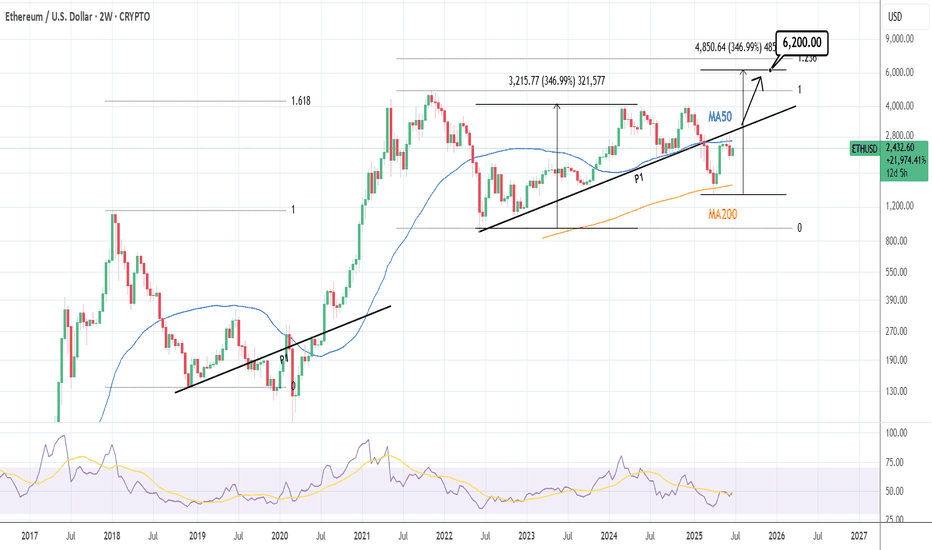

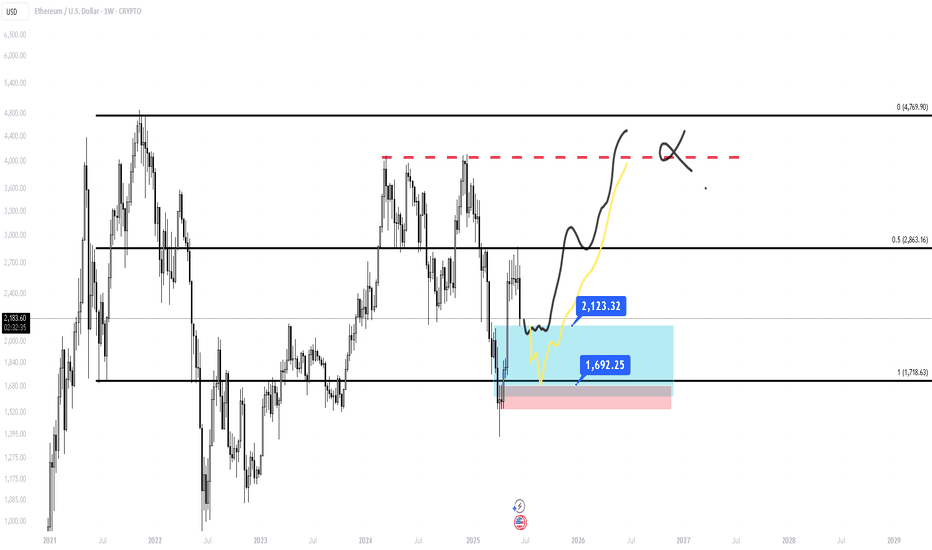

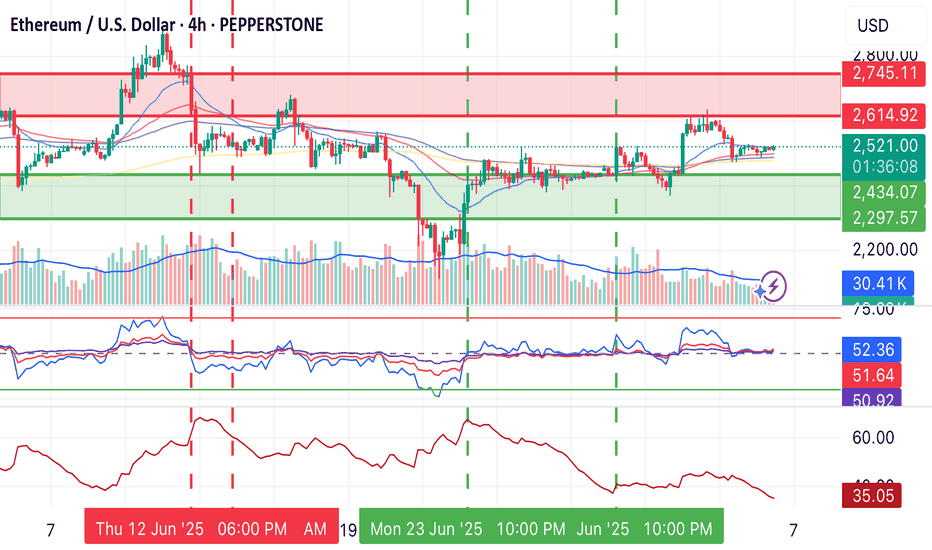

ETHUSD: Waiting for one last breakout.Ethereum remains neutral on its 1D technical outlook (RSI = 48.083, MACD = -39.26, ADX = 21.833), failing so far to close over its 2W MA50, where it's been rejected in the past 3 candles. The last Resistance before the price starts the parabolic rally is the P1 trendline. The price has been trading over it for the majority of this Cycle and only broke under it during the recent Tariff War. A breakout there, extends the Cycle to possibly at least a +346.99% rally from the bottom (TP = 6,200).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

