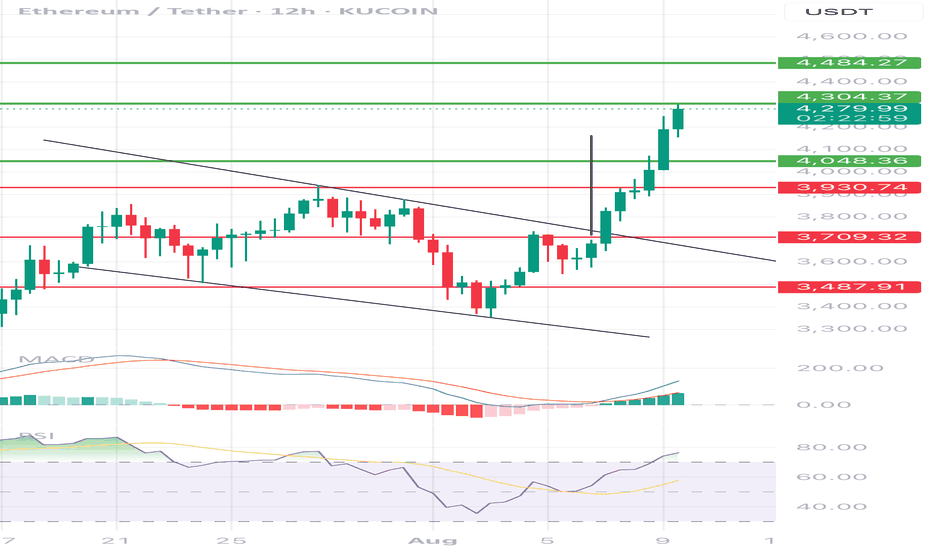

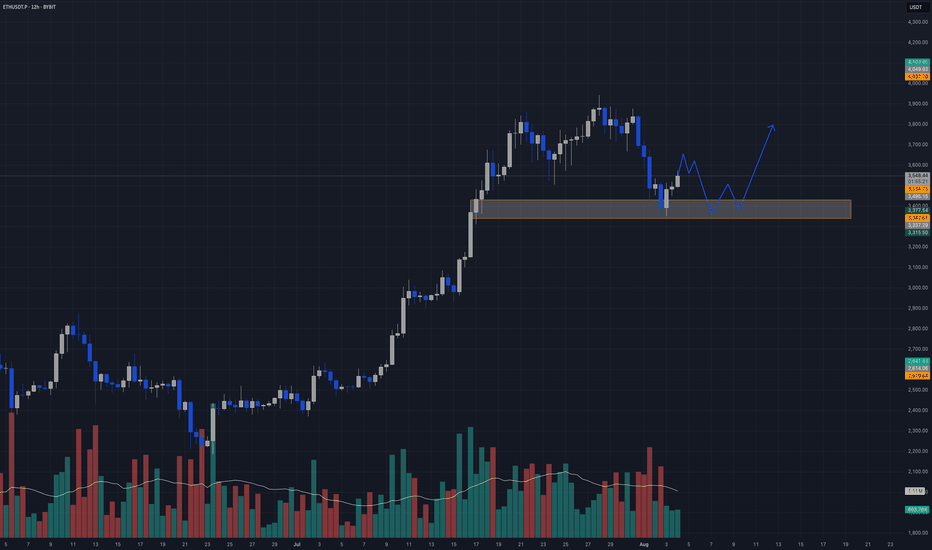

ETHUSDT 12H chart uptrend1. Breaking out of the downward channel

• Black lines show an earlier inheritance channel.

• The course struck the mountain and it is quite dynamically, which is a strong upward signal.

2. Current price

• ETH is around USD 4,274, just below the resistance at USD 4,304.

• Another resistance is 4,484 USD (potential target if the upward trend persists).

3. Support

• The next support: 4,048 USD - if the course is corrected, then there may be the first "test".

• stronger support below: USD 3,930, $ 3,709, $ 3,487.

4. Indicators

• MacD: MacD line strongly above the signal, the histogram is growing - confirms the upward trend.

• RSI: around 75 - close to the purchase zone, which can mean a short -term correction, but with a strong RSI trend can stay high for a long time.

5. Scenarios

• Bull: Punction and maintenance above USD 4,304 can open the road to 4,484 USD and possibly higher.

• Bear: rejection from USD 4,304 and a descent below 4,048 USD may cause a deeper correction in the direction of $ 3,930 or even $ 3,709.

📌 The short -term market is warmed up, so a small pullback is possible, but the structure looks very bullshit after this burst from the downward channel.

ETHUPUSDT trade ideas

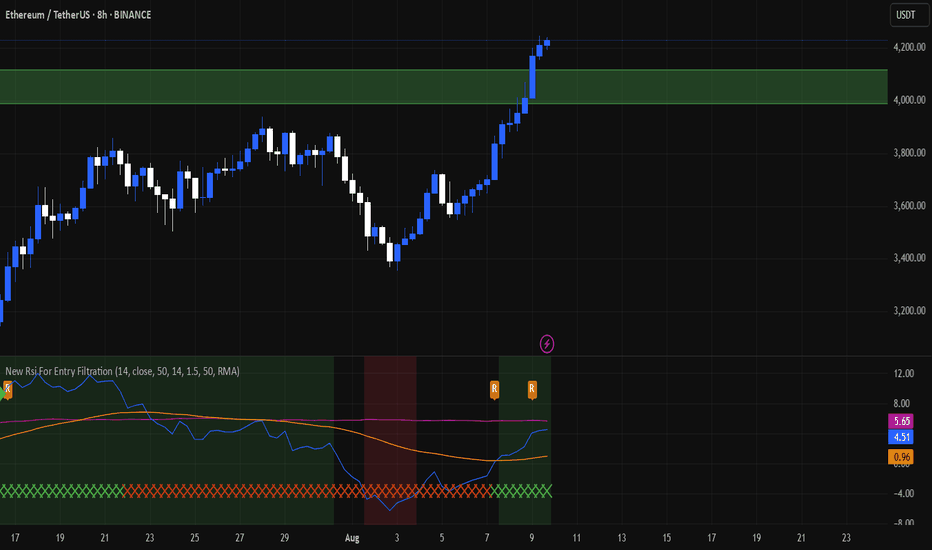

Ethereum is heading towards $5,000 and above.Ethereum broke the $4,000 level after months. Congratulations to all its patient holders. My analysis is that the price is heading towards $5,000. Because Bitcoin dominance is also on a downward trend below 60%.

This analysis is not a financial recommendation. Crypto is a very risky market and you may lose some or all of your money in it. Especially futures trading.

