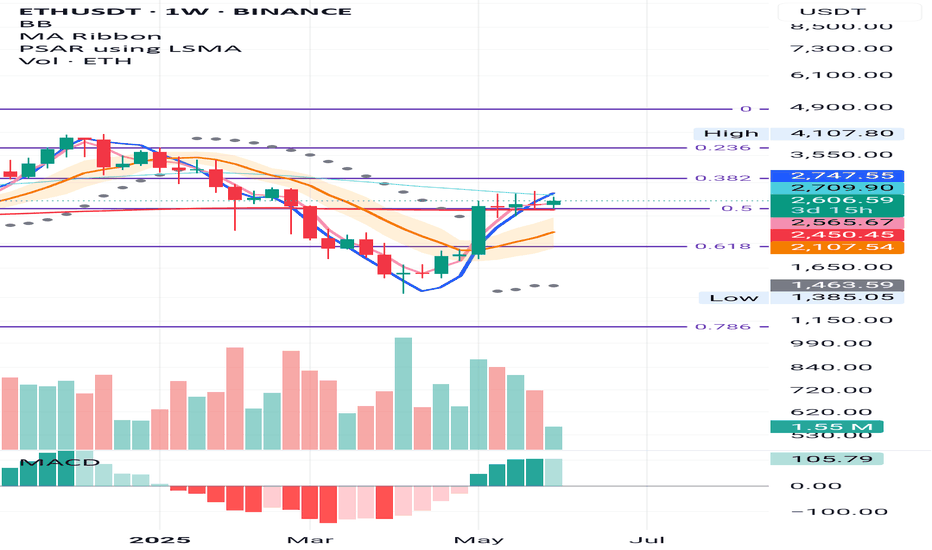

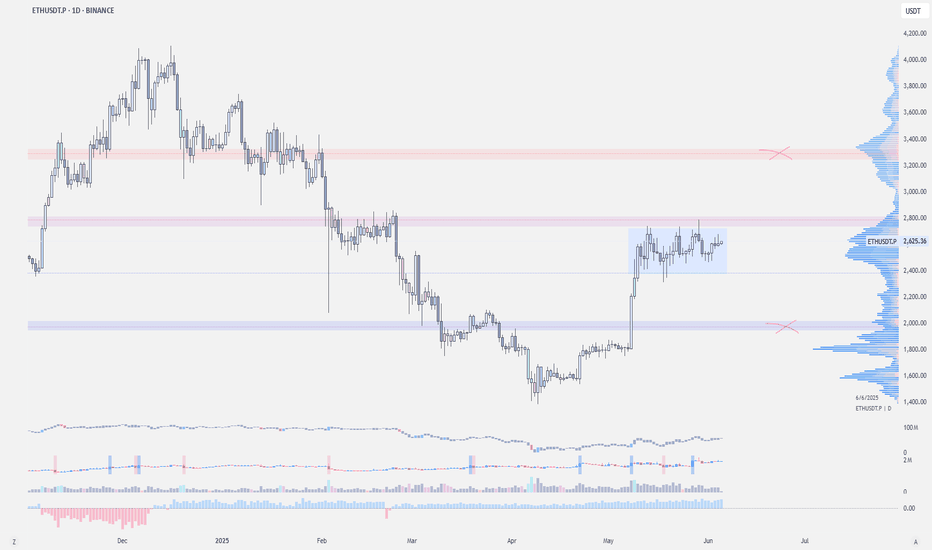

ETH Weekly – Signs Aligning for a Long Setup

ETH is forming subtle higher lows above the 0.5 Fibonacci level and the 200MA—both sitting near the same key support zone.

The 50MA is currently acting as resistance, but structurally we’re seeing MLR > SMA > BB center, and the PSAR flipped bullish since the week of May 12.

We now have all the signals needed for a valid long entry on this timeframe.

Feel free to drop your thoughts in the comments—good or bad, all engagement is appreciated.

Take profits. Manage risk. Stay sharp.

