ETHUSD.PI trade ideas

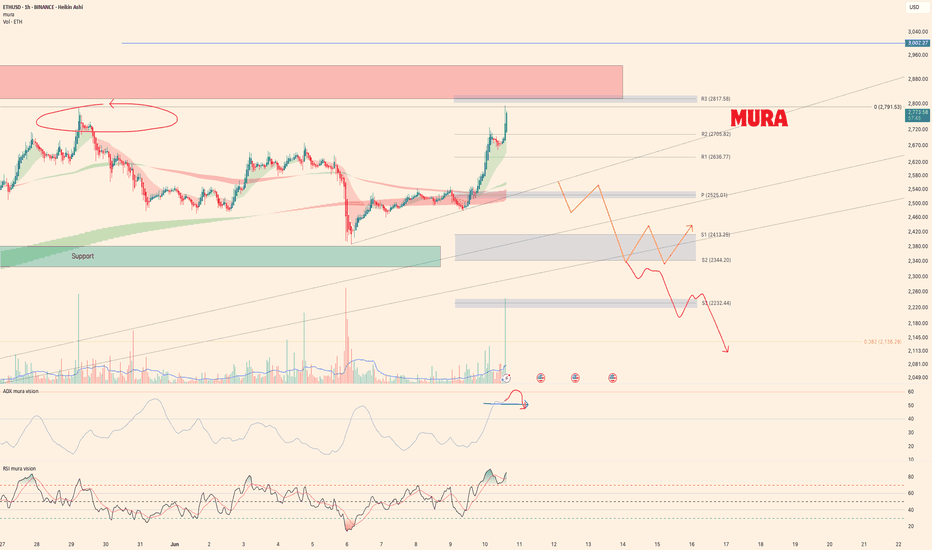

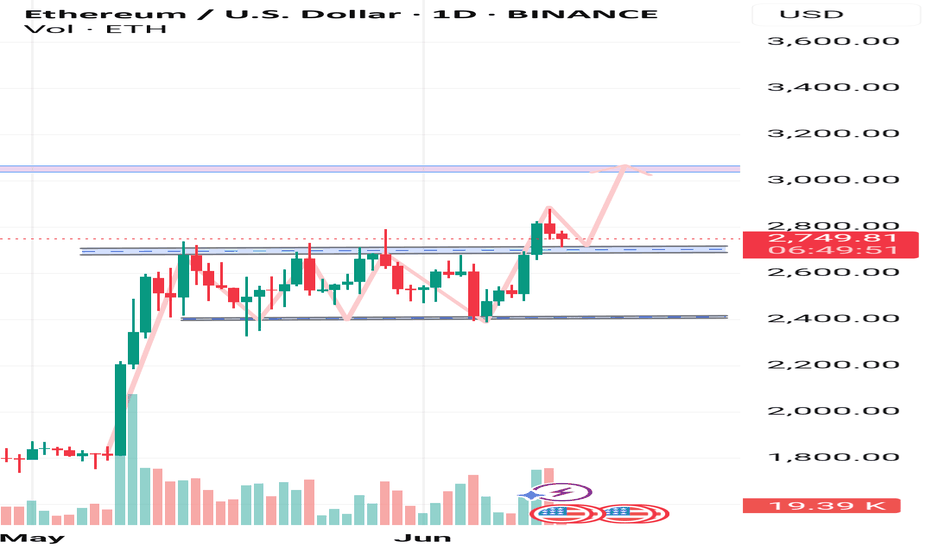

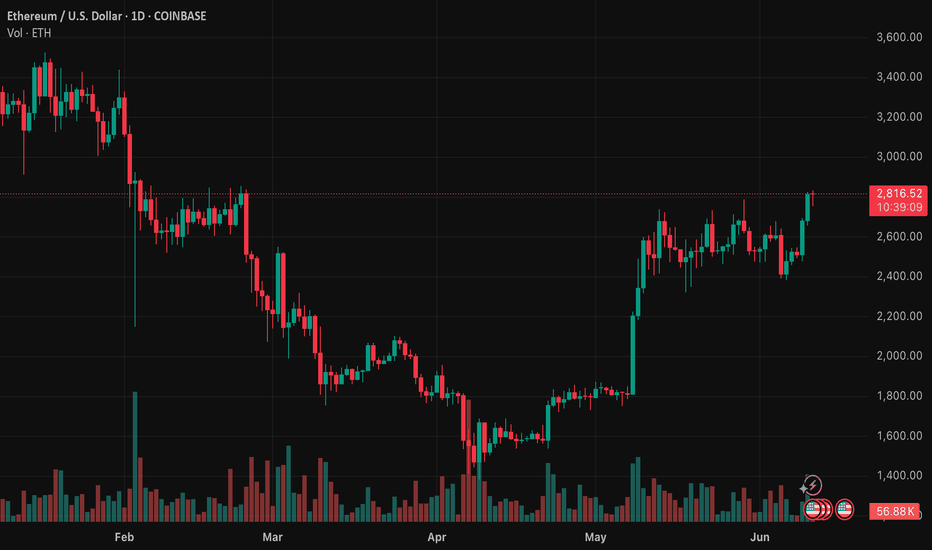

Weekly trading plan for EthereumEthereum continues its growth and has already updated the local top at $2,791. Above the current price is an important resistance zone and after its breakdown it will be possible to see the price above 3k

Write a comment with your coins & hit the like button and I will make an analysis for you

The author's opinion may differ from yours,

Consider your risks.

