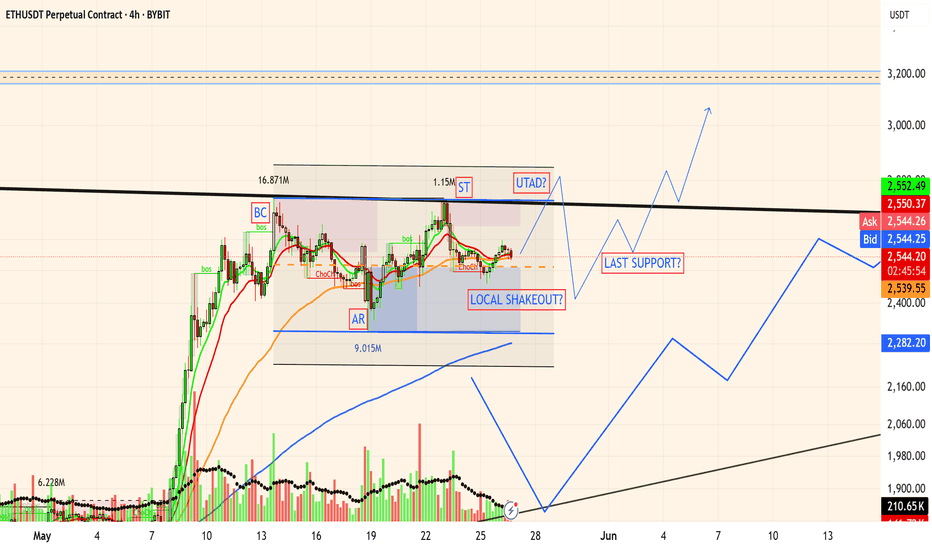

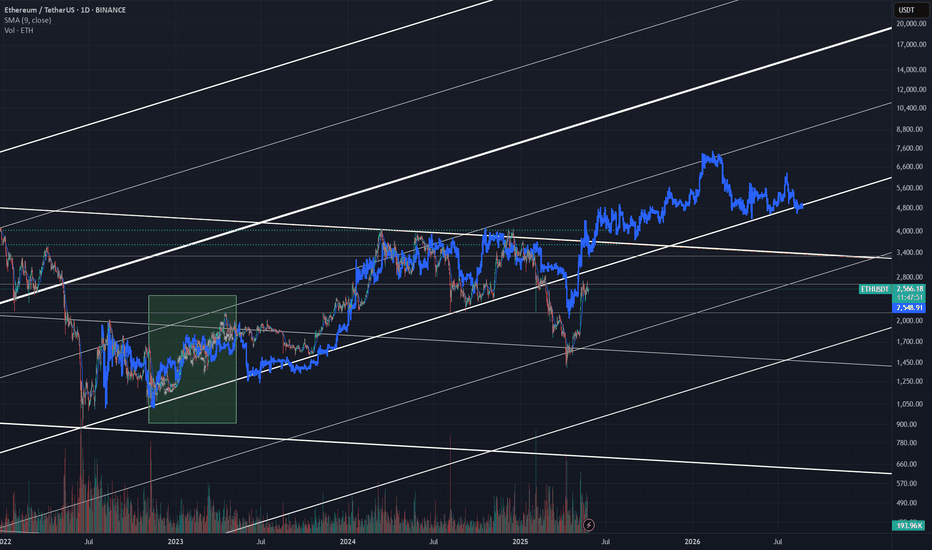

Ethereum 4H - Wyckoff?It is always very difficult to understand the dynamics with fragmented volumes, where peaks almost always coincide with an abrupt move.

This is Ethereum on 4H, a position I am following, although I prefer larger timeframes.

I am not currently trading, but rather holding pending better times.

Remember to be careful, these are delicate and dangerous times, especially for those who are not so experienced.

You can copy the setup and follow it by yourself.

ETHUST.P trade ideas

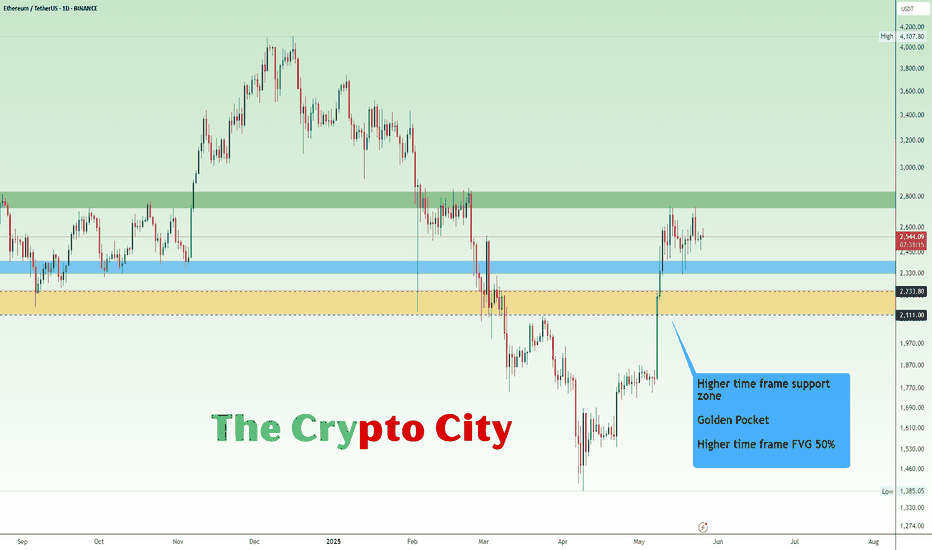

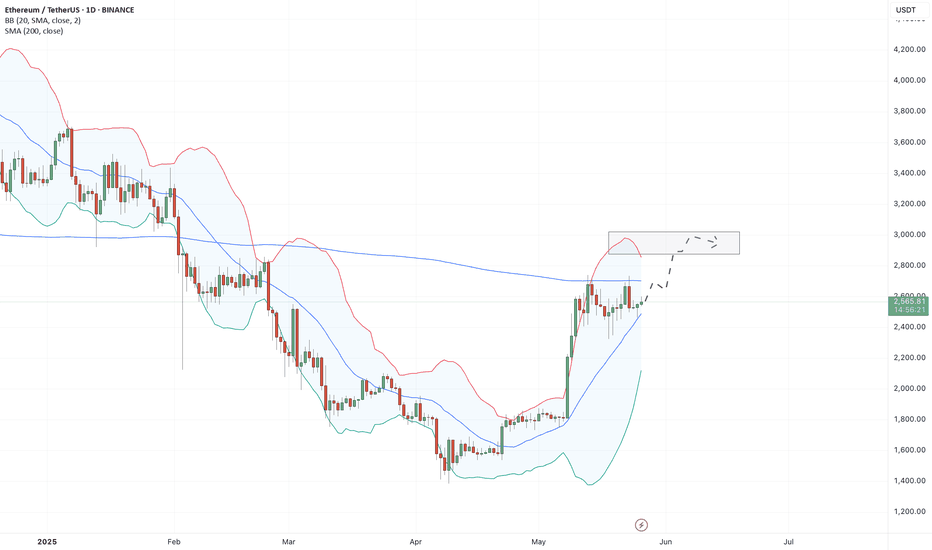

ETH USDTEthereum’s $2,328–$2,400 blue support zone was an excellent buy range. If the price breaks below this zone, the last opportunity to buy may be at the yellow support zone.

