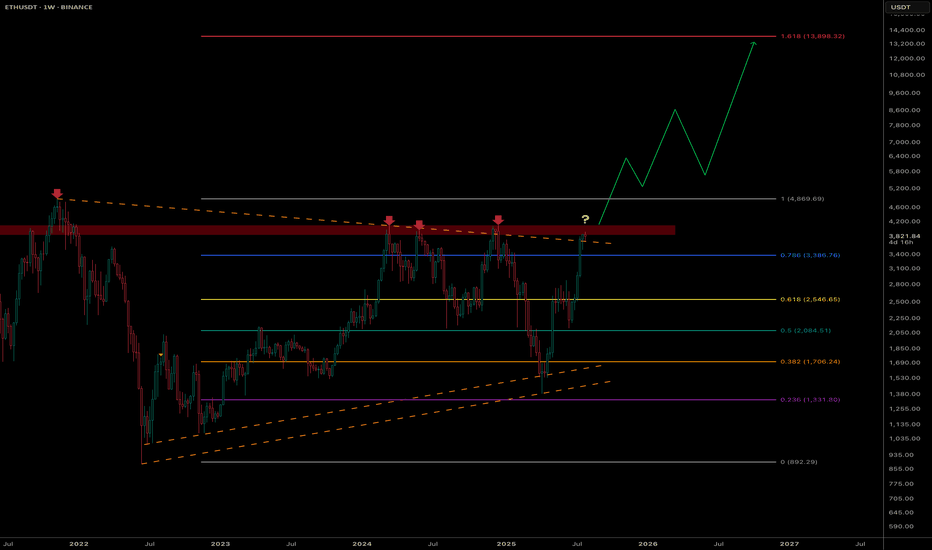

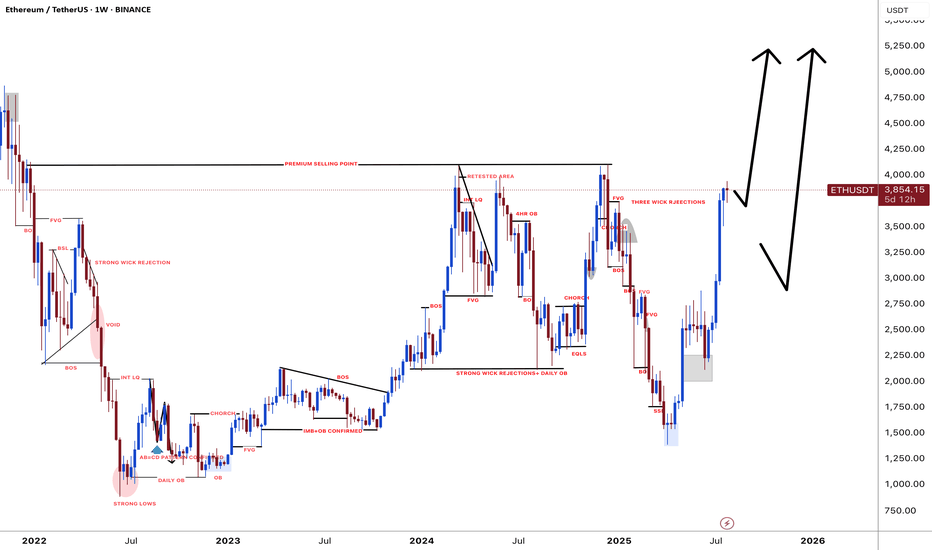

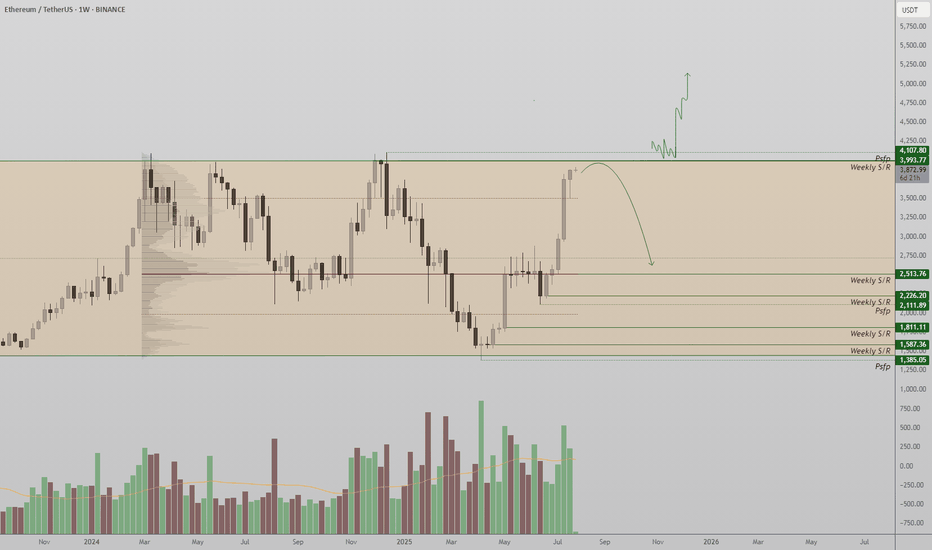

ETH what is next !This chart displays the weekly price action of Ethereum (ETH), which is currently retesting a key resistance zone around the $4,000 level. This area has acted as a major barrier since 2021, rejecting price multiple times and preventing further upside.

Now, ETH is once again approaching this critical level. If we can get a decisive breakout and a strong weekly close above $4,000, it could signal the beginning of a significant bullish move.

A confirmed breakout could open the door to a rally toward the previous all-time high near $4,860. If momentum continues, the Fibonacci extension points to a long-term target around $13,898 — the 1.618 extension level.

In summary:

👉 A breakout and close above $4,000 could mark the start of a strong bullish trend, with potential targets at $4,860 and $13,898.

Until that breakout is confirmed, though, we remain at a key resistance zone — so it's important to stay cautious.