ETHEREUM trade ideas

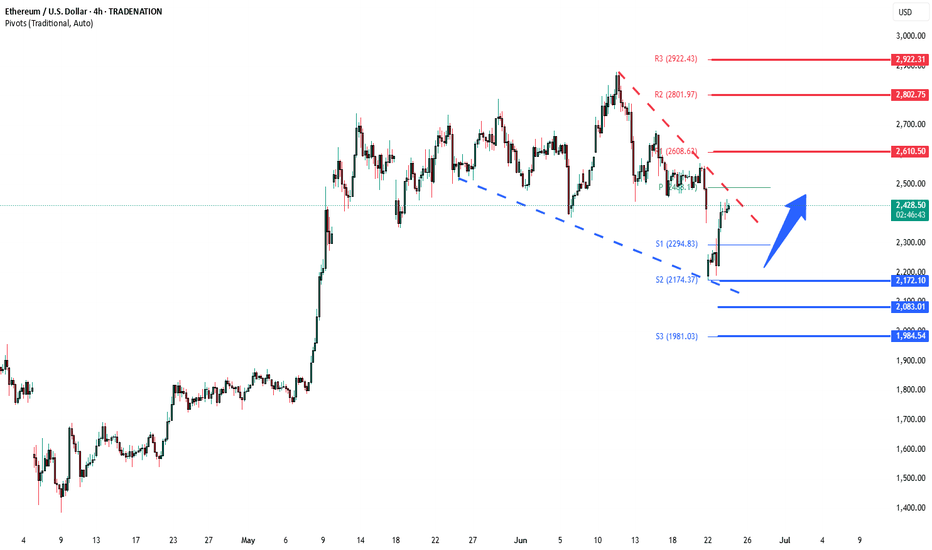

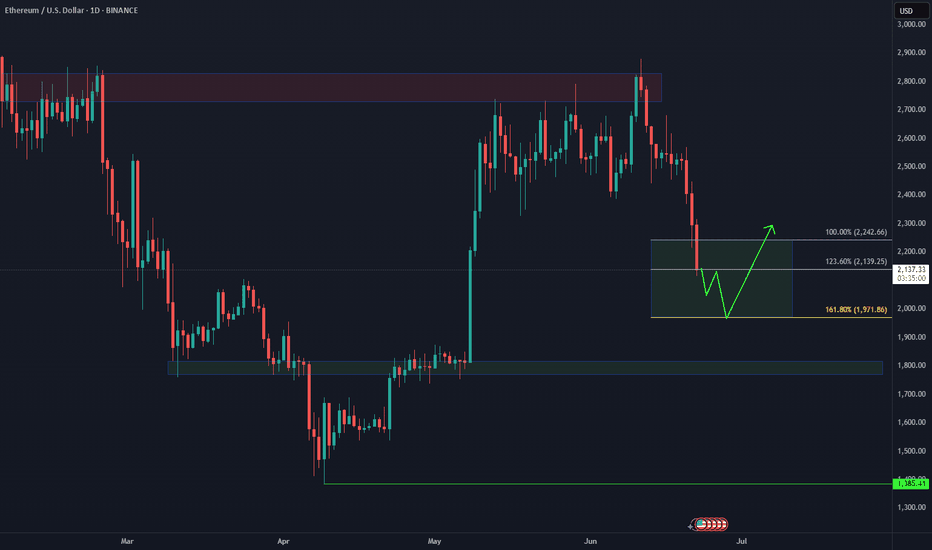

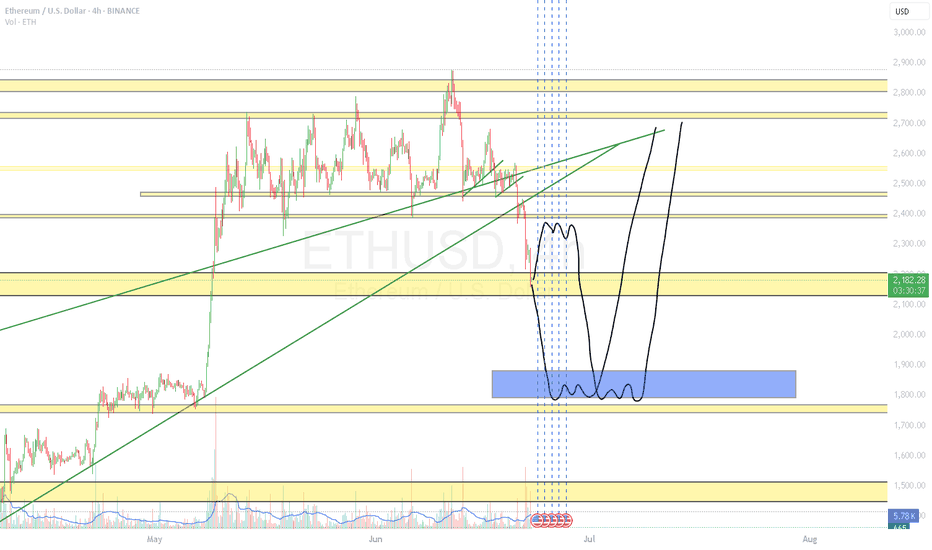

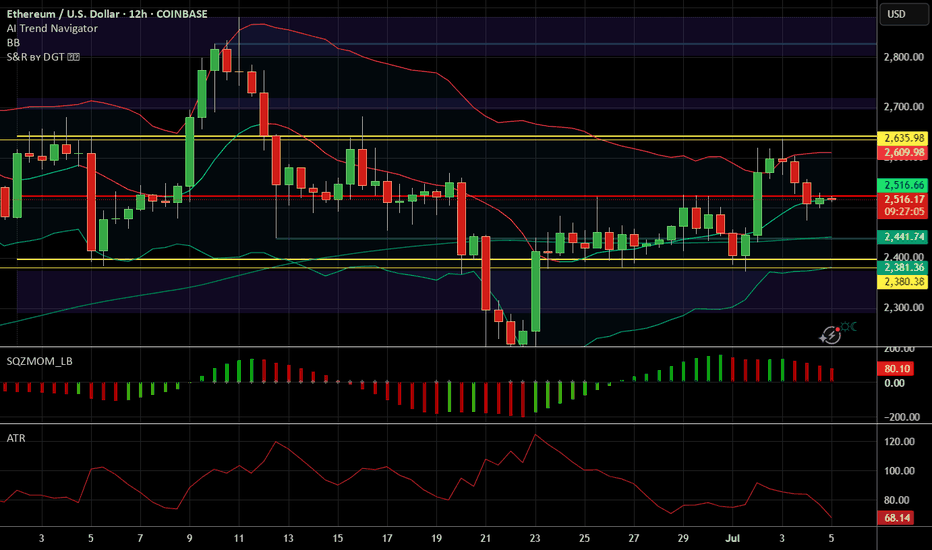

ETHUSD Energy buildup supported at 2,170Trend Overview:

ETHUSD remains in a bullish trend, characterised by higher highs and higher lows. The recent intraday price action is forming a continuation consolidation pattern, suggesting a potential pause before a renewed move higher.

Key Technical Levels:

Support: 2,170 (primary pivot), followed by 2,080 and 1,980

Resistance: 2,610 (initial), then 2,800 and 2.920

Technical Outlook:

A pullback to the 2,170 level, which aligns with the previous consolidation zone, could act as a platform for renewed buying interest. A confirmed bounce from this support may trigger a continuation toward the next resistance levels at 2,610, 2,800, and ultimately 2,920.

Conversely, a daily close below 2,170 would suggest weakening bullish momentum. This scenario would shift the bias to bearish in the short term, potentially targeting 2.080 and 1,980 as downside levels.

Conclusion:

ETHUSD maintains a bullish structure while trading above the 2,170 support. A bounce from this level would validate the consolidation as a continuation pattern, with upside potential toward the 2,610 area. A breakdown below 2,170, however, would invalidate this view and suggest deeper corrective risk.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