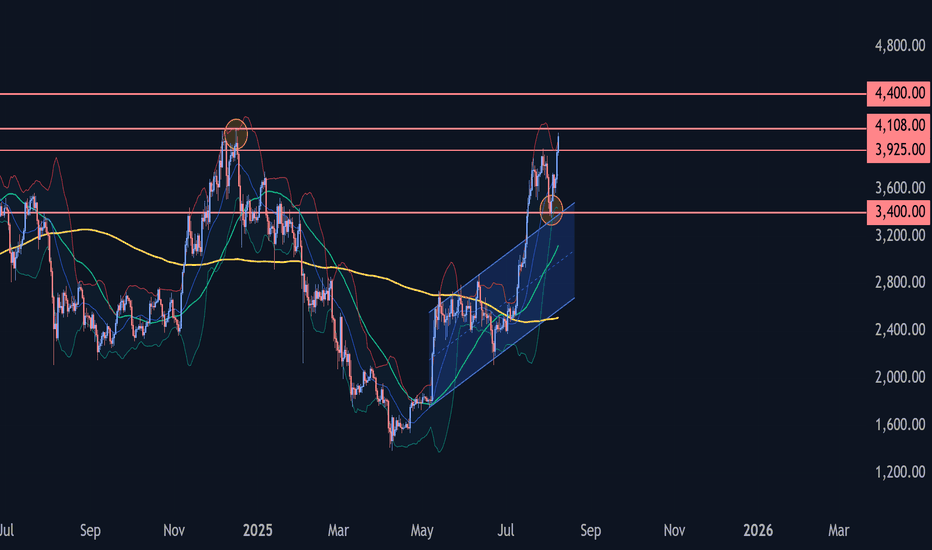

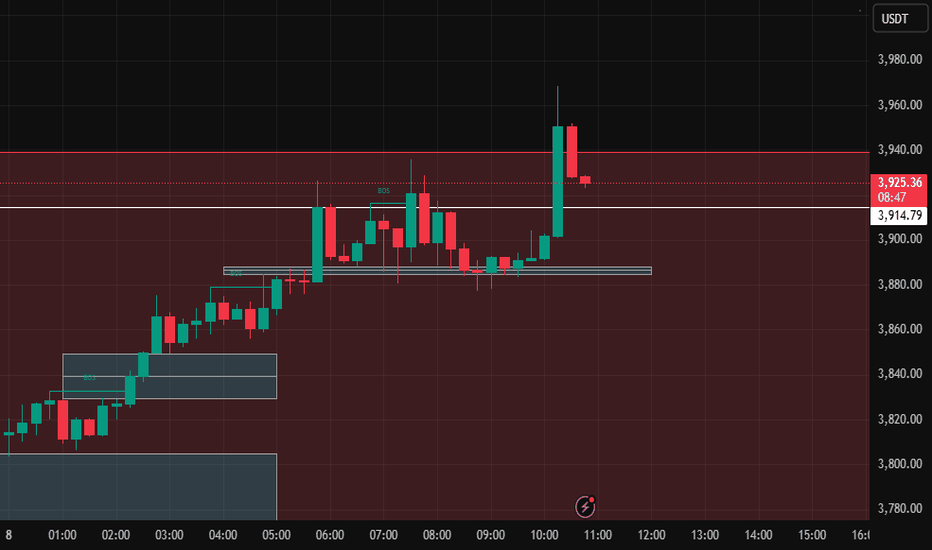

Ethereum Wave Analysis – 8 August 2025- Ethereum broke the resistance level 3925.00

- Likely to rise to resistance level 4108.00

Ethereum cryptocurrency recently broke the resistance level 3925.00 (which stopped the previous impulse wave 1 at the end of July).

The breakout of the resistance level 3925.00 continues the active impulse wave 3, which started earlier from the support zone lying at the intersection of the support level 3400.00 and the upper trendline of the daily up channel from April.

Given the clear daily uptrend, Ethereum cryptocurrency can be expected to rise to the next resistance level 4108.00 (multi-month high from December) – the breakout of which can lead to further gains toward 4400.00.