ETHUSDT.P trade ideas

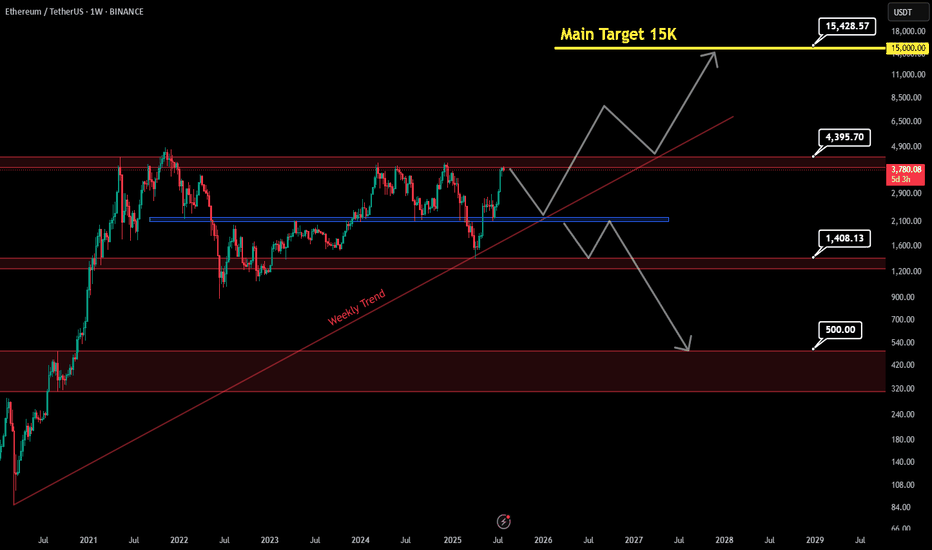

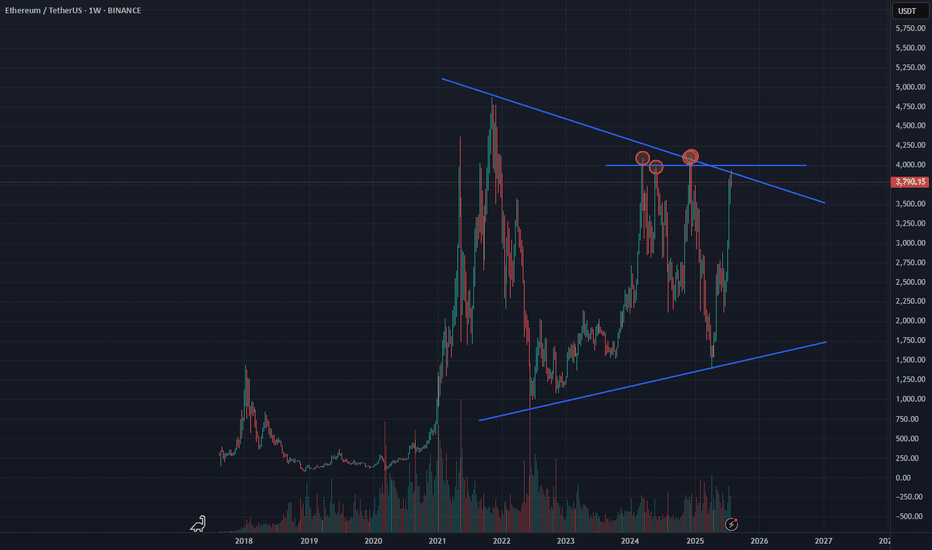

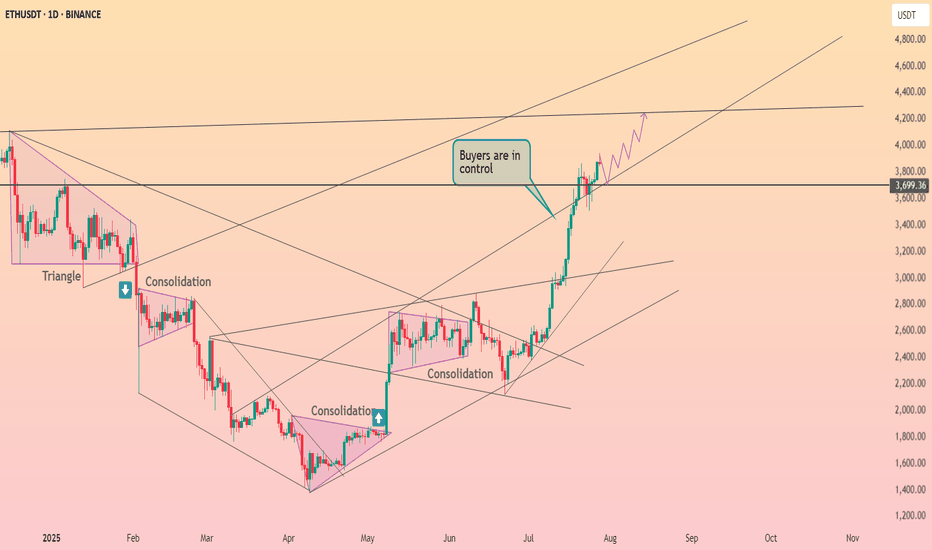

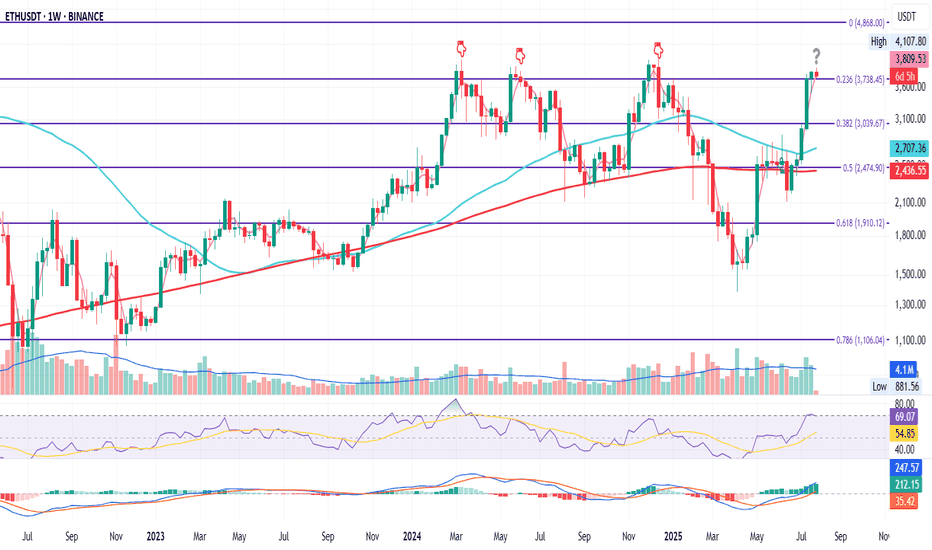

Ethereum to 15K ? or fall to 500$ !!📊 Ethereum – Long range outlook

If the price manages to break the red resistance zone above and hold above it, the path will be poised to reach the main target at $15,000, as shown by the rising arrows. If it fails, it has another opportunity to regroup buyers from the resistance at $2,228, with a very important trend that will support the upward move.

If the price fails to break the rebound from $2,227, closes this area ($2,227), and then breaks the weekly trend, we expect a sharp drop to $1,408 and even $500 in the long term.

