ETHUST.P trade ideas

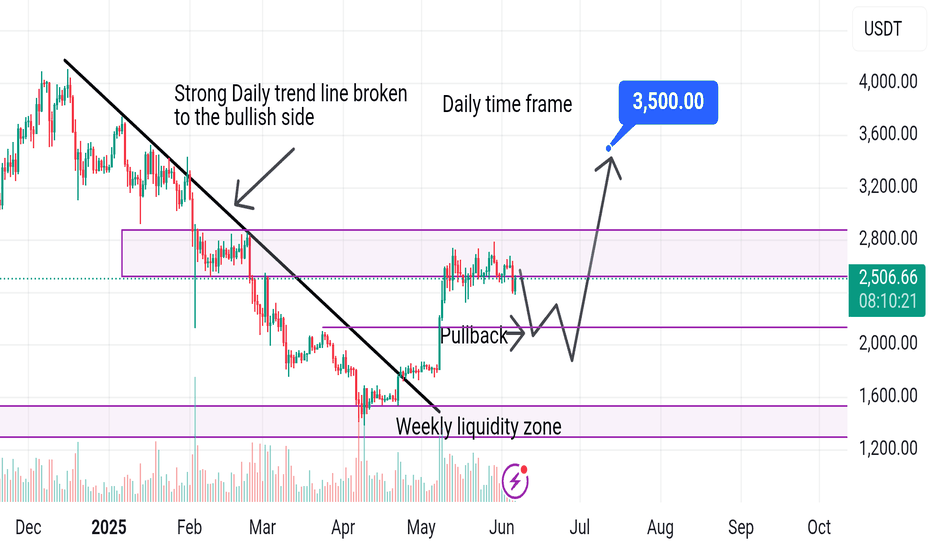

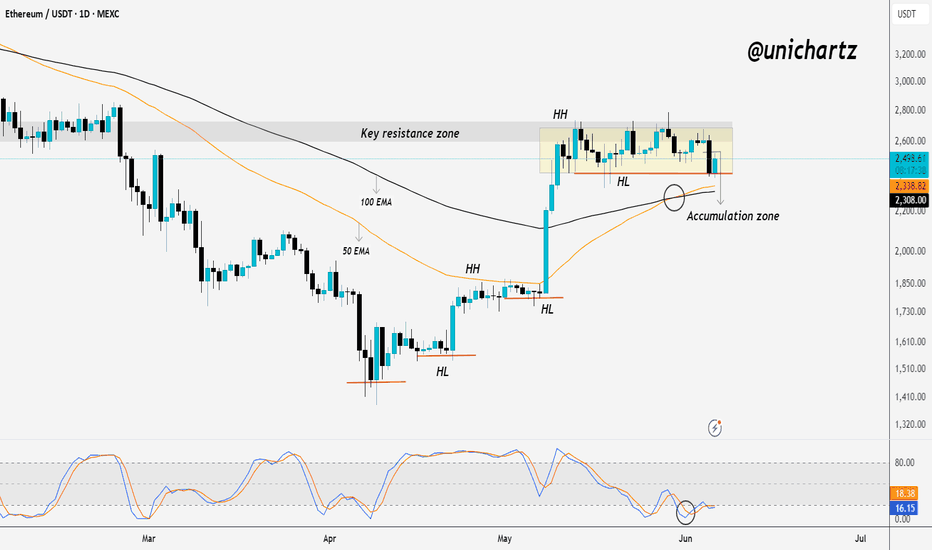

ETH Technical Structure: Bullish Bias Unless This Level BreaksEthereum is at an interesting spot.

After forming a clear bullish structure with Higher Highs (HH) and Higher Lows (HL), ETH entered an accumulation zone right below the key resistance zone.

Currently, price is retesting the 50 EMA + 100 EMA confluence zone — a critical area of demand. This level has previously acted as a strong support, and the Stoch RSI is bouncing from oversold territory, signalling possible bullish momentum ahead.

If ETH holds this accumulation zone and the EMA support, we could see another push toward the key resistance zone or even a breakout. However, if this zone fails, a deeper pullback toward lower support levels is likely.

For now, watch how price reacts here — this is a decision point.

If you liked it, do comment and follow us for regular market updates.

