ETHUST.P trade ideas

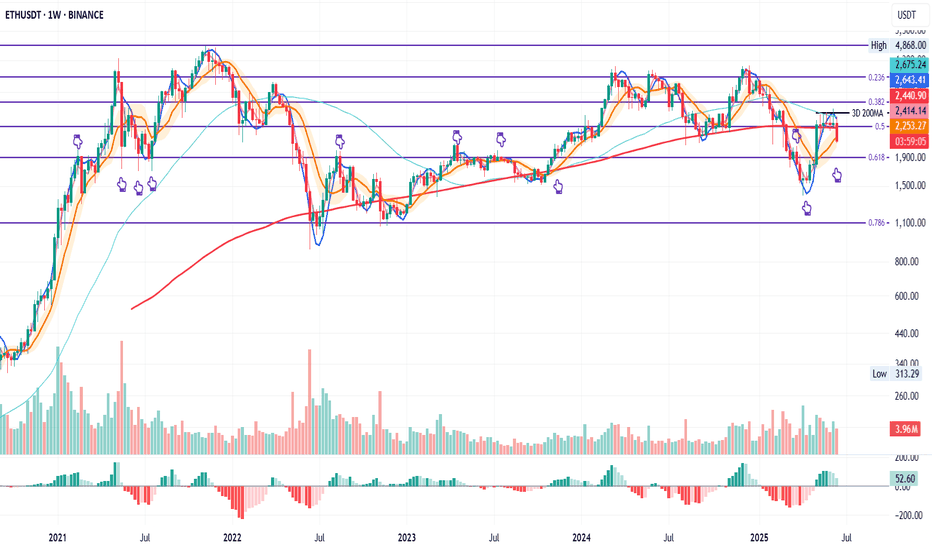

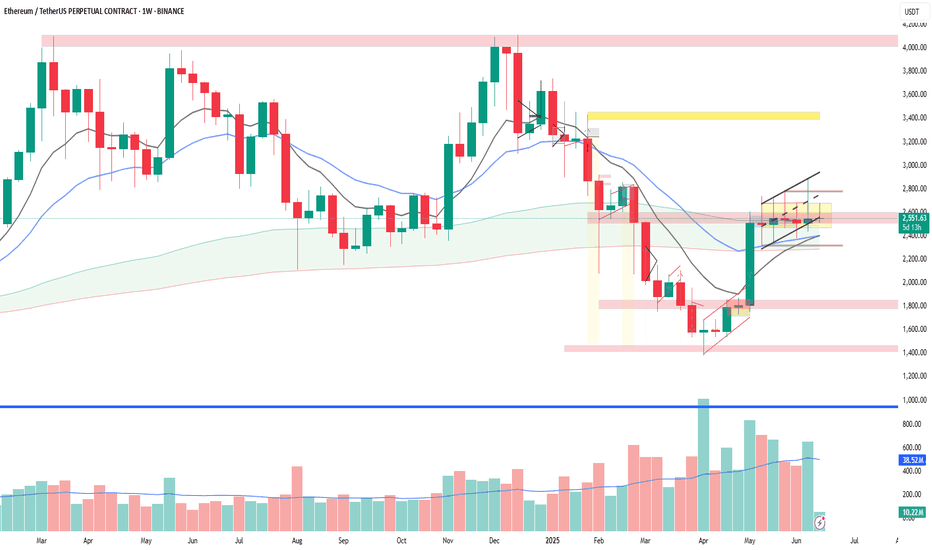

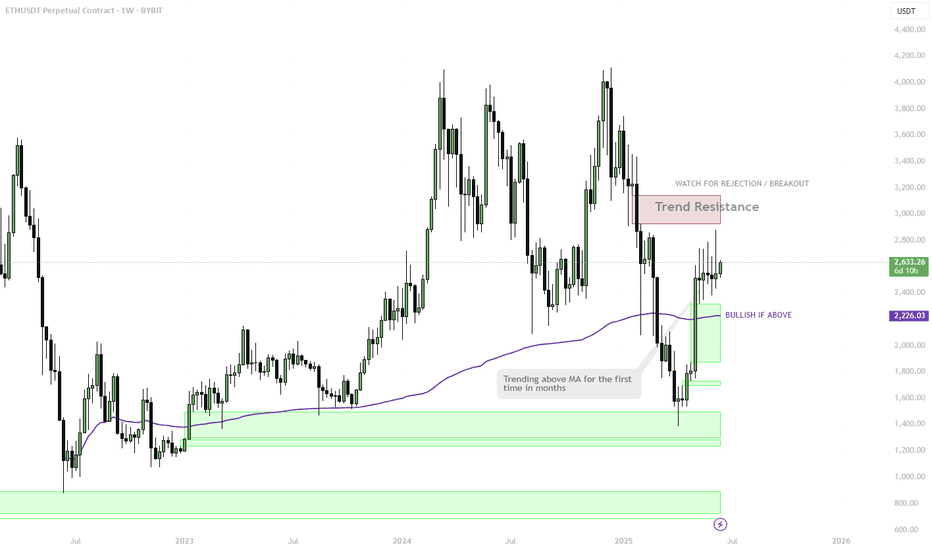

ETH Weekly – Eyes on $1900When panic creeps in, zoom out.

ETH on the weekly has lost both the 200MA and the 0.5 Fib.

In my opinion, if the BB center doesn’t hold here, price could retest the 0.618 Fib level a zone it tends to flirt with often.

The $1900 area might become a solid buy zone.

Always take profits and manage risk.

Interaction is welcome.

Your Trading System Isn't the Problem. Your Discipline Is.📘 Your Trading System Isn't the Problem. Your Discipline Is.

