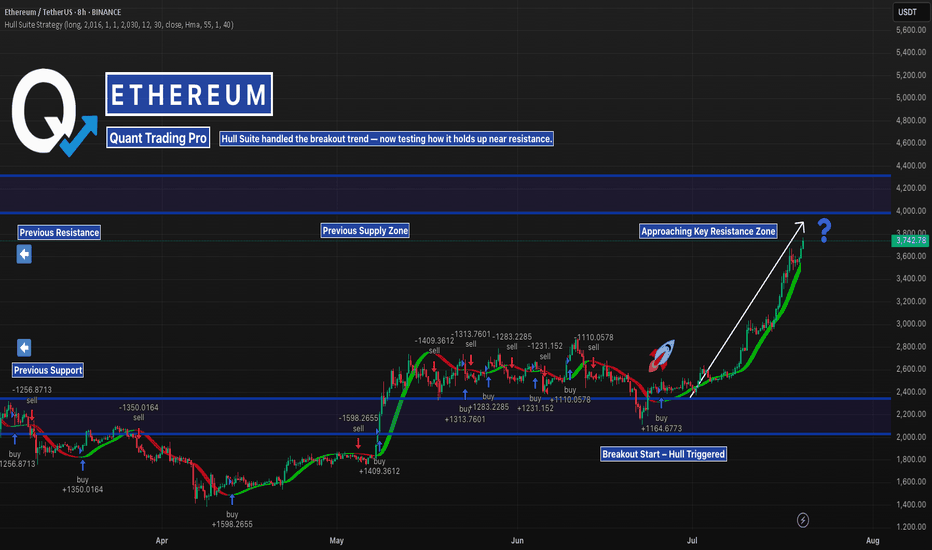

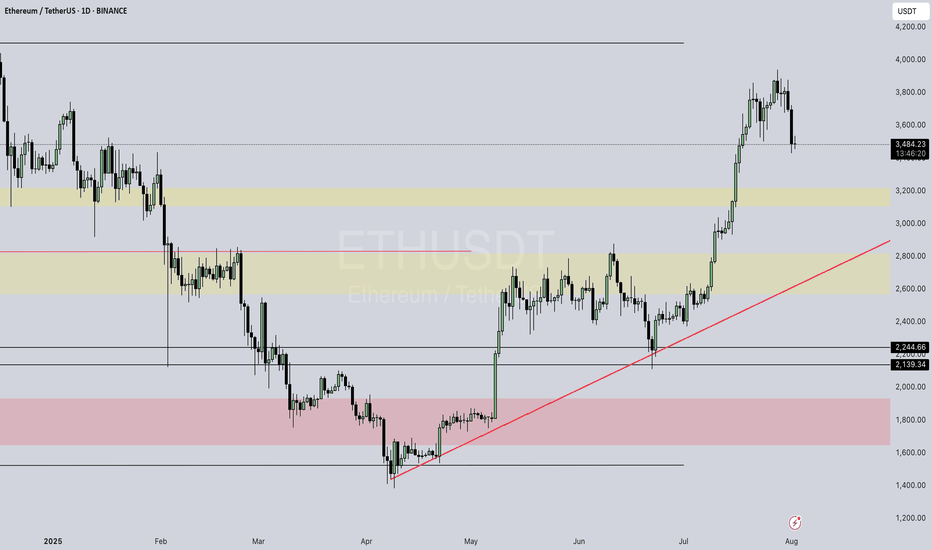

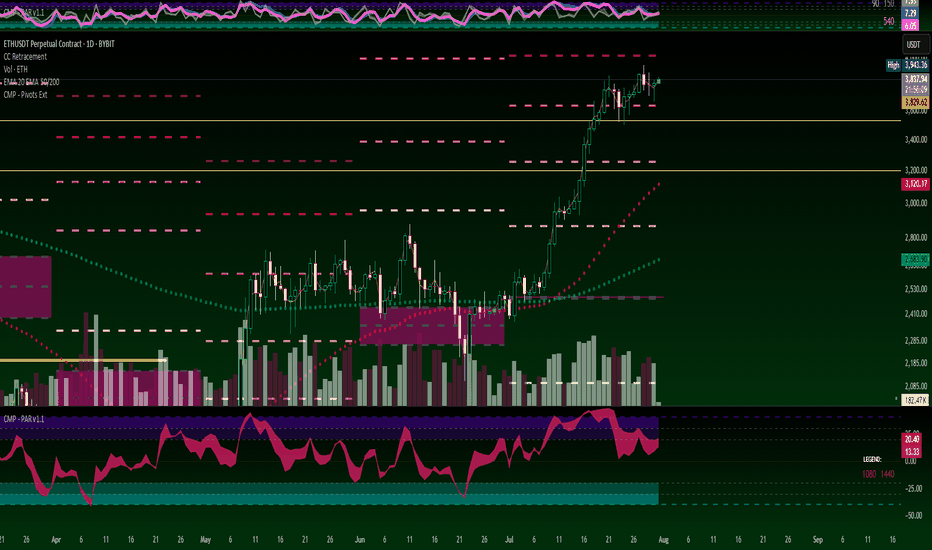

ETH in Liftoff Mode — But Resistance AheadEthereum has been trending hard — with the Hull Suite catching the breakout perfectly from the $2,200 base.

But now it’s flying straight into a key resistance zone that capped price earlier this year.

This is where many trend strategies get tested. Will Hull keep riding the wave — or will we start seeing signs of exhaustion?

📊 Watching closely how it reacts near the previous supply zone. These are the conditions where robust backtests matter most.

