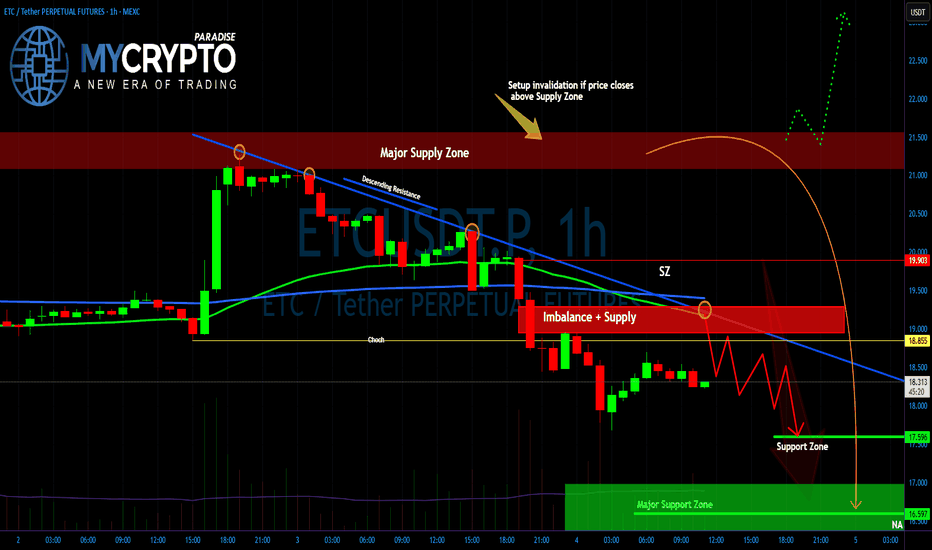

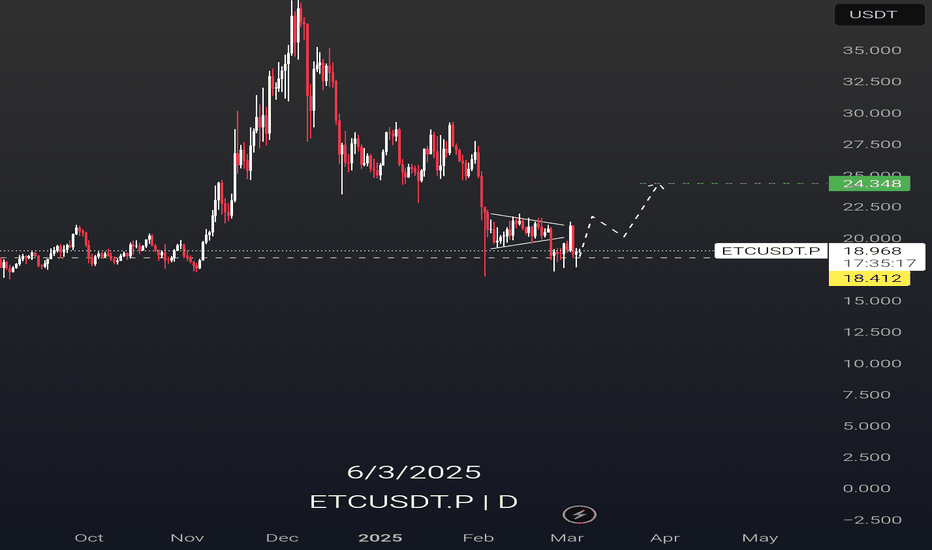

Price correction is the best buying opportunity...Hello friends

With regard to the growth of Ethereum, we saw that Ethereum Classic also had good growth, and now with the correction of Ethereum, this currency has entered a correction, which gives us the opportunity to enter a purchase transaction with capital and risk management, and to buy step by step in the specified steps and move with it to the specified goals.