In the coming weeks, if Ethereum breaks above the green resistance zone at $2,727–$2,833, we could see new highs. I believe this breakout would signal the beginning of a new bull run.

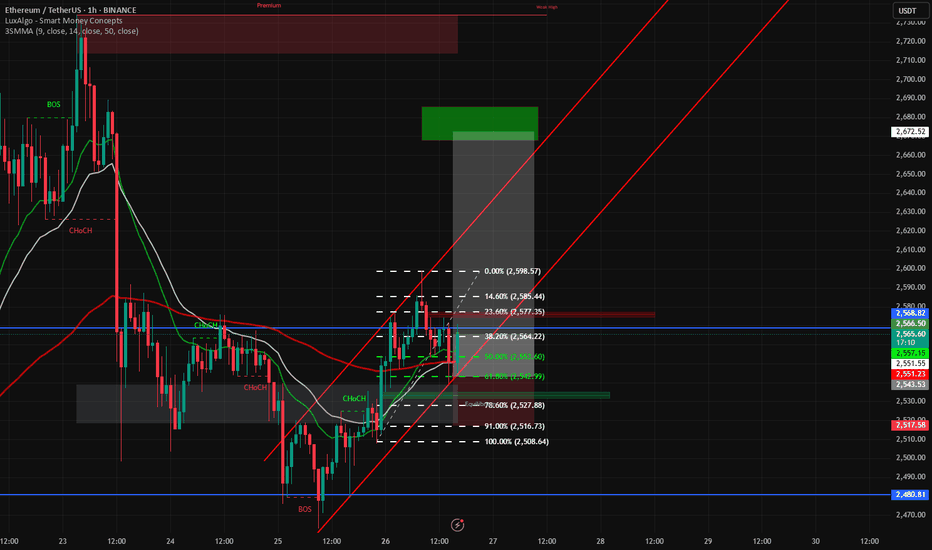

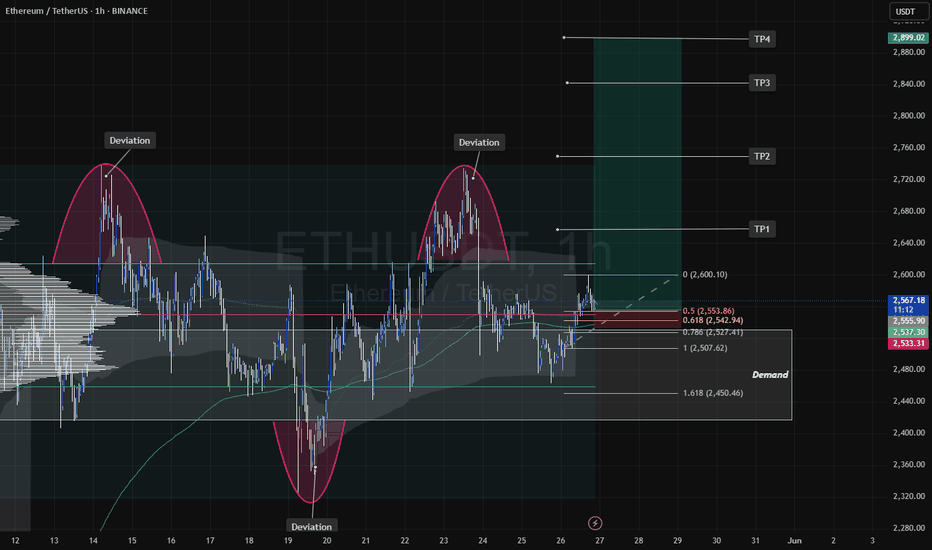

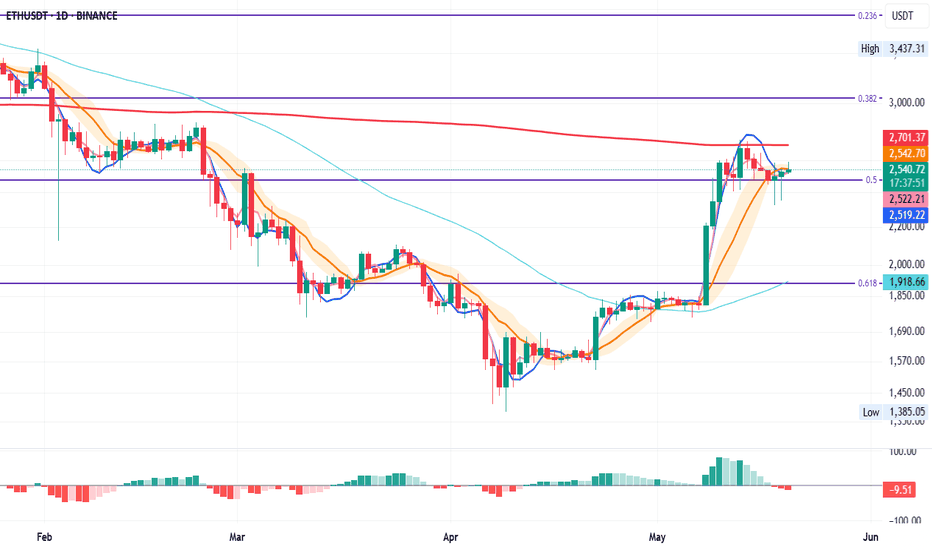

Strategic Rebound from Fibonacci 50%-61.8% Within Bullish ChanlThis trade is based on a confirmed bullish structure following a Break of Structure (BOS) and multiple Change of Character (CHoCH) signals, indicating a potential trend reversal. Price is currently trading within a rising channel, pulling back into the key Fibonacci 50%-61.8% retracement zone (2,551 – 2,539 USDT).

This area aligns with a possible institutional order block, increasing the likelihood of a bullish reaction. The trade targets a move back toward the local high around 2,598 USDT, with potential extension to the liquidity zone near 2,670 USDT. A protective stop-loss is placed below structure at 2,527 USDT, ensuring a favorable risk-to-reward ratio.

