EURCAD trade ideas

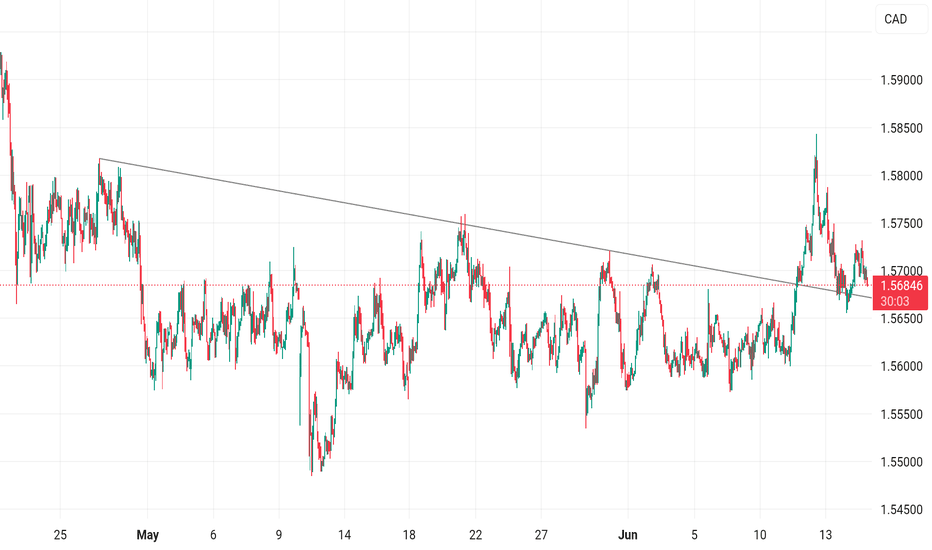

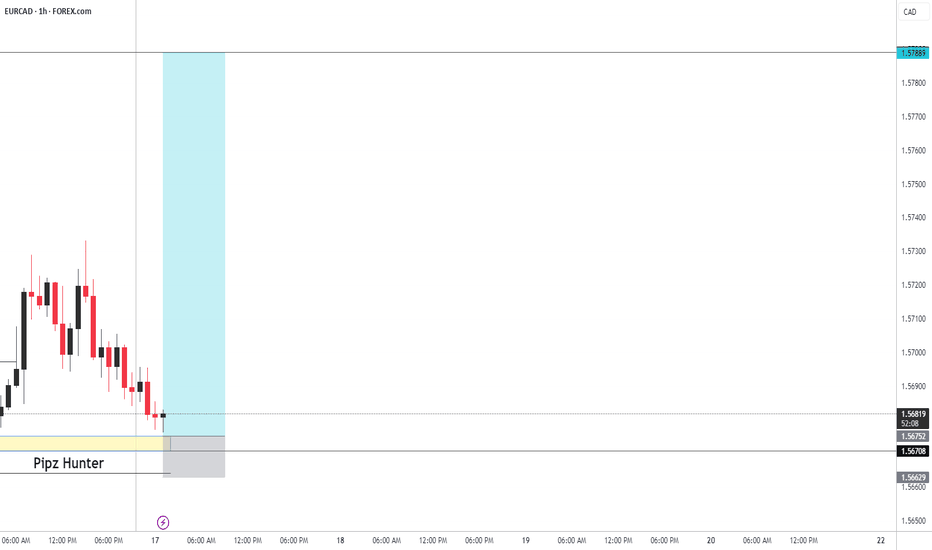

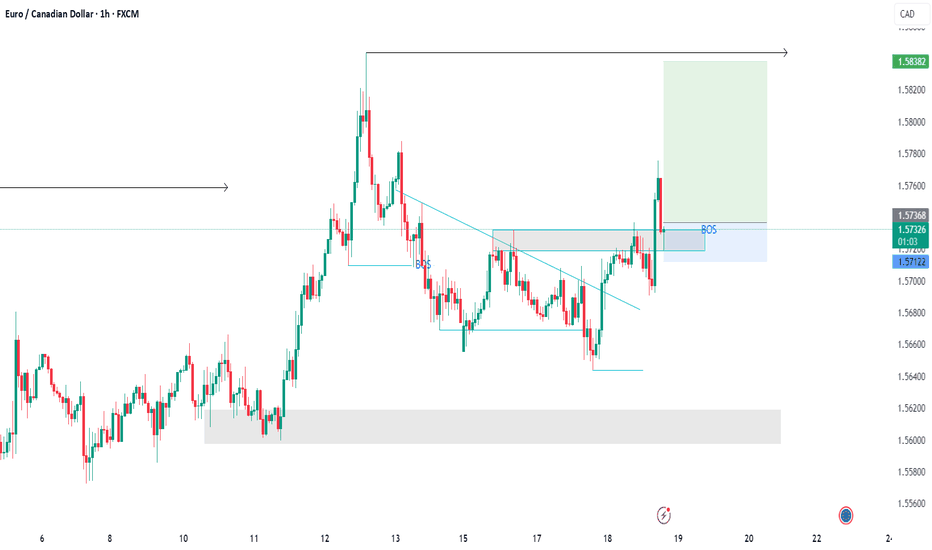

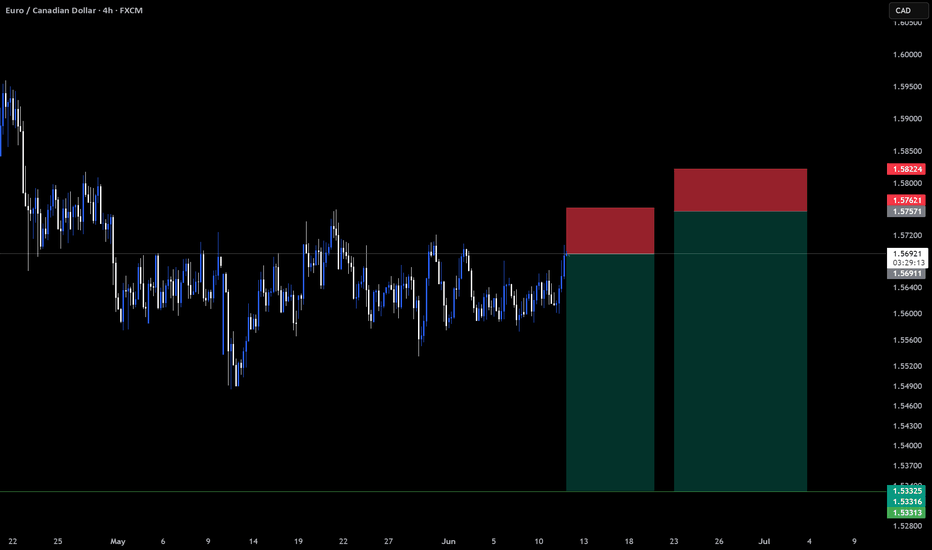

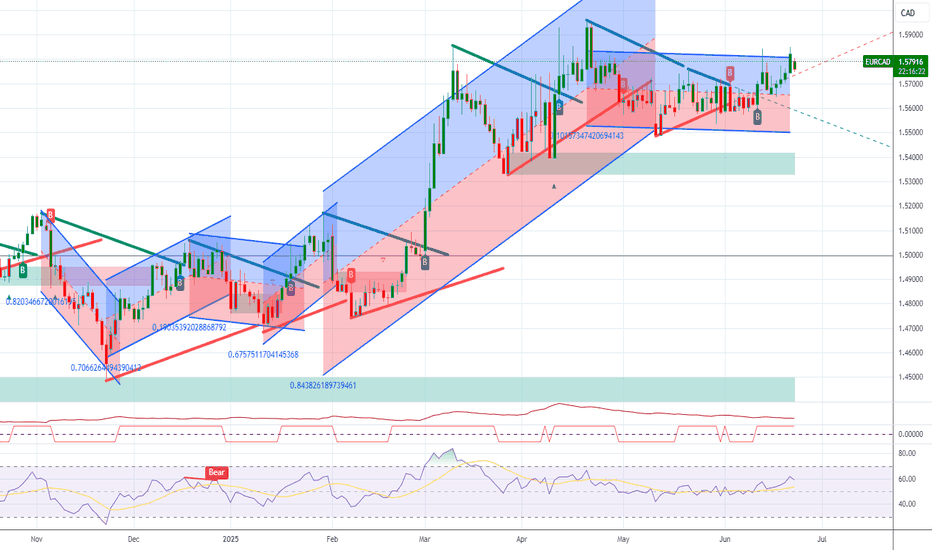

EURCAD Sell- Go for short term sell then manage your trade

- keep looking for sell even if price goes one more up

- potentially go lower

- in any case it has to at least go down to 1.5500 level or lower

- Refine entry with smaller SL for better RR, if your strategy allow

A Message To Traders:

I’ll be sharing high-quality trade setups for a period time. No bullshit, no fluff, no complicated nonsense — just real, actionable forecast the algorithm is executing. If you’re struggling with trading and desperate for better results, follow my posts closely.

Check out my previously posted setups and forecasts — you’ll be amazed by the high accuracy of the results.

"I Found the Code. I Trust the Algo. Believe Me, That’s It."

