ETHUSD.PI trade ideas

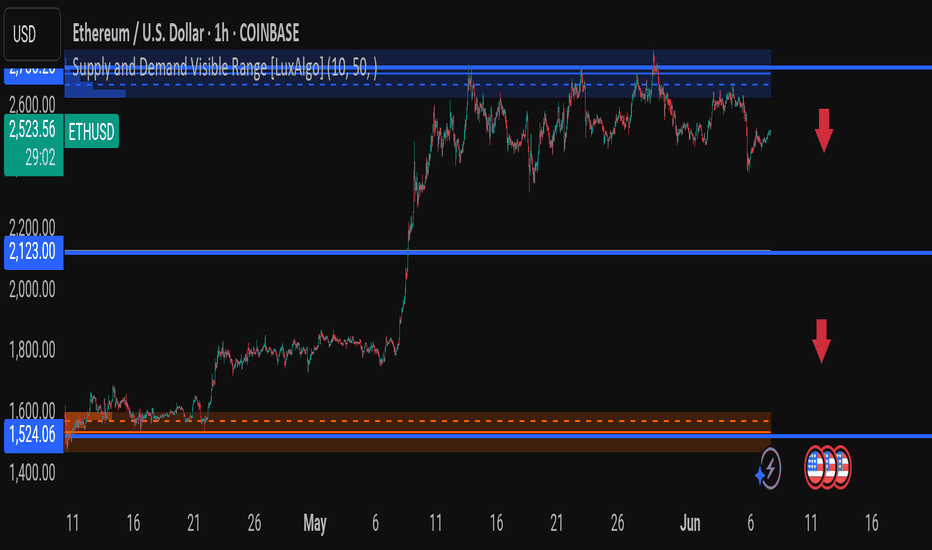

ETHUSD 1H – Supply Zone Rejection! Will Ethereum Retest $2,100 Ethereum is currently trading at $2,524, just below the critical supply zone between $2,560 – $2,600, where price has been repeatedly rejected. The bulls are showing signs of exhaustion – is a deeper correction on the horizon?

🔵 Major Technical Zones:

🔹 Resistance (Sell Zone): $2,560 – $2,600

🔹 Mid Support: $2,123

🔹 Key Demand Zone: $1,524 – $1,600 (High-Volume Buy Area)

📉 Bearish Scenario (Likely if rejection holds):

A failure to break above $2,600 could lead to a breakdown toward $2,123.

If $2,123 doesn’t hold, $1,524 is the next target — a zone with historical demand and a previous breakout base.

🧠 Volume Profile Insight:

Notice how volume increases around $1,524, indicating strong buyer interest in this zone. The space between $2,100 and $1,524 is thin — expect fast movement if $2,100 cracks.

📆 Key Dates:

Economic events marked on the chart (June 11–16) could act as catalysts for volatility.

---

💬 Do you think ETH will break above the supply or is this the calm before the drop? Share your analysis below!

#Ethereum #ETHUSD #CryptoAnalysis #PriceAction #SupplyDemand #LuxAlgo #SmartMoney #TradingView

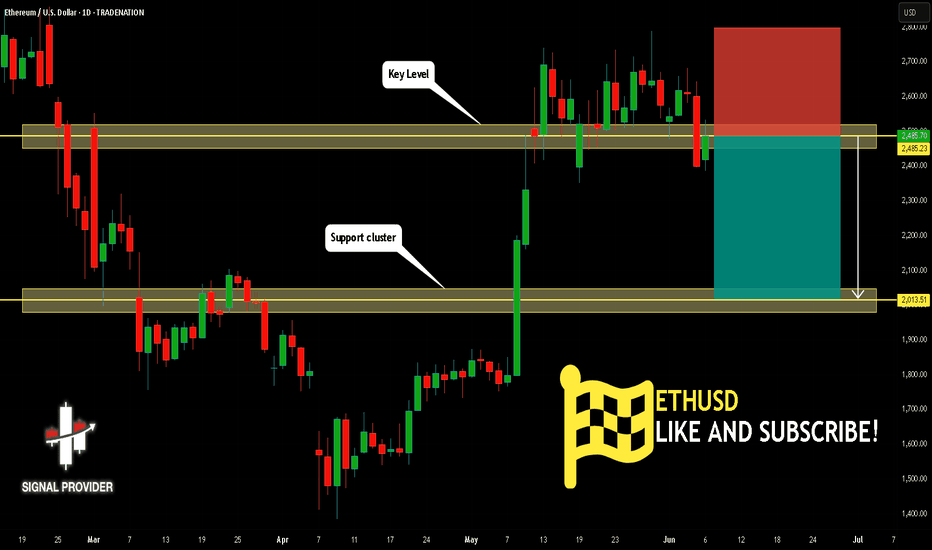

ETHUSD Is Going Down! Sell!

Here is our detailed technical review for ETHUSD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 2,485.23.

The above observations make me that the market will inevitably achieve 2,013.51 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