ETHUST.P trade ideas

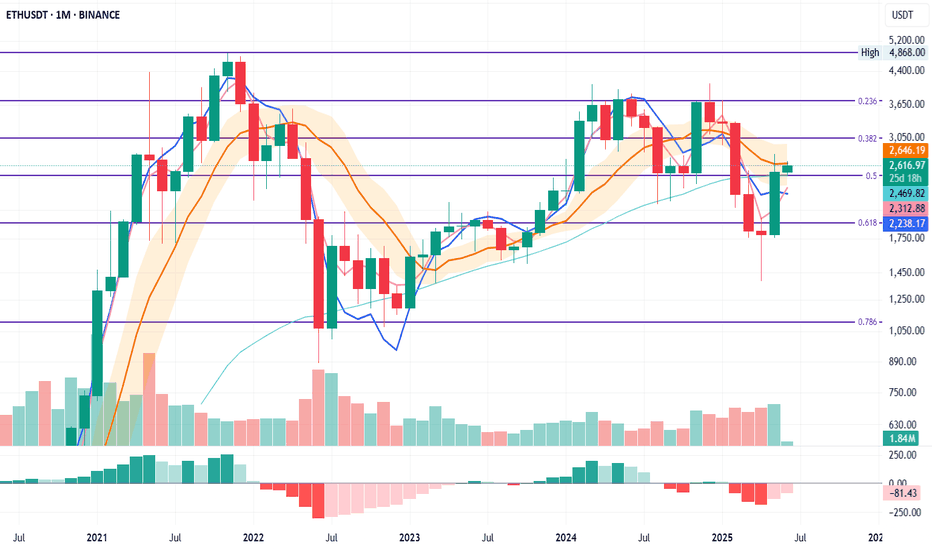

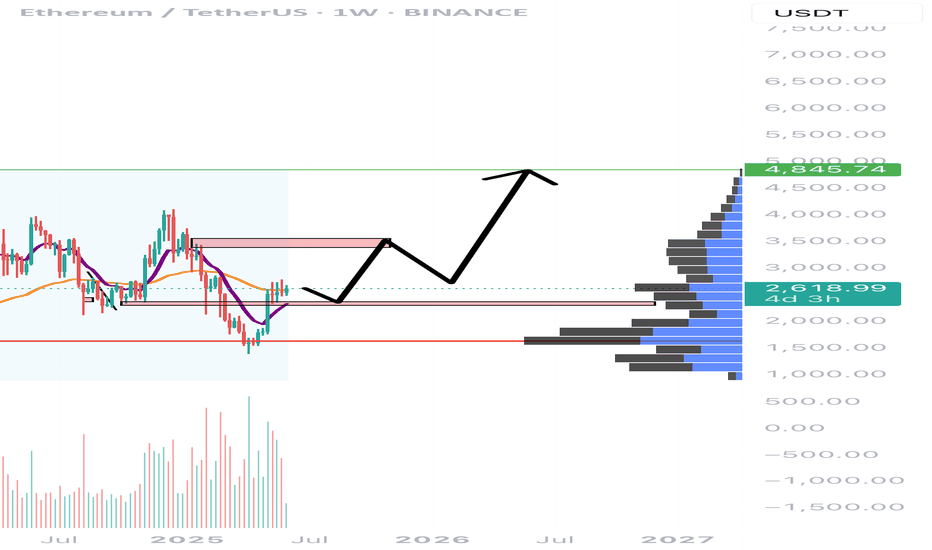

ETH Monthly – Fibonacci Structure in Play

ETH has been respecting the monthly Fibonacci levels with surprising precision.

There was a clear double top at the 0.236 Fib in May and November 2024, with a base forming at the 0.5 Fib. That same 0.5 Fib now acts as support, aligned with the 50MA.

The BB centre is currently stopping price, but for how long remains to be seen.

SMA is above MLR and rising, which supports a bullish bias.

If this structure holds, the next resistance zones may align with the higher Fib levels.

Feel free to drop your thoughts in the comments—good or bad, all engagement is appreciated.

Take profits. Manage risk. Stay sharp.

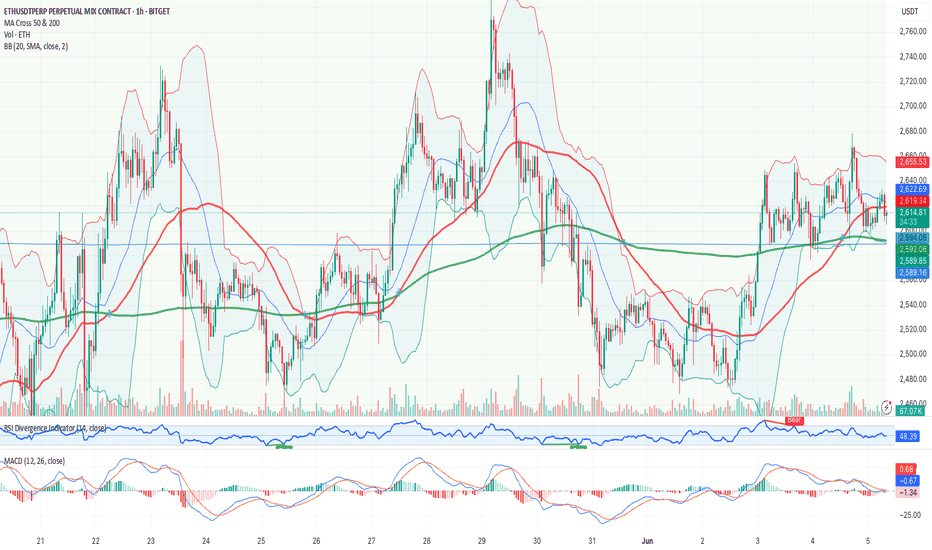

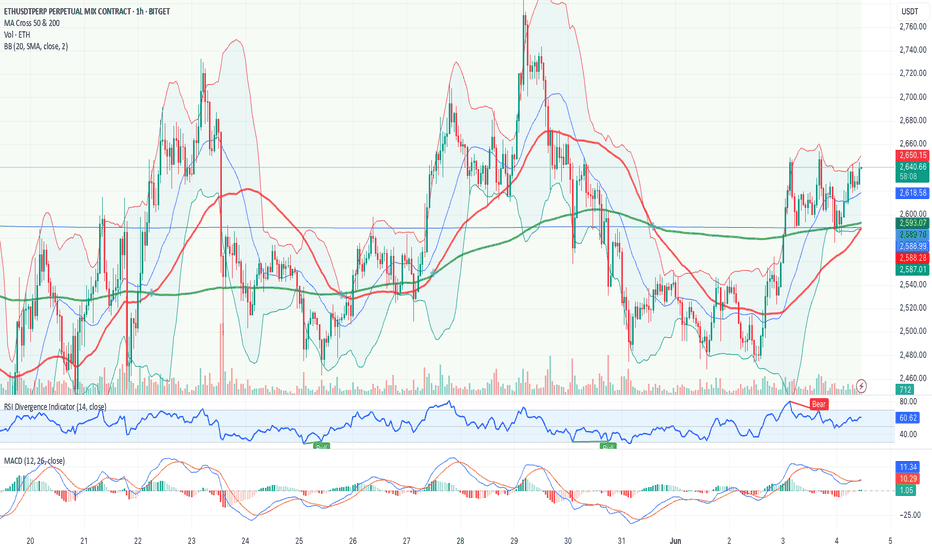

Technical Analysis – ETHUSDT (1h) – BITGET

1. Main Trend:

The short-term trend is currently sideways/slightly bullish. After a bearish phase, ETH has recovered above the 200-period moving average (green line), but struggles to decisively break the resistance around 2,620–2,640 USDT. The 50-period moving average (red) is close and often crossing the 200, indicating stability/uncertainty in the trend.

2. Key Levels:

Supports: 2,594 USDT (MA 200), 2,589 USDT (BB), 2,588 USDT

Resistances: 2,622 USDT (BB + recent local high), 2,655 USDT

Breakdown: A clear hourly close below 2,590 USDT could open the door to declines towards 2,550/2,520 USDT.

Breakout: Only a strong close above 2,622–2,655 USDT would confirm a new bullish momentum.

3. Technical Indicators:

RSI (45.73): Neutral, near oversold territory but without clear divergences (potential for rebound but risk of further weakness).

MACD: Still negative, indecisive signal with MACD line below Signal and both flat: no dominant momentum.

Bollinger Bands: Price is near the mid-band, typical of lateral phases. Bandwidth is low, suggesting the possibility of an imminent volatility spike.

Trading Signal

Asset: ETHUSDT Perpetual (1h)

Direction: Short

Entry: 2,592 USDT

(below the dynamic MA200 support and near the lower BB edge, confirming intra-hour weakness)

Stop-loss: 2,622 USDT

(above the central BB line and first resistance level)

Take-profit:

TP1: 2,555 USDT (previous lows and static support)

TP2: 2,520 USDT (next key historic level)

Confidence: Medium

Additional Notes:

Consolidation phase; volatility likely in the coming hours.