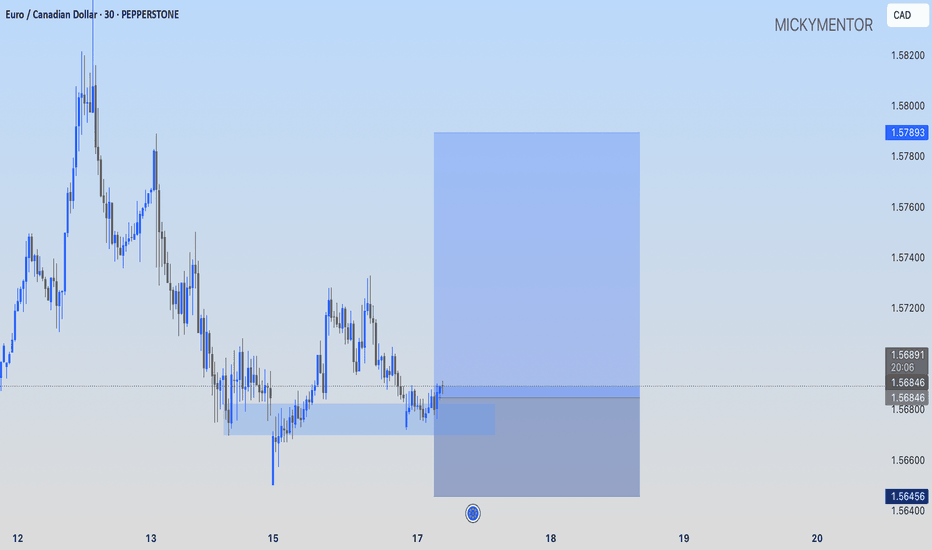

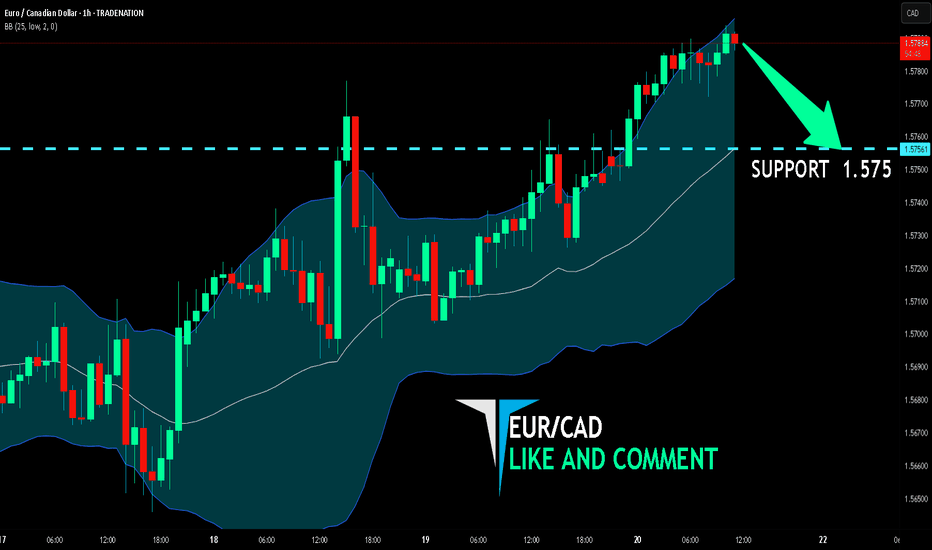

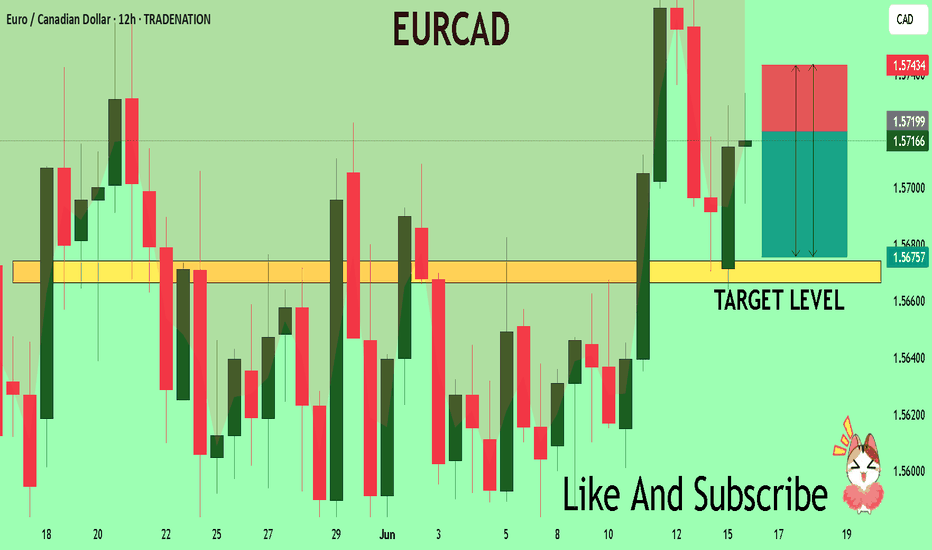

EURCAD: Short Trade Explained

EURCAD

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell EURCAD

Entry - 1.5823

Stop - 1.5865

Take - 1.5738

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

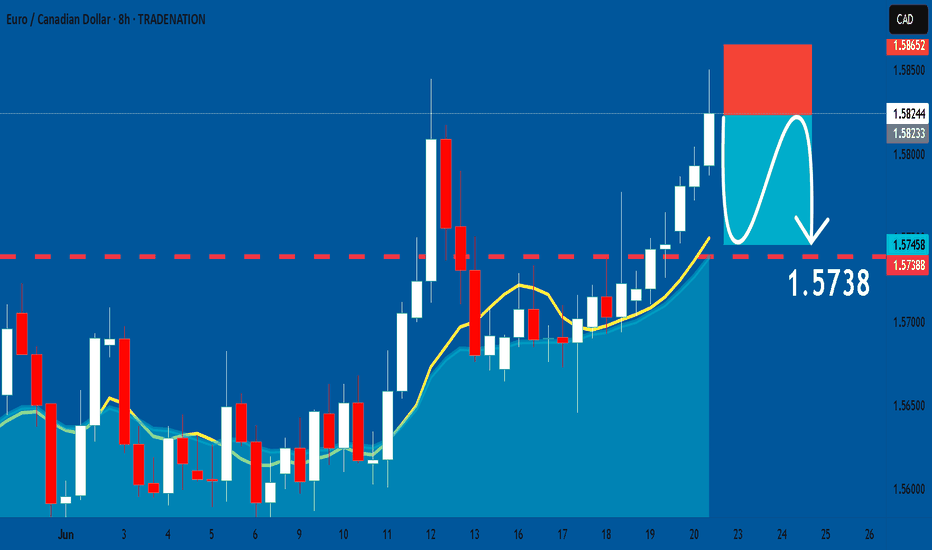

EUR/CAD SELLERS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

The BB upper band is nearby so EUR-CAD is in the overbought territory. Thus, despite the uptrend on the 1W timeframe I think that we will see a bearish reaction from the resistance line above and a move down towards the target at around 1.575.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/CAD Long Bias🚀 EUR/CAD – Strong Long Opportunity Based on Multi-Factor Confluence

Over the past week, I conducted a comprehensive macro and sentiment-driven analysis across G10 FX pairs. Among several potential setups, EUR/CAD emerged as the most fundamentally and technically aligned long opportunity, supported by a confluence of high-probability signals across positioning, macro divergence, and capital flow sentiment.

🔍 Key Drivers Behind the EUR/CAD Long Bias:

1️⃣ Macroeconomic Divergence (ENDO View)

🇪🇺 Eurozone has shown relative stability in core macro indicators:

Inflation continues to cool, providing flexibility for ECB rate guidance.

GDP growth remains structurally flat but not contracting — suggesting resilience.

🇨🇦 Canada, on the other hand:

Shows a deteriorating inflation-growth mix.

