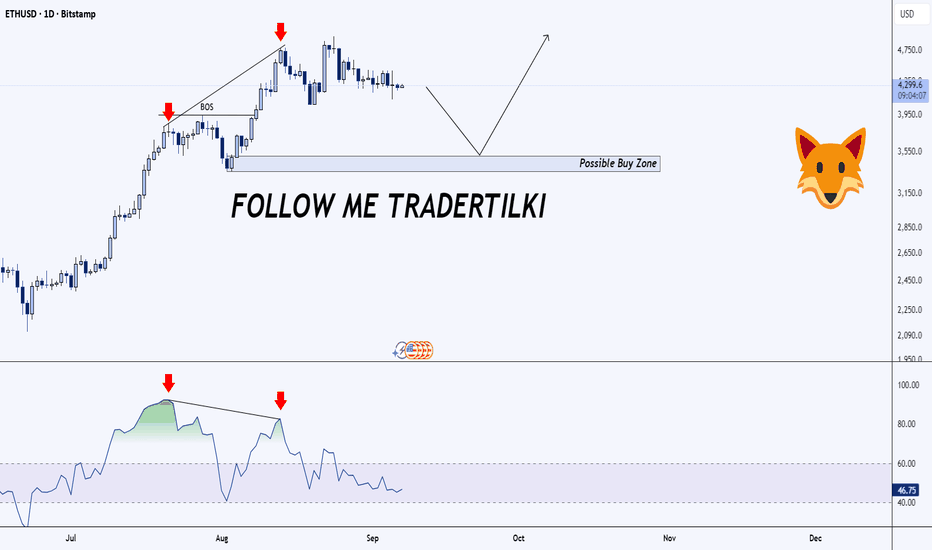

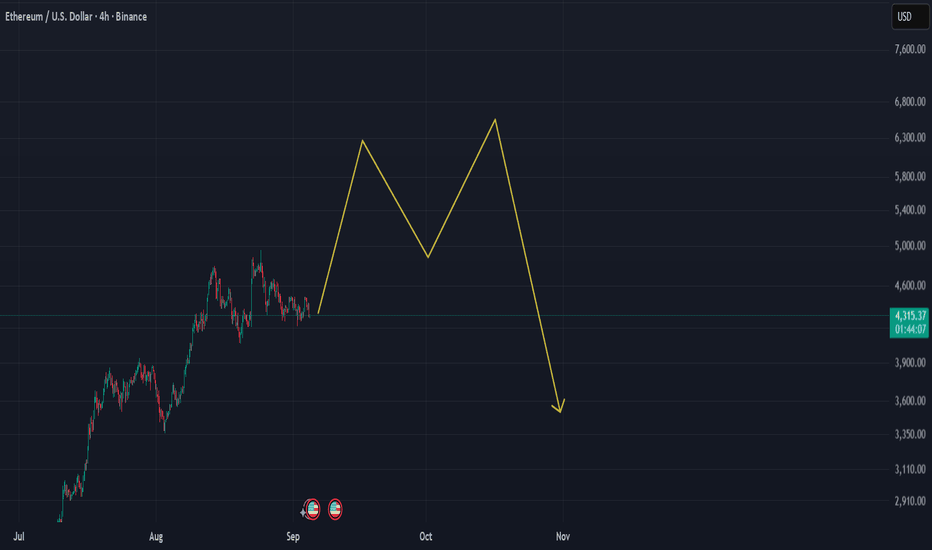

Ethereum climbing, but RSI throwing shade stay sharpGuys, I’ve also put together an Ethereum analysis for you.

Ethereum is an amazing coin that’s not up for debate. But it’s already climbed quite a bit. I haven’t bought in at this point, but if it drops to the 3,538.0 – 3,357.0 range, I’d definitely be looking to buy.🔥

Right now, we’re in an uptrend, but on the 1‑day chart I spotted a divergence on the RSI indicator. It looks like this divergence might be playing out. If the price falls below the 4,000 level, that would confirm the divergence is in effect.

Guys, I would like to thank everyone who supports my analyses with their likes. Your likes boost my motivation, and that's why I share these analyses.

ETHUSD trade ideas

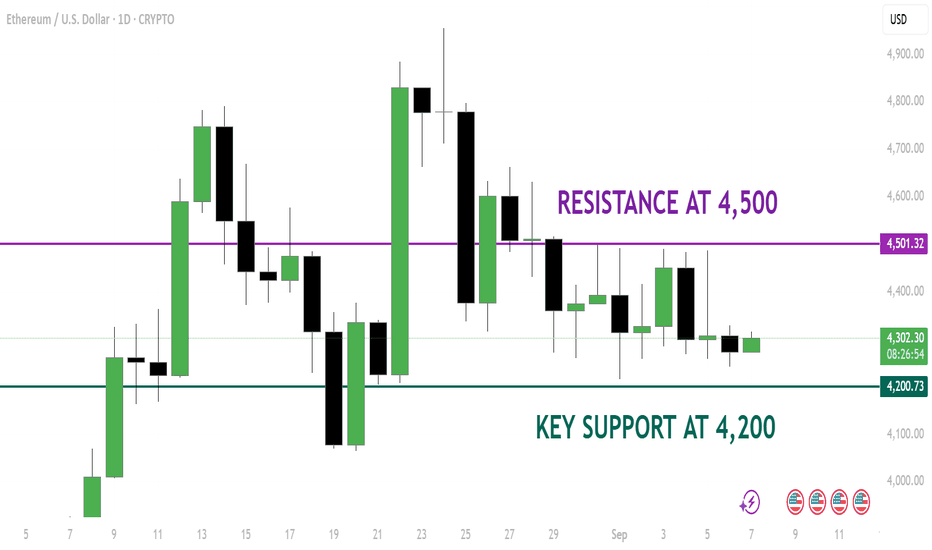

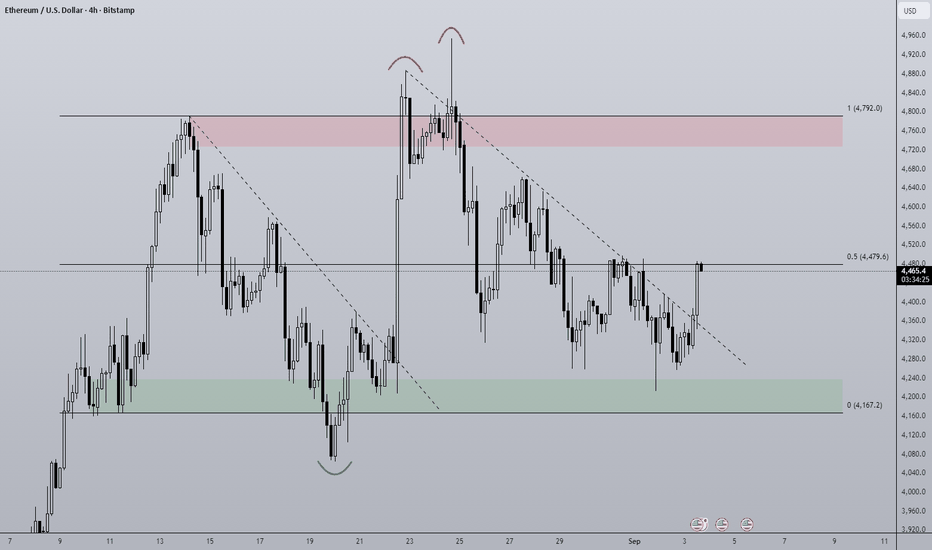

Ethereum (ETH/USD) Daily UpdateETH had a strong rally through July–August, but now price is consolidating between $4,200–$4,500.

