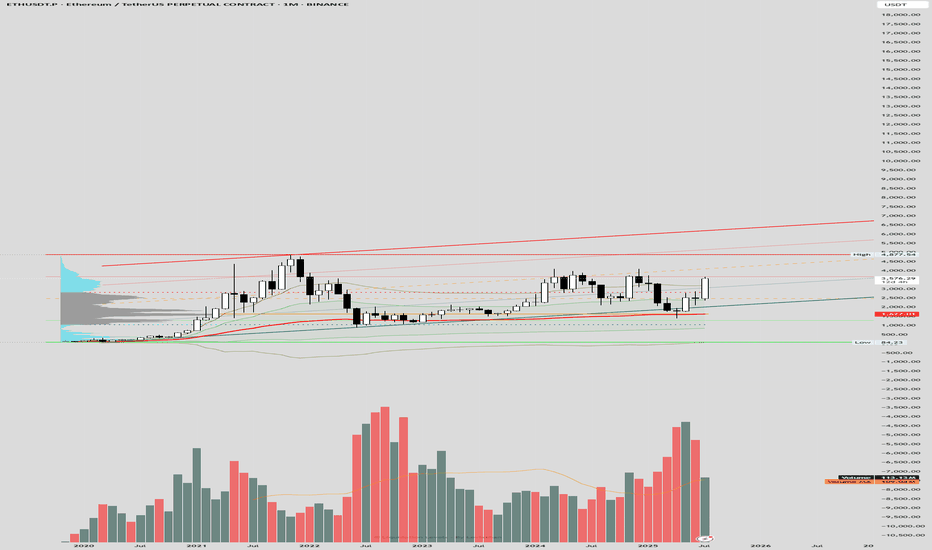

ETH Monthly Chart (AVWAP)The chart highlights a bullish structure with the AVWAP providing key dynamic support and resistance levels. The price has recently approached the upper AVWAP deviation around $4,977.54, aligning with the prior bull flag scenario's resistance zone. The red trendline indicates a potential upper boundary, while the green and orange lines suggest intermediate supports and resistances, with the current price near $3,579.48 testing the middle range. The lower AVWAP deviation near $842.23 serves as a critical invalidation level. Volume remains supportive, with spikes corresponding to price movements, and the volume moving average (109.4k) indicates steady activity.

Real-time data shows ETH trading at $3,565-$3,600, consistent with the chart's mid-range levels, driven by ETF inflows and on-chain activity. A breakout above $3,700-$4,000 with increased volume could target $3,834-$4,000 or higher, while support at $2,533-$2,700 remains vital. Sentiment on X and web sources is optimistic, though volatility persists due to external factors.

ETHUPUSDT trade ideas

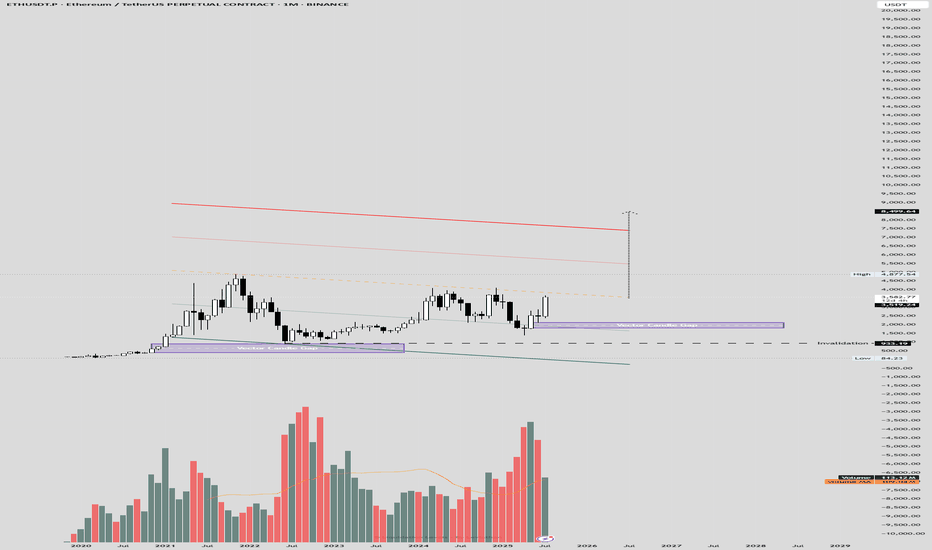

ETH Monthly ViewThe monthly chart suggests a potential bull flag pattern, with a strong upward trend followed by consolidation. The "Vector Candle Gap" indicates a breakout zone around $4,977.64, with recent price action testing resistance near $3,700-$4,000. Volume trends support the bullish case, showing increased activity during the initial rise and consolidation. The moving average reinforces an upward trajectory, but a downward-sloping trendline and support at $933.19-$2,800 suggest invalidation risks if the price drops below these levels.

Real-time data shows ETH trading at $3,565-$3,600, bolstered by institutional inflows into spot ETH ETFs and on-chain activity. The bull flag aligns with a potential target of $3,834-$4,000 if the breakout sustains with strong volume. Key support lies at $2,533-$2,700, with sentiment on X and web sources remaining optimistic, though volatility persists due to macroeconomic and regulatory factors.