*Trade safely with us*

#ETC/USDT#ETC

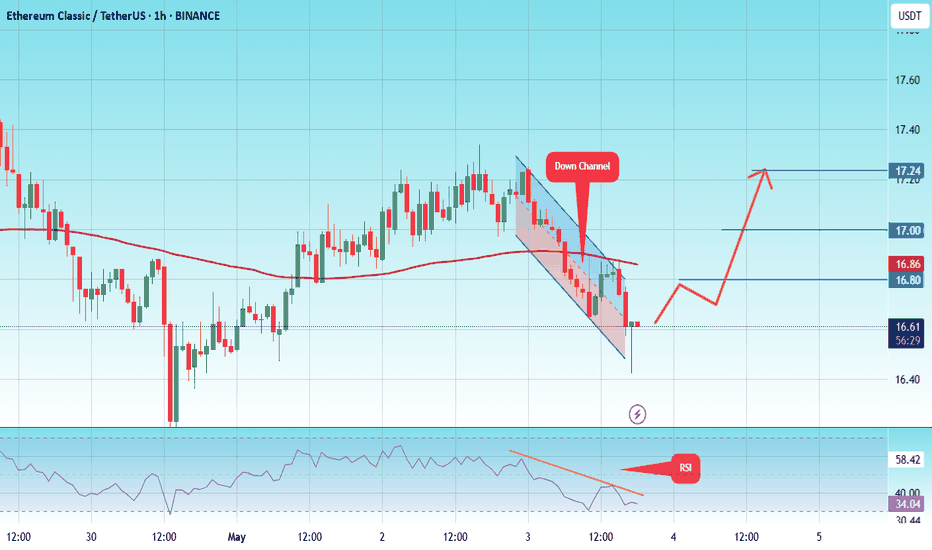

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 16.50, which acts as strong support from which the price can rebound.