✅ Bullish Case

If ETH holds above $4,200 support and breaks past $4,500 resistance, we could see momentum carry toward $4,800–$5,000 next.

❌ Bearish Case

If ETH loses $4,200 with a strong close, watch for a deeper pullback toward $3,950–$3,800.

🎯 Takeaway

ETH is in a sideways consolidation after a strong run. The next breakout from this range will likely decide the next big move.

👉 Are you leaning bullish continuation or bearish pullback here?

Don't forget to follow me, boost this post and comment your ideas.

-Neo

ETH/USD: Could $5,000 Be Just Around the Corner?Ethereum (ETH) is currently trading at $4,285, experiencing a slight decline from the previous close. Intraday, it reached a high of $4,474 and a low of $4,261. The $4,300–$4,400 range has been acting as a key support zone, and a breach below this could see ETH testing the $4,000 level, with the 50-day EMA providing additional support. Immediate resistance is observed around $4,530, and a successful breakout above this level could pave the way for a move towards $5,000.

Market sentiment shows the Relative Strength Index (RSI) approaching overbought territory, indicating potential for a short-term pullback. Significant institutional accumulation continues, with firms like BlackRock increasing their ETH holdings. The approval of Ethereum ETFs in the U.S. and Australia has led to increased investor participation, contributing to upward price pressure.

Short-term volatility is expected as ETH tests these key support and resistance levels. A breakout above $4,530 could signal a bullish continuation towards $5,000, while a drop below $4,000 may lead to further downside. Long-term prospects remain positive, supported by growing institutional interest and favorable market conditions.

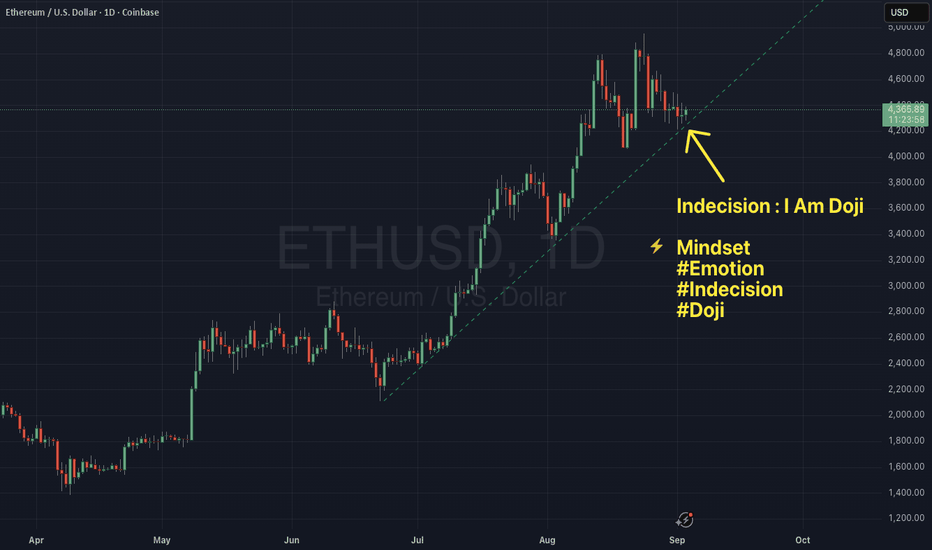

Indecision - The Human Experience of Being A DojiContext : Daily Chart ETHUSD.

Uptrend intact.

Price sitting right on the trend line.

Price consolidating into a series of dojis.

Imagine this scenario.

You have a plan.

You're a trend trader.

You're looking to get long.

You start to observe the context…

We’re into September.

Tech showing signs of correcting.

Gold heading up.

This chart... right here, right now is consolidating.

And so you experience a little flicker.

A small niggle …

There it is.

The voice of doubt.

"I should get long but maybe this is the one that gives way".

You feel a moment of indecision.

And you’re stuck frozen

The human version of a doji.

Indecision has a cost and takes a toll.

Not just in lost opportunity BUT in energy and confidence.

A simple practice to help guard against this:

Pre-decide the conditions.

Write down before you enter what tells you to stay in and what tells you to step aside.

Separate the signal from the noise.

Notice the flicker of doubt, but act on your plan, not the passing thought.

Doubt will always show up.

The edge comes from knowing what you’ll do when it does.

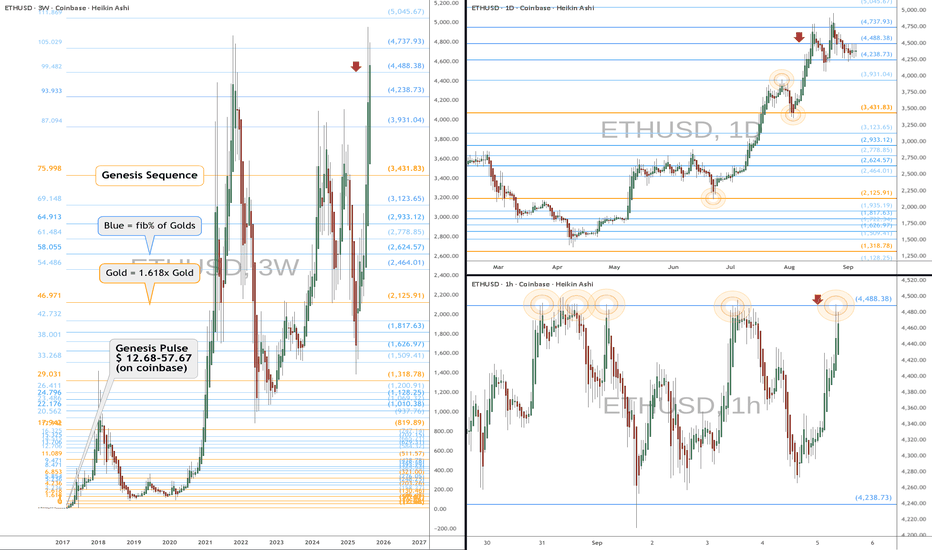

ETH eyes on $4488: Proven Genesis Fib holding up new ATHETH has been consolidating near its highs.

Banging its head into a Genesis Fib at $4488,38

Break could be VIOLENT, rejection could be DOOM.

See "Related Publications" for previous charts that NAILED key levels.

===========================================================

.