If price breaks and closes strongly above 2,622, bearish scenario is canceled; consider switching to long.

Macro: watch for BTC volatility and possible knock-on effects on ETH.

Pattern: no strong reversal pattern; situation dominated by uncertainty.

Reasoning:

The price action shows indecision and fluctuations within a tight range, but repeated tests of support without a strong rebound suggest underlying weakness. Failure to reclaim 2,622 strengthens the case for a short-term short, with a tight stop to protect against potential “fake breakouts.”

$ETH - Short-term Outlook Ethereum is stuck in a neutral zone. Unless it breaks above the $2.8k resistance, altcoins likely won't see much movement either.

It's consolidating below the resistance, in a high-volume node after strong impulse from $1.7k

No strong seller absorption yet at resistance → suggests indecision

We have to break above the mid-range for a bullish shift or possible retest of the supply zone at $3k to $3.4k

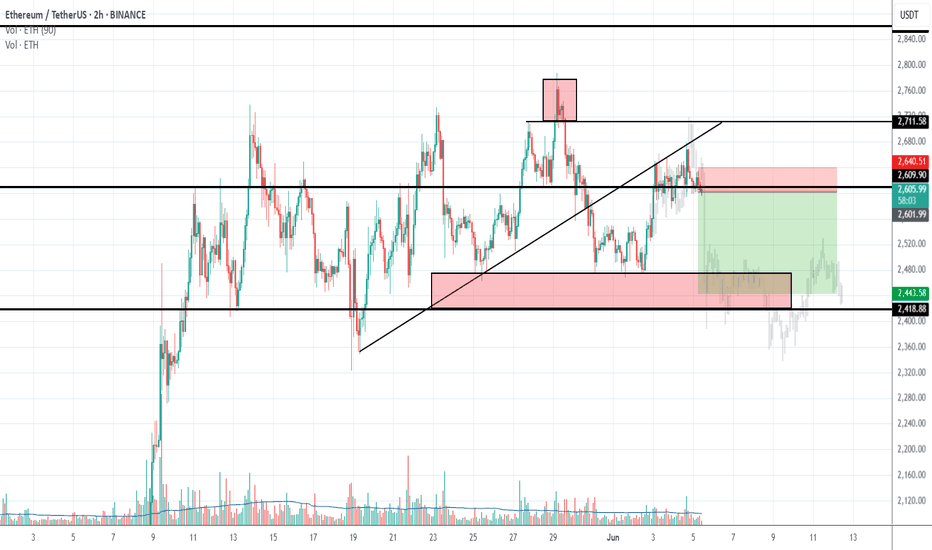

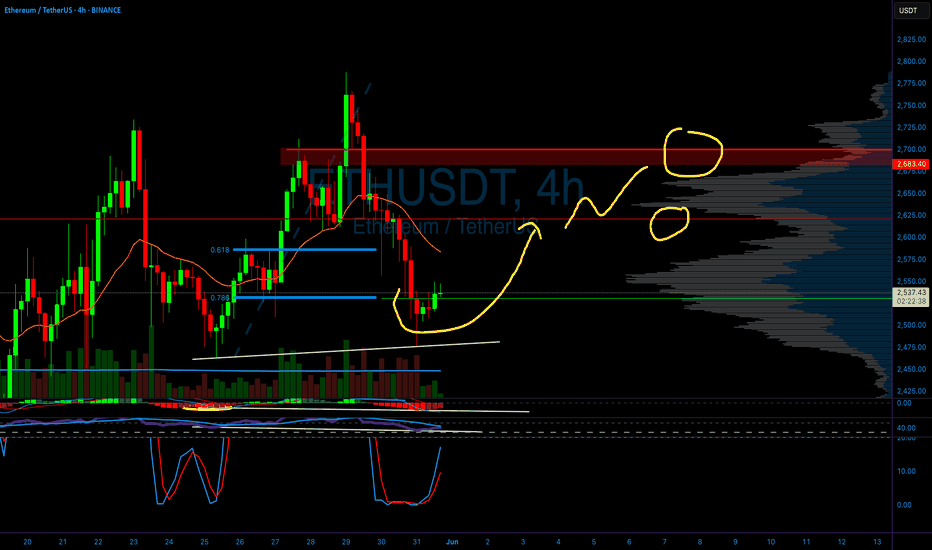

ETH Breakdown Retest in Progress — More Downside Ahead?🧱 Breakdown Retest Structure

The triangle/wedge was broken to the downside around May 28–30.

After the breakdown, price has rallied back and is now hovering around the lower boundary of the broken triangle—classic bearish retest behavior.

This structure often plays out as:

Breakdown → retest of support as resistance → continuation down.

🔴 Confluence for Bearish Outlook:

Lower Highs + Weak Momentum: Recent price spikes are showing rejection wicks near $2,700, indicating seller strength.

Volume Drop: Weak follow-through on the bounce suggests it's a corrective rally, not accumulation.

EMA Pressure: The price is struggling to hold above the 20 EMA, showing hesitation.

Bearish AB=CD Structure: The rally from the bottom might be forming a harmonic ABCD correction before the next leg down.

Major Resistance Zone ($2,720–$2,800) is being respected—multiple rejections are evident.

⚠️ Bearish price projections:

If ETH fails to reclaim $2,720–$2,750 and closes below $2,580 on the 4H chart, expect downside targets:

🎯 Target 1: $2,460 (recent support zone)

🎯 Target 2: $2,220 (origin of the last rally)

🛑 Invalidation: 4H close and hold above $2,800 would invalidate this bearish thesis.

🧠 Summary

You're spotting what looks like a bearish retest after a breakdown, which is a high-probability short setup in technical analysis. While bulls are attempting to push back, unless ETH breaks back into the triangle, the path of least resistance looks down.

📌 Conclusion: Wait for a 4H rejection near $2,700 with strong bearish candle for confirmation. Stop above $2,800. Profit targets: $2,460 and lower.