Main Target : 15,000$

eth buyI think Ethereum is ready for a historic bull run, it has collected almost all the lower stops and has done everything right in terms of the right trend pattern. But from a fundamental perspective, with the arrival of President Trump and the launch of Ethereum ETFs, we can see a historic growth for Ethereum from a fundamental perspective, but we have to wait for the right pattern for the entry point. I will specify a few ranges for you, and my expectation is that Ethereum will be at $20,000.

ethereumI think Ethereum is ready for a historic bull run, it has collected almost all the lower stops and has done everything right in terms of the right trend pattern. But from a fundamental perspective, with the arrival of President Trump and the launch of Ethereum ETFs, we can see a historic growth for Ethereum from a fundamental perspective, but we have to wait for the right pattern for the entry point. I will specify a few ranges for you, and my expectation is that Ethereum will be at $20,000.

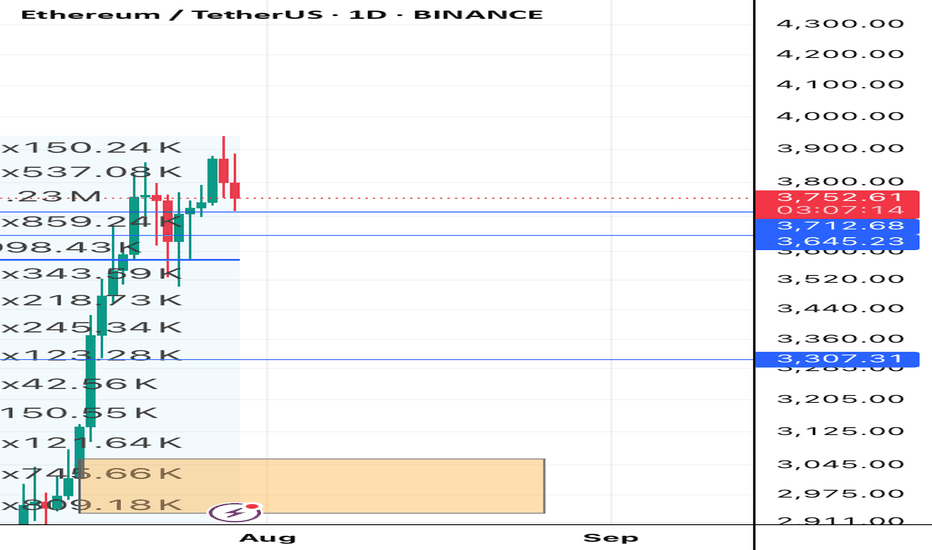

Ethereum Turns 10 Amid Bullish News and Institutional AccumulatiJuly 23, 2025 - World Liberty Financial a crypto project linked to U.S. President Donald Trump spent millions to acquire more Ethereum and acquired more than 3,400 ETH

July 29, 2025 - World Liberty Financial purchased 256.75 ETH for $1 million

July 29, 2025 - The mining company BitMine, which has adopted the strategy of accumulating Ethereum (ETH), presented the results of a study according to which the cost of replacing Ethereum is $60 thousand. The current price of the altcoin is 15 times lower, it fluctuates around $3.8 thousand

Against the backdrop of such strong news, tomorrow July 30, 2025 ETH will have a bile tomorrow, 10 years since the coin was created

Ethereum has tried to break through the $4,000 mark and stay there 4 times already

Against the backdrop of such powerful news, it is clear that institutional investors are clearly preparing for the fact that the coins will grow in the long term, and for some time to strengthen on new ATN

In the near future, you can focus on the $4100 and $4200 marks

Also, you should not bet on growth, a correction from the current marks to $3600 is always possible

AI-powered charting tools and news sentiment analyzers indicate a continued bullish trend

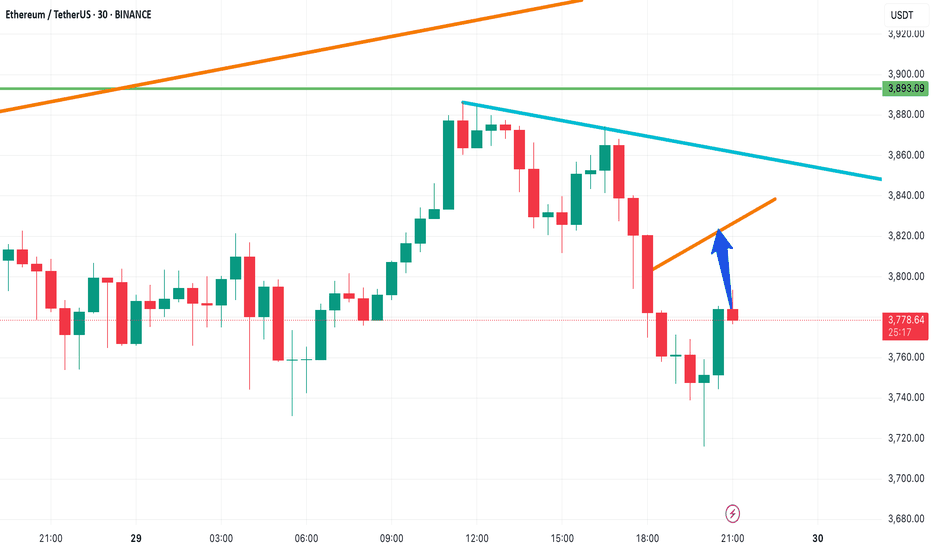

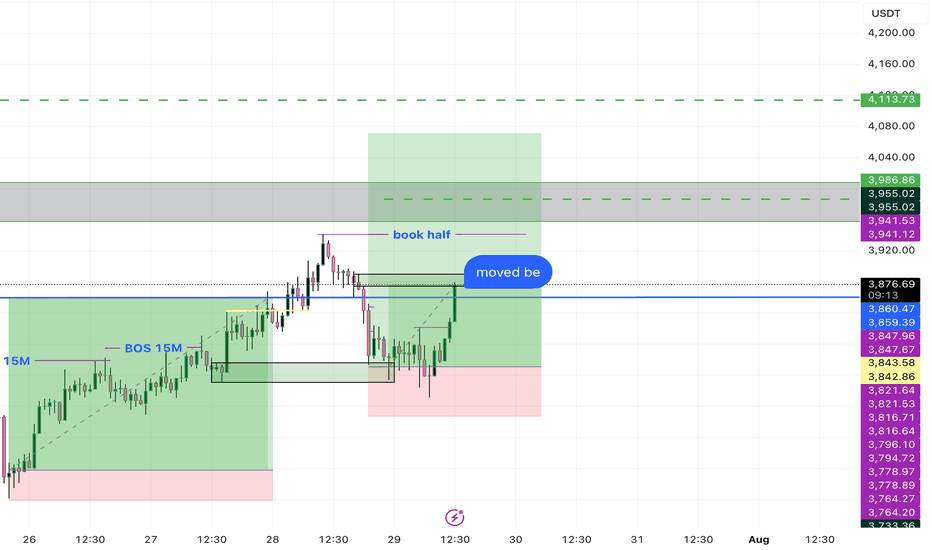

ETH Update – Eyes on the $3,820 Zone📈 ETH Update – Eyes on the $3,820 Zone

Ethereum is showing bullish momentum, and there’s a strong chance it could rally toward the orange resistance line around $3,820.

