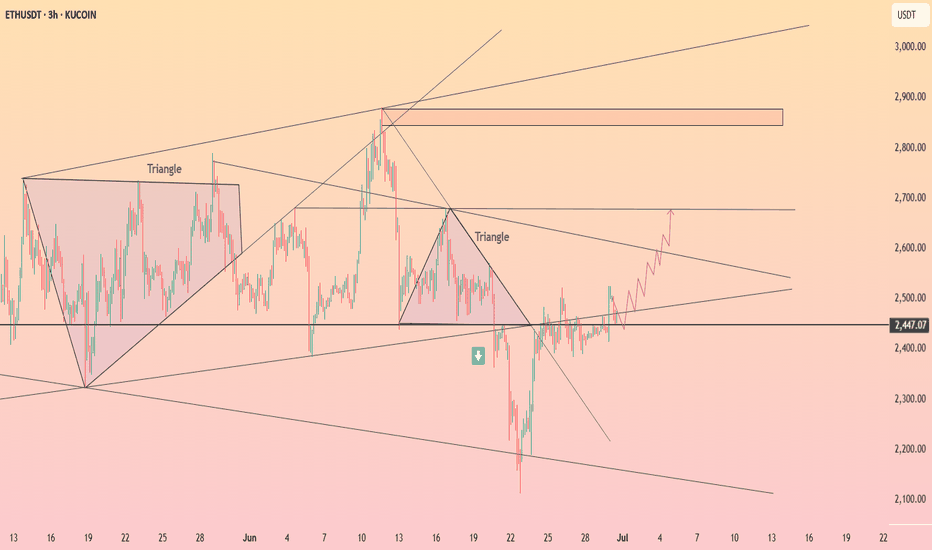

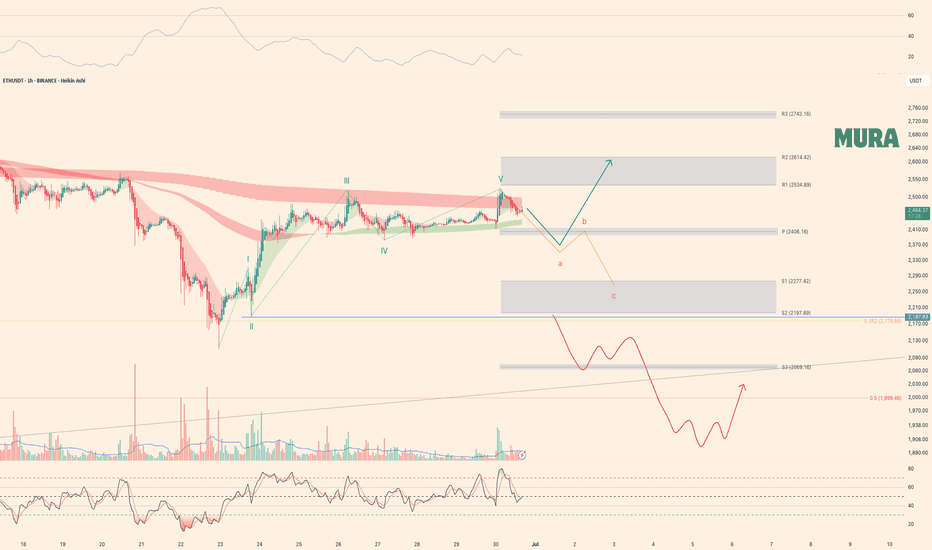

ETH 30min: Bearish Triangle Forming After RSI Divergencehelo guys

Ethereum is currently trading within a clear range, and recently formed a bearish triangle pattern near the top of the consolidation. A visible RSI divergence confirmed the loss of bullish momentum as price made a higher high, but RSI printed a lower high — a common sign of exhaustion.

Now, ETH is moving downward within the triangle, and pressure is building near the lower edge of the range. If the pattern breaks down as expected, the next likely move is a drop toward the support zone around $2,370–2,380, which marks the bottom of the range.

This setup shows a typical structure:

Divergence → Triangle → Breakdown toward range low

Unless price reclaims the triangle top quickly, bears have the upper hand in the short term.

ETHUPUSDT trade ideas

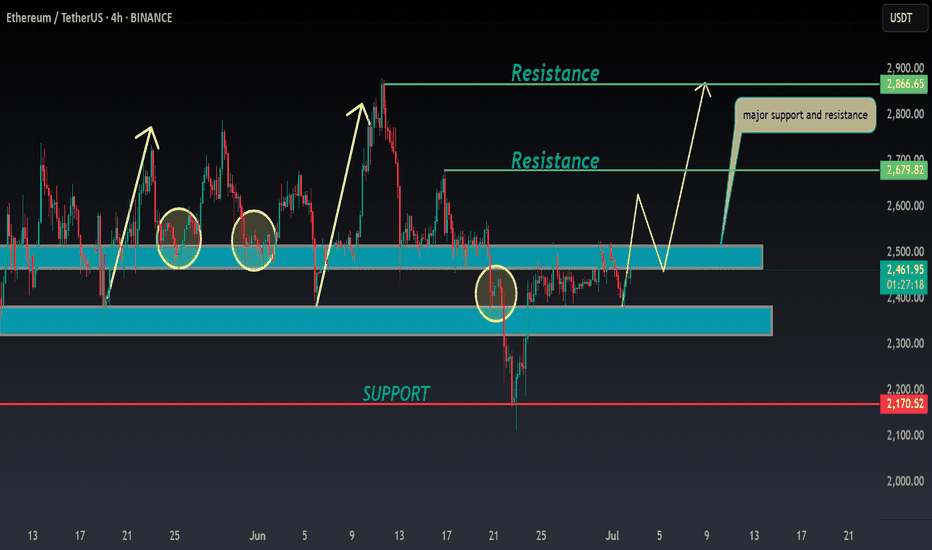

ETH ANALYSIS🔮 #ETH Analysis 🚀🚀

💲💲 #ETH is trading between support and resistance area. There is a potential rejection again from its resistance zone and pullback from support zone. If #ETH closes above 2500$ then we would see a bullish move