Retail Sales and Industrial Production trends are softening.

ENDO analysis flags CAD as one of the weakest among G10 currencies.

2️⃣ Positioning – COT Report & Z-Scores

Speculative traders are increasing their long exposure to EUR (COT net longs rising +13,887 last week).

Z-Score on EUR long positions: +1.33 → statistically elevated interest in long EUR exposure.

CAD positioning is flat-to-negative, with no bullish buildup in speculative flows.

This gives EUR a clear relative edge in terms of speculative conviction.

3️⃣ Score & EXO Sentiment Framework

EUR/CAD is one of few pairs showing clear directional consensus across:

✅ EXO Score Sheet: Long Bias confirmed.

✅ RR_w Sheet: Strong risk/reward rating supports further upside.

✅ IR Forecast Sheet: ECB-CAD policy spread favors EUR strength in medium term.

4️⃣ Market Sentiment – Risk Regime

We are currently in a “Risk-On” sentiment regime, which generally favors currencies like EUR over defensive, commodity-linked currencies like CAD.

CAD tends to underperform in reflationary sentiment waves — especially when Oil fails to support the currency.

5️⃣ Cluster & Trend Confirmation

While not a primary factor, cluster analysis shows that EUR/CAD is not in a weak trend regime.

Trend alignment over 30 and 14 days remains favorable.

🔚 Conclusion:

EUR/CAD is one of the few pairs this week that aligns across all analytical fronts: macro, positioning, sentiment, and structure. In a crowded FX environment, such confluence is rare and valuable.

