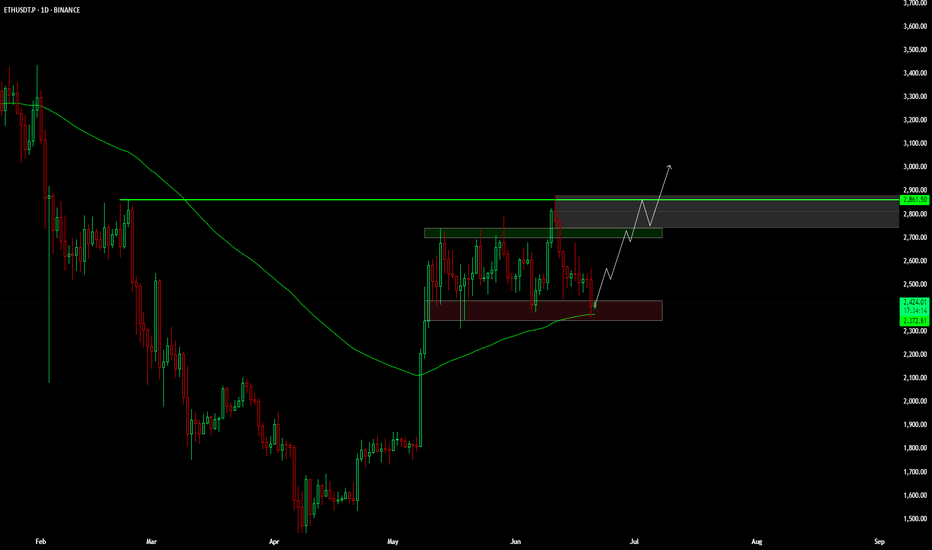

ETH READY TO GO 3000$ ???🔍 ETH/USDT Analysis – Daily Timeframe

ETH is currently trading at $2,427, holding above the key support zone around $2,370 - $2,390, which is aligned with the 100 EMA. This zone has acted as a strong accumulation area.

📈 Market Structure:

Price is consolidating inside a horizontal range. A confirmed breakout above the resistance zone ($2,650 - $2,700) could lead to a bullish continuation towards the major resistance at $2,861.

📊 Technical Outlook:

Trend: Sideways range (accumulation phase)

100 EMA: Acting as dynamic support

Breakout Potential: Bullish continuation expected on breakout and retest

📌 Trade Plan (Not Financial Advice):

Entry Idea: Break and close above $2,700 zone

Target: $2,861 and higher

Invalidation: Daily candle close below $2,370

ETH is building strength above its 100 EMA. A breakout from this range can trigger a fresh bullish leg.

🔁 Like & share your opinion! Always DYOR before trading.

ETHUST trade ideas

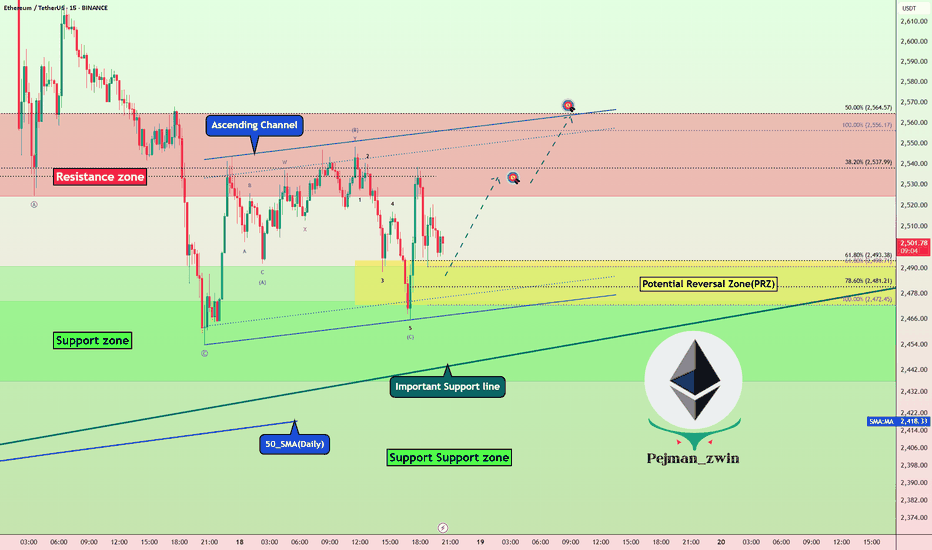

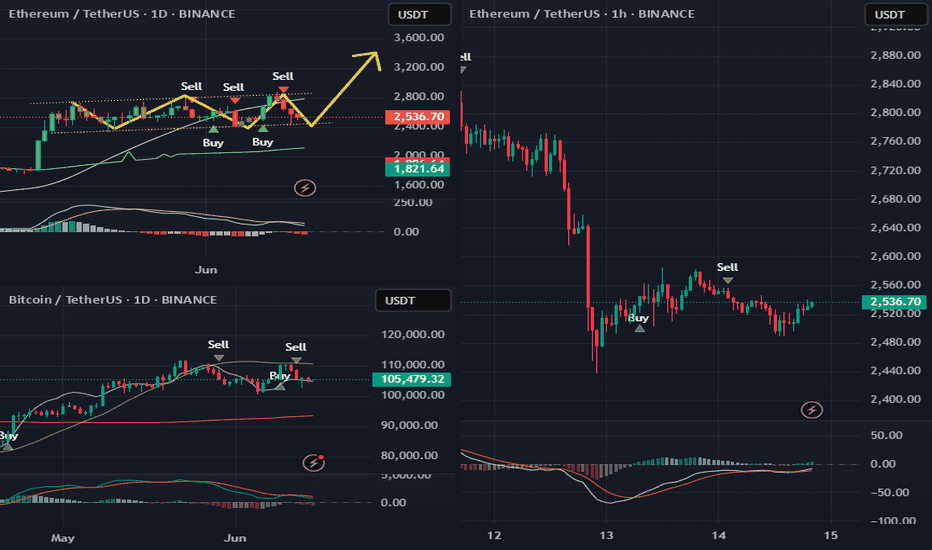

Ethereum at PRZ: Bullish Setup _ Short termEthereum ( BINANCE:ETHUSDT ) reacted from the Potential Reversal Zone (PRZ) around the confluence of key Fibonacci levels , the Important Support line and 50_SMA(Daily) .

