ETHUST.P trade ideas

Ethereum Surges Past Resistance as Trump Halts Tariff Plans..!🚨 **Market Update** 🚨

President Donald Trump has announced a 90-day pause on the full effect of new tariffs for certain countries, and the markets are reacting strongly! 📈 Both the stock and crypto markets are surging as a result.

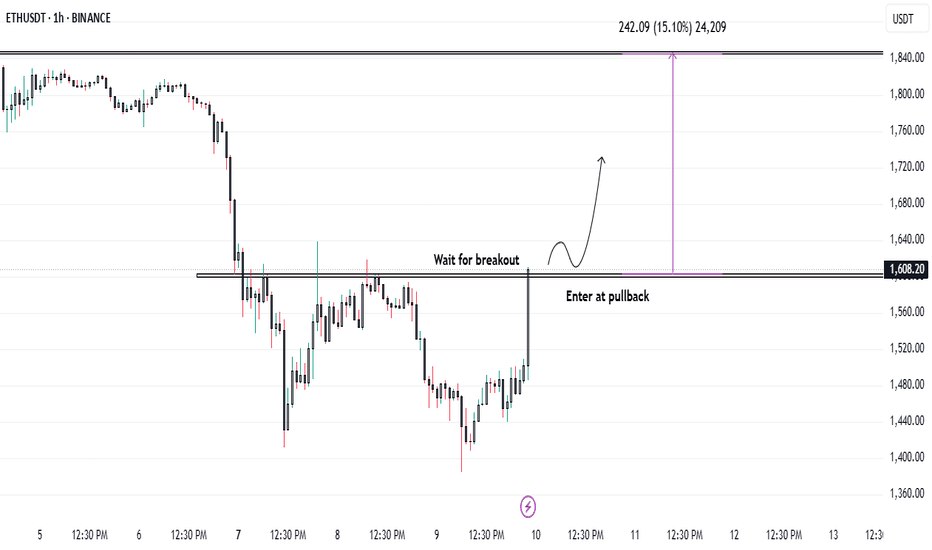

Right now, Ethereum is testing the $1600 resistance level on the 1-hour timeframe. 💥 Our trading strategy is to let it break the resistance and sustain above it, then look for a solid entry on the pullback.

