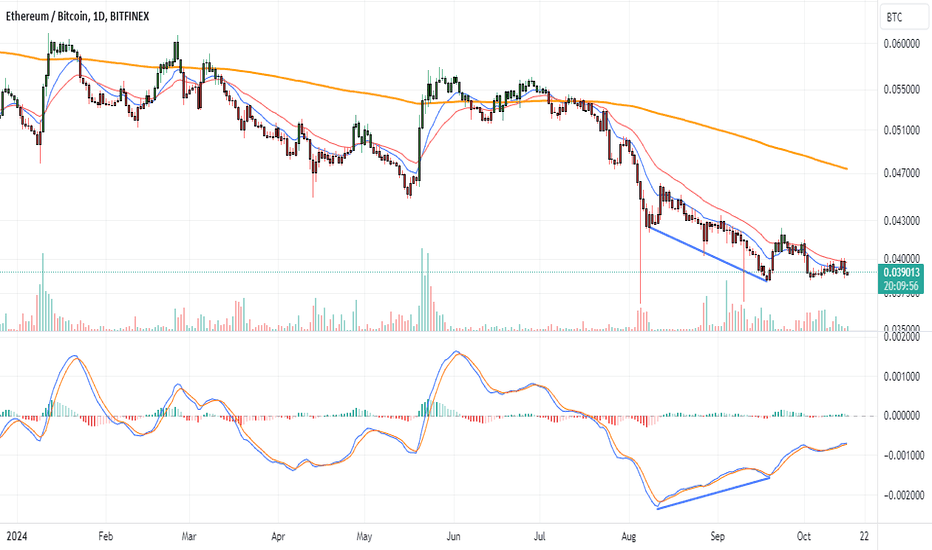

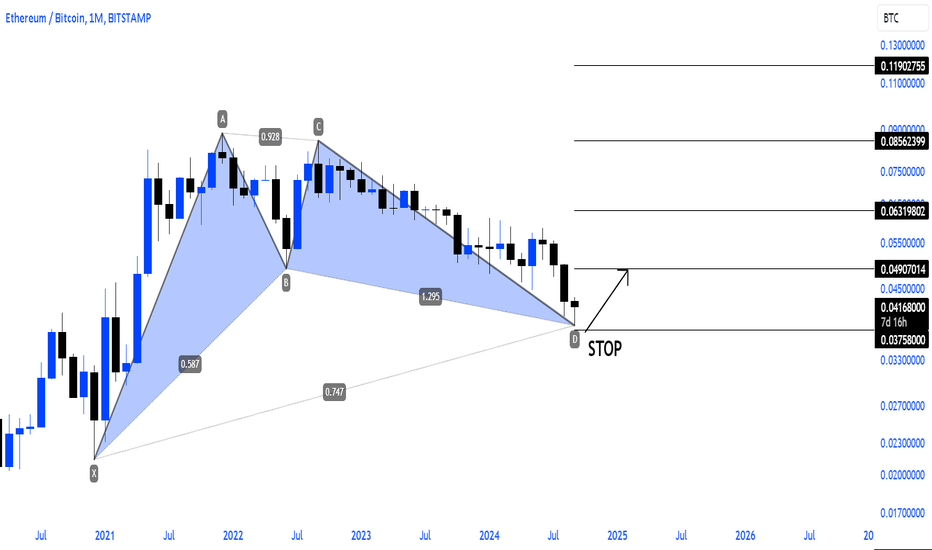

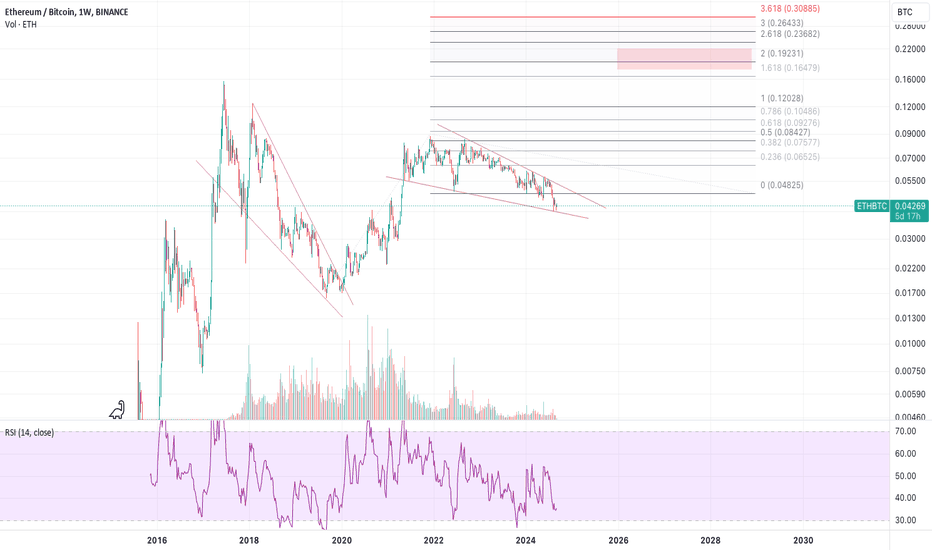

[ETH/BTC] Divergence at bottomBITFINEX:ETHBTC looks interesting. Big brother Bitcoin seems to overshadow Ethereum since forever as we can see the ratio keep getting lower and lower from time to time.