Wish you successful trades ! mura

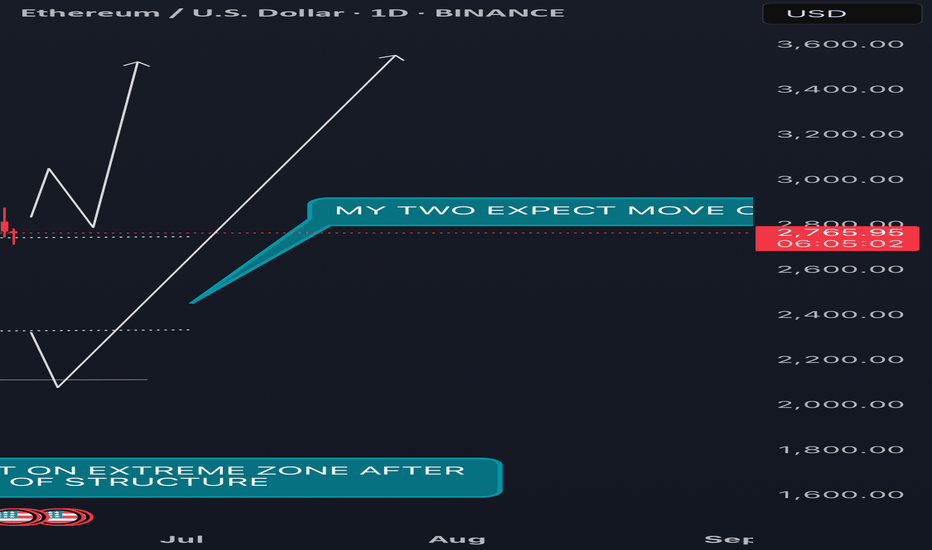

ETH/USDT – Bullish Setup UnfoldingEthereum has broken a key market structure, confirming bullish momentum. After the structure break, we saw a clean retest on our order flow level, signaling strong buyer interest.

Current Outlook:

📈 ETH is showing solid bullish continuation signs

📊 Higher highs and higher lows forming

🔁 Retest confirmation adds confluence

📍Key levels:

💡 My Strategy: Adding to long positions. As long as ETH holds above the retest zone, upside potential remains strong. I’m targeting the next major resistance zone.