Entry price: 16.62

First target: 16.80

Second target: 17.00

Third target: 17.24

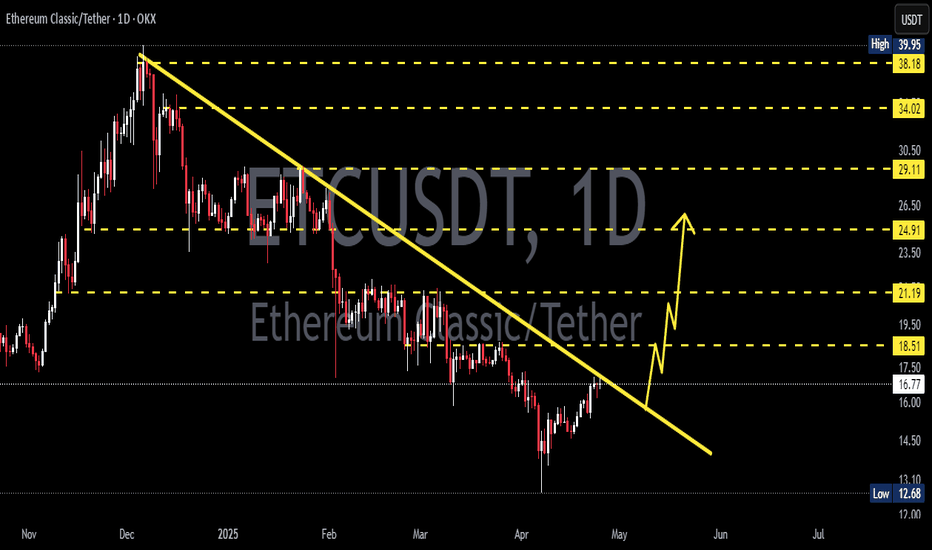

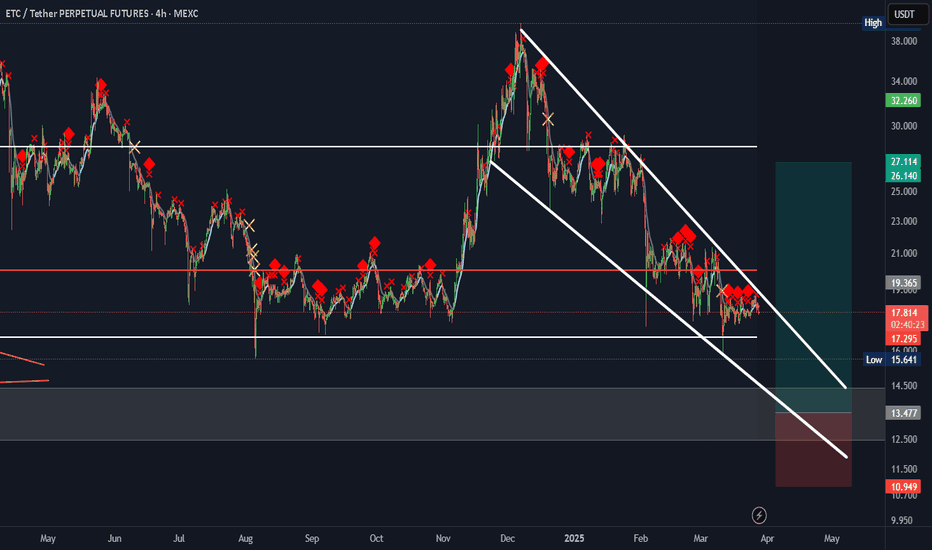

ETC/USDT 4h chart Hello everyone, let's look at the 4h graph etc to USDT, in this situation we can see how the price came out of the top of the lasting downward trend. Going further, let's check the places of potential target for the price:

T1 = $ 17.44

T2 = $ 18.75

Т3 = 20.73 $

T4 = 22.48 $

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = $ 16.25

SL2 = $ 15.05

SL3 = $ 13.74

SL4 = $ 12.66

Looking at the RSI indicator, we see

As we entered the upper part of the range again, which apparently affected the slow price of the price.

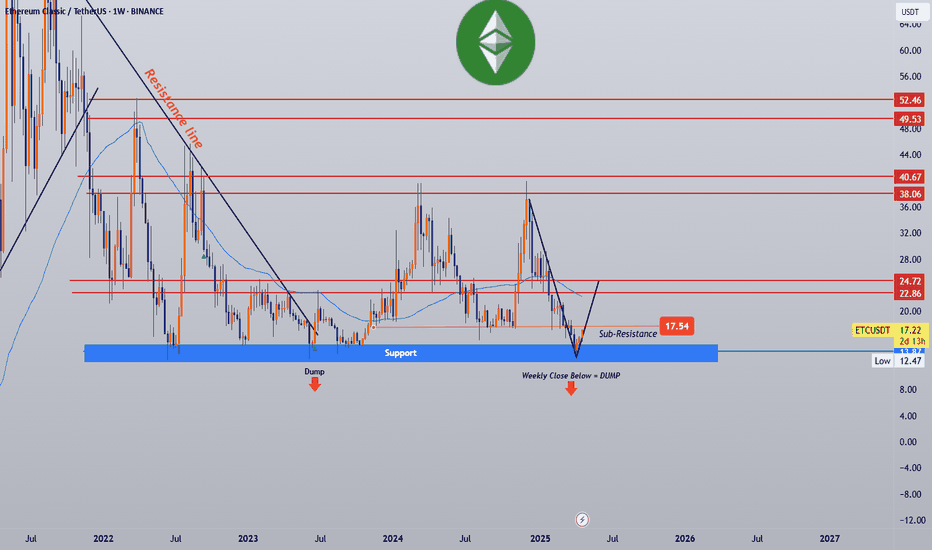

#ETCUSDT Analysis — Holding Final Line of Defense📉 #ETCUSDT Analysis — Holding Final Line of Defense Mid-term

🗓 Published: April 25, 2025

🕰 Timeframe: 1W | 📊 Exchange: Binance

🔍 Technical Overview

Ethereum Classic is sitting right above its multi-year horizontal support zone ($12.5–$14.5), a level that previously triggered major rebounds in mid-2022 and late 2023.

This is the third major test of this zone. So far, the structure is holding—but this is the last stronghold before a full breakdown risk.

📌 Support Zone: $12.47–$14.5 (blue band)

📌 Short-Term Sub-Resistance: $17.54

📌 Structure: Range-bound since mid-2022

🔻 Panic Level (Invalidation Zone)

📉 Weekly Close Below $12.47 = Confirmed Breakdown

This would likely trigger a dump move, exposing ETC to deeper lows unseen since 2020.

🟥 High risk of long liquidation cascade below this support.

🎯 Upside Targets (If Rebound Holds):

TP1: $17.54 – sub-resistance zone

TP2: $22.86 – local range high

TP3: $24.72 – next breakout level

TP4: $38.06 – macro mid-cycle top

TP5: $49.53–52.46 – full extension zone

🟩 If this weekly support holds, ETC could offer a +100% to +200% upside in wave-based structure recovery.