💸Current Price -- $2,462

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀💸

#ETH #Cryptocurrency #DYOR

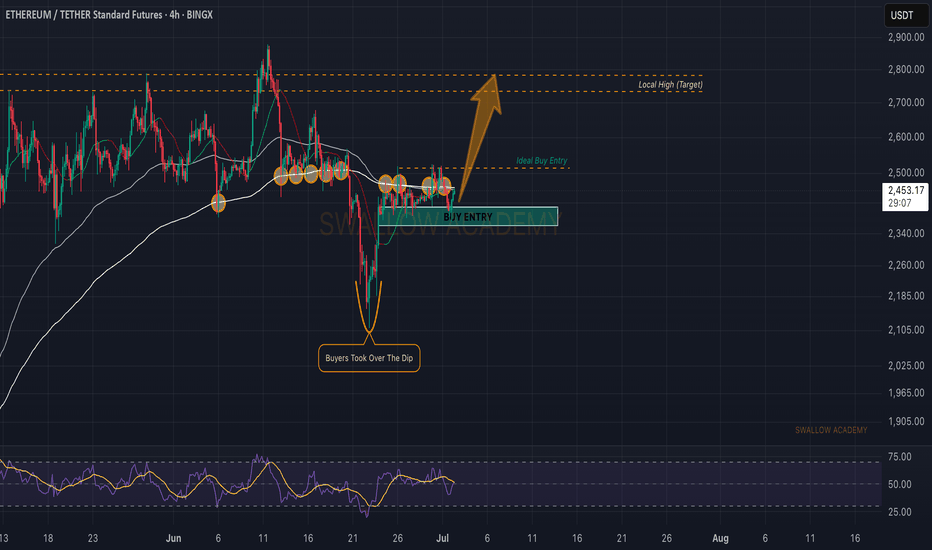

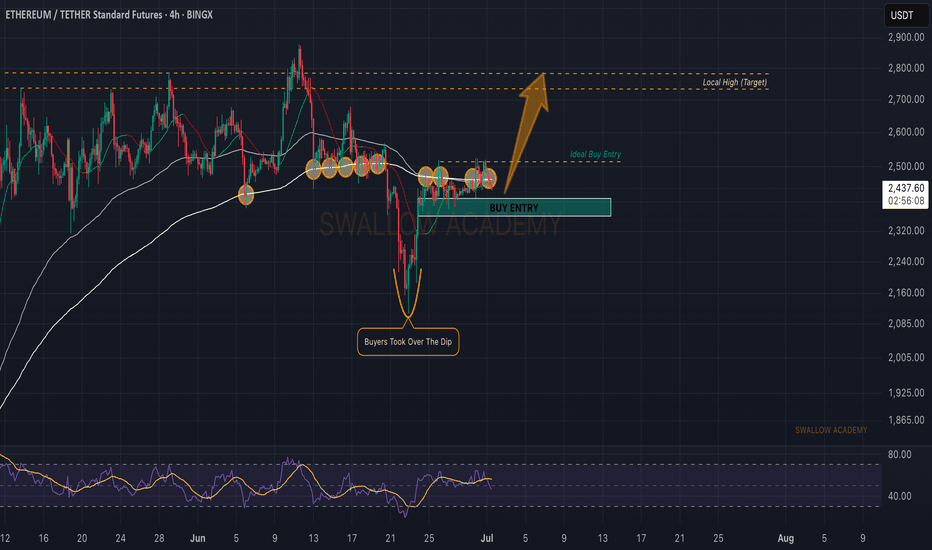

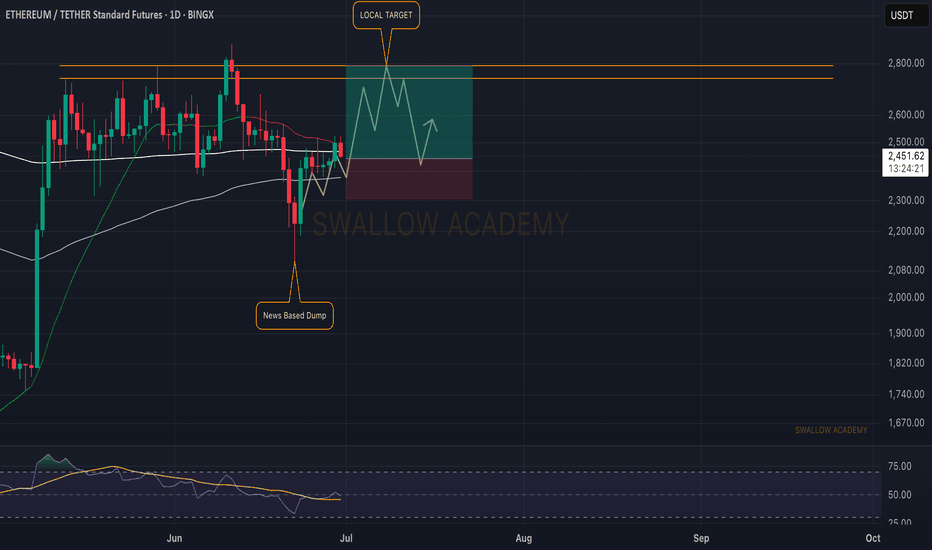

Ethereum (ETH): Good Start, Seeing Buyside DominanceEthereum has done well, where we have established a proper support area near the local buy zone, which should be enough for us to have a proper bounce from here towards our target of $2800.

As long as buyers keep the dominance near the buy area, we are bullish!