Hard truth:

Your endless search for a new system is a smokescreen.

The best system in the world can't save you from poor discipline.

Here's why discipline matters more than your strategy:

You quit your system after a few losses, never allowing it to prove its value.

You deviate from your rules when emotions run high—wrecking consistency.

You're focused on shiny objects instead of sharpening the knife you already have.

🎯 The solution?

Commit to discipline. Track your adherence rigorously. Measure your success by consistency, not immediate outcomes.

TrendGo’s power isn’t just in clear signals—it's in enabling disciplined action.

🔍 Stop blaming your tools. Own your discipline.

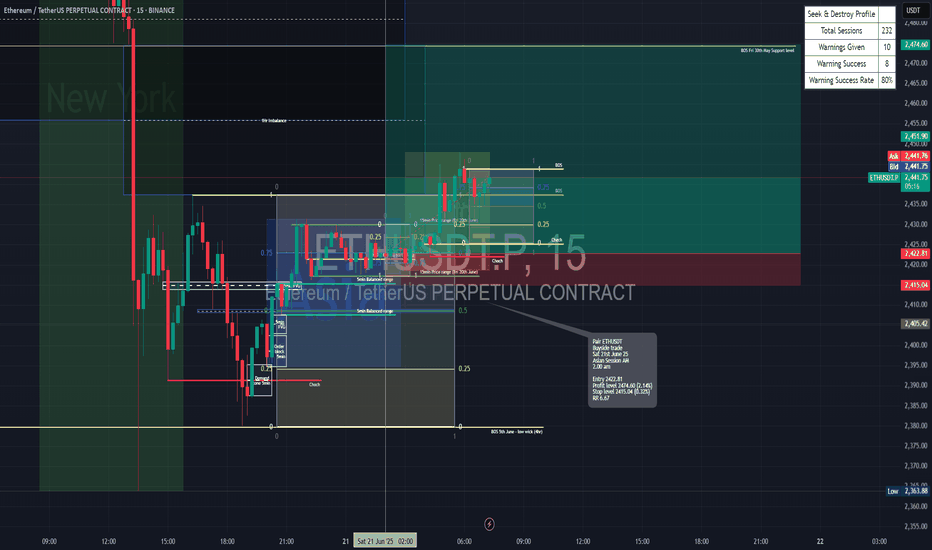

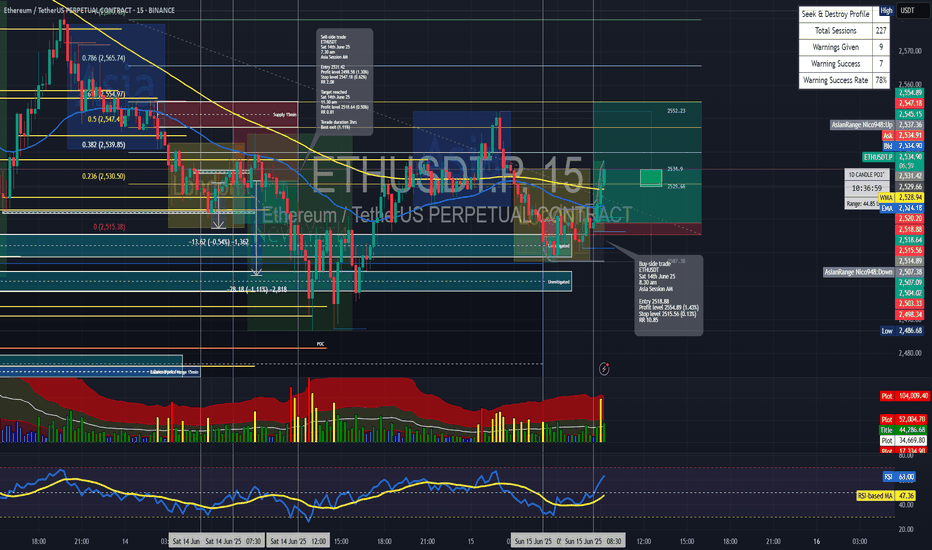

Long trade

15

min overview

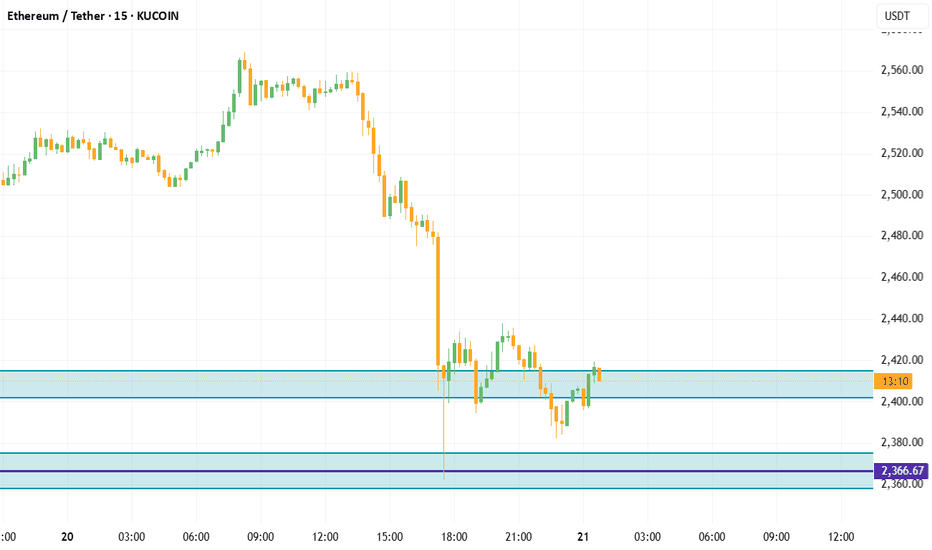

🟢 Trade Journal Entry – Buyside Trade

📍 Pair: ETHUSDT

📅 Date: Saturday, June 21, 2025

🕒 Time: 2:00 AM (Asian Session AM)

⏱ Time Frame: 15 Minutes

📈 Direction: Buyside

📊 Trade Breakdown:

Entry Price 2422.81

Profit Level 2474.60 (+2.14%)

Stop Loss 2415.04 (−0.32%)

Risk-Reward

Ratio 6.67 1

🧠 Context / Trade Notes:

BOS 5th June – 4HR Low Wick:

Break of structure observed on June 5th from a 4-hour low wick.