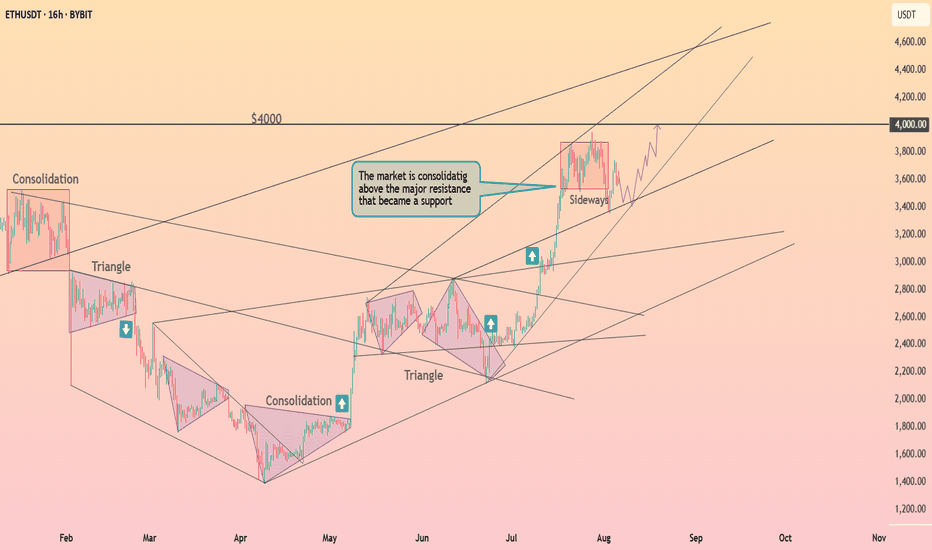

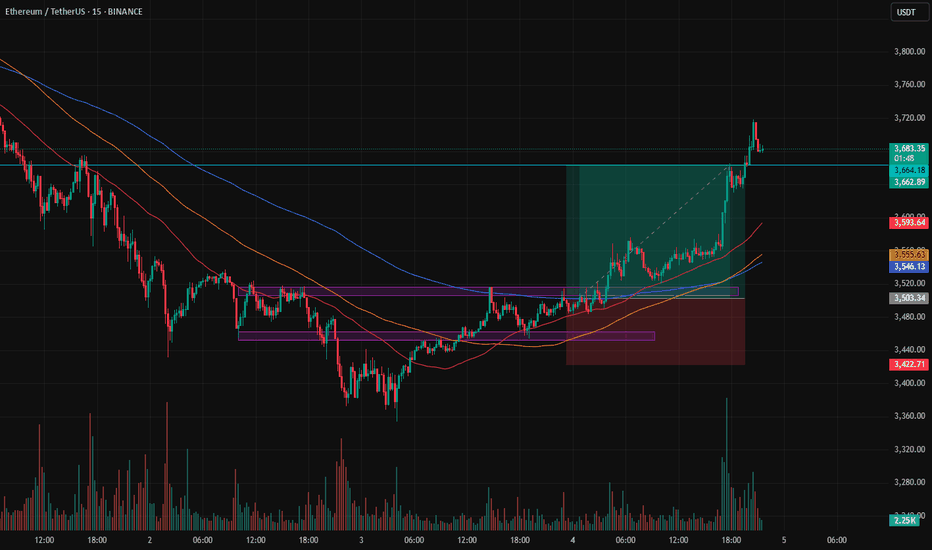

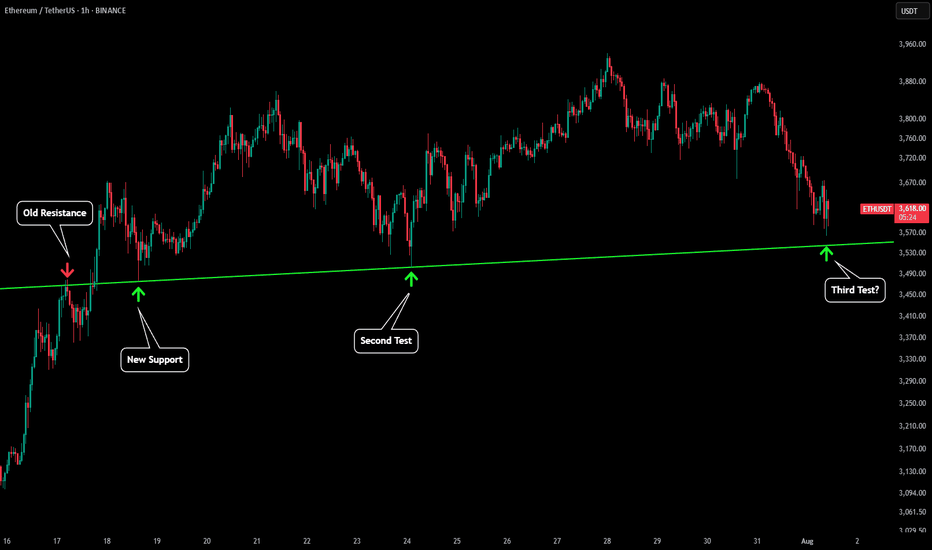

As ExpectedAs expected in the previous analysis and earlier ones, the price has been climbing toward the 4000 level.

However, it hasn't touched 4000 yet.

For now, it’s interacting with the **3,942.13** level, which could be an important support.

If the price fails to hold this level, we might see some short-term bearish movement.

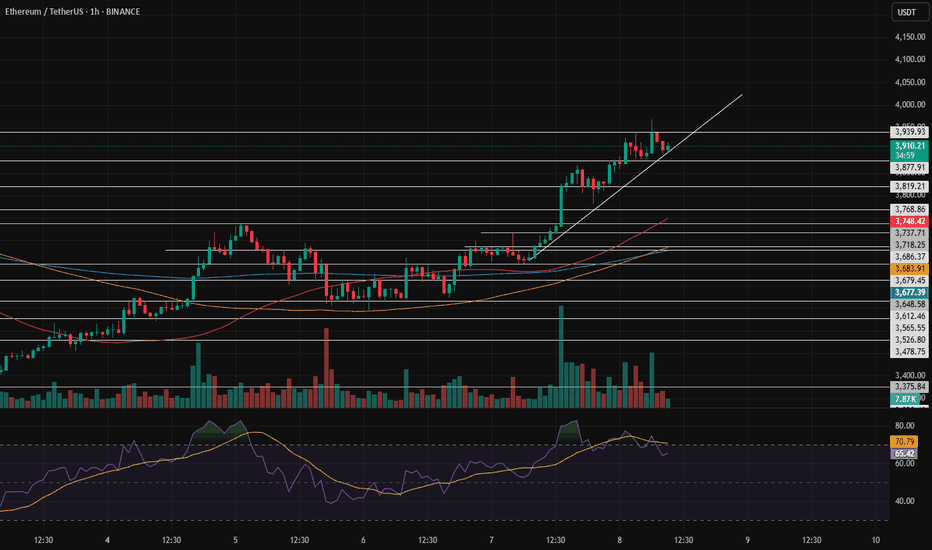

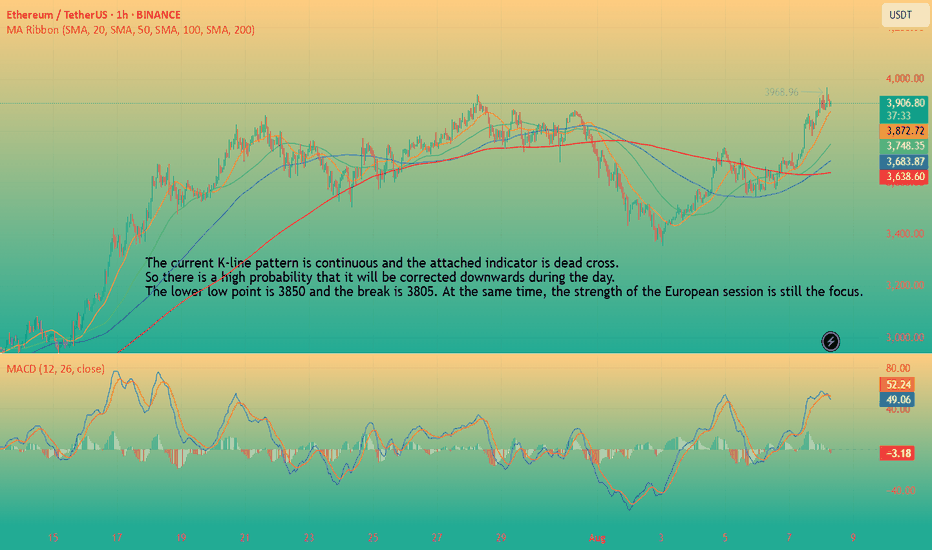

ETH-----Sell around 3905, target 3850 areaAugust 8th ETH Contract Technical Analysis:

Today, the long-term daily chart closed with a small bullish candlestick pattern, with consecutive bullish candlestick patterns and a single bearish candlestick pattern. The price is above the moving average, and the accompanying indicator shows a death cross with shrinking volume. The overall upward trend is very clear, but the current price is deviating from the moving average, so traders should be aware of the risk of a large pullback. There are also news and data stimuli. The short-term hourly chart shows a pattern of oscillating upward movement, with prices continuing to break higher. The more such a trend is, the more we need to pay attention to the support level of the pullback. This is crucial. Many friends want to sell, and that's fine, but you must not be greedy. Only short-term trading is necessary. If you can't do it, don't do it. Currently, the price is under pressure, with consecutive bearish candlestick patterns and the accompanying indicator showing a downward death cross. A pullback is also important for the day.

Today's ETH Short-Term Contract Trading Strategy:

Sell at the current price of 3905, with a stop loss at 3935 and a target of 3850.

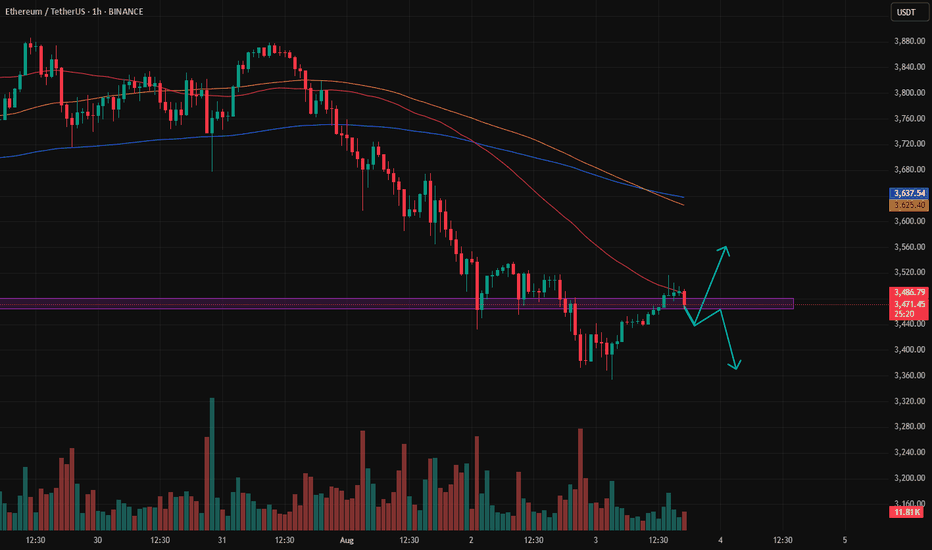

Cracks in my systemCracks in my system

- Re entries and on weak swings.