—

#ETHUSD #Ethereum #TrendAnalysis #HullSuite #BreakoutTrading #ResistanceZone #QuantTradingPro #TradingView #CryptoAnalysis

ETHUSDT trade ideas

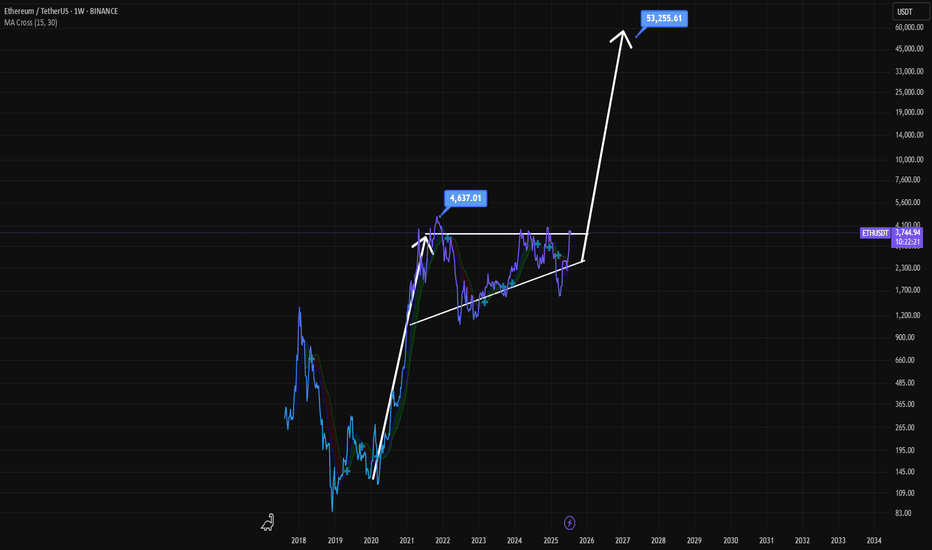

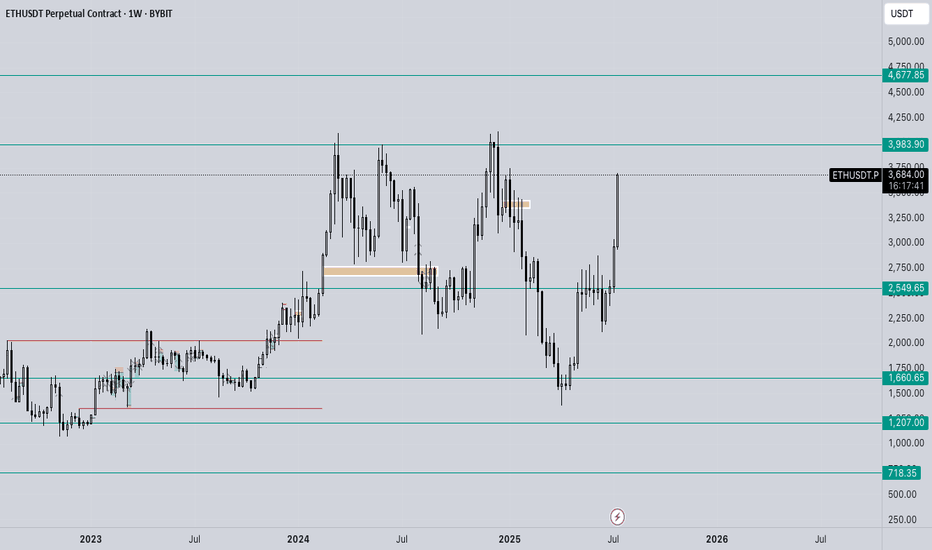

Ethereum's Path to $53,000: Multi-Year Breakout Pattern?This is a long-term technical analysis chart for the Ethereum/TetherUS (ETH/USDT) pair, presented on a weekly (1W) timeframe and using a logarithmic scale. The logarithmic scale is important as it visualizes percentage-based movements equally, which is crucial for analyzing an asset that has experienced exponential growth over many years.

Crucially, the date on the chart is "Jul 20, 2025," which is in the future. This indicates the chart is not just an analysis of past events but a speculative forecast of future price action.

Key Elements and Pattern Analysis

The chartist has identified and drawn a classic bullish continuation pattern known as an Ascending Triangle. Let's break down its components:

The Prior Uptrend (The "Flagpole"): Before the triangle formation, there was a massive upward price move starting in 2020 and peaking in late 2021. This powerful uptrend is the prerequisite for a bullish continuation pattern.

The Ascending Triangle Pattern: This is the multi-year consolidation phase that has been forming since the peak in late 2021.

Horizontal Resistance: The top of the triangle is a flat resistance line drawn at the previous all-time high, marked with a label at $4,637.01. The price has tested this level and failed to break through it, establishing it as a significant supply zone.

Ascending Support: The bottom of the triangle is a rising trendline. The price has made a series of "higher lows" since the market bottom in 2022. This indicates that despite pullbacks, buying pressure is consistently stepping in at higher price levels, showing underlying strength.

The Projected Breakout and Target: The core of this analysis is the prediction of what happens next.

Breakout: The chartist predicts that the price will continue to consolidate within this triangle until approximately late 2025 or early 2026. At that point, it is projected to break out decisively above the horizontal resistance.

Measured Move Target: The extremely bullish price target of $53,255.61 is calculated using a common technical analysis technique called a "measured move." The height of the triangle at its widest part (from the low around mid-2022 to the resistance line) is measured and then projected upward from the breakout point. This results in the highly ambitious target.

Interpretation and Narrative

The story this chart tells is as follows:

After its parabolic run in 2020-2021, Ethereum entered a necessary, long-term consolidation period.

During this multi-year phase, it has been building a massive base of support, with buyers absorbing selling pressure at progressively higher prices (the higher lows).

The chartist believes this long period of accumulation will eventually resolve to the upside, with a powerful breakout above the previous all-time high.

Such a breakout would signal the end of the consolidation and the beginning of a new major bull market cycle for Ethereum, with a projected target far exceeding the previous peak.

Important Caveats

Highly Speculative: This is a long-term forecast. Technical patterns are about probabilities, not certainties, and they can fail. The future date and extreme target price highlight the speculative nature of this analysis.

Pattern Invalidation: The entire bullish thesis is invalidated if the price breaks down below the ascending support trendline. Such a breakdown would be a significant bearish signal, suggesting a major trend reversal instead of a continuation.

External Factors: This technical analysis does not account for fundamental factors, macroeconomic shifts, regulatory changes, or other black swan events that could dramatically impact the price of Ethereum.