Swallow Academy

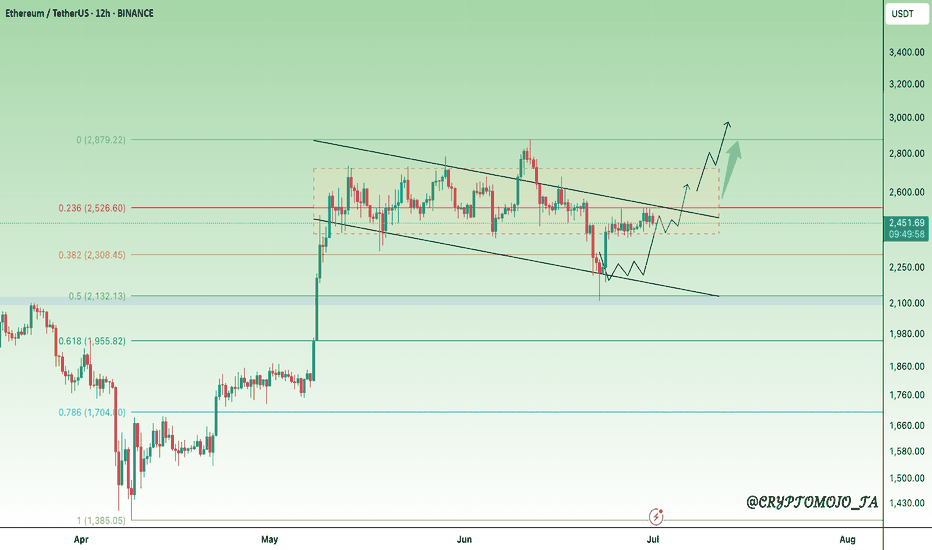

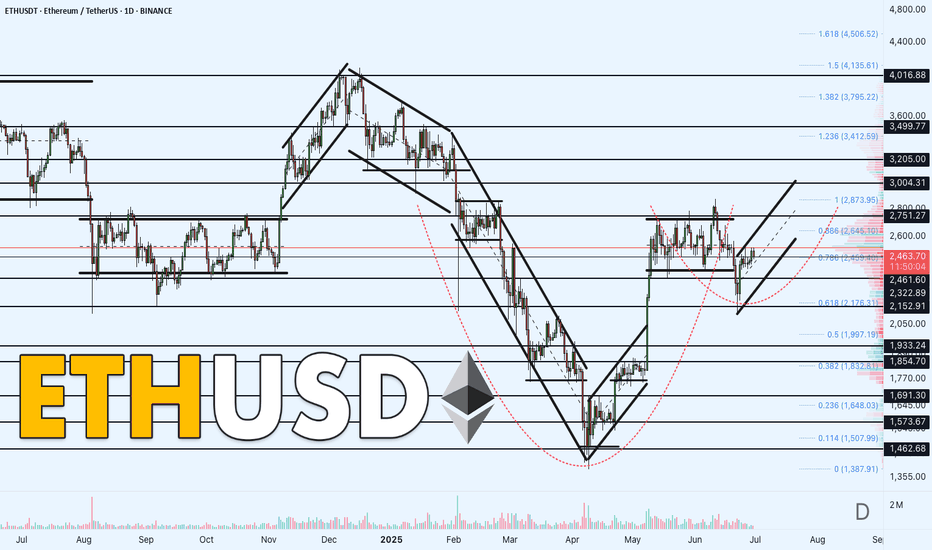

Q3 Could Be Big for #ETH, Breakout Watch ON#ETH bounced exactly from the 0.5 level of Fib Retracement, as expected.

Now it appears to be gearing up for its next breakout move!

After weeks of chopping inside a falling channel, ETH is showing signs of strength. It's reclaiming key levels and slowly pushing toward the breakout zone near $2,520.

A breakout above this resistance could trigger a sharp move toward $2,880 and beyond.

However, bulls need to hold the $2,300 zone, a drop below might delay the pump.

Structure is bullish, just needs confirmation.

IMO, Q3 could be massive for ETH.

Like & retweet for more updates.

#Ethereum

Ethereum (ETH): Hovering Near EMAs | Might Be Good Buying SpotEthereum is still hovering near local lines of EMAs, where we are expecting to see a volatile breakout very soon.

Now we have 2 buy entries, where the best option is after breaking the local resistance area, which is above the EMAs but overall, with the current buyside dominance we have had, we are seeing good chances for the price to reclaim the $2800 within days from here on.

Swallow Academy

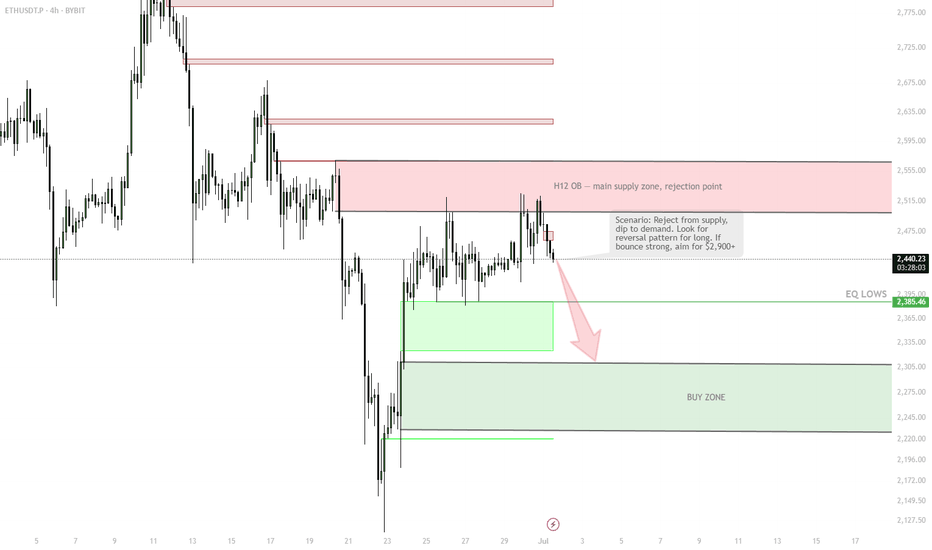

ETH | H12 Supply Rejection & Demand Bounce PlanSELL ZONE $2,520–2,560

→ Short from supply, rejection expected

Triple tap + SFP = short trigger

↓

EQ LOWS $2,380–2,400

→ TP1 / watch for bounce

↓

BUY ZONE $2,280–2,320

→ Main long zone, enter on confirmation (bullish candle/SFP)

STOP below $2,250 = cancel idea

↑

TP1 $2,500

TP2 $2,900–3,000 (if strong bounce)

Main scenario — short from supply zone, target demand at $2,280–2,320. Long only if bounce is strong. Stop below $2,250. No confirmation — no trade.