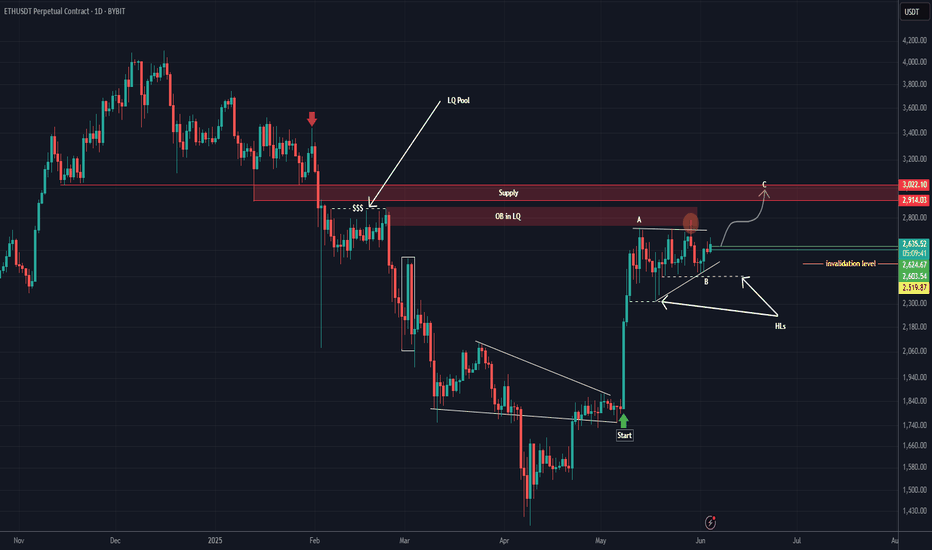

Ethereum is still bullish! (1D)First of all, read the text carefully to avoid any misunderstandings.you should know that the market is currently at a sensitive point, and Ethereum’s bullish move does not necessarily mean other coins will follow the same path.

As marked on the chart, the START of Ethereum’s bullish move began after a lengthy and deep correction. Observing ETH's current behavior, this wave is sharp and appears to be more of a time-based correction rather than price-based. Wave B moved sideways and took significantly more time than wave A, suggesting that wave C could very well begin without a deep pullback, pushing price toward higher levels.

There’s a liquidity pool in the upper area that we’ve highlighted. In order for this momentum to slow down, price likely needs to hunt a major liquidity level.

There was a fresh order block inside the liquidity pool, and although price touched it, there wasn’t a deep reaction | lows weren’t taken out, and all the lows during the correction have remained intact, which is a bullish signal.

It seems that price intends to at least reach the red zone we've marked.

For this scenario to play out, the two green lines near the current price candles must hold. A daily candle closing below the invalidation level would invalidate this outlook.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

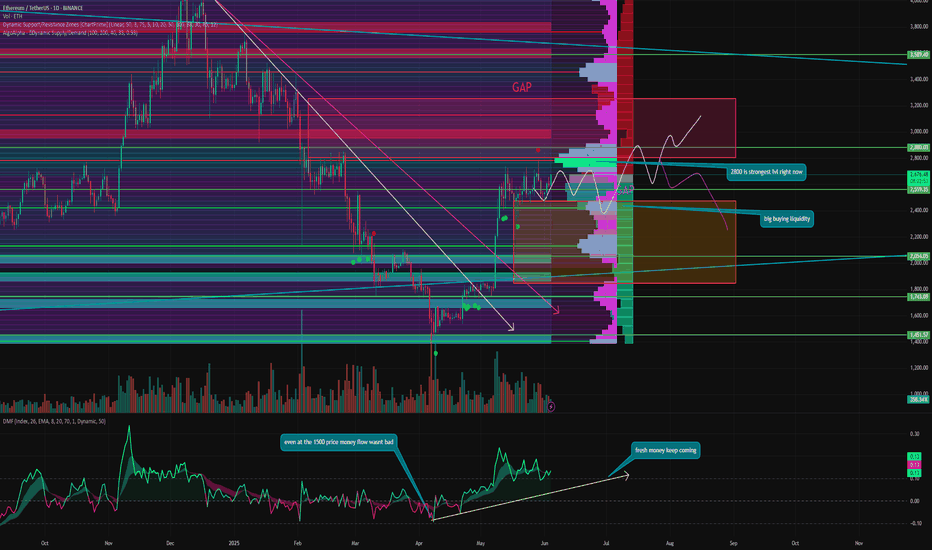

ETH Season already STARTS?!⚡️ Hello everyone! It's been quite a while since my last review of ETH, so it's time for an update.

ETH has followed my green path exactly (I repainted it beige on this chart for convenience).

While Bitcoin is stuck at the 106-104,000 level, ETH looks more confident. In addition, the asset is currently fueled by very bullish sentiment in X, as well as a large number of rumors about partnerships.

BUT! ETH currently has the most overheated funding rate, 3 times higher than BTC and even slightly higher than SOL, which is obviously more speculative.

In addition, there is a huge GAP below us, leading all the way to 1,850!

Let's figure out what might await ETH in the near future and why:

⚙️ Metrics and indicators:

DSRZ - resistance at 2800 is currently the strongest level, and ETH is actively storming it, forming an ascending flag.

DSD - a large amount of buying liquidity is at the 2,600 - 2,400 levels. Therefore, we only see wicks from this range. The price almost instantly recovers when it falls below 2,500.

DMF - capital inflows into ETH continue to this day, albeit in smaller volumes, and divergence is observed.

But, surprisingly, even at a price of 1,500, the DMF indicator did not drop significantly, meaning that no one was disappointed in ETH as was suggested in the media. Liquidity practically did not leave the asset.

📌 Conclusion:

ETH now looks much more interesting than BTC. The first cryptocurrency has long since exhausted its momentum, and its small ATH update only confirmed this.

A lot of positivity around ETH is supporting the price and pushing it up. And let me remind you that Ethereum is now almost 50% below its ATH, so it is much easier for it to move.

And a couple more important facts: ETH recently broke SOL's dominance on the daily chart. This means that even in this pair, changes have begun and the less liquid SOL has started to lose ground.

In addition, while there are large outflows from BTC ETFs, there are inflows into ETH ETFs. This means that ETH may indeed be preparing for its momentum.

📊 I see two paths, both on the chart:

Beige - BTC remains in range and ETH begins its movement. Where the first goal is to close the GAP to 3,200.

Purple - the market begins a standard summer correction and ETH, having gathered short sellers' liquidity from 2,800 to 2,900, goes down to close the GAP.

🔥 Have a great summer, guys! Don't forget to take a break from the charts and get some fresh air sometimes!

Ethereum on the Edge?📉 Ethereum on the Edge?

ETH is showing weakness around key resistance, and the current price action suggests a potential move down to $2590 in the coming sessions.

Bearish divergence + low volume = 🚨 warning signs!

💬 What’s your take? Are you bullish or bearish on ETH?

📌 Follow for more real-time crypto insights and market updates!