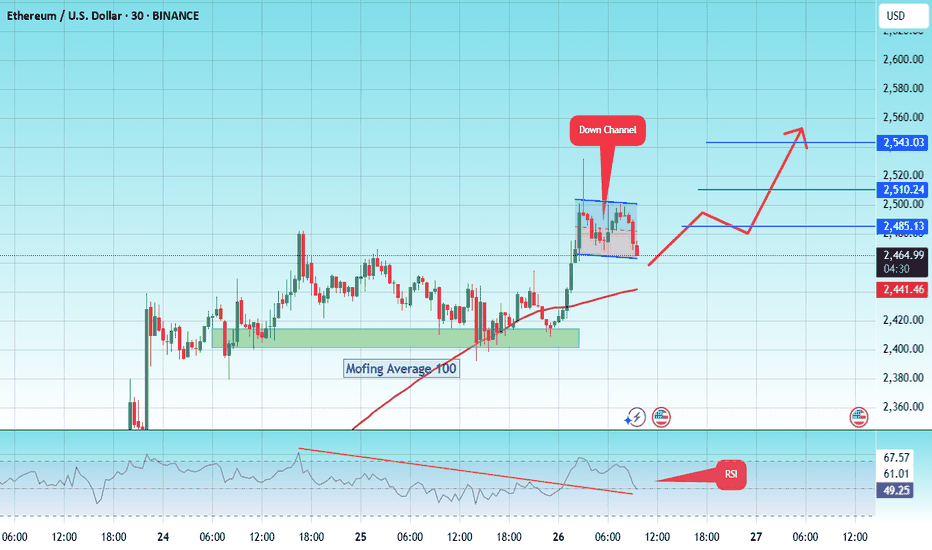

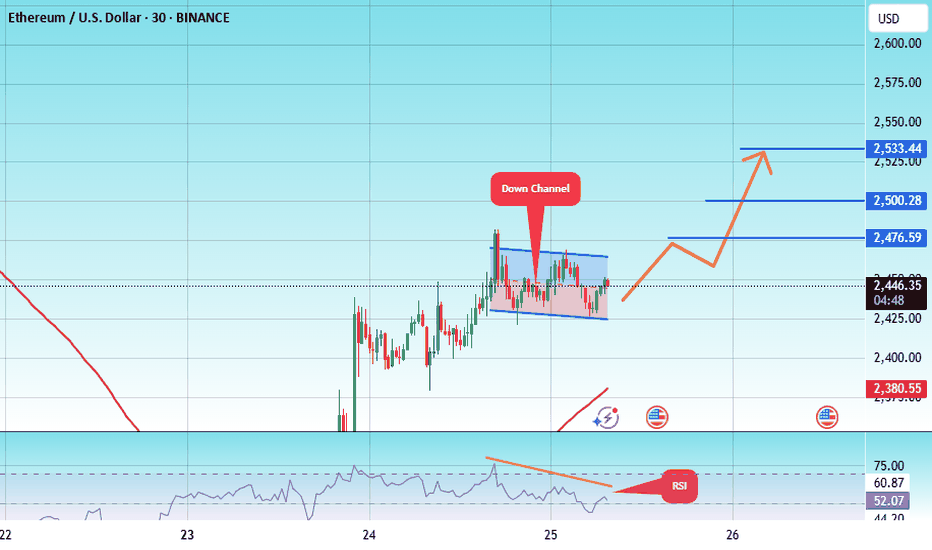

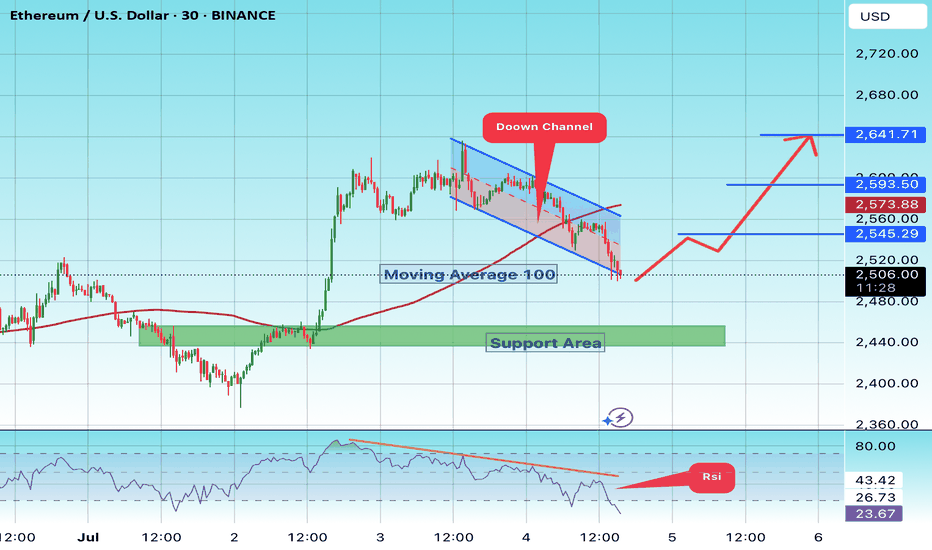

Ethereum is still bullish!#ETH

The price is moving within a descending channel on the 30-minute frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 2450, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 2400.

Entry price: 2460.

First target: 2485.

Second target: 2510.

Third target: 2543.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

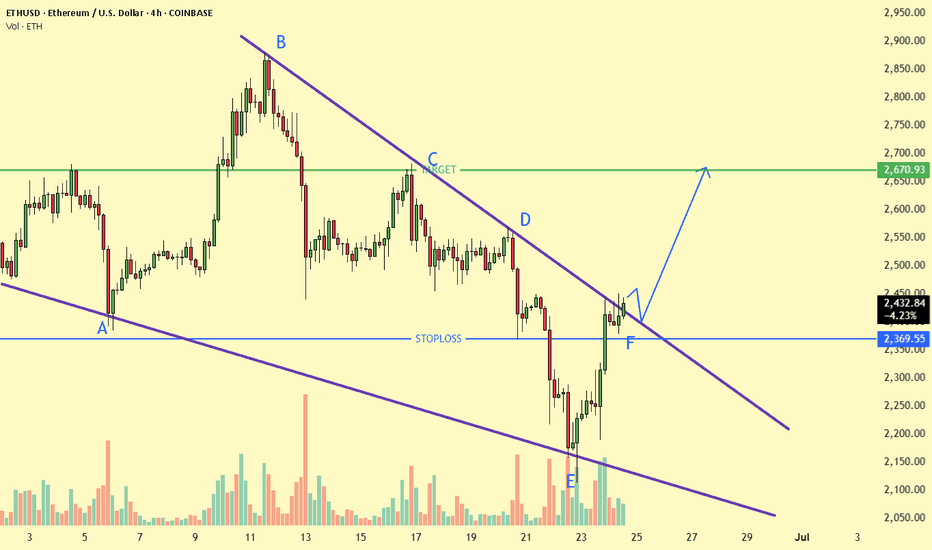

#ETH/USDT#ETH

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 2427.

We have a downtrend on the RSI indicator that is about to break and retest, which supports the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 2447