Stay tuned and trade wisely! 🚀💰

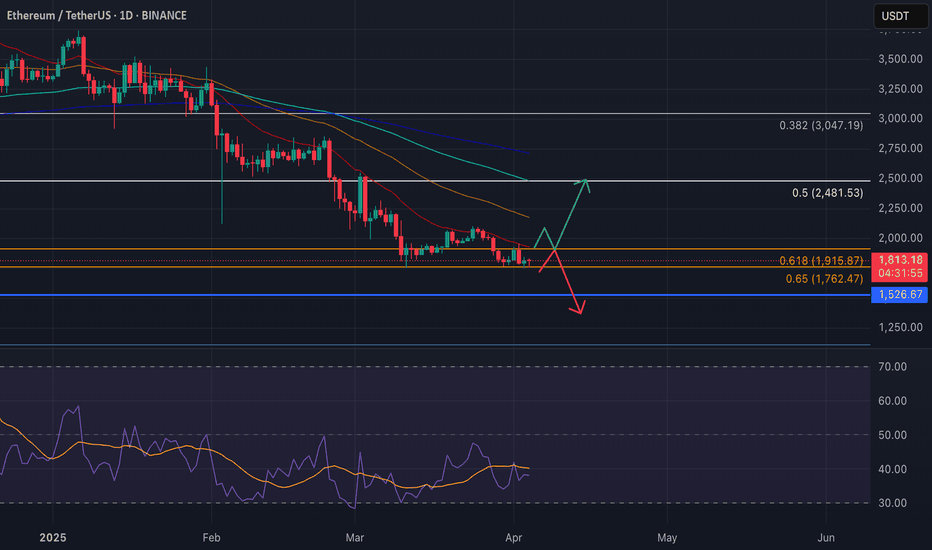

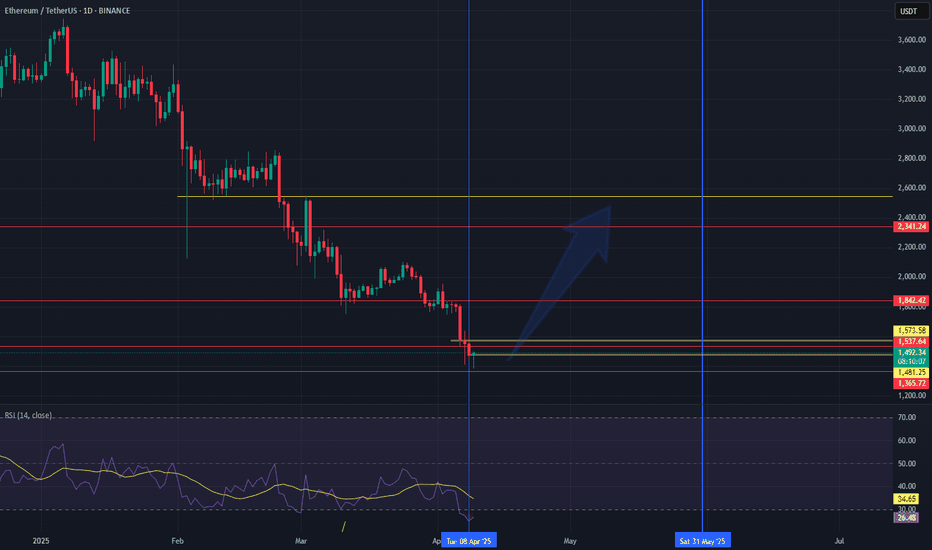

ETHEREUM floating between two powers📊 Ethereum (ETH/USDT) - Daily Outlook 📊

🔹 Current Price: $1,809

🔹 Key Levels:

🟢 Support: $1,762 (Fib 0.65), $1,915 (Fib 0.618)

🔴 Resistance: $2,481 (Fib 0.5), $3,047 (Fib 0.382)

🔮 Possible Scenarios:

📉 Scenario 1: Bounce from Fib 0.65 📈

ETH is testing the key golden pocket zone ($1,762–$1,915).

If buyers step in, we could see a relief rally towards the $2,000-$2,100 zone.

Breaking above $2,100 could trigger a move towards $2,480 (Fib 0.5).

🔹 Odds: 55/45

📈 Scenario 2: Break Below 0.65, Retest Lower Levels 🚨

If ETH loses $1,762, it may drop further towards the $1,600-$1,500 range.

Bearish EMAs (all sloping down) suggest ongoing downside pressure.

RSI is still weak, showing no strong reversal signals yet.

🔹 Odds: 45/55

⚠️ EMA & RSI Considerations

ETH is trading below all key EMAs (50, 100, 200), confirming a bearish structure.

RSI is hovering around 40 but not yet oversold, meaning more downside is possible.

A bullish divergence on RSI would strengthen the bounce scenario.

🎯 Key Watch Points:

1️⃣ Holding above $1,762-$1,915 zone = bullish potential.

2️⃣ Reclaiming 50 EMA ($2,100) = stronger confirmation for upside.

3️⃣ Losing $1,762 = further downside risk.

🚀 Short-term caution, but golden pocket zone (right now) could be a reversal opportunity, especially if you do believe in ETH in a long-term.