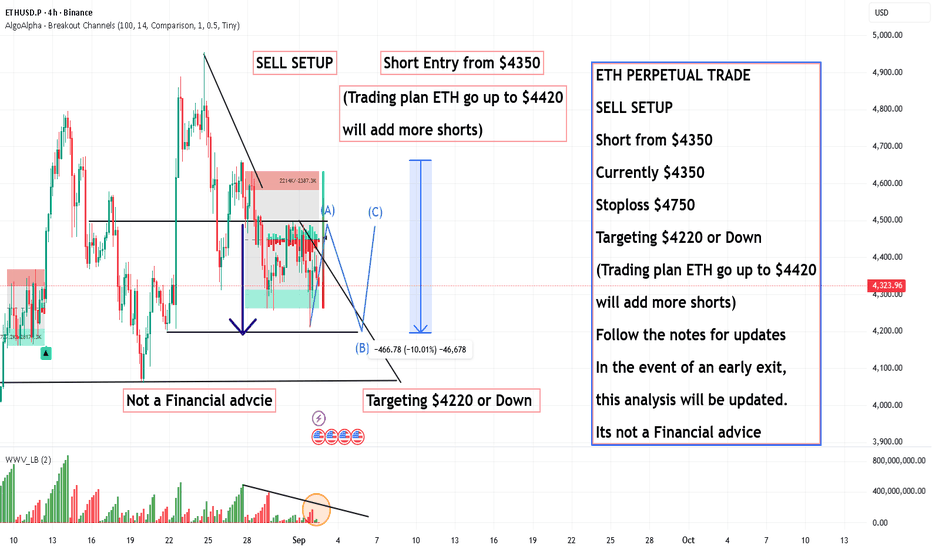

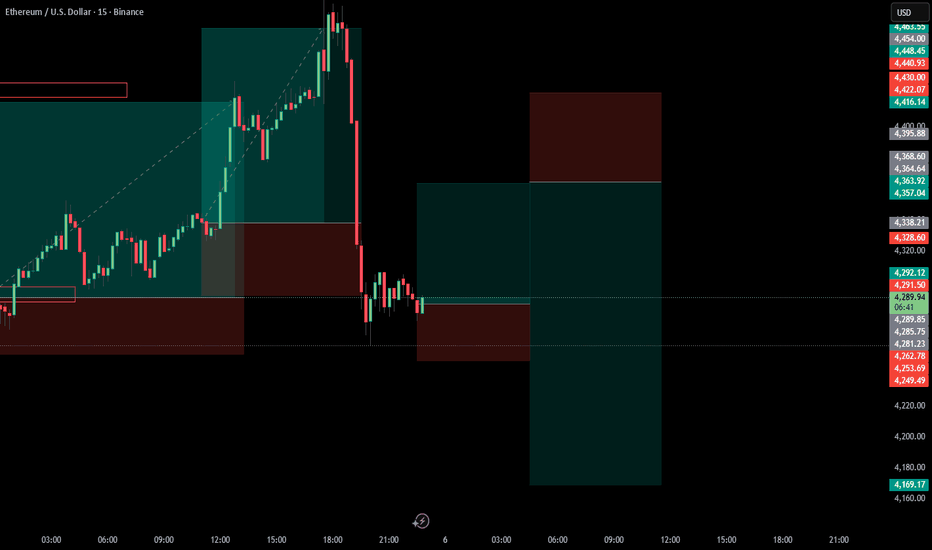

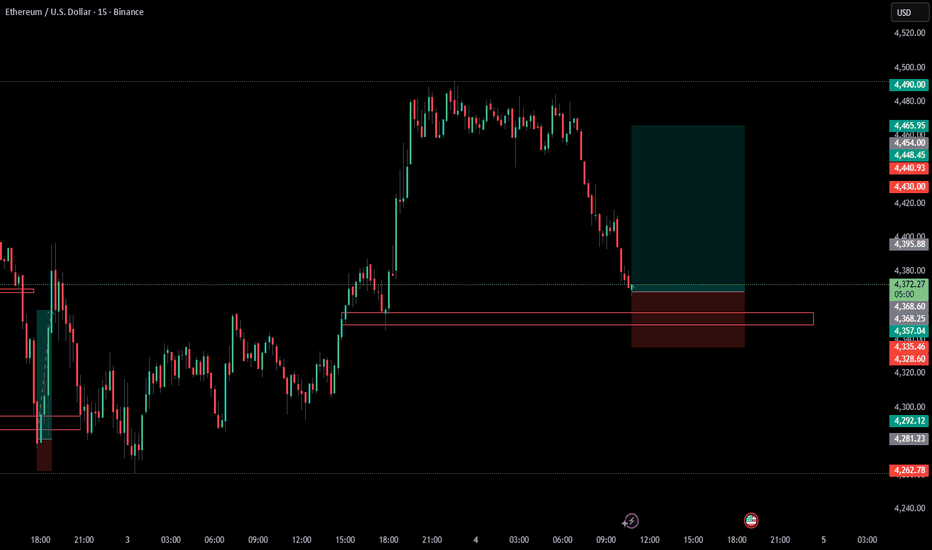

ETH PERPETUAL TRADE SELL SETUP ,Short from $4350ETH PERPETUAL TRADE

SELL SETUP

Short from $4350

Currently $4350

Stoploss $4750

Targeting $4220 or Down

(Trading plan ETH go up to $4420

will add more shorts)

Follow the notes for updates

In the event of an early exit,

this analysis will be updated.

Its not a Financial advice

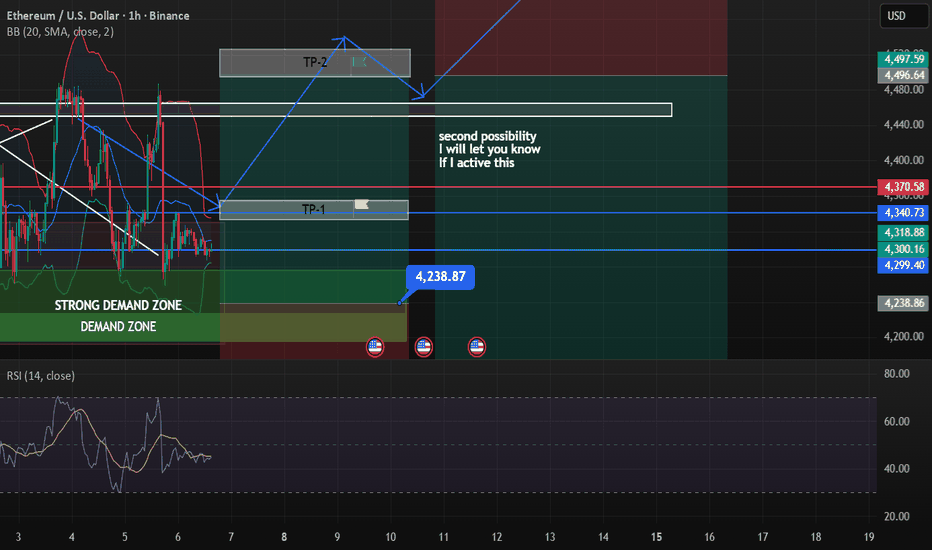

ETHUSD BUY NOW 4280🟢 ETHUSD – Bullish Setup at 4280 Long Opportunity

Ethereum is showing strong bullish momentum, bouncing off key demand near 4280, with buyers stepping in aggressively. Price action confirms support holding, and technical indicators suggest continuation toward higher resistance zones.

🔹 Trade Idea: BUY ETHUSD @ 4280

- Entry: 4280

- Stop Loss: 4215 (below recent demand zone)

- Take Profit: 4450 / 4600

- Risk/Reward: ~2:1

📊 Technical Confluence:

- Bullish structure intact above 4267 support

- MACD crossover and RSI trending upward

- Price respecting ascending trendline

- Volume spike confirming buyer interest

💬 Narrative:

ETH continues to consolidate within a rising channel, with institutional interest and positive sentiment driving upside. A clean break above 4450 could open the path to 4600 and beyond.