THANK YOU

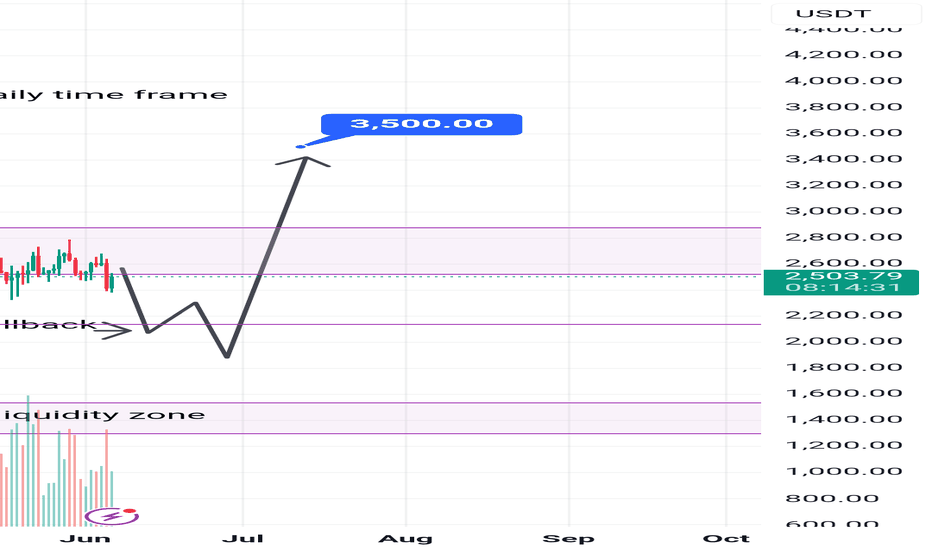

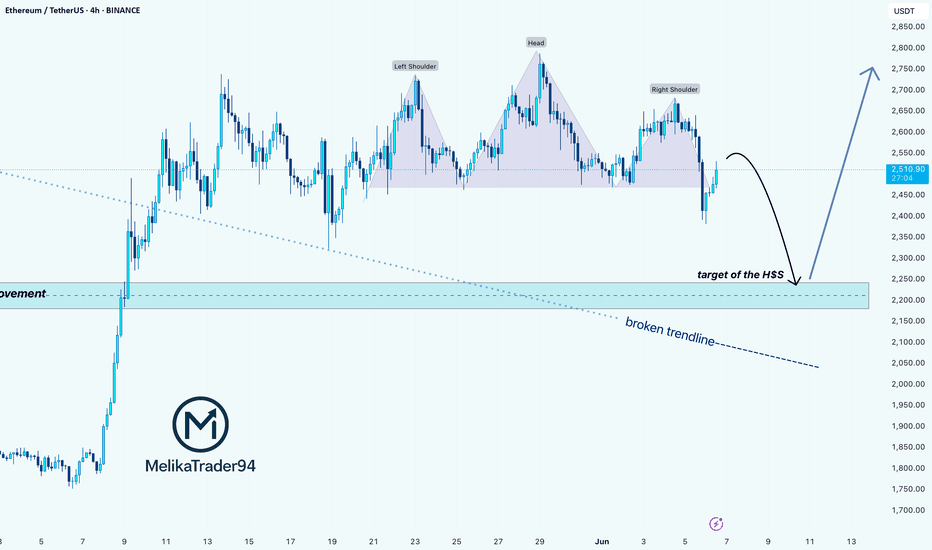

Ethereum Breakdown Ahead? Classic Head & Shoulders Pattern Hello Guys!

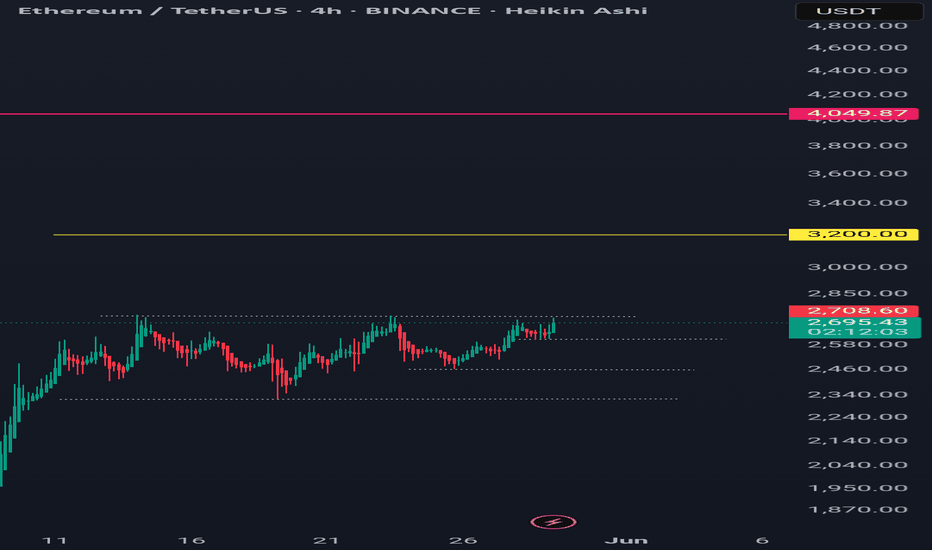

Ethereum looks like it’s setting up for a potential drop after forming a textbook Head & Shoulders pattern on the 4H chart.

This pattern (marked clearly with a left shoulder, head, and right shoulder) is often seen before a price reversal. Right now, ETH has already broken below the neckline (around $2,480), confirming the bearish pattern, and is currently retesting that level from below.

📉 What’s Next?

If the pattern plays out, we could see ETH drop toward the projected target zone around $2,200–$2,250, which is highlighted in blue on the chart. This zone also lines up with a previous area of interest and sits near a broken trendline, adding confluence to the setup.

✅ What I see:

Resistance: ~$2,500 (neckline retest)

Target: ~$2,200 support zone

Broken trendline adds downside pressure

Unless bulls reclaim the neckline quickly and push above the right shoulder (~$2,650), this looks like a bearish continuation setup.