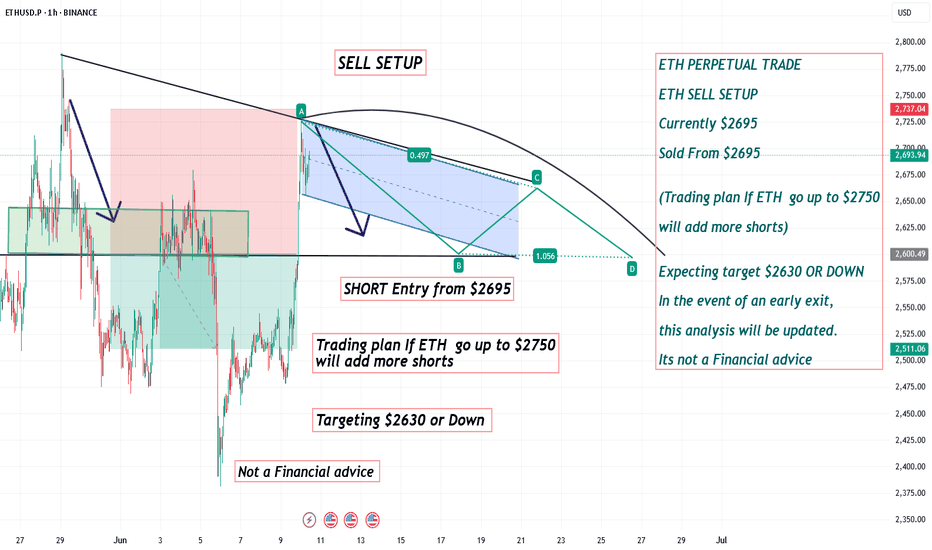

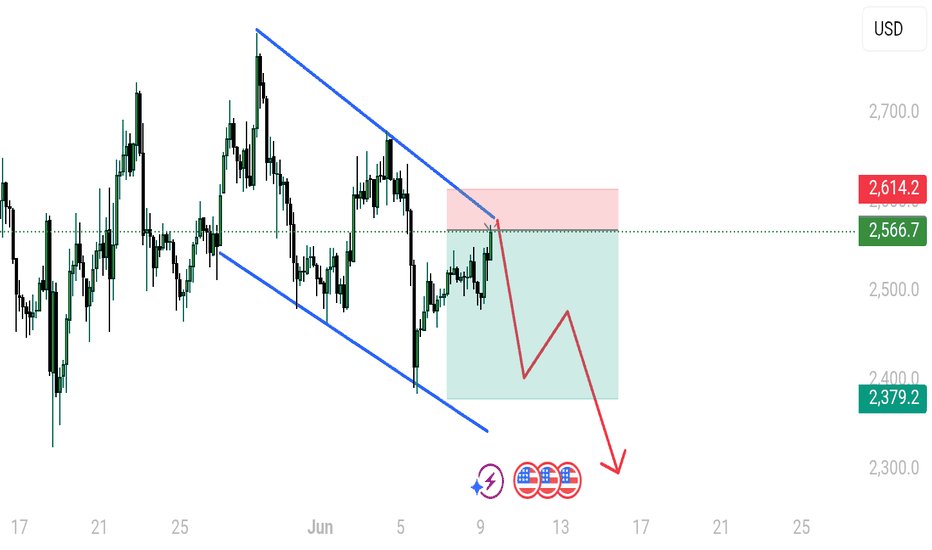

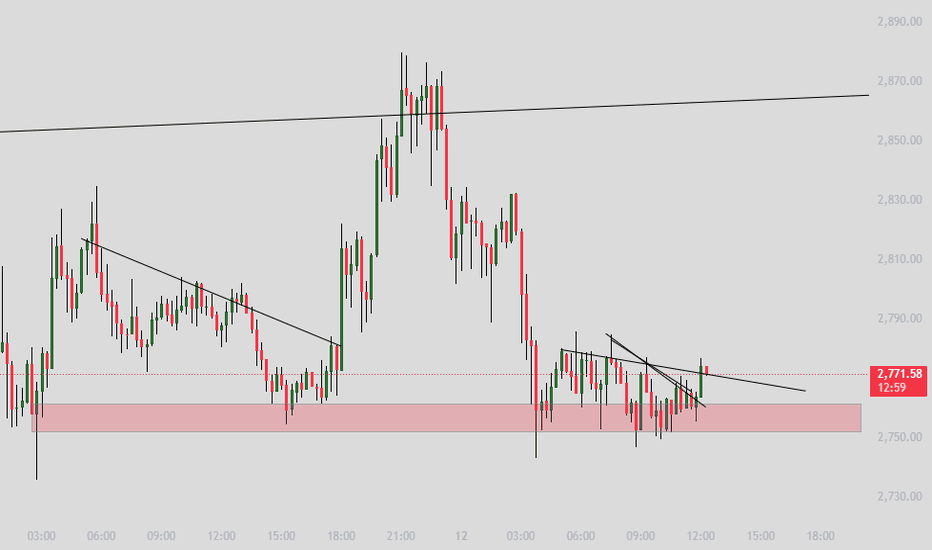

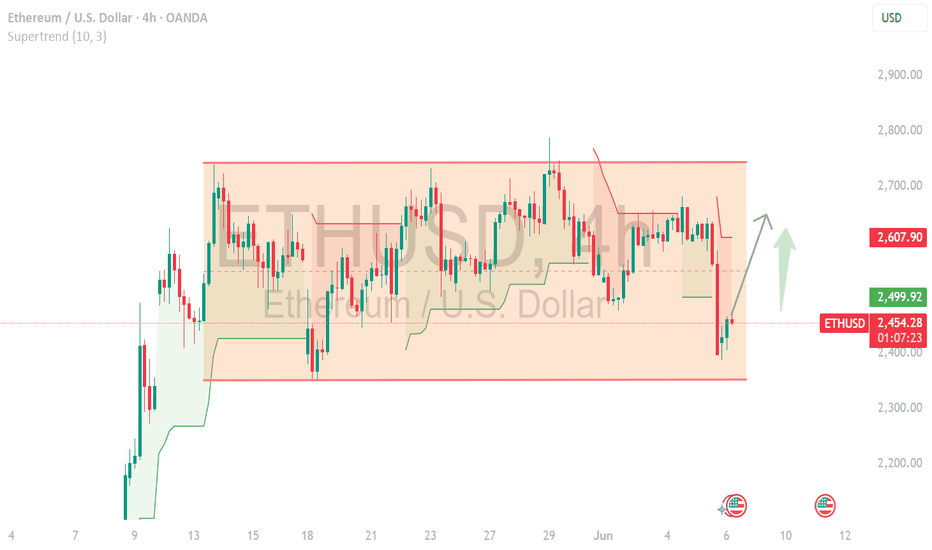

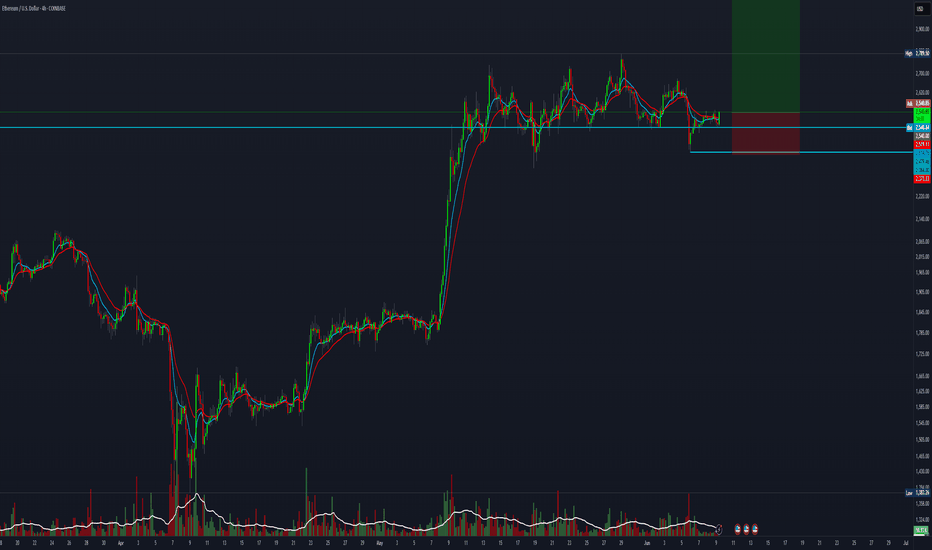

ETHUSD next move ETHUSD – 4H Chart Analysis

Structure: Downward Parallel Channel

Market Behavior: Price is respecting both support and resistance levels within the channel