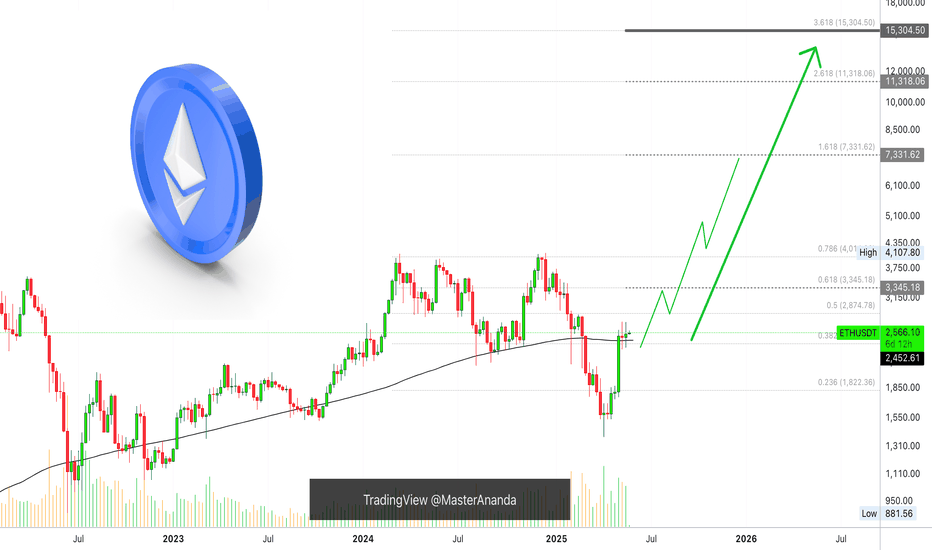

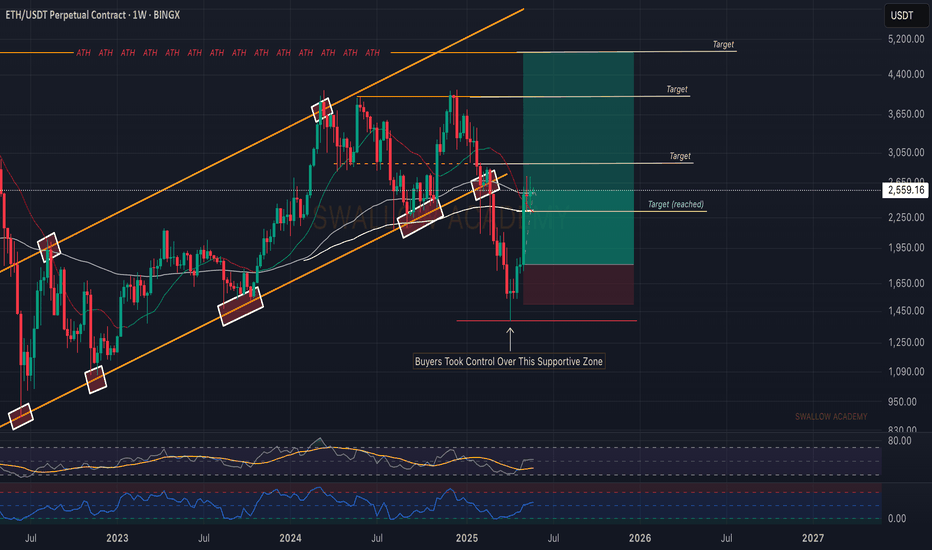

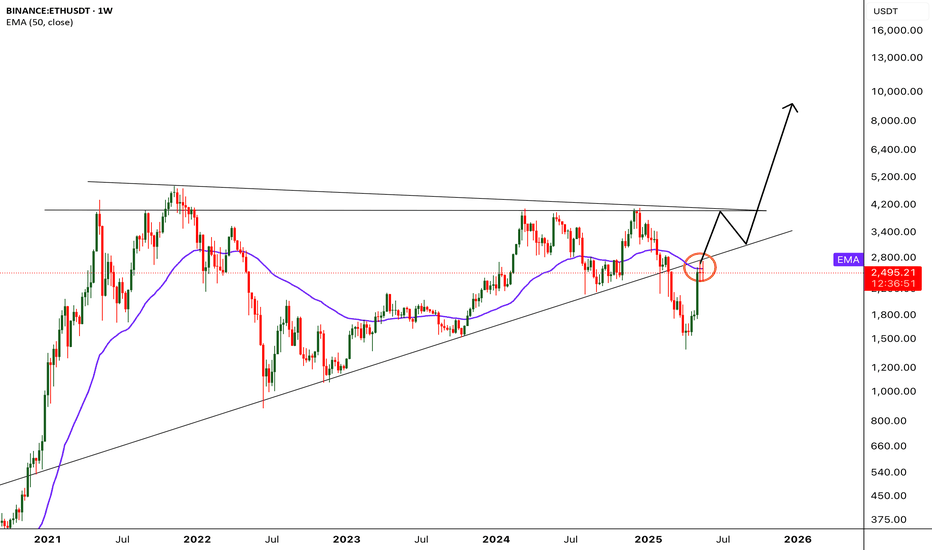

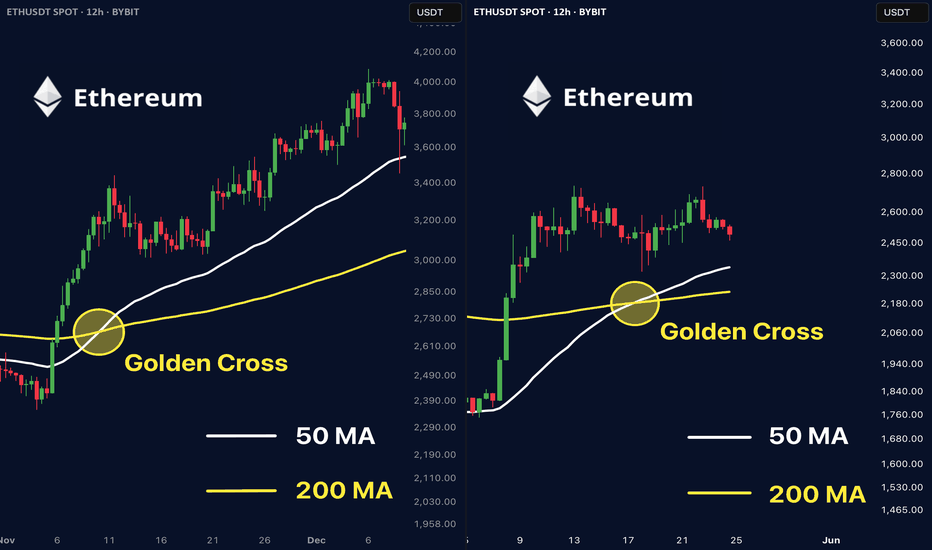

Ethereum Breaks Above MA200, Long-Term Bullish Cycle ConfirmedThe 5-May week marked not only a major advance and recovery above the August/September 2024 low prices, but it also signals a recovery for Ethereum above MA200 long-term, weekly timeframe.

This simple signal confirms that the bulls are in. But there is more.

After breaking above this level, Ethereum closed two additional weeks green above it, both times wicking lower but recovering. So this level has been conquered, retested and continues to hold. This means that we have at least 6 months of bullish action confirmed based on the chart, technical analysis.

There are also some great signals based on the long-term.

» RSI: The weekly RSI has a strong reading (bullish) and produced a major higher low compared to June 2022. This signal matches what happened at the end of the previous bearish cycle.