In summary, the chart presents a very bullish long-term outlook for Ethereum, based on the formation of a classic ascending triangle pattern. It forecasts a multi-year consolidation followed by a powerful breakout and a new, explosive bull run to over $50,000. However, this should be viewed as one possible scenario among many, with its own specific conditions for validation and invalidation.

Disclaimer: This is not a financial advise. This analysis is purely for informational purposes and should not be considered as investment advice. Trading involves risk, and you should consult with a financial professional before making any decisions.

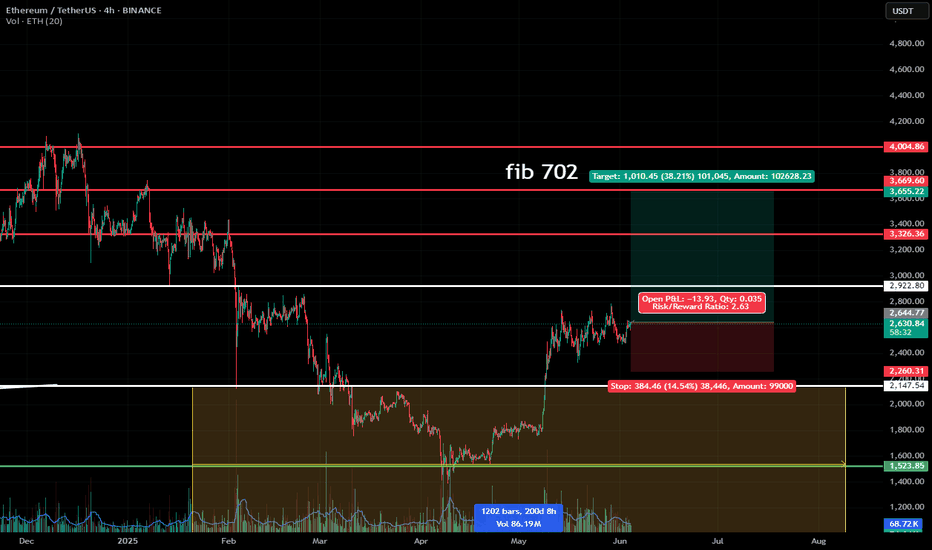

Ethereum Price Hits 6-Month High, Up Next $4,000BINANCE:ETHUSDT has managed to navigate recent market volatility with significant support from investors. As companies increasingly mirror Bitcoin’s corporate treasury use case, Ethereum is gaining traction.

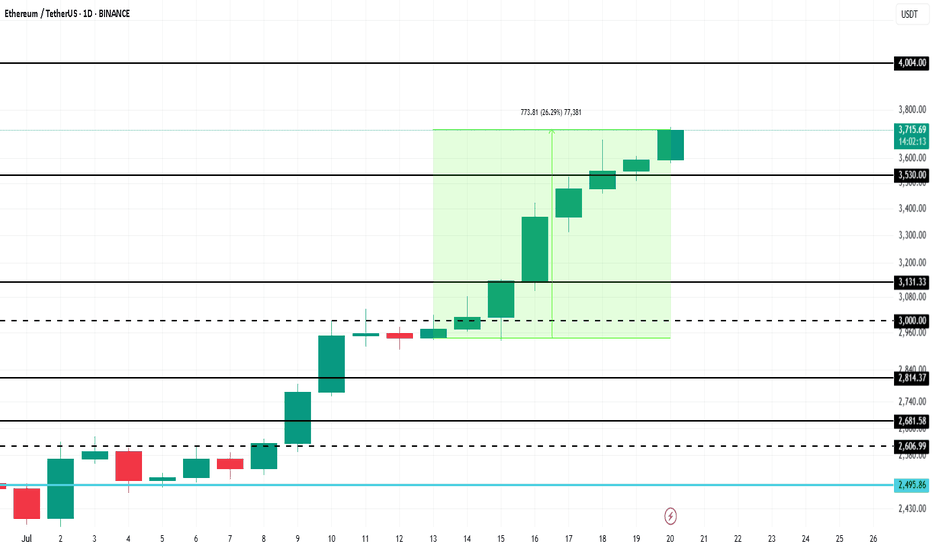

BINANCE:ETHUSDT price surged 26% over the past week , reaching $3,715 and marking a 6-month high. The rally strengthened after ETH formed a Golden Cross last week. With this bullish momentum, Ethereum is now targeting $4,000 in the coming days, benefiting from investor confidence and growing institutional interest.

However, if BINANCE:ETHUSDT bullish momentum weakens and investors opt to sell, the price could decline to $3,131 . This would erase recent gains and invalidate the current bullish outlook.

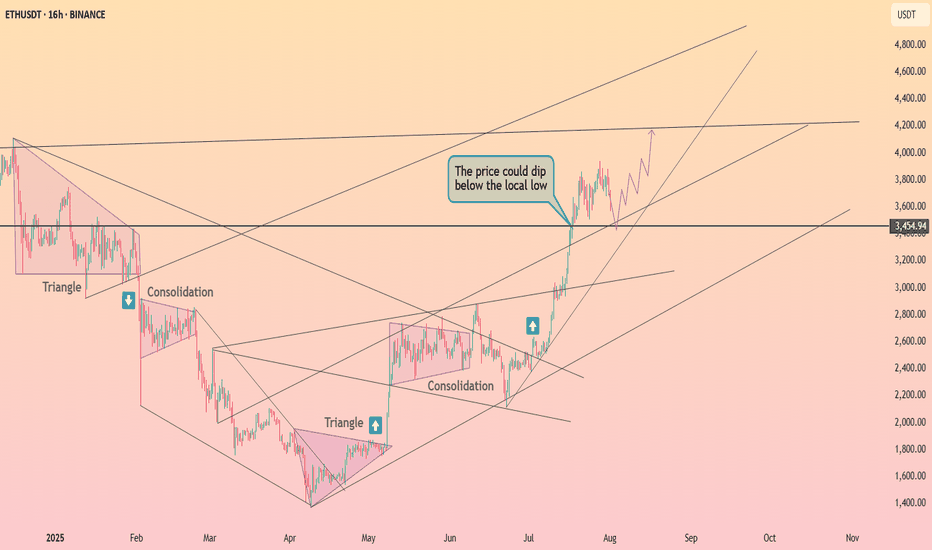

ETH - Ranges overview (update) We've had some nice movements on ETH lately so let's have a look at where we are.