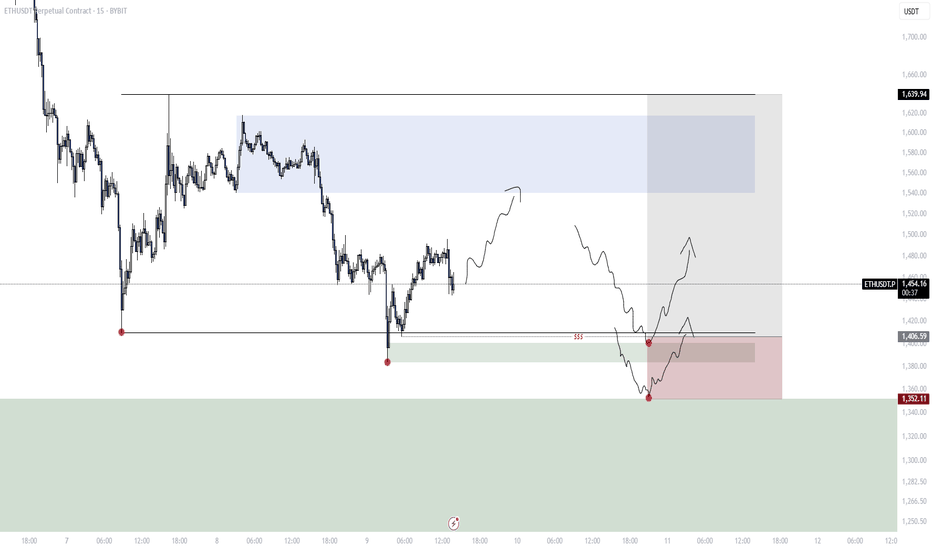

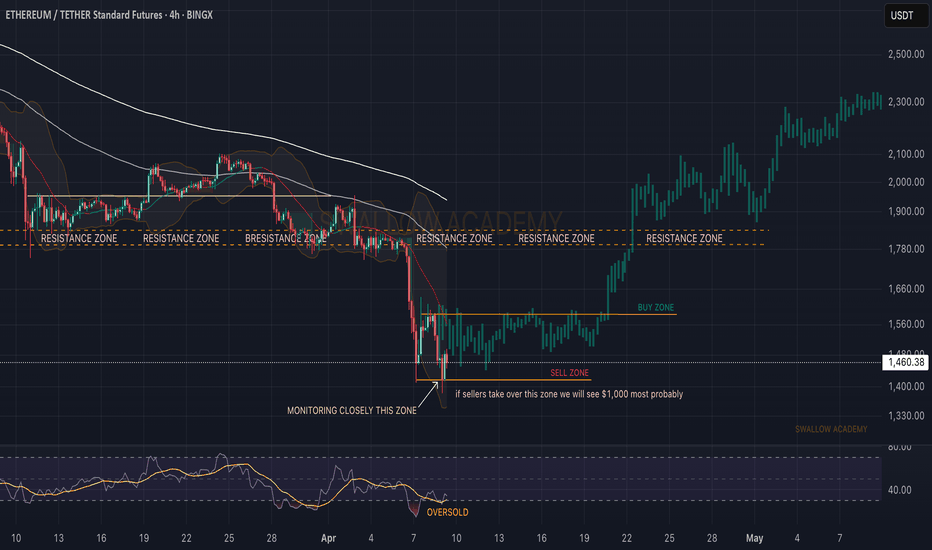

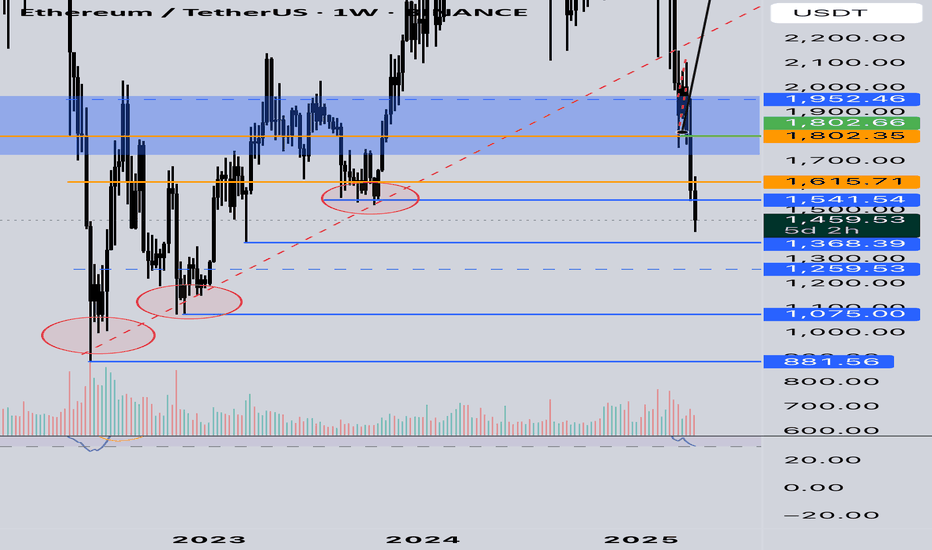

Ethereum (ETH): Buyers Losing Dominance | Liquidity HuntingBuyers are losing dominance on ethereum, where we see how sellers keep on pushing and pushing down, which might result in another wave of selloff.