From an Elliott Wave point of view , we can identify a Expanding Flat (ABC/3-3-5) structure ending right above the Support zone ($2,474-2,437) .

The structure also hints at the formation of a new upward leg , potentially leading ETH toward the Resistance zone ($2,564-$2,524) and the upper line of the Ascending Channel .

I expect Ethereum to test the 38.2%($2,531=First Target) - 50%($2,561) Fibonacci retracement levels on the way to a potential retest of the previous swing highs .

Note: Stop Loss (SL) = $2,451= Worst Stop Loss(SL)

Please respect each other's ideas and express them politely if you agree or disagree.

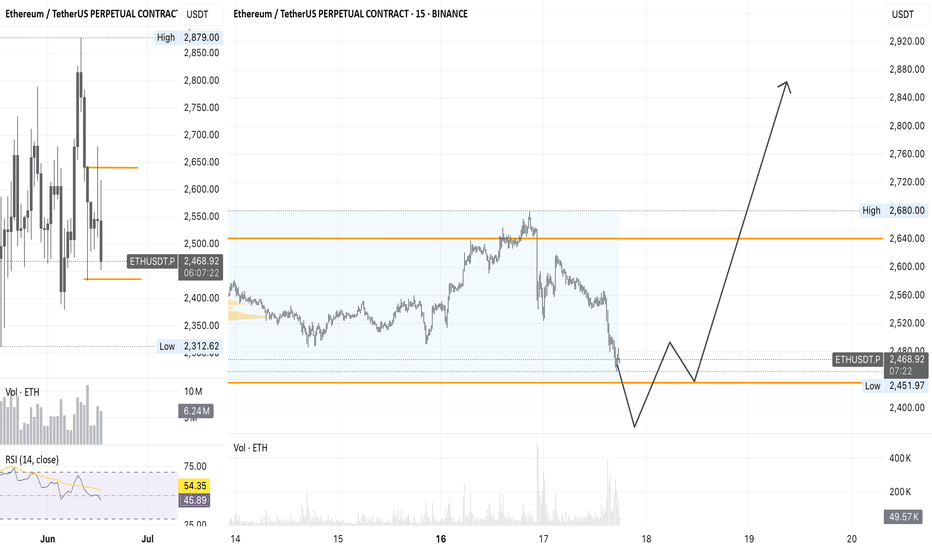

Ethereum Analyze (ETHUSDT), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

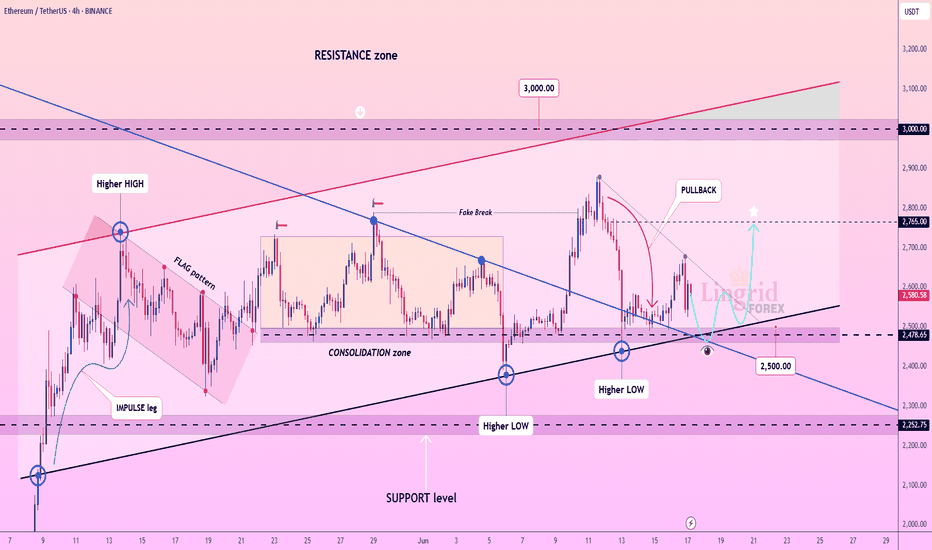

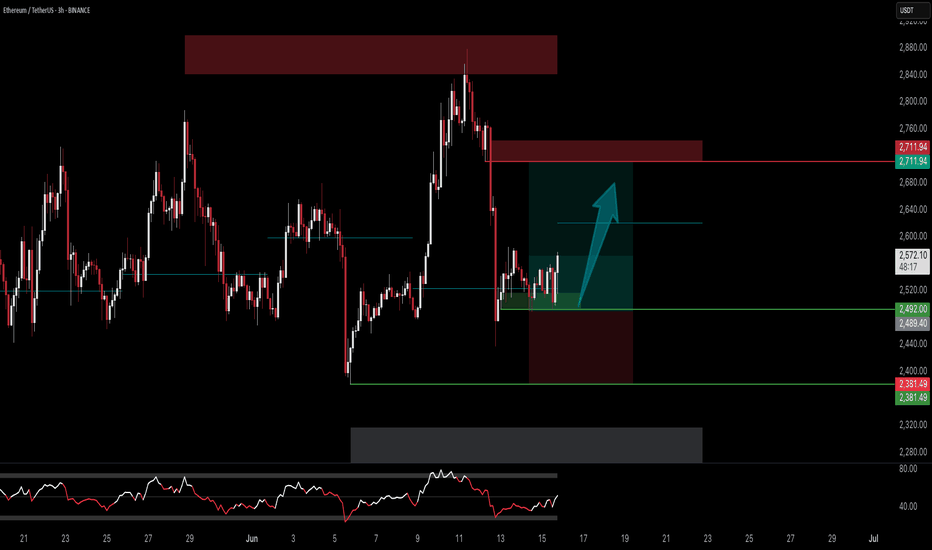

Lingrid | ETHUSDT potential Bullish Trade from the ConfluenceBINANCE:ETHUSDT is retesting a key support area near 2500 following a deep pullback from the 2765 rejection zone, while holding above a multi-week ascending trendline. The recent bounce has not yet invalidated the bullish structure, and the confluence with the downward breakout level adds significance to this zone. A higher low above 2480 could trigger a sharp reversal back toward the 2765 resistance.