But something interesting seems to be happening at the moment as the price is making divergence setup with MACD still keep rising up to today. If this thing blow to the upside, then we might see a jump in ETH price, at least for the short term, in comparison with its big brother Bitcoin.

Cherio...

ETHBTC.P trade ideas

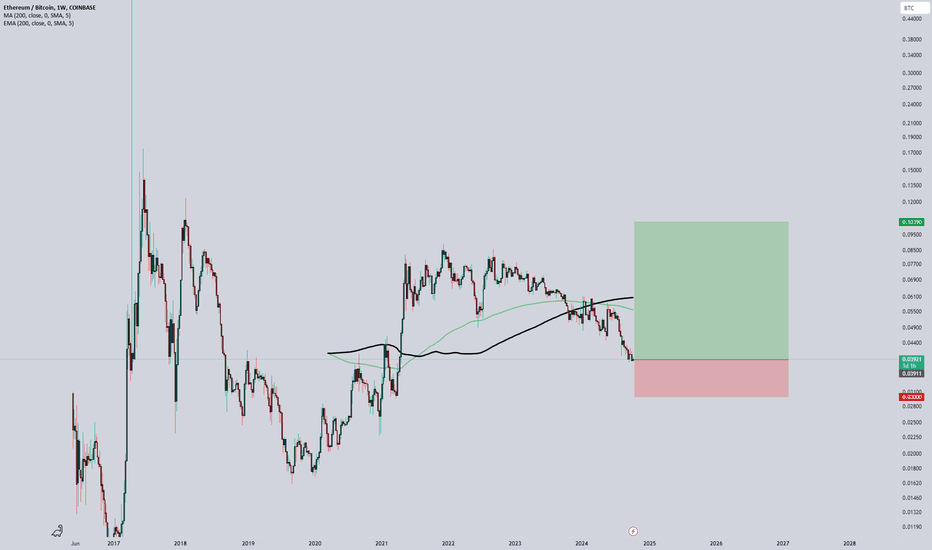

ETHBTCLong term trend line being revisited this week...

Haven't seen that for eth in a while

Is this the psychological low or is eth destined for obscurity diluted out by other layer one chains...

From the stats I've seen from eths l2chains the eth economy is well and truly active with scaling nearing completion

Solana is the nearest competitor by use but the chain has decentralization issues and therefore has shut down multiple times in the last few years for periods..

Ethereums security lies in being able to access the network at all times.. something no competitor has managed at scale as of yet

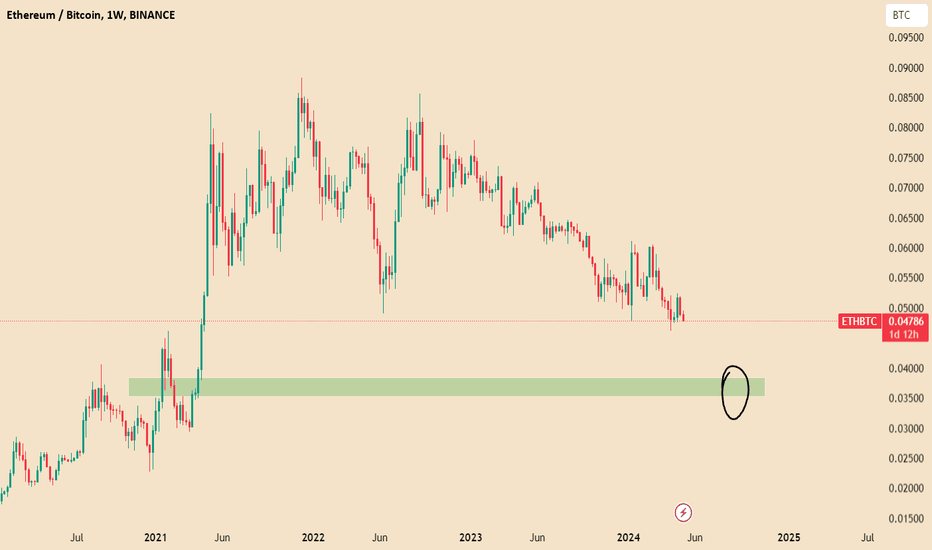

ETHBTC is close to a heavy bounce indicating an alt seasonETHBTC is close to a long term trendline and we can expect a hefty bounce which will trigger the alt season. HOWEVER, do not think this bounce will hold. ETH is weak, ETH has no future in my opinion and this is just a bounce.

Get ready to capitalise on it.