🧠 Strategy Insight

ETC remains a range-bound asset unless we get weekly confirmation above $24.

However, this support zone offers a risk-defined opportunity for long exposure — but only if BTC remains constructive.

💡 Low leverage and DCA approach advised in this region. Breakdown = hard cut.

🗣 What’s Next?

Watch this weekly candle closely. As long as we close above $14–15, the bounce setup remains valid. Reclaim of $17.54 would confirm early trend reversal.

📢 This is the "make or break" zone. Either the base holds... or the floor drops out.

Please keep in mind that this is not financial advice and the purpose of these charts is to provide an idea of coin movement, not buy or sell signals. The cryptocurrency market is highly volatile and not suitable for everyone, so be aware of the potential risks before making any investment decisions. The information presented here is a personal effort and is subject to success or failure, and we welcome constructive criticism.

Good luck to all.

🙏we ask Allah reconcile and repay🙏

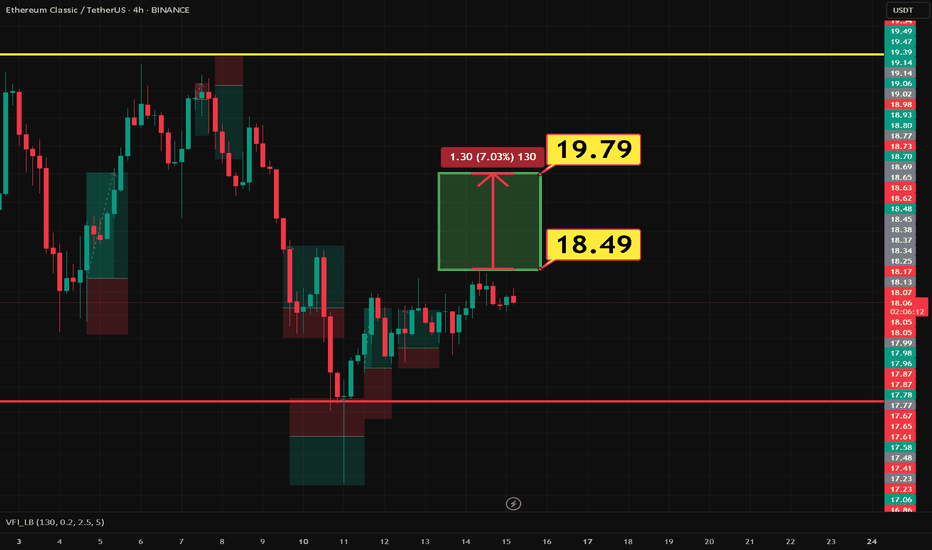

ETC LONG SETUP ALL trading ideas have entry point + stop loss + take profit + Risk level.

hello Traders, here is the full analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied. Please also refer to the Important Risk Notice linked below.

Disclaimer

ETCUSDT: Breakdown or Bounce? A Critical Move Is Coming!Yello, Paradisers! Is ETCUSDT about to collapse further, or are the bulls ready to fight back? Let’s break it down!

💎#ETCUSDT remains in a strong downtrend, continuously rejecting the descending resistance and struggling to hold above key levels. Recently, the price tested the imbalance zone at $18.995 but got smacked down, a clear sign that sellers are still in control.

💎Adding further bearish confirmation, the 50 EMA has crossed below the 200 EMA, reinforcing the downside momentum. This classic death cross signals that sellers have the upper hand, increasing the probability of further declines.

💎If ETC retests the $18.995 supply zone and faces rejection again, expect another leg down toward $17.590 and potentially the major support at $16.576. A failure to find strong buying interest at these levels would confirm further downside continuation.

💎However, if ETC manages to break and hold above $18.995, it could signal strength. In this case, price may push toward $21.288, but it must first clear $19.288 with strong volume to invalidate the bearish setup. A confirmed breakout would shift momentum bullish, opening the door for a potential rally toward $22 and beyond.