» MACD: The weekly MACD also produced a long-term higher low compared to July 2022 coupled with a bullish cross. This indicator is trending full-upwards and leaves no room for doubt. Ethereum is set to grow long-term. Let me show you the MACD...

What would you do if you knew, with a high level of certainty, that Ethereum will trade at $7,000 or higher this same year? How would you take action? How best to profit from this knowledge/information?

Namaste.

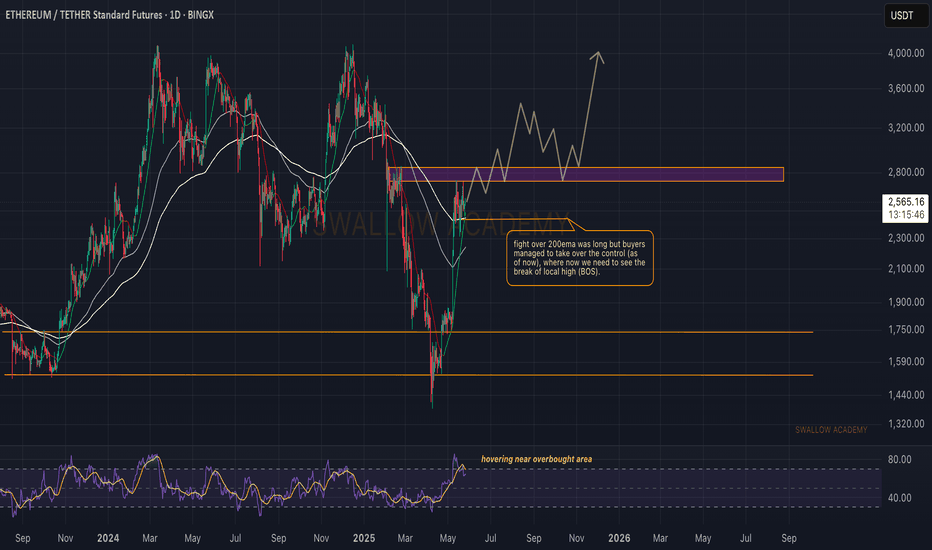

Ethereum (ETH): Buyers Secured EMAs, Possible Breakout IncomingEthereum has recently secured the branch of EMAs, and now that we see the dominance that buyers have shown multiple we are expecting to see a break of the local highs area, which would then send the price to $3,000 and then $4,000.

As of now it is a little early to tell about the certainty of that movement, so we have to wait for Monday to pass, as Mondays are tricky days and can sometimes just be a fakeout movement.

Swallow Academy

Ethereum (ETH): Buyers Secured The EMAs, Another Push Incoming!Ethereum has recently secured the branch of EMAs, where now it seems that buyers are going for the break of structure, which then would result in a movement towards our other target zones.

So with that being said, our game plan has not changed; we are looking for further movement to upper zones, and so far we are in good profits (thanks to the entry that we caught on lower zones).

Swallow Academy

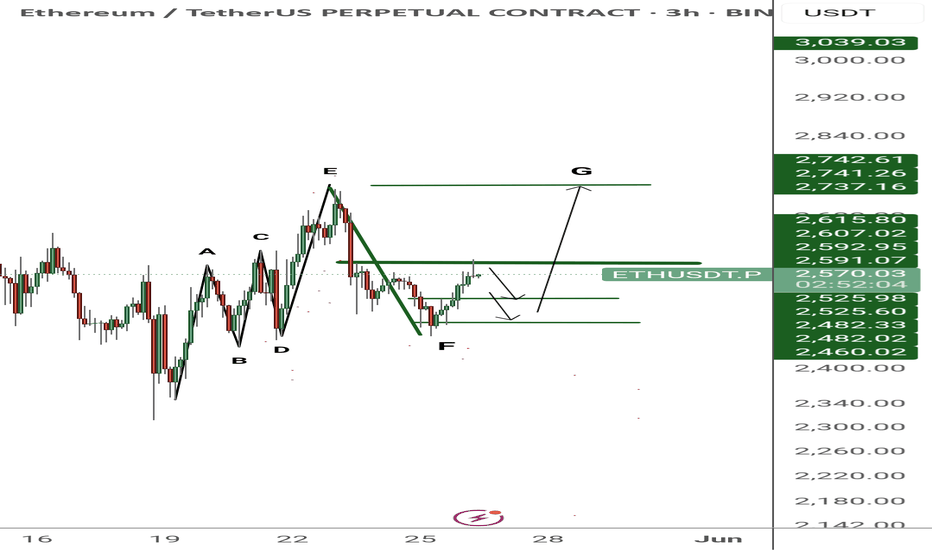

ETH-USDTUpdate: Expanding Diametric Reaching Final StageEthereum is unfolding a textbook 7-legged Expanding Diametric on the 3H chart — one of the cleanest emotional and structural patterns in corrective formations per Glenn Neely’s NeoWave theory.

Here’s the breakdown so far:

🔷 Wave A: Initiated with strong emotion — longest leg so far

🔷 Wave B: Quick contraction

🔷 Wave C: Moderate bounce — smaller than A, larger than B

🔷 Wave D: Contracting correction, smaller than B

🔷 Wave E: Sharp upward push, but still less than A

🔷 Wave F: Deep and emotional drop — aligns with the rhythm

Now we are preparing for the final Wave G, which must:

🔹 Expand beyond Wave E (and possibly near A)

🔹 Remain corrective, not impulsive

🔹 Appear emotional — many mistake G for the start of a new trend

🔹 Likely hit the 2737–2742 USDT zone

🔹 Possibly begin after one last minor drop (trap) to maintain deception and rhythm

⚠️ If Wave G forms as expected, this pattern completes a full Expanding Diametric, meaning the next significant structure afterward may be either a complex correction or a trend resumption.

📌 Keep an eye on short-term rejections, but the larger wave psychology points toward one final emotional spike before pattern conclusion.

BINANCE:ETHUSDT BINANCE:BTCUSDT COINBASE:ETHUSD INDEX:BTCUSD BYBIT:BTCUSDT.P

ETH mignt be preparing for the breakoutETHUSD is aligning with the overall cryptocurrency trend, led by Bitcoin. Compared with the latter, ETH has an MVRV indicator positioned at approximately 1.3, which makes the trend for ETH a relatively young trend, thus having a potential for continuation.

Bitcoin is positioned at peak, which makes it relatively difficult for traders to join: stop-loss should be wider, and the extended liquidation risk still can easily wipe traders out of positions with the regular volatility.

With ETHUSD, the situation might be more interesting as it’s located in the trading range, and the potential move up may be more aggressive and straightforward, if and when it will break the current resistance of area of $2600.

Don't forget - this is just the idea, always do your own research and never forget to manage your risk!