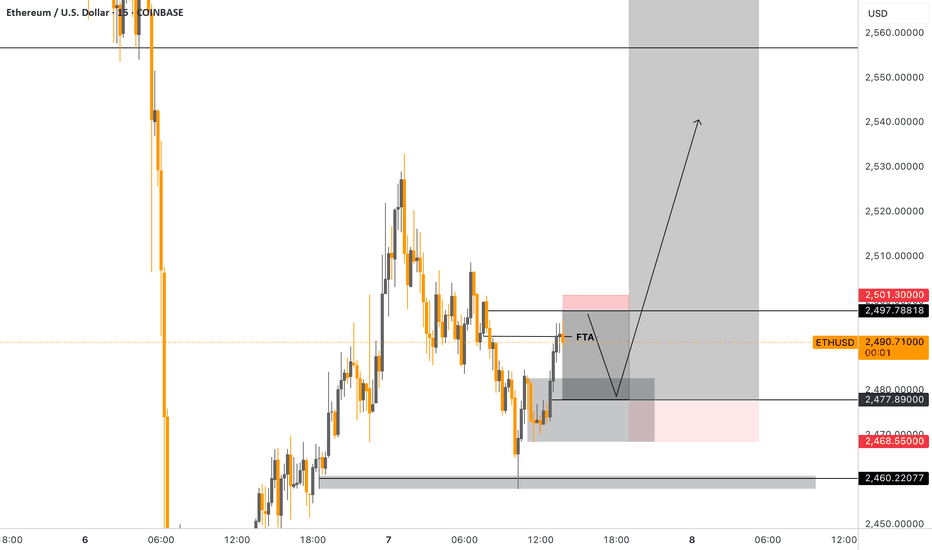

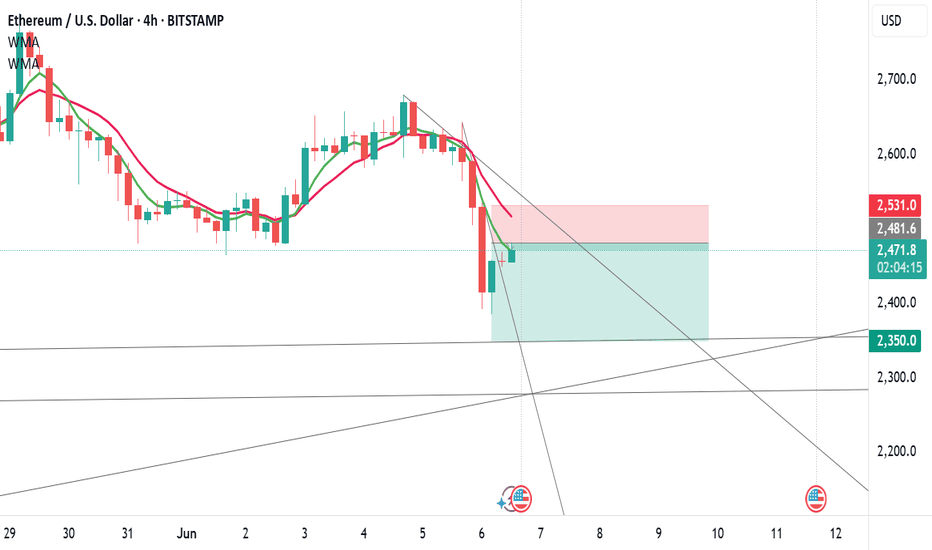

ETHUSDETHUSD – Bearish Sell Setup (AUTH Liquidity Model)

ETHUSD is currently in a retracement phase after rejecting from a recent high. Price action is approaching a zone rich in overhead liquidity, offering a clean short opportunity based on AUTH (Areas of Liquidity) principles.

⸻

Key Elements of the Setup:

FTA – First Trouble Area:

A minor demand zone just below current price where a short-term reaction could occur. This is not the main target, but a potential bounce point.

Inversion Point:

A previously supportive level that now acts as resistance. Often, this is where trapped buyers from earlier rallies exit, fueling momentum for further downside.

VAL – Value Area Low:

A historically high-volume area where price previously consolidated. It often acts as a target for rebalancing moves.

AUTH Liquidity Zones:

• Above price: Stacked buy stops above recent highs and wick clusters

• Below price: Sell-side liquidity in the form of equal lows, trendline bounces, and inefficient zones

The setup anticipates a sweep of upper liquidity before a drop into deeper value.

⸻

Execution Idea:

The setup favors a short entry after liquidity above is cleared and bearish confirmation prints on a lower timeframe. The goal is to enter after price rejects from high liquidity and begins targeting value and imbalance zones below.

⸻

Disclaimer: This is a technical idea shared for educational purposes only. It does not constitute financial advice. Always perform your own analysis and manage risk responsibly.