As previously discussed IF we reclaimed 2.5K we should expect the market to aggressively trade towards the HTF buyside (3.4K and 4K).

The buyside at 3.4K has been traded through already so no let's be PATIENT and see IF we get through 4K and higher.

As always WAIT FOR THE MARKET TO SHOW YOU ITS HAND.

Stay safe and never risk more than 1-5% of your capital per trade. The following analysis is merely a price action based analysis and does not constitute financial advice in any form.

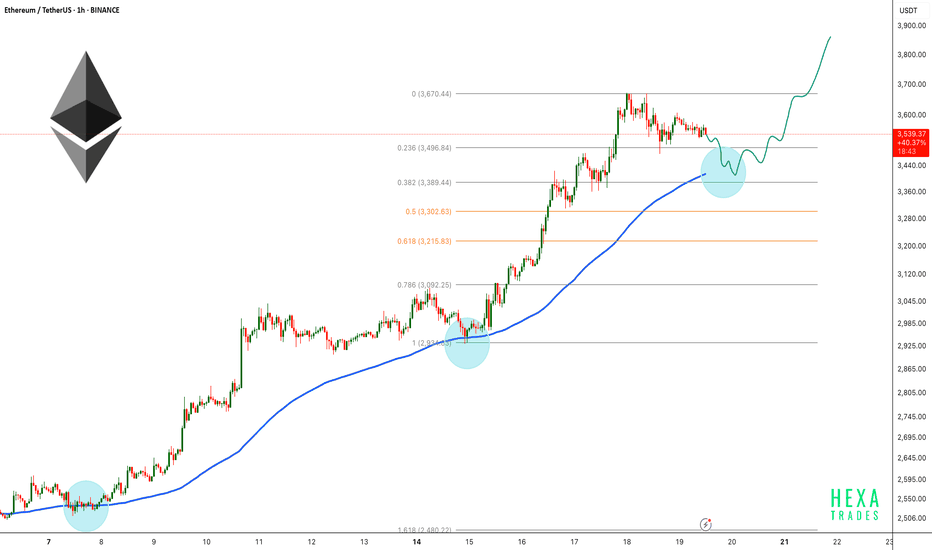

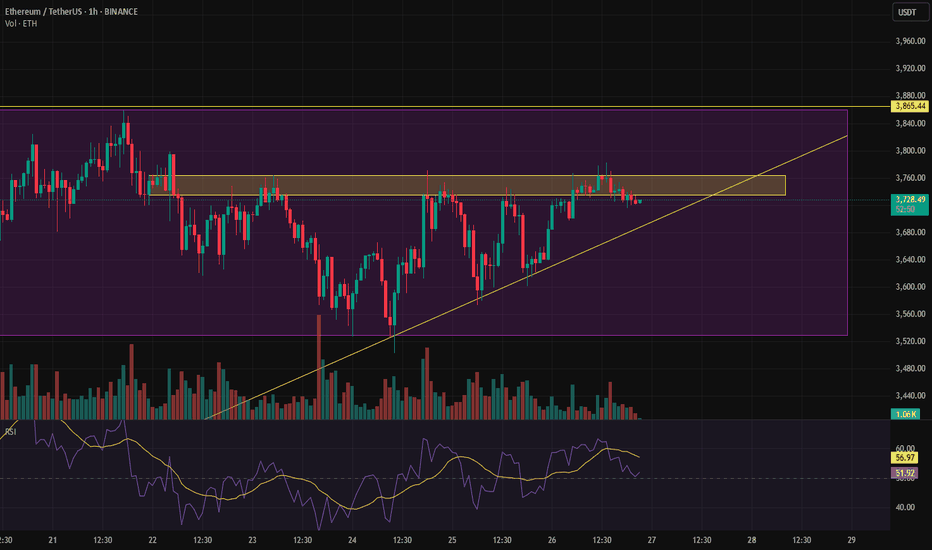

ETH Healthy Retest Before Next Rally!Ethereum continues to trade within a strong uptrend on the 1-hour chart, respecting the 100 EMA consistently throughout the rally. After a strong impulse move, the price is now consolidating near the recent highs.

ETH price could retest the 0.382 Fibonacci level and the 100 EMA before continuing upward. A successful retest would signal strength and could lead to a bullish continuation toward the $3900 - $4000 range.

Similar historical retests of the 100 EMA led to strong rallies, and we could see a repeat of that pattern if support holds.

Cheers

Hexa

BITSTAMP:ETHUSD CRYPTOCAP:ETH

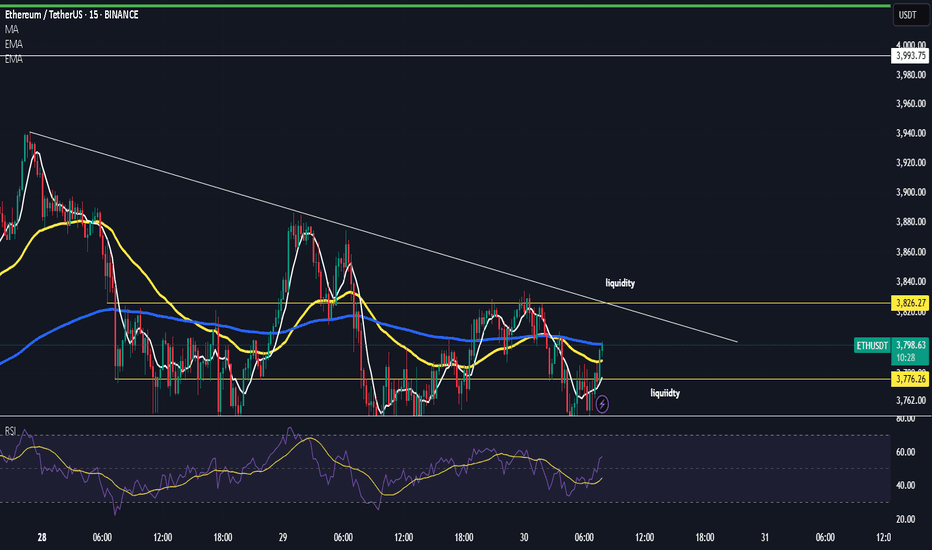

Is Ethereum Ready to Break Out? Watch This Key Trendline!Is Ethereum Ready to Break Out? Watch This Key Trendline!