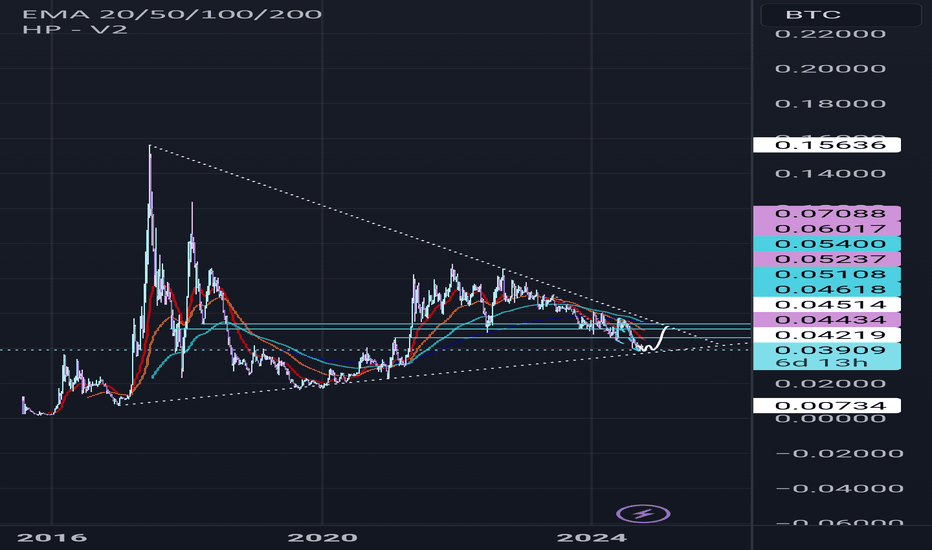

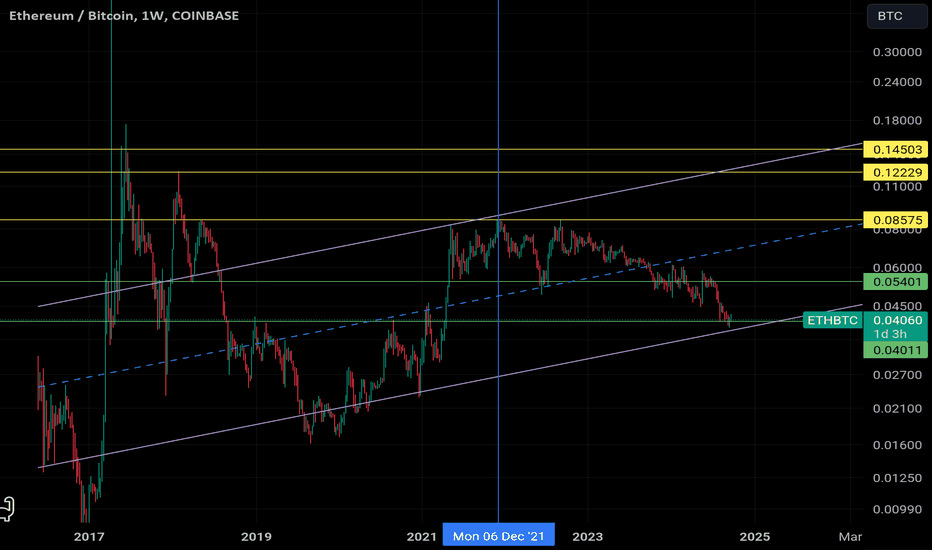

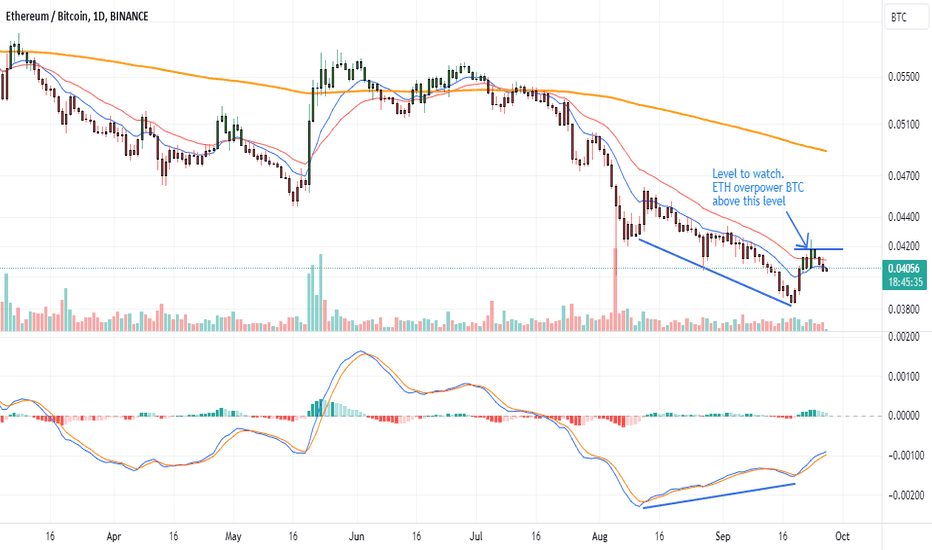

ETH / BTC: A Potential Shift In Performance

It's no secret that Ethereum's price performance has been relatively underwhelming in the past 1-2 years, lagging behind the broader market.