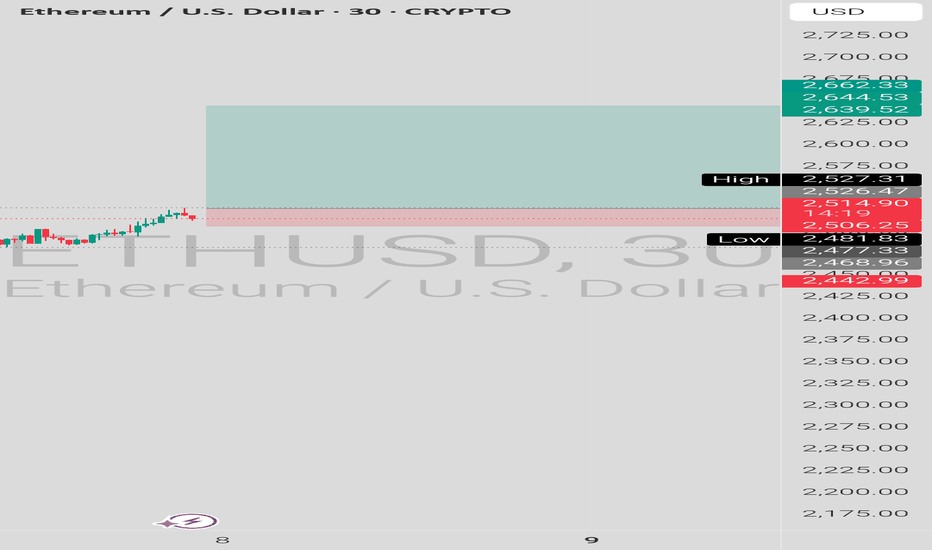

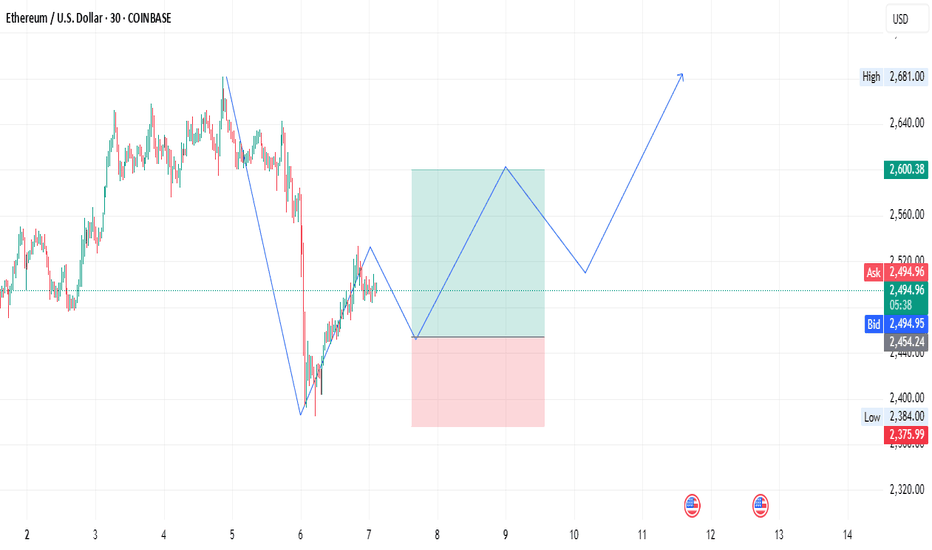

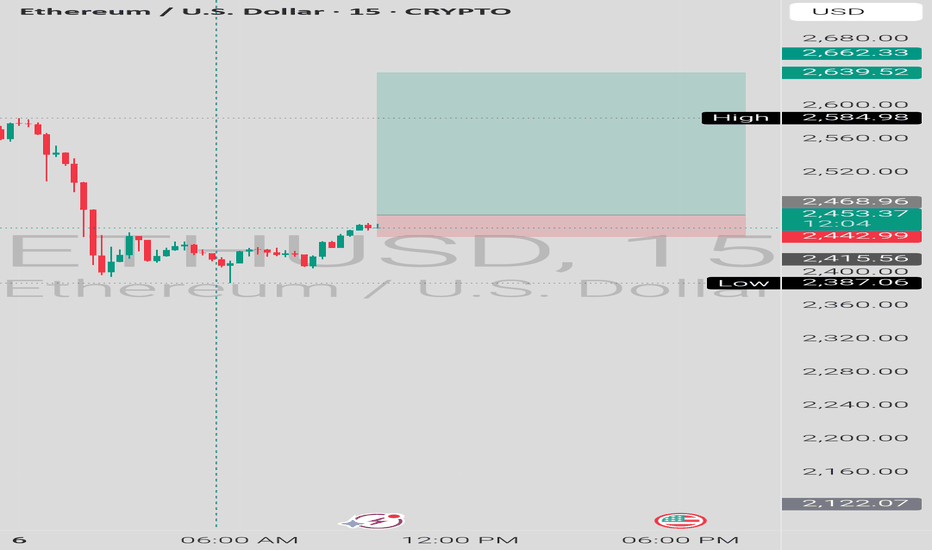

ETH/USD Long Setup – Bullish Reversal in Play📅 Date: June 7, 2025

⏱ Timeframe: 30-Minute (COINBASE)

📊 Pair: Ethereum / U.S. Dollar (ETH/USD)

💡 Trade Idea Summary:

Ethereum is showing signs of a bullish reversal after a strong corrective move. Price has formed a potential higher low structure and is preparing for a bullish continuation.

🔹 Entry: $2,454

🎯 Target: $2,600

🛡️ Stop Loss: $2,376

⚖️ Risk-Reward Ratio: ~1.9:1

📈 Technical View:

Recent downtrend appears exhausted with a clear bounce from the $2,384 zone.

Break of lower highs indicates shift in momentum.

Expecting a short-term dip to retest the higher low before continuation towards $2,600.

Ideal for swing traders or short-term bullish setups.

📌 Trade Management Tips:

Watch for bullish confirmation near $2,454 before full entry.

Trail stop if price breaks above $2,520 for risk reduction.

Avoid the trade if price closes below $2,376 on the 30m chart.

🔔 Disclaimer: Not financial advice. Always do your own research and manage risk appropriately.

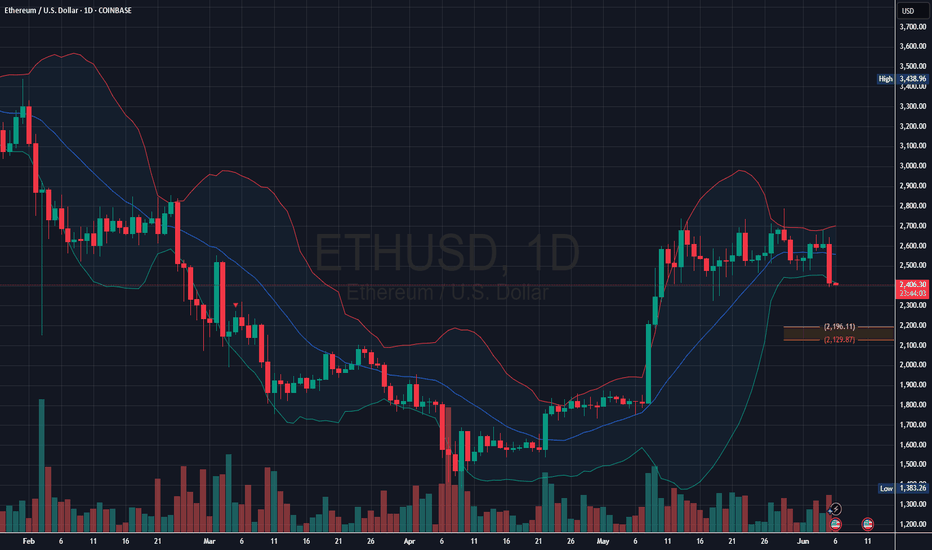

Downside Risk Ahead: ETH Drops Below 20-Day MA

The last few candles show strong red bodies, suggesting selling pressure.