Observing the current NY session sweep of the liquidity from the London low wick signalled Sellside exhaustion.

Order Block & Retest:

A bullish OB formed on a prior swing, with a clean mitigation of price (Fri, 20th price range) and BOS, confirming buy-side interest.

5min TF Observation - entry:

Narrative:

Utilising DRT levels (coined by Ali Khan) to navigate the range and unfolding price action.

Target imbalance zone 1Hr.

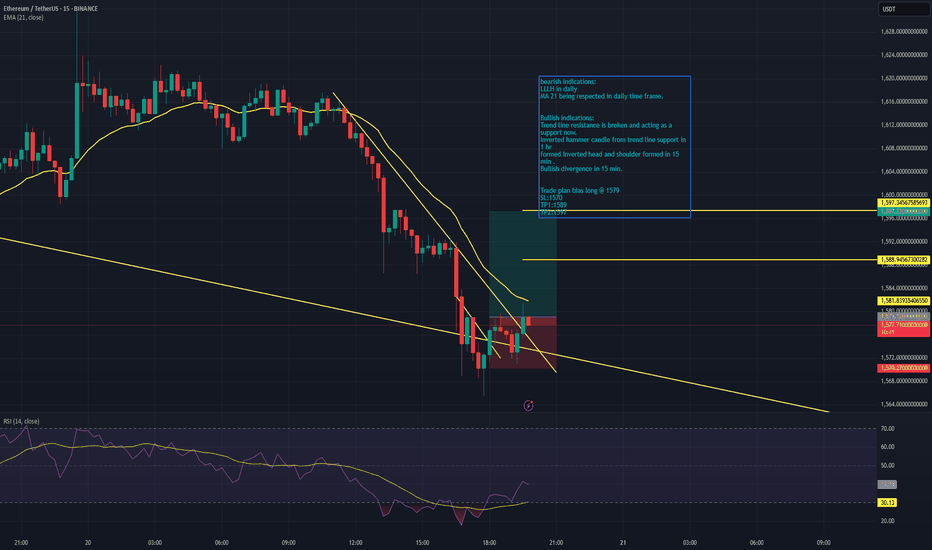

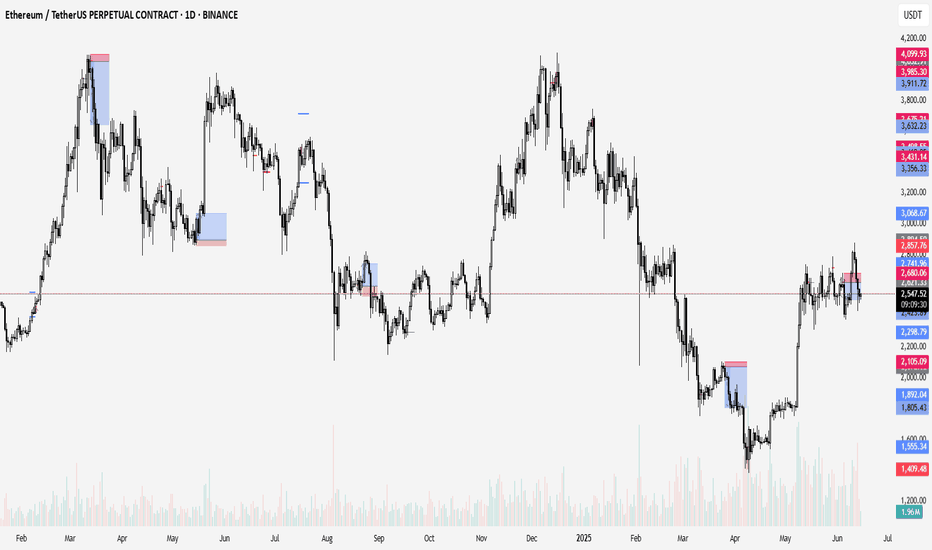

ETH -bullish indicationsbearish indications:

LLLH in daily

MA 21 being respected in daily time frame.

Bullish indications:

Trend line resistance is broken and acting as a support now.

Inverted hammer candle from trend line support in 1 hr

formed Inverted head and shoulder formed in 15 min .

Bullish divergence in 15 min.