First target: 2476

Second target: 2500

Third target: 2533

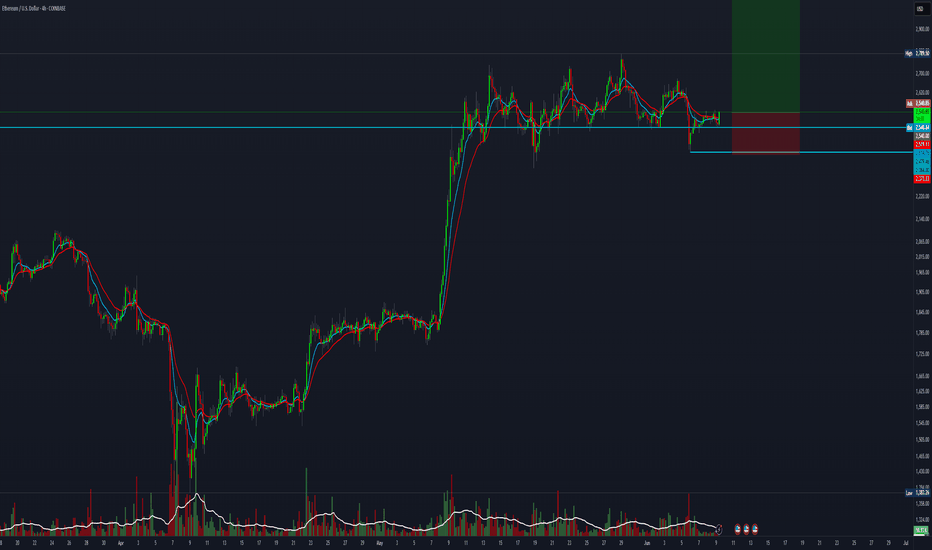

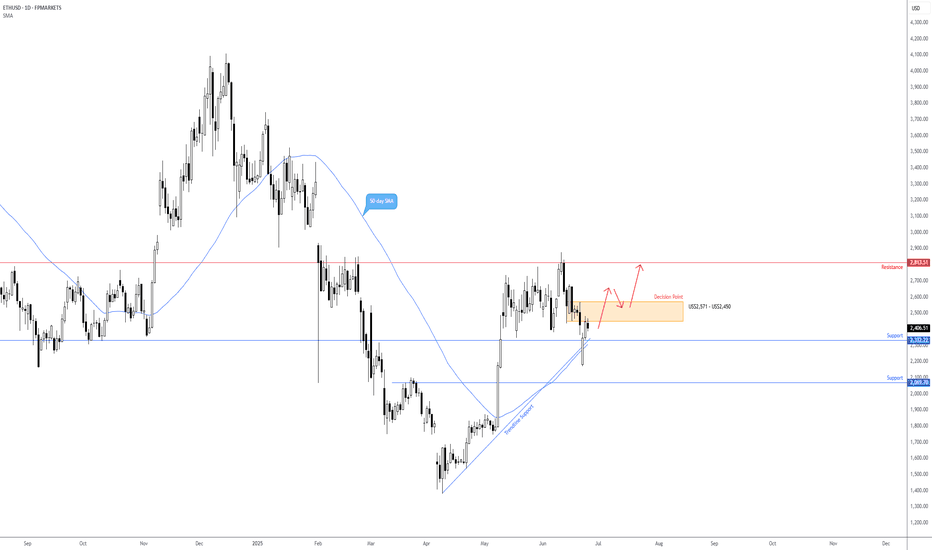

Significant level in play on ETH/USDI intend to keep the following post concise and to the point.

As exhibited on the daily timeframe of ETH/USD (Ethereum versus the US dollar), price recently shook hands with support from US$2,332. Not only does this base serve as a historically significant barrier, but it also coincides with the 50-day simple moving average at US$2,305 and a trendline support, extended from the low of US$1,381.

Given the current support in play, I am closely monitoring the overhead decision point zone at US$2,571 – US$2,450. It was within this area that a ‘decision’ was made to whipsaw through the noted support area. Consequently, if price engulfs the said decision point, this could unearth a short-term bullish scenario towards resistance at US$2,813.