#Ethereum #ETH #CryptoAnalysis #TradingView #CryptoSignals #ETHPricePrediction

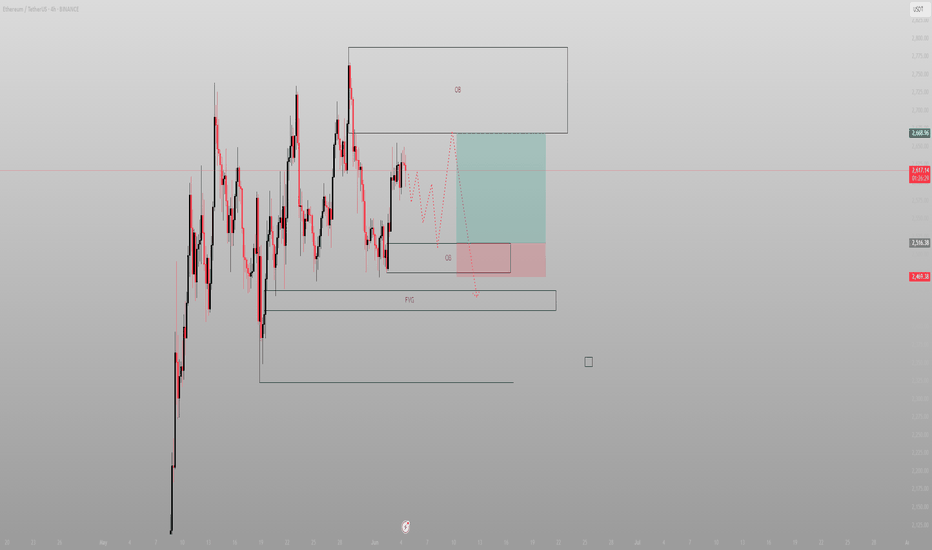

If price doesn’t break you, it’s building you.ETH has been printing higher-timeframe indecision — but within that noise, the structure is crystal clear. We're trading between two OBs. That’s not chaos. That’s preparation.

Here’s the map:

Price has respected the lower OB multiple times — but has yet to displace from it

There’s a clean FVG below, untouched — it’s the draw if this OB fails

To the upside: upper OB is where the game flips — either distribution or continuation

Until then, this is a defined range between intent and indecision

Execution here isn’t about speed — it’s about patience.

How I’m positioning:

A break and close below the OB = short into the FVG at ~2469

If price instead consolidates here and pushes up, I’ll wait for rejection at the upper OB for a reversal short

Only if we displace through the top OB and hold it, do I flip bias back to longs

This isn’t the time to guess. It’s time to observe. Let price do the heavy lifting — your job is to interpret.

More like this — structure-driven setups with real intent — are detailed in the profile description.

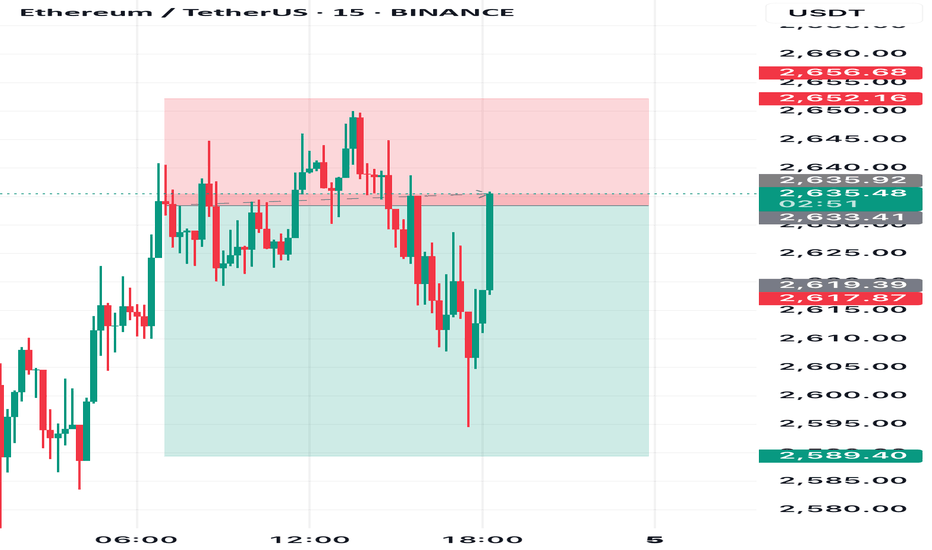

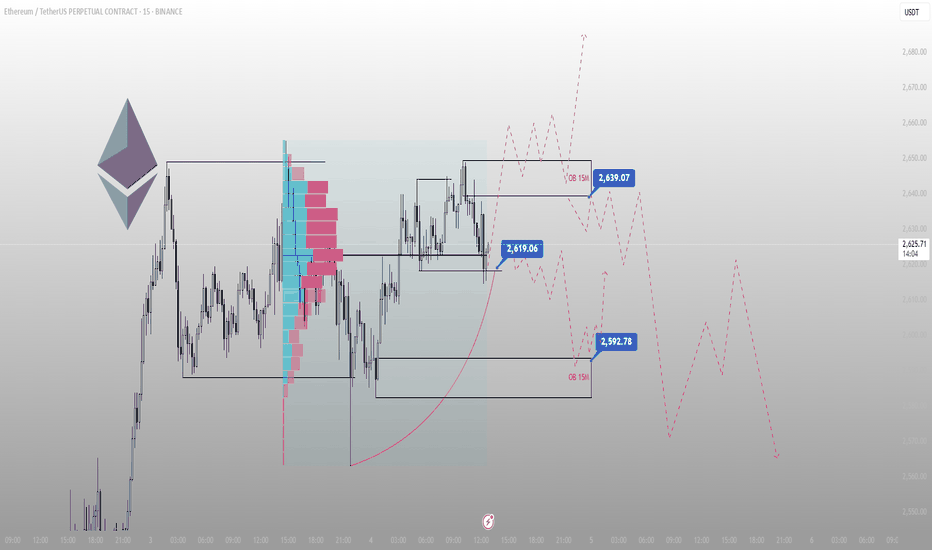

No impulse here is random. Each wick is a message.ETH has been rotating around inefficiency — not in confusion, but in setup.

This isn’t sideways. It’s structured accumulation just beneath premium OB.

Here’s the narrative:

Price swept the local low, then tapped the 2,619.06 level — a key reaction zone

Above us: a 15M OB at 2,639.07 — this is where early longs will either get paid or punished

Below: 2,592.78, the real demand block — if we break down, that’s the last hold before structure flips

The volume profile shows clear interest at mid-range — meaning Smart Money isn’t chasing price. It’s absorbing.