Trade plan bias long @ 1579

SL:1570

TP1:1589

TP2:1597

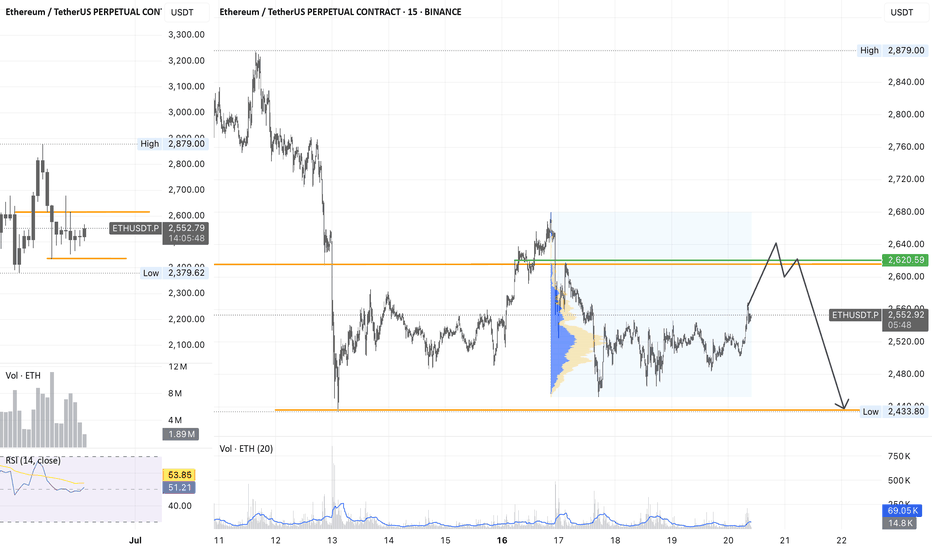

SHORT ETH🔷 Setup Summary: SFP + Key Volume Combo

1. Context:

Pattern: Double Top + SFP (Swing Failure Pattern)

Timeframe: Likely M15–H1 (possibly during Asian/European session)

Background: Price breaks previous high slightly (liquidity grab), then sharply reverses — a clear trap.

2. Confirmation:

A clear Key Volume candle appears at the top — signaling market maker action.

A strong rejection candle (pinbar or engulfing) confirms the SFP.

Price fails to hold above the new high — trap confirmed.

3. Entry Strategy:

Entry: After the SFP confirmation candle closes.

Stop Loss: Above the SFP high or Key Volume wick (a “valid” SL, not necessarily tight).

Take Profit:

Short-term: 3R (if trading intra-session).

Long-term: Target demand zone or Daily support if trend supports it.

4. Risk Management (per system guidelines):

Max risk per trade: 1–2% of account.

If setup invalidates: cut the loss immediately, don’t widen SL or overtrade.

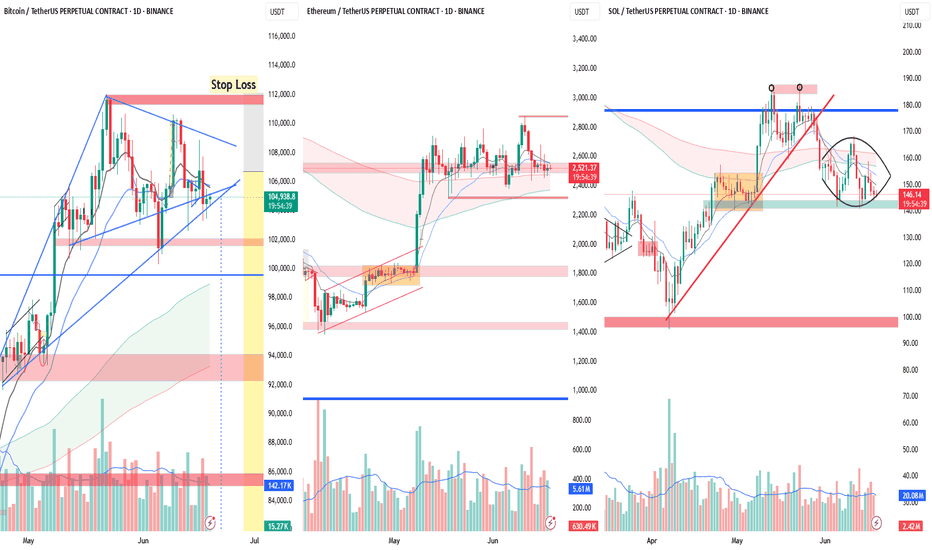

Crypto at a Crossroads: BTC, ETH & SOL – 3 Charts, 3 Messages📊 Market Overview:

The crypto market often moves together — but BTC, ETH, and SOL are telling 3 very different stories right now. From Bitcoin’s coiled spring to Ethereum’s indecision and Solana’s struggle — this divergence could define the next major trend.

1️⃣ Bitcoin (BTC): The Market’s Trigger

BTC is tightening in a Symmetrical Triangle after a powerful uptrend — a textbook Bull Pennant.

🔼 Lower highs + higher lows = pressure build-up

🔇 Volume drying up → classic pre-breakout setup

⚡ A decisive move (esp. above $ 108K) will likely lead the entire market

Bias: Bullish continuation likely, but prepare for either direction.

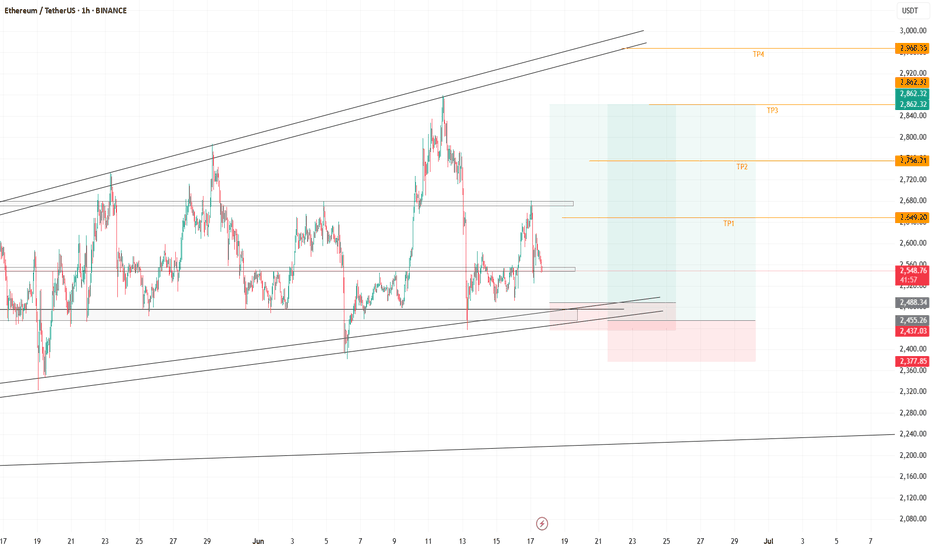

2️⃣ Ethereum (ETH): The Waiting Game

ETH is stuck in a rectangle range between $ 2,450–$ 2,800.