Price has closed below the middle Bollinger Band (20-day moving average), often a trigger point for downside momentum. This suggests a transition from neutral/bullish to bearish momentum.

Recent highs failed to break the previous peak near $2,900. This forms a lower high, indicating weakening buying strength.

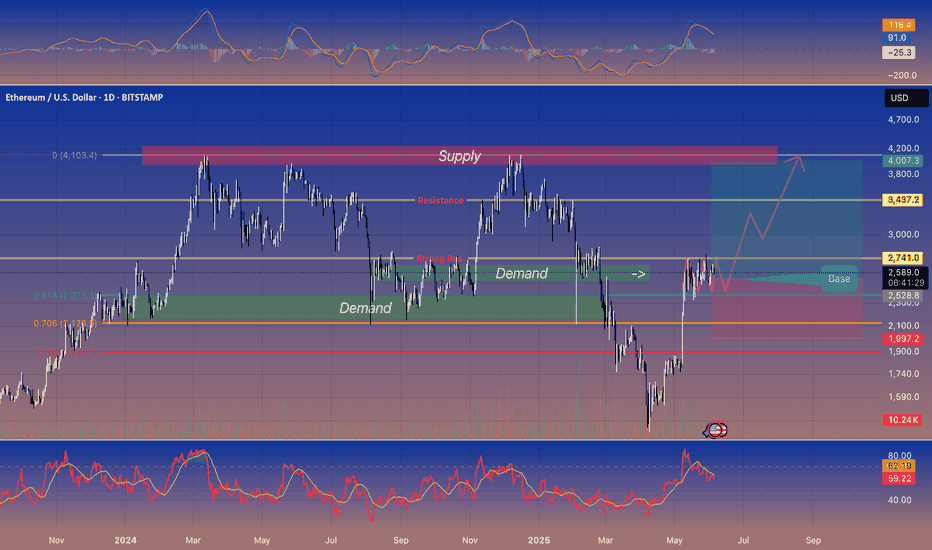

Ethereum (ETH/USD) Technical Analysis — Bearish Rejection Below 🔍 Ethereum (ETH/USD) Technical Analysis — Bearish Rejection Below Resistance ⚠️

📅 Date: June 4, 2025

📊 Chart Type: 2-Hour Timeframe

💱 Exchange: Binance

---

🧠 Overview:

The chart displays a clear range-bound market between well-defined resistance and support zones. The most recent price action suggests a rejection from the resistance region, hinting at a possible downward move toward support.

---

🟧 Key Levels:

Resistance Zone: $2,720 – $2,760

Price has tested this zone multiple times and failed to break above decisively.

Marked as a strong supply area where sellers dominate.

Support Zone: $2,460 – $2,490

This area has historically attracted buying interest, causing price reversals.

---

📉 Market Structure & Price Action:

The recent swing high formed a lower high relative to the peak on May 29, suggesting bearish momentum.

A projected bearish move is marked on the chart with a blue arrow 📉, forecasting a drop from around $2,640 down to the support zone near $2,480.

Multiple failed attempts to break resistance signal a potential trend continuation to the downside within this trading range.

---

⚠️ Trading Implications:

Short-term bias: Bearish 🔻

Confirmation needed: A breakdown below $2,600 with volume would strengthen bearish conviction.

Target for bears: $2,480 support area

Invalidation zone for this outlook: A breakout and close above $2,760 would shift the bias to bullish.

---

📌 Conclusion:

Ethereum is currently trading within a well-defined horizontal channel. With the latest rejection near resistance, the probability favors a move down to the support area. Traders should monitor key levels closely for confirmation before entering positions.

📈 Tip: Use proper risk management and watch for candlestick confirmation at critical levels.