Current Position: Price is testing the upper boundary / resistance zone

📉 Sell Bias – Potential rejection from resistance zone

Entry: 2559

Stop Loss: 2614

Target: 2379

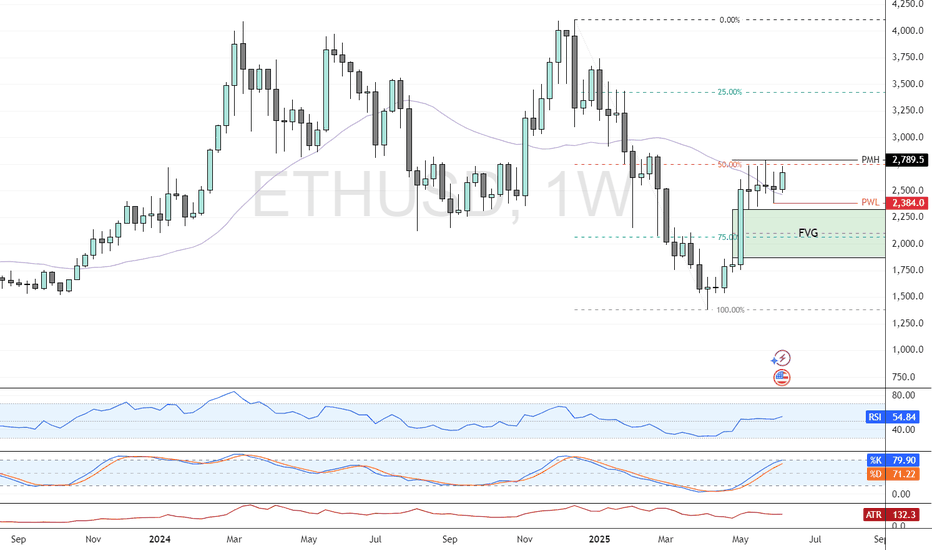

Ethereum Near Monthly HighFenzoFx—Ethereum trades near $2,790, aligning with its monthly high and the 50.0% retracement level. A wide Fair Value Gap could act as a price magnet, while bearish candlestick wicks signal selling pressure.

Stochastic at 79 nears overbought territory, suggesting a potential bearish wave if $2,790 resistance holds. A drop below $2,100 could align with the Fair Value Gap.

The bearish outlook is invalidated if ETH closes above $2,790.

>>> Trade ETH swap free at FenzoFx.

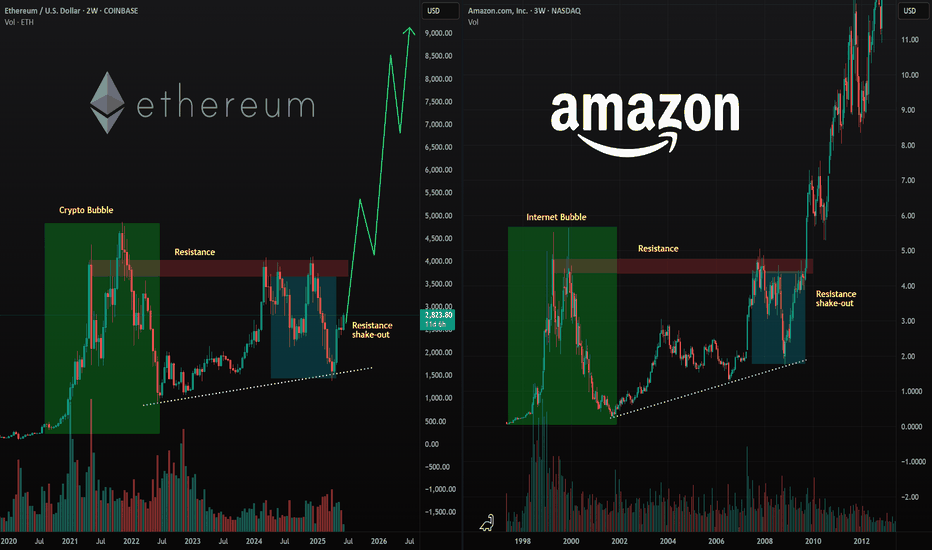

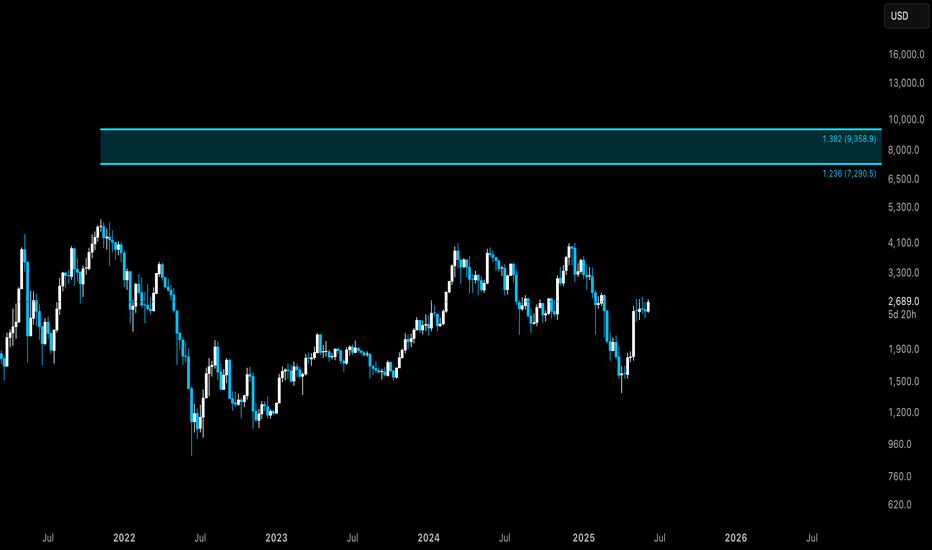

Ethereum Looks Identical to Early-Day AmazonToday I look at Ethereum versus early-day Amazon and the similarities between the internet bubble and the 2021 crypto bubble. Everyone talks about how the internet bubble popped, but few people talk about what came afterward. There was a strong recovery in the markets, and the internet was mass adopted by the public—along with the technology of home computers.