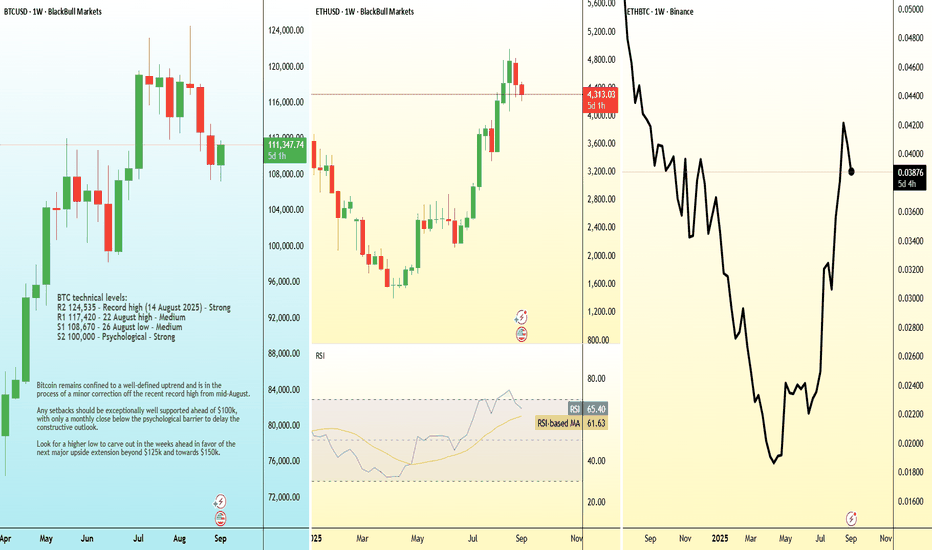

Why Ethereum is Outperforming Bitcoin? | FX ResearchWhile Bitcoin did manage to push to a fresh record high, the broader august trend reflected cautious investor sentiment, supported by modest momentum and ongoing macro uncertainty. The narrative suggests price resilience, but without the forcefulness needed for the next wave of bullish momentum.

In stark contrast, Ethereum continued with its run of outperformance—posting double-digit returns and surpassing its 2021 peak to hit fresh all-time highs. Its rally was powered by robust institutional demand, record ETF inflows, and active on-chain metrics like rising transaction volumes and reduced network fees. Favorable regulatory signals, particularly stablecoin-friendly legislation, further stoked confidence in ETH’s utility-driven narrative.

This divergence has shifted the ETHBTC dynamic sharply in ETH’s favor. As Bitcoin grinded higher with subdued volatility, Ethereum’s performance underscored its emergence as the speculative bellwether, attracting capital rotating away from Bitcoin’s more mature positioning.