- If stopped out, the book stipulates, Don't take a re-entry. What did this kunt do with ETH last night? He re-entered a short.

- Be content with a weekly 2%ROI objective The Leader says. What did I do? again, had more than the weekly objectives met and somehow found away to messing up.

A note to myself.

This is (July and August) the consistent I have ever been since buying my first Crypto back in December 2024, about 6 months of learning to trade. I am getting better.

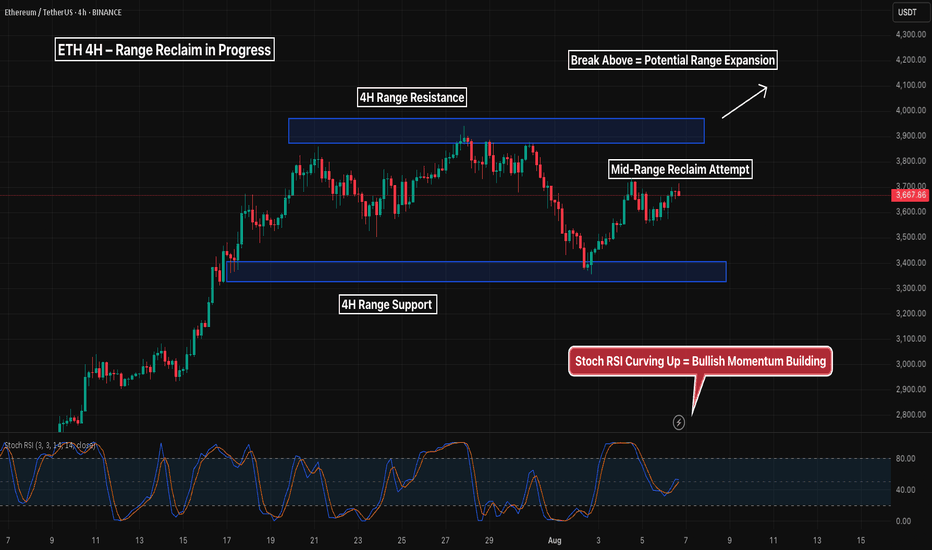

ETH 4H – Range Reclaim in Progress, But Can Bulls Break the Top?Ethereum continues to respect the clean horizontal 4H range between ~3350 (support) and ~3950 (resistance), with price now attempting a reclaim of the mid-range following a strong bounce from demand.

Stoch RSI is curling upward, suggesting building bullish momentum — but the real test lies in the upper supply zone, where price has failed several times before.

If price can flip mid-range into support and reclaim the highs with volume, this opens the door for potential range expansion and trend continuation.

Key points:

– Strong bounce from range support

– Mid-range reclaim attempt underway

– Watch for reaction at 3950 resistance

– Stoch RSI rising from bottom = bullish confluence

Until the top breaks cleanly, this remains a range-bound environment — so be prepared for both scenarios. Next moves will define the weekly trend.

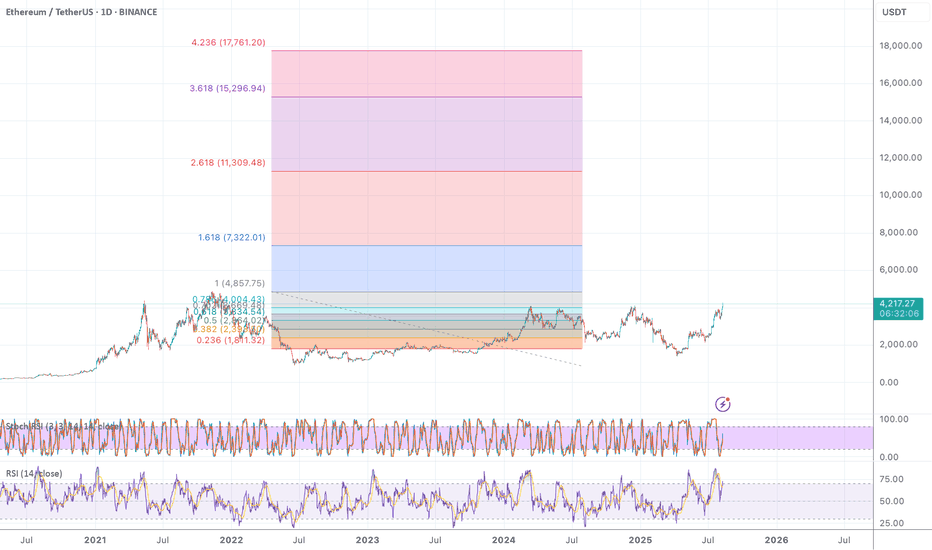

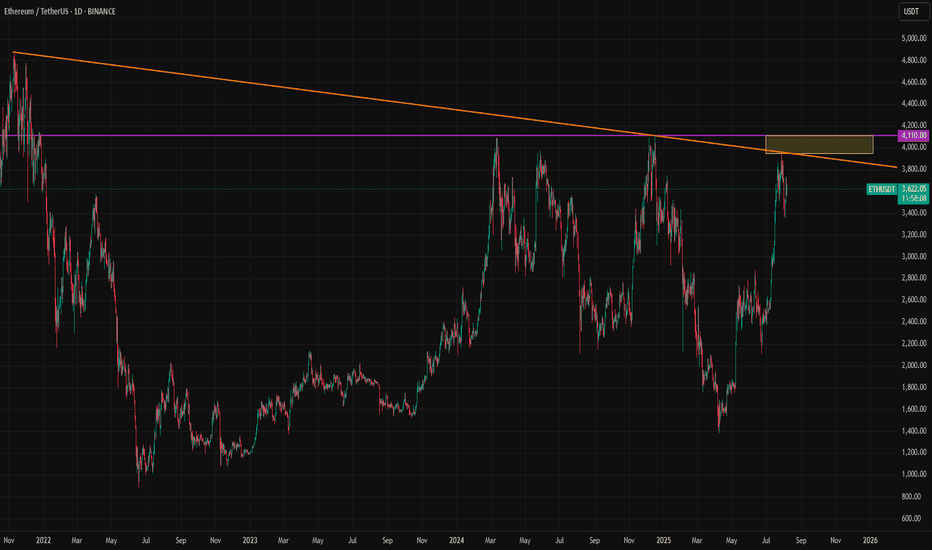

Ethereum Profit-Taking in Progress, Longterm Bullish Case StandsEther was unable to break above the trendline following its strong rally. In the medium term, our base case remains bullish, with expectations of over 100% return within a year. However, in the short term, some downward pressure and profit-taking are currently in play.

Two days ago, the Ethereum ETF experienced its largest single-day net outflow. If this turns into a trend, a broader selloff may begin. Should ETH approach the 3000 level, it could present a strong opportunity to re-enter from the bullish side.

There is also a chance of a trendline breakout occurring before a significant downward reaction. If that happens, it would suggest that demand for ETH is stronger than previously realized, and our base case may actually be too conservative.