In the 15-minute timeframe, Ethereum (ETHUSDT) is testing a major descending trendline. If a strong bullish candle closes above this level and price action holds, we could see a move toward the $3,637 resistance zone.

This area has acted as a significant technical level in the past, and a confirmed breakout may trigger further upside momentum.

🚀 A successful breakout could provide a solid long entry setup, with $3,637 as the first target. Keep a close eye on this move—momentum is building.

💡 Don’t miss more high-probability setups like this! Follow for real-time crypto analysis and trade ideas.

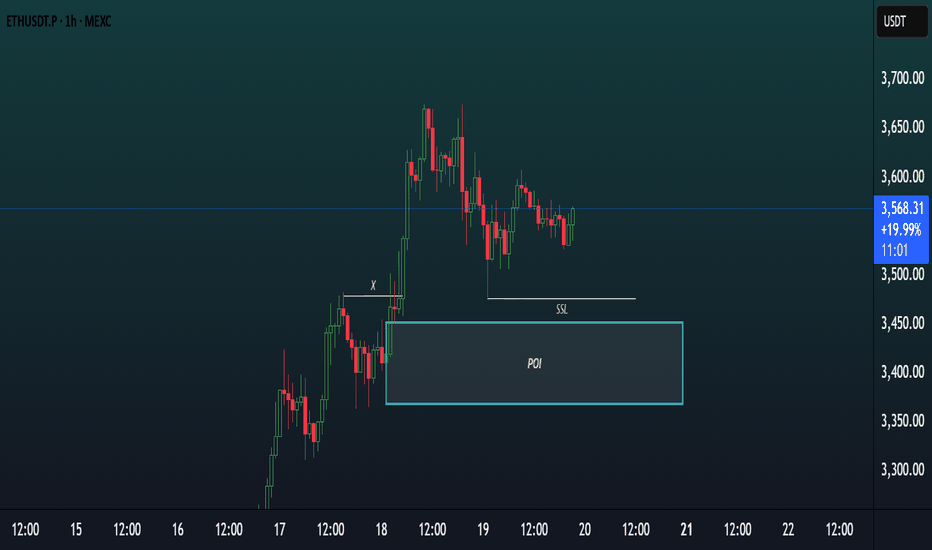

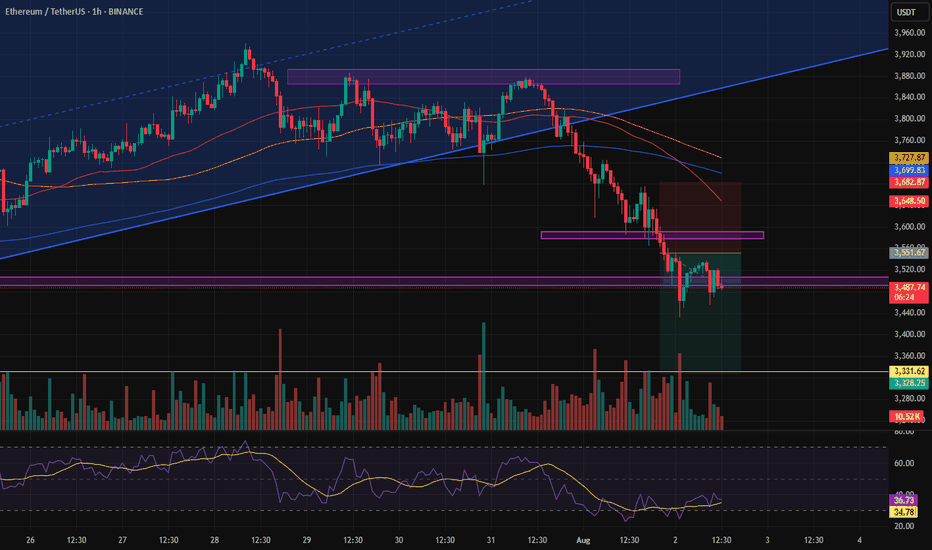

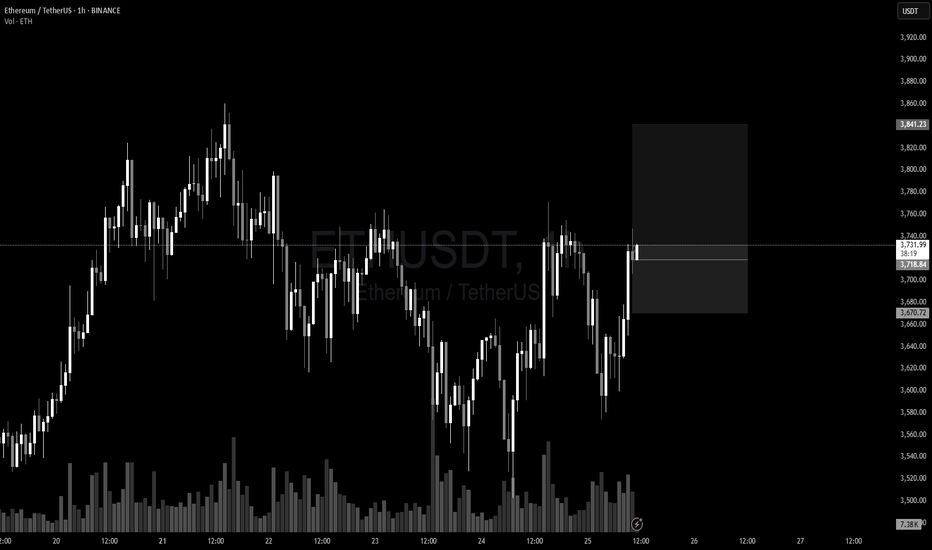

Chart Analysis (ETHUSDT, 1H)This chart showcases a Smart Money Concepts (SMC) style analysis on the 1-hour timeframe of ETHUSDT.P, focusing on a potential bullish setup.