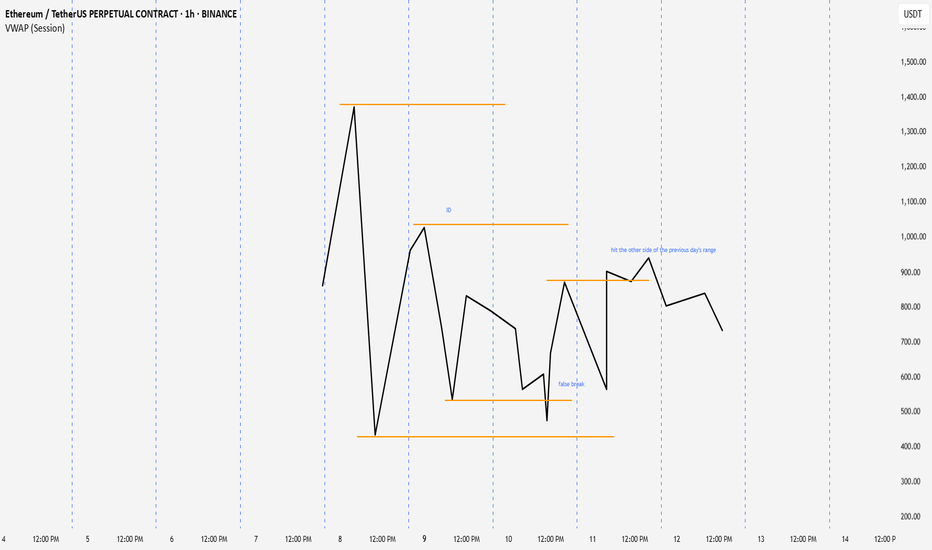

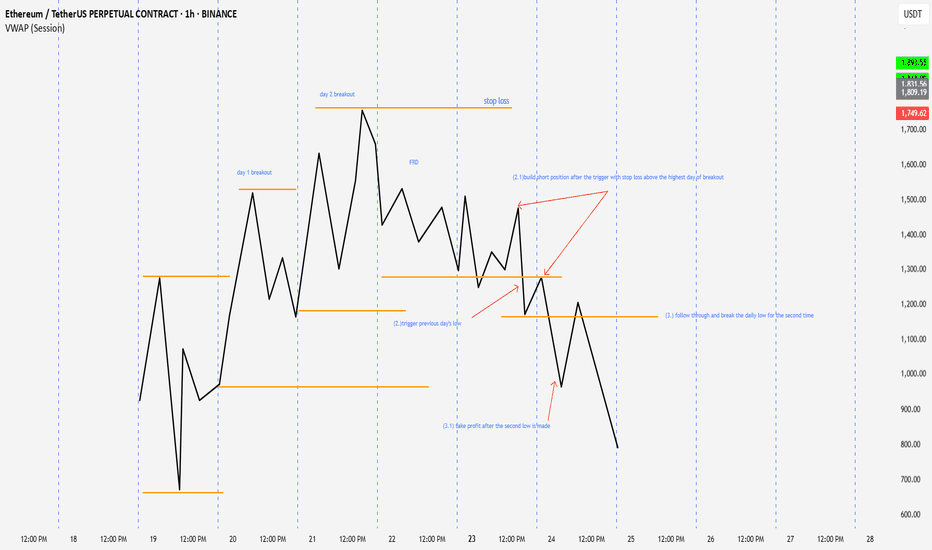

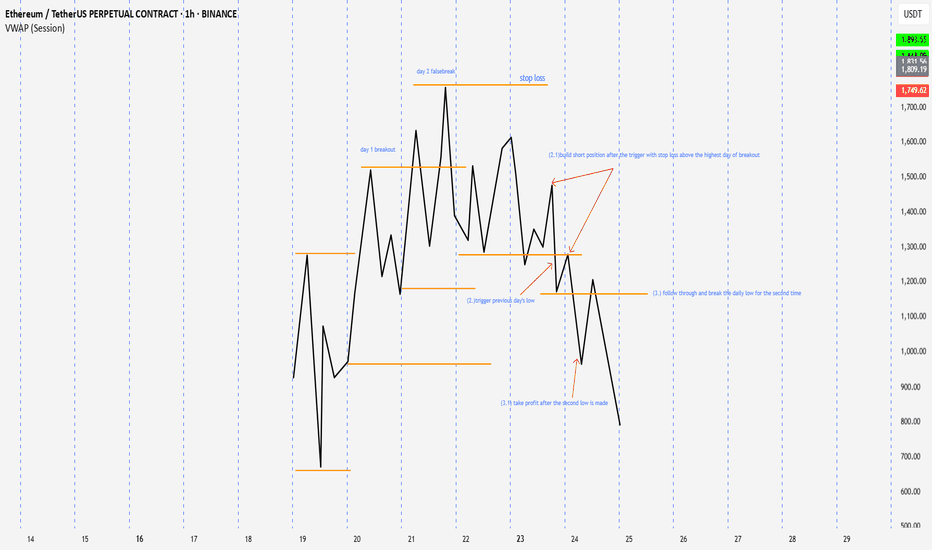

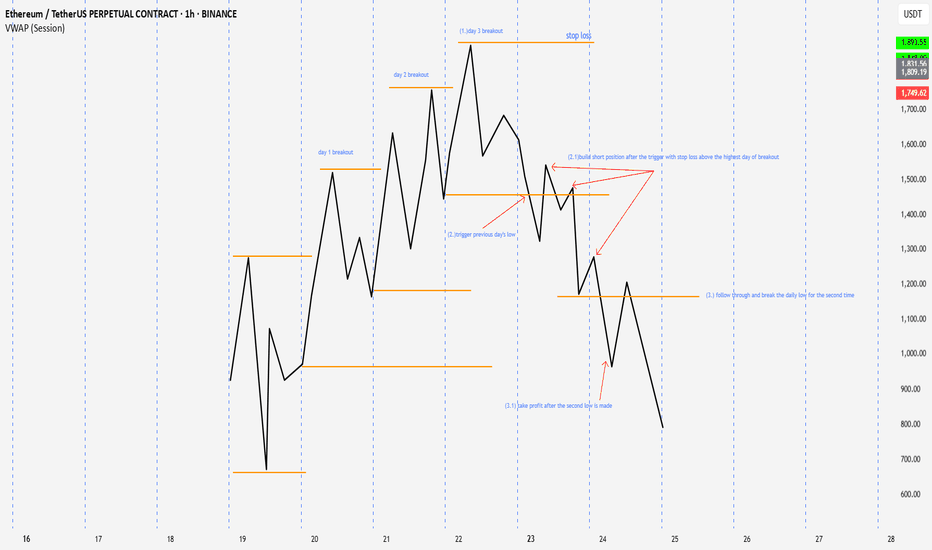

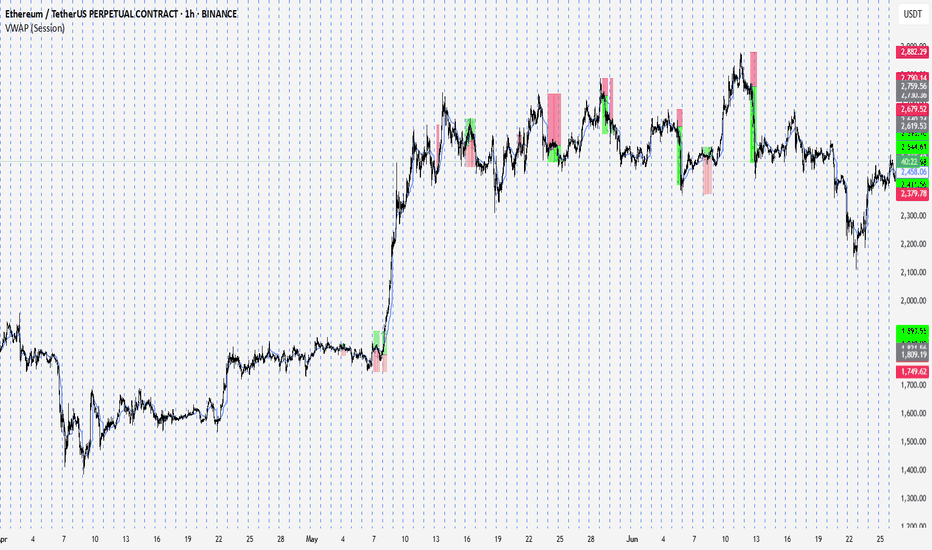

doing the homeworktesting 3days of breakout, frd,fgd, day one false break with the break of daily level as trigger to start to build position. for entry . buy if it dip below daily vwap during the sessions. stop is above the high or the low of the signal day. targeting the second push. for inside day, trying to capture the false break back to the other side or daily high or low 90% winrate. let see when I apply it in real time

ethusdt no trade zoneETH is stuck in a range, wait for the sweep of range high, then closing below the range high and take the