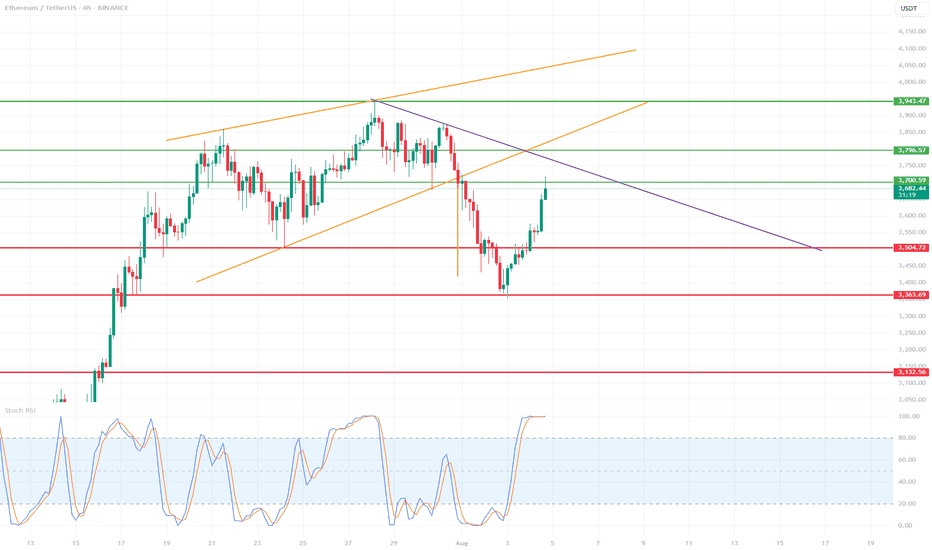

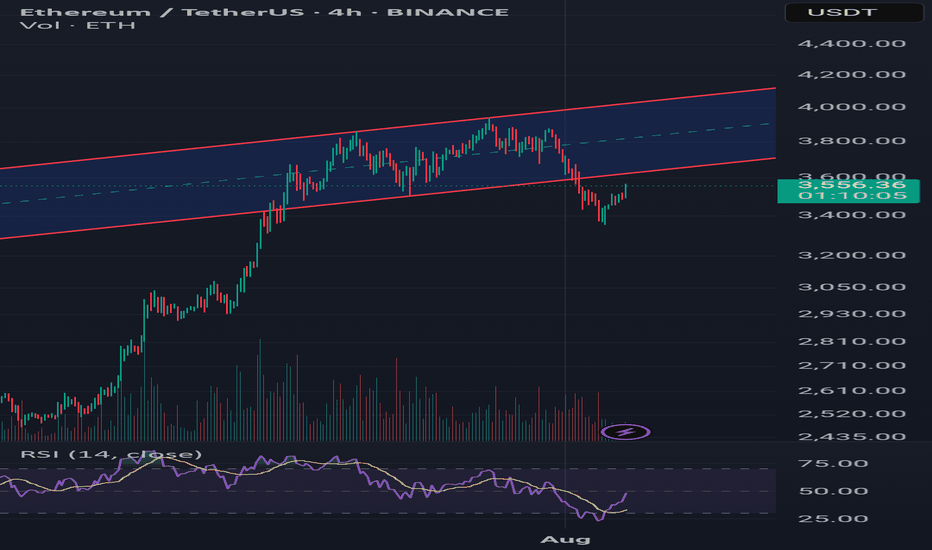

ETHUSDT 4H Chart Review🔍 General Technical Context:

Prior Trend: Upward (strong rally from around 3,150 USDT).

Current Structure: After breaking out of the ascending channel, there was a strong decline, but is currently rebounding upward – it looks like a test of prior support as resistance.

📈 Key Horizontal Levels (Support/Resistance):

Resistance:

3,794 USDT – strong resistance resulting from the prior high (green line).

3,943 USDT – high of the ascending channel.

Support:

3,504 USDT – prior support, now potentially acting as resistance (red line).

3,383 USDT – July support.

3,132 USDT – strong base support, potential correction low.

📉 Technical Patterns:

Broken Upward Channel (orange lines): A clear downward breakout suggests a weakening of the previous trend.

Downward Trendline (purple): The current price is approaching it – a test and reaction (bounce or breakout) may occur.

📊 Stochastic RSI (oscillator at the bottom):

The indicator is entering the overbought zone (>80).

This may indicate an impending slowdown or correction, especially if the price encounters resistance at the purple downward trendline.

🔮 Scenarios:

✅ Bullish (if the breakout is upward):

A breakout of the purple trendline and resistance at 3,794 USDT could signal further gains towards 3,943 USDT or higher.

Confirmation could come from a retest of the purple line as support.

❌ Bearish (if resistance rejected):

Rejection from the trendline or the 3,794 USDT zone = possible correction to 3,504 or 3,383 USDT.

Break of 3,383 = potential decline to the 3,132–3,150 USDT zone.

🧭 Conclusion:

The market has regained strength from the local low but is at a potentially strong resistance zone.

Stochastic RSI overbought + near resistance = high risk of a near-term correction.

The key will be price performance within the purple trendline and 3,794 USDT.

Weekly trading plan for EthereumLast week, BINANCE:ETHUSDT mirrored Bitcoin's moves, hitting all three of our targets. While we're seeing strong recovery now, the overbought RSI suggests a pullback may be coming soon.

Key Takeaways:

Recent longs opened yesterday during the trend shift → Consider managing risk

Better re-entry post-correction than sitting through volatility

Last week's pullback was shallow → Downward continuation remains possible

Markets reward patience - don't force trades in overbought zones

ConsenSys: Powering the Future of Cryptocurrency InfrastructureCryptocurrency ecosystem is actively maturing and investors are increasingly drawn to infrastructure providers that underpin the decentralized economy. Consensys is a leading blockchain software company, stands out with its flagship MetaMask wallet and a suite of Ethereum-focused solutions. With a robust business model and global adoption, Consensys offers a pretty interesting case for those, who are eyeing the backbone of Web3.

MetaMask: The Leading Crypto Wallet

Consensys’s flagship product, MetaMask, is one of the most widely used cryptocurrency wallets globally, competing closely with Trust Wallet for market dominance. Unlike centralized exchange storage, MetaMask is a decentralized, self-custodial wallet—essentially software that allows users to manage digital assets independently. With an estimated 30 million monthly active users, MetaMask facilitates billions in transactions, verifiable on the Ethereum blockchain.

MetaMask generates revenue through a 0.875% fee on token swaps, contributing to a reported $60 million in net profit for 2024. Its user base is spread across various markets, including Nigeria, Indonesia, the United States, South Korea, and Germany. In regions like Nigeria, where banking systems charge high fees, MetaMask transforms cash flow by enabling low-cost transactions. In developed markets like the U.S. and Germany, it serves as a gateway for asset storage and decentralized app (dApp) interactions.

A key growth catalyst for MetaMask is the potential launch of its own governance token. Unlike competitors Trust Wallet and Gnosis, MetaMask lacks a native token, which could streamline transactions and boost revenue by reducing reliance on third-party staking providers. Market speculation suggests a token launch could enhance MetaMask’s valuation and make it by this a hot topic for discussions.