If price breaks above this level, the next target will be the blue trendline, marking the next key resistance.

🚀 Stay ready — momentum is building.

🔔 Follow for more clean setups and real-time analysis!

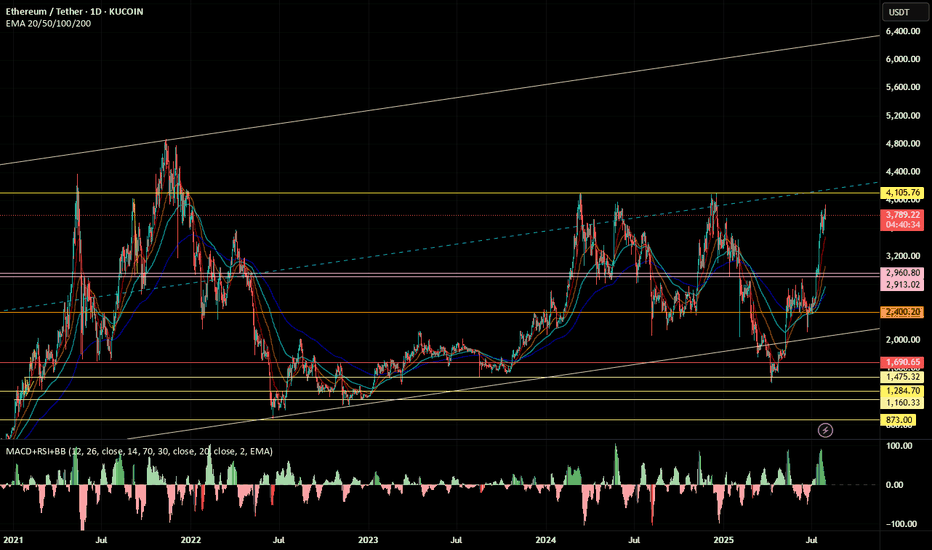

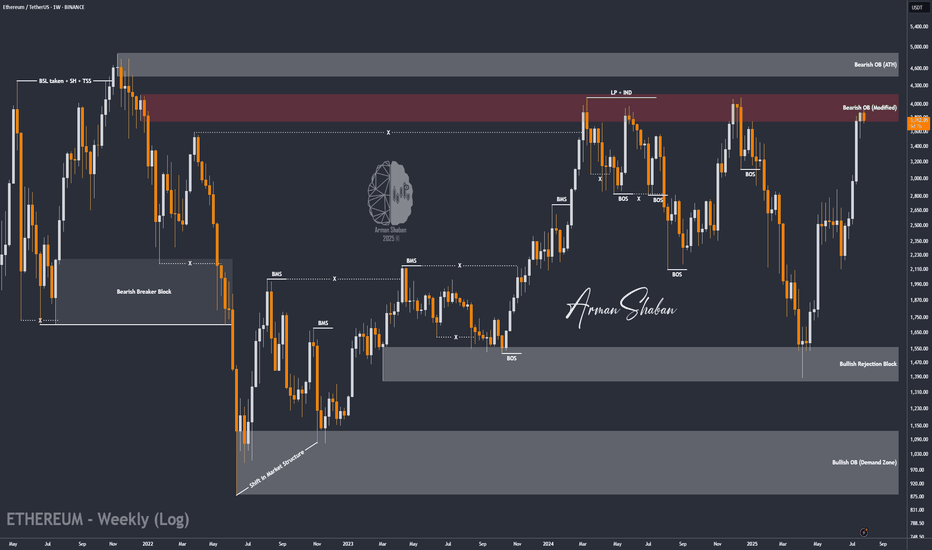

ETH/USDT | at a Crossroads – Hold Above $3440 or Sharp Fall!By analyzing the Ethereum chart on the weekly timeframe, we can see that after reaching $3940 and touching the key supply zone, ETH entered a slight correction and is currently trading around $3756. The key question now is whether it can hold above $3440 by the end of the week and push past $4000. If it does, we can expect another bullish leg toward $4100 and $4470. However, if the $3440 support fails, a sharp decline may follow — so this level is critical.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Ethereum destroyed resistance at the $3700 level ┆ HolderStatBINANCE:ETHUSDT remains stuck between $3,260 and $3,320, forming a tightening range with bullish undercurrents. Price is holding a higher low and consolidating under resistance, hinting at re-accumulation. A breakout above $3,325 could send ETH toward $3,400+ in short order. Bulls remain in control above $3,260.

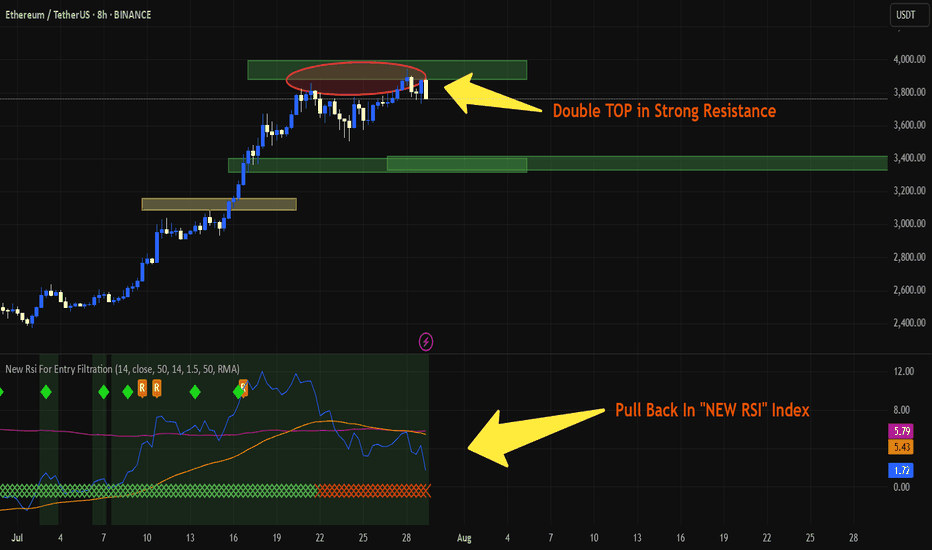

ETH is PullbackingAs I said befor, a double top has formed at around $4,000 and I guess we have a pullback to around $3,500. The "new RSI Index" is showing a pullback and strong divergence. If ETH breaks $4,000, this analysis will be rejected.

"IT is NOT a commercial advice. you may lose all your money in crypto Specially in FUTURE trading."