📈 Key Levels

Buy zone: 2475–2520

Sell trigger: breakdown below 2450

Target: 2765

Buy trigger: breakout above 2620

💡 Risks

A breakdown below 2475 would cancel the bullish setup

Lack of volume on bounce attempts may signal weakness

Macro events or BTC drop could drag ETH lower regardless of setup

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

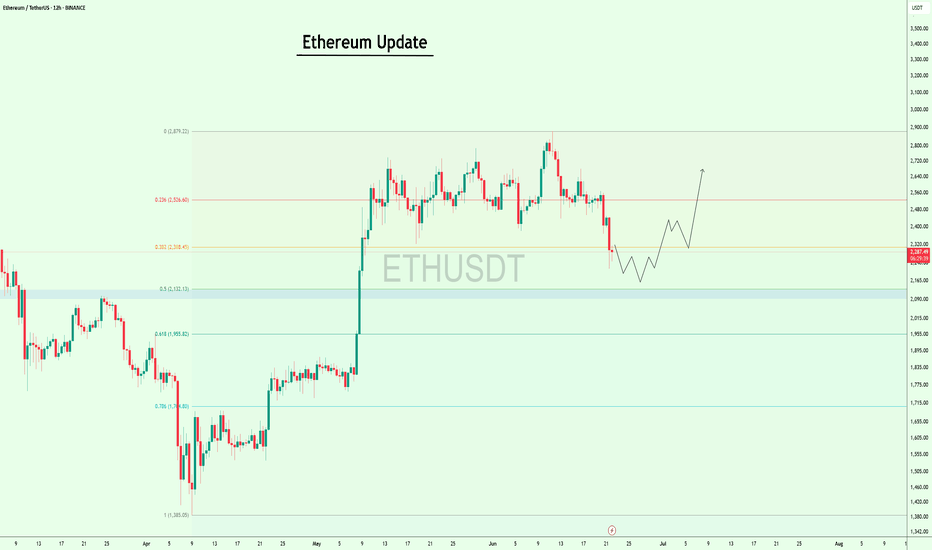

#Ethereum Update!!CRYPTOCAP:ETH has broken below the $2,308 resistance zone and is now trading lower.

Price is approaching a key demand area around $2,132–$2,000, where we’ve seen strong buyer reactions in the past.

IMO, if bulls step up and defend this zone, we could see a recovery bounce aiming for $2,526, the next major resistance ahead.

I’ll keep you updated as things develop.

If you find my updates helpful, don’t forget to like and follow for more! DYOR, NFA

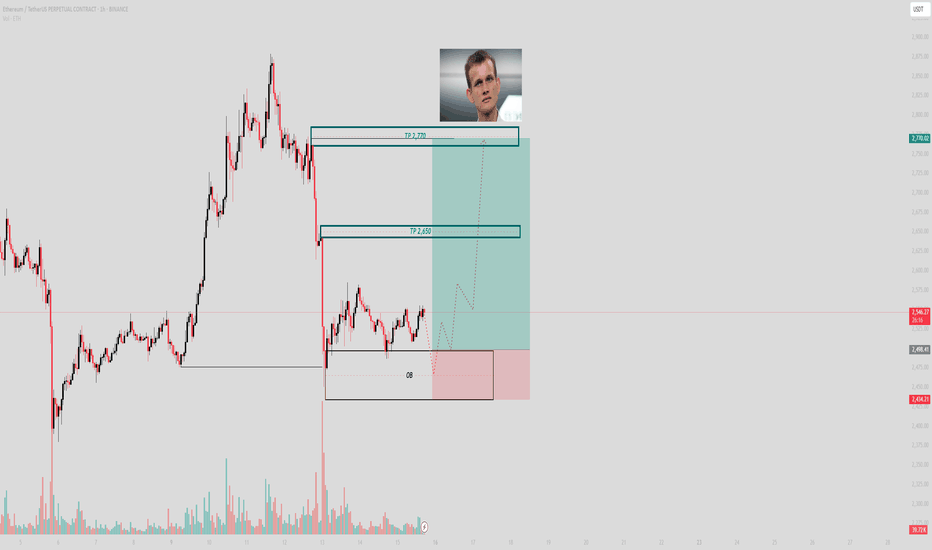

Vitalik didn’t draw this box. I did — and I’m trading itPrice delivered the sweep. Now it’s coiling inside my range, hovering just above the 1H OB like it’s waiting for permission. I don’t need permission. I need structure — and I’ve got it.

The logic:

ETH dropped into a clear demand zone — not a guess, a confirmed 1H Order Block. Since then, it’s printed compression just above the OB. Every wick into the range was absorbed — no expansion, just preparation.

Above us? Two objectives:

TP1: 2650 — inefficiency fill and previous high-volume rejection

TP2: 2770 — full reprice and external liquidity sweep

If price dips into the OB again? That’s not invalidation — that’s refinement.

Execution:

Entry: 2480–2500 (or on OB retest)

SL: Below 2434

TP1: 2650

TP2: 2770

You don’t chase this. You wait for it — then load it without hesitation.

Final thought:

“Smart Money doesn’t buy the candle. It buys the context.”