Expectations:

Hold above 2,619 → target 2,639 and reevaluate

Failure below 2,592 → rotation opens into inefficiency

Execution plan:

Clean long above 2,619, invalidation below 2,592

Short only if price flips 2,639 and fails to hold it on the retest

This is a reaction zone — I’m not chasing. I’m positioned.

Don’t confuse consolidation with indecision. Smart Money’s already placed.

More trades mapped like this — before they move — are in the profile description.

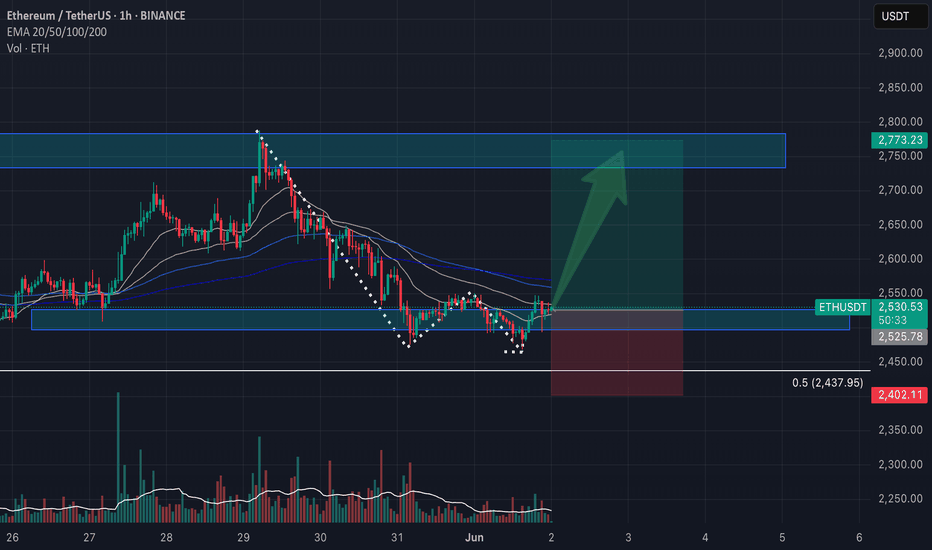

ETH/USDT – Bullish Reversal From Demand Zone | 1H SetupAfter a clean downtrend with lower highs and lower lows, ETH has just printed a clear local reversal from the previous demand zone around $2 480–$2 510 .

Price-action shows us a rounded bottom, that is holding above the 0.5 Fib from the previous pump.

We now see:

✅ Break of structure on the lower timeframes (check 15m)

✅ Price reclaiming 20/50 EMA with increasing volume

✅ Strong green engulfing candle, coming before momentum shift

✅ Stop hunter candle below support and quick recovery aka retest.

Trade Idea:

If ETH holds above $2510–$2520, we may see a strong move toward the next supply zone near $2750–$2780 .

Entry: $2520–$2530

Stop-loss: Below $2440 (or around $2400 for safer invalidation below Fib 0.5)

Targets:

• TP1: $2666

• TP2: $2720

• TP3: $2770

🟩 Watch for confirmation with a candle close above $2540 + volume spike.

🟥 Cancel if price loses $2480 local support zone.