😐 Flat MAs = no short-term trend

📉 ETH is neutral → waiting for BTC to move first

Strategy: React to breakout or breakdown from range boundaries.

3️⃣ Solana (SOL): The Weakest Link

SOL shows clear signs of reversal and relative weakness.

⚠️ Double Top near $185 in May

🔻 Lost multi-month trendline

🛡️ Testing critical support at $ 140–145

🌀 Attempting a Rounding Bottom (accumulation?) but still below key MAs

Watch: Support must hold. Break below = major downside risk.

🎯 Trade Strategy:

If BTC Breaks Up (above $ 108K):

🚀 Long BTC → Targets: $ 118K–$ 120K

✅ Long ETH above $ 2,800

🧨 Aggressive Long SOL above $ 160 (trendline reclaim)

If BTC Breaks Down (below $ 104K):

⚠️ Short BTC → Targets: $ 100K, $ 98K

⚠️ Short ETH below $ 2,450

🚨 High-conviction Short SOL below $ 140 → Potential drop to $ 100 zone

❌ Invalidation:

📉 Bullish thesis invalid if BTC breaks below triangle

📈 Bearish invalidated if BTC breaks up (Stop loss above $112K)

🔚 Final Word:

BTC is the market’s steering wheel — ETH is parked, SOL is stalling.

⏳ The triangle is near apex. A breakout will ripple across all coins.

Which direction are YOU betting on? Bullish or Bearish? Drop your view below!

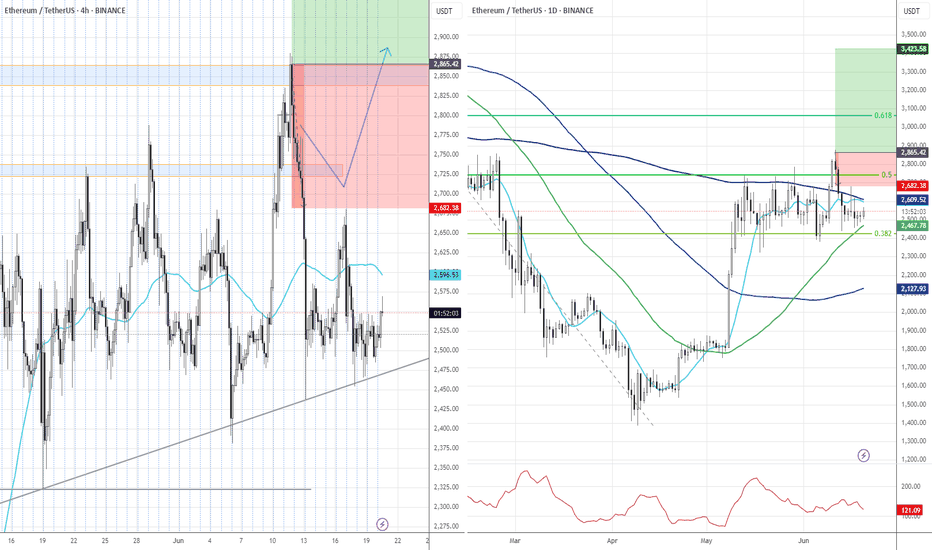

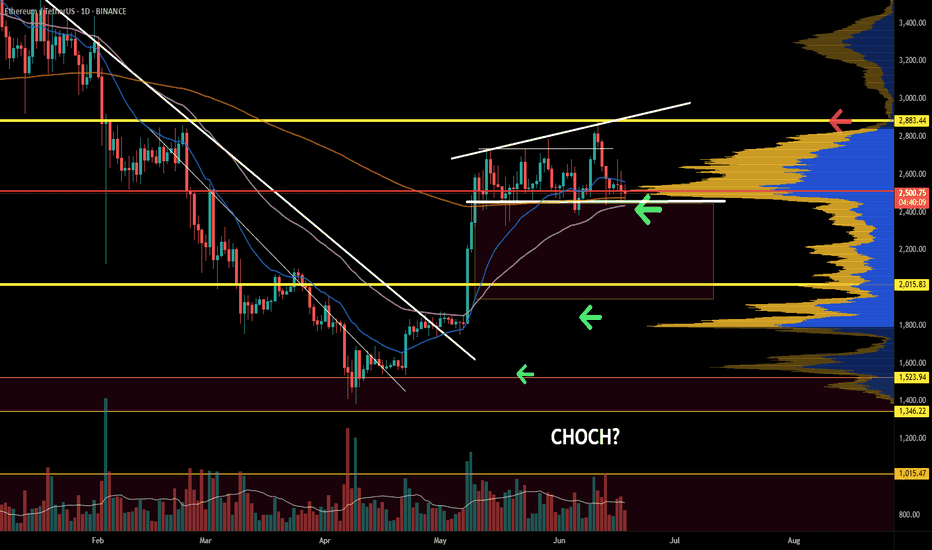

ETH/USDTETH remains in a consolidation phase. Attention is on the nearest liquidity zone — a sweep or reaction here could signal the next move. Failure to reclaim and hold above the $2600 level on the weekly close opens the door for a potential drop into the $2000–$2300 range, aligning with a possible manipulation phase before reversal.