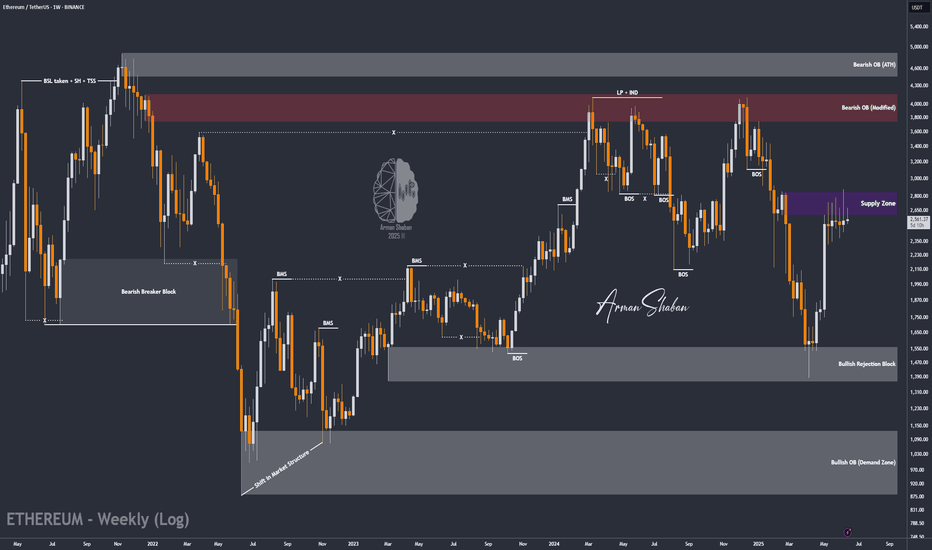

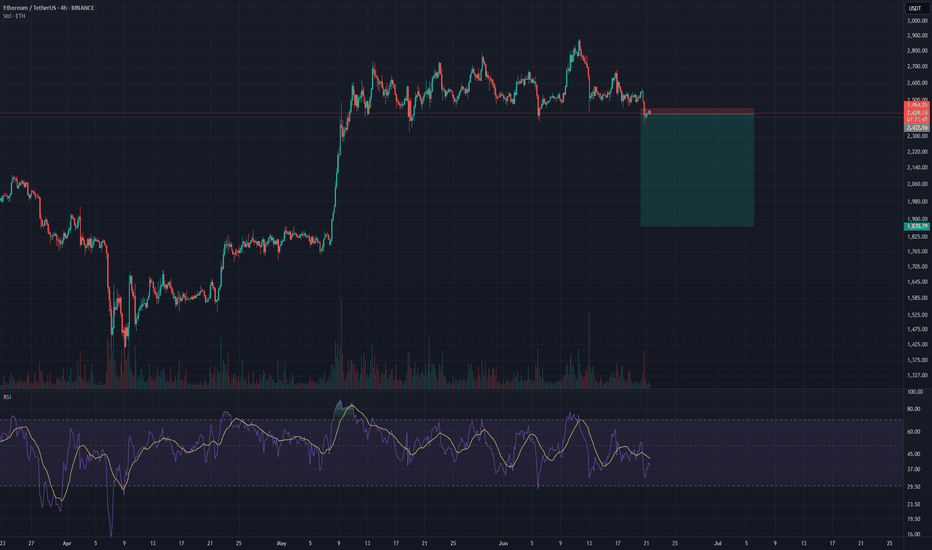

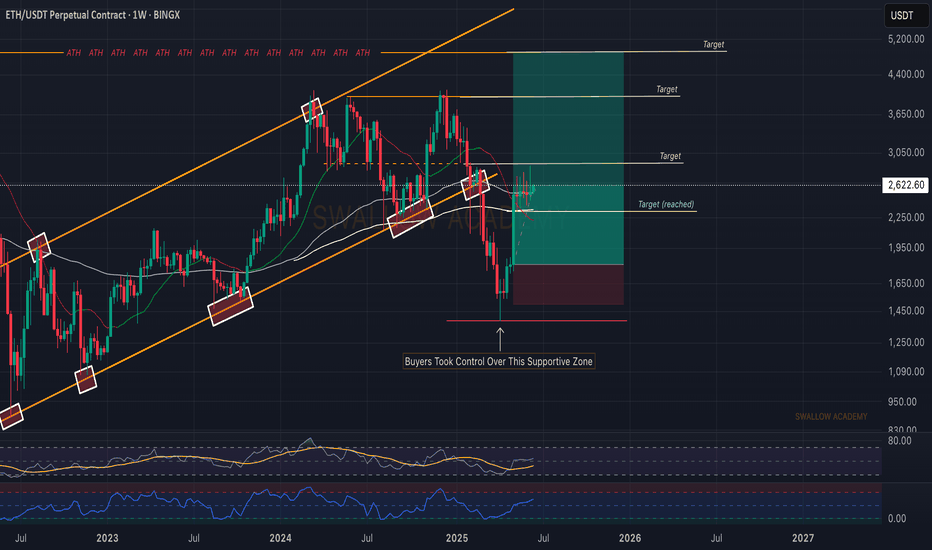

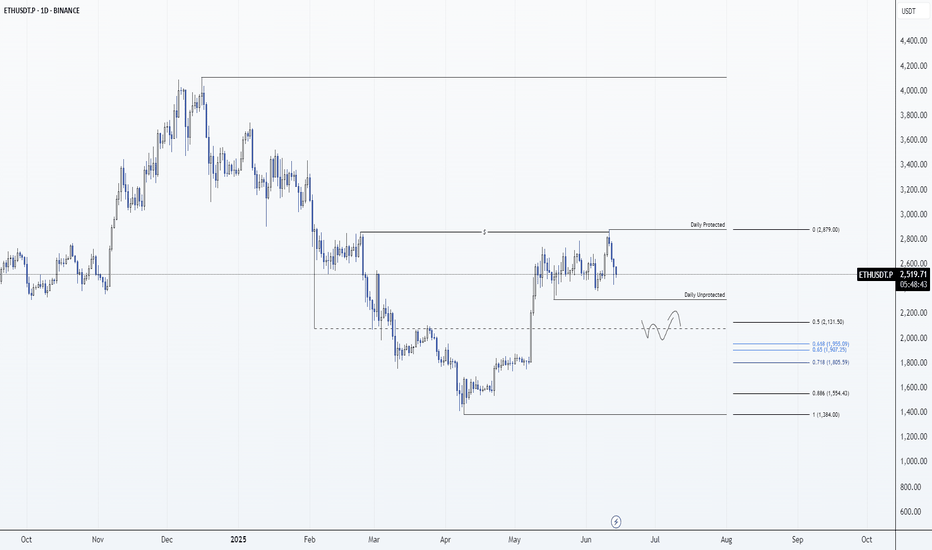

Ethereum Holds the Line – Is $2,300 the Key to the Next Rally?By examining the #Ethereum chart on the weekly (logarithmic) timeframe, we can see that after rising to $2,880, the price faced selling pressure and corrected down to $2,500. This upward move created a large Fair Value Gap (FVG) between $1,870 and $2,300, which is likely to be filled in the medium term if the price drops further.

However, as long as Ethereum continues trading above the $2,300 level and does not close below it, we can still expect further bullish movement.