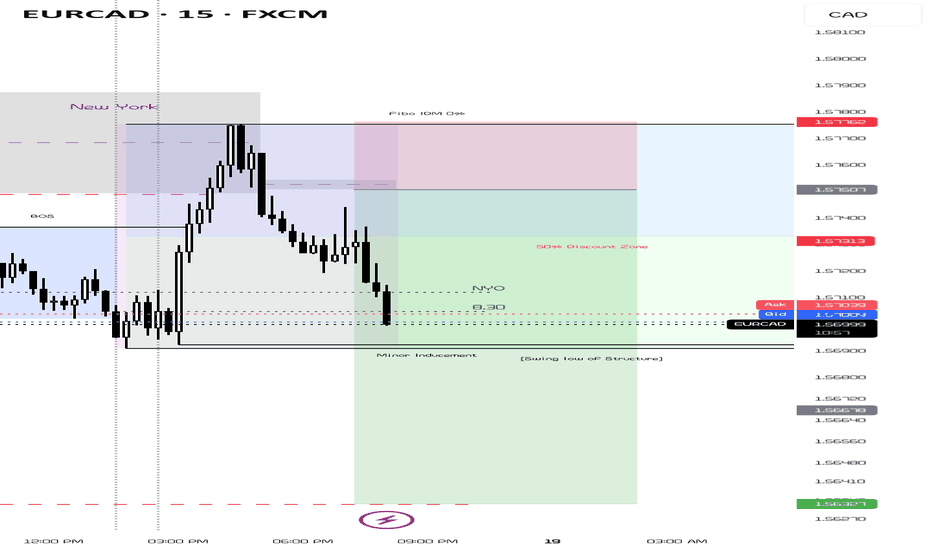

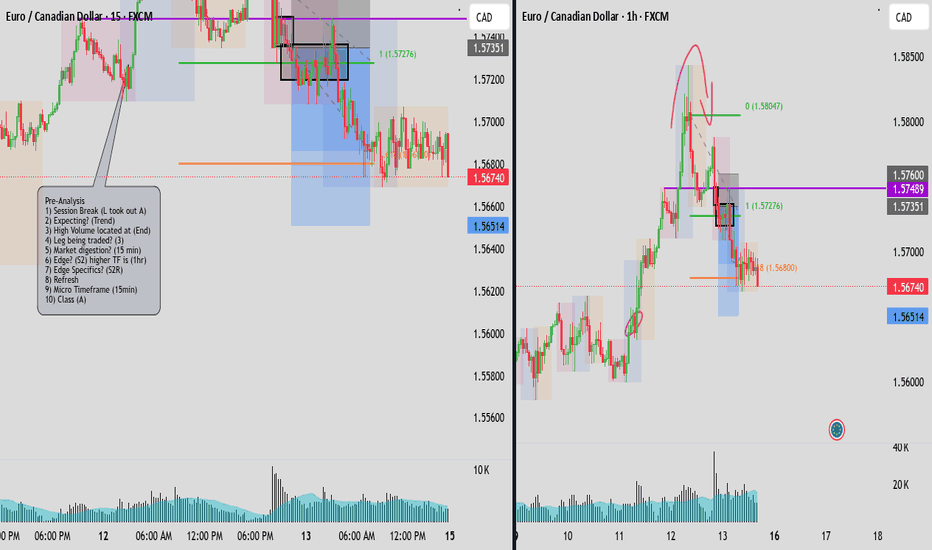

EURCAD Set To Fall! SELL!

My dear subscribers,

This is my opinion on the EURCAD next move:

The instrument tests an important psychological level 1.5718

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.5674

My Stop Loss - 1.5743

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

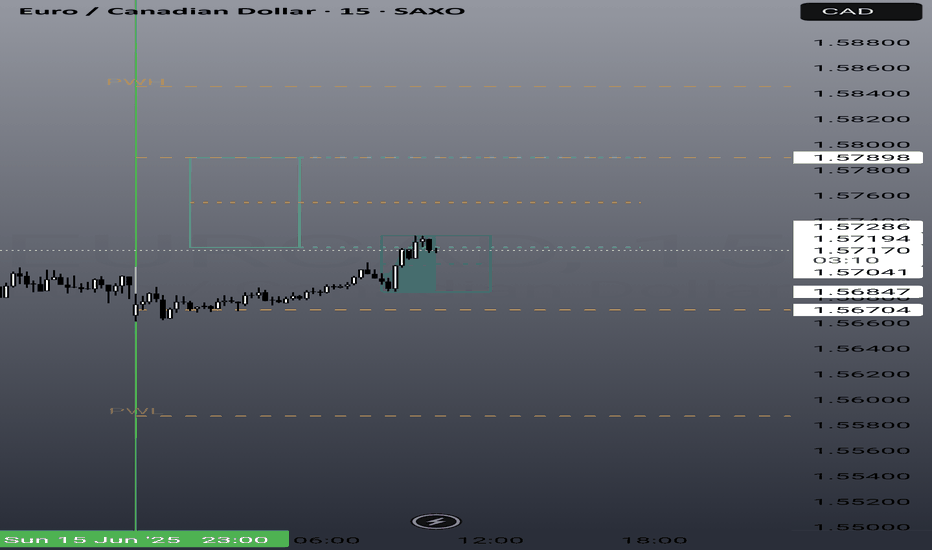

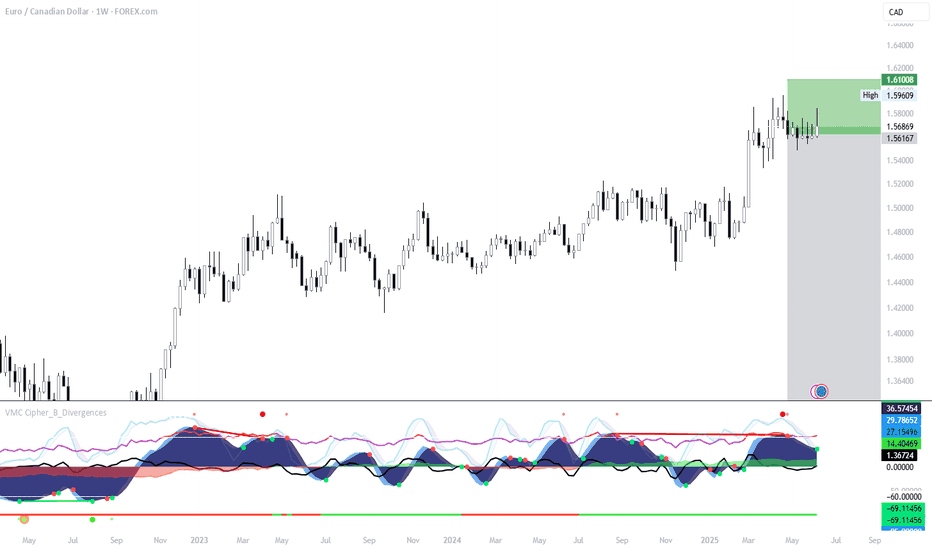

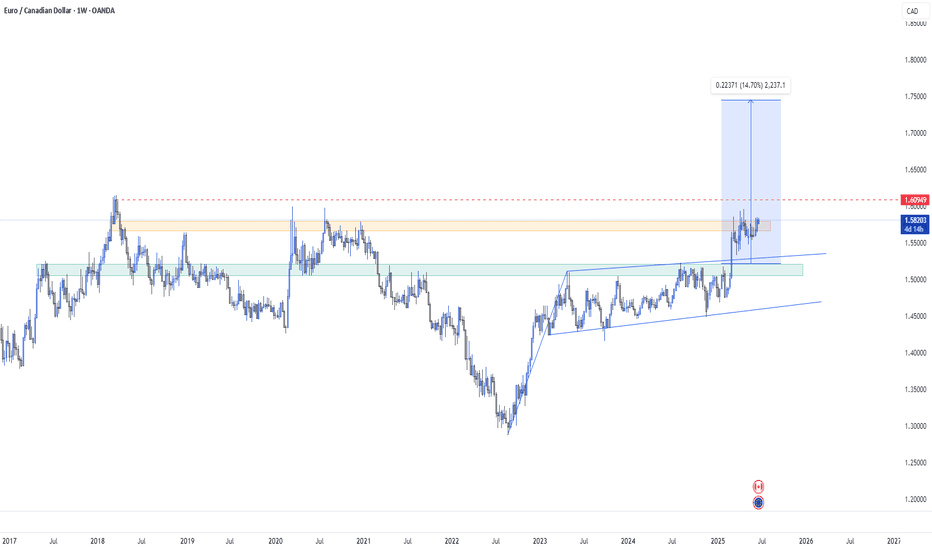

EUR/CAD Weekly Short Setup – Bearish Reversal Play

Initiated a short position on EUR/CAD from a key resistance zone after a significant upward move showing signs of exhaustion.

🔻 Entry: ~1.5689

🔻 Stop Loss: 1.6100 (Approx. 3.10%)

🎯 Take Profit: 1.3390 (Approx. 14.67%)

⚖️ Risk/Reward Ratio: 4.73

Price is reacting to a weekly supply zone with multiple confluences, including weakening bullish momentum on the VMC Cipher B indicator. The divergence signals a potential top, supporting a bearish outlook.

Looking for a move back to the lower range of the broader consolidation. Patience is key on this swing setup.