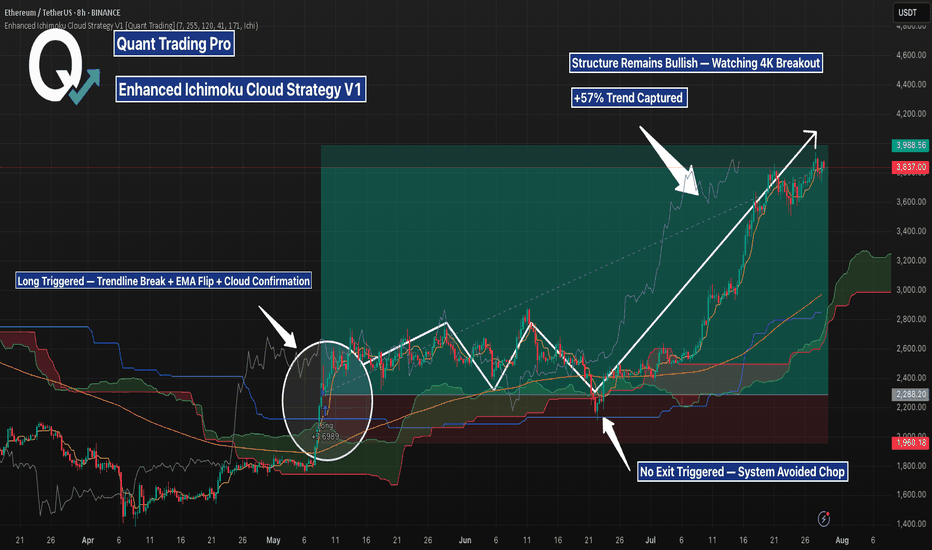

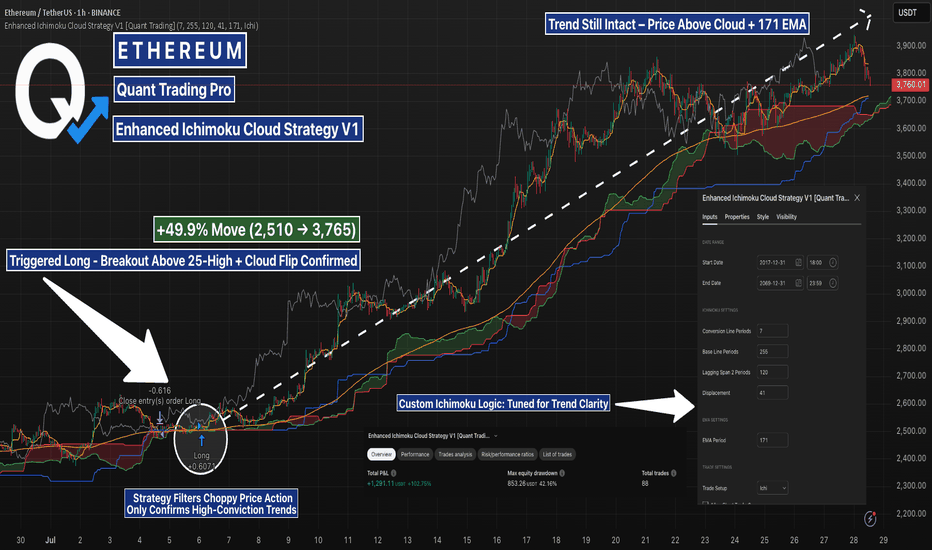

ETHUSD 8H — Strategy Nailed the Breakout, But Is $4K Next?This Ethereum 8H chart captures a powerful trend reversal, triggered by the **Enhanced Ichimoku Cloud Strategy V1**. After months of chop, the system delivered a clean entry and held the full breakout — now nearing key resistance around \$4K.

---

**📊 Setup Breakdown:**

* Entry triggered after **three major confirmations**:

* Breakout above long-term trendline

* Flip above the **171 EMA**

* Bullish **Ichimoku Cloud alignment**

* Strategy entered long near **\$2,530**, and has held the move for over 80 days

* Current price: \~\$3,988 — a **+57% trend** captured without exit signal

---

**⚙️ Strategy Logic:**

The strategy uses:

* Custom Ichimoku inputs: *(7 / 255 / 120 / 41)*

* A 171 EMA trend filter for signal clarity

* Optional “Cloud Mode” to confirm direction

* A memory-based system that reduces false chop signals

On this trade, the system **ignored mid-trend noise**, stayed in position, and let the move fully play out — exactly what it’s designed for.

---

**🔍 What to Watch Next:**

* Price structure remains bullish as ETH nears the psychological **\$4K resistance**

* Cloud support rising beneath — confirming healthy structure

* A clean break above \$4K could trigger another leg, while rejection may form a range

---

This is a prime example of how **low-frequency, high-conviction signals** can lead to massive upside when paired with disciplined exits. Backtest this strategy on your favorite altcoin pairs and compare.

Let me know when you’re ready to move to the next chart brother — this one’s ready for the spotlight 🔥

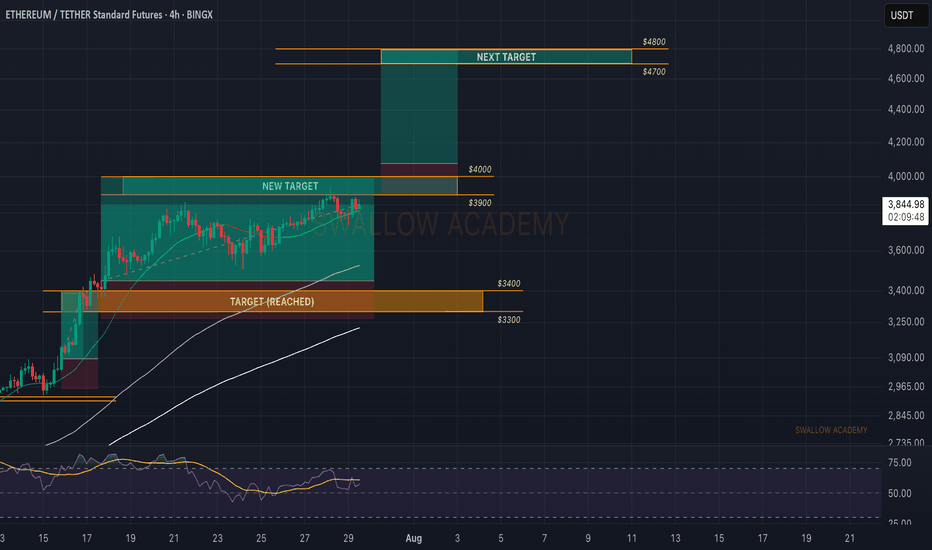

Ethereum (ETH): Approaching $4000, Targeting Next $4800Ethereum is still below our current target, which is $4000. Soon to approach it, we are looking for a breakout from there and another trade to be opened right after the breakout.

The game plan is simple: 1 trade has been successfully closed, and the second one is almost near the target. Now waiting for the third one to be activated!