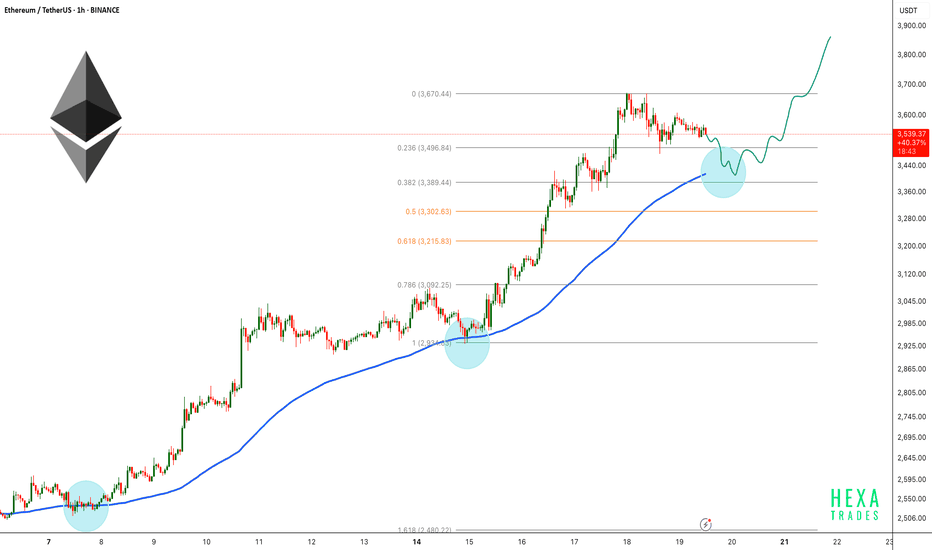

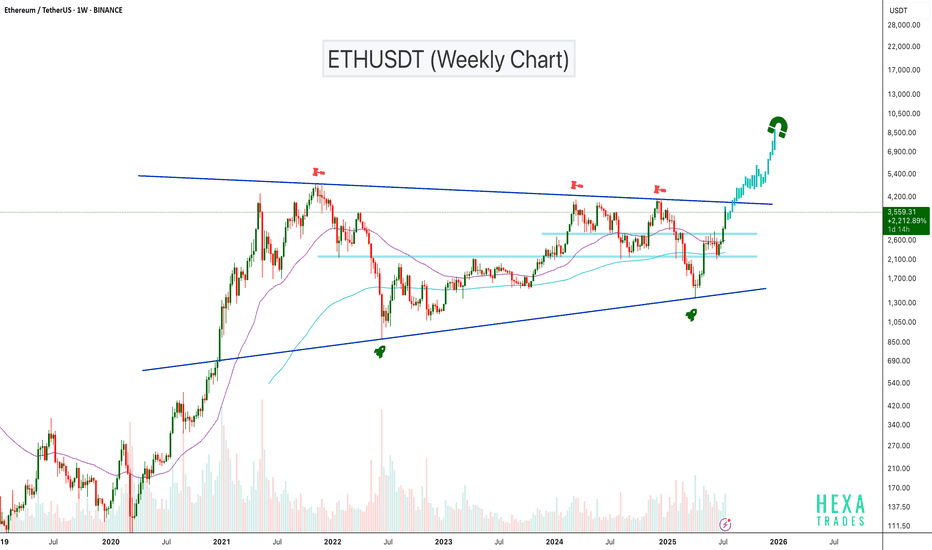

ETH Healthy Retest Before Next Rally!Ethereum continues to trade within a strong uptrend on the 1-hour chart, respecting the 100 EMA consistently throughout the rally. After a strong impulse move, the price is now consolidating near the recent highs.

ETH price could retest the 0.382 Fibonacci level and the 100 EMA before continuing upward. A successful retest would signal strength and could lead to a bullish continuation toward the $3900 - $4000 range.

Similar historical retests of the 100 EMA led to strong rallies, and we could see a repeat of that pattern if support holds.

Cheers

Hexa

BITSTAMP:ETHUSD CRYPTOCAP:ETH

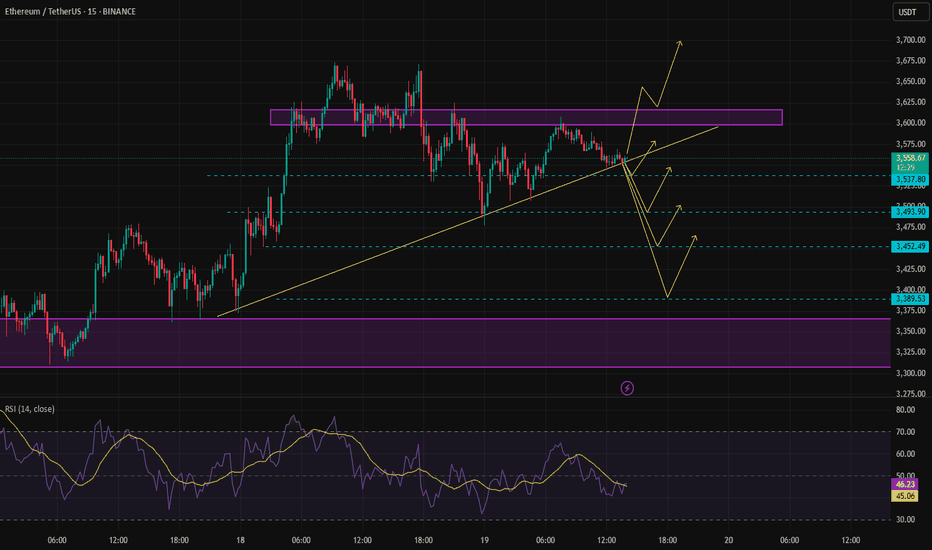

Is Ethereum Ready to Break Out? Watch This Key Trendline!Is Ethereum Ready to Break Out? Watch This Key Trendline!