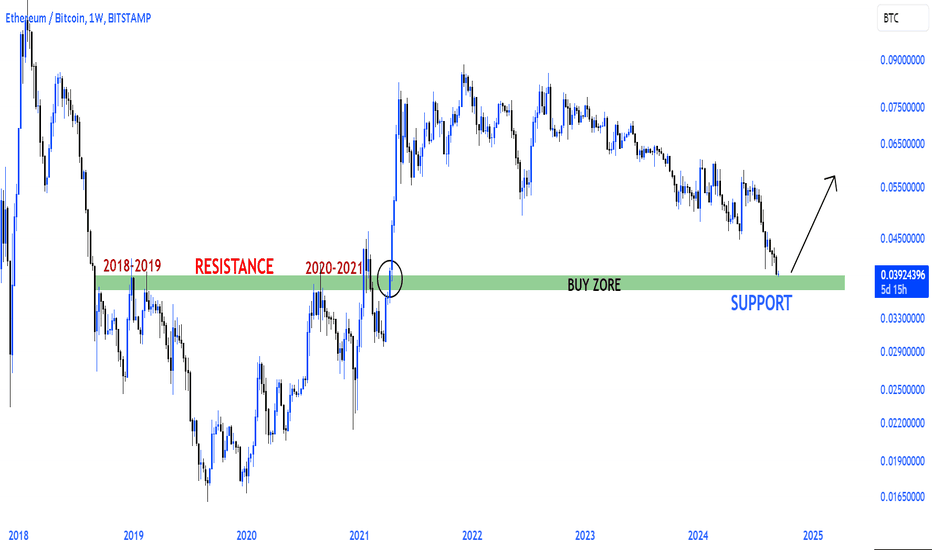

A more clear picture emerges when we examine Ethereum's performance against Bitcoin.

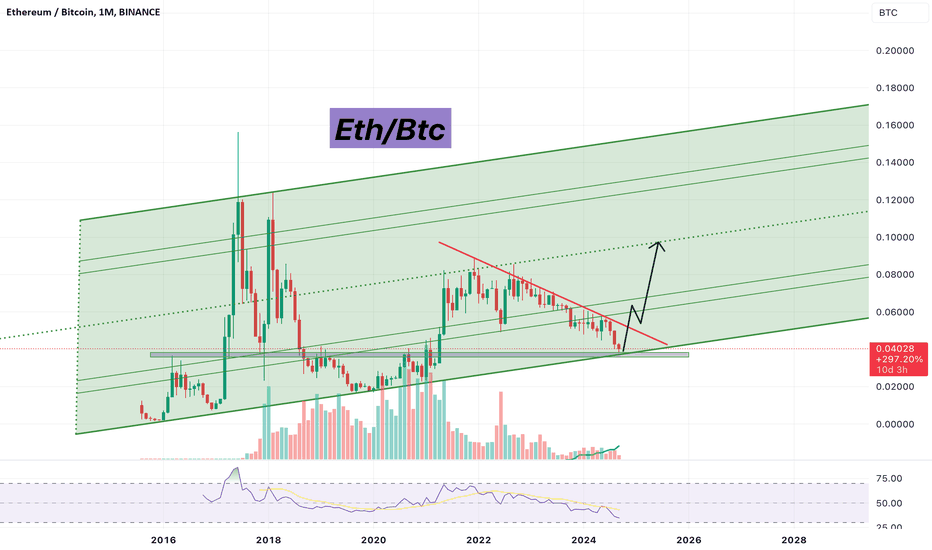

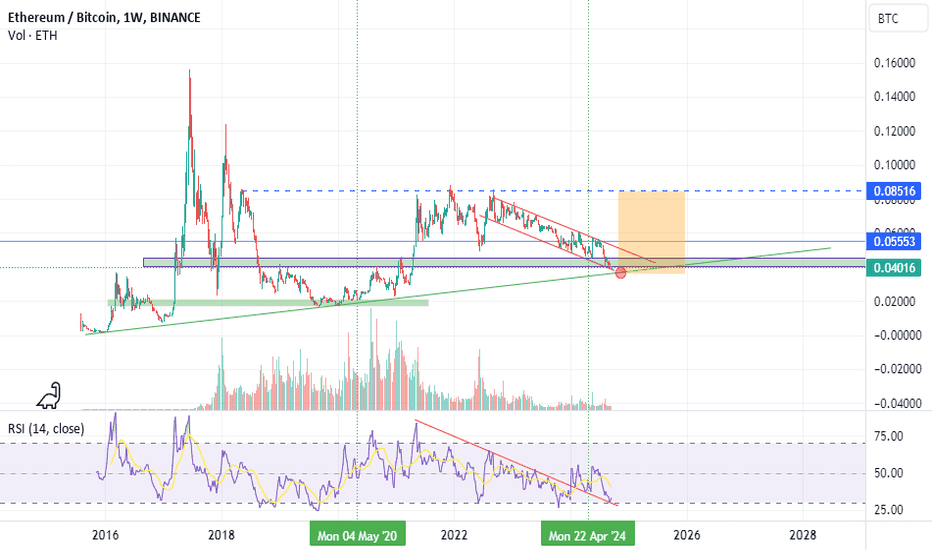

On a weekly timeframe, the ETH/BTC chart reveals a long-term uptrend channel. However, within this uptrend, the pair has been in a downtrend since December 2021.