Stay patient, Paradisers! The market always rewards discipline. If we see confirmation, we take action. If not, we wait. Trade smart, not fast! 🎖

MyCryptoParadise

iFeel the success 🌴

etc buy midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

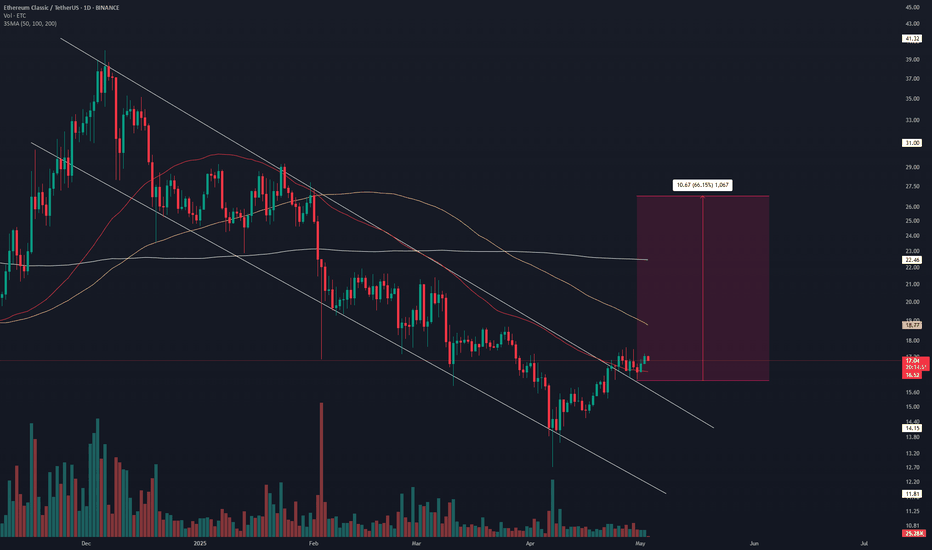

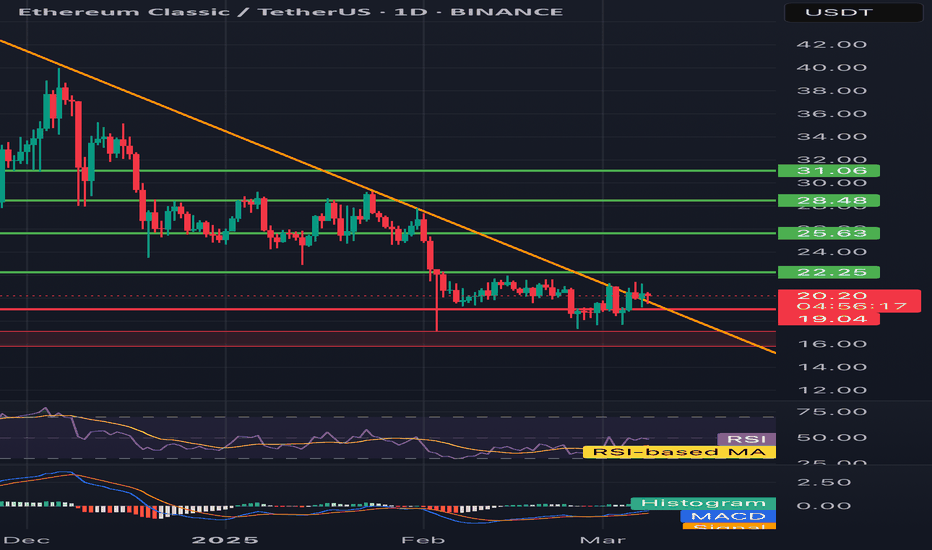

ETC/USDT 1D chart reviewHello everyone, let's look at the 1D chart etc to USDT, in this situation we can see how the price moves in a slight side trend in which you can see the output sideways from the downward trend line.

However, let's start by defining goals for the near future the price must face:

T1 = 22.25 $

T2 = = $ 25.63

Т3 = 28.48 $

T4 = 31.06 $

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = 19.04 $

However, you can still see a strong support zone that strongly maintains the price from a larger decline zone from $ 17.11 to $ 15.82.

Looking at the RSI indicator, you can see a return to the center of the range despite slight price movements on the chart, however, there is still room for a potential new growth movement.