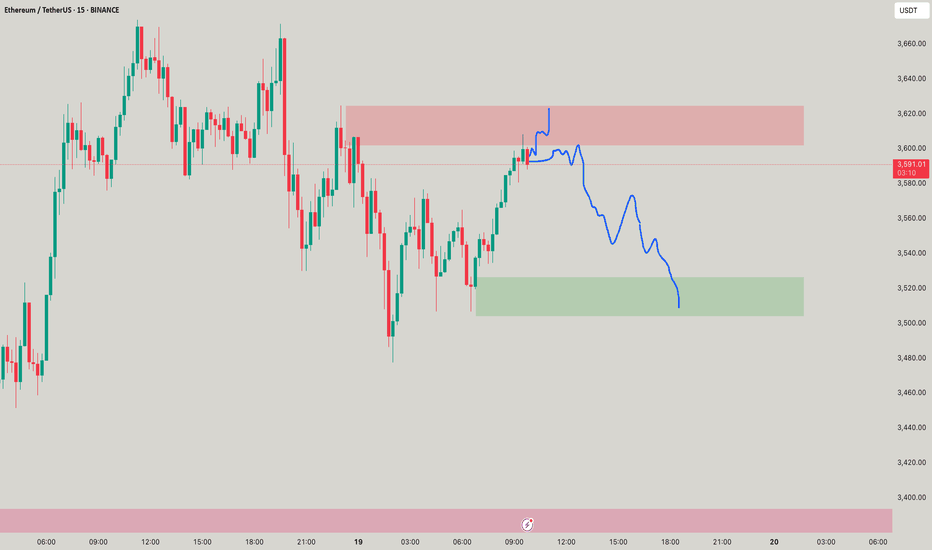

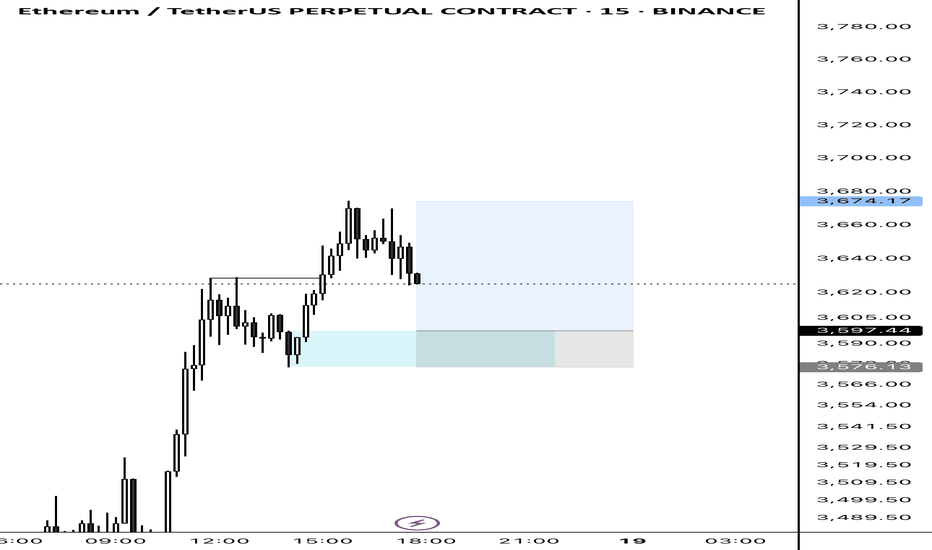

In the 15-minute timeframe, Ethereum (ETHUSDT) is testing a major descending trendline. If a strong bullish candle closes above this level and price action holds, we could see a move toward the $3,637 resistance zone.

This area has acted as a significant technical level in the past, and a confirmed breakout may trigger further upside momentum.

🚀 A successful breakout could provide a solid long entry setup, with $3,637 as the first target. Keep a close eye on this move—momentum is building.

💡 Don’t miss more high-probability setups like this! Follow for real-time crypto analysis and trade ideas.

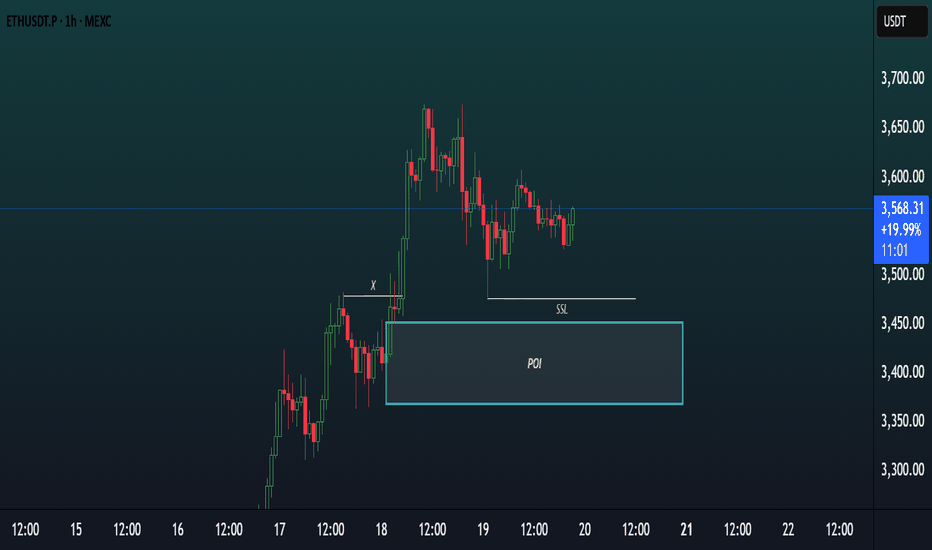

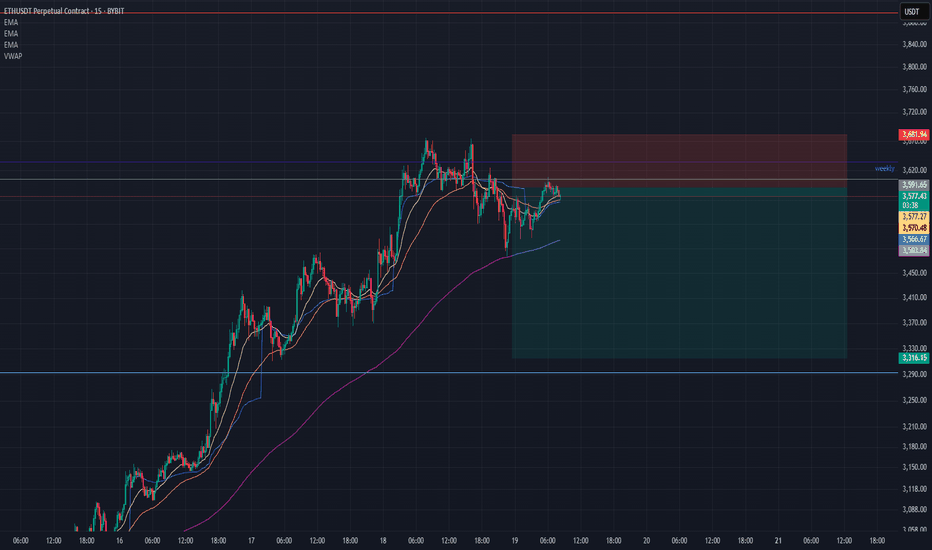

Chart Analysis (ETHUSDT, 1H)This chart showcases a Smart Money Concepts (SMC) style analysis on the 1-hour timeframe of ETHUSDT.P, focusing on a potential bullish setup.

Key Elements:

POI (Point of Interest)

A demand zone is clearly marked around the $3,400–$3,460 area, highlighted as a potential reversal zone where price may react bullishly.

SSL (Sell-Side Liquidity)

Sell-side liquidity has been swept below a recent low, indicating a possible liquidity grab before a reversal.