short, target weekly low. 2nd scenario is wait for to take out the weekly low and any daily candle closing failed to close below this level take the long entry and target the range high. Otherwise expecting this week choppy mean sideways. no major move. Will update if found any good trade.

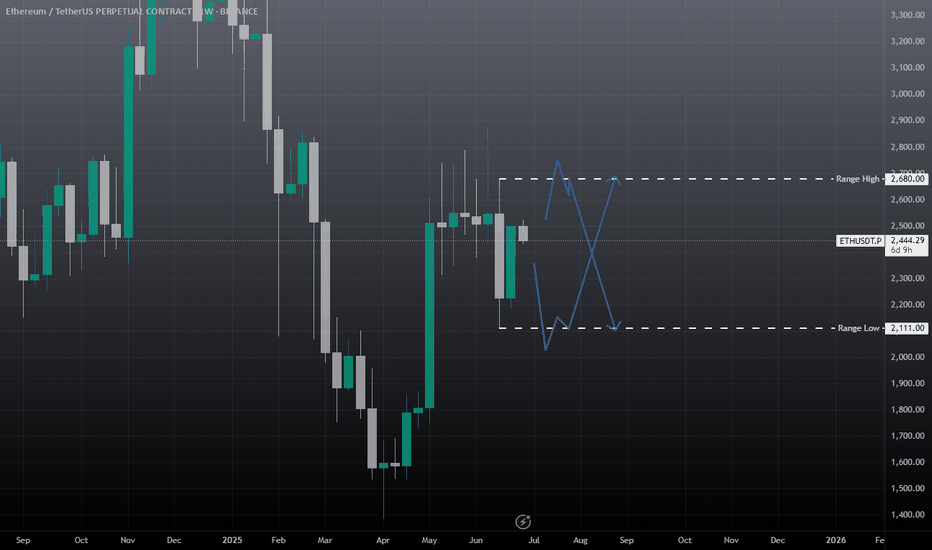

Weekly trading plan for EthereumBINANCE:ETHUSDT Last week, price mostly traded in a range. For this week, I've updated key levels, marked them on the chart, and modeled several scenarios. We can expect a pullback—possibly a deeper correction—before another push toward resistance levels. If price breaks the local low but then reclaims the weekly pivot point, I'll consider opening long positions without waiting for a deeper pullback.