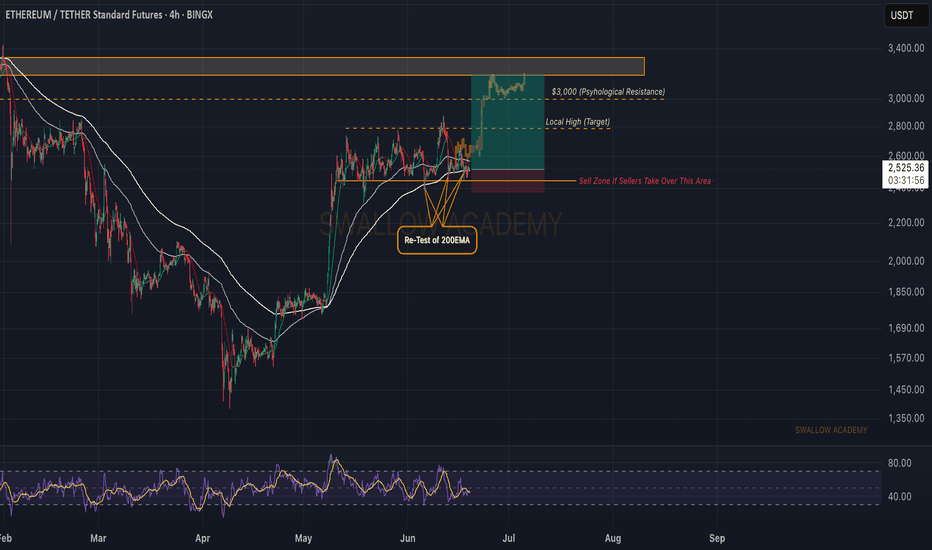

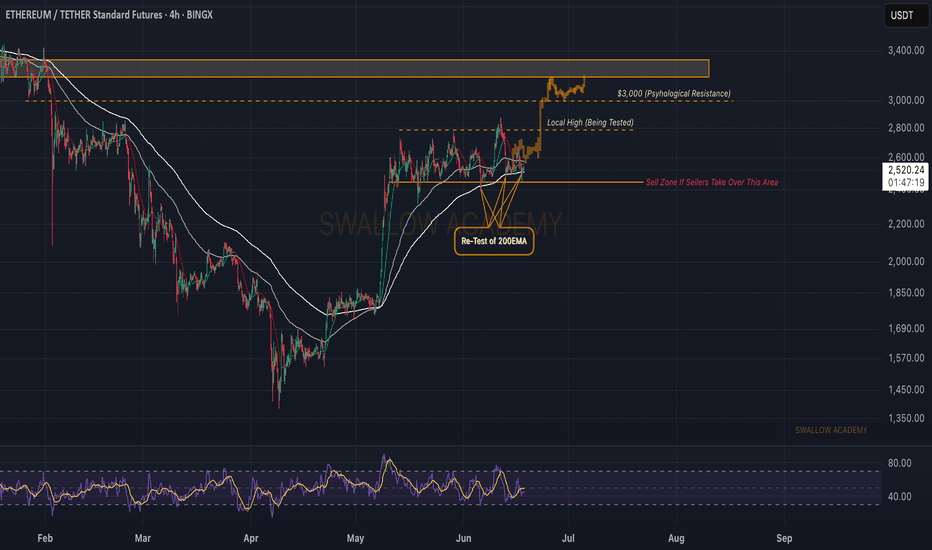

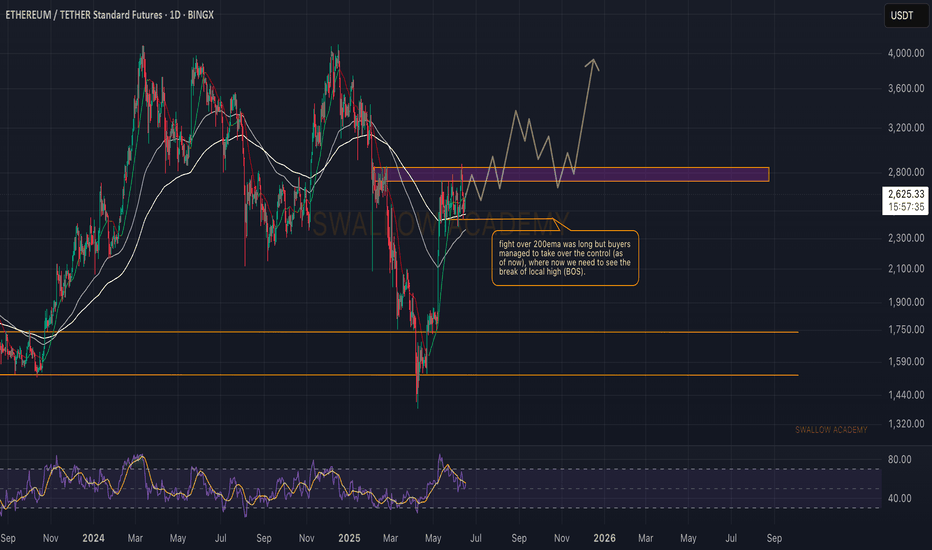

Ethereum (ETH): Golden Buy Zone | Buyers Taking ControlBuyers are taking control near the 200EMA, which could give us a really good bounce to upper zones from here on.

We see whales accumulating the ETH, which confirms our saying that Ethereum has not yet reached its potential.

The key zone is the 200EMA as of now.

Swallow Academy

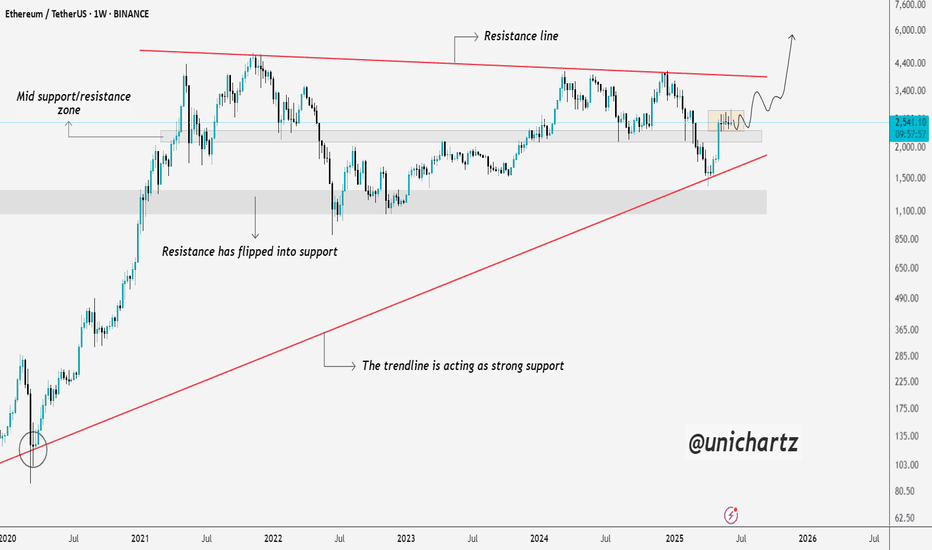

Ethereum Weekly Chart Shows Strength Above Key SupportEthereum is showing strong structure on the higher time frame. After rejecting lower levels, price has reclaimed the mid support/resistance zone, and is now consolidating just above it.