X (Previous Break of Structure)

Point “X” marks a significant BOS (Break of Structure) indicating bullish intent in prior price action.

Current Price Action

Price recently tapped into the POI, swept SSL, and is now consolidating slightly above the zone — suggesting accumulation or preparation for a bullish move.

Bias:

Bullish — Expecting a possible reversal or continuation to the upside after liquidity sweep and POI mitigation.

ATH FOR Ethereum!!!Hello friends🙌

As you know, Ethereum has been on an upward trend these days and we can say that buyers have entered, but not completely...👀

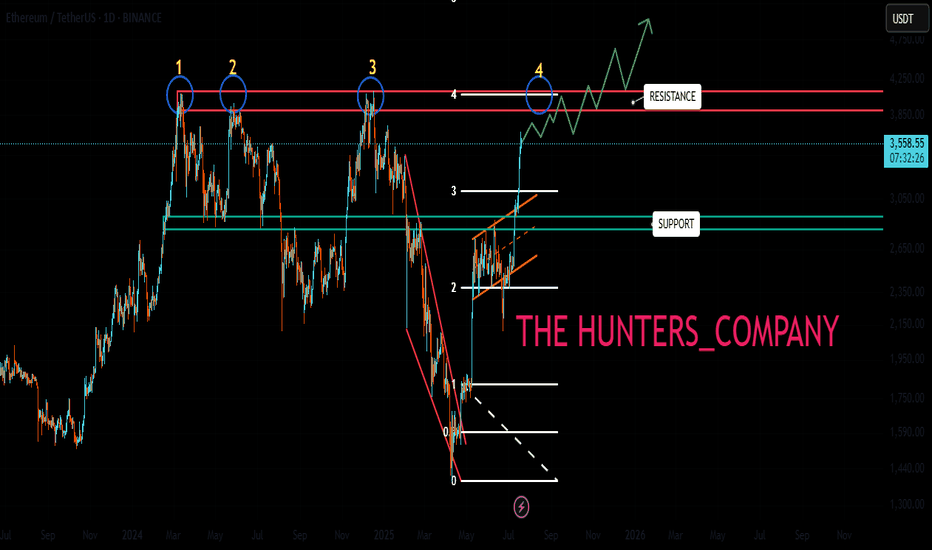

🔊Now, considering the resistance that Ethereum is facing, namely the number 3900 to 4100, we need to see what reaction the price will see this time when the price reaches this resistance for the 4th time?

✔We will most likely make a small correction and this time this major resistance will be broken again and we will witness a higher ceiling.

✔Otherwise, I have an important and key support that we have identified for you and if the price drops, this support is a good area to buy again.

And finally, observe risk and capital management⚠

🔥Follow us for more signals🔥

*Trade safely with us*

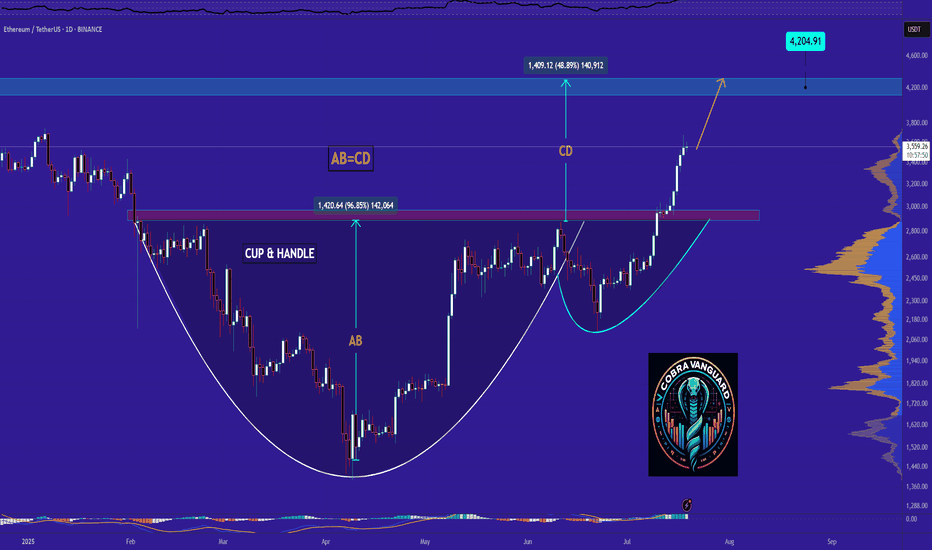

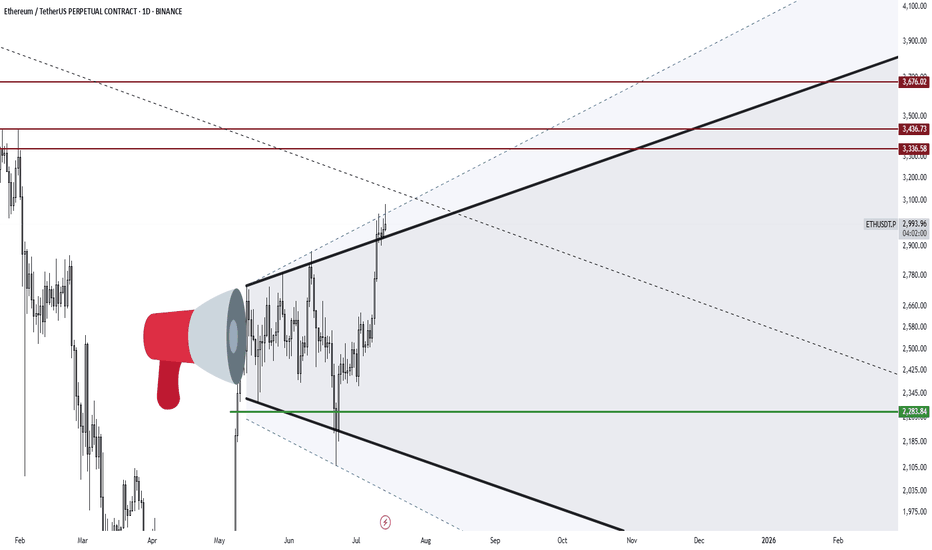

ETHUSDT Gearing Up for Explosive MoveBINANCE:ETHUSDT has been trading inside an ascending triangle pattern for the past 1,600 days. The price is now moving toward the triangle's resistance zone with strong volume support. A confirmed breakout above this resistance could trigger a powerful bullish move, with potential targets in the $6,000–$8,000 range.