Swallow Academy

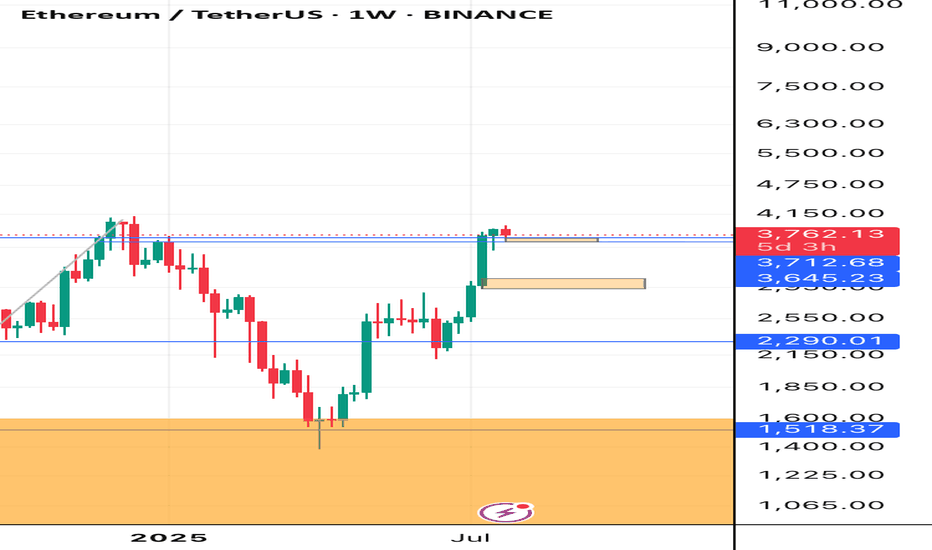

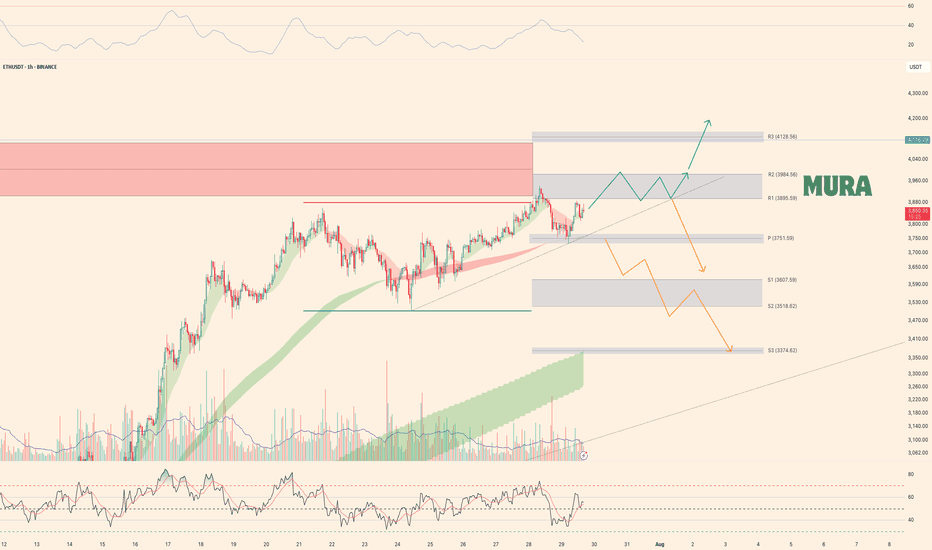

Weekly trading plan for EthereumLast week's BINANCE:ETHUSDT price action performed perfectly according to our scenarios - hitting our first target and establishing a new local high. Currently, price remains above the weekly reversal level at $3,751, maintaining potential for an advance toward Resistance #2.

Key Considerations:

While above $3,751 → Resistance #2 remains in play

Break below reversal level + trendline → Likely retest of last week's low

Such breakdown would likely breach both primary support levels

Trade Plan:

Bulls: Watch for continuation above $3,751

Bears: Require confirmed break of trendline + reversal level

As always, confirmation is key - trade the breaks, not the anticipations

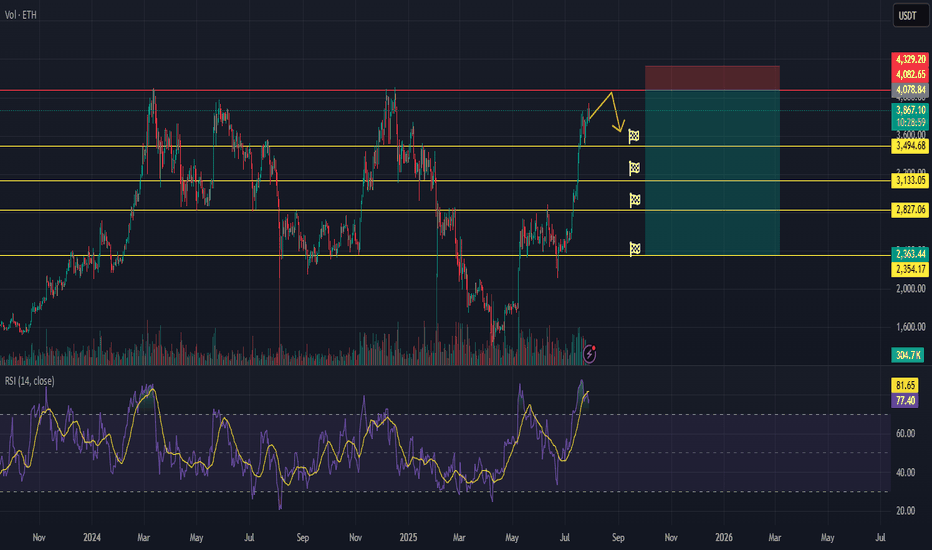

ETHUSDT short positionhi traders

🔻 Short Position Setup – Overextended at Resistance

ETH/USDT is currently trading near a major resistance zone (~$4,080–$4,330), which historically marks the top of the trading range. This level has acted as strong resistance multiple times in the past, and price is now showing signs of overextension after a sharp upward move.

📊 Technical Indicators

RSI (14): Currently overbought at 77.44, with the moving average at 81.65 — levels that have previously led to pullbacks.

Volume: Elevated during the move up, but may begin to taper as momentum slows into resistance.

🧭 Trade Strategy: Short From the Top

Entry Zone: Around current levels near $4,080–$4,330

Rationale: Shorting the top of the range with overbought RSI, expecting a retracement or range rejection

🎯 Target Zones (Take-Profit Levels)

We are monitoring multiple support levels for potential profit-taking:

TP1: $3,494

TP2: $3,133

TP3: $2,827

TP4 (max target): $2,354–$2,363

⚠️ Important Note: Although we’ve identified several potential targets, we expect to close the short position earlier — depending on how the price behaves during the retracement. We'll monitor market structure, volume, and lower timeframe signals on the way down.