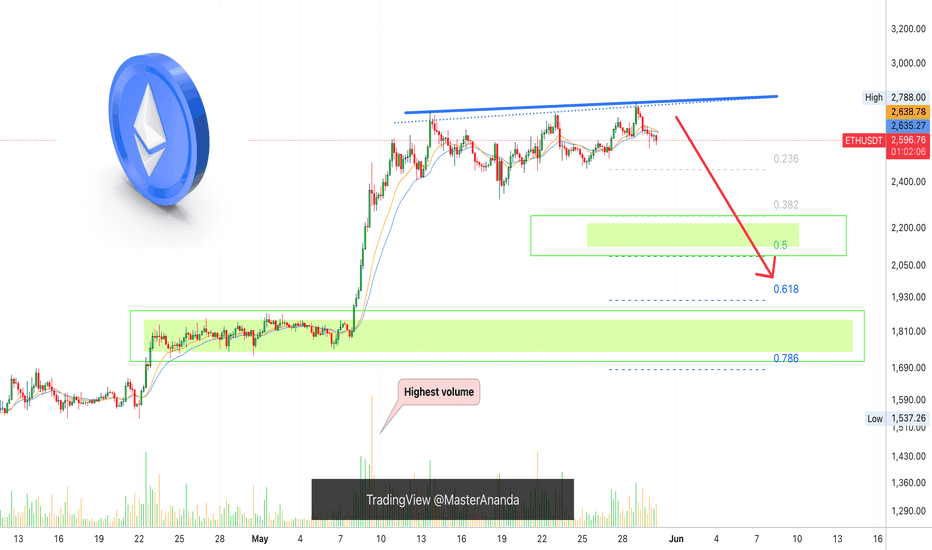

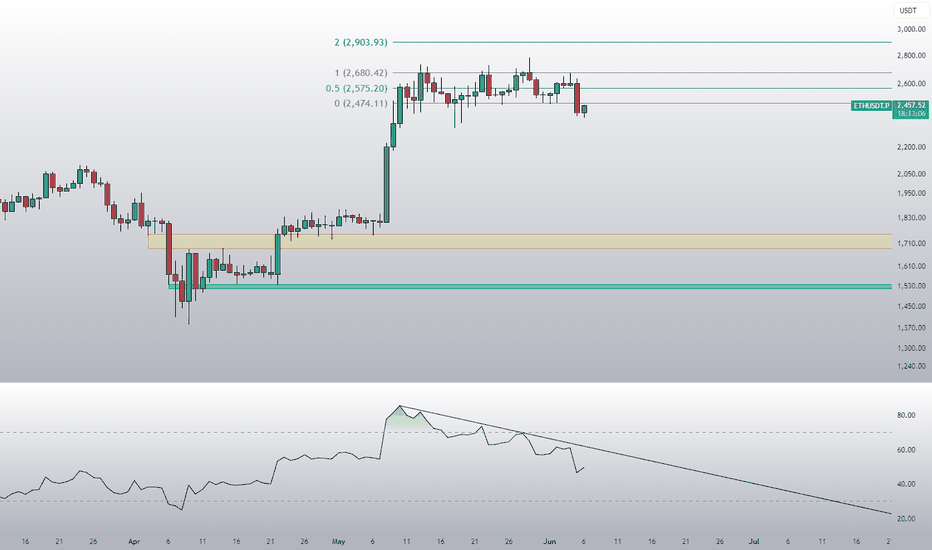

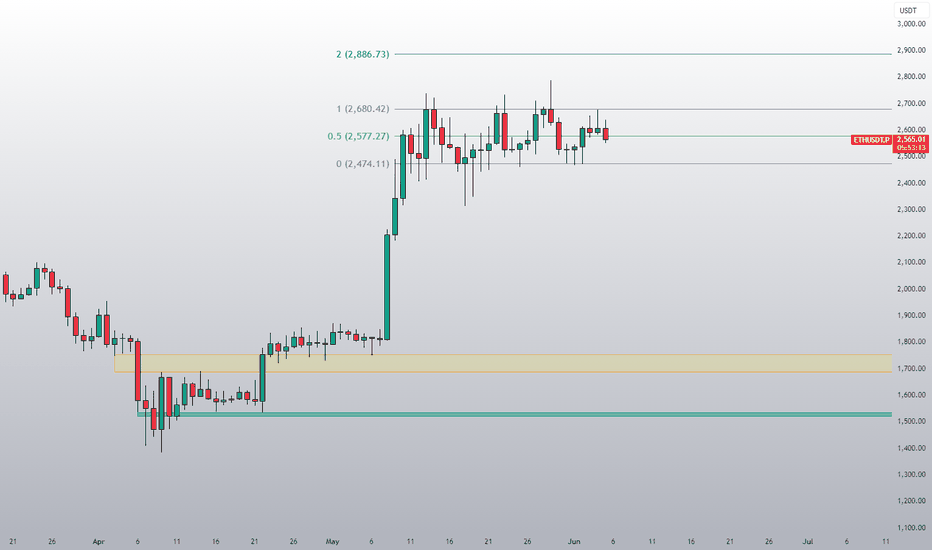

Ethereum Danger Zone —Protection, Correction or Continuation?Ethereum can be seen trading below EMA55 on the 4H timeframe. The biggest volume session happened 9-May and it was red. This tells us that there is correction potential after a very strong 101.1% bullish growth wave.

There are mainly three levels to consider for the correction potential after ~100% growth. 0.382, 0.618 & 0.786 Fib. retracement levels. After the test of these levels, whichever one comes last, we can read the chart again and see if Ethereum will continue lower or produce a bullish wave.

One thing is very certain though, after strong growth, there is always a correction/retrace. This is what you are seeing now in this chart. The start of the drop. Taking action is best.