Cheers

Hexa🧘♀️

BITSTAMP:ETHUSD

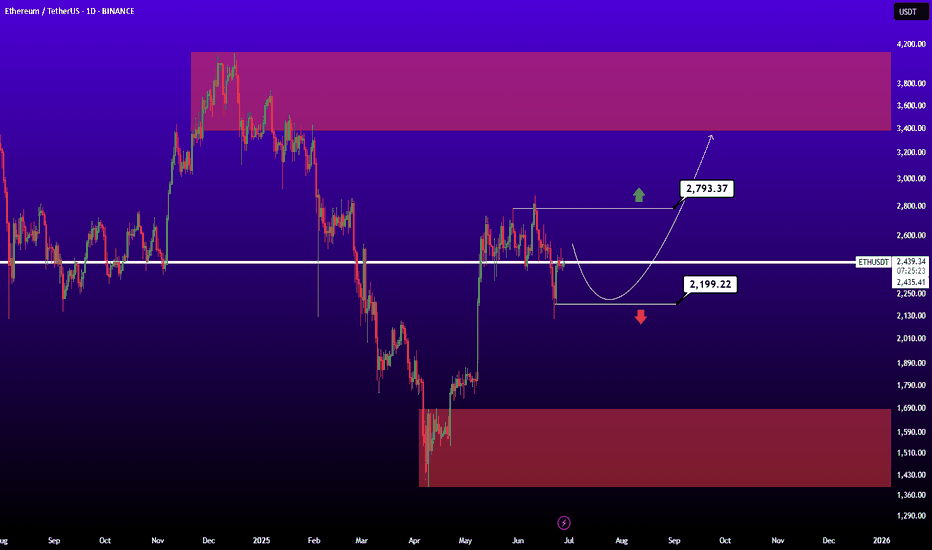

Best Buy Entry for EthereumIn my opinion, if Ethereum is going to make a minor pullback, the best entry zones have already been marked with arrows on the chart.

However, if the price continues upward without a correction, we should wait for clear confirmation, as the bullish momentum appears weaker compared to the previous move

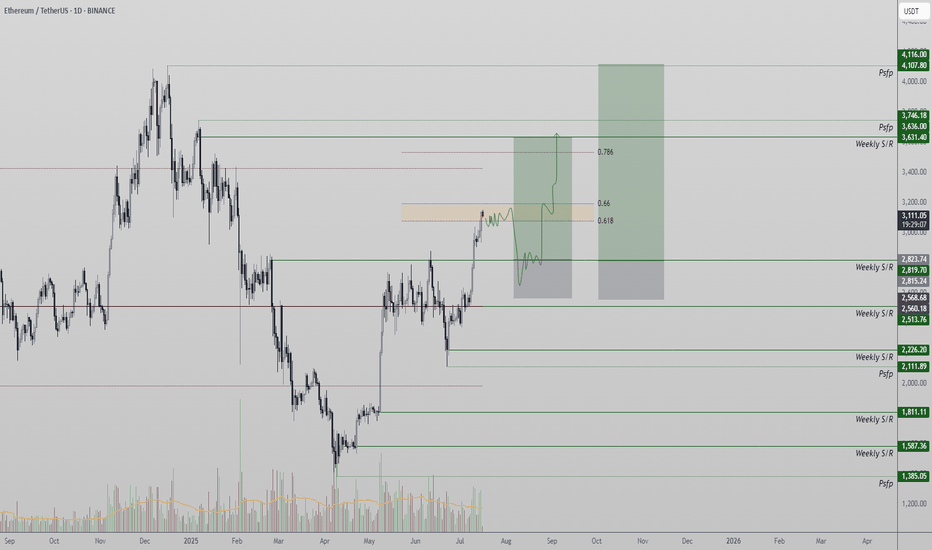

Ethereum Hits Golden Pocket Resistance — Rejection or Breakout?Ethereum (ETH) is facing a pivotal moment as it trades directly into the Golden Pocket — a Fibonacci zone widely recognized for its strong influence on price behavior. As ETH reaches this resistance, traders are watching closely to determine whether a rejection will lead to a bullish retest at lower levels, or if a breakout will confirm continuation toward much higher targets. The next few days will be key in defining the near-term trend.

- Golden Pocket Resistance: Ethereum is trading at the 0.618–0.65 Fibonacci retracement zone, a historically reactive level.

- Bullish Retest Zone at $2,800: A rejection could lead to a healthy high-low formation at this support.

- Upside Target at $3,600: A breakout above the Golden Pocket would likely accelerate the move toward this high-time frame resistance.

Ethereum’s current price action has entered a region of significant resistance: the Golden Pocket, which lies between the 0.618 and 0.65 Fibonacci retracement levels. This zone often acts as a strong inflection point, either halting price momentum temporarily or confirming a breakout with strong follow-through.

Should Ethereum face rejection from this zone, price could rotate back down to the $2,800 region, which now aligns with a key support structure and potential bullish retest zone. This would allow for a higher low formation, reinforcing the uptrend and setting the stage for a long opportunity targeting previous highs.

So far, no rejection has occurred, but if it does, it will likely be seen as a buy-the-dip opportunity for traders aiming to re-enter the trend. This would also mark a textbook retracement within a bullish market structure.

Alternatively, if Ethereum breaks above the Golden Pocket without rejection and consolidates above it, this would be a strong bullish confirmation. In that scenario, the next likely destination is the $3,600 high-time frame resistance, a key level that has previously acted as a major barrier.

Volume and candle structure over the next few sessions will offer key signals — a strong impulse with follow-through would favor the breakout scenario, while weak closes and rejection wicks would support the retracement idea.

Ethereum is at a make-or-break level. A rejection from the Golden Pocket could lead to a healthy correction toward $2,800, offering a long setup. However, if ETH breaks through this resistance with strength, a rally toward $3,600 becomes the high-probability scenario. The next move will likely define Ethereum’s short-term trend.