Infura: Ethereum’s Infrastructure Backbone

Beyond MetaMask, Consensys’s Infura provides critical infrastructure for Ethereum COINBASE:ETHUSD , the world’s second-largest blockchain. Infura’s API services enable developers to build and scale dApps without running their own nodes, supporting over 430,000 developers and processing transactions worth over $1 trillion annually. Infrastructure is integral to Ethereum’s ecosystem, powering everything from DeFi platforms to NFT marketplaces.

Infura’s revenue model, based on usage fees ($40–$50 per 200,000 API requests), capitalizes on Ethereum’s growth. As transaction volumes rise—up 83% since 2017—Infura’s role as a reliable backend for MetaMask and other dApps positions it as a critical part of Consensys’s business.

Sharplink: Smart Contracts for Enterprises

Consensys’s Sharplink division develops software for smart contracts, serving high-profile clients like Ernst & Young , Airbus EURONEXT:AIR , JPMorgan NYSE:JPM , Microsoft NASDAQ:MSFT , and Amazon $NASDAQ:AMZN. Solutions enable secure and automated agreements on Ethereum, with applications ranging from supply chain management to digital identity. Central banks in countries like Norway and Israel are also exploring Sharplink’s technology for digital currency initiatives.

Staking and Asset Management

Consensys owns approximately $500 million in Ethereum and other cryptocurrencies, generating income from staking and other revenue-generating operations, thereby complementing the company's software offerings, ensuring financial stability, and providing access to the growth of the cryptocurrency market.

Why Consensys Stands Out

Lets take Kraken or Bybit, for example. Their reported trading volumes are quite difficult to verify, but at the same time, Consensys' decentralized products provide transparency. Every MetaMask transaction and Infura API call is recorded on Ethereum’s public ledger, allowing investors to validate activity. Such openness mitigates the exaggeration common in crypto, where claims of user bases or turnovers can be inflated.

Consensys’s diversified portfolio—spanning wallets, infrastructure, smart contracts, and staking, as we told before—reduces reliance on any single revenue source. Its global reach, from emerging markets like Nigeria to tech hubs like the U.S., further de-risks its business model. Major investors, including BlackRock, JPMorgan, and Microsoft, have already backed Consensys, signaling that way confidence in its long-term potential.

The Road Ahead

Founded by Ethereum co-founder Joseph Lubin, Consensys has raised $1 billion to date, with a reported valuation target of $7 billion for a potential IPO. While the timeline for going public remains uncertain, the company’s focus on Ethereum’s ecosystem positions it to benefit from Web3’s expansion. Challenges, such as regulatory scrutiny and competition from wallets like Trust Wallet or blockchains like Solana, exist, but Consensys’s entrenched role in Ethereum gives it a competitive edge.Cryptocurrency ecosystem is actively maturing and investors are increasingly drawn to infrastructure providers that underpin the decentralized economy. Consensys is a leading blockchain software company, stands out with its flagship MetaMask wallet and a suite of Ethereum-focused solutions. With a robust business model and global adoption, Consensys offers a pretty interesting case for those, who are eyeing the backbone of Web3.

MetaMask: The Leading Crypto Wallet

Consensys’s flagship product, MetaMask, is one of the most widely used cryptocurrency wallets globally, competing closely with Trust Wallet for market dominance. Unlike centralized exchange storage, MetaMask is a decentralized, self-custodial wallet—essentially software that allows users to manage digital assets independently. With an estimated 30 million monthly active users, MetaMask facilitates billions in transactions, verifiable on the Ethereum blockchain.

MetaMask generates revenue through a 0.875% fee on token swaps, contributing to a reported $60 million in net profit for 2024. Its user base is spread across various markets, including Nigeria, Indonesia, the United States, South Korea, and Germany. In regions like Nigeria, where banking systems charge high fees, MetaMask transforms cash flow by enabling low-cost transactions. In developed markets like the U.S. and Germany, it serves as a gateway for asset storage and decentralized app (dApp) interactions.

A key growth catalyst for MetaMask is the potential launch of its own governance token. Unlike competitors Trust Wallet and Gnosis, MetaMask lacks a native token, which could streamline transactions and boost revenue by reducing reliance on third-party staking providers. Market speculation suggests a token launch could enhance MetaMask’s valuation and make it by this a hot topic for discussions.

Infura: Ethereum’s Infrastructure Backbone

Beyond MetaMask, Consensys’s Infura provides critical infrastructure for Ethereum, the world’s second-largest blockchain. Infura’s API services enable developers to build and scale dApps without running their own nodes, supporting over 430,000 developers and processing transactions worth over $1 trillion annually. Infrastructure is integral to Ethereum’s ecosystem, powering everything from DeFi platforms to NFT marketplaces.

Infura’s revenue model, based on usage fees ($40–$50 per 200,000 API requests), capitalizes on Ethereum’s growth. As transaction volumes rise—up 83% since 2017—Infura’s role as a reliable backend for MetaMask and other dApps positions it as a critical part of Consensys’s business.

Sharplink: Smart Contracts for Enterprises

Consensys’s Sharplink division develops software for smart contracts, serving high-profile clients like Ernst & Young, Airbus, JPMorgan, Microsoft, and Amazon. Solutions enable secure and automated agreements on Ethereum, with applications ranging from supply chain management to digital identity. Central banks in countries like Norway and Israel are also exploring Sharplink’s technology for digital currency initiatives.

Staking and Asset Management

Consensys owns approximately $500 million in Ethereum and other cryptocurrencies, generating income from staking and other revenue-generating operations, thereby complementing the company's software offerings, ensuring financial stability, and providing access to the growth of the cryptocurrency market.

Why Consensys Stands Out

Take Kraken or Bybit, for example. Their reported trading volumes are quite difficult to verify, but at the same time, Consensys' decentralized products provide transparency. Every MetaMask transaction and Infura API call is recorded on Ethereum’s public ledger, allowing investors to validate activity. Such openness mitigates the exaggeration common in crypto, where claims of user bases or turnovers can be inflated.

Consensys’s diversified portfolio—spanning wallets, infrastructure, smart contracts, and staking, as we told before—reduces reliance on any single revenue source. Its global reach, from emerging markets like Nigeria to tech hubs like the U.S., further de-risks its business model. Major investors, including BlackRock, JPMorgan, and Microsoft, have already backed Consensys, signaling that way confidence in its long-term potential.

The Road Ahead

Founded by Ethereum co-founder Joseph Lubin, Consensys has raised $1 billion to date, with a reported valuation target of $7 billion for a potential IPO. While the timeline for going public remains uncertain, the company’s focus on Ethereum’s ecosystem positions it to benefit from Web3’s expansion. Challenges, such as regulatory scrutiny and competition from wallets like Trust Wallet or blockchains like Solana, exist, but Consensys’s entrenched role in Ethereum gives it a competitive edge.

Bullish engulfing flex on the weeklyWhat’s up Candle Fam,

Ethereum just pulled a bullish engulfing flex on the weekly — and it’s not here to play. The recent correction shook out late longs, but structure remains beautifully intact.

🎯 LONG Setup

📍 Entry: $3,430–$3,340

🩸 Stop Loss: $3,190

🎯 Targets:

TP1: $3,750

TP2: $3,980

TP3: $4,200

📊 Strategy: Weekly OB + FVG Reclaim

– Weekly: Clean engulfing candle reclaiming the $3.2k–3.4k order block

– Daily: Structure holding higher lows — bullish market structure intact

– LTF: Watch for CHoCH + volume spike around $3.4k (12H/1H footprint shows absorption)

🧠 Footprint Flow:

– Aggressive shorts caught below $3.4k

– Buyers stepping in with clear delta divergence

– POC shifting higher = reclaim attempt underway

⚠️ Invalidation below $3,200 — breaks HTF structure

⛓️ Stick to low leverage or spot to manage broader macro risks.