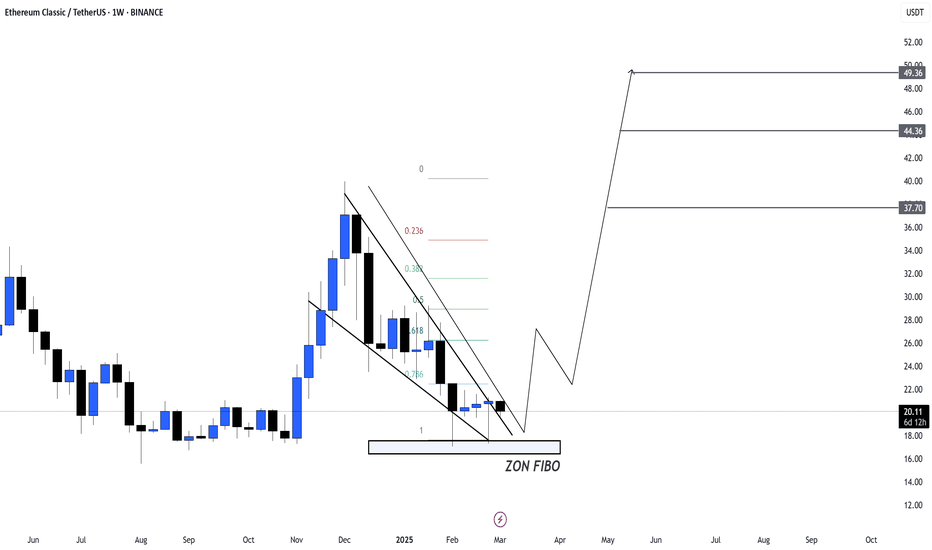

Ethereum Classic 8X Trade-Numbers (6,480% Potential)The longest consolidation phase ever is still happening. This is positive for the upcoming bull-market. The longer it takes for Ethereum Classic to move forward, the stronger the growth when it does.

The profits potential on the title is based on a $183 conservative target. As you can see on the chart, ETCUSDT can reach $282 or even $450 or higher. What is important here is the entry and long-term hold.

Let's do some maths:

5X with a $20 entry and a target at $300 would equal to 1,400%. That would be a total 7,000% growth potential with 5X at current price. ETCUSDT.

Another example is 7X, same entry and a target of $444. That would be a huge 14,840% potential if such a target is hit. Without leverage, that would be 2,120%, from $20 to $444.

Below you can find more conservative numbers but still very strong.

_____

LONG ETCUSDT

Leverage: 8X

Entry levels:

1) $21.1

2) $20.1

3) $19.1

Targets:

1) $25.8

2) $27.6

3) $31.2

4) $37.1

5) $44.9

6) $52.5

7) $63.5

8) $77.2

9) $92.8

10) $102

11) $117

12) $128

13) $142

14) $160

15) $183

Stop-loss:

Close monthly below $18

Potential profits: 6480%

Capital allocation: 5%

_____

Something important, once the initial bullish breakout happens, the first jump, there is no going back. Once this move happens, Ethereum Classic, Bitcoin and the entire market will never be the same. The lowest prices after the end of this incoming bull-market will be many times higher compared to what we are seeing today. It is truly the last chance to see Crypto at a discount, trading this low. Once the market starts to move, it will a new world.

Hundreds of thousands of new millionaires will be created. A new economy, the nouveau rich, it will be a different world.

It is not the same saying, "the market is going up," vs experiencing this growth. When the next bull-market start, it will be wild, it will be crazy, it will be amazing and we will be rewarded big time for being early.

Anyway, I am ready for the biggest cycle since I started to write and trade. What about you?

Are you ready for change? Positive change.

It will be amazing. I am telling you.

Namaste.

ETC USDT#Ethereum Classic ( BME:ETC ) Bullish Reversal from Fibonacci Zone 🚀

Ethereum Classic (ETC/USDT) is currently trading at $20.06, forming a falling wedge pattern, which is historically a bullish reversal signal. The price has reached the Fibonacci golden zone (0.786 level), which often acts as a strong support level for trend reversals.

If the reversal holds, the next upside targets are:

🎯 Target Levels:

T: $48.00 🔥