Essentially, the price has been moving from the upper boundary of the uptrend channel towards the lower boundary. It appears to have reached this lower boundary recently.

This suggests that Ethereum might be poised for a period of outperformance relative to Bitcoin.

Note: This doesn't imply a massive shift of capital from Bitcoin to Ethereum. Rather, it suggests that Ethereum could potentially appreciate at a faster rate than Bitcoin. The conditions for this shift may be maturing.

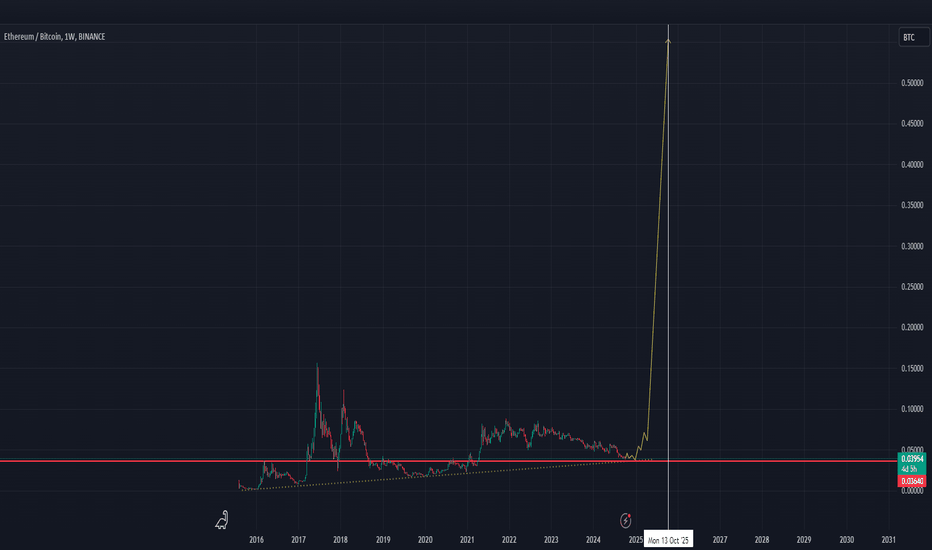

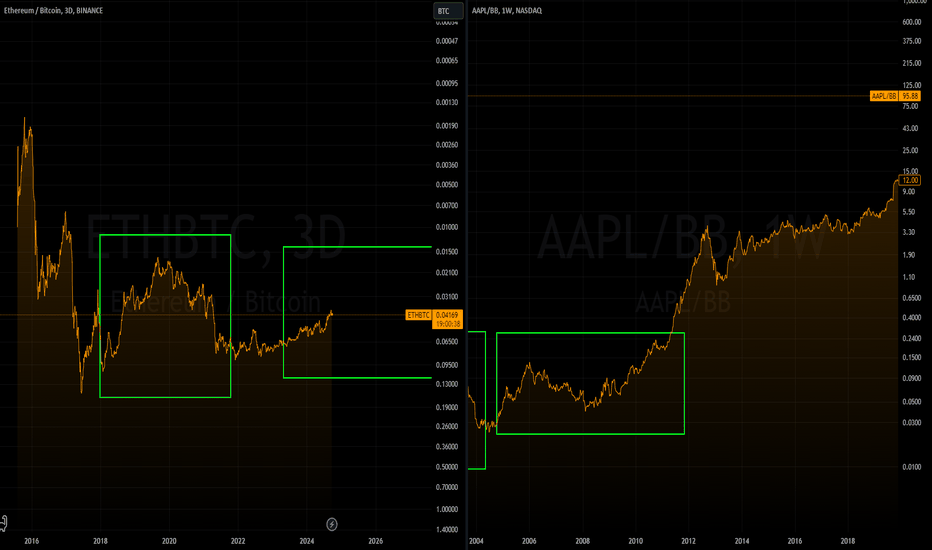

ETH/BTC Inverted - Apple / Blackberry. Times different?

Don't follow alt coins much nor Ethereum but I decided to check out the ETH/BTC pair inverted it and found a very strong similar pattern that Apple and Blackberry made after the dotcom bubble.

Apple as the strongest competitor in the smart phone scene left Blackberry spinning in circles with a last jump to try gain market share resulting in a fail of the share price.

Today? we see Ethereum playing out in similar fashion where Bitcoin started then Ethereum tried to tail the success of Bitcoin's innovation.

PoS could be similar to trying to put a physical keyboard on a smart phone.

If this is the case and Bitcoin goes on the run I expect it to, this could be the final wave of Ethereum's market share.