No hopium, just structure.

Stick to the craft. Trade the plan.

Candle Craft | Signal. Structure. Execution.

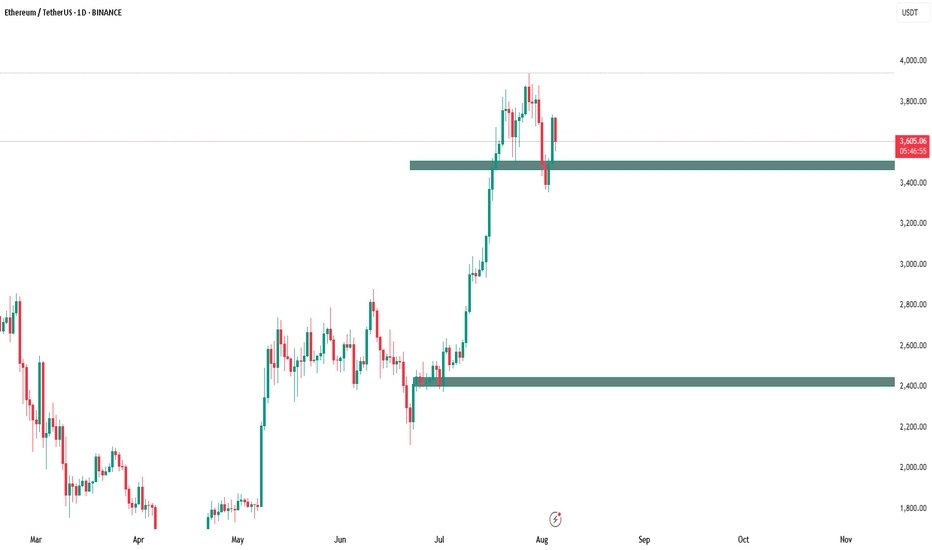

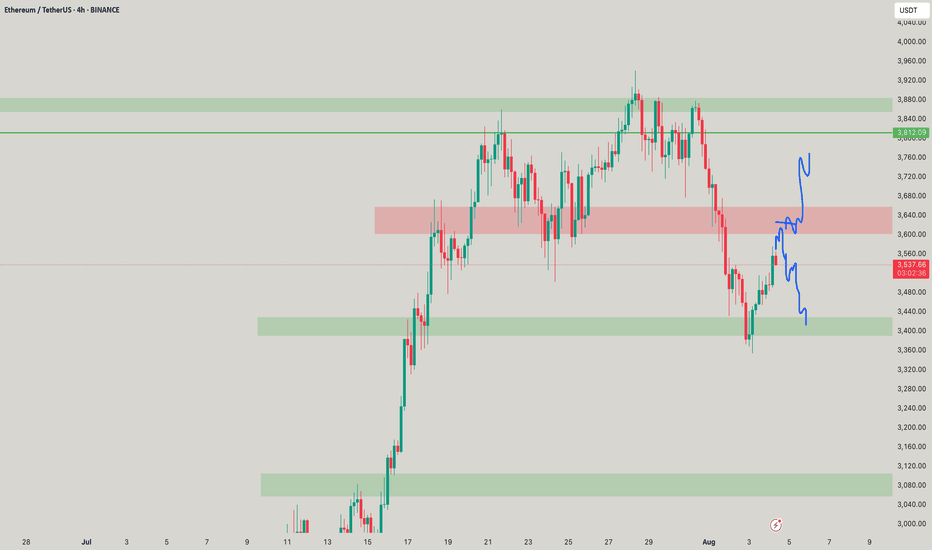

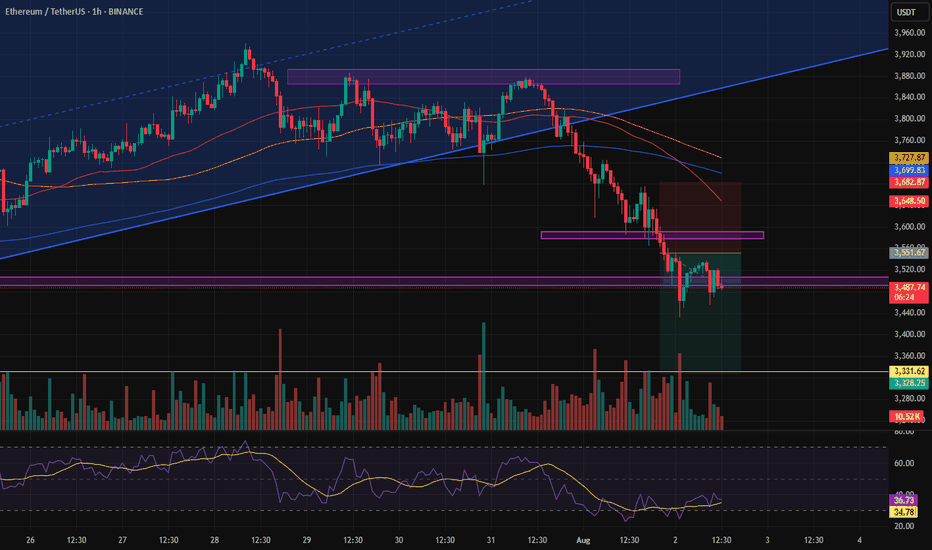

Ethereum at Critical Retest – Pullback or Breakout?Ethereum saw a sharp rally followed by a steady climb inside a rising channel. Recently, price broke below the channel’s lower boundary, signaling potential weakness. Now, ETH is retesting the broken trendline, which could be a classic pullback scenario.

Scenario 1 – Bearish Continuation:

If ETH fails to reclaim the channel and rejects around $3,600–$3,650, selling pressure may return.

Potential targets: $3,400 → $3,250 and, in extension, $3,050.

RSI is recovering from oversold levels but still below midline, hinting at possible limited upside before another drop.

Scenario 2 – Bullish Reclaim:

A daily close above $3,650 with strong volume would invalidate the breakdown and suggest a false break.

In that case, ETH could re-enter the channel and aim for $3,850 and the upper boundary near $4,050.

Risk Management:

Bearish entry: Wait for rejection candle on retest → SL above $3,700.

Bullish entry: Wait for confirmed breakout above $3,650 with volume → SL below $3,550.