What’s key here is the long-term rising trendline, which has held beautifully since 2020 and once again acted as a springboard for the recent bounce. This kind of confluence — trendline + zone flip — adds weight to the current price structure.

If ETH maintains this zone, we could see accumulation continue, followed by a breakout toward the upper resistance line. For now, the chart leans bullish, but patience is key as consolidation plays out.

DYOR, NFA

ETHUSDT Perpetual – Breakout Trade SetupThis setup represents a clean long position entry on ETHUSDT.P with clear invalidation and target levels.

Trade Details:

Position: Long

Entry Price: $2,540.75

Stop Loss: $2,430.58

Take Profit: $2,705.33

Risk-to-Reward (RRR): ~1.45

Timeframe: Not specified (likely 1H or 4H)

Setup Rationale:

Price is attempting a recovery from a local support zone, aiming for continuation toward $2,700 resistance area.

Trade assumes strength in bullish follow-through if $2,540 is held.

Tight stop loss below the key liquidity area ($2,430s) protects from downside volatility.

Conclusion:

This is a classic trend-continuation breakout trade, entering slightly above consolidation with a moderate risk-reward ratio. Close monitoring of price action around the entry zone is important for managing exposure if the breakout fails.

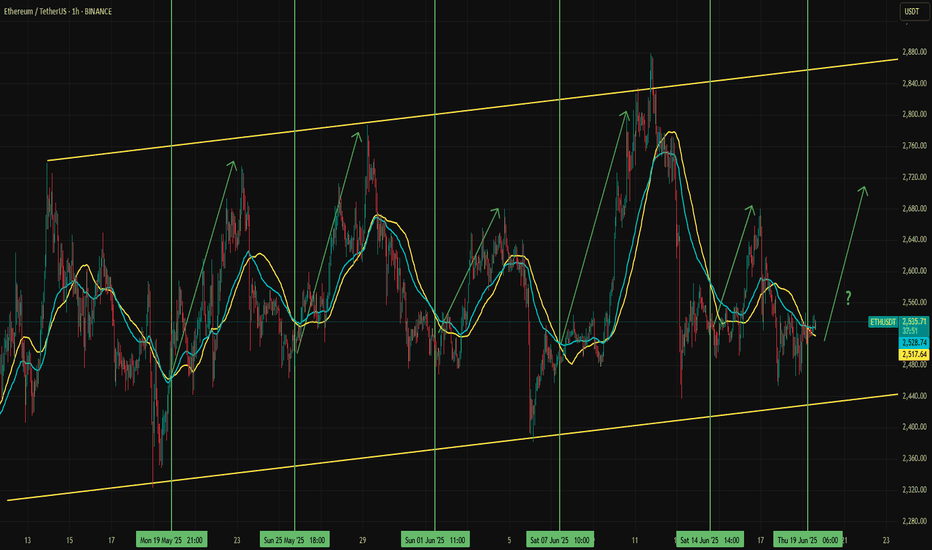

Potential Long Setup for EthereumEther stabilized in a slightly positive trend after breaking the previous uptrend. Since mid-May, this flattish trend channel has continued, offering some trading opportunities within it.

When Ethereum approaches the lower line and the 50 EMA crosses above the 50 SMA, an ETHUSDT surge has followed each time since the channel formed. Traders could expect a similar move again. However, the key risk is potential negative pressure on stock markets due to geopolitical concerns and the correlation effect on the crypto market and a break of the channel.

ETH LONG✅ Trading Setup Summary

1. Setup Type:

🔹 SFP (Swing Failure Pattern) or Trap at Key Level

🔹 Possibly forming a double bottom or liquidity grab at a known support zone.

2. Market Context:

🔸 Price returns to a previous key level with a volume spike

🔸 Likely in a bullish market structure (MS) or forming a reversal after a down move

🔸 Entry based on trap logic and session volume confirmation

3. Entry Logic:

✔ Wait for a stop hunt/SFP at liquidity zone

✔ Confirm with volume spike

✔ Enter after the rejection/confirmation candle

4. Stop Loss:

📍 Set just beyond the trap wick (below for long, above for short)

🎯 SL is defined and logic-based, not random

5. Target (TP):

🎯 Use 3–4R reward for intraday/session-based trades

🎯 Consider holding for more if Daily timeframe supports a longer move

6. Timeframe:

🕐 Entry on M15/M5, context from H1/D1

📌 Key Strategy Concepts Used

Trap (SFP)

Volume confirmation

Market Structure (MS)

Key Level (Support/Resistance)

Defined SL with good RR

Session-based entry (likely Asian session scalp)