Exclusive FX research from LMAX Group Market Strategist, Joel Kruger

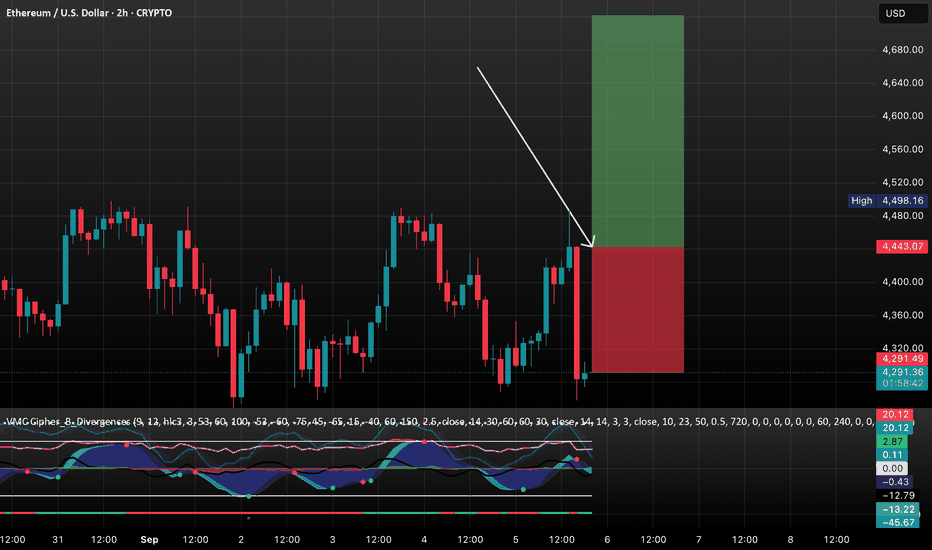

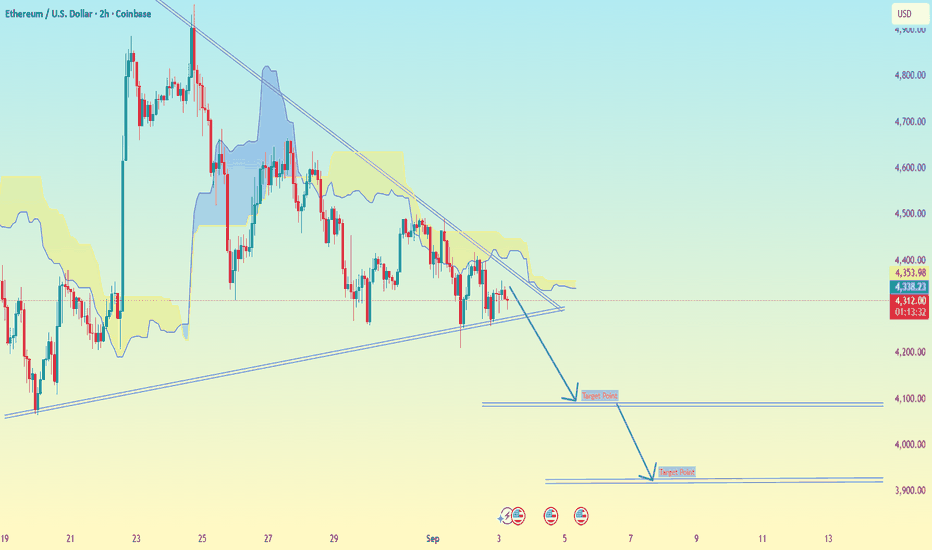

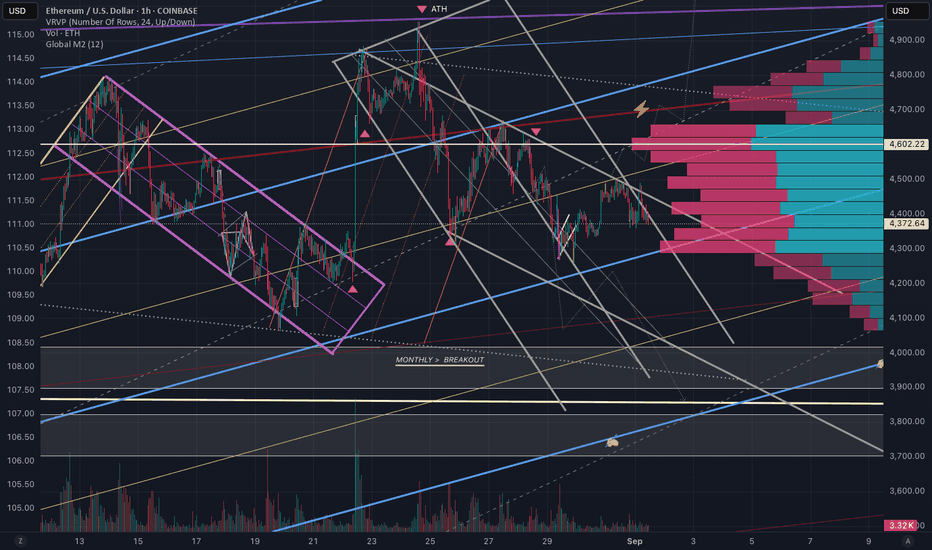

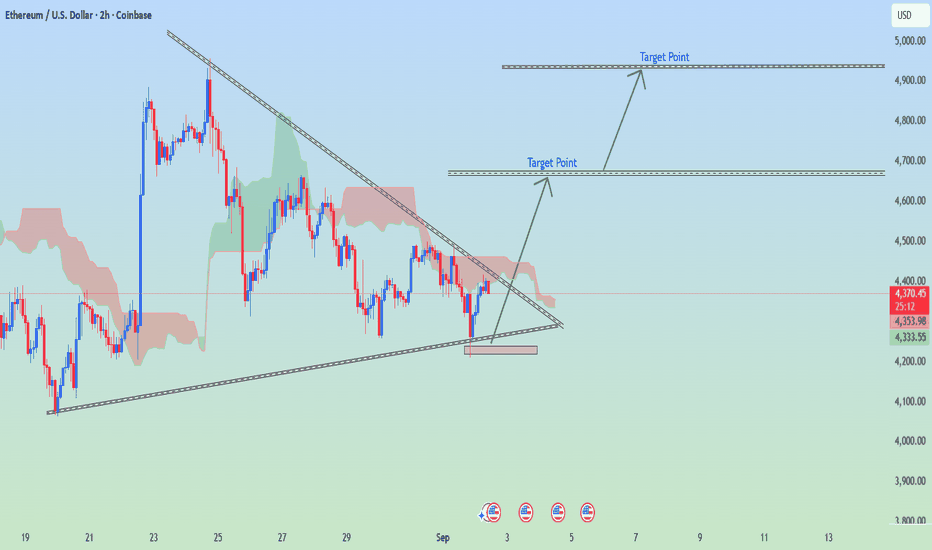

ETH/USD (Ethereum vs USD) chart (2H timeframe.ETH/USD (Ethereum vs USD) chart (2H timeframe, Coinbase), here’s what I see:

---

📊 Setup

ETH is trading around 4,314 USD.

Price is under the Ichimoku cloud (bearish bias).

A descending triangle pattern is visible, with a support trendline below.

Your chart projection shows downside targets.

---

🎯 Target Points

First Target: ~ 4,100 USD

Second Target: ~ 3,900 USD

These are marked with blue arrows on My chart.

---

⚠ Stop-Loss Suggestion

Above 4,420 – 4,450 USD (break above resistance + cloud).

---

✅ Summary:

ETH looks bearish short-term while below the cloud and resistance.

First target: 4,100 USD

Second target: 3,900 USD

Stop-loss above 4,420 – 4,450 USD

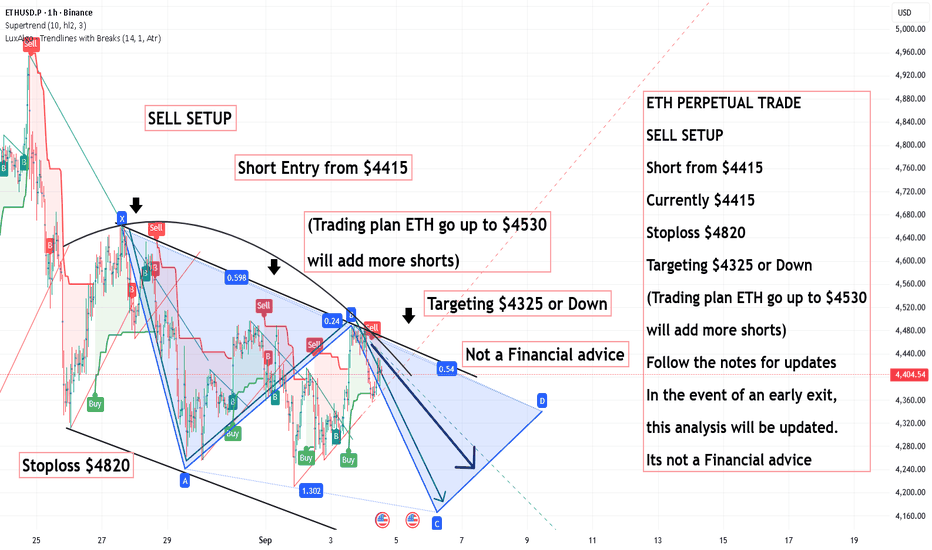

ETH PERPETUAL TRADE ,SELL SETUP Short from $4415ETH PERPETUAL TRADE

SELL SETUP

Short from $4415

Currently $4415

Stoploss $4820

Targeting $4325 or Down

(Trading plan ETH go up to $4530

will add more shorts)

Follow the notes for updates

In the event of an early exit,

this analysis will be updated.

Its not a Financial advice

Ethereum Whales Scoop Up 260K ETH, Fueling $5K Recovery Hopes

The cryptocurrency market is witnessing a significant shift as Ethereum whales accumulate massive positions, with recent data showing an unprecedented 260,000 ETH purchased in just 24 hours. This substantial whale activity is generating considerable optimism among investors and analysts, who are now eyeing a potential recovery toward the psychologically important $5,000 price level.

Massive Whale Accumulation Signals Market Confidence

Large-scale Ethereum holders, commonly referred to as "whales" in the cryptocurrency community, have demonstrated remarkable confidence in ETH's future prospects through their recent buying behavior. The acquisition of 260,000 ETH in a single day represents approximately $650 million worth of Ethereum at current market prices, indicating that institutional and high-net-worth investors are positioning themselves for what they perceive as an imminent price rally.

This whale accumulation pattern is particularly significant given the broader market context. While many retail investors remain cautious following recent market volatility, sophisticated investors with substantial capital reserves are taking advantage of current price levels to build sizeable positions. The concentrated nature of these purchases suggests coordinated confidence among major market participants rather than isolated buying decisions.

The timing of this accumulation is noteworthy as well. Ethereum has been trading in a consolidation phase following its previous rally, and whale activity often serves as a leading indicator of upcoming price movements. Historical data shows that significant whale accumulation periods frequently precede major price breakouts, lending credence to the bullish sentiment surrounding ETH's near-term prospects.

Bitcoin Profit Rotation Driving Ethereum Demand

A particularly interesting aspect of the current market dynamics is the apparent rotation of capital from Bitcoin into Ethereum. As Bitcoin approaches resistance levels and shows signs of consolidation, savvy investors are taking profits from their BTC positions and reallocating these funds into ETH. This rotation strategy reflects a sophisticated understanding of market cycles and the relative value proposition between the two leading cryptocurrencies.

Bitcoin's recent performance has been strong, but many analysts believe that Ethereum may offer superior upside potential in the coming months. The rotation from BTC to ETH is not merely a short-term trading strategy but reflects fundamental beliefs about Ethereum's technological advantages and ecosystem growth potential. This capital rotation is providing additional buying pressure for ETH while simultaneously reducing selling pressure from profit-taking activities.

The scale of this rotation is substantial enough to impact market dynamics significantly. When large holders move capital between cryptocurrencies, it often creates momentum that smaller investors follow, potentially amplifying the initial movement. This phenomenon could be contributing to the sustained buying pressure we're observing in Ethereum markets.

Technical Analysis Points to $5K Target

From a technical analysis perspective, the current whale accumulation is occurring at what many chartists consider optimal entry levels. Ethereum's price action has formed what appears to be a strong support base, and the addition of substantial whale buying is providing the foundation for a potential breakout to higher levels.

The $5,000 price target that has emerged in analyst discussions is not arbitrary. This level represents a significant technical milestone that would place Ethereum at new all-time highs, surpassing its previous peak reached during the 2021 bull market. Achieving this target would require approximately a 50-60% rally from current levels, which, while substantial, is not unprecedented for Ethereum during strong market phases.

Several technical indicators are aligning to support this bullish thesis. The accumulation by whales is reducing the available supply on exchanges, creating conditions for price appreciation when demand increases. Additionally, on-chain metrics show declining ETH reserves on major exchanges, suggesting that holders are moving their assets to cold storage with long-term holding intentions.