I believe we are heading into a mass adoption phase for crypto. We've had a bubble-and-pop scenario, and now that major institutions are investing in crypto, we are set up for mass adoption—very similar to what happened with home computing and the internet as a technology. I see Ethereum as being the "Amazon" of this new wave, and Bitcoin as being the "Apple." Big things are coming in these markets.

As always, stay profitable.

– Dalin Anderson

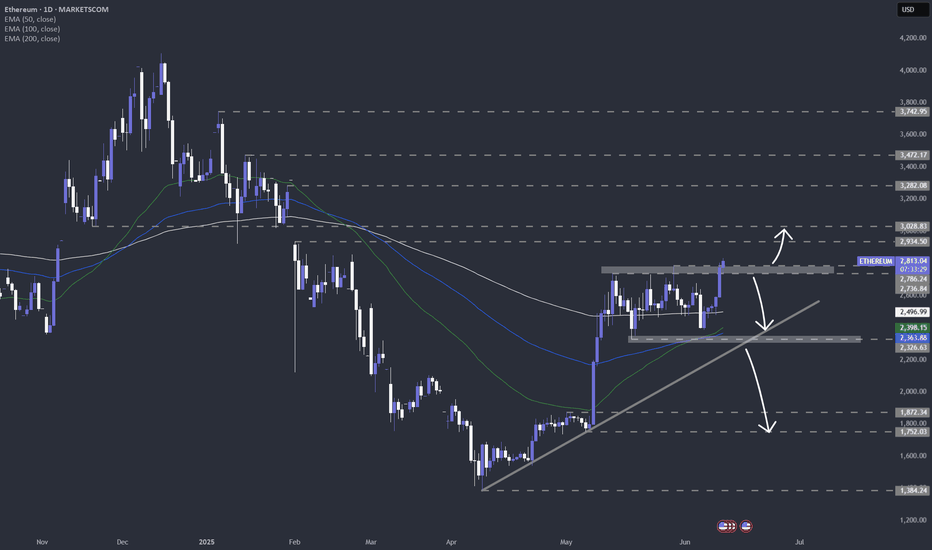

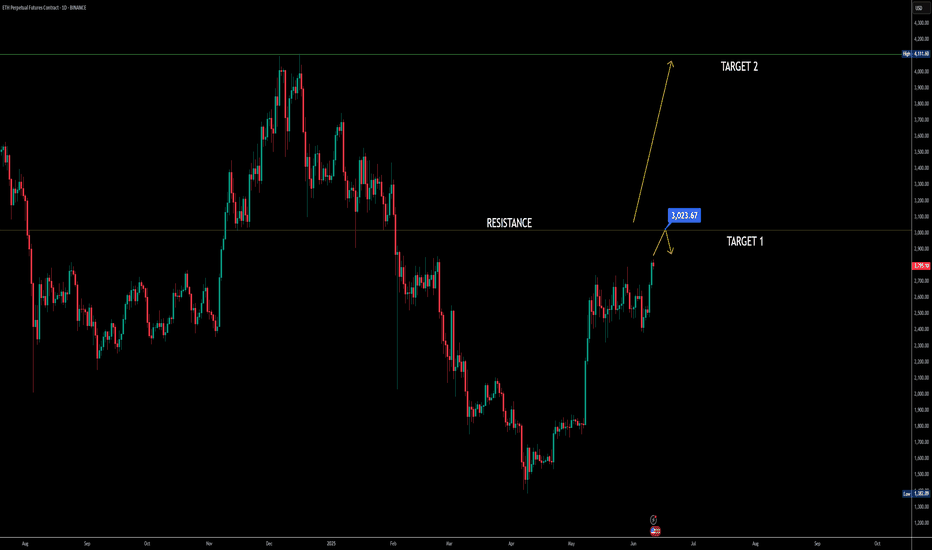

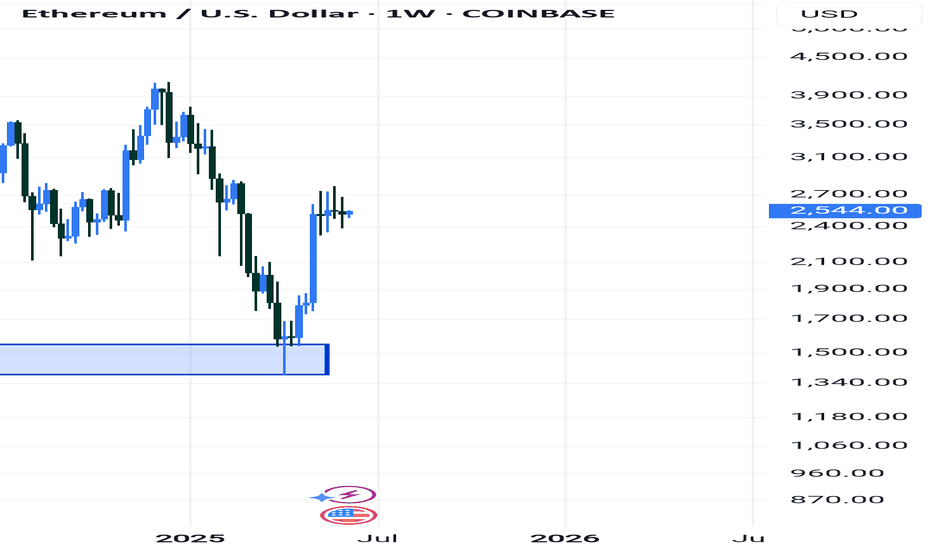

Ethereum bulls are enjoying the momentAfter violating the upper side of the range, MARKETSCOM:ETHEREUM is now aiming for the 3000 zone. Will the buyers have enough steam to drag it there? Let's have a look.

CRYPTO:ETHUSD

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

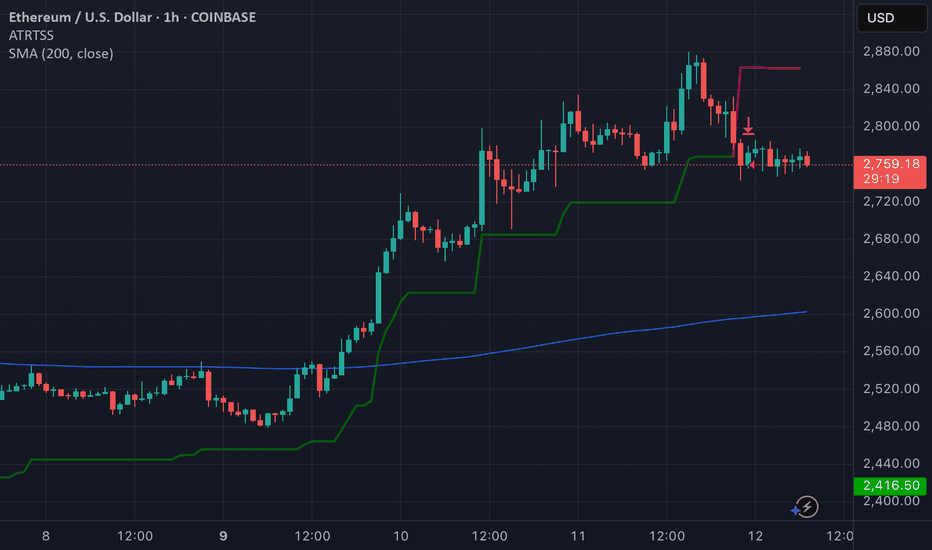

ETHUSD broke the Resistance level 2800.00 👀 Possible scenario:

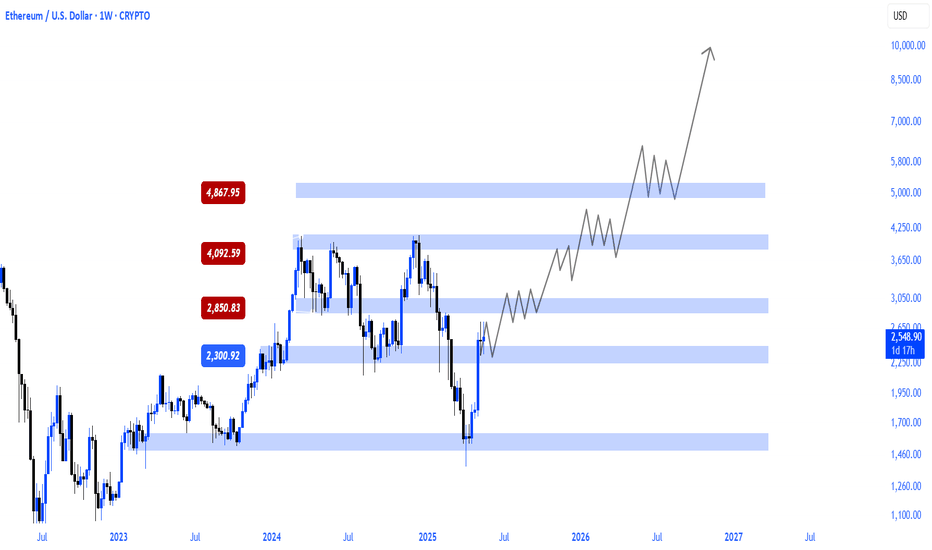

Ethereum overtook Bitcoin in derivatives trading, hitting $110B — a 38% jump — compared to Bitcoin’s $84.7B. ETH price climbed 4% to $2,820, its highest since February. Key growth drivers include strong inflows into US spot ETH ETFs ($890M over 16 days), rising DeFi activity (TVL up 32% to $118.8B), and positive SEC signals. The Pectra update boosted scalability and reduced costs. OpenSea also saw peak user activity since 2023.

With ETF staking approval, ETH could reach $5,500–6,700 by year-end, and $10,000–20,000 by 2030. Crypto analyst suggests ETH may mirror Bitcoin’s 2021 rally. If ETH breaks the $4,200 and reclaims the 1-week MA50, it could stage a massive run — possibly topping $10K by 2026, or even $15K in a parabolic scenario.

✅ Support and Resistance Levels

Support level is now located at 2,390.00.

Now, the resistance level is located at 2,850.00.