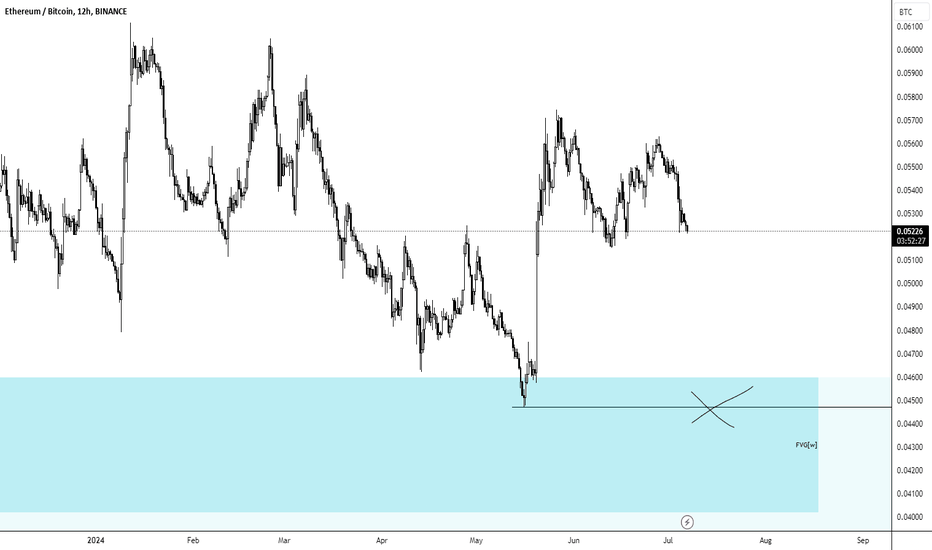

Ethereum is a dealEvening mate , i gave you eth at 1600$ but once again i see a chance to accumulate this giant.

Price right now is on a very strong support which we can also consider as a retest. There’s a massive pitchfork i see which causes candles to react beautifully, as you see we are hitting the floor atm .

I think buying eth now is like buying eth below 500$ in the last cycle, it also indicates a good reversal signal for altcoins as well .

Love you all .

Daddy sharkie :)

ethereum outlookIs Ethereum dead? I don’t think so. It’s been in a period of hibernation, but I believe it's poised for a comeback. ETH has been in a descending channel for some time, but it's nearing the bottom. I expect it to retest the green multi-year trendline and bounce upward. The weekly RSI has already broken out and is currently being retested. The red circle marks where I anticipate the bounce, and from there, I believe ETH will rise again, catching many by surprise.

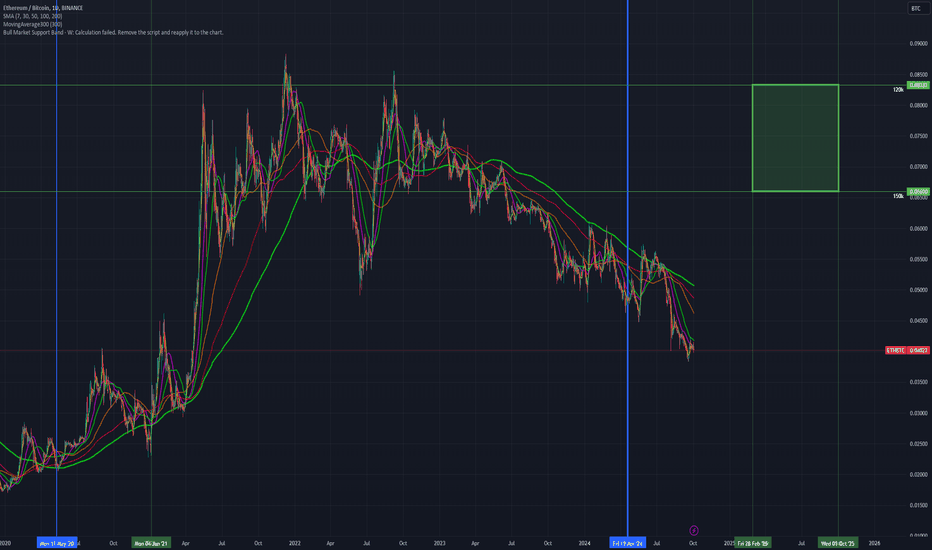

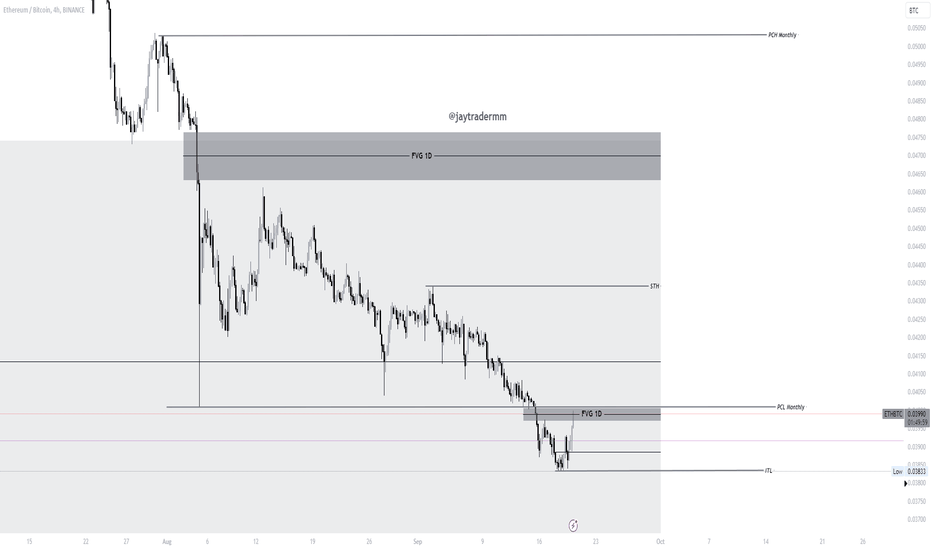

Getting Ready for a Strong Bull Market in ETHBTC!🚀 The pair seems to have bottomed out, and the arguments are increasingly favorable for an upward movement: 88.89% Bullish vs. 11.11% Bearish.