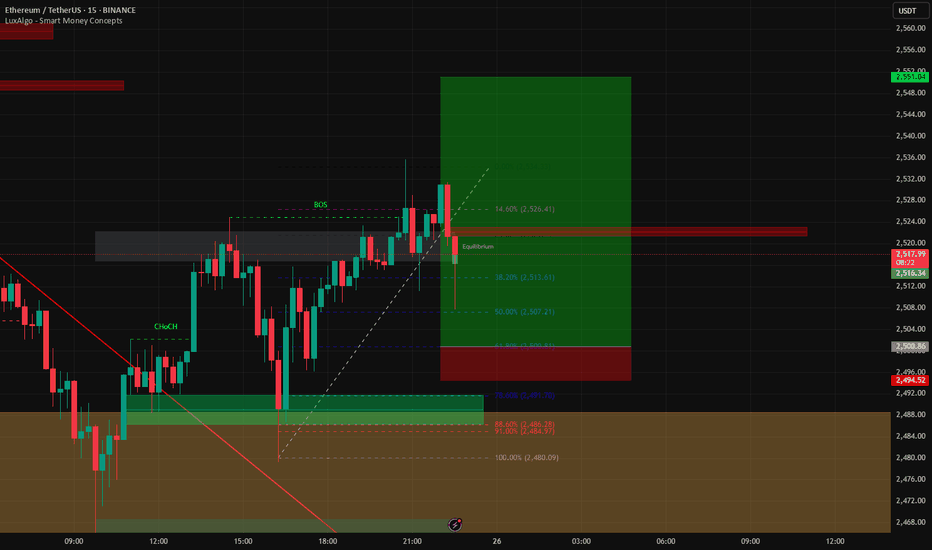

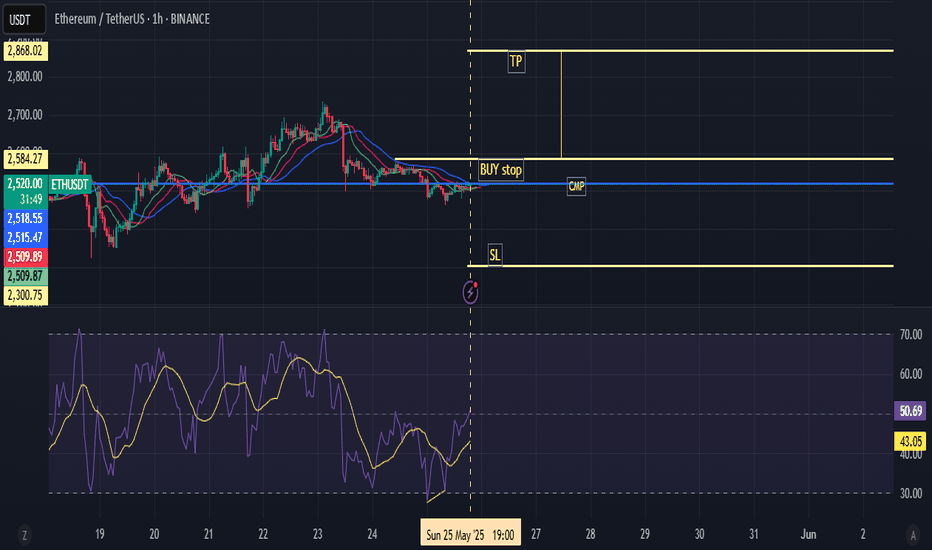

ETH/USDT – Rejection from Equilibrium Zone After BOS, Bullish I'm watching a bullish setup on ETH/USDT (15-minute chart) based on Smart Money Concepts.

After a confirmed Change of Character (ChoCH) and a Break of Structure (BOS) to the upside, price retraced into the equilibrium zone and tapped a key support level near 2500 USDT — a psychologically and technically significant level. This area also aligns with the 50%-61.8% Fibonacci retracement and sits just below a bullish Order Block.

I’m positioning a Buy Limit at 2500 USDT, anticipating a continuation move back toward recent highs.

Entry: 2500 USDT

Stop Loss: 2,480 USDT (below previous low)

Take Profit: 2,534 USDT (recent swing high)

Risk: 20 USDT

Reward: 34 USDT

Risk:Reward Ratio ≈ 1:1.7

The wick into the zone suggests a liquidity sweep and potential bullish reversal. A strong bullish candle or a new BOS would confirm the continuation bias.

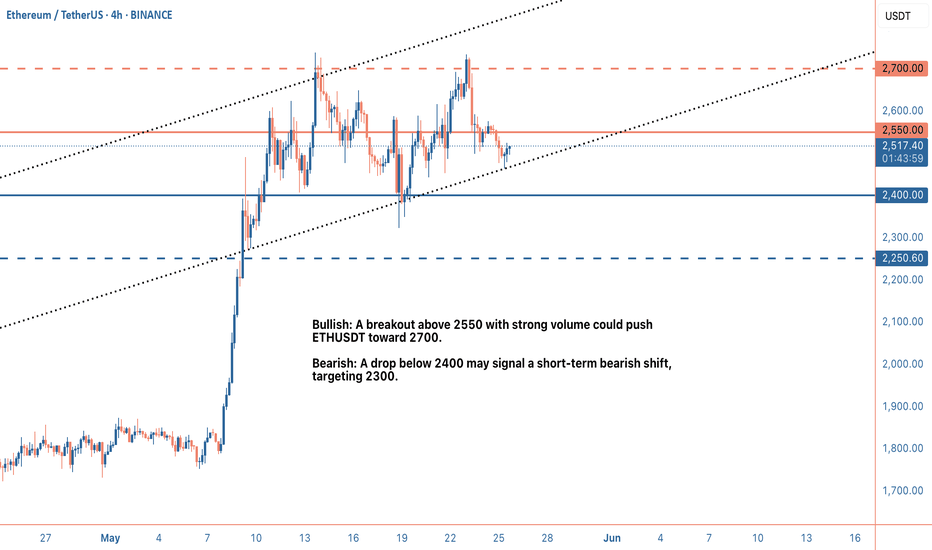

ETHUSDT at 2511: Breakout or Breakdown at 2550?Ethereum (ETHUSDT) is currently trading at 2511 on the 4-hour timeframe, sitting in a consolidation phase after a recent uptrend. Over the past few days, the price has shown resilience, bouncing off a key support level around 2400 and now testing a critical resistance at 2550. This 2550 level is a make-or-break point: a clean break above it could spark a bullish move toward 2700, while rejection here might send the price back to retest 2400. The broader market vibe is cautiously positive, with Ethereum’s upcoming upgrades generating some buzz, though regulatory uncertainties could weigh things down if negative headlines hit. Volume has been tapering off during this consolidation, which is normal, but keep an eye out, a breakout with strong volume will carry more weight.

From a technical standpoint, the 50-period moving average (MA) sits at 2450, and the 200-period MA is at 2300, with the price comfortably above both. That’s a solid bullish sign for now, but the 50-period MA is starting to flatten out, hinting that the upward steam might be cooling off. The Relative Strength Index (RSI) is at 60, right in the neutral zone, not overbought or oversold, so there’s room for the price to swing either way. Over on the MACD, the line is above the signal line, showing bullish momentum, but the histogram bars are shrinking, which could mean that momentum is losing some juice. Traders should watch for a breakout or a MACD crossover to get a clearer sense of what’s next.