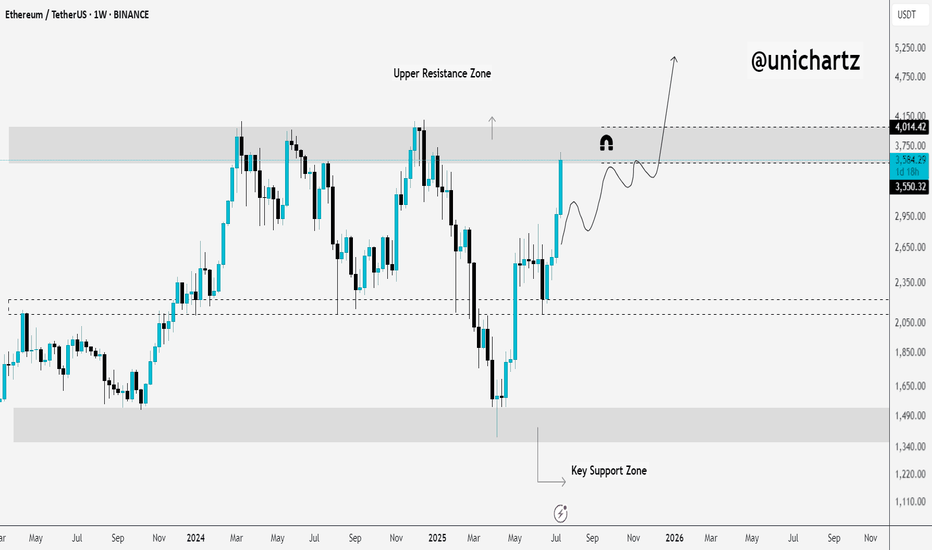

Altseason Starts Here? ETH Hits Critical Resistance!Ethereum has finally reached the upper resistance zone — and this could be the decisive moment for Altseason.

This level has historically acted as a major turning point for ETH. If it breaks and holds above this zone, we could see capital start flowing aggressively into altcoins.

🧠 Why it matters:

ETH reaching resistance usually signals a rotation phase from BTC to ETH.

If ETH breaks above, altcoins tend to follow with explosive momentum.

If it gets rejected, we may see a short-term cool-off.

This is the zone where narratives shift. Eyes on the breakout — or the rejection.

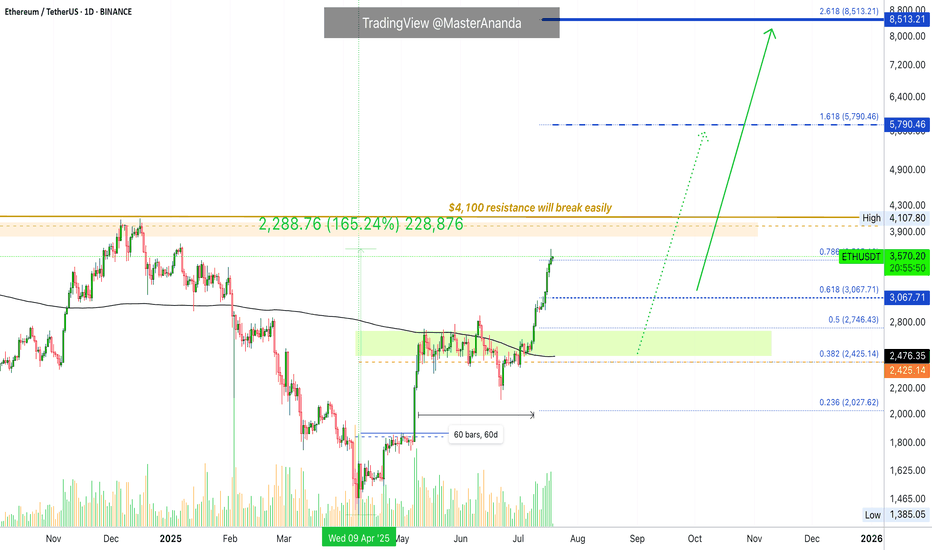

Ethereum · No Reason To Stop · Will Continue RisingEthereum will continue rising. Remember Ether is number two and it is awesome, to start, and it follows Bitcoin like darkness follows the light. There is no reason for Ether to move down. There is no necessity for ETH to stop its major advance, in fact, it has been lagging behind and it needs to catch up. Bitcoin is waiting and will continue waiting but it won't wait forever so Ethereum must wake up and is waking up. We are going up.

Ethereum has grown 165% since its 7-April low. This is more than XRP and its capital is twice as much. Boom! The best part? Ethereum will continue growing straight up for weeks and months. It needs to be trading at a new all-time high as soon as possible just so that the market can feel at ease and know, once again, that Crypto is here to stay.

What has been suppressed can't stay suppressed forever. Crypto went through a fight but challenges only made us that much stronger. We are now happy and grateful for everything that we went through because we know that we can take anything the world throws at us.

The chart. Green, green, green straight up. Two months of consolidation. That's the key. ETHUSDT went sideways for almost two months and this reveals what comes next. The advance outside the consolidation range has been happening for 8 days. 60 days of sideways can support at least an entire month of growth. When the entire month is consumed, we can expect a retrace, nothing more, followed by additional growth.

In short, Ethereum will continue rising. If you see a shakeout, know that growth will always resume in a matter of days. If you see a drop, know that this is a bear-trap, the bulls now own the game. If you are in doubt, come read my articles and I will publish something that you will understand and agree is right, so you can continue holding until you can reach the big prize.

The time to sell will come, but it isn't now. Right now is the time to hold strong. Not only Ethereum, but Cardano, XRP, BTC, Dogecoin, Solana and the rest of the altcoins. This is only the start.

I expect Ether will continue rising. $8,000 now looks like such an easy target...

Very good indeed. If you enjoy the content, follow me.

Namaste.