Write a comment with your coins & hit the like button and I will make an analysis for you

The author's opinion may differ from yours,

Consider your risks.

Wish you successful trades ! mura

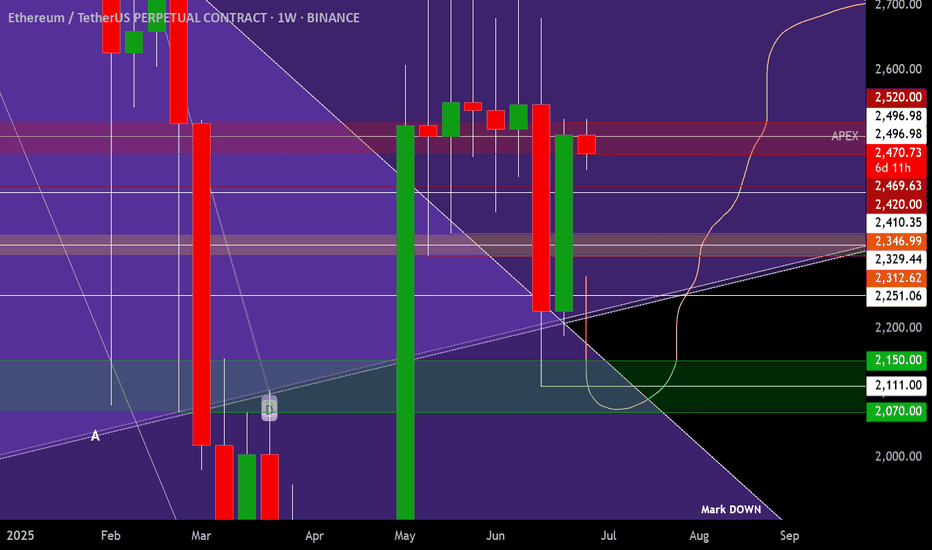

ETHUSDT WEEKLY UPDATE — PART 1

When Conviction Fails: Apex Rejection, Hidden Redistribution, and the Illusion of Demand

Good morning, good afternoon, good evening, wherever you're tapping in from. Now, as always, I’m not here to waste your time with unnecessary waffle. Let’s get straight into it and unpack this mess step-by-step.

THE APEX REJECTION | MORE THAN JUST A WICK

So picking up from last week's update, we find ourselves right at the crossroads, and not the romantic kind either. What we’re looking at right now so far, is a clean yet 100% conclusive rejection from the apex of a key macro structure.

This isn’t just any level. This is the intersection of vertical momentum and horizontal memory, the apex of a triangle that’s been forming for months. This is where bullish intent was supposed to hold, supposed to assert dominance, but instead, what did we get? A strong push into resistance, a failure to fix above it, followed by exhaustion and signs of institutional unloading.

Now, to the untrained eye, this may look like a pullback, or even a healthy correction. But we’re not here to look at charts with retail goggles. We’re here to track the true intent behind the price action, and if you know your schematics, this is screaming redistribution. And not just any redistribution, the kind that happens right before the market changes its personality.

WHERE ARE WE IN THE SCHEMATIC?

If we overlay Wyckoff logic on top of this structure, it's very clear:

We’ve had our PSY (preliminary support).

Followed by a spring, a shakeout, and a fake rally.

Now we’re dancing around what appears to be the UTAD (upthrust after distribution) — but weaker.

This isn’t classic distribution, it’s redistribution masked in macro confusion.

Here’s the thing this range isn’t just price consolidation, it’s behavioural conditioning. This long, choppy sideways movement is designed to wear out both bulls and bears, making them question their bias, mismanage their risk, and either overstay or exit too early.

The market is methodical, not random. These candles aren’t accidents, they are footprints of algorithmic trap setting, and right now, it looks like the net is about to close.

VOLUME TELLS THE TRUTH

Let’s not forget volume. Look at the weekly volume through this recent push:

Decreasing volume on the rallies,

Higher volume on the red closes,

And multiple spikes that failed to carry price past resistance.

That’s your dead giveaway. You don’t need to be a wizard, just follow the clues. Price is being pushed, not lifted. Demand isn’t stepping in, liquidity is being removed. This isn’t smart money accumulation, if confirmed by the endd of this week, this most recent move up cout be doing of smart money unloading, Quietly and Efficiently.

THE MARKDOWN IS PRIMED

Let’s now address the elephant in the room, the range low and point C of the triangle on the 4H.

T hat’s where liquidity is sitting.

That’s where the market’s next objective lies.

We’ve now failed to reclaim the apex, the wick was slapped down, and unless something significant shifts, the next logical move is to sweep that C point, take out the emotional support, and either:

Tap into true demand (if it exists), or

Begin the cascade toward the final green demand zones between 2,150–2,070, which we marked weeks ago.

And don’t forget, this sweep may not be clean. We could get a fakeout bounce mid-range — enough to bait in more longs, only to roll over again.

PSYCHOLOGICAL LAYER

What’s happening here isn’t just technical, it’s emotional warfare. This entire range has been one long gaslight for the average trader. Between the failed breakouts, failed breakdowns, and chaotic intraday behaviour, retail has been turned into liquidity.

And if you’re still trying to long blindly at the top of this, hoping for 3k ETH without a confirmed structure reclaim, then respectfully, you’re the product right now.

Coming next in Part 2:

A full breakdown of the 4H macro setup

Analysis of the internal range mechanics

Recalculated fib zones

Where the liquidity pockets are

What the most probable path is short, medium, and long-term

Stay tuned — I’ll keep the flow coherent, structured, and aggressive. No fluff. No hopium. Just structure, psychology, and execution.

Ethereum Leveling Map — ETH/USDT 1DNo directional bias for Ethereum, but will use levels to spot entries for intraday.

Right now located at POC and seems balanced for both sides.

Potential Adam&Eve setup in development.