🛡️ Risk Management

Stop-loss: Above the previous highs (~$4,330), to limit downside risk if the breakout is sustained

Regular monitoring is essential, as macro conditions and ETH sentiment can shift rapidly.

✅ Conclusion:

We're recommending a short trade at the top of a well-defined range, with confirmation from overbought RSI and historical rejection zones. The trade includes multiple targets, but it’s likely to be managed actively and closed partially or fully before reaching the final levels.

ETH: Will Price Continue Upwards Movement! ETH has been steadily bullish in recent times, as the crypto market experienced a significant increased a safer option to invest around the global investment community. DXY and other major currencies currently experiencing a major drawdown in prices which indirectly helping the crypto market to remain bullish. While looking at how eth has performed in recent past, we can see it creating a record high in coming weeks.

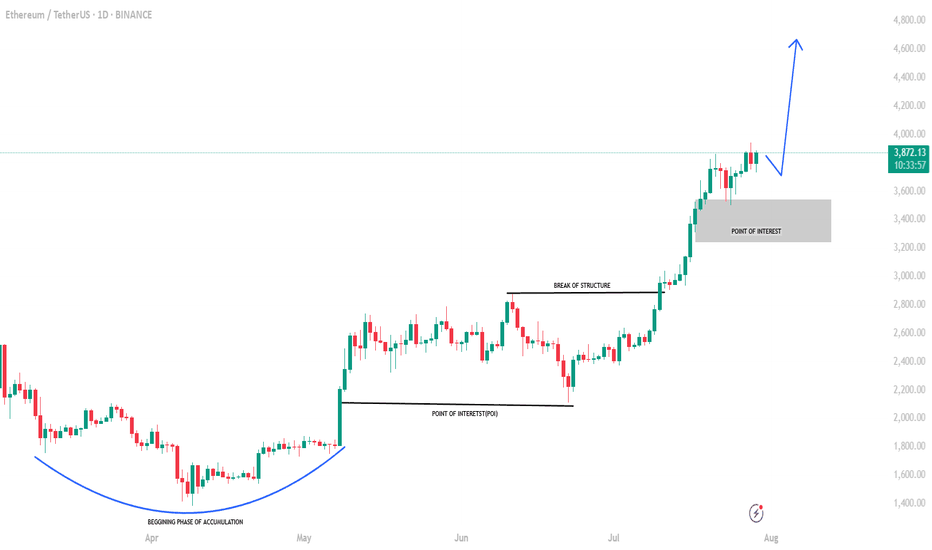

Ethereum Price to Reach $4,000, but Market Top Suggests DelayBINANCE:ETHUSDT current price stands at $3,872, holding above its local support level of $3,742. While ETH is approaching the $4,000 mark , it has not yet managed to breach it. This resistance could continue to hold, limiting Ethereum's immediate potential for further gains.

Currently, 96% of BINANCE:ETHUSDT total supply is in profit. Historically, when the profitable supply surpasses 95%, it signals a market top . This has been followed by price corrections as investors begin to secure profits.

If the market top triggers a reversal, BINANCE:ETHUSDT price could drop to $3,530 or lower . A sharp decline to $3,131 is also a possibility, erasing much of the recent gains made in the past month.

On the other hand, if the influx of new addresses continues and strengthens, BINANCE:ETHUSDT may finally break through the $4,000 resistance. Should this happen, ETH could rise towards $4,425, with a renewed surge in price. This would invalidate the bearish thesis and push Ethereum into a new bullish phase.

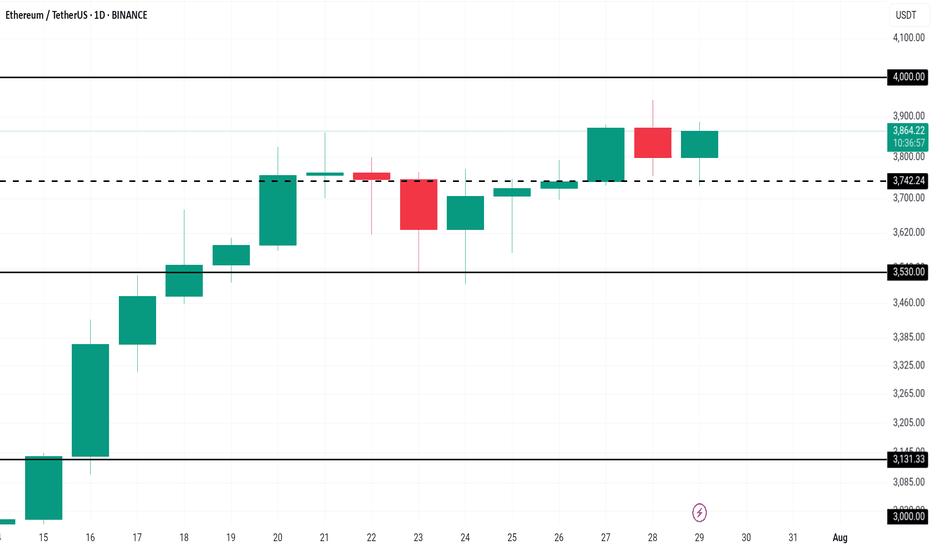

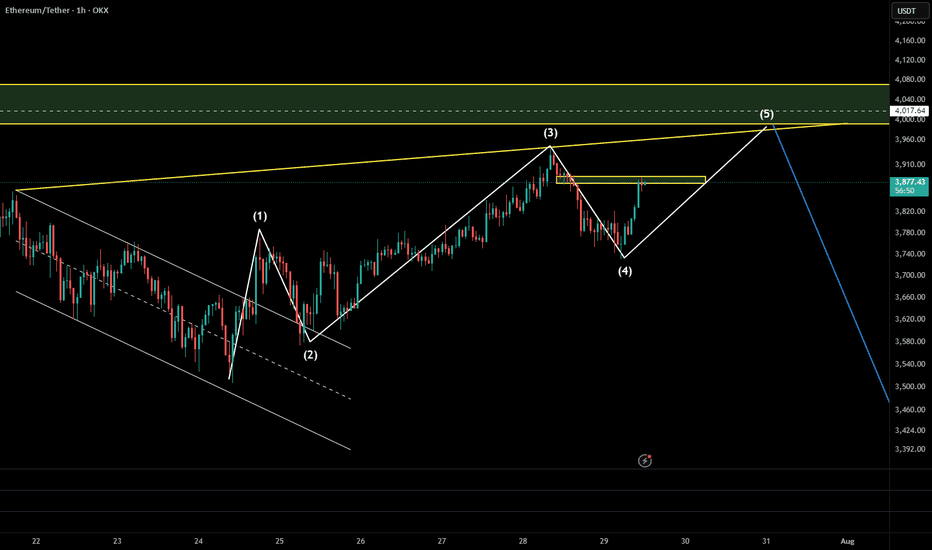

#ETHUSDT: Price is going as expected in previous ideas on eth!!ETHUSDT is performing well as expected in our previous analysis, as the price has reached the $4000 area. There are two potential areas where the price could reverse. The first is a small correction, which could cause a sharp price reversal without a significant price correction. The second area is a void price, which may be filled before any further strong bullish movement.