Written by FP Markets Chief Market Analyst Aaron Hill

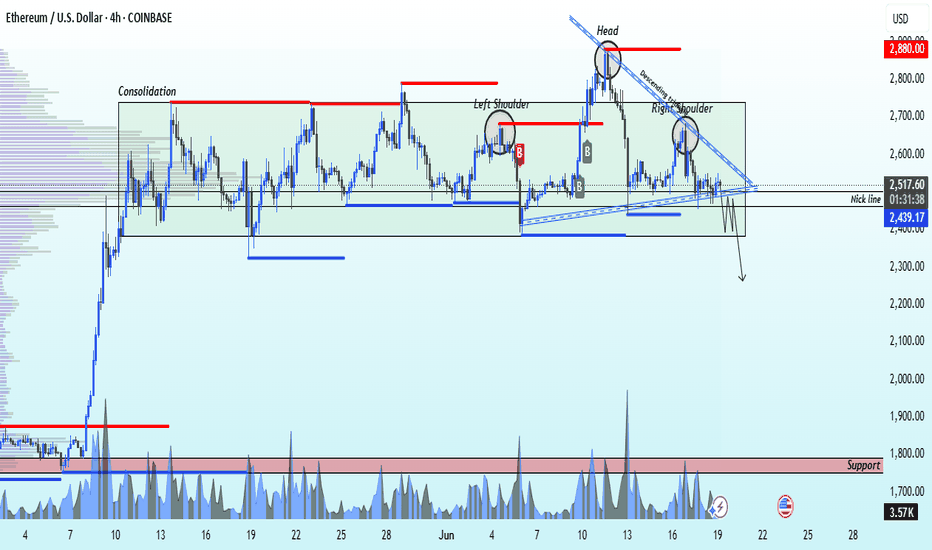

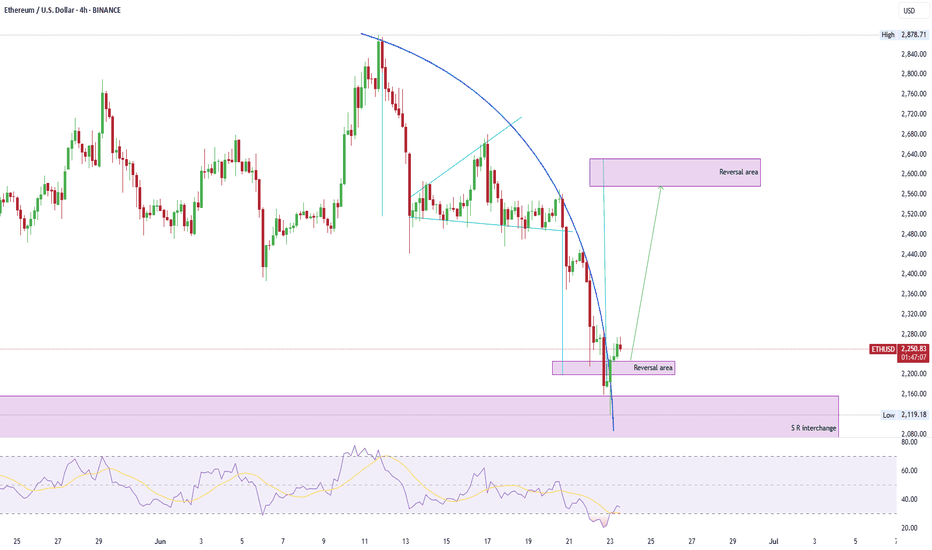

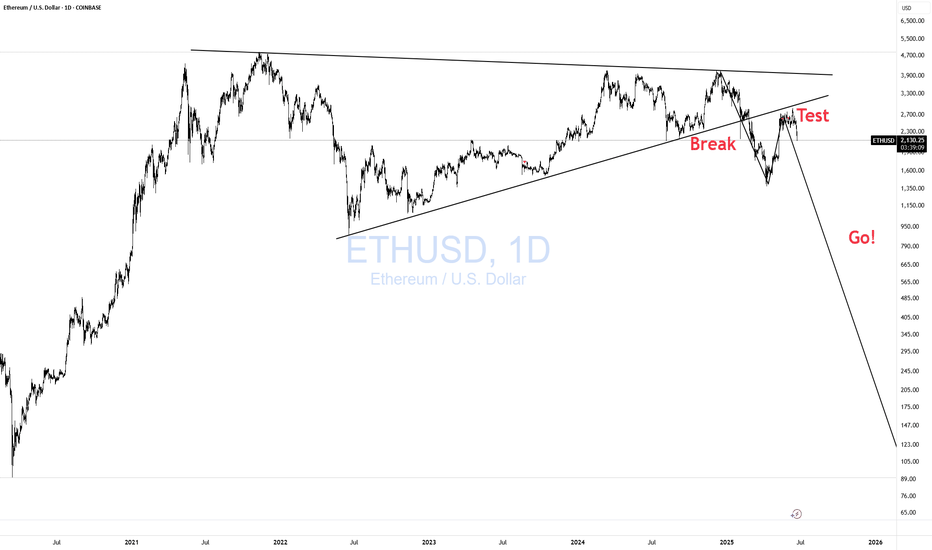

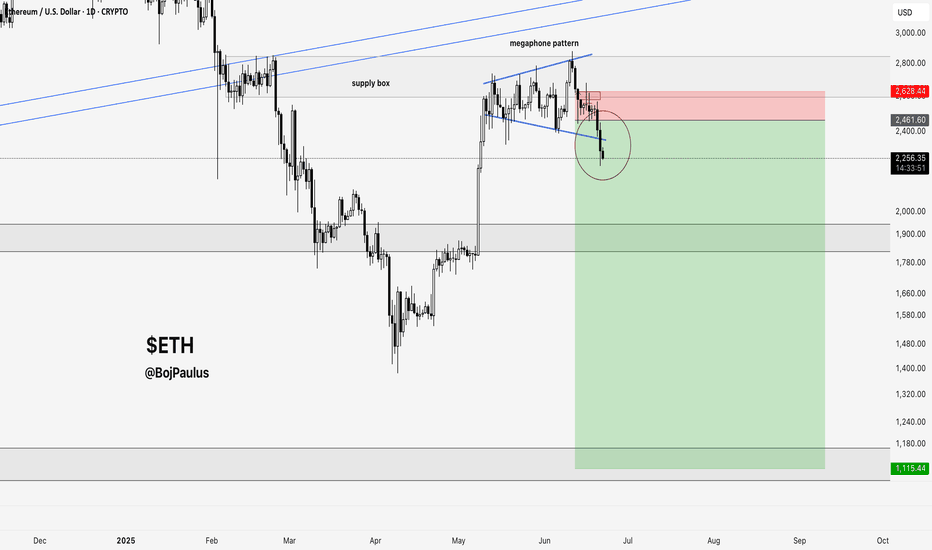

ETHUSD selling momentum head and shoulder 📉 ETH/USD Technical Breakdown Alert 📉

🚨 Pattern Formation: Head & Shoulders + Descending Triangle 🚨

On the 4H time frame, ETH/USD has confirmed a Head and Shoulders pattern, with a strong descending triangle breakdown from the neckline at $2,450.

🔻 Bearish Momentum Building

The market structure is signaling further downside pressure. A clean break below the neckline has triggered a strong sell signal.

🎯 Technical Target

1st Support Zone: $1,765

(Watch this level for potential bounce or further continuation)

💡 This setup aligns with classic bearish continuation patterns — risk management is key as always.

📊 Stay sharp, trade smart.

👉 Like, Follow, Comment & Join our community for more real-time updates and technical setups.