There’s also a potential pattern taking shape: an ascending triangle, with the flat resistance at 2550 and a rising support line from 2400. This setup is typically bullish, but it’s not a done deal until we see a confirmed break above 2550. If that happens, especially with a volume spike, it’s a green light for bulls. On the flip side, if the price slips below 2400, it could signal a short-term bearish shift. For now, 2550 is the level to watch, it’s where the action will heat up. Whether you’re trading the breakout or the rejection, this is a spot to plan your moves carefully!

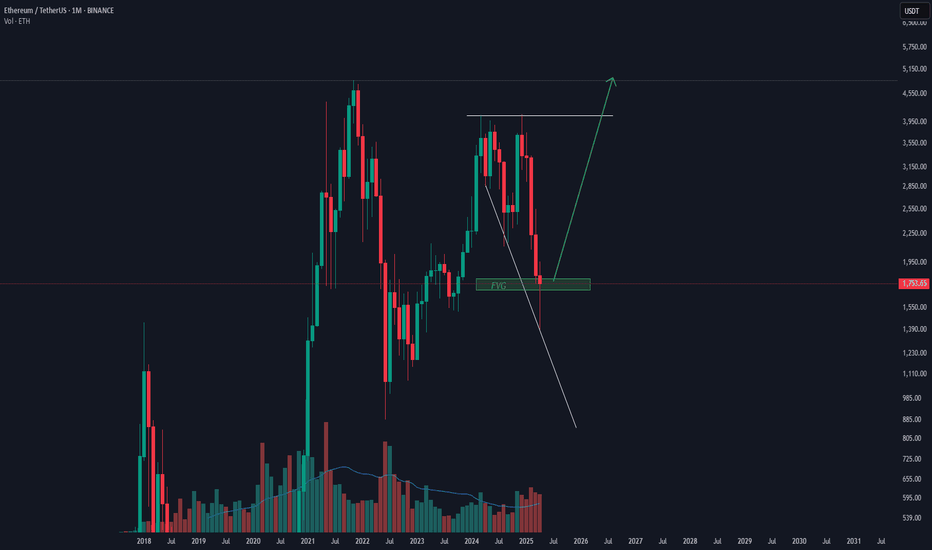

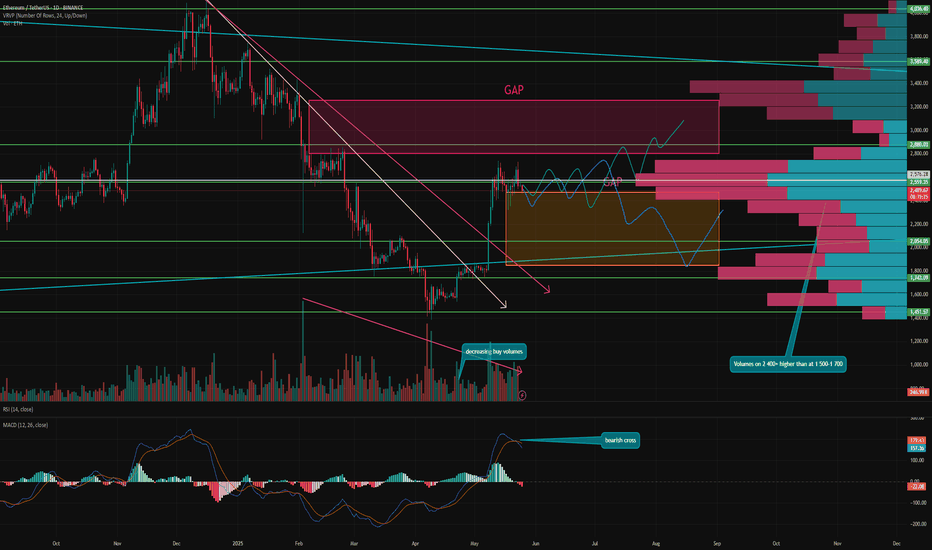

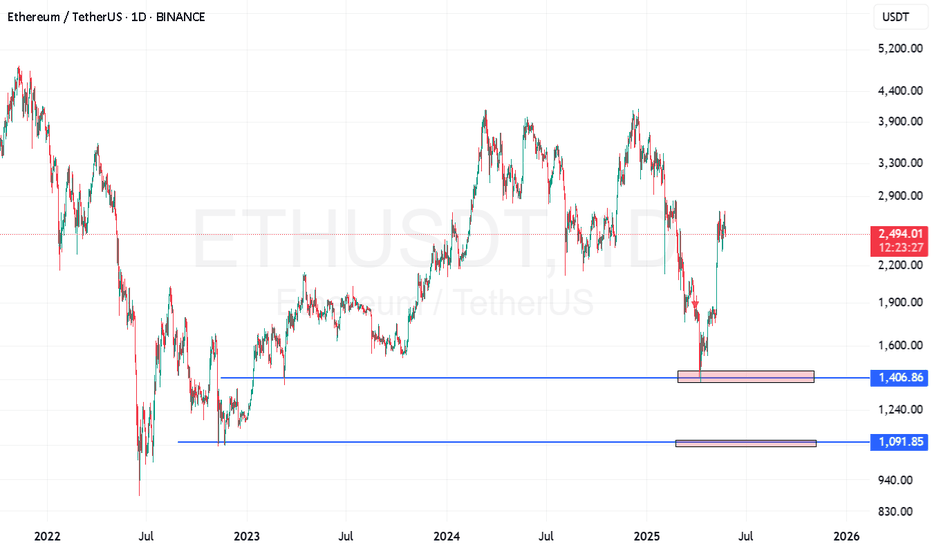

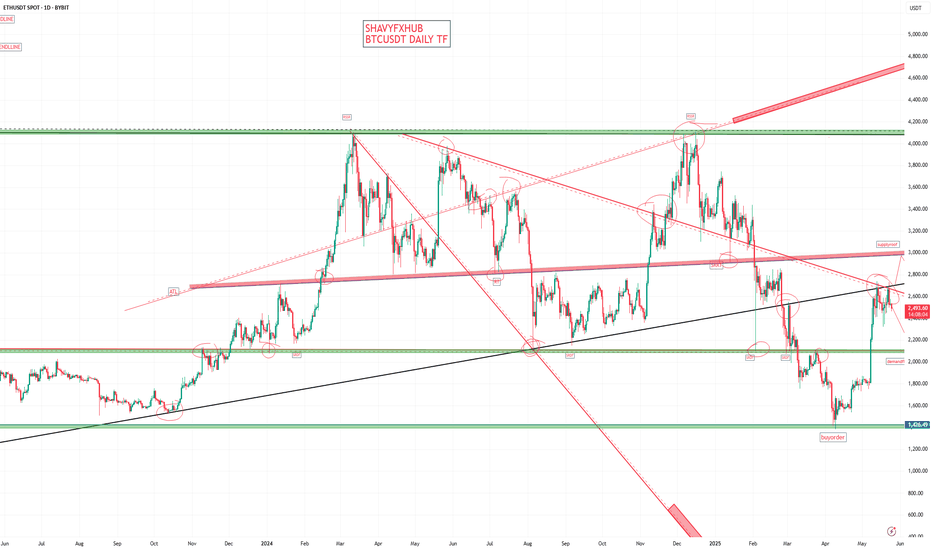

ETH cheaper than $1,500 already this SUMMER? Hi! While many are already predicting an alt-season and hundreds of X's, let's see if it's really so? 🤔

While bitcoin is updating ATH day by day. ETH is still trading almost 40% cheaper than its peak in this cycle . And on the low time frame it is already forming a double top pattern, signaling a downside risk in the near future.