Despite all signs telling us that we should see a proper upward movement to the resistance zone, currently it does not matter; we are in the liquidity hunting phase with markets right now.

2 zones we keep an eye on; whichever we reach and secure first, there we will head the most likely as well!

Swallow Academy

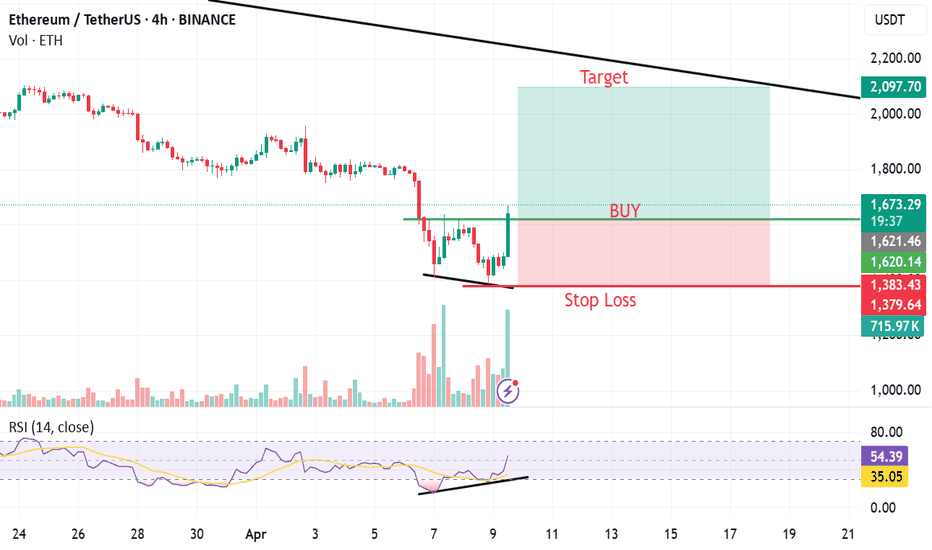

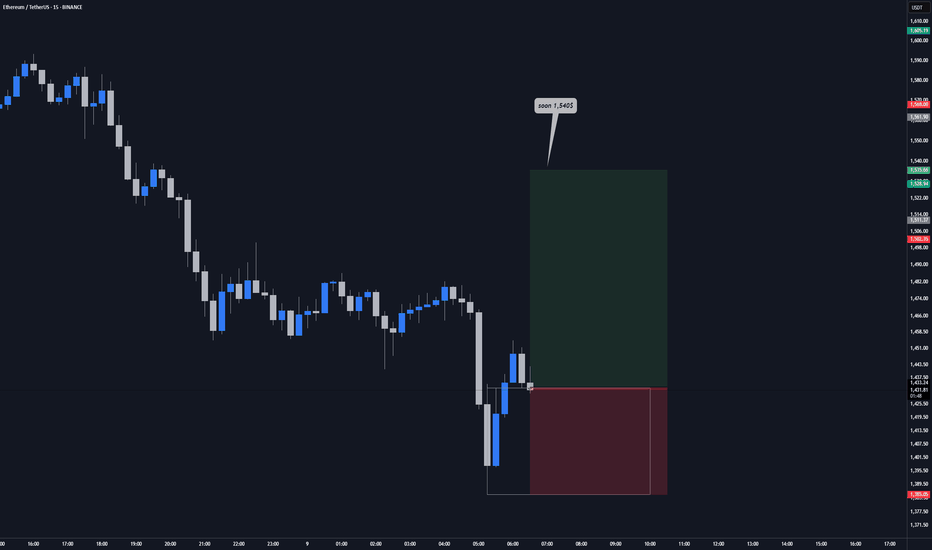

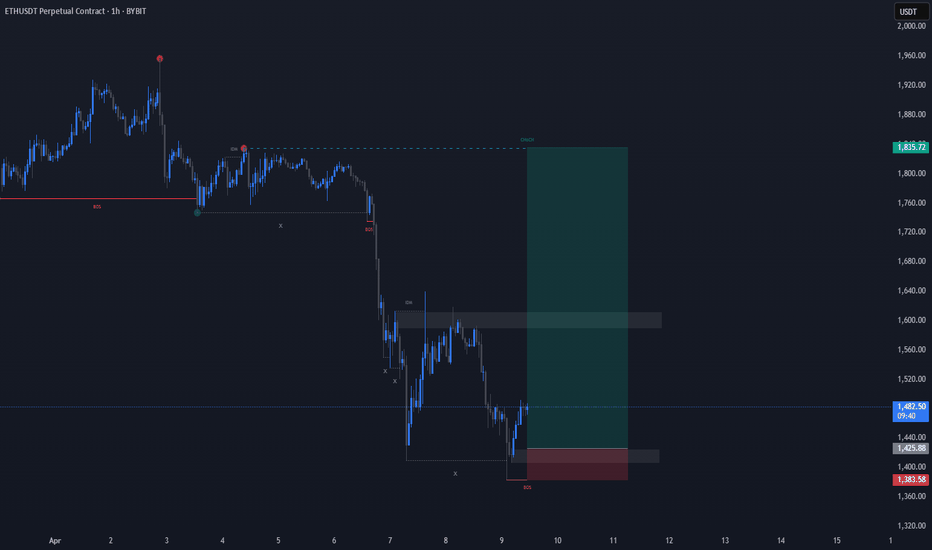

ETHUSDT Long SetupWe’ve been in a clear bearish trend, with multiple (BOS) to the downside. However, a recent liquidity sweep of the previous low, followed by a (CHoCH) to the upside, suggests a potential bullish reversal is in play.

Before the CHoCH occurred, price swept a key liquidity zone below the most recent swing low, inducing sellers and triggering stop-losses.

There are two key supply zones overhead:

$1,425 Recently mitigated during a retracement.

$1,600 Still unmitigated could act as resistance.

TP is above all of them but possible with momentum.