#EURCAD #ForexShort #SwingTrade #TechnicalAnalysis #RiskReward #TradingView

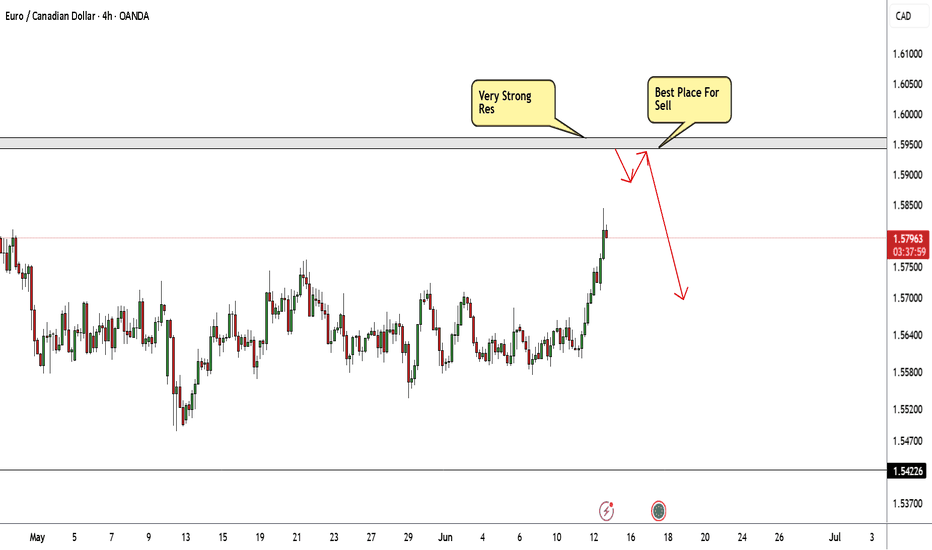

EUR/CAD Best Place To Sell Very Clear , Ready For 250 Pips ?Here is my opinion on EUR/CAD , I See that the price will touch 1.59500 and then go down very hard cuz it`s a very good res area and forced the prices to go down very hard last time and prove that it`s a good res , so i will sell this pair when the price touch this area and give us a good bearish price action for confirmation .