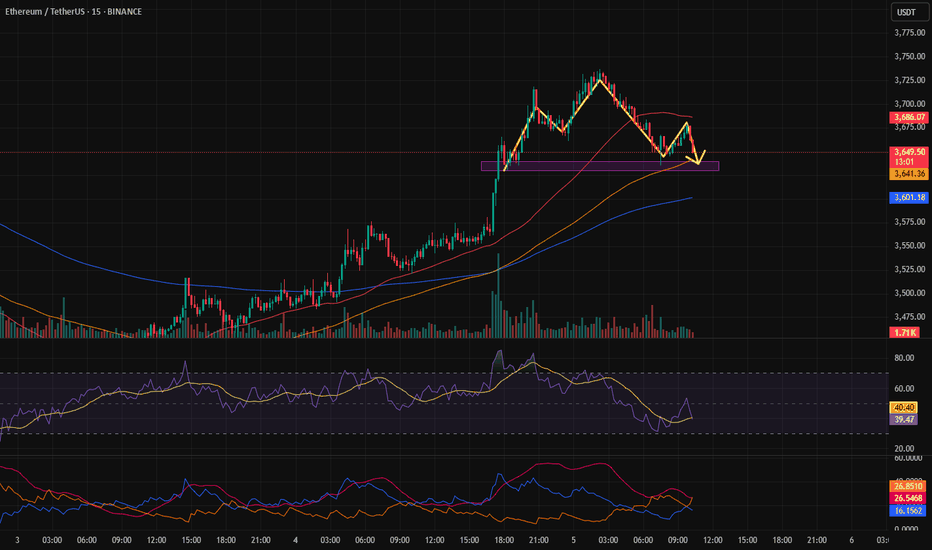

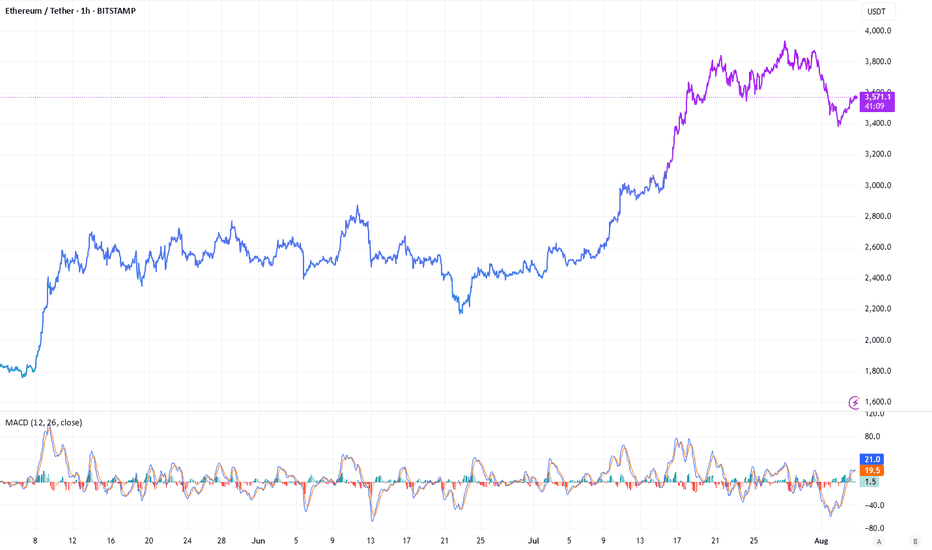

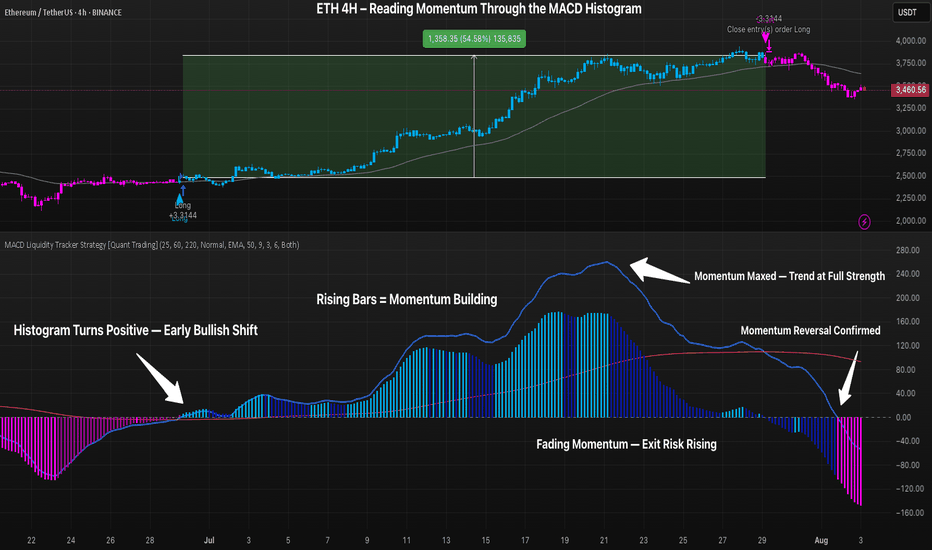

ETH 4H – MACD Histogram Caught The 54% Increase, Did You?The MACD Liquidity Tracker Strategy doesn’t just catch trends — it shows you how strong they are. On this ETH 4H chart, a textbook move unfolds:

🔹 Histogram flipped positive → Long entry triggered

🔹 Rising bars = building momentum

🔹 Tallest bar = momentum peak (July 21)

🔹 Shrinking bars signaled a weakening trend before price ever reversed

🔹 Histogram turned negative → clean exit at the top

The MACD histogram is a direct visual of momentum:

– Bars rising = acceleration

– Bars shrinking = exhaustion

– Crossing below 0 = confirmation of reversal

⚙️ Strategy Settings:

– MACD: 25 / 60 / 220

– EMA Filter: 50 / 9 / 3

– Entry Mode: Histogram + Crossover Combo

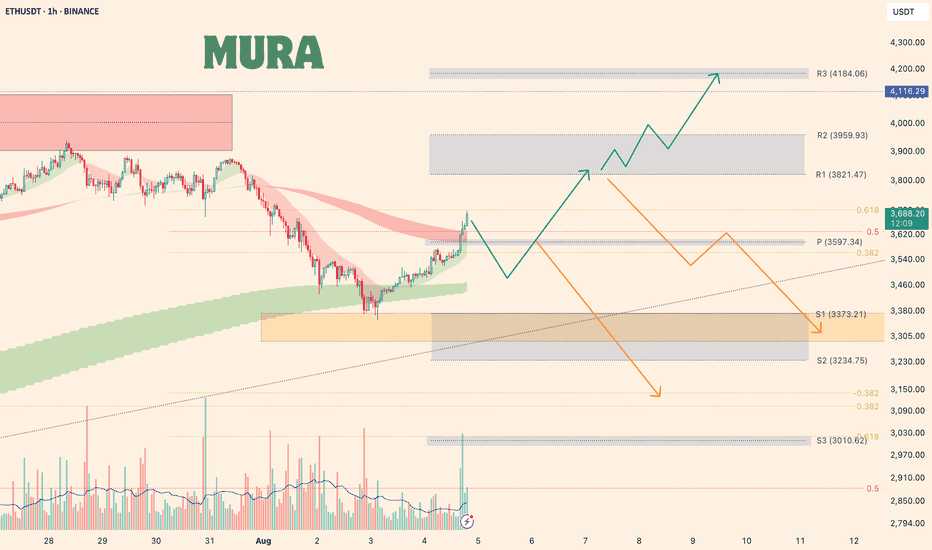

Patience to identify the market trendBased on the previous analysis, after hitting the sell target, the price made an upward correction.

Right now, it’s unclear whether we’re seeing the beginning of a trend reversal to the upside, or if the price is going to drop back below the zone, giving us another short opportunity.

If it does drop again, there’s a possibility it could fall as far as 3000.

We need to be patient and let the market show its hand — then we can respond accordingly.