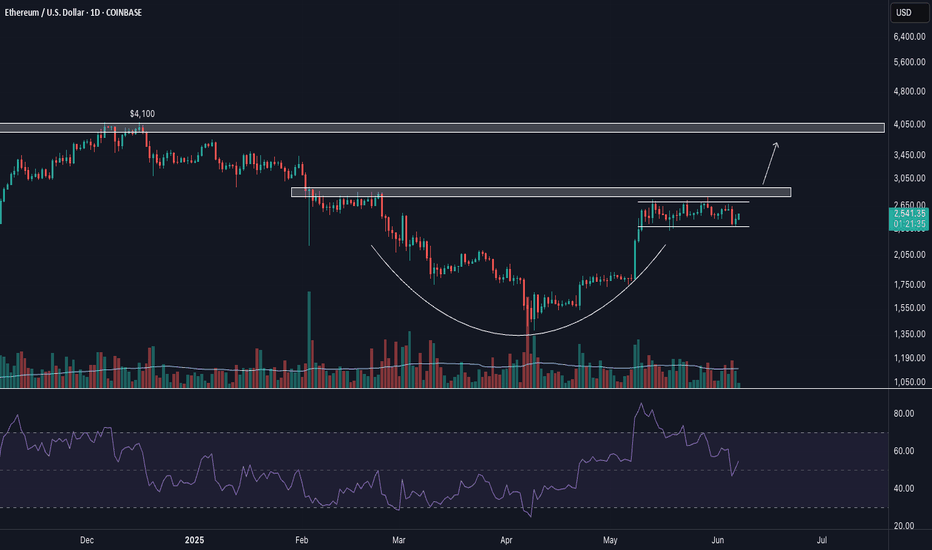

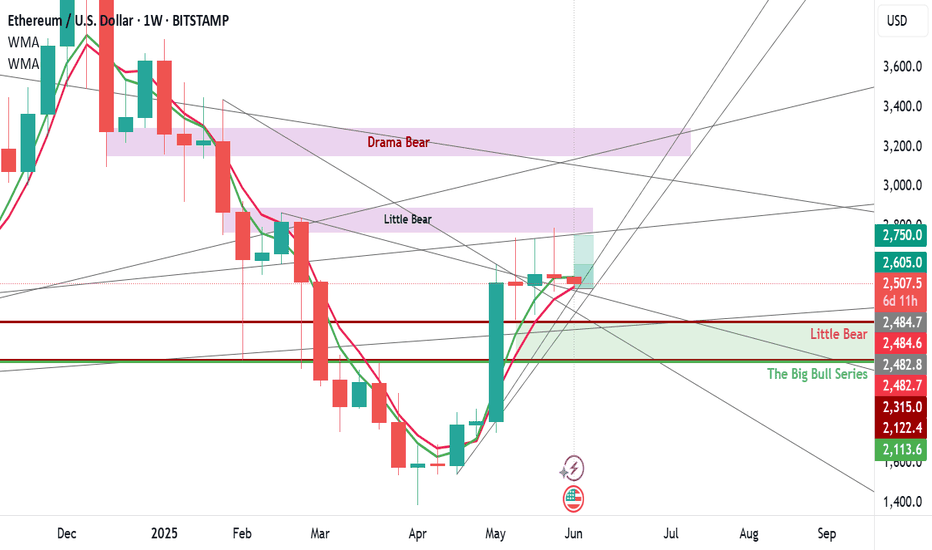

Ethereum (ETHUSD) • Daily • Trading ideaEthereum (ETHUSD) • Daily Chart 🚀

---

🔑 Key Levels

* Demand Zone (Support): \$2,350–2,550

* Price has bounced here twice in the last year.

* Immediate Resistance: \$2,741

* Multiple rejections around this level recently.

* Next Major Resistance: \$3,437

* Former highs in late 2024/early 2025.

* Big Supply Zone (Strong Sell Area): \$4,000–4,200

---

💡 What’s Happening?

* ETH is sitting in a “base” between \$2,528–2,741 (green box).

* If it breaks above \$2,741 on strong volume, it can run toward \$3,437 and eventually \$4,000+.

* If it falls below \$2,528 (demand), the next support is around \$1,997.

---

🎯 Trade Idea

* Bullish Entry: Buy on a daily close above \$2,741 + higher-than-usual volume.

* First Target: \$3,437 (take partial profit).

* Final Target: \$4,000–4,200 (major sell area).

* Stop-Loss: Below \$2,500 (just under support).

* Bearish Scenario:

* If price drops below \$2,528 with big volume, look for a possible move down toward \$1,997.

---

📈 Indicators (Confirmation Only)

* Volume: Watch for a spike on any breakout above \$2,741.

* MACD & RSI: If both are rising (not overbought), it adds confidence—though price and volume matter most.

---

👍 Summary

ETH is coiling in a strong support zone. A clean break above \$2,741 on good volume can send it to \$3,437, then \$4K+. If support fails, \$1,997 is next. Trade with proper stops and watch volume for confirmation.

— Feel free to leave a 🚀 if this helps!