Fundamental Drivers Supporting Price Recovery

Beyond technical factors, several fundamental developments are supporting the case for Ethereum's price recovery. The network's transition to proof-of-stake consensus has fundamentally altered ETH's economic model, introducing deflationary mechanisms that reduce supply over time. This structural change creates long-term upward pressure on prices, particularly when combined with sustained demand.

The growth of decentralized finance (DeFi) continues to drive demand for ETH as the primary collateral and gas token for the Ethereum ecosystem. Recent developments, including major DeFi protocols expanding their offerings and new innovations in yield generation, are attracting both institutional and retail capital to the Ethereum network. This increased activity translates directly into increased demand for ETH.

Layer 2 scaling solutions are also contributing to Ethereum's value proposition by making the network more accessible and cost-effective for users. While some initially worried that Layer 2 solutions might reduce demand for mainnet ETH, the opposite has proven true. These scaling solutions are enabling new use cases and bringing more users to the Ethereum ecosystem, ultimately increasing overall network value and ETH demand.

Institutional Adoption Accelerating

The whale accumulation we're observing is likely driven, at least in part, by increasing institutional adoption of Ethereum. Major corporations, investment funds, and financial institutions are recognizing Ethereum's potential as both a store of value and a platform for innovation. This institutional interest is providing a stable foundation of demand that supports higher price levels.

Recent regulatory clarity in various jurisdictions has made it easier for institutions to hold and trade Ethereum. The approval of Ethereum ETFs in multiple markets has provided traditional investors with regulated exposure to ETH, broading the potential investor base significantly. This institutional infrastructure is creating new channels for capital to flow into Ethereum, supporting the whale accumulation trend.

The institutional adoption story extends beyond simple investment holdings. Many institutions are building applications and services on Ethereum, creating operational demand for ETH that goes beyond speculative investment. This utility-driven demand provides a more stable foundation for price appreciation than speculation alone.

Market Sentiment and Risk Factors

While the whale accumulation and associated price targets are generating significant optimism, it's important to consider potential risk factors that could impact Ethereum's trajectory. Macroeconomic conditions continue to influence cryptocurrency markets, and changes in monetary policy or economic outlook could affect investor appetite for risk assets like ETH.

Regulatory developments remain a key consideration for Ethereum's future. While recent regulatory clarity has been generally positive, ongoing discussions about cryptocurrency regulation in major markets could introduce volatility. However, Ethereum's established position and broad ecosystem make it less vulnerable to regulatory challenges than smaller, less established cryptocurrencies.

Competition from other blockchain platforms also represents a consideration, though Ethereum's first-mover advantage and network effects provide substantial competitive moats. The ongoing development of Ethereum 2.0 and associated scaling solutions are addressing many of the performance concerns that competitors have attempted to exploit.

Looking Ahead: October Catalyst Potential

Many analysts are pointing to October as a potential catalyst month for Ethereum's price recovery. This timing aligns with historical patterns showing that the fourth quarter often brings increased cryptocurrency market activity. The combination of whale accumulation, institutional adoption, and seasonal patterns could create a perfect storm for price appreciation.

The prediction of a potential "bear trap" in September, where prices might temporarily decline to the mid-$3,000 range before surging in October, reflects sophisticated market timing strategies. Such scenarios often catch retail traders off-guard while providing additional accumulation opportunities for sophisticated investors who understand market cycles.

Conclusion

The recent whale accumulation of 260,000 ETH represents a significant vote of confidence in Ethereum's future prospects. Combined with capital rotation from Bitcoin, technical breakout potential, and strong fundamental drivers, conditions appear favorable for a substantial price recovery toward the $5,000 target level.

While short-term volatility remains possible, the sustained whale buying suggests that sophisticated investors are positioning for longer-term appreciation. The combination of reduced supply through staking and burning mechanisms, increased institutional adoption, and ongoing ecosystem development creates a compelling investment thesis for Ethereum.

Investors should remain aware of potential risks and market volatility, but the current accumulation pattern by whales provides strong evidence that major market participants expect significant appreciation in Ethereum's value. As the cryptocurrency market continues to mature and institutional adoption accelerates, Ethereum appears well-positioned to benefit from these broader trends, potentially making the $5,000 price target achievable in the coming months.

The convergence of technical, fundamental, and sentiment factors creates an unusually positive outlook for Ethereum. While past performance doesn't guarantee future results, the current whale accumulation pattern mirrors successful accumulation phases that have preceded major rallies in Ethereum's history, suggesting that similar outcomes may be possible in the current market cycle.

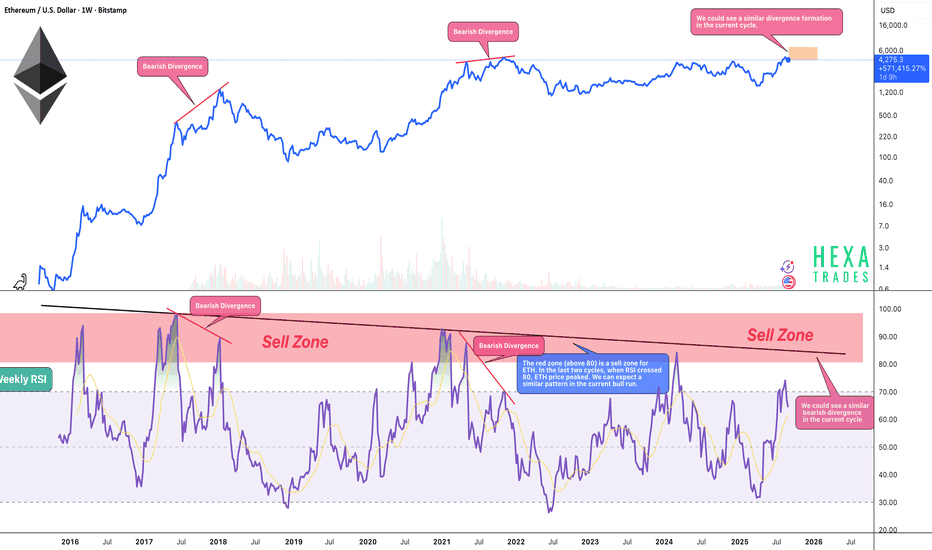

Ethereum Peak Incoming!The above ETH chart highlights the historical relationship between Ethereum’s weekly RSI and major cycle peaks. The red sell zone (RSI above 80) has consistently marked high-risk areas where ETH price eventually topped out.

📜Historical Patterns

🔷 2017 Bull Run

- RSI reached 98 (extreme overbought).

- ETH price peaked soon after.

- A bearish divergence followed, where ETH made higher highs while RSI made lower highs — signaling exhaustion before the major correction.

🔷 2021 Bull Run

- RSI peaked at 92, lower than the 2017 cycle.

- ETH price again topped within this red sell zone.

-A clear bearish divergence formed as ETH pushed to new highs while RSI declined. This preceded the end of the cycle.

🔷 Current Cycle (2025)

-RSI is trending higher and approaching the 80+ sell zone once again.

- Based on the cycle-to-cycle decline (98 → 92 → projected 85), this run could see its RSI peak around 85.

- If ETH price enters the 80+ RSI zone while forming a bearish divergence, ETH could be trading in the $6K–$7K range.

- The projected timing for this peak is late Q4 2025 or early Q1 2026.

📉 Declining RSI Peaks Show Market Maturity

-Each bull run has shown a lower RSI peak compared to the last (2017: 98 → 2021: 92 → projected 2025: 85).