Please use strict risk management while trading.

Team Setupsfx_

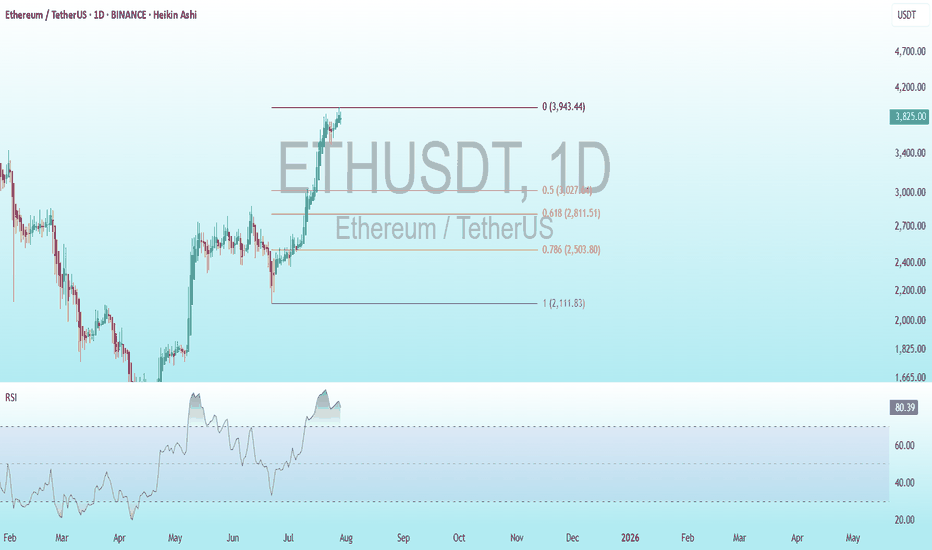

ETH Bearish DivergenceBINANCE:ETHUSDT

Rezistance Levels: 3,943.44.

Support: 2,111.83

Trade Setup:

Target 1: 3,027.64 (0.50 Fibonnaci Golden Zone).

Target 2: 2,811.51 (0.618 Fibonnaci Golden Zone).

Target 3: 2,503.80 (0.786 Fibonnaci Golden Zone).

Target 4: 2,111.83 (1 Fibonnaci).

Stop Loss: 3,943.44 (above recent high, ~25% above current price).

RSI Analysis: The RSI shows a bullish divergence (price making lower lows while RSI makes higher lows), suggesting potential upward momentum. Current RSI is around 80.39, nearing overbought territory (>70), so caution is advised.

Ethereum at a Critical Crossroad: Will $4,000 Finally Break ?Ethereum is once again approaching the psychologically significant $4,000 resistance level, a high-timeframe barrier that has rejected price on multiple occasions. As the second-largest cryptocurrency by market cap pushes higher, traders are closely watching for signs of a breakout—or another range-bound rejection.

Ethereum has entered a decisive phase, with price action now testing the upper boundary of a long-standing trading range. After multiple failed attempts to breach the $4,000 mark, ETH is consolidating just below this level, creating an environment filled with both opportunity and risk. Whether Ethereum can break through or gets rejected again will shape its mid- to long-term outlook.

Key Technical Points:

- Major Resistance at $4,000: A psychologically important level and long-time price cap on high timeframes

- Defined Trading Range: ETH has remained range-bound between $1,300 and $4,000 for an extended period

- Critical Candle Closes Needed: Breakout requires strong daily or weekly closes above $4,000 to confirm

Ethereum’s price is hovering just under the $4,000 resistance zone, which has acted as a ceiling for price action since early 2022. From a high time frame perspective, ETH has been range-bound, trading between $1,300 as the range low and $4,000 as the range high. Each visit to this upper boundary has led to a rejection and a subsequent rotation back toward mid-range or lower levels.

Now, with momentum building and bullish sentiment returning across the crypto market, Ethereum finds itself at another pivotal moment. The key technical requirement for a confirmed breakout will be a decisive daily or weekly close above the $4,000 level. Without this confirmation, any temporary push above the resistance could result in a fakeout and trap late long entries.

Volume behavior around this zone remains mixed. While there is some bullish buildup in recent sessions, there has not yet been a significant influx in volume to confirm conviction from buyers. This aligns with the historical pattern of Ethereum trading at resistance before eventually pulling back, suggesting caution is still warranted.

However, should ETH close decisively above $4,000 and turn this level into support, it would mark the first major break of this range since its inception. This would likely trigger a wave of bullish momentum, possibly sending Ethereum to new yearly highs, with $4,500–$5,000 being the next logical resistance zones based on historical price pivots and Fibonacci extensions.

What to Expect in the Coming Price Action

Ethereum’s price action is currently neutral-bullish but hinges entirely on its interaction with the $4,000 resistance. A confirmed breakout could usher in a powerful rally toward new highs, while another rejection would likely continue the long-standing range between $1,300 and $4,000. Until a decisive move occurs, traders should remain cautious and reactive rather than overly anticipatory.

ETH Weekly Flip ZoneETH on the Weekly

ETH just closed the week above the 0.236 Fib level at $3738.45.

It’s the fourth attempt to conquer this zone since the June 2022 bottom.

If price holds above this level, the odds of continuation increase.

If it fails, we could see downside.

It may also just consolidate here for a while.

RSI just touched overbought, and MACD remains green — still some room for upside.

I remain bullish long term, but this looks like a smart area to manage risk if you’re late to the move, or take partial profits.

Always take profits and manage risk.

Interaction is welcome.

ETH 1H Cloud Strategy Nailed the Trend, But Is It Losing Steam?This Enhanced Ichimoku Cloud Strategy filtered out the chop and triggered a high-conviction long at 2510 — backed by a bullish cloud flip, 25-period breakout, and alignment above the 171 EMA. Since then, price has climbed nearly +50%, with the trend still intact above both cloud and EMA.

The custom parameters (7 / 255 / 120 / 41) are tuned for clarity and patience, making it ideal for swing entries on volatile assets like ETH and SOL.

Want to optimize for your own asset? Just load the strategy, tweak the inputs, and run a parameter test using TradingView’s Strategy Tester.

#ETHUSD #Ichimoku #TradingStrategy #TrendFollowing #TradingView #CryptoTrading #AlgoTrading