Bullish Arguments:

Monthly Bullish FVA

Monthly Discount Array

Weekly swing low being disrespected

Daily swing low being disrespected

Daily Bullish FVG respected

Daily swing high being disrespected

4H swing high being disrespected

4H swing low being disrespected

Bearish Argument:

Monthly PCL being respected so far.

🔍 We are on the verge of a bull market. Remember to manage your risk and be masters of your emotions! Don’t hesitate to take profits and, most importantly, learn from your mistakes and successes.

Let’s go for it! 💪

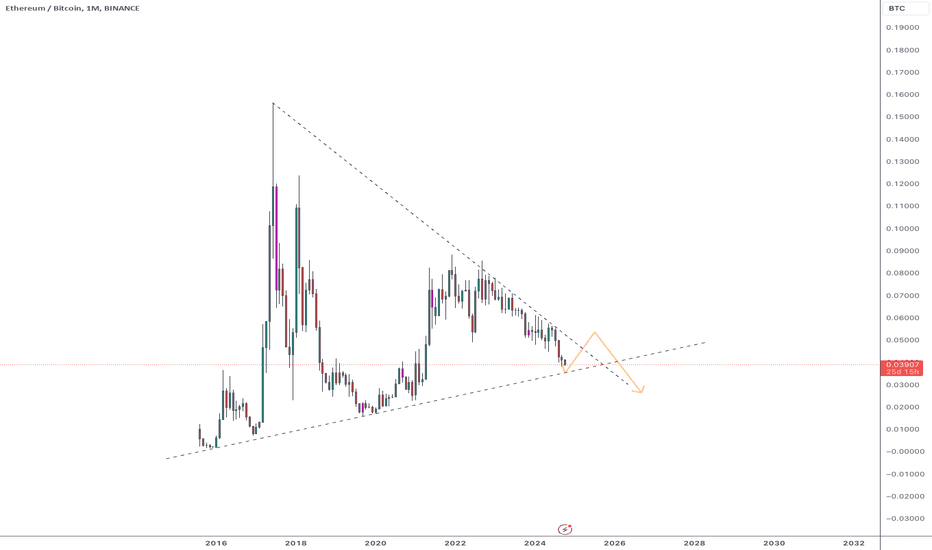

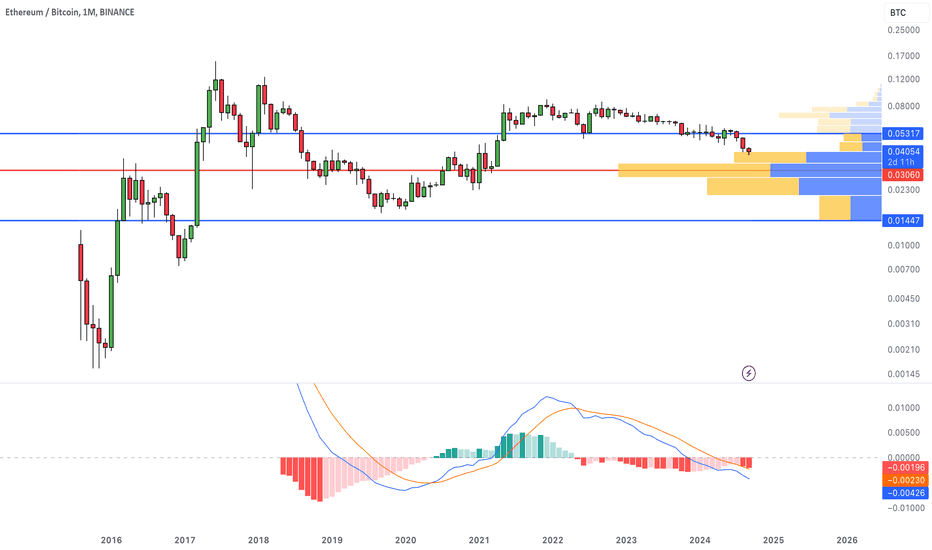

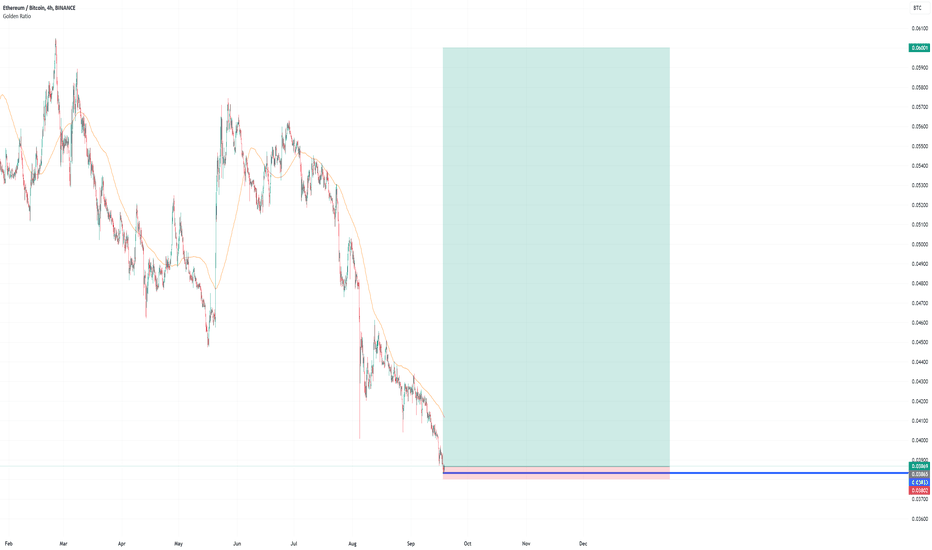

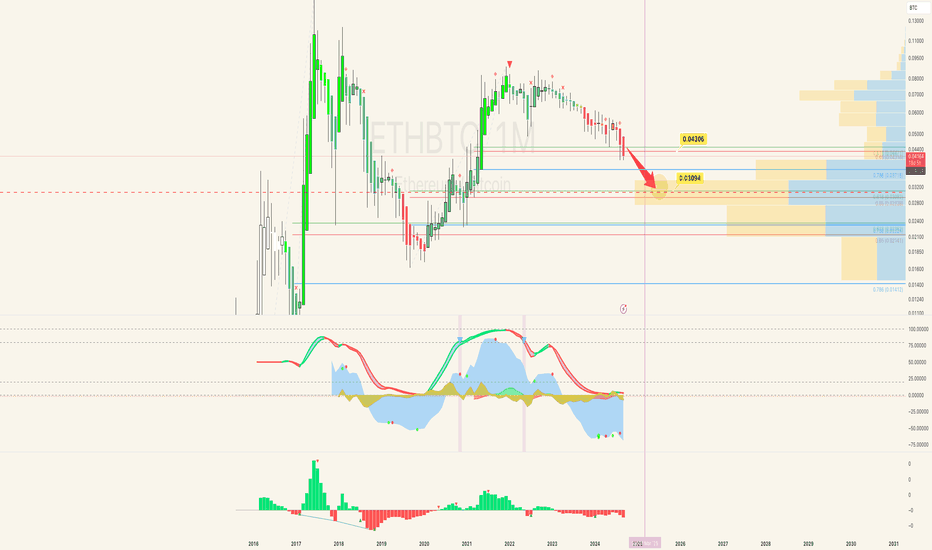

ETHBTC ForecastETHBTC looks like it is headed for 0.03094 - 0.032 level. Especially, if we confirm 0.043 as a resistance in the coming months and stay under it.

This is a monthly chart so it will take many months to complete this move. In my view this could happen in one of two ways. The first scenario is that BTC will start the parabolic move and leave behind ETH which is my base scenario in the next 6 months. The second scenarios is that ETH will continue to bleed down and BTC will stay rangebound or slowly rise in the coming months.

Here is my plan:

I will be accumulating ETH if it quickly visits the 0.030-0.032 ETHBTC levels. That is when I will be looking for ETH bottoming and turning. If we bounce from the 0.043 level and confirm with volume as support, then I will be looking to buy any breakout patterns in this long timeframe.

This is not a financial advice and DYOR