#Ethereum #ETHUSD #Crypto #Support #Resistance #Volume

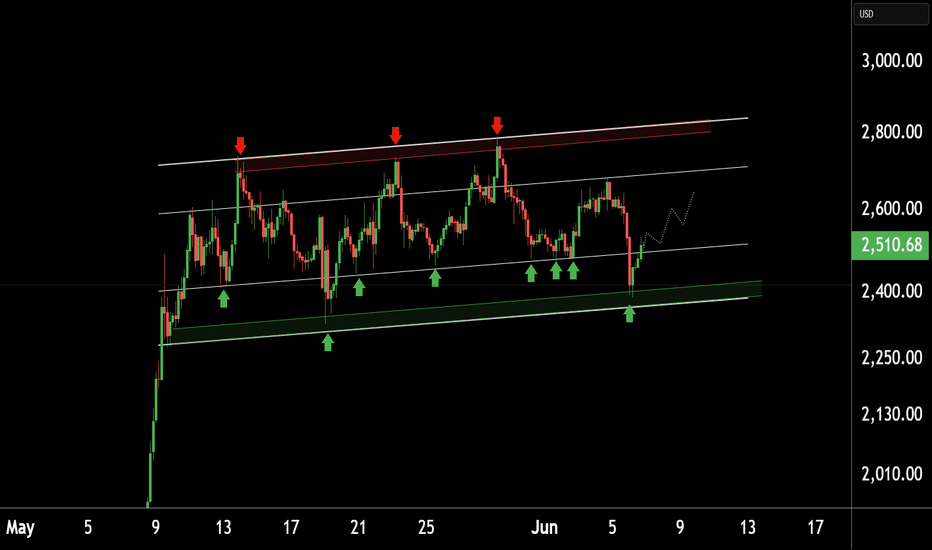

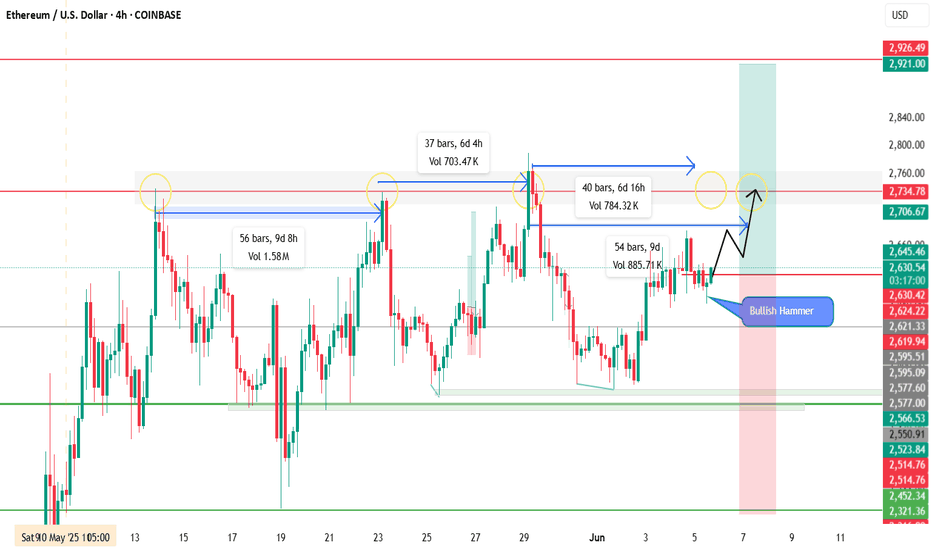

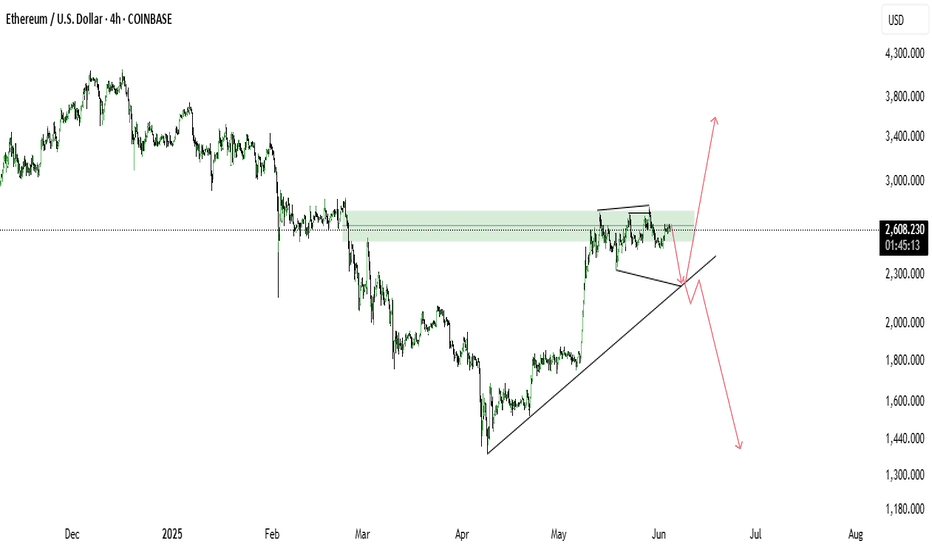

ETHUSDETH is showing signs of a potential resistance retest, echoing previous price behavior. On the 4H chart, historical data suggests ETH typically revisits resistance zones within 6–9 days (±). The pair has been ranging between support and resistance, and a strong bullish hammer has just formed — signaling a potential shift in momentum.

📍 Entry: Market (Instant)

🛑 Stop Loss: 2312

🎯 Take Profit: 2913 (1:1 Risk-Reward)

📊 Plan: Trade aligned with historical timing and price structure. Entering on bullish confirmation.

⚠️ Note: Manage risk accordingly — structure looks promising, but always respect your stop.