Key Elements:

POI (Point of Interest)

A demand zone is clearly marked around the $3,400–$3,460 area, highlighted as a potential reversal zone where price may react bullishly.

SSL (Sell-Side Liquidity)

Sell-side liquidity has been swept below a recent low, indicating a possible liquidity grab before a reversal.

X (Previous Break of Structure)

Point “X” marks a significant BOS (Break of Structure) indicating bullish intent in prior price action.

Current Price Action

Price recently tapped into the POI, swept SSL, and is now consolidating slightly above the zone — suggesting accumulation or preparation for a bullish move.

Bias:

Bullish — Expecting a possible reversal or continuation to the upside after liquidity sweep and POI mitigation.

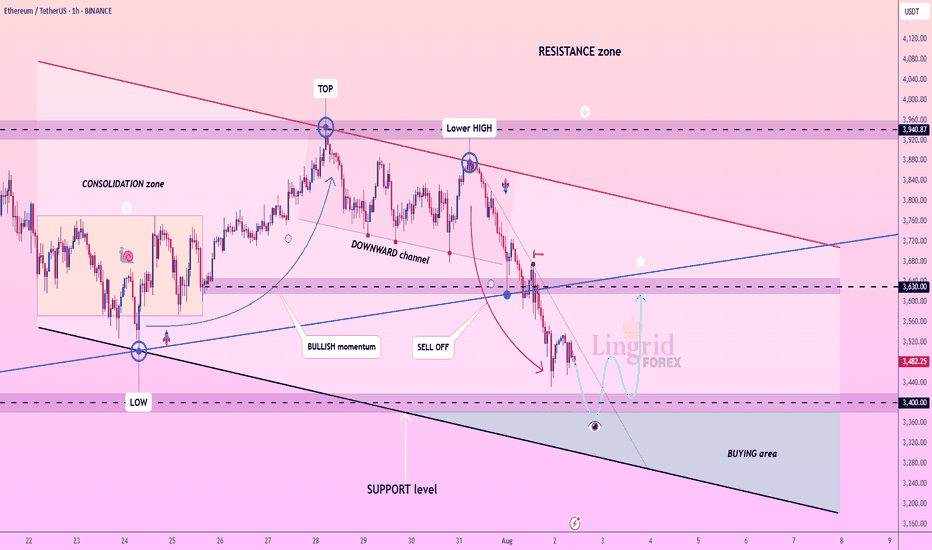

Lingrid | ETHUSDT Short-Term Move: Buying Opportunity at SupportThe price perfectly fulfilled my last idea . BINANCE:ETHUSDT is attempting a bounce after dipping into the lower boundary of its channel near the $3,400 support level. Price action has followed a descending structure with lower highs inside a broad downward channel. As long as the $3,400 zone holds, a rebound toward the mid-range resistance at $3,630 remains viable. Current positioning inside the "BUYING area" suggests momentum may flip bullish if a reversal structure forms.

📉 Key Levels

Buy trigger: Break above $3,630

Buy zone: $3,250 – $3,400

Target: $3,630 – $3,720

Invalidation: Break below $3,250

💡 Risks

Momentum still favors sellers from the recent sell-off

Failure to reclaim mid-range resistance could cap upside

Broader trend remains within a bearish channel structure

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Eth / UsdtBINANCE:ETHUSDT

### 📈 **Ethereum (ETH/USDT) Update – Technical Snapshot**

💵 **Current Price:** \~\$3,490

🔺 **Intraday High:** \$3,670 | 🔻 Low: \$3,453

---

### 🧱 **Support Zones**

✅ **\$3,500–\$3,600** → Key short-term demand zone

✅ **\$3,000–\$3,200** → Strong mid-term cushion

✅ **\$2,000–\$2,500** → Long-term on-chain investor base

⚠️ **\$2,120** → If broken, risk accelerates toward \$2,000

---

### 📉 **Resistance Zones**

🚫 **\$3,860–\$3,900** → Breakout zone = Bullish confirmation

🚫 **\$4,100–\$4,500** → Major zone with historic pressure

🚀 **\$5,000–\$5,300+** → ATH targets if macro + ETF narrative holds

---

### 📊 **Strategy Overview:**

| 🧭 Scenario | 📌 Strategy |

| ------------------------ | --------------------------------------------------------------- |

| ✅ **Bullish Bias** | Hold above \$3,600 → eyes on \$3,900–\$4,000 next |

| 💥 **Breakout Play** | Clean break above \$4,500 = open skies toward \$5,000–\$5,300+ |

| 🧯 **Bearish Risk** | Below \$3,500 could revisit \$3,000 or \$2,500 support bands |

| ⛔ **Critical Breakdown** | Breach under \$2,120 = watch for strong downside toward \$2,000 |

---

### 🧠 **Final Thoughts**

ETH is in **consolidation near highs**.

• Volume & ETF inflows are key catalysts

• Indicators like **RSI, MACD, Fib zones** can help confirm setups

---

⚠️ **Disclaimer:** Not financial advice. Always **DYOR** and manage your risk wisely. 🧠📉