Quality levels for support $2150, 2000, 1800, 1500.

Resistances $2700, 3000, 3500, 4000

Keep in mind it will follow BTC price action by most of time.

Happy trading

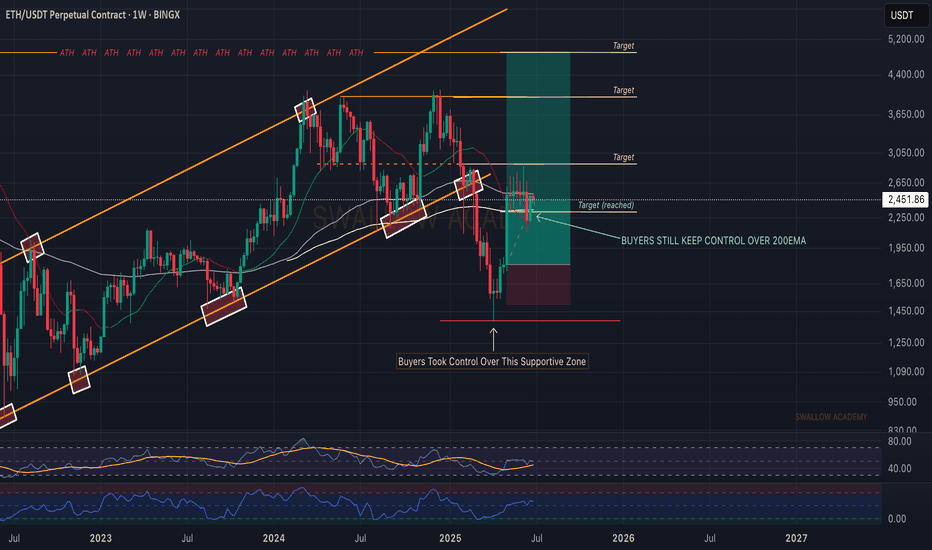

Ethereum (ETH): Buyers Above The EMAs | Looking For $2800Buyers are back in control where they secured the lines of EMAs, which means that we are expecting the $2800 to be reached this week.

Now, despite us currently seeing some kind of weakness in markets, we think that EMAs will still be holding it's ground so as long as we are above them, we are bullish here!

Swallow Academy

Ethereum (ETH): Buyers Took Back Control Over 200EMABuyers are back in control over the 200EMA, so nothing is lost yet. We keep our bullish game plan here. As many know, ETH is still far from its potential...considering the fact that BTC has already outperformed itself.

Time for ETH to shine now!

Swallow Academy

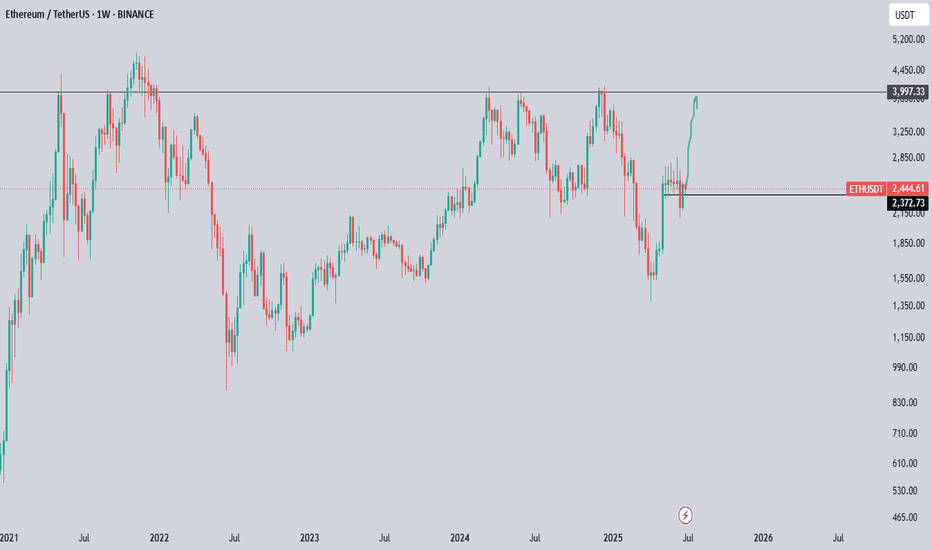

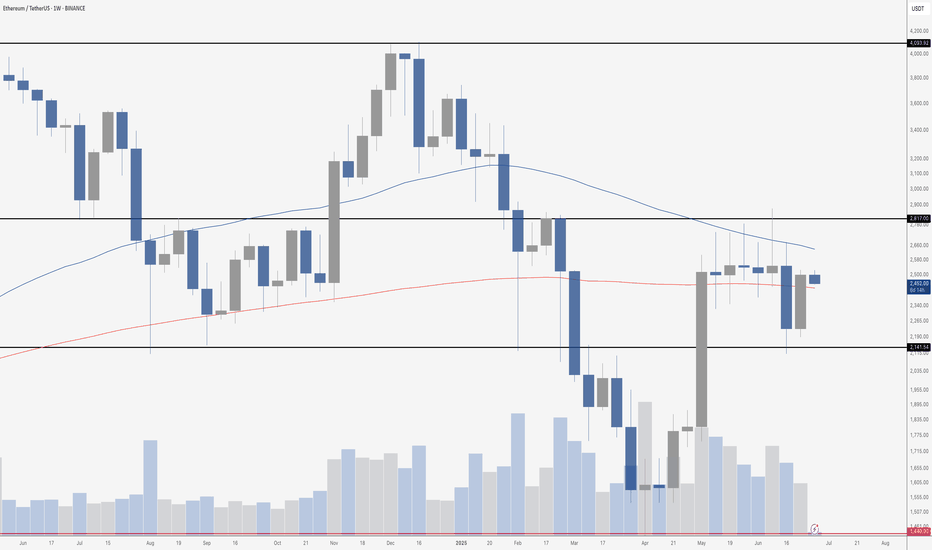

ETH IN NO-MAN'S LANDEthereum is caught in no-man’s land. After a sharp rally in May that pushed price cleanly above the 200-week moving average, ETH has now slipped back between the 200 MA (around $2,400) and the 50-week MA (just under $2,600). It’s a classic case of being stuck in the middle – too weak to break higher, too strong to roll over completely. This is where momentum goes to die.