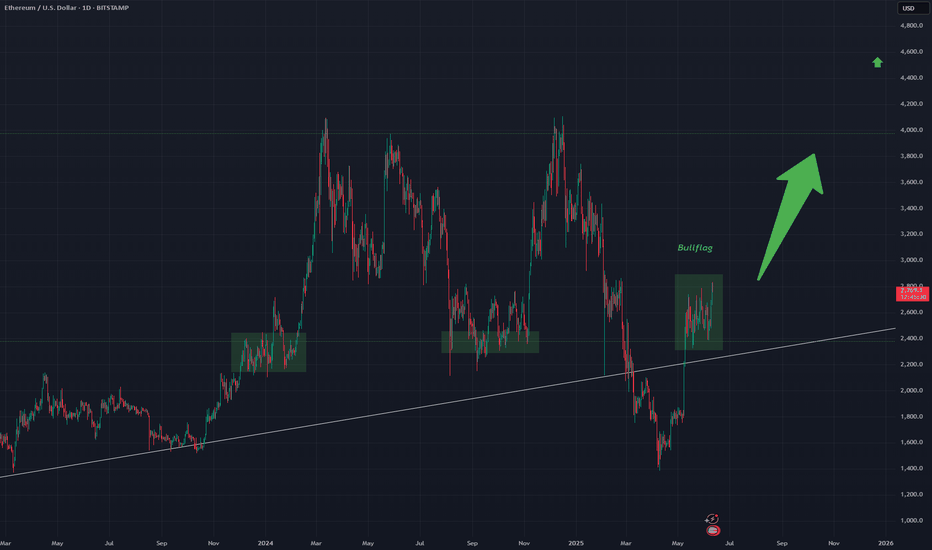

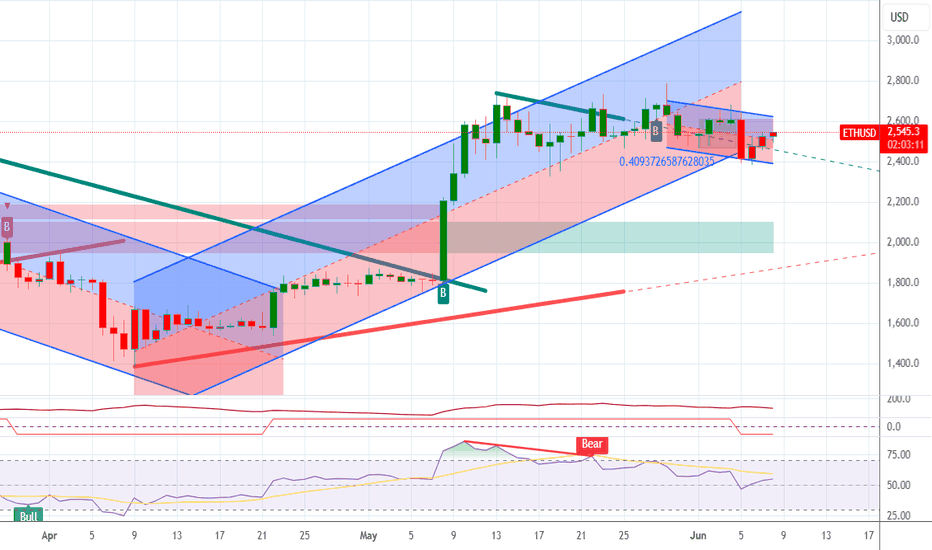

ETHEREUM BULLFLAGA nice bullflag structure has presented itself on this daily timeframe

I think this bullflag will allow ETH to catch up to BTC in term of alts vs BTC

I expect a very strong bullish move to be coming in the next month or next month breaking out of this bullflag

Green horizontal has been seen previously as a point of support.

ETH HIT THE LIKE TO MANIFEST THISETH/USD is teasing the breakout zone again... 👀

Are we finally ready for liftoff, or is it another fakeout? 🚀🔄

The chart’s looking spicy, and the energy feels right. 🌌

Hit that like to manifest the pump — we’re in this together. 💎🙏

Let’s speak green candles into existence! 📈✨

#ETH #Ethereum #CryptoVibes #ManifestMoneyMoves #ETHUSD #ToTheMoon"

$Eth Breaks Key Resistance! Is $4100 Coming Next? Ethereum has officially broken above its previous resistance at $2900 and is now aiming for the critical $3000 psychological level. Here's a step-by-step breakdown of what to expect next, including MACD, RSI signals, and CPI data impact.

🔹 Step 1: Breakout Confirmation

Ethereum has successfully broken above the $2900 resistance level — this area is now acting as immediate support.

🔹 Step 2: Next Short-Term Target – $3000

ETH is expected to hit the round number resistance at $3000, which is the next major level to watch. This is the first price target.

🔹 Step 3: MACD & Stochastic RSI Support Bullish Move

MACD is crossing to the bullish side, showing increasing momentum.

Stochastic RSI is also favoring bullish continuation — indicating a likely move to $3000 and beyond.

🔹 Step 4: Possible Rejection Zones

If ETH faces rejection near $3000 or $3500, especially if Bitcoin shows weakness or stalls, expect a pullback.

🔹 Step 5: Target 2 – $4100 if Breakout Continues

If ETH convincingly breaks above $3000 and sustains momentum, $4100 becomes the next major target. This level aligns with the previous high and potential macro continuation.

🔹 Step 6: Watch CPI Data Impact

A positive CPI reading will strengthen bullish sentiment and help ETH push toward $4100.

A negative CPI surprise might trigger a reversal — but even in that case, a short-term hit of $3000 remains likely.