Longs or shorts only considered upon clear confirmation and valid setup. No rush — let the market come to you.

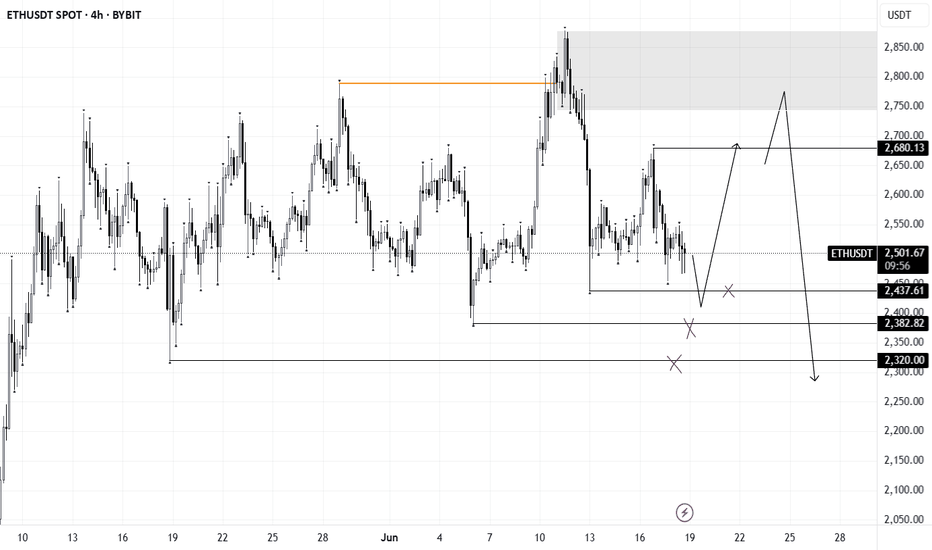

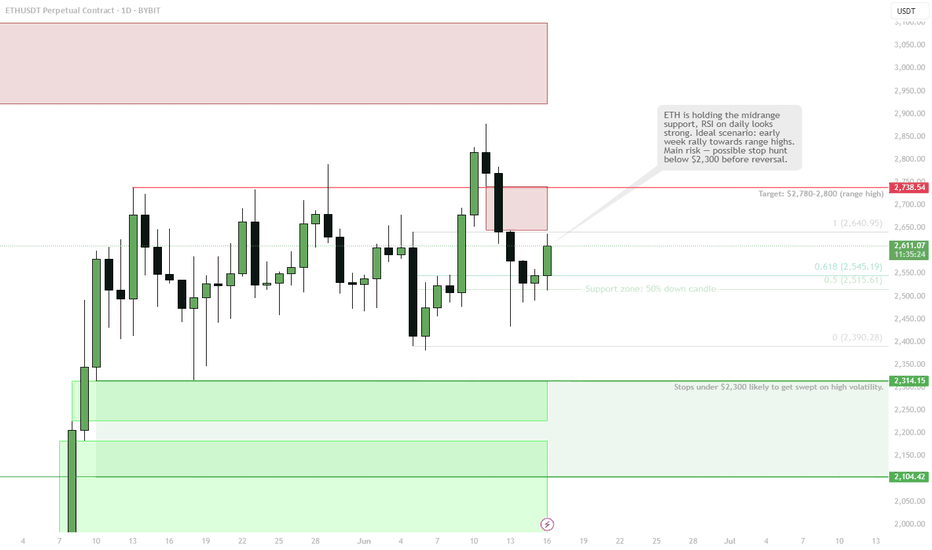

ETH/USDT – 6 Weeks of Doji: The Calm Before the Storm?⏳ Summary:

Ethereum has been moving sideways for 6 straight weeks, printing back-to-back doji candles — a rare phenomenon in any market. Price is trapped, pressure is building, and volatility is near its breaking point. History shows: after this much indecision, a violent breakout is almost inevitable.

🚨 What’s Happening?

6 consecutive weekly dojis — this kind of tight-range compression hasn’t been seen on ETH in years.

Price is squeezed between $ 2,500 support and $ 2,620 resistance.

Volume has dried up, and momentum is fading (RSI flat, wedge breakdowns on 4H/1D).

Bulls and bears are in a deadlock… and that never lasts long.

The longer the coil, the harder the snap.

🎯 Trading Roadmap (No Fluff):

📈 Bullish Breakout Trigger: Weekly candle close above $ 2,620 → Potential rally to $ 2,745 and $ 2,880 (Fib zones).

📉 Bearish Breakdown Trigger: Daily or weekly close below $ 2,500 → Expect a flush to $ 2,300 and $ 2,120 support levels.

🎯 Manage risk tight. This setup offers clean invalidation and powerful upside/downside potential.

📊 Why This Matters:

Markets don’t go silent for 6 weeks without a reason. ETH is gathering energy like a coiled spring — and once direction is decided, it can move fast and far. This is the kind of setup traders wait weeks to catch.

🤔 What Do You Think?

Is ETH quiet before the pump, or are bears waiting to break it down hard?

🗨️ Drop your thoughts, charts, or counter-setups below!