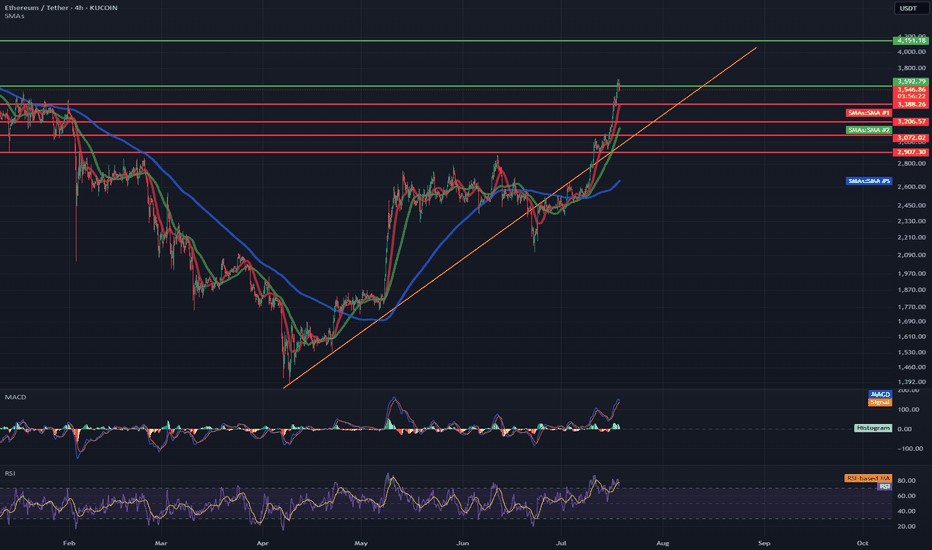

ETH/USDT 4H Chart✅ Market Trend and Structure:

Uptrend: The highlighted orange trend line shows continuous growth since mid-April. The price is trading above the 50- and 200-period moving averages (EMA and SMA), confirming bullish sentiment.

Current price: around 3556 USDT – very close to local highs.

Resistance break in the 3200–3300 USDT area, which now acts as support.

📈 Technical Levels:

Resistance (red horizontal lines):

3600–3650 USDT – local resistance resulting from market reaction.

3888 USDT – next historical resistance level.

4133 USDT – established long-term target (green dashed line at the top).

Support:

3300 USDT – strong support after a previous breakout.

3080 USDT – previous high, now the next support level.

3070 / 2900 USDT – key technical support levels in the event of a larger correction.

📊 Indicators:

MACD:

The MACD is in a strongly bullish zone, but:

The histogram is flattening.

A bearish crossover pattern is possible in the following candles – a signal of weakening momentum.

RSI:

RSI ~74 – is in the overbought zone, which often heralds a correction or at least consolidation.

A value above 70 confirms the bullish trend but may suggest that momentum is overheated.

📌 Conclusions and Scenarios:

🔼 Upside Scenario (trend continuation):

If the price remains above 3300–3350 USDT, it could move towards 3888, and then 4133 USDT.

A break above 3650 USDT on heavy volume will be a strong continuation signal.

🔽 Corrective scenario (short-term pullback):

The RSI and MACD suggest a possible correction.

Potential pullback to:

3300 USDT (retest of previous resistance as support).

SMA 200 (~2600 USDT) with a deeper downward move.

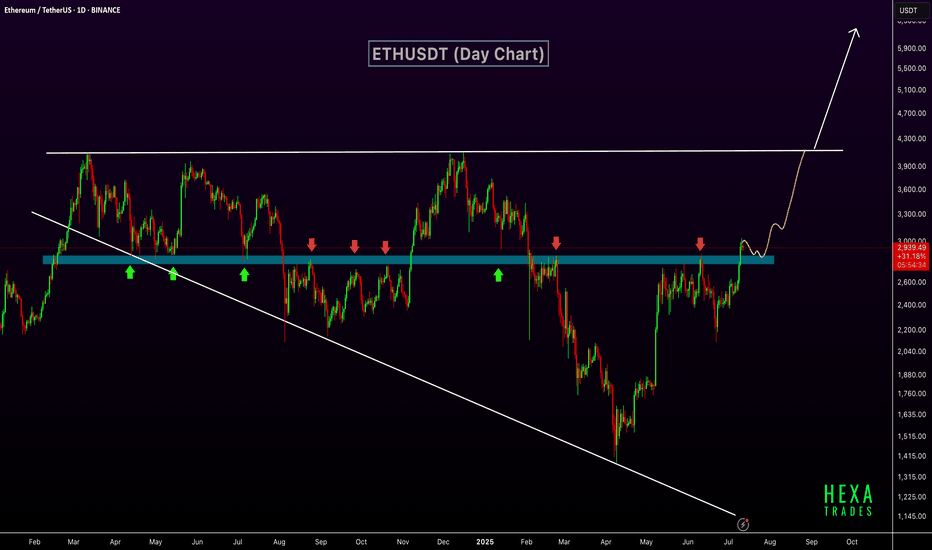

ETH Breaks Key Resistance – $6K Possible if Wedge BreaksETHUSDT has broken out above a key horizontal resistance zone that has historically acted as a strong support and resistance level. This zone, marked in blue, has seen multiple rejections and bounces over the past year, confirming its significance.

The recent breakout above this zone indicates a shift in market structure and suggests growing bullish momentum. The price action shows a clean move above resistance, with potential for a retest before continuing higher. The market is also forming a long-term broadening wedge pattern. The next target lies near the upper resistance of the wedge, around $4,000. If the price breaks above this broadening wedge, it could open the path toward the $6,000 level.

Regards

Hexa

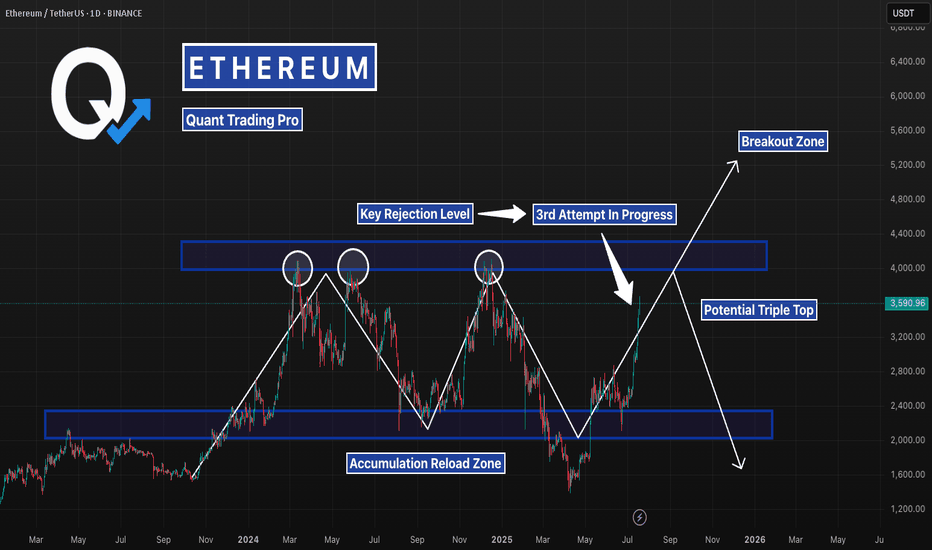

ETH 3rd Attempt at Resistance — Breakout or Bull Trap?Ethereum is back at a major level that’s rejected it twice already. A breakout here could finally end the range and send price into discovery — but if history repeats, this might be the ultimate fakeout before a sharp reversal. All eyes on the next few candles.