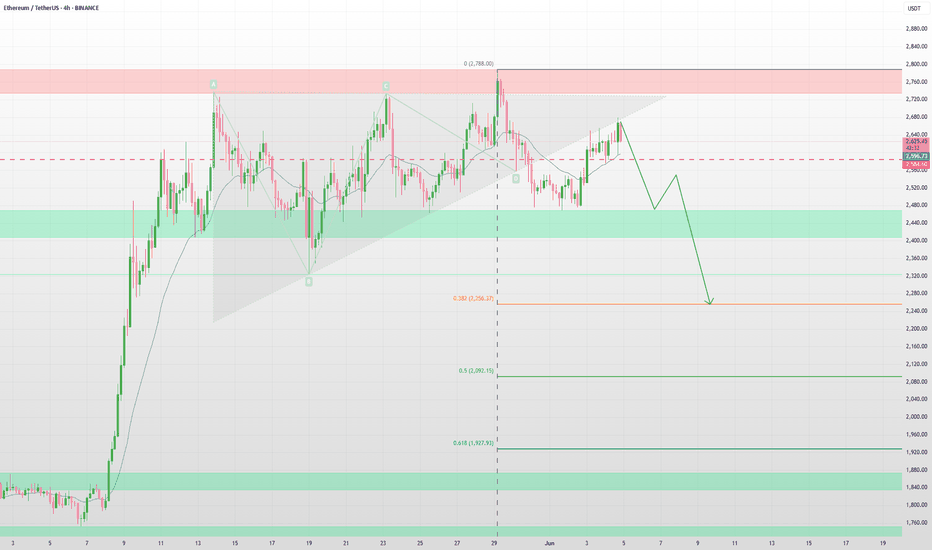

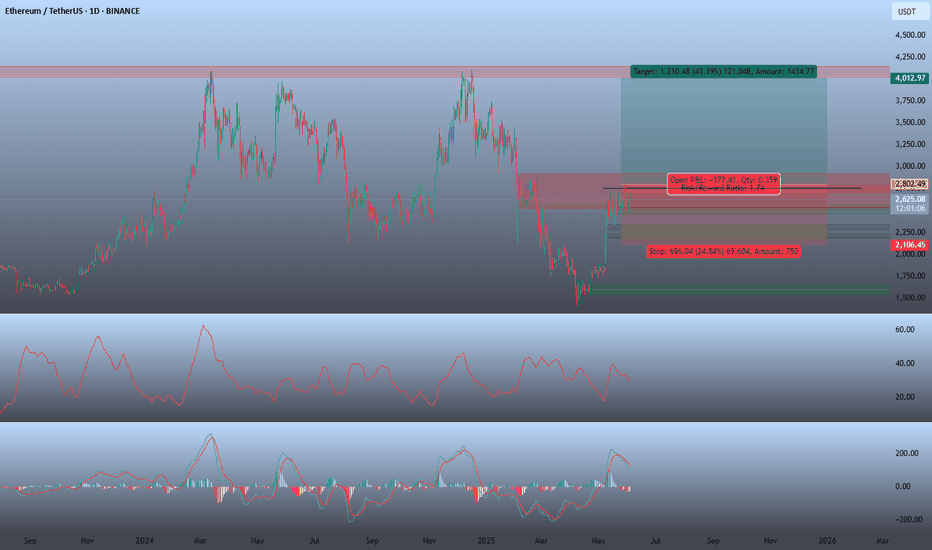

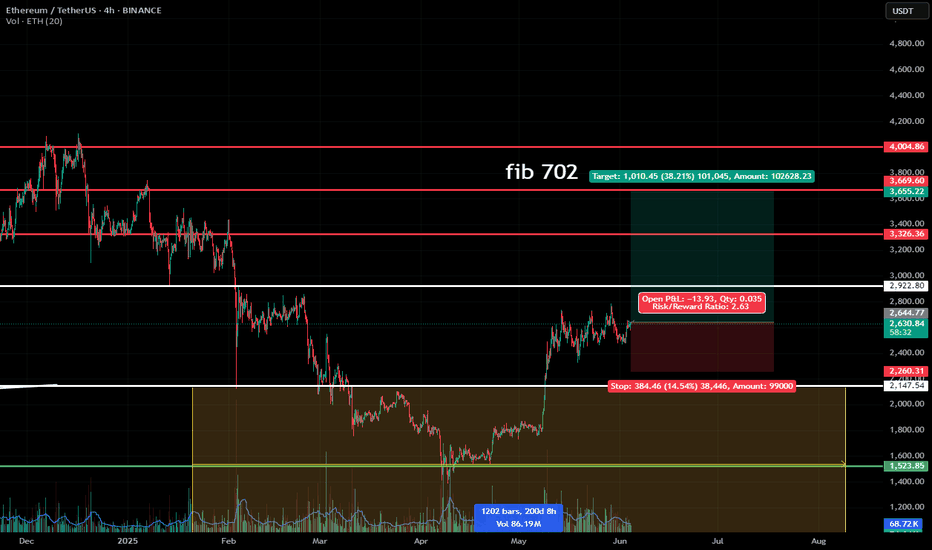

BUY Ethereum (ETH/USDT) Breakout strategy Long term.Instrument: Ethereum / USDT

Timeframe: 1-Day (D1)

Trade Type: Trend Continuation (Conditional Long)

Risk/Reward Ratio: 1.74

Duration: 2–6 months

📉 Trade Parameters (If Triggered)

Entry (Pending Trigger): 2,802.49

Target: 4,012.97

Stop Loss: 2,106.45

Risk: ~24.84%

Reward: ~43.19%

📌 Trade Thesis

This trade will be valid if ETH/USDT reclaims and holds above the 2,800 zone, confirming a bullish breakout continuation.

Currently, ETH is trading below the entry trigger, but the broader market structure and momentum suggest a potential move toward retesting the key breakout zone.

🧱 Structural Context

High-Volume Resistance: The 2,600–2,800 area is a historically significant resistance block, previously acting as supply during multiple failed attempts to break higher.

A clean break-and-hold above this region would confirm accumulation completion and mark a trend resumption.

📉 Momentum Signals

MACD: The MACD remains in bullish alignment, with positive histogram bars and a rising signal line. A renewed MACD surge on breakout would confirm trend continuation.

Stochastic RSI: Recently cooled from overbought and now resetting — this provides momentum room for a fresh leg upward if price breaks out.

🎯 Target Zone Rationale

4,000–4,100 is a macro swing high and psychological resistance area. It represents a natural magnet for bullish momentum once 2,800 is cleared and confirmed.

🧠 Strategy Notes

This is a conditional trade setup — do not enter unless price breaks and holds above 2,800 with supporting volume. The trade structure offers a healthy R:R of 1.74, but the wide stop reflects daily volatility and must be sized accordingly.

Keep watch for:

Bitcoin and NASDAQ correlation

Macro catalysts (e.g., inflation data, ETH ETF news)

Breakout confirmation via candle close above 2,800 on solid volume

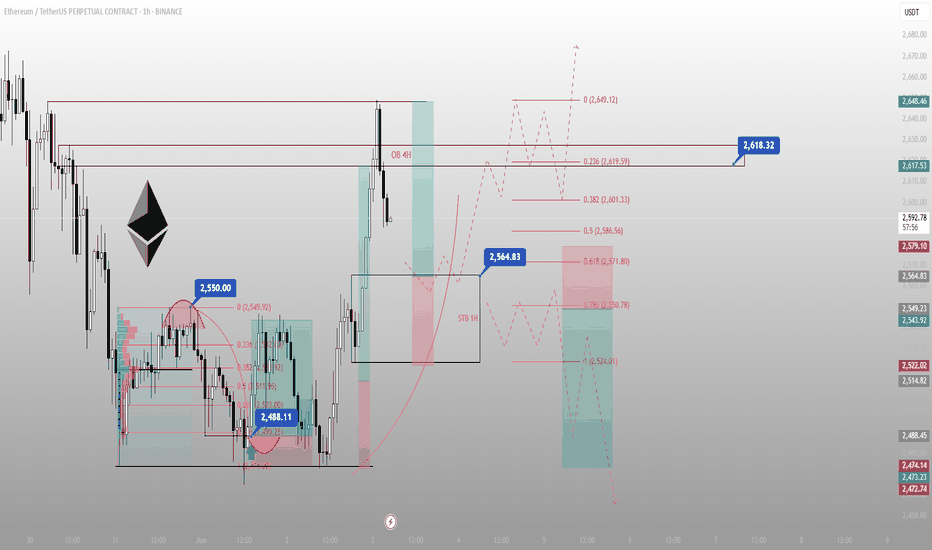

They bought the dip. I anticipated the shift.This ETH setup didn’t require hopium — just structure, volume, and timing.

The chart respected every level I mapped days ago. And now? Price is setting the table again.

We swept liquidity below 2488.11 — textbook turtle soup into a bullish STB on the 1H.

Then price ripped clean into the 4H OB and tapped 2649.12 — the fib extension target. That’s not retail momentum. That’s interbank delivery at work.

Now we’re pulling back. And here’s where it gets clear:

The 0.5–0.618 zone sits between 2586.56–2571.80

It overlaps with the 1H STB zone — a demand pocket from the origin of the expansion

If price consolidates above 2550.78 (the 0.786) and flips 2564.83 again, I expect continuation back toward 2618.32 and 2648.46

If we sweep 2524.01 without reaction — then it’s a deeper rotation

This isn’t a “buy support” setup. This is a model-driven continuation based on structure and internal range logic.

Entry bias is valid above 2580. Below 2524 — it’s invalidated.