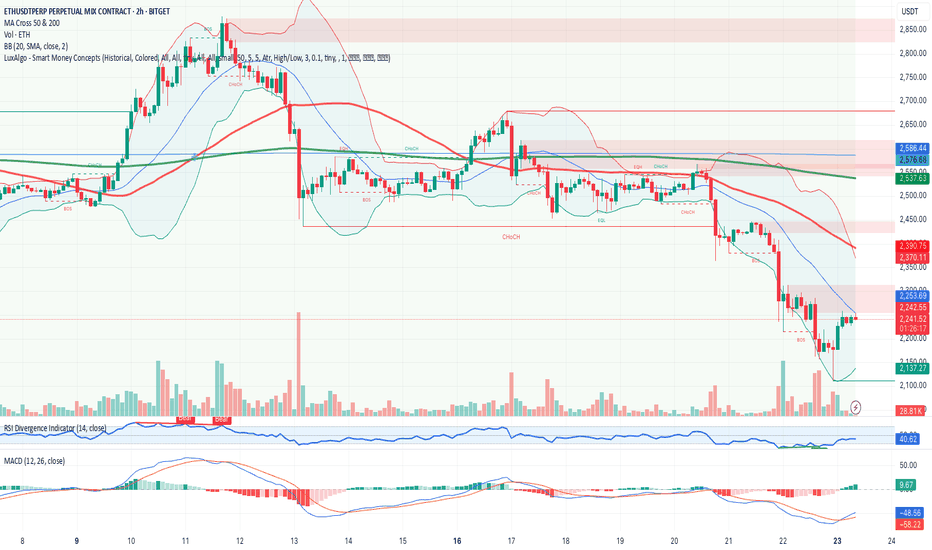

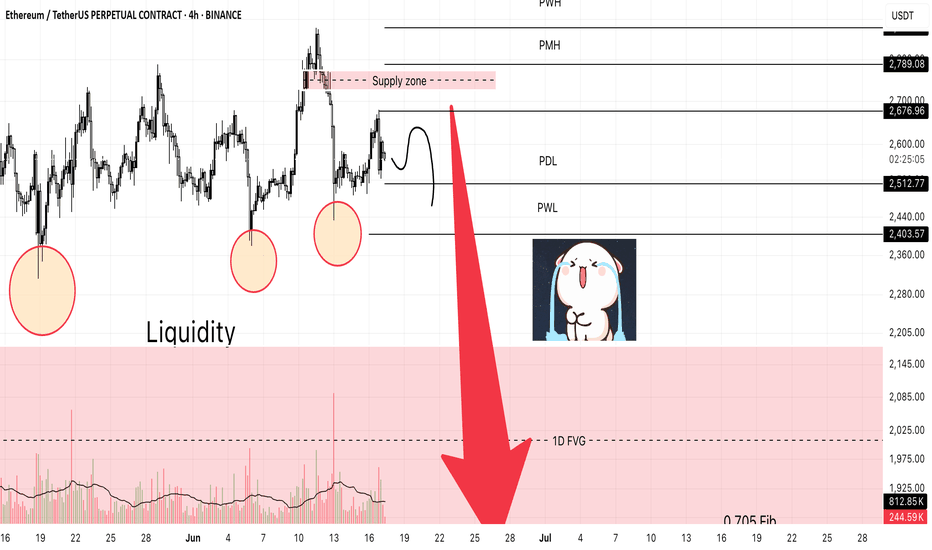

ETH: The Structure Remains BearishAs of now, the overall market structure for Ethereum still appears bearish.

Here's what I'm watching:

From the NY Open, I think there's a high possibility of a quick liquidity grab to the upside followed by a correction downward.

However, this sweep may not even happen. It will largely depend on geopolitical developments, particularly the Iran-Israel conflict, which remains a major market-moving factor.

I don’t know what kind of news could trigger this, but judging by the chart, there’s absolutely nothing bullish for now and honestly, it might even get uglier than it already was between Iran-Israel.

What’s below? A lot of liquidity.

On the chart, I’ve highlighted key downside targets:

Previous Day Low (PDL)

Previous Week Low (PWL)

One Day Fair Value Gap (1D FVG)

My personal expectation: a delivery of price into the 0.705 Fibonacci zone of the recent impulse.

This area also includes the Point of Control (POC) and completes the 1D FVG fill.

That’s where I’ll be looking for a potential bullish reversal.

Outlook for July

I'm still hopeful that the market tone shifts bullish in July.

Why? I expect a wave of positive narratives:

Trump’s proposed tariff adjustments

Multiple ETF approvals (especially altcoin-related)

Retail attention coming back

The setup is forming but for now, ETH remains under bearish pressure.

Stay tuned. Take care. More to come.