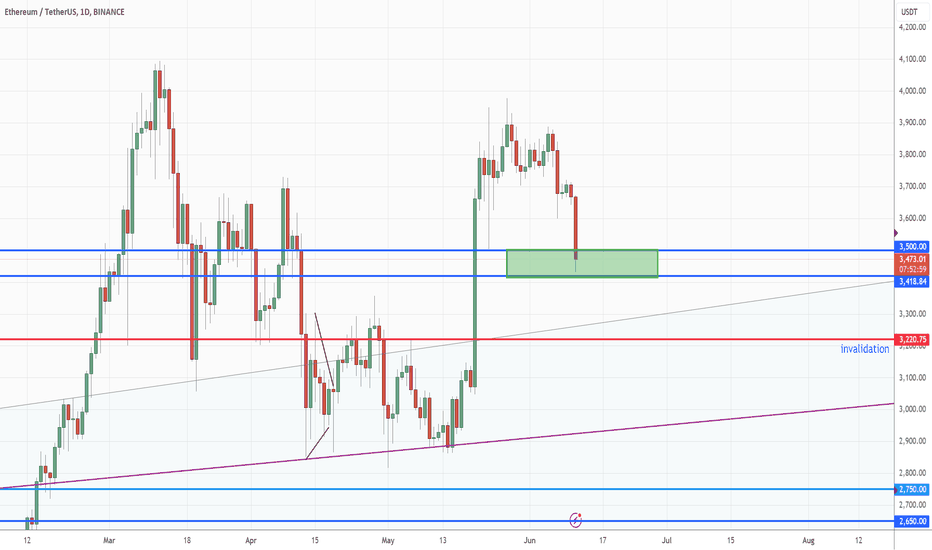

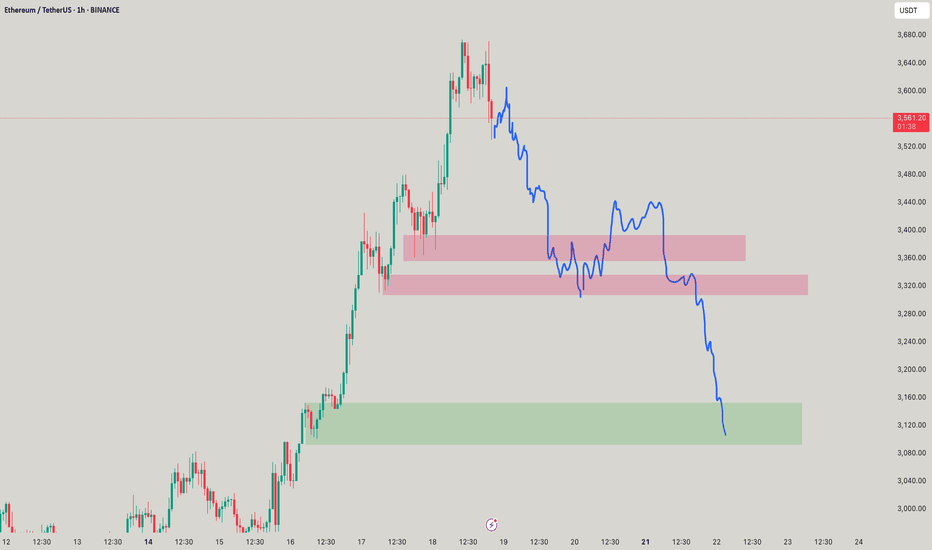

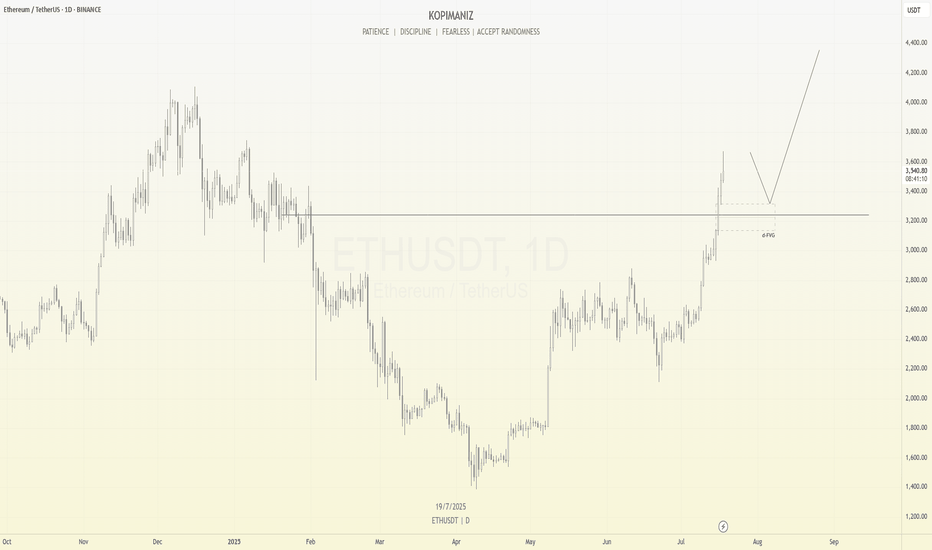

ETHUSDT Analysis – Potential Pullback Before ContinuationAfter a strong bullish rally, ETHUSDT may be ready for a short-term correction. The price has broken a key structure and is now trading well above previous resistance.

I'm expecting a potential pullback into the Fair Value Gap (FVG) area around $3,200, which also aligns with a retest of the previous resistance now turned support. If this level holds, it could act as a springboard for the next bullish leg, possibly targeting the $4,000+ region.

This setup follows a typical market behavior where price fills imbalance zones before resuming its trend.

Key levels:

Support zone: $3,200 – $3,300

Bullish continuation target: $4,000 – $4,400

Let’s see how price reacts at the FVG zone. Patience and discipline are key.