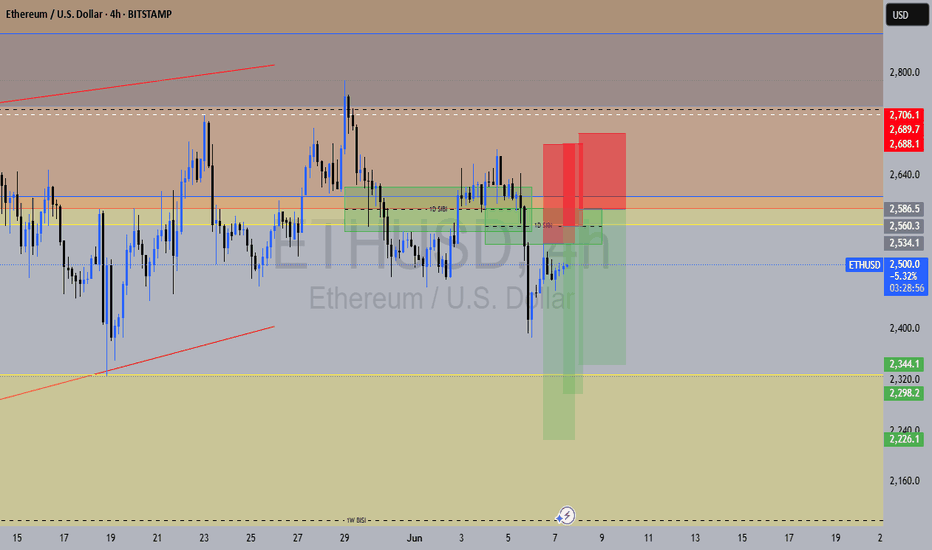

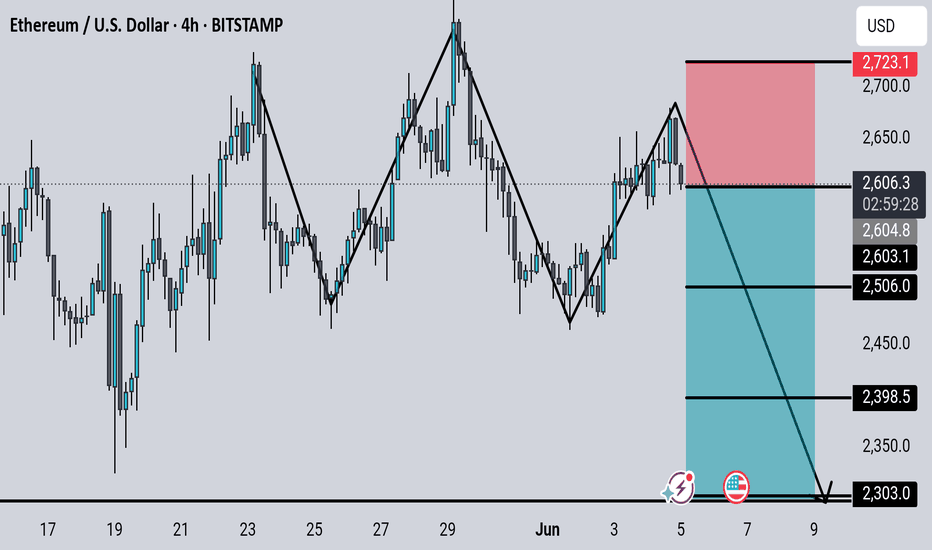

ETHUSD – 4H Chart AnalysisPrice has reached a key resistance zone around the 2,700 level. The market structure suggests potential for a downward move from this area, forming lower highs and indicating selling pressure.

📉 Sell Idea

Entry: 2,605

Target 1: 2,506

Target 2: 2,398

Target 3: 2,303

Stop Loss: Above 2,725

Structure-based trade setup with risk-to-reward in favor of sellers. Will be watching for confirmation through bearish price action on lower timeframes.

⚠️ This is not financial advice. For educational and analysis purposes only.