The market moves in waves and will never stop this pattern, it fluctuates. To trade, one buy lows near support; sells high when resistance hit. 100% growth is very strong for the second biggest Cryptocurrency project, the #1 Altcoin.

After a strong bullish wave there is always a correction. After the correction there can be more correction but at some point the market turns. Each chart/pair needs to be considered individually on multiple timeframes to have a better understanding as to what will happen next.

In a single day, based on the news, market conditions can always change. Stay alert!

Namaste.

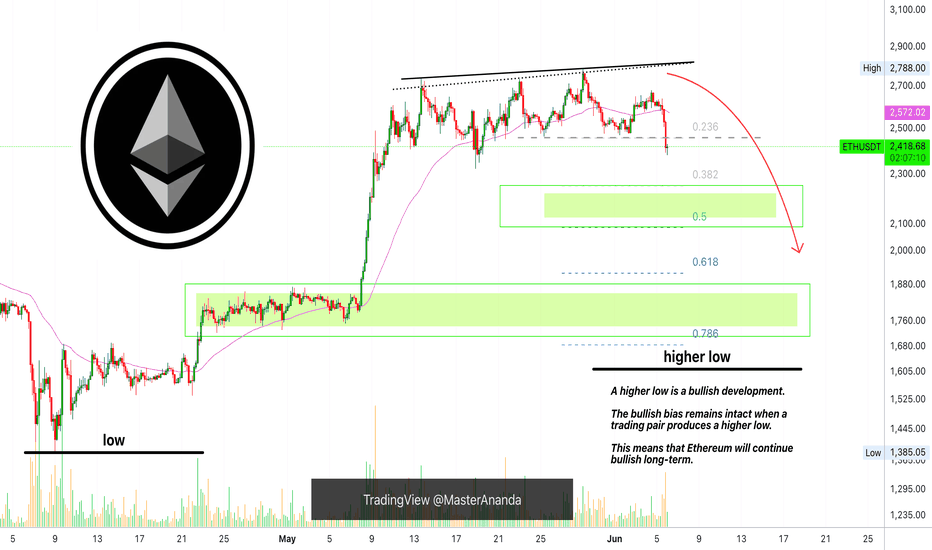

Ethereum, Guessing The Next Move ($1,500 or $2,000?)The million dollars question; What about Ethereum, lower or recovery?

And this is truly a million dollars question because knowing the answer can make you millions. It can either safe you lots of money or it can make you lots of money.

👉 Ethereum is going lower.

The 18-May low happened at $2,323, and this low wasn't challenged, the drop yesterday ended as a higher low. But, there is something... We lost some important support levels.

ETHUSDT lost the 0.236 Fib. retracement, when this happens, the action tends to move to the next lower-level which is below the 18-May low.

Looking at the 4H TF, ETHUSDT lost EMA55 and MA200, so these are also pointing lower.

Just a few days back I mentioned $2,000 entry LONG opportunity for Ethereum, this price might be possible but it is still really early.

The market has been sideways and this breakdown is new. It would be good to wait for the weekly session close to see what prices we will get, without this information, I can say that it is still too early to say, but I can still make my guess. My guess is that it is going lower.

Thank you for reading.

Namaste.