ETH Update An Update on ETH/BTC Trend Chart

Ai :

As of October 2023, we’ve seen some notable developments in the ETH/BTC trend chart that could impact market strategies and investment decisions. Here’s a concise update to keep you informed:

Current Market Overview:

The ETH/BTC pair has exhibited a mix of volatility and stability over the past few weeks. Here are some key observations:

Recent Price Movements:

Ethereum (ETH) has shown resilience, pulling the ETH/BTC ratio higher amidst increased interest in decentralized finance (DeFi) projects and NFTs.

Bitcoin (BTC) remains strong but shows signs of slight consolidation after its recent rally.

Support and Resistance Levels:

The current support level is around 0.065 BTC, while resistance is observed at 0.075 BTC. Chart analysis indicates that if ETH can maintain its momentum, it may break through this resistance, further strengthening its position against BTC.

Market Sentiment:

Sentiment around ETH is cautiously optimistic, driven by ongoing developments in the Ethereum network, including the advancement of Layer 2 solutions and potential future upgrades like Ethereum 2.0.

Meanwhile, Bitcoin continues to garner institutional interest, which adds a layer of complexity to the ETH/BTC dynamics.

Technical Analysis:

Moving Averages: The 50-day moving average hints at a bullish crossover, suggesting a possible upward trend for ETH relative to BTC.

Relative Strength Index (RSI): Currently sitting at 60, indicating that ETH is neither overbought nor oversold, leaving room for further growth.