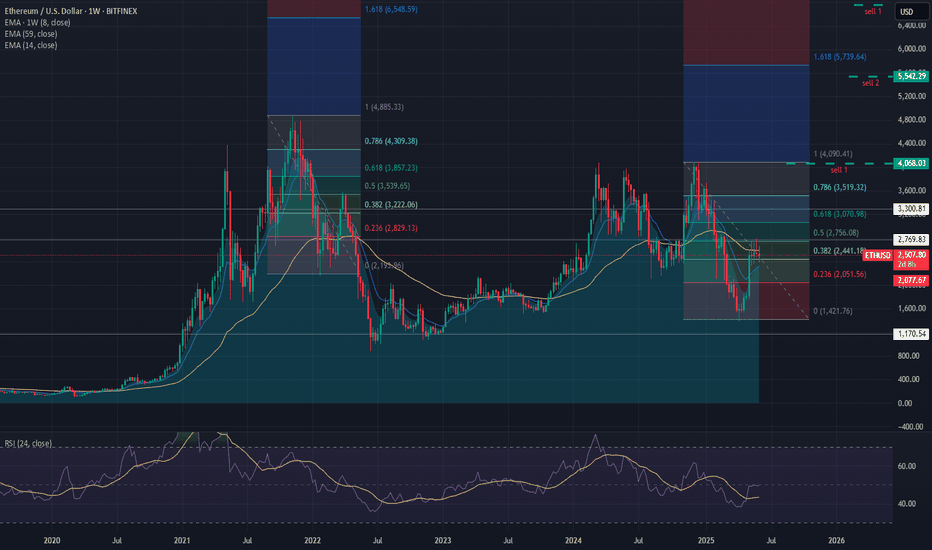

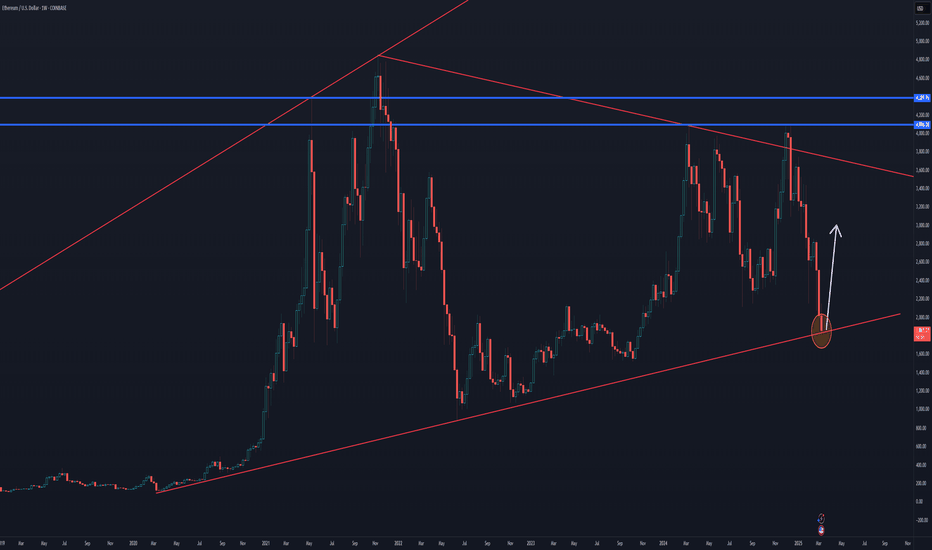

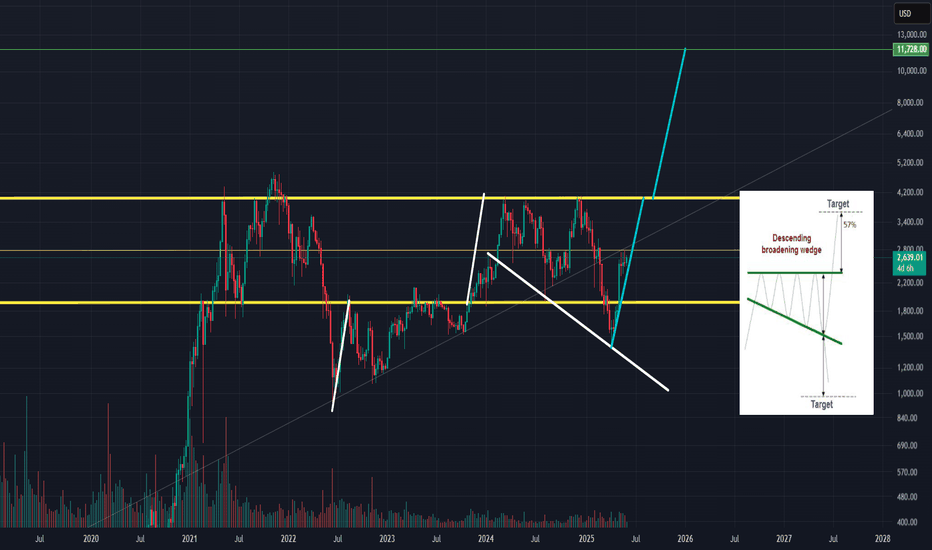

$ETH Broadening Wedge TargetCRYPTOCAP:ETH reached its technical target of $4K from the ascending triangle (Jul '22-Oct '23).

CRYPTOCAP:ETH appears to be back in the multi-year range between $1.9K-$4K.

If the Bull Market continues, the current macro pattern could develop into a flat top broadening wedge with a target of $11.7K.

Invalidation if it fails to break $4K, or falls to Hades.

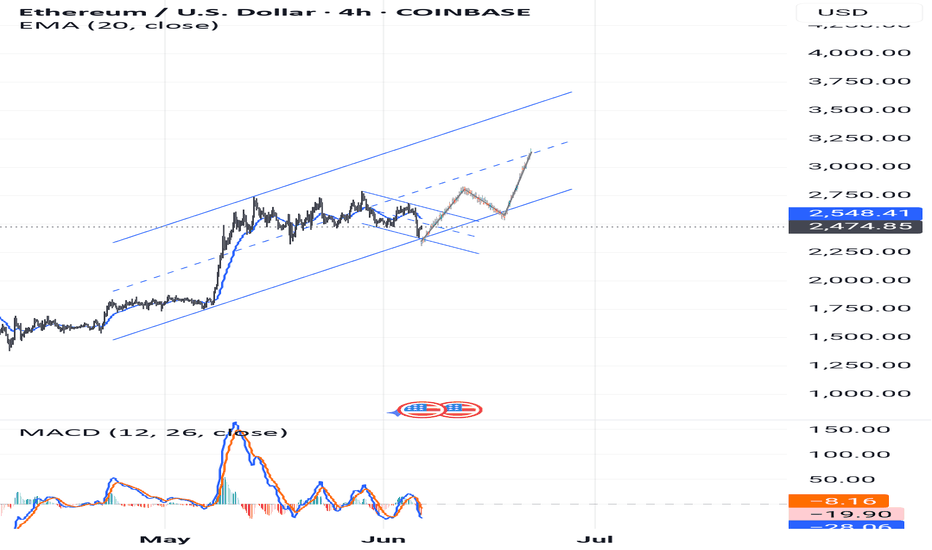

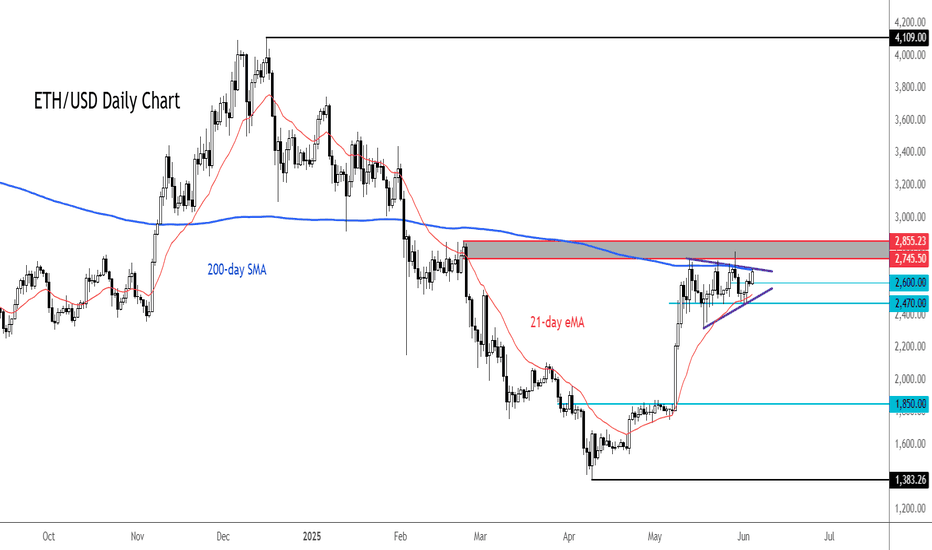

ETH/USD gearing up for potential breakoutThe ETH/USD has been coiling inside a bullish continuation pattern for several weeks now and a breakout could be on the cards soon. The consolidation suggests ETH is gearing up for a potential breakout soon, as it chips away at resistance coming from the 200-day moving average near $2700.

Further resistance is seen between $2745 to $2855, as shaded in grey on the chart. If it gets through this area of resistance in the coming days, then a big breakout could be on the cards, with the first stop likely around $3,000, but we could go much further than that over time, given the length of the current consolidation.

However, it is essential that the ETH/USD doesn't break the support trend of the consolidation pattern and key support at $2470 now. If it does, then that would invalidate the bullish price structure.

By Fawad Razaqzada, market analyst with FOREX.com

ETH at a Critical Decision Level – $2260Ethereum is currently showing strong price action around the key decision level of $2260. This zone will likely determine the next major move:

A breakout above could trigger a bullish continuation.

A rejection here may send ETH down, possibly all the way toward $1000 in the long term.

📌 Stay tuned — we'll update you as the move unfolds. Keep in touch!