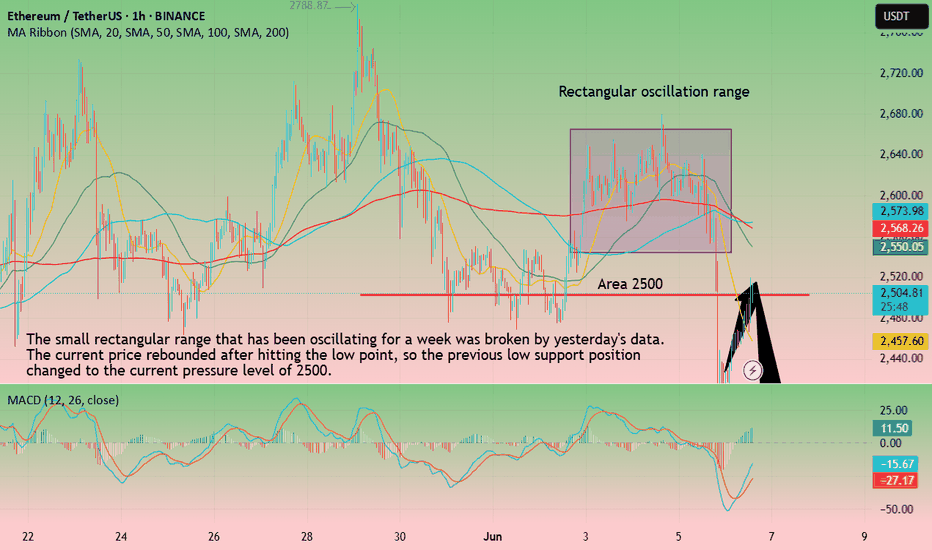

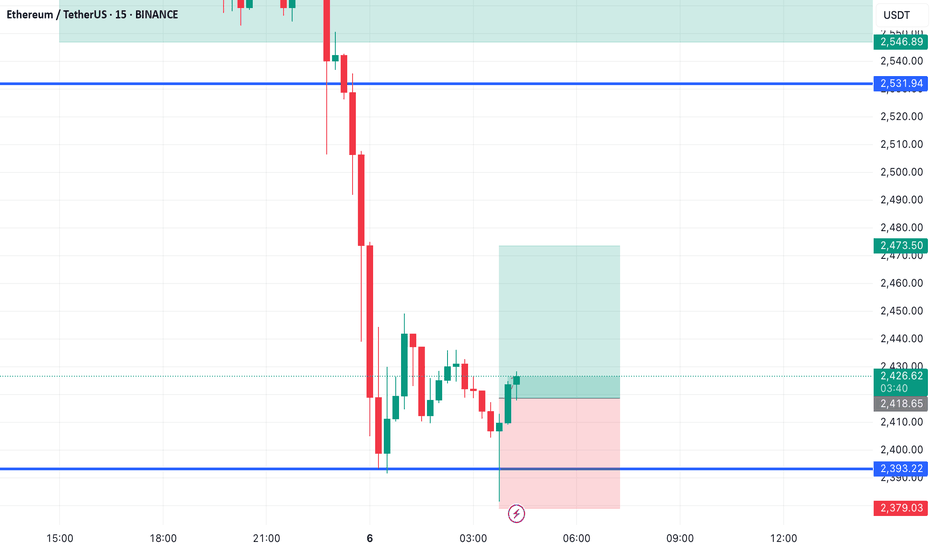

ETH-----Sell around 2500, target 2400 areaTechnical analysis of ETH contract on June 6:

Today, the large-cycle daily level closed with a large negative line yesterday, and the K-line pattern was still a single negative and single positive. The price was below the moving average. The attached indicator was dead cross. The bottom support position of the rectangle below was in the 2300 area. This is what we should focus on next week. Only when this position is broken, the overall downward trend will be formed and move downward; the short-cycle hourly chart maintained a range oscillation trend for a week. Under the stimulation of yesterday's data, it continued to break downward. It is necessary to pay attention to a top-bottom conversion pattern. The previous low support of 2500 has turned into the current pressure level.

ETH short-term contract trading strategy:

Short in the 2500 area, stop loss in the 2550 area, and the target is the 2400 area

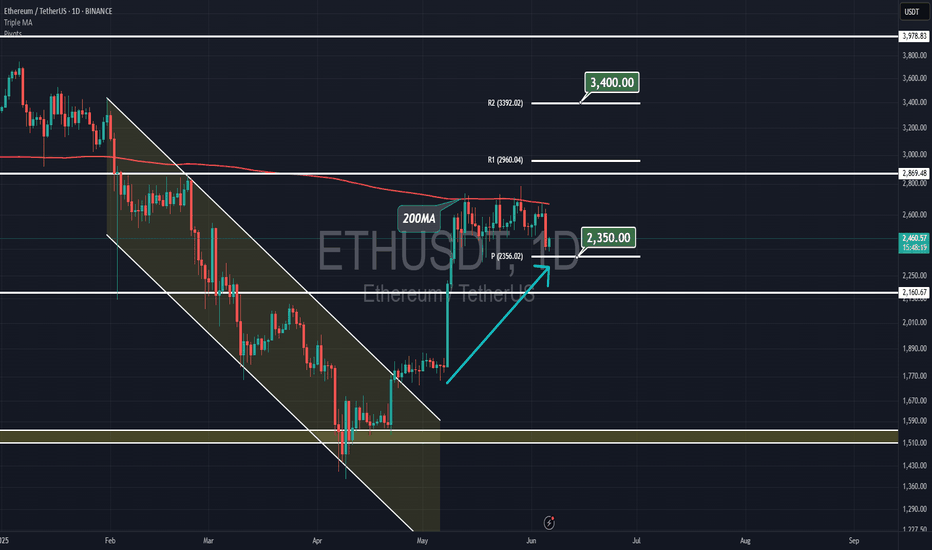

ETHUSDT still in range soon breakout to the upside and 7K$As we mentioned a lot this time ETH will also pump with BTC and soon we are looking for new high on this chart like the green arrows and what we need now is a little patience and let it cook.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

Ethereum Update

We know ETH made a good bounce at Major Support Keylevel and printed a +74% of good impulse up 🔥

But as of current structure and for my own opinion panda fam this structure is an obvious bearish and we already broke down below on trend support same time ETH made a multiple rejection at 2.6k resistance keylevel.