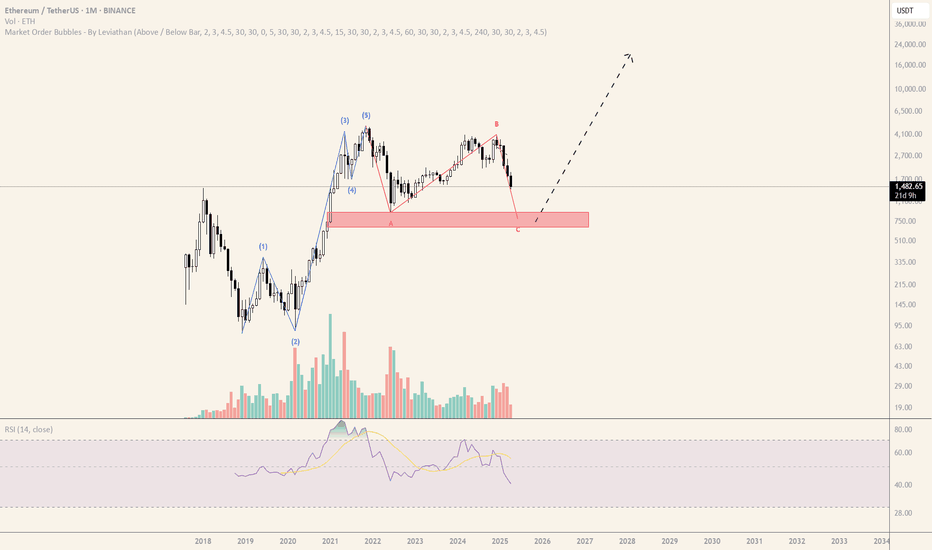

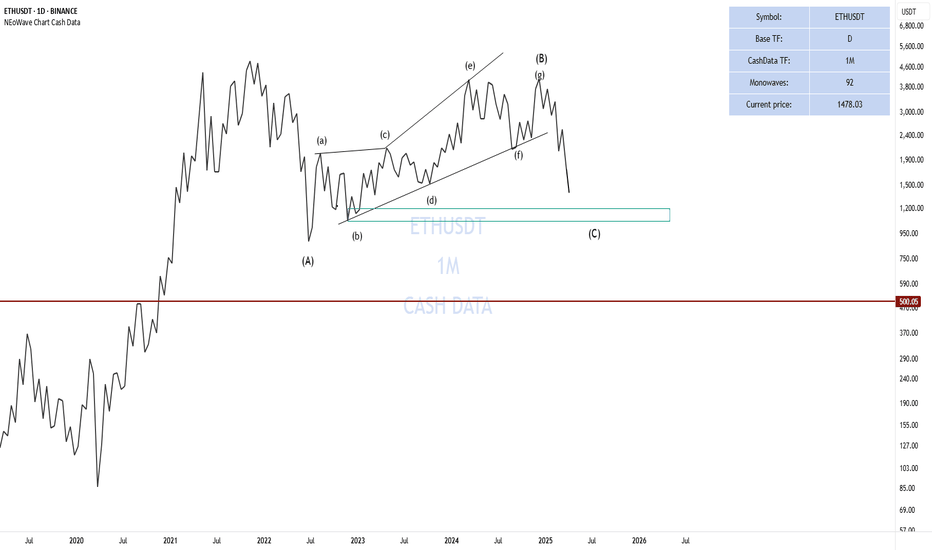

Ethereum (ETH) Forecast with NEoWave1M Cash Data Chart

Based on the price size of wave-B, it appears that a flat pattern with a regular wave-B is forming. In this pattern, wave -C typically retraces the entirety of wave -B, though a flat with a C-failure may occur at times.

Our primary scenario suggests that wave -C could conclude within the 1000–1200 range, indicating a flat with a C -failure. However, if the price breaks strongly through the 1000–1200 range and consolidates below this level, wave-C might extend to the 700–807 range.