I don’t guess entries. I forecast structure.

More models and trades? Check the profile description. Precision lives there.

ETH/USDT Trading Signal🔥 ETH/USDT Trading Signal 🔥

Ethereum is looking strong!

📈 Trend is bullish

💡 Idea: Go LONG if price breaks

2,648🛑Stop−loss:2,592

🎯 Take-profit:

2,700and2,740

Why?

Trend is up

Indicators (RSI & MACD) confirm

Key resistance is about to break!

Like if you think ETH will pump! 🚀

#ETH #Crypto #Trading #Ethereum

Market Crashing? How to Profit from the Dips?Every time the market crashes, do you feel like it's over?

What if those red candles are exactly what pros are waiting for?

In this post, I’ll show you how fear can become profit.

Hello✌

Spend 3 minutes ⏰ reading this educational material.

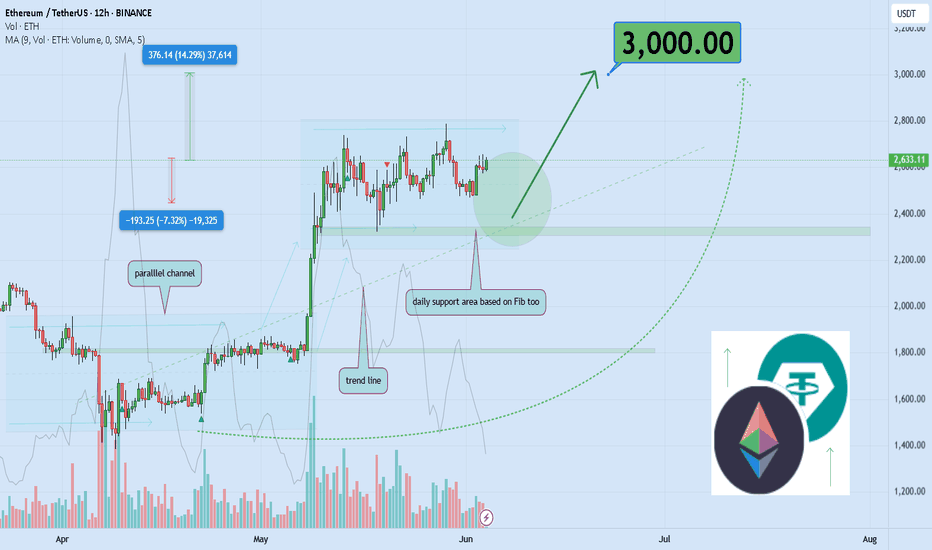

🎯 Analytical Insight on Ethereum :

After a strong recent surge, ETH maintains its bullish momentum, backed by solid trading volume and a well-defined upward structure. A crucial daily support zone—aligned with both a Fibonacci area and a rising trendline—continues to hold firm. My primary target is the psychological $3,000 mark, offering around 14% potential upside if the current momentum persists. 🔍

Now , let's dive into the educational section,

💥 Market Psychology: Why Traders Panic in Crashes

When red candles start stacking up, most traders go into “exit” mode. Emotions like fear of losing money, social pressure, and FUD override logic. The average trader sells at the worst possible moment. Why? Because no one taught them that corrections are part of a healthy market. Meanwhile, seasoned players understand that bear markets are not the end — they're prime territory for growth. Fear is not a warning; it's often a signal.

📊 TradingView Tools to Catch Gold in the Red

TradingView is more than just a charting platform — it's a full toolkit for reading the market’s emotional state. One of the most effective tools during dips is the Volume Profile . It reveals where big money is stacking up. When prices fall but volume spikes, it often signals accumulation by whales. Another useful resource is the Fear & Greed Index , which, while external, can be embedded in custom TradingView dashboards to gauge sentiment.

Then there's RSI on lower timeframes , which helps spot oversold conditions and potential reversals. MACD Divergences also offer golden entry signals when paired with price action. And here’s the real kicker: you can use Pine Script to create custom alerts for all these indicators — so you’re not just reacting to fear, you're stalking opportunity.

🧠 Flip the Script: Discount or Danger?

Perspective is everything. If you see dips as danger, your instincts will push you to run. But if you see them as discounts, you’ll start planning your moves. Simple price action tools work wonders here. Look for double bottoms on the 4H, or Pin Bars on strong support zones. But be patient — always wait for confirmation. The real difference between losing and winning traders? One waits. The other guesses.

🛠 Smart Entry Strategies During Bloody Markets

Let’s get practical. If the market has dropped 20%, consider using a DCA (Dollar Cost Averaging) strategy. Break your capital into 3–5 parts and enter at different key support levels. Another strong setup is the Breakout-Retest Entry: wait for a key level to break, then re-enter after a pullback. Stop losses? Use the ATR to calculate realistic SL zones — and yes, you can display this dynamically on TradingView. Alerts, backtests, and auto-calculations make your game clean, not lucky.

🧩 Recap & Final Suggestion

When fear floods the market, the smart see opportunity. With the right mindset and TradingView tools in hand, you can shift from panic-driven reactions to data-driven decisions. Discipline, proper tools, and a fresh perspective — that's your winning trio during a crash. Open your charts, prep your indicators, and get ready to do what the pros do: profit from fear.

always conduct your own research before making investment decisions. That being said, please take note of the disclaimer section at the bottom of each post for further details 📜✅.

Give me some energy !!

✨We invest countless hours researching opportunities and crafting valuable ideas. Your support means the world to us! If you have any questions, feel free to drop them in the comment box.

Cheers, Mad Whale. 🐋

ETH/USDT 1DAY CHART UPDATE !!ETH has broken out of a long-term downtrend (black diagonal trendline) and is now in a consolidation phase below the $2,800–$2,850 resistance.

The price is currently $2,612, showing hesitation below the key horizontal resistance.

Resistance Zones:

$2,800–$2,850: Key horizontal resistance. Breaking above this confirms bullish continuation.

$3,200 and $3,600: Medium to long-term bullish targets.

Support Zones:

$2,000–$2,200: Strong horizontal support + ascending trendline + 50 EMA (red line)

$1,410: Key long-term support (unlikely to be tested soon unless the market reverses)

ETH breaks and closes above $2,850 ➝ $3,200 → $3,600 → $3,800+ likely to rise

The structure suggests that a higher low will likely form before the breakout.

If ETH rejects at $2,850, expect a retest of $2,000–$2,200 (golden zone)

This would create a bullish higher low setup and could be a strong buy-dip opportunity.

Thanks for your support!

DYOR. NFA