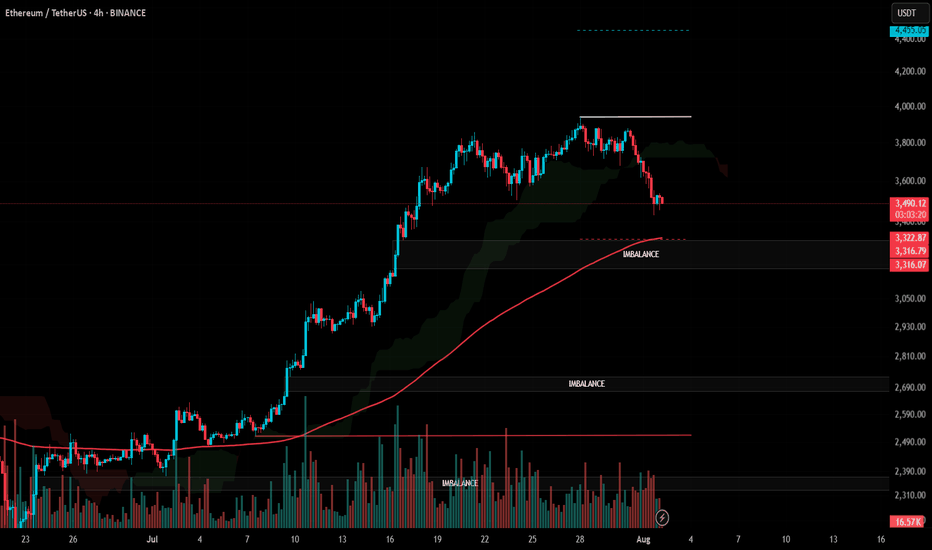

#ETH Update #6 – Aug 02, 2025#ETH Update #6 – Aug 02, 2025

Although Ethereum may seem like it has dropped significantly, it still hasn’t completed the correction of its last impulsive move. If we are to say a proper correction is happening, Ethereum must pull back to the $3,300 zone. If it continues upward without reaching this level, the risk of a deeper retracement increases. That’s why it would be much healthier for Ethereum to extend this pullback and complete the correction around $3,300.

If this correction is completed, the next target will be around $4,450. There is also an imbalance zone around $3,300, and since the price is already close, it might aim to fill that as well — possibly even reaching down to the $3,200 level. Contrary to much of the current market sentiment, Ethereum is heading toward a correction in a very healthy manner, and I believe completing this move would be the best scenario.

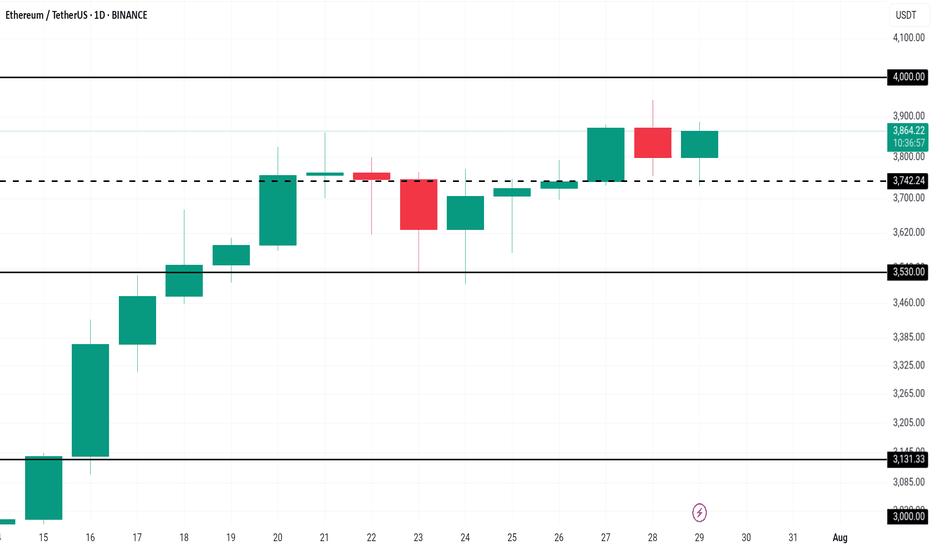

Ethereum Price to Reach $4,000, but Market Top Suggests DelayBINANCE:ETHUSDT current price stands at $3,872, holding above its local support level of $3,742. While ETH is approaching the $4,000 mark , it has not yet managed to breach it. This resistance could continue to hold, limiting Ethereum's immediate potential for further gains.

Currently, 96% of BINANCE:ETHUSDT total supply is in profit. Historically, when the profitable supply surpasses 95%, it signals a market top . This has been followed by price corrections as investors begin to secure profits.

If the market top triggers a reversal, BINANCE:ETHUSDT price could drop to $3,530 or lower . A sharp decline to $3,131 is also a possibility, erasing much of the recent gains made in the past month.

On the other hand, if the influx of new addresses continues and strengthens, BINANCE:ETHUSDT may finally break through the $4,000 resistance. Should this happen, ETH could rise towards $4,425, with a renewed surge in price. This would invalidate the bearish thesis and push Ethereum into a new bullish phase.