— Livia 😜

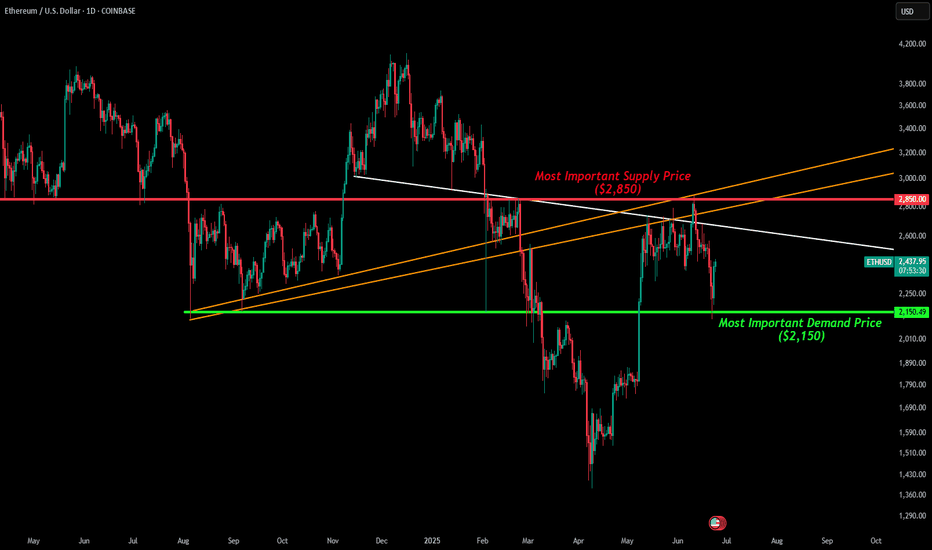

ETH - Most Important LinesHere we have the most important lines drawn for ETH's current short term structure.

In terms of price we have a red and a green line.

The red line represents the strongest level for current sellers to offload. This level is right around $2,850. It was a strong level for old buyers and since price has been trading below it has been flipped into resistance and continues to be a level for sellers. Once price can start closing daily candles above this level it will be flipped back into an important demand zone and price can move higher.

The green line represents the strongest level for current buyers to accumulate. This level is right around $2,150 and has been defended by buyers for the past year with many tests.

If you go back and look at our tradingview posts for the past year you will see how we have been pointing out these levels as extremely important. Current day, not only did the recent top come in at $2,879 but the recent low also came in at $2,111 giving validity to these levels mentioned above.

In addition to these price levels we have also added important trendlines that stretch back many months. A white trendline and two orange trendlines. The white trendline is what we are currently watching to see if it continues to act as resistance. If price is able to break above somewhere within those 2 orange trendlines is where we could see ETH's price top out again. If price is able to break above both orange trendlines that is when we will finally see this bearish momentum flip and start the climb back towards the critical $4,100 level.