-This reflects ETH’s market maturity: price continues to grow, but volatility and overbought extremes decline cycle by cycle.

🐻 Bearish Divergence Watch

- After previous RSI peaks, ETH displayed a consistent bearish divergence:

Price → higher highs

RSI → lower highs

- This pattern has historically signaled weakening momentum before a macro top.

- We could see a similar divergence formation in the current cycle, marking a potential exhaustion phase.

🎯 Trading Implications

- RSI above 80 = high-risk sell zone.

- A projected RSI peak near 85 could align with ETH’s cycle high.

- ETH may trade in the $6K–$7K range if this setup plays out.\

- Expected peak timing: end of Q4 2025 or beginning of Q1 2026.

- Monitoring RSI and divergence signals will be key in spotting the top.

Conclusion: In 2017, ETH peaked with the RSI hitting 98, while in 2021 the RSI topped at 92. For the current 2025 cycle, the projected RSI peak is around 85. This consistent decline in RSI peaks across cycles highlights ETH’s market maturity, with reduced volatility as the asset grows. Historically, each major top has also been preceded by a bearish divergence, and a similar setup could form again. Traders should remain cautious as ETH approaches the red sell zone above 80 RSI.

Cheers

Hexa

CRYPTOCAP:ETH BITSTAMP:ETHUSD BINANCE:ETHUSDT

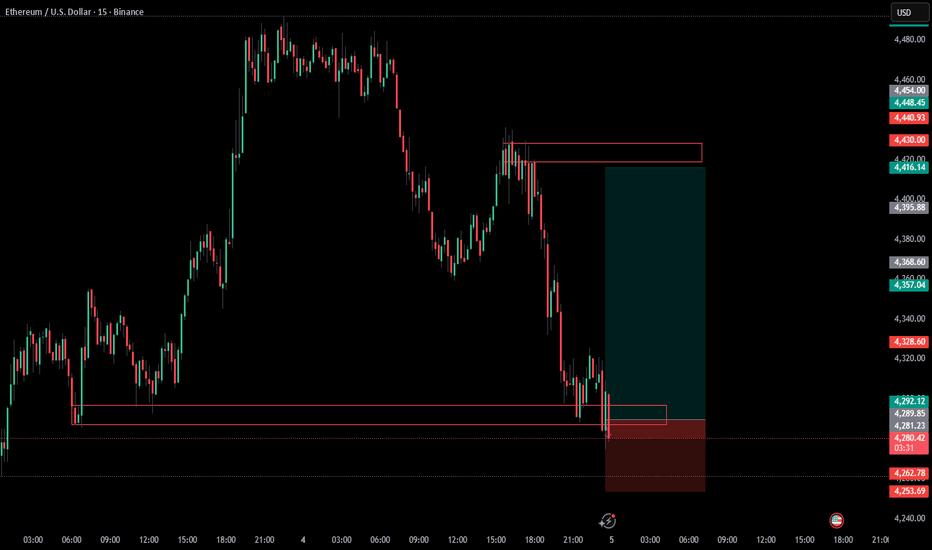

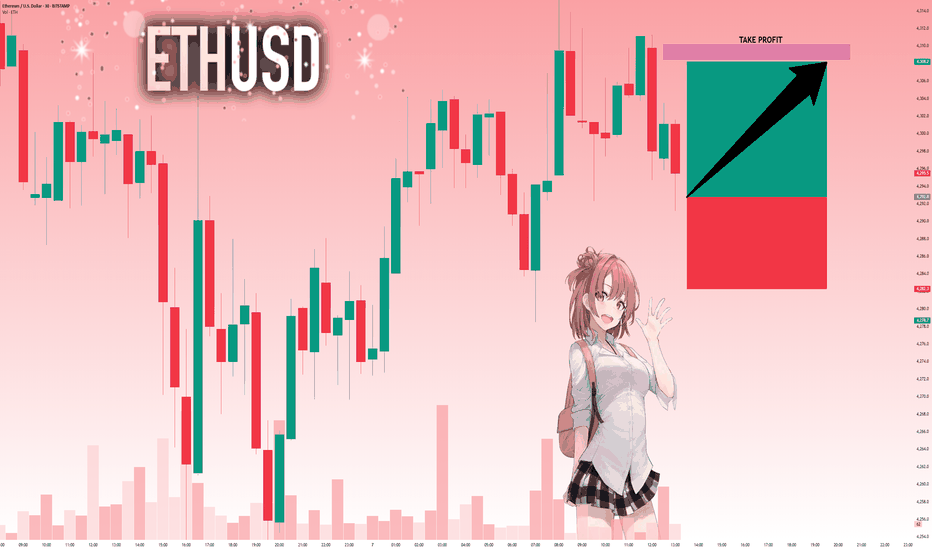

ETHUSD: The Market Is Looking Up! Long!

My dear friends,

Today we will analyse ETHUSD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 4,292.8 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 4,308.2.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

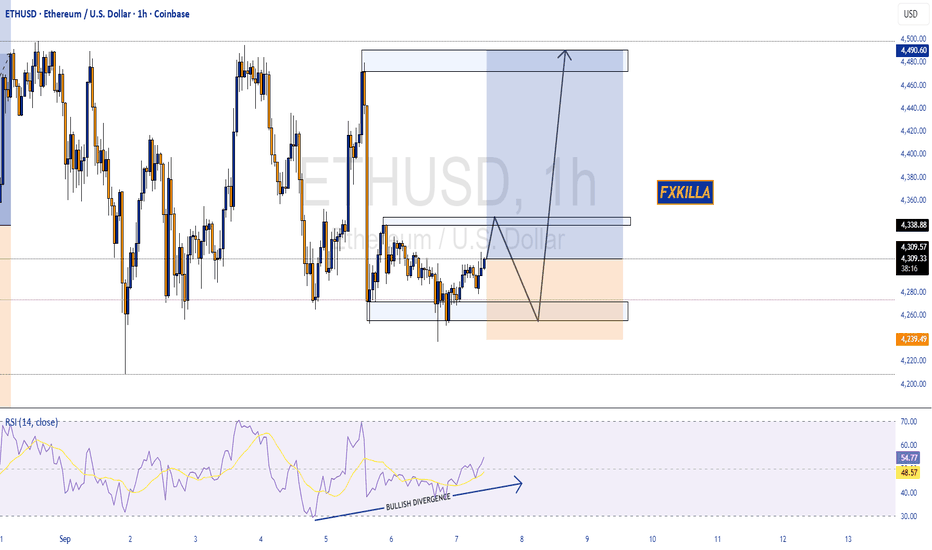

ETH/USD (Ethereum vs US Dollar) ETH/USD (Ethereum vs US Dollar) 2-hour chart on Coinbase.

From My chart setup:

Price is consolidating inside a falling wedge pattern.

I have marked two breakout targets already.

📌 Targets shown on your chart:

First target point: around 4,700 – 4,720

Second target point: around 4,940 – 4,960

⚠ Important Notes:

A wedge breakout to the upside would confirm these targets if volume supports the move.

If ETH fails to break above the wedge and loses support (~4,300 – 4,250), the setup becomes invalid and could drop further.

ETHUSD BUY NOW 4287🟢 ETHUSD – Bullish Setup at 4287 Long Opportunity

Ethereum is holding strong above key support at 4280–4290, showing signs of bullish continuation. Price action confirms buyer strength, with momentum indicators aligning for a potential breakout toward higher resistance zones.