Key Levels to Watch:

Support: $2900, $2800

Resistance: $3000 (Target 1), $3500 (Interim), $4100 (Target 2)

Ethereum's price structure looks bullish above $2900, supported by technical indicators and macro optimism. The $3000 level is within reach, and if momentum continues, $4100 is the next upside target. Keep an eye on BTC behavior and CPI release for confirmation or reversal signals.

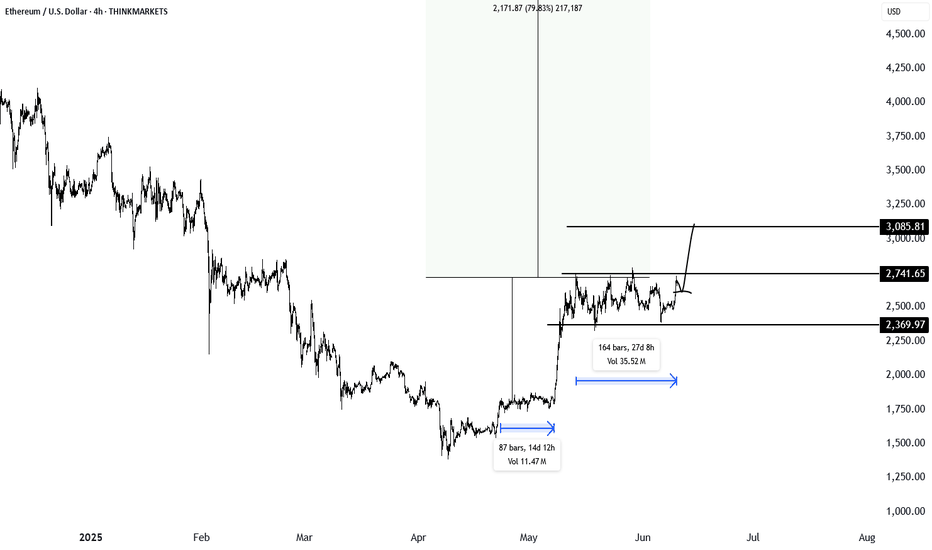

Ethereum set for breakout? Watch this 27-day patternEthereum is forming a 27-day pattern that could trigger a major breakout. After last week's failed move in Bitcoin, Ethereum now sits at a critical level. A breakout above 2741 could signal the start of a big rally, especially if US deregulation news lands. Could this be the beginning of a big move? Watch the full analysis and share your thoughts in the comments.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

ETH: USD & Stablecoins are ALLIES | Stablecoin SuperCycle Part 2Video Timestamps:

0:00 U.S. Dollar & Stablecoins are now BEST FRIENDS

3:28 Ethereum DOMINATES Stablecoin Market!

4:00 Ethereum Risk & Regression Analysis

5:58 Hong Kong to use Chainlink protocol in CBDC pilot project

7:34 Ethereum Elliott Wave Count + Fibbonaci Work + Bull Market Price Targets

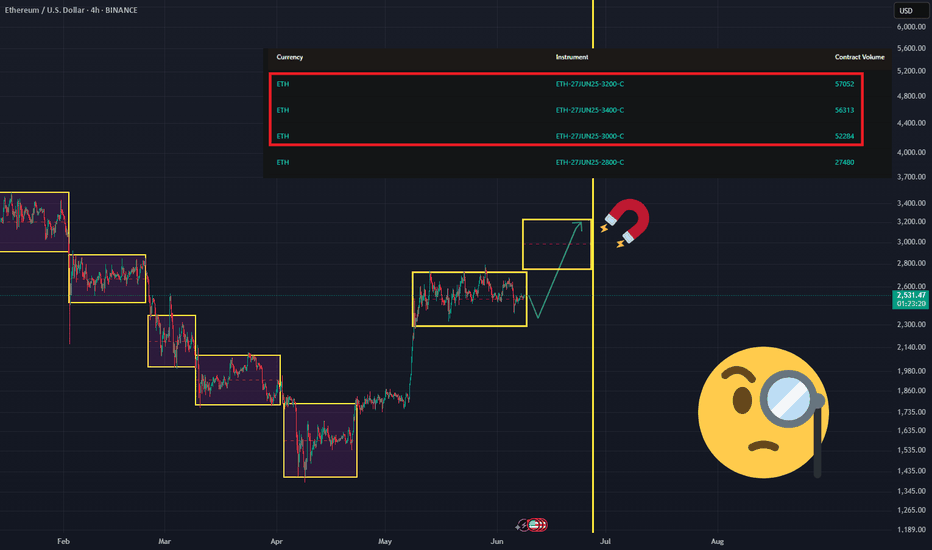

Once It Starts, It Might Be Too Late to Jump InHey guys, vacation’s over — time to get back behind the screen and into the reports. Naturally, I kicked things off with a deep dive into ETH options activity , because that’s where the real market whispers come from.

Here’s what stood out:

Over the past week, the biggest trading volume and open interest inflow came at strikes $3000–$3200–$3400 (see screenshot). Most of the action was in standalone calls , though a portion showed up as call spreads — meaning some players are betting on a controlled rally, not just blind bullishness.

The June 27, 2025 expiry remains the clear leader in open interest — still the date everyone’s watching.

With implied volatility at 67.9% , ETH has about a 68% probability (1σ) of reaching $2,950 by expiry — just 18 days away .

Key Takeaways:

$3000–$3200 looks totally within reach.

$3400 , though? Less than 15% chance based on current levels.

The sentiment among options traders is clearly bullish — they’re positioning for a breakout up from the sideways range, roughly by the full width of the pattern.