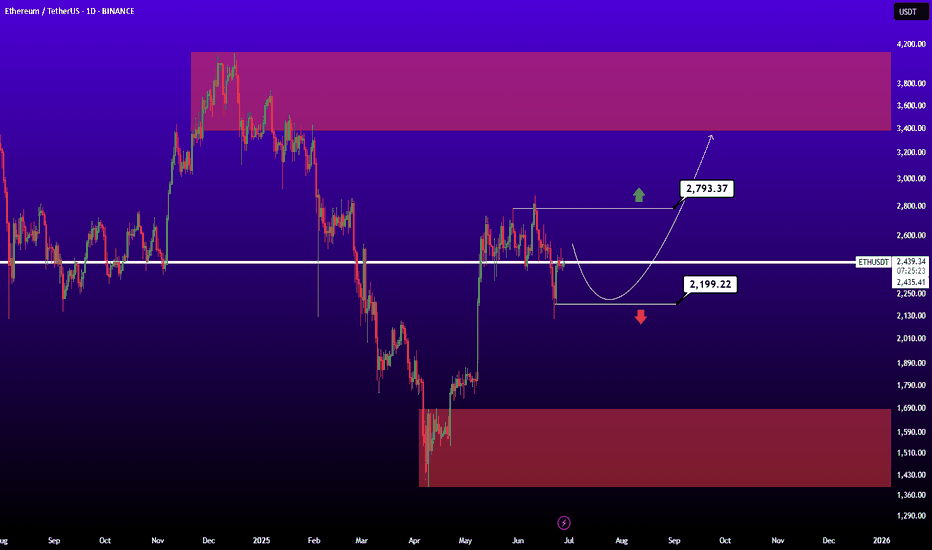

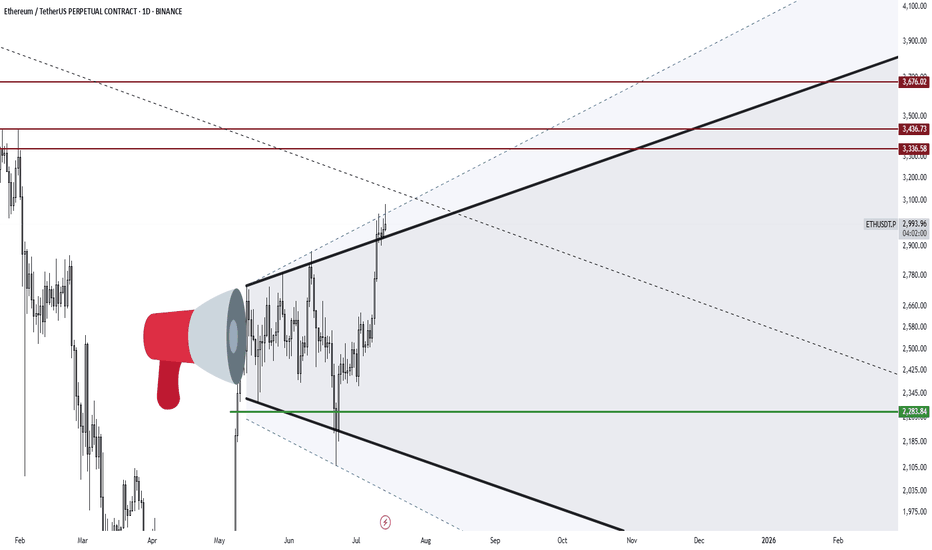

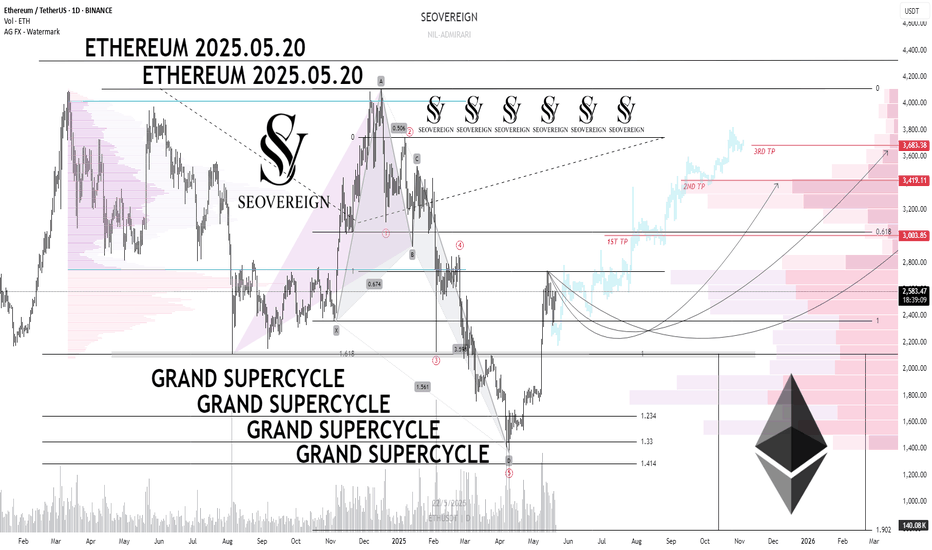

ETHEREUM Long Outlook – Grand Supercycle Perspective(2025.05.21)Hello everyone,

This is SeoVereign, operator of the SeoVereign Team.

Today, I would like to share an Ethereum analysis based on the daily (1D) chart for the first time in a while.

Before reading this post, please refer to the idea I uploaded on April 18, 2025, through the link below. It will help you better understand the context:

🔗

(Clicking the image will take you to the corresponding link.)

If you look at the April 18 idea, you’ll see that I presented a bullish outlook based on the Deep Crab pattern.

This analysis is a continuation of that idea.

Through years of research, I’ve observed that when a Deep Crab pattern sees a rebound from the PRZ (Potential Reversal Zone), the trend that begins from that point tends to extend for a long time.

If you look closely at the chart, you’ll also see the 2.24 Fibonacci extension level.

Some people messaged me saying, “Since it went above 1.902 and even exceeded the 2.0 Fibonacci line, isn’t this Deep Crab invalid?”

However, I’ve studied harmonic patterns in depth for a long time and have set my own Fibonacci criteria based on that research.

In this particular Deep Crab case, I define the invalidation level as 2.24.

Therefore, I judged that the pattern is still valid, and this allowed me to forecast a long-term bullish trend.

Back to the main point,

Based on this Deep Crab pattern, I’ve consistently maintained a bullish outlook on the daily chart,

and so far, there have been no clear signals indicating a reversal into a bearish trend.

Thus, I would like to post a continuation of the bullish outlook on the daily chart.

On May 19, 2025, there was a sharp drop around the 2,587 USDT level.

At that time, our team expected the bullish trend that started from around 2,447 USDT to hold its low and continue.

However, the price broke below 2,447 USDT and made a new low.

We then closely monitored Bitcoin’s movement in response.

Typically, strong volatility occurs before a major trend begins.

Bitcoin was also showing significant volatility at the time.

So we concluded: “Let’s maintain a bullish stance, but do not be fully convinced until the previous high of 2,587 USDT is clearly broken upward.”

And by the time this post is published, we’ve confirmed that the price has indeed broken above 2,587 USDT.

Therefore, I have come to the conclusion that the bullish trend is still valid.

Based on this, I present the following three target levels.

🎯 SeoVereign’s Ethereum Bullish Targets

1st Target: 3,000 USDT

2nd Target: 3,400 USDT

3rd Target: 3,700 USDT

The market still shows strong volatility.

I sincerely hope you all trade wisely and calmly, achieving great returns,

and may great fortune be with you both in trading and in life.

I’ll see you again in the next daily analysis.

Thank you.

- SeoVereign