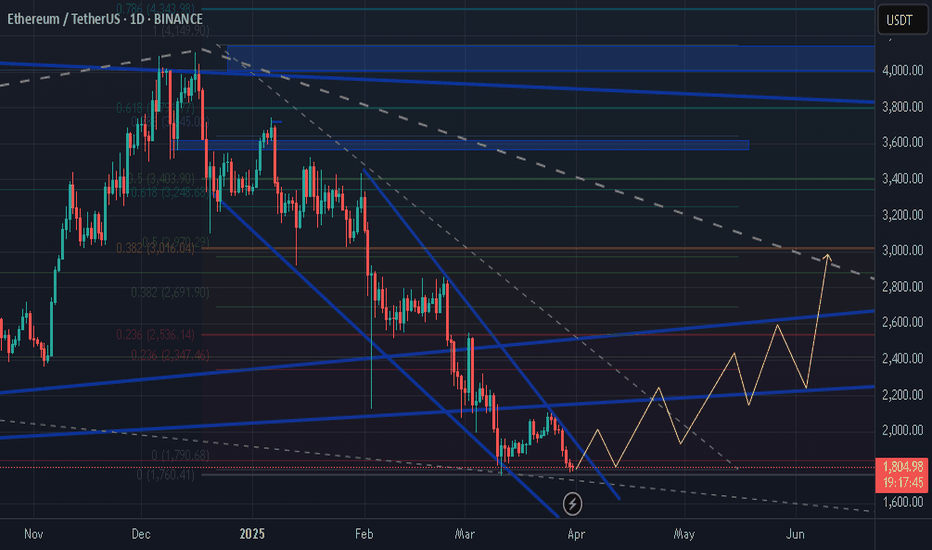

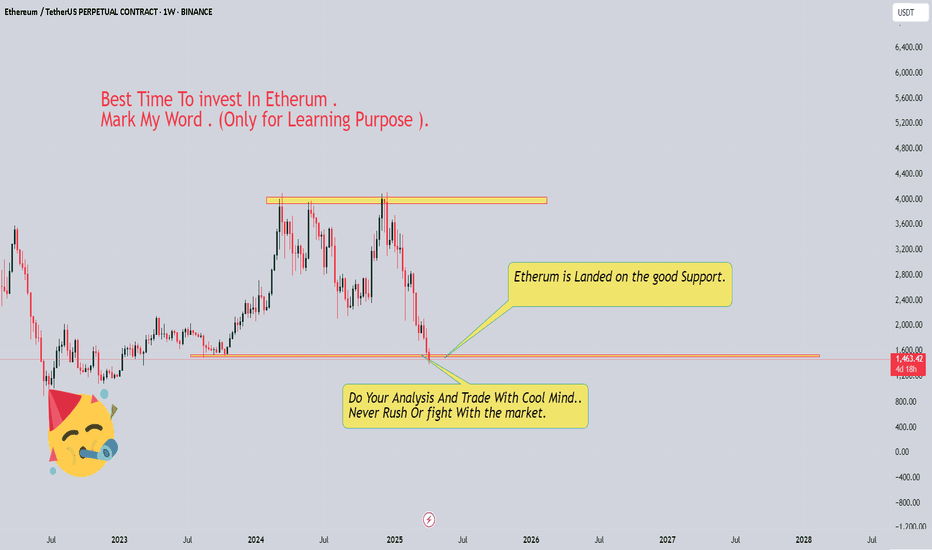

ETH looks intresting in 4HAlthough there are many bad news around tariffs, I think market have already priced it all, so we can have a bounce as a retracement.

As ETH has fallen to 1400 level from 3300 ( more than 58%), it completed 5 wave an bearish impulse( Wave A from ABC retracement), now I believe it can go for a B wave, reaching 2100$ as a solid and fair price for Etherium.

Support: 1090$-1200$-1370$

Resistances: 1760$-1980$-2100$-2620$

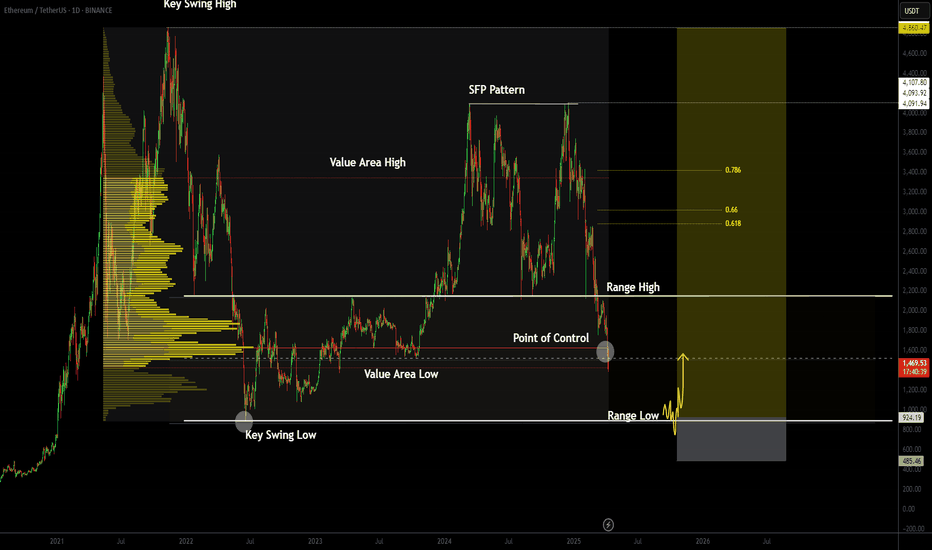

Bearish Trend Continues as Range Rotation DevelopsGood evening traders,

In today’s analysis we’re focusing on Ethereum, which remains firmly in a strong bearish trend with no current signs of reversal. Price has recently broken back into its previous trading range, confirming a bearish retest at the range high before accelerating downward toward the range midpoint.

Ethereum is now showing signs of minor consolidation on lower timeframes near the midpoint, suggesting that the market has accepted price back within the old range. This acceptance increases the probability of a full range rotation toward the channel low, which is situated around the $800 support level.

At that level, if price action confirms support and presents a valid shift in market structure, it could offer a high-probability long setup with defined risk. This would potentially trigger a full range rotation back toward the highs, continuing a larger high-timeframe sideways structure. Until then, risk management remains key, as the current trend still favors the downside.