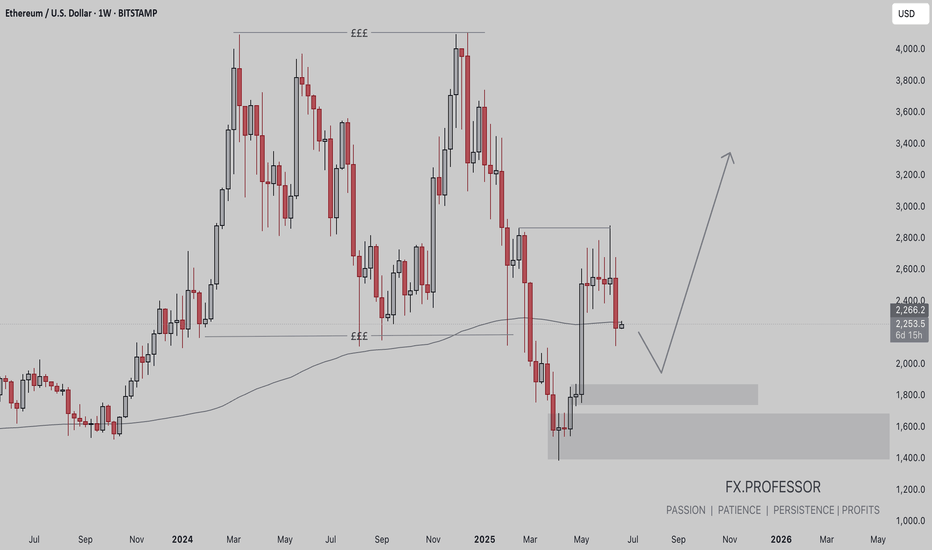

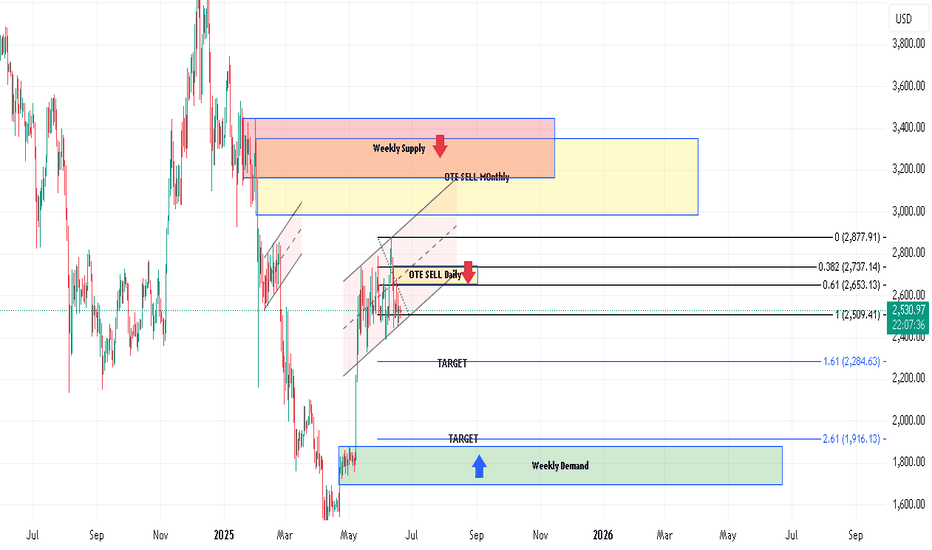

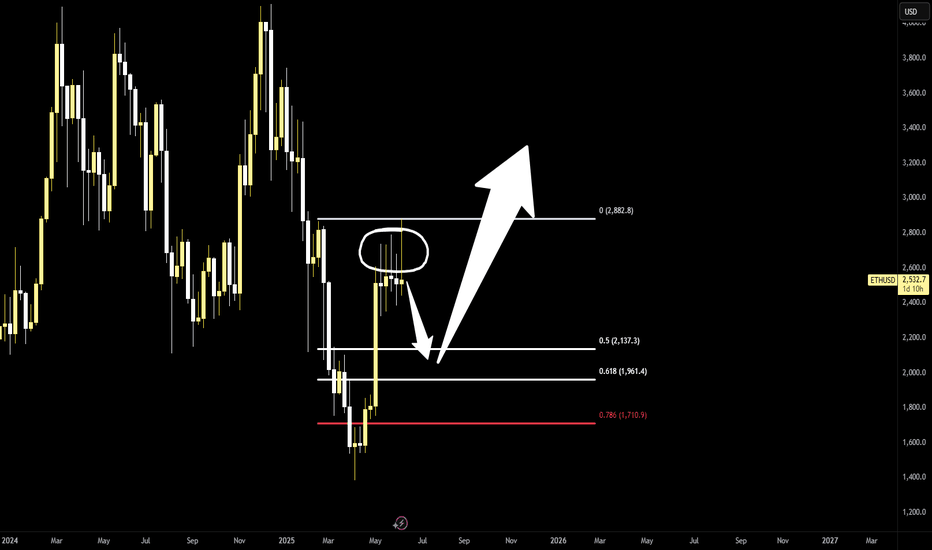

ETH BUY BIASEthereum (ETH/USD) – Weekly Chart Summary

• Current Price: ~$2,250

• Trend: Bearish structure with lower highs and lower lows

• Key Zones:

• Support (Demand): $1,800–$2,000 and $1,400–$1,700

• Resistance: $2,800–$3,600 (liquidity zone)

• 200-Week MA: Acting as dynamic support near current levels

• Outlook: Potential drop into demand zones, followed by a strong bullish reversal targeting the $3,200–$3,600 region

• Risk: Failure to hold $1,800 could trigger deeper losses

📈 Bias: Wait for price to reach key demand zones before entering long positions.

Ethereum: How Deep Into the Buying Area?📉 CRYPTO:ETHUSD is currently testing the extreme buying zone $2140–$1970 — a key area where a bullish reaction is anticipated. But if the bounce fails to materialize next week, eyes shift to the next potential demand zone near $1800.

This level aligns with prior structure and could offer a stronger base for the next leg higher — as long as the broader structure remains intact.

ETH UPDATE Eth is at a major strong support of 2200.

But i dont think this gonna hold much longer and we will go for the blue box,