With the current growth we have closed a small GAP at the level of 2,250 - 2,650. But there is still a GAP above us in the zone of 2,800 - 3,250. In addition, below us there is now a GAP formed in the range of 1,850 - 2,450. And as we know, 99% of GAPs tend to close sooner or later.

❓ But here's the question - which one will close sooner? Let's get to the bottom of it!

⚙️ Indicators and metrics:

MACD - has already given a bearish section, signaling a potential trend change.

Volume - since February 3, all further declines, the volume of ETH purchases has only declined, signaling a decline in interest in the asset. Even at 1400 and below, buying volumes were still disastrously low . Showing the lack of interest in the asset even at such prices.

VRVP - shows buying and selling volumes at price levels in relation to each other. It is noticeable that at the levels of 2,400 - 2,750 the trading volumes increase significantly , and in both directions. Showing that this level is still a strong resistance , and the mood in ETH is extremely speculative and few people are interested in it at 1,400, but at 2,500 it is good choice! 😁

📌 Conclusion:

In my opinion, this was a purely technical rebound for ETH after a long decline . As well as for the altcoin market as a whole. Those altcoins that were simply declining more rapidly than others are the ones that are growing fastest now.

Besides, I remind you that summer is coming soon and there will be less liquidity on the market. So unless the current market conditions push ETH to 3,000 and above . We can definitely not expect it in summer and the most probable scenario in my opinion is blue. I don't think we will see ETH at 1,500 and below (unless Trump does something weird), but it is possible to close GAP and go to 1,800.

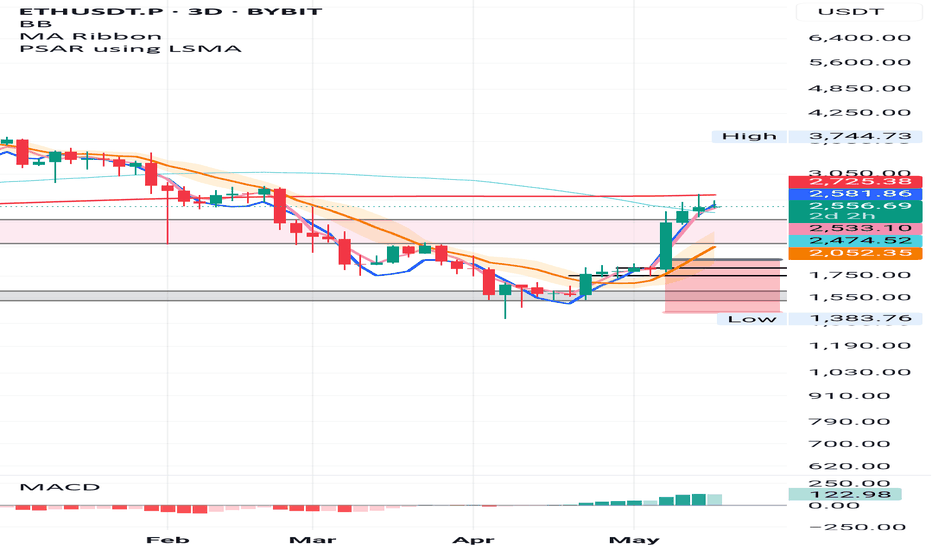

ETH 3D – System Trigger, 200MA Test & Death Cross Insight

This was the actual trigger for my ETH long.

The system gave the green light on 3D:

✅ PSAR flip

✅ MLR > SMA > BB center

Now ETH is testing the 200MA from below, which lines up with the 50/200 death cross — often seen as bearish, but here it likely confirms the bottom already built through March–April.

MACD is pushing up strong.

The signal came from this chart — and I'm still in the move.

ETH Update: Pressed Between Key Levels on the Daily

ETH is currently pressed between the 200MA and the 50% Fibonacci level—two major areas of interest.

On May 14th, we saw a clear rejection at the 200MA, followed by solid support at the 50% Fib on May 18th-19th. 📉

MLR < SMA < BB Center isn't ideal, so we need to play it safe and let price do its thing. If we close above the BB Center and macro conditions support the move, we could see upside. 🌱

⚠️ Keep safe, follow for unbiased TA, and always manage risk! 📊

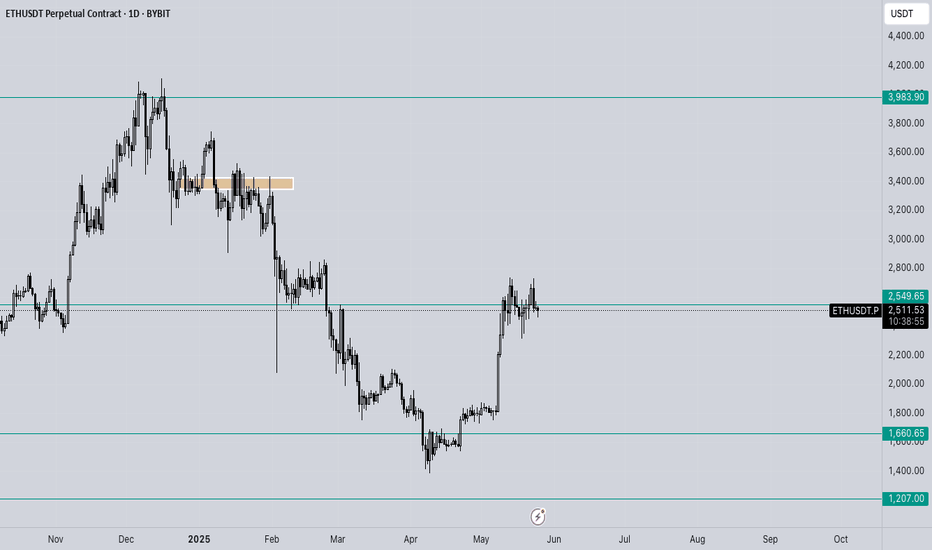

ETH - Ranges overview Let's have a look at how ETH is trading alongside BTC setting a new all time high.

Not much has happened on the side of ETH since our last chart analysis. ETH is lagging in comparison to BTC and is yet to show us a willingness to aggressively push higher.

The plan remains straightforward and the exact same as previously.