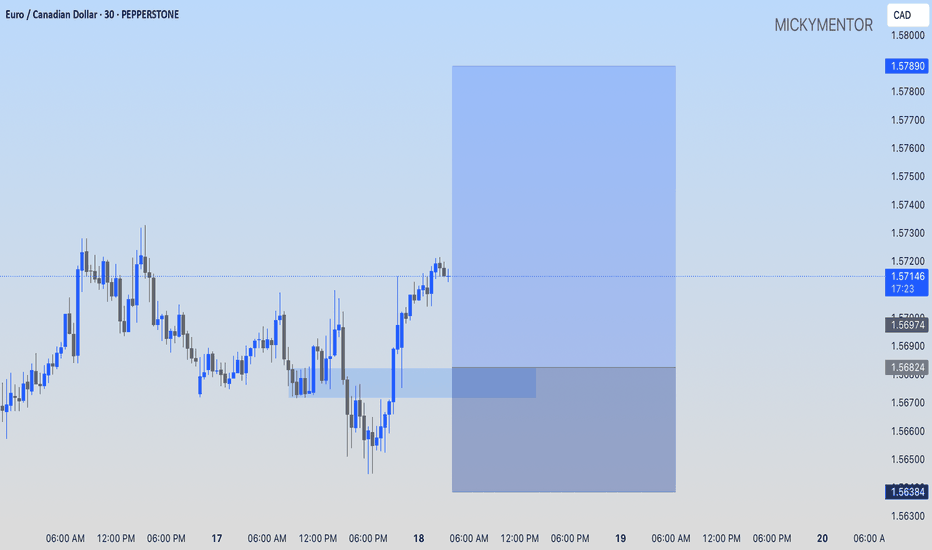

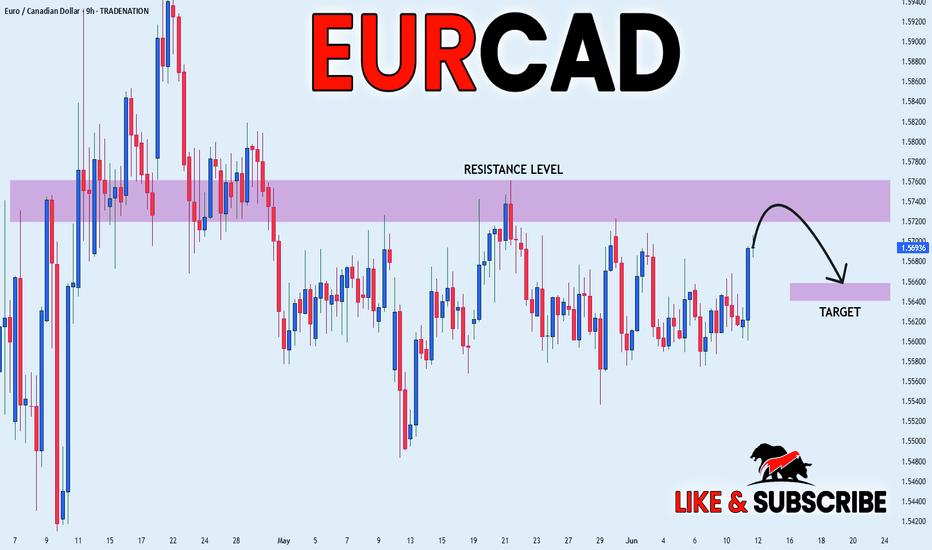

EUR_CAD LOCAL SHORT|

✅EUR_CAD is going up now

But a strong resistance level is ahead at 1.5760

Thus I am expecting a pullback

And a move down towards the target of 1.5660

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

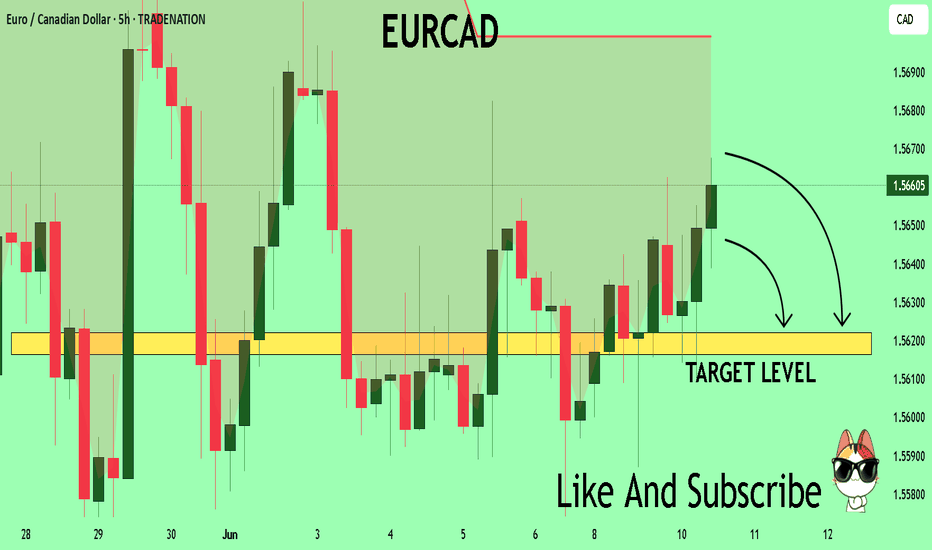

EURCAD The Target Is DOWN! SELL!

My dear friends,

My technical analysis for EURCAD is below:

The market is trading on 1.5657 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.5622

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EUR/CAD Weekly – Bull Flag Breakout with Macro Tailwinds Technical Structure:

The sharp rally from mid-2022 to early 2024 forms the flagpole.

The tight, downward-sloping consolidation (roughly mid-2023 to early 2025) forms the flag.

The recent breakout above the 1.5800–1.6000 zone confirms the flag breakout.

📊 Key Bull Flag Characteristics Met:

Prior strong impulsive move (flagpole)

Consolidation downward/slightly sideways in a tight range (flag)

Breakout with momentum above flag resistance

🌍 Fundamentals Confirm the Technical Picture:

As outlined previously, the macro environment aligns perfectly with this bullish breakout:

🔹 Euro Strength:

ECB is easing cautiously — still relatively hawkish vs peers.

Inflation remains sticky, reducing pressure for rapid cuts.

Eurozone economic data is stabilizing, especially in manufacturing.

🔻 Canadian Dollar Weakness:

Falling oil prices hurt CAD (Canada is a petro-currency).

BoC is dovish and may begin rate cuts sooner.

Domestic economic data (housing, retail) shows cracks.

🧭 Final Summary:

✅ Flag Breakout Thesis

✅ Bull flag structure validated

✅ Clean breakout and momentum

✅ Macro drivers support sustained upside

🔔 Key Levels:

Breakout Zone: 1.5800–1.6000

🔔 What to Watch Next:

ECB July meeting commentary

Canadian employment and CPI data

Crude oil weekly inventory reports

Risk-off sentiment (which usually supports EUR over CAD)

📈 Target Projection:

If 1.6000–1.6095 breaks, we look for:

🎯 Target: 1.72 – 1.74 (mid to late 2025)

🔰 Invalidation: Break back below 1.5250