Until one of those moving averages gives way, expect more chop and indecision. A breakout above the 50-week could reignite bullish momentum, but a drop below the 200-week would bring $2,141 support back into play. For now, Ethereum’s just dancing between the lines.

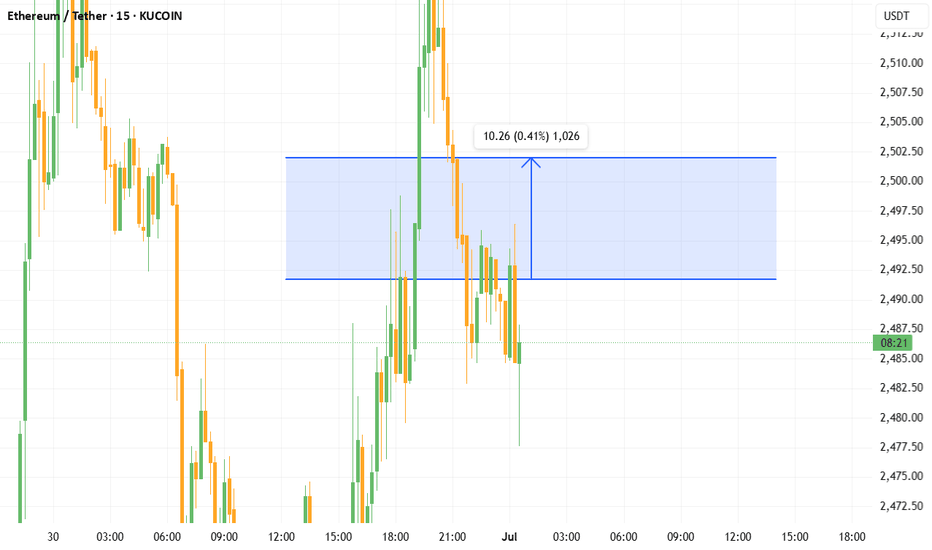

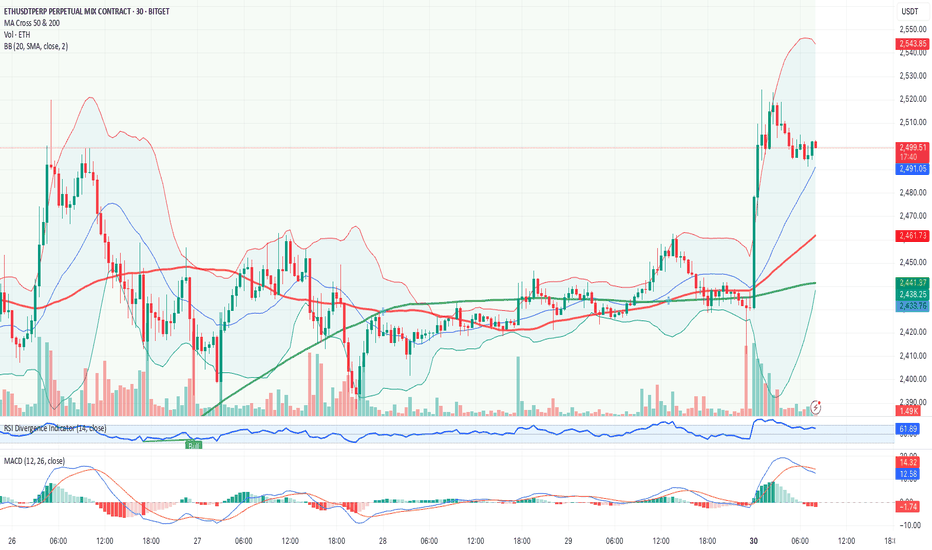

Technical Analysis of the Financial Chart

1. Main Trend

The overall trend for the ETH/USDT chart (30-minute timeframe) appears bullish, confirmed by the recent breakout above the $2,480 resistance level and price maintaining above the moving averages (MA 50 and MA 200).

The latest upward momentum pushed the price to around $2,510, but the current candlestick seems to be consolidating at this level.

2. Key Levels

Resistance:

$2,543 (next critical level).

Support:

$2,480 (previous resistance, now acting as a key support zone).

$2,461 (aligned with the MA 50 and prior consolidation).

Breakout: A breakout above $2,480 has occurred. The bullish trend is likely to continue as long as the price remains above this level.

3. Technical Indicators

RSI (Relative Strength Index):

Currently around 63, indicating positive momentum but not yet overbought (70+), suggesting more upside potential.

MACD:

Both the MACD and Signal lines are above 0 with a recent bullish crossover. However, the lines are converging, pointing to potential consolidation.

Moving Averages (MA 50 & MA 200):

The price is trading well above both moving averages, reinforcing the bullish outlook.

4. Risk/Opportunity

Entry Point: Long above $2,505 (continuation of the bullish trend).

Stop-loss: $2,470 (below the breakout level and MA 50 to reduce risk).

Take-profit:

Level 1: $2,543 (first visible resistance).

Level 2: $2,570 (potential extension of the trend).

Confidence Level: High (given the strong breakout and supporting technical indicators).

Recommendation

Trading Setup:

Asset: ETH/USDT

Direction: Long

Entry: $2,505

Stop-loss: $2,470

Take-profit:

Level 1: $2,543

Level 2: $2,570

Confidence: High

Additional Notes:

Monitor volatility and volume: A drop in volume may signal weakening momentum.

Bollinger Bands indicate possible tightening after the breakout, suggesting consolidation.

🏦 Conclusion: The current setup supports a bullish continuation strategy with a favorable risk/reward ratio.