Reason is bitcoin, btc broke the major major support of 100k and gave a 4h closing below 100k which is a breakdown of a sentimental support too.

Look for short, dont long right now until market cools down from the war.

If iran retaliates and a war officially breaks then were going to 90k or below, we also have a cme gap around that point

Stay safe everyone

Et herino getting rejected - bigger correction likely- several strong wicks to the upside

- yellow stripe signal on the 2D time-frame (comments)

- Bitcoin looking like it wants lower as well

Best case scenario for ETH here would be a correction that leads to a HIGHER LOW above 2000$. Potential surge above 3000$ and 4000$ later this year.

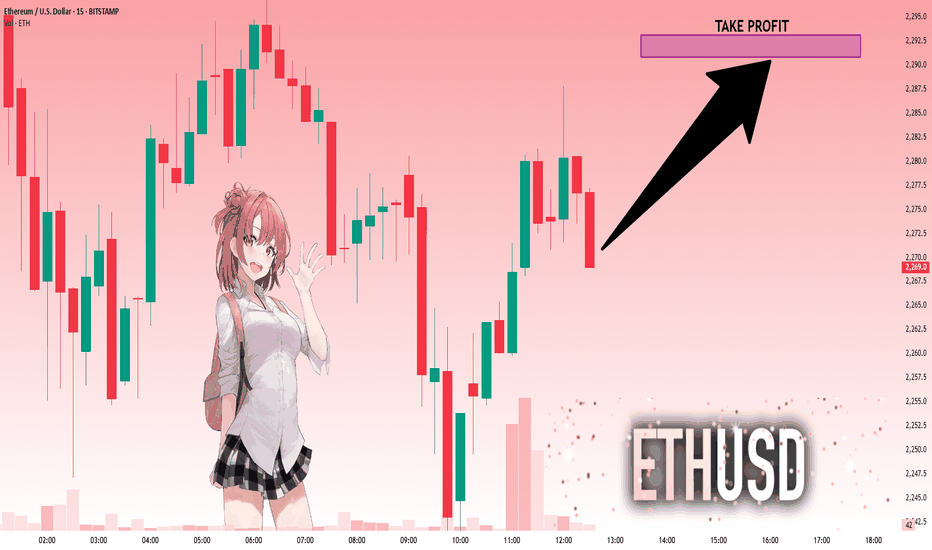

ETHUSD: Will Go Up! Long!

My dear friends,

Today we will analyse ETHUSD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 2,270.9 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 2,290.8.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

ETH/USDT#ETH

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower limit of the channel at 2440, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 2440.

Entry price: 2500.

First target: 2545.

Second target: 2539.

Third target: 2641.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.