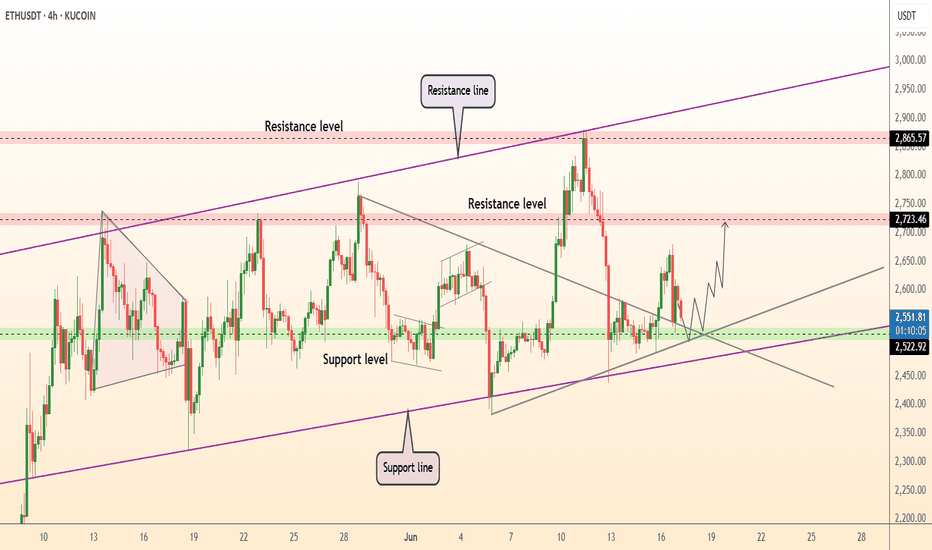

DeGRAM | ETHUSD held the trend line📊 Technical Analysis

● Price just printed a long-tailed rebound on the 4-month purple up-trend and the 2 520-2 560 demand strip, also reclaiming a broken pennant base—confirming a fake breakdown and locking the zone as fresh support.

● A higher-low sequence is compressing against the descending 2 650 trend cap; a 4 h close above it activates the 2 723 horizontal target and projects the channel-median swing toward 2 865.

💡 Fundamental Analysis

● Net staking deposits keep outpacing withdrawals while CME ether futures open-interest hit a six-week high, signalling renewed institutional hedging ahead of the spot-ETF ruling and supporting upside bias.

✨ Summary

Buy 2 540-2 580; clearance of 2 650 aims 2 723, stretch 2 865. Invalidate below 2 450.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

Ethereum (ETH): Are We Doomed or Will We See $3000?Struggle is huge on Ethereum, where we are at a major support area (or let's call it a neckline, as it suits it more here), which is also close to the 200EMA.

So strong a base has formed there that each time we reach that point, we see a strong bounce and dominance from buyers, and yet we always go back to that area.

So, same as Bitcoin, we wait for any more confirmations near the current zone. If we see a breakdown from the neckline area, the drop will be nasty; if we see proper buyside dominance, we will be heading for $3000. So let's wait...

Swallow Academy

Ethereum (ETH): Buyers Are Back | Waiting For Next Target NowETH is back with strong buyside dominance after the choppy rollercoaster movement. Since our entry we have filled so far our first target area, where we took some profits and moved SL to entry so now we are waiting for the next target to be hit to take more profits and move SL once again closer.

Swallow Academy

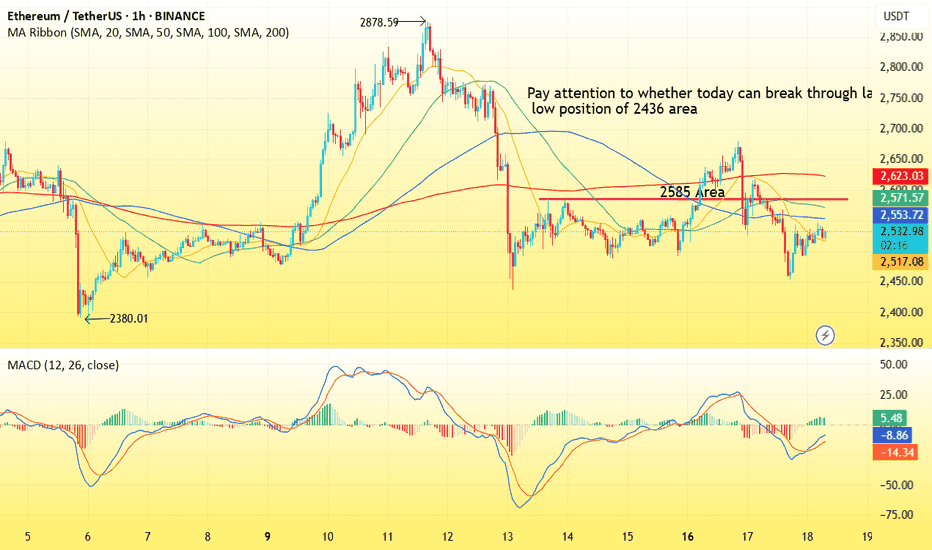

ETH(20250618) market analysis and operationTechnical analysis of ETH contract on June 18:

Today, the large-cycle daily level closed with a small negative line yesterday, and the K-line pattern continued to fall. The price was at a high level but had no strength and continued trend. Instead, it was easy to fall under normal pressure. The attached indicator was dead cross, and the big trend was still very obvious. In this way, we are more optimistic about the price continuing to fall and breaking the low point in the future; the short-cycle hourly chart fell continuously yesterday, and the European session continued to break the previous day's low point in the US session. It is still in a corrective trend, but according to the current trend, it is highly likely to continue today. Whether it can break down the low point of last week needs to be paid attention to. There is no room for operation during the day, so wait and see today, focusing on the strength and weakness of the European session and the unemployment data in the evening.

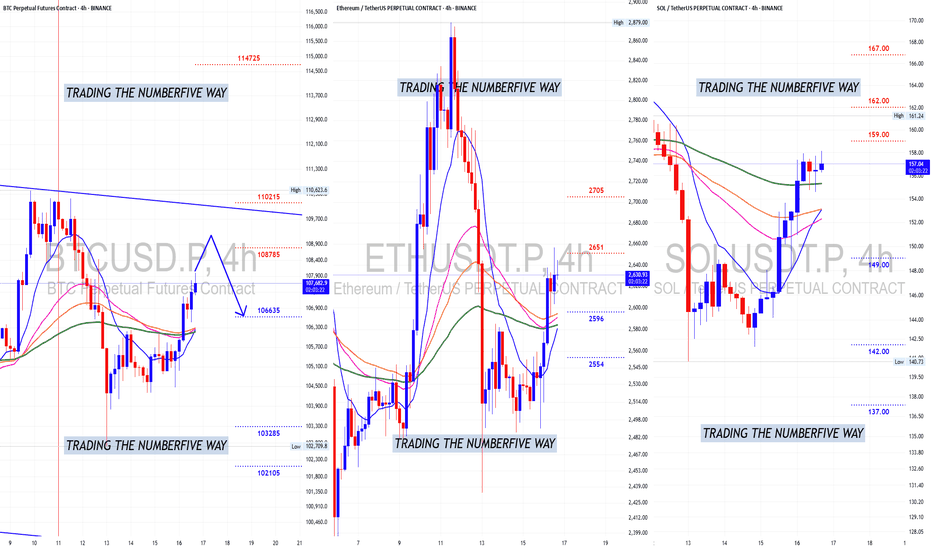

BITCOIN; Is It Printing a Lower High?BITCOIN Is it printing a lower high?