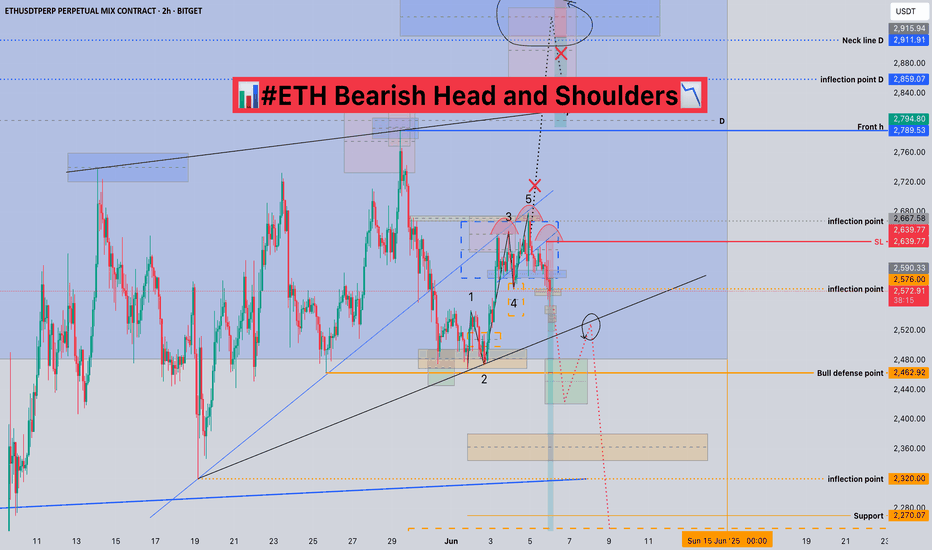

#ETH Bearish Head and Shoulders📊#ETH Bearish Head and Shoulders📉

🧠From a structural perspective, we failed to break through the blue resistance zone yesterday, but fell below point 4, which means that the previous rise is over and the probability of continuing the bullish force is reduced. If it went straight up yesterday and reached the heavy resistance area of 2860-2911 that I want to focus on, then I would try to short trade, but the market did not give us such an opportunity.

➡️From a graphical perspective, we have built a bearish head and shoulders structure in the resistance area, and we have formed a rising wedge after this period of sideways consolidation. Both models are bearish expectations, so we need to be wary of the risk of a pullback.

Let's take a look👀

🤜If you like my analysis, please like💖 and share💬 BITGET:ETHUSDT.P

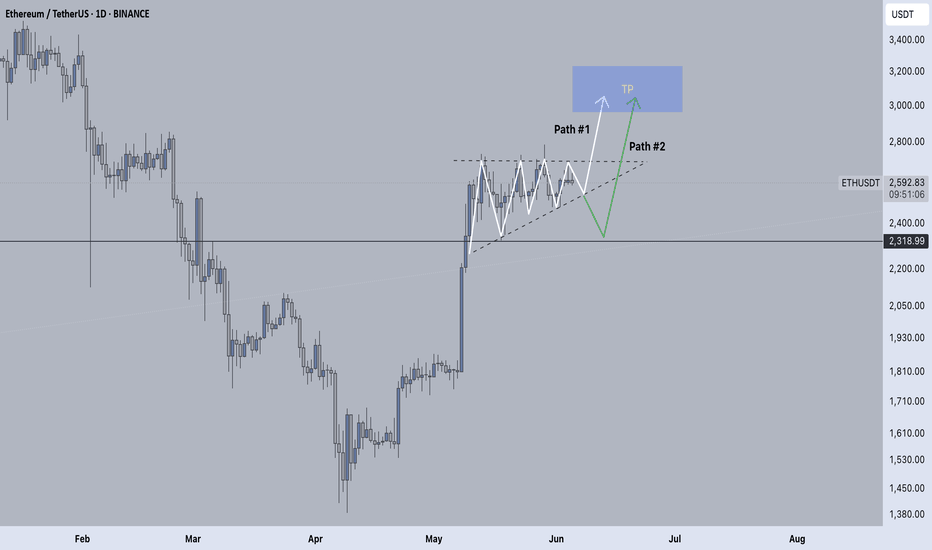

ETH Ascending TriangleETH has formed a clear ascending triangle pattern with a possibility of imminently breaking out to the upside. If rejected, we could see a breakdown to the ~2,300 support and subsequent rebound.

My bias is still bullish. We'll let the market tell us what happens and respond accordingly. Worst case scenario is more boring consolidation.

Stay patient.

Happy trading,

Melonfarmer

ETH/USDTStrong Accumulation can be seen on #ETH, BlackRock buying more than usual, as well as bigger wallets and whales are accumulating heavily in the last two weeks. Something is loading for ETH and I think our decision to swap all of our XRP into ETH will play out big. In the meantime. Since taking full profit on XRP, its down 7% since then, meanwhile our ETH position is at 6% in profit. This is the beginning

ETH/USDT – Short-Term Bearish SetupETH/USDT – Short-Term Bearish Setup

Ethereum is losing momentum near resistance.

I’m watching a short position with a near-term target at $2,546.

💡 Structure looks clean – waiting for confirmation to ride the move.

📉 Quick setup. Tight risk. Let’s trade it smart.

🔔 Follow for more real-time setups like this!

HolderStat┆ETHUSD channel climbCRYPTOCAP:ETH cruises within a steep four-hour rising channel; the latest triangle breakout paused near 2.6 k. Converging trendlines, former consolidation support and higher-low structure all aim for the 2.9 k liquidity zone. Bulls steer while the channel median holds.