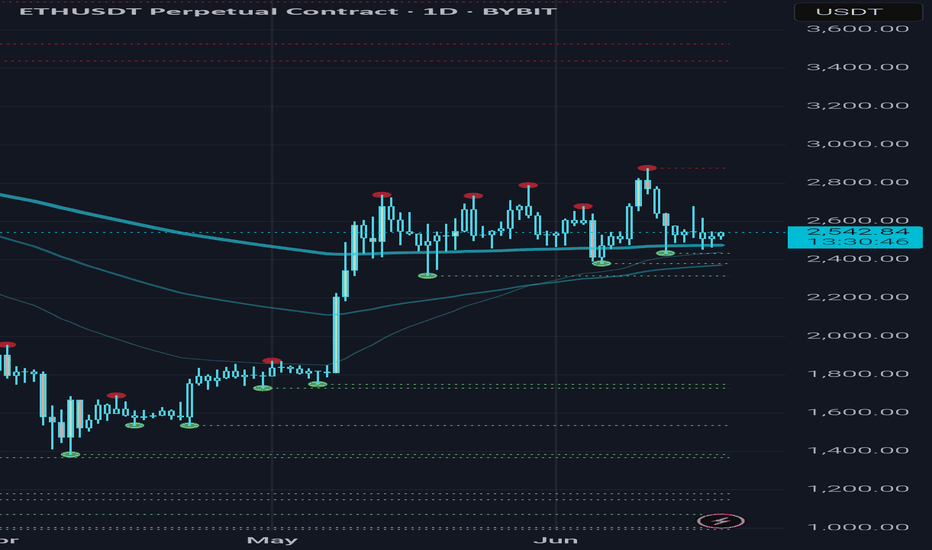

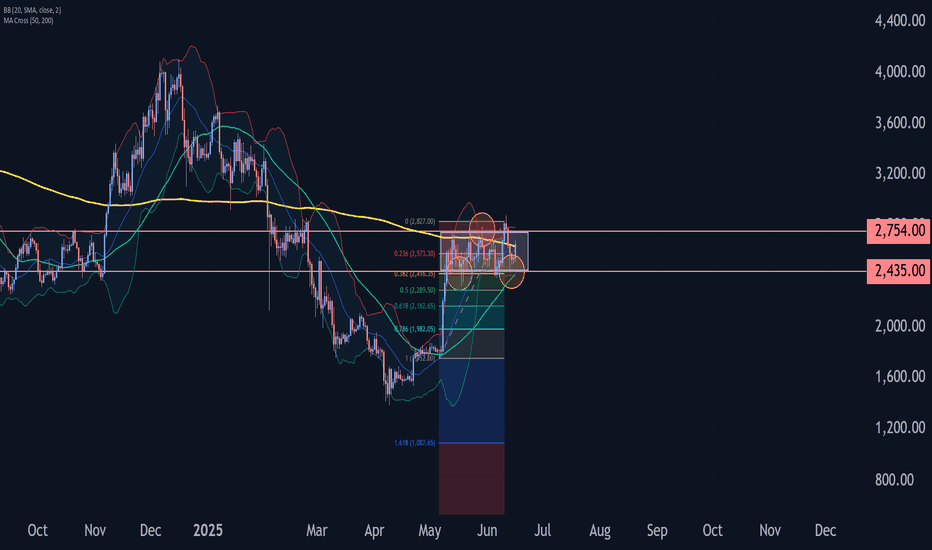

Ethereum Wave Analysis – 16 June 2025

- Ethereum moving inside sideways price range

- Likely to rise to the resistance level 2754.00

Ethereum cryptocurrency recently reversed up from the support zone between the support level 2435,00 (lower border of the active narrow sideways price range from May), lower daily Bollinger Band and the 38.2% Fibonacci correction of the upward impulse from May.

The upward reversal from this support zone continues the active minor impulse wave 3 of the intermediate impulse wave (3) from last month.

Ethereum can be expected to rise to the next resistance level 2754.00 (upper border of the active sideways price range).

ETH Eyes Key Resistance — Bullish Structure Holds!🎯 Trading Plan:

Scenario 1 (Bullish Continuation):

Buy or hold as long as price holds above VWAP

Target move toward $3,000 –$3,430 (resistance zone)

If breakout above $3,430 — watch for acceleration

Scenario 2 (Rejection at Resistance):

Wait for confirmation of rejection (e.g., weekly SFP or bearish engulfing) in $3,000 –$3,430 zone

Consider short/hedge if rejection is confirmed, targeting a move back toward $2,600–$2,222

Invalidation:

Structure turns bearish only if price closes below $2,222

🔔 Triggers & Confirmations:

Uptrend intact as long as price is above VWAP

Confirmation required for shorts: look for SFP or clear reversal pattern at resistance

📝 Order Placement & Management:

🔼 Buy/Hold: While price is above $2,222

🛡️ Stop: Close below $2,222 (monthly close)

🎯 Targets: $3,150 → $3,430

🔻 Short/Hedge (optional): On confirmed weekly rejection at resistance

🎯 Short Target: $2,600–$2,222

🚨 Risk Warning:

Main structure is bullish; any shorts are strictly countertrend and require strong confirmation

ETH is holding the midrange supportETH tagged 50% of the down candle that took out local lows — textbook support zone for new longs.

Main risk: stops under $2,300 probably get swept before real reversal — watch for fakeout.

Holding above $2,400 keeps the bullish thesis alive, next target $2,780–2,800.

As always — manage risk, don’t get caught on the wrong side of a sweep.

Long trade

15min ~ TF

🟢 ETHUSDT – Buyside Trade

Date: Saturday, 14th June 2025

Session: Asia Session AM

Time: 8:30 AM

Entry Timeframe: Intraday (short-term confirmation)

Trade Parameters

Entry: 2518.88

Take Profit: 2554.89 (+1.43%)

Stop Loss: 2515.56 (−0.13%)

Risk-Reward Ratio (RR): 10.85

🧠 Trade Reasoning

This entry was taken after ETHUSDT displayed strong bullish intent early in the Asia session, with price forming a liquidity sweep below local lows, quickly followed by a reversal candle and bullish order block on the lower timeframes.

Testing system on ETHlooked at 17 trades . 5 wins= 29.41% ,8 losses= 47.06%, 4 breakevens= 23.53%. average losing trade is 1% of account size and the average win is 5.14 times the risk==> 1:5.14 r:r .so every trade trade has a >50% chance of not losing and when it goes right it will hit hard, with the average winner is 5 times bigger than the loser. this is the worst performing pair that i have tested on so my confidence is boosted because i know that my edge is working in any market and the worst performing one is still profitable