IF we reclaim 2.5K and hold it, expect us to aggressively trade towards the 3.4K-4K range.

IF we fail to hold 2.5K (clean break and hold below) expect ETH to trade back toward 1.8K.

Stay safe and never risk more than 1-5% of your capital per trade. The following analysis is merely a price action based analysis and does not constitute financial advice in any form.

ETH - Trading at crucial resistance levelBINANCE:ETHUSDT (1W CHART) Technical Analysis Update

ETH is currently trading at $2500 range and the price is at crucial resistance zone, previously ETH had one if its largest crash after this support line was broken, now the same support line is acting as resistance.

50 EMA is also acting as a strong resistance in this are.

ETH needs to breaks this resistance to reach the next resistance around 4k USDT. if ETH cross 3K then 4k is an easy target.

Im expecting this resistance to break in next couple of weeks.

Short term target 3100

Mid Term Target 4000

Long Term Target 7000-9000a

a

aRemember to set your stop loss.

Follow our TradingView account for more technical analysis updates. | Like, share, and comment your thoughts.

Cheers

GreenCrypto

ETHEREUMKey Determinants of Ethereum Price Movement

Ethereum’s price is influenced by a combination of technological, market, regulatory, and macroeconomic factors:

1. Technological Developments and Upgrades

Ethereum 2.0 and The Merge: Transition to a proof-of-stake consensus has improved energy efficiency and scalability, enhancing Ethereum’s appeal.

Layer 2 Solutions: Technologies like Optimism and Arbitrum reduce transaction costs and increase throughput, encouraging broader adoption.

Upcoming Updates (e.g., Pectra Update): Simplify smart contract transactions and allow fees to be paid in tokens other than ETH, improving competitiveness against other blockchains.

2. Institutional Adoption and Investment

Growing interest from institutional investors, including the approval of Ethereum ETFs, increases capital inflows and market confidence.

Tokenization of real-world assets on Ethereum by financial firms supports long-term demand.

3. Decentralized Finance (DeFi) and dApps Growth

Ethereum remains the leading platform for DeFi protocols, NFTs, and decentralized applications, driving network activity and demand for ETH.

Expansion of use cases strengthens Ethereum’s fundamental value.

4. Competition from Other Blockchains

Faster and cheaper alternatives like Solana and Sui pose competitive risks, potentially limiting Ethereum’s market share and price growth.

5. Regulatory Environment

Regulatory clarity or uncertainty significantly impacts investor sentiment and price volatility. Positive regulatory developments tend to boost prices, while crackdowns can depress them.

6. Market Sentiment and Macro Factors

Broader crypto market trends, investor risk appetite, and macroeconomic conditions (inflation, interest rates, USD strength) influence ETH price movements.

Volatility in traditional markets and geopolitical events can drive safe-haven demand or risk-off selling.

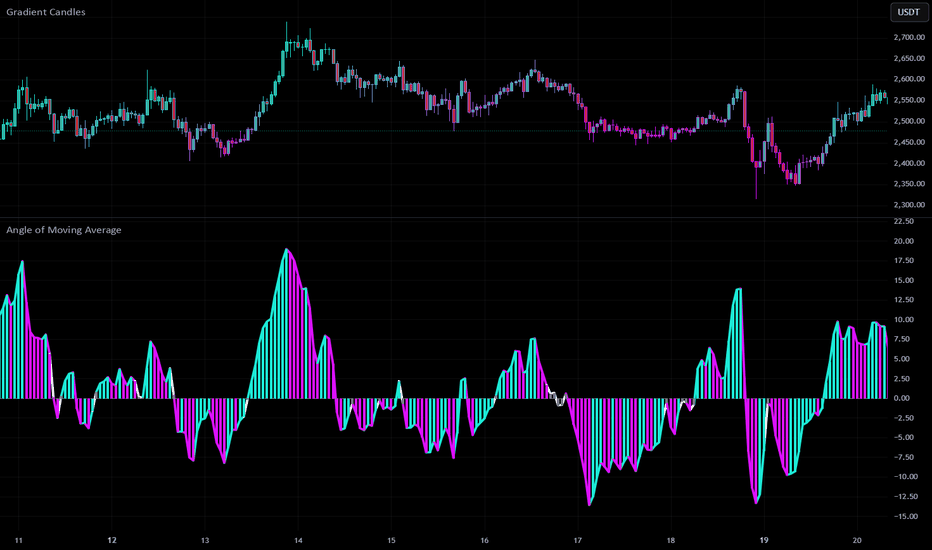

Trade the Angle, Not the Chop: Angle of MA ExplainedNot all moving averages are created equal. While most traders rely on the slope of a moving average to gauge trend direction, the Angle of Moving Average script by Mango2Juice takes it a step further—literally measuring the angle of the MA to help filter out sideways markets and highlight trending conditions.

Let’s explore how this tool works, how we use it at Xuantify, and how it can sharpen your trend-following strategy.

🔍 What Is the Angle of Moving Average?

This indicator calculates the angle of a moving average (default: EMA 20) to determine whether the market is trending or ranging. It introduces a No Trade Zone , visually marked in gray, to signal when the angle is too flat—suggesting the market is consolidating.

Key Features:

Measures the slope of the moving average

Highlights ranging zones with a gray color

Helps filter out low-momentum conditions

Customizable MA type and length

🧠 How We Use It at Xuantify

We use the Angle of Moving Average as a trend filter —not a signal generator.

1. Trend Confirmation

We only take trades in the direction of a steep enough angle. If the MA is flat or in the gray zone, we stay out.

2. Entry Timing

We combine this with structure tools (like BOS/CHOCH) to time entries after the angle confirms a trend is underway.

🎨 Visual Cues That Matter

The script uses color to show when the market is:

Trending : Clear slope, colored line

Ranging : Flat slope, gray line (No Trade Zone)

This makes it easy to:

Avoid choppy markets

Focus on momentum-driven setups

Stay aligned with the dominant trend

⚙️ Settings That Matter

You can customize:

MA Type : EMA, SMA, etc.

MA Length : Default is 20

Angle Sensitivity : Adjust to define what counts as “flat”

⚙️ Higher timeframe alignment

You can look at HTFs for better and stronger entry and exit points.

Below a 1H and 4H chart where the 4H clearly adds strong buying power for a good long entry point.

🔗 Best Combinations with This Indicator

We pair the Angle of MA with:

Structure Tools – BOS/CHOCH for trend context

MACD 4C – For momentum confirmation

Volume Profile – To validate breakout strength

Fair Value Gaps (FVGs) – For sniper entries

⚠️ What to Watch Out For

This is a filter , not a signal. It won’t tell you when to enter or exit—it tells you when not to trade . Use it with price action and structure for best results.

🚀 Final Thoughts

If you’re tired of getting chopped up in sideways markets, the Angle of Moving Average is a simple but powerful filter. It helps you stay out of low-probability trades and focus on trending opportunities.

Try it, tweak it, and see how it fits into your system.