🔹 Trade Idea: BUY ETHUSD @ 4287

- Entry: 4287

- Stop Loss: 4215 (below recent structure)

- Take Profit: 4450 / 4600

- Risk/Reward: ~2:1

📊 Technical Confluence:

- Bullish engulfing candle on 1H

- MACD crossover and RSI above 50

- Price respecting ascending channel

- Volume spike confirming accumulation

💬 Narrative:

ETH continues to attract institutional interest, with inflows rising and sentiment shifting bullish. A clean break above 4350 could accelerate toward 4600, especially if BTC maintains strength.

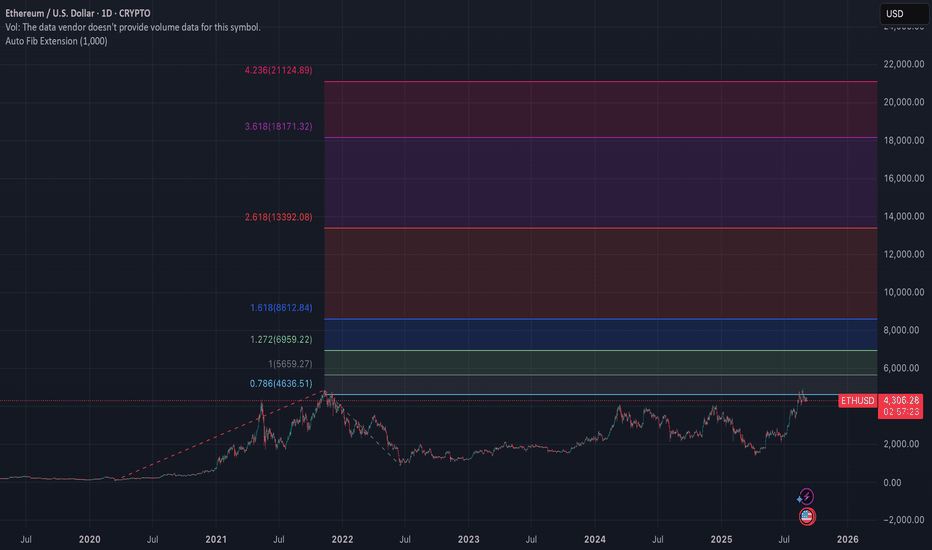

ETHUSD AUTO FIB 1000 DEPTH MACRO🔎 Key Fibonacci Levels (depth 1000 chart) / Set at 1000 to closely track 4 year cycle

0.618 → $3,839 (recently reclaimed, now support)

0.786 → $4,636 (current resistance zone)

1.000 → $5,659 (macro breakout confirmation)

1.272 → $6,959

1.618 → $8,612

2.618 → $13,392

3.618 → $18,171

4.236 → $21,124

📊 Probabilistic Outlook (based on history + structure)

0.786 ($4,636): Very close overhead. Odds of testing = 80–90% in this cycle.

1.000 ($5,659): Historically tagged in every ETH cycle. Odds = ~85% if bullish structure holds.

1.272 ($6,959): Tagged in all past ETH bull cycles. Odds = ~75%.

1.618 ($8,612): Historically hit in every run. Odds = ~65%.

2.618 ($13,392): Hit in both 2017 and 2021. Odds = ~45% (usually requires euphoric late-cycle blowoff).

3.618 ($18,171): Hit in 2/3 historical cycles. Odds = ~25–30%.

4.236 ($21,124): Extreme extension, only tagged in strongest cycles. Odds = ~15–20% (basically “mania top” territory).

⚖️ Summary

High confidence: ETH tests $5.6k–7k (1.0 → 1.272 Fib) this cycle.

Likely but needs momentum: ETH pushes to $8.6k (1.618 Fib).

Possible in full mania: $13k (2.618 Fib).

Euphoric blow-off only: $18k–21k (3.618–4.236).

ETH UPDATEMy former analysis of ETH touch my support and resistance twice total %10 at least %5

But unfortunately it wasnt my path I expected direct and strong candles but we couldnt stay over the resistance and fall twice this may be sign for not the push my main target (red box)

Now we will see third one but if we fail again It wont be good for ETH. I will active my second order if I see weakness So you may want to close all your positions when we hit full target, after TP1 put stop loss to break even and wait this is your choice I will let you know for other uptades keep following

Always manage your own risks this is not a investment advise I am not responsible neither your loss nor profit.

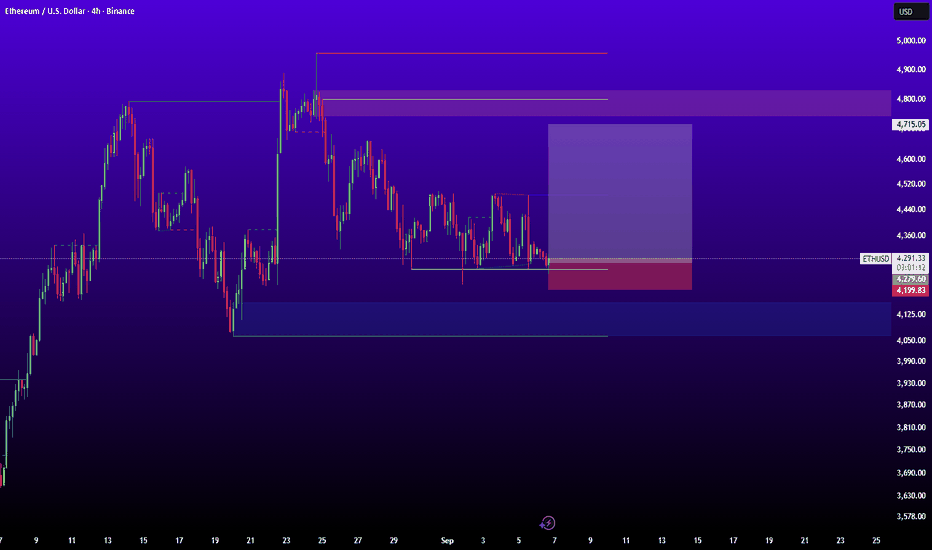

Ethereum 4H Range As we approach nearly a month in the range from $4000-4800 it looks like ETH is making a move once again.

Previously once hitting $4800 price gradually sold off back towards range low creating a bearish trendline, once the price broken above that level a rapid move up to range high within two candles.

Now looking at the chart we have a similar setup, strong breakout from the bearish trendline up into midpoint. Bitcoin currently retesting a key level of $112,000, should BTC flip this level I could see alts getting the greenlight to move up and Ethereum up to the highs.

Should BTC reject from $112,000 it makes sense that ETH range midpoint would be strong resistance, rejection could lead to a range low retest. Anything else that isn't either range high, range low or midpoint is noise and for me no action required, no need to over complicate it.

ETHUSD BUY 4350ETHUSD Long Setup – Eyeing Momentum Above 4350

📌 Entry: 4350

🛡️ Stop Loss: (Set based on your risk tolerance, e.g., below recent support)

🎯 Target: (Optional – define based on resistance zones or fib levels)

Ethereum is showing signs of strength after consolidating near a key support level. A clean break above 4350 signals bullish intent, supported by improving volume and short-term trend alignment. This setup favors momentum traders looking to capitalize on a potential leg up toward the next resistance zone.

Watch for confirmation on lower timeframes and monitor BTC correlation for added confluence. Ideal for intraday or swing entries depending on volatility.

#ETHUSD #CryptoTrading #Ethereum #BreakoutSetup #BullishBias #MomentumTrade #TradingViewIdeas

Want me to tailor this for meme-style engagement or algo-friendly tagging? I can remix it in seconds.