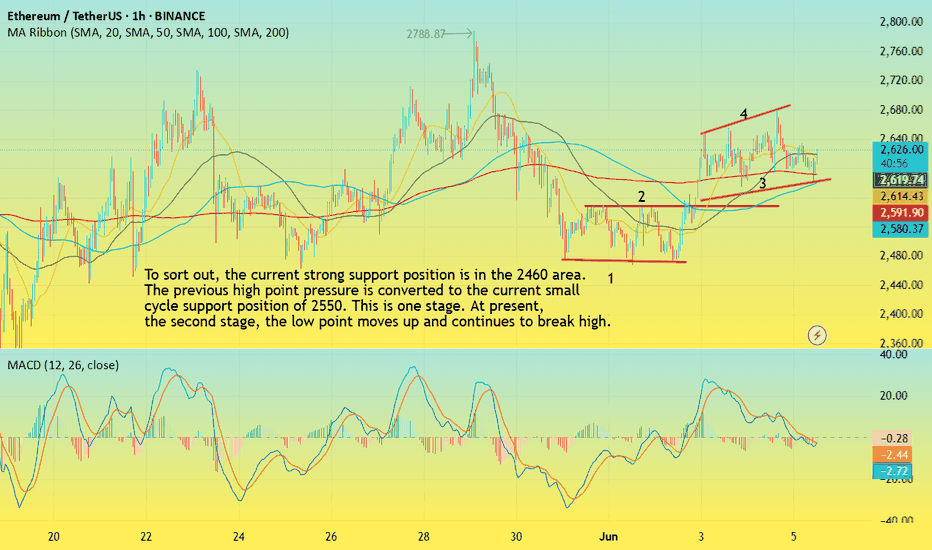

ETH-----Buy around 2620, target 2675 areaTechnical analysis of ETH contract on June 5:

Today, the large-cycle daily level closed with a small positive line yesterday, the K-line pattern continued to rise, the price was above the moving average, the attached chart indicator dead cross shrank, and the overall trend fell into a small range of shocks, but it should be noted that the price continued to consolidate at a high level, and the retracement had no strength and continuation. After each retracement, it was accompanied by a rapid rise or even a break, so there is a high probability that it will rise after consolidation; in terms of the short-cycle hourly chart trend, the price continued to break the high, although the time point is wrong, but it can be seen that the low support of the retracement is moving up, the current K-line pattern is continuous, the attached chart indicator dead cross shrank, so there is still a demand for rising within the day.

ETH short-term contract trading strategy:

Buy at the current price of 2620 area, stop loss at 2590 area, and target at 2675 area;

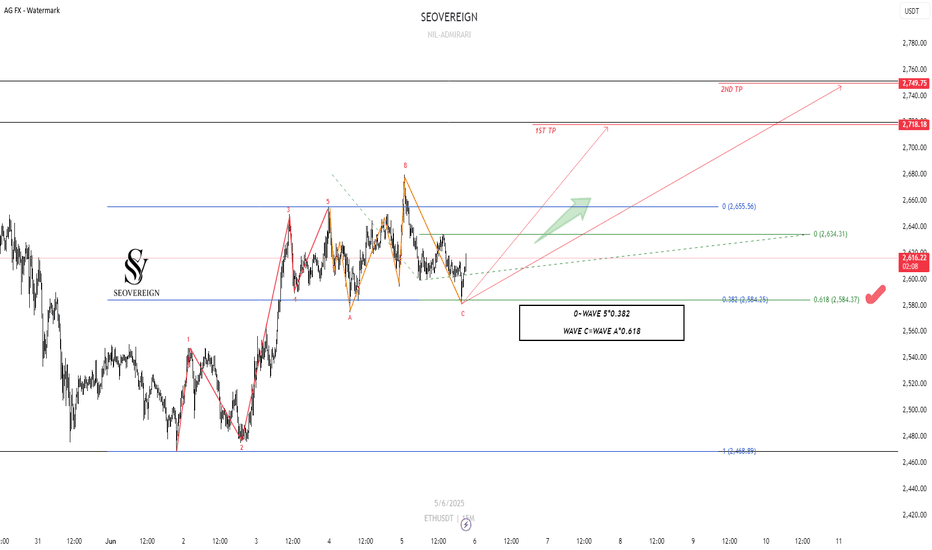

Ethereum Long Setup – Chart Analysis (June 5, 2025)We are the SeoVereign Trading Team.

With sharp insight and precise analysis, we regularly share trading ideas on Bitcoin and other major assets—always guided by structure, sentiment, and momentum.

🔔 Follow us to never miss a market update.

--------------------------------------------------------------------------------------------------------

Here is a technical analysis of Ethereum.

The current wave structure is considered to be in the final stage of a corrective wave, with the following evidence based on length ratios.

First, the 5th wave of wave C forms a length that is 0.618 times that of waves 0 to 3.

Second, the fact that wave C ended at the 0.382 Fibonacci retracement level of waves 1 to 5 increases the possibility of technical support.

As these conditions are met, the current zone is considered a valid buying point for entering a long position.

Target Prices

1st target: 2,700

2nd target: 2,750

This zone overlaps with past resistance and technical retracement ratios, making it appropriate as a short-term liquidation zone.