Well by the way is moving (playing lazy) and knowing that its 4hrs Bullish TIME Cycle is near the end we can only say that if it doesn't turn on the boosters then it will be in trouble.

Next drop will start soon and once we see how low bears were able to push price down we will know if target price of $118k will be possible by end of month/first week of July or not.

$114K started to show up on radar but with the TIME bulls have left I don't think will be possible to get there . Will see how bulls play their last hand of the month.

We'll follow with updates so stay tuned.

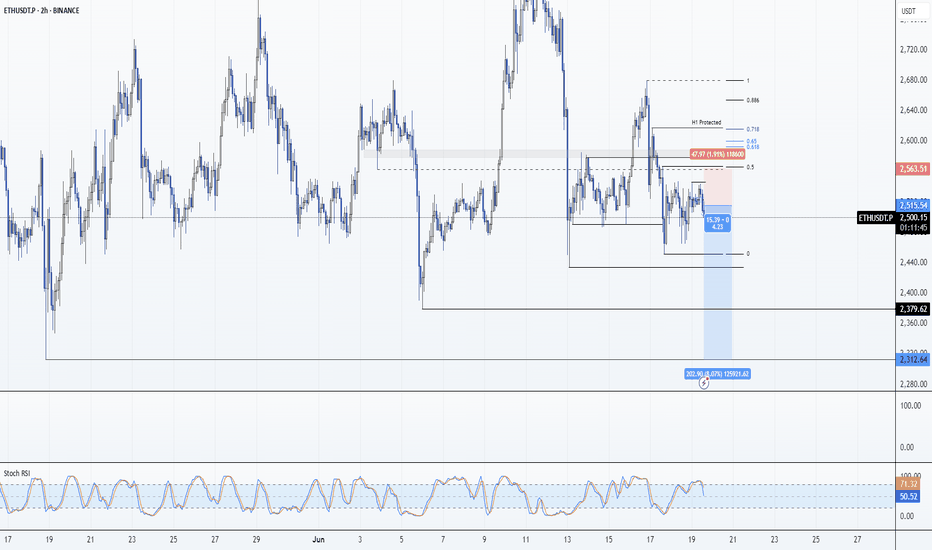

ETH: Short 19/06/25Trade Direction:

ETH Short

Risk Management:

- 0.5%

Reason for Entry:

- Failure to reclaim weekly open

- Loss of weekly open, monthly open, and Monday low

- H2 timeframe oversold but within a reclaimed bearish order block

- Clear bearish grind price action aligning with higher timeframe bearish trend

- Higher confidence in shorts at current level than higher up

Additional Notes:

- Total market cap looks heavy, global situation especially middle east is continuing to see a risk off mindset for risk assets like crypto.

- Until price gives me a reason not to have to assume this is continuing bearish.

- Potential to short higher if this fails

Ethereum (ETH): Time To See Proper Breakout | $3000 IncomingEthereum is still in a sideways channel on smaller timeframes, where we are looking for the price to reach the $2,834 area. Once there, we will be monitoring closely to see either the breakout from there or another rejection and smaller ride to lower zones.

Overall we are bullish on ETH; liquidity needs to flow here now.

Swallow Academy

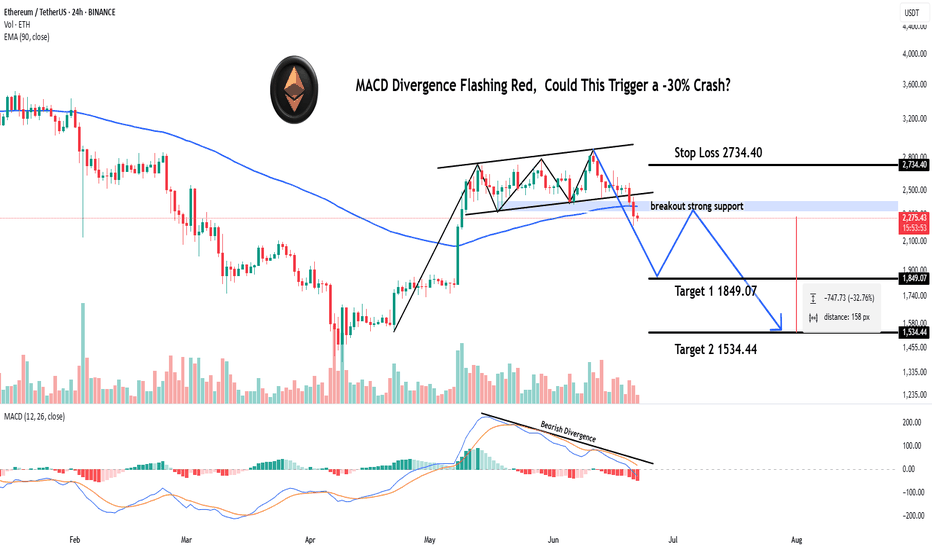

MACD Divergence Flashing Red, Could This Trigger a -30% Crash?Hey Realistic Traders!

Bearish Reversal Signal Flashing on BINANCE:ETHUSDT , Is the Bull Run Over?

Let’s Break It Down..

On the daily timeframe, Solana (SOL) has formed an ascending broadening wedge, which has now broken to the downside through both the lower trendline and a major support zone, indicating a shift in market structure.

Price action has also remained consistently below the 200-day EMA, signaling a potential transition from a bullish to a bearish trend.

A bearish divergence has appeared on the MACD indicator, where price makes higher highs while the MACD forms lower highs. This divergence indicates that buying momentum is weakening, even as the price pushes higher. Such a pattern often precedes a trend reversal and supports the expectation that the price may continue to move lower.

Given these technical signals, the price is likely to continue moving lower toward the first target at 1849.07, with a possible extension to the second target at 1534.44.

This bearish outlook remains valid as long as the price stays below the stop-loss level, currently marked at 2734.40. A move above this level would invalidate the bearish setup.

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: "Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on ETHUSDT.