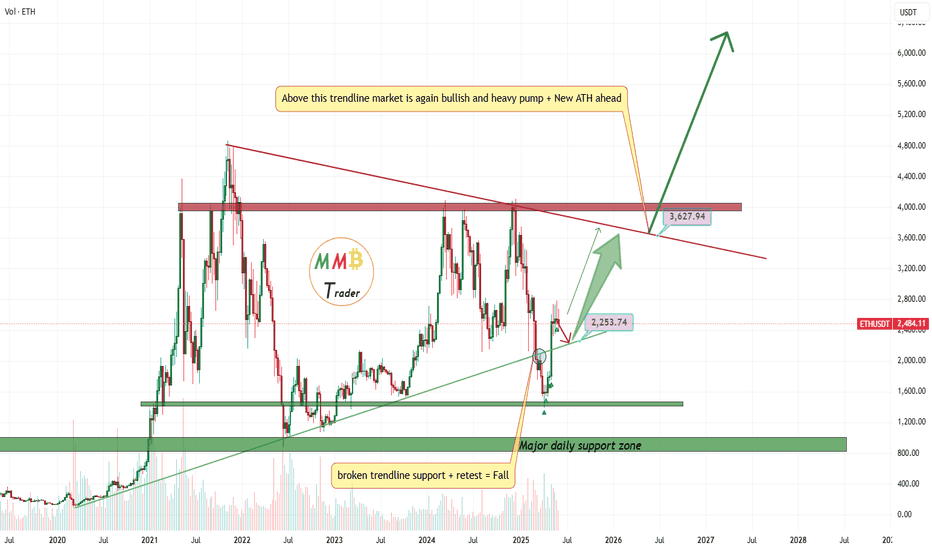

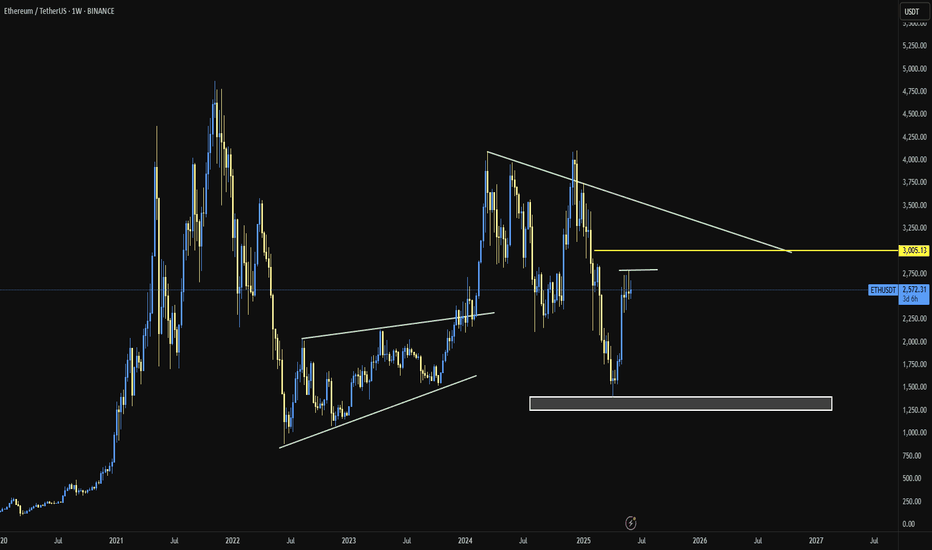

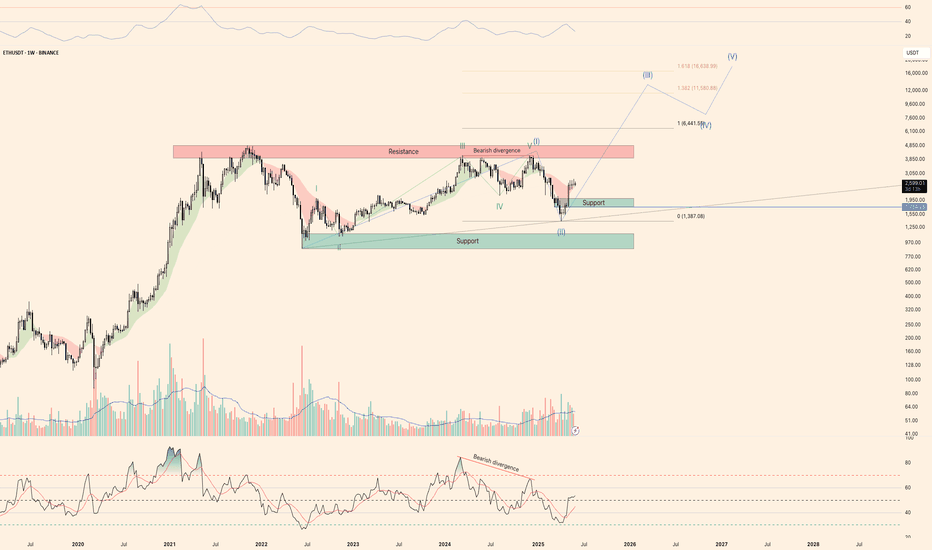

Global overview of the weekly TF on ETH In general, if we look at the weekly TF, we can see the Bearish divergence, which has already worked itself out and the price showed a strong bullish reversal, but for 4 weeks we have been observing a weak sideways trend.

We can draw a trend line along the two bottom points. It is important to note that the level of $1,754 is the key level and if it is broken, we can forget about the growth and wait for the fall to the support zone. The local support zone should be in the range of $2,023-$1,754, in case of correction this range should be protected before the subsequent growth.

If we interpret the movement from June 2022 to December 2024, we have 5 rising waves, the 3rd wave was really slow, but still the rules of 5 waves were not broken. So there is a chance that the price is now in the second wave and we are really waiting for the 3rd long wave in the form of bullrun on ETH, given the length of the first wave, we may see a rise above 10k on ETH.

Global resistance is in the $3,950-$4,860 range

Also, given that the top of wave 5 is only 0.4% higher than the top of wave 3, depending on the exchange, we can also suggest other options for the development of events

One alternative is the ABCDE triangle, this is a long triangle of 4 years. Wave B could end either at the peak on March 11, 2024 or at the peak on December 9, 2024.

In